#quickbook users list

Explore tagged Tumblr posts

Text

Quickbooks Users Guide to Streamlining Business Processes

Introduction to Quickbooks

Navigating the complexities of running a business can feel overwhelming at times. That's where QuickBooks steps in—a powerful ally designed to simplify your financial management tasks and streamline your operations. Whether you're a seasoned entrepreneur or just starting out, understanding how to leverage QuickBooks effectively can transform the way you handle your finances. Imagine having all your accounting needs met in one place, freeing up time for strategic planning and growth. With its user-friendly interface and robust features, QuickBooks is not just software; it’s a game-changer for countless businesses around the globe. As we explore its various functionalities, benefits, and tips for optimization, you'll discover how this tool can elevate your organizational processes—making life easier for you as a business owner. Let’s dive into the world of QuickBooks users and unlock its full potential!

Understanding the Different Features and Functions of Quickbooks

QuickBooks is a versatile tool designed to cater to various business needs. Its user-friendly interface allows even non-accountants to navigate with ease. At its core, QuickBooks offers essential features like invoicing, expense tracking, and payroll management. Users can create customized invoices in minutes and track payments seamlessly. Inventory management is another standout feature. Businesses can monitor stock levels and generate reports that keep them informed about sales trends. The software also shines in reporting capabilities. From profit-and-loss statements to cash flow forecasts, users have valuable insights at their fingertips. Integration options expand functionality further. QuickBooks connects effortlessly with numerous third-party applications for e-commerce, CRM systems, and more. Mobile access adds convenience too; users can manage finances on the go through the dedicated app—ideal for busy entrepreneurs or teams constantly on the move.

The Benefits of Using Quickbooks for Streamlining Business Processes

QuickBooks offers a plethora of advantages for businesses looking to streamline their processes. One significant benefit is its ability to automate routine tasks. By handling invoicing, expense tracking, and payroll automatically, QuickBooks saves time that can be redirected towards strategic initiatives. Another major advantage lies in its real-time reporting capabilities. Business owners gain instant insights into financial health without sifting through piles of paperwork. This clarity allows for informed decision-making. Collaboration becomes simpler with QuickBooks as well. Multiple users can access the same data simultaneously, enhancing communication among team members and improving overall productivity. Moreover, integrating third-party applications expands functionality further. Whether you need customer relationship management or inventory control tools, QuickBooks easily adapts to fit your unique business needs. The software provides a user-friendly interface which minimizes training time and accelerates onboarding for new employees.

Tips and Tricks for Maximizing Efficiency in Quickbooks

To maximize efficiency in QuickBooks, start by customizing your dashboard. Tailor it to show the most relevant information for your business at a glance. Utilize keyboard shortcuts to speed up data entry and navigation. Familiarize yourself with common commands that help you avoid excessive mouse clicks. Regularly reconcile accounts to ensure accuracy. This practice not only prevents discrepancies but also saves time when preparing reports. Consider setting up recurring transactions for regular payments or invoices. Automating these tasks frees up valuable hours each month. Take advantage of the reporting features available within QuickBooks. Use these insights to make informed decisions quickly rather than sifting through piles of data later on. Invest some time in training your team on best practices within QuickBooks. A knowledgeable user is an efficient one, reducing errors and improving workflow across the board.

Utilizing Third-Party Apps and Integrations with Quickbooks

QuickBooks is powerful on its own, but combining it with third-party apps can elevate your business processes. These integrations expand functionality and tailor the software to suit your unique needs. Consider incorporating tools for project management, customer relationship management (CRM), or inventory tracking. This brings all aspects of your operations into one cohesive platform. For instance, integrating a CRM like Salesforce with QuickBooks allows seamless access to customer data while managing financials simultaneously. You can track sales more effectively without juggling multiple systems. Don’t forget about automation! Tools like Zapier connect QuickBooks to various applications, automating repetitive tasks such as invoicing or data entry. This saves time and reduces errors. Explore the vast ecosystem of available integrations in the QuickBooks App Store. Testing different options will help you find what best enhances your workflow and captures valuable insights for informed decision-making.

Best Practices for Organizing and Managing Data in Quickbooks

Organizing and managing data in QuickBooks is crucial for maintaining efficiency. Start by setting up a clear chart of accounts. This helps classify income and expenses accurately, making financial tracking easier. Regularly reconcile your bank statements within QuickBooks. This practice ensures that your records match your actual bank account, reducing discrepancies. Use classes or locations to track different segments of your business. This allows for detailed reporting on various operations, helping you identify areas for improvement. Consider establishing a routine for data entry. Consistency prevents backlogs and reduces errors over time. Leverage the memo field in transactions to add context. These notes can provide clarity during audits or when revisiting past entries. Don't forget to back up your data regularly! Protecting information is essential to safeguard against loss or corruption.

Common Mistakes to Avoid when Using Quickbooks for Business Processes

Many QuickBooks users fall into common pitfalls that can hinder their business processes. One major mistake is neglecting regular backups of data. This can lead to disastrous losses if a system failure occurs. Another frequent error is improper categorization of transactions. Misclassifying expenses or income can distort financial reporting, leading to misguided decisions down the line. In addition, overlooking software updates may leave you vulnerable to bugs and security threats. Staying current with updates ensures your system runs smoothly. Many users fail to take advantage of available features like automated invoicing or recurring billing. Utilizing these tools can save considerable time and reduce manual errors in everyday tasks. Being mindful of these mistakes will help streamline operations and improve overall efficiency when using QuickBooks for your business needs.

Conclusion

Streamlining business processes is essential for efficiency and growth. Quickbooks serves as a powerful tool that can help users achieve just that. With its diverse features, understanding how to leverage them effectively can lead to significant improvements in productivity. Utilizing integrations with third-party apps enhances the functionality of Quickbooks, providing additional resources tailored to your specific business needs. This allows you to customize your approach and simplify workflows even further. Staying organized within Quickbooks is crucial for data management. Implementing best practices ensures information remains accessible and up-to-date, reducing the risk of errors or lost data. Avoid common pitfalls by educating yourself on frequent mistakes made by other users—knowledge truly is power. Embracing these strategies not only optimizes your use of Quickbooks but also positions your business for future success in an increasingly competitive landscape. As you continue exploring what this software has to offer, remember that each step taken towards streamlining processes brings you closer to achieving greater operational efficiency.

0 notes

Text

As Per the New Rule, How to Link Aadhaar with the IRCTC Account to Book Tatkal Tickets?

The Ministry of Railways has announced an important update for travellers. From 1st July 2025, Passengers who want to book their Tatkal tickets must have their Aadhaar verified on the official website of IRCTC.

This new rule of IRCTC ensures tight security and stops fraudulent bookings for a safe and secure journey for the genuine passengers.

While Tatkal train tickets are gone in just a few minutes, if you want your Tatkal booking faster, getting Aadhaar verified today is a smart move you can make. In this blog, you’ll be guided about:

New rule, and what do they mean?

How do you link your Aadhaar with your IRCTC profile?

Step-by-step to link Aadhaar Card

Answers to the most common questions about the latest update

Why did IRCTC make Aadhaar Linking Mandatory for Tatkal Ticket Booking System?

IRCTC has tightened Tatkal ticket booking rules to:

To reduce fake bookings & tout misuse

To speed up passenger verification

To allow passengers to pre-fill verified passenger details

Pre-Requisites

Before you proceed with linking your Aadhaar, you must have the following:

An active IRCTC account

Valid Aadhaar number

Mobile number linked to Aadhaar number

How to Link Aadhaar to IRCTC (Step-by-Step Guidance)

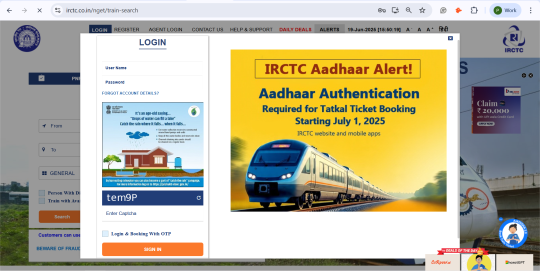

Step 1: Visit the Official Website of IRCTC www.irctc.co.in

Step 2: Go to the Menu on the top right corner.

Step 3: Click on “Log in”.

Step 4: Enter your username and login password. Enter the captcha shown below.

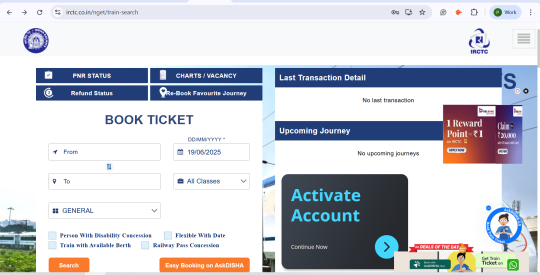

Step 5: Once you sign in, you will land on the home page. Now, click on the menu icon shown in the top right corner.

Step 6: Look for “Authenticate user” in “My Account” section.

Step 7: You will be redirected to the screen as shown below.

Step 8: Enter your 12-digit Aadhaar number. Here, your name must be written the same as on your Aadhaar Card.

Step 9: Click on “Verify Details and Receive OTP.” Note that you will only receive OTP when your name and your birthdate are matched using your aadhaar number.

Step 10: Enter the OTP received on your device and click the checkbox below to confirm the details you have entered.

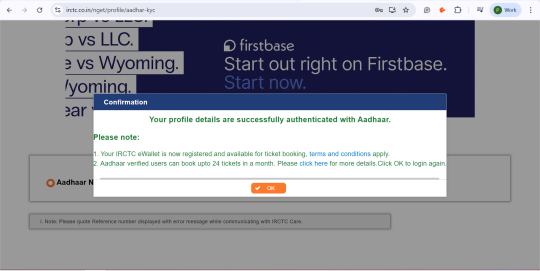

Step 11: Click on “Submit” and wait for confirmation.

How to Add Aadhaar-Verified Passengers to Your Account?

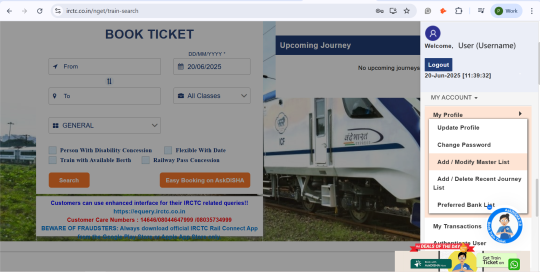

Step 1: Go to Menu > My Profile > Add/Delete Master List as shown below.

Step 2: You will be redirected to the screen shown below. Fill out the details and hit the “Submit” button.

Note: Having your master list ready in the IRCTC helps you get your tickets booked faster.

Top Tatkal Ticket Booking Tips for 2025

Log in 10–15 minutes early to avoid sudden logouts.

Use fast, stable internet while booking your tickets.

Make sure you are on mobile data for the added privacy of your data.

Pre-save payment methods and top up the IRCTC eWallet in advance.

Create and Aadhaar-verify your Master List for instant autofill.

Choose boarding or destination stations wisely for better seat availability.

Don’t waste time choosing berths. Select ‘Book’ if confirm berths are not available.

Prefer UPI or net banking over debit cards with slow OTP delivery.

Use the QuickBooks option if your Master List is set.

Stay calm, type accurately, and don’t refresh the payment page.

Frequently Asked Questions (FAQs): IRCTC Aadhaar Linking for Tatkal Booking System

Q. Is linking Aadhaar on IRCTC compulsory for Tatkal booking system in 2025?

A. It is not compulsory for all kinds of bookings. But, for Tatkal tickets, having Aadhaar-based verification is recommended for faster processing and to avoid last-minute errors.

Q. What if my Aadhaar is not linked to IRCTC?

A. You can still book tickets. Every time you wish to book tickets for you and your co-passengers, you will have to enter and verify manually each time, which can make the booking process longer.

Q. Can I book Tatkal tickets without linking Aadhaar?

A. Yes, it is possible.

Q. How many passengers can I add after linking Aadhaar?

A. A regular IRCTC account can add up to 6 passengers to the master list. If your account is Aadhaar verified, you can add up to 12 passengers.

Q. Will linking Aadhaar speed up Tatkal booking for sure?

A. Since passenger details are pre-verified. But practical speed still depends on your internet speed, payment method, and IRCTC server load. So stay prepared.

Final Thoughts

Being a citizen of India, Aadhaar-based verification is not optional, but a must-have if you wish to get your tickets booked hassle-free.This small step of Aadhaar verification is a step taken by IRCTC that enables genuine passengers to grab their Tatkal tickets without any unnecessary issues. So, don’t wait until the last minute! Link your Aadhaar today, understand the new booking flow, and travel stress-free tomorrow.

Source Link: IRCTC New Rules You Must Know Before Your Next Confirmed Train Ticket Booking

0 notes

Text

1099-K Reporting: What Every Online Seller Needs to Know

Overview

Starting with the 2024 tax year, online selling platforms began sending 1099-K forms to many more users. You don’t need to be running a full-blown business to get one anymore. Even casual sellers might find one in their mailbox this year.

And here’s the thing: the IRS gets a copy too. So if you’re not prepared, you could end up in a tax headache you never saw coming.

Let’s walk through the details so you can avoid all that.

Introduction

What Changed With the 1099-K in 2024 and 2025?

Let’s rewind a bit.

Until recently, the rule was:

You only got a 1099-K if you made $20,000 and had 200+ transactions through a third-party payment network.

That changed starting with the 2024 tax year, following IRS announcements made in late 2023 and 2024.

For the 2024 tax year, the threshold dropped to $5,000 in gross payments with no minimum transaction requirement.

For 2025, it will drop further to $2,500, again with no minimum transaction requirement.

And starting in 2026, the threshold will be $600 with no transaction minimum.

That means way more people will be affected, including folks who don’t think of themselves as “sellers” at all.

Sold a vintage guitar from your garage? You might get one.

Flipped a few items on eBay for fun? That too.

Accepted freelance payments on PayPal? You’re in.

Why Does the 1099-K Matter So Much?

Because the IRS sees it.

When you receive a 1099-K, the IRS gets a copy, which means they’re expecting to see that income on your tax return—even if you think it shouldn’t count as taxable.

This creates a big problem if:

You forgot to report it.

You think it’s not income (but don’t explain that).

You can’t back up your records.

That’s when you get flagged. And once that happens, you're dealing with notices, penalties, and extra paperwork—none of which are fun.

Bottom line: the 1099-K doesn’t mean you owe tax, but it does mean you need to be ready to explain what’s what.

Do You Have to Pay Tax on Everything Listed?

Not always.

Here’s what most people don’t realize:

The 1099-K shows gross payments before fees, returns, shipping, or costs.

So if you sold a used laptop for $400 (but you bought it years ago for $1,000), it still shows up on the form… even though it’s not taxable. That’s why tracking your original purchase price matters so much now.

But if you’re selling for profit—whether it’s digital products, vintage clothes, or freelance services—then yes, that counts as income. You’ll need to report it and deduct your expenses to avoid overpaying.

The tricky part? The IRS doesn’t know what’s taxable and what’s not. That’s on you to clarify.

What Should You Do? (Starting Now)

If this all sounds stressful, here’s the good news:

You don’t have to wait until tax season to get organized.

Here’s what to do starting today:

Separate business from personal: If you're using one PayPal account for everything—client payments, online sales, splitting dinner with friends—it’s time to open a second one just for business.

Track every transaction: Use accounting tools (even a simple spreadsheet) to log what you sold, for how much, and what you originally paid.

Save your receipts: For personal items, you’ll want to prove you sold them at a loss if that’s the case. That could keep you from paying tax you don’t actually owe.

Use software that syncs: Use accounting software like BDGAGSS, QuickBooks, Wave, FreshBooks, or others that connect to Etsy, Shopify, or PayPal, can save you hours and reduce risk.

What If You Get a 1099-K By Mistake?

This happens more often than you’d think.

Sometimes platforms issue 1099-Ks for things that aren’t income, like reimbursing a friend for concert tickets or splitting rent. If that’s the case, you can:

Contact the platform and ask for a corrected form.

Include a written explanation with your tax return.

Keep documentation showing what the payment was for.

Being proactive is your best defense. The more clarity you can offer up front, the less likely you are to hear from the IRS later.

Conclusion

The phased 1099-K threshold updates announced by the IRS starting in late 2023 and implemented in 2024 and 2025 aren’t just technical tax changes—they’re a wake-up call for online sellers everywhere.

Even if you don’t think of yourself as a business owner, the IRS might treat you like one. That means it’s time to take your records, tracking, and reporting seriously.

The sooner you adapt, the smoother your next tax season will be. No surprises. No scrambling. Just peace of mind.

Stay ahead of it now, and you’ll thank yourself later.

Blogged by: BDGAGSS

0 notes

Text

Recurring Revenue Companies: Why Investors Love Them and How to Spot the Best in 2025

In an unpredictable economy, one thing remains constant: recurring revenue is king. Whether you're a buyer looking to acquire your next asset or a founder preparing for exit, focusing on recurring revenue companies can significantly improve your ROI, business stability, and long-term scalability.

In this guide, we’ll explore what makes recurring revenue so valuable, the top industries driving this model in 2025, and how to evaluate companies built on predictable income streams.

What Is a Recurring Revenue Company?

A recurring revenue company generates consistent income through repeat transactions or ongoing subscriptions. This could be monthly, quarterly, or annually—creating reliable cash flow regardless of new customer acquisition.

Examples include:

Subscription-based SaaS platforms

Membership programs

Retainer-based service businesses

Managed IT and support services

Leasing or rental companies

Why Recurring Revenue Is So Powerful

✅ Predictable Cash Flow

Unlike one-time transactions, recurring models ensure a baseline of income every month.

✅ Easier Valuation and Acquisition

Buyers and investors pay a premium for recurring income—especially when churn is low and LTV (lifetime value) is high.

✅ Higher Lifetime Value (LTV)

If you retain clients long-term, your return on acquisition cost improves dramatically.

✅ Lower Operational Stress

Planning inventory, staffing, and growth becomes easier when income is steady and forecastable.

Primary Keyword Strategy

Primary Keyword: recurring revenue companies Long-Tail Variants: best recurring income businesses 2025, companies with monthly recurring revenue models LSI Keywords: subscription-based business, revenue predictability, scalable service models, stable income businesses, passive income opportunities

Top Industries for Recurring Revenue Models in 2025

💻 1. SaaS and Digital Tools

Cloud software for accounting, marketing, or productivity (e.g., QuickBooks, Canva, Asana)

🧑⚕️ 2. Health & Wellness

Gyms, wellness apps, meal delivery subscriptions, mental health coaching

📦 3. Ecommerce Subscriptions

Subscription boxes (e.g., beauty, food, pet supplies)

🧾 4. Managed Services & Agencies

Marketing firms, IT support, bookkeeping with monthly retainer clients

🏠 5. Property Management & Rentals

Commercial leasing, co-working memberships, vacation home rentals

How to Evaluate a Recurring Revenue Company

🔍 Revenue Breakdown

What % of revenue is recurring vs. project-based?

Are contracts month-to-month or long-term?

📉 Churn Rate

Customer retention is key. Look for churn under 5–7% monthly (or even lower annually).

💰 Customer Lifetime Value (LTV)

High LTV relative to CAC (customer acquisition cost) is a positive sign.

📈 Growth Trends

Is revenue growing steadily without excessive marketing spend?

Are upsells or product bundles increasing ARPU (average revenue per user)?

🤝 Team and Support Infrastructure

Is the model scalable with minimal hiring?

Are SOPs in place to reduce owner dependency?

Where to Find Recurring Revenue Companies for Sale

Digital acquisition platforms (e.g., Acquire.com, Flippa, FE International)

Business broker listings categorized by revenue model

LinkedIn buy-side deal groups

Industry newsletters and communities (e.g., MicroConf, SaaS Academy)

FAQs: Buying or Starting a Recurring Revenue Business

Q: Are recurring revenue companies more expensive to acquire? A: Yes, but rightfully so. Most sell for higher EBITDA multiples due to their stability and profitability.

Q: Can I build recurring revenue from scratch? A: Absolutely. Many solopreneurs launch MRR models with memberships, digital products, or consulting retainers.

Q: What’s the best way to finance a purchase? A: Seller financing, SBA loans (in the US), or partner investors are common. Banks prefer recurring models due to risk mitigation.

Q: What should I watch out for? A: Fake retention (e.g., forced contracts), underpriced tiers, high churn, or misleading revenue reporting.

Final Thought: Predictability is Power

Recurring revenue isn’t just a trend—it’s a competitive advantage. Whether you’re buying, building, or scaling a business, targeting or creating recurring revenue companies puts you on a more predictable and profitable path.

🎥 For real-world case studies and buyer success stories, subscribe to our YouTube Channel.

0 notes

Text

Empowering Modern Businesses with Secure Cloud Hosting: OneUp Networks

Oneup networks

In today’s digital landscape, businesses need more than just fast internet and good software—they need secure, reliable, and scalable IT solutions that support remote teams, streamline operations, and protect critical data. That’s where OneUp Networks comes in.

🧾 Accounting Cloud Services Built for Professionals

OneUp Networks specializes in tailored cloud solutions for accounting firms, CPAs, and financial professionals. Their robust platform supports top industry software, ensuring businesses can access their work securely—anytime, anywhere.

CPA Hosting: Perfect for accounting and bookkeeping professionals who rely on apps like Drake, QuickBooks, and Sage.

QuickBooks Hosting: Enjoy remote access, faster workflows, and enhanced data security for QuickBooks Desktop users.

QuickBooks Enterprise Hosting: Scalable and secure cloud hosting built specifically for QuickBooks Enterprise.

Sage Hosting: High-performance hosting for Sage applications, built for reliability.

Wolters Kluwer Hosting: Supporting Wolters Kluwer tax and accounting software for smooth operations.

Thomson Reuters Hosting: Fully secured cloud access to UltraTax CS and other Thomson Reuters solutions.

🛡️ IT & Cybersecurity Services You Can Trust

Cybersecurity is no longer optional—it’s essential. OneUp Networks delivers enterprise-grade security, managed backup, and full IT support services to help businesses stay protected and productive.

Cybersecurity: From vulnerability scans to threat detection, protect your business around the clock.

Virtual Desktop Infrastructure (VDI): A secure and flexible remote desktop solution ideal for hybrid and remote teams.

Managed Backup: Ensure your data is always safe with disaster recovery and automatic backups.

Managed IT Services: Comprehensive IT support for businesses that need expertise without building a full internal team.

🔍 Transparent & Trusted

With clear pricing, a powerful infrastructure, and a mission-driven team, OneUp Networks is more than a vendor—they're your technology partner.

Want to learn more about who they are? Visit their About Us page, or check out their latest blogs for expert insights.

📞 Get in Touch

If your business needs cloud hosting, cybersecurity, or IT support—Contact OneUp Networks today. Their experts are ready to help you transition to a more secure, productive digital workspace.

Tags: #CloudHosting #QuickBooksHosting #ManagedIT #Cybersecurity #RemoteWork #AccountingSoftware #TechSupport #VDI #OneUpNetworks

Let me know if you want a version tailored for another platform or with a different tone!

4o

You said:

give a description about oneup networks

ChatGPT said:

Here’s a professional description of OneUp Networks you can use for websites, social media profiles, business listings, or marketing materials:

OneUp Networks is a trusted provider of secure, cloud-based hosting and managed IT services, specializing in solutions for accounting firms, finance professionals, and small to mid-sized businesses. With a focus on reliability, performance, and cybersecurity, OneUp Networks empowers businesses to work remotely and efficiently using industry-leading applications like QuickBooks, Sage, Drake, and Thomson Reuters.

From CPA hosting to virtual desktop infrastructure (VDI), cybersecurity, and data backup, OneUp Networks delivers scalable solutions designed to support growth, protect sensitive data, and streamline operations. Their infrastructure is built on cutting-edge technology with top-tier data centers, ensuring maximum uptime and performance.

Whether you're a solo accountant or a growing enterprise, OneUp Networks offers the tools and support to help your business thrive in today’s digital-first world.

0 notes

Text

Top Salesforce Consulting Services and Partner Companies in Canada

In today’s fast-paced digital economy, managing customer relationships effectively is more critical than ever. Salesforce has become a top CRM platform, giving companies the tools they need to increase sales, improve customer satisfaction, and streamline operations. However, when companies collaborate with seasoned consulting and development professionals, Salesforce's true potential is revealed. This blog examines the state of Salesforce consulting services in Canada and highlight why Umano Logic stands out among Salesforce Partner Companies and Salesforce Development Companies in the region.

Why Businesses Need Salesforce Consulting Services

Businesses might not fully utilize Salesforce's suite of powerful tools if they don't have the proper implementation strategy. Salesforce Consulting Services benefit businesses by:

Customize and configure Salesforce to meet specific business needs

Integrate Salesforce with other systems (ERP, marketing automation, etc.)

Train employees for smooth adoption

Analyze data for actionable insights

Optimize workflows and automate repetitive tasks

Partnering with the right consultants ensures a smoother deployment and better long-term returns on your CRM investment.

The Rise of Salesforce Partners in Canada

Digital transformation has grown significantly in Canada, where businesses are looking for CRM platforms that are scalable and agile. As a result, the number of Salesforce Partners in Canada has increased, offering customized solutions to companies of all kinds. These Salesforce-certified partners provide implementation strategies that are in line with industry standards and adhere to best practices.

Whether you are a Vancouver-based business or a Toronto-based startup, there are a number of benefits to collaborating with a local partner.

In-depth understanding of regional markets and regulations

Personalized support and on-site consultations

Cost-effective services tailored for Canadian businesses

What Makes Salesforce Development Companies Valuable

Salesforce Development Companies use their technical know-how to realize that vision, while consulting lays the groundwork. These businesses enhance your CRM capabilities by creating custom apps, integrating APIs, migrating data, and creating automation tools.

Services typically include:

Custom app development on Salesforce Lightning

Apex and Visualforce coding

Integration with third-party platforms (HubSpot, Mailchimp, QuickBooks)

Custom dashboards and reporting tools

Ongoing support and optimization

Why Umano Logic is Your Trusted Salesforce Partner in Canada

At Umano Logic, we provide high-impact Salesforce consulting services by fusing in-depth domain knowledge with a client-first philosophy. As one of Canada's top Salesforce Development Companies and certified Salesforce Partners, we have provided specialized Salesforce implementations to help companies in a variety of industries, including healthcare and retail, optimize their return on investment.

What sets Umano Logic apart:

Certified Salesforce experts with years of experience

Agile project management for timely delivery

Focus on scalability, data security, and user adoption

Transparent pricing and dedicated support

Conclusion :

One of the most important steps in your digital transformation process is selecting the right Salesforce partner companies. Umano Logic provides dependable, creative, and effective Salesforce solutions in Canada, whether you require strategic consulting or practical development. Start now to increase customer satisfaction, empower your teams, and discover new efficiencies.

Visit: https://www.umanologic.ca/salesforce-list

0 notes

Text

How to Automate Your Business in 1 Hour a Week

Key Takeaways

By automating your business one hour per week, you’ll be able to make everyday processes more efficient and effective. Plus, it cuts down on busywork and prevents expensive mistakes made by employees!

Begin with the easy stuff – the repetitive, manual tasks that you can automate with intuitive, no-code tools your team is already used to using.

Start with automating low-risk processes, and thoroughly test your automations before implementing them to minimize any potential disruption or complexity.

Define clear goals and measure your time savings. By concentrating on productivity gains and performance improvements, you can make sure that your automation initiatives return genuine value.

Keep data privacy and security top of mind. Look for automated tools with established protection protocols, and make sure your staff receives ongoing training and education about safe practices!

Continue to scale your automation efforts, reinvesting the time you save into activities of greater value, while fostering a culture of teamwork and collaboration that drives continuous improvement.

Automating your business in 1 hour a week involves setting up tools and systems. These will automate your daily processes, freeing you up to spend less time on administrative chores and more on what counts.

Many small businesses in the U.S. Use easy software for emails, billing, and scheduling to cut down on manual steps. Products such as Zapier, QuickBooks, and Calendly are perfect for shops, home-based services, and offices in the local community.

Many of them operate directly from a mobile phone or laptop, with help documentation designed to be user-friendly. Begin by choosing one category—for example, communication or invoicing—and implement one new solution per week.

The second part of this post gets into the nitty-gritty with step-by-step instructions, tangible examples, and advice on selecting the right tools.

Why Automate Your Business?

Automating repetitive business tasks is one of the best ways to save both time and money. In jurisdictions such as Los Angeles, the cost of business is prohibitive. Automation is one of the main tools that allow companies to stay competitive in today’s dynamic and fierce market.

It accomplishes this by processing repetitive tasks, paving the way for teams to concentrate on more important objectives. Most people realize that with some simple tools, even an hour a week can go a long way towards helping them stay on top of things.

Save Precious Time Instantly

Take care of basic tasks such as scheduling appointments, sending reminders, or organizing documents with automation tools. That translates to business owners and staff being able to focus more time and energy on growth, not busywork.

In high-paced urban environments, time is of the essence. When multiplied by 3.6 hours saved weekly, it’s significant. …saving their teams more than 23 days annually! Some basic time-saving tools are calendar apps, auto-responders, and to-do list apps.

By listing out tasks that need to be done repeatedly, you can easily recognize which tasks to automate first.

Cut Down Repetitive Tasks

So jobs such as data entry, sending standard emails, or updating spreadsheets occur over and over again. More than 40% of workers spend at least 25% of their work week on such tasks.

Automating responses with straightforward workflows or email templates liberates a team’s efforts from performing the same task every day. By listing out these jobs we can get a better idea of what jobs stand to benefit the most from automation.

Reduce Costly Human Errors

Automated systems are far more effective at detecting errors. Machines produce errors at a rate of 1 to 4.1 errors per 10,000 data entries compared to 100 to 400 for humans.

That’s millions more dollars not lost to errors—more than $12.9 million on average for bad data! Tools with built-in double checks and educating staff on the importance of avoiding these errors can help prevent disasters.

Improve Team Productivity Now

With reduced busywork, your teams will have more time to work on high-value capital projects. According to McKinsey Global Institute, 44% of workers report that automation allows them to focus on higher value tasks.

Establish objectives, measure baseline and post-implementation, utilize collaborative tools that improve team productivity. Automated messages or project updates help teams stay in sync.

Boost Customer Satisfaction Easily

Quick responses are important. With automation, you can immediately respond to every customer inquiry and automatically follow up as needed.

Targeted messages – Personalized emails and satisfaction surveys show customers you value their feedback. This provides you glowing reviews and repeat business.

Identify Quick Automation Wins

Identifying quick wins with automation begins with an audit of your existing process. Examine every step and identify areas that bottleneck your department. Tackle first those tasks that take up the most time.

For example, many businesses lose up to 10 hours every week on simple, repeated tasks—like sending the same reminder emails or restarting a device. These are perfect opportunities for quick automation wins.

Pinpoint Your Biggest Time Sinks

Measure the time it takes to complete each task. Utilize simple time-tracking tools such as Toggl or Harvest to help visualize where time is spent.

Break it down—maybe you see that filling in client forms or posting podcast updates eats a chunk of your week. Discuss with your team and determine buy-in. This gives a reasonable gauge to identify the true time-sinks.

Look for Simple, Repeatable Steps

Look for work where there are clear, repeatable steps. Map these out in a workflow diagram to visualize the process and prevent confusion.

Creating a reminder email every week, or developing a cadence for social media posts—those are simple, repeatable steps. When there’s a simple step to automate, put that task at the top of your list. As you can imagine, it doesn’t take much to update each time!

Start with Low-Risk Processes

Start with low-risk processes that the organization can survive an initial failure on. Start small and test your automation ideas within a single department or between just two small teams.

It is important to document what transpired in the process so you can learn from it. Prove your savings of time and money—be it $3,000 in savings from reducing print alone!

Ask Your Team for Ideas

Conduct team-wide discussions to generate automation ideas. For those more introverted members of your team, consider using an anonymous box.

Maintain a running list of all suggestions, regardless of scale. This opens up additional areas to find time and cost savings.

Your 1-Hour Weekly Automation Plan

Sign up now! Just one hour a week dedicated to automation can literally change the game for your business. You’ll be amazed at the tangible improvements you’ll start to experience! A lot of folks assume automation is too time intensive or intimidating. Once you turn it into a weekly bite-sized plan, it’s completely manageable!

Creating a one-hour plan allows you to put your attention toward achievable wins. This prevents tasks from building up, plus you start to notice incremental results much quicker. Eliminate the busy work that is draining your productivity! You’ll discover additional time by eliminating activities such as emailing the same report repeatedly or tracking action items manually.

With a plan, you can identify where you’re wasting time, determine the most effective solutions to implement, and achieve consistent progress over time. Soon, each week you find it easier to hit the ground running. Here’s how to create the most value during your one hour per week.

1. Choose One Small Task Weekly

Pick One Small Task to Automate per Week. This makes it manageable and prevents you from getting overwhelmed or paralyzed by a large undertaking. Once you’ve chosen a task, the best place to begin is with the tasks you already do daily or weekly. Consider automating appointment bookings, reminder texts, or extracting reports for customers!

As an example, if you currently spend an hour every Monday finding and compiling weekly stats, automate a report to do that. Make sure to review the outcome of last week’s item before deciding on your next one. When you’ve completed one automation successfully, choose the next one on your priority list.

If something could use some adjusting, make that part of your hour to come up with a solution. Maintain a running list of tasks that consume time in 10-minute bites. Imagine confirmation emails, invoice reminders, or social media outreach! Keep a record of what you accomplish weekly, either in an easy spreadsheet or using a task management software. This accurately reflects your victories and what still needs to be done.

2. Map the Current Workflow Simply

You can’t automate what you can’t identify, and first you should find out how your time is spent. 2. Outline the Existing Workflow in Detail. You can do this with a whiteboard, sticky notes, or an easy, no-cost flowchart program such as Lucidchart.

Begin with one business process—perhaps the way you process a client application paper form or the way you generate and deliver weekly reports. Map the existing workflow in order to simplify it. Document clearly who is responsible for each action and their due dates.

This allows you to identify steps that are redundant or create bottlenecks. Distribute these workflow maps to your team. Someone else will be able to spot workarounds you don’t notice or tell you quicker methods to operate new technology. Once everyone has the same map in front of them, it’s easier to get buy-in.

With a little cooperation, you can all help each other to ease the administrative burden!

3. Select a Simple Automation Tool

Consider solutions that seamlessly integrate with your current systems, especially if you’re focused on business process automation. For instance, if you’re based in Los Angeles and fully utilizing G Suite, platforms like Zapier or Make (formerly Integromat) are excellent options. On the other hand, if your organization heavily uses Microsoft products, Power Automate might be a better cultural fit for automating business processes.

Look for features such as templates for email marketing and drag-and-drop funnel creation. Additionally, assess how easily the process automation tool can integrate into your CRM or project management tools. Specific functionalities like periodic reports, auto-generated emails, or syncing tasks between different tools can enhance your workflow automation.

Review tools side-by-side and ask questions like: Can they send emails at set times? Can they integrate with my client management system? Choose tools that are easy to implement and require minimal technical skills. When in doubt, check online reviews or consult your professional network about successful business automation strategies.

4. Set Up the Basic Automation

Set Up the Basic Automation. For instance, create a basic automation that triggers a welcome email whenever a new client submits a form. Most tools walk you through steps—choose your trigger (like a new form entry), pick the action (send an email), and set the message.

Follow the step-by-step guide that your tool provides and don’t get caught up in the bells and whistles at this point. Take notes of the steps you took, or capture the screen. This is helpful to document to share with the team, or revisit and update if you need to in the future.

Having documentation of the setup makes it easier for new team members to come up to speed. You’ll want to test your setup by running it through a real scenario. Was that email successfully sent? Timing of the report release? If it doesn’t, retrace your steps and correct things where you missed the mark.

5. Test Your New Automated Flow

Test Your New Automated Flow. 5. Run your automated flow and observe the results. You may realize that you forgot to add a step, or that the timing needs to be adjusted. Solicit input from whoever else is utilizing the workflow. They’ll catch what you overlook, though!

For instance, they might intercept an email that arrives to the wrong inbox or a report that leaves out an important point. Develop a to-do list of items to test. Your emails are sent, reports are on schedule, and the data is accurate!

Take your hour to debug or adjust things as needed. The ideal outcome here is for the process to be smooth enough for you not to need to intervene each time an issue arises.

6. Tweak Based on Early Results

After you’ve completed your first run through, analyze what worked and what didn’t. Through it all, you saved how much time exactly? Anyone have a bad experience with the new configuration? This is where you can make some small tweaks to optimize.

Perhaps you rework the content of an email to be more informative or adjust the timing of a report to receive it sooner. Maintain a log of what you fix and why. This allows you to monitor what’s performing well.

It gives you a historical record should you ever need to roll back a change. Continue to review each automation every few weeks to determine if the automation still meets your needs as your business expands.

7. Document Your Quick Setup

Clear documentation helps their new teammates succeed, too. 7 Document Your Quick Setup. Outline the process you followed, what apps worked best, and how to troubleshoot potential issues. Include advice or capture images whenever possible.

Send this to your colleagues so other people can replicate successful approaches or troubleshoot problems in the meantime without having to be trained. Create a short doc to get them up and running or using the automations immediately. This fosters a much more cohesive team and reduces onboarding time.

8. Plan Next Week’s Tiny Task

Take a few minutes at the end of your hour to think about what you accomplished. Review your ongoing list and decide what the next task is that you want to tackle. Solicit your staff’s feedback on what would be most useful to them.

Schedule in the next session on your calendar, and continue making it a regular occurrence. Having a list of upcoming tasks means you’ll never be at a loss for what to do next. You won’t be left spinning your wheels trying to figure out what you should start with!

Choose the Right Simple Tools

To prepare your business for automation with as little as one hour a week, begin by choosing the right simple tools. Be sure they’re appropriate for you! The right simple tools can save you hours of time, minimize errors, and allow you to accomplish more with less effort.

Most find that they are saving more than ten hours per week right away. They do this by automating repetitive tasks such as data entry, email responses, or appointment scheduling. This allows you to spend your time only on the areas of your business that require your attention the most.

Focus on User-Friendly Software

Focus on user-friendly software. Software with user-friendly interfaces and built-in tutorials ensures an easy onboarding process, even for those lacking technical expertise. Robust support, such as live chat or comprehensive FAQs, will aid in quick resolution of issues.

Don’t take their word for it. Before you buy, try out the tool with a demo or free trial. Survey your staff to see how they feel about the change after the first week. Their perspective is invaluable and can help determine which tools actually facilitate progress and which ones hinder it.

Explore No-Code/Low-Code Options

Platforms such as Zapier or Airtable allow you to configure automations without a single line of code. This is great for small businesses that don’t have a lot of time to roll things out. Experiment with no-code tools, such as for sending automated follow-up emails or tracking new leads through a customized form.

Do your research and compile a list of tools that fit your team’s needs. Save them for everyone to experiment with on their own projects!

Consider Free or Freemium Plans

Consider Free or Freemium Plans. Many automation tools we mentioned have free versions, like Trello or Mailchimp. These are great ways to test features before committing payment wise. Review what features are included and which aren’t, so you can determine if the free plan will meet your needs.

Test a couple out and determine which one most effectively accomplishes the task.

Check Integration Capabilities Easily

Choose solutions that will seamlessly integrate with your existing tools and software. Create a short list of the applications you want to integrate���such as your event calendar, CRM, or accounting package.

As you navigate your trial, pay attention to how intuitive it is to connect it all together, and make note of which options integrate seamlessly with your other tools.

Prioritize Tools You Already Use

Prioritize Tools You Already Use. Choose the apps your team is already familiar with, such as Google Workspace or Slack. Third, most popular apps today—including GIS—have built-in automation tools that are underutilized at best.

Compile a prioritized list of these tasks. Next, figure out what processes you can automate further, such as sorting emails automatically or scheduling reminders. Allow your staff to recommend modifications with a focus on what they’re using the most.

Measure Your Automation Impact

Learn how to get the most from automating your business. Measure your automation impact in one hour a week or less.

Getting started tracking what’s new is essential. Providing clear measures will go a long way to illustrate what’s working, where progress is slowing, and the value that automation is bringing. Effective tracking can reveal significant savings, improve staff morale, and ensure your team remains engaged and aligned with automation tools.

Track Time Saved Each Week

It helps to begin by knowing how long routine tasks take prior to implementing automation. Utilize easy-to-use time-tracking software or a simple spreadsheet.

This is often as much as 30% less time spent on repeat tasks. With weekly reports, these trends really pop, illustrating time saved in reality. Encourage your staff to track their time. Others discover that time-tracking apps, such as Toggl or Clockify, seamlessly integrate into their workflow.

Monitor Task Completion Rates

Monitor completion rates, manual vs. Automated. Create a dashboard, perhaps using something like Google Data Studio, to visualize these metrics so they are readily accessible.

Establish explicit benchmarks, and you’ll be able to tell if automation is making the grade. Then, week after week, as you view this progress, see if you can identify patterns or a slow-down that will require a course correction.

Calculate Simple Return on Investment

This adds up savings from reduced time and errors. Use a simple formula—Cost Saved/Cost Spent on Automation.

Start tracking these figures as a baseline. Disseminate the actual impact to everyone who should see it! This is extremely helpful when looking to plan future upgrades or more substantial changes.

Gather Feedback from Your Team

Gather feedback from your team. Distribute anonymous surveys and have lunch-and-learn type meetings to discuss what’s going well and what’s not.

Maintain a running list of feedback and use these to inform your future actions.

Adjust Based on Performance Data

Measure performance metrics regularly. Change your approach when you identify a bottleneck.

Document each adjustment and share lessons learned, so all stakeholders continue to be informed and aligned.

Avoid Common Automation Pitfalls

No matter how sophisticated the automation software, AI can lead to disaster if mismanaged. Businesses in funding hubs such as Los Angeles face distinct hurdles—from rapid expansion to fluctuating technology requirements—making business process automation crucial. By avoiding these key pitfalls, teams can prevent unnecessary time, money, and hassle.

Don't Overcomplicate Things Early

Don’t overcomplicate things too soon and begin with the basics. We see this as businesses dive into large systems only to find themselves ironically spending more hours maintaining them.

An automation checklist will help ensure automation stays simple and straightforward. Take note of what went well and what didn’t. Share these highlights with your team so your whole crew is clear on what to go after.

Even small wins, such as automating a simple email follow-up, have immediate, clear outcomes.

Avoid Automating Broken Processes

Clean up your house before you turn on automation. If a workflow is broken, automating it will only break it faster. For instance, if your invoice approvals take forever due to missing steps, repair that process before automating it.

Make a list of processes that should be improved. Give your team a chance to help identify weak points so important details don’t fall through the cracks. In this manner, you achieve optimal outcomes when you automate.

Set Realistic Expectations Now

Automation does save time, but it’s not magic in a can. Have conversations with your team about what’s feasible to change and the kind of timeline that it requires.

Document Specific Outcomes as you begin the process. Develop a beautiful, simple, easy-to-understand roadmap and timeline that outlines steps and goals. Patience pays off—steady progress beats quick burnout.

Remember the Human Touch Matters

There is still an appetite among the people for honest, actual help. Identify when a call or text from a human being is needed, such as for complex billing inquiries.

Consider how to ensure easy intervention from staff when appropriate. Allow your communications staff to customize automated responses to be friendlier or more engaging.

Test Before Going Fully Live

Don’t go all-in on the hot new tool right away. Keep track of what is successful and what should be improved.

Create a test checklist and engage staff to provide input. It may take a little longer initially, but addressing issues from the start saves a lot more time later.

Keep Your Automated Data Safe

When you begin configuring business automation, protecting your data should be top priority. Select tools that have robust security certifications. Protecting this is critically important, particularly if you keep files on the go, or share sensitive information!

For automated data transfers, security protocols must be established beforehand. File transfer management software and custom file transfer scripts help make sure your files get where they’re going. They accomplish this task without leaks and without loss of data.

Whether it’s that some tools aren’t capable of supporting all types of file transfers, or they don’t integrate smoothly with your other applications. Doing that can put your data at risk and slow you down.

Understand Tool Security Features

As a rule of thumb, always seek automation platforms that openly share their security measures. Look for features like encrypted transfers, strong user authentication, and audit logs.

Write out the security features each tool has, and develop a checklist. Implement automation tools security practices. Regularly revisit your automation tools’ security settings.

File transfer security is further improved when using bi-directional integrations. Second, they save a lot of manual labor that can lead to data loss and increased error rates from manual hand-offs.

Follow Data Privacy Best Practices

Ensure your enterprise adopts a data privacy policy that complies with your automation strategy. Write down what regulations you have to comply with in terms of customer or company data.

Create and implement a data minimization best practices checklist—such as only collecting information that is absolutely required, ensuring data is encrypted, and removing outdated information immediately.

Regularly disseminate information and educate your team on privacy regulations, maintaining awareness among all involved parties as to what is required.

Use Strong Access Controls Always

Use strong access controls always. Protect your automated data from prying eyes or meddling hands. Document who on your team has which permissions in your automation tools.

It’s a good idea to audit these permissions every so often. Discuss the importance of access controls with your employees so they can better protect data.

Scaling Your Automation Efforts

It may seem like small potatoes, but building automation into your business step by step can make a tremendous impact. As a business scales, previously manageable manual processes become bottlenecks or introduce errors that frustrate customers.

Nevertheless, with as little as an hour a week, you will begin to experience tangible benefits. Begin by selecting one or two activities—for example, email follow-ups or appointment bookings—to automate and test out. Automation has helped a lot of small businesses realize time savings of more than 10 hours per week on these tasks.

That translates to more time and energy for what matters most.

Build on Weekly Successes Slowly

Every time you implement a new automation, make a note of what’s effective and what is not. Document the time saved and the issues that arose. When a new process is going well, think about how you can implement that process elsewhere in your business.

Perhaps your staff saves ten hours a week automating social media posts—let other leaders know so they can do it, too. Keeping simple records of these wins goes a long way to ensure everyone’s still on the same page while inspiring further ideas.

Connect Different Automated Tasks

Connect different automated tasks. Find ways that your automations can connect with each other. If a new customer registers, their information can immediately flow into your email list.

This simple action will send them a welcome message with no further action required on your part! Map out these connections in a diagram so your team can visualize the big picture. This allows you to identify any holes, as well as demonstrate where additional time savings can be achieved.

Reinvest Saved Time Strategically

Reinvest saved time strategically. Don’t just look at the hours saved by automating a task. Perhaps that looks like devoting extra hours to customer service or expanding your operations in innovative directions.

Create a running list of new initiatives that can benefit from the additional time. Solicit ideas from the team, as well. In the long run, all these processes compound. One small business saved 12 hours a week and increased their business by 40% in just six months!

Conclusion

To make your business a lot more enjoyable and a lot more profitable, set aside no more than one hour a week. Organize your processes, choose solutions that are right-sized for you, and measure success. Test it on a small scale, such as automated email responses or order tracking messages. Choose tools that are compatible with your existing ecosystem – Zapier, QuickBooks, and Slack are all great examples. Monitor your metrics closely, and adjust as you proceed. Be aware of dangerous practices, and don’t allow shortcuts to catch you off guard. Once you start to understand the process, expand your automation process little by little. Many of those little shops LA that came up this route and are now saving 10-20 hours a week. Looking to automate your business in just one hour a week? Begin now with small steps and allow the hours to accumulate.

0 notes

Text

Top Financial Management Tools to Keep Your Business on Track

Cflow is widely recognized for its ability to streamline workflows and automate tasks, but it's also crucial to integrate strong financial management tools into your business processes. Managing your finances efficiently ensures that your business can stay on track, make informed decisions, and grow sustainably.

In this blog, we’ll explore the top financial management tools, including Cflow, that can help you keep your business finances organized, secure, and ready for success.

Top Financial Management Tools for Businesses

Here’s a list of some of the best financial management tools available today, each offering unique features to meet different business needs:

1. Cflow - Automating Financial Workflows

Cflow is a workflow automation platform that can be customized to streamline your financial processes. While primarily a workflow tool, Cflow allows you to integrate financial data into your workflows, ensuring that everything from invoice approvals to budget tracking is done efficiently. It’s perfect for businesses that want to improve their internal processes and align their financial management with overall operations.

Key features include:

Workflow automation for financial tasks (e.g., expense approvals).

Seamless integration with other financial tools.

Real-time tracking and reporting.

2. QuickBooks

QuickBooks is one of the most popular accounting tools for small and mid-sized businesses. It offers:

Expense tracking.

Invoice generation.

Payroll management.

Tax preparation assistance. QuickBooks integrates with many other business tools, making it a convenient all-in-one solution for managing day-to-day finances.

3. Xero

Xero is known for its intuitive design and robust cloud-based features. It provides:

Real-time cash flow tracking.

Easy invoicing and billing.

Bank reconciliation automation.

Seamless collaboration with accountants and bookkeepers. Xero is an excellent choice for businesses seeking a user-friendly yet powerful financial management platform.

4. FreshBooks

FreshBooks is ideal for service-based businesses and freelancers. It specializes in:

Time tracking.

Client invoicing.

Expense organization.

Online payment acceptance. FreshBooks simplifies financial management for those who need fast, easy-to-use solutions without complicated features.

5. Zoho Books

Zoho Books is part of the larger Zoho ecosystem and is a great fit for growing businesses. Features include:

Automated workflows.

Recurring invoices.

Project tracking.

Multi-currency handling. Zoho Books integrates well with other Zoho apps, making it perfect for businesses already using the Zoho suite.

6. Wave

Wave offers free financial management software, making it a top choice for startups and small businesses with tight budgets. It includes:

Accounting and invoicing tools.

Receipt scanning.

Basic payroll features (paid add-on). Wave is simple, reliable, and perfect for businesses just getting started.

Key Features to Look For in a Financial Management Tool

Choosing the right tool depends on your specific business needs. However, some key features to prioritize include:

Ease of use: Tools should simplify your work, not complicate it.

Integration capabilities: Look for tools that connect easily with your CRM, payroll, or project management systems.

Scalability: Choose a solution that can grow with your business.

Security: Financial data must be protected with the highest standards of encryption and compliance.

Reporting and analytics: Good financial management tools offer detailed insights that help you make smarter business decisions.

How Financial Management Tools Keep Your Business on Track

The right tools do more than just automate tasks — they empower businesses to:

Stay organized and minimize errors.

Gain real-time visibility into financial health.

Plan and allocate resources more effectively.

Avoid costly compliance mistakes.

Build confidence among stakeholders and investors.

By investing in financial management software, businesses can focus more on strategic growth rather than getting bogged down in manual accounting tasks.

youtube

Final Thoughts

Staying on top of your finances is critical for business success. With the right financial management tools, such as Cflow for workflow automation and others like QuickBooks and Xero for accounting, you can streamline operations, improve decision-making, and position your business for sustainable growth.

Whether you're a startup, a growing company, or an established enterprise, there’s a financial tool that fits your needs. Evaluate your options carefully and choose the one that best supports your goals.

SITES WE SUPPORT

AI Work force Screen

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

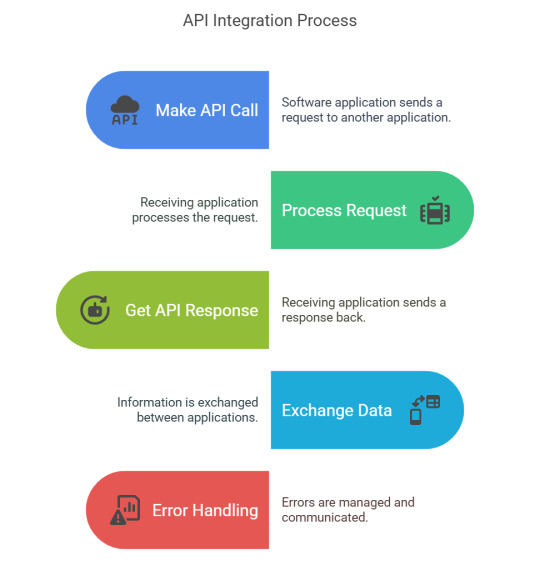

Simple No-Code Guide to API Integrations for Non-Technical Users

If you’re not a developer, the term "API integration" might sound intimidating. But here’s the good news: you don’t need to know how to code to make different apps talk to each other. Thanks to no-code integration platforms like Konnectify, automating workflows and syncing data is now easier than ever.

What is an API? (And Why Should You Care?)

An API (Application Programming Interface) is like a digital messenger that helps different applications exchange information. Every time you:

✔️ Check the weather on your phone ✔️ Pay for something online with PayPal ✔️ Receive a Slack notification about a new email

An API is working in the background, connecting systems and transferring data in real time.

Example: When you book a flight online, the travel website doesn’t store flight data. Instead, it calls airline APIs to fetch the latest seat availability and pricing, then displays it on your screen.

What is API Integration?

API integration is simply connecting two or more apps so they can share data automatically—no manual input needed.

🔹 Example: Running an online store? Connect Shopify with a payment gateway like PayPal or Stripe so that transactions process instantly.

Without API integration, you’d have to manually update orders, payments, and inventory, wasting hours. With API automation, everything happens seamlessly.

Why API Integrations Matter

Businesses of all sizes rely on APIs to streamline operations and boost efficiency. Here’s why:

✅ Automation – Reduces repetitive tasks (no more copy-pasting data) ✅ Data Syncing – Ensures consistency across platforms (no outdated info) ✅ Better User Experience – Faster, smoother interactions for customers ✅ Scalability – Easily handle business growth without extra manual work

But there’s one problem…

Why API Integrations Were Hard (Until Now)

For years, API integration required developers and custom coding. Non-technical users had to deal with:

❌ Confusing API documentation ❌ Complex authentication protocols ❌ Security & data management headaches

That meant businesses either hired developers or struggled with manual work. But not anymore.

No-Code API Integration: The Game-Changer

No-code platforms like Konnectify are changing the game.

They let anyone—marketers, business owners, or sales teams—connect apps without coding.

💡 Think of it like LEGO: You drag and drop blocks (apps), set up rules (triggers & actions), and let the automation do its thing.

How No-Code API Integration Works (Simple Breakdown)

1️⃣ Choose the Apps You Want to Connect (e.g., Shopify + QuickBooks) 2️⃣ Define Triggers & Actions (e.g., "When a new Shopify order comes in, add it to QuickBooks") 3️⃣ Drag, Drop, and Connect – No coding, just automation

Example: If someone subscribes to your email list, a no-code platform can: ✔️ Add them to Mailchimp ✔️ Create a new customer record in HubSpot ✔️ Send a welcome message via Slack

All automatically, without you touching a thing.

Best No-Code API Integration Platform: Konnectify

Among no-code platforms, Konnectify stands out as a powerful yet easy-to-use tool for connecting your apps.

🚀 Why Choose Konnectify? 🔹 Drag-and-Drop Interface – Build workflows visually 🔹 Pre-Built Templates – No need to start from scratch 🔹 100+ Integrations – Connect CRM, finance, marketing, and support tools 🔹 Real-Time Data Sync – Instantly updates across all connected apps 🔹 User-Friendly Dashboard – Monitor and manage integrations easily

For non-tech users, Konnectify is the simplest way to automate your workflows without relying on developers.

Real-World Use Cases: How Businesses Use API Integration

📩 1. Marketing Automation

Connect Mailchimp + HubSpot → Sync leads & send personalized emails

Auto-trigger email sequences based on user behavior

🛒 2. E-Commerce & Inventory Management

Sync Shopify + QuickBooks → Auto-update sales & inventory

Link WooCommerce + ShipStation → Automate shipping updates

🎧 3. Customer Support Optimization

Integrate Zendesk + Slack → Get real-time support notifications

Sync Intercom + CRM → Auto-log customer interactions

📊 4. Finance & Accounting Automation

Connect Stripe + Xero → Auto-generate invoices

Sync PayPal + QuickBooks → Automate revenue tracking

📈 5. Lead & Sales Tracking

Link Google Ads + Google Sheets → Auto-track lead data

Connect Facebook Ads + CRM → Route leads to sales teams instantly

With no-code API integration, businesses save time, money, and effort by eliminating manual processes.

How to Get Started with No-Code API Integration

1️⃣ Identify Your Integration Needs – What apps do you need to connect? 2️⃣ Choose a No-Code Platform – Konnectify is an excellent choice. 3️⃣ Design Workflows Visually – Use a drag-and-drop interface to set up triggers & actions. 4️⃣ Test & Launch – Make sure everything works smoothly. 5️⃣ Monitor & Optimize – Regularly check your integrations and tweak them as needed.

Final Thoughts: The Future of API Integration

API integration is no longer just for developers. No-code platforms like Konnectify have made it accessible to everyone—business owners, marketers, and even freelancers.

If you’re still manually transferring data, you’re wasting valuable time.

💡 The smartest businesses are automating. Are you?

📖 Read the full guide here: API Integration for Non-Technical People

🚀 Start automating today with Konnectify—the easiest no-code API integration platform.

#saas#saas development company#saas platform#saas technology#software development#it services#information technology#ipaas#b2b saas#software

0 notes

Link

0 notes

Text

How to Choose the Best Real Estate CRM Software for Your Business in Dubai

How to Choose the Best Real Estate CRM Software for Your Business in Dubai

Dubai's real estate market is dynamic and highly competitive, requiring businesses to manage customer relationships efficiently. A robust Real Estate Customer Relationship Management (CRM) software can streamline operations, enhance customer engagement, and drive sales. However, selecting the best CRM software for your real estate business in Dubai requires careful consideration of several factors. Here’s a comprehensive guide to help you make an informed decision.

1. Identify Your Business Needs

Before choosing a CRM, assess your business requirements. Are you primarily managing property sales, rentals, or both? Do you need automation for lead generation, follow-ups, and reporting? Identifying these needs helps in selecting a CRM tailored to your business model.

2. Look for Real Estate-Specific Features

Not all CRMs are built for real estate businesses. Ensure the software includes essential features such as:

Lead Management – Capture and track leads from multiple sources.

Property Listings Integration – Sync with property portals like Bayut and Dubizzle.

Automated Follow-Ups – Schedule reminders and emails for potential clients.

Contract and Document Management – Store and manage agreements digitally.

Financial Tracking – Monitor payments, commissions, and transactions.

3. Cloud-Based vs. On-Premises Solution

Dubai’s real estate market moves fast, so accessibility is key. A cloud-based CRM offers flexibility, allowing agents to access data on the go. On-premises solutions, while offering more control, require IT infrastructure and maintenance. Choose one that aligns with your operational needs.

4. Integration Capabilities

Your CRM should seamlessly integrate with other tools, such as:

Accounting Software (e.g., QuickBooks, Xero)

Marketing Platforms (e.g., Mailchimp, Google Ads)

Communication Tools (e.g., WhatsApp, SMS gateways)

Real Estate Portals for automated property listings

5. Ease of Use and Customization

A complex CRM can slow down operations instead of improving them. Opt for user-friendly software with an intuitive interface. Additionally, customization options should allow you to modify workflows, reports, and dashboards to match your business processes.

6. Mobile Accessibility

Dubai’s real estate professionals are constantly on the move. A CRM with a mobile app ensures agents can update property details, track leads, and communicate with clients from anywhere.

7. Compliance with UAE Real Estate Regulations

Ensure the CRM complies with Dubai’s real estate regulations, including RERA (Real Estate Regulatory Agency) guidelines. Features like secure document management and compliance tracking can prevent legal issues.

8. Customer Support and Training

Opt for a CRM provider that offers reliable customer support and training. A software with 24/7 assistance, live chat, and training sessions ensures smooth adoption and troubleshooting.

9. Pricing and Scalability

Compare pricing plans and ensure the CRM offers good value for money. Consider software that can scale with your business, accommodating more users and properties as you grow.

10. Reviews and Testimonials

Check user reviews and testimonials to gauge customer satisfaction. Look for case studies of real estate firms in Dubai successfully using the CRM to ensure its reliability.

Final Thoughts

Choosing the best Real Estate Management software Dubai is a crucial step toward enhancing customer relationships, optimizing operations, and boosting sales. By evaluating your business needs, ensuring essential features, and considering integration, compliance, and scalability, you can invest in a CRM that drives success in Dubai’s competitive property market.

Looking for the right Real Estate CRM software? Explore top solutions tailored for Dubai’s real estate industry today!

0 notes

Text

Improving Design and Budget Accuracy with Estimating Software

In the construction industry, precise cost estimation and streamlined project management are crucial for success. Estimating software offers architects and contractors an efficient way to plan, budget, and execute projects, particularly when working with small businesses. Utilizing these tools, a contractor for a small business can simplify complex processes and enhance collaboration, ensuring that projects stay on track and within budget.

For those specializing in design, chief architect, and other professionals, estimating software integrates seamlessly into workflows, providing data-driven solutions to meet client expectations effectively.

Benefits of Estimating Software for Contractors

1. Accurate Cost Estimates

One of the most significant advantages of contractor software is its ability to generate precise cost estimates. With access to databases containing thousands of cost items and real-time updates, contractors can create detailed budgets that account for labor, materials, and location-specific pricing. This accuracy helps avoid unexpected expenses and builds client trust.

2. Improved Project Planning

Estimating software allows contractors to map out project timelines, allocate resources, and foresee potential challenges. Features like area-specific cost adjustments and integration with scheduling systems ensure that every aspect of the project is carefully planned and executed.

3. Enhanced Efficiency

Manual calculations are time-consuming and prone to mistakes. Rapid Estimating Software used by a contractor working for a small business automates these processes, enabling contractors to focus on delivering quality work rather than managing spreadsheets. The ability to import material lists and export data to tools like QuickBooks further streamlines operations.

4. Better Communication with Clients

Transparent and professional estimates improve communication between contractors and clients. By presenting detailed breakdowns of costs and timelines, contractors can address client concerns proactively, ensuring satisfaction from the outset.

How Estimating Software Supports Chief Architects

1. Seamless Material Integration

For architects working on intricate designs, the ability to import material lists directly into estimating software is a game-changer. This feature saves time, reduces errors, and ensures that project budgets align with the design specifications.

2. Access to Comprehensive Databases

Architects can benefit from software features like built-in cost databases for residential, commercial, and remodeling projects. These resources provide accurate, location-specific cost data, helping architects design within their client’s budget constraints.

3. Collaborative Workflows

Designing and building require close collaboration between architects and contractors. Estimating software bridges this gap by enabling both parties to work from the same data sets, ensuring alignment on costs, materials, and timelines. This shared understanding leads to smoother project execution.

Key Features of Estimating Software

Cost Databases: Access to over 37,000 cost items with updates tailored to zip codes ensures accurate estimates.

Pre-Built Assemblies: Streamlined design and estimation processes using ready-made templates for various project types.

Integration with Tools: Export capabilities to scheduling systems and financial tools like QuickBooks improve overall efficiency.

Customization Options: Adjust labor rates, area modifiers, and user databases to meet unique project needs.

Why Small Businesses Benefit the Most

Small businesses often operate with limited aids and tight budgets, making efficiency a priority. Contractor software for small businesses offers these companies an affordable way to enhance project planning and execution without requiring extensive manpower.

1. Cost Savings

By generating accurate estimates and reducing errors, the software minimizes unnecessary expenses. It also helps small businesses stay competitive by enabling them to deliver high-quality work within budget.

2. Scalability

As small businesses grow, estimating software can scale with them, offering features that adapt to larger projects and more complex requirements.

3. Professionalism

Providing clients with polished, detailed estimates reflects positively on the business, helping establish trust and credibility in the market.

Conclusion