Text

DIGIPIN is a smart, shareable pin based on your location for your address that helps find the right places within the right timeframe.

0 notes

Text

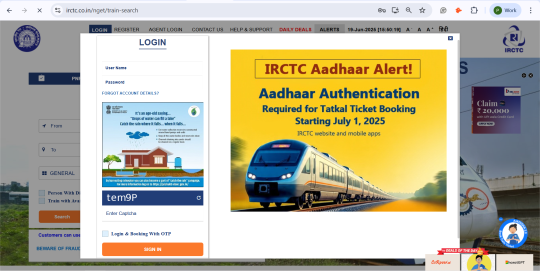

As Per the New Rule, How to Link Aadhaar with the IRCTC Account to Book Tatkal Tickets?

The Ministry of Railways has announced an important update for travellers. From 1st July 2025, Passengers who want to book their Tatkal tickets must have their Aadhaar verified on the official website of IRCTC.

This new rule of IRCTC ensures tight security and stops fraudulent bookings for a safe and secure journey for the genuine passengers.

While Tatkal train tickets are gone in just a few minutes, if you want your Tatkal booking faster, getting Aadhaar verified today is a smart move you can make. In this blog, you’ll be guided about:

New rule, and what do they mean?

How do you link your Aadhaar with your IRCTC profile?

Step-by-step to link Aadhaar Card

Answers to the most common questions about the latest update

Why did IRCTC make Aadhaar Linking Mandatory for Tatkal Ticket Booking System?

IRCTC has tightened Tatkal ticket booking rules to:

To reduce fake bookings & tout misuse

To speed up passenger verification

To allow passengers to pre-fill verified passenger details

Pre-Requisites

Before you proceed with linking your Aadhaar, you must have the following:

An active IRCTC account

Valid Aadhaar number

Mobile number linked to Aadhaar number

How to Link Aadhaar to IRCTC (Step-by-Step Guidance)

Step 1: Visit the Official Website of IRCTC www.irctc.co.in

Step 2: Go to the Menu on the top right corner.

Step 3: Click on “Log in”.

Step 4: Enter your username and login password. Enter the captcha shown below.

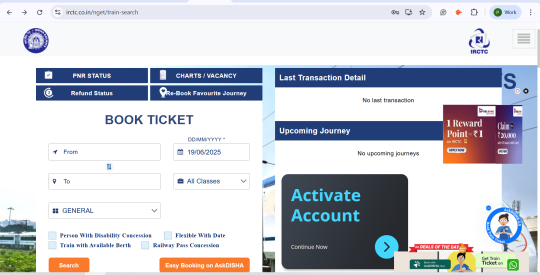

Step 5: Once you sign in, you will land on the home page. Now, click on the menu icon shown in the top right corner.

Step 6: Look for “Authenticate user” in “My Account” section.

Step 7: You will be redirected to the screen as shown below.

Step 8: Enter your 12-digit Aadhaar number. Here, your name must be written the same as on your Aadhaar Card.

Step 9: Click on “Verify Details and Receive OTP.” Note that you will only receive OTP when your name and your birthdate are matched using your aadhaar number.

Step 10: Enter the OTP received on your device and click the checkbox below to confirm the details you have entered.

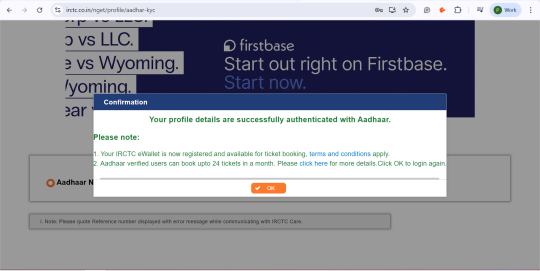

Step 11: Click on “Submit” and wait for confirmation.

How to Add Aadhaar-Verified Passengers to Your Account?

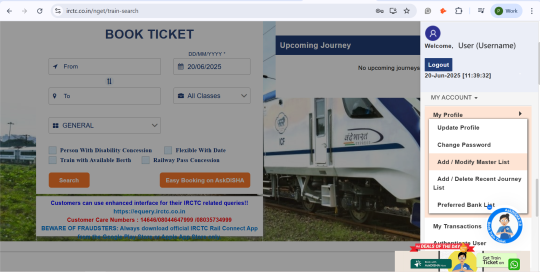

Step 1: Go to Menu > My Profile > Add/Delete Master List as shown below.

Step 2: You will be redirected to the screen shown below. Fill out the details and hit the “Submit” button.

Note: Having your master list ready in the IRCTC helps you get your tickets booked faster.

Top Tatkal Ticket Booking Tips for 2025

Log in 10–15 minutes early to avoid sudden logouts.

Use fast, stable internet while booking your tickets.

Make sure you are on mobile data for the added privacy of your data.

Pre-save payment methods and top up the IRCTC eWallet in advance.

Create and Aadhaar-verify your Master List for instant autofill.

Choose boarding or destination stations wisely for better seat availability.

Don’t waste time choosing berths. Select ‘Book’ if confirm berths are not available.

Prefer UPI or net banking over debit cards with slow OTP delivery.

Use the QuickBooks option if your Master List is set.

Stay calm, type accurately, and don’t refresh the payment page.

Frequently Asked Questions (FAQs): IRCTC Aadhaar Linking for Tatkal Booking System

Q. Is linking Aadhaar on IRCTC compulsory for Tatkal booking system in 2025?

A. It is not compulsory for all kinds of bookings. But, for Tatkal tickets, having Aadhaar-based verification is recommended for faster processing and to avoid last-minute errors.

Q. What if my Aadhaar is not linked to IRCTC?

A. You can still book tickets. Every time you wish to book tickets for you and your co-passengers, you will have to enter and verify manually each time, which can make the booking process longer.

Q. Can I book Tatkal tickets without linking Aadhaar?

A. Yes, it is possible.

Q. How many passengers can I add after linking Aadhaar?

A. A regular IRCTC account can add up to 6 passengers to the master list. If your account is Aadhaar verified, you can add up to 12 passengers.

Q. Will linking Aadhaar speed up Tatkal booking for sure?

A. Since passenger details are pre-verified. But practical speed still depends on your internet speed, payment method, and IRCTC server load. So stay prepared.

Final Thoughts

Being a citizen of India, Aadhaar-based verification is not optional, but a must-have if you wish to get your tickets booked hassle-free.This small step of Aadhaar verification is a step taken by IRCTC that enables genuine passengers to grab their Tatkal tickets without any unnecessary issues. So, don’t wait until the last minute! Link your Aadhaar today, understand the new booking flow, and travel stress-free tomorrow.

Source Link: IRCTC New Rules You Must Know Before Your Next Confirmed Train Ticket Booking

0 notes

Text

The Role of Instant Digital Loans in Managing Unexpected Life Events

The Rise of Digital Loans in the World

The digital revolution has drastically transformed financial services in the last two decades. Fortunately, there are borrowing systems like quick loan Apps or emergency loan Apps that help people fund on an immediate basis. It has played a significant role in making digital loans incredibly convenient for individuals seeking instant financial funding. It allows you to access money from anywhere, anytime. With the integration of AI in the financial sector, faster online loan application processes with e-KYC have been possible. This dynamic shift is because of several factors, including the wide adoption of smartphones, internet connectivity and the growth of digital awareness among people.

Emergencies can occur at any time. From house renovation to medical expenses, these unpredictable emergencies can arise anytime. Having access to THESE instant personal loans has proven to be a boon for the people. With 100% paperless loan applications and hassle-free loan disbursals, a personal loan can help fulfil financial requirements in many unexpected life events.

The Role of Instant Digital Loans in Managing Unexpected Life Events

Medical emergency A medical emergency is a highly unpredictable life event that can happen to anyone without prior hints. Health always comes first before anything else. It is essential to be healthy to enjoy life at its best. You can avail of an instant personal loan due to its salient feature of instant cash loan availability; digital personal loans are the best option to swiftly support your or your family member's medical expenses.

Home Renovations Whether you need to repair your house on an urgent basis, funding through online loan apps comes in handy. House renovation demands a significantly high amount of money due to the expenses involved in each repair service. Instant loans make quick cash available to give your home a fresh look.

Travel Expenses Instant cash loans can be used to fund sudden travel expenses. Travelling because of emergency situations can hit you anytime. Digital apps can provide immediate loans for immediate travel expenses, without unnecessary financial stress.

Relocation Sometimes, we relocate to a new place for better job offers, business opportunities, or educational purposes. During these emergency situations, instant digital loans serve as an excellent source of financial funding. Availing instant digital loans in such situations ensures that you never miss an amazing opportunity that uplifts you and provides you with a comfortable life.

Key Features of the Instant Digital Loans

Let’s have a quick look at some key features of instant digital loans:

Quick loan approval process: Digital lenders provide a quick approval process that saves time and effort.

24/7/365 Accessibility: Digital loan platforms are accessible 24/7/365 due to their digital nature. To get a loan you do not have to visit the branch physically.

100% paperless loan application: Digital lenders provide 100% paperless loan applications. Online loan applications only require minimal documentation and an easy e-KYC process.

Flexible eligibility criteria: Digital lenders are keeping their eligibility criteria flexible so that people from any financial background can quickly take advantage of instant personal loans.

Customised loan products: Digital Lenders offer customised loan products that meet the unique requirements of their distinctive customers.

Competitive Interest Rates: Digital lenders provide instant personal loans at competitive rates. This makes online loans much more affordable.

Quick loan disbursal: Digital lenders disburse loan amounts directly to your bank account within a few minutes of your application.

In The Bottom Line…

Today, people coming from different financial backgrounds have access to mobile devices. The availability of quick loan apps, websites, and digital lending has leaped modernisation in such a short period. By providing seamless, user-friendly, and 100% paperless loan applications, digital lending platforms have enabled cost-effective and faster digital loans for everyone. Digital lending platforms have such flexible eligibility criteria that people from different backgrounds do not feel excluded from the benefits of such fantastic funding options. In short, you can apply for your instant digital personal loan from the comfort of your home without stepping outside.

Chinmay Finlease Limited is one of the fastest loan-approving digital lending platforms that offers tailored loan products. You can now avail of an instant personal loan of up to ₹2 Lakhs within a few minutes of your application getting approved.

Apply for your instant personal loan today and take a leap of faith toward your dreams and life goals!

0 notes

Text

Want to Apply for a 2 Lakh Personal Loan? Check Out the Eligibility Requirements Here

It has been really easy to get small loans nowadays in the digitalised world. Many NBFCs and online loan apps provide quick loans in minutes. Also, the unsecured nature of the loan, where you are benefited of applying for a loan without providing any collateral is a boon. This blog will tell you exactly how can you get a loan of ₹2 Lakhs and what are the eligibility requirements of getting one.

Check below the Eligibility Criteria to apply for a Personal Loan

NationalityGenerally, banks and NBFCs in India prefer borrowers who are Indian citizens.

Age RequirementsMost banks and NBFCs require a borrower to be at least 21 years old and maximum age for personal loan application is 60 years. Age criteria might differ from lender to lender, hence check it with your lender first.

Income RequirementsFor Salaried Professionals: If you are a salaried professional, the required minimum salary for loan approval is 20,000 INR.For Self-Employed Individuals: As a self-employed individual, you must have a valid proof of a stable income source of your business for at least two years.

Stable EmploymentYou are generally required to have a stable employment with at least 6 months of employment.

Credit Score RequirementsA good credit score is typically accepted by digital lenders and banks for a personal loan. With a score above 700, you can secure a good personal loan offer.

Documents Required for a Personal Loan

Identity Proof: You must have a valid identity document that proves your citizenship and transparent identification details.

PAN Card details: You must have a PAN number to proceed for a personal loan.

Proof of Income:

For salaried professional: You need to submit last 3 months’s bank statement that shows regular salary credited to your account.

For self-employed individuals: You need to submit last 3 months’ of bank statements.

How to Apply for a Personal Loan at Chinmay?

Chinmay finlease Limited is a reputed RBI approved NBFC in India that provides personalised loan products to the citizens of India. From streamlined application process to final loan disbursement, Chinmay ensure the borrower can avail a loan with stress-free procedure.

Benefits of Chinmay Personal Loans

Instant Loan Approval: Backed by an AI-operated system, you can get instant loan approval from the lenders.

Quick Disbursement: You will receive the amount in the moments of calculation.

Entirely Digital Loan Application: Digital loan applications neglects the need of traveling, meaning you can sit at your home and apply for the loan.

No Collateral Requirement: No collateral required to apply for a Personal Loan.

24/7 Customer Service: You receive round-the-clock customer service from our executives. From solving your basic queries to driving you through the loan application process, we prioritize assistance.

Transparent Loan agreement: You will get clearly mentioned loan T&Cs in the loan agreement. There is no scope for feeling surprises later on.

No Hidden Fees: From application fee, monthly interest rate, annual percentage rate, and additional charges, all are clearly mentioned in the loan agreement. There are no hidden charges that can drain your pocket.

Flexible Loan Repayment Tenure: You can choose your repayment tenure and stick to your budget while fulfilling your financial requirements, side by side.

Zero Paperwork: Entirely digital documentation eases the process of loan application.

Conclusion

When you feel financially stuck, a loan of ₹2 Lakhs is what you must seek from Chinmay Finlease Limited. Small funding and easy repayments makes a loan from Chinmay the most affordable way to fund your life’s emergencies. You do not need to think about collateral to get financial relief. It’s easy and affordable!

Stay tuned on our website for more informative blogs.

0 notes

Text

Is it Safe to get Online Personal Loans from Instant Loan Apps?

Gone are the days when securing a loan meant endless paperwork, long queues at bank branches, and long waiting periods. However, this is no longer a scenario in the financial sector as digitalisation has given a completely new shape to how people lend and borrow. Introducing Instant Loan Apps- a technological master that promises to lend money with just a few steps. Instant Loan Apps have been a popular choice for taking personal loans, offering a blend of convenience, speed, and accessibility that traditional lenders simply can't match.

Just like any advanced innovation, the rise of instant loan apps has brought both opportunities and challenges. While they offer a lifeline to those in need of quick cash, they also open up to risks and pitfalls. The allure of easy money is strong, but is it too good to be true? Are these digital lenders financial saviors or a wolf in sheep's clothing? In this blog, we’ll have a clear learning and do justice to the title.

The Pros of Online Personal Loans

There's no denying the appeal of instant loan apps. Here's why they've gained such popularity:

Digital-First Approach: These apps operate entirely online, eliminating the need for physical paperwork or in-person meetings. You can apply for a loan anytime, anywhere.

Quick Processing: They promise loan approvals in minutes.

Minimal Documentation: Often, all you need is a smartphone and basic KYC documents.

Small to Medium Loan Amounts: Most apps offer short-term personal loans ranging from a few hundred to several thousand.

Short Repayment Periods: Loans are typically designed to be repaid within weeks or months.

Paperless Process: Say goodbye to mountains of forms and documentation.

Accessibility: These apps often cater to borrowers with lower credit scores who might be rejected by traditional lenders.

The Cons of Online Personal Loans

However, it's not all roses in the world of instant loans. Here are some concerns to be aware of:

High Interest Rates: The convenience often comes at a cost, with interest rates that can be significantly higher.

Short Repayment Terms: The pressure to repay quickly can lead to a cycle of debt if you're not careful.

Data Privacy Concerns: These apps require access to your personal and financial data, raising questions about data security.

Predatory Practices: Some lenders may engage in aggressive collection tactics or hidden fees.

Impact on Credit Score: Multiple loan applications can negatively affect your credit score.

Safety Measures to take while applying for a loan!

While there are risks involved, you can take steps to ensure a safer borrowing experience:

Research: Look for apps with good reviews, proper licensing, and a track record of fair practices.

Read: Understand all terms and conditions and privacy policies, especially regarding interest rates and fees.

Check: Ensure the app is regulated by relevant financial authorities in your country.

Protect: Be cautious about what permissions you grant the app and how your data will be used.

Responsible: Only take loans you can afford to repay, and avoid borrowing from multiple apps simultaneously.

Yes, it is Safe to get Online Personal Loans from Instant Loan Apps.

The question of safety isn't a simple yes or no- it's a subtle issue that requires careful consideration and responsible action on the part of the borrower. As you navigate this digital lending landscape, arm yourself with knowledge, exercise due diligence, and always prioritize your financial well-being. Remember, the safest loan is one you can comfortably repay without risking your financial future. By staying informed, vigilant, and responsible, you can harness the benefits of instant loan apps while minimizing the risks.

Ultimately, your financial journey is in your hands. Make decisions that align with your long-term financial goals, and don't hesitate to seek professional advice if you're unsure. Staying educated and cautious is your best defense against potential pitfalls and your surest path to financial empowerment.

The key takeaway: Instant Loan Apps can be a useful financial tool when used wisely and with caution. They can provide a lifeline in emergencies or help bridge short-term financial gaps.

Source Link: Online Personal Loans is safe from Instant Loan Apps?

0 notes

Text

Union Budget 2025: What’s Changed from Last Year?

Chinmay Finlease knows that the beginning of each year drives everyone’s attention to the budget of the year. The introduction of a budget creates concern and expectations for taxpayers, salaried employees, business persons, industrialists and each person in India.

While Hon’ble Finance Minister Nirmala Sitharaman has recently introduced the budget in Lok Sabha for the year 2025-26. The budget is an effort by the government to accelerate the growth of the nation, securing inclusive development, strengthening private sector investments and enhancing the expenditure power of the middle-class people of India.

The key expectations from the budget for this year were focused on simplified taxes, economic development and other key sectors. This brief guide shows you the major changes and the comparison of Union Budget 2024 and union budget 2025.

What is the Union Budget?

The Union budget is an official financial statement by the Government of India, presented every year by the financial minister.

When the Union Budget 2025 was introduced?

1 February, 2025, Saturday

What Is Included in a Budget?

Estimating Revenue: This section includes direct and indirect taxes on various goods and services and non-tax revenue.

Capital Budget: It includes infrastructure investments and long-term development projects.

Planning Expenditure: This includes expenses that will be made by the government on various sectors like defence, education, healthcare, infrastructure, and social welfare.

Receipts: These consist of tax revenue, non-tax revenue, and borrowings.

Key Purposes of Budget

Economic Growth and Stability

Resource Allocation

Social Welfare

Investment & Deficing Management

Revenue Generation

What to Expect for Salaried Professionals

No tax for citizens with annual income up to ₹12.75 lakh under the new tax regime

Comparison of Union Budget 2024-25 and 2025-26

Category

Union Budget 2024-25

Union Budget 2025-26

Economic Development

Focused on self-reliance (Atmanirbhar Bharat) & MSMEs, employment, skilling, and middle class

Emphasising the Vision for "Viksit Bharat" with increased private sector investment

Agriculture & Rural Development

₹1,22,528.77 Crore allocated

PM Kisan Yojana continued

₹ 1.37 lakh crore allocated

Expanded Kisan Credit Card (₹5 lakh credit to 7.7 crore farmers)

Improve research, develop seeds that resist pests and climate challenges

Increase the availability of over 100 new seed varieties

PM Dhan Dhaanya Krishi Yojana

MSMEs & Startups

₹50,000 crore allocated for MSMEs

MUDRA limit doubled ₹20 lakhs from ₹10 lakhs.

Increased credit guarantee cover of ₹ 20 Crore

Customized credit card limit ₹5 lakh for microenterprises

₹2 crore loans for first-time entrepreneurs

Education & Healthcare

Expansion of medical colleges & skill development

1.48 lakh crore to education, employment and skill development

50,000 Atal Tinkering Labs, 10,000 more medical seats

AI Centres of Excellence

₹ 500 crore to setting up a Centre of Excellence in AI for education

Infrastructure & Urban Development

₹10 lakh crore capital outlay

PM Gati Shakti Plan

₹1 lakh crore Urban Challenge Fund

New Greenfield Airports

₹530 crore UDAN expansion

Tax Reforms & Benefits

Simplified tax slabs

focus on digital tax filing

Higher deductions for senior citizens

Higher TDS limit on rent

Revised Tax Slabs with progressive rates

No tax for citizens with annual income upto ₹ 12 lakhs

Banking & Financial Sector

FDI in insurance is capped at 74%

INR 3,500 crores for the incentive scheme, with INR 3,000 crores for BHIM-UPI and INR 500 crores for RuPay debit cards

FDI in insurance increased to 100%

Grameen Credit Score System

Defence & National Security

₹6.21 lakh crore allocation including pension

rises by 9.53% to ₹6.81 lakh crore, focusing on pensions, salaries, and modernisation

Nuclear Energy Mission

Gig Economy & Worker Welfare

Limited formal provisions

a comprehensive framework to extend formal recognition and social security benefits

Improving social security for gig workers and healthcare access

Investments & Employment

₹15,000 crore for Affordable and Mid-income Housing (SWAMIH)

Rs 6,323 crore and RE of Rs 6,350 crore

₹20,000 crore for R&D

Expanded tourism sector

SWAMIH Fund-2 for housing, R&D budget remains unchanged

Revenue & Expenditure

Estimated to be Rs 32,07,200 crore

Estimated at ₹16.13 Lakh crore, or about 4.9 per cent of GDP

Estimated to be Rs 34,96,409 crore, an increase of 11.1% over the revised estimates for 2024-25.

Fiscal deficit estimated at 4.4% of GDP

Conclusion

The Union Budget for fiscal year 2025-26 has been built upon the framework of fiscal year 2024-25 by bringing into focus higher investments, increased credit availability, improved taxation benefits, and enhanced support for innovation, infrastructure, and national security.

Source Link: Difference Between Union Budget

0 notes

Text

Everything to Know About the Loan Application Process of Chinmay Finlease Limited

Digitalization has certainly amended the financial services sector, in every possible way. The incredible jump towards technology has made it convenient for individuals to manage their finances anytime and anywhere. With services like instant money transfers and quick online loan approvals, accessing financial resources has never been this easy before.

As a reputed RBI-approved Non-Banking Financial Company (NBFC), Chinmay Finlease Limited offers the most convenient personal loan services. The instant personal loan app is especially designed for young salaried individuals, allowing quick access to funds for personal purposes such as home improvement, medical emergencies, or consumer durable purchases.

In this article, let’s have a clear picture of the services offered by Chinmay Finlease Limited and the process they follow to provide instant services.

Loan Services offered by Chinmay Finlease Limited

Instant Personal Loan

Money plays a vital role in everybody’s life. The unexpected need for money can arise any time. And gone are the days when you had to rely on a family member or friend to lend you money when needed. Therefore, to meet unexpected medical emergencies, a sudden repair, home renovation, travel, or debt consolidation, having access to an instant personal loan from Chinmay is a boon. Instant Personal loans are unsecured loans that assist you in times of financial crisis and help cover your immediate expenses.

Instant Consumer Durable Loan

At any point of time, or during Home Renovation, the need for new home appliances and electric gadgets crops up to make your home perfectly match your desires. The requirement for Consumer Durable products like Refrigerators, Washing Machines, Microwaves, and other appliances has become essential nowadays and buying these has become even more costlier. But what if you don't have cash and the product is on sale?

To meet this gap, a Consumer Durable Loan from Chinmay allows you to purchase Consumer Durables online or in person. These loans are finely curated to meet your needs, and never miss out on your favorite products at special prices. This loan enables you to buy large and pay little.

Instant Emergency Loan

An Instant Emergency Loan is a type of short-term personal loan designed to meet an unexpected occurrence. A financial emergency can occur anytime, and access to quick monetary funds is important. An emergency loan from Chinmay Finlease Limited is a reliable option to meet and manage unforeseen expenses such as medical bills, immediate travel, and quick repairs.

Eligibility Criteria for Chinmay Instant Personal Loan

The applicant must be an Indian citizen

The applicant’s age must be between 21 to 60

The applicant must be a salaried professional or self-employed

The applicant must have a stable source of income

Have valid KYC documents (Aadhar Card, PAN Card)

How to Apply for a Chinmay Digital Personal Loan

Download the Chinmay App and Sign Up To start with the Chinmay Personal Loan application, download the app from the Google Play Store or the Apple App Store. After installation, you will be redirected to the signup page. Register using your active email address or mobile number.

Fill in your Basic Details Once you finish the registration process, you will be redirected to your basic information screen. Fill in all the essential information asked and submit.

KYC (Know Your Customer) KYC (Know Your Customer) involves uploading your Aadhar and PAN Cards for identity verification. Ensure all your documents are clearly visible and genuine in order to avail your personal loan faster.

Employment Status Provide your correct employment details. It includes the name and contact information of your employer, job title, and your monthly salary. If you are self-employed, you will need to provide applicable business details.

Bank Verification To verify your income, you will need to submit proof of your earnings by uploading your last three months' bank statements or recent salary slips.

Loan Selection Once your income and bank details are verified and confirmed, choose a loan amount from the proposed loan amount. Select the loan that best suits your financial requirements and repayment capacity.

e-Sign & e-Mandate After selecting your preferred loan offer, accept the loan offer with e-signature and process your e-mandate for easy repayment.

Loan Disbursement Once your Chinmay loan application is approved, the loan amount will be disbursed directly into your bank account.

Why Choose Chinmay as your pocket-friendly Loan Provider?

100% Security & Safety: Chinmay works on the regulatory framework of RBI, and therefore, is one of the safest and most secured loan lending platforms.

Quick Disbursement: Get an Instant Personal Loan of Rs. 10,000 to 2 lakhs within 15 minutes.

No Asset Submission: To get an Instant Personal Loan, you do not have to submit any collateral.

Digitalized Loan Process: It is completely 100% online and hassle-free digital loan process.

Borrow Multiple Times: You can borrow multiple times.

Transparency: Chinmay proposes no hidden fees or surprise charges.

Zero Paperwork: Get the loan without filling out long forms.

Round-the-Clock Customer Support: Get instant support from our Customer executives 24/7/365.

Chinmay as a whole!

Being an RBI-approved NBFC, Chinmay Finlease Limited offers security and significant benefits to loan seekers. No matter what’s the purpose of your loan, you can get benefitted with user-friendly loan application process, instant approval, and quick disbursement.

Here, we make your loan experience smooth and hurdle-free. From registering to loan approval and disbursement, Chinmay personal loan app has offered a secured platform to its customers for over 28 years.

For further inquiries, feel free to contact the customer representative or simply visit our official website for more detailed information. Download the Chinmay loan app today and make your first move towards financial freedom!

Source Link: Know About the Chinmay Finlease Limited Loan Application Process

0 notes

Text

A credit score is a number that rates a consumer's creditworthiness. It ranges from 300 to 950.

0 notes

Text

Everything You Need to Know About Credit Scores

Money usually plays a major role in shaping a person’s life and frame of mind. It always requires mindful planning in the long term to make the best of your life. To upbeat this mindful planning it is important to look at the best available financial opportunities surrounding you.

While life can take unpredicted turns and may surprise you with unexpected financial lows, there are several who opt for a personal loan to meet their financial needs. As these loans often provide urgent support. Nonetheless, it becomes essential to determine what factor makes it best to fit in our lives.

New to some and already known by some- The Credit Score

Whether you want to secure a personal loan for personal purposes, renovate your home, buy a phone, get a home appliance, or pay debts, knowledge about your credit report and score will help you throughout your financial journey. This blog is jotted to let you know everything about credit scores. So, let’s get started.

What is a Credit Score?

A credit score represents a customer’s financial reliability numerically. This score is derived from your credit files, representing your creditworthiness. This file tells about the financial management of an individual at every stage of life. To secure eligibility for your unexpected financial planning, credit score is an influential factor. The credit score ranks from 300 to 850 and helps lenders figure out your loan repayment capability. A credit score of 700 to 800 is generally considered good. A score of 800 or above is considered excellent.

Why do High Credit Scores matter?

Lower Interest Rates:

A good credit score helps you borrow money at lower interest rates.

Better Credit Cards:

A good credit score enhances flexibility for credit cards, making you eligible to get credit cards that offer benefits such as cashback and travel rewards.

Easy Loan Approvals:

While you apply for a loan, your lender finds a valid reason to trust you because of your healthy & well-maintained credit score. They find you reliable for lending money. Hence, it results in easy loan approvals for you.

Longer Tenure Loan Approvals:

Long-tenure loans usually put lenders at higher potential risk. Thus, a good credit score is mandatory for long-tenure loan approval.

Disadvantages of Low Credit Score

Loan and Credit Card Rejection:

Lenders do not lend money to those customers who have low credit scores. Hence, it fosters chances for your loan application and credit card request to face rejection.

Higher Interest Rates:

A bad credit score does not make you eligible for lower interest rates. Thus, it makes you pay more for your loan in the long term.

No Credit Cards, No Rewards:

To qualify for the best credit card offers and rewards, your credit score must be well-maintained. If your credit score is relatively low, you won’t be eligible to experience premium discounts.

How do you build your Credit Score?

These easy tips listed below will help you achieve the best credit score.

Pay your bills on time.

This is the primary factor on which credit score depends heavily. Every late payment can push your credit score down. Paying bills on time reflects you as a responsible borrower and can bring a drastic change in your credit report.

Keep an eye on your Credit Reports.

Review your credit reports frequently and keep checking if there are any inaccuracies and dispute errors. Watching out for your credit score regularly enables you to boost your credit health by taking significant steps of improvement.

Stop frequent credit card applications.

Do you opt for new credit cards frequently? Then, this tip is for you. Frequent credit card applications have a negative impact on your credit score. It is advisable to keep limited cards for your better credit score.

Set up auto payments.

Setting up automatic payments for your monthly installments can make you worry-free. Your installments will always be paid on time without even bothering you. This tip also includes keeping a sufficient amount in your relevant account so you always keep track of your timely payments.

Conclusion

A Credit score is a key role player in your overall financial health. By understanding how it works and taking mindful steps to improve it, you can secure better loan terms and achieve your financial goals.

Chinmay Finlease Limited is one of the leading NBFCs, specializing in lending short-term unsecured personal loans app. Our mission is to bridge the gap with our advanced and flexible credit products for salaried young professionals.

See you in the next blog! Stay Connected!

Source Link: Know About Credit Scores

0 notes

Text

The emergence of Non-Banking Financial Companies (NBFCs) has significantly reshaped how loans are easily accessed and operated across the country.

0 notes

Text

Understanding Personal Loans: A Better Alternative to Credit Cards?

We can find endless options while opting for a reliable source of financial funding. However, browsing the right fund provider is often tricky. Therefore, it becomes important to conduct accurate research on the pros and cons of each fund source and consider one.

To conduct accurate research, you must consider a few factors like amount, interest rates, repayment terms, disbursement time, and risk associated with the source fund. While choosing amongst many, making an informed decision that balances one's financial goals with risks becomes essential.

Moreover, among several sources of funds, in this blog, we’ll have a deep discussion on 2 important sources- Personal Loanand Credit Cards.

What is a Personal Loan?

A Personal Loan is an unsecured loan form provided by Financial Institutions that does not require collateral or asset submission. It comes with the feature of flexible repayment options, readily approved loans within minutes, and fixed monthly installments set for a period of 6 months. The funds are ideal for several personal purposes, such as protecting medical expenses, covering major life events, purchasing appliances for home renovations and meeting unexpected life emergencies.

What is a Credit Card?

A Credit Card is a flat card provided by the Bank as a pre-approved credit facility to its customers. The card has an inbuilt credit limit that a customer can use to purchase goods and services. This credit limit of the person is decided on the credit score & credit history of the user. The credit card limit increases as and when you repay the spent amount.

What are the benefits of choosing a Personal Loan?

Nowadays, applying for an online personal loan has become easier because of the digital wheel and engagement of AI-driven technologies at every step. These advancements have simplified the loan application process, reducing the time and paperwork associated with loan approval. With these advancements, here are some of the major benefits of applying for a personal loan without the hassle of traditional banking methods:

Lower Interest Rates

One of the significant advantages of a personal loan is Lower Interest Rates. For customers with a well-maintained credit score & history, the interest rate is lowered when taking a Personal Loan. Considering the following, it becomes helpful for the customer to save money in the long term.

Fixed Repayment Schedule

Another significant benefit of a personal loan is a fixed repayment schedule. With a personal loan, borrowers benefit from the predictability of fixed terms and timely repayments. This consistent awareness allows you to make better financial planning as it provides insight into monthly spending in advance.

Larger Borrowing Amount

When you need to borrow a considerable amount of money, go for a personal loan. It is very beneficial in the long term because of its low interest rates and Annual Percentage Rates (APR). Nowadays, personal loan apps give access to large funding for personal purposes such as home renovations, medical expenses, or home appliances.

Instant Approvals

The involvement of digitalisation in the financial sector has promoted the growth of real-time transactions and quick loan approvals. You can get your personal loan approved instantly from the comfort of your own home. You do not have to visit the bank to apply for the loan or to submit documents. The entire loan process is carried out from the comfort of your home.

Improved Credit Score

Adding personal loans to your credit profile improves your credit score in the long run. A well-planned and well-managed loan repayment can positively impact your credit score. Timely EMI repayments reflect your responsible behaviour towards your financials. Eventually, it results in improved creditworthiness.

Reduced appeal to Overspend

Personal loans provide a lump sum amount of money as per your loan application. Once you have consumed the total amount, you cannot overspend without reapplying for another loan. Therefore, a Personal loan is a sound option where you can limit your impulsive spending habits and nurture your disciplined financial behaviour.

..which is the best?

While both personal loans and credit cards are best in their places and reliable too, the decisions between the two wholly and solely depend on individual circumstances, goals, and preferences. It is important to take time to know and assess your needs and make an informed decision that aligns with your current situation. Moreover, we always advise you to keep your financial situation, income pattern, borrowing needs, and repayment capacity in mind. This analytical approach will enable you to make sound decisions when choosing your next financial funding source.

However, for you, if a personal loan is the preferred option, we encourage you to consider Chinmay Finlease Limited as your trusted loan provider, offering a variety of loan features to meet your financial needs and avail of several loan-related benefits to make a reliable choice.

0 notes

Text

Wedding Loan: Cover your Big Day Expenses with Chinmay Personal Loan

Your Wedding Day!

The most precious moment in someone’s life is- The Wedding Day! The idea of you having a big fat wedding where you fulfill and celebrate your smallest dreams and experience the biggest gestures with the love of your life. Your eyes sparkling with excitement, heart brimming with love, and…of course, wallets shaking with anxiety.

Several couples and their families pull themselves back from the ideal wedding celebration because of financial realities and vulnerabilities since the average cost of a wedding equals a down payment on a home. But what if we introduce you to the concept of wedding loans, from where you can fulfill every wedding dream without stressing over finances?

So, this blog is for those couples and families who want to manage wedding expenses effortlessly and without any financial commotion. So, this is the right time to read this blog, gain knowledge, and get started with your wedding preparations, such as Wedding Attire, Venue, Catering, Decor, Photography, and more.

What are Wedding Loans?

A Wedding loan is a type of personal loan significantly designed to meet the costs associated with your wedding. These loans are unsecured, and you do not have to provide any collateral. The fixed interest rates and repayment terms allow you to budget for your big day and beyond without the stress of fluctuating payments.

Why should you consider a Wedding Loan?

Usually, we all save and prepare ourselves in advance for our wedding day and start saving for it. Sometimes, the savings and credit card limits are not enough for big fat Indian weddings, therefore, we provide lump-sum funds that couples and families can use during weddings. Hence, wedding loans from Chinmay are perfectly curated for people from diverse financial backgrounds with affordable interest rates and flexible repayment options.

Why choose Chinmay Personal Loan for Wedding Expenses?

A flexible and hassle-free option for financing your wedding costs is the Chinmay Personal Loan. It is made to make your trip to "I do" as easy as your first dance, with competitive interest rates, fast approval processes, and customer-friendly terms. Here are some salient Features you must know about Chinmay wedding loan:

100% Digital Loan Application: Incredibly AI-powered digital loan application process gives you a hassle-free loan experience.

24/7 customer support: 24/7/365 customer support assists you from the start of the loan process to your repayments.

Quick Loan Application Process: Quick loan application process to deliver the financial solution faster than ever.

15-Minutes Loan Approval: Once you apply, you will receive your loan approval within 15 minutes!

Competitive interest rates: With competitive interest rates, chinmay loan is designed to match the requirements of people from various financial backgrounds.

Stress-free Online Documentation: As chinmay promises the entire digital loan application process, you only submit your document digitally!

E-KYC: Your identity verification will be done by e-KYC.Hence, you do not need to visit our physical branch even once!

Loan Disbursement directly into your bank account: Within a few hours of your loan application approval, you can see the magic when your loan amount will be reflected in your bank account.

What Wedding Expenses Can You Cover with a Chinmay Personal Loan?

Here's where things get exciting! The Chinmay Personal Loan is like an all-access pass to your wedding dreams. Let's break down some of the essential expenses you can cover:

Venue Rental: Reserve your ideal space without sacrificing style and ethnicity.

Decorations: Create a flowery paradise at your location.

Wedding Attire: Choose your preferred wedding gown and suit without having to give up your savings.

Catering: Set up a variety of cuisines for your wedding day.

Jewellery: Put money into gold, silver or platinum that represents your unending love without draining your bank account.

Photography: Take pictures and videos to save every special moment of your most valuable day!

Entertainment: Music and entertainment are the second most attractive part of every wedding to keep the celebration going.

Event Management: Hire a professional wedding planner to help you create the ideal wedding day.

Wedding Stationery Checklist: Create a wonderful first impression with gorgeous wedding invitations, bride and groom badges and many more.

The 6 Easy Steps to follow to get a Wedding Loan from Chinmay

Download the Chinmay personal loan app from the Play Store or Apple Store

Check your eligibility by entering your basics

Gather the necessary documents as cited

Fill out the instant personal loan application

Wait for a quick 15-minute loan approval

You will soon see the loan amount reflected directly into your bank account.

Conclusion: Your Happily Ever After Starts Here

Let's pause as we come to the end of our exploration of the Chinmay Personal Loan and wedding loans online. Your wedding day is an important financial occasion, a celebration of love, and evidence of devotion towards your spouse. But it doesn't have to be a cause of worry or financial hardship, so use resources like the Chinmay Personal Loan. We hope you feel more assured and enthusiastic about the possibilities as you proceed with your wedding planning adventure, equipped with an understanding of how marriage loans operate and what the Chinmay quick loan app has to provide.

Here's to love, laughter, and a lifetime of happiness- without the financial headaches. Cheers to your Happily ever after!

Source Link: Instant Wedding Loan App

#Wedding Loan#Wedding Loan App#Marriage loan#Marriage loan app#online Marriage loan#instant Wedding Loan#quick Wedding Loan#Apply for a Wedding Loan Online

0 notes

Text

Apply for a personal loan to fund your wedding expenses, up to ₹2 Lakh without collateral. Get a wedding loan at affordable interest rate, flexible EMI options, and zero paperwork.

#Wedding Loan#Wedding Loan App#Marriage loan#Marriage loan app#online Marriage loan#instant Wedding Loan#quick Wedding Loan#Apply for a Wedding Loan Online#Instant Wedding Loan Online

0 notes

Text

No need to break your Savings for Festivities. Get an Instant Personal Loan from Chinmay!

The most awaited part of the year, the Festive Season, is finally here! As we all know, festivals bring much joy, togetherness, happiness, and celebration among people. With this zest for enjoying the festivals and the love to fulfil the needs of our family members, there come unavoidable expenses- gifts, clothes, home decor, travel and more.

Shopping for new clothes, delicacies, home decor and other items has always been a trend during festive times. To meet their needs, you often need to dip into your bank savings and manage your finances to support your family’s joy. But what if we say that you do not have to take unnecessary financial stress, and your finances will be easily managed, that too digitally?

Yes, you read it right! Instant Personal Loans from Chinmay Finlease Limited have made this possible. Loans from Chinmay are easy to apply and easy to get! The most amazing thing about a personal loan from Chinmay is the freedom of usage. It means you can use it however you like, with no end-use restrictions.

In this blog, let’s explore together how, Chinmay Personal Loan can be your perfect financial companion this Diwali.

How can Chinmay Personal Loans light up your Diwali and help you purchase what you need?

Dream Holiday Trips

No festivals or holidays are complete without travelling. Holidays are indeed fun, but because of the many holidays, we certainly feel the need to go out and refresh ourselves with an amazing trip. These moments of happiness should not be stressful. This is why you should get a personal loan and instant funding for your Diwali vacation.

Vehicle Purchase

We Indians believe that buying a vehicle during Diwali on holidays brings good fortune in our life. If money has been a reason you could not buy your dream vehicle, then this Dhanteras you should definitely consider buying your a vehicle with an instant personal loan from Chinmay.

Home Renovation

Fresh Festival, Fresh Look! That is what we expect during every festive season. From giving yourself a new look to renovating and decorating your house is another type of festive joy. This Diwali, give your house a fresh look by supporting your renovation expenses with an instant personal loan.

Upgrade your Furniture and Appliances

The Festival is all about inviting positivity into our lives by improving our quality of life. Purchasing new appliances and furniture during the festive season is another level of joy because the festive sales in retail stores and online stores help us save money. Don’t worry. To tackle your financial worries, an instant personal loan can link you with discounted Diwali purchases.

Mobile & Laptop Purchase

Mobile devices have become a necessity in the world of digitalisation. From staying connected to your loved ones to online shopping, mobile devices are indeed an amazing gadget that helps people in everyday life. If you are looking to replace your old mobile device with the latest technically equipped gadget, then this is the right opportunity to get one by funding it with an instant personal loan.

How can you make the most of Instant Personal Loan this Diwali?

Pre-plan your expenses:

You can pre-plan your finances and save earlier before the festive season. It will not only help you ease out your stress level, but it will also be gentle on your pockets.

Set a budget:

Setting a definite budget for each festival can help you manage your finances better. This habit will save you from making unnecessary purchases.

Control Impulse Buying:

Let’s face it! We all have bought something that was never a requirement, definitely we had sincere regrets afterwards. But, this lesson teaches us to control our impulse buying urges and to make buying decisions wisely.

Why choose Chinmay to fulfil your Personal Loan needs?

When choosing the right Personal Loan Provider, Chinmay Finlease Limited stands out as one of the most suitable. Our aim is to provide transparency and provide customer-centric loan service. Here are some of the best reasons that will help you believe in taking a personal loan from Chinmay, this Diwali Season.

100% Digital Process:

Chinmay Personal Loans offers an AI-powered digital process to make your online borrowing experience smooth.

Quick Loan Approval:

Our loan process is designed in a way that can give you loan approval within 15 minutes.

No collateral required:

You do not need to provide your valuables as a security to avail a loan.

Competitive Interest Rates:

We offer affordable interest rates and equal monthly payments.

Minimal Documentation:

With minimal documentation and a 100% paper-free loan process, we make your online loan process hassle-free.

24/7 Customer Service:

Our dynamic chat support and customer support executives are available round the clock to help you through the loan process and solve your loan query.

Conclusion

Finally, winding up this blog, we saw how the small personal loan from Chinmay can help you multiply the joyous wave in your house by funding your necessities this festive season.

Chinmay personal loans offers you online personal loans up to 2 lacs with zero paperwork. It means, you do not require to visit our branch physically. By simply installing our online loan app, this festive season you can get your financial support within 15 minutes whenever you need it!

Do consider Chinmay personal loans online to boost your festival experience!

Source Link: Get Instant Personal Loan in This Diwali Festival

0 notes

Text

All You Need to Know About Money Mule.

What is a Money Mule?

A Money Mule is an individual who works on behalf of criminals, fraudsters, and wrongdoers, knowingly or unknowingly, and they are often called “SMURFER”[1]. They receive and transfer illegally earned money from one place to another. They allow someone to use their Bank Accounts to transfer fraudulent money, and in return, they get a small commission. Some Money Mules are aware of their fraudulent practices and involvement in criminal activity, while others are unaware of the situation that they are unknowingly helping and assisting fraudsters as mediators in money laundering schemes and fraudulent activities.

When was Money Mule addressed?

The RBI Governor, Mr ShaktiKanta Das, unusually addressed Money Mule on July 3, 2024, with the MDs and CEOs of both Public and Private Sector Banks [2].

How does the racket of Money Mules work?

Employment:

The Fraudsters recruit the Money Mules by posting job opportunities for “payment processing agents”, “money transfer agents”, and “local processors” over the internet. They also often run appealing advertisements on social media platforms to attract more people to join. These people fall into a trap when they learn that they’re promised to receive high earnings with minimal effort.

Collecting Funds:

Once these individuals are recruited, they receive funds from the fraudsters electronically, through cheques, courier services, cash deposits, or on behalf of others.

Moving Funds:

Once the funds are credited to the mules’ bank account, they are instructed to transfer them to another bank account, often overseas or to a concerned person. This helps the wrongdoers to hide their identities and avoid detection by the law.

Promising “Easy money with little effort”:

In exchange for this service, the money mules earn a small portion of the fraud money transferred as commission.

Why do criminals recruit Money Mules?

Secrecy: Wrongdoers often recruit Money mules to hide their identity. They keep these mules as intermediaries and practise money laundering movements.

Cross-Border Transactions: These intermediaries facilitate the movement of funds across borders easily, making it difficult for law enforcement to track these transactions and fraudsters behind the crime.

How do you suspect the Money Mule Trap?

Here are some signs to look for when you suspect a money mule trap:

The Person offering you a job has no proven identity and does not communicate with you using an official business address. Instead, he communicates with you using generic email addresses.

The people are allowing you to keep a certain percentage of the money you are asked to transfer, that is too very excessively high for minimal work.

The job description lacks clarity. It requires little or no qualification or experience.

The pressure to start work at the earliest.

No clear guidance is provided. These fraudsters do not carry on clear communication for why you need to transfer the money.

What do you do if you find yourself in a Money Mule Trap?

If you find yourself trapped in this situation where you are unknowingly assisting a fraud by money mule account to help them receive and transfer money, here’s what you should do:

Contact your bank officials immediately. Inform them about the incident and consider changing your bank account.

Stop the conversation with the fraudster right away.

Report this scam to your nearby police station or cyber community.

Being part of a money mule can lead you to dangerous consequences like your own money loss. When victims file a complaint, your bank account details can lead the police to you and make them consider you a fraud, leading you to jail.

How to avoid becoming a Money Mule and protect yourself against it!

When you find an opportunity that seems too good to be true, follow your instincts and perform a background check on the company.

If you are offered a high-paying job with minimal effort, be cautious.

Do not apply for a job where they force you to use your account to receive and transfer money with an “easy money with less effort” label.

Before accepting a job offer, research the company and its legacy.

If a person you are dating online or do not know in real life offers you some easy money in exchange for letting them use your bank account. Stop right there! Never trust any random people you meet online, especially in terms of money.

Never share your personal information or financial and banking details with anyone online.

Never Share OTP, PIN, or any secret code i.e password with anyone. Banks and financial institutions will not ask for OTP, PIN from customers in any situation so be aware.

Never CLICK on any unwanted SMS, EMAIL, or WhatsApp Link.

With a smart growing world, keep expanding your knowledge and make outsmart money mules!

Source Link: Know About Money Mule

0 notes

Text

0 notes

Text

Bank vs NBFC Personal Loan

When faced with an unexpected expense, one always chooses for a personal loan. A Personal loan provides lump sum funds that can be used for virtually anything: getting a new bike, covering a medical emergency, going on a much-needed vacation, or getting a new phone.

The mind often runs after 2 main types of lenders: Traditional banks and Non-Banking Financial Companies (NBFCs). Both of them have their own listed advantages, rules & regulations, audience, and challenges. Therefore, it becomes necessary to understand both and make the right decision.

What is a Bank Personal Loan?

Banks offer various financial services other than loans. They are often considered a go-to place for those with solid credit scores who can meet the strict banking eligibility criteria. They offer lower interest rates as they have huge funds, primarily from customer deposits. This makes bank loans more trustworthy to those who choose speed over convenience.

What is an NBFC Personal Loan?

Personal Loans from NBFCs specialise in bridging the gaps left by banks. It offers services to customers with less-than-perfect credit scores or those who are in need of instant funds. NBFCs’ ability to provide loans faster makes it attractive for consumers who are unable to meet banking criteria.

Bank vs NBFC Personal Loan:

Choosing the right option for you The table below mentions a respectful distinction between Banks and NBFCs when getting a personal loan. This will help you make an informed decision that aligns with your financial goals.

Feature

Bank Personal Loan vs NBFC Personal Loan

Application Process

Involves a detailed application process

Streamlined application process

Security

Typically offers secured and unsecured loans.

Primarily offer unsecured loans

Rural Reach

Extensive reach, including rural areas.

Primarily urban-focused

Processing Speed

Slower due to rigorous documentation and approval processes.

Faster processing times, often with instant approvals.

Credit Score Impact

Strict checks: a rejected loan application can negatively impact the score.

Less rigorous checks have a slightly lower impact on credit scores from inquiries.

Interest Rate

Lower due to their access to cheaper funding sources

Higher rates to repay repayment are associated with higher risk associated with lending.

Eligibility Criteria

Rigorous Credit Checks and require a Good Credit Score

More flexible, making loans accessible to broader income groups, including those with poor or minimal credit history.

Documentation

Extensive documentation is required

Minimal documentation

Loan Amounts

Offer higher Loan amounts due to a more extensive capital base.

Lower offering, depending on the NBFC.

Loan Tenure

Offers longer tenures

Tenures are shorter and less flexible than banks.

Foreclosure Charges

Usually, there are lower foreclosure charges

Higher foreclosure charges

Prepayment Flexibility

Often allows prepayment with minimal to no charges after a specified period.

Prepayment options are available but often with higher charges.

Loan Disbursal Time

Takes longer due to stringent approval processes

Quicker disbursal times, often within a few days.

Customer Service

Standardized loan products that lack personalization and customization

More personalized customer service and a high degree of customization in loan products.

Innovation

Typically slower when adopting new technologies.

Often quicker to implement innovative lending practices and technologies.

Branch Network

Extensive branch network providing nationwide access

Limited physical presence but accessible through digital channels.

Online Accessibility

Rigid online platforms, complex to access.

User-friendly online interfaces tailored for ease of use.

Innovations and Offers

Less frequent special offers or innovations in loan structuring.

More likely to offer promotional rates and innovative loan structures.

CTA

With the information stated above, it is found that both Banks and NBFCs are valuable Personal Loan providers. Choosing between the 2 largely depends on individual’s immediate financial needs, credit score ratings, and others.

However, for instant loan processing and more flexible eligibility criteria- an NBFC is like Chinmay Finlease Limited is the best option. Chinmay, as an RBI- approved NBFC specialises in providing unsecured Personal Loans up to Rs. 2 Lakhs for a period of 180 days. Opting for Chinmay Finlease Limited means getting a loan from an NBFC Loan App that is quick and 100% paperless.

0 notes