#refund-consulting-program-reviews

Explore tagged Tumblr posts

Text

How To Manage Negative Online Reviews For Your Business?

No one likes to receive terrible online reviews, but it’s an inevitable thing in the world of business. While it’s normal to feel insulted and take it as an offense at first, it matters how you handle these negative reviews.

Having such reviews is healthy for your business because, with these, you can set standards on how you can improve your services. You don’t need to worry about any of this on your own if you can’t handle it. Leave it to the hands of a reliable SEO agency providing services of an SEO company in Chandigarh.

Monitor Online Platforms

Stay vigilant and regularly monitor online platforms where customers can leave reviews about your business, such as review websites, social media platforms, and search engine listings. Being aware of negative reviews as soon as they are posted allows you to respond promptly and address the concerns.

Stay Calm and Objective

It’s natural to feel defensive when faced with negative feedback, but it’s crucial to stay calm and objective in your response. Take a step back, carefully read the review, and try to understand the customer’s perspective. Remember, a thoughtful and professional response can go a long way in resolving the issue.

Respond Promptly

Time is of the essence when dealing with negative reviews. Respond to them promptly to demonstrate that you value customer feedback and are committed to resolving any issues. Ignoring or delaying responses can worsen the situation and give the impression that you don’t care about your customers’ concerns.

Personalize Your Responses

Address the reviewer by name if possible and use personalized language in your response. This shows that you are genuinely engaging with the customer and not providing a generic reply. Acknowledge their concerns, apologize for any inconvenience caused, and offer a solution or steps to rectify the issue.

Take the Conversation Offline

While it’s important to respond publicly to negative reviews, it’s equally essential to take the conversation offline. Provide a contact email or phone number where the customer can reach out to discuss the issue in more detail. This demonstrates your willingness to resolve the problem privately and shows other potential customers that you are proactive in addressing concerns.

Offer a Resolution

In your response, provide a solution or offer to make amends. Whether it’s a refund, a replacement, or additional assistance, showing that you are willing to go the extra mile to resolve the issue can help mitigate the impact of the negative review. Be transparent about your intentions and actions to rebuild trust with the customer and other readers.

Encourage Positive Reviews

Actively encourage your satisfied customers to leave positive reviews about their experiences. This helps counterbalance negative reviews and showcases the positive aspects of your business. Implement strategies such as sending follow-up emails, offering incentives, or creating a loyalty program to encourage customers to share their positive experiences online.

Learn from Feedback

Negative reviews can provide valuable insights into areas where your business may be falling short. Use them as an opportunity to learn, adapt, and improve your products, services, or customer experience. By addressing recurring issues, you can prevent similar negative reviews in the future and enhance your overall business operations.

Seek Professional Help if Needed

In some cases, negative reviews may be particularly damaging or involve false information. If you encounter such situations, it may be beneficial to consult with a reputation management professional who can guide how to handle the issue effectively and minimize any long-term damage.

5 notes

·

View notes

Text

Settle Your IRS Debt Smartly: Understanding the Offer in Compromise with IRS

If you’re feeling overwhelmed by tax debt and unsure how to move forward, you’re not alone. Many individuals and businesses find themselves facing large IRS tax balances they simply cannot afford to pay in full. That’s where an Offer in Compromise with IRS can be a game-changer. This program allows qualified taxpayers to settle their tax liabilities for less than the full amount owed — and in many cases, much less.

At Hall & Associates, we help individuals, families, and businesses navigate the complexities of the IRS Offer in Compromise program with confidence. Let’s dive into what this program is, who qualifies, and how we can help you achieve a fresh financial start.

What Is an Offer in Compromise with IRS?

An Offer in Compromise (OIC) is a legal agreement between a taxpayer and the IRS that allows the taxpayer to settle their tax debt for less than the full amount owed. The IRS may accept an OIC if it believes:

You truly cannot afford to pay the full debt.

There is doubt as to the amount of the tax liability.

Paying in full would cause financial hardship.

This settlement option is part of the IRS’s Fresh Start Initiative and is designed to help taxpayers in genuine need get back on their feet without the burden of overwhelming debt.

Why Consider an Offer in Compromise?

Choosing an Offer in Compromise with IRS could be the right move if:

You owe a significant amount in back taxes and can’t afford to pay it all.

You’re facing wage garnishment or tax liens.

You want to avoid more aggressive IRS collection tactics.

You need peace of mind and financial breathing room.

The IRS doesn’t grant these offers easily. But with the right preparation and representation, you can present a strong case that reflects your true financial situation.

Who Qualifies for an Offer in Compromise?

The IRS uses a strict set of criteria to determine who is eligible for an Offer in Compromise. Key factors include:

Income and Expenses: You must demonstrate that your income is insufficient to pay the full debt.

Asset Equity: The IRS reviews the value of your property, savings, and other assets.

Ability to Pay Over Time: If you can afford to pay off your tax debt over time through an installment plan, you may not qualify.

The application process includes submitting IRS Form 656 and Form 433-A (OIC) or 433-B (OIC), depending on whether you’re an individual or a business. You’ll also need to pay a non-refundable application fee and provide supporting documentation.

How Hall & Associates Can Help

Applying for an Offer in Compromise with IRS can be complex and time-consuming. At Hall & Associates, our tax resolution experts handle the entire process for you — from reviewing your financials to submitting a strong, well-supported offer to the IRS.

Here’s what we offer:

Free Consultation: We evaluate your eligibility and explain your options clearly.

Full Financial Review: Our team digs deep into your finances to craft the strongest possible case.

Experienced Representation: We communicate directly with the IRS on your behalf, reducing your stress and ensuring compliance.

Negotiation Expertise: We understand how to position your case for acceptance, based on IRS standards and your unique circumstances.

You don’t have to face the IRS alone. Our experienced professionals have helped hundreds of clients reduce or eliminate tax debt through the Offer in Compromise program.

Common Myths About the Offer in Compromise Program

Myth 1: The IRS Always Says No Truth: While the IRS does carefully review each offer, thousands of OICs are accepted each year. The key is submitting a realistic offer with the proper documentation.

Myth 2: You Have to Be Completely Broke Truth: You don’t have to be destitute. The IRS looks at your ability to pay, not just your current income or bank balance.

Myth 3: It’s Easy to Do It Yourself Truth: Technically, you can apply on your own, but errors in documentation or misrepresenting your financial picture can lead to delays or rejections. Working with a professional increases your chances of approval.

What Happens After the Offer Is Accepted?

Once your Offer in Compromise with IRS is accepted, you’ll need to:

Stick to the agreed-upon payment plan.

Stay compliant with all future tax filings.

Avoid defaulting, or the IRS could reinstate the original debt.

Successfully completing your OIC gives you a fresh start, free from the weight of back taxes and the stress of constant collection notices.

Final Thoughts

An Offer in Compromise with IRS offers real hope for people drowning in tax debt. It’s not a loophole or a quick fix — it’s a legitimate option for those who meet the criteria and are willing to follow through.

At Hall & Associates, we specialize in helping taxpayers navigate this process and secure the relief they need. Don’t wait for the IRS to take more drastic action. Contact us today and let’s explore whether an Offer in Compromise is the right path for you.

Ready to Take Control of Your Tax Debt?

Visit https://www.hallsirs.com/services/offer-in-compromise/ to learn more or schedule your free consultation. We’re here to help you find peace of mind and get back on solid financial ground — one step at a time.

1 note

·

View note

Text

What is LMIA in Canada? Meaning and Full Form Explained

If you're exploring work or immigration opportunities in Canada, you might have come across the term LMIA. But what is LMIA in Canada, and why is it so important for foreign workers and Canadian employers alike?

In this article, we’ll explain the LMIA full form in Canada, LMIA meaning, the process, costs involved, and how it connects to other immigration streams like the OINP International Student Stream, Advanced Canada Workers Benefit, and even PR card renewal. Whether you are an employer looking to hire a foreign worker or an international student aiming for permanent residency, understanding LMIA is essential.

What is LMIA?

LMIA stands for Labour Market Impact Assessment. It is a document issued by Employment and Social Development Canada (ESDC) that Canadian employers may need before hiring a foreign worker. The purpose of LMIA is to prove that there is a genuine need for a foreign worker and that no Canadian citizen or permanent resident is available to do the job.

When an employer receives a positive LMIA, it means they are authorized to hire a foreign worker for a specific position because no qualified local talent is available.

LMIA Full Form in Canada

The LMIA full form in Canada is Labour Market Impact Assessment. It is a crucial step in the Temporary Foreign Worker Program (TFWP) and impacts various immigration pathways. Employers must demonstrate that the employment of a foreign worker will not negatively affect the Canadian labor market.

LMIA Meaning and Importance

The LMIA meaning goes beyond a simple document. It represents the Canadian government's effort to protect its labor market while allowing skilled foreign workers to contribute to the economy. The assessment ensures that the job offer is genuine and that wages and working conditions meet Canadian standards.

A positive LMIA is often needed for the following:

Applying for a work permit

Increasing Comprehensive Ranking System (CRS) points in Express Entry

Supporting a permanent residency application through provincial nominee programs like the OINP International Student Stream

LMIA Application Process

Here’s a basic overview of how the LMIA process works:

Job Advertisement: The employer must advertise the job in Canada to prove no local workers are available.

Submit Application: The employer submits an LMIA application to ESDC.

ESDC Review: ESDC reviews the job offer, wages, working conditions, and recruitment efforts.

Receive Decision: A positive LMIA allows the foreign worker to apply for a work permit; a negative LMIA denies the request.

LMIA Canada Cost and Application Fee

Understanding the LMIA Canada cost is vital for employers. The current LMIA application fee is CAD $1,000 per position. This fee is paid by the employer and cannot be passed on to the foreign worker. Other potential costs include legal fees, advertising costs, and administrative expenses.

Summary of LMIA Canada Costs:

Expense

Estimated Cost

LMIA Application Fee

CAD $1,000 per position

Legal/Consulting Fees

CAD $1,000 - $3,000+

Advertising Costs

Variable

Employers hiring for high-wage or low-wage positions, caregivers, or agricultural workers may be subject to different processing streams and timelines.

LMIA and OINP International Student Stream

The Ontario Immigrant Nominee Program (OINP) has various streams, one of which is the OINP International Student Stream. While this stream does not necessarily require an LMIA, having a job offer supported by an LMIA can strengthen an applicant’s profile, especially if applying under the Employer Job Offer: International Student stream.

In general, a valid LMIA-backed job offer helps prove the genuineness of employment and eligibility for PR through provincial and federal programs.

LMIA and Advanced Canada Workers Benefit

While not directly linked, understanding the Advanced Canada Workers Benefit (ACWB) is helpful for those planning to work in Canada. The ACWB is a refundable tax credit for low-income workers and may be relevant to foreign workers who gain permanent residency and start earning in Canada.

Once you become a permanent resident and begin working in Canada, you may be eligible for this benefit depending on your income level and family situation.

LMIA and PR Card Renewal

For individuals who have already become permanent residents and are looking into PR card renewal, LMIA may not directly impact the renewal process. However, if your LMIA-supported work experience helped you gain PR status in the first place, maintaining that employment history and continuing to meet residency obligations is important.

To renew a PR card, you must have spent at least 730 days in Canada during the last five years and continue to meet your residency obligations.

Who Needs an LMIA?

Not all foreign workers need an LMIA. Some individuals are exempt due to international agreements (like NAFTA/USMCA), intra-company transfers, or open work permits issued to spouses or students.

However, if you're applying for a job in Canada and don’t fall under an LMIA-exempt category, your employer must apply for one before you can get your work permit.

Final Thoughts

Understanding what is LMIA in Canada is crucial if you’re a foreign worker, student, or employer navigating Canada’s immigration system. From the LMIA full form in Canada to the LMIA meaning and LMIA application fee, each component plays a vital role in the hiring and immigration process.

Whether you're applying through the OINP International Student Stream, checking your eligibility for the Advanced Canada Workers Benefit, or preparing for PR card renewal, LMIA can directly or indirectly influence your path.

For many, LMIA is the gateway to building a future in Canada — securing legal employment, gaining valuable work experience, and eventually qualifying for permanent residency.

0 notes

Text

Singapore Student Visa: Complete Guide to Requirements and Application Process

Planning to study in Singapore? Whether you're aiming for a top university or a specialized diploma course, understanding the student visa process is essential. If you're looking for expert assistance, consulting a Singapore Student Visa Expert in Ahmedabad can give you a head start. Meanwhile, this guide will walk you through the visa application process in a clear and simple way.

Why Choose Singapore for Higher Studies?

Singapore is recognized as one of Asia’s premier education hubs, offering:

World-class universities and polytechnics

A multicultural, safe, and clean environment

Globally recognized degrees and diplomas

English as the main language of instruction

Its strategic location and excellent academic infrastructure make Singapore a popular destination for international students from across the world.

Do You Need a Student Visa for Singapore?

Yes. International students must apply for a Student Pass if they are enrolled in full-time courses offered by recognized institutions in Singapore.

Key Requirements for a Singapore Student Visa

To apply for the Student Pass, you will typically need:

A valid passport

An official offer letter from a recognized Singaporean institution

Recent passport-sized photographs

A completed Student Pass application (eForm 16) via the SOLAR system

Proof of financial ability to cover tuition and living expenses

Past academic records (transcripts, certificates)

Medical examination results (may be requested by ICA)

Step-by-Step Student Visa Application Process

1. Get Admission Offer

Secure admission at an approved educational institution in Singapore.

2. Register on SOLAR

Once accepted, your institution will register your details on the SOLAR system (Student’s Pass Online Application & Registration).

3. Fill Out eForm 16

Using your SOLAR reference number, log in and complete eForm 16 online.

4. Submit Required Documents

Upload all the required documents, including your passport, admission letter, and photographs.

5. Pay the Visa Application Fee

A non-refundable processing fee is required at the time of submission.

6. Wait for ICA Approval

The Immigration & Checkpoints Authority (ICA) reviews your application, which usually takes a few weeks.

7. Receive IPA Letter

Once approved, you’ll receive an In-Principle Approval (IPA) letter, which allows you to enter Singapore and collect your Student Pass upon arrival.

Validity and Renewal of Student Pass

Your Student Pass is valid for the duration of your course. If your program extends beyond the original period, your institution will help you apply for a renewal before it expires.

Can You Work While Studying in Singapore?

Yes. International students enrolled in full-time programs at approved institutions are allowed to:

Work part-time up to 16 hours per week during academic terms

Work full-time during vacation periods

Note: Always check with your school and the Ministry of Manpower (MOM) for the most updated regulations.

Conclusion

Applying for a Singapore Student Visa is an important step in your academic journey. By understanding the process and preparing the necessary documents in advance, you can ensure a smooth application experience. If you're ever unsure, a qualified visa consultant in Ahmedabad can help you navigate the process with ease.

Studying in Singapore can be a life-changing opportunity—and it all begins with a well-prepared visa application.

0 notes

Text

Buy Cenforce in Canada - Low Price for Pills, Fast Delivery

In today’s fast-paced world, maintaining good health, including sexual wellness, is essential for overall well-being. Erectile dysfunction (ED) is a condition that affects millions of men globally, including in Canada. Fortunately, effective treatments like cenforce are now available online at affordable rates. If you’re looking to buy Cenforce in Canada at a low price for pills and fast delivery, this guide will walk you through everything you need to know.

What Is Cenforce?

Cenforce is a highly effective generic version of Viagra, containing the active ingredient Sildenafil Citrate. It is commonly used to treat erectile dysfunction by increasing blood flow to the penis during sexual stimulation, resulting in a firm and lasting erection. Manufactured by Centurion Laboratories in India, Cenforce has become a trusted name for ED treatment worldwide.

Buy cenforce Cenforce is available in multiple strengths, including:

Cenforce 25 mg

Cenforce 50 mg

Cenforce 100 mg

Cenforce 150 mg

Cenforce 200 mg (Black)

Each strength is designed to meet the individual needs of users depending on the severity of their ED.

Why Buy Cenforce in Canada?

1. High Prevalence of ED

Canada has seen a rising number of men experiencing erectile dysfunction, especially those over 40. With a growing demand for effective and affordable treatments, Cenforce has become a popular choice.

2. Affordable Option

Compared to branded Viagra, Cenforce is much more affordable, often available at a fraction of the cost. For those seeking budget-friendly solutions, Cenforce offers significant savings without compromising on quality.

3. Trusted by Thousands

Cenforce has built a solid reputation based on user reviews and clinical effectiveness. Many Canadian users report positive results, including improved performance and satisfaction.

Where to Buy Cenforce in Canada at Low Price for Pills

Finding a reliable source to buy Cenforce in Canada is crucial. Fortunately, many online pharmacies now cater to Canadian customers, offering competitive pricing and discreet delivery.

Tips for Choosing the Right Vendor:

Licensed Online Pharmacy: Ensure the pharmacy is certified and complies with Canadian healthcare regulations.

Transparent Pricing: Compare prices across platforms and beware of hidden fees.

Customer Reviews: Look for authentic feedback to verify the vendor’s reliability.

Return/Refund Policy: Check if the site offers a money-back guarantee or easy return policy.

Some popular online platforms offer bulk discounts, free shipping on large orders, and loyalty programs. Always make sure the seller provides genuine Cenforce pills.

Fast Delivery Across Canada

One of the key concerns for buyers is timely delivery. When you buy Cenforce in Canada, most top-rated online pharmacies offer fast delivery services—sometimes even next-day delivery in major cities like Toronto, Vancouver, Montreal, and Calgary.

Shipping Features to Look For:

Express Shipping Options

Tracking Number Provided

Discreet Packaging

Local Warehouses for faster dispatch

Thanks to improvements in online logistics and partnerships with Canadian couriers, Cenforce can be delivered to your doorstep quickly and safely.

How to Use Cenforce Safely

Before you start using Cenforce, here are some important points to consider:

1. Consult a Doctor

While Cenforce is available without a prescription on many websites, it is strongly recommended to consult a doctor before use, especially if you have underlying health conditions or take medications.

2. Dosage Guidelines

Start with 50 mg if you are new to ED medications.

Adjust dosage based on efficacy and side effects.

Do not exceed 200 mg within a 24-hour period.

3. How to Take

Take 30-60 minutes before planned sexual activity.

Do not consume with heavy meals or alcohol.

Only take once a day.

4. Side Effects

Common side effects include:

Headache

Flushing

Nasal congestion

Dizziness

Indigestion

Severe side effects are rare but require medical attention (e.g., chest pain, vision changes, priapism).

Is Cenforce Legal in Canada?

Yes, Cenforce is legal in Canada when purchased for personal use. Importing generic ED medication from trusted international pharmacies for personal consumption is allowed under Canadian law, provided it complies with Health Canada guidelines.

Always verify if the product is being sourced from reputable manufacturers and ensure the packaging complies with Canadian standards.

Benefits of Buying Cenforce Online in Canada

Here’s a quick summary of the advantages:

Benefit

Description

Affordable

Much cheaper than brand-name alternatives like Viagra

Convenient

Order from your home with just a few clicks

Discreet

No awkward in-person pharmacy trips

Fast Delivery

Receive your pills in a matter of days

Multiple Strengths

Tailor dosage to your specific needs

Final Thoughts

If you’re struggling with ED and want a proven, affordable, and fast solution, buying Cenforce in Canada is a smart choice. With its low price for pills and fast delivery, Cenforce is helping thousands of men across Canada regain their confidence and improve their quality of life.Before making a purchase, ensure that you choose a reliable online pharmacy, understand the correct dosage, and follow safe usage practices. With the right information and precautions, Cenforce can be an effective ally in your journey toward better sexual health.

0 notes

Text

Steps to Choose the Right Canadian Immigration Consultant in Bangalore

The decision to move to Canada is a significant one, involving a series of complex steps, paperwork, and legal formalities. That’s why it’s important to work with experienced Immigration Consultants in Bangalore who can guide you through the process effectively. Whether you’re applying for permanent residency, a work visa, or student permit, the right consultant ensures your application is well-prepared and stands the best chance of success. This guide outlines the essential steps to help you select the right Canadian immigration consultant in Bangalore, while also considering expertise like an Australia Immigration Consultant in Bangalore if you are exploring multiple options.

1. Check Credentials and Licensing

The first step in choosing a reliable consultant is to verify their credentials. Ensure the consultant is authorized to represent immigration cases and has experience dealing with Canadian visa applications. A certified professional will be well-versed in all immigration categories and their requirements.

2. Review Specialization Areas

Not all consultants handle every type of visa. If you are specifically applying for Canadian immigration, make sure the consultant specializes in Canadian PR, Express Entry, or Provincial Nominee Programs. It also helps if the consultancy has experience in other countries—such as an Australia Immigration Consultant in Bangalore—which may indicate a broader understanding of international migration laws.

3. Ask for a Profile Evaluation

A good consultant will begin by evaluating your profile—education, experience, age, and language skills—and recommend the right immigration pathways. This initial evaluation should be transparent, personalized, and based on actual immigration policies, not vague promises.

4. Understand the Services Offered

Look for consultants who offer end-to-end services, from document preparation and form filling to visa submission and interview preparation. Comprehensive Immigration Consultants in Bangalore will also assist with updates and provide guidance throughout the journey.

5. Look for Transparency in Fees

Always ask for a written agreement outlining the fees, services included, and refund policies. Trustworthy consultants maintain complete transparency, so you are fully aware of what you're paying for without hidden costs.

6. Check Reviews and Client Feedback

Online reviews and testimonials offer valuable insights into the consultant's reliability and service quality. Look for success stories or client feedback that reflect a consistent track record of positive results.

7. Evaluate Communication and Support

Your consultant should be easily reachable and responsive to your queries. Whether it’s regular updates on your case or answering concerns, consistent communication is key to a smooth immigration experience.

Conclusion

Choosing the right Canadian immigration consultant in Bangalore is one of the most important decisions you’ll make during your immigration journey. The right consultant offers not just expertise, but also peace of mind. Whether your goal is Canada or you're also exploring options through an Australia Immigration Consultant in Bangalore, ensure your consultant is well-qualified, experienced, and transparent. With the right Immigration Consultants in Bangalore, your path to a better future becomes clearer and more achievable.

0 notes

Text

How to Choose the Right IVF Center for Your Family

Choosing to undergo IVF is a major milestone in your fertility journey. While the decision itself may be emotional, selecting the right IVF center is just as important—if not more. With numerous options available, especially in growing medical hubs like Indore, it's essential to know what to look for in a clinic that aligns with your needs and values.

If you're searching for a reliable and experienced IVF center in Indore, or anywhere else, this guide will help you make an informed choice for your family's future.

1. Check the Clinic’s Success Rates

One of the first things to research is the clinic’s success rate, particularly for patients in your age group and with similar fertility issues.

Ask for data on live birth rates, not just pregnancy rates.

Success should also be evaluated across different procedures like IVF, ICSI, or donor cycles.

2. Assess the Doctor’s Experience and Expertise

An experienced fertility specialist can make a significant difference in your treatment outcome.

Look for:

Board-certified reproductive endocrinologists

Experience in handling complex or similar cases

A patient-centric, empathetic approach

If you're consulting an IVF specialist in Indore, ask about their qualifications, training, and success stories with local patients.

3. Explore Available Services and Technologies

Top-tier IVF centers offer a comprehensive range of services and advanced reproductive technologies, including:

IUI, IVF, and ICSI procedures

Egg, sperm, and embryo freezing

Donor programs (egg, sperm, embryo)

Preimplantation Genetic Testing (PGT/PGS)

Laparoscopic and hysteroscopic diagnostics

4. Understand Costs and Financial Options

Ask for a detailed breakdown of:

Consultation fees

IVF cycle costs

Medication and lab test charges

Embryo freezing or storage fees

Package deals or discounts

EMI or zero-interest financing

Refundable plans for multiple cycles

5. Consider Location and Accessibility

IVF treatment often requires multiple visits, sometimes daily during stimulation and monitoring phases. Choosing a conveniently located clinic can reduce travel fatigue and time away from work or family.

6. Look Into Support Services

Fertility treatment isn’t just medical—it’s emotional too. Look for a center that provides:

Psychological counseling or support groups

Diet and lifestyle guidance

Fertility coaching or education sessions

7. Schedule a Consultation and Ask Questions

Book an initial consultation to get a feel for the clinic’s environment and staff. Ask:

Are the doctors listening to your concerns?

Are your questions answered clearly?

Do you feel supported and respected?

Your instincts during this first visit will tell you a lot about the clinic’s overall approach.

8. Read Reviews and Testimonials

Patient feedback can offer valuable insights into real experiences. Look for:

Verified testimonials on the clinic’s website

Reviews on Google or healthcare forums

Ratings of staff behavior, communication, and success rates

If you're considering a particular IVF center in Indore, online reviews can help validate your decision or encourage further research.

Final Thoughts

Finding the right IVF center isn’t just about the highest success rates—it’s about trust, transparency, and comfort. Your chosen clinic should not only provide excellent medical care but also understand your emotional journey and support you through every step.

Whether you're just starting your research or planning treatment soon, take the time to explore options thoroughly. The right IVF center in Indore can make all the difference in turning your dream of starting a family into reality.

0 notes

Text

Metcon-6™ Review: Can 6 Minutes a Day Really Transform Your Body? (Spoiler: YES.)

That hour on the treadmill, grueling weight sessions, and endless gym memberships are not the keys to a lean, strong, energized body.

But thousands of people are ditching marathon workouts for Metcon-6™ by Chandler Marchman—a 6-minute daily program that claims to burn fat, build muscle, and skyrocket energy faster than traditional training.

Is it legit?

I tested it. I researched it. Here is the unfiltered truth.

See More about "Metcon-6" Here!

What is Metcon-6? – The Science of 6-Minute Workouts

Metcon-6™ stands for Metabolic Conditioning in 6 Minutes—a revolutionary approach to fitness that maximizes fat burn in minimal time.

By using high-intensity, scientifically optimized exercises that:

Trigger EPOC (burn calories for 48+ hours post-workout)

Boost human growth hormone (for lean muscle gains)

Crush stubborn fat (especially belly & thigh fat)

Require NO equipment (do it anywhere, anytime)

However, who created this? Moreover, can you trust him?

Click Here to Download PDF "Metcon-6" eBook by Chandler Marchman!

About Chandler Marchman – The Man behind the Method

Chandler Marchman is not a random influencer—he is a D1 athlete-turned-coach with a degree in Exercise Science.

After training elite athletes and busy professionals, he discovered a game-changing truth:

Metcon-6™ is his proven formula to get twice the results in a fraction of the time.

PERFECT FOR:

Overweight & frustrated dieters

Busy professionals with no time for the gym

Stay-at-home parents who need quick workouts

Athletes wanting explosive endurance

Anyone who HATES long workouts

NOT FOR:

Bodybuilders (this is not a bulk-up program)

People who enjoy 2-hour gym sessions

Those with severe heart/joint issues (consult a doctor first)

The Jaw-Dropping Benefits – Real Users, Real Results

People using Metcon-6 report:

15-30 lbs of fat loss in weeks

Visible muscle tone without heavy weights

Crazy energy spikes (no more afternoon crashes)

More free time (6 minutes vs. 60+ at the gym)

However, what is the catch?

The Brutal Pros & Cons

PROS:

Only 6 minutes a day (No more "I don’t have time")

No equipment needed (Hotel room? Done)

Works for all fitness levels (Modifications included)

60-day money-back guarantee (Zero risk)

CONS:

HARD at first (You will sweat… a LOT)

Digital-only (Need a phone/laptop)

Requires discipline (No program works if you skip days)

Pricing & Guarantee – Is It Worth It?

Metcon-6 costs just $20 (one-time payment).

Let us put that in perspective:

1 personal training session = $50-$100

1 month of a gym membership = $30-$100

Metcon-6 = Less than $1 per day for life-changing results.

IN ADDITION, it has backed by a 60-day "No-Questions-Asked" refund policy.

Translation: Try it for 2 months. If you do not love it, get every penny back.

Final Verdict – Should You Buy It?

If you want:

A lean, toned body

More energy than a double espresso

To ditch long, boring workouts forever

Then YES—Metcon-6 is worth every penny.

Click Here to Download eBook "Metcon-6" PDF by Chandler Marchman!

0 notes

Text

SR&ED Consulting Services for Ottawa Businesses

Businesses in Ottawa are actively pursuing technological advancement and innovation to stay ahead in competitive markets. The cost of research and development, however, can be substantial. SR&ED Consulting in Ottawa helps companies navigate the Scientific Research and Experimental Development (SR&ED) tax credit program offered by the Canadian government.

This program, administered by the Canada Revenue Agency (CRA), is designed to encourage R&D efforts through tax incentives. Whether it’s software development, engineering, or prototyping, many activities that involve solving technical challenges may qualify under SR&ED.

What is the SR&ED Program?

The SR&ED program supports Canadian companies by providing refundable and non-refundable tax credits for eligible R&D work. It applies across industries and encourages innovation by reducing financial risks.

SR&ED may cover:

Wages for technical and engineering staff

Material costs used in experimental processes

Subcontractor or consultant fees

Overhead expenses directly tied to R&D

Development of new processes, products, or systems

Both successful and unsuccessful projects may qualify, as long as a systematic investigation was carried out to resolve uncertainty.

Role of a Consultant in SR&ED Claims

Navigating SR&ED requirements is not always straightforward. A qualified consultant helps identify eligible activities, organizes documentation, and ensures compliance with CRA standards. Their role is essential in translating technical work into terms the CRA can evaluate and approve.

Key tasks of an SR&ED consultant include:

Evaluating R&D activities against eligibility criteria

Writing technical project descriptions for the T661 form

Calculating and allocating expenses properly

Coordinating with technical teams and finance departments

Guiding businesses through CRA audits, if needed

In cities like Ottawa, where tech-driven industries are prominent, having a consultant who understands both the local ecosystem and the federal rules is an asset.

How Ottawa Businesses Benefit

Ottawa is home to a mix of established firms, startups, and government-funded organizations, many of which are involved in scientific or technical development. Local businesses often don’t realize the extent of work that may qualify under SR&ED.

Examples of eligible local activities may include:

Developing new IT infrastructure or applications

Enhancing telecommunications technology

Engineering improvements in manufacturing workflows

Environmental innovations such as sustainable packaging

Research in biotech, medical devices, or aerospace

Whether you're improving a product or solving a technical bottleneck, SR&ED may help recover a portion of your investment. Find us here

Common Filing Challenges

Even when the work qualifies, companies often run into roadblocks when preparing their SR&ED claims. This can lead to missed opportunities or delayed returns. Consultants are skilled in preventing these common issues.

Frequent errors in SR&ED filings:

Misunderstanding what constitutes a technological uncertainty

Submitting overly generic or sales-focused project descriptions

Missing out on internal documentation that proves eligibility

Incorrectly tracking or attributing R&D costs

Filing late or missing relevant tax schedules

Getting these details right improves your chances of approval and reduces the likelihood of a CRA review.

Improving Documentation and Process

A major part of SR&ED success lies in documentation. Keeping proper records makes it easier to justify a claim and withstand CRA scrutiny. Consultants help implement systems that streamline this process throughout the year.

Helpful records to maintain include:

Timesheets for team members involved in R&D

Meeting notes that track research progress and technical decisions

Experimental data, failed tests, and iterations

Design documentation and version histories

Financial breakdowns of costs tied to research work

Having these records in place means you won’t have to scramble at tax time or risk submitting an incomplete claim.

When to Bring in a Consultant

Some businesses wait until tax season to seek SR&ED help. However, involving a consultant earlier in the R&D process provides better results. They can advise on what documentation to collect and identify qualifying activities from the start.

Consider hiring a consultant if:

Your company is starting a new R&D project

You’re unsure if certain technical work qualifies

You’ve had an SR&ED claim denied or reduced in the past

You don’t have internal resources for technical reporting

You’re interested in optimizing claims across multiple projects

Early support leads to smoother, more thorough submissions and maximized returns.

Selecting the Right SR&ED Consultant in Ottawa

Ottawa offers a range of consulting firms that specialize in SR&ED claims. Choosing the right partner depends on your industry, company size, and the complexity of your R&D work.

Look for a consultant who:

Understands your technical domain

Has experience with CRA compliance and documentation

Offers support throughout the entire claim process

Has a history of successful claims in your industry

Uses a performance-based or transparent pricing model

Having a consultant nearby also offers practical benefits, such as easier access to in-person meetings or site visits.

0 notes

Text

Why R&D Tax Consultants Are Essential for Innovative Businesses

Innovation is at the heart of every successful business. Whether you're developing new technology, improving existing processes, or testing prototypes, your activities could qualify for valuable tax incentives. But navigating the complexities of the R&D tax incentive can be overwhelming. That’s where R&D tax consultants come in.

R&D tax consultants specialise in helping businesses identify, document, and claim research and development (R&D) activities that are eligible under government tax incentive programs. In Australia, the R&D Tax Incentive program is designed to encourage innovation by providing tax offsets for eligible R&D expenditures. However, the guidelines are specific, and claims must be supported by detailed evidence.

Hiring R&D tax consultants gives you access to professionals who understand the technical and financial aspects of the incentive. They work closely with your team to review your projects, assess eligibility, and prepare all necessary documentation. This reduces the risk of audit issues and ensures you don’t miss out on potential refunds.

For startups and small businesses, cash flow is often tight. The R&D tax offset can make a big difference by returning a percentage of your R&D costs, allowing you to reinvest in growth. The right R&D tax consultants can help you access this funding quickly and without stress.

What sets experienced consultants apart is their ability to align your innovation strategy with compliance. They not only maximise your claim but also help you build a strong, consistent approach to tracking and reporting R&D work year after year.

At Fullstack Advisory, our R&D tax consultants have helped hundreds of innovative businesses across Australia unlock their full tax benefit potential. We take a proactive approach, guiding you through eligibility criteria, project descriptions, cost breakdowns, and submission to ensure your application meets all ATO requirements.

In an increasingly competitive landscape, every advantage matters. By working with expert R&D tax consultants, your business can stay focused on innovation while we handle the complex tax work behind the scenes.

0 notes

Text

The Ultimate Guide to Choosing an Online Garden Center for All Your Gardening Needs

In an age where convenience meets creativity, more gardening enthusiasts are turning to the internet for their green-thumb needs. Whether you're a beginner planting your first tomato or an experienced gardener redesigning your backyard oasis, an online garden center can be your go-to destination for plants, tools, advice, and more — all delivered straight to your doorstep.

Why Shop at an Online Garden Center?

Traditional garden centers are great for browsing, but they come with limitations — travel time, seasonal stock, and sometimes unhelpful staff. An online garden center removes these barriers, offering a more flexible and comprehensive experience.

Here are a few standout benefits of using an online garden center:

1. Wider Selection

Unlike physical stores restricted by floor space and local climate, online garden centers offer a massive range of plants, seeds, tools, soil amendments, fertilizers, planters, and decor. You’ll find everything from exotic bonsai trees to heirloom vegetable seeds in one place.

2. Convenient Shopping

With 24/7 access, you can shop from the comfort of your home and avoid the hassle of carrying heavy bags of soil or mulch. Most stores offer fast delivery options, too.

3. Expert Gardening Advice

Many reputable online garden centers provide blogs, planting calendars, how-to videos, and even virtual consultations with horticulturists. It’s like having a garden coach at your fingertips.

4. Product Comparisons and Reviews

Detailed product descriptions and verified reviews help you make informed choices. It’s easier to compare products online than walking aisle to aisle in a physical store.

What You Can Buy from an Online Garden Center

Most online garden centers offer more than just plants. You can typically find:

Outdoor & indoor plants: Annuals, perennials, shrubs, trees, and houseplants.

Seeds & bulbs: For vegetables, herbs, flowers, and native plants.

Soils & fertilizers: Organic mixes, compost, peat-free soils, and nutrient boosters.

Gardening tools: From hand trowels and pruners to raised beds and watering systems.

Decor: Planters, garden lights, trellises, birdbaths, and furniture.

Some even offer subscription boxes, seasonal bundles, or kits for beginners.

Customer Testimonial

“As someone who lives in a small town with limited gardening resources, discovering an online garden center was a game-changer. I ordered herb seeds, compost, and a few garden tools from [EverGreen Supply], and everything arrived quickly and in perfect condition. The customer support team even helped me create a planting schedule based on my zone. I’m hooked!” — Liam H., Fort Collins, CO

FAQ: Online Garden Center

Q1: Are plants safe to ship through the mail?A: Yes. Reputable online garden centers use professional-grade packaging and select the right shipping times to ensure plants arrive healthy and undamaged.

Q2: What if my plant or item arrives damaged?A: Most online garden centers offer satisfaction guarantees or replacement/refund policies. Be sure to read the return policy before purchasing.

Q3: How do I know what to plant in my region?A: Many sites include USDA hardiness zone filters and offer planting calendars based on your zip code or location.

Q4: Can I get organic or eco-friendly gardening products online?A: Absolutely. Many online centers focus on sustainability and offer organic seeds, peat-free compost, and eco-conscious pest control options.

Q5: Do online garden centers offer discounts or loyalty programs?A: Yes. Many offer first-time buyer discounts, seasonal sales, and reward programs for frequent purchases.

Tips for Choosing the Right Online Garden Center

Not all online garden centers are created equal. Here’s what to look for:

Positive reviews on Google, Trustpilot, or gardening forums.

Clear product descriptions with care guides and planting instructions.

Responsive customer service via chat, email, or phone.

Sustainability practices, such as recyclable packaging or support for local growers.

Educational resources, like planting guides or zone maps.

Also, pay attention to return policies and shipping fees — some centers offer free shipping for orders over a certain amount.

Conclusion: Grow More, Worry Less with an Online Garden Center

Shopping at an online garden center is more than a convenience — it's a gateway to better gardening. With access to a wider variety of plants and products, expert guidance, and hassle-free delivery, it’s easier than ever to create the garden of your dreams, no matter your space or experience level.

0 notes

Text

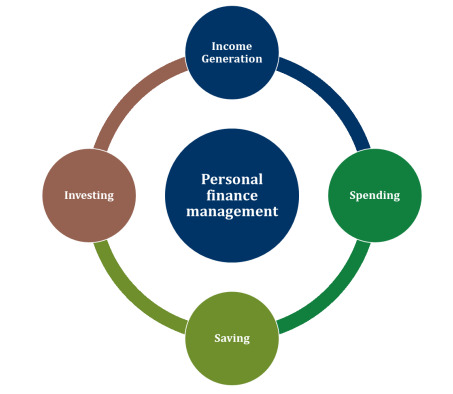

How to Manage Personal Finances During Economic Downturns

Economic downturns can be stressful and uncertain, impacting everything from job security to investment returns. During these challenging times, strong Personal Finance Management becomes more important than ever. By adopting smart financial strategies, you can protect your savings, reduce financial anxiety, and emerge stronger when the economy rebounds. Here’s a detailed guide on how to manage your personal finances during tough economic times.

1. Reassess Your Budget

The first step in effective Personal Finance Management during a downturn is revisiting your budget. Track your income and expenses carefully. Categorize your spending into "needs" and "wants," and prioritize essential expenses like housing, utilities, groceries, and insurance.

Trim discretionary spending wherever possible. Cut back on dining out, entertainment subscriptions, or luxury shopping. Small savings add up and can create a valuable cushion during uncertain times.

2. Build or Strengthen Your Emergency Fund

If you haven't already, building an emergency fund should become a top priority. Ideally, you should aim to save three to six months' worth of living expenses. This fund acts as a financial buffer against job loss, medical emergencies, or unexpected expenses.

If you already have an emergency fund, consider strengthening it. Redirect any bonuses, tax refunds, or windfalls to bolster your savings. In the world of Personal Finance Management, having a strong emergency fund is your best defense against economic shocks.

3. Manage Debt Wisely

High-interest debts can become a major burden during an economic downturn. Review your existing debts and create a plan to manage them efficiently:

Focus on paying off high-interest credit card balances first.

Avoid taking on new, unnecessary debt.

Explore refinancing or consolidation options if it reduces your interest rate.

If you’re struggling with payments, communicate proactively with lenders to explore hardship programs.

Good debt management is a critical part of resilient Personal Finance Management.

4. Reevaluate Financial Goals

During economic uncertainty, it may be necessary to adjust your financial goals temporarily. Postpone large discretionary purchases, reconsider aggressive investment strategies, and realign your savings plans based on your current situation.

It doesn’t mean abandoning your dreams — it simply means adapting your approach until the economic climate improves. Flexibility is key to smart Personal Finance Management during downturns.

5. Diversify Income Sources

Depending solely on one source of income can be risky during unstable economic periods. Consider finding additional ways to earn money, such as freelancing, consulting, or part-time work. Even modest side income can provide financial security and reduce stress.

Diversification is not only important in investments but also in income — an often-overlooked aspect of Personal Finance Management.

6. Continue Investing Wisely

It's tempting to panic and pull out investments when markets are volatile, but rash decisions often lead to long-term losses. Stick to your investment plan if it’s aligned with your risk tolerance and long-term goals.

Focus on diversified portfolios and avoid trying to time the market. Remember, downturns are often followed by recoveries, and staying invested can help you benefit when the market rebounds.

7. Stay Informed but Avoid Panic

Stay updated on economic news but avoid becoming overwhelmed by negative headlines. Make decisions based on facts, not fear. Solid Personal Finance Management requires calm and rational thinking, especially when emotions are running high.

8. Seek Professional Advice if Needed

If you're unsure about your financial strategy during a downturn, consulting a financial advisor can be a wise move. A professional can offer personalized guidance, help you avoid costly mistakes, and provide reassurance during volatile times.

Final Thoughts

Effective Personal Finance Management during economic downturns requires proactive steps, disciplined habits, and a calm mindset. By reassessing your budget, managing debt carefully, bolstering savings, and making informed decisions, you can navigate financial storms successfully.

Remember, downturns are temporary. Smart management today not only protects your current financial health but also sets you up for future success when the economy eventually bounces back.

0 notes

Text

MS-Insurance: Trusted Life & Travel Insurance Provider in Saskatoon

Life Insurance in Saskatoon – Secure Your Family’s Future

Life insurance is essential for financial security, especially in Saskatoon, where families rely on it for protection. Whether you are looking for term life, whole life, or universal life insurance, choosing the right plan ensures your loved ones are financially covered in case of unexpected events. At MS Insurance, we help you find the best policies to suit your needs.

Benefits of Life Insurance in Saskatoon

Financial Protection: Ensures your family’s financial stability.

Debt Coverage: Pays off outstanding loans and mortgages.

Funeral Costs: Helps cover final expenses.

Tax-Free Payout: Beneficiaries receive a tax-free death benefit.

Types of Life Insurance Available

Term Life Insurance – Covers a specific period with affordable premiums.

Whole Life Insurance – Lifelong coverage with a cash value component.

Universal Life Insurance – Flexible premium options with investment benefits.

Why Choose MS-Insurance for Life Insurance in Saskatoon?

Expert insurance advisors

Customized plans for individuals and families

Competitive rates with trusted providers

Super Visa Insurance in Saskatoon – Stay Covered During Visits

Super Visa Insurance is mandatory for parents and grandparents visiting Canada under the Super Visa program. This insurance provides emergency medical coverage during their stay. MS-Insurance offers tailored plans to ensure complete protection.

Key Features of Super Visa Insurance

Meets IRCC Requirements: Mandatory for Super Visa applications.

Medical Emergency Coverage: Covers hospitalization, ambulance services, and treatments.

Multiple Entry Coverage: Covers up to 10 years with renewals.

Fast Claims Processing: Easy and quick claim settlements.

How to Choose the Best Super Visa Insurance in Saskatoon?

Compare plans from multiple providers.

Look for direct billing to avoid upfront medical costs.

Choose a plan with no hidden fees and extensive coverage.

Visitor Insurance in Saskatoon – Peace of Mind for Tourists

Visitor Insurance in Saskatoon ensures that travellers are protected against medical emergencies, accidents, and unforeseen situations while visiting Canada.

Why Do You Need Visitor Insurance?

Health Care Costs: Covers expensive medical treatments in Canada.

Accident Coverage: Protection against unforeseen injuries.

Trip Interruptions: Coverage for trip cancellations or interruptions.

What’s Included in Visitor Insurance?

Doctor consultations and hospitalisation

Prescription drugs and emergency treatments

Ambulance and diagnostic services

Travel Insurance Provider in Saskatoon – Secure Your Trips

A reliable travel insurance provider in Saskatoon ensures your trips are safe, whether domestic or international. MS-Insurance provides comprehensive policies that cater to different travel needs.

Coverage Offered by a Travel Insurance Provider in Saskatoon

Trip Cancellation & Interruption – Refunds for unexpected cancellations.

Emergency Medical Coverage – Covers hospitalisation abroad.

Baggage Loss or Delay – Compensation for lost luggage.

Flight Delays & Missed Connections – Covers additional expenses.

How to Choose the Best Travel Insurance Provider in Saskatoon?

Compare policies for comprehensive coverage.

Check customer reviews and claim settlement ratios.

Choose a provider with 24/7 assistance.

At MS Insurance, we are committed to helping you find the right travel insurance coverage tailored to your needs.

FAQs

1. Why is life insurance important in Saskatoon?

Life insurance ensures financial security for your family, covering debts, funeral expenses, and future needs.

2. What is the minimum coverage required for Super Visa Insurance in Saskatoon?

Super Visa Insurance must provide at least $100,000 in coverage for emergency medical expenses.

3. Can visitors get health insurance in Saskatoon?

Yes, visitor insurance provides coverage for medical emergencies, doctor visits, and hospitalization.

4. How much does travel insurance cost in Saskatoon?

The cost varies based on the coverage amount, duration, and traveller’s age. It is best to compare different plans.

5. Can I get same-day approval for Super Visa Insurance?

Yes, many providers offer same-day approval for Super Visa Insurance if all documents are submitted correctly.

Choosing the right insurance in Saskatoon is crucial for your safety and financial well-being. Contact MS Insurance today to find the best policy that fits your needs!

0 notes

Text

Dominica Citizenship by Investment 2025: A Complete Guide

Introduction

In an increasingly interconnected world, second citizenship is more than just a luxury—it’s a strategic asset. Dominica’s Citizenship by Investment (CBI) program continues to be one of the most sought-after pathways for investors looking for enhanced global mobility, financial security, and tax optimization. This guide explores why Dominica remains a top destination for economic citizenship in 2025.

Why Choose Dominica for Citizenship by Investment?

Dominica offers an attractive CBI program backed by political stability, economic resilience, and a strong legal framework. With a Dominica passport, investors gain visa-free or visa-on-arrival access to over 145 countries, including the Schengen Zone, the UK, and Singapore. Moreover, Dominica has a business-friendly tax system with no capital gains, inheritance, or wealth taxes—making it an ideal jurisdiction for financial diversification.

Eligibility Criteria for the Dominica CBI Program

Dominica’s CBI program is open to individuals over 18 who meet the required financial and legal criteria. Applicants must have a clean criminal record and undergo thorough due diligence. Dependents, including spouses, children, parents, and grandparents, can also be included in the application, provided they meet eligibility requirements.

Investment Options for Dominica Citizenship in 2025

Investors can choose between two primary investment routes:

Economic Diversification Fund (EDF) Contribution – A non-refundable donation starting at $100,000 for a single applicant.

Real Estate Investment – A minimum investment of $200,000 in government-approved real estate projects. This option also provides potential returns through rental income or resale after the holding period.

Step-by-Step Application Process

Initial Consultation – Work with an authorized agent to assess eligibility.

Document Collection – Submit identification, financial records, and police clearance certificates.

Due Diligence Review – The government conducts background checks.

Approval & Investment – Upon approval, make the required investment.

Oath of Allegiance & Passport Issuance – Receive official citizenship documents and a Dominica passport.

Costs and Fees Associated with Dominica CBI

Aside from the investment, applicants must pay government fees, due diligence fees, and processing costs. These expenses vary depending on family size and the chosen investment route. Additional costs may include legal and administrative fees, making it crucial to budget accordingly.

Comparing Dominica’s CBI with Other Caribbean Programs

While Dominica’s CBI program is among the most affordable, alternatives such as Saint Kitts and Nevis or Grenada offer similar benefits. However, Dominica stands out due to its streamlined processing time, low investment threshold, and lack of residency requirements.

Tax Benefits and Financial Advantages

Dominica’s tax policies favor global investors. There are no wealth, inheritance, or capital gains taxes, making it an attractive jurisdiction for asset protection. Offshore banking opportunities further enhance financial flexibility, providing a secure environment for wealth management.

Challenges and Common Pitfalls in the CBI Process

Navigating the CBI process requires careful planning. Common mistakes include failing to meet due diligence requirements, incomplete documentation, and working with unauthorized agents. To avoid delays or rejections, applicants should seek guidance from reputable advisors.

Future Outlook: Dominica CBI in 2025 and Beyond

The demand for second citizenship continues to rise, and Dominica’s CBI program is expected to evolve with global trends. Potential policy adjustments may include enhanced due diligence measures or investment threshold changes. However, Dominica remains a top contender for those seeking an efficient and cost-effective route to a second passport.

Conclusion

Securing Dominican citizenship through investment in 2025 offers unparalleled benefits. With a streamlined process, global mobility, and tax advantages, this program remains a top choice for investors. If you’re ready to start your journey toward economic citizenship, now is the time to take action.

Start your Dominica CBI application today and unlock a world of new opportunities with Flying Colour relocation Services!

0 notes

Text

Tax Season Alert : Beware of Scams & Fraud!

Tax season is a prime time for fraudsters looking to take advantage of unsuspecting individuals and businesses. Whether it's taxpayers engaging in risky practices or scammers trying to deceive people, the consequences of tax fraud can be severe, including hefty fines, penalties, and even legal action.

To help you stay vigilant, here’s a detailed breakdown of fraudulent activities to avoid and scams to watch out for:

Taxpayer Fraud: Risky Practices to Avoid

Some individuals and businesses may try to manipulate their tax filings to reduce their tax burden. However, these practices can result in audits, penalties, or even criminal charges.

1.Underreporting Income

Failing to report all sources of income, such as cash payments, freelance gigs, or side businesses, is a major red flag. The IRS uses sophisticated tracking systems to detect inconsistencies, so ensure all earnings are properly reported.

2.Inflating Expenses

Claiming higher expenses than actually incurred is a fraudulent act. Whether it's business costs, home office expenses, or travel deductions, all claims must be legitimate and supported by receipts.

3.False Deductions

Exaggerating or fabricating deductions, such as charitable donations or medical expenses, can lead to serious penalties. The IRS may request verification, so only claim deductions that you can substantiate.

4. Falsifying Documents

Altering tax forms, invoices, or receipts to misrepresent financial details is considered tax fraud. Always maintain accurate records and provide truthful information.

5.Misclassifying Workers

Businesses may intentionally misclassify employees as independent contractors to avoid payroll taxes. However, if the IRS determines misclassification, companies may face back taxes, penalties, and lawsuits.

Common Tax Scams: Stay Alert!

Scammers use various deceptive tactics to trick taxpayers into revealing sensitive information or making fraudulent payments. Here are the most common schemes to be aware of:

1.IRS Impersonation Calls

Scammers often pretend to be IRS agents, demanding immediate payments or threatening arrest. Reminder: The IRS will never call to demand payment without prior written notice. If you receive such a call, hang up and report it to the IRS.

1. Phishing Emails & Messages

Fraudsters send fake emails or text messages claiming to be from the IRS, directing recipients to click on malicious links. Never share personal or financial details via email—the IRS does not initiate contact this way.

3. Refund Fraud & Identity Theft

Scammers steal Social Security numbers (SSNs) to file fraudulent tax returns and claim refunds. Protect your SSN by filing taxes early, using secure tax software, and monitoring your financial statements.

4. Fake Audits & Threatening Notices

Some criminals pose as IRS officials, claiming you are under audit and demanding an immediate payment. Always verify any audit request directly with the IRS by checking your tax account online or calling the official IRS helpline.

5. Fraudulent Tax Software & Fake Preparers

Using unverified tax software or shady tax preparers can put your personal data at risk. Choose reputable tax professionals or well-known tax software programs to ensure your information remains secure.

Protect Yourself & Your Business

File Early: The sooner you file, the less likely scammers can use your identity for refund fraud.

Use Strong Security Measures: Enable multi-factor authentication for tax-related accounts and use strong passwords.

Verify IRS Communications: Always confirm IRS requests by checking their official website or calling the verified helpline.

Monitor Financial Accounts: Regularly review your bank and tax-related accounts for any suspicious activity.

Consult a Professional: Businesses and individuals should work with licensed tax professionals to ensure compliance and prevent errors.

Tax fraud and scams can have serious consequences, but by staying informed and taking preventive measures, you can protect your hard-earned money.

Have any questions or tips to share? Drop them in the comments below! Let’s help each other stay safe this tax season.

0 notes

Text

Criminal Tax Lawyer New York: Expert Help for Unfiled Tax Returns

Navigating the complexities of tax law can be overwhelming, especially when dealing with unfiled tax returns or criminal tax matters. If you are facing such issues in New York, seeking the assistance of a qualified criminal tax lawyer is crucial. Whether you need a criminal tax defense attorney near you or are specifically searching for an unfiled tax returns lawyer in New York, this guide will provide clarity on how to move forward.

Why You Need a Criminal Tax Lawyer in New York

Tax law is a specialized field that requires in-depth knowledge and expertise. A criminal tax lawyer new york can help you understand your legal obligations and represent you if you are under investigation by the Internal Revenue Service (IRS).

Tax-related offenses, including tax evasion, failure to file returns, or providing false information, can result in severe penalties, including hefty fines and imprisonment. Having an experienced attorney by your side ensures you’re equipped to handle these legal challenges.

Unfiled Tax Returns: A Serious Concern

One of the most common tax issues individuals and businesses face is unfiled tax returns. Failing to file your taxes can result in significant consequences, including:

Penalties and interest: The IRS imposes late-filing and late-payment penalties, which accrue interest over time, increasing your overall tax liability.

Loss of refunds: If you fail to file within three years of the due date, you forfeit any tax refund you may have been entitled to.

Criminal charges: Repeatedly failing to file taxes can lead to criminal charges, potentially resulting in jail time.

By consulting with an unfiled tax returns lawyer new york, you can mitigate these risks. These professionals can guide you in filing past-due returns and negotiating with the IRS to reduce penalties.

Services Offered by an Unfiled Tax Returns Attorney in New York

An unfiled tax returns attorney New york provides a wide range of services to help clients resolve their tax issues, including:

Reviewing Your Financial Records: They will assess your financial situation to determine your tax obligations and calculate any amounts owed.

Filing Past-Due Returns: The attorney will ensure your unfiled tax returns are submitted accurately and promptly, minimizing potential penalties.

Negotiating with the IRS: A skilled attorney can negotiate on your behalf to settle tax debts through programs like Offer in Compromise or Installment Agreements.

Legal Representation: If your case escalates to a criminal investigation, a criminal tax lawyer will represent you in court and work to secure the best possible outcome.

Criminal Tax Defense Attorney Near Me: How to Choose the Right One

When searching for a criminal tax defense attorney near me, it’s essential to consider the following factors:

Experience: Look for an attorney with extensive experience in handling criminal tax cases and dealing with the IRS.

Specialization: Ensure the lawyer specializes in both criminal tax law and unfiled tax returns to address your specific needs.

Reputation: Check reviews and testimonials from past clients to gauge the attorney’s success rate and client satisfaction.

Communication: Choose a lawyer who is approachable and communicates clearly about your case and legal options.

Benefits of Hiring a Criminal Tax Lawyer in New York

The right legal representation can make a significant difference in resolving your tax issues. Here are some benefits of hiring a criminal tax lawyer in New York:

Peace of Mind: Knowing that an expert is handling your case allows you to focus on other aspects of your life or business.

Legal Protection: Your attorney will ensure that your rights are protected throughout the legal process.

Reduced Penalties: Skilled negotiation can result in reduced penalties and a more manageable resolution to your tax issues.

Avoiding Criminal Charges: Prompt action by your lawyer can prevent your case from escalating to criminal charges.

Conclusion

Dealing with tax issues, particularly unfiled tax returns or potential criminal charges, can be daunting. However, you don’t have to face these challenges alone. By working with a criminal tax lawyer in New York or an unfiled tax returns attorney, you can resolve your tax matters efficiently and effectively.

Don’t let unresolved tax problems jeopardize your financial stability or freedom. Contact a criminal tax defense attorney near you today to take the first step toward resolving your tax issues and securing peace of mind.

0 notes