#sankla buildcoon project in hadapsar

Text

Investing in real estate at the financial year's start with Sankla Buildcoon offers strategic financial advantages. By investing early, you can maximize tax benefits, such as deductions on home loan interest and principal repayment under sections 24(b) and 80C of the Income Tax Act. Additionally, property prices tend to rise, so early investment can yield significant capital appreciation. Sankla Buildcoon ensures quality construction, prime locations, and timely project delivery, enhancing the value of your investment. Seize the opportunity to grow your wealth and secure your future with Sankla Buildcoon's trusted real estate projects.

#Sankla Buildcoon#sankla buildcoon project in bhugaon#real estate projects by sankla buildcoon#sankla sommet in bhugaon#sankla buildcoon project in hadapsar annexe#sankla project in hadapsar annexe#sankla project in hadapsar#sankla buildcoon project in hadapsar#residential projects by sankla#commercial projects by sankla#2bhk in bhugaon#upcoming launch in bhugaon#new launch in bhugaon#Residential project in bhugaon#premium project in bhugaon#2 BHK property for sale in bhugaon#3 bhk proprty for sale in bhugaon#Residential project in bavdhan#2 BHK property for sale in bavdhan#3 bhk proprty for sale in bavdhan#ready to move project in bavdhan#Residential project in hadapsar annexe#3 bhk proprty for sale in hadapsar annexe#3 bhk property for sale in hadapsar#east world hadapsar annexe#satyam niranjani hadapsar#Avani by Sankla Buildcoon#sankla sommet

2 notes

·

View notes

Text

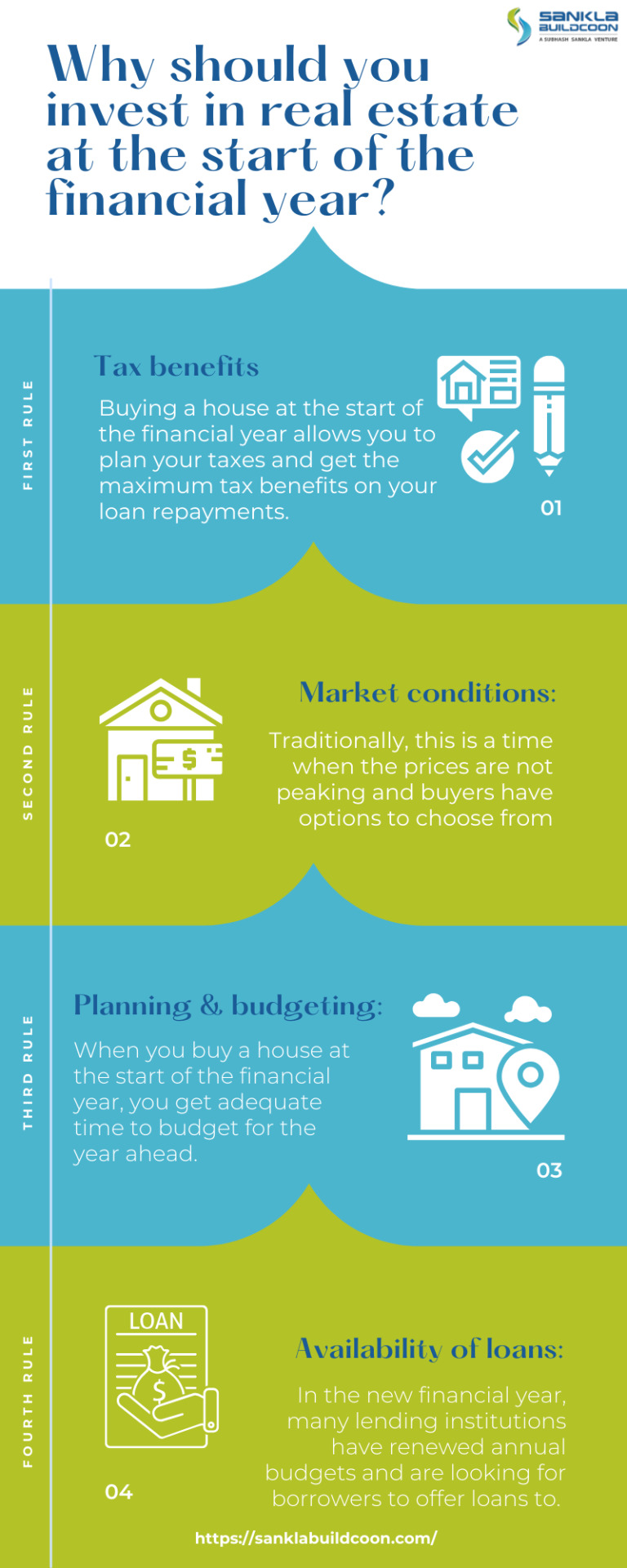

Why should you invest in real estate at the start of the financial year?

There is no denying the fact that real estate investments are wealth creators. Add to it the fact that they can generate regular income via rents and hedge against inflation, every individual should consider investing in property. If you have made up your mind about buying a house, then here are some reasons why you should plan it at the start of the coming financial year.

Tax benefits: When you buy a house by availing of a home loan, you get various tax benefits. These include tax deductions for repaying the principal and interest of the home loan, buying a house under the affordable housing category, and additional deduction of the interest paid on the home loan for first-time homebuyers. Buying a house at the start of the financial year allows you to plan your taxes and get the maximum tax benefits on your loan repayments.

Market conditions: Usually, at the turn of the financial year, markets are favorable for real estate investments. Traditionally, this is a time when the prices are not peaking and buyers have options to choose from. Make sure that you research the market and talk to a professional to assess market conditions before making the purchase.

Planning and budgeting: When you buy a house at the start of the financial year, you get adequate time to budget for the year ahead. April is the month when most people lay out investment and tax-saving goals. Buying a house takes care of both these needs and helps you generate wealth over time.

Availability of loans: In the new financial year, many lending institutions have renewed annual budgets and are looking for borrowers to offer loans to. Hence, it can be a good time to get a home loan at favorable rates and terms.

If you are looking to invest in real estate in Pune, then you will be overwhelmed with the number of options available. Before making your decision, ensure that you research the market and talk to an experienced professional. There are numerous factors that you must consider before buying a house. This includes the quality of construction, location, amenities, and reputation of the developer. In Pune, Sankla Buildcoon is a name synonymous with high-quality and top-class constructions.

To know more continue reading the blog : Why should you invest in real estate at the start of the financial year?

#sankla project in hadapsar annexe#Sankla Buildcoon#sankla buildcoon project in hadapsar annexe#sankla sommet in bhugaon#real estate projects by sankla buildcoon#sankla buildcoon project in bhugaon#2 bhk in bhudgaon#sankla buildcoon projects in bhugaon#sankla project in hadapsar#sankla buildcoon project in hadapsar#residential projects by sankla#commercial projects by sankla#2bhk in bhugaon#3bhk in bhugaon#new launch in bhugaon#upcoming launch in bhugaon#Satyam business court by sankla#sankla exclusive vistas#satyam niranjani hadapsar#2 BHK property for sale in hadapsar annexe#premium project in bavdhan#3 bhk proprty for sale in bhugaon

1 note

·

View note

Text

To decide your home loan EMI based on your income with Sankla Buildcoon, start by calculating your total monthly income, including all sources. Next, determine your monthly expenses to understand your financial commitments. Financial experts recommend that your EMI should not exceed 40-50% of your monthly income. Use online EMI calculators to estimate the EMI for different loan amounts, interest rates, and tenures. Ensure you have a good credit score to secure better interest rates. Consider your future financial goals and maintain sufficient savings for emergencies. This careful planning ensures a manageable EMI, aligning with your financial stability and goals.

#sankla project in hadapsar annexe#sankla buildcoon project in hadapsar annexe#sankla sommet in bhugaon#real estate projects by sankla buildcoon#sankla buildcoon project in bhugaon#Sankla Buildcoon#3 bhk proprty for sale in bhugaon#2bhk in bhugaon#residential projects by sankla#premium project in bhugaon#new residential projects in pune#commercial projects by sankla#commercial property for sale in koregaon park pune#real estate pune#2 bhk in bhudgaon#3 bhk proprty for sale in bavdhan#3 bhk flats in pune kharadi#home loan#EMI#new launch in bhugaon#new properties in koregaon park pune#upcoming launch in bhugaon#premium residential projects in pune#2 BHK property for sale in bavdhan#2 BHK property for sale in bhugaon#Residential project in bavdhan#3 bhk proprty for sale in hadapsar annexe#east world hadapsar annexe#3 bhk property for sale in hadapsar#Avani by Sankla Buildcoon

1 note

·

View note