#sun1h

Explore tagged Tumblr posts

Text

Astro Notes 🗒️

cancer females give me the “ cute girl next door” vibes lol

moon square jupiter is an underrated fame indicator

i’m sorry but scorpio women >>>>>> scorpio men

a lot of libras come off like they’re flirting unintentionally.. like you could be talking to a libra and you would think they’re flirting with you with those sparkly eyes and charming smile but they literally act like that w everyone. don’t feel special 😂 respectfully

mars 3rd house people are so feistyy

having your rising sign at a scorpio degree (8, 20) gives you a lot of sexual appeal/intimidating presence

leo saturn people are constantly having an identity crisis

virgo saturn people might feel like their life is unlucky

the way scorpio moons process pain is SO different than the other signs.. they really hold onto that feeling and will literally act like you’re dead to them if you hurt their feelings severely.

sun in 1st/7th/10th house people usually end up in the public eye pretty easily

taurus 6h people are very good with animals

#astrology#astro notes#astro placements#astro community#astrology observations#scorpio placements#taurus#taurus 6h#cancer placements#cancer astrology#moon square jupiter#libra#mars 3rd house#leo saturn#virgo saturn#sun1h#sun7h#sun10th house

1K notes

·

View notes

Photo

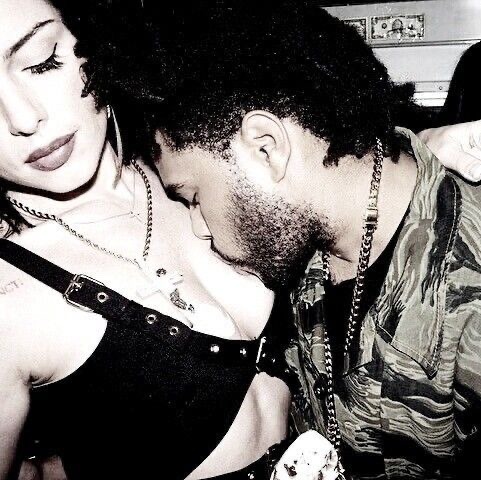

Junichi Okada ( V6 )

Scorpio Rising, Leo Midheaven

Approximate time of birth: Around 5:00 AM

Reliability: The data comes from the person

Source: 5ちゃんねる (entry n°5)

#scorpio asc#nc#v6#johnny & associates#mer1h#sun1h#ura1h#nep2h#mar2h#moon5h#jup12h#sat12h#ven12h#plu12h#12h stellium#birth time

2 notes

·

View notes

Text

DeFi Lending Explained: The Alternative Banking System

DeFi Lending (Decentralized Finance Lending) is changing how we interact with money and access financial services. By removing traditional banks from the equation, DeFi Lending unlocks global, permissionless financial tools through robust lending and borrowing protocols.

While you may already be familiar with other components of the DeFi ecosystem — like trading platforms and crypto wallets — DeFi Lending protocols are a newer addition to crypto markets. They’ve quickly become one of its most powerful innovations, allowing users to earn yield on digital assets or borrow funds without intermediaries.

Unlike banks, which typically offer 0%–3% interest on savings accounts, permissionless platforms often provide yields of 10%–15% on stablecoins such as USDC and USDT, depending on algorithmic rates. Other altcoins can offer even higher returns, though they come with increased volatility and market risk.

DeFi Lending Explained

DeFi Lending protocols are new financial instruments reshaping the DeFi market into a more open, unbias, efficient, and accessible alternative to traditional finance. It kicked off in 2017 with MakerDAO on the Ethereum network — where smart contracts replace financial intermediaries, and anyone with a wallet could lend, borrow, and earn.

No bank branches. No credit checks. No paperwork.

At its core, crypto lending allows users to deposit digital assets into decentralized protocols and earn yield — often far higher than the 2% scraps traditional banks toss your way. That same pool of capital is tapped by borrowers, who leverage collateral and borrow against it — all without asking permission from a single institution. It's financial access, without the gatekeeping.

Most platforms utilize algorithmic interest rates that adjust based on supply and demand between lenders and borrowers — or more specifically, utilization rate — ensuring lenders are rewarded when demand is high and borrowers always know the cost of capital. Everything runs on smart contracts, meaning no bias, no delays, and no hidden fees.

You might know DeFi wallets or DEXs, but lending is the backbone of decentralized finance. It's where idle assets start working. It's how capital flows across blockchains. And it’s still early. As more protocols launch with permissionless lending, vaults, curators, and real-time credit scoring — like Credora’s system — are setting new standards. Decentralized lending is shaping up to be a full-blown alternative to the banking system — not just for the degens, but for institutions, the bankless, and everyone in between.

DeFi Lending isn’t just a product. It’s a movement — toward financial self-custody, global access, and open systems that don't care about your credit score or region.

How Does Decentralized Lending Work?

DeFi Lending operates on non-custodial, permissionless protocols that allow users to lend or borrow assets without needing approval from centralized institutions. Here’s how it works:

Depositors – Earn Interest by Supplying Crypto

Users can deposit their stablecoins or other cryptocurrencies into a protocol such as Morpho. These funds are added to a liquidity pool, which other users can borrow from. The interest earned depends on market demand and is often significantly higher than traditional bank savings rates. Think of it like a crypto-powered savings account — but with higher yields and no middlemen.

Vaults – Managed by Curators

Vaults, or liquidity pools, are managed by curators (market makers) who optimize yield strategies for depositors by directing liquidity into other protocols or pools. Think of it like how banks reinvest customer deposits — but in DeFi, it’s automated and transparent.

Borrowers – Crypto as Collateral

Borrowers must provide tokens as collateral valued higher than the loan amount and keep up with interest payments. This protects lenders and mitigates defaults. If the collateral’s value drops too far, the protocol auto-liquidates the position to preserve the vault. Interest payments contribute to vault growth, benefiting depositors.

Key Features of DeFi Lending

Different lending platforms introduce a wide range of features that traditional banks simply can’t match — from permissionless access to non-custodial control and real-time, algorithmic interest rates. Here’s what makes crypto lending a compelling alternative.

Want the full breakdown? Check out our deep dive: DeFi Lending vs Traditional Lending for a side-by-side comparison.

Permissionless Access

No approvals. No restrictions. No waiting. With just a wallet and Wi-Fi, anyone can tap into permissionless lending — regardless of geography or credit history. It’s financial access on your terms, running 24/7 on-chain. While banks sleep, DeFi stays open.

Non-Custodial Control

Unlike banks that take custody of your funds, decentralized lending protocols are non-custodial. That means you maintain control of your assets at all times. Your crypto stays in your wallet or in smart contracts — not behind a desk at a financial institution.

Higher Yields on Stablecoins

While banks offer a modest 0.1% to 3% APY on savings, DeFi Lending protocols routinely deliver 10%–15% APY on stablecoins like USDC and USDT. These dynamic rates are driven by real-time market demand and executed automatically through smart contracts — no middlemen, no fine print.

Transparent & Algorithmic Interest Rates

Rates in lending protocols adjust in real time based on supply and demand — not some opaque decision made in a bank’s boardroom. Most protocols use algorithmic models to set borrowing costs and lender rewards, so you always know what you’re signing up for.

Business Lending & Borrowing

DeFi is starting to reshape more than just personal finance, digital holdings and investors — it's unlocking new ground in financial transactions. Traditionally, businesses have relied on banks, paperwork-heavy applications, and long approval timelines just to access working capital. But with a crypto lending platform, the entire process can be streamlined. A business can use its crypto assets as collateral or even build a credit profile through on-chain activity, and get access to liquidity within minutes — not weeks.

This is a game-changer, especially for startups and businesses in emerging markets that are typically underserved by legacy banking systems. No more waiting for a greenlight from a credit officer halfway across the world. The implications are huge: faster growth cycles, decentralized funding models, and a level playing field for businesses that don’t fit the mold of traditional finance.

And the options keep growing. Some decentralized applications now offer undercollateralized lending through credit assessment platforms, flexible repayment terms, while others allow tokenized invoices or real-world assets to be used for capital. It’s early days, but business finance is going borderless — and the runway for innovation is wide open.

Top DeFi Lending Platforms

Lending apps have seen explosive growth in recent years. The total value locked (TVL) in DeFi protocols jumped from approximately $9.1 billion in July 2020 to $90.8 billion, according to DeFiLlama — a staggering 900% increase. It’s one of the fastest-growing lending and borrowing markets, highlighting both the demand and rising adoption of DeFi as a serious alternative to traditional banking.

Today, a handful of platforms dominate the DeFi Lending space, known for offering competitive rates, innovative features, and proven reliability. Here are some of the major players shaping the lending landscape:

Aave

One of the OGs in the space. Aave lets you lend and borrow a wide range of assets across multiple chains. Known for its flash loans, dynamic interest rates, and massive liquidity. It’s battle-tested and governed by its community via the AAVE token.

Compound

Another heavyweight. Compound helped pioneer algorithmic interest rates and non-custodial lending. Simple UI, efficient, and deeply integrated across DeFi. It’s been around long enough to earn its stripes — and your trust.

Morpho

A rising star blending the best of peer-to-peer lending with liquidity pools. Morpho optimizes rates for both sides of the market and recently launched Morpho Blue, a permissionless lending layer. Oh, and they just partnered with Credora to bring vault risk ratings into the mix — institutional vibes, DeFi roots.

MakerDAO

This one’s a bit different. Maker doesn’t offer lending pools — it lets you mint DAI (a decentralized stablecoin) by locking up crypto as collateral. It’s overcollateralized lending with a twist. Think of it as borrowing against yourself.

MORE Markets (Upcoming)

A fresh contender making waves on Flow blockchain. MORE Markets lets you lend, earn, and borrow in a sleek, permissionless setup. With curated vaults and rapid TVL growth, it's quickly becoming one of the most promising DeFi protocols outside the usual Ethereum crowd.

Risks & Challenges

Despite its benefits, DeFi Lending apps come with certain risks that users should keep in mind:

Smart Contract Vulnerabilities

DeFi Lending relies on smart contracts, and any bugs or vulnerabilities in the code can be exploited by attackers. While top protocols undergo extensive audits and offer bug bounties, security risks still exist — and exploits have happened.

Liquidation Risks

Crypto-backed loans require collateral. If the value of that collateral drops below a set threshold, the protocol may automatically liquidate it to protect lenders. This risk is heightened during high market volatility, especially with non-stablecoins and memecoins. Undercollateralized lending is also gaining traction — where the collateral posted is less than the loan amount — adding another layer of risk.

Impermanent Loss & Market Volatility

While stablecoins provide price stability, lending or borrowing more volatile cryptocurrencies exposes users to price swings that can affect returns or trigger liquidations.

Regulatory Uncertainty

Global regulators are still figuring out how to approach DeFi. Future rules could impact how lending protocols operate, where they're accessible, and what kind of user verification (KYC) is required.

How to Get Started

Interested in earning passive income through DeFi Lending or borrowing crypto? Here’s a simple step-by-step to get started:

Step 1: Choose a Lending Platform

Browse and select a protocol from our DeFi Lending Directory that fits your needs.

Step 2: Set Up a Crypto Wallet

Pick a secure, compatible wallet from our DeFi Wallet Directory to interact with the protocol.

Step 3: Deposit Funds

Transfer your stablecoins or crypto assets into your wallet, then deposit them into the lending platform to start earning interest.

Step 4: Monitor Your Investments

Keep an eye on your deposited funds, earned interest, and loan health to avoid liquidation risks and maximize returns.

Final Thoughts

DeFi Lending is more than a new way to move money — it’s a new way to move. It gives users something TradFi never could: open access, global reach, and real yield that isn’t tied to legacy infrastructure. Whether you're stacking stablecoins or putting idle assets to work, this isn’t just finance with better rates — it’s finance with no ceiling.

We're not talking about small tweaks to old systems. We're talking about a full-on reimagination of what financial freedom looks like — where wallets replace paperwork, and smart contracts handle what used to take banks days to approve. DeFi Lending isn’t about asking permission. It’s about showing up, connecting your wallet, and being part of a financial system that works for you — not against you.

As infrastructure matures and adoption ramps up, the lines between Web2 banking and Web3 finance will only blur further. But make no mistake — DeFi isn’t trying to copy banks. It's building a parallel system, one that’s faster, fairer, and designed for the digitally native world.

Whether you're an investor looking for better returns or a borrower seeking more flexible terms, DeFi Lending offers an unmatched crypto-native alternative to the traditional banking system.

Source: DeFi Lending Explained: The Alternative Banking System

1 note

·

View note

Text

#astrology#sun1H

sun 1h

-sun in the 1st house often influences a persons ego to want to be centre stage

-this placement can cause a person to act/behave vigorously, impulsively and even aggressively at times

-sun in the 1st house can suggest that a persons life purpose relates to spontaneous self expression and that self discovery is very important to people with this placement

-people with this placement are usually very self motivated but can be selfish at times

-people with the sun in their 1st house will often relate more to the traits of their ascendant sign

-may have a strong sense of who they are and a greater ability to express this

-are often very confident, sure of themselves, ready to take the initiative and are full of life

-often do not care what other people think about them

-the sun in the 1st house provides a very abundant energy, meaning that people with this placement are often very positive and optimistic and tend to have the ability to inspire others to be the same

-people with this placement are usually able to express themselves very well as the energy of the sun is in the house of self expression and first impressions

-often natural born leaders and others will find themselves wanting to follow them as they are so determined, confident and self assured

-not only are they usually very confident and determined, they are often go-getters who are always ready to take the initiative, say yes to new opportunities and are able to make things work

-its often common for people with this placement to become/feel independent and highly motivated from a very young age

-may often have a constant need to be the centre of attention which can sometimes rub people the wrong way and bother some of the people in their life

-although they are generally seen as natural leaders, they can sometimes come across as overwhelming to others at times because of this and due to the fact that they can be controlling and like to have things on their own terms

-despite people with this placement often coming across as very confident at all times, there is still an ability for them to be insecure; but having the sun in the 1st house usually means that they hide and mask this insecurity with fake confidence

-the sun in the 1st house may also cause people with this placement to become obsessed with the way they look [in a healthy/positive or unhealthy/negative way]

-some may find people with this placement inspiring while others may find them overwhelming

-people with this placement usually love to make a great first impression and what people think of them is commonly very important to them

-because of the suns energy in their 1st house, people with this placement are often able to recover from illness/difficult times in their lives quickly

-their need for recognition is often very strong and usually one of the traits that characterises them the most

-they may seem pushy at times because they tend to have a strong will and power to overcome obstacles, weaknesses and dark periods in their life

-some of the negative traits this placement can feature include a potential overbearing and egotistical nature, arrogance, a need to always argue and too much pride

299 notes

·

View notes

Photo

Masaharu Fukuyama

Aquarius Rising, Scorpio Midheaven

Approximate time of birth: 06:40 AM

Reliability: The data comes from the person

Source: Ameblo

0 notes

Photo

PH-1

Cancer Rising, Pisces Midheaven

Approximate time of birth: Around 04:00 am

Reliability: The data comes from the person

Source: Nugustrology

#cancer asc#ph-1#leo stellium#2h stellium#nc#sun1h#mer2h#mar2h#ven2h#plu5h#sat7h#ura7h#nep7h#moon9h#jup12h#splay#birth time

0 notes

Photo

Ayaka Sasaki (Momoiro Clover Z)

Gemini Rising, Pisces Midheaven

Approximate time of birth: 04:47 AM

Reliability: The data comes from the person

Source: 5ちゃんねる (entry n° 505)

#gemini asc#nc#momoiro clover z#sun1h#ven1h#plu7h#jup8h#nep8h#ura9h#sat11h#moon11h#mer12h#mar12h#bowl#birth time

0 notes

Text

DeFi Lending Explained: The Alternative Banking System

DeFi Lending (Decentralized Finance Lending) is changing how we interact with money and access financial services. By removing traditional banks from the equation, DeFi Lending unlocks global, permissionless financial tools through robust lending and borrowing protocols.

While you may already be familiar with other components of the DeFi ecosystem — like trading platforms and crypto wallets — DeFi Lending protocols are a newer addition to crypto markets. They’ve quickly become one of its most powerful innovations, allowing users to earn yield on digital assets or borrow funds without intermediaries.

Unlike banks, which typically offer 0%–3% interest on savings accounts, permissionless platforms often provide yields of 10%–15% on stablecoins such as USDC and USDT, depending on algorithmic rates. Other altcoins can offer even higher returns, though they come with increased volatility and market risk.

DeFi Lending Explained

DeFi Lending protocols are new financial instruments reshaping the DeFi market into a more open, unbias, efficient, and accessible alternative to traditional finance. It kicked off in 2017 with MakerDAO on the Ethereum network — where smart contracts replace financial intermediaries, and anyone with a wallet could lend, borrow, and earn.

No bank branches. No credit checks. No paperwork.

At its core, crypto lending allows users to deposit digital assets into decentralized protocols and earn yield — often far higher than the 2% scraps traditional banks toss your way. That same pool of capital is tapped by borrowers, who leverage collateral and borrow against it — all without asking permission from a single institution. It's financial access, without the gatekeeping.

Most platforms utilize algorithmic interest rates that adjust based on supply and demand between lenders and borrowers — or more specifically, utilization rate — ensuring lenders are rewarded when demand is high and borrowers always know the cost of capital. Everything runs on smart contracts, meaning no bias, no delays, and no hidden fees.

You might know DeFi wallets or DEXs, but lending is the backbone of decentralized finance. It's where idle assets start working. It's how capital flows across blockchains. And it’s still early. As more protocols launch with permissionless lending, vaults, curators, and real-time credit scoring — like Credora’s system — are setting new standards. Decentralized lending is shaping up to be a full-blown alternative to the banking system — not just for the degens, but for institutions, the bankless, and everyone in between.

DeFi Lending isn’t just a product. It’s a movement — toward financial self-custody, global access, and open systems that don't care about your credit score or region.

How Does Decentralized Lending Work?

DeFi Lending operates on non-custodial, permissionless protocols that allow users to lend or borrow assets without needing approval from centralized institutions. Here’s how it works:

Depositors – Earn Interest by Supplying Crypto

Users can deposit their stablecoins or other cryptocurrencies into a protocol such as Morpho. These funds are added to a liquidity pool, which other users can borrow from. The interest earned depends on market demand and is often significantly higher than traditional bank savings rates. Think of it like a crypto-powered savings account — but with higher yields and no middlemen.

Vaults – Managed by Curators

Vaults, or liquidity pools, are managed by curators (market makers) who optimize yield strategies for depositors by directing liquidity into other protocols or pools. Think of it like how banks reinvest customer deposits — but in DeFi, it’s automated and transparent.

Borrowers – Crypto as Collateral

Borrowers must provide tokens as collateral valued higher than the loan amount and keep up with interest payments. This protects lenders and mitigates defaults. If the collateral’s value drops too far, the protocol auto-liquidates the position to preserve the vault. Interest payments contribute to vault growth, benefiting depositors.

Key Features of DeFi Lending

Different lending platforms introduce a wide range of features that traditional banks simply can’t match — from permissionless access to non-custodial control and real-time, algorithmic interest rates. Here’s what makes crypto lending a compelling alternative.

Want the full breakdown? Check out our deep dive: DeFi Lending vs Traditional Lending for a side-by-side comparison.

Permissionless Access

No approvals. No restrictions. No waiting. With just a wallet and Wi-Fi, anyone can tap into permissionless lending — regardless of geography or credit history. It’s financial access on your terms, running 24/7 on-chain. While banks sleep, DeFi stays open.

Non-Custodial Control

Unlike banks that take custody of your funds, decentralized lending protocols are non-custodial. That means you maintain control of your assets at all times. Your crypto stays in your wallet or in smart contracts — not behind a desk at a financial institution.

Higher Yields on Stablecoins

While banks offer a modest 0.1% to 3% APY on savings, DeFi Lending protocols routinely deliver 10%–15% APY on stablecoins like USDC and USDT. These dynamic rates are driven by real-time market demand and executed automatically through smart contracts — no middlemen, no fine print.

Transparent & Algorithmic Interest Rates

Rates in lending protocols adjust in real time based on supply and demand — not some opaque decision made in a bank’s boardroom. Most protocols use algorithmic models to set borrowing costs and lender rewards, so you always know what you’re signing up for.

Business Lending & Borrowing

DeFi is starting to reshape more than just personal finance, digital holdings and investors — it's unlocking new ground in financial transactions. Traditionally, businesses have relied on banks, paperwork-heavy applications, and long approval timelines just to access working capital. But with a crypto lending platform, the entire process can be streamlined. A business can use its crypto assets as collateral or even build a credit profile through on-chain activity, and get access to liquidity within minutes — not weeks.

This is a game-changer, especially for startups and businesses in emerging markets that are typically underserved by legacy banking systems. No more waiting for a greenlight from a credit officer halfway across the world. The implications are huge: faster growth cycles, decentralized funding models, and a level playing field for businesses that don’t fit the mold of traditional finance.

And the options keep growing. Some decentralized applications now offer undercollateralized lending through credit assessment platforms, flexible repayment terms, while others allow tokenized invoices or real-world assets to be used for capital. It’s early days, but business finance is going borderless — and the runway for innovation is wide open.

Top DeFi Lending Platforms

Lending apps have seen explosive growth in recent years. The total value locked (TVL) in DeFi protocols jumped from approximately $9.1 billion in July 2020 to $90.8 billion, according to DeFiLlama — a staggering 900% increase. It’s one of the fastest-growing lending and borrowing markets, highlighting both the demand and rising adoption of DeFi as a serious alternative to traditional banking.

Today, a handful of platforms dominate the DeFi Lending space, known for offering competitive rates, innovative features, and proven reliability. Here are some of the major players shaping the lending landscape:

Aave

One of the OGs in the space. Aave lets you lend and borrow a wide range of assets across multiple chains. Known for its flash loans, dynamic interest rates, and massive liquidity. It’s battle-tested and governed by its community via the AAVE token.

Compound

Another heavyweight. Compound helped pioneer algorithmic interest rates and non-custodial lending. Simple UI, efficient, and deeply integrated across DeFi. It’s been around long enough to earn its stripes — and your trust.

Morpho

A rising star blending the best of peer-to-peer lending with liquidity pools. Morpho optimizes rates for both sides of the market and recently launched Morpho Blue, a permissionless lending layer. Oh, and they just partnered with Credora to bring vault risk ratings into the mix — institutional vibes, DeFi roots.

MakerDAO

This one’s a bit different. Maker doesn’t offer lending pools — it lets you mint DAI (a decentralized stablecoin) by locking up crypto as collateral. It’s overcollateralized lending with a twist. Think of it as borrowing against yourself.

MORE Markets (Upcoming)

A fresh contender making waves on Flow blockchain. MORE Markets lets you lend, earn, and borrow in a sleek, permissionless setup. With curated vaults and rapid TVL growth, it's quickly becoming one of the most promising DeFi protocols outside the usual Ethereum crowd.

Risks & Challenges

Despite its benefits, DeFi Lending apps come with certain risks that users should keep in mind:

Smart Contract Vulnerabilities

DeFi Lending relies on smart contracts, and any bugs or vulnerabilities in the code can be exploited by attackers. While top protocols undergo extensive audits and offer bug bounties, security risks still exist — and exploits have happened.

Liquidation Risks

Crypto-backed loans require collateral. If the value of that collateral drops below a set threshold, the protocol may automatically liquidate it to protect lenders. This risk is heightened during high market volatility, especially with non-stablecoins and memecoins. Undercollateralized lending is also gaining traction — where the collateral posted is less than the loan amount — adding another layer of risk.

Impermanent Loss & Market Volatility

While stablecoins provide price stability, lending or borrowing more volatile cryptocurrencies exposes users to price swings that can affect returns or trigger liquidations.

Regulatory Uncertainty

Global regulators are still figuring out how to approach DeFi. Future rules could impact how lending protocols operate, where they're accessible, and what kind of user verification (KYC) is required.

How to Get Started

Interested in earning passive income through DeFi Lending or borrowing crypto? Here’s a simple step-by-step to get started:

Step 1: Choose a Lending Platform

Browse and select a protocol from our DeFi Lending Directory that fits your needs.

Step 2: Set Up a Crypto Wallet

Pick a secure, compatible wallet from our DeFi Wallet Directory to interact with the protocol.

Step 3: Deposit Funds

Transfer your stablecoins or crypto assets into your wallet, then deposit them into the lending platform to start earning interest.

Step 4: Monitor Your Investments

Keep an eye on your deposited funds, earned interest, and loan health to avoid liquidation risks and maximize returns.

Final Thoughts

DeFi Lending is more than a new way to move money — it’s a new way to move. It gives users something TradFi never could: open access, global reach, and real yield that isn’t tied to legacy infrastructure. Whether you're stacking stablecoins or putting idle assets to work, this isn’t just finance with better rates — it’s finance with no ceiling.

We're not talking about small tweaks to old systems. We're talking about a full-on reimagination of what financial freedom looks like — where wallets replace paperwork, and smart contracts handle what used to take banks days to approve. DeFi Lending isn’t about asking permission. It’s about showing up, connecting your wallet, and being part of a financial system that works for you — not against you.

As infrastructure matures and adoption ramps up, the lines between Web2 banking and Web3 finance will only blur further. But make no mistake — DeFi isn’t trying to copy banks. It's building a parallel system, one that’s faster, fairer, and designed for the digitally native world.

Whether you're an investor looking for better returns or a borrower seeking more flexible terms, DeFi Lending offers an unmatched crypto-native alternative to the traditional banking system.

Source: DeFi Lending Explained: The Alternative Banking System

1 note

·

View note

Photo

Kazumi Morohoshi (Hikaru Genji)

Leo Rising, Taurus Midheaven

Approximate time of birth: 04:36 AM

Reliability: The data comes from the person

Source: 5ちゃんねる (entry n°3)

#leo asc#nc#hikaru genji#johnny & associates#mar1h#sun1h#mer2h#plu2h#ven3h#ura3h#jup3h#nep4h#moon5h#sat10h#bucket#birth time

0 notes

Photo

Akira Akasaka (Hikaru Genji)

Taurus Rising, Capricorn Midheaven

Approximate time of birth: 04:45 AM

Reliability: The data comes from the person

Source: 5ちゃんねる (entry n°3)

#taurus asc#nc#hikaru genji#johnny & associates#1h stellium#taurus stellium#mer1h#sun1h#ven1h#sat2h#moon3h#plu6h#ura6h#nep8h#jup10h#mar10h#splash#birth time

0 notes

Photo

Naeun (April)

Taurus Rising, Aquarius Midheaven

Approximate time of birth: 06:08 am

Reliability: The data comes from the person

Source: Nugustrology

#taurus asc#april#dsp#nc#sat1h#sun1h#ven2h#mar7h#plu8h#moon9h#nep10h#ura11h#jup12h#mer12h#splay#birth time

0 notes

Photo

Haruka Kodama (HKT48)

Virgo Rising, Gemini Midheaven

Approximate time of birth: 03:46 am

Reliability: The data comes from the person

Source: 5ちゃんねる

#virgo asc#hkt48#nc#mer1h#sun1h#moon4h#plu4h#jup5h#nep5h#ura6h#sat8h#mar12h#ven12h#grand trine#splay#birth time

0 notes

Text

DeFi Lending Explained: The Alternative Banking System

DeFi Lending (Decentralized Finance Lending) is changing how we interact with money and access financial services. By removing traditional banks from the equation, DeFi Lending unlocks global, permissionless financial tools through robust lending and borrowing protocols.

While you may already be familiar with other components of the DeFi ecosystem — like trading platforms and crypto wallets — DeFi Lending protocols are a newer addition to crypto markets. They’ve quickly become one of its most powerful innovations, allowing users to earn yield on digital assets or borrow funds without intermediaries.

Unlike banks, which typically offer 0%–3% interest on savings accounts, permissionless platforms often provide yields of 10%–15% on stablecoins such as USDC and USDT, depending on algorithmic rates. Other altcoins can offer even higher returns, though they come with increased volatility and market risk.

DeFi Lending Explained

DeFi Lending protocols are new financial instruments reshaping the DeFi market into a more open, unbias, efficient, and accessible alternative to traditional finance. It kicked off in 2017 with MakerDAO on the Ethereum network — where smart contracts replace financial intermediaries, and anyone with a wallet could lend, borrow, and earn.

No bank branches. No credit checks. No paperwork.

At its core, crypto lending allows users to deposit digital assets into decentralized protocols and earn yield — often far higher than the 2% scraps traditional banks toss your way. That same pool of capital is tapped by borrowers, who leverage collateral and borrow against it — all without asking permission from a single institution. It's financial access, without the gatekeeping.

Most platforms utilize algorithmic interest rates that adjust based on supply and demand between lenders and borrowers — or more specifically, utilization rate — ensuring lenders are rewarded when demand is high and borrowers always know the cost of capital. Everything runs on smart contracts, meaning no bias, no delays, and no hidden fees.

You might know DeFi wallets or DEXs, but lending is the backbone of decentralized finance. It's where idle assets start working. It's how capital flows across blockchains. And it’s still early. As more protocols launch with permissionless lending, vaults, curators, and real-time credit scoring — like Credora’s system — are setting new standards. Decentralized lending is shaping up to be a full-blown alternative to the banking system — not just for the degens, but for institutions, the bankless, and everyone in between.

DeFi Lending isn’t just a product. It’s a movement — toward financial self-custody, global access, and open systems that don't care about your credit score or region.

How Does Decentralized Lending Work?

DeFi Lending operates on non-custodial, permissionless protocols that allow users to lend or borrow assets without needing approval from centralized institutions. Here’s how it works:

Depositors – Earn Interest by Supplying Crypto

Users can deposit their stablecoins or other cryptocurrencies into a protocol such as Morpho. These funds are added to a liquidity pool, which other users can borrow from. The interest earned depends on market demand and is often significantly higher than traditional bank savings rates. Think of it like a crypto-powered savings account — but with higher yields and no middlemen.

Vaults – Managed by Curators

Vaults, or liquidity pools, are managed by curators (market makers) who optimize yield strategies for depositors by directing liquidity into other protocols or pools. Think of it like how banks reinvest customer deposits — but in DeFi, it’s automated and transparent.

Borrowers – Crypto as Collateral

Borrowers must provide tokens as collateral valued higher than the loan amount and keep up with interest payments. This protects lenders and mitigates defaults. If the collateral’s value drops too far, the protocol auto-liquidates the position to preserve the vault. Interest payments contribute to vault growth, benefiting depositors.

Key Features of DeFi Lending

Different lending platforms introduce a wide range of features that traditional banks simply can’t match — from permissionless access to non-custodial control and real-time, algorithmic interest rates. Here’s what makes crypto lending a compelling alternative.

Want the full breakdown? Check out our deep dive: DeFi Lending vs Traditional Lending for a side-by-side comparison.

Permissionless Access

No approvals. No restrictions. No waiting. With just a wallet and Wi-Fi, anyone can tap into permissionless lending — regardless of geography or credit history. It’s financial access on your terms, running 24/7 on-chain. While banks sleep, DeFi stays open.

Non-Custodial Control

Unlike banks that take custody of your funds, decentralized lending protocols are non-custodial. That means you maintain control of your assets at all times. Your crypto stays in your wallet or in smart contracts — not behind a desk at a financial institution.

Higher Yields on Stablecoins

While banks offer a modest 0.1% to 3% APY on savings, DeFi Lending protocols routinely deliver 10%–15% APY on stablecoins like USDC and USDT. These dynamic rates are driven by real-time market demand and executed automatically through smart contracts — no middlemen, no fine print.

Transparent & Algorithmic Interest Rates

Rates in lending protocols adjust in real time based on supply and demand — not some opaque decision made in a bank’s boardroom. Most protocols use algorithmic models to set borrowing costs and lender rewards, so you always know what you’re signing up for.

Business Lending & Borrowing

DeFi is starting to reshape more than just personal finance, digital holdings and investors — it's unlocking new ground in financial transactions. Traditionally, businesses have relied on banks, paperwork-heavy applications, and long approval timelines just to access working capital. But with a crypto lending platform, the entire process can be streamlined. A business can use its crypto assets as collateral or even build a credit profile through on-chain activity, and get access to liquidity within minutes — not weeks.

This is a game-changer, especially for startups and businesses in emerging markets that are typically underserved by legacy banking systems. No more waiting for a greenlight from a credit officer halfway across the world. The implications are huge: faster growth cycles, decentralized funding models, and a level playing field for businesses that don’t fit the mold of traditional finance.

And the options keep growing. Some decentralized applications now offer undercollateralized lending through credit assessment platforms, flexible repayment terms, while others allow tokenized invoices or real-world assets to be used for capital. It’s early days, but business finance is going borderless — and the runway for innovation is wide open.

Top DeFi Lending Platforms

Lending apps have seen explosive growth in recent years. The total value locked (TVL) in DeFi protocols jumped from approximately $9.1 billion in July 2020 to $90.8 billion, according to DeFiLlama — a staggering 900% increase. It’s one of the fastest-growing lending and borrowing markets, highlighting both the demand and rising adoption of DeFi as a serious alternative to traditional banking.

Today, a handful of platforms dominate the DeFi Lending space, known for offering competitive rates, innovative features, and proven reliability. Here are some of the major players shaping the lending landscape:

Aave

One of the OGs in the space. Aave lets you lend and borrow a wide range of assets across multiple chains. Known for its flash loans, dynamic interest rates, and massive liquidity. It’s battle-tested and governed by its community via the AAVE token.

Compound

Another heavyweight. Compound helped pioneer algorithmic interest rates and non-custodial lending. Simple UI, efficient, and deeply integrated across DeFi. It’s been around long enough to earn its stripes — and your trust.

Morpho

A rising star blending the best of peer-to-peer lending with liquidity pools. Morpho optimizes rates for both sides of the market and recently launched Morpho Blue, a permissionless lending layer. Oh, and they just partnered with Credora to bring vault risk ratings into the mix — institutional vibes, DeFi roots.

MakerDAO

This one’s a bit different. Maker doesn’t offer lending pools — it lets you mint DAI (a decentralized stablecoin) by locking up crypto as collateral. It’s overcollateralized lending with a twist. Think of it as borrowing against yourself.

MORE Markets (Upcoming)

A fresh contender making waves on Flow blockchain. MORE Markets lets you lend, earn, and borrow in a sleek, permissionless setup. With curated vaults and rapid TVL growth, it's quickly becoming one of the most promising DeFi protocols outside the usual Ethereum crowd.

Risks & Challenges

Despite its benefits, DeFi Lending apps come with certain risks that users should keep in mind:

Smart Contract Vulnerabilities

DeFi Lending relies on smart contracts, and any bugs or vulnerabilities in the code can be exploited by attackers. While top protocols undergo extensive audits and offer bug bounties, security risks still exist — and exploits have happened.

Liquidation Risks

Crypto-backed loans require collateral. If the value of that collateral drops below a set threshold, the protocol may automatically liquidate it to protect lenders. This risk is heightened during high market volatility, especially with non-stablecoins and memecoins. Undercollateralized lending is also gaining traction — where the collateral posted is less than the loan amount — adding another layer of risk.

Impermanent Loss & Market Volatility

While stablecoins provide price stability, lending or borrowing more volatile cryptocurrencies exposes users to price swings that can affect returns or trigger liquidations.

Regulatory Uncertainty

Global regulators are still figuring out how to approach DeFi. Future rules could impact how lending protocols operate, where they're accessible, and what kind of user verification (KYC) is required.

How to Get Started

Interested in earning passive income through DeFi Lending or borrowing crypto? Here’s a simple step-by-step to get started:

Step 1: Choose a Lending Platform

Browse and select a protocol from our DeFi Lending Directory that fits your needs.

Step 2: Set Up a Crypto Wallet

Pick a secure, compatible wallet from our DeFi Wallet Directory to interact with the protocol.

Step 3: Deposit Funds

Transfer your stablecoins or crypto assets into your wallet, then deposit them into the lending platform to start earning interest.

Step 4: Monitor Your Investments

Keep an eye on your deposited funds, earned interest, and loan health to avoid liquidation risks and maximize returns.

Final Thoughts

DeFi Lending is more than a new way to move money — it’s a new way to move. It gives users something TradFi never could: open access, global reach, and real yield that isn’t tied to legacy infrastructure. Whether you're stacking stablecoins or putting idle assets to work, this isn’t just finance with better rates — it’s finance with no ceiling.

We're not talking about small tweaks to old systems. We're talking about a full-on reimagination of what financial freedom looks like — where wallets replace paperwork, and smart contracts handle what used to take banks days to approve. DeFi Lending isn’t about asking permission. It’s about showing up, connecting your wallet, and being part of a financial system that works for you — not against you.

As infrastructure matures and adoption ramps up, the lines between Web2 banking and Web3 finance will only blur further. But make no mistake — DeFi isn’t trying to copy banks. It's building a parallel system, one that’s faster, fairer, and designed for the digitally native world.

Whether you're an investor looking for better returns or a borrower seeking more flexible terms, DeFi Lending offers an unmatched crypto-native alternative to the traditional banking system.

Source: DeFi Lending Explained: The Alternative Banking System

1 note

·

View note

Photo

Muto Jun (Genin Wa Jibun Ni Aru)

Leo Rising, Taurus Midheaven

Approximate time of birth: 04:55 am

Reliability: The data comes from the person

Source: 1

#leo asc#genin wa jibun ni aru#moon1h#sun1h#mer2h#plu5h#mar5h#nep7h#ura7h#sat11h#jup12h#ven12h#nc#grand square#split#birth time

0 notes

Photo

Miyuki Watanabe (AKB48)

Virgo Rising, Gemini Midheaven

Approximate time of birth: 5:58 AM

Reliability: The data comes from the person

#virgo asc#akb48#sun1h#mer2h#jup2h#mar2h#moon3h#plu3h#ura5h#nep5h#sat6h#ven12h#nc#2h stellium#bowl#birth time

0 notes

Photo

Hikaru Yaotome (Hey! Say! Jump)

Sagittarius Rising, Libra Midheaven

Approximate time of birth: 8:05 AM

Reliability: The data comes from a website

Source: 5ちゃんねる (entry 7)

#sagittarius asc#hey say jump#johnny & associates#sun1h#ven1h#mer1h#sat2h#moon7h#mar7h#jup9h#plu12h#ura2h#nep2h#nc#sagittarius stellium#1h stellium#split#birth time

0 notes

Photo

Masaki Suda

Pisces Rising, Sagittarius Midheaven

Approximate time of birth: 6:36 AM

Reliability: The data comes from the father

Source: 5ちゃんねる (entry 432)

#pisces asc#sun1h#mer1h#ven2h#mar5h#jup8h#plu9h#nep11h#ura11h#sat12h#moon12h#nc#f#grand square#splay#birth time

0 notes

Text

DeFi Lending Explained: The Alternative Banking System

DeFi Lending (Decentralized Finance Lending) is changing how we interact with money and access financial services. By removing traditional banks from the equation, DeFi Lending unlocks global, permissionless financial tools through robust lending and borrowing protocols.

While you may already be familiar with other components of the DeFi ecosystem — like trading platforms and crypto wallets — DeFi Lending protocols are a newer addition to crypto markets. They’ve quickly become one of its most powerful innovations, allowing users to earn yield on digital assets or borrow funds without intermediaries.

Unlike banks, which typically offer 0%–3% interest on savings accounts, permissionless platforms often provide yields of 10%–15% on stablecoins such as USDC and USDT, depending on algorithmic rates. Other altcoins can offer even higher returns, though they come with increased volatility and market risk.

DeFi Lending Explained

DeFi Lending protocols are new financial instruments reshaping the DeFi market into a more open, unbias, efficient, and accessible alternative to traditional finance. It kicked off in 2017 with MakerDAO on the Ethereum network — where smart contracts replace financial intermediaries, and anyone with a wallet could lend, borrow, and earn.

No bank branches. No credit checks. No paperwork.

At its core, crypto lending allows users to deposit digital assets into decentralized protocols and earn yield — often far higher than the 2% scraps traditional banks toss your way. That same pool of capital is tapped by borrowers, who leverage collateral and borrow against it — all without asking permission from a single institution. It's financial access, without the gatekeeping.

Most platforms utilize algorithmic interest rates that adjust based on supply and demand between lenders and borrowers — or more specifically, utilization rate — ensuring lenders are rewarded when demand is high and borrowers always know the cost of capital. Everything runs on smart contracts, meaning no bias, no delays, and no hidden fees.

You might know DeFi wallets or DEXs, but lending is the backbone of decentralized finance. It's where idle assets start working. It's how capital flows across blockchains. And it’s still early. As more protocols launch with permissionless lending, vaults, curators, and real-time credit scoring — like Credora’s system — are setting new standards. Decentralized lending is shaping up to be a full-blown alternative to the banking system — not just for the degens, but for institutions, the bankless, and everyone in between.

DeFi Lending isn’t just a product. It’s a movement — toward financial self-custody, global access, and open systems that don't care about your credit score or region.

How Does Decentralized Lending Work?

DeFi Lending operates on non-custodial, permissionless protocols that allow users to lend or borrow assets without needing approval from centralized institutions. Here’s how it works:

Depositors – Earn Interest by Supplying Crypto

Users can deposit their stablecoins or other cryptocurrencies into a protocol such as Morpho. These funds are added to a liquidity pool, which other users can borrow from. The interest earned depends on market demand and is often significantly higher than traditional bank savings rates. Think of it like a crypto-powered savings account — but with higher yields and no middlemen.

Vaults – Managed by Curators

Vaults, or liquidity pools, are managed by curators (market makers) who optimize yield strategies for depositors by directing liquidity into other protocols or pools. Think of it like how banks reinvest customer deposits — but in DeFi, it’s automated and transparent.

Borrowers – Crypto as Collateral

Borrowers must provide tokens as collateral valued higher than the loan amount and keep up with interest payments. This protects lenders and mitigates defaults. If the collateral’s value drops too far, the protocol auto-liquidates the position to preserve the vault. Interest payments contribute to vault growth, benefiting depositors.

Key Features of DeFi Lending

Different lending platforms introduce a wide range of features that traditional banks simply can’t match — from permissionless access to non-custodial control and real-time, algorithmic interest rates. Here’s what makes crypto lending a compelling alternative.

Want the full breakdown? Check out our deep dive: DeFi Lending vs Traditional Lending for a side-by-side comparison.

Permissionless Access

No approvals. No restrictions. No waiting. With just a wallet and Wi-Fi, anyone can tap into permissionless lending — regardless of geography or credit history. It’s financial access on your terms, running 24/7 on-chain. While banks sleep, DeFi stays open.

Non-Custodial Control

Unlike banks that take custody of your funds, decentralized lending protocols are non-custodial. That means you maintain control of your assets at all times. Your crypto stays in your wallet or in smart contracts — not behind a desk at a financial institution.

Higher Yields on Stablecoins

While banks offer a modest 0.1% to 3% APY on savings, DeFi Lending protocols routinely deliver 10%–15% APY on stablecoins like USDC and USDT. These dynamic rates are driven by real-time market demand and executed automatically through smart contracts — no middlemen, no fine print.

Transparent & Algorithmic Interest Rates

Rates in lending protocols adjust in real time based on supply and demand — not some opaque decision made in a bank’s boardroom. Most protocols use algorithmic models to set borrowing costs and lender rewards, so you always know what you’re signing up for.

Business Lending & Borrowing

DeFi is starting to reshape more than just personal finance, digital holdings and investors — it's unlocking new ground in financial transactions. Traditionally, businesses have relied on banks, paperwork-heavy applications, and long approval timelines just to access working capital. But with a crypto lending platform, the entire process can be streamlined. A business can use its crypto assets as collateral or even build a credit profile through on-chain activity, and get access to liquidity within minutes — not weeks.

This is a game-changer, especially for startups and businesses in emerging markets that are typically underserved by legacy banking systems. No more waiting for a greenlight from a credit officer halfway across the world. The implications are huge: faster growth cycles, decentralized funding models, and a level playing field for businesses that don’t fit the mold of traditional finance.

And the options keep growing. Some decentralized applications now offer undercollateralized lending through credit assessment platforms, flexible repayment terms, while others allow tokenized invoices or real-world assets to be used for capital. It’s early days, but business finance is going borderless — and the runway for innovation is wide open.

Top DeFi Lending Platforms

Lending apps have seen explosive growth in recent years. The total value locked (TVL) in DeFi protocols jumped from approximately $9.1 billion in July 2020 to $90.8 billion, according to DeFiLlama — a staggering 900% increase. It’s one of the fastest-growing lending and borrowing markets, highlighting both the demand and rising adoption of DeFi as a serious alternative to traditional banking.

Today, a handful of platforms dominate the DeFi Lending space, known for offering competitive rates, innovative features, and proven reliability. Here are some of the major players shaping the lending landscape:

Aave

One of the OGs in the space. Aave lets you lend and borrow a wide range of assets across multiple chains. Known for its flash loans, dynamic interest rates, and massive liquidity. It’s battle-tested and governed by its community via the AAVE token.

Compound

Another heavyweight. Compound helped pioneer algorithmic interest rates and non-custodial lending. Simple UI, efficient, and deeply integrated across DeFi. It’s been around long enough to earn its stripes — and your trust.

Morpho

A rising star blending the best of peer-to-peer lending with liquidity pools. Morpho optimizes rates for both sides of the market and recently launched Morpho Blue, a permissionless lending layer. Oh, and they just partnered with Credora to bring vault risk ratings into the mix — institutional vibes, DeFi roots.

MakerDAO

This one’s a bit different. Maker doesn’t offer lending pools — it lets you mint DAI (a decentralized stablecoin) by locking up crypto as collateral. It’s overcollateralized lending with a twist. Think of it as borrowing against yourself.

MORE Markets (Upcoming)

A fresh contender making waves on Flow blockchain. MORE Markets lets you lend, earn, and borrow in a sleek, permissionless setup. With curated vaults and rapid TVL growth, it's quickly becoming one of the most promising DeFi protocols outside the usual Ethereum crowd.

Risks & Challenges

Despite its benefits, DeFi Lending apps come with certain risks that users should keep in mind:

Smart Contract Vulnerabilities

DeFi Lending relies on smart contracts, and any bugs or vulnerabilities in the code can be exploited by attackers. While top protocols undergo extensive audits and offer bug bounties, security risks still exist — and exploits have happened.

Liquidation Risks

Crypto-backed loans require collateral. If the value of that collateral drops below a set threshold, the protocol may automatically liquidate it to protect lenders. This risk is heightened during high market volatility, especially with non-stablecoins and memecoins. Undercollateralized lending is also gaining traction — where the collateral posted is less than the loan amount — adding another layer of risk.

Impermanent Loss & Market Volatility

While stablecoins provide price stability, lending or borrowing more volatile cryptocurrencies exposes users to price swings that can affect returns or trigger liquidations.

Regulatory Uncertainty

Global regulators are still figuring out how to approach DeFi. Future rules could impact how lending protocols operate, where they're accessible, and what kind of user verification (KYC) is required.

How to Get Started

Interested in earning passive income through DeFi Lending or borrowing crypto? Here’s a simple step-by-step to get started:

Step 1: Choose a Lending Platform

Browse and select a protocol from our DeFi Lending Directory that fits your needs.

Step 2: Set Up a Crypto Wallet

Pick a secure, compatible wallet from our DeFi Wallet Directory to interact with the protocol.

Step 3: Deposit Funds

Transfer your stablecoins or crypto assets into your wallet, then deposit them into the lending platform to start earning interest.

Step 4: Monitor Your Investments

Keep an eye on your deposited funds, earned interest, and loan health to avoid liquidation risks and maximize returns.

Final Thoughts

DeFi Lending is more than a new way to move money — it’s a new way to move. It gives users something TradFi never could: open access, global reach, and real yield that isn’t tied to legacy infrastructure. Whether you're stacking stablecoins or putting idle assets to work, this isn’t just finance with better rates — it’s finance with no ceiling.

We're not talking about small tweaks to old systems. We're talking about a full-on reimagination of what financial freedom looks like — where wallets replace paperwork, and smart contracts handle what used to take banks days to approve. DeFi Lending isn’t about asking permission. It’s about showing up, connecting your wallet, and being part of a financial system that works for you — not against you.

As infrastructure matures and adoption ramps up, the lines between Web2 banking and Web3 finance will only blur further. But make no mistake — DeFi isn’t trying to copy banks. It's building a parallel system, one that’s faster, fairer, and designed for the digitally native world.

Whether you're an investor looking for better returns or a borrower seeking more flexible terms, DeFi Lending offers an unmatched crypto-native alternative to the traditional banking system.

Source: DeFi Lending Explained: The Alternative Banking System

1 note

·

View note

Photo

Karina Nose

Pisces Rising, Sagittarius Midheaven

Approximate time of birth: 7:49 AM

Reliability: The data comes from the person

0 notes

Photo

Misako Ito

Gemini Rising, Pisces Midheaven

Approximate time of birth: 5:47 AM

Reliability: The data comes from the person

#gemini asc#sun1h#jup1h#sat3h#moon4h#plu5h#ura6h#nep7h#ven11h#mar11h#mer12h#nc#locomotive#grand trine#birth time

0 notes