#tax deducted at source tamil

Text

Understanding Professional Tax Registration: A Comprehensive Guide for Businesses

Streamlining Finances: A Guide to Professional Tax Registration Online in India

The Professional Tax Registration Procedure involves the state governments in India charging individuals who earn income or practise professions such as chartered accountants, lawyers, and doctors. Different states have varying rates and collection procedures for this service, which are imposed at the state level. Not all states enforce this tax, with Karnataka, West Bengal, Andhra Pradesh, Telangana, Maharashtra, Tamil Nadu, Gujarat, Assam, Chhattisgarh, Kerala, Meghalaya, Odisha, Tripura, Madhya Pradesh, and Sikkim being exceptions. This tax applies to entrepreneurs, working individuals, traders, and various occupations.

Professional tax is collected by specific Municipal Corporations and most Indian states, serving as a revenue source for the government. The maximum annual amount payable is INR 2,500, with predetermined slabs based on the taxpayer's income. Employers deduct this tax from employees' salaries in private companies and remit it to the Municipal Corporation. Professional tax is mandatory, and individuals are eligible for income tax deductions for this payment.

To initiate Professional Tax Registration, individuals must register their mobile number and email ID. After registration, they receive a unique username and password through secure channels like mobile and email. Through the Citizen portal, applicants create a self-assessment application and submit it for professional tax assessment.

The procedure of conversion of LLP into a Private Limited Company

1. Determine Eligibility:

- Confirm whether you meet the criteria for professional tax filing based on your income from profession, trade, or employment.

2. Gather Necessary Documents:

- Collect essential documents, including proof of income, identification, and other relevant details.

3. Online Registration:

- Initiate the professional tax filing by registering online through the designated portal.

4. Provide Personal Information:

- Enter accurate personal information, including your name, address, contact details, and PAN.

5. Employment Details:

- Furnish details regarding your profession, trade, or employment, along with relevant employment records.

6. Income Declaration:

- Declare your income earned through profession, trade, or employment within the specified format.

7. Compute Tax Liability:

- Calculate your professional tax liability based on the applicable slab rates and income brackets.

8. Payment Submission:

- Pay professional tax through the online portal using the available payment options.

9. Generate Acknowledgment:

- Obtain an acknowledgement receipt or confirmation of your professional tax filing for future reference.

10. Compliance with Due Dates:

- Ensure timely filing and payment to adhere to the specified due dates and avoid penalties.

11. Periodic Review:

- Periodically review your professional tax filing status to stay compliant with any regulation changes.

12. Seek Professional Assistance:

- Consult with tax professionals or experts to ensure accurate and smooth professional tax filing.

Conclusion

Navigating the intricacies of Professional Tax Registration in India requires understanding the diverse rates and procedures across states. While not uniformly enforced, this tax is mandatory for entrepreneurs, working individuals, traders, and professionals in specific occupations. With a maximum annual payment cap and Eligibility for income tax deductions, it is a crucial revenue source for governments. The online registration process, facilitated through secure channels and the Citizen portal, streamlines the filing procedure. Additionally, the guide for converting LLPs into Private Limited Companies emphasises the importance of eligibility confirmation, document collection, accurate information entry, and timely compliance to ensure a seamless transition with the possibility of seeking professional assistance if required.

0 notes

Text

Top 4 Areas for Real Estate Investment in Chennai.

The purchase of properties for sale in the city of Chennai, including but not limited to Thirumullaivoyal, Nungambakkam, Mylapore, and Besant Nagar, is packed with several benefits. To start with, it helps in getting a steady source of income via rent, which gives a person financial security.

Being part of diverse communities, apartment markets are likely to sustain or grow, which translates to long-term gains for investors.

Additionally, real estate is a shield against inflation since it lacks devaluation and relative stability in the changing economic conditions of Chennai.

The real estate sector in Chennai has the benefit of diversifying investment portfolios, which curtails the risk of volatility.

Tax deductions and allowances make investments in such an area more attractive than in other regions.

It is through the apartments in these locations that the investors have the levers to call the shots as they decide on the strategic issues for profitable returns.

To sum up, investing in Chennai’s Thirumullaivoyal, Nungambakkam, Mylapore, and Besant Nagar apartments creates a strong and unswerving avenue for the accumulation of wealth other than investments in the stock and bond markets.

Besant Nagar:

The attractive apartments for sale in Besant Nagar, located in the south of Chennai in India, open a new chapter of investment. A gem situated on the idyllic Bay of Bengal shores; Besant Nagar has a well-deserved reputation as one of the most popular residential areas in Chennai.

Urging that Besant Nagar shares the same environs as Adyar, Taramani, Guindy, Palavakkam, Madippakkam, and Velachery, the flats in Besant Nagar benefit from the surrounding facilities and infrastructure.

At the heart of beautiful neighborhoods and near seafront roads, these apartments provide transport links to metro stations like Nasdanam, Teynampet, Shaidabad, and Little Mount. Residents who walk these roads will have easy access to the amenities in these areas.

Thirumullaivoyal:

It is through an inscription from the Masilamninathar temple that Thirumullaivoyal is documented, giving insight into its historic importance during Chola and Pandya times.

More importantly, the land that Sembiyan Mahadevi donated in 970 CE yielded great outcomes. Administratively, it falls under the Avadi assembly constituency in Tamil Nadu, with some known places like Puzhal Lake and SIDCO Women Industrial Park being the most prominent.

Railway communication with Chennai and highway ways allowing access to neighboring locations are the major means of transportation.

Mylapore:

Navigate Mylapore, a bustling cultural destination in Chennai, famed for its iconic Kapaleeshwarar temple alongside other calming temples such as Ramakrishna.

Explore the legacy of the colonial period in San Thome Basilica and Luz Church. Shop at humming markets and savor authentic cuisine at neighborhood cafes. 3 words: 194 words The Role of Sports in Modern Society.

Exploring the Social, Psychological, and Economic Benefits of Coastal Living Near Marina Beach or Elliot's Beach for You to Enjoy Explore some of the charms of apartments for sale in Mylapore,merging heritage and modernity in Chennai's cultural hub.

Nungambakkam:

Nungambakkam is always the well-known European Western suburb of the city of Chennai, which has a lot of history and old-world European charisma. 6.3 kilometers away to the southwest, one can visit it from Pantheon Road or Poonamallee Highway, which leads directly to the place.

The corporations 'industrial estates have a big demand in the area; the Tamil Nadu Industrial Investment Corporation is only 4.2 kilometers away from it. Not only local people, but also Nungambakkam railway station, are at a short distance from them, and shopping centers like Ispahani Centre and Bergamo Mall are also nearby.

Shoppers who are specifically looking to buy apartments in Nungambakkam find a historical assortment in the area, which is appealing beyond the modern conveniences and even relates to the community ambiance.

0 notes

Text

tamil nadu: Disappointed with Tamil Nadu govts ordinance to ban online gaming: E-Gaming Federation

A day after Tamil Nadu promulgated an ordinance to ban online gambling, including online games of chance comprising rummy and poker, and setting up regulations for online gaming, Sameer Barde, chief executive officer (CEO) of E-Gaming Federation, has expressed his disappointment on the decision.

“We are surprised and disappointed at the Ordinance issued by the Tamil Nadu Government, which categorises Rummy as a game of chance. Being a game of skills, Rummy has been settled by the Supreme Court and held to be a protected trade under Article 19(1)(g) of the Constitution,” he said in a statement.

Tamil Nadu governor RN Ravi’s assent to ban online gaming as well as regulate such companies follows a cabinet decision to take the ordinance route to crack down on online games involving wagering, acting on a report by a committee headed by a retired judge that was evidenced addictive behavior, debt traps, and suicides caused by playing games involving stakes online.

On online rummy, the report underscored that the algorithms are known to the developers, rendering the code “pseudo-random,” and added that the possibility of deploying bots to interact with users has always existed.

“No mechanism is available for auditing the centralised server architecture of the gaming systems,” the government notification released on Friday said, referencing the report.

Barde said Tamil Nadu bringing Rummy under the ambit of a game of chance is directly in violation of the Supreme Court judgments and the recent judgment of the High Court of Madras, which overturned the law banning online games including Rummy.

Discover the stories of your interest

“In its detailed judgment, the Honorable High Court of Madras reaffirmed the preponderance test for distinguishing between games of skill and games of chance, especially in the context of rummy, reinforcing that both rummy and poker are games of skill.”

He added that his organisation was examining the Ordinance and would take appropriate action in due course.

Overall landscape

There have been a lot of deliberations on structuring online gaming policies as well as simultaneous crackdowns on gaming companies on allegations of tax fraud.

Last month, ET had reported that the

income tax department issued show-cause notices to seven online gaming companies and about three dozen high-value players active on their portals.

The possible tax evasion in these cases was expected to be about Rs 28,000 crore, sources hasd told ET. Income tax authorities had in February uncovered an online gaming portal with 8 million registered players and gross earnings of about Rs 58,000 crore over a three-year period.

In September,

a government panel suggested that India should create a regulatory body to classify online games as based on skill or chance, introduce rules to block prohibited formats, and take a stricter stance on gambling websites,

The panel of Prime Minister Narendra Modi’s top officials has for months been drafting regulations for the country’s online gaming sector, where foreign investors such as Tiger Global and Sequoia Capital have backed gaming startups Dream11 and Mobile Premier League, hugely popular for fantasy cricket.

The Central Board of Direct Taxes is also working out detailed guidelines on taxability of the online gaming sector to clear any ambiguity regarding taxation. Gross winnings face a flat 30% tax. The gaming portals are required to deduct tax at source at the rate of 0.1% for winnings of over Rs 10,000.

Stay on top of technology and startup news that matters. Subscribe to our daily newsletter for the latest and must-read tech news, delivered straight to your inbox.

Source link

Originally published at Melbourne News Vine

0 notes

Text

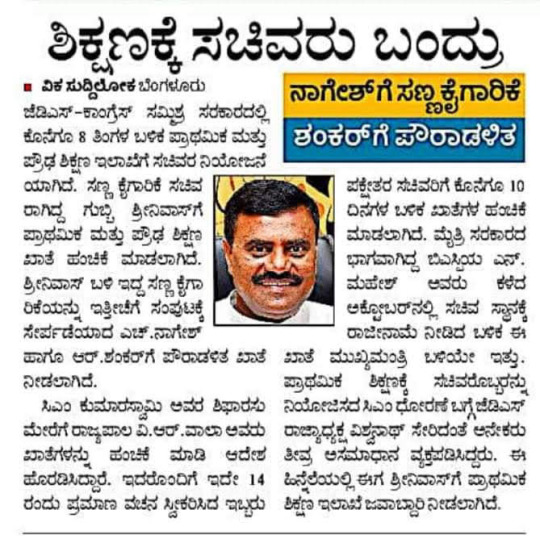

[22/6 8:26 ಪೂರ್ವಾಹ್ನ] Babu Anjanappa: ╭───────────────────╮

🌄 *S̴h̴u̴b̴o̴u̴d̴h̴a̴y̴ : 22 Jun/जेस्ट मासा (Tuesday) ग्रीष्म ऋतू*🙏🏻

╰───────────────────╯

*Today's top News* ➣➣➣➣➣➣➣➣➣➣➣➣➣➣

1. Nation celebrated the seventh International Day of Yoga virtually due to the coronavirus pandemic. The lead programme of the event, held by the Union Ministry of AYUSH, began at 6:30 am. During the programme, Union Minister of State for AYUSH Kiran Rijiju & PM Modi addressed the nation.

2. Vice President, M. Venkaiah Naidu appealed to the people to make Yoga a part of their daily lives.

3. The Record of 80 lakh COVID-19 vaccine doses administered so far on 1st day of nationwide free vaccination drive (21 June). All citizens above the age of 18 can avail free vaccination at any govt facility. The Centre will buy 75% of the total vaccine production from vaccine manufacturers & give it to the state govts free of cost.

4. J&K govt cancels annual Shri Amarnath Ji Yatra in view of COVID-19 pandemic.

5. The Govt has extended the waiver of Inter-State Transmission system (ISTS) charges on transmission of electricity generated from solar & wind sources up to 30th June 2025. Earlier, it was up to 30th June 2023.

6. Former Inspector General of Punjab Police Kunwar Vijay Pratap Singh today joined the Aam Aadmi Party at Amritsar.

7. Tripura, Chief Minister Biplab Kumar Deb on 21 June inaugurated the mega vaccination drive for the age group of 18- 44 yrs as part of the pan-India vaccination drive for June 21 and 22.

The programme was organised at IMA house Agartala.

8. Tamil Nadu Assembly session to continue till June 24. The session began yesterday with the address of Governor Banwarilal Purohit.

9. Tamil Nadu govt has released guidelines for protecting school students from sexual abuse. The regulation states that every school should have a eight member student protection counsel group consisting of the school headmaster or headmistress, teachers, members of the parent teachers association, non teaching staff, outside members and management representatives.

10. Ahead of PM Modi’s June 24 J-K outreach the Congress has demanded repeal of JK Reorganisation Act, 2019, and restoration of status quo ante in the erstwhile state.

11. From Jul 2021, a higher Tax Deducted At Source (TDS) rate would be applicable for Income Tax Return (ITR) non-filers, according to the Finance Act, 2021. If a taxpayer has not filed TDS in the last 2 years & TDS deducted each year more than ₹50,000, the tax department will charge more while filing the ITR from July 1.

12. The Centre has initiated major penalty proceedings against former West Bengal Chief Secretary Alapan Bandyopadhyay for alleged misconduct & misbehavior. The wrangle over Bandopadhyay began after the chief minister and he both skipped a meeting with Prime Minister Narendra Modi over Cyclone Yaas last month.

13. The Central Board of Secondary Education (CBSE) and Council for the Indian School Certificate Examinations (CISCE) boards have told the Supreme Court that class XII board examination results would be declared by July 31.

14. The security forces Indian Army & CRPF on Monday (21June) morning eliminated 3 top Lashkar-e-Taiba (LeT) terrorists, including Mudasir Pandit, in an encounter at Gund Brath in J&K Sopore.

15. The Indian Air Force (IAF) has raised the 2nd Rafale squadron, the ' *101 Falcons of Chhamb & Akhnoor* ' at Ambala. Ambala ahead of their formal induction at the Hasimara airbase in West Bengal.

16. Chief of Defence Staff General Bipin Rawat has called a meeting on Wednesday of the tri-services and other stake holders to understand their concerns over theatre commands and iron out differences before working towards the raising of maritime and air defence commands this year.

*✈INTERNATIONAL NEWS*

1. PM Modi announced that our country, along with UN and WHO, is launching an app called M-Yoga aiming to provide easy access to Yogic practice all over the world.

2. Pakistan Foreign Minister Shah Mahmood Qureshi has alleged that India is using Afghanistan for “carrying out terrorist activities” in Pakistan.

3. The Canadian govt has extended the suspension of direct flights from India to Canada till next month (21 July). The announcement in this regard was made on (21 June) Monday by the Public Health Agency of Canada.

4. India received USD 64 billion in Foreign Direct Investment in 2020, the 5th largest recipient of inflows in the world, according to a UN report.

5. Swami Vivekananda Cultural Centre, Embassy of India, Seoul South Korea, celebrated the 7th International Day of Yoga (IDY) celebrations in Seoul by organising yoga events at Busan University of Foreign Studies and Gandong-gu office in collaboration with Korea Yoga Association Yesterday (21 June).

*🌎WORLD NEWS🌍*

1. *International Yoga Day:* The UN has marked the day to raise awareness about the many benefits of practising Yoga for people all over the world. The date 21 June was chosen because it is the longest day in Northern Hemisphere. The word Yoga has originated from the Sanskrit word Yuja which means 'to join or to unite.

2. *US Navy tests new aircraft carriers's metal with powerful explosions* . The massive explosive was set off underwater near USS Gerald R. Ford, the first of a new class of advanced aircraft carriers, in the Atlantic Ocean.

3. The 7th International Day of Yoga was observed in Bangladesh with great enthusiasm across the country. Several events were organised in Dhaka & other parts of Bangladesh to mark the occasion.

4. Sweden's parliament ousted PM Stefan Lofven in a no-confidence vote on 21 June, giving the Social Democrat leader a week to resign & hand the speaker the job of finding a new govt, or call a snap election.

*🚣🚴🏇🏁🏊Sports:*

1. Men's Cricket WTC Final: 4th day's play between New Zealand and India washed out completely due to rain.

Uganda's Olympic squad has become the first to test positive for COVID-19 on arrival in Japan. The competition is due to start on 23rd of July.

2. Union Minister of Youth Affairs and Sports and Minister of the Ministry of Ayush Kiren Rijiju announces 25 Fit India Yoga centers across 9 states on occasion of IYD2021.

*USD 74.19 💷GBP 103.34*

_In Kohima(Nagaland)_

*🥇Gold ₹48,040©10 gm 24 (Krt)*

🥈 *Silver ₹73,100©Kg*

⛽ *Petrol ₹ 96.58*

⛽ *Diesel ₹ 90.85*

*LPG : ₹ 828.50/14.2 reKg*

*BSE Sensex* 52,574 46

*NIFTY* : 15,746.40

Ⓝⓐⓥⓔⓔⓝ Ⓚⓤⓜⓐⓡ

*🇮🇳Facts about India🇮🇳*

Rishikesh is a city in India’s northern state of Uttarakhand, in the Himalayan foothills beside the Ganges River. The river is considered holy, and the city is renowned as a center for studying yoga and meditation. Temples and ashrams (centers for spiritual studies) line the eastern bank around Swarg Ashram, a traffic-free, alcohol-free and vegetarian enclave upstream from Rishikesh town.

Rishikesh is primarily famous for its spiritual importance. ... Rishikesh is the beginning of the famous Char Dham Yatra (Gangotri, Yamunotri, Kedarnath, Badrinath). There are a number of Ayurveda centres also where you can experience the ancient healing methods for body and mind.

The Bharat Mandir was established on the banks of the holy Ganges in around 12th Century by Guru Shri Shankaracharya. Inside the temple, there is an idol of lord Vishnu, made out of a single Saligram. Shri Shankaracharya also placed the Shri Yantra above the Vishnu idol.

*😀Thought of the day*

Happiness is when what you think, what you say, and what you do are in harmony." — *Mahatma Gandhi*

*Joke of the day*

*पप्पू* : मां सारे खिलौने बेड के नीचे छिपा दो...

*पप्पू की मां* : क्यों..?

*पप्पू* : क्योंकि मेरा दोस्त डब्बू आ रहा है..

*पप्पू की मां* : डब्बू खिलौने चुरा लेगा क्या...?

*पप्पू* : नहीं, वह अपने खिलौने पहचान लेगा

*😳Why❓❓❓*

*Why Don't We Remember Being Babies?*

Virtually nobody has memories from very early childhood because at that age, our brains don't yet function in a way that bundles information into the complex neural patterns that we know as memories. This is called "semantic memory

Until sometime between the ages two and four, try you however, children lack "episodic memory" -- memory regarding the details of a specific event. Such memories are stored in several parts of the brain's surface, or "cortex." For example, memory of sound is processed in the auditory cortexes, on the sides of the brain, while visual memory is managed by the visual cortex, at the back. A region of the brain called the hippocampus ties all the scattered pieces together. The hippocampus, tucked very neatly in the middle of our brain, is responsible for pulling those all together and tying them. At the age of seven, children could still recall more than 60% of the recorded events, but children who were just a year older remembered only about 40 %

The reason we don’t remember being babies is because infants and toddlers don’t have a fully developed memory. But babies as young as six months can form both short-term memories that last for minutes, and long-term memories that last weeks.

*LEARN Sanskrit*🙏🏻

*आकृति* : आकार Shape

🤔 *How it works* ⁉

*How the Telephone Works.*☎️📞

When a person speaks into a telephone, the sound waves created by his voice enter the mouthpiece. An electric current carries the sound to the telephone of the person he is talking to. ... When a person talks into the telephone, the sound waves strike the diaphragm and make it vibrate.

When two telephones are connected, analog voice data is transmitted over the copper wires of the PSTN (Public Switched Telephone Network). The voice data is then converted into electrical signals which are eventually routed in the switching centers. Finally, a connection is made and communication is possible.

The number dialled on a landline is routed via the telephone wire to the Electric cross connect system at the local telephone exchange. This system has a direct mapping for the number dialled to the location of the called person. It simply switches the call to subsequent cross connects till the destination is reached.

Something that converts energy from one form to another is called a *transducer* . The loudspeaker in a phone works in the opposite way: it takes an incoming electrical current and uses magnetism to convert the electrical energy back into sound energy you can hear.

💁🏻♂️ *GK TODAY*

*Alexander Graham Bell* , best known for his invention of the *telephone* , revolutionized communication as we know it. His interest in sound technology was deep-rooted and personal, as both his wife and mother were deaf.

🛕 *VEDIK GNAN*

*NARASIMHA* Avatar, Lord Vishnu incarnates himself as a semi-man, semi-lion in this world. The king of demons (asuras), Hiranyakasyapa, wanted to become immortal and wanted to remain young forever. To this end, he meditated for Lord Brahma and because of his severe penance, the gods were frightened and asked Brahma to pacify the king. Brahma was impressed by his austerity and granted him a wish. HiranyaKasyapa wished that he be neither killed by a man or beast, nor in daylight or at night and neither inside or outside a building. Having obtained the wish he considered himself the supreme God and frobade all worship of gods by anyone.

But his son Prahlada, was an ardent devotee of Vishnu. This enraged Hiranyakasyapa very much. He ordered numerous ways to kill Prahlada including asking his sister Holika to sit with Prahlada in the fire. But everytime Prahlada escaped unhurt. Enraged, once he asked Prahlad to show him the Lord Vishnu. Prahlad said, "He is everywhere". Further enraged, Hiranyakasyapa knocked down a pillar, and asked if Lord was present there. Lord Vishnu then emerged as a half lion, half man from the pillar which was neither inside the house nor outside, and the time was evening, neither night nor day. He then killed Hiranyakasyapa thus saving the life of his devotee Prahlada.

🧬 *HEALTH CARE:© HOME REMEDIES*🩺

( *Note* : These home tips followed in villages/ancient traditions, it is up to you to use it or not🙏🏻)

*Health Benefits of Sweet Lime or Mosambi*

Juice helps enhance Immunity.

Vitamin C and other antioxidants present in sweet lime or its juice can help strengthen immunity. It helps stay away from colds and flu. Stimulate blood circulation and thus strengthens the immune system.

*Regards*

───────────────────╮

*🙏PLZ FOLLOW GOVT. NORMS, MAINT SOCIAL DISTANCE, KEEP YOURSELF ©YOUR FAMILY SAFE🌼*

╰───────────────────╯

[23/6 7:46 ಪೂರ್ವಾಹ್ನ] Babu Anjanappa: ╭───────────────────╮

🌄 *S̴h̴u̴b̴o̴u̴d̴h̴a̴y̴ : 23 Jun/जेस्ट मासा (Wednesday) ग्रीष्म ऋतू*🙏🏻

╰───────────────────╯

*Today's top News* ➣➣➣➣➣➣➣➣➣➣➣➣➣➣

1. A two-day monsoon session of the Maharashtra legislature will begin from July 5 to 6th July.

2. The all-party meeting convened by PM Modi in New Delhi on Thursday (24 June).

3. J &K former CM Farookh Abdullah and Mahbooba Mufti to attend all party meeting called by PM Modi on June 24.

4. Leaders of several opposition parties including the Trinamool Congress, the Samajwadi Party, the Aam Aadmi Party, the Rashtriya Lok Dal and the Left assembled at Natinoalist Congress Party chief Sharad Pawar's residence in New Delhi on 22 Jun (Tuesday) & discussed various issues facing the country, amid heightened speculation about the possibility of a third front against the ruling BJP.

5. *Gujarat CM Vijay Rupani e-launches Agricultural Diversification Scheme-2021,* benefiting vanbandhu- farmers in tribal areas. will get fertilizer-seed assistance of Rs. 31 crores in which 45 kg of urea, 50 kg of NPK and 50 kg of ammonium sulphate will be provided. Seeds of crops like maize, Bitter Melon (karela), Calabash (dudhi), tomato, millet, etc. are provided under this scheme.

6. Lok Sabha Speaker Shri Om Birla virtually inaugurated an online Indian and foreign language learning course for Members of Parliament, State / UT Legislatures, Officials and their families.

7. 22 cases of the Delta Plus variant of the coronavirus have been detected in India, with 16 from Maharashtra & the remaining from Madhya Pradesh and Kerala.

8. To check whether a taxpayer will be eligible to pay Tax Deducted at Source (TDS) at higher rates from next month, the Income Tax department has introduced a new functionality on the tax portal. The new section 206AB. If a taxpayer has not filed TDS in the last 2 years & aggregate of TDS exceeds Rs 50,000 in each year, the Income Tax department will charge more while filing the income tax returns (ITR) from July 1. The rate of TDS will be either twice the rate specified under the relevant section or provision or 5%, whichever is higher.

9. *The last date of filing Tax Deducted at Source (TDS) for the fourth quarter of financial year 2020-21 has been extended to June 30*

10. Tamil Nadu Chief Minister MK Stalin assures resolutions in Assembly against Farmer laws, the Citizenship Amendment Act. He said it would not be appropriate to adopt such resolutions.

11. The Andhra Pradesh High Court on Tuesday sentenced two IAS officials to one month’s imprisonment and a fine of Rs 1,000 each for not implementing court orders on the filling of certain vacancies in the horticulture department. panchayat raj commissioner Girija Shankar and horticulture commissioner Chiranjeevi Chowdary .

12. Supreme Court to hear plea of convict in Rajiv Gandhi assassination case after 3 weeks. A G Perarivalan, serving life sentence in the Rajiv Gandhi assassination case, seeking grant of parole. Rajiv Gandhi was assassinated on the night of May 21, 1991 at Sriperumbudur in Tamil Nadu by a woman suicide bomber.

13. Bengaluru court in Karnataka has directed former PM HD Deve Gowda to pay Rs 2 crore to Nandi Infrastructure Corridor Enterprise Ltd for allegedly defaming the company in 2011.

14. *CBSE to conduct optional exam between 15 August to 15 Sept* : The CBSE said if the candidates are not satisfied with their result, CBSE will provide online facility for registration for the examination. The facility to register for written exam will be offered online at CBSE’s official website - cbse.nic.in.

15. Raksha Mantri Rajnath Singh will visit the Cochin Shipyard Limited on June 25 (Friday) to review the progress of the Indigenous Aircraft Carrier (IAC). He is on two-day Kochi visit.

16. Lt. Gen. Ajay Kumar Suri took over as the Director General (DG) and Colonel Commandant of the Army Aviation on 21 June.

17. The Defence Ministry has signed a contract with Goa Shipyard Ltd for construction of two Pollution Control Vessels for Indian Coast Guard today. The Defence Ministry has said that it has been done at a cost of about Rs 583 crore.

18. *Born Today*🐣

Actor *Raj Babbar* (born 23 June 1952) is a Hindi and Punjabi film actor and politician belonging to Indian National Congress. 3 times member of the Lok Sabha and a 2 times member of the Upper House of the Indian Parliament. He was the President of Uttar Pradesh Congress Committee.

*✈INTERNATIONAL NEWS*

1. External Affairs Minister S Jaishankar is scheduled to address the United Nations Security Council (UNSC) debate on Afghanistan on 23 June (Wednesday).

2. UN Secretary-General on Myanmar has claimed that about 10,000 refugees have fled from Myanmar to India & Thailand as clashes in that country led to “acute” new displacements and alleged that the regional threat of the crisis is real.

3. India & China are likely to hold another round of diplomatic talks this week on eastern Ladakh with a focus on moving forward in disengagement of troops in the remaining friction points.

4. The United Kingdom posted a liaison officer at the Indian Navy's Information Fusion Centre (IFC) that has emerged as a key hub in tracking movements of ships and other developments in the Indian Ocean. Lt Commander Stephen Smith will be based full-time at the Centre.

5. US Pharma giant Pfizer is in the final stages of an agreement with India to supply anti-COVID-19 vaccines, Chief Executive Officer Dr Albert Bourla said.

*🌎WORLD NEWS🌍*

1. Pak PM Imran Khan has ruled out hosting American bases in Pakistan for military action inside war-torn Afghanistan, fearing it might lead to his country being "targeted in revenge attacks" by terrorists.

2. US President Joe Biden is looking forward to meet with his Afghan counterpart Ashraf Ghani on 25 June (Friday).

3. American Airlines will cut hundreds of flights over the next 3 weeks to avoid overloading its operation as demand for summer air travel rises faster than once expected.

4. Today 23 June - International Widow's Day is observed. To raise awareness globally about the violation of human rights that widows suffer & faces in several countries following the death of their spouses.

*🚣🚴🏇🏁🏊Sports:*

1. The ICC has announced prize money for the winner and runner-up of the World Test Championship Final. The winning team of the final between India and New Zealand will receive about 12 crore rupees along with an ICC Test Championship Mace. The losing team will receive 6 crore rupees approximately. The final match will start on June 18 at Ageas Bowl, Southampton.

2. Chinese swimmer star Sun Yang was banned for more than four years on Tuesday for breaking anti-doping rules, after a retrial at the Court of Arbitration for Sport.

3. Former captain Younis Khan on Tuesday (June 22) stepped down as Pakistan's batting coach. He was appointed last year in November on a two-year contract until the 2022 ICC T20 World Cup. The Pakistan team is due to start a tour of England from June 25 to July 20 for three ODIs and three T20Is. The team will next go to the West Indies from July 21 to August 24 to feature in five T20Is and two Tests.

4. *Norman Pritchard*

An Indian athlete & the first Olympic medal winner from India : Norman Gilbert Pritchard (23 June 1877 – 31 October 1929), also he was a British-Indian sportsperson and actor who became the first Asian-born athlete to win an Olympic medal when he won two silver medals in athletics at the 1900 Paris Olympics representing India.

5. International Olympics Day is observed on June 23 every year to celebrate sports and health. The occasion marks the day when International Olympic Committee was founded in 1894. ... Baron Pierre de Coubertin founded the International Olympic Committee (IOC) in 1894 and laid foundation of the Olympic Games.

*USD 74.31 💷GBP 103.24*

_In Bhubaneswar(Odhs)_

*🥇Gold ₹48,110©10 gm 24 (Krt)*

🥈 *Silver ₹73,100©Kg*

⛽ *Petrol ₹ 98.27*

⛽ *Diesel ₹ 96.15*

*LPG : ₹ 836/14.2 Kg*

*BSE Sensex* *52,588.71*

*NIFTY* : *15772.75*

Ⓝⓐⓥⓔⓔⓝ Ⓚⓤⓜⓐⓡ

*🇮🇳Facts about India🇮🇳*

1 note

·

View note

Photo

First Choice Finance Consultants is one of the Top financial consultants providing cost effective value added solutions to meet all business needs of customers under one roof.

We follow highest level of professional ethics and quality in all our financial consultancy services. Our Vision is to offer High quality financial services to our valued customers at affordable prices within agreed time lines.

Our Core values being Integrity , Innovation and Quality that drives us to achieve excellence. We cover a wide range of financial services such as Bookkeeping & Accounting , VAT Consultancy services , GST Consultancy services , Management Accounting services , TAX computations and TAX returns filing , Financial Investment Services , Internal Auditing services , SAP Finance (FICO) Implementations and Customization services and much more.

Our esteemed clients come from various backgrounds and industries , both from India and overseas. We guarantee every client efficient personalized services that will exceed their expectations... We have a fast-growing team of qualified , experienced and dedicated Certified Financial and Tax professionals with innovative and commercial approach to meet today’s highly challenging business environment.

We create positive , memorable experience for our valued customers and establish ever lasting relationship with them. We are committed to excellence in whatever we do. Exceptional quality of our services , a transparent approach , speedy completion and timely delivery at low cost forms the hallmark of our organization.

Our continuous focus and dedication to unmatched quality sets us apart in the market. All our activities are Services Oriented only. We do not involve in Trade of any Tangible goods (Products , Stocks , Properties or any other inventories in business).

Our Specialization

Accounting and Bookkeeping Service Providers

,

Accounting and Financial Service Providers

,

Accounting Firm

,

Accounting Service Providers

,

Accounting Support Service Providers

,

Accounts Payable Ageing Report & Summaries Preparation Service Providers

,

Accounts Receivables Management Service Providers

,

Accounts Reconciliation Service Providers

,

Acquisition Strategy Advisors

,

Adjustments to Year-end Accounts Preparation Service Providers

,

Assets /equipment Ledgers Preparation Service Providers

,

Auditors

,

Balance-sheet Preparation Service Providers

,

Billing and Technical Support Providers

,

Bookkeeping Service Providers

,

Books Balanced & Reconciled Quarterly Preparation Service Providers

,

Bpo Company

,

Bpo Finance Service Providers

,

Bpo Placement Agency Service Providers

,

Break-up of Expenses Reports Preparation Service Providers

,

Business Audit Support Service Providers

,

Business Consultants

,

Business Intelligence and Analytics Service Providers

,

Business Management Consultants

,

Business Process Outsourcing Consultants

,

Cash Flow Statement Preparation Service Providers

,

Change Management Service Providers

,

Consulting and Financial Service Providers

,

Corporate Finance Advisors

,

Credit Management Service Providers

,

Credit Risk Management Service Providers

,

Custom Software Development Service Providers

,

Customer Analytics Service Providers

,

Customer and Technical Support Service Providers

,

Customer Experience Optimization Service Providers

,

Customer Order Processing Service Providers

,

Customer Reports Preparation Service Providers

,

Data Analytics Service Providers

,

Data Entry and Management Service Providers

,

Data Monetization Service Providers

,

Day-to-day Bookkeeping & Accounting Preparation Service Providers

,

Debt Management Service Providers

,

Digital Marketing Service Providers

,

Digital Strategy Service Providers

,

E-commerce Support Service Providers

,

Employee Reports Preparation Service Providers

,

Erp Consultants

,

Estate Planning Service Providers

,

Event Analysis Reports Preparation Service Providers

,

Expenses Ledger Preparation Service Providers

,

Expert Tax Advisor Service Providers

,

External Audit Support Service Providers

,

Finance and Accounting Service Providers

,

Financial Advice Service Providers

,

Financial Advisors

,

Financial Audit Support Service Providers

,

Financial Reporting Service Providers

,

Financial Service Facility Providers

,

Financial Statements Preparation Service Providers

,

General Ledger Preparation Service Providers

,

Growth Strategy Service Providers

,

Human Resource Management Service Providers

,

Income Statement (Profit & Loss) Preparation Service Providers

,

Incorporation & Restructuring Advisors

,

Insurance Planning Service Providers

,

Internal Audit Support Service Providers

,

Inventory Audit Support Service Providers

,

Investment Advisor on Annuities

,

Investment Advisor on Bank Products

,

Investment Advisor on Bonds

,

Investment Advisor on Certificates of Deposit

,

Investment Advisor on Commodities

,

Investment Advisor on Cryptocurrencies

,

Investment Advisor on Exchange-traded Funds

,

Investment Advisor on Index Funds

,

Investment Advisor on Insurance

,

Investment Advisor on Investment Funds

,

Investment Advisor on Mutual Funds

,

Investment Advisor on Options

,

Investment Advisor on Retirement Plans

,

Investment Advisor on Stocks

,

Investment Consultants

,

Investment Support Service Providers

,

Invoice to Cash Transformation Service Providers

,

Iso Audit Support Service Providers

,

Lead Generation and Qualification Support Service Providers

,

Management Accounts Preparation Service Providers

,

Market Research Service Providers

,

Monitoring Employee Time and Attendance Service Providers

,

Mutual and Index Funds Management Service Providers

,

Net Worth and Cash Flow Analysis Service Providers

,

New Business Service Advisors

,

Operations Management Service Providers

,

Payroll Service Provider

,

Payroll Support Service Providers

,

Payroll Taxes and Deductions Service Providers

,

Pricing Optimization Service Providers

,

Process Mapping Service Providers

,

Profitability Assessment Service Providers

,

Property Investment Consultants

,

Real Estate Bookkeeping Service Providers

,

Retirement Investment Consultants

,

Risk Management Consultants

,

Sap Fico Consultants

,

Sap Finance Implementations Consultants

,

Setting Up and Making Adjustments to Direct Deposit Accounts Service Providers

,

Sg&a Optimization Service Providers

,

Sourcing and Procurement Service Providers

,

Stock Audit Support Service Providers

,

Stocks and Bonds Investment Consultants

,

Storage of Documents Service Providers

,

System Audit Support Service Providers

,

Tax Advisors

,

Tax Planning Advisors

,

Tax Planning Consultants

,

Tax Preparation Support Service Providers

,

Tax Problems Consulting Service Providers

,

Technology It Business Consulting Service Providers

,

Tqm Audit Support Service Providers

,

Trial Balance Preparation Service Providers

,

Virtual Accounting & Bookkeeping Service Providers

,

Virtual Assistant Service Providers

,

Virtual Assistant Solutions Providers

,

Wealth Management Consultants

,

Workflow Automation and Optimization Support Providers

,

Write-up Service Providers

,

First Choice Finance Consultants

Address :57/29, 5th lane, 2nd Main Rd, Indira Nagar, Adyar, Chennai - Tamil Nadu 600020

Email:[email protected]

Phone:+91 98410 62636

Website:

https://firstchoicefinanceconsultants.weebly.com/

https://first-choice-finance-consultants.business.site/

GMB :https://g.page/first-choice-finance-consultants?share

Social Website:

https://firstchoicefinanceconsultants.weebly.com

https://first-choice-finance-consultants.business.site/

https://www.tradeindia.com/first-choice-finance-consultants-29656712/

https://www.indiamart.com/company/82469870/

https://www.justdial.com/Chennai/First-Choice-Finance-Consultants-Adyar/044PXX44-XX44-200417222503-P1U9_BZDET

http://www.linkedin.com/in/srinivasan-ceo-first-choice-finance-consultants-chennai-india/

http://www.facebook.com/firstchoicefinanceconsultants

https://www.linkedin.com/company/first-choice-finance-consultants/

https://www.bing.com/maps?osid=340dabaf-0fff-467c-a0bd-45cb04b3d53d&cp=12.998218~80.249283&lvl=16&imgid=2398acb3-f891-4069-b522-7b0bd9df14a6&v=2&sV=2&form=S00027

0 notes

Text

Guiding Through the Online Professional Tax Registration Procedure in India

Streamlining Finances: A Guide to Professional Tax Registration Online in India

The Professional Tax Registration Procedure involves the state governments in India charging individuals who earn income or practise professions such as chartered accountants, lawyers, and doctors. Different states have varying rates and collection procedures for this service, which are imposed at the state level. Not all states enforce this tax, with Karnataka, West Bengal, Andhra Pradesh, Telangana, Maharashtra, Tamil Nadu, Gujarat, Assam, Chhattisgarh, Kerala, Meghalaya, Odisha, Tripura, Madhya Pradesh, and Sikkim being exceptions. This tax applies to entrepreneurs, working individuals, traders, and various occupations.

Professional tax is collected by specific Municipal Corporations and most Indian states, serving as a revenue source for the government. The maximum annual amount payable is INR 2,500, with predetermined slabs based on the taxpayer's income. Employers deduct this tax from employees' salaries in private companies and remit it to the Municipal Corporation. Professional tax is mandatory, and individuals are eligible for income tax deductions for this payment.

To initiate Professional Tax Registration, individuals must register their mobile number and email ID. After registration, they receive a unique username and password through secure channels like mobile and email. Through the Citizen portal, applicants create a self-assessment application and submit it for professional tax assessment.

The procedure of conversion of LLP into a Private Limited Company

1. Determine Eligibility:

- Confirm whether you meet the criteria for professional tax filing based on your income from profession, trade, or employment.

2. Gather Necessary Documents:

- Collect essential documents, including proof of income, identification, and other relevant details.

3. Online Registration:

- Initiate the professional tax filing by registering online through the designated portal.

4. Provide Personal Information:

- Enter accurate personal information, including your name, address, contact details, and PAN.

5. Employment Details:

- Furnish details regarding your profession, trade, or employment, along with relevant employment records.

6. Income Declaration:

- Declare your income earned through profession, trade, or employment within the specified format.

7. Compute Tax Liability:

- Calculate your professional tax liability based on the applicable slab rates and income brackets.

8. Payment Submission:

- Pay professional tax through the online portal using the available payment options.

9. Generate Acknowledgment:

- Obtain an acknowledgement receipt or confirmation of your professional tax filing for future reference.

10. Compliance with Due Dates:

- Ensure timely filing and payment to adhere to the specified due dates and avoid penalties.

11. Periodic Review:

- Periodically review your professional tax filing status to stay compliant with any regulation changes.

12. Seek Professional Assistance:

- Consult with tax professionals or experts to ensure accurate and smooth professional tax filing.

Conclusion

Navigating the intricacies of Professional Tax Registration in India requires understanding the diverse rates and procedures across states. While not uniformly enforced, this tax is mandatory for entrepreneurs, working individuals, traders, and professionals in specific occupations. With a maximum annual payment cap and Eligibility for income tax deductions, it is a crucial revenue source for governments. The online registration process, facilitated through secure channels and the Citizen portal, streamlines the filing procedure. Additionally, the guide for converting LLPs into Private Limited Companies emphasises the importance of eligibility confirmation, document collection, accurate information entry, and timely compliance to ensure a seamless transition with the possibility of seeking professional assistance if required.

0 notes

Text

No new Tamil releases from March 27?

By: Entertainment Desk | Chennai |

Published: March 11, 2020 3:29:49 pm

T Rajhendherr said the TDS adds to the burden of distributors.

T Rajhendherr, President of the Chennai Thiruvallur Kancheepuram Distributors’ Association, has said that the TDS (Tax Deducted at Source) imposed on distributors’ income should be cancelled. In…

View On WordPress

0 notes

Text

JIPMER Biochemistry & Biotechnology Research Fellow Post

New Post has been published on https://biotechtimes.org/2019/08/05/jipmer-biochemistry-biotechnology-research-fellow-post/

JIPMER Biochemistry & Biotechnology Research Fellow Post

Biochemistry & Biotechnology Research Fellow Post

B Tech Biotechnology, Msc Biochemistry and Medical Biotechnology candidates are requested to attend walk-in-interview for Junior Research Fellow position. Jawaharlal Institute of Postgraduate Medical Education and Research (JIPMER) Biotechnology Research Fellow Post. Check out the details given below:

Jawaharlal Institute of Post Graduate Medical Education and Research (JIPMER), Puducherry-605006

Position Title: Junior Research Fellow

Monthly Emoluments: Rs.25,000/- + HRA (Rs.5,000/-)

Project Details:

Project Title: Effect of Colchicine in Septic Shock (COLISEPS Trial) – A Pilot Study

Duration: 3 years

Principal Investigator: Dr. R. Venkateswaran, Associate Professor of Medicine.

Essential Qualifications: M.Sc in Medical Biotechnology, Pharmacology, Biochemistry or Equivalent degree. BE or B. Tech in Biotechnology or Equivalent Degree.

Desirable Qualifications and Experience:

Good communication skills in Tamil and Proficiency in English

Basic computer knowledge required for data entry and data analysis.

Experience: Animal (Mice) handling, ELISA and Western Blot techniques

Any Publication in Science Citation Indexed Journal

National Eligibility Test Qualified (like ICMR-JRF, CSIR-UGC, JGEEBILS)

Upper Age Limit: Not exceeding 28 years as on 28th August 2019. However, can be relaxed for OBC/SC/ST candidates as per norms.

How to apply: Interested candidates fulfilling the eligibility criteria may register online and attend the walk-in-interview.

Selection procedure: Registered applicants will be screened and eligible candidates will be intimated by email, on 15th August 2019 to attend the interview. On 28th August 2019, after certificate verification, all candidates found eligible will have to appear for the written test. Based on the performance in the written test, the top 5 (Five) candidates will be shortlisted to appear for Personal Interview. List of Shortlisted Candidates will be displayed in the Departmental Notice Board at 2 PM on the same day. The final merit list will be drawn after the Interview, with the Selected candidate and Waitlisted candidates. The same will be valid for one year from the date of Publications of results.

Download Application Form

View Notification

TERMS AND CONDITIONS for appointment to the post of JUNIOR RESEARCH FELLOW

The appointment is PURELY on TEMPORARY BASIS (co-terminus with the project) will be initially for a period of ONE YEAR and the extension may be granted up to THREE YEARS based on the performance with effect from the date of joining. If the period is not extended further, the same will lapse automatically.

If the performance of the appointee is not found satisfactory by the Principal Investigator, then an appointment can be terminated at any time without assigning any reason.

If the appointee wishes to resign, it can be done by giving one month’s notice or by paying one month’s salary.

The appointee is not entitled to any T.A. for attending the interview and joining the appointment.

Qualification, experience, other terms, and conditions may be relaxed/altered at the discretion of the Principal Investigator. The decision of the Competent Authority will be final.

The appointee shall perform the duties as assigned to him/her. The competent authority reserves the right to assign any duty as and when required. No extra/additional allowances will be admissible in case of such assignment.

The appointee shall be on the whole time appointment of the JIPMER and shall not accept any other assignment, paid or otherwise and shall not engage himself/herself in private practice of any kind during the period of contract.

The appointee shall not be entitled to any benefit like Provident Fund, Pension, Gratuity, Medical Attendance Treatment, Seniority, Promotion, etc. or any other benefits available to the Government Servants, appointed on regular basis.

The appointee will not be eligible to get official accommodation/quarters allotment within the campus as applicable to the other regular employees of this Institute.

The Income Tax or any other tax liable to be deducted, as per the prevailing rules will be deducted at source before effecting the payment, for which the Department will issue TDS Certificate/s.

For further queries, if any, contact Principal Investigator with an email of the subject mentioned as “Enquiries about DST-SERB COLISEPS project recruitment”

Dr. Venkateswaran R, Email ID – ([email protected]) Associate Professor, Department of Medicine, JIPMER, Puducherry – 605006.

0 notes

Text

BORN IN INDIA I SERVED FROM INDIA I TO THE GLOBE

Dated: 01.06.2020

Opportunities in the Post-Covid-19 World under the Make in India Initiative

This slideshow requires JavaScript.

The Make in India Initiative and Opportunities in the Post-Covid-19 World

1.0 The Covid-19 besides unsettling and plunging the world in unprecedented severe economic crisis has also thrown up a universe of opportunities for India, specifically for those enterprises who wish to be a part of the India growth story. The unreliability of the Chinese Political System in not warning the world in time about the impending pandemic threat and its unscrupulous attempts to exploit the economic meltdown to entrench its strategic and economic interest has shaken the confidence of the world in China as a reliable trade/ economic ally. The world has started looking to other destinations to keep the global economic engine moving with India emerging as a key potential destination.

2.0 However, to be a part of the India growth story its important to understand and engage with regulatory environments of India, while understanding the India growth story.

3.0 Thus far participation of India in the global economy has risen and is high, in terms of GDP, trade, etc. India has developed know-how and succeeded in exporting a huge basket of goods and services to a large number of countries. It has specialised in sectors which will likely to be in high demand in the near future e.g., information, communication and technology (ICT) services, pharmaceuticals and medical devices etc. The government aims at getting India even more and better integrated into the global economy, the objectives are to double India’s share of world trade, to makes India a hub for global value chain under the make in India flagship; to boost foreign investment inflows by modernizing regulations and to attract more savings from Indians living abroad.

The imposition of US tariffs on Chinese products world accelerate the rejigging of value chains. Preliminary data suggests that India has seized some of the market shares lost by China, with more success in capital and skill intensive industries than in labour intensive ones. Smart policy making has also led to enablement and success of India industry. For instance the ICT sector has been able to function under the Shop and Establishment Act and hence was not subject to the 45 labour laws which apply to industries.

4.0 Addressing domestic bottlenecks; infrastructure and business environment :-

The 2014 OECD Economic Survey of India (OECD, 2014) concluded that manufacturing, for which the production process tends to be more fragmented than for services, suffered most from tax cascading – taxes were levied on each successive transfer, inclusive of any previous tax being levied, as indirect taxes levied on inputs were not creditable from indirect taxes levied on outputs. The Goods and Services Tax (GST), by allowing firms to deduct taxes on inputs, is a clear improvement for the manufacturing sector when implementation costs will disappear.

4.1 Infrastructure bottlenecks have lessened:

The quality of infrastructure is a key determinant of countries’ participation in global value chains . As exports of goods tend to be more intensive in energy and transport than services, they suffer more from infrastructure bottlenecks.

Electricity : India has made significant progress in increasing electricity generation and transmission capacities, in particular from renewable sources, to fulfil its commitment to provide electricity for all. Total generation increased from 1000 TWh in 2010 to 1600 TWh in 2017, making India the third-largest electricity market in the world (IEA, 2018). In 2018, electricity reached every village and the government aims to provide electricity for all by 2019.

Ports : Container traffic at Indian ports is increasing rapidly. The Sagarmala programme launched in 2015 aims at modernising and developing ports, enhancing port connectivity, supporting coastal communities and stimulating port-linked industrialisation. The government also aims at improving infrastructure effectiveness, reducing the turnaround time at major ports from about 3.4 days in 2018 to the global average of 1-2 days by 2022-23 (NITI Aayog, 2018). The Sagarmala programme, launched in 2015 for the period to 2025, aims at reducing logistic costs – both direct costs and inventory handling costs – for foreign and domestic trade by developing and rehabilitating ports. It also aims at doubling the share of water transportation in the modal mix, since it is more cost-effective and emits less greenhouse gas than road and railway transport (FICCI, 2018). More than 605 projects have been identified by the government under the Sagarmala initiative, with a budget of INR 8.8 trillion (about 5.1% of FY 2018/19 GDP). As of 2018, 89 projects were completed and 443 were under various stages of implementation and development.

Turnaround time at major ports has reduced from 107 hours in FY 2011-12 to close to 60 hours in the first seven months of FY 2018/19.Measures to improve the ease of trading across borders have been taken, including the replacement of manual forms with e-filing, e-delivery and e-payment for shipping lines and agents, and a reduction in charges for non-peak hours at ports. The government has also abolished restrictive cabotage rules that prevented foreign ships from transporting containers between Indian ports.

Major Ports are being made more competitive in this regard , the Major Port Authorities Bill, 2020 was introduced in Lok Sabha . The Bill seeks to provide for regulation, operation and planning of major ports in India and provide greater autonomy to these ports. It seeks to replace the Major Port Trusts Act, 1963. Key features of the Bill include Public Private Partnership (PPP) projects. The Bill defines PPP projects as projects taken up through a concession contract by the Board. For such projects, the Board may fix the tariff for the initial bidding purposes. The appointed concessionaire will be free to fix the actual tariffs based on market conditions, and other conditions as may be notified. The revenue share in such projects will be on the basis of the specific concession agreement.

Roads : The Bharatmala programme, launched in 2017 for a five-year period, aims at developing 83 677 km of roads, including economic corridors to strengthen links between manufacturing centres and export hubs. Roads account for the lions share in inland freight transport. The overall cost of the programme was estimated at INR 6.9 trillion (4% of FY2018/19 GDP). The programme relies partly on public-private partnerships, in particular for highways. As of February 2019, 137 road projects with an aggregate length of 6 530 km had been awarded and were in various implementation stages.

Labour regulations: Various measures have been taken to make labour regulations and institutions friendlier to job creation (OECD, 2019). Taking into account the COVID -19 pandemic many State Govt., have suspended the application of most of the labour laws for a considerable duration for instance UP has done so for three years ,Gujarat has also taken similar measures.

5.0 Reform Momentum : To keep up the reform momentum and speed up the dispatching of manufacturing exports, the government has proposed the creation of Coastal Employment Zones. Tax benefits linked to employment creation would add to existing incentives for Special Economic Zones. Coastal Zones are also likely to relax labour regulations. As of March 2019, 14 Coastal Zones have been proposed and plans were being developed for four pilot ones in Andhra Pradesh, Gujarat, Maharashtra, and Tamil Nadu.

5.1 Proposed Coastal Employment Zones: In its Three Year Action Plan 2017/18 to 2019/20, the government (NITI Aayog) suggested the creation of two Coastal Employment Zones, one on the east coast and the other on the west coast, to capture agglomeration effects and attract large multinational firms leaving China because of rising labour costs.

The main features of the proposed zones would be:

–Large areas (i.e. larger than existing special economic zones) with flexible land conversion rules. Coastal zones are to be spread over 500 km2 or more and include existing habitations and industry structures. They will have sufficiently flexible land conversion rules to permit the conversion of these habitations and structures into alternative uses over time as industrialisation proceeds.

-Flexibility in the Floor Space Index would also be granted.

– More liberal and business-friendly regulations. Coastal zones should have liberal labour laws, as is currently the case in Gujarats Special Economic Zones. -They may also have more liberal land acquisition rules (as done in Tamil Nadu and Gujarat).

-Tax breaks for new firms creating many jobs. For new firms and firms creating many jobs, government financial support could be envisaged in the form of an upfront benefit for firms, in contrast to the existing tax relief that firms can only benefit from once they become profitable.

-Proximity to deep draft ports.

– Public investment on infrastructure. The central government may commit to investing up to INR 50 billion (0.03% of FY 2018 GDP) in each coastal zone to meet the infrastructure and housing needs.

– Trade facilitation and trade liberalisation. Clearance time for imports and exports will be reduced to international levels within the zones.

5.2 Trade Facilitation : India has launched the National Trade Facilitation Action Plan for 2017-2020, after ratifying the WTO Trade Facilitation Agreement in 2016. This plan aims at increasing the efficiency of cross-border trade by reducing border and documentary compliance time, permitting exporters to electronically seal their containers at their own facilities, and reducing physical inspections. The Plan foresees a decline in dwell time for imports to within three days for sea cargo, within two days for air cargo and on the same day for land customs. For exports, the aim is to reach below two days for sea cargo and on same-day for air cargo. Implementing the governments Plan, including the Indian Customs Single Window Project, will facilitate trade.

5.3 FDI Norms : India has recently taken steps towards more competitive services by raising or eliminating limits on foreign equity in civil aviation, cable and satellite broadcasting and the insurance sector and allowing for foreign branches for reinsurance activities. For single-brand retail trade, India has eased local sourcing requirements in 2019 by relaxing the definition of goods subject to the 30% local sourcing requirement. Single-brand retailers will also be allowed to open online stores before setting up brick-and-mortar ones (not more than two years after). India has liberalised its FDI policy in many sectors over the past two decades. Since 2014, India has been a top reformer: caps on foreign participation have been raised and more sectors have been brought under the automatic route, avoiding the administrative burden associated with the government approval route. The opening was most ambitious in the air, real estate and retail distribution sectors. In 2017, the Foreign Investment Promotion Board was abolished and the government approval system was simplified and decentralised –concerned ministries are now invited to accept or reject FDI projects within a shorter timeframe (8-10 weeks). Overall, the OECD FDI Restrictiveness Index suggests that in 2018 India was more open than several other EMEs, including China, Indonesia and Malaysia. While global FDI flows declined three years in a row to 2018, FDI inflows to India as a share of GDP have remained relatively robust.

The government aims at making India a more attractive FDI destination. FDI restrictions in single-brand retail, digital media, contract manufacturing and coal sector were loosened in August 2019. Local sourcing norms for single-brand retail FDI have been softened. In presenting its Budget for FY 2019-20, the government indicated that further reforms are likely, including in the insurance, aviation and media sectors.

5.4 FTAs: India has used preferential trade agreements as a key component of its trade and foreign policy, especially since the early 2000s. It has concluded bilateral agreements with several Asian countries (including South Korea in 2009 and Japan in 2011). It is party to various regional trade agreements, including the SAFTA, the Asia Pacific Trade Agreement, and the ASEAN.

6.1 Policy And Implementation Framework For The Make In India Initiative : The Department for Promotion of Industry and Internal Trade (DPIIT) drives the efforts in this direction and has come up with a road map for the largest manufacturing initiative undertaken by a nation in recent history. In a short space of time, the obsolete and obstructive frameworks of the past have been dismantled and replaced with a transparent and user-friendly system. This is helping drive investment, fostering innovation, developing skills, protecting Intellectual Property (IP) and building best-in-class manufacturing infrastructure.

7.1 Make In India Campaign Main Focus Areas : Make in India initiative has made significant achievements and has been reviewed now, focusing on 27 sectors – 15 manufacturing sectors and 12 champion service sectors under Make in India 2.0 programme. The Department for Promotionof Industry and Internal Trade is coordinating action plans for 15 manufacturing sectors, while Department of Commerce is coordinating action plan for 12 service sectors. The revised list of the 27 Sectors are as follows:

1. Aerospace and Defence

2. Automotive and Auto Components

3. Pharmaceuticals and Medical Devices

4. Bio-Technology

5. Capital Goods

6. Textile and Apparels

7. Chemicals and Petrochemicals

8. Electronics (ESDM)

9. Leather &Footwear

10. Food Processing

11. Gems and Jewelry

12. Shipping

13. Railways

14. Construction

15. New and Renewable Energy

16. Information Technology & Information Technology enabled Services (IT & ITeS)

17. Tourism and Hospitality Services

18. Medical Value Travel

19. Transport and Logistics Services

20 Accounting and Finance Services

21. Audio Visual Services

22. Legal Services

23. Communication Services

24. Construction and Related Engineering Services

25. Environmental Services

26. Financial Services

27. Education Services

8.1 Ease of Doing Business : The Government is introducing several reforms to create possibilities for getting Foreign Direct Investment (FDI) and foster business partnerships. Some initiatives have already been undertaken to alleviate the business environment from outdated policies and regulations. This reform is also aligned with parameters of World Bank’s ‘Ease of Doing Business’ index to improve India’s ranking on it. This is driven by reforms in the areas of Starting a Business, Construction Permits, Getting Credit, Protecting Minority Investors, Paying Taxes, Trading across Borders, Enforcing Contracts, and Resolving Insolvency.

9.1 Intellectual Property Rights: IPR Policy was launched in May 2016. Its aim is to spur creativity and stimulate innovation and ensure effective IPR protection in India. In order to promote innovation the following measures have been taken. Final Patent (Amendment) Rules, 2019 – published on 17th September, 2019, amending The Patents Rules, 2003 has led to significant simplification of rules, especially for startups and MSMEs. . The Patent (Second Amendment) Rules, 2019 published to reduce fees for small entity/MSMEs for processing of patent applications under various sections of the Patents Act, 1970 will incentivize MSMEs to file for more patents.

10.1 Industrial Corridors: Infrastructure is integral to the growth of any industry. The government intends to develop industrial corridors and build smart cities with state-of-the- art technology and high-speed communication. Along with the development of infrastructure, the training for skilled workforce for the sectors is also being addressed.

11.1 Growth of Micro, Small and Medium Enterprises Sector: The Indian economy is likely to emerge as one of the leading economies in the world, with an envisioned GDP of USD five trillion economy by 2024. Our vision is to ensure that at least a contribution worth USD two trillion come from MSME sector. To accomplish this, M/o MSME has taken many steps during the year for technology advancement, skill development and job creation for empowerment of MSME Sector.

12.1 Skill Development Programme: The skill ecosystem in India is undergoing major reforms and policy interventions as India embarks on its journey to become a Knowledge Economy. The skill gap study by the National Skill Development Corporation (NSDC) for the period of 2010-2014 reports that over 109.73 million additional skilled manpower will be required by 2022 across different sectors.

13.1 Conclusion : A close watch at these regulatory, trade and other trends would help spot granular opportunities for instance : – The textile sector provides and illustrative case, within textile exports, the share of yarns and fabrics, which are increasingly automated, has increased while the share of labour-intensive products, like carpets, has declined . A focus on the low -technology segment for textile, garment and footwear, reveals that India has stopped gaining market shares since 2013; Vietnam now has a larger market share. Overall, manufacturing exports have fallen as a share of total exports and their composition has shifted from labour-intensive to high skill and technology-intensive items. A boom in PPE products demand could reinvigorate the testile sector . Manufacturing has emerged as one of the high growth sectors in India.

The Make in India campaign helps to place India on the world map as a manufacturing hub and give global recognition to the Indian economy. The large investment in manufacturing will bring in more capacity creation in the country. The tax reliefs given to start ups and MSME‟s will boost sustainable employment and the quality of startups in the design led manufacturing sector. Make in India mission is one such long term initiative which will realize the dream of transforming India into manufacturing hub. Make in India campaign also focuses on producing products with zero defects and zero effects on environment.

Connect for B2B & G2G Business

Team S.J. EXIM SERVICES- TEAM Q-FREIGHT I Team ETON Solutions

CP: Mr. Ravi Jha

Web: www.q-freight.com I www.sjeximtech.com

EMAIL: [email protected] I [email protected]

TEL NO: +91-9999005379

Facebook: www.facebook.com/sjeximservices I www.facebook.com/CCQFreight

“We Design & Create Solutions for Government, Corporates, MSME & Individuals across Industry Verticals”

NOTE: All Inquiries are solicited via email only. The Sourcing Services are paid without any prejudice

Disclaimer: Please refer to the official Source before effecting any decision. We are not responsible for the data or notification published at the source; we are only reproducing the same for your Ease of Doing Business.

Opportunities in the Post-Covid-19 World under the Make in India Initiative BORN IN INDIA I SERVED FROM INDIA I TO THE GLOBE Dated: 01.06.2020 Opportunities in the Post-Covid-19 World under the Make in India Initiative…

0 notes

Text

Now You Can Check If Your Employer Is Contributing To The EPF A/c

Do you get an SMS when your bank transaction fails for any reason?

But have you heard of someone getting a similar intimation from the Employees’ Provident Fund Organisation (EPFO) on the failure of the employer to deposit contributions in your Employees’ Provident Fund (EPF) account?

Recently, EPFO took another step to improve transparency. It decided to intimate subscribers through email or SMS every time their employer fails to deposit its contribution. To access the press release, click here.

Why did EPFO take such a step?

In the past there have been instances where employers not only skipped their contributions deliberately, but also didn’t deposit contributions deducted from the employees’ salary.

And, such unethical incidents have been steadily on the rise since FY 2012-13.

Defaulting employers…

(Source: The Hindu Business Line)

Tamil Nadu and West Bengal have reported the maximum cases of such deliberate defaults.

What happens when your employers deduct your contribution, but don’t credit it to your account?

If contributions remain un-deposited for more than six months, then the employer has to pay 25% p.a. interest along with dues.

If it remains outstanding for more than two months, but less than four months, then the employer has to pay 10% p.a. interest along with the amount due.

For a delay of more than four months but less than six months, the interest penalty increases to 15% p.a.

Despite such stringent laws, employers refuse to pay heed. An employee remains under the impression that since the amount is deducted from his salary, the employer must have credited this to his/her EPFaccount.

At present, you can only check your credit balance. But with this initiative of EPFO, you will be able to track the contribution frequency of your employer as well.

Do you solely depend on EPF for your retirement planning ?

Ideally, you shouldn’t. There’s no doubt that EPF is one of the most attractive investment avenues from the retirement planning perspective, since it fetches you perhaps the higher tax-adjusted yield in the fixed-income category.

However, depending entirely on it would severely constrain your portfolio.

First, try to estimate the corpus you might require at retirement using PersonalFN’s retirement calculator. You may use PersonalFN’s calculator to do this exercise.

Second, depending on years left for your retirement and your risk appetite you should create a personalised retirement plan. You should also take into account your existing kitty of retirement savings.

Want PersonalFN to help you accomplish your goal of blissful retirement?

Yes?

Do not hesitate to call us on 022-61361200.

You can also Schedule a Call with our investment consultant, or even drop a mail at [email protected] and we will be happy to help you.

PersonalFN is a SEBI registered investment advisor. We will handhold in the path of wealth creation and living a blissful retired life.

How good is the idea of investing in mutual funds for retirement?

It’s imperative for you to invest in assets that keep pace with inflation. In other words, you should have exposure to assets such as equity and real estate. But as you know, investing in real estate requires a considerable capital commitment, for which many of us aren’t ready always.

This makes it all the more critical for you to invest in equity oriented mutual funds to create a dependable corpus for retirement. You should invest in them through a Systematic Investment Plan (SIP) route.

Retirement is a significant financial goal and you should not ignore, plan for it today!

This post on " Now You Can Check If Your Employer Is Contributing To The EPF A/c " appeared first on "PersonalFN"

#EPF#Provident Fund#Pension Fund#TaxBenefitofEPF#EPFTransfer#EPFBalance#CheckEPFBalanceonline#EPFO#PersonalFinance#FinancialPlanning

0 notes

Text

Atal Pension Yojana(APY)-Scheme Details, Amount, Elgibility

There are many investments that we must look upon to make our tomorrow secure from any financial problems. For government employees, there are so many ways like GPF, PPF, and many more. Thus, for the unorganized sector, there are various schemes came into force. Atal Pension Yojana or APY is one of them. So, let’s know more about it!

What Is Atal Pension Yojana?

Atal Pension Yojana or APY is implemented with an objective to provide the pension benefits to individuals in the unorganized sector. Pension Funds Regulatory Authority of India (PFRDA) synchronizes this plan. However, those who are in the organized sector and have no recourse for pension can also apply for this scheme.

The Central Government of India has launched three programs:

Jan Suraksha schemes during 2015-16, Atal Pension Yojana (APY),

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), and

Pradhan Mantri Suraksha Bima Yojana (PMSBY).

Due to immense public response from the Pradhan Mantri Jan Dhan Yojana to avail banking with zero balance account, our former Finance Minister Late Shri Arun Jaitley decided to create an expanded and enhanced version of the National Pension Scheme, i.e., Atal Pension Yojana. It is a replacement for the former Swavalamban pension Yojana. In Atal Pension Yojana (APY), the investor will receive their accumulated amount as a monthly payment, just as a regular income.

In case, if you (the investor) pass away, your family or better half avails of it. However, if both, i.e., you and your spouse pass away, your nominee will receive the bulk of the amount. Hence, it’s a source of income in old age.

Thus, it helps people of retirement ages to save money for future needs. The entire bulk pension money depends on the amount you devote towards it every month. Added to this, your age is also taken into consideration. One can get this amount from the age of 60 years.

What Are The Extensions We Have From NPS In APY?

APY was launched in 2015 by Finance Minister Arun Jaitley. On the one hand, where NPS is for everyone, APY focuses on the unorganized sector. According to a circular issued by the Income Tax Department in 2016, contributions to APY will be eligible for the same tax benefit as NPS.

a. Age

The customer should be at least 18 years of age to open an NPS account. The maximum age is 55 years. For APY, a person must be 18 years or older to apply. The maximum age for contributing is 40 years.

b. Investment