#taxpayer

Text

✨ NEW POST! ✨

Would You Rather Owe Taxes or Get a Tax Refund This April? The Answer Might Surprise You!

29 notes

·

View notes

Text

she sleeps like she pays taxes fr

her name is Alyssa :3

7 notes

·

View notes

Text

The vast majority of civilian government employees that are military vets suffer from the Dunning-Krueger Effect.

2 notes

·

View notes

Text

These Sun Bears are Man

They have round ears and human eyes. They are Bouba. They are Squinkly. They are mischievous. They pay taxes.

Do not pet. 10/10

8 notes

·

View notes

Text

Harry has cost taxpayers up to £100k with legal fight to get back his bodyguards

28 notes

·

View notes

Text

Oregon Department of Revenue delinquent taxpayer list.

https://revenueonline.dor.oregon.gov/tap/_/#1

1 note

·

View note

Text

Is Capitalism Working: Landowners (1)

When I asked the question, “Is capitalism working?" (see last post) I quoted Kate Raworth’s definition of capitalism wherein it is argued that our present economic system is designed to provide profit for the already wealthy – shareholders, landowners and moneylenders. It is certainly true that increases in share price and dividends are not matched by an equal increase in workers pay: shareholders increase their wealth at the expense of ordinary working people. Similarly, we can check if landowners and landlords have seen an increase in their wealth compared to the rest of us.

The whole question of land ownership and associated wealth is a complicated one, not least because landowners have been very good at hiding their assets, and therefore their wealth and income. An additional problem is that there are different types of landowner. Today I am going to deal with the aristocracy and gentry.

The aristocracy and gentry, relics of Britain’s feudal past, still own 30% of Britain’s land. Much of this is agricultural land and until we left the EU they received taxpayers money in the form of farming subsidies, based not on need but on the size of their land holdings. Under this scheme the aristocracy and landed gentry have received tens of millions of pounds of taxpayers money. This has helped them double their wealth over recent years.

“Britain’s 600 aristocratic families have doubled their wealth in the last decade and are as ‘wealthy as at the height of Empire’” (inews: 19/07/19)

One reason their wealth has increased is because

Countless peers with major landholdings and stately homes have put all their assets into discretionary trusts, thereby evading both public scrutiny and inheritance tax." Guardian: 07/09/17)

In addition

“The asset-owning super-rich to the extent that they include the aristocracy would appear to have benefited during the period after the financial crisis from factors such as quantitative easing which allowed them to use those assets to secure mortgages and debts to buy further assets.” (Inews.co: 19/07/19)

Put simply, quantitative easing (QE), the governments preferred way out of the financial crash of 2008, saw a massive increase in the money supply, which in turn saw a massive rise in wealth for the already wealthy. QE led directly to asset price inflation. In short the landowning aristocracy and gentry saw the value of their land rise and rise.

“QE…increases the prices of things such as shares and property” (BBC News: 01/11/22)

Consequently, as the majority of the UK population saw a fall in their living standards and wages due to Tory austerity, the aristocracy and landed gentry saw their wealth increase.

At this point it is important to note that the aristocracy have the legal right to sit in the House of Lords. They are not voted in. They represent no one but themselves, yet they are a powerful influence on the laws of this country. It is therefore inconceivable that the laws they influence do not profit them in some way.

One law in particular springs to mind.

“One legal provision unique to England and Wales has been of particular importance to these aristocratic landlords: over the centuries they built many millions of houses, mansion blocks and flats, which they sold on a leasehold rather than freehold basis. This meant that purchasers are not buying the property outright, but merely a time-limited interest in it, so even the “owners” of multimillion-pound residences have to pay ground rent to the owner of the freehold, to whom the property reverts when their leases (which in some areas of central London are for no more than 35 years) run out. This is unearned income par excellence.” (Chris Bryant, Guardian, 07.09.17)

Another use they make of the laws they themselves influence is the avoidance of inheritance tax. Quoting Chris Bryant again

The primary means of squirrelling away substantial assets so as to preserve them intact and deliver a healthy income for aristocratic descendants without bothering the taxman is the trust. Countless peers with major landholdings and stately homes have put all their assets into discretionary trusts, thereby evading both public scrutiny and inheritance tax.”

In conclusion, the evidence shows that certainly over the last 15 years, as the majority of working people have became poorer, the aristocracy and landed gentry have become steadily richer. This fits Kate Raworth’s definition of capitalism, not only because it sees the already wealthy making even more money at the expense of the rest of us, but it also demonstrates how they influence the legal and political system to secure and reproduce their already privilege position within society.

#capitalism#Kate Raworth#aristocracy#uk politics#landed gentry#trusts#inheritance tax#tax avoidance#EU. subsidies#taxpayer#House of Lords#democracy

2 notes

·

View notes

Text

i love you USPS I love you NASA i love you taxpayer funded services that actually contribute positively to society i love you libraries i love you public transport

189K notes

·

View notes

Text

People who wonder why your taxpayer is going to waste by students protesting heres a note here,

if you are sure that you care about your tax payers money going to waste by universities then think about the billions and billions of dollars that went to israel by far inform of "aid"!

●#askyourrep for why did it went for them when you cant afford to go to hospitals ?

●#askyourrepresentative Ask them why did you tax payer money went to israel (who has free healthcare btw) when you cant even call an ambulance because it costs so much?

●#askyourepresentative ask them your fellow americans are sleeping on roadsides when israelis get free guns from their vigilanti leadera to takeover a palestinian home by force???

and dont believe it is antisemite because there are jewish students in there in those protests.

if you reallycare about your tax payer money #askyourepresentative ?!

these very universities had students during south africas occupations. and they will stand for humanity even if politicians forget why they took votes and even when journalist forget theur responsibility !!

#freepalestine #freegaza

So far israel has killed over 35000 palestinians.. un says its a genocide, if you are a human; then stand for one!

#treatmalakamer #jewsagainstgenocide #freedomflotilia #holocaustsurvivorsagainstgenoside #bushlied #bidenlies #freepalestine #freegaza #stoprafahinvasion #endsettlercolonialism #stoppalestinianinvasion #feednorthgaza #ceasefirenow #voterswantceasefire #stopaipac #stopthegenocide #freehealthcare #aaronbushnellnotalone #rachelcorriestillalive #rachelcorrie #boycottCATinc. #neveragaintoanyone #warcriminals #USAiscomplicite #ARMYFORPALESTINE #israelisterroriststate #iransrighttodefend #victorytoiran #stoparmingisrael #gotohellbinsalman #stopaipac #disclosedivest #stopprojectnimbus #christainmurdered #stopkilling #antiwar #A15Actions #housingcrisis #hypocrates

#jewsagainstgenocide freedomflotilia holocaustsurvivorsagainstgenoside freepalestine freegaza#world#taxpayer#usa#trump

0 notes

Text

Unraveling the Mysteries of Taxes: Your Ultimate Guide from National Tax Reports

Taxes can often seem like an impenetrable maze, but with the right guidance, you can navigate them with ease. National Tax Reports offers a comprehensive resource to demystify taxes and provide clarity on even the most complex tax issues. In this guide, we'll explore how National Tax Reports can empower you with the knowledge and tools needed to conquer your tax challenges confidently.

Understanding Tax Essentials

National Tax Reports serves as your go-to resource for understanding the fundamentals of taxation. From deciphering different tax types to comprehending intricate tax laws, this platform delivers comprehensive coverage of tax essentials. Whether you're a novice taxpayer or a seasoned pro, National Tax Reports provides clear, concise explanations to help you grasp essential concepts and make well-informed decisions.

Streamlining Tax Form Navigation

Filling out tax forms can be a daunting task, but National Tax Reports simplifies the process with user-friendly guidance. Whether you're tackling Form 1040 for individual income tax or navigating intricate forms for business taxes, National Tax Reports offers step-by-step instructions and invaluable tips. With their intuitive resources at your disposal, you can navigate tax forms effortlessly, ensuring accuracy and compliance every step of the way.

Maximizing Deductions and Credits

Minimizing tax liability is key, and National Tax Reports is your ally in maximizing deductions and credits. The platform provides in-depth guides on various tax deductions and credits available to individuals and businesses. Whether you're claiming deductions for charitable contributions, education expenses, or healthcare costs, National Tax Reports offers expert advice to help you capitalize on available tax breaks and save money on your taxes.

Staying Up-to-Date with Tax Laws

Tax laws are constantly evolving, but National Tax Reports keeps you in the know with timely updates and analysis. Stay informed about the latest changes and developments that may impact your tax situation, from new tax legislation to updated filing deadlines. With National Tax Reports as your trusted resource, you can stay compliant with tax laws and avoid costly penalties.

Leveraging Tax-Advantaged Strategies

National Tax Reports also equips you with insights into tax-advantaged strategies to optimize your tax savings. Whether you're planning for retirement or exploring investment opportunities, the platform offers expert advice and guidance. From maximizing contributions to tax-advantaged accounts to implementing tax-efficient investment strategies, National Tax Reports helps you navigate complex tax scenarios with confidence.

Empowering Taxpayers with National Tax Reports

Taxes no longer need to be shrouded in mystery, thanks to National Tax Reports. With comprehensive coverage of tax essentials, user-friendly guidance for navigating tax forms, and expert insights into maximizing deductions and credits, National Tax Reports empowers taxpayers to take control of their tax situation confidently. Whether you're a beginner or a seasoned taxpayer, National Tax Reports provides the knowledge and resources you need to navigate the tax landscape with ease.

Learn more about Unraveling the Mysteries of Taxes: Your Ultimate Guide from National Tax Reports! For more information, please visit: https://nationaltaxreports.com/

1 note

·

View note

Text

Filing income tax returns is an essential obligation for every taxpayer. It not only helps you abide by the law but also ensures that you are contributing to the development of the nation. Under Section 139(8A) of the Income Tax Act, taxpayers have the option to file their income tax returns for the last three years. File Your Last 3 year of Income Tax Return for AY 2022-23, AY 2023-24 & AY 2024-25.

or Contact Us +91 9818209246

#IncomeTax#TaxFiling#TaxSeason#ITR#ITRfiling#TaxReturn#TaxPayer#TaxCompliance#FinancialYear#TaxDeductions#TaxRefund#TaxPlanning#TaxBenefits#TaxSavings#Taxation#TaxDeadline

1 note

·

View note

Text

R&D Tax Credits: HMRC's Clawback Demands

Many SME businesses, which previously were able to apply for and receive Research and Development (R&D) tax breaks from HMRC for their innovative endeavours, find themselves now being pursued by HMRC to reimburse the funds received. HM Revenue and Customs (HMRC) is re-evaluating past claims for research and development (R&D) tax relief, prompted by a realisation of significant levels of error and…

View On WordPress

#Advice for Comapanies#Advice for Taxpayers#HMRC#hmrc investigation#HMRC Investigations#Penalties#Small Businesses#Tax Fraud#taxpayer

0 notes

Text

Le président de la Chambre, Greg Fergus, a réprimandé le leader conservateur Pierre Poilievre pour son utilisation du mot "WTF" pendant la période de questions, car il est "communément compris comme n'étant pas parlementaire". M. Poilievre a alors répondu au président de la Chambre : "Où sont les fonds ?

Poilievre n'a pas bronché et a tenu tête au président devant l'aberration des Libéraux. 👏👏👏

Trudeau, pour sa part, a continué de réciter les balivernes habituelles qui ne surprennent plus personne.

Trudeau et son entourage doivent faire face à la justice.

_________________________

House Speaker Greg Fergus chastised Conservative Leader Pierre Poilievre for his use of the word "WTF" during Question Period, as it is "commonly understood as unparliamentary." Mr. Poilievre then replied to the Speaker of the House: "Where are the funds?

Poilievre didn't flinch, standing up to the Speaker in the face of the Liberals' aberration. 👏👏👏

Trudeau, for his part, continued to recite the usual drivel that no one is surprised by anymore.

Trudeau and his entourage must face justice.

#vol#argent#contribuable#fondspublics#ottawa#canada#justice#senat#chambredescommunes#peuple#population#canadien#canadienne#robbery#money#taxpayer#publicfunds#people#TuckerCarlson#trump#usa

0 notes

Text

The UK is not faring well either.

Congrats! WEF

7 notes

·

View notes

Text

franky drinks sparkling water

9K notes

·

View notes

Text

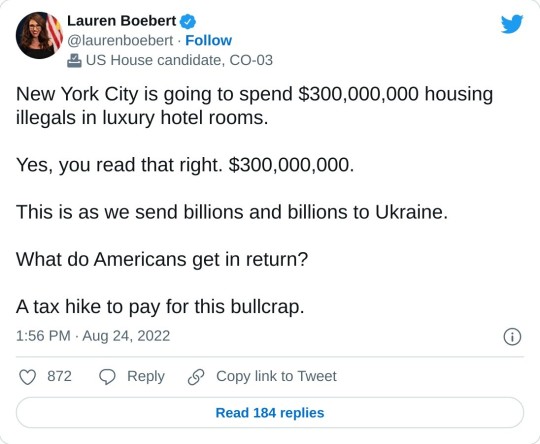

Border Blunder

Aloha kākou. The Uniparty believes Americans are gullible enough to believe the Senate’s Border Bill will secure the border. The Lanford-Schumer Border bill sends $60 Billion to Ukraine and $20 Billion to the Border. The remainder $14 Billion goes to Israel. How then does this bill address the southern border crisis? Why does Ukraine get the bulk of taxpayer’s monies and border security get a…

View On WordPress

0 notes