#testsat

Text

#sat#satprep#sattest#satexam#prepsat#testsat#examsat#whatissat#onlinesat#onlinesattest#satdiagnostic#satstrategy#satinusa#satreport#satresult#satscore#scoresat#satbubblesheet

0 notes

Photo

Planning to take the SAT on May 6 or June 3? Get ready with Elite SAT Prep! We have more than 25 years of experience helping students reach their SAT score goals and gain entrance to the colleges of their dreams. In-person and online programs available. Schedule a free diagnostic SAT test today! Learn more at https://www.y2academy.com/sat-test-prep/ #sattest #sattestprep #sattesting #sattestprepclass #satmock #satmockexam #satmocktest #sattestpreparation #sattestpreparationclass #sattestpreparationonline #testsat #satclasses #satclass #satclassesonline https://www.instagram.com/p/CpdQESvs7iH/?igshid=NGJjMDIxMWI=

#sattest#sattestprep#sattesting#sattestprepclass#satmock#satmockexam#satmocktest#sattestpreparation#sattestpreparationclass#sattestpreparationonline#testsat#satclasses#satclass#satclassesonline

0 notes

Text

Biden declared medically ‘fit’ ahead of 2024 campaign at 80yrs

President Joe Biden was declared ?fit for duty? by his doctor after the final annual medical check-up before he is expected to declare he?s running for re-election in 2024, when he will be 82.

Biden, the oldest person ever to be US president, began a series of tests last year at to determine how fit he is

He spent Thursday morning, Feb. 16, completing the testsat Walter Reed National Military…

View On WordPress

0 notes

Photo

AT&T tees up 24 GHz for drive testsAT&T is asking the Federal Communica...https://bitprime.co/att-tees-up-24-ghz-for-drive-tests/?feed_id=2222&_unique_id=5d7ef0c54a150

0 notes

Text

Dynamism has declined across Western economies

A BIG PROBLEM when attempting to tell if competition has weakened is that experts have stopped trying to answer the question. In the 1930s industrial economists viewed an uncompetitive industry as one in which a few firms had a large share of output and prices were high or quality low. Roll forward 80 years and competition regulators take refuge behind legal definitions of types of misconduct, such as price-fixing. If you ask them whether economy-wide dynamism has ebbed, they often insist that there are no analytical concepts or satisfactory data that allow that question to be answered, rather like medieval geographers who refuse to consider any evidence that the world is round unless it is written by members of the church in ecclesiastical Latin.

This learned helplessness reflects the tricky legacy of Robert Bork, an American scholar and judge who wrote “The Antitrust Paradox”, a deeply influential book published in 1978. It correctly criticised blundering state intervention in the 1960s and 1970s, and pointed out that many big firms were efficient and many concentrated industries competitive. But Bork went further and argued there was no logical or empirical link between competition, profits and concentration. He also wrote that, when assessing takeovers, it did not matter if consumers were damaged by higher prices and less supply, as long as firms captured enough profits from efficiencies, so that in aggregate both were better off.

Get our daily newsletter

Upgrade your inbox and get our Daily Dispatch and Editor's Picks.

Bork’s view of real firms has aged badly. He described the dynamism of Detroit’s carmakers just before Japanese rivals exposed them as lazy and dangerous, and criticised AT&T’s break-up, which became a triumph for consumers. Forty years later the economy has changed. A battery of new studies link concentration, profits and falling wages. Intellectual property, not physical objects, is where the action is, and tech has created networked business models. Since 1978 total profits (that is corporate free cashflows, or the money that firms make after paying for investment) have risen from 1.9% of GDP to 4.5%. It is sensible to ask why competition is not bringing earnings down to earth and what might be done to boost it. The alternatives are to do nothing about inequality, or to introduce draconian taxes or regulation to redistribute income.

A working definition is that an industry may be uncompetitive if there is a concentration of sales, employees, intellectual property or data, and if returns on capital are abnormally high for long periods of time, with little sign of churn or new entrants. If you want a sense of the global hotspots, follow the money. It points you towards America, tech and others sectors not exposed to trade.

Consider the global pool of abnormal profits, or all the earnings that companies make above a hurdle rate for their cost of capital. This exercise assumes an 8% cost of capital excluding goodwill and includes the world’s top 5,000 non-financial firms. In order to capture intangible assets, these figures capitalise research and development (R&D) spending as an asset with a ten-year life.

Global “excess” profits are $660bn. Some 72% of that is made by American firms, split between tech, health care and sectors that are not exposed to trade, such as airlines and defence (see chart). Other industries that are exposed to trade, including manufacturing, are less important. Europe accounts for 26% of the global pool of excess profits. Firms in the rest of the world capture 2%, with Chinese firms earning less than the hurdle rate.

Three tests

At the national level, America and Europe can be examined using three tests: concentration, abnormal profits and openness. America scores badly.

Take concentration first. The numbers need to be treated with caution, but between 1997 and 2012 it rose in two-thirds of 900-odd census industries, with the weighted average market share of the top four firms growing from 26% to 32%. It continued to rise in 2012-14. A tenth of the economy is made up of industries where four firms have more than two-thirds of the market.

Profits are indeed abnormally high. A good measure is the free cashflow of corporate firms. This is 76% above its 50-year average, relative to GDP. There are pockets where profits and prices are high compared with other countries, including airlines, credit cards, telecoms, pharmaceutical distribution and credit checking. As anyone who has squeezed into an old economy-class seat or signed fiddly receipts at the check-out knows, these industries clearly lag behind the rest of the world. They also involve thickets of regulation.

As for openness, America is still the world’s largest centre of innovation. It spends $450bn a year on R&D, 20% more than China and more than Europe, Japan and South Korea combined. But business churn is subdued: of the listed firms that made a very high return in 1997, 50% still did in 2017 (using a hurdle of 15% and excluding goodwill). Fewer new firms are being started. And America’s opening up to the world has stalled, with trade to GDP falling steadily since 2011 and the output of foreign firms’ subsidiaries in America stagnating.

America became a unitary market more than 100 years ago. Europe has not finished the job. The typical big European firm is smaller than its American rival, reflecting a punier domestic market, with more global spread, showing the need to escape that market. There are few big tech firms. The largest generators of excess profits include Unilever and Nestlé, drugs firms, and luxury-goods stars such as LVMH that dress Crazy Rich Asians, not locals.

Nonetheless, there are grounds for concern. Europe relies on American tech firms. Concentration is creeping up. A forthcoming study by Chiara Criscuolo and colleagues at the OECD, a club of mainly rich countries, shows that the average market share of the top four firms in each industry has risen by three percentage points since 2000, roughly half of the rise in North America. The free cashflow of non-financial firms as a share of GDPis 18% above its 20-year average. A very profitable listed firm in 1997 had a 46% chance of still being very profitable in 2017. Like America, Europe has suffered a decline in the number of new firms. It is weak on innovation, spending half as much on R&D in absolute terms as America. It scores better on trade, however, which has risen slightly relative to GDP since 2007.

Joseph Schumpeter, an Austrian economist, distinguished between two kinds of competition. There is the daily battle of wits between two apple sellers. And then there are breakthroughs by entrepreneurs that transform how industries operate. These leaps are unpredictable. In 1920 America’s cutting-edge giants included the Central Leather Company and Baldwin Locomotive, but they were soon overtaken by a new generation of consumer-goods firms. Perhaps today giant profits will stimulate a new leap in competition amid the fears of decline.

There are some green shoots. Investment among listed firms in America is rising at an annual rate of 18% as the Trump boom motors along. A giddy mood should lead to more start-ups. Retail, media and health-care firms live in terror of digital competitors. Some investors think that artificial intelligence could create the next Schumpeterian revolution. Masayoshi Son, a Japanese investor, is betting $100bn on the Singularity, the moment when computers become more intelligent than humans.

Other signs point towards entrenched power. The high stockmarket values of profitable firms show that investors think their advantages will endure. Protectionism will reduce competition. There are few new entrants in, say, internet search or American airlines or telecoms. And powerful firms intend to stay powerful tomorrow. Of the total capital spending and R&D done by America’s leading 500 companies, the top 20 firms account for 38%. Big firms are buying innovative start-ups. And data may bind customers to incumbent firms. At the heart of this is the modern world’s greatest creation and biggest source of fear—the tech industry.

America’s opening up to the world has stalled

America’s opening up to the world has stalled

This article appeared in the Special report section of the print edition under the headline "The big picture"

0 notes

Text

SAT Test Day Strategies for August 27, 2022

#sat#satprep#sattest#satexam#prepsat#testsat#examsat#whatissat#onlinesat#onlinesattest#satdiagnostic#satstrategy#satinusa#satreport#satresult#satscore#scoresat#satbubblesheet

0 notes

Text

Plan and strategy for SAT preparation in one month

#sat#satprep#sattest#satexam#prepsat#testsat#examsat#whatissat#onlinesat#onlinesattest#satdiagnostic#satstrategy#satinusa#satreport#satresult#satscore#scoresat#satbubblesheet

0 notes

Text

SAT Exam Day Tips for May 7th, 2022

#sat#satprep#sattest#satexam#prepsat#testsat#examsat#whatissat#onlinesat#onlinesattest#satdiagnostic#satstrategy#satinusa#satreport#satresult#satscore#scoresat#satbubblesheet

0 notes

Text

#sat#satprep#sattest#satexam#prepsat#testsat#examsat#whatissat#onlinesat#onlinesattest#satdiagnostic#satstrategy#satinusa#satreport#satresult#satscore#scoresat#satbubblesheet

0 notes

Text

SAT Practice Test Bubble-sheet Scoring Made Easy and Time-Saving

#satprep#sattest#satexam#prepsat#testsat#examsat#whatissat#onlinesat#onlinesattest#satdiagnostic#satstrategy#satinusa#satreport#satresult#satscore#scoresat#satbubblesheet

0 notes

Text

Upcoming Spring Exams 2022

#act#actprep#acttest#actexam#prepact#testact#examact#whatisact#onlineact#actdiagnostic#actstrategy#actinusa#actreport#standardizedtest#sat#satprep#sattest#satexam#prepsat#testsat#examsat#whatissat#onlinesat#onlinesattest#ssat#ssatexam#ssattest#ssatprep#prepssat

0 notes

Text

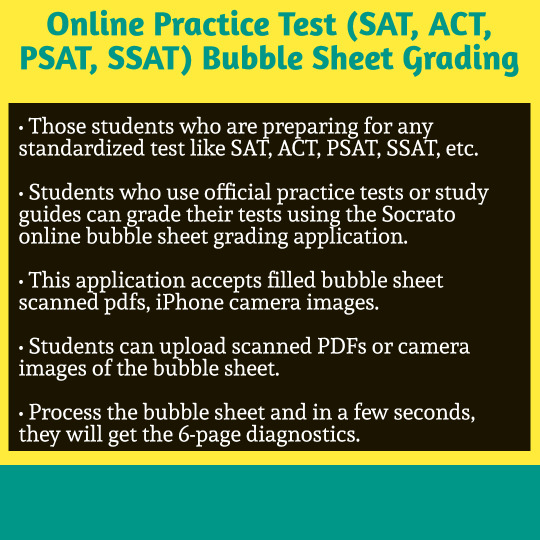

Online Practice Test (SAT, ACT, PSAT, SSAT) Bubble Sheet Grading

#act#actprep#acttest#actexam#prepact#testact#examact#whatisact#onlineact#actdiagnostic#actstrategy#sat#satprep#sattest#satexam#prepsat#testsat#examsat#whatissat#onlinesat#onlinesattest#satdiagnostic#satstrategy#satinusa#satreport#iseeonline#iseeprep#iseetest#prepisee#iseediagnosticreport

0 notes

Text

Important tips to fill the SAT Bubble-Sheet on the Test Day March 12, 2022

#sat#satprep#sattest#satexam#prepsat#testsat#examsat#whatissat#onlinesat#onlinesattest#satdiagnostic#satstrategy#satinusa#satreport#satresult#satscore#scoresat#satbubblesheet

0 notes