#trustees in bankruptcy

Text

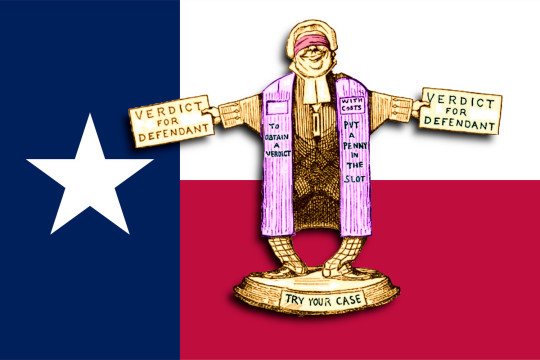

One of America’s most corporate-crime-friendly bankruptcy judges forced to recuse himself

Today (Oct 16) I'm in Minneapolis, keynoting the 26th ACM Conference On Computer-Supported Cooperative Work and Social Computing. Thursday (Oct 19), I'm in Charleston, WV to give the 41st annual McCreight Lecture in the Humanities. Friday (Oct 20), I'm at Charleston's Taylor Books from 12h-14h.

"I’ll believe corporations are people when Texas executes one." The now-famous quip from Robert Reich cuts to the bone of corporate personhood. Corporations are people with speech rights. They are heat-shields that absorb liability on behalf of their owners and managers.

But the membrane separating corporations from people is selectively permeable. A corporation is separate from its owners, who are not liable for its deeds – but it can also be "closely held," and so inseparable from those owners that their religious beliefs can excuse their companies from obeying laws they don't like:

https://clsbluesky.law.columbia.edu/2014/10/13/hobby-lobby-and-closely-held-corporations/

Corporations – not their owners – are liable for their misdeeds (that's the "limited liability" in "limited liablity corporation"). But owners of a murderous company can hold their victims' families hostage and secure bankruptcies for their companies that wipe out their owners' culpability – without any requirement for the owners to surrender their billions to the people they killed and maimed:

https://pluralistic.net/2023/08/11/justice-delayed/#justice-redeemed

Corporations are, in other words, a kind of Schroedinger's Cat for impunity: when it helps the ruling class, corporations are inseparable from their owners; when that would hinder the rich and powerful, corporations are wholly distinct entities. They exist in a state of convenient superposition that collapses only when a plutocrat opens the box and decides what is inside it. Heads they win, tails we lose.

Key to corporate impunity is the rigged bankruptcy system. "Debts that can't be paid, won't be paid," so every successful civilization has some system for discharging debt, or it risks collapse:

https://pluralistic.net/2022/10/09/bankruptcy-protects-fake-people-brutalizes-real-ones/

When you or I declare bankruptcy, we have to give up virtually everything and endure years (or a lifetime) of punitive retaliation based on our stained credit records, and even then, our student debts continue to haunt us, as do lawless scumbag debt-collectors:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

When a giant corporation declares bankruptcy, by contrast, it emerges shorn of its union pension obligations and liabilities owed to workers and customers it abused or killed, and continues merrily on its way, re-offending at will. Big companies have mastered the Texas Two-Step, whereby a company creates a subsidiary that inherits all its liabilities, but not its assets. The liability-burdened company is declared bankrupt, and the company's sins are shriven at the bang of a judge's gavel:

https://pluralistic.net/2023/02/01/j-and-j-jk/#risible-gambit

Three US judges oversee the majority of large corporate bankruptcies, and they are so reliable in their deference to this scheme that an entire industry of high-priced lawyers exists solely to game the system to ensure that their clients end up before one of these judges. When the Sacklers were seeking to abscond with their billions in opioid blood-money and stiff their victims' families, they set their sights on Judge Robert Drain in the Southern District of New York:

https://pluralistic.net/2021/05/23/a-bankrupt-process/#sacklers

To get in front of Drain, the Sacklers opened an office in White Plains, NY, then waited 192 days to file bankruptcy papers there (it takes six months to establish jurisdiction). Their papers including invisible metadata that identified the case as destined for Judge Drain's court, in a bid to trick the court's Case Management/Electronic Case Files system to assign the case to him.

The case was even pre-captioned "RDD" ("Robert D Drain"), to nudge clerks into getting their case into a friendly forum.

If the Sacklers hadn't opted for Judge Drain, they might have set their sights on the Houston courthouse presided over by Judge David Jones, the second of of the three most corporate-friendly large bankruptcy judges. Judge Jones is a Texas judge – as in "Texas Two-Step" – and he has a long history of allowing corporate murderers and thieves to escape with their fortunes intact and their victims penniless:

https://pluralistic.net/2021/08/07/hr-4193/#shoppers-choice

But David Jones's reign of error is now in limbo. It turns out that he was secretly romantically involved with Elizabeth Freeman, a leading Texas corporate bankruptcy lawyer who argues Texas Two-Step cases in front of her boyfriend, Judge David Jones.

Judge Jones doesn't deny that he and Freeman are romantically involved, but said that he didn't think this fact warranted disclosure – let alone recusal – because they aren't married and "he didn't benefit economically from her legal work." He said that he'd only have to disclose if the two owned communal property, but the deed for their house lists them as co-owners:

https://www.documentcloud.org/documents/24032507-general-warranty-deed

(Jones claims they don't live together – rather, he owns the house and pays the utility bills but lets Freeman live there.)

Even if they didn't own communal property, judges should not hear cases where one of the parties is represented by their long term romantic partner. I mean, that is a weird sentence to have to type, but I stand by it.

The case that led to the revelation and Jones's stepping away from his cases while the Fifth Circuit investigates is a ghastly – but typical – corporate murder trial. Corizon is a prison healthcare provider that killed prisoners with neglect, in the most cruel and awful ways imaginable. Their families sued, so Corizon budded off two new companies: YesCare got all the contracts and other assets, while Tehum Care Services got all the liabilities:

https://ca.finance.yahoo.com/news/prominent-bankruptcy-judge-david-jones-033801325.html

Then, Tehum paid Freeman to tell her boyfriend, Judge Jones, to let it declare bankruptcy, leaving $173m for YesCare and allocating $37m for the victims suing Tehum. Corizon owes more than $1.2b, "including tens of millions of dollars in unpaid invoices and hundreds of malpractice suits filed by prisoners and their families who have alleged negligent care":

https://www.kccllc.net/tehum/document/2390086230522000000000041

Under the deal, if Corizon murdered your family member, you would get $5,000 in compensation. Corizon gets to continue operating, using that $173m to prolong its yearslong murder spree.

The revelation that Jones and Freeman are lovers has derailed this deal. Jones is under investigation and has recused himself from his cases. The US Trustee – who represents creditors in bankruptcy cases – has intervened to block the deal, calling Tehum "a barren estate, one that was stripped of all of its valuable assets as a result of the combination and divisional mergers that occurred prior to the bankruptcy filing."

This is the third high-profile sleazy corporate bankruptcy that had victory snatched from the jaws of defeat this year: there was Johnson and Johnson's attempt to escape from liability from tricking women into powder their vulvas with asbestos (no, really), the Sacklers' attempt to abscond with billions after kicking off the opioid epidemic that's killed 800,000+ Americans and counting, and now this one.

This one might be the most consequential, though – it has the potential to eliminate one third of the major crime-enabling bankruptcy judges serving today.

One down.

Two to go.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/16/texas-two-step/#david-jones

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#texas two-step#bankruptcy#houston#texas#mess with texas#corruption#judge david jones#fifth circuit#southern district of texas#elizabeth freeman#yescare#corizon#prisons#private prisons#prison profiteers#Michael Van Deelen#Office of the US Trustee#sacklers#bankruptcy shopping#johnson and johnson#impunity

259 notes

·

View notes

Text

Re-Build Your Credit with King of Cars BC | Get Car Loans & More!

Welcome to King of Cars BC Ltd! Rebuilding your credit has never been easier. Whether you've never had a loan, faced bankruptcy, late payments, or been refused by a financial institution, we've got a solution for you.

We even help if you've surrendered your previous vehicle or are involved in a trustee settlement proposal.

Click to learn more about how we can assist you in securing auto loans or leasing options:

https://creditonline.dealertrack.ca/Web/Default.aspx?Token=18ee61a0-88d9-43a9-a006-77f7f8c69d96&Lang=en

#Car Loans#Credit Rebuilding#Financing Solutions#Auto Leasing#Bad Credit Financing#Bankruptcy Assistance#Late Payments#Financial Institution Refusal#Rejected Loan Applications#Trustee Settlement Proposal

3 notes

·

View notes

Text

Navigating Contractor Bankruptcy: Options For Pool Owners

Navigating Contractor Bankruptcy: Options For Pool Owners - #jayweller #bankruptcy, #Bankruptcyassistance, #Bankruptcyattorneys, #BankruptcyLawyer, #BankruptcyTrustee, #Chapter11, #Chapter7, #FilingForBankruptcy, #Tampa, #WellerLegalGroup - https://www.jayweller.com/navigating-contractor-bankruptcy-options-for-pool-owners/

#bankruptcy#Bankruptcy Assistance#Bankruptcy Attorneys#bankruptcy trustee#Chapter 11 Bankruptcy#chapter 7#Chapter 7 Bankruptcy#Chapter 7 Bankruptcy Trustee#Contractor Bankruptcy#file for bankruptcy#Filing For Bankruptcy#Florida#swimming pool company bankruptcy#Tampa#Weller Legal Group

0 notes

Text

How a Richmond Hill Bankruptcy Advisor Can Aid in Your Debt Relief

An insolvency advisor in Richmond Hill can help you comprehend how the bankruptcy procedure works to help you get financial obligation relief. An accredited insolvency trustee, or LIT (previously called a personal bankruptcy trustee), can be this kind of consultant.

A LIT can give insightful, timely and practical suggestions and orient you in the right direction as you deal with life-changing choices in a precarious financial circumstance.

Comprehending How Insolvency Functions

Bankruptcy in Canada is a legal proceeding handled in federal courts, following guidelines according to the Personal bankruptcy and Insolvency Act.

When an individual can no longer repay arrears, declaring personal bankruptcy can provide a fresh monetary start. It does this by disposing of unsecured debts, such as charge card financial obligations and medical expenses, while offering the debtor instant protection from financial institution actions like harassing collection calls and legal risks, while at the same time permitting some procedure of payment to the creditors utilizing the individual's possessions to repay a portion of the outstanding debt.

In theory, it's a win-win agreement for everyone involved; the bankrupt individual gets relief from crippling debt and creditors get a reasonable share of the settlement for what they are owed.

When you total the number of bankruptcy duties and requirements, you get your discharge. The discharge from personal bankruptcy is what removes all debts declared in the bankruptcy filing.

Debts In Personal Bankruptcy

Personal bankruptcy can get rid of most unsecured debts, including:

credit card financial obligations,

medical bills,

lines of credit,

unsecured bank loans,

tax debts,

payday advance,

unpaid utility bills, such as electrical and telephone bills.

Safe financial obligations such as home mortgages and auto loans that are guaranteed with an asset or security can not be incurred in bankruptcy.

These financial obligations receive unique treatment in insolvency:

Trainee loans that are less than 7 years old (if trainee loans are between 5 and 7 years old, the trustee might appeal and make a challenge application to have them consisted of).

Kid assistance payments.

Spousal support/ spousal support payments.

The court ordered fines and restitution payments.

Debts acquired from deceitful activities.

Richmond Hill Insolvency Exemptions

When you're faced with overwhelming debt and simply do not have a method to repay your creditors, the primary step is to talk with a certified insolvency trustee. A LIT will examine your monetary scenario and help you decide if filing for insolvency is the very best service for your financial issues.

Determining and assessing your finances will include an evaluation of:

Your earnings and budget, because you will be required to make a month-to-month payment into your personal bankruptcy based upon government limitations embedded in the Bankruptcy and Insolvency Act. If your earnings are above the limit, you are required to pay for surplus income.

Your possessions may be utilized to repay the outstanding debt.

Though your assets might be sold and used for repayment of debts, insolvency laws in Canada enable exemptions based on where you live.

If you declare personal bankruptcy in Richmond Hill, you can keep:

Individual clothing for you and your dependents.

Family furnishings and home appliances.

Equipment/tools that you use to earn money are worth as much as $14,405.

All RRSP, RRIF, and SPSP savings, other than contributions made in the last 12 months before bankruptcy filing.

Automobile, truck, or any motor vehicle worth up to $7,117.

Your home, if the equity does not exceed $10,783.

If your home has an equity value over the exemption limit, your LIT can help you make plans with your lenders to buy back the asset by paying off the amount that exceeds the limit.

Your LIT can also explore other financial obligation relief alternatives to keep you home while still dealing with your debt. Insolvency options can consist of a debt management plan or a customer proposal.

How Do You Submit Personal Bankruptcy?

A licensed insolvency trustee will do all the paperwork and filing for you. After your initial consultation, when you have actually examined all your choices and decided that bankruptcy is the best option, you will need to provide more personal details to complete all of the needed documents. Your trustee will also assist in the process of preparing a proposition or official strategy for your creditors.

When all the documents are signed, the trustee will send all the paperwork to the workplace of the Superintendent of Personal Bankruptcy (OSB) and send a bankruptcy notice to all your financial institutions. At this moment, you are considered lawfully insolvent and this can not be reversed without a court order.

Upon submitting the insolvency, the automated stay of proceedings immediately works. This prevents creditors from continuing any collection actions against you. This stress eliminating feature "stays" or stops annoying phone calls, wage garnishments, freezing your bank accounts, and taking legal action against you.

If financial institutions continue to bug you, the automated stay gives you the legal protection to sue them and take them to court.

As a legally insolvent individual, you are required to carry out several insolvency tasks. These duties consist of:.

make your monthly payments.

attend 2 counseling sessions.

Report your earnings and costs regularly to your trustee,.

offer essential tax details.

attend a creditors' meeting or evaluation, if needed.

If a financial institution's meeting or examination with the Official Receiver is called during the insolvency process, you will get a notice and will be required to take care of and respond to numerous questions under oath about your financial affairs.

Your trustee will meet with you before the meeting or evaluation to go through a number of questions you are likely to be asked, and help you prepare for the assessment.

An automated insolvency discharge will apply after 9 months for a first-time bankrupt. A creditor, your trustee, or the Superintendent of Personal Bankruptcy can oppose your discharge if you have not completed any bankruptcy requirements.

Your personal bankruptcy can also take longer than nine months if you have surplus income. If you have effectively completed your bankruptcy responsibilities, your discharge will not be challenged, and you can begin a new life with a fresh monetary start.

If you are thinking about eliminating unmanageable debt, speaking to an insolvency advisor in Richmond Hill can help put things in perspective. A licensed insolvency trustee is the best consultant you can talk to, as they are the only debt professionals accredited by the federal government to deal with these legal procedures.

They can help you understand how insolvency will affect you and your family and guide you through options that can likewise handle your debt problems.

#bankruptcy advisor richmond hill#richard killen trustee#business#bankruptcy services brampton#credit counselling brampton

0 notes

Text

Settle your debts and start living again ! Get expert advice, without obligation.

Avoiding debt is a priority for everyone, regardless of the circumstances. Fortunately, there are various ways to overcome it, and professionals are available to assist you throughout the process. If you're a homeowner, refinancing your mortgage can be a viable solution. For additional guidance on debt elimination strategies, simply complete the form found at [https://clearyourdebts.net ]. Our trusted partners, including mortgage brokers, financial advisors, and debt relief specialists, will promptly reach out to you with a customized solution tailored to your specific situation. This service is completely free, accessible across Quebec, including Montreal, Saguenay, Gatineau, Sherbrooke, Quebec City, Trois-Rivières, and comes with no obligation on your part. Types of services offered by our partners: • Consolidation loan • Informal proposal • Consumer proposal • Bankruptcy • Voluntary deposit

#Settling debts#debt solutions#debt elimination#debt consolidation#consolidation loan#mortgage refinancing#voluntary deposit#avoiding bankruptcy#consumer proposal#informal proposal#financial advisor#bankruptcy trustee#creditor negotiation

0 notes

Link

#chapter 7 trustee#chapter 7 bankruptcy lawyer clackamas#chapter 7 bankruptcy attorneys IN clackamas#chapter 7 bankruptcy attorneys clackamas#chapter 7 bankruptcy attorney in clackamas#clackamas chapter 13 bankruptcy lawyers#chapter 13 bankruptcy lawyers in clackamas#chapter 13 bankruptcy lawyer clackamas#chapter 13 bankruptcy lawyers clackamas#clackamas chapter 13 bankruptcy attorney#personal bankruptcy lawyers clackamas#clackamas personal bankruptcy attorneys#bankruptcy lawyer in clackamas#bankruptcy lawyers in clackamas

0 notes

Link

#bankruptcy trustee chapter 7#rockville md chapter 7 bankruptcy attorneys#chapter 7 bankruptcy attorneys rockville md#chapter 7 bankruptcy lawyers in rockville md#rockville md chapter 7 bankruptcy lawyers#bankruptcy law firm rockville md#rockville md bankruptcy law firm#rockville md bankruptcy attorneys#bankruptcy law firm in rockville md

0 notes

Text

Conspiracy theorist Alex Jones’ Infowars media empire will be shut down and sold off, a bankruptcy court-appointed trustee said in an emergency court filing Sunday, signalling the end of the notorious far-right outlet that Jones has used to spread dangerous misinformation and lies.

231 notes

·

View notes

Text

Make him poor as a church mouse and remove him from public discourse forever.

#alex jones#Republican propagandist#infowars#f—king asshole#republican assholes#maga morons#trump sycophants#sandy hook elementary shooting#mass shooting#school shooting#victim harassment

95 notes

·

View notes

Text

The Sacklers woulda gotten away with it if it wasn't for those darned meddling feds

The saga of the Sacklers, a multigenerational billionaire crime family of mass-murdering dope-peddlers, is an enraging parable about how the wealthy, the courts, and sadistic high-powered lawyers collude to destroy the lives of millions, profit handsomely, and evade justice.

But there's an unexpected twist to this tale. After the Sacklers procured a sham bankruptcy that denied their victims the right to sue while leaving their fortune largely intact, the Supreme Court – yes, this Supreme Court – saw through the scam and froze the process, pending a full hearing:

https://www.nytimes.com/2023/08/10/us/supreme-court-purdue-pharma-opioid-settlement.html

The Sacklers basically invented modern, legal dope peddling. Arthur Sackler, the family's original crime-boss, revived the practice of direct-to-consumer drug marketing, dormant since the death of the medicine show, to peddle Valium. An aggressive and shrewd lobbyist, Arthur built the family fortune and, more importantly, its connections:

https://www.timesofisrael.com/how-the-sackler-family-built-a-pharma-dynasty-and-fueled-an-american-calamity/

A generation later, the family's business company created Oxycontin, and procured misleading and false research about the drug's safety kickstarting the opioid epidemic, whose American body-count is closing in on a million dead. Armed with inflated claims about opioid safety, the Sacklers' pharma reps bribed, cajoled and tricked doctors into writing millions of prescriptions for oxy.

This scam had a natural best-before date. As ODs flooded America's ERs and bodies piled up in America's morgues, it became increasingly clear that something was rotten. The Sacklers pursued a multipronged campaign to keep the truth from coming to light, and to keep the billions flowing.

On the one hand, they hired McKinsey to find novel ways to encourage doctors to keep writing prescriptions and to convince pharmacists to turn a blind eye to abuse. McKinsey had all kinds of great ideas here, including paying pharma distributors cash bonuses for every overdose death in their territory:

https://www.nytimes.com/2021/02/03/business/mckinsey-opioids-settlement.html

When the issue of these deaths came up in public, the Sacklers blamed "criminal addicts" for their own misery, stigmatizing both people who desperately needed pain relief and the people who'd been deliberately hooked on the Sacklers' products. The legacy of this smear campaign is still with us, both in the contempt for people struggling with addiction and in the cruel barriers placed between people in unbearable agony and medical relief.

But mostly, the Sacklers kept their names out of it. They laundered their reputations by donating a homeopathic fraction of their vast drug fortune to art galleries and museums in a bid to make their names synonymous with good deeds.

The Sacklers didn't invent this trick. Think of the way that history's great monsters – Carnegie, Mellon, Rockefeller, Ford – are remembered today for the foundations and charities that bear their names, not for the untold misery they inflicted on their workers, their crimes against their customers, and the corruption of governments.

But the Sacklers made those Gilded Age barons seem like amateurs. They invented a modern elite philanthropy playbook that Anand Giridharadas documents in his must-read Winners Take All, about the charity-industrial complex that washes away an ocean of blood with a trickle of money:

https://memex.craphound.com/2018/11/10/winners-take-all-modern-philanthropy-means-that-giving-some-away-is-more-important-than-how-you-got-it/

As part of this PR exercise, the individual Sacklers kept their names and images out of the public eye. For years, there were virtually no news-service photos of individual Sacklers. When journalists dared to criticize the family, they used vicious attack-lawyers to intimidate them into retractions and silence (I was threatened by the Sacklers' lawyers).

They also worked their media mogul pals, like Mike Bloomberg, who added their names to the "Friends of Mike" list that Bloomberg reporters were required to consult before writing negative coverage:

https://pluralistic.net/2020/02/29/friends-of-mike-enemies-of-the-people/#sacklerbergs

But Stein's Law says that "anything that can't go on forever will eventually stop." As lawsuits mounted, the Sacklers found themselves increasingly synonymous with death, not charitable works. But like any canny criminal, the Sacklers had a getaway plan.

First, they extracted vast sums from Purdue and shifted it into offshore financial secrecy havens:

https://www.reuters.com/article/us-purduepharma-bankruptcy/sacklers-reaped-up-to-13-billion-from-oxycontin-maker-u-s-states-say-idUSKBN1WJ19V

Even as this money was disappearing into legal black holes, the Sacklers demanded – and received – extraordinary protection from the courts, who aggressively sealed testimony and materials presented through discovery:

https://www.reuters.com/investigates/special-report/usa-courts-secrecy-judges/

When this gambit finally failed, the Sacklers insisted that were down to their last $4 billion, and, with trillions in claims pending against them, they declared bankruptcy.

When a normal person declares bankruptcy, they are required to divest themselves of nearly everything of value they possess, and then still find themselves hounded by cruel arm-breakers who deluge them with threatening calls and letters:

https://pluralistic.net/2021/05/19/zombie-debt/#damnation

But for the richest people in America, bankruptcy is merely a way to cleanse one's balance sheet of liabilities for any atrocity you may have committed on the way, without giving up your fortune.

The Sacklers are a case-study in how a corrupt bankruptcy can be conducted.

Purdue Pharma presents a maddening case-study in the corrupt benefits of bankruptcy. When it was announced in March, many were outraged to learn that the Sacklers were going to walk away with billions, while their victims got stiffed.

First, they converted their victims' right to compensation into "property" that the Sacklers themselves owned. This transferred jurisdiction over these claims from the regular court system to the bankruptcy court. A bankruptcy judge – not a jury – would decide how much each of these claims was worth, and then what how much of that worth these victims (now recast as creditors) would be entitled to through the bankruptcy.

Thus tens of thousands of claims were nonconsensually settled without a trial, by an administrative judge with no criminal jurisdiction, not a federal judge who'd undergone Senate confirmation:

https://pluralistic.net/2021/03/31/vaccine-for-the-global-south/#claims-extinguished

These "coercive restructuring techniques" are not available to everyday people who are drowning in student debt or credit-card bills – these are the exclusive purview of the wealthiest Americans, who enjoy a completely different bankruptcy system that is rigged in their favor.

Three judges – David Jones and Marvin Isgur of Houston and Bob Drain of New York – hear 96% of the country's large corporate bankruptcies:

https://www.creditslips.org/creditslips/2021/05/judge-shopping-in-bankruptcy.html

These judges are unbelievably horny for corporations, embracing a legal theory "that casts the invention of the limited liability corporation alongside that of the steam engine as a paradigmatic development in the pursuit of prosperity":

https://prospect.org/justice/how-do-you-solve-a-problem-like-the-sacklers-purdue-pharma-bankruptcy/

Now there are more than three bankruptcy judges in America, so how do the nation's biggest companies get their cases heard by these three enthusiastic Renfields for corporate vampirism?

They cheat.

For example: when GM was facing bankruptcy, it argued that it was a New York company on the basis that it owned a single Chevy dealership in Harlem, and got in front of Judge Drain.

The Sacklers were – characteristically – even more brazen. They really wanted to get their case in front of Judge Drain, the nation's most enthusiastic supporter of "third party releases," through which bankrupt billionaires can wipe the slate clean, securing dismissals of all claims by the people they wronged.

Drain is also uniquely hostile to independent examiners, "an independent third-party appointed by the court to investigate 'fraud, dishonesty, incompetence, misconduct, mismanagement, or irregularity…by current or former management of the debtor."

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3851339

If you're the Sacklers, hoping to keep two thirds of your billions and extinguish all claims by your victims, there is no better helpmeet than Judge Robert Drain of the Southern District of New York.

So, 192 days before filing for bankruptcy, the Sacklers opened an office in White Plains, New York (a company may claim jurisdiction in a specific court once they've operated a business there for 180 days).

Then they filed a bankruptcy in which they altered the metadata on their casefile, inserting the code for a Westchester county hearing into the machine-readable, human-invisible parts of the documents they uploaded to the federal Case Management/Electronic Case Files (CM/ECF) system (they also captioned the case with "RDD, for "Robert D Drain").

They chose their judge, and the judge obliged. UCLA Law's Lynn LoPucki is one of the leading scholars of these bankruptcy "megacases," and has written extensively on why these three judges are so deferential to corporate criminals seeking to flense themselves of culpability. She sees judges like Drain motivated by "personal aggrandizement and celebrity and ability to indirectly channel to the local bankruptcy bar. The judge is the star and the ringmaster of a megacase – very appealing to certain personalities."

Thus, these judges are "willing and eager to cater to debtors to attract business…[an] assurance to debtors that…these judges will not transfer out cases with improper venue or rule against the debtor…"

https://www.fulcrum.org/concern/monographs/02870w66d

This kind of judge-shopping goes beyond the Sacklers; the cases that Drain and co preside over make a mockery of the idea of America as a land of equal justice. "Prepack" and "drive-through" bankruptcies are reliable get-out-of-jail-free cards for capitalism's worst monsters: private equity firms.

Whether PE murdered your grandmother by buying her care-home and putting each worker in charge of 30 seniors:

https://www.washingtonpost.com/local/portopiccolo-nursing-homes-maryland/2020/12/21/a1ffb2a6-292b-11eb-9b14-ad872157ebc9_story.html

or poisoned your kids by filling your neighborhood with carcinogens:

https://www.webmd.com/special-reports/ethylene-oxide/20190719/residents-unaware-of-cancer-causing-toxin-in-air

limited liability wipes the slate clean.

30% of America's bankruptcies are private equity companies using the bankruptcy system to wipe away claims for their misdeeds, while keeping a fortune, thanks to the shield of limited liability.

Take Millennium Health, JamesS lattery's fake drug-testing company, which promised to help nursing homes figure out whether seniors were abusing (or selling) their meds by testing their piss for angel dust and other drugs. Slattery defrauded Medicare and Medicaid for millions, borrowed $1.8 billion (Slattery got $1.3 billion of that). He eventually walked away from this fraud after paying a mere $256m to settle all claims, and kept a fortune in assets, including the 40 vintage planes his private company ("Pissed Away LLC" – I am not making this up) owned:

https://prospect.org/justice/how-do-you-solve-a-problem-like-the-sacklers-purdue-pharma-bankruptcy/

For the wealthy, bankruptcy is the sport of kings, a way to skip out on consequences. For the poor, bankruptcy is an anchor – or a noose. This is by design: judges who preside over elite bankruptcies speak of their protagonists as heroic "risk takers" and tiptoe around any consequences, lest these titans be chained to a mortal's fate, costing us all the benefits of their entrepreneurial genius.

PE companies helped the Sacklers design their own bankruptcy strategy, and it was a standout, even by the standards of Bob Drain and his kangaroo bankruptcy court. But now, the Supreme Court has pumped the brakes on the whole enterprise.

The judges ruled that the exceptions the Sacklers took advantage of were intended for bankrupts in "financial distress" – not billionaires with vast fortunes hidden overseas. In so doing, the court threatens all manner of corrupt arrangements, from "the Boy Scouts, wildfires and allegations of sexual abuse in the church diocese — where third parties get a benefit from a bankruptcy they themselves aren’t going through.”

The case was brought by the DoJ's US Trustee Program, which lost in the Second Circuit when it tried to halt the Purdue bankruptcy and argued that the Sacklers themselves had to declare bankruptcy to discharge the claims against them.

Now the Supremes have hit pause on the bankruptcy the Second Circuit approved, and will hear the case themselves. It's only one step on a long road, but it's an unprecedented one. Some of the country's filthiest fortunes are riding on the outcome.

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” tomorrow (Aug 12) at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/11/justice-delayed/#justice-redeemed

Image:

Edwardx (modified)

https://commons.wikimedia.org/wiki/File:Serpentine_Sackler_Gallery,_June_2016_05.jpg

CC BY-SA 4.0

https://creativecommons.org/licenses/by-sa/4.0/deed.en

#scotus#us trustee program#drive-through bankruptcy#coercive restructuring techniques#blood money#opioids#opioid epidemic#oxycontin#purdue pharma#elite philanthropy#reputation laundering#elite impunity#sacklers#judge drain#sdny#bankruptcy#bankruptcy shopping#friends of mike#pluralistic#debt#mckinsey

171 notes

·

View notes

Text

Everyone loves a good snack. Regular meals are important for your health, but they are also a tyrannical regime that keeps you from shovelling MSG-laden tortilla chips into your mouth six or seven times a day. In the interest of personal freedom, I took over my cousin's failing food truck business and started serving up schedule-busting goodies all over town.

Admittedly, I didn't really care about feeding the masses. I definitely did not care about cooking for, and cleaning up after, random individuals that I would never meet again. What I got into this business for was the truck, a beaten-up old Isuzu NRR that I thought would make a good vehicle with which to tow. If I held out for long enough, then I could pay myself with the truck in lieu of a paycheque when the company went bankrupt.

Of course, I couldn't just sit on my hands and do nothing. To make things look good for the bankruptcy trustees, I was told, I had to put in a serious effort to craft and sell food across town. Soon I was selling hot dog buns stuffed full of Cheetos for seventeen dollars a pop. Customers lined up around the block. To my surprise and anger, this was the moment in which my natural-born business instincts finally manifested to produce some big-league cheddar. Some even maintained a website dedicated to tracking my every move around town, even commenting on my double-clutching as I tried to maneuver that tricky intersection before the downtown bridge without stopping for the red light.

Money was pouring in from a fanatical customer base, which made it improbable that I could pull off my truck-instead-of-cash trick. Not like I could stop for long enough to change the plate on the thing. I was invited to food festivals, park openings, and even had my own Netflix show for a little while, because they didn't want to pay writers anymore, and filming me for two hours of slinging greaseball fried food out of the window of my truck was cheaper. Don't worry: I made sure to ruin all of their takes by talking randomly about 1980s Korean economy cars, a topic that advertisers absolutely despise.

So what took out my business? It wasn't competition, or even that time I rammed the Mayor's limousine while rushing to the scene of a multi-vehicle accident to serve up hot snacks to the brave firefighters. Ultimately, it was my cousin, who wanted his now-successful business back. Without my brave leadership (and gonzo, irresponsible driving) at the helm, the quality of the food immediately dropped, and he went under. There is good news, however. I did get to keep the truck after all, even though Cousin Neutral had to torch it for the insurance money first.

204 notes

·

View notes

Text

Introducing Your Chapter 13 Bankruptcy Trustee’s Role

Introducing Your Chapter 13 Bankruptcy Trustee’s Role - #jayweller #bankruptcy, #Bankruptcyattorneys, #BankruptcyLawyer, #Chapter13, #Clearwater, #FilingForBankruptcy, #Tips, #WellerLegalGroup - https://www.jayweller.com/introducing-your-chapter-13-bankruptcy-trustees-role/

#bankruptcy#Bankruptcy Attorneys#Bankruptcy Laws#bankruptcy trustee#Bankruptcy Trustees#chapter 13#chapter 13 bankruptcy#Chapter 13 Bankruptcy Trustee#Clearwater#credit#file for bankruptcy#Filing For Bankruptcy#Florida#Trustee#Trustee Chapter 13 payment#Trustee in bankruptcy#Weller Legal Group

0 notes

Text

Managing Your Debts With A Bankruptcy Trustee In Scarborough

A bankruptcy trustee in Scarborough can help you sort out your bankruptcy petition and debt problems and aid you in paying your creditors back in order.

Let a bankruptcy trustee in Scarborough guide you through filing for bankruptcy and dealing with unpaid debt. In life, there are many instances where you’d need to take out a loan to pay bills or to take care of emergencies, and things get out of control.

If you ever find yourself on the verge of filing for bankruptcy, always remember that options are still available. You aren’t alone when filing a bankruptcy petition; a bankruptcy trustee’s job is to assist you throughout the process.

You won’t have to worry about how to start your petition or how to deal with your current creditors. Trustees have a variety of roles and responsibilities wherein they aid both parties in the case to reach a compromise and have a proper repayment plan.

In Bankruptcy, What Is the Role of The Trustee?

When you file for bankruptcy and request the help of a trustee, you will be appointed one by the court. These professionals have knowledge and skills regarding legal issues in bankruptcy, accounting, business, and management.

Trustees are there to oversee the bankruptcy process and manage the case when needed. Depending on the type of insolvency case, trustees or Licensed Insolvency Trustees (LITs) have the power to ensure the process is followed under the law.

LITs are compensated for the services they offer. For administering the process, they receive a commission based on the percentage paid to the holders of the secured claims. Their payment falls upon reasonable expenses depending on how the case goes.

How Do You Work With A Bankruptcy Trustee?

It all begins when you file for a bankruptcy petition. Once the petition gets approved, the court appoints a LIT to handle your case. You get a notice with all the information you need to contact the LIT assigned to you.

What might surprise you is that you only get to meet the LIT assigned to you once you go to the meeting creditors. All information presented to the court goes through the trustee, who will verify your assets and liabilities.

If you have any questions about the bankruptcy process, you can always ask the trustee assigned to you. They can answer your questions and advise you on the best options for your case.

The Role Of A Bankruptcy Trustee

A LIT has many different roles, depending on the kind of bankruptcy petition they’ve been assigned. They can handle more or fewer roles or control when the situation needs it. Trustees are always expected to mediate the case and to be entirely unbiased.

Facilitates The Meeting Of Creditors

LITs facilitate the 341 meetings or the meeting of creditors, which is mandatory for debtors to attend. Trustees will ask you about your financial situation and the legitimacy of your documents. The sessions are often short, and only some creditors are required to attend.

Can Object To Discharge

A trustee can object to a discharge when there are false statements from the debtor to the trustee or judge. It happens when fraudulent activity is spotted in the proceedings or in the paperwork that the debtors provide.

Review Or Approve Loan Cram-Downs

Cram-downs often happen when the court is imposing a bankruptcy reorganization plan. It still happens even when there are objections from creditors. Trustees have the responsibility of reviewing or approving these types of procedures.

On The Debtor’s Side:

Reviewing The Debtor’s Financial Data

LITs are tasked to review all the data you submit to the court. All your paperwork must go through a trustee when filing a bankruptcy petition. They will also decide whether you need to provide more documents or prove that your documents are legitimate

Examining The Debtor’s Property And Assets

The trustee assigned to you will also have to look up your assets and property. It‘s essential to have a third party check them to ensure that everything is well accounted for and put into writing before finalizing any documents.

Liquidating And Collecting The Debtor’s Nonexempt Property And Assets

The debtor’s assets and properties are evaluated, measured, and liquidated by the LIT. The procedure is done to repay unsecured debts or other related debts properly. The way that the creditors are paid is through priority.

Handling The Sales Of The Debtor’s Property Or Assets

The trustee’s responsibility is representing the debtor in selling their property under a bankruptcy proceeding. They are also responsible for reorganizing a debtor's business or any assets that would continue operation after the bankruptcy petition.

Converting Debtor Assets To Cash

As the LIT is in charge of the debtor’s assets and properties throughout the bankruptcy proceeding, they also have the power to convert the assets into cash. It’s done so that the LIT can pay off creditors on the priority list easier.

Reviewing Exemptions Claimed By The Debtor

In a bankruptcy petition, debtors can claim several reasons they should be qualified for bankruptcy. It’s the LIT’s job to check whether the claims are valid and if the bankruptcy petition is legitimate enough for approval.

The Creditors' Meeting: Why Does It Matter?

You might often come across the creditor's meeting or the 341 meeting and wonder why it’s crucial. In the meeting, trustees must verify your identity and current financial documents. You have to be prepared with all your documents and paperwork for the presentation.

The LIT can also ask you questions under oath to verify whether the information you’ve given is accurate and truthful. Meetings like these are essential to help sort out your financial situation and give creditors an idea of your ability to repay your debts.

Once the meeting concludes, you can talk with the LIT to turnover nonexempt property. The LIT can then assign you a schedule based on the repayment plan you and the creditors agreed upon.

Are Trustee Relationships Important?

You can work things out better if you are familiar with a LIT's different roles and responsibilities. Understanding how bankruptcy works will make your and the LIT's responsibilities more manageable and timelier.

That means you can provide the documents and paperwork the LIT needs without getting confused. You are also aware of the actions that the trustee can take within the bankruptcy process.

You can also ask questions regarding the process of the LIT. Remember that you are working with the trustee, and a strong relationship comes from respect for each other’s roles in the procedure. You can contact a bankruptcy trustee in Scarborough if you have more queries.

#bankruptcy trustee scarborough#can you declare bankruptcy on cra debt#consumer proposal calculator#richard killen trustee

0 notes

Text

Advantages of choosing Clear Your Debts

Obtain a prompt and free solution for your debt situation by filling out the form at https://clearyourdebts.net/ . Our service is available throughout Quebec and comes with no obligation on your part.

#Settling debts#debt solutions#debt elimination#debt consolidation#consolidation loan#mortgage refinancing#voluntary deposit#avoiding bankruptcy#consumer proposal#informal proposal#financial advisor#bankruptcy trustee#creditor negotiation

0 notes

Link

#chapter 7 bankruptcy attorney#bankruptcy in Oregon#bankruptcy chapter 7 trustee#bankruptcy chapter 7 Oregon#bankruptcy chapter 7 filing#bankruptcy chapter 7 attorney#bankruptcy chapter 13 attorney#bankruptcy attorneys in Oregon#bankruptcy attorneys in bend Oregon

0 notes

Text

Hadas Gold at CNN:

Conspiracy theorist Alex Jones’ Infowars media empire will be shut down and sold off, a bankruptcy court-appointed trustee said in an emergency court filing Sunday, signalling the end of the notorious far-right outlet that Jones has used to spread dangerous misinformation and lies.

Earlier this month, a bankruptcy judge ruled that Jones’ personal assets would be liquidated to help pay off the nearly $1.5 billion he owes the families of victims of the Sandy Hook massacre. But at that time, the judge ruled Jones’ media company Free Speech Systems, the parent of Infowars, would not be liquidated partly because the process would be costly and lengthy.

The dismissal of the bankruptcy case against the outlet meant that the families were free to go after Jones’ assets, including Infowars, in state court. Since Jones is the owner of Free Speech Systems, a court appointed trustee was put in charge of the company.

The trustee wrote on Sunday that since being appointed, he “began planning to wind-up (Free Speech Systems’) operations and liquidate its inventory.”

But the trustee said the process was “derailed” when one of the Sandy Hook victim’s parents filed a motion in a Texas District Court to be granted custody of all of Free Speech Systems’ assets, including Infowars.

As a result, Jones’ trustee asked the bankruptcy judge for an emergency stay in the case to allow them to conduct an “orderly wind-down and sale process” of Infowars.

In a statement, Christopher Mattei, an attorney for Sandy Hook families from Connecticut who were in favor of liquidating the company, said “this is precisely the unfortunate situation that the Connecticut families hoped to avoid when we argued that the Free Speech Systems/InfoWars case should have remained with the bankruptcy court rather than being dismissed.”

The end is near for InfoWars, the far-right conspiracy theorist outlet run by Alex Jones.

See Also:

MeidasTouch: InfoWars Being Shut Down

21 notes

·

View notes