#why did cash app close my account

Text

Im sorry if this post comes off weird and not very understandable, but I (and a friend) have been forced to live with something horrible and traumatizing (at the hands of someone we called A FRIEND) for the last few days and I am about to burst and need to get this out somewhere where I feel safe.

(TRIGGER WARNING: faked Sui attempt mention below, me being gaslit, lied to, made to feel like I was an idiot and a harasser)

It all started a few days ago by a message from (someone that I called a friend)’s account. Lets call them Wolf.

In the past, during our short friendship, a friend and I discovered that Wolf liked making jokes about Sui. Alot. Everyday, practically. But not only jokes. Once, she faked a Sui attempt, filmed it, and sent it to my friend N. My friend, traumatized, told me in the group chat and we were very pointed in saying that such things were not a laughing matter. Please keep on mind, Wolf is in her late 20’s. An age where you would think people no longer do such things.

Now, back to what happened. It all started a few days ago by a message from Wolf’s account.

Wolf’s account left a lengthly message in the Discord chat we share with N, my friend. The message was by someone we did not know, telling us that Wolf had committed a Sui attempt and was now in the hospital.

We were told by “Jordyn” that she was only telling the people closest to Wolf what happened, and that none of Wolf’s In Real Life friends knew. It was only us, and Wolf’s parents. She told us to stay quiet and to not post on Wolf’s personal instagram, as to not let anyone know.

Why were we being told this? Why did Jordyn “take” Wolf’s phone, go into her Discord account, and decide to send a message in a Discord chat that had had NO ACTIVITY FOR 10+ DAYS?

Something was nagging at me and my friends mind, something felt wrong with what was all being said.

Constantly were inconsistencies popping up in her messages and constantly did something feel OFF. Something didnt feel right.

Why were we, two random people on Wolf’s Discord list, being told all of this? Why were we being told by “Jordyn” that none of Wolf’s In Real Life friends knew, but we, were being told all of this information?

The next day (8 to 10 hours after receiving the first message), still hesitant to believe it all after receiving NO proof or concrete information, I asked what hospital she was being held at, so that I could see about sending flowers. Sure we weren’t close, but it was the least I could do. The answer I received?

“She's gotten a lot of flowers. Like pretty much the whole room is filled with flowers. We might get her a P.O. Box or get her a cash app account set up, so people can donate.”

Once again, why were we being told (without being pushed but still told nonetheless) that we could donate money to a Cashapp that Jordyn was going to make for Wolf’s rehabilitation or that we could send cards to a PO box? But oh sorry, no one’s been told what happened but flowers are everywhere, so much so that we’re tripping over them so send money instead.

Today, after multiple days of being told “updates” that didnt line up with what would happen to a Sui attempt survivor, I had a lengthly conversation with the friend that was living through all of this with me.

I decided to ask if “Jordyn” was comfortable sharing information on what happened. (She had already told my friend everything in Private Dms, so why not tell me, a medical student studying in neurology and psychology, and who is studying on how to help rehabilitate Sui Survivors?)

She said yes, so I asked. I asked, as delicately as I could, on what happened, because the things she had said did NOT line up with what procedures a doctor would normally do.

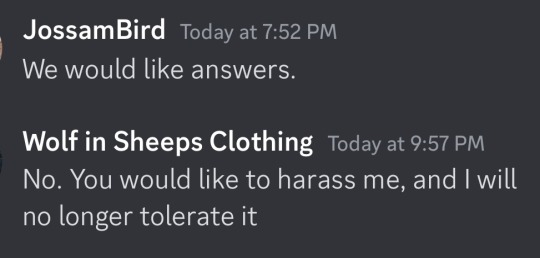

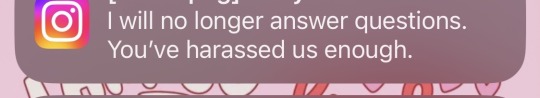

The answer I received? Wolf’s account leaving the Discord server, and this:

All I did was ask questions (because nothing was lining up and everything felt WRONG in everything this Jordyn/Wolf/whoever person was forcing down our throats on Discord everyday, and I figured I was owed that much since hey, Im being told all of this all of these horrible details in what happened) but I guess I was only allowed to that and only that, and to send money of course.

I (and my friend N) was made out to be a fool, an idiot. I was Gaslit, lied to, and manipulated.

Your name is not Wolf, but that is what you are. You are a Wolf in Sheep’s clothing, and that is what you will remain forever in my mind.

25 notes

·

View notes

Text

FULL STORY OF THE SAGA OF THE EXPLOSIVE PHONE AND THE ELECTRONICS STORE THAT TRIED TO GET ME TO COMMIT DOMESTIC TERRORISM! -

This is going to take a hot minute to type, so be patient

on June 18th 2024 I was out running errands, and picked up dinner, in doing so I overdrew the credit union account, I THOUGHT I had zeroed it out, but it had actually overdrawn.

I didn't find out until after the bank had closed, and since the 19th was Juneteenth (a federal holiday in the states) the CU was closed.

I THOUGHT I could sign the account up through Zelle and/or cashapp and just transfer money directly into the account, but Zelle continually failed, and cash app let me enroll it, but not transfer the money to the account.

Continually they said the issue was with the DEBIT CARD, not the account and told me to call the bank. I couldn't.

On the 20th, I woke up early enough to call the bank, and began the arduous process of verifying over the phone with my dad just so I could talk to them, and Zelle, and try to figure out why the everloving hell the zelle system said there was something wrong with the card and not letting me even sign up so I could transfer money into the account.

I spent four hours on this. Calling one, calling the other, being on hold. and NO ONE could fix the problem.

I repeated myself so many times I was tired of hearing myself. I got one person who said it was the carrier, so I had to call t-mobile, except it wasn't tmobile it was mint, and tmobile transferred me to aura and not mint, and finally to mint who said 'oh that feature is already unlocked on the account you need to call the banking institution or zelle.

On the final call to zelle, the new tech was refusing to accept the verification. and starts going through her little trapper keeper script of why she was refusing to accept the verification when we had all the answers all the info and had ACTIVELY BEEN VERIFYING FOR FOUR HOURS until this point when she says, off handedly during her script read (she was literally just reading the fucking bullet points, I could HEAR the pauses as she shifted line down) "Your account must have more than a dollar in it to enroll"

I spin, looking at the phone only to realize that the phone my dad is holding has expanded, and popped the back of itself off. And immediately begin internally panicking but externally I'm just being frustrated because THAT was the problem for the past four hours, not me entering info wrong, not the information being incorrect with the bank, not the debit card being mislinked, not a system error THE ACCOUNT WAS ALREADY OVER DRAWN AND IT TOOK FOUR HOURS AND WIGHT TECHS TO TELL ME THIS CONDITION?!

I tell dad to immediately hang up the phone and give it to me, I'm ready to rip my hair out and he thinks I'm going to throw the phone and kind of clings to it. I say, firmer. "Give me that timebomb NOW" and he goes 'what is the pro- what the fuck is that?"

I saiod "That is a spicy pillow and you need to give itt to me -now-. I'm taking it to best buy it should still be under warranty." "Yeah, yeah.." and he handed me the phone "When did that happen?" "When you took the phone out of the case to talk to zelle a second ago. It's blowing out, and It doesn't need to be here." "Yeah you go handle... this..."

I explain the zelle issue why it wouldn't enroll, and go get dressed, grab the spicy ravioli and run out the door with the idea that I'll go to the credit union two cities over, fix the overdraft and then take care of the phone return. While driving it's still expanding so I reprioritize and decide to return the phone first.

In my mind, this is a simple thing. I know the phone is under warranty, it has become a safety issue, their standard practice of "keep this and send it off" is not a viable option so it will HAVE to be a refund/in store exchange.

I know this because I've had to do this once before in the past. I know how their policies work, I know the standard returns but more importantly I know the severity of a bloated li-ion battery and how fucking important it is to get it into a safe disposal unit to be picked up by hazardous waste techs with a fireproof vehicle

I go in, at this point I am forwardly professional, I am not panicked, excitable or anything I have my mask of professionalism on and I'm all fucking business. I go to customer service and say 'I need to make a return but before that, do you have a fire blanket or fire suppressant for this fire hazard" and I gently set the phone on the counter. My only thought is to safely contain this ACTIVELY EXPANDING lithium battery.

She looks down, eye go wide and goes "I don't know let me check" and runs to the back, I hear from the back "We have a bucket of sand" and I retort "That will do, this needs to be contained immediately please"

They come get it, and take the potential fire hazard to be buried in the sand bucket. NOW we may commence the return process. I immediately put on the customer service interaction mask, and give them the information for the account, I joke that my receipt for the purchase had bleached out in the car (It had, I keep it in the sunglasses holder and it had legitimated denatured) and we agree that is why they have everything digital.

The CS says it's a rapid exchange in store for this, I said yay, that's actually really nice, because 'express' is not great. She agrees, and sends me to the mobile department, I say take all the time they need, I'll pick a new phone and confirm it's what my dad wants, and I know the paperwork is going to take a hot minute.

I confirm dad doesn't care as long as it's functional, so I pick out the same type, but updated model of phone (Moto G Stylus 2023 model to replace the 2021 model that is buried in sand in the back)

I talk to mobile, connecting with the associate over customer horror stories and the like while the new phone that he, customer service, geek squad techs, and two other associates and a manager have seen, agreed this is going to be an instore exchange because of the circumstances.

We begin setting up the phone and I realize the sim card is still in the bomb. I roll back over in my wheelchair to ask if it's safe to get the sim card. And they say they have to check the IMEI anyway and I bawk. We've already confirmed it's probably not safe to turn the phone on right now, and they say it's okay, it's on the sim tray. I didn't know that, good information. And I ask, cautiously, if it'd be okay to turn it on BRIEFLY so I can get only the login email on it to know which email my dad used for logging into google so I can get his contacts and account synched

the tech says "I don't recommend it" I asked if it would be okay to do so knowingly against advice to turn it on, get the info, turn it off and rebury the thing?

By now, it's been confirmed the battery is no longer expanding, and it's not actively leaking, smoking or heating up. We all agree it's a compromised cell within the battery but it hasn't been breeched, so it's safe-ISH to handle, briefly, but it shouldn't be agitated too much just in case.

I suggest removing the back fully so there's no pressure points. I'm ignored.

I get the info, turn off the fire bomb and hand it back, where it's taken back to what I assume is the sand bucket.

after a little while, the replacement phone is ready for login, I begin setting up the phone for my dad and logging in his information so it'll be set up and ready to go. They begin the return paperwork for the other phone.

At this point it's been about 45 minutes. It's been a smooth process where everyone was on the same side of 'we do not want to agitate the bomb, and Asrya should be leaving with a functional phone and NOT a fire hazard."

when they try to do the return, the SKU (sales identification number) comes up as dead meaning that the store chain doesn't carry that model any more, and the system won't accept the item as a return for cash, credit, or refund. It just -won't- . Initially, I tell them I've had to do this only twice before (I didn't mention it was spread out over like twelve years that I've been using this specific protection plan with Best Buy) and that they may have to store manager override it.

I've had to utilize this process before with laptops I had to exchange due to manufacture defects... so I actually do know how the policy works, the former general manager of the store had explained it to me YEARS ago.

So I tell them that it happens, and to take their time, I know it's a pain in the ass and I'm sorry I'm taking up so much resources, but it's really okay and as long as the end result is good, I don't mind waiting.

At this point it's 1 in the afternoon.

I've been at the best buy for an hour.

The manager comes up after a while, telling me that it's physically impossible. And I'm going to have to use the 'express return' system, it's the only solution that their system is allowing them to process.

I start getting frustrated, which means I start crying because I am fighting the urge to begin yelling. I've now been here for over an hour, I was in the middle of handling the situation and I NEED the phone in order to process the banking issue this all started with so my dad doesn't get charged overdraft fees.

I explain I can't wait a week for a new phone and what am I supposed to do with the bloated phone?

they explain this process, and get snippy telling me "It's 2-3 days not a week" I tell them it's 2-3 BUSINESS days "well... yeah" "This is THURSDAY, at the earliest it'll process Friday then ship out on Monday, if I'm LUCKY it'll arrive on TUESDAY at the earliest, and maybe not until Thursday of next week! During that whole time my dad's account will have overdraft fees being applied to it for each day! We can't afford that! On top of that you want me to pay a 70$ deposit just to do this! We do not have that money right now"

I was told I could apply for and use the best buy credit card.

I asked for a phone number to call, that there HAD to be an alternative solution, I said I didn't want to take the fire hazard home with me.

By now they had REMOVED THE PHONE FROM THE BUCKET and were walking around with it after me, trying to get me to take the fucking compromised battery.

I tell them to put that thing back in the sand bucket. And they give me 'corporate's number' a 1877 number. I ask if that's the number to call to talk to a supervisor or manager because this is an exception to the policy if ever there was one. If anyone would have the directions for overriding this dead sku problem, it should be the store manager's area or district manager

I am told there is no area or district manager.

I am FLOORED, I realize I've not been around this system for a couple of years but that information just... baffles me. I ask who THEY call when they have a situation come up that can't be handled in store.

They tell me they call the 1877 number.

I am BAFFLED by this, but I call the 1877 number, the call id comes up as 'best buy express kiosk" and I groan because I recognize this as the trunk line call center. I brace for and prepare to handle this for an hour. I am still trying to be as professional as possible.

I have now been here for going on two hours.

I roll out into the entry way, they CHASE ME with the fucking firebomb of a phone and ask if I'm leaving. I look back at them holding this fucking bloated phone and say no I'm just trying to get out of everyone's way so I can call the number and would they PLEASE put that thing back again and leave it in the safe bucket!

I spend the better part of hour three struggling to get through these customer service techs, explaining the situation and begging for them to transfer me to a manager or supervisor. I'm being denied this at every turn until I get to "returns" and am told to ask THEM for a manager by a tech who seemed to understand the situation and why I was calling.

I'm transferred, the tech listens, agrees that I should NOT be handed a firebomb to go home with, and should not be expected to ship a bloated li-ion battery in the mail and that it should be an in store return with store credit. I ask her to please explain this to the manager and go to remove my headset and put her on speaker so the manager can hear it from corporate

the call disconnected

I break

I begin crying, as quietly as I can, and the manager goes 'well' and I explain the call disconnected... I have to get back to that point.. and roll back into the entry way to begin the process again.

I'm crying, I just need this to work.

I've been here for nearly three hours.

The new tech that answers refuses to confirm the account and begins insisting I give my personal number and email to him. Refusing to accept the account information.

He puts me on hold. I call the corporate number again, merge the calls, and he has me on a mute hold. I get another tech that sound like the same guy, who also eventually puts me on hold, and then disconnects the call.

I'm sobbing and breaking down at this point, I'm having a panic attack, and struggling to maintain any type of composure at this point. I tell them I'm going out to my car so I'm not causing a scene in their store and is the manager positive there is no other option. I need to be leaving with a working phone, or at least I do NOT need to be leaving with a fucking FIRE HAZARD that they are expecting me to ship in the mail it is ILLEGAL to ship compromised batteries in the mail.

this fucking manager looks me dead in the face and says I can purchase a new phone to use, and just bring it back after the 'express return' is finished, or I can just do the express return, but there is NO WAY at all physically for her to do the return, in any shape, form or fashion, that I will have to take the fire hazard phone with me and ship it to their facility when the new phone comes in the mail in five days or so

I say I do not feel comfortable holding onto a FIRE HAZARD for a week, much less being without the ability to do the banking and is best buy going to cover the overdraft fees I'll be incurring and what am I supposed to do with a fucking bloated phone that could explode?!

Her solution? "You can go to walmart and buy a bucket and sand and put it in there if you don't feel safe with it, I hear that sand is good for batteries like this"

I snap... I just.. break down and begin crying because at this point I've been here for three hours, I know what she's suggesting is absolutely wrong, she's lied to me about not having an area/district manager, and she's standing over me like some fucking goon while telling me to take a BOMB home and then send it in the federal post in a week!

I break down, I take the stupid fucking bomb, they make me factory reset the phone I had been working on previously, I take the sim card, and I ask again if there is ANYONE I can call to talk to that will help. Who do THEY call when there's a situation because there HAS to be SOMEONE. They insist that nope, there's ONLY the 1877 number to the call centre.

I'm bawling, I'm broken, and crying I'm having heart issues, my head is screaming, my face feels burnt, and I roll out to the car and put the chair away. While unpacking the chair I realize I had actually put a pack of switch thumbsticks in the cart because I had been hoping to buy them with the leftover store credit I'd have when they all thought it was going to be a store credit exchange.

With my legs SCREAMING in pain, and barely able to walk, I limp back in on my crutches, unintelligibly sobbing and return the nearly-pilfered item, then go back to the truck. St this point I've set the phone on my driver's seat, I begin working on possibly loading the chair back on the truck when there's a loud, gunshot-like POP noise

and for a brief, horrifying moment, I think the battery has just exploded in my truck. Only to realize the heat had actually boiled a bottle of soda, and THAT was what had just exploded.

I'm determined, angry, frustrated, pissed, and petty... I don't want this fucking bomb in my possession, I know for a goddamn fact I am not supposed to have this bomb in my possession, I know that if it goes off and causes damages that best buy will be liable for it, and frankly, while the payout might be nice the inconvenience of having to deal with the damage, replacement, insurance, lawyers, and court costs and investigation are too much for me to handle. I don't want to go through it I JUST want a phone that works, the bank situation to be fixed and to NOT HAVE A FUCKING BOMB IN MY POSSISSION

I begin calling the useless as fuck call centre again, and for the next three and a half hours (totaling seven now) I continually try to explain, repeat, get transferred, sobbing, crying and getting hung up on by asshole techs. and I'm losing more and more composure as it goes on.

I FINALLY get a tech who says 'it should be store credit' I said I need the instructions on how to do that because the manager is claiming to not know how to do it. and I beg her to talk to the manager. Success. I go back in side, clinging to this tiny spider thread of hope that they'll fix it.

the manager takes my phone, asks if she can step tot he side, I say yes, and she comes back and they're both just repeating that the only solution is for me to send this bomb in the mail

I tell them it's ILLEGAL to send it, it's literally a federal crime. It CANNOT be policy to do this. None of them will budge. None will do the override, they're INSISTING I have to wait for a phone to come in, and then send a BOMB in the mail. I tell them this is probably why we've had mail trucks catch fire if they're telling people to do this it's ILLEGAL

The fucking manager says 'it's not actively leaking, it's not smoking or how it SHOULD be legal to send it in the mail' I ask for the salary person she mentioned. I go tot the mobile guy I'd been talking to six hours ago. I ask HIM to get me the salary person. This woman comes over and stands over me, arms crossed, with them angrily standing in front of me, arms crossed, like they're trying to intimidate me out of the store for trying to run a scam.

they continue to tell me there's no other option that they wouldn't spend six hours to tell me know they'd help if they could that I'm going to have to use the mail system.

I ask the salary manager who they call. She says corporate. I say that is horseshit. She gets offended and I clarify. That if their new policies is to call the call center number they gave me that is a horse shit policy and THEY are in danger of running into DANGEROUS situations like this without a way of getting out or around it. Who do I call to complain about that policy then?

"You can complain but it won't do anything to change the answer"

"Who do I call?!"

They give me no answer.

I leave

after seven hours of fighting with them. I leave, in possession of a fire hazard, my head pounding, feeling sick, having now gone through MULTIPLE break downs, melt downs, and panic attacks over the past seven hours of being on site trying to get them to do the right things.

I go home and explain to my parents what happened, I unload the tiny amount of groceries I'd picked up (twenty bucks of emergency cash) and realize how much bullshit it is what had happened. So I begin calling the local investigative news stations to see if they want to look into this.

One of the news stations is VERY interested in the fact this store told me to buy a bucket of sand to put a dangerous fire/explosive into. They're interested that the store can't be called with inbound calls, that there's apparently no area or district manager to call, that the store sent me home with an explosive and told me to send it in the mail.

I send the store to the news station. I call other stations, they're not as interested. That's fine. I'm advised to call the attorney general of commerce and leave them the story. I do.

June 21 2024 - I still need to correct the banking situation so I determine to drive to the bank, make a physical deposit with some change I have on hand to bring the account high enough to accept the cash app deposit I tried to withdraw two days before. And while I am in the area of the credit union, I'll go to a different best buy, explain what happened, and see if they give me the same answer.

The bank was thankfully open two hours later than I though, giving me plenty of time. They accepted the deposit, and I was on my way, I get to the other Best Buy.

The battery has expanded again by this point. But still no leaks, smoke, or active heat but I don't trust it, and moving it is a bad idea. I take it inside, I explain what happened and this store is absolutely horrified of my story.

I show them receipts of what happened. I explain their responses, their 'solutions' and their suggestions. This store's crew is just locked in abject horror that this happened. I explain why the other store wouldn't do the store credit and they say 'let me call my manager' and I tell them about how the other store told me there was NO area or district manager.

They look confused "Well he's kind of a roaming district manager, but... yeah... we have... I have a lot to tell Abby."

I breathe a sigh of relief. I was right, there's an area manager, and a roaming district manager... I wasn't crazy I did remember correctly how their policies worked... I tell them about the 'we call corporate' situation and how I was on the phone for 7 hours thereabouts, being hung up on.. they all continue to look horrified... at this point they hit the same dead sku issue, and I lament a possible repeat. They said they were NOT going to let me have that bomb back, we were NOT going to be sending it through the mail (one even said 'Isn't that considered like.. terrorism?!" and I agreed I was pretty sure it was. ) they said I was leaving with a phone they just had to get 'Abby' to tell them how to bypass this... and she did. In like.. five minutes.

"Is store credit okay? It'll probably have to be store credit" "YES! That's perfect, it means I can just get the phone and a new plan..." They help me find a phone they have (Moto G 5g 2024 model) and even with a new plan, I had 33% of store credit left over!

They tell me that phone is NOT leaving the sand bucket, and there's a brief funny moment of one associate holding up the sim tray (they'd used it to confirm the IMEI and confirm it was the phone under warranty) and the tech laughing and holding this tiny piece of plastic "This is probably the least problematic part of the phone"

I agree... the situation was handled, and I tell them I DID report them to the AG, and the news stations, and one of the associates goes "I'm REALLY surprised that store did that... that's the main hub store of the district, and he's on vacation right now but Roy, the district manager... that's his HOME store... I don't know what they were thinking" and I go "Roy.... Roy.... Mister Roy? Kinda tall, brown/black hair? Used to be the General manager of that store? THAT Mister Roy is the district manager?" "Yeah! He was the general manager there for a while." "Yeah about three0four years ago, I've met him! He's the one who told me about the way the protection plans work"

They all agreed he was not going to be happy, and any new friends that store makes from my reports were justified, they were glad I raised hell about the battery because it would have been a disaster if it'd gone off, and "didn't they know how dangerous these batteries are" and "why the hell did they send you home with that?" and me agreeing it was insane and wrong and just... feeling better to know I wasn't crazy in the way I knew the world was SUPPOSED to work.

So in the end - the banking situation was handled, I was able to get a new working phone for my dad, that did indeed transfer all information, contacts, images and everything over (for as evil as it's become, google synching system and account connections are INCREDIBLE for this exact situation) and I had enough money left over to get the switch thumbsticks I'd wanted to get from the other store... I still have some money left over. and they were cheaper than my local store.

the news station hasn't gotten back to me yet, but they may not until Monday at the earliest, but the situation is done at least, (largely) and the end was a good one.

and that concludes the epic saga of "Asrya and the exploding battery - and the store manager that wanted her to commit an act of domestic terrorism"

3 notes

·

View notes

Note

Piers: maybe we’re the real monsters not the zombies.

Chris: maybe I should beat you with a wrench.

@rebelwithoutacock here ya go

Sleep was near impossible out in the field. With monsters lurking around every corner, it was drilled into every BSAA soldier to keep one eye closed and the other open. Piers took the motto to heart as did his captain. Rest was a commodity neither of the men could afford at the moment, but they were both stubborn in their own right to admit it aloud as they each tossed and turned in their respective sleeping bags.

Piers was the first one to give in to his defeat. He sighed, taking notice that Chris's shoulders scrunched while the man turned to his right, facing away from him.

"Can't sleep either, can you?" Piers muttered.

"Not when you're talking," Chris huffed tiredly. "We have three hours. You better make the most of it."

"Right," Piers sighed. It was obvious the captain was in no mood for a conversation. Piers didn't hold it against Chris while he looked up at the sky, trying to count how many stars were up and about. He hoped at some point the action would make him tired enough.

Piers took in a deep breath, not able to help himself as a silly thought broached his brain.

"Chris?"

"Hm?"

"Do you sometimes think that maybe we're the real monsters and not the zombies?"

The growl that escaped from Chris could undo the most hardened of men as murmured bitterly.

"Maybe I should beat you with a wrench."

Piers suppressed a snort that wanted to escape him. He ended up smiling so big that his lips began to hurt.

"I wouldn't be too hasty. Whose gonna cover your ass from monsters when we storm the main branch?"

"I survived Raccoon City. I can survive a piece of shit terrorist and his black market buddies."

"Does it ever go away, the memory of that place?"

Chris at this point opened his eyes. He blinked a few times and furrowed his brows. A part of him wanted to tell Piers to shut up and back off, yet there was an honesty inside of himself that beckoned to come forth.

"No," Chris admitted. "No it doesn't."

"Figures." Piers sighed.

"How did you wind up in this field again?" Chris asked, curious as to why his comrade sounded disappointed.

"Besides you scouting me?" Piers quipped. He hesitated before answering. "I lost some men and women from my original team to a bio attack. Back when I was first training in the army. Every one of them zombified. You know, when you asked me to join you and I heard about what you experienced, I thought--finally. Someone that gets it."

Chris made a face, still facing away from his partner while he let the tale sink in, not having the heart to ask for anymore details.

"I know I've made some questionable choices earlier that almost got us killed, I'm sorry."

"No," Chris let out a deep breath through his nose. "I was too harsh. You know, if you want to talk about what happened back then, I'll listen."

Piers turned his head toward Chris, staring at his back while thinking the offer over.

"Maybe we can take a rain check. It's a long story."

"I'll hold you to it." Chris muttered.

"Chris,"

"Hm?"

"Everyone on the team is alright." Piers reassured, thinking about earlier on in the day how both he and Chris got separated from the main group. "We'll see them again."

Chris didn't say a word for he didn't have the stomach to tell Piers that the chances of that were unlikely. Especially when Chris himself looked back while they escaped, watching as men and women he had known for years were torn apart in a violent frenzy by ravenous creatures that eerily looked human.

If you like my work and feel generous, feel free to donate to my ko-fi account or my cash app account!

Cash App: $JayRex1463

#drabbles#piers nivans#chris redfield#resident evil#resident evil 6#piers x chris#re chris#re piers#resident evil fandom#chris x piers#for whatever reason i cant tag ya

49 notes

·

View notes

Text

Okay let's do this Blog because today just sucked ass. Get your popcorn kids I got some BS drama coming your way and most of it is my fault for not saying fuck off..

So about the start of the beginning of July I was told I won $5000 for a photo of my wife I posted on FB. The girl I was talking to wanted me to get an app called CASH APP so I could get my prize. I didn't think too much of it and got the APP. Then she told me I need to send her accountant $100 for a processing fee. That should have been the 1st red flag but nope my dumbass kept moving forward. The girl could get the APP to work.... so she told me to send her accountant $200 for a processing Fee for PAYPAL. I know 2nd red flag. So I gave him the money but she still couldn't figure out how to give me my prize. So she then told me that she is now going to give me $10,000 but I have to give her accountant $500 for a processing fee. I told her no I'm not going to do that and she is just trying to scam me fuck off. Well she got all snowflake on me and told me she is a good person and she is not trying to scam me. I told I did believe her and go away.

Well she got so upset she had her boss step in to fix everything. Keep in mind my dumbass gave them access to my FB, my business bank account and my business ATM card. So her boss told me that they going to send a check, but I need to put that check into my business checking account. Then take the money and buy Bitcoin with it. That would be the 3rd red flag. So the whole time the boss is reminding me not to scam her or she is going to call the cops. Plus she bugged me for 3 days if the check came in the Mail yet. Everyday I would tell her no not yet and I'm not going to con you and your employee out of your money. Which I thought was odd because I was told it was post to be my prize that's it. So the check showed up and I told the boss I was going to talk to the bank. The boss me to deposit it in an ATM. I asked her why. The boss she just got mad and told me to shut up and do as I'm told to do.

4 red flag. So I deposited the $20,000+ into the ATM and sent over a photo. The boss then told me to take the money and buy Bitcoin with it. I told I can't the bank has to process the check to see if it's real. The boss got upset and didn't understand why the bank would do that. Then she told me to buy Bitcoin using the ATM. I told her you can't do that. The Boss why not? I told because you can't. The boss then ask why can't you take out the $20,000? Because the bank has to process the check to see if it clears or not. The boss asked what does that mean? I told the boss your going to have to wait. At this the boss quit texting me.

I then drove to the sheriff's command center but they were closed. So I called the police and told them what was going on. The dispatcher told me to wait for a police officer for I could give them my statement. I waited 2 hours and the cop never showed up.

The part I hated the most is I didn't want to tell my wife about this because I didn't need her BS drama in my life. So I lied to her and told her my dad's truck broke down. The whole time my wife went on and on about how my father doesn't have dementia and like to fuck 20 yr. old girl and secret. Which is some kind of bullshit that she made up in her head. My dad does have dementia and no he's not actually fucking any 20 year olds. He is getting on some of those fangirl porn sites but that's about it. I do feel bad that I had to lie to her that way it's just I don't need to hear her BS. As I've said several times in my blog she loves to gaslight that shit out of me and this is just one more thing to hold over my head. And I don't need that.

So after the cop didn't show up I decided to go home and deal with the scam issue in the morning. So in the morning I went to the substation told him what was going on gave him a statement. They made a copy of the envelope that the check came in and the bank receipt from the money I deposited. I did ask him if I was in trouble and they told me no as long as you don't spend any of the money I told him while I'm going to go to the bank and tell them about it. They gave me a form to give to the bank that the money is fake. I got done with the police I went straight to the bank. I told the bank what happened and they decided to give me a new card and a new account number for my business. The guy I talked to at the bank was actually really nice and told me this is actually a really normal thing for people to use Bitcoin for scams which I didn't know that. I told him am I going to get any trouble for this I said no we'll hold on to the money because the check will more unlikely will not go through. I asked him then what if the check does go through and everything is okay. He told me I'd get to keep the money. I told him is that legal and he said it's absolutely legal. I got done with the bank and went to my car. While I was in my car I changed my password to my FB, PayPal and deleted the Bitcoin app. I was going to delete the cash app but I couldn't figure out how I'll have to work on that one later.

The whole time I was at the police station and the bank the boss was texting and trying to call me. Telling me that you was going to tell the police about what's going on. I decided to turn around and let her know exactly what I did by informing the police department about her scam. Again she didn't seem to understand what I wrote and kept on going on and on about how I was going to be arrested. Hey then got on Facebook and blocked her and everyone associated with her. But somehow I don't know how she got unblocked and she kept harassing me. I then told her go away leave me alone. Then later that morning I got a text from a guy that said he was from the FBI. Which I knew was a lie because the FBI doesn't text you or call you. I told the FBI agent I didn't have her money that the police in the bank have the money and he didn't seem to understand that either. He just threatened to put me in jail for fraud. I then went back to the police station told him I was going on and they told me just to block his phone number. So that's what I did. And that is been my adventure for the last couple days dealing with a scam. It has been extremely stressful. Unfortunately I did take out some of that stress in my wife which isn't fair but she's always climbing up my ass so it's not easy being around her some days which I've talked about before. So hopefully everything with this scam thing is done and over with.

072620242016

0 notes

Text

Why Did Cash App Close My Account? Understanding the Reasons behind Cash App Closing Accounts

Introduction

Many users have experienced the frustration of having their Cash App account closed unexpectedly. Understanding the reasons behind Cash App closing accounts can help users prevent such incidents and take appropriate steps if it happens. This article delves into the common reasons why Cash App shut down accounts and offers guidance on how to avoid these issues.

Common Reasons for Cash App Closing Accounts

Violation of Terms of Service

One of the primary reasons for Cash App closing accounts is the violation of their Terms of Service. Cash App has strict policies to ensure the security and integrity of its platform. Activities such as:

Fraudulent behavior: Engaging in scams, using fake identities, or conducting suspicious transactions.

Inappropriate use: Utilizing the platform for prohibited transactions, such as gambling or purchasing restricted items.

These activities can trigger automatic account reviews and potential closures.

Unverified Accounts

Another common reason for Cash App closing accounts is failure to verify account information. Cash App requires users to provide accurate personal information, including full name, date of birth, and the last four digits of their Social Security Number (SSN). If this information is not verified, the account may be limited or eventually closed to comply with regulatory standards.

Suspicious Activity

Cash App employs sophisticated algorithms to detect suspicious activities. Accounts showing unusual patterns, such as frequent large transfers or multiple transactions with unknown users, may be flagged for review. If the activity is deemed too risky, Cash App may shut down the account to protect against potential fraud.

Chargebacks and Disputes

Frequent chargebacks and disputes can also lead to Cash App closing accounts. While users have the right to dispute unauthorized transactions, an excessive number of disputes can signal high-risk behavior. To mitigate risks, Cash App may opt to close accounts with frequent chargeback requests.

Steps to Take if Cash App Closes Your Account

Contacting Customer Support

If you find that Cash App closed your account, the first step is to contact their customer support. Providing all necessary information and verifying your identity can help resolve the issue more quickly. Be sure to explain the situation clearly and ask for specific details about why your account was closed.

Filing a Complaint

If customer support does not resolve the issue, you can file a complaint with external agencies like the Better Business Bureau (BBB) or the Consumer Financial Protection Bureau (CFPB). These organizations can assist in mediating disputes between consumers and financial institutions.

Legal Options

In cases where significant funds are at stake, seeking legal advice may be beneficial. A lawyer specializing in financial disputes can offer guidance on potential legal actions to recover your money.

Preventing Account Closures

Adhering to Terms of Service

To avoid closing your Cash App account, always adhere to the platform’s Terms of Service. Ensure your activities align with the allowed uses of the app and avoid any transactions that could be considered suspicious or fraudulent.

Verifying Your Account

Complete the verification process promptly. Providing accurate and up-to-date information helps build trust with Cash App and reduces the risk of account limitations or closures.

Monitoring Account Activity

Regularly monitor your account for any irregularities. Report any unauthorized transactions immediately to Cash App to prevent your account from being flagged for suspicious activity.

Conclusion

Understanding why Cash App closed your account can help you prevent similar issues in the future. By following the platform’s guidelines, verifying your account, and monitoring your activity, you can maintain a secure and active Cash App account. If your account is closed, swift action and understanding your rights can aid in resolving the issue and recovering your funds.

0 notes

Text

How to Reopen If Cash App Closed Your Account?

Cash App closed your account if you violate its Terms of Service. This includes sending money to suspect accounts, committing illegal transactions, or sharing account information with a third party. Cash App can freeze your funds and close your account if they deem these activities as violating their guidelines. If the company detects suspicious activity on your account, it may temporarily lock or restrict it to ensure your safety. It could be due to suspicious activity from an outside source or because you are trying to buy illegal products such as drugs, weapons, or gambling.

Sometimes the Cash App shut down account for money laundering. This will result in the immediate closure of your account and the freezing of any remaining funds. If you wish to reopen your account, contact their customer service team via email or app to explain your situation. Be prepared with any requested documents or details to expedite the process. Depending on their policy, they may also ask you to undergo identity verification. Let’s begin and learn more about it.

Why does Cash App close accounts?

Cash App shutting down accounts could be due to so many different reasons. Here is why did my Cash App get closed:

Like any other financial institution, Cash App has rules that its users must adhere to. Account closure can result from violations, whether intentional or not.

Cash App checks for unusual account activity to prevent fraud. If it detects something unusual, Cash App may temporarily or permanently close an account.

Cash App may close your account if it detects an issue, such as unauthorised access. This is done to protect your personal information and funds.

How to reopen your closed Cash App account?

To reopen when your Cash App has been closed, you will need to follow a set of steps to identify the reason for closure and resolve it. Here are the steps to reopen closed Cash App account:

The first step is to contact Cash App's Customer Support team via its app or website and explain your situation. Ask if your account can be reopened. Be polite and clear in your communication, and be ready to provide any additional information or documents that they may require.

Once you have reopened your account, all your previous transaction history will be available. Cash App has strict policies that could result in your account being closed for any violations. To avoid this, it is important to read and adhere to all the terms of service.

What happens if I sent money to a closed Cash App account?

Usually, if you sent money to a closed Cash App account it will be returned to your account. Processing times may vary. It is best to contact customer support for any specific case. Cash app users are required to follow a strict set of guidelines to ensure a safe, secure experience. Cash App can close an account that contains funds in certain circumstances, including fraudulent activity and violating the Terms of Service. This can be very distressing when money is available for users to access.

It is essential to investigate the reasons for your account being closed and resolve any outstanding issues. You may need to investigate fraudulent activity, resolve conflicts with other users, or take preventative measures so it does not happen again. Sometimes, the decision to permanently close a Cash App Account cannot be appealed. The user must understand why their account was closed and take preventative steps. They may be able to reopen the Cash App account if they are still able to do so.

What should I do if Cash App closes my account with money in it?

Contact Cash App Support to learn how to get your money back if your account has been closed, but there is still money inside. It may be necessary to verify your identity or resolve any issues. If your Cash App account closed with money in it. In that case, it is essential to contact customer service immediately to retrieve the funds from your account and reopen it. Due to security or compliance concerns, reopening your account may take some time. Be patient and work closely with customer service as they help you in the process.

Contacting Cash App's customer service team through the app or the website is the first step. They will evaluate and provide advice on how to reopen an account. The chances of successfully reopening the account are increased if you are open and cooperative. It is essential to be patient at this stage as customer service will need to take time to assess the situation and decide.

1 note

·

View note

Text

Most common reasons why is your Cash App account closed?

Cash App is one the most popular digital payment app among millions of smartphone users. It allows you to send money, receive it, and manage your account with just a couple of taps. Cash App is a convenient app, but some users find that their account has been closed unexpectedly. Your Cash App account closed due to several reasons. These include violating the Terms of Service, engaging in suspicious or unauthorized activities, having verification issues, and suspicions of money laundering. A notification will usually be sent with specific instructions for what to do after an account is closed. Cash App may have closed your account due to a violation of their terms and conditions.

Cash App will ask you to follow their instructions and provide documentation, such as your transaction history or proof of identification. This will ensure that your account is treated fairly and impartially. Let's start by learning about the most common reasons why did my Cash App get closed. We will also discuss what you can do if this happens to your account and how to avoid it in the future.

Why Your Cash App Account Was Closed?

Cash App aims to offer a smooth and secure financial experience to its users. However, Cash App accounts can be closed for a variety of reasons which are mentioned below:

Cash App account closed for violating terms of service. This includes fraud, the use of false identities or illegal transactions. Accounts may be immediately closed and funds seized if someone violates the rules.

Cash App accounts can also be closed if they are suspected of being used to gamble. This is a violation of their terms of service agreement, and it allows them to close any suspected account of gambling activity.

Cash App's policy is to close any account that has been dormant or inactive for an extended period. This ensures users are active on the platform.

Cash App monitors account activity closely to detect signs of fraudulent or suspicious behaviour. Cash App may close your account if it is flagged as having unusual activity. This will protect you and the platform.

Cash App's security measures require users to confirm their identity. Your account could be closed if you do not complete the verification process or provide incorrect information.

Excessive chargebacks can cause account closure. These occur when customers dispute transactions through their bank and request refunds. Cash App may consider many chargebacks to be a sign that the platform is being abused or fraud.

How to Avoid Cash App Account Closed?

Cash App users are often in the unfortunate situation of having their accounts closed. This can be frustrating and confusing if they still have money in it. Do not worry: you can recover your money with the right knowledge. It is essential to follow the Cash App's guidelines and terms of service to avoid frustration and inconvenience. Here are some helpful tips to prevent account closed issues on Cash App:

Cash App will only allow you to keep your account operational if you adhere to the terms of service. For example, using Cash App to fund gambling activities is against their rules and could result in its closure. Other instances include unapproved behaviour, identity verification problems and suspicious behaviours.

If you have a Cash App account closed with money that was intended to be there, your first step should always be to contact customer service to explain the situation and get clarification. If an account is closed for violating the terms of service or due to fraud, all funds will be returned.

Cash App should be notified immediately if you notice any suspicious or unauthorized transactions.

Avoid engaging in prohibited activity such as fraud, money laundering or excessive chargebacks.

Cash App customer support takes all allegations of fraud or illegal activity seriously and will work hard to resolve any issues quickly. Please follow their instructions, including completing any requests for identity verification and documents. Also, be sure to review your account activity regularly and report any suspicious or unauthorized transactions.

0 notes

Text

Why Cash App Closed my Account for no Apparent Reason?

Imagine waking up one day, ready to check your Cash App account and conduct some transactions, only to find that your account has been closed without any apparent reason. Frustrating, right? Unfortunately, this is a situation that many people have found themselves in. In today's digital age where financial transactions are increasingly conducted online, it can be distressing when a platform like Cash App suddenly shuts down your account. But fear not! In this blog post, we will explore why Cash App may close accounts seemingly out of the blue and provide you with helpful tips on how to retrieve your money from a closed Cash App account. So sit back, relax, and let's get started on unraveling this mystery together!

Why did Cash App closed my account?

One of the most frustrating things for Cash App users is when their account gets closed without any clear explanation. So, why did Cash App closed my account? Well, there could be a variety of reasons behind it.

Cash App has stringent security measures in place to protect its users and prevent fraudulent activities. If they suspect any suspicious or unauthorized activity on your account, they may decide to close it as a precautionary measure.

If you violate Cash App's terms of service or engage in activities that go against their policies, such as using the app for illegal transactions or violating money laundering regulations, they have the right to terminate your account.

Furthermore, if you fail to verify your identity or provide inaccurate information during the verification process requested by Cash App, they may also choose to close your account.

It's important to note that sometimes mistakes happen too. There have been instances where accounts were closed due to errors or misunderstandings on Cash App's end. However, reaching out to their customer support team can help resolve such issues.

In conclusion (not concluding yet!), understanding why Cash App closed your account can be difficult since specific details are not always explicitly provided. It's crucial to review their terms of service and use the app responsibly while keeping communication open with their support team should any problems arise with your account status.

How to get my money from a cash app that closed my account?

Losing access to your Cash App account can be a frustrating experience, especially if you have money sitting in it. But don't worry, there are steps you can take to retrieve your funds.

Reach out to the Cash App support team immediately. Explain the situation and provide any relevant details about your account closure. They may ask for some additional information or documentation to verify your identity and ownership of the funds.

Next, explore alternative options for accessing your money. If you had linked a bank account or debit card to your Cash App, contact them directly and explain the situation. They may be able to assist you in recovering the funds or transferring them elsewhere.

Consider reaching out to legal authorities if necessary. If all else fails and you believe that Cash App unjustly closed your account without reason, consult with an attorney who specializes in financial matters.

Remember, each case is unique and there is no guarantee of success in retrieving your funds. However, by taking these steps diligently and seeking appropriate assistance when needed, you increase your chances of resolving this frustrating issue effectively.

Stay persistent and proactive throughout this process – hopefully soon enough you'll have access to those hard-earned dollars once again!

What do I do when my cash app was shut down?

So, you wake up one day to find that your Cash App account has been shut down. Panic sets in as you wonder what to do next. Don't worry, you're not alone. Many people have found themselves in this unfortunate situation with no apparent reason behind it.

The first thing you should do is reach out to the Cash App customer support team. They may be able to provide some insight into why your account was closed and if there's any way to resolve the issue. Be prepared for a potentially lengthy process, as it can take time for them to investigate and respond.

While waiting for a response from Cash App, consider reaching out to your bank or credit card company. If there were any pending transactions or funds left in your closed Cash App account, they may be able to help retrieve those funds.

It's also important to review the terms and conditions of using Cash App. Make sure you haven't violated any policies that could have led to the closure of your account.

In the meantime, start exploring alternative payment apps that are available on the market. There are several options like Venmo or PayPal that offer similar services and might be worth considering as a backup solution.

Remember, patience is key during this frustrating time. Keep calm and keep reaching out for answers until you find a resolution regarding your closed Cash App account with money still inside it.

My cash app account closed with some money in it

In the end, it can be incredibly frustrating and confusing to have your Cash App account closed without any apparent reason. It leaves you wondering what went wrong and how you can get your money back. However, there are steps you can take to resolve this situation.

If your Cash App account has been closed with money in it, the first thing to do is reach out to Cash App customer support immediately. Explain the situation clearly and provide any necessary information they may require. They will guide you through the process of recovering your funds or reopening your account if possible.

It's important to remain patient throughout this process as resolving such issues may take time. Keep all communication records with Cash App customer support for reference in case further assistance is needed.

Additionally, consider reaching out on social media platforms like Twitter where companies often respond promptly to public complaints or concerns. Tagging Cash App's official handle might catch their attention and expedite the resolution process.

While waiting for a response from Cash App, explore alternative options for accessing your funds such as transferring them to another bank account or using a different payment app that meets your needs.

Remember, facing an unexpected your Cash App account closed with money in it is undoubtedly frustrating but staying calm and proactive will increase the chances of finding a solution sooner rather than later.

Disclaimer: The purpose of this article is purely informational and should not be considered legal or financial advice. Always contact professional help when dealing with specific cases related to personal finance matters.

0 notes

Text

Why is my Cash App Account Closed with Money? (How do I reopen it?)

Cash App, as with any fintech company, is subject to strict rules to ensure its users’ safety and compliance with the regulations of the government. Certain users might encounter an issue that is unexpected and frustrating, such as Cash App account closed with money. In the event of one or more reasons (which we will discuss in greater detail below), you may discover the account on the Cash App accounts has been shut down.

And if you are in this situation and you are looking for a way to reopen closed Cash App account. Let’s look at the reasons for Cash App account closed and steps to reopen your account again and address frequently asked questions and issues.

Why did my Cash App Account Get Closed?

Cash App, like every financial institution, follows certain guidelines and rules to guarantee the safety and security of its customers. Here are a few of the most possible reasons why your Cash App account closed:

· Cash App actively monitors accounts for fraud or suspicious transactions. If your account has been linked with a suspicious transaction or unauthorized usage, it could be shut down to protect you and the platform.

· Cash App takes security very seriously. Any suspicious login attempts or security issues could lead to account closed to protect yourself.

· Sometimes Cash App account closed due to violation of terms of services. For instance, if you engage in illegal actions, making use of the app to conduct commercial transactions in violation of authorizations, and performing transactions that violate their rules.

· The Cash App can shut down accounts if they are unable to verify the identity of the user. It is common for users to not be able to provide the required documents to verify their identity.

· Charged or disputes over transactions can result in the closure of accounts. It is essential to resolve any discrepancies or disputes quickly.

How do I Reopen my Closed Cash App Account?

When you complain that Cash App closed my account, and you believe it was due to an error or you have resolved the problems that led to the closing, you are able to try to open it again. Here is step by step method on how to reopen closed Cash App account:

· The first step is to contact Cash App’s customer service. This can be done by clicking the profile icon within the app, then selecting “Support,” and explaining your circumstance. Be as specific as you can.

· If your Cash App closed account to problems with identity verification, make sure you submit any requested documents promptly. Cash App might request a photo ID as well as other details.

· Cash App assistance will guide you through the process of opening a new account. Follow their directions attentively, and remain patient because it could take time to look over your application.

· Cash App will contact you primarily via email. Be sure to check your email inbox for any updates or requests for more details.

FAQ

Can I continue to be able to access my closed Cash App account?

If your Cash App account is closed, you will not be able to use it until it is opened.

What is the time frame to reopen the closed Cash App account?

The process for reopening the account that was closed may vary in accordance with the circumstances. It could take anywhere from several days to several weeks; therefore, patience is the key.

What do I do if I believe my account has been closed due to a mishap?

Call Cash App support right away, give all the information required and provide a detailed explanation of your situation. They will assist you with the process of opening a new account.

Can I transfer my balance to a different Cash App account if mine is closed?

It is recommended to fix the issue with closure and restart your account to access your funds. Cash App’s policies could make it difficult to transfer funds from accounts that are closed.

0 notes

Text

What are the main reasons for Cash App closes accounts due to suspicious activity?

Why Cash App Closed my Account for no Apparent Reason?

Have you ever experienced the frustration of having your Cash App account suddenly closed without any explanation? It is a perplexing situation that many users have found themselves in, and it can leave you feeling helpless and bewildered. After all, you trusted Cash App with your hard-earned money, only to have them shut down your account without warning or justification.

In this blog post, we will delve into the main reasons why Cash App closes accounts due to suspicious activity. We’ll also address what happens to your money if your account is closed and provide guidance on how to reopen a closed Cash App account. So let’s dive in and shed some light on this puzzling issue!

Why Cash App Closed my Account for no Apparent Reason?

One of the most frustrating aspects of having your Cash App account closed is the lack of a clear reason. It can leave you wondering what you did wrong and why your account was flagged for suspicious activity. While Cash App doesn’t disclose specific details about their security measures, there are several common reasons that may lead to an account closure.

If there were multiple instances of unauthorized transactions or fraudulent activity associated with your account, it could be flagged as a potential risk. This is done to protect both you and other users from financial harm.

Engaging in prohibited activities such as money laundering or using Cash App for illegal purposes can result in immediate closure. Cash App has strict policies in place to ensure compliance with laws and regulations governing financial transactions.

Another possible reason for account closure is if you violated Cash App’s terms of service or community guidelines. This could include actions like sending spam messages, harassing other users, or engaging in any form of fraudulent behaviour.

It’s also important to note that if your identity verification process fails or if the information provided doesn’t match up with their records, Cash App may choose to close your account as a precautionary measure.

While these are some general reasons why accounts may be closed by cash app due to suspicious activity, it’s crucial to remember that each case is unique and individual circumstances play a role in the decision-making process.

What happens to my money if the Cash App account is closed?

What happens to my money if the Cash App account is closed? This is a common concern for users who find their accounts unexpectedly closed. When your Cash App account is closed, you may be worried about losing access to your funds. However, rest assured that your money does not simply disappear into thin air.

When Cash App closes your account due to suspicious activity or violations of its terms of service, it typically holds any remaining balance in your account. You will need to go through a verification process and provide additional information to prove ownership before the funds are released.

Cash App’s priority is ensuring the security and legitimacy of transactions on its platform. By closing accounts with suspicious activity, they aim to protect both their users and themselves from fraudulent or illegal activities.

If you believe that your account has been wrongfully closed or if you have questions about accessing your funds after closure, it’s best to reach out directly to Cash App’s customer support for assistance. They will guide you through the necessary steps to resolve any issues related to accessing your money.

Remember, while having an unexpected closure can be frustrating and inconvenient, Cash App takes these measures for the safety and protection of all its users’ finances.

How do I know if my Cash App is closed?

If you’re wondering whether your Cash App account has been closed, there are a few ways to find out. First, you might notice that you can no longer access the app or log in to your account. This could be a sign that your account has been closed.

Another indication of a closed Cash App account is if you receive an email or notification from Cash App stating that your account has been deactivated due to suspicious activity. They may provide some details about the specific activity that led to the closure.

Additionally, if you try to send money or make transactions using your Cash App and encounter errors or issues, it could mean that your account is closed. Sometimes, payments will fail and display an error message indicating that the transaction cannot be completed because the recipient’s account is inactive.

In any case, if you suspect that your Cash App account has been closed, it’s best to contact their customer support team for clarification. They will be able to provide more information about why your account was closed and guide you on potential steps moving forward.

Remember, this blog section provides some insights into how one might determine if their Cash App is closed but does not offer conclusive answers. Always reach out directly to Cash App for accurate and comprehensive information regarding your specific situation

How do I reopen closed cash app account?

If your Cash App account has been closed due to suspicious activity or any other reason, you may be wondering how to reopen it. While the process can vary depending on the specific circumstances, there are some general steps you can take to try and regain access to your account.

First, it’s important to understand why your account was closed in the first place. Cash App typically closes accounts if they detect unauthorized transactions, fraudulent activity, or violations of their terms of service. If you believe that your account was closed unfairly or by mistake, you can contact Cash App customer support for assistance.

To reopen a closed Cash App account, start by reaching out to their customer support team either through the app or their website. Provide them with all relevant information about your account closure and explain why you believe it should be reopened. They will review your case and determine whether reopening is possible.

It’s worth noting that not all accounts can be reopened. In some cases, if suspicious activity is detected or if there have been multiple violations of the terms of service, Cash App may permanently close an account with no option for reopening.

If reopening is approved, follow any instructions provided by customer support regarding identity verification or additional security measures. Once these steps are completed successfully, your cash app account may be reopened and accessible again.

Remember that prevention is always better than cure when it comes to keeping your Cash App account safe from closure. Be vigilant against scams and ensure that all transactions conducted through the app are legitimate. By following good security practices and staying within the app’s terms of service guidelines, you can reduce the risk of having your cash app account closed in the future.

0 notes

Text

Once the validation of my two phases and six days of serious buying and selling, I receive an email saying which i used a technique based on high frequency investing whilst all trades ahead of the information are handbook. I mail an electronic mail into the chat, their help and my account manager with no answer due to the fact a week.

I have furnished a screenshot as proof of payment. They only preserve marking guidance tickets as solved and telling me I have to upload proof of payment. I would by no means deal Using these fellas once more

Disorders for Participation in Traders Contests: Genuine proprietors maintain this sort of occasions utilizing demo accounts and never the actual types. In contests on genuine investing accounts, There's a possibility of not having back the money deposited by anybody Buying and selling with no prize.

A trader need to not loose in excess of 12% of beginning fairness. This selection is static and doesn't Adhere to the equity from the account.

The only real reason of Funded Following is to choose your money and tire you out with quite possibly the most incompetent assist ive at any time encountered. I did some research and understood their Dependable pilot reviews are all faux/paid out experiences.

This cookie is indigenous to PHP apps. The cookie is used to shop and discover a end users' special session ID for the goal of controlling consumer session on the web site. The cookie is actually a session cookies and is deleted when all the browser Home windows are closed.

A trader need to enter or execute a trade after every day for three days a week. There are no most boundaries to this rule.

A trader need to not unfastened much more than twelve% of setting up fairness. This amount is static and won't Keep to the equity of the account.

Quick product does not have any targets to qualify traders for bonus. A trader is likely to make twelve% of all income designed over the account.

.., no person will be there that prop review will help you. When you Get in touch with help desk they immediate you to speak to your account supervisor, Whilst you account manager is not any the place to generally be viewed.

OneUp Trader supplies a unique prop trading application for investors that makes it easier to get in to the sector. OneUp associates with multiple prop trading firms in order to warranty buying and selling funds that can be as high as $250,000.

I've opened a assistance ticket along with a staff members named Esla assisted me. Without having one hour I have acquired my funded account.

Most traders have a difficulty with moving into the marketplaces simply because they deficiency the funds required to choose pitfalls and see large returns. This can be why traders turn to Trade the Pool. Trade the Pool does a lot more than provide you with the cash you need to get into prop buying and selling. Trade the Pool also:

which I finally obtained what was as a result of me. their nicely-structured strategy for reclaiming me out.

1 note

·

View note

Text

Why I am received a notification from Cash App saying that your account has been closed?

Have you ever received a notification from Cash App saying that your account has been closed? It can be frustrating and confusing to suddenly lose access to your funds. But don’t worry, you’re not alone! Many users have experienced this issue and are left wondering what they did wrong. In this blog post, we’ll explore the reasons why Cash App may close an account, what happens when it does, and most importantly — how you can potentially get your account reopened. So sit back, relax, and let’s dive into the world of closed Cash App accounts!

How do I get my deleted Cash App account back?

If you’ve received a notification that your Cash App account has been deleted, the first thing to do is to understand why it happened. Cash App may close an account for various reasons such as suspicious activity or a violation of their terms of service. Once you know the reason behind your account closure, you can take steps to potentially get it reopened.

The best way to start is by contacting Cash App support and explaining the situation. Be sure to provide any necessary information they may need, such as your email address or phone number associated with the account. You can reach out through the app itself or via their website.

It’s important to be patient during this process, as it may take some time for them to investigate and make a decision on reopening your cash app account. In some cases, they may ask for additional documentation or verification before making a final decision.

Getting a deleted Cash App account back will depend on individual circumstances and whether or not there was indeed a violation of their policies. However, taking proactive steps such as reaching out to support can increase your chances of successfully resolving the issue.

Can you make a new Cash App if they closed your account?

If your Cash App account has been closed for any reason, you may be wondering if you can simply create a new account to continue using the service. Unfortunately, it’s not that simple.

When you attempt to create a new Cash App account after having one closed, the app will likely detect that you’ve had an account in the past and ask you to verify your identity. This means providing personal information such as your name, address, date of birth, and social security number.

If Cash App determines that you previously violated their terms of service or engaged in fraudulent activity on their platform, they may deny your request for a new account altogether.

Even if they do allow you to create a new cash app account after closing your old one, keep in mind that any funds associated with the previous account will not transfer over. You’ll need to start from scratch with building up balances and adding payment methods.

While it is technically possible to make a new Cash App after having one closed down by the company , there are many factors at play including verifying identity details and whether or not previous violations were made which makes this option less than ideal.

What happens when Cash App closed your account?

When Cash App closes your account, it can be frustrating and confusing. But what exactly happens when this occurs?

You will receive a notification from Cash App explaining the reason for the closure. This could be due to suspicious activity or violation of their terms of service.

Once your cash app account is closed, all pending transactions will be canceled and any funds in your account will be returned to the original funding source. However, if there are any outstanding fees or charges on your account, these must be paid before receiving a refund.

It’s important to note that once an account is closed by Cash App, there is no way to reopen it. You’ll need to create a new account if you wish to continue using their services.

Additionally, having an account closed by Cash App may impact your ability to use other financial apps as they may share information about users who violate their policies.

Having a Cash App account closed can have significant consequences and it’s important for users to understand why this might happen and how they can prevent it in the future.

Can Cash App account be suspended?

Cash App account suspension is a common occurrence that can happen for various reasons. Some of the most common reasons include suspicious activity, violation of terms and conditions, or failure to verify your identity. If you find yourself in this situation, it is important not to panic.