Don't wanna be here? Send us removal request.

Text

Is XTrade One of Reliable Brokerage Platforms?

Like meeting new people, the level of trust is higher when someone reputable is pointing to reliable brokerage platforms. For this reason, many brokers tend to use a famous persona to promote their brand. We can notice the tendency that football teams or players are one of the first choices for these platforms. Why is this the case? Of course, we can only guess, but one reason could be the target audience of these "reliable" brokerage platforms. Think of it, and you can conclude that football goes side by side with predicting the match outcome. However, not all football fans are gambling, nor all traders like football. Still, if the audience of some broker is a football lover, we can connect the dots. As we are covering Xtrade, we must mention that they were hiring Christiano Ronaldo as their brand ambassador. Of course, Christiano Ronaldo is a famous and reputable player. However, some of the acts of Xtrade don't go in line with this. Seemingly, they were using the renowned name to address the particular kind of opportunist behavior. In the following lines, you will conclude whether their behavior is opportunist or not.

Location of the Xtrade

OffersFx is a company behind Xtrade at this moment. If you are browsing from Europe, when searching for Xtrade, you will get the OfferFx website. In other territories, you will get the respective Xtrade website translated to the local language. The company is from Cyprus, which is of the best administrative offices. Besides Cyprus, they have offices in Australia, Belize, and South Africa. Seemingly, all of these regulate the work of Xtrade: Securities and Exchange Commission (CySEC) from CyprusSecurities and Investments Commission (ASIC) from AustraliaInternational Financial Services Commission (IFSC) from BelizeFinancial Services Board (FSB) from South Africa In terms of regulation, this could be a good sign. But why is this the case? Well, at the height of its career, the company was sponsoring Christiano Ronaldo and two football clubs. However, the same year, CySEC suspended the license of the Xtrade, previously XForex. Soon after, the angry customers organized the strike in Limassol, Cyprus. The company had no choice but to leave Cyprus and form Xtrade International Limited in Belize. When the dust settled, Xtrade founded OffersFx to run its business from Cyprus, again. Regardless of the present Xtrade, it seems that previous ones were not reliable brokerage platforms.

Technical Side of the Platform

The website itself is very professional and well designed. You can relatively easy navigate with a drop-down menu in the right top hand corner of the site. Following the standards, in the right down corner, you will find the webchat function. At this point, there is no option to alternate between different languages. Based on your location, you will get the website with your local language. As far as the platform goes, the only available platform their web-based platform. You won't find MT4 nor some of the mobile apps. However, they have optimized their web application, which you can use on your mobile. The interface is a charting platform that has some technical analysis tools. There are a variety of options traders for deposits and withdrawals. You can choose from credit and debit cards, wire transfer, and many different types of online wallets, including PayPal. There are no fees for withdrawals or deposits, and the withdrawals can take up to five business days to process. At the same time, there is an inactive account fee. However, we couldn't find the cost or details on this fee.

Assets and Types of Accounts

There are multiple assets to trade: - CFD's - Indices - Commodities - Stocks - Forex - ETF's, - Bonds and - Cryptocurrencies. Similar to industry standards, there are four different account types with Xtrade. Seemingly, all previous "reliable" brokerage platforms brought a lot of experience to Xtrade. Any aspect of their solution is following the industry standards, trying to overcome the expectations. The same goes for the first type of accounts, which is the standard account. The minimum deposit for this account is $200. It seems that the only difference between this and the following accounts is the lack of personalized training. It looks like they crafted an excellent offer for novice traders. However, training and education are the most important. Otherwise, trading can resemble the gamble. On the other hand, the spreads are extremely high, with a fixed spread of five pips for EURUSD. The spread of this height is not typical for reliable brokerage platforms. Only brokers known as scams are using these spreads. The next account up is a premium account with the minimum deposit size is $1,000. In this case, you will get personalized training. Moreover, the spreads are reduced slightly, with the standard EURUSD spread being three pips. Of course, this is still not a good offer. The somewhat better offer for other assets you can get with the platinum account. The minimum deposit size is not so high, as it is $5,000. What is interesting is that the spread for the EURUSD stays the same with this account. Finally, there is the VIP account. The minimum deposit size is $25,000. In this case, you will get the same perks as for the previous, but the EURUSD spread is two pips. Of course, this is still not great.

Education and Customer Support of Reliable Brokerage Platforms

Except for the primary account, you will get personalized training. Xtrade also provides courses, e-books, video tutorials, webinars, and a resource library. There are a plethora of ways to get customer support. You can do it by phone, webchat, email and also by fax (I doubt many people still use this method). Their customer support services are available 24 hours a day from Sunday 10 pm GMT to Friday at 10 pm GMT. When we tested, their webchat platform is very responsive, helping as much as possible.

Is Xtrade one of Reliable Brokerage Platforms?

The majority of customer reviews are negative towards Xtrade. Many claims are that they are scamming their customers. To refresh your memory, this is the company that had organized a revolt against it! At the same time, some reputable bodies are regulating Xtrade. It should be enough to enlist Xtrade in reliable brokerage platforms. It is because the regulatory authorities would stop Xtrade if pushing their customers to deposit more money. And it is what customer reviews claim they are doing! Like some of their previous entities, Xtrade or OffersFx might lose their license. For this reason, you should keep your eyes opened when trading with Xtrade.

Read the full article

0 notes

Text

Reliable Brokerage Firms Are Visible: Is WiseTrade?

Our reviews and validity of pointing to reliable brokerage firms need enough data. However, some points are sure signs of whether the company is reputable or not. For example, having as much detail about the platform is a positive sign. It is because reliable brokerage firms tend to provide users with very transparent platforms. Imagine, if you are trustworthy and you provide the best service - you would use that as marketing. Otherwise, you would try to hide the platform, customer reviews, or anything that leads to you. Having no signs is a sure sign that something is wrong with the broker. As reliable brokerage firms feature headlines for both good and bad, you can find information on them. For all others, you are shooting in the dark. In this review, we are covering the company from Bulgaria with not much info online. From the following, you may conclude whether OWiseTrade belongs to the group of reliable brokerage firms.

Location of the Company

KSA Consulting Ltd owns and operates OWiseTrade from its office in Sofia, Bulgaria. Besides this, there is not much information about oWiseTrade online. Even the information on their website is scarce. Since no financial authority regulates OWiseTrade, we can conclude that the location is not a coincidence. As Bulgaria is a part of the EU, it has its perks in terms of marketing. However, being unregulated places it in the same class as any of the offshore companies.

Technical Side of the Platform

The first impression of oWiseTrade is quite good. It is because the website is easy to navigate. As we know, having a user-friendly website is a prerequisite for platform traders will use. Moreover, the design with fresh brand colors of gold and black on white gives a nice feeling. Seemingly, for those that spend hours and hours of trading, these little things can make a difference. However, the design itself has some warning signs. Even though we are supporters of cryptocurrencies, having a "Buy Bitcoin" button seems a bit shady. It is because this market is highly volatile, and usually connected with fraudulent activities. Encouraging your users to trade currencies isn't a sound business move if you tend to be among reliable brokerage firms. OWiseTrade offers various platforms to trade. These include their mobile application, available on iOS or Android. However, we couldn't find their app when we were looking for the app in the Google Play and the iOS App Store. Of course, they have a web-based platform. What is interesting is that they claim to have multiple platforms to download. In this way, they tend to approach both novice and experienced traders. However, you can't make a deposit or withdraw money via some regular option. There are a few different options available from credit and debit cards to Qiwi Wallet, WebMoney, and finally, Yandex.

Types of Assets and Accounts

The information on spreads is not very clear. They mention the floating spreads, which are usually higher and fluctuate. Since they promote trading with cryptocurrencies, it is following the same logic. However, as their website seems to be focused solely on crypto, they do not specify which cryptos are available! Furthermore, you won't get any information on whether you can trade any other assets. At the same time, they also offer only four types of accounts. Unlike others, the first available account is the gold account. Using the gold account, you can trade on the MT4 web and mobile platforms. As MT4 is the choice of expert traders, you will need time to perfect it. However, it will do you only good. For this reason, oWiseTrade is providing regular training by the personal account manager. Furthermore, the expert advisor will provide you a 24/5 customer support. You will have access to the resource and knowledge centers. These are quite good since they also include webinars. I must add that none of the account types offer any detail on the minimum deposit needed for each account, which is not too helpful. The next account is the platinum account. Following the standards, you will receive all of the benefits of the gold account. Of course, you will get extras of daily market alerts and one-on-one training. Finally, the premium account is the one with the most perks. The difference to the gold account is in personal bonus policy and personal trading conditions. Following the lack of overall information, it is not very clear what all of this means. And whenever there is not enough info, we can say that it is a red flag.

Reliable Brokerage Firms Feature Strong Education

Education is available, but you can't access the education section without opening an account. At this point, we can notice the pattern here. They are not providing any data about the platform nor education. Thereby, to check it, all you have to do is - to open an account! To help you with this, you will get 25/5 customer support. These numbers are quite uncommon, of course, and entirely promotional. The available means of communication are a phone, email, and an online contact form. As far as we are concerned, the first task of their customer support should be to provide more information. Reliable brokerage firms nourish their FAQ sections. Furthermore, they do care about web presence. By practicing thorough explanations, these companies save a lot of time by not addressing the same issues twice. On the other hand, how do you tend to build trust if someone can't get to know you? In an era of the internet, the web presence is possibly an essential part of your business.

Hard to Tell if oWiseTrade is in the Group of Reliable Brokerage Firms

The same goes for customer reviews. As we couldn't find anyone using this platform, we may conclude it is impossible to use it. Of course, this could be because they are a new company. However, it is more likely that they didn't have any users. In this case, it means that their platform is not ready, and it is a website for a future project. In another possible scenario, the company doesn't even exist. As the company that runs oWiseTrade could be performing some other activities. In this case, this website might serve some other purpose. For all the abovementioned, it is easy to conclude that one should avoid oWiseTrade. As it is a company with literally no information, why would you deposit your money there? Furthermore, are you familiar with the ways that you give them your money? Seemingly, there are many red flags about this company. On the other hand, if they are the company that is new on the market, all of this is logical. However, if this is the case, you should probably wait for some time before trading with them. In the meantime, choose some of the reliable brokerage firms. To get information on which one is a reliable one, read our reviews.

Read the full article

0 notes

Text

Wealth Capital: Reliable Brokerage from Estonia?

Is Estonia the location for the most reliable brokerage companies? It is a good economy, but the answer is - no. The most reliable brokerage companies reside in the financial centers. Since most of the trading happens in the trading centers of the world, this would be a logical step. Of course, you as an educated trader can trade from whatever place you choose. Furthermore, you can select any location to get you set for your work. All you need is a stable internet connection and an account at any of the reliable brokerage companies. However, it is entirely different when you are a service provider. Getting connected with the official offices and authorities is of utmost importance. When choosing the proper stream of behavior, this would be a logical move. At the same time, many companies use suspicious locations as the countries of their choice. In the following article, we will review the Wealth Capital, a company that has chosen Estonia for their offices.

The Company Behind Wealth Capital

Astra Consulting OU, a company from Estonia, runs the Wealth capital. As this is another broker from Estonia, there must be a reason for that. One reason is that it is a European country, which gives a sense of confidence. However, Estonia is not a country with strict financial regulations. In this case, we are wondering is there a regulation at all. Since there is no authority to control this company, fraudulent activities are possible. It is essential to state that we are not pointing out that these activities performed. We suggest that deceptive behavior is likely to happen.

Technical Side of the Platform

Another website from Estonia is using a blue color. Their logo is blue and black with a white background. As for any broker from Estonia, we can conclude that their web presence is well done. The website is available in 3 different languages: English, German, and Spanish. The only way to trade with Wealth Capital is by their web-based platform, logging in via a browser. Their website homepage features pictures that resemble an application for mobile phones. However, this is just the mobile version of the web-based application. It is a bit suspicious, and likely that it is a web application used as a mobile one. When it comes to deposits and withdrawals, available methods are Visa, MasterCard, and wire transfer. Comparing to other brokers, this is quite limited. There is no access to withdrawals and deposits via e-wallets.

Assets Available to Trade

In the case of Wealth Capital, you can trade stocks, indices, Forex, and cryptocurrencies. However, the amount of individual assets in these classes is relatively small. I can also see that the spread is relatively wide, with there being a 2.8 pip spread on the EURUSD pair. If you have read any of the previous reviews, you should know it's relatively high, with the average being about 1.5 pips. Like others, they feature different types of accounts. The four different trading accounts are available, from basic to advanced, and from an expert to master. Since it is the European based broker, it seems that all trading accounts have to hold the euro as their nominated currency. The first account, the basic one, has the minimum deposit of €5,000. For this amount of money, you can get a: part-time account manager one-on-one live training session with the market expert one month of special trading events trade signals once a week market review once a week webinars and seminars once a month access to their exclusive ebooks access to the video academy The following, an advanced account, has a minimum deposit of €25,000. In this case, you will get: full-time consultation account manager two one-on-one live training sessions with an expert two months of special trading events signals twice a week a market review twice a week webinars and seminars twice a month access to the ebooks and video academy The third, an expert account, requires the minimum deposit of €75,000. You will receive: fixed spreads individual support and assistance from your account manager four live one-on-one sessions with a market expert four months of special trading events signals three times a week a market review also three times a week webinars and seminars weekly exclusive access to their eBooks and video academy Finally, we move on to the master account. The minimum deposit hers is custom, and it is probably over 100,000 euros. It has multiple benefits, such as: fixed spreads special concierge services in terms of your account management unlimited live one-on-one sessions upon request daily signals daily market review access to their books and video academy custom webinars and seminars personal training which is typical for this type of account

Diversified Accounts Point to Reliable Brokerage Companies

Like others, they feature different types of accounts. The four different trading accounts are available. They range from basic to advanced, and from an expert to master. Since it is the European based broker, it seems that all trading accounts have to hold the euro. The first account, the basic one, has the minimum deposit of €5,000. For this amount of money, you can get a: part-time account managerone-on-one live training session with the market expertone month of special trading eventstrade signals once a weekmarket review once a weekwebinars and seminars once a monthaccess to their exclusive ebooksaccess to the video academy The following, an advanced account, has a min deposit of €25,000. In this case, you will get: full-time consultation account manager two 1on1 live training sessions with an expert two months of special trading events signals twice a week a market review twice a week webinars and seminars twice a monthaccess to the ebooks and video academy The third, an expert account, requires the minimum deposit of €75,000. You will receive: fixed spreadsindividual support and assistance from your account managerfour live one-on-one sessions with a market expertfour months of special trading eventssignals three times a weeka market review also three times a weekwebinars and seminars weeklyexclusive access to their eBooks and video academy Finally, we have a master account. The minimum deposit hers is custom, and it is probably over 100,000 euros. It has multiple benefits, such as: fixed spreadsspecial concierge services in terms of your account managementunlimited live one-on-one sessions upon requestdaily signalsdaily market reviewaccess to their books and video academycustom webinars and seminarspersonal training which is typical for this type of account

Education and Customer Support

As mentioned above, education is available on the website. It comes in the form of eBooks, webinars, videos, and daily market reviews and analysis. As stated previously, these are only available once you open an account. There could be a reason for this. The reviews are mentioning that they are not so good. Seemingly, we can conclude that they are not providing excellent service and covering that up. This would be a sound strategy. At the same time, the customer support they offer has different methods. These include live webchat via telephone, email, and a WhatsApp function. The latest is one of the unique options. It is because WhatsApp messaging is not typical for reliable brokerage companies. However, when we were writing this on Saturday, they were not available via their webchat. We can only assume that they were available on Sunday evening when the Forex market opens. If not, this is a severe case of lack of support.

Can we Consider Wealth Capital as one of Reliable Brokerage Companies?

Since Wealth Capital has very low reviews, its customers are urging to avoid this broker. Since we checked all, most of their customers state that they scammed them. Connecting this with the location with no regulation, we can say it is not wise to trade via Wealth Capital. As we can conclude that their customers don't have anything nice to say about them, the website and the design hold no importance.

Read the full article

0 notes

Text

Looking For a Reliable Brokerage? Trade Ltd Review

When looking for a reliable brokerage, most will avoid offshore brokers. One reason for this is that most will choose companies in countries with strict financial regulations. At the same time, some countries provide other benefits for companies. Nowadays, you can run a company online, without even showing at the office. Therefore, many choose states with lower taxes to establish their company. However, when looking for a reliable brokerage, it is not wise to choose one of these companies. Since trading has many possibilities of fraudulent activities, avoiding regulation is a bad sign. It is because of the policy that the company has toward rules. Why would that company threat you any better? To explain these matters, we are reviewing Trade Ltd, as an example of this type of behavior. In the following lines, we will check the usual parameters. As it is at the very same beginning, the location will show us whether you should stop or continue looking for a reliable brokerage after checking Trade Ltd.

Why Trade Ltd has Multiple Locations?

Company Bushido Technologies runs and operates Trade Ltd from their office in Tallinn, Estonia. At the same time, their parent company is Masterpay Ltd, with an address in Baku, Azerbaijan. Seemingly, the partner company in an offshore destination is processing their payments. The choice of these locations is intriguing since one is great for taxes, and another is an offshore location. What is making our doubts stronger is that their customer support resides in Latvia. Why choosing all these locations? The company has an opportunist type of behavior. As mentioned above, do you think that they will have a different stance on their customers? Onto the regulation part where I'm sure as you can guess they aren't regulated, again a big red flag and another reason not to trust them as a broker.

Is Good Technical Side Enough When Looking for Reliable Brokerage?

Not all trading websites from Estonia are bad. Unlike some others, Trade Ltd has a beautiful site with a sleek design. At the first look, it is a very extravagant, colorful design with the background of the night sky. Furthermore, their website is available in English, Spanish, Italian, German, Russian, and Arabic. What is more important is that the website feels very smooth, making it user-friendly. As we are covering the aspects of the usage, this side could point us to Trade Ltd. Seemingly, they are covering the best practices of both the design and the trading industry. As Trade Ltd works in conjunction with the MT4 platform, this is the only feasible way to trade. You can download the MT4 app on your phone and trade via Trade Ltd. The choice of the MT4 is right, off course. It is because it is the platform that is effortless for both the novice and expert traders. MT4 features a lot of technical analysis instruments and algorithmic indicators favored by expert traders. Following the right practices, there are three different ways to deposit your money. Available methods are debit or credit cards, Bitcoin, or wire transfer. However, their terms and conditions state that withdrawals can take up to 21 days. Connect this with the location of a payment processing company, and we could smell the problem!

Types of Accounts and Assets to Trade

When it comes to account types, there are five different versions. These are standard, silver, gold, platinum, and VIP account. Of course, each of them has various perks and extras. The first account is the standard account that needs a minimum of $200 deposit to open. The average spread of this account is 3.2 pips (very high). Furthermore, there is also a 50 cents commission fee paid per trade. For $200, you will have access to a personal account manager. Moreover, you will have a financial market introduction, educational tools, and live webinars. The second account in the line is the silver account, with the minimum deposit size of $1,000. The average spread of this account is 3 pips and there is no commission fee paid. Similar to the previous, you'll receive a personal account manager. Again, there are a private financial market introduction and educational tool. This time, you will have a daily market newsletter. In this case, we are not sure why the previous account doesn't get the newsletter. The third account is the gold account with a minimum deposit of $5,000. The average spread is 2.8 pips, which is still rather high. However, this account has some new extras. In this case, you will receive trading signals, free trading notifications, and a technical analysis expert consultation. The platinum account is the one with the minimum deposit size is $25,000, but with the average spread of 2.3 pips. This time you will get market analysis, live access to their live trading room. Also, you will enjoy personalized analysis and strategies, as well as their educational tools. Finally, the last account is the VIP account, with minimum deposit size of $50,000. Of course, the average pip spread is better but still not the greatest. Surprisingly, it is only 1.8 pips. However, you will receive a few extras, such as a tailored technical analysis consultation. You will have access to the trading live room and also EFX plus bank forecasts, among other things. As VIP, we expect that you will get the proper treatment.

Education and Customer Support

Educational tools vary in terms of your account size. Unlike the technical side, their education section is not among the best. At the same time, customer support is available via email, webchat, and telephone. The latest is open Monday to Friday from 8 am to 10 pm, GMT+2. Due to the location of their customer support, you should comply with this timezone. If the customer is first, why is this the case?

When Looking for a Reliable Brokerage, Should You Consider Trade Ltd?

What customers say is not connected with the timezone. It is because there are many other issues to tackle. The most common reviews are that it is a scam. Seemingly, people are not being able to withdraw their money. It goes for profits of any kind. Seemingly, this is another case of the broker acting unlawfully and tricking clients out of their hard-earned money. As there are a lot of bad brokers out there, traders need to be careful when depositing their money. In this case, you are placing your money in an offshore zone. Without further analysis, Trade Ltd doesn't seem like a trustworthy broker. So, when looking for a reliable brokerage firm, avoid Trade Ltd.

Read the full article

0 notes

Text

Is OMCMarkets a Reliable Brokerage Platform?

The blue color of the sea in Montenegro makes it a touristic, but is it also suitable as a reliable brokerage platform location? Most of the time, due to the offshore companies, the combination of the seaside and brokerage raises some red flags. Of course, it would be great if proven differently. However, the whole notion of brokerage is to position itself in the financial centers of the world. As top-notch of traders reside in the UK, US, Germany, or France, why would you place your company anywhere else? However, we must admit that OMC Markets also has a beautiful website. As we tend to answer which broker has the best trading platform, website usability is essential. However, besides design, it is of utmost importance that traders can click orders at the appropriate time. For this reason, we are thorough conduction research of all instances of OMC Markets. Let's see if they feature a reliable brokerage platform or not.

Is Paradise Location a Sign of Reliable Brokerage Platform

This paradise location is a small European country of Montenegro. Eventuall Ltd is the company that runs this broker with its registered office in Montenegro. Besides this registration info, there is no sign that any administrative office supervises their work. Not a surprise, since this country of Montenegro doesn't have a financial regulatory body to our knowledge. We may conclude that this location is a paradise for brokerage companies and tourists. However, it is not suitable for those visiting the OMC Market website. If there is no regulatory body to oversee their work, it is not secure to deposit your funds with them.

Technical Information

Similar to beaches, the OMC Markets website has excellent design, making it beautiful. As it is very user friendly, you can navigate around the site with ease. Seemingly, the website is very professional, but the platform features only a web-based trading platform. For this reason, it is more suitable for novice traders. Expert traders prefer some technical standards. In most cases, the well designed web-based platform won't attract them. Even though we can't be sure about this notion, it is far more unlikely. Unlike trading options, there are a plethora of options for deposits and withdrawals. You can use credit and debit cards and also a variety of e-wallets. Moreover, there is also a possibility to pay via Bitcoin. One point to look for is the bonus they offer. It is because terms and conditions provide information that until you meet some trade capacity, you can't withdraw your money.

Type of Assets and Accounts

On the other hand, the platform offers a variety of assets able to trade. At OMC Markets, you have options from bonds to Forex, from commodities to stocks, and even cryptocurrencies. Of course, the exceptionally high spreads are the downfall of this platform. Compared to any other reliable brokerage platform, fluctuating around 3.5 pip spread mark is abnormally high. There are six different types of accounts. Similar to others, the first one is the primary account, with a minimum deposit of $250. This account grants you 24/7 support access to the education center. Moreover, you will have daily market reviews, pro webinars, and price alerts. The second is the bronze account, with a massive jump in the deposit size. It is unlikely that some will trade with $10,000 for a low added value. It is because the only perk you will get is the junior account manager. As many platforms have full support for this amount, it is unlikely that you will place your funds in the hands of the junior. Following these jumps, the silver account unlocks with a deposit of $25,000. In this case, you will speak with the senior manager. To conclude, a $15,000 difference goes to the difference in the expertise. For $25,000 more, you will get a VIP account manager and a personalized strategy. Ok, it is $50,000 again for the difference in the knowledge. The final account is the platinum account. However, there are no details offered with this account. It means that you will probably get the owner or the whole team! Seemingly, besides the difference in the level of seniority, there are no more perks you are getting.

Educate, and You Wouldn't Need Further Advice

If you get a proper education, why would anyone suggest a trade? For this reason, knowledge is crucial as a starting point, but in the following years as a trader, too. In the case of OMC Markets, all account types gain access to their education center. However, there is no in depth education you can expect here. Most of the content on their website you can get online for free. The same goes for their webinars and private trading strategy. At the same time, customer support is available 24/7 via email, telephone, and webchat. When testing out their webchat, the waiting time was more than 15 minutes. Finally, we gave up. Similarly, their customers' reviews are far from positive. There is no positive customer review, and the majority spoke about how they could not withdraw any money. In most cases, these were the stories of scams. One person mentioned that the account manager traded instead of them and wiped their whole account! Was it a senior account manager? This situation only is alarming enough to doubt whether OMC Markets is a reliable brokerage platform. Since there are multiple brokers out there, one should choose only the best.

Is OMC Market a Reliable Brokerage Platform?

To conclude, we wouldn't place OMC Markets in our top choice. You should probably avoid them at any cost. Since it is an unregulated company with a high chance of scamming people, there is no way that the reasonable persona will deposit money to OMC Markets. Seemingly, this implies even for $250 deposits. It might be that the company policy of significant sums for upper accounts has a strategy to make $250 look small. But why would you lose any amount of money? When trading with a reliable brokerage platform, you will become better over time. Placing money at this platform could be more of a support for beautiful web design than it is a wise business move.

Read the full article

0 notes

Text

The Signs of Reliable Brokerage Company: MarketCFD

How many red flags do you need to find out that the trading platform is not a reliable brokerage company? Does the business blue of the website improve reliability? Seemingly, the blue color is a popular business color. However, it is not enough to judge based only on UI/UX criteria. Both reliable brokerage companies or not, companies tend to follow industry and design standards. For some, the reason behind lies in covering their flaws. Similar to a wolf using the sheepskin, sometimes it could be a sign of fraudulent activities. For this reason, we are reviewing the MarketCFD as a broker that has a blue colored website with a lot of red flags. What are these red flags? As always, we are covering the broker location, platform review, education availability, and customer support. Since all brokers usually have these sections, lacking some of these can also bee a red flag itself.

Reliable Brokerage Company Regulation

Plus One ltd, a company based in Tallinn, Estonia is operating the MarketCFD platform. Seemingly, there is no information about the financial regulation of this company. Even though Estonia is a famous offshore destination, there is no information on this company regulation. Furthermore, information about the company itself is scarce. As we may conclude, having a proper location with no information available is a bad sign. For this reason, we can classify the proper location with the lack of regulation as one of the red flags.

MarketCFD Platform And Technical Information

A similar occurs when reviewing the MarketCFD platform. As stated on their website, the platform features a mobile app. However, it was impossible to find the app on Google Play or the iOS app store. Besides the mobile app, the website doesn't mention any other trading platform. Because of this, we can't say whether there is even a web-platform online. As far as we are concerned, this is also a big red flag. As expert traders place much emphasis on the technical side of the platform, it is hard to believe that they will place a deposit. For the same reason, any reasonable person will expect to screen the platform before using it. If this information is not provided, you may feel that your money is in jeopardy. At the same time, there are a plethora of options to make a deposit. Moreover, you can make withdrawals in a number of ways via debit and credit card. There is a number of e-wallets such as Skrill and Neteller, too.

Type of Trading Accounts

Similar to options for deposit, they covered the accounts well. The explanations are good, and the proposal seems logical. The platform has 6 different options. The first option is the green account with a minimum deposit of $250. Similar to many, you will get the 24/6 support, and access to the education center. Seemingly, you will have daily market reviews, webinars and market events updates. The next account is the silver account with the minimum deposit of $2,500. For this amount of money, you will receive all of the extra features that are in the green account plus added extras. These extras are 10 trade signals and 10 one-on-one expert sessions. The third is the gold account. Like silver, you will get the perks of the previous accounts with an add-on. In this case, the addon consists of 15 trade signals and two one-on-one expert sessions. For this service, you would need to deposit anywhere between $5,000 and $10,000. The next account is the platinum account for those who deposit between $10,000 and $20,000. As a common rule, you will have the same perks and more trading signals and sessions. This time, it is 20 trade signals and unlimited one-on-one expert sessions. The penultimate account, VIP account, demands from $20,000 up to six figures. This account features 30 trade signals and, like the previous, unlimited one-on-one expert sessions. The final account provides both unlimited trade signals and one-on-one expert sessions. As the black account's minimum deposit is $100,000, this type of attention is expected.

Education and Customer Support

The platform is explaining a variety of options such as eBooks, chart analysis, webinars, video courses. Furthermore, there are video chart analysis and live market summaries. Unlike regulation and availability, this is a good sign. Seemingly, the platform is covering all the aspects except for the possibility of trading. If you encounter this platform and follow the advice of others, you can consider them as a reliable brokerage company. Their customer support is available 24/6 via their online contact form, over the phone or via email. However, we can't prove they are good or not.

Is MarketCFD are Reliable Brokerage Company?

Similar to regulation, trading platform, and customer support, we couldn't find any comment for this broker. One plausible cause is that this is the new broker that is preparing the platform. If this is the case, it justifies all the abovementioned. All except the lack of regulation. If all of this is true, the advice is to wait for a while before trading with MarketCFD. It is because building trust takes time. For this reason, learning from the experience of others is of utmost importance. Another possibility is that this is not a reliable brokerage company. In case it is a scam, they covered it all right. The website has a reliable brokerage color. Second, you will have no trouble to deposit your money, and the accounts are logical. The support is available in 3 different languages: Russian, Polish and English. It might be that the platform is targeting Russian and Polish markets. For this reason, it may happen that local websites have more information. Whatever is the case, the red flags are outnumbering the blue color of the website. If we are correct with this assumption, you should avoid trading with MarketCFD.

Read the full article

0 notes

Text

Brokerage Supporting Football Team: Investous Review

When searching for a reliable brokerage team, the football team would not have anything to do with it. Even though popularity is universal, there are situations when it is not applicable. One of these is mixing football or influencers with the service that has nothing to do with it. There were cases like this before, hiring both footballers and influencers. When choosing a reliable brokerage team, it is logical to use different criteria. For this reason, we are covering all the facts about the location, platform, education, and support. It is because of these factors that determine whether your reliable brokerage team is the winning team, as well. In the following lines, we are reviewing Investous, as the company that was the sponsor of PSV Eindhoven. However, PSV Eindhoven canceled this sponsorship due to the damaged reputation. For those who don't know, this is an old and successful football team from the Netherlands. Does this story tells enough about the reliability of Investous? Check in the rest of the article.

Supporting Netherlands, Establishing Company in Cyprus

Establishing a company in Cyprus is a good sign. It is because Cyprus securities and exchange commission (CySEC) regulates this company. As CySEC is one of the more respected financial conduct authority bodies, this could mean that the Investous is a reliable brokerage team. If Cyprus has fielded better football teams, it could happen that Investous would sponsor them. Of course, the reason behind the moves of trading companies is mainly commercial. If this sponsorship is bringing new traders, it is viable. Even though the reasons might be different, these moves seem legit. Establishing a company in Cyprus and sponsoring a famous club in the Netherlands - legit! However, maybe they will sponsor a company from Cyprus after PSV disastrous sponsorship cancellation.

Technical Side of the Platform

Similar to the traditional football club, Investous features traditional platform - MT4. Traders that use the MT4 platform for ages will love that they have this option. Moreover, you can also trade on the Investous platform via their mobile app and online web-based platform. You can install a mobile app via Google Play and the app store. Their web-based platform is convenient to use, too. Furthermore, it is visible on its website without creating an account. Unlike some other brokers, it is an excellent move to enable the customer to get to grips with it first. The platform itself has a simple feel, and it is easy to open and close trades. However, the charting platform is not too in-depth. So, don't expect many indicators for technical analysis. It is unfortunate since they cover a lot of assets, and you would need this analysis. These assets are CFDs, Forex, Commodities, Stocks, and Indices.

Types of Players of Reliable Brokerage Team

You can open up to four types of accounts on the Investous platform. The first is the basic account where the minimum deposit for this account is $250. Seemingly, Investous is following the best practices of reliable brokerage teams. The standard spreads for this account are 2.5 pips for the EURUSD pair. This account will provide a few extras as one basic lesson and one free withdrawal fee. The next account type is the gold account. The minimum deposit size for this account is a jump up to $5,000. In this case, the standard spread for the EURUSD pair is two pips. Still high but not to extremes. To compensate, you will get two basic lessons, one monthly webinar, and one free withdrawal per month, as well. The platinum account is the third with the minimum deposit is $10,000. In this account, Investous offers a bit lower spread of 1.6 pips. Furthermore, three advanced lessons, two monthly webinars, and three free monthly withdrawals. Finally, we have the VIP account with a minimum deposit of $50,000. The standard spread for the EURUSD pair of this account is 1.1 pips. The extras you can get with this account are five advanced lessons and five monthly webinars. For $50,000 of investments, there would be no fees associated with withdrawals. As for the deposits and withdrawals go, there is a limited amount of options here. Seemingly, you can use either credit or debit card, wire transfer of the Skrill payment system. However, there are no other methods available at this time.

Education and Customer Support

There are other good options from Investous in terms of education. From an overview, it seems that they provide education on technical analysis and fundamental analysis. It is not so common to feature this type of knowledge, which is quite useful. However, one condition is that education differs on the account type taken. Their customer support is available via phone, email, or online web chat. Unlike other impressions, their customer support left us waiting, causing us to give up in the end. So far, Investous made a good feeling, and this was a surprise. When they do, we assume that they provide support in five languages, as on the website. These are English, Dutch, German Italian, and Spanish.

Is Investous a Reliable Brokerage Team? Not for PSV

In addition to the conclusion is a fun fact about customer feedback. Seemingly, feedback on Investous was hard to find. There are only two reviews, and both negative. Of course, it is impossible to draw any viable conclusions from these. Unlike other brokers, the company is very new, lasting only for a year. It will take time before other customers provide their experience with them. Therefore, we can't conclude at this point whether they are reliable or not. Due to the Cyprus regulation, and a few smart moves, it seems that Investous has a reliable brokerage team. If PSV didn't shake the ground, we would encourage new traders to join this platform. If we compare them with PSV Eindhoven, they made some excellent choices. However, since they lost PSV and lack the tradition, we can't consider them a reliable brokerage team yet. To prove their worth, many traders would need to win many games.

Read the full article

0 notes

Text

El Currency: Is it Far for The Most Reliable Brokerage?

Do professional traders care about the most reliable brokerage or the highest leverage? Or both? So, what brokers do professional traders use? There is no doubt that professional traders can live and work from any place in the world. As you may know, different exchanges have different timezones. Since the platforms we are reviewing are mostly web-based, Wi-Fi is enough to score the winning trade. However, the location of the company plays a different role apart from its touristic flares. For this reason, we are reviewing the brokers in a quest to find the most reliable brokerage as your companion on the trading journey. In this case, we are reviewing the company with the name pointing out its origin. El Currency is a company that features an exotic flair of paradise combined with its purpose.

Are the Most Reliable Brokerage Offices at the Beach?

There is no doubt that the Marshall Islands are an excellent spot for your vacation. However, for the company location, as in the case of El Currency, you should watch out. It is because choosing this offshore paradise for a company raises some flags. At the same time, the Marshall Islands is the first country that abandoned the dollar as an official currency. You may remember the shock to the world with the news of the Marshall Islands' embracing crypto as the national currency. However, this whole notion removes the country from the standard financial system. For this reason, companies registered at Marschall Islands are harder to trust. And El Currency is situated precisely at this location. Their parent company, Hello Technology ltd, has a central office at the Marschall Islands. There are other offices, like one in Scotland in the city of Dundee. However, as we find out, El Currency is not regulated by the UK authorities. Seemingly, no regulated brokers stand no chance to be considered as the most reliable brokerage. Furthermore, if they perform any activities in the UK, they could close any time soon. Besides this, we debunked many dark moments of this platform that could lead to their closure.

Technical Side of the El Currency Platform

The El currency website itself features a simple plain design with an easily navigable layout. At first glance, you will notice the crypto converter. Seemingly, they are promoting as the crypto broker. Following the blockchain hype, they are pointing out to the crypto in the worst manner. In El Currency's opinion, the most significant feature of crypto is a chance to make money. Right until some point, the other side of the coin is that the market is highly volatile. It means that it is a good chance to lose some money, too. Besides, there is no preview or a demo on how to use the platform. Does it then seem like the most reliable brokerage? Since we couldn't find any data on their platform, we can't present to you the trading experience with El Currency. Unlike for others, we can't provide info about whether you can use a mobile and tablet version, too.

Assets and Accounts

As above mentioned, their focus is primarily on crypto coins. At the same time, they offer standard currencies, such as the euro, the pound, and the US dollar. To trade these currencies, you would need to open one of four available accounts. Of course, the silver, gold, diamond, and VIP account depend on the amount of currency you can deposit. The first (silver account) has a min deposit size of $500 up to $1,999. It goes with 24/7 support, and one on one basic training. It also provides access to the basic education center and an unlimited 365 trading dashboard. The second (gold account) has an addon of trading signals. However, these signals are limited. To compensate a bit, you will get a personal account manager — all of this for $2,000 to $9,999. For the third account (diamond account), you will need to deposit $10,000 to $49,000. Besides the benefits of a gold account, you will not get anything more for an extra $40,000. Finally, the VIP account is for those that deposit more than $50,000. In the end, by enrolling in the VIP account, you will receive one-on-one training by the pro trader. When it comes to deposits and withdrawals, there are a few methods you can use. The company allows withdrawals and deposits via credit or debit card use, bank wire, or via bitcoin payment.

Education Section and Customer Support

In the case of El Currency, some forms of education are present but far from pointing to the most reliable brokerage. It is because all of the videos lead to other websites. Seemingly, they are outsourcing and redirecting education as an essential feature of any platform. On the other hand, they are stating that the training is available for some accounts. As we noticed, this is an account manager available for gold accounts onwards. However, we don't consider an account manager as a trainer. At the same time, support is available in English and German. They are available 24/7 and via mail, phone and online contact form. However, we doubt that any customer support can handle the words their users use on the internet. It is because all the reviews radiate on El Currency as a scam. Seemingly, no one was able to withdraw any money after the initial account setup. Moreover, we couldn't find any comment on the platform itself. Therefore, we can conclude that these reviews are correct and that El Currency is not the most reliable brokerage.

Visit Marschall Islands for the Beach, not for The Most Reliable Brokerage

To conclude, El Currency is far from the most reliable brokerage. If we sum up all the info we got on them, we can conclude that they are not to be trusted. Besides their platforms that seem shady, there is no trusted authority regulating this company. Imagine leaving over $10,000 for getting any training or support? Similar to the curiosity that killed the cat, you can try it, too. In this case, you will risk this money. Only to find out whether these people know the business. Of course, visiting their offices would be the best model. Since only professional traders can afford the endeavor of visiting the Marschall Islands, it is hard to believe that novice will try. From my experience on what brokers do expert traders use, this is the destination for their vacation. Seems that the most viable scenario is that the expert trader will drink some cocktail at the beach of Marschall Islands. However, the screen of their laptop or mobile will not feature the El Currency platform.

Read the full article

0 notes

Text

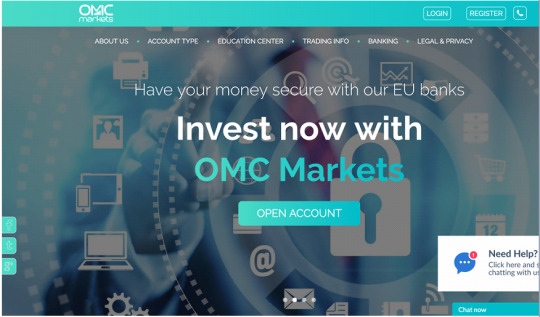

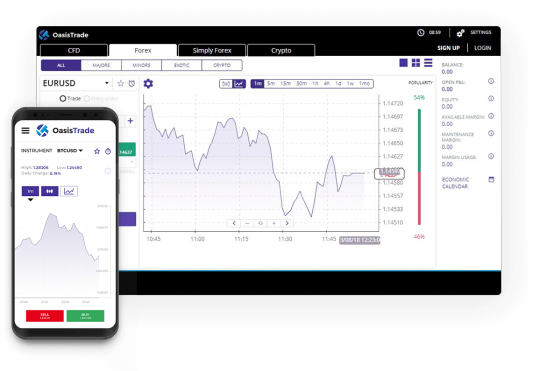

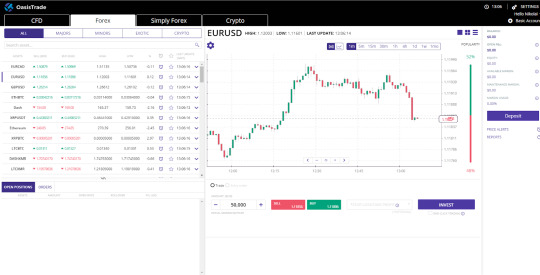

Reliable Brokerage Firm: Oasis Trade Review

When embarking on your trading career, it is of utmost importance to find a reliable brokerage firm. As your trading journey may end with one wrong decision, finding proper education and reviews is crucial. For this reason, we are helping you choose the proper platform. In this case, the appropriate platform means finding an efficient way to survive the stormy sea of trading. One of these platforms we are about to review is Oasis Trade. In the following article, we will cover the standard features for any reliable brokerage firm. As we examine their origin, platform, education, and customer support, some answers could appear. Hopefully, these answers will guide us in deciding whether Oasis Trade is a reliable brokerage firm.

Regulation Points to a Reliable Brokerage Firm

From the first idea of Brexit, many financial centers in Europe claimed taking over the title from London. As we know, the London Exchange is one of the biggest in the world. Moreover, due to its historical growth and colonial possessions, Britain was the leader in trade. However, due to its structured banking system, Frankfurt was well-known as a city of finance. For this reason, the regulatory authorities are rigid in overseeing the companies in Frankfurt. Thereby, establishing the company in Germany, especially in Frankfurt, could be a sign of a reliable brokerage firm. As you may conclude, official offices of Oasis Trade are in Frankfurt, Germany. Therefore, they are joining many successful companies, taking registration number 24865 IBC 2018. Their other offices are in Switzerland, Hong Kong, Singapore, and Australia. Since an international company, Oasis Trade offers multilingual support.

Technical Side of the Platform

The first impression of the platform is that it is very sleek. It is available via desktop, mobile, and tablet. Seemingly, the web-based platform provides the necessary information. However, both mobile and tablets are also very user-friendly. In most cases, optimization for all devices is hard to accomplish. As we tested many, Oasis Trade made a quite similar user experience. Why is this important? Well, trading could be very stressful sometimes. Imagine a moment when you have to close the position and the platform freezes? Because of this, we did our best to test the usage of both mobile and desktop versions. To conclude, in terms of the stability of their platform, that Oasis Trade is a reliable brokerage firm. Similar to usability, the security of the platform is following the latest trends. As Oasis Trade is featuring segregated accounts, high-end encryption keeps funds safe. In the end, opening the account is quite simple. Let the intuition guide you, and you won't be wrong. It is hard that you will have any issues. But, if you do, their contact support will guide you through the process.

Education & Customer support

Nowadays, a critical aspect of a reliable brokerage firm is its customer support. In this case, Oasis Trade's customer support is excellent, with a chatbot greeting you in instant. In case the chatbot is not able to help, company representatives are also available 24/6. They provide support by either live chat, a phone call, or by email. When contacted their support via web chat, the high level of market and technical knowledge was easy to notice. Furthermore, their communication was both efficient and effective. At the same time, professional support implies only to the reliable brokerage firm. For all other cases, having disordered support means the possible demise of your account. Of course, if you educate yourself on trading, nobody can make an influence. To do so, you would need a lot of trading material. Seemingly, this is the spot where Oasis Trade truly shines. Having an ample and useful education section is a mark of the reliable brokerage firm. It is because an extensive range of learning materials helps traders grasp and understand the markets. All this leads to better trading results, having low risks, and stable profits. Besides the free knowledge to browse and learn, the FAQ section is quite abundant. Even though you may feel used to their great support, their updated FAQ could be enough for an answer.

Asset Choices of Oasis Trade

The first step in education, especially with novice traders, is what are the types of assets you can trade. However, these types vary from platform to platform. At the same time, choosing the asset that suits you is vital. For this reason, the education section might not cover them all. However, a reliable brokerage firm may think a step ahead. In this case, providing this information for the crypto coins. Even though they are not trading them. Yet, some companies have a limited number of assets available. Furthermore, there is no option to educate yourself on all possible variations of trading. It is far from the case with Oasis Trade. It is because they can provide an extensive portfolio of assets. They offer all the assets classes: commodities, indices, currencies, and cryptocurrencies. Unlike others, Oasis Trade excels with crypto coins. They are providing not only the standard cryptos but also the emerging coins. These are IOATA, NEM, and TRON, among others. The conclusion is that it as a big plus. In this case, it shows how Oasis Trade is steaming ahead of other platforms.

Is Oasis Trade a Reliable Brokerage Firm?

Due to all the above mentioned, we are subscribers of a belief that Oasis Trade is a reliable brokerage firm. Of course, most traders don't finish the game with profits. Therefore, having a reliable brokerage firm doesn't grant success. On the other hand, what it guarantees is a starting point for success. In this case, it means that the education section can make a great trader from you. Thereby, you should study the learning material and practice as much as you can. By spending as much time as you can on the platform, you can come up with conclusions. These would lead to better moves in the future. As you progress, you will be able to tackle more and more severe issues. Of course, you wouldn't need customer support or education at that point. At that time, you would make your own technical and fundamental analysis. However, having a platform that you are used to will remove the hustle and speed up your journey to any financial goal you have. To conclude, as our goal is to answer what is a good brokerage firm, we can state that Oasis Trade could be your companion on that journey.

Read the full article

#oasis trade#reliable brokerage#trading#forex#cryptocurrencies#trading strategy#investing#broker review

0 notes

Text

Oasis Trade Review

When embarking on your trading career, it is of utmost importance to find a reliable brokerage firm. As your trading journey may end with one wrong decision, finding proper education and guidance is crucial. For this reason, we are helping you choose the proper platform. In this case, the appropriate platform means finding an efficient way to survive the stormy sea of trading. One of these platforms we are about to review is Oasis Trade. In the following article, we will cover the standard features for any of these platforms. As we examine their origin, platform, education, and customer support, some answers could appear. Hopefully, these answers will guide us in deciding whether Oasis Trade is a reliable brokerage firm.

Regulation Points to a Reliable Brokerage Firm

From the first idea of Brexit, many financial centers in Europe claimed taking over the title from London. As we know, the London Exchange is one of the biggest in the world. Moreover, due to its historical development and colonial possessions, Britain was the leader in trade. However, thanks to its structured banking system, Frankfurt was well-known as a city of finance. For this reason, the regulatory authorities are rigid in overseeing the companies in Frankfurt. Establishing the company in Germany, especially in Frankfurt, could be a sign of a reliable brokerage firm. As you may conclude, official offices of Oasis Trade are in Frankfurt, Germany. They are joining many successful companies, taking the registration number 24865 IBC 2018. Their other offices are in Switzerland, Hong Kong, Singapore, and Australia. Being an international company, Oasis Trade offers multilingual support on their platform.

Technical Side of the Platform

The first impression of the platform is that it is very sleek. It is available via desktop, mobile, and tablet. Seemingly, the web-based platform provides the necessary information. However, both mobile and tablets are also very user-friendly. In most cases, optimization for all devices is hard to accomplish. As we tested many, Oasis Trade made a quite similar user experience. Why is this important? Well, trading could be very stressful sometimes. Imagine a moment when you have to close the position and the platform freezes? Because of this, we did our best to test the usage of both mobile and desktop versions. We concluded, in terms of stability of their platform, that Oasis Trade is a reliable brokerage firm. Similar to usability, the security of the platform is following the latest trends. As Oasis Trade is featuring segregated accounts, high-end encryption is keeping your funds safe. In the end, opening the account is quite simple. Let the intuition guide you, and you won't be wrong. It is hard that you will have any issues. But, if you do, their contact support will guide you through the process.

Education & Customer Support

A critical aspect of a reliable brokerage firm is their customer support. In this case, OasisTrade's customer support is excellent, with a chatbot greeting you immediately. In case the chatbot is not able to help, company representatives are also available 24/6. They provide support by either live chat, a telephone call, or by email. When contacted their support via web chat, the high level of market and technical knowledge was easy to notice. Furthermore, their communication was both efficient and effective. Consequently, these guys radiate experience and the ability to cover more tasks. It is never enough to emphasize how support is vital for inexperienced traders. At the same time, professional support implies only to the reliable brokerage firm. For all other cases, having disordered support means the possible demise of your account. Of course, if you educate yourself on trading, nobody can make an influence. To do so, you would need a lot of trading material. And this is the spot where Oasis Trade truly shines. Having an ample and useful education section is a mark of the reliable brokerage firm. An extensive range of educational materials helps traders grasp and understand the markets. All this leads to better trading results, having low risks, and stable profits. Besides the free knowledge to browse and learn, the FAQ section is quite abundant. Even though you may feel used to their great support, their updated FAQ could be enough for providing an answer.

Asset Choices of Oasis Trade

The first step in education, especially with novice traders, is what are the types of assets you can trade. However, these types vary from platform to platform. For this reason, the education section might not cover them all. The reliable brokerage firm may think a step ahead and provide this information for the cryptocurrencies. Even if they are not trading them. However, most companies have a limited number of assets available. Furthermore, there is no option to educate yourself on all possible variations of trading. It is far from the case with Oasis Trade. It is because they can provide an extensive portfolio of assets. They offer all the assets classes: commodities, indices, currencies, and cryptocurrencies. Unlike others, Oasis Trade excels with cryptocurrencies. They are providing not only the standard cryptos but also the emerging currencies such as IOATA, NEM, and TRON, among others. Think of it as a big plus since it demonstrates how OasisTrade is steaming ahead against other platforms.

Is Oasis Trade a Reliable Brokerage Firm?

Due to all the abovementioned, we are subscribers of a belief that Oasis Trade is a reliable brokerage firm. Of course, most traders don't finish the game with profits. Therefore, being a reliable brokerage firm doesn't guarantee success. What it guarantees is all the prerequisites for success. In this case, it means that the education section can make a great trader from you. Thereby, you should study the learning material and practice as much as you can. By spending as much time as possible on the platform, you can come up with conclusions and make better moves in the future. As you progress, you will be able to tackle more and more severe issues. Of course, you wouldn't need customer support or education at that point. At that time, you would make your own technical and fundamental analysis. However, having a platform that you are used to will remove the hustle and speed up your journey to any financial goal you have. As our goal is to answer what is a good brokerage firm, we can state that Oasis Trade could be your companion on that journey. Read the full article

0 notes

Text

Oasis Trade Review

When embarking on your trading career the first steps you should take should be choosing the correct broker and acquiring the correct education about the financial markets. If you are currently at this stage I suggest you check out our review of OasisTrade below to see why they could be the broker for you. OasisTrade

OasisTrade are an online financial trading broker based in Germany (Frankfurt to be precise). They are registered in the region under the number 24865 IBC 2018. As well as their main base in Germany they also have offices in Switzerland, Hong Kong, Singapore, and Australia. This is very positive as it shows me they are able to provide multilingual support to customers and clients from a variety of regions. Their platform

The company offers a sleek web based platform that we are very impressed with. It provides the trader with all the necessary information and is very easy to navigate around. The web based platform is available to use via desktop, mobile and tablet, and when trying the mobile and tablet optimised versions we found them to be similar in terms of their user experience and overall sleek look and feel. Opening and closing positions was simple and easy, and should be perfect for both new and more experienced traders alike. An important point to note here is that in regards to security OasisTrade do their utmost to make sure their customers are safe, customer funds are kept in segregated accounts and their website in general is secured by high end encryption. Opening an account is also a simple process, all that is needed are a few details and the minimum deposit of $250 and you should be all set to start trading. The company certainly seems to be placing themselves as an innovator in the trading industry. Offering a user-friendly experience is their unique selling point and after testing it out ourselves we feel once you have opened an account with them you won’t want to change again. Asset choices

Sometimes, especially with newer traders it is difficult to know which markets you want to trade and this becomes particularly difficult if the broker you are using doesn’t have a wide range of access to different markets available. This is far from the case with OasisTrade who are able to provide an extensive portfolio of assets to trade from. The different asset classes they provide are commodities, indices, currencies and cryptocurrencies. It is with cryptocurrencies that the platform really excels, providing not only the standard cryptos but also the emerging currencies such as IOATA,NEM and TRON among others. This is a big plus and demonstrates how OasisTrade are really steaming ahead against other platforms. Education & Customer support OasisTrade customer support is very well-organized with a chatbot that greets you upon entering the website.You are able to reach their representatives 24/6 by either live chat, a telephone call, or by email. Having the benefit of a customer service team that is available constantly is a real bonus especially for inexperienced traders who may need help with understanding certain aspects of the platform or the market in general. In terms of the customer support representatives we found them to have both a high level of market and technical knowledge and when contacting them via the web chat they were very responsive and dealt with the questions we had efficiently and effectively. When it comes to the educational side of the platform we feel that OasisTrade have built a great amount of knowledge to pass on to their traders in their educational modules. They even provide some of this for free, you can check out their getting started and FAQ pages for some snippets of fantastic knowledge and advice. When opening an account with them you will have access to a more extensive range of educational materials, these also provide traders with more gems to really help them grasp and understand the markets they are trading. Look no further then OasisTrade… In our opinion OasisTrade is a reliable company and an excellent choice for beginners and experienced traders alike. However, before you start, it is important to study their learning material. This will give you a wonderful platform to then start profiting from the markets. We have done the research for you and really feel that with OasisTrade you will not go wrong. Read the full article

0 notes

Text

OMC Markets

Website The OMC Markets website is nicely built which feels well designed and user friendly. My first impressions are really good and I can navigate around the site with ease. As mentioned, I am very impressed with the website as it feels very professional and puts me at ease immediately. The Company OMC markets is run from Montenegro. They are owned and operated by a company named Eventuall Ltd with their registered office being in Montenegro. In terms of regulation there is nothing listed on their website nor is there anything regarding regulation online in relation to OMC markets or Eventuall ltd. This is not surprising considering they are based in Montenegro where there is no financial regulatory body to my knowledge. This should be the first red flag for potential traders and investors when looking for a broker as it is vital they choose a broker that can be trusted and is regulated by a stringent financial conduct authority. Their platform And Technical Information OMC markets only seem to provide a web based trading platform. This platform is very simple and easy to use and I would say it is more for the beginner trader due to the simplicity but that is not to say that the more experienced trader should completely avoid it. A variety of assets able to be traded on the OMC markets platform from bonds to Forex to commodities to stocks and even cryptocurrencies. A downfall of their platform is the very high spreads. When looking at this we could see that it fluctuated around 3.5 pip spread mark which is extremely high compared to other reputable brokers. When it comes to account types there are 6 different ones. The first one is the basic account which requires a minimum deposit of $250 and with this you receive 24/7 support access to the education centre daily market reviews Pro webinars and price alerts. The next account is the bronze account where there is quite a big jump in deposit size. This requires a $10,000 deposit and the only added extra you received for this account is a junior account manager in addition to the extras previously stated in the basic account. The next account is the silver account where the deposit is a minimum of $25,000 and with this the only extra you receive on top of the previous mention is instead of a junior account manager you have a senior account manager which does not seem like too much extra to me considering there is a $15,000 extra deposit. Moving on we have the gold account where you receive a VIP account manager and a personalised strategy and to receive these extras your minimum deposit would need to be $50,000. The final account offered is the platinum account however there are no details offered with this account as you are informed that you would need to speak to them in person. Now onto deposits and withdrawals there are a variety of different options available from credit and debit card to a variety of e-wallets that you can pay through, there is also the possibility to pay via Bitcoin. In regard to withdrawals trainers will need to be careful as there are bonuses provided with each account which are essentially risk free trades however their conditions state that if one of these bonuses is taken then the customer cannot withdraw anything from their account until a certain trade capacity is met so traders beware.

Education As mentioned in the above section all account types gain access to OMC markets education centre. However due to the credibility of the company and them as a broker I cannot see the education offered as being to in depth or helpful and it may be something that is easily attainable online for free, and that also goes for their webinars and private trading strategy. Customer Support The customer support is available 24/7 and they can be contacted via email telephone order online web chat. When testing out their web chat it was extremely unreliable as I waited over 15 minutes for a response and in the end gave up. So How Reliable Are They, What Have Customers Said? When it comes to how reliable they are and what customers have said I think you can predict that it is far from positive. I read a fair amount of reviews and did not find one positive one, the majority of reviews spoke about how they could not withdraw any money or that they had been scammed out of their money with one person mentioning that the account manager traded for them and wiped their whole account leaving them with nothing. This sounds as though the company took their money and blamed it on the account managers trading which is obviously a scam. So in terms of reliability I would absolutely categorically call them 100% unreliable please take note of this traders. In Conclusion All in all I think it is pretty safe to say that this company should be avoided at all costs not only are they unregulated they are also scamming money out of unknowing customers. I would urge all traders new and experienced to be aware of the many “brokerage” firms running similar practices. Traders, avoid OMC Markets! Read the full article

0 notes

Text

Investous