Top choice for affordable, high-pass-ratio pre-licensing with small classes for personalized instruction. Pass with confidence!

Don't wanna be here? Send us removal request.

Text

Find the Best Claim Adjuster Classes Near Me

When you're looking to become a licensed insurance adjuster, finding the right claim adjuster classes near me is the first step. Whether you're in the Irving area or across Texas, Texas Insurance Training Academy offers high-quality training that prepares you to excel in the insurance industry.

Why Location Matters When Choosing Claim Adjuster Classes

Finding claim adjuster classes near me is important for several reasons:

Convenience: Attending local classes means you won’t have to worry about long commutes, making it easier to balance your education with work and personal life.

Local Networking: By attending classes near your area, you have the opportunity to connect with professionals and fellow students who are also based locally, which can lead to valuable job opportunities.

State-Specific Education: Insurance regulations and procedures can vary by state. Local classes ensure that you receive training specific to Texas laws and regulations, giving you a competitive advantage when you begin your career as an adjuster.

What to Expect from Our Claim Adjuster Classes

At Texas Insurance Training Academy, our claim adjuster classes near me are designed to provide you with hands-on, practical training. Here’s what you’ll learn:

Claims Process: Understand how to assess and process various types of claims, from property damage to liability claims.

Damage Evaluation: Learn how to evaluate damages and estimate repair costs to determine the appropriate settlement for claimants.

Insurance Policies: Gain a deep understanding of different insurance policies and how to interpret them when processing claims.

Ethics and Laws: Understand the ethical guidelines and legal considerations involved in insurance claims, ensuring that you act with integrity and professionalism at all times.

Why Choose Texas Insurance Training Academy for Your Claim Adjuster Classes

When searching for claim adjuster classes near me, consider the advantages of choosing Texas Insurance Training Academy:

Experienced Instructors: Our instructors are experts in the insurance industry, offering real-world knowledge that prepares you for the challenges you'll face as a claims adjuster.

Flexible Scheduling: We understand that life can be busy. Our classes are scheduled at convenient times to fit into your busy lifestyle, offering both day and evening sessions.

State-Approved Courses: All our courses are approved by the Texas Department of Insurance, so you can be confident that the education you’re receiving is up to the required standards.

Job Placement Assistance: After completing your training, we offer job placement assistance to help you secure a position in the insurance industry.

Enroll in Claim Adjuster Classes Near Me Today

Don’t wait to begin your journey toward becoming a licensed claim adjuster. Our claim adjuster classes near me offer the training you need to pass your licensing exam and succeed in your career. Click here to learn more and enroll.

Conclusion

Searching for claim adjuster classes near me has never been easier with Texas Insurance Training Academy. We offer comprehensive training in a convenient location, helping you take the next step in your career as an insurance adjuster. Start your training today and prepare for a successful future in the insurance industry.

Business Name: Texas Insurance Training Academy Address: 800 W Airport Fwy #610, Irving, TX 75062, United States

Call to Action: Want to book an appointment? Visit our website: https://texasinsurancetrainingacademy.com/

0 notes

Text

In-Person Insurance Adjuster Classes: Why They Are Essential for Your Career

If you’re pursuing a career as an insurance adjuster, hands-on training is essential for your success. At Texas Insurance Training Academy in Irving, Texas, we offer in-person insurance adjuster classes that provide you with the real-world knowledge and skills you need to pass the licensing exam and thrive in this field.

Why In-Person Insurance Adjuster Classes Are Important

While online courses may offer convenience, in-person insurance adjuster classes provide unique benefits that are difficult to replicate in a virtual setting. At Texas Insurance Training Academy, we understand the value of face-to-face instruction, and our in-person classes create an engaging, interactive environment that helps you better understand the material.

Here are some reasons why in-person adjuster classes are beneficial:

Hands-On Experience: By attending in-person classes, you’ll have the opportunity to participate in simulations, case studies, and practical scenarios that mimic real-world situations.

Immediate Feedback: With in-person instruction, you can ask questions on the spot and receive immediate feedback, helping to clarify complex concepts.

Networking Opportunities: In-person classes allow you to connect with fellow students and instructors, expanding your professional network in the insurance industry.

Focus and Motivation: A structured in-person learning environment helps you stay focused and motivated, allowing you to complete the course and prepare for the licensing exam more effectively.

What You’ll Learn in Our In-Person Insurance Adjuster Classes

At Texas Insurance Training Academy, our in-person insurance adjuster classes are designed to equip you with the necessary knowledge and skills for your career. Some of the key topics covered in our curriculum include:

Claims Process: Learn the step-by-step process of handling insurance claims, including investigation, evaluation, and settlement.

Property Damage Assessment: Understand how to assess damages to property and vehicles and determine the appropriate compensation.

Legal and Ethical Considerations: Gain an understanding of the legal and ethical responsibilities of an insurance adjuster, ensuring you always act in the best interests of your clients and employers.

Interviewing Techniques: Learn how to conduct interviews with claimants, witnesses, and other relevant parties to gather information and assess claims effectively.

Why Choose Texas Insurance Training Academy for Your In-Person Adjuster Classes

Texas Insurance Training Academy offers some of the best in-person insurance adjuster classes in the state, with a curriculum that prepares you for both the licensing exam and a successful career in the insurance industry. Here’s why you should choose us:

Experienced Instructors: Our instructors are seasoned professionals with years of experience in the insurance industry, offering you real-world insights and expertise.

Comprehensive Training: Our in-person courses cover every aspect of insurance adjusting, from the basics to advanced techniques, ensuring you are fully prepared for your new role.

State-Approved: Our courses are approved by the Texas Department of Insurance, ensuring you receive top-quality education that meets state standards.

Small Class Sizes: We offer small class sizes to ensure personalized attention and a better learning environment for all students.

Start Your Career Today with In-Person Insurance Adjuster Classes

If you’re ready to start your career as an insurance adjuster, there’s no better place to begin than at Texas Insurance Training Academy. Our in-person insurance adjuster classes offer everything you need to succeed. Click here to learn more and enroll.

Conclusion

The insurance industry offers a stable, rewarding career, and in-person insurance adjuster classes are the key to gaining the knowledge and skills necessary for success. At Texas Insurance Training Academy, we provide top-notch training to help you pass the licensing exam and kick-start your career in insurance adjusting.

Business Name: Texas Insurance Training Academy Address: 800 W Airport Fwy #610, Irving, TX 75062, United States

Call to Action: Want to book an appointment? Visit our website: https://texasinsurancetrainingacademy.com/

0 notes

Text

What to Look for in the Best Insurance Schools in Texas

Choosing the right school for your insurance education is a crucial decision that will set the foundation for your career. At Texas Insurance Training Academy, we pride ourselves on being one of the top insurance schools in Texas, offering a comprehensive, hands-on learning experience that prepares you for success in the insurance industry.

Why Texas Insurance Training Academy is Among the Best Insurance Schools

When looking for an insurance school, it’s important to choose one that offers quality instruction, flexible scheduling, and a supportive learning environment. Texas Insurance Training Academy ticks all these boxes, providing you with the tools and resources you need to succeed in the insurance industry.

Here’s why we stand out:

Experienced Instructors: Our instructors are industry veterans who bring years of knowledge to the classroom. They’re not just teaching from textbooks—they’re offering real-world insights that you can apply immediately.

Comprehensive Courses: We offer a variety of courses, including property and casualty, life insurance, and health insurance, ensuring that you have the option to specialize in the area that excites you most.

In-Person Classes: Unlike many online-only programs, we offer in-person classes that allow for interactive learning, hands-on experience, and networking with fellow students and instructors.

State-of-the-Art Facilities: Our school is equipped with the latest technology to enhance your learning experience, making sure that you have everything you need to succeed.

What You Should Look for in an Insurance School

When choosing an insurance school, keep the following factors in mind:

Accreditation: Ensure that the school you choose is accredited by the Texas Department of Insurance. Texas Insurance Training Academy is fully accredited, ensuring that you receive education recognized by the state.

Instructor Quality: Look for instructors who have practical experience in the insurance industry. Our instructors at Texas Insurance Training Academy bring years of real-world experience to the classroom.

Success Rate: Check the school’s success rate in helping students pass licensing exams and secure jobs in the insurance industry. Our school has a high success rate, thanks to our comprehensive curriculum and dedicated instructors.

Flexibility: Whether you’re working full-time or have a busy schedule, look for a school that offers flexible class schedules. We offer a variety of scheduling options, so you can balance your education with other commitments.

Benefits of Attending Texas Insurance Training Academy

At Texas Insurance Training Academy, we provide more than just insurance education. We offer a community and a supportive environment that encourages students to succeed. Our insurance school offers benefits such as:

Personalized Support: From one-on-one coaching to small class sizes, you’ll receive the personalized support you need to thrive.

Job Placement Assistance: We assist students in finding jobs after they complete their courses, ensuring that you have a smooth transition into the workforce.

Comprehensive Exam Preparation: Our courses prepare you for licensing exams with mock tests, practice questions, and study guides.

Enroll Today and Start Your Career in Insurance

Are you ready to start your journey toward becoming a licensed insurance agent? Enrollment is simple, and our insurance school offers the education and resources you need to succeed.

Conclusion

Finding the right insurance school is a key step toward a successful career in insurance. At Texas Insurance Training Academy, we provide high-quality, hands-on education that will prepare you for a bright future in this thriving industry.

0 notes

Text

Top Insurance Schools in Texas: How to Choose the Right One for You

If you're considering a career as an insurance adjuster, it's essential to choose the right insurance school of Texas to ensure you receive the best possible education and training. With so many options available, it can be overwhelming to find a school that suits your needs. At Texas Insurance Training Academy, we offer a comprehensive curriculum designed to provide you with the knowledge and skills required to become a licensed insurance adjuster in Texas.

Why Choose an Insurance School in Texas?

When looking for the best insurance school of Texas, you’ll want to consider a few key factors to make sure you’re receiving the highest quality education. Local schools have the advantage of:

Texas-Specific Education: Insurance laws, regulations, and procedures vary from state to state. A local insurance school ensures that you receive training specifically tailored to Texas laws, ensuring you’re fully prepared for the state licensing exam.

Proximity: Choosing a local school can save you time and travel costs. With an insurance school of Texas like Texas Insurance Training Academy, you won’t have to travel far to receive the best training.

Networking Opportunities: Attending a local school also provides networking opportunities with instructors, fellow students, and local employers, which can be valuable when starting your career.

What to Look for in an Insurance School in Texas

When choosing the right insurance school of Texas, consider the following factors:

Accreditation and Licensing: Ensure that the school is accredited and approved by the Texas Department of Insurance (TDI). This ensures that the curriculum meets state standards and that you will be eligible for licensing upon completion.

Experienced Instructors: The best insurance schools have instructors who are seasoned professionals with years of experience in the industry. Look for schools that offer real-world insights and practical knowledge.

Comprehensive Curriculum: A well-rounded curriculum is crucial. Your school should cover everything from the basics of insurance to advanced topics like claim assessment and legal issues.

Job Placement Assistance: Some schools offer job placement assistance after graduation. This can be a huge benefit, helping you land your first job in the industry and kickstart your career.

Why Texas Insurance Training Academy Is the Best Choice

At Texas Insurance Training Academy, we pride ourselves on being the insurance school of Texas that offers top-tier education. Here's why:

State-Approved Courses: Our courses are approved by the Texas Department of Insurance, ensuring you receive the highest quality education and are eligible for state licensing exams.

Experienced Instructors: Our instructors have years of experience in the insurance industry and provide real-world insights that are invaluable in your training.

Comprehensive and Flexible Curriculum: We offer both in-person and online classes to fit your schedule, with a curriculum that covers all the essential topics you need to pass your licensing exam and excel in your career.

Job Placement Support: We assist students with job placement, ensuring that after you complete your training, you’ll be prepared to enter the job market with confidence.

Get Started at Texas Insurance Training Academy Today

Choosing the right insurance school of Texas is a crucial step in becoming a licensed insurance adjuster. Texas Insurance Training Academy offers comprehensive, state-approved training that will help you succeed in your career.

Conclusion

Your journey to becoming a licensed insurance adjuster starts with choosing the right insurance school of Texas. At Texas Insurance Training Academy, we offer expert instructors, a comprehensive curriculum, and job placement support to ensure you have all the tools you need for success in the insurance industry. Enroll today and take the first step toward a rewarding career.

Business Name: Texas Insurance Training Academy Address: 800 W Airport Fwy #610, Irving, TX 75062, United States

Call to Action: Want to book an appointment? Visit our website: https://texasinsurancetrainingacademy.com/

0 notes

Text

Why Our Life Insurance Course in Irving is the Best Choice for Your Career

If you're passionate about helping people secure their financial future, becoming a life insurance agent is a rewarding career choice. At Texas Insurance Training Academy in Irving, Texas, we offer a comprehensive life insurance course that provides all the skills and knowledge you need to succeed in this dynamic field.

Why Choose Our Life Insurance Course?

Our life insurance course is specifically designed for individuals who want to become licensed agents. At Texas Insurance Training Academy, we focus on providing high-quality, hands-on training to ensure that you are fully prepared to pass your licensing exam and begin your career in the insurance industry.

Here are some reasons why our life insurance course stands out:

Expert Instructors: Our experienced instructors will guide you through all aspects of life insurance, from policy basics to more advanced topics like underwriting and claims.

In-Depth Curriculum: You’ll learn everything from insurance terminology to financial planning, giving you a solid foundation to work with clients.

Flexible Scheduling: We offer multiple class times to accommodate your schedule, making it easier for you to balance work, school, and personal life.

What You’ll Learn in Our Life Insurance Course

Our life insurance course covers a wide variety of topics that will prepare you for the licensing exam and your future career. Here are just a few of the key areas we focus on:

Types of Life Insurance Policies: You’ll gain a deep understanding of term life insurance, whole life insurance, universal life, and variable life policies.

Insurance Math: We cover the essential formulas and concepts necessary to calculate premiums, death benefits, and policy values.

Ethical and Legal Aspects: Learn about the legal and ethical obligations of being a life insurance agent, including client privacy, trust, and how to follow regulations.

Sales Techniques: Effective sales strategies will be taught to help you interact with potential clients and provide them with the best coverage options.

Why Life Insurance Is a Great Career Choice

Becoming a licensed life insurance agent opens up many career opportunities. With a life insurance course from Texas Insurance Training Academy, you'll be ready to work in various sectors, including financial planning, estate planning, and risk management. The insurance industry is consistently growing, and life insurance agents are in high demand.

A career in life insurance offers flexibility, the potential for high earnings, and the satisfaction of helping people secure their families' futures. With the right training, you can excel in this field and build a successful, long-lasting career.

Enroll in Our Life Insurance Course Today

Ready to get started? Enroll in our life insurance course today! We offer convenient in-person classes that will give you the skills and confidence you need to pass the licensing exam and become a successful life insurance agent.

Conclusion

Don’t wait to take the first step toward a rewarding career in life insurance. At Texas Insurance Training Academy, our expert instructors and comprehensive curriculum will ensure that you’re well-prepared for success. Contact us today to begin your journey!

Business Name: Texas Insurance Training Academy Address: 800 W Airport Fwy #610, Irving, TX 75062, United States

Call to Action: Want to book an appointment? Visit our website: https://texasinsurancetrainingacademy.com/

0 notes

Text

Top Insurance Courses in Irving: Your Path to a Successful Career

If you're looking to start or advance your career in the insurance industry, Texas Insurance Training Academy in Irving, Texas, offers the best insurance courses to help you succeed. Whether you're new to the industry or looking to upgrade your skills, our academy provides a variety of training programs that will equip you with the knowledge you need to thrive in this growing field.

Why Choose Insurance Courses at Texas Insurance Training Academy?

When it comes to education, quality matters. Our insurance courses in Irving are designed by industry professionals who understand the practical skills required to excel in the insurance world. Unlike other programs, we offer in-person training that allows you to interact with instructors and classmates, creating a more hands-on learning experience. This interactive environment fosters better retention of knowledge and ensures that you’re fully prepared for real-world challenges.

By choosing Texas Insurance Training Academy, you'll benefit from:

Expert Instructors: Learn from seasoned professionals with years of experience in the insurance industry.

Comprehensive Curriculum: Our courses cover a range of topics, including property and casualty, life, health insurance, and more.

Flexible Scheduling: We offer classes at various times to accommodate your busy schedule.

Popular Insurance Courses You Can Take

At Texas Insurance Training Academy, we offer a wide selection of insurance courses, including:

Life Insurance: Learn everything you need to know about selling and managing life insurance policies.

Property & Casualty Insurance: This course is perfect for those interested in working with home, auto, and other property-related insurance claims.

Health Insurance: Understand the complexities of health plans and how to help clients navigate the world of healthcare coverage.

Each course is designed to provide you with a strong foundation in the insurance industry, making it easier for you to pass licensing exams and get started in your new career.

How Insurance Courses Prepare You for a Successful Career

Insurance is a career that can offer long-term stability and financial rewards. However, it requires the right knowledge and skills to succeed. Our insurance courses are tailored to ensure that you’re not just passing a test, but gaining valuable insights that will serve you throughout your career.

In our courses, you’ll learn the ins and outs of claims, underwriting, risk management, and customer service. Plus, our instructors provide real-world scenarios that allow you to apply what you've learned in practical situations. This level of preparation is essential when you’re working with clients who trust you to protect their most important assets.

Enroll in Insurance Courses Today

Are you ready to take the first step toward a successful career in insurance? Enrollment is easy! Just visit our website and sign up for the insurance courses that fit your career goals. At Texas Insurance Training Academy, we’re committed to your success.

Conclusion

Don’t wait any longer to start your career in insurance. With the right training, you can open doors to many exciting opportunities. At Texas Insurance Training Academy, we provide the education and resources needed to help you succeed in this competitive industry.

Business Name: Texas Insurance Training Academy Address: 800 W Airport Fwy #610, Irving, TX 75062, United States

Call to Action: Want to book an appointment? Visit our website: https://texasinsurancetrainingacademy.com/

0 notes

Text

Choosing the Right Insurance Schools in Texas: What You Need to Know

Most individuals who are interested in pursuing a career in the insurance industry in Texas are aware that choosing the right insurance school is vital to ensure a successful career. You want to make sure that you acquire the skills and knowledge needed to excel in various sectors of the insurance industry, and the right school can provide you with just that. As you consider your options, you'll want to think about the factors that will set you up for success, from accreditation to curriculum and faculty. By doing your research and selecting a reputable insurance school, you'll be well on your way to a rewarding and lucrative career.

With respect to selecting an insurance school, there are several factors you should consider. You'll want to look for a school that is accredited by a recognized accrediting agency, as this ensures that the school meets certain standards of quality. You should also consider the curriculum, making sure that it covers the topics and skills you need to succeed in the insurance industry. Additionally, you'll want to look at the faculty, seeking out instructors who have experience in the field and can provide you with real-world insights and guidance. By considering these factors, you can find a school that will provide you with a comprehensive education and prepare you for success.

If you're looking for a top-notch insurance school in Texas, you may want to consider the Texas Insurance Training Academy. With experienced instructors and a wide range of courses, this school can provide you with the skills and knowledge you need to succeed in the insurance industry. From property and casualty insurance to life and health insurance, the Texas Insurance Training Academy offers a variety of courses that can help you achieve your career goals. With a focus on providing students with the skills and knowledge they need to succeed, this school is an excellent choice for anyone looking to start or advance their career in the insurance industry.

Attending a reputable insurance school can have a significant impact on your long-term career prospects. By graduating from a well-respected school, you'll have access to networking opportunities, higher earning potential, and job security. You'll be able to connect with other professionals in the industry, learn about new developments and trends, and position yourself for advancement opportunities. Additionally, many employers prefer to hire graduates from reputable schools, so you'll have a competitive edge in the job market. As you consider your options, think about the benefits that a reputable insurance school can provide, and how it can help you achieve your career goals.

The success stories of graduates from reputable insurance schools are a testament to the value of a high-quality education. Many graduates have gone on to successful careers in the insurance industry, working for top companies and earning competitive salaries. You can read testimonials and success stories from graduates who have attended the Texas Insurance Training Academy, and see for yourself the impact that a reputable insurance school can have on your career. By hearing from graduates who have been in your shoes, you can get a sense of what to expect and how to make the most of your education.

In the end, choosing the right insurance school in Texas is vital to ensuring a successful career in the insurance industry. You want to make sure that you select a school that will provide you with the skills and knowledge you need to succeed, and that will set you up for long-term career success. By considering factors such as accreditation, curriculum, and faculty, and by looking at the unique aspects of schools like the Texas Insurance Training Academy, you can make an informed decision. Visit the Texas Insurance Training Academy at 800 W Airport Fwy #610, Irving, TX 75062, United States. Take the first step towards a successful career in the insurance industry - visit our website to book an appointment or enroll today!

0 notes

Text

Master the Essentials of Life Insurance with Our Comprehensive Courses

Many individuals are seeking to secure their financial futures, and as a result, the demand for life insurance agents is on the rise, presenting you with a unique opportunity to build a successful career in this field. You are likely aware that life insurance plays a vital role in the modern financial landscape, providing individuals and families with protection and peace of mind. As you consider a career in life insurance, you will need to acquire the necessary skills and knowledge to excel in this industry. Your success will depend on your ability to understand the complexities of life insurance and provide expert guidance to your clients.

In terms of becoming a successful life insurance agent, you will need to possess a deep understanding of the key concepts and principles that underpin the industry. You will need to develop a strong foundation in areas such as policy types, risk management, and customer service. Your ability to communicate complex ideas in a clear and concise manner will also be imperative in building trust with your clients. Obtaining comprehensive life insurance training is the key to unlocking your full potential in this field. You will gain the skills and confidence needed to navigate the complex world of life insurance and provide your clients with the expert guidance they deserve.

Our life insurance courses are designed to provide you with a thorough understanding of the industry, covering key subjects such as life insurance policies, annuities, and estate planning. You will gain a deep understanding of the different types of life insurance policies, including term life, whole life, and universal life. Our courses will also cover the importance of risk management, underwriting, and claims processing. With our comprehensive curriculum, you will be well-equipped to succeed in the life insurance industry and provide your clients with the expert guidance they need.

By taking our life insurance courses, you will benefit from expert instructors who have years of experience in the industry. You will also enjoy flexible scheduling, allowing you to balance your studies with your other commitments. Upon completion of our courses, you will receive certifications that will enhance your career prospects and demonstrate your expertise to potential clients. You will be able to take advantage of our state-of-the-art facilities and cutting-edge technology, providing you with a unique learning experience that will prepare you for success in the life insurance industry.

Our life insurance training has a proven track record of success, with many of our students going on to build successful careers in the industry. You can read testimonials from our satisfied students who have achieved their goals and are now enjoying successful careers in life insurance. With our comprehensive training, you will be able to increase your earning potential, enhance your career prospects, and enjoy a sense of personal fulfillment that comes from helping others achieve their financial goals.

In the final analysis, life insurance courses are an imperative step for those interested in pursuing a career in life insurance. You will gain the skills, knowledge, and confidence needed to succeed in this exciting and rewarding field. For more information on our life insurance courses, visit the Texas Insurance Training Academy at 800 W Airport Fwy #610, Irving, TX 75062, United States. We encourage you to visit our website and book an appointment to take the first step towards a successful career in life insurance.

0 notes

Text

Why the Insurance School of Texas is Your Gateway to a Successful Career

Insurance professionals are in high demand, and you are looking to capitalize on this trend by pursuing a career in the industry, and what better place to start than in Texas, a hub for insurance careers. You want to get a head start in this field, and choosing the right school is crucial to your success. With the Insurance School of Texas, you can gain the knowledge and skills needed to excel in this booming industry. As you consider your options, you should know that enrolling in a reputable insurance school can open doors to new opportunities and set you up for a successful career.

The insurance industry in Texas is booming, with a growing demand for skilled professionals like you. You can take advantage of this trend by enrolling in the Insurance School of Texas, which can provide you with the training and expertise needed to succeed. The school's experienced instructors, hands-on training, and successful alumni are just a few features that set it apart from other institutions. You will have access to a variety of courses and certifications, including those in property and casualty insurance, life and health insurance, and risk management, giving you a comprehensive understanding of the industry.

What makes the Insurance School of Texas stand out is its commitment to providing you with the skills and knowledge needed to succeed in the industry. You will learn from experienced instructors who have years of experience in the field, and you will have the opportunity to participate in hands-on training, giving you practical experience. The school's successful alumni are a testament to its effectiveness, and you can be confident that you will be well-prepared for a successful career. The school offers a range of program offerings, including courses in insurance principles, insurance law, and risk management, as well as certifications in areas such as insurance adjusting and underwriting.

But don't just take our word for it - the school's success stories speak for themselves. You can hear from former students who have found success after completing their courses, and you can learn about their experiences in the industry. You will be inspired by their stories and motivated to achieve your own goals. With the Insurance School of Texas, you can gain the skills and knowledge needed to succeed in the industry, and you can start your journey to a successful career.

In summarization, the Insurance School of Texas is your gateway to a successful career in the insurance industry. You can trust that you will receive comprehensive training and be well-prepared for a successful career. The Texas Insurance Training Academy, located at 800 W Airport Fwy #610, Irving, TX 75062, United States, is your partner in achieving your goals. You can visit our website to book an appointment or enroll in one of our programs today and take the first step towards a successful career in the insurance industry.

0 notes

Text

Top Insurance Training Programs in Texas: Unlock Your Career Potential Today

It's no secret that the insurance industry is a complex and competitive field, and having proper training is imperative for a successful career. You know that staying ahead of the curve is vital, and that's where insurance training comes in. As you consider a career in insurance, you'll want to explore the various paths available to you, from auto and life insurance to health and commercial insurance. With the right training, you'll be well-prepared to take on these roles and succeed in your chosen career.

As you explore into the world of insurance, you'll discover that comprehensive training is key to unlocking your potential. You'll have access to a range of career paths, each with its own unique challenges and opportunities. By choosing the right insurance training program, you'll gain industry recognition, certification, and hands-on experience that will set you apart from the competition. You'll be able to choose from a variety of programs, including auto, life, health, and commercial insurance, and you'll have the flexibility to take courses in-person, online, or part-time, depending on your schedule and learning style.

The benefits of choosing the right insurance training program are numerous, and you'll want to consider them carefully as you make your decision. With a program like the one offered by Texas Insurance Training Academy, you'll get the best possible start in your insurance career. You'll gain a deep understanding of the industry, as well as the skills and knowledge you need to succeed. You'll also have access to experienced instructors and a supportive learning environment, which will help you stay motivated and focused as you work towards your goals.

So, how do you get started? You can begin by exploring the different insurance training programs available to you, and considering your career goals and interests. You can then enroll in a program that aligns with your needs, and start working towards your certification. To take the first step, you can visit the Texas Insurance Training Academy website, where you'll find all the information you need to get started. You can also book an appointment to speak with an advisor, who will be happy to answer any questions you may have and help you choose the right program for you.

To put it briefly, selecting the right insurance training program is imperative for a successful career in the insurance industry. You owe it to yourself to choose a program that will provide you with the skills, knowledge, and industry recognition you need to succeed. At Texas Insurance Training Academy, you'll find a range of programs designed to help you achieve your goals. Visit Texas Insurance Training Academy today, located at 800 W Airport Fwy #610, Irving, TX 75062, United States. You can also Visit our website to book an appointment and take the first step towards a successful career in insurance.

0 notes

Text

How to Get Your Claims Adjuster License in Texas: A Step-by-Step Guide

Introduction:

The role of a claims adjuster is essential in the insurance industry, particularly in Texas, where a rapidly growing market demands skilled professionals. Claims adjusters are responsible for investigating insurance claims, assessing damages, and determining the amount payable to policyholders. With the increase in natural disasters and accidents, the need for licensed adjusters has never been greater. Obtaining a claims adjuster license in Texas is a structured process that ensures aspiring professionals have the necessary skills and knowledge to perform their duties effectively. This guide will walk you through the essential steps needed to secure your claims adjuster license and kickstart your career in this rewarding field.

Step-by-Step Guide:

Research Licensing Requirements

The journey to becoming a licensed claims adjuster in Texas begins with understanding the basic licensing requirements. To qualify for a claims adjuster license, candidates must be at least 18 years old, possess a high school diploma or equivalent, and pass a background check. It's crucial to have a clean criminal record, as certain offenses may disqualify applicants. Additionally, familiarity with the insurance industry and a commitment to ethical practices are highly beneficial. Researching these requirements will provide a solid foundation for the steps that follow, ensuring that you meet the necessary criteria before moving forward.

Complete a Pre-Licensing Course

Once you have a clear understanding of the requirements, the next step is to complete a pre-licensing course. Enrolling in a course such as the one offered at the Texas Insurance Training Academy is highly recommended. This course provides a comprehensive curriculum that covers essential topics such as Texas insurance regulations, claims handling processes, and effective communication with clients. By taking this course, you not only gain in-depth knowledge of the industry but also prepare yourself for the state licensing exam.

The benefits of completing a pre-licensing course extend beyond just exam preparation. Students often receive practical insights from experienced instructors, which can enhance their understanding of real-world scenarios in claims adjustment. Additionally, many courses include practice exams and study materials that can significantly increase your chances of passing the licensing exam on your first attempt.

Pass the Texas Licensing Exam

After completing your pre-licensing course, it's time to prepare for the Texas licensing exam. This exam is a critical step in the licensing process and requires thorough preparation. To succeed, it's essential to review the material covered in your pre-licensing course and engage in additional study sessions to reinforce your knowledge. Utilizing practice tests can also be incredibly beneficial in identifying areas where you need further review.

On exam day, arrive early to ensure you have ample time to relax and gather your thoughts. Bring all necessary documentation, including your pre-licensing course completion certificate and valid identification. Staying calm and confident during the exam can make a significant difference in your performance. Remember, the exam is designed to test your knowledge and preparedness for the role of a claims adjuster, so trust in the training you’ve received.

Submit Your Application and Background Check

Once you pass the licensing exam, the next step is to submit your application to the Texas Department of Insurance. This application includes your personal information, proof of completion of the pre-licensing course, and results from the background check. Be sure to double-check that all documentation is complete and accurate before submission to avoid any delays in processing your application. The Texas Department of Insurance typically processes applications within a few weeks, so patience is key during this stage.

Start Your Claims Adjusting Career

Congratulations! Once your application is approved, you will officially be a licensed claims adjuster in Texas. Now it's time to jump-start your career in this dynamic field. Networking with industry professionals, joining insurance associations, and seeking mentorship opportunities can all be valuable steps as you begin your career. Many licensed adjusters find success by starting with an insurance company, but independent adjusting is also a viable path. Whichever route you choose, your new license opens the door to numerous opportunities in the insurance industry.

Conclusion:

Obtaining a claims adjuster license in Texas is an achievable goal that requires careful planning and commitment. By following these key steps—researching licensing requirements, completing a pre-licensing course, passing the state exam, submitting your application, and finally starting your career—you can position yourself for success in the insurance industry. The Texas Insurance Training Academy is dedicated to helping you navigate this process smoothly and effectively.

Call to Action: To learn more about the claims adjuster licensing process or to book an appointment, visit our website at Texas Insurance Training Academy.

Texas Insurance Training Academy 800 W Airport Fwy #610, Irving, TX 75062, United States.

0 notes

Text

Everything You Need to Know About the Texas Adjuster License Course

Introduction:

Becoming a licensed insurance adjuster in Texas is a rewarding career path, but it starts with obtaining the right qualifications. One of the most critical steps in this journey is completing a Texas adjuster license course. This course not only prepares you for the state licensing exam but also equips you with the knowledge and skills necessary to succeed in the competitive insurance industry. Whether you're new to the field or seeking a career change, professional training is essential to navigate the complex regulatory landscape and understand the nuances of claims adjustment. The Texas adjuster license opens the door to a fulfilling career with opportunities for growth and specialization.

What the Texas Adjuster License Course Covers:

The Texas adjuster license course is comprehensive, covering a wide range of topics that are critical for success in this profession. One of the primary areas of focus is state regulations. Understanding Texas-specific laws and guidelines for claims handling is vital, as adjusters must comply with these regulations in every aspect of their work. The course also delves into claims handling procedures, teaching students the step-by-step processes required to manage claims efficiently and ethically.

In addition to theoretical knowledge, practical skills are a major component of the course. Learners gain valuable hands-on experience in policy interpretation, which is key to determining coverage and payouts. Claims processing is another focal point, where students learn how to accurately assess damage, file reports, and manage customer relationships throughout the claims process. Ethics in claims handling is also emphasized, as insurance adjusters must act with integrity and fairness, balancing the needs of the client with the policies of the insurer. These skills are essential for adjusters, ensuring they can handle real-world claims confidently and competently.

The Path to Success with the Right Course:

Choosing the right Texas adjuster license course is crucial for passing the state exam and building a successful career in insurance claims adjustment. A well-structured course not only prepares you for the exam but also provides the foundational knowledge needed for a long-term career. The Texas adjuster license exam is known to be challenging, but a comprehensive course that covers all aspects of claims handling and state regulations gives students the confidence they need to succeed.

Many students who have taken a Texas adjuster license course have gone on to enjoy rewarding careers in claims adjustment. They often share success stories of how the course prepared them not only to pass the exam but also to excel in their day-to-day responsibilities. The right training program instills the technical expertise and ethical grounding needed to navigate even the most complex claims, helping adjusters thrive in a highly competitive market.

Why Texas Insurance Training Academy:

When it comes to selecting a course, Texas Insurance Training Academy stands out as the premier provider of the Texas adjuster license course. We offer a tailored learning experience with expert instructors who bring years of industry experience to the classroom. Our instructors understand the intricacies of claims adjustment and provide real-world insights that you won’t find in generic courses. This expertise ensures that our students are not only prepared for the exam but also equipped to handle the demands of the job.

Flexibility is another hallmark of our program. We offer both in-person and online options, allowing students to learn in the format that works best for their schedule. Whether you prefer a hands-on classroom environment or the convenience of remote learning, our course is designed to fit your lifestyle. The Academy’s high pass rates and positive testimonials from former students highlight the success of our program. Graduates of Texas Insurance Training Academy consistently praise the thorough preparation they received, which has helped them build successful careers as licensed insurance adjusters.

Conclusion:

Taking a Texas adjuster license course is an important step toward a successful and fulfilling career in the insurance industry. With the right training, you'll be prepared not only to pass the state licensing exam but also to excel in the real-world tasks of claims adjustment. If you're ready to take the next step in your career, consider enrolling in a course that provides both comprehensive knowledge and practical skills.

Call to Action: To learn more about our Texas adjuster license course or to book an appointment, visit our website at Texas Insurance Training Academy.

Texas Insurance Training Academy 800 W Airport Fwy #610, Irving, TX 75062, United States.

0 notes

Text

Top Benefits of In-Person Insurance Adjuster Classes: Learn Face-to-Face

Introduction:

In today’s fast-paced world, many educational opportunities have shifted online, but for industries like insurance adjusting, nothing beats the value of in-person learning. Attending in-person insurance adjuster classes offers a unique and immersive learning experience that cannot be fully replicated through virtual platforms. In-person instruction allows for hands-on learning, direct engagement with experienced professionals, and immediate feedback that ensures comprehension of critical concepts. This is particularly crucial for aspiring insurance adjusters who need to navigate complex regulations and perform detailed evaluations. By choosing in-person insurance adjuster classes, students gain the advantage of real-world practice and face-to-face interaction, setting them up for long-term success in the field.

Benefits of In-Person Learning:

The interactive nature of in-person classes is one of the key reasons why they are so effective. Students can ask questions in real time, engage in lively discussions, and gain clarity on difficult topics immediately. This direct interaction fosters a deeper understanding of the material, especially in a field as detail-oriented as insurance adjusting. Additionally, in-person classes offer networking opportunities with both instructors and peers. Building relationships within the insurance community is crucial for career growth, and these classes provide a chance to form those valuable connections early on. Whether it’s collaborating on case studies or learning from the experiences of others in the room, the networking aspect of in-person learning cannot be understated.

Moreover, the structure of in-person insurance adjuster classes often includes practical exercises, allowing students to simulate real-world situations. This type of hands-on training prepares adjusters for the types of claims and scenarios they will encounter once they are licensed and working in the field. By learning in an environment that encourages collaboration and practice, students not only build their knowledge but also their confidence in applying what they’ve learned.

How In-Person Classes Improve Skills:

Face-to-face learning is especially beneficial when it comes to mastering complex insurance concepts. In-person insurance adjuster classes offer live demonstrations, role-playing exercises, and immediate feedback that ensure each student fully grasps the skills needed to succeed. For instance, students may participate in mock claim assessments, learning how to accurately evaluate damages and determine settlements in a controlled setting. Instructors can provide personalized guidance, pointing out areas of improvement and reinforcing best practices that are essential for success.

Role-playing scenarios in an in-person setting also enhance critical thinking and decision-making skills, as students must adapt to dynamic, real-time situations. This experiential learning approach accelerates the mastery of important skills like negotiation, communication, and claim analysis. These sessions offer adjusters the opportunity to refine their abilities, enabling them to confidently manage real-world claims and client interactions once they enter the workforce. Additionally, students benefit from observing how instructors and peers approach problem-solving, offering new perspectives and techniques that may not emerge in a digital classroom.

Why Choose Texas Insurance Training Academy for In-Person Classes:

Texas Insurance Training Academy is renowned for its comprehensive and hands-on approach to education. Our in-person insurance adjuster classes are designed to provide students with the personal growth and professional development they need to excel in the insurance industry. We pride ourselves on offering an environment that promotes learning through interaction, direct feedback, and real-world experience. With our experienced instructors, students are guided by professionals who have worked in the field for years, bringing real-world expertise to every session.

Our classes focus on creating a supportive and dynamic learning atmosphere where students are encouraged to ask questions, engage in discussions, and actively participate in practical exercises. The curriculum is tailored to ensure that every adjuster, whether new to the field or seeking continuing education, is equipped with the knowledge and skills needed to pass the state licensing exam and succeed in their career. The relationships students build during our in-person sessions also provide a strong network of peers and mentors to lean on as they navigate their professional journeys.

Conclusion:

For insurance adjusters, there’s no substitute for the immersive, hands-on experience provided by in-person training. These classes not only help students master complex concepts but also enhance their practical skills through real-world simulations and live feedback. In-person training prepares adjusters to confidently handle the demands of the job, from claim assessments to client interactions. By investing in this type of education, insurance adjusters set themselves up for long-term success in an ever-evolving industry.

Call to Action: To learn more about our in-person insurance adjuster classes or to book an appointment, visit our website at Texas Insurance Training Academy.

Texas Insurance Training Academy 800 W Airport Fwy #610, Irving, TX 75062, United States.

0 notes

Text

Why Life Insurance Courses are Essential for a Successful Insurance Career

Introduction:

In today’s competitive insurance industry, professional education is more crucial than ever. Aspiring agents must not only pass licensing exams but also understand the complexities of insurance products and how they can be best utilized to serve clients. Life insurance, in particular, is one of the cornerstones of the industry. Taking specialized life insurance courses provides individuals with a solid foundation for a successful career. By gaining expertise in life insurance, agents are better equipped to offer tailored solutions that meet their clients' unique needs, thereby positioning themselves as trusted advisors.

The Importance of Life Insurance Courses:

Life insurance courses cover a wide range of critical topics that every insurance agent must master. From understanding different policy types such as term life, whole life, and universal life, to learning how to assess risk and navigate legal requirements, these courses offer a comprehensive education. Agents are also taught how to explain policy details in a way that’s clear to their clients, ensuring that the insured are fully informed before making decisions. For agents, having this in-depth knowledge means they can provide more accurate advice and guide clients through the decision-making process more effectively, which ultimately leads to stronger client relationships and business growth.

Moreover, life insurance courses are essential for staying current with regulatory updates. The life insurance industry is subject to frequent changes in laws and regulations, which can affect policy structures, compliance requirements, and sales processes. Agents who have taken the time to study and stay informed through life insurance courses are not only able to provide better service but are also more likely to avoid legal pitfalls and protect their reputation.

Industry Growth and Opportunities:

The demand for life insurance professionals continues to grow as market trends shift and new regulatory standards are introduced. In a world where financial security is increasingly prioritized, more people are recognizing the importance of life insurance as part of their long-term financial planning. This has created a surge in opportunities for agents who have the necessary qualifications. By completing life insurance courses, agents position themselves for career advancement, whether they are looking to join an established agency or build their own business.

Agents who specialize in life insurance also have the opportunity to diversify their skill set and tap into niche markets, such as estate planning, business succession, or supplemental retirement income strategies. The comprehensive education provided by life insurance courses ensures that agents can handle these more complex client needs. As a result, those who invest in their education find that they are better prepared for these opportunities, giving them a competitive edge in the industry.

Why Texas Insurance Training Academy:

Texas Insurance Training Academy offers life insurance courses that are designed to be both thorough and practical, providing aspiring agents with all the tools they need for success. Our courses are led by industry professionals with years of experience, offering insights that go beyond textbook knowledge. Whether you’re new to the industry or looking to expand your expertise, our curriculum is designed to ensure you’re fully prepared to serve clients in today’s ever-changing market.

At Texas Insurance Training Academy, we pride ourselves on our student success rates. Many of our students have gone on to build thriving careers, thanks in large part to the education and support they received during our courses. We offer both in-person and online learning options to accommodate all schedules, ensuring that everyone has the opportunity to succeed. Testimonials from former students highlight the confidence and knowledge they gained through our life insurance courses, which have helped them build lasting relationships with clients and advance their careers.

Conclusion:

Taking life insurance courses is essential for anyone looking to thrive in the insurance industry. By building a solid foundation of knowledge, agents can better serve their clients, stay compliant with regulatory standards, and capitalize on the growing demand for life insurance professionals. If you’re serious about your insurance career and want to equip yourself with the expertise needed to succeed, enrolling in life insurance courses is the first step.

Call to Action: To book an appointment or learn more, visit our website at Texas Insurance Training Academy.

Texas Insurance Training Academy 800 W Airport Fwy #610, Irving, TX 75062, United States.

0 notes

Text

Career Acceleration: How a Texas Insurance Course Can Open Doors for You

In the diverse and dynamic world of career opportunities, the insurance industry in Texas offers a wealth of prospects for those looking to advance their professional journey. Whether you’re a recent graduate, considering a career change, or aiming to boost your credentials, a Texas insurance course can be a powerful catalyst for career acceleration. Here’s how investing in this course can pave the way to success in the Lone Star State's thriving insurance market.

Understanding the Texas Insurance Landscape

The Robust Texas Insurance Market

Texas is home to one of the largest and most varied insurance markets in the U.S. The state’s expansive insurance sector covers everything from property and casualty to life and health insurance, presenting numerous opportunities for professionals to specialize and excel.

Economic Impact

The insurance industry significantly impacts Texas’s economy, contributing to job creation and financial stability. With the state's growth and urbanization, the demand for insurance products and services continues to rise, offering a promising environment for career development.

Regulatory Environment

Licensing Requirements

To enter the insurance field in Texas, obtaining the necessary licenses is crucial. The Texas Department of Insurance (TDI) regulates these requirements, ensuring professionals meet the standards needed to practice. A Texas insurance course prepares you by covering specific regulations and guidelines, setting you up for success in this regulatory framework.

The Importance of a Texas Insurance Course

Comprehensive Coverage of Licensing Material

Texas-Specific Content

Insurance principles are consistent nationwide, but each state has its unique regulations. A Texas insurance course provides in-depth knowledge of the state’s laws, market dynamics, and regulatory environment, ensuring you’re well-prepared to navigate Texas-specific challenges.

Exam Preparation

Passing the licensing exam requires thorough preparation. This course equips you with essential knowledge and skills, covering key topics such as insurance fundamentals, ethics, and state-specific regulations, thus enhancing your chances of exam success.

Skill Development for Success in the Field

Customer-Centric Approach

The insurance industry focuses heavily on customer service. A Texas insurance course teaches you to address the unique needs of Texas residents, helping you develop skills to provide exceptional service and build strong client relationships.

Sales and Marketing Strategies

Effective sales and marketing are critical in a competitive market. The course explores local demographics, cultural considerations, and digital marketing techniques, equipping you with strategies to stand out and attract clients.

Advantages of Holding a Texas Insurance License

Increased Career Opportunities

Industry Recognition

A Texas insurance license boosts your professional credibility and demonstrates your commitment to meeting state standards. This recognition opens doors to numerous career opportunities within Texas’s expansive insurance market.

Niche Specialization

Texas offers diverse insurance sectors, and a license allows you to specialize in areas such as auto, homeowners, or commercial insurance. Specialization enhances your expertise and makes you a valuable asset in your chosen field.

Flexibility and Entrepreneurial Opportunities

Independence

With a Texas insurance license, you can work independently as an agent or broker. This flexibility allows you to build your client base, set your own hours, and shape your career path.

Entrepreneurial Ventures

For the entrepreneurial-minded, a Texas insurance license provides the opportunity to start your own agency or brokerage. Texas’s vibrant business environment and diverse population create ample opportunities to establish a successful insurance business.

Navigating Career Paths in the Texas Insurance Industry

Entry-Level Opportunities

Insurance Agent

A Texas insurance license qualifies you for roles such as insurance agent, where you represent companies and assist clients in finding suitable coverage. This role serves as a foundation for gaining industry experience and building client relationships.

Customer Service Representative

Insurance companies in Texas often seek customer service representatives for handling inquiries, policy changes, and claims processing. A Texas insurance license enhances your qualifications by providing a deeper understanding of state-specific products and regulations.

Advancing Your Career

Broker

With experience, you can advance to a broker role, acting as an intermediary between clients and multiple insurance companies, offering a broader range of products and services.

Specialized Roles

Continued education and additional certifications can lead to specialized roles such as underwriter, risk analyst, or claims adjuster. These positions require advanced expertise and contribute to strategic functions within the industry.

Continuing Education and Professional Growth

Lifelong Learning

Staying Informed on Industry Changes

The insurance industry is continuously evolving. Ongoing education helps you stay updated on trends, technologies, and regulatory changes. Texas insurance courses often highlight the importance of lifelong learning and provide resources for staying current.

Pursuing Advanced Certifications

Beyond basic licensing, advanced certifications in areas like risk management or employee benefits can enhance your career prospects and open doors to higher-level positions.

Networking and Industry Involvement

Joining Professional Organizations

Networking is crucial for career advancement. Joining industry-specific organizations and attending events connects you with peers, keeps you updated on trends, and uncovers new growth opportunities.

Engaging in Continuous Professional Development

Participating in conferences, workshops, and seminars provides ongoing professional development, broadens your knowledge, and helps you connect with industry leaders.

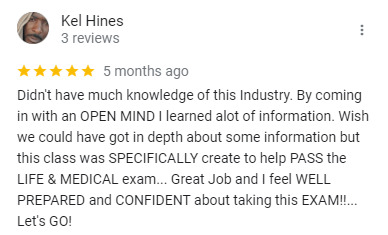

Customer Review

Conclusion

A Texas insurance course is more than just a step toward obtaining a license; it’s a gateway to a successful and fulfilling career in Texas’s vibrant insurance market. From comprehensive licensing material to essential skill development, these courses prepare you to navigate the complexities of the industry effectively.

Holding a Texas insurance license opens up a range of career opportunities, offers flexibility, and provides the potential for entrepreneurial ventures. By continuing to learn, seeking advanced certifications, and actively participating in the industry, you can ensure long-term success and growth in one of the nation’s most dynamic insurance markets.

Start your journey in the Texas insurance industry today, and let a Texas insurance course unlock doors to a world of career possibilities.

0 notes

Text

The Importance of Ethics and Professionalism in Insurance Adjuster Training

In the ever-evolving insurance industry, insurance adjusters play a critical role in assessing and settling claims. Their decisions impact both policyholders and the broader perception of the insurance industry. Ensuring that adjusters are trained with a strong emphasis on ethics and professionalism is essential for maintaining the integrity and effectiveness of the claims process. Here’s why these qualities are so crucial in insurance adjuster training:

1. The Evolution of Insurance Adjuster Training

Insurance adjuster training has come a long way, focusing not just on technical skills but also on the importance of ethical behavior and professionalism. As the industry adapts to new challenges, it's recognized that the ethical conduct of adjusters affects not only individual claims but the industry's reputation as a whole.

2. Core Components of Training

Technical Proficiency: Adjusters need a solid understanding of insurance policies, regulations, and assessment methods. However, this technical knowledge must be paired with a strong ethical foundation to ensure fair and accurate claim evaluations.

3. Ethical Decision-Making

A key aspect of adjuster training is ethical decision-making. Adjusters often face situations where they must balance competing interests. Training should include scenarios that teach transparency, honesty, and empathy, helping adjusters make decisions that uphold fairness and integrity.

4. Professional Conduct

Professionalism in insurance adjusting goes beyond expertise. It encompasses effective communication, respect for diversity, and a commitment to upholding the industry’s reputation. Training should stress the importance of confidentiality, avoiding conflicts of interest, and conducting oneself in a manner that fosters trust.

5. Impact of Ethical Behavior on Customer Trust

Ethical behavior is fundamental to building and maintaining trust with policyholders. When adjusters act with fairness and transparency, it enhances the insurer’s reputation and fosters long-term customer relationships. Conversely, unethical behavior can damage trust and lead to negative publicity and legal consequences.

Case Study: An adjuster who undervalues a claim to benefit the insurer's bottom line may gain short-term financial advantages but face long-term repercussions, including damaged reputation, loss of customer trust, and potential legal actions. Ethical practices, on the other hand, preserve the insurer's credibility and encourage positive customer feedback.

6. Legal and Regulatory Compliance

Ethics and professionalism are closely tied to legal compliance. Adjusters must navigate complex regulations that vary by jurisdiction. Training should ensure that adjusters understand these legal requirements and the consequences of non-compliance, aligning ethical conduct with legal obligations.

7. Role of Continuing Education

Given the dynamic nature of the insurance industry, ongoing education is crucial. Continuing education programs that include ethical training help adjusters stay current with industry trends and legal changes. Workshops, webinars, and case studies on real-world scenarios foster a culture of continuous improvement and ethical awareness.

Customer Review

Conclusion

The role of ethics and professionalism in insurance adjuster training is indispensable. Adjusters influence the customer experience and the industry’s reputation significantly. While technical skills are essential, ethical decision-making and professional conduct are equally important. By integrating these elements into training programs, insurers promote a culture of integrity and fairness, benefiting both individual adjusters and the industry as a whole. As the industry continues to evolve, a steadfast commitment to ethics and professionalism remains crucial for sustaining trust and confidence among policyholders.

0 notes

Text

Exam Tips & Strategies for Insurance Training Success

Embarking on a career in the insurance industry opens doors to growth and opportunity, but first, you must conquer your licensing exams. Whether you're gearing up for the Property and Casualty exam, Life and Health exam, or any other insurance certification, preparation is key. Here’s a complete guide to help you ace your insurance licensing exams with confidence and ease.

Understanding Insurance Training Exams

Before diving into your study plan, it's essential to grasp what your exam entails. Insurance licensing exams cover a wide array of topics such as insurance laws, regulations, policies, and practices. Be ready for questions on risk management, underwriting principles, and insurance ethics. Familiarize yourself with the test structure and content to set yourself up for success.

Tip 1: Know Your Exam Content

Start by reviewing the exam syllabus or outline provided by your training provider. Identify key topics and areas where you might need extra practice. Understanding the content thoroughly will help you focus your study efforts on the most crucial areas.

Tip 2: Develop a Study Plan

Create a structured study plan that breaks down the material into manageable sections. Set daily or weekly goals and stick to a schedule that includes time for review and practice exams. A well-organized plan will keep you on track and reduce last-minute cramming.

Tip 3: Utilize Multiple Resources

Don’t rely on just one study resource. Combine textbooks, online courses, practice exams, and study guides to reinforce your learning. Different resources offer various perspectives and can help clarify complex concepts in ways that suit your learning style.

Tip 4: Practice with Sample Exams

Sample exams are excellent tools for assessing your readiness. Look for practice questions that mirror the format and difficulty of the actual test. Time yourself while taking these practice exams to simulate test conditions and review your answers to pinpoint areas for improvement.

Tip 5: Understand Test-Taking Strategies

Effective test-taking strategies can enhance your performance. Manage your time wisely during the exam—don’t linger too long on challenging questions. Use the process of elimination to narrow down answer choices, and read each question and option carefully to avoid common pitfalls.

Tip 6: Stay Calm and Confident

Feeling nervous on exam day is normal, but try to stay calm and trust in your preparation. Get a good night’s sleep before the exam, arrive early, and take deep breaths to center yourself. Confidence in your preparation will help you approach each question with a positive mindset.

Tip 7: Review and Reflect

After the exam, take some time to reflect on your performance. Consider which questions were challenging and which areas you felt well-prepared in. This reflection will help you identify strengths and areas for improvement in your future study efforts.

Tip 8: Maintain Continuous Learning

Achieving your insurance license is just the beginning. To advance in your career, commit to lifelong learning. Stay updated on industry trends, regulations, and best practices through ongoing education, professional certifications, and networking. Continuous development will ensure you remain competitive and successful in the insurance field.

Customer Review

Conclusion

Success in your insurance licensing exams requires dedication and a strategic approach. By following these tips and strategies, you’ll be well-prepared to tackle your exams and excel in your insurance career. Stay focused, stay disciplined, and trust in your preparation. With the right mindset, you’re on your way to achieving your career goals in the dynamic world of insurance.

Good luck, and remember: Your hard work and preparation will pay off!

#Insurance exam tips#Insurance licensing preparation#Property and Casualty exam#Test-taking strategies

0 notes