Text

2023_05_18 the next month

There’s a lot going on between now and Friday June 16th. The following is NOT a comprehensive list of economic / trading events. I don’t guarantee the accuracy or importance of any of this info.

Friday 5/19/23

Options Expiration

NY Fed President Williams, Fed Governor Bowman, Fed Chairman Powell, and former Fed Chair Bernanke speak. (There’s more Fed speakers on Monday, but I think this is a big day, as opposed to Bullard, Barkin, and Bostic speaking on Monday 5/22.)

Wednesday, 5/24/23

FOMC minutes released

Thursday, 5/25/23

Real GDP

Friday 5/26/23

Consumer sentiment (final May)

Wednesday 5/31/23

JOLTS

Thursday 6/1/23

Productivity and costs 1Q rev

Manufacturing PMI

Monday 6/5/23

Services PMI (final May)

Durable goods (May)

Quarterly Financial Report (1Q23)

Thursday 6/8/23

Advance Economic Indicators

Friday 6/9/23

Quarterly Services Survey (1Q23)

Wednesday 6/14/23

FOMC policy decision

Friday 6/16/23

S&P Indexes Rebalance (S&P 500, 400, 600)

(last of 3 in June) Additions/Deletions for the Russell Indexes (6pm PT)

Triple Witch (expiration of equity and index options and index futures)

0 notes

Text

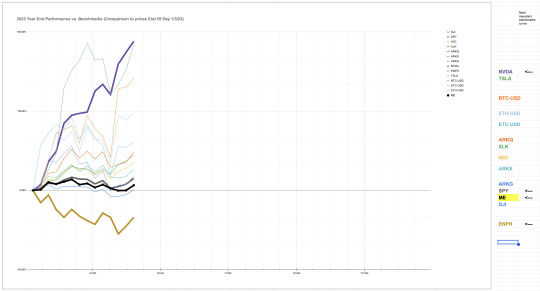

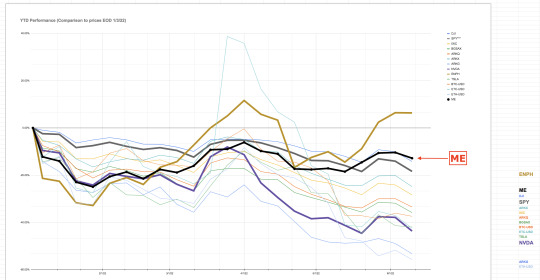

2023_03_31 - 1Q23 update

Bad News: All of my benchmarks are ahead of me except ENPH and the Dow.

Good News: I am YTD positive (though not by much), and I have been selling some gains to build my cash position.

Stats:

3/31/23 - My portfolio was up 3.23% from 1/3/23 closing prices. Of the 13 benchmarks against which I measure my performance (see graph, below), I am only beating ENPH (ENPH is -16.99% down for the year so far - understandable since it was so massively up last year), and ^DJI (up .42% up for the year so far). [NVDA, TSLA, BTC going crazy.]

3/31/23 - My portfolio is 60.2% cash (compared to 55.12% in cash on 1/3/23 close). [I am expecting massive dips. Let’s see if any of my low buys execute.]

3/31/23 - 49 live sell orders, 62 live buy orders, 39 holdings (long). No derivatives, no options.

0 notes

Text

2023_03_09

I don’t know if it will be up or down, but the market move will be very dramatic at some point between March 17 - March 22.

Between March 14 CPI numbers, March 15 PPI, March 17 Consumer Sentiment and Leading Indicators, March 20 QFR and then the FOMC meeting March 21-22, the market is either going to be utterly spooked or irrationally exuberant.

Either way, I think the effect will even out after a few days. Let’s see.

My limit orders are ready to go.

0 notes

Text

2023_02_04

Since the start of the year, I’ve been mostly trading down my cost bases and cleaning up weakness, because I expect a big dip (in the stocks I like) before the end of March. Low buys and buybacks are alredy live limit orders, and we’ll see if I can improve my standing among my benchmarks.

0 notes

Text

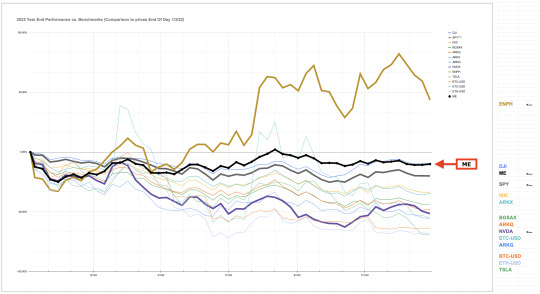

2023_01_03

Bad News: My portfolio did not end up positive for 2022.

Good News: I beat almost all of my benchmarks for the year, and I am comfortable with how I set myself up for the 2023 trading year, in terms of investments, existing live orders (I trade via limit orders), and dry powder.

Stats:

12/30/22 - My portfolio was down -10.05% from 1/3/22 closing prices. Of the 13 benchmarks against which I measure my performance (see graph, below), I beat all but two: ENPH (43.65% up for the year), and ^DJI (-9.4% down for the year).

12/30/22 - My portfolio is 54.6% cash (compared to 17.03% in cash on 1/3/22 close).

12/30/22 - 69 live sell orders, 44 live buy orders, 45 open positions (long). No derivatives, no options.

0 notes

Text

2022_06_13

I haven’t been updating since January, because I’ve been too busy changing my strategy and clawing back my losses. Also, I’ve been working on visualizing my results against a variety of benchmarks, and even though I’m down on the year, my strategy seems to be working, maybe?

I am now beating all my benchmarks (DJI, SPY, ARKX, IXIC, ARKQ, BGSAX, BTC-USD, ETC-USD, TSLA, NVDA, ARKG, ETH-USD), except ENPH (which is the only one of my benchmarks that is positive on the year.

Let’s see if I can go positive this year!

(all price data is taken on Friday’s market close of each week)

0 notes

Text

2022_01_19

NOTE: I am not a finance professional. I am not giving investment advice. I am an anonymous person stating my opinions online, i.e., you shouldn’t trust me. There are no guarantees that my numbers are correct, or that my thinking is sound.

I’m a bargain hunter, limit orders only, no stops.

I could be totally wrong about this (ALWAYS DO YOUR OWN RESEARCH, AND CONSULT AN ACCREDITED PROFESSIONAL), but I think 401k and IRA money will start to flow into the market in Feb and maybe March, and there are some real bargains now:

ENPH < 130

APPS < 44

TAN < 69

XBI < 95

SQ < 121

RDW < 6

Currently holding: ACIU, ACTG, ADSK, AFMD, APPS, ARKQ, ARKX, ARRY, ARWR, AVIR, AWK, CDTX, CGW, DNLI, EA, ENPH, ENVX, FLEX, INSG, LGO, LITE, LUNA, MAXN, MKSI, NBIX, NBSE, NOK, PDOTU, QS, QUIK, RDW, SLDP, SPCE, SQ, TAN, XBI

0 notes

Text

2021_08_13

NOTE: I am not a finance professional. I am not giving investment advice. I am an anonymous person stating my opinions online, i.e., you shouldn’t trust me. There are no guarantees that my numbers are correct, or that my thinking is sound.

I’m a bargain hunter, limit orders only, no stops.

ETFs

TAN - Like it under 81, love it under 76.

XBI - Like it under 110.

XLRE - Like it under 30, but I bet it’s not going there again.

Stocks Don’t buy stocks unless you look forward to their earnings calls, and are genuinely excited by the company’s business model, management, and news. These are stocks I generally like a lot.

ENPH - Like it under 156. Love it for long-term hold.

ARWR - Like it under 60, and feel like some overdue catalysts might infuse some energy

AFMD - Like it under 6.

FLEX - Like it under 16. I really like how Revathi Advaithi runs the company.

LUNA - Like it under 10, love it under 7. Very intrigued by products and research.

QCOM - Like it under 122. Would love to pick it up there.

NVDA - Like it under 165.

MAXN - Like it under 12.

ENVX - like it under 12. Love it for long-term hold.

LICY - like it under 6. Love it for long-term hold, and the sustainable business it is in.

NOK - like it under 5. Love it for long-term hold - Pekka knows what he’s doing.

Holding ACTG, AFMD, APPS, ARKQ, ARKX, ARRY, ARWR, AVIR, AWK, CGW, DNLI, EA, EMN, ENPH, ENVX, FLEX, INSG, LGO, LIT, LITE, LUNA, MAXN, MKSI, NBIX, NBSE, NOK, PDOTU, QCOM, QS, QUIK, SPCE, TAN, XBI.

0 notes

Text

2021 February 22

NOTE: I am not a finance professional. I am not giving investment advice. I am an anonymous person stating my opinions online, i.e., you shouldn’t trust me. There are no guarantees that my numbers are correct, or that my thinking is sound.

Patience I have been waiting for some stocks that I like to drop around 20% or more off their 52 week highs. This week, many have. Some examples:

ENPH - 52 week high is $229.04 - 20% down is $183.23. It is well below that right now.

MAXN - 52 week high is $57.97 - 20% down is $46.38. It is well below that right now.

TAN (Solar ETF) - 52 week high is $125.98 - 20% down is $100.78. It is getting close to that now.

SPCE - 52 week high is $62.80 - 20% down is $50.24. It is well below that right now.

AFMD - 52 week high is $7.48 - 20% down is $5.98. It is below that right now.

INSG - 52 week high is $21.93 - 20% down is $17.54. It is well below that right now.

LITE - 52 week high is $112.08 - 20% down is $89.66. It went to that level today already.

0 notes

Text

2020 December 28

Hope all of your buy orders are in, because there might be some flash sales in a lot of sectors over the next few weeks. Know what you want, and at what price you want it.

0 notes

Text

2020 December 08

NOTE: I am not a finance professional. I am not giving investment advice. I am an anonymous person stating my opinions online, i.e., you shouldn’t trust me.

Money in the market moves from the impatient to the patient A lot of stuff is overvalued, and there’s been a lot of volatility. My current buy orders are priced between

20% below recent highs and March 2020 lows

ETFs

TAN - Like it under 75 and think there's a chance it might "flash crash" into the 60s - unlikely, but possible.

XBI - Like it under 110.

SMH - Like it under 150.

XLRE - Like it under 30.

ARK ETFs - Like them at least 15% down from where they are now, and like ARKQ the most.

Stocks Don’t buy stocks unless you look forward to their earnings calls, and are genuinely excited by the company’s business model, management, and news.

ENPH - Like it under 110, like it a lot under 80. Nuts about it in the 40s, 50s and 60s.

LITE - Like it under 81.

ARWR - Like it under 60, love it under 40.

AFMD - Like it under 4. Under 3 is scary.

FLEX - Like it under 15.

LUNA - Like it under 7.

QCOM - Like it under 120. Love it under 80.

NVDA - Intrigued under 500, like it under 450, love it under 300.

Holding MAXN, APPS, INSG, ARWR, XBI, QUIK, AFMD, SPCE, EA, NOK, ENPH, TAN, LUNA, FLEX, NBIX, LITE, ACTG, ARRY, CGW.

0 notes