Don't wanna be here? Send us removal request.

Text

in Dominica, the great slippage of golden pports

The small town of Atherton, in San Francisco Bay (California), is popular with renowned athletes, successful Silicon Valley billionaires and prominent politicians. It is more surprising that in 2013, Danhong “Jean” Chen had the means to afford a dream villa with her husband for nearly $6 million (5.7 million euros), given her income as an immigration lawyer.

The little local mystery was finally dispelled following a long investigation by the SEC, the American financial markets watchdog, which unraveled the gigantic scam set up by the couple to am at least $12 million by embezzling money from foreign investors seeking to obtain a residence permit in the United States, for almost a decade.

The day after his indictment, October 18, 2018, Mr.me Chen managed to leave the United States thanks to an umed name, Maria Sofia Taylor, written on her Dominican pport. The lawyer, however, has no ties with Dominica, a little Caribbean confetti stuck between Guadeloupe and Martinique: to escape American justice, she secretly bought this second citizenship a few weeks earlier, as part of a pport of convenience program implemented by the island. And it is far from being an isolated case.

Thousands of people have acquired Dominican nationality in this way by taking advantage of the program “citizenship by investment” (CBI, “citizenship through investment”). This system, set up by the government in 1993, allows any foreign national to acquire a pport in less than three months, on the sole condition of paying $100,000 or investing double that amount in the economy. local, without even having to set foot on the island.

For the first time, a joint investigation by World, the Organized Crime and Corruption Reporting Project (OCCRP) consortium, the American NGO Government Accountability Project and a dozen partner media shed light on the abuses of this pport of convenience program. For more than a year, journalists pored over a list of 7,700 recent holders of Dominican pports, compiled from public sources and court documents.

Circumvention of sanctions to broadcast La Liga

Among these thousands of new Dominicans – often entire families coming mainly from China, Russia and Middle Eastern countries – we find a litany of criminals and crooks of all kinds: Taiwanese fraudsters, Azeri oligarchs, a former Afghan minister accused of war crimes and torture, a senior officer in Gaddafi’s Libya, former spies, financial fraudsters and even Russian billionaires under sanctions and arms dealers. The list also contains many senior public officials: two central bank governors and a former head of Saddam Hussein’s nuclear program alongside Samir Rifaï, the former Jordanian prime minister (2009-2011), who had nevertheless declared a few years ago years he didn’t love “not, from a personal point of view and in general, that a Jordanian has another nationality”.

0 notes

Text

KPK Eksekusi Mardani Maming ke Lapas Sukamiskin Bandung

Jaksa Eksekutor Komisi Pemberantasan Korupsi (KPK) mengeksekusi terpidana Mardani Maming ke Lapas Sukamiskin Bandung, Jawa Barat. Mantan Bupati Tanah Bumbu, Kalimantan Selatan itu dijebloskan ke penjara selama 12 tahun atas kasus suap izin usaha pertambangan (IUP).

"Jaksa Eksekutor KPK, telah selesai melaksanakan eksekusi pidana badan dengan terpidana Mardani H Maming dengan cara memasukkan yang bersangkutan ke Lapas Sukamiskin, Bandung," kata Kepala Bagian Pemberitaan KPK, Ali Fikri dalam keterangan tertulisnya, Senin (4/9/2023).

Selain pidana penjara, Maming juga diwajibkan membayar denda sebesar Rp 500 juta. Kemudian, membayar uang pengganti sebesar Rp 110, 6 miliar. "Eksekusi tersebut sebagaimana amar putusan Mahkamah Agung," ungkap Ali.

Sebelumnya, Mahkamah Agung (MA) menolak kasasi yang diajukan Mardani maming atas kasus suap izin usaha pertambangan. Hal ini diketahui dari putusan kasasi yang diajukan Mardani Maming dengan nomor perkara 3741/K/Pid.Sus/2023. Putusan kasasi yang diajukan Mardani H Maming tertanggal 1 Agustus 2023.

Maming mengajukan kasasi itu setelah divonis hukuman penjara 12 tahun dengan denda Rp 500 juta dan uang pengganti sebesar Rp 110,6 miliar oleh Pengadilan Tinggi Banjarmasin.

"Tolak perbaikan uang pengganti menjadi Rp 110.604.371.752, subsidair 4 tahun penjara,” bunyi putusan kasasi Mardani H Maming seperti dikutip, Rabu (2/8/2023).

Pengadilan Tinggi (PT) Banjarmasin memperberat hukuman Mardani Maming menjadi 12 tahun penjara dalam kasus dugaan korupsi izin usaha pertambangan dan operasi produksi (IUP OP) di Tanah Bumbu.

PT Banjarmasin menolak banding yang diajukan Mardani dengan pertimbangan perbuatan korupsinya mempengaruhi iklim investasi yang ada di Kabupaten Tanah Bumbu dan juga telah menimbulkan suasana tidak kondusif.

0 notes

Text

Preston counterfeit boss found guilty in one of UK's biggest tax fraud case

The mastermind of a fake designer clothing scam has been convicted of one of the UK’s largest ever carousel tax frauds.

Sock manufacturer Arif Patel, 55, of Preston, and his criminal gang tried to steal £97 million through VAT repayment claims on false exports of textiles and mobile phones.

They also imported and sold counterfeit clothes that would have been worth at least £50 million, had they been genuine. The proceeds were used to buy property across Preston and London through offshore bank accounts.

Following a joint investigation between HM Revenue and Customs (HMRC) and Lancashire Police, Patel was yesterday (April 11) found guilty of false accounting, conspiracy to cheat the public revenue, the onward sale of counterfeit clothing and money laundering.

Co-accused Mohamed Jaffar Ali, 58, of Dubai, was also found guilty of conspiracy to cheat the revenue and money laundering yesterday.

The convictions follow a 14-week trial at Chester Crown Court.

Reporting restrictions have now been lifted and it can be revealed for the first time that 24 members of the criminal empire were convicted in five trials between 2011 and 2014 and jailed for a total of more than 116 years.

HMRC has also restrained more than £78 million of the gang’s UK assets and proceedings are now underway to recover these funds for the public purse.

Richard Las, Director, Fraud Investigation Service, HMRC, said: “These guilty verdicts close a significant chapter in one of the biggest tax fraud cases ever investigated by HMRC.

“For more than a decade HMRC and our partners have worked tirelessly and together to bring this gang to justice.

“Arif Patel lived a lavish lifestyle at the expense of the law-abiding majority. Tax crime is not victimless and fraudsters like this pair steal the money that funds the NHS and other vital public services we all rely on.

“Our work doesn’t stop here. We have more than £78 million of the gang’s UK assets restrained and have begun the process to recover all those proceeds of crime.”

Sam Mackenzie, Assistant Chief Constable, Lancashire Constabulary, said: “While presenting himself as a genuine and reputable businessman Arif Patel in fact used stolen taxpayers’ cash to line his own pockets and fund a lavish lifestyle.

“This is money that should have been used to fund the vital public services which we all rely on and to which most of us contribute our fair share by working hard and paying tax.

“I welcome these guilty verdicts which are the culmination of a lengthy and complex investigation which has involved many years of hard work and dedication by police officers and staff and partners from HMRC who have worked together in a truly joint operation.”

Patel was convicted in his absence, having remained in Dubai throughout the trial.

The CPS will now pursue confiscation proceedings against the defendants, to prevent them enjoying the benefits of their criminal enterprise.

Patel’s Preston-based company, Faisaltex Ltd, was the heart of his criminal empire. From here, he ran the counterfeit clothing import operation and false export business.

As well as being a major player in the overall criminal conspiracy, Jaffar Ali also laundered the proceeds through bank accounts he set up in Dubai and offshore.

Patel and the Faisaltex group of companies had turned to bulk imports of counterfeit clothing in 2004. During the next three years dozens of containers with fake designer clothing inside were stopped at ports across the UK, including Liverpool, Southampton and Felixstowe.

Onward distribution to UK traders was confirmed when a delivery to a Glasgow wholesaler was intercepted by police and revealed to be poorly made designer rip-offs.

He also used the business, from 2004, to make fraudulent VAT repayment claims on supposed high-value goods and yarns. In total, the gang fraudulently claimed £97 million on false exports of textiles and mobile phones, but HMRC stopped £64 million of the claims.

The scam is known as a carousel fraud, where goods are purportedly sold to genuine buyers, but in fact the whole process is controlled by the criminal, who instigates a paper trail of alleged sales and exports in order to reclaim VAT.

Patel frequently travelled to Dubai to meet Jaffar Ali and also made trips to China and Turkey to set up deals with manufacturers of counterfeit clothing. The profits were laundered by Jaffar Ali through freezone companies and bank accounts held in the UAE.

Money was sent to British Virgin Island-registered companies, which Patel then used to buy property in his hometown of Preston, including commercial properties on Fishergate, the city’s main shopping street.

Patel’s criminal enterprise relied on dozens of lieutenants around the UK, including professional enablers. This involved two chartered accountants from a Preston-based practice: Anil Hindocha, 69, from Preston, and Yogesh Patel, 66, from Aylesbury.

Hindocha was jailed for 12 years and 10 months in 2014 after being found guilty of false accounting, conspiracy to cheat the public Revenue and money laundering.

Yogesh Patel was jailed for five years and seven months after being found guilty of conspiracy to cheat the public revenue and money laundering.

Patel travelled to Dubai in July 2011 and failed to return. He was tried in his absence at Chester Crown Court where he was found guilty of all charges yesterday, April 11. He will be sentenced next month.

Jaffar Ali was also found guilty of conspiracy to cheat the public revenue and money laundering. After attending the majority of the trial, he failed to attend court on March 27 and a warrant was issued for his arrest. He will also be sentenced next month.

Arif Patel’s brothers Munaf Umarji Patel and Faisal Patel are on Lancashire Police’s wanted list.

0 notes

Text

You may not know Amit Raіzada’s name, but some of KC’s wealthy won’t soon forget it

On December 26, 2012, Amit Raizada drove his wife, Amanda Raizada, to the office of his estate-planning attorneys. Amanda was presented with several large binders filled with documents and instructed to sign where indicated.

“Amit told me that I needed to sign the documents and to trust him because everything he did was for the good of the family,” Amanda later stated in a sworn affidavit.

Amit Raizada was, and still is, CEO of Spectrum Business Ventures, a private investment firm that was headquartered then on Kansas City’s Country Club Plaza. Personal financial statements at the time valued the couple’s estate at $90 million.

Seven days earlier, Amanda Raizada had signed an amended postnuptial agreement. Amit Raizada and his attorney Pete Smith, of McDowell Rice Smith & Buchanan, have since argued in court that Amanda voluntarily signed the postnuptial agreement; Smith has supplied evidence of a monthlong correspondence between him and Sheldon Bernstein, who served as Amanda Raizada’s legal counsel for the postnup, prior to her signing the agreement.

But Amanda Raizada alleges — and e-mails introduced into the couple’s divorce proceedings confirm — that Smith chose Bernstein to serve as Amanda’s counsel. Smith wrote to Amit on November 5, 2012: “Attached is Sheldon Bernstein’s business card. Amanda needs to contact him. He has the agreement and all the documents. I met with him to provide the background.” Four minutes later, Amit forwarded Smith’s e-mail to Amanda and wrote, “Please call the guy and set up the next available appointment.”

Could Bernstein serve as an independent and disinterested legal counsel for Amanda Raizada, given that opposing counsel Smith handpicked him and met with him prior to Amanda’s even knowing his name? That question is at issue in the couple’s ongoing divorce proceedings, due to what Amanda discovered a year later, after she and Amit separated. (Bernstein declined to comment for this story.)

By signing the postnup, Amanda had cleared the way for a reshuffling of the Raizadas’ estate plans — plans that, upon execution, resulted in the transfer of 70 percent of the assets on her side of the couple’s financial statement into irrevocable trusts for their children and Amit Raizada–owned entities.

Amit Raizada moved to Miami last year, following a decade spent building his fortune in the Kansas City area. He did not respond to requests for comment for this article.

Born in India in 1976, Raizada was brought to the United States when he was about 18 months old. He attended high school in Farmington Hills, Michigan, and college at Michigan State University and Cornell University, according to a 2004 deposition. After college, Raizada moved to Florida and met Amanda; the two took up residence in Michigan, where she finished her degree at Michigan State, and he opened three Nextel wireless retail locations in Grand Rapids. In 2000, Raizada sold the Nextel stores, and the couple resettled in Olathe. Amanda is from the area and graduated from Olathe North High School.

Raizada’s first Kansas City–area business venture was Cellular 4 Less, a chain of authorized Cingular Wireless retail outlets with locations in St. Joseph, Lawrence, Mission, Shawnee, Lenexa and Bonner Springs. Cellular 4 Less also operated kiosks inside local Wal-Marts.

On July 8, 2002, Raizada stopped in at a US Bank in Olathe to make a deposit for Cellular 4 Less. While waiting for one teller to process his deposits, he handed another teller roughly $2,000 in cash and asked her to change it into higher bills. The teller asked for Raizada’s ID and Social Security number. At that point, a dispute broke out. Several bank employees swore under oath that Raizada called the tellers “fucking whores” and “fucking bitches.” He also allegedly spit on the bank supervisor and punched her in the chest. Raizada stated in a subsequent deposition that he felt he was being discriminated against by the US Bank employees because of his race. He later sued US Bank and settled out of court.

Raizada was arrested and charged with two counts of battery and one count of disorderly conduct. He later agreed to a 12-month diversion program and undertook an anger-management class. Raizada also paid a settlement to one of the tellers after she filed a civil suit against him.

Representing Raizada in these legal actions was Phillip “Chuck” Rouse, of the law firm Douthit Frets Rouse Gentile & Rhodes. During this period, Raizada moved his office into the same building as Rouse’s firm: 903 East 104th Street, near Holmes Road and Interstate 435. According to Kansas business filings, Rouse and the other partners in the firm still retain ownership interests in some of Raizada’s businesses. The firm, which now has its office in Leawood’s Park Place district, declined to comment for this story.

0 notes

Text

Anger Over ‘Shambolic’ Phone App Shares Sale

Britain’s financial regulator faces criticism this weekend over the “shambolic” listing on the London Stock Exchange of a healthcare company facing allegations that some of its shares were traded fraudulently.

The Financial Conduct Authority (FCA) approved Umuthi Healthcare Solutions for admission to the London Stock Exchange (LSE) in March. The company has developed a smartphone app to help medicines reach doctors in remote rural areas.

Trading is now suspended in the firm. Police in South Africa are investigating claims that millions of nonexistent shares were sold to investors for about £2.45m before the flotation.

Anthony Morris, of the Umuthi major shareholder group, said: “This listing has been a complete shambles and should never have been allowed. There has been an abject failure by the Financial Conduct Authority.”

The firm denies any wrongdoing. It said the claims concerned share sales prior to its public listing between private individuals that “do not involve the company or its directors”.

The LSE’s main market has about 1,300 companies from more than 70 countries. Listing is described as a “badge of quality”.

The FCA, which reviews company prospectuses before admission to the LSE, has faced criticism of its performance and effectiveness over the last year after a string of financial scandals. Campaigners described the disclosure earlier this month by the Observer that the regulator has paid staff more than £125m in bonuses since 2016 as an “absolute insult”.

Umuthi has operations in South Africa, but wants to expand to other African countries and Europe.

The South African Police Service said last week that the company’s chief executive, Gert Viljoen, and a female consultant, Connie van Nieuwkerk, were arrested over fraud allegations earlier this month.

A police spokesman said: “It is alleged that the CEO with another executive persuaded the shareholders to buy shares that did not exist. Thirty shareholders lost R50m [£2.45m] due to misrepresentation. The investigation is continuing.”

Investors claim the FCA missed a series of red flags that should have blocked the listing. Van Nieuwkerk was fined by financial watchdogs last year in South Africa for the publication of financial statements that were false or misleading.

One of Umuthi’s non-executive directors, Colin Bloom, a prominent Conservative party supporter and a government adviser on faith, said he had resigned from the company last month. He said he had no knowledge of any suspicious activity and has asked the Serious Fraud Office to investigate.

Umuthi has developed a smartphone app that allows doctors and pharmacies in remote areas to directly order drugs from healthcare suppliers. It was listed on the LSE on 4 March, but trading is now suspended.

Umuthi said in a trading update on Thursday: “Mr Viljoen has been released on bail. The allegations appear to relate to over-the-counter sale of Umuthi shares, transactions over which the company and Mr Viljoen had no control or involvement.

“In addition, a consultant to the company, Connie van Nieuwkerk, was arrested as part of the same allegation.

“Ms van Nieuwkerk had no operational role at the company.

“As a result of the arrest, the company has terminated forthwith the consultancy agreement with Ms van Nieuwkerk.”

Viljoen has denied any wrongdoing and says the listing went through “rigorous verification processes”. Van Nieuwkerk did not respond to a request for comment.

An FCA spokesperson said: “We are aware of the issues raised here and are liaising with the relevant authorities in South Africa. As issues relating to the company emerged, we immediately suspended the listing to protect investors, and at the current time it remains suspended.”

This footnote was added on 8 November 2022: The FCA recorded that in October 2021, a director of the Company (“the Director”) was arrested and charged by South African police on suspicion of fraud. The charges against him were dropped in December 2021.

0 notes

Text

Cựu Giám đốc Bệnh viện Bạch Mai bắt tay thổi giá thiết bị y tế như thế nào?

Viện Kiểm sát nhân dân tối cao vừa hoàn tất bản cáo trạng và truy tố 8 bị can về tội "Lợi dụng chức vụ quyền hạn trong khi thi hành công vụ" xảy ra tại Bệnh viện Bạch Mai và một số đơn vị liên quan.

Các bị can gồm Nguyễn Quốc Anh - nguyên Giám đốc Bệnh viện Bạch Mai; Nguyễn Ngọc Hiền - nguyên Phó Giám đốc Bệnh viện Bạch Mai; Trịnh Thị Thuận, Lý Thị Ngọc Thủy - nguyên Trưởng phòng và Phó phòng Tài chính Bệnh viện Bạch Mai; Phạm Đức Tuấn - Chủ tịch kiêm Giám đốc Cty Công nghệ Y tế BMS; Ngô Thị Thu Huyền - Phó Giám đốc Công ty BMS; Trần Lê Hoàng - thẩm định viên Công ty Thẩm định giá và Dịch vụ tài chính Hà Nội (VFS); Phạm Minh Dung - nguyên Tổng giám đốc Công ty VFS.

Theo cáo trạng, xuất phát từ việc biết Bệnh viện Bạch Mai có chủ trương phát triển ngoại khoa nên khoảng tháng 5/2016, Phạm Đức Tuấn đến gặp Nguyễn Quốc Anh để bàn việc hợp tác cung cấp các hệ thống robot hỗ trợ phẫu thuật cho bệnh viện.

Phạm Đức Tuấn giới thiệu về Công ty BMS là đơn vị phân phối hệ thống Robot Rosa hỗ trợ phẫu thuật thần kinh sọ não và Robot Mako hỗ trợ phẫu thuật khớp gối và đề nghị được cung cấp, bán hai hệ thống này với giá 39 tỷ đồng Robot Rosa và 44 tỷ đồng Robot Mako cho Bệnh viện Bạch Mai.

Tuy nhiên, Nguyễn Quốc Anh không đồng ý cho Bệnh viện Bạch Mai mua với lý do bệnh viện không có vốn đầu tư, thủ tục đề xuất Bộ Y tế phê duyệt phức tạp, cần phải tổ chức đấu thầu; ngoài ra, do đây là các phương pháp, kỹ thuật điều trị mới, chưa đánh giá được hiệu quả, có bệnh nhân điều trị hay không, nên Nguyễn Quốc Anh đề nghị Phạm Đức Tuấn làm đề án liên danh, liên kết để đặt máy tại Bệnh viện Bạch Mai, thủ tục và thẩm quyền sẽ do Bệnh viện Bạch Mai quyết định, còn giá máy chỉ cần có Chứng thư thẩm định giá và Công ty BMS chịu trách nhiệm liên hệ đơn vị thẩm định giá.

Sau khi trao đổi, Nguyễn Quốc Anh và Phạm Đức Tuấn đã đi đến thống nhất Công ty BMS không bán các hệ thống robot cho Bệnh viện Bạch Mai mà tham gia liên doanh, liên kết lắp đặt các hệ thống robot hỗ trợ phẫu thuật tại Bệnh viện Bạch Mai, với giá thiết bị do Tuấn đưa ra.

Bị can Quốc Anh đã đồng ý việc này dù không thông qua Đảng ủy, Ban Giám đốc và Công đoàn bệnh viện. Bị can này còn chỉ đạo Phó Giám đốc Nguyễn Ngọc Hiền cùng Phòng Tài chính kế toán Bệnh viện Bạch Mai hoàn thiện các thủ tục để liên doanh với Cty BMS.

Tháng 1/2017, các bên ký Đề án xã hội hóa, trang bị 2 loại robot phẫu thuật nói trên trong đó, Robot Rosa được xác định có giá 39 tỷ đồng. Trong số tiền này, BMS nhận chi phí khấu hao máy là hơn 23 triệu đồng và chi phí lãi vay hơn 4,1 triệu đồng dù doanh nghiệp này không vay tiền để mua máy móc.

Ngày 23/2/2017, Công ty BMS mới nhập khẩu Robot Rosa từ Pháp về sân bay Nội Bài; hàng mới 100% và nguyên giá là hơn 7,4 tỷ đồng (đã bao gồm 5% thuế nhập khẩu). Từ thời điểm này đến tháng 5/2020, Bệnh viện Bạch Mai đã sử dụng robot này thực hiện phẫu thuật sọ não cho 639 ca bệnh, thu hơn 22,9 tỷ đồng. Bệnh viện Bạch Mai đã thanh toán chi phí liên quan cho Công ty BMS liên quan 551 ca bệnh.

Theo kết luận giám định, tiền phẫu thuật bằng Robot Rosa là hơn 6,6 triệu đồng/ca nhưng Bệnh viện Bạch Mai và Công ty BMS thu hơn 23 triệu đồng/ca; hưởng chênh lệch hơn 16,5 triệu đồng/ca.

Đến nay, Bệnh viện Bạch Mai mới liên hệ, trả số tiền chênh lệnh nói trên cho 86 người bệnh. Bị can Phạm Đức Tuấn đã nộp 10 tỷ đồng để trả tiền chênh lệch 16,5 triệu đồng cho 551 ca thu sai.

Với hệ thống Robot Mako, điều tra xác định do đơn vị phân phối rút khỏi thị trường Việt Nam, không hỗ trợ phần mềm nên Công ty BMS đang bị lỗ. Do đó, cảnh sát không xem xét dấu hiệu vi phạm liên quan loại robot này.

Quá trình điều tra, cảnh sát còn xác định bị can Phạm Đức Tuấn đã nhiều lần "biếu" tiền, USD trị giá hơn 300 triệu đồng cho Giám đốc Bạch Mai Nguyễn Quốc Anh và 150 triệu đồng cho Phó Giám đốc Nguyễn Ngọc Hiền. Sau đó, hai bị can đã nộp lại số tiền này cho cơ quan điều tra.

0 notes

Text

Les presumptes estafes amb criptomonedes inunden l’Audiència Nacional

Les presumptes estafes amb criptomonedes com bitcoin o ethereum, han irromput amb força en els tribunals espanyols, on s’acumulen denúncies i querelles de milers d’afectats que han vist evaporar-se centenars de milions d’euros mitjançant esquemes piramidals. Les criptomonedes o criptodivises són monedes virtuals que es basen en codis encriptats de seguretat per certificar transaccions electròniques de compra i venda de béns i serveis, i d’aquestes ja existeixen prop de 5.000, tot i que només 40 d’elles presenten liquiditat dins del mercat. El setembre del 2020, la capitalització total d’aquest mercat era de 336.000 milions de dòlars.

De moment, a Espanya el presumpte frau més greu per volum defraudat és el d’Algorithms Group, empresa d’inversió en bitcoin establerta a Londres que podria haver defraudat més de 280 milions d’euros a prop de 3.000 inversors i que ja investiga l’Audiència Nacional. La querella, presentada per Zaballos Abogados, enumera una sèrie de presumptes delictes com estafa, intrusisme, blanqueig de capitals, delictes societaris, apropiació indeguda i associació il·lícita, i s’adreça contra Javier Biosca –en recerca i captura des del 10 de maig passat–, la seva dona Paloma Gallardo, i el seu fill Javier.

L’advocada Emilia Zaballos, presidenta de l’Associació d’Afectats per Inversions en Bitcoins, advoca per la creació de tribunals especialitzats en aquestes operatives i lamenta la desídia que, segons el seu parer, han mostrat tant la Comissió Nacional del Mercat de Valors (CNMV) com el Banc d’Espanya, que adverteixen sobre aquests xiringuitos financers, però no els impedeixen operar.

Estafa piramidal

Per sota del volum presumptament defraudat per Algorithms figura Nimbus, que segons un informe forense de la Guàrdia Civil hauria estafat prop de 136 milions d’euros. S’ha presentat una denúncia en un jutjat de Huelva del despatx Aranguez Abogados i l’Audiència Nacional s’ha de pronunciar sobre la seva competència, després que el jutjat s’inhibís. El cervell de la trama és A. Z., que entre el 2009 i el 2016 va ser responsable de l’àrea de riscos de l’Orient Mitjà del Banc Mundial. El 2020 va crear Nimbus a Malta, i l’octubre d’aquell any la societat ja va deixar de fer front als compromisos amb els seus inversors, al voltant de 4.000.

Segons consta a la denúncia, Nimbus seguia un esquema d’estafa piramidal o de Ponzi, mitjançant el qual en comptes de comprar i vendre criptoactius, en realitat no va desenvolupar cap tipus d’activitat financera, sinó que es va limitar a abonar els interessos dels primers inversors amb el capital ofert pels següents. El funcionament de Nimbus, que garantia retorns d’entre el 7% i el 15% mensuals, podria ser constitutiu dels delictes d’estafa, blanqueig de capitals i organització criminal.

Blanqueig i organització criminal

Un altre dels casos que ja investiga l’Audiència Nacional és el d’Arbistar 2.0, el perjudici econòmic del qual supera actualment els 41 milions d’euros però que podria ascendir fins als 100 milions. El titular del Jutjat Central d’Instrucció número 4, José Luis Calama, va acceptar la inhibició d’un jutjat de Tenerife a l’entendre que els investigats, dirigits per Santiago Fuentes Jover, podrien haver incorregut en presumpta estafa agreujada, organització criminal i un delicte continuat de falsificació en document mercantil.

Arbistar hauria ordit presumptament una trama defraudatoria prometent als inversors rendibilitats d’entre el 8% i el 15% mensual, pagant-los setmanalment –sempre els dissabtes– i donant-los l’opció de sumar-ho a les quantitats inicials invertides o bé optar pel reembors. Igual que en el cas de Nimbus, el que presumptament va passar va ser que van utilitzar una part dels diners obtinguts dels inversors per entregar-los a altres anteriors en paga dels alts interessos convinguts, assenyala el jutge.

0 notes

Text

Three in court charged over €6m 'ghost broker' fraud

Two businessmen and an art teacher have appeared in court charged in connection with €6 million "ghost broker" motor insurance policy fraud.

Forty-five-year-old Alexander Afanaschenko of Bewley Drive in Lucan, 38-year-old Mikhail Yegorov from Charnwood Court in Clonsilla, and 44-year-old Elena Olenik from Berryfield, Finnstown in Lucan, Dublin, were brought before Blanchardstown District Court today.

The charges follow an investigation by the Garda Special Investigations Unit in Roads Policing Division based at Dublin Castle.

The court was told that more than 2,500 motor insurance policies, valued at €6 million were identified as having been fraudulently obtained from ten insurance companies.

Garda George Thurlow told the court it was alleged Mr Afanaschenko was a director of a named company which operated as a "ghost broker" from January 2013 until September 2018.

He faces 210 charges: 91 counts of money laundering, 76 deception charges, one count of fraudulent trading contrary to the Companies Act, as well as being accused of using false documentation.

Fraudulent documents were allegedly used get policies with beneficial premiums.

Originally from Russia, Mr Afanaschenko has lived in Ireland for 18 years and was the holder of Irish, Moldovan and Russian passports. There was no objection to bail with conditions.

The court was told that Mikhail Yegorov is from Ukraine, but identifies as Irish and has lived in Ireland since 2014.

Garda Sergeant John Carey said Mr Yegorov is accused of 21 money laundering offences by possessing the proceeds of criminal conduct, and one charge of fraudulent trading of a ghost broker venture.

It is alleged he worked with Mr Afanaschenko and that he and his co-accused were paid to use false information, including fake licences and no claims bonus certificates, to get genuine insurance policies with reduced premiums.

The court heard €180,000 allegedly went through one bank account over two years.

The two businessmen had bail set with €5,000 lodgements, and their legal aid applications were deferred.

The judge ordered them to sign on regularly at their local Garda stations, to surrender travel documentation, alert gardaí if they will be away from their homes for more than 24 hours, not to leave the jurisdiction, and have no contact with injured parties.

The third accused, self-employed art teacher Elena Olenik who is originally from Latvia, faces 15 money laundering charges and 20 counts of forgery of documents, Garda Thurlow told the court.

Her solicitor Wayne Kenny said she is currently on the Pandemic Unemployment Payment and she was granted legal aid.

The court was told the Director of Public Prosecutions directed trial on indictment in the Circuit Court.

All three have been remanded on bail to appear again at Blanchardstown District Court in July for service of the book of evidence and to be returned for trial.

0 notes

Text

Điều ít biết về ông chủ vụ 'thổi giá' thiết bị ở Bệnh viện Bạch Mai

Mới đây, Cơ quan Cảnh sát điều tra (C03) Bộ Công an khởi tố vụ án Lừa đảo chiếm đoạt tài sản xảy ra tại Bệnh viện Bạch Mai, Công ty cổ phần Công nghệ y tế BMS (Công ty BMS) và các đơn vị có liên quan; đồng thời, khởi tố bị can, bắt tạm giam đối với Phạm Đức Tuấn (sinh năm 1979, Chủ tịch HĐQT kiêm Giám đốc Công ty BMS) cùng hai bị can khác tội Lừa đảo chiếm đoạt tài sản.

Theo Bộ Công an, Phạm Đức Tuấn bị khởi tố để điều tra vụ việc liên quan đến hành vi, thủ đoạn gian dối, câu kết hợp thức các thủ tục để nâng khống lên nhiều lần giá trị hệ thống thiết bị y tế đưa vào hợp đồng liên doanh, liên kết với Bệnh viện Bạch Mai, nhằm chiếm đoạt số tiền lớn của người bệnh. Theo đó, số tiền các đối tượng chiếm đoạt được xác định lên đến trên 10 tỷ đồng.

Ngoài việc đứng đầu Công ty BMS, ông Phạm Đức Tuấn còn là người đại diện pháp luật của 3 công ty khác, tạo nên các liên danh để tham gia đấu thầu cung cấp thiết bị, vật tư y tế nhiều cơ sở y tế trong cả nước với tổng giá trị hàng trăm tỷ đồng.

Căn cứ giấy chứng nhận đăng ký doanh nghiệp do Sở KH&ĐT TP.Hà Nội cấp, 3 công ty do Phạm Đức Tuấn đứng đại diện pháp luật gồm:

Đầu tiên là Công ty Cổ phần Đầu tư Tuấn Ngọc Minh, thành lập năm 2008, có địa chỉ tại đường Thụy Khuê, quận Tây Hồ. Tuấn là giám đốc công ty này với vốn điều lệ 50 tỷ đồng.

Tiếp đó, tháng 1/2005, với vốn điều lệ 20 tỷ đồng, Phạm Đức Tuấn thành lập Công Ty TNHH Energy and Life Value với ngành nghề chính là sản xuất thiết bị, dụng cụ y tế, phục hồi chức năng…

Doanh nghiệp thứ ba ông Tuấn đại diện pháp luật là Công ty Cổ phần Khoa học Công nghệ mới BMS được thành lập vào giữa tháng 7/2020 với vốn điều lệ 80 tỷ đồng.

Một ngày trúng 3 gói thầu

Theo tài liệu VietNamNet có được, các công ty trên đã tham gia đấu thầu nhiều gói cung cấp vật tư và trang thiết bị y tế tại các cơ sở ở các địa phương với tổng giá trị lên đến hàng trăm tỷ đồng.

Trước thời điểm lãnh đạo công ty này bị bắt giữ (ngày 1/9), trong các ngày 20-21/8, Công ty BMS lần lượt trúng hai gói thầu gồm gói cung cấp bổ sung vật tư cho phẫu thuật các chuyên khoa năm 2020 của Bệnh viện T.W Quân đội 108 với giá 1,9 tỷ đồng và gói mua sắm trực tiếp vật tư y tế cho Bệnh viện Đa khoa tỉnh Yên Bái với giá gần 1 tỷ đồng.

Đáng chú ý, riêng trong ngày 23/4, Công ty BMS trúng 3 gói thầu mua sắm trang thiết bị, phương tiện phục vụ phòng chống dịch Covid-19 của Sở Y tế TP.Hải Phòng với giá trị các gói từ 3 tỷ đồng đến hơn 8 tỷ đồng.

Ngoài việc trúng gần như tuyệt đối các gói thầu mà công ty này tham gia, BMS còn trúng thầu bằng hoặc chênh lệch không đáng kể so với giá gói thầu.

Cụ thể, tại gói thầu ở tỉnh Nghệ An, liên danh Công ty TNHH Việt Quang - Công ty TNHH AT và T - CTCP Asiatech Việt Nam - BMS trúng gói thầu 45,035 tỷ đồng, trong khi giá gói thầu là 45,125 tỷ đồng.

Ngoài các gói thầu trên, liên danh giữa Công ty BMS và Công ty CP Đầu tư Tuấn Ngọc Minh (đều do Phạm Đức Tuấn đứng tên đại diện pháp lý) còn trúng những gói thầu từ hàng chục đến hàng trăm tỷ đồng với chênh lệch ít.

Cụ thể, liên danh 2 công ty kể trên trúng gói thầu “Vật tư thay thế thuộc dự án phê duyệt dự toán, kế hoạch lựa chọn nhà thầu mua vật tư y tế năm 2020" của Bệnh viện Thể thao Việt Nam với giá trúng thầu hơn 68 tỷ đồng.

Năm 2019, liên danh BMS - Công ty CP đầu tư Tuấn Ngọc Minh tiếp tục trúng gói thầu của mua sắm tài sản công với giá hơn 252,87 tỷ đồng, trong khi đó giá gói thầu là 252,98 tỷ đồng.

Sau khi Phạm Đức Tuấn bị khởi tố, bắt tạm giam, Đại hội đồng cổ đông đã bổ nhiệm bà Phạm Thị Thanh Thủy giữ chức vụ giám đốc - người đại diện pháp luật cho Công ty Cổ phần BMS.

0 notes

Text

百名中国人申请移民被骗7800万 FBI悬红通缉华人律师陈丹虹

美国联邦调查局(FBI)指控加州着名华人律师陈丹虹与其律师事务所,涉嫌炮制一场大规模的移民欺诈案件,不仅导致上百名中国申请者绿卡和钱财均两空,涉案金额更高达上千万美元(折合近7,800万港元),而陈丹虹怀疑已逃离美国,FBI因此悬红500万美元(折合约3,900万港元)通缉她归案。 本报国际组报道

美国司法部及美国证券交易委员会公开的文件显示,陈丹虹自1998年获得律师执业资格以来,便常年活跃在移民领域,她的律师事务所自成立至今更是已经给上百名来自中国的投资人代理了资金多达5,200多万美元的「EB-5」(折合约4亿560万港元)投资移民业务。

「EB-5」门槛低限制少

据悉,EB-5是目前广受中国人青睐的一种投资移民美国的途径,因其门槛低、限制少,流程简单。其卖点在于,只要投资50万至100万美元到美国,能给美国创造10个就业机会,你就可以获得美国绿卡。同时,EB-5也是不少美国地方官员「招商引资」并「提升政绩」的摇钱树,甚至一些美国高官和他们的亲属还会专门来中国给做EB-5投资项目的移民公司「站台」,邀请中国人投资他们推荐的EB-5项目。

然而,由于法律和监管的漏洞太多,EB-5投资移民项目也很快就成为了众多不法分子眼中的肥肉。过去几年裏,围绕EB-5项目的诈骗案件可谓是层出不穷,甚至于不少案件还闹出了美国地方政府的官员曾给背过书的丑闻。而除害得中国的投资者绿卡、钱财两空,这个问题重重的移民项目,也被美国舆论质疑未能给美国的经济发展和就业带来太多好处,本该流向贫穷落后地区的钱反而被投入了富裕地区的项目,进一步加大了贫富差距。

疑陈丹虹已逃离美国

一些美国地方官员和项目负责人也曝出滥用乃至私吞EB-5项目投资人钱财的腐败丑闻。即便丑闻不断且频繁爆雷,对于那些对美国绿卡乃至身份有需求的国人来说,门槛和限制相对较低的EB-5投资移民项目仍然有着极强的吸引力。这便给陈丹虹继续���骗的机会。值得注意的是,尽管目前已经了解陈丹虹行骗事迹的一些中国网民已经开始骂她是无良律师,但她在出事前在不少美国华文媒体及内地的移民资讯网站乃至正规媒体上都是以正面形象出现。

0 notes

Text

Scarborough teacher accused of sexually assaulting 10-year-old boy

A 24-year-old male teacher at a private Islamic school in Scarborough is facing charges after a 10-year-old student was allegedly driven off school property and sexually assaulted earlier this month.

Toronto police say that on Feb. 16 at about 11:15 a.m., a 10-year-old boy was taken from the grounds of The Islamic Foundation of Toronto School at Nugget Avenue and Markham Road.

Investigators allege the boy was driven to Neilson Road and McLevin Avenue in the Malvern area and sexually assaulted.

After the assault, the child was driven back to school.

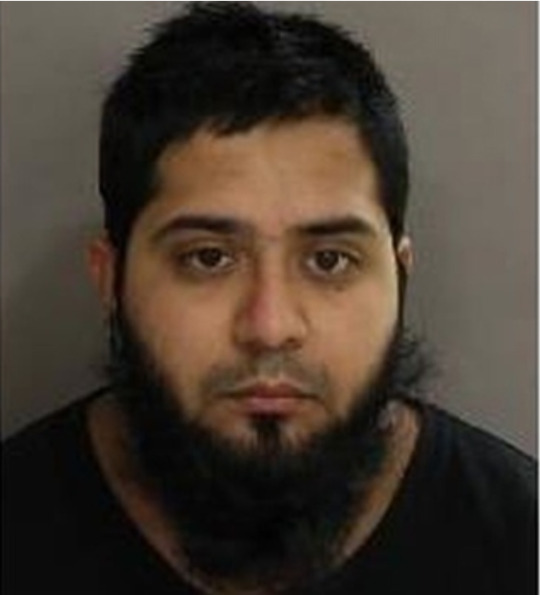

On Tuesday, police arrested a suspect identified as Saleh Momla.

He was charged with one count of sexual assault and one count of sexual interference.

None of the charges have been proven in court.

Const. Jenniferjit Sidhu said Momla’s image was released as investigators believe there are other victims who have not yet come forward.

Islamic Foundation of Toronto spokesperson Yusuf Badat said the accused was employed at the school in a program where children memorize the Quran. The victim was enrolled in that program.

Badat said that once the school was made aware of the allegations, Momla was banned from school grounds.

He later resigned.

Sidhu said the school distributed letters to go home with each student after they were made aware of the allegations.

Badat said the letters urged any child who has been victimized to contact police immediately.

0 notes

Text

Former Southport A&E Doctor Made Up Qualifications in Bid to Win Lucrative Work as Expert Court Witness

A former Merseyside A&E doctor who filled his CV with bogus qualifications in a bid to win work as an expert witness in court cases was struck off.

Dr Titus Odedun, an ex-consultant in A&E medicine at Southport and Ormskirk hospitals, pretended to be a specialist in trauma, orthopaedics and surgery.

A medical misconduct tribunal ruled he had “no right to use the various titles he awarded himself” and found he did so “in order to obtain a greater volume of medico-legal work at a significantly higher fee”.

Odedun gave expert evidence in court cases while claiming to be more highly trained than he was, as well as exaggerating his professional experience in witness statements.

He also claimed to be a consultant in trauma and orthopaedic surgery in an online database of medical experts, despite having no such qualifications.

The tribunal described his lies as “persistent misbehaviour over a long period of time” and ruled his name should be erased from the doctors’ register.

The Medical Practitioners Tribunal Service (MPTS) said in its ruling: “His conduct amounts to persistent dishonesty and an abuse of his position as an expert. Dr Odedun’s misconduct was a serious breach of good medical practice.”

A medical expert, known only as Mr A, who testified against Odedun, said he would have been the “youngest consultant ever” if his alleged work history had been accurate.

The MPTS made the following rulings:

That Odedun “falsely stated” on his profile on the website expertsearch in 2011 that he was a consultant trauma and orthopaedic surgeon.

That he “falsely stated” he was a member of the Surgical Research Society.

That he prepared 18 medico-legal reports in which he “falsely stated” he was a consultant in trauma and aesthetics surgery and orthopaedics – as well as making this same claim “whist giving evidence in court” in November 2007.

That he “falsely stated” in a witness statement in June 2008 that he had worked as a consultant surgeon at Stoke Mandeville Hospital and Southport and Ormskirk hospitals.

That, during a court hearing in February 2009, he “agreed that you were a consultant trauma surgeon when you knew that you were not”.

That while giving evidence in court in August 2010, Odedun “falsely stated” he was a fellow of the Faculty of A&E Medicine when in fact his membership had lapsed, as well as claiming to be a consultant in trauma and aesthetics surgery and an orthopaedics consultant.

That in a witness statement in December 2011, he “falsely stated” he was a consultant trauma and A&E surgeon.

Southport and Ormskirk Hospital NHS Trust confirmed to the MPTS that Odedun worked as an A&E consultant from 1992 until his retirement in 2005, after which he began taking on medico-legal work as an expert witness.

The doctor’s prognosis

The ECHO approached Odedun at his luxury Southport home. He told an ECHO reporter that a solicitor’s firm based in Manchester had brought the case against him because he was so successful with whiplash claimant reports.

Odedun said: “The General Medical Council (GMC) have found me guilty of practising in three different areas - accident and emergency, cosmetic and orthopaedics. The GMC only qualified me in accident and emergency but I am a surgeon trained in cosmetics and orthopaedics.

“I have more than 25 years of cosmetic experience and no single complaint from any patient.”

The former doctor who is now retired, said: “This has spoilt my name. I have 38 years of unblemished medical practice with medical certificates to prove it.”

0 notes

Text

Public Statement - QFX Absolute Return Fund (Jersey) Limited

The Commission has issued this public statement under Article 17(1) of the Collective Investment Funds (Jersey) Law 1988, as amended ("the Collective investment Funds Law").

This statement is made in order to warn investors and others against dealing with unauthorised funds. The persons named below are holding out as being unregulated funds, pursuant to the Collective Investment Funds (Unregulated Funds) (Jersey) Order 2008 ("the Order"), whilst not meeting the requirements to be eligible for unregulated fund status under the Order.

QFX Absolute Return Fund (Jersey) Limited BBA Capita QFX Sterling Liquidity Fund (Jersey) BBA Capita QFX Dollar Liquidity Fund (Jersey) BBA Capita QFX Euro Liquidity Fund (Jersey) BBA Capita QFX Sterling Liquidity Plus Fund (Jersey) BBA Capita QFX Dollar Liquidity Plus Fund (Jersey) BBA Capita QFX Euro Liquidity Plus Fund (Jersey) BBA Capita QFX Sterling Short Duration Bond Fund (Jersey) BBA Capita QFX Dollar Short Duration Bond Fund (Jersey) BBA Capita QFX Euro Short Duration Bond Fund (Jersey) (collectively, "the Unauthorised Funds")

It appears to the Commission that the Unauthorised Funds are holding out as being unregulated funds, pursuant to the Order. The Unauthorised Funds do not meet the requirements to be eligible for unregulated fund status under the Order.

Further, it appears to the Commission that the Unauthorised Funds are being promoted by BBA Capita Capital Management LLP. The principal persons of BBA Capita Capital Management LLP and the Unauthorised Funds are noted as being Mr Robert Taylor-Barefoot, Mr Jeremy Wright and Mr Alex Ariana ("the Unauthorised Individuals"). The Commission wishes it to be known that the Unauthorised Funds, the Unauthorised individuals and BBA Capita Capital Management LLP have contravened Article 10 of the Collective Investment Funds Law (misleading statements and practices). The Commission considers that they have made statements which they know to be misleading, false or deceptive, for the purpose of inducing another person to enter or offer to enter into an investment agreement, in contravention of the Collective Investment Funds Law.

The Commission wishes it to be known that:

The Unauthorised Funds do not meet the requirements to be eligible for unregulated fund status under the Order;

2. The QFX Absolute Return Fund (Jersey) Limited ("QFX") is purporting to be a company incorporated in Jersey under the Companies (Jersey) Law 1991, as amended. QFX has, at no stage, been a company incorporated in Jersey.

3. Documentation in possession of the Commission, noted as an offering document of the QFX Absolute Return Fund (Jersey) ("the Offering Document"), shows that the Unauthorised Funds are being promoted by BBA Capita Capital Management LLP. BBA Capita Capital Management LLP has never been registered, nor applied for registration, under any of the regulatory laws administered by the Commission1.

4. The Offering Document lists the Unauthorised Individuals as the principal persons of BBA Capita Capital Management LLP and the Unauthorised Funds. The Unauthorised Individuals have never been registered, nor applied for registration, as Principal Persons or Key Persons, under any of the regulatory laws administered by the Commission1.

5. BBA Capita Capital Management LLP is not connected in any way to Capita Group Plc and companies within the Capita Group. The Capita Group has headquarters in London and has a presence in various jurisdictions including Jersey, Entities within the Capita Group are authorised by the Commission to conduct regulated activities.

6. The Offering Document lists Andium Trust Company Limited as 'Registered Agent'. Andium Trust Company Limited is not Registered Agent of BBA Capita Capital Management LLP or the Unauthorised Funds and has not acted for the Unauthorised Individuals. Andium Trust Company Limited is authorised by the Commission to conduct regulated activities.

7. The Offering Document lists Carey Olsen as 'Legal Adviser as to Jersey law'. Carey Olsen is not Legal Adviser to BBA Capita Capital Management LLP, the Unauthorised Funds, or the Unauthorised Individuals, nor has any lawyer in the firm acted for such persons. Carey Olsen is a Channel Islands based law firm, also authorised by the Commission to conduct regulated activities.

8. The Offering Document contains references to various fictitious Jersey legislation.

0 notes

Text

Public Statement - BBA Capita Asset Management (Jersey) Limited

BBA Capita Asset Management (Jersey) Limited Mr Robert Taylor-Barefoot (also known as Mr Robert Barefoot), born 20 August 1975 Mr Jeremy Wright, born 17 April 1970 Mr Alex Ariana

It appears to the Commission that BBA Capita Asset Management (Jersey) Limited, the principal persons of which are noted as being Mr Robert Taylor-Barefoot, Mr Jeremy Wright and Mr Alex Ariana, is carrying on or holding out that it is carrying on financial service business when it is not authorised to do so pursuant to the provisions of the Financial Services Law.

The Commission wishes it to be known that:

BBA Capita Asset Management (Jersey) Limited has never been registered, or applied for registration, under the Financial Services Law. Therefore, any financial service business, as defined in Article 2 of the Financial Services Law and carried out by BBA Capita Asset Management (Jersey) Limited since 1 July 1999, is a breach of Article 7 of the Financial Services Law;

Mr Robert Taylor-Barefoot, Mr Jeremy Wright and Mr Alex Ariana have never been registered, nor applied for registration, as Principal Persons or Key Persons, under the Financial Services Law;

BBA Capita Asset Management (Jersey) Limited is purporting to be a company incorporated in Jersey under the Companies (Jersey) Law 1991, as amended. However, BBA Capita Asset Management (Jersey) Limited is not, nor has it ever been, a company incorporated in Jersey;

From documentation held by the Commission it would appear that BBA Capita Asset Management (Jersey) Limited, operated by Mr Robert Taylor-Barefoot, Mr Jeremy Wright and Mr Alex Ariana, displays warning signs of being set up for a fraudulent purpose;

BBA Capita Asset Management (Jersey) Limited is not connected in any way to Capita Group Plc and companies within the Capita Group. The Capita Group has headquarters in London and has a presence in various jurisdictions including Jersey. Entities within the Capita Group are authorised by the Commission to conduct regulated activities; and

The Commission has issued a previous public statement concerning Mr Robert Taylor-Barefoot, Mr Jeremy Wright and Mr Alex Ariana (and others), January 2009.

1 note

·

View note