Text

Gurugram has a king of good times. Lakeforest Wines is both liquor monopoly & a renaissance

‘It used to be the monopoly of Ponty Chadha,’ Neeraj Sachdeva, Lakeforest founder, said. After running a wine business in California, Sachdeva now rules Gurugram.

Neeraj Sachdeva, founder of Lakeforest Wines, at his office in Gurugram's Sector 18 | Photo: Sagrika Kissu | ThePrint

Gurugram: Neeraj Sachdeva’s world of affluence is divided into two hemispheres. On weekends, he tees off at Gurugram’s exclusive DLF Golf Club, often sharing the greens with the likes of cricket legends Kapil Dev and Yuvraj Singh. But come Monday, he’s back at his Sector 18 office, steering the growth of his liquor empire, Lakeforest Wines, now virtually a household name across Delhi-NCR.

But 55-year-old Sachdeva is no ordinary booze baron—he’s the first mover behind Gurugram’s transformation into Delhi-NCR’s liquor mecca. Selling everything from Red Label to Chilean reds to Japan’s Suntory Whisky Toki, shiny, mall-like chain outlets have become a symbol of the city’s pride and identity. In Haryana, a state where alcohol was banned between 1996 and 1998 and the market was long confined to dingy shops, Sachdeva returned from the US in 2004 with a vision to reshape how alcohol was sold, seen, and savoured in Gurugram—and pulled it off. Today, he’s not just a local player; he’s one of India’s biggest importers of wine – the quintessential drink of the wealthy.

“I always had confidence in myself that I would make it very big. I always wanted to make a lot of money,” Sachdeva said, seated in his plush office, surrounded by shelves of top-selling wine bottles.

A certified sommelier, Sachdeva ran a successful wine business in California before he decided to return to India 18 years ago, when the liquor market was dominated by barons like Ponty Chadha and Vijay Mallya. At first, Sachdeva had plans to manage the import section of Chadha’s operations, but the deal fell through. That’s when he opened his own upscale liquor store in Gurugram in 2007, located in the buzzing Sahara Mall and with celebrities like Ajay Devgn and Shilpa Shetty adding glamour to the inauguration.

Back then, convincing Sahara Mall’s management to allow a liquor store wasn’t easy, and he ended up with a shop tucked away at the back. But nearly two decades later, Gurugram’s liquor market has exploded, and there’s even a local saying: “There are fewer people and more liquor stores in Gurugram.”

With Haryana’s relatively liberal excise policy, a per capita income that’s topped the national average by about 70 per cent for years, and Gurugram’s cosmopolitan corporate culture, competitors like Discovery Wines and, later, G-Town are also vying for the high-end space now.

Sachdeva, however, had already carved out his advantage by securing the only Imported Foreign Liquor (IFL) licence in the region until 2018, establishing an early monopoly in the sector.

“From 2008 till 2017-2018, Neeraj Sachdeva was the king of imported liquor,” said a senior excise official in Gurugram on condition of anonymity. This dominance was largely due to Sachdeva’s control over the exclusive bottle in licence (BIO) and the L1 BF licence, which allowed him to import and distribute alcohol across Haryana. The official also noted that no one else could afford the steep import license fee until prices dropped from a high of Rs 50 crore in 2018. As a result, Haryana now has 16 L1B license holders.

Even though we now have an L1-BF licence, we still source certain wines from Neeraj because we don’t have the same access to international wine markets. He was ahead of his time and had branded himself in a way that made him stand out

-Abhimanyu Singla, owner of Discovery Wines

“While domestic players like Singlas, Mahalaxmi, and ADS stayed local, Sachdeva supplied top hotels like the Taj, Crowne Plaza, and Oberoi and through this he established relationships with big hoteliers, bars, and HNIs (high net worth individuals), building a strong distribution network,” added the official.

Sachdeva’s taste for luxury is reflected in his wine brand, Niccolo Sanitino, which he claims is the Italian version of his name. His influence reaches far and wide —politicians, cricketers, and Bollywood stars alike buy from him because they “trust the quality” of his liquor, he said.

“I can easily say that right now I am the number one private liquor importer in India. I am the only one with a backward integration channel. I even supply liquor to my competitors, Discovery Wines and G-Town, and big bars and restaurants in Sector 29 of Gurugram,” Sachdeva added. “For me, buying liquor should be akin to a shopping experience, and I have ensured Gurgaon has that. I want the world to learn the Gurugram way.”

Global ambitions

When Neeraj Sachdeva was growing up in Delhi, he had his fair share of brushes with future celebrities—playing cricket with Shah Rukh Khan, his senior at St Columba’s school, partying with fellow Delhi University student Akshay Kumar in Vasant Kunj, and, later, forging a close friendship with Vivek Oberoi.

“As a kid, I admired many people. Now, those people are my fans,” he smiled.

But Sachdeva isn’t content with merely lubricating the parties of India’s rich and famous or running his glitzy retail outlets—20 in Gurugram and a few in West Bengal and Uttar Pradesh.

The two other pillars of his business are import and distribution and that’s where he is smelling the greatest opportunities.

His goal is to become the world’s biggest distributor of liquor, and he is doing everything he can to get there. He already owns a distillery in France and breweries in Chile, Spain and Scotland, where Lakeforest Wines produces its own gin, wine, and tequila. It also imports and sells its wines in India under brands such as Woodbridge, Temalo, and La Fantasia, starting at Rs 900 per bottle.

Currently, Lakeforest Wines owns around 12 liquor brands worldwide and represents one of the world’s largest wine groups, Constellation, in India. They are also launching their own tequila brand, Don Santos.

“Popular brands in the world don’t get entry into India. We partner with them and import those brands under our panels. We have already given people our retail experience. Now, we want to show how distribution is done,” said Sachdeva.

First wine, then beer

As Sachdeva gears up to conquer new realms in the liquor industry, his competitors are taking notes.

“Sachdeva has followed in the footsteps of Amandeep Singh Dhall from the Brindco Group,” said a competitor, asking to remain anonymous. “Dhall began by focusing on the import and distribution of premium wines before later expanding into beer.”

Dhall was a top player in the wine business—until his arrest last year in the Delhi excise policy case for allegedly paying kickbacks to Aam Aadmi Party (AAP) leaders. Other than Brindco, distributors such as Pernod Ricard and IndoSpirits were also named in the case and denied licence renewals in Delhi last year.

With a gap in the market, other players are vying for dominance and Sachdeva is a frontrunner.

“India is developing a taste for wine, with consumption rates on the rise. Sachdeva stands out as one of the largest importers in this growing market,” said a senior official of the International Spirits and Wines Association of India (ISWAI). “The wine market is small and fragmented, but it is the most prestigious segment.”

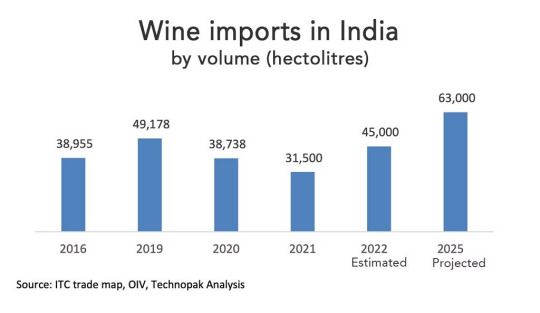

India’s wine market dipped from Rs 1,900 crore in 2020 to Rs 1,625 crore in 2021 during the pandemic, but high-end wines weathered the storm better, according to an industry report by the consultancy firm Technopak. By 2022, the market was rebounding, with projections to reach Rs 3,795 crore by 2025.

The “premiumisation” of the alcohol industry and the growing social acceptance of wine are key drivers of this growth, with imported wines anticipated to make up 18 percent of the market, the report added.

According to a Forbes report last October, wine consumption in India increased by 29 per cent in 2022, with an estimated 10 million Indians reportedly drinking it regularly.

In 2023-24 alone, Sachdeva imported wine worth over Rs 85 crore. Even his main competitors, Discovery and G-Town (formerly Jagdish Wines), purchase a portion of their imported wine from him.

“Even though we now have an L1-BF licence, we still source certain wines from Neeraj because we don’t have the same access to international wine markets,” said Abhimanyu Singla, owner of Discovery Wines. “He was ahead of his time and had branded himself in a way that made him stand out.”

For Sachdeva, quality is paramount in his premium wine imports—reputation is everything. His import business follows a rigorous process—the company first procures wine samples, tastes them, and then visits the wineries in those countries to ensure consistency before starting the shipment.

“We get most of our shipments in cooler periods because temperature is a constraint and the fluctuation should not be more than 10 degrees. It’s very hot in June and July, so your wine will be cooked, and you are done,” said Sachdeva.

Much like Dhall, Sachdeva is also turning his attention to imported beer. His target is Europe, with a focus on bringing prominent beer brands from Belgium, the Czech Republic, and Germany into the Indian market.

I would go to people’s houses (in the US), teach them about wine, and do tastings with their friends. Soon, the word spread, and instead of going to wineries, people came to my store to taste wine and get it bottled

-Neeraj Sachdeva

These lofty dreams require deep pockets due to India’s prohibitively high tariffs on imported alcohol. Any finished alcoholic product entering India faces a 150 per cent basic duty, according to the ISWAI official—and that’s just the beginning.

“India has very high tariffs. After basic duty, the finished product that comes to India, goes to the states, and then there are additional duties charged on imported products, and that makes the entire process really expensive,” the official added.

But more than tariffs, Sachdeva’s biggest concern is retaining quality and freshness. To overcome this, he’s working on efficient distribution channels.

“Europe is a hub of good beers, but it’s a difficult market to crack because the transit time is too long. We plan to logistically bring the beer to India. The day it is brewed, we will get it here,” said Sachdeva.

The long game

Sachdeva’s life seems straight out of a Bollywood movie: a liquor baron living in the ultra-exclusive Camellias complex, hosting parties twice a week to strengthen his network, and playing golf with the who’s who of Gurugram. At the end of a long day, he enjoys his whiskey and vodka in the comfort of his opulent apartment, where the building even boasts its own movie theatre, cigar bar, and bowling alley.

“I am an out-and-out businessman, and you can call me a social butterfly,” said Sachdeva, whose flamboyant personality matches his bold business strategies.

Despite his straightforward nature and accessibility, Sachdeva draws strict boundaries to protect grand vision. He keeps his inner circle tight, allowing only three childhood friends—who work alongside him and know every detail of his business—into his confidence. He doesn’t like to name them and keeps them out of the public eye.

Sachdeva once learned the hard way about the risks of the liquor business when he opened a store in Faridabad and ended up spending a day in jail, accused of defrauding the administration.

“That store was run by my uncle but was in my name. I closed the unit. Can you imagine, I’ve never even been to Faridabad. You can’t trust anyone in this business. Rich people in India have a lot of money, and they want to pull everyone down,” he said solemnly.

Currently, Sachdeva and his team of three friends-cum-business partners are preparing to launch an Initial Public Offering (IPO) to allow them to offer shares of the company to the general public and institutional investors. It’s a move that would place his private liquor company firmly on the industry map.

My father is very serious about his business. After graduation, he told me he wouldn’t give me any position without first understanding the business and working as a regular employee for a few years

-Riya Sachdeva, head of Lakeforest Wines’ media and public relations

He’s set a three-year target for this goal. His three-floor glass-fronted office is bustling with private equity investors, investment bankers, and auditors, all preparing him for this big step.

“You have to qualify for all the SEBI rules and regulations, get your accounts audited—listing on the stock exchange is seen as a sign of respectability for a liquor baron,” said an employee working at the headquarters of Lakeforest Wines.

At any given time, Sachdeva has multiple projects in the air. He’s even distributing a few brands for Diageo, one of the largest liquor companies in the world.

“I am going to meet Diageo India MD Ashish Parikh at Golf Club,” said Sachdeva, as he rushed out of his office on a busy afternoon in his Range Rover.

Love story with wine

Sachdeva’s is not a rags-to-riches story, but his family has gone through some rough patches.

His mother, Kamlesh, who now lives in The Magnolias—a high-end gated complex next to Camellias—recalled how she had to take charge of the family’s finances after her husband, Sachdeva’s late father, suffered losses in the auto ancillary business he ran in Delhi’s Kashmiri Gate. To make ends meet, she stitched school uniforms, eventually hiring 10 workers as her business grew. But luxuries were few. When wealthier relatives visited and bought Coca-Cola bottles for the kids, Neeraj would never touch them.

“He always felt that the relatives were being arrogant and mocking our financial situation. He would say, ‘Mumma, I will be super rich someday,’” said Kamlesh, smiling.

After finishing his schooling and college in Delhi, Sachdeva moved to the US in 1994, chasing the capitalist dream of becoming a wealthy businessman—not in wine, but in garment trading.

While staying with his uncle, an Intel employee in California, a visit to a vineyard changed everything. Sachdeva shifted his focus to the wine industry, taking jobs at wine stores and earning his certification as a sommelier. His entrepreneurial instincts quickly kicked in.

“While working at a store, it crossed my mind that wine tastes different every year—so what if I open a wine tasting room inside the store?” said Sachdeva.

At the time, he encountered scepticism about whether an Indian could pull off such a venture, but he persisted, and eventually, his wine tasting room became a hit. His concept was simple: pay $5 to taste a flight of 5-6 wines, and if you bought a bottle, the tasting fee would be adjusted.

Whenever I ask (Neeraj) to slow down, he says, ‘Ma, it’s not about me anymore but about the 400 people who work with me. Their lives are dependent on me. They expect an increment every year, and I can’t be selfish

-Kamlesh Sachdeva

“I would go to people’s houses, teach them about wine, and do tastings with their friends. Soon, the word spread, and instead of going to wineries, people came to my store to taste wine and get it bottled,” said Sachdeva.

This is when Sachdeva began networking. He conducted wine tastings with the MD of Intel, the Rockefeller group, and built valuable contacts in the industry. In 1996, he opened his first store in El Dorado Hills, marketing himself by conducting tastings with the city’s elite.

Business was thriving, but in the mid-2000s, his wife Ruchira set India plans in motion. As a homeopathic doctor, she was unable to practice in the US and wanted to return home.

Sachdeva followed her in 2004. Within just two months in Gurugram, it struck him that he could create a wine oasis in the city.

“Back then, stores were dingy, shabby, and had black-coloured grilles as if the alcohol was being supplied from a jail,” recalled Sachdeva. “There was nothing here, and I had all the knowledge of the industry. I was sure I couldn’t fail here.”

A few initial hiccups didn’t deter him.

“It used to be the monopoly of Ponty Chadha back then. So, I met him and asked him to let me handle his import section of the business,” Sachdeva said. When the deal didn’t materialise, he devoted himself to opening his new store. Since then, there’s been no looking back.

A slight hangover

In April 2022, actor Nargis Fakhri inaugurated Lakeforest’s grandest outlet yet—an 11,000-square-foot luxury store, L1 West, in Sector 17/18, complete with a sommelier, a vast selection of high-end brands, and even a wine gallery. Sachdeva, dapper in a cream-coloured suit, was present at the event, mingling with other members of Gurugram’s high society.

Earlier this month, another Lakeforest outlet opened at the Delhi-Gurugram Rajokri border, touted in social media posts as a “woman-friendly store with an immense parking space”.

Puttering around her luxury apartment, however, 75-year-old Kamlesh Sachdeva said she wishes her son would press pause for a while. She pointed out that he has earned enough to secure the future of their family for generations.

“But whenever I ask him to slow down, he says, ‘Ma, it’s not about me anymore but about the 400 people who work with me. Their lives are dependent on me. They expect an increment every year, and I can’t be selfish,’” she said.

A devout follower of the Brahma Kumaris, a spiritual movement that advocates teetotalism and simple living, Kamlesh fills her days with meditation, kitty parties, and card games with her society friends. But it still gets lonely in her Magnolias apartment, which her son gifted her two years ago, while he shifted to the nearby Camellias.

“Such a big house, and see, I am alone. We got so involved in building our empire that we forgot to enjoy our lives,” she said, pointing to family pictures on the walls.

Sachdeva’s wife, Ruchira, shares similar sentiments.

“As you grow bigger, you’re bound by obligations that must be fulfilled. You see couples enjoying their time together; we don’t have that, and I often complain about it,” said Ruchira, who runs a charitable dispensary in Gurugram.

Ruchira has been urging Sachdeva to take a trip to Europe with her to visit their younger daughter Rima, who’s studying in Spain, but he hasn’t found the time.

“I’m going alone now,” she said. “When I got married in 1994 and went to the US with him, I didn’t know we would become so big.”

0 notes

Text

Forexdoc

Market orders

There are 2 main types of market orders. Market execution and pending orders. Market execution is the method by which traders execute orders at the current price within fractions of a second. This means that system will automatically open the order when trader decide to click on “buy” or “sell” button. Pending Order is an order that has not yet been executed and therefore has not yet become an actual trade. Unlike market orders executed immediately at the current price, pending orders are queued and executed only when the market reaches the specified price, allowing traders to automate their entry and exit strategies based on predetermined conditions. These are the types of pending orders:

Buy Limit – trade request to buy at the Ask price that is equal to or lower than thatspecified in the order. The current price level is higher than the value in the order;

Sell Limit – trade request to sell at the Bid price that is equal to or higher than thatspecified in the order. The current price level is lower than the value in the order;

Buy Stop – trade request to buy at the Ask price that is equal to or higher than thatspecified in the order. The current price level is lower than the value in the order;

Sell Stop – trade request to sell at the Bid price that is equal to or lower than thatspecified in the order. The current price level is higher than the value in the order;

Buy Stop Limit – this type is the combination of the two first types being a stop orderfor placing Buy Limit;

Sell Stop Limit – this type is a stop order for placing Sell Limit.

It is not an easy task to find mentor, especially these days. Most trading pages on Instagram and social media platforms are scam. They will tell how you can get rich quick, how they have best strategy that works around 90% of the time and will show you pictures like this:

That is NONSENSE. Don’t believe them! First of all, good trader will never open more than 3 (max 4) positions. Opening too many positions is the worst thing that you can do. You need to focus, and you cannot do that when you open more than 3 positions.

Not just that, if you are wrong, you will blow your account very fast. But whyscammers do this? Answer is simple. They have two demo accounts. On one account they buy and on another one they sell.

They will open as many positions as they can so they can win more. And guess what. When positions are closed they will show pictures of winning account.

Finding an honest mentor is the fastest way to learn to trade Forex. With mentor, you will avoid many mistakes and sometimes save many years of trial and errors.

Trading psychology

As you progress as a trader you will become involved in thinking and probably reading about trading psychology. Trading psychology is a broad term that encompasses the study of traders and their emotional issues about trading. Tradingpsychology literature takes its cues from scientific study of psychology, common sense, and the experience of traders and trading gurus. If you are interested in trading psychology, it probably means that you are further along in your trading education. If you are one of the traders with an interest in trading psychology, you have moved beyond looking for the perfect trading system. You now understand the important role emotions play in trading results. One thing that many traders fail to recognize is the intricate relationship between what you risk and the emotions you experience during trading. In fact, risk and trading psychology are two sides of the same coin.

Markets change, new opportunities will always come. Don’t rush, be patient and always have a trading plan. Good traders are successful but humble people. Being a trader is a lifelong challenge

Make sure to always go back at previous chapter where I shared more pictures of different candlestick patterns that can be useful. And AGAIN: don’t just enter the trade based on candlestick pattern signal! Combine them with support/resistance zones, trendlines, indicators and other tools.

When it comes to fundamental analysis and trading news, I suggest you to avoid to trade it. As a beginner, the best move is to avoid to trade the news. To keep track of these news during the day and weekend, you can check some economic calendars on the internet.

Here we can see one example where price formed higher highs and higher lows (uptrend) and then market reacted to the news with a massive bearish candles that stopped out all previous buyers.

When trading double top (and double bottom) there are three types of entries:

1) aggressive entry – at second top formation; 2) safer entry – when price breaks neckline; 3) patient entry – when price goes back to retest the neckline.

You can see this on a picture 59.

Double Bottom

The double bottom is also a trend reversal formation, but this time we are looking to go long (to “buy”) instead of short (to “sell”). These formations occur after extended downtrends when two valleys or “bottoms” have been formed.

You can see on the picture 60 that after the previous downtrend price formed two valleys and it wasn’t able to go below a certain level. Notice how the second bottom wasn’t able to significantly break the first bottom. This is a sign that the selling pressure is about finished, and that a reversal is about to occur. The price broke the neckline and made a nice move up. Remember, just like double tops, double bottoms are also trend reversal formations.

Same rules that apply on double top, also apply here with double bottom, so I will not repeat them.

Sometimes double tops (and double bottoms) are not so easy to spot like on picture 61. This is still validdouble top formation. This massive bullish candle didn’t break previous high.

This time we can see simple combination of a price structure, candlestick pattern and Stoch. RSI indicator. Price formed lower high with a bearish engulfing pattern and our Stoch. RSI gave us “sell” signal. Price went down to break previous low and retest it. When price retested previous low we can see another bearish engulfing pattern and Stoch. RSI “sell” signal. This time indicator provided us with two good entries.

Very good way to use Fibonacci tools is to combine them with other things we learned in this course (support/resistance, indicators and patterns).

On picture 135 below, there are at least two clear trading opportunities that can be identified using a combination of Fibonacci and support/resistance. The rally from point B came to a halt at point C, at the 38.2% retracement of the AB swing. Once the old support around 0.7870 is broken, this clearly points to a continuation to the downside after that shallow pullback to the 38.2% Fibonacci level. Trader could use this information to expect a sizeable continuation - hence, trader may wish to have a profit target around the 161.8% extension (0.7755) of the BC swing as opposed to merely the 127.2% extension (0.7812). If this trade was missed, there was another great opportunity to sell once price retested that old support level of 0.7870. Even without a Fibonacci convergence this would have been a trade on its own. But the fact that there is a 61.8% retracement there too (i.e. of the CD swing), this therefore increased the probability of price turning at that broken support level. The stop loss could have been very tight 15 or so pips above 0.7870, providing a highly favorable risk to reward ratio.

Here we can see example on a H1 and M5 charts. On H1 chart we can see that price confirmed support zone and formed two strong bullish wick rejections. On M5 we can see that price formed strong bullish candle that broke previous high. Retest occurred and that was a good place to enter a” buy” trade.

0 notes

Text

0 notes

Text

Gold Bulls Eyeing Historic Super-Cycle Breakout Level

Nearly 12 years ago on 9/1/2011, I pointed to “the power of the pattern” and suggested that "gold should be flat to down for years to come."

And, if you look at the chart below, you can see that this unfolded as expected.

Fast forward to today (12-years later), and Gold is trading around $50 higher… and nearing a potential change in character once again.

Looking at today’s long-term monthly chart of Gold, I am of the opinion that the stage is being set for a new Gold Super-Cycle to start. 12 years higher, followed by 12 years sideways, followed by…

So, where does it start? On a breakout above resistance at (1).

Should this occur, we have a 161% fibonacci extension target near $3000 and a 261% extension near $5000.

Probably a good idea to keep an eye on this breakout level. Stay tuned.

0 notes

Text

Poonawalla Fincorp Ltd

POONAWALLA daily timeframe chart, which has been consolidating over the last few sessions, has now broken out suggesting this positive move will continue

A bullish pattern is forming on the daily time frames.

The stock is also making higher bottom formation.

Momentum indicators like the RSI and MACD are displaying bullish signals, indicating that the stock will continue to advance in the next few weeks.

Based on the technical data presented above, we recommend buying POONAWALLA at the CMP of 295 and averaging at 285, with upside targets of 315 and 325, and a stop-loss of 274.

0 notes

Text

Flag breakout on daily charts makes ABB an attractive buy; likely to hit fresh record highs

ABB, part of the heavy electrical equipment space, gave a breakout from a Flag pattern on the daily charts which has opened room for the stock to head towards Rs 3,500 level, suggest experts. The stock hit a record high of Rs 3,445 on 2 September 2022 but it failed to hold on to the momentum. However, the stock saw a vertical rise in the last 1 month, outperforming benchmark indices in the same period. A bullish flag pattern is formed with strong uptrends and is considered a continuation pattern. The neckline of the pattern was placed above Rs 3,200 levels. The stock closed at Rs 3,312 on 1 March 2023. The stock rose by about 19% in 1 month compared to over 1% fall seen in the Nifty50 in the same period. Short term traders can look to buy the stock now or on dips for a possible target towards Rs 3,500, suggest experts. ABB stock is trading well above most of the short and long term moving averages such as 5,20,30,50,100 and 200-DMA on the daily charts which is a positive sign for the bulls.

MACD is above its center and signal line which is a bullish indicator, Trendlyne data showed. The stock is trading near overbought levels which suggests that a near term pullback could be on the cards. ABB stock is in an overall uptrend and forming higher highs – higher lows structure on monthly scale from the past three months. On a weekly scale as well it has retested the previous resistance zone and formed a strong bullish candle. “On daily scale ABB stock has given consolidation breakout after thirteen sessions and formed a strong Bullish candle. It has also formed a Pole & Flag pattern on daily scale which is a bullish continuation pattern with noticeable volumes,” Arpit Beriwal, Analyst, Equity Derivatives and Technicals, MOFSL, said. “It is holding well above its 20 DEMA and RSI (Relative strength index) has given breakout which suggests momentum is likely to continue in coming sessions,” he said. Overall, ABB is witnessing strong buying demand in capital good space and the stock is likely to outperform in the near future, suggest experts. “Looking at the overall chart structure on daily scale we expect the stock to move higher towards Rs 3,500 zones,” recommends Beriwal. “We recommend buying the stock at current levels with keeping stop loss below Rs 3,190 levels on a closing basis for an upside move towards Rs 3,500 zones,” he added.

0 notes

Text

INDIA RUPEE Equity inflows, dollar retreat help rupee log best week since mid-Jan

The Indian rupee rose on Friday, logging its best weekly performance in seven weeks on the back of the dollar's pullback and equity inflows.

The rupee rose 0.77% on the day to close at 81.9650 per dollar, aided by possible dollar inflows-related investment into shares of Adani Group companies. [USN:L4N35A2TX]

For the week, the rupee was up 0.95%, its biggest weekly advance since mid-January. The rupee began the week on the defensive, falling to near 83 on Monday, on concerns over the U.S. inflation outlook.

The Reserve Bank of India likely sold dollars via public sector banks to prop up the rupee. [USN:L4N3570WO]

The RBI's resolute defence of the 83 level alongside how markets were positioned in wake of the Adani inflow has helped turnaround the near-term outlook on the rupee, a spot trader at a private sector bank said.

"We reckon the rupee has shifted into the new range of 81.80-82.30," Amit Pabari, managing director at CR Forex said.

The dollar index was down about 0.5% this week and the U.S. currency declined against major Asian currencies. This was despite U.S. near and far maturity yields reaching multi-year highs and a further repricing of the Federal Reserve terminal rate expectations.

The Fed's favoured inflation gauge rose more than expected, data released last Friday showed.

"We now expect the Fed funds rate to peak at a higher level..," ING Bank said in a note. "We think the Fed will now hike in March, May and June (by 25 basis points each."

ING, however, maintained its view that the U.S. central bank will cut rates late this year.

Futures have fully priced a 25 bps hike at the next three meetings and about 14 bps of rate cuts this year.

0 notes

Text

The FX Global Code: Why Now Is the Time

So, how has adhering to the Code helped us?It has become a training and education tool for new members of our FX, trade support, and operations teams and is part of our onboarding materials.It has prompted a review of our policies and an in-depth discussion about the Code’s applicability, which has strengthened our understanding of how the market functions as well as its best practices.It has empowered our trading staff to demand best execution practices, and all our counterparties must sign the Code.It has enabled us to continuously improve our policies and procedures. Each update has removed ambiguity.It has increased our confidence in our internal policies and procedures and highlighted the strength of our governance framework to clients.As corporations and asset managers look to demonstrate their commitment to environmental, social, and governance (ESG) values, they should embrace an opportunity for a thorough review of the governance framework supporting their FX business.Signing the Code has also benefitted our clients. It has integrated a global standard that contributes to an efficient and ethical functioning of an otherwise fragmented and decentralized FX market. Counterparties that have signed the Code can use it as a guide in unexpected circumstances or disputes, such as fair treatment of all clients with settlement transactions on Queen Elizabeth II’s funeral, an unexpected public holiday. Initiatives have also sought to reward firms that sign on to the Code with access to additional pockets of liquidity. For example, the global FX trading platform 360T announced that as of 1 October 2022 only Code signatories or market makers offering firm liquidity will be able to make prices anonymously on its electronic communication network (ECN), 360TGTX.What if I told you that the largest, most liquid market in the world is also one of the least understood? Its $2.1 trillion daily spot turnover dwarfs that of bonds or equities, and all its transactions are conducted over the counter (OTC). The market also connects thousands of participants in 52 different jurisdictions and facilitates a further $5 trillion daily in forwards, swaps, and options, in addition to spot transactions.

I am talking, of course, about the highly fragmented foreign exchange (FX) market.

Such a large and interconnected market should operate in an open, liquid, fair, robust, and transparent manner. Since the global financial crisis (GFC), the FX market’s daily turnover has approximately doubled. That has raised expectations regarding transparency and liquidity and has necessitated increased oversight. I have had a front-row seat to the FX market’s evolution over the last 20 years and recall all too well how it often made headlines for all the wrong reasons as information imbalances between dealers and clients led to abuses. “Suspicion of Forex Gouging Spreads,” the Wall Street Journal blared in February 2011: “Some of the largest investment firms in the U.S. have been overcharged by banks for currency trades, bank insiders and others claim, broadening the scope of alleged abuses in pockets of the $4 trillion foreign-exchange market.”

In response to such excesses, G10 central bank governors launched a global initiative to establish the FX Global Code (“the Code”) in May 2015. Over the next several years, representatives from 16 central banks, in collaboration with private market participants from both the buy-side and sell-side, drafted a comprehensive document. RBC Global Asset Management (RBC GAM) participated in one of the working groups.

The final 70-plus-page document, published in 2018, went beyond ethics to embody industry best practices. Organized around six leading principles, the Code outlined what market participants expected from themselves and each other:

Ethics: “To behave in an ethical and professional manner to promote the fairness and integrity of the FX market.”

Governance: “To have a sound and effective governance framework to provide for clear responsibility for and comprehensive oversight of their FX market activity, and to promote responsible engagement in the FX market.”

Execution: “To exercise care when negotiating and executing transactions.”

Information Sharing: “To be clear and accurate in their communications and to protect confidential information.”

Risk Management and Compliance: “To promote and maintain a robust control and compliance environment to effectively identify, manage, and report on the risks associated with their engagement in the FX market.”

Confirmation and Settlement Processes: “To put in place robust, efficient, transparent, and risk-mitigating post-trade processes to promote the predictable, smooth, and timely settlement of transactions in the FX market.”

The Code is not part of regulatory frameworks in most jurisdictions, so adherence to it is voluntary and signifies the participant’s commitment to good governance and good practices as well as promoting fair, transparent, liquid, and robust markets. The Code is meant to apply to all wholesale FX market participants — both buy- and sell-side as well as trading venues and other entities that provide brokerage and execution services. The Code allows for proportional implementation, however, as specific circumstances and variations in business activities may dictate. This acknowledges that dealers’ activities are inherently different from those of asset managers, corporations, or central banks, and not every principle applies to every participant. For example, as an asset manager, RBC GAM doesn’t make markets for clients and doesn’t conduct any proprietary trading on behalf of the firm, so many of the sell-side rules don’t apply to us. Determining which principles apply is the first step before a market participant can confirm adherence to the Code.

As a living document, the Code is maintained and updated to reflect market changes, which is a key objective of the Global Foreign Exchange Committee (GFXC). The GFXC website is an excellent resource for information and tools to facilitate adoption. The original 2018 version of the Code was updated in 2021, and with each triennial revision, participants are expected to re-affirm their commitment to the latest document.

In the four years since the Code’s release, most sell-side FX market participants have signed on. Buy-side adoption, however, has been slow to follow. Limited resources, that FX constitutes a small part of their business, the Code’s voluntary nature, and the perception that it’s a “sell-side thing” are among the reasons cited for the poor buy-side uptake.

Having worked as a portfolio manager for more than 20 years, I find this perplexing. We have relied on our in-house FX desk for execution for more than 25 years at RBC GAM. Based on our experience, we believe that as an ecosystem, the FX market requires all participants to know, follow, enforce, and uphold the principles. We care about best execution in FX just as we do in fixed income and equities: It’s an important part of our governance framework.

As the FX market grows and evolves, more needs to be done to improve its functioning and integrity. Progress requires all buy-side professionals to commit to globally recognized best practices. And progress continues with engagement in continually improving them. We have sought to do this at RBC GAM and hope other asset managers will recognize the benefits of signing on to the Code and adhering to its principles.

0 notes

Text

Oil Market Driven by Sudden Changes in Assessments of Supply, Demand, Commerzbank Says

The oil market has recently been pulled back and forth by sudden changes in market participants' assessments of supply and demand, with a focus on oil supply from Russia and oil demand in China, Commerzbank said in a Monday note.

Western sanctions against Russia have had a noticeable impact on oil supply and shipping routes, with the EU having almost completely halted Russian oil imports and Russia having to reroute supply to Asia at steep discounts, the bank noted.

Meanwhile, China's oil demand is forecast to rise by 900,000 barrels per day on average for the year, according to the International Energy Agency, almost half of the expected increase in global oil demand.

Other signs that oil demand in China is picking up include Saudi Arabia raising official selling prices for oil shipments to Asia in March for the first time in six months, as well as China significantly increasing import quotas for crude, Commerzbank said. China appears to be making sure refineries can replenish stocks for an expected boom in demand, according to Commerzbank.

0 notes

Text

Oil Rebounds, Still Poised for Another Monthly Decline

WTI crude futures rose almost 2% to above $77 per barrel on Tuesday, underpinned by optimism that China's economic recovery will spur fuel demand.

Investors expect China's oil imports to hit a record high in 2023 amid rising demand for transportation fuel and as new refineries come online.

On the supply side, Russia revealed its plans to cut oil exports from its western ports by up to 25% in March, exceeding its announced output curbs of 500,000 barrels per day.

Still, the US benchmark is down more than 2% in February, on track for a fourth consecutive monthly decline amid lingering concerns about a recession-driven demand downturn.

Hotter-than-expected US economic data fanned concerns of more Federal Reserve interest rate hikes that could weigh on demand at a time when inventories continue to rise.

The latest EIA report also showed that US inventories rose by 7.648 million barrels to 850.6 million in the week ending February 17th, the highest level since September.

0 notes

Text

Brent Heads for 4th Monthly Decline

Brent crude futures traded around $82 per barrel on Tuesday and were on pace to decline for the fourth straight month, as the prospect of further monetary tightening and surging US stockpiles outweighed demand optimism from top importer China and production cuts from Russia.

Stronger-than-expected US economic data and hawkish signals from policymakers reinforced expectations that the Federal Reserve will need to keep raising interest rates to tame inflation.

The latest EIA report also showed that US inventories rose by 7.648 million barrels to 850.6 million in the week ending February 17th, the highest level since September.

Keeping a floor under prices, Russia announced its plans to cut oil exports from its western ports by up to 25% in March, exceeding its announced output curbs of 500,000 barrels per day.

On top of that, investors expect China’s oil imports to hit a record high in 2023 amid rising demand for transportation fuel and as new refineries come online.

0 notes