Don't wanna be here? Send us removal request.

Text

Opportunity Cost of Completing Your Assignments Early vs Waiting Until the Deadline

One aspect of Economics that I feel can be implemented anywhere in life is the idea of Opportunity Costs. I didn't realize it but as a college student and a young adult, every decision I make follows the idea of opportunity costs. What will I gain out of this decision vs what will I lose and vice versa? I will say however that one example of opportunity costs that has plagued me would have to be the Opportunity Cost of Completing Your Assignments Early vs Waiting Until the Deadline. Let's take a look at some of the Costs and Benefits of this conundrum.

In terms of the Benefits of completing your assignments early, there are :

Not having to worry about work later on

Freeing up time for finals

Earning points early on

Higher Work Quality

In terms of Costs for completing your assignments early, there are:

More stress early on

Less information or understanding of the topic you're covering

Forgetting the concepts you work on

Taking time during lectures, classes, and work to finish

In terms of Benefits for waiting until the deadline, there are:

Better Understanding of Concepts

More free time for personal life

Less long-term Stress

In terms of Costs for waiting until the deadline, there are:

More short-term stress

Possibility of not being able to complete your work

Less time to study for finals

Instructors not accepting your work

Worse Grades

Lack of applicational understanding

Now arguably, after looking at the costs and benefits of the Opportunity Cost of Completing Your Assignments Early vs Waiting Until the Deadline, I would have to say that completing your assignments early looks like the best option overall. But at the end of the day, we as people have free will and free choice to make the decision we want to. And that is where I see the beauty of economics. We have free will and free choice and because/despite that we are able to come up with various theories, correlations, and equations that help us predict what would be better or worse for us as a society. Opportunity cost is one of many theories that we implement into our daily lives constantly and shows how economics is derived from our unique ability as humans to derive ideas from our natural instincts and apply them to other fields in life.

Mohammed Kazmi

ID Number: 20888495

UCI ID: [email protected]

(Submitted through classmates account because Tumblr Link was unavailable/faulty)

0 notes

Text

Oligopoly of 2000's Baggy Jeans: Jnco

As current fashion trends shift back to more baggy-fitting silhouettes, the rise of demand for wide-leg jeans has caused a soar in prices in recent years. This is more prominent in the vintage community, as the supply for old 2000s brands are limited. The lack in supply has led certain brands such as Jncos, a popular rave/skater brand in the 90s and early 2000s, to have a certain appeal in the way they may seem luxurious or rare.

This graph shows that web searches for Jncos have reached an all-time peak since the mid-2010s, illustrating the rise in consumer demand. As a result of increased consumer demand and a limited supply, vintage Jnco jeans could vary between $100 to 1,000 dollars for a single pair in today’s economy. This illustrates an oligopoly market because they are one of the only 2000s brands that continues to produce the same product as they did 20-30 years ago, leading to strong consumer loyalty as well as setting themselves as a reputable brand and more desirable when compared among their competitors. Additionally, as their line of products is sold online exclusively, they can have a significant influence on the market price by reducing the number of sellers.

As stated before, Vintage Jnco Jeans can reach prices up to 1,000 dollars. This alone is absurd. The reason for this is because of the increased popularity of the “vintage” or old designs of Jncos that attract a wide range of young teens, including myself to spend hundreds of dollars on these exclusive “rare” pants. Despite Jnco’s lack of marketing, it is the die-hard consumers who are actively increasing the popularity of the brand and the market prices of these jeans, leading to an oligopoly market in the second-hand clothing apps such as eBay or Depop, where the majority of vintage Jncos are sold currently. The number of Jnco sellers on these apps is very limited, leading to them having a chokehold on the market price. Additionally, acquiring Vintage Jncos to resell today requires connections or consistent thrifting, creating a barrier to entry.

As fashion trends continue to shift each decade, it is a matter of time before Jncos lose the spark that they have today. As for me, I will take the opportunity to keep collecting these jeans and hopefully pass them onto my kids same as the 40-50 year-old original owners of these pairs are doing today.

name: benson yeung ID: 38942660 Discussion: tueday 7:00-7:50

0 notes

Text

Matthew Stank ID#94688618

Yuvraj Chera ID#53672029

0 notes

Text

The Struggles With Choosing a Major in College

As students in college one appliance of econ in the real world that many students have dealt with including myself is the opportunity cost/trade off of choosing a major. Choosing a major has many factors that come into play like salary expectations, the demand for that certain career path, financial aspects, and personal interest. There are usually two main paths that many people have advised me to take while asking them for advice when I was picking mines.

The first option is to disregard what you like doing and choose a major in a career path that has a higher demand in the job market. By doing this, you have a higher chance of making a decent amount of money right out of college even if you do not like it. Many people argue that your job does not have to be something that you enjoy doing, your main goal is just to make money so that you are able to live. Some pros of this is that you will have a better chance of having job security, being financially stable once you graduate which can also lead to a better work life balance. However, on the other hand, some cons of doing this is that you will have a lack of fulfillment which can decrease your passion and motivation and can lead to regret. Some argue that there is no point in pursuing this career path if you can be miserable everyday.

The second option is to choose a major that you do enjoy even if that certain career field might be in low demand and that there is no guarantee that you will be able to get a job with it after getting a four year degree. Some pros of this is that you will have passion and interest for your job if you do find a job. Because you actually enjoy what you do, you are willing to deepen your understanding of harder concepts which can overall help you grow as a person. On the flip side, because it will be harder to find an actual job, you might not have financial stability and will have fewer job opportunities. This could also lead to you needing an even higher education or even changing your career path, which will take more time, effort and money.

As you can see choosing a major has many trade offs, it just depends on what you value and deem to be more important.

Alyssa Tran

Student ID: 58544534

0 notes

Text

Opportunity Costs of Traveling to Peru with Friends While Skipping School

After a stressful two quarters, my friends and I were in desperate need of a break. So we thought, why not go to Peru? However, since all 3 of us are going to be gone during spring break, the only option would be to go during the first week before work gets overwhelming again. As I continued to explore the possibility of exploring Peru with my friends, I began connecting it to what I considered the most prominent microeconomic concept: opportunity cost.

To summarize, the concept describes how every single choice we make has an underlying cost, even if it is not monetary. Say, for example, choosing to eat at the Anteatery for dinner can carry the opportunity cost of going out to In n out to grab a double-double, or that watching youtube for an hour can have the opportunity cost of 1 hour of homework that could've been completed instead.

My choice in choosing this Peruvian expedition over fulfilling school requirements starkly embodies the idea of opportunity cost, leading me to thoughtfully evaluate the pros and cons associated with this unconventional decision.

The first important opportunity cost that I have to face is the days of school that I will be missing since it will extend from Thursday to Tuesday. The four-day absence has the potential to create a significant backlog in work, as I’ll need to catch up on the lectures, discussions, and hands-on activities missed. Moreover, the risk of missing quizzes and other time-sensitive assignments, which cannot be retaken or submitted late, adds to the challenge. The effort required to compensate for this lost time not only involves catching up on missed content but also coping with potential gaps in understanding that could have been mitigated if I had chosen to attend those sessions. This scenario could lead to a notable decline in my academic performance, as lower marks could snow ball into potentially lower overall final grade, ultimately affecting my academic standing and potentially narrowing my future opportunities.

Additionally, the second opportunity cost to consider is the financial investment. Dividing travel expenses among my friends made the journey more financially feasible, allowing us to explore a part of the world we might not have been able to afford individually. With the airline tickets being $600 round trip, an estimated 12 meals at $20 per meal, with around $400 in additional expenditures, the trip comes out to an estimated cost of $1240. By allocating funds toward this adventure, we are giving up other potential uses for our money, such as saving for future educational needs, investing, or even spending on different trips. Additionally, such a large shared financial commitment can also introduce the risk of potential disagreements over budgeting and expenditures—a risk that necessitates careful consideration and management.

Lastly, from a broader perspective, our choice in choosing to travel to Peru while skipping school also represents the opportunity cost of adhering to societal norms and expectations regarding education and responsibility. As freshmen, we are often faced with pressures to follow a traditional educational path, which is seen as a prerequisite for success. By choosing to travel, we are actively challenging the conventional expectations, opting for experiential learning and personal development over traditional academic achievement. This decision reflects a broader contemplation of our values, underscoring our willingness to explore alternative paths for knowledge and personal growth.

In conclusion, opting to travel to Peru with friends instead of attending school encapsulates the essence of opportunity cost—a fundamental economic principle highlighting the inherent trade-offs in every decision. This journey prompted a deep analysis of the benefits and sacrifices involved, urging us to carefully evaluate our choices. By prioritizing experiential learning and the cultivation of lifelong memories over conventional academic pursuits, we aimed to maximize the value of our experiences, fostering personal growth and strengthening our bonds in the process.

1 note

·

View note

Text

Oligopoly

In the complex web of economic systems that govern our world, the concept of oligopoly stands out as a fascinating and prevalent phenomenon. An oligopoly occurs when a market is dominated by a small number of large firms, often leading to limited competition. This economic structure has profound implications for consumers, businesses, and the overall market dynamics.

Typically, in an oligopolistic market, a handful of firms control a significant share of the total market. These firms wield substantial market power, allowing them to influence prices, output levels, and, in some cases, even collude to maintain their dominance.

One of the most striking examples of oligopoly exists in the global automobile industry. A small number of major players, such as Toyota, Ford, Volkswagen, and General Motors, control a significant portion of the market. These companies have the ability to impact pricing strategies, technological advancements, and industry trends. The close competition among these giants often leads to intense rivalry and strategic maneuvering.

The soft drink industry provides another compelling example of oligopoly. Companies like Coca-Cola and PepsiCo dominate the market, holding a duopoly that allows them to set prices, control distribution channels, and engage in aggressive marketing strategies. The barriers to entry in this industry are high, making it challenging for new players to disrupt the established order.

The tech industry, particularly in the realm of smartphones and operating systems, is characterized by oligopolistic features. Apple and Samsung, for instance, command a substantial share of the global smartphone market. Similarly, in the realm of operating systems, Microsoft and Apple hold significant sway. These firms not only compete but also shape industry standards and innovations.

Oligopolies have a profound impact on consumers, often resulting in both advantages and disadvantages. On the positive side, the intense competition among oligopolistic firms can drive innovation, pushing companies to invest in research and development to gain a competitive edge. However, the limited number of players can also lead to higher prices, as the dominant firms have the power to set and maintain premium pricing levels.

Governments often face challenges in regulating oligopolistic markets. Striking a balance between fostering healthy competition and preventing monopolistic behavior is a delicate task. Antitrust laws and regulatory bodies play a crucial role in ensuring that oligopolies do not engage in unfair practices that harm consumers or stifle innovation.

Xuanqi Zang

ID:30296276

0 notes

Text

Microeconomics of UCI Parking

Steven Velasquez

ID: 72484895

0 notes

Text

Opportunity costs: MEAL PLAN VS TAKE OUT

WENDA YU 95327262

ECON 7PM - [email protected]

0 notes

Text

The Booming Market of Formula 1: Market Demand

Angelo Ilagan

57561339

Two years ago, I found my love for Formula 1, the pinnacle of all motorsport racing. I have always loved cars ever since I was a child, but this was the gateway to consistently watching and following racing. My interest began when I watched the “documentary” series for the sport on Netflix called Formula 1: Drive to Survive. The series began in the 2018 season and has continued on every year. Since then, there has been an increasing interest in F1 in the United States as the demand for F1 was always present worldwide, especially in Europe. Last year, the Las Vegas Grand Prix was held since its last F1 race from 1982. This year, I would like to attend the closest Formula 1 race to me and evaluate the market demand for me and other fans of the motorsport.

When we focus on market demand, we can see an increase in demand as more people will be interested in going after the race from last November. As demand increases, the quantity of tickets will increase while staying at the same price, allowing more people, like me, to purchase and attend the race weekend. However, if the FIA and Formula 1 increase the amount of seats available in the stands. I hope to attend the race this November and hopefully open more races in different states.

0 notes

Text

https://docs.google.com/presentation/d/14YAqVMrH1V-3tTgQMN6V8AsWRA2FdSBCrp4ENaM-nuo/edit?usp=sharing

Evelyn Wang

ID#: 68352666

0 notes

Text

The Indie Game Revolution

Name: Steven Yi

Student ID#: 81369380

Email: [email protected]

Currently in the video game industry, there is some kind of revolution occurring. Essentially, the majority opinion of Triple A games is falling, while the opinion of Indie Games is skyrocketing.

For those unfamiliar with video game industry terms, I will first state that the terms “Triple A” and “Indie” are very subjective as well as not very concretely defined. Therefore, I will stick to definitions which I believe fit the best for how most people use the terms. “Triple A” games are games developed and published by major publishers/firms in the industry; these are firms such as Nintendo, Activision, Square Enix, and Ubisoft. “Indie” games are game developed but not necessarily published by relatively smaller teams/firms in the industry; these are firms such as Team Cherry who made Hollow Knight, Daniel Mullins who made Inscryption, and Arrowhead Studios who made Helldivers 2.

The video game industry may appear to be sort of an oligopoly, but it is more accurately described as a monopolistically competitive market due to the large number of firms as well as the fact that the goods/games are similar but differentiated.

Ever since around the height of the pandemic in 2020, the consumer preferences for Triple A games were slowly shifting towards more reputable Indie games. The reason is that this era of gaming in particular was characterized by multiple underwhelming or average quality Triple A releases such as Call of Duty: Vanguard, Starfield, as well as Skull and Bones. There were some successes, yes, but the general opinion of Triple A games continued to slowly dwindle down over the last 4 years. In addition to this, Triple A studios continued to incorporate highly-disliked features in their games such as microtransactions (which is paying for digital items inside a game that you probably already paid for; items that are typically overpriced and could be as miniscule as a menial amount of in-game currency).

Although I have no concrete statistics to show this, social media as well as my friends have very adamantly shown their detest for the quality of most Triple A games these days. It is even evident in this Reddit poll:

That is a whopping and nearly 2x the amount of people saying no versus the people saying yes. This is also in the r/videogames subreddit which is a subform specifically dedicated to video games, and the poll was taken about 6 months ago which was September 2023. In this year, particularly disappointing Triple A games were released such as Redfall and Call of Duty: MWIII (2023).

Some notable Indie games released during that era of 2020-2024 had a very good reputation however, such as Inscryption. The release of Inscryption in 2021, and its very positive feedback, was a harbinger for the revolution that would come in a few years.

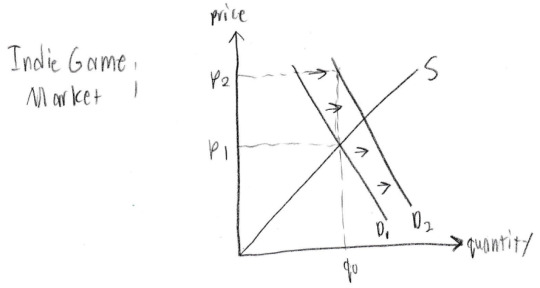

Due to the monopolistically competitive nature of the market, this slow change in preference from preferring Triple A games to preferring Indie games more subsequently resulted in a shift to the left for the market demand curves of Triple A game firms, and a shift to the right for the market demand curves of Indie game firms. This is shown in the images below:

Figure 1

Figure 2

As shown in Figure 1, as the demand curve shifts left, Triple A consumers become willing to pay less for the same quantity of goods. In this case the price they are willing to pay shifts from p1 to p2 where p1 > p2.

In Figure 2 on the other hand, as the demand curve shifts right, Indie game consumers become willing to pay more for the same quantity of goods. For this graph, the price they are willing to pay shifts from p1 to p2 where p1 < p2.

These graphs show that Triple A consumers will only pay for a lower price, at the same quantity they demanded before. Inversely, Indie game consumers will pay slightly more for the same quantity as before.

But these demand shifts were slow and gradual throughout the years. Until, the famous indie game Lethal Company released October 2023. Word spread about how fun Lethal Company was, and its quality resulted in an explosion of greater preference towards Indie games versus Triple A games. This was evident in the fact that Lethal Company sold approximately 10 million copies as of today’s date: March 15, 2024, and it beat multiple other well-known Triple A games in the Top Sellers list of the highly popular video game store Steam. This explosion in preference resulted in a large shift to the right for the market demand curves of Indie game firms, as shown below:

Figure 3

In Figure 3, the demand curve shifts from D2 to D3. This shows that at q0, consumers are willing and able to pay much more than before the demand shift, where they are now willing and able to pay p3 and p3 > p2. Or, in another way, for the same price p2 they are now willing and able to purchase q1 where q1 > q0. This graph shows that Indie game consumers are willing and able to pay even more for the same amount of games they demanded before the demand shift, or if the price remains the same then their quantity demanded will have increased.

Corroborating the recent figure shown, the Indie game Palworld was released in January 2024, and it sold about 25 million copies as of today’s date, which surpasses previous and recent Triple A games out of the water. It surpasses even some of the best-quality ones such as Hogwart’s Legacy’s 24 million and even Nintendo’s (THE name brand of the video game industry) Tear’s of the Kingdom’s 20 million.

Now, the new Indie game that is currently erupting with popularity is Helldivers 2. This game has currently sold 8 million copies as of today’s date. Given that it was released February 8, 2024, that makes it selling at an average of 1.5 million copies per week. Although its number of copies are not as high as many famous Triple A games, its popularity and reputation have evidently been increasing at an alarming rate; its reputation has most likely surpassed the reputation of many other Triple A games released recently. If you are curious, just look up “Is COD MW3 better than Helldivers 2,” or anything related to COD MW3 or Helldivers 2. You will find that the gaming community vastly prefers Helldivers 2, despite the Call of Duty franchise being well-known as well as having a much larger budget. In addition to this Helldivers 2 has already surpassed the Triple A game Skull and Bones which was released February 16, 2024, and sold about only 1 million copies.

This entire Indie Game Revolution demonstrates how consumer preferences can be powerful in how the market demand curve shifts for firms in a monopolistically competitive market. In this case, the general quality of the goods from Triple A firms resulted in a decrease in consumer preference for those goods, which resulted in a shift towards preferring Indie firms’ goods. Here is a funny meme that shows the consumers’ general distaste for current Triple A games, which received 10,000 upvotes and was posted on the Helldivers Reddit subforum (BG3 is Baldur’s Gate 3, another somewhat-Indie game):

References:

0 notes

Text

The Rise and Fall of the Golden Era of Japanese Sports Cars

Name: Manav Anand

Student ID: 55378875

I love cars. Particularly Japanese sports cars from the late 80’s and early 90’s. As I learned more and more about economics, I began to learn how heavily the economy was responsible for the rise and fall of the sports cars I love so much. Here I will describe the economic events which had a cascading effect on the Japanese car industry from the early ‘70s to late ‘90s, and car culture today. The story begins with underdog Japanese automakers competing against the oligopoly of the "Big 3" American car companies and dominating in the midst of a global gas crisis. Flush with cash, alongside a strong domestic economy, Japanese carmakers poured their heart and soul into engineering exciting sports cars and insane race cars, pioneering new technology and facing off against European racing legends. Finally, a decline in the Japanese economy and changes in import law led automakers to end sports car development, marking the end of a “golden era” of Japanese sports cars.

Part 1: Oil crisis

The 1973 oil crisis was caused by the total embargo of oil to the United States (among other countries) which caused significantly higher gas prices and gasoline shortages. Due to a price ceiling on oil imposed in 1971, it was more profitable to import cheap oil to secure a larger profit. Subsequently, By 1972, more than 80% of the oil in the United States was imported, leading to a devastating reduction in supply when the embargo came. The quantity sold became extremely low, and the equilibrium price of gasoline shot up. A second oil crisis (different cause, similar effect) also happened in 1979, and famous pictures from this time show how severe gas shortages had become throughout the late 70s.

These repeated gas crises caused a demand for more fuel efficient cars, and small, efficient Japanese imports were the solution to the demand. Combined with a better perception of the quality of Japanese vehicles, the efficient, practical imports had begun to dominate the existing oligopoly of “Big Three” American car manufacturers Ford, Chrysler and GM. The Big 3 struggled to match the quality and efficiency of Japanese cars, and spent the next few years playing catch-up to win back their share in the overall US car market. These firms were engaged in monopolistic competition, and Japanese firms had entered and began securing short-run profits. The Big 3 companies had actually set up their financial downturn, as they had spent their money on marketing and production of big cars while ignoring the market's desire for compact cars. The Japanese automakers focused on what the market wanted, making cars which provided maximum utility to US consumers. Comparing car advertisements from the 1970s clearly shows this ideology difference. The American companies inability to satisfy the demands of US consumers led to them being outsold by firms that could, showing how even massive corporations must abide by economic fundamentals, or face massive failure.

As if there weren’t enough things going well for the Japanese in the ‘70s and ‘80s, the dollar-to-yen ratio allowed the Japanese imports to be profitably sold at much lower prices than Domestic vehicles, further increasing the competitiveness of Japanese Imports in America. Even the Japanese government played a hand, identifying how critical the automobile industry was to the economy, and taking measures to financially support its growth. The extreme success of the 70’s, along with a booming Japanese economy due to smart governmental decisions, leads us to the golden era of Japanese sports cars.

Part 2: The Golden Era

Flush with cash, consumer demand for luxury goods in Japan skyrocketed, and automakers were happy to spend their extra money on expensive R&D for sports cars, leading to the introduction of turbochargers for increased power, electronically adjustable suspension, Adjustable aerodynamics and more. It is often said that the easiest way to make a small fortune in racing, is to start with a large fortune. It is also often said "Win on Sunday, Sell on Monday" Referring to how even if automakers lost money by racing, racing success would be powerful marketing for the firm. We can see in the RX-7 advertisement how directly Mazda used their racing pedigree to market their vehicles. Racing is expensive, and Japanese automakers had the resources to race in the big leagues. Japanese automakers succeeded in the racing world, with not just good performances, but dominating ones.

The Calsonic Nissan R32 Skyline, entered in the Australian Touring Car Championship won every race it was entered in for 3 seasons. Its performance was so unbelievable, it permanently earned the Skyline GTR the nickname “Godzilla”. Consumers could purchase street-going versions of these cars, and enjoy the racing technology for themselves. The all wheel drive system was so advanced for its time, that even today, car enthusiasts continue to modify and use this system in their custom, high performance vehicles.

Honda had devoted its resources towards Formula 1, and from the years of 1987-1991, won 5 consecutive constructor and driver’s championships alongside the Mclaren and Williams Racing Teams. Developing just one Formula one race engine costs extraordinary amounts of money. Interviews with Nigel Mansell, who drove Honda-powered Williams cars from 1985 to 1987, revealed that Honda were making and developing 4 to 6 totally different engines in a single season during this time.

Outside of racing, Honda was developing the Honda NSX (Also known as the Acura NSX, as the NSX was used to launch the Acura Brand). The Honda NSX was a mid engined sports car intended to compete against automakers like Ferrari and Lamborghini. The desire for a lightweight chassis led to the development of the aluminum chassis, which paved the path for aluminum manufacturing in automobiles for years to come. The famous racing driver Ayrton Senna, who was driving for McLaren/Honda in F1 at this time, was consulted for input on the handling and chassis.

Until the NSX, consumers were forced to put up with temperamental Italian exotics if they wanted a super car; They were hot, noisy, and cramped, with a plethora of mechanical issues and oversights. The Honda NSX, in contrast, was reliable, comfortable, and practical. The Honda NSX was a newcomer to the supercar scene, and completely shifted the market; If Honda could do it, why didn't all the other manufacturers do it? The Honda NSX went on to sell well, and gain celebrity status, being regarded as one of the greatest sports cars to ever exist due to its practicality combined with amazing handling. Even as the NSX aged, its accomplishments were so great, that It stood as the benchmark for another one of the greatest sports cars to ever be made. The Mclaren F1 was the first "hyper car", a car that truly had no limits or constraints, other than to be the very best. It held the automoblie top speed record for 24 years. Its designer, Gordan Murray said: "The moment I drove the 'little' NSX, all the benchmark cars–Ferrari, Porsche, Lamborghini–I had been using as references in the development of my car vanished from my mind,"

Mazda had been competing in endurance racing, slowly trying to win Le Mans in a car powered by their signature Wankel Rotary Engine. In 1991, the team drivers were told to drive all-out, forgoing the usual conservative racing strategy employed by teams to ensure that the cars would survive to cross the finish line after 24 hours of racing. The car’s superior fuel efficiency meant the car could stop for fuel less often over the course of the race, and the superior reliability of the engine displayed in earlier racing meant that drivers could push the engine to its limits. The engine was so reliable, that after winning the race, covering 3,000 miles at an average speed of 128 mph, Mazda engineers said that the engine was in condition to complete another race with nothing more than an oil change. The money spent on R&D during this time allowed for innovation of technologies in the harshest conditions an automobile could be subject to, and these technologies would slowly be developed into the technology we have today.

Part 3: Where Did it All go?

The golden era of sports cars, fueled by the success of efficient, practical and reliable Japanese cars would have to come to an end eventually. Economic conditions began to decline in Japan, meaning that cars had to be sold at much higher prices abroad for profits to be made. Domestically in Japan, consumers did not have expendable income to spend on sports cars. The increase in the price of imports led to a decline in the units sold overseas, and changes to import law made this decline even more severe. Automakers would have to spend additional resources to comply with different US safety and emissions standards. Automotive manufacturers finished development of one final generation of sports cars in the late 90’s, and took their focus away from sports car development.

Although the era is now long in the past, the cultural influence of these cars is undeniable. The children who grew up watching Fast and Furious are finally old enough to buy the sports cars they saw on the big screen. Automakers are now once again developing fun, sports cars, but for many people, they simply do not scratch the same itch. New cars cannot replicate the analogue feeling, as modern technology trades driving experience for electronic convenience. Gone are the days where a teenager could work part time and buy a new sports car for themselves, and instead younger generations are scooping up old Japanese cars instead. Despite 30+ years of advancement, many car enthusiasts consider modern sports cars as inferior to the classics, and demand has skyrocketed accordingly. Legendary sports cars such as the Nissan Z, Mazda Miata, Toyota Supra, Honda Civic Type R and Acura Integra have all made a comeback with new, modern interpretations of the sports car formula, but are still often overshadowed by their older counterparts at car meets and shows. The famous 25-year import rule means that the dwindling supply of cars domestically cannot be replenished with cars from abroad.

The economic forces which guide the capitalistic world we live in are strong and relentless. While countless firms have collapsed into financial ruin, Japanese auto firms made a series of extremely wise economic decisions which allowed them to experience massive growth and the ability to show the world what they were capable of. Japanese automakers didn’t simply succeed as firms in this time period, they established themselves as a force to be reckoned with. They took on almost every other auto manufacturer across all types of vehicles, and showed them that they had fallen complacent in creating products that consumers actually demanded. Their achievements and design still stand strong today, delivering experiences yet to be replicated.

Sources Used:

https://www.roadandtrack.com/car-culture/a28632/acura-nsx-mclaren-f1-gordon-murray/

https://scholarworks.uni.edu/cgi/viewcontent.cgi?article=1030&context=draftings

https://www.wardsauto.com/news-analysis/energy-crisis-aided-japanese-imports

0 notes

Text

The Trade-off of Leather Working

I have taken up the trade of leather working in my leisure time for the past 4 months. While I have not made many large scale projects I have made simple wallets and keychains.

To get started with leather projects of course the first thing you need is leather. But aside from that, tools are the second most important part of leatherworking.

Before I started to begin learning about leather work I researched where to focus my efforts as there are many possible skills one could learn, yet the tools for each one are vastly different. I basically narrowed down to 3 main categories.

Primitive leather work ( making of items such typically straps, belts, wallets)

Luxury leather work ( making/repair of jackets, shoes, bags)

Tooling (using leather and tools to make designs)

If I wanted to apply the concept of preferences my list would look like

Tooling > Luxury

Primitive> Tooling

Primitive> Luxury

My list is rational and satisfies completeness. It aligns very well with my goal of looking for something cheap and fun. Primitive leather working fills both those categories. Tooling is quite expensive, but creatively stimulating. To get my feet wet with tooling I purchased a stamp of a Brontosaur to brand my wallets, but the small 1”” stamp alone cost me almost $20. The reason why Luxury HAS to be the last resort is because of all the expensive oils, stains and higher end leather that I would end up working with.

I started out with Primitive leather work because I really did not have my tools. The only leather I had were some scrap bits of leather I bought off of someone else. I was given a leather starting kit for the Holidays with waxed thread, whole punchers, etc. The first thing I made was a sling similar to the one above (although not as nice). Over winter quarter I started to produce more wallets. The issue with this is my PPF. I only have scraps so realistically I can’t really produce much, and everything I make is technically lower quality as I am learning. The decision choice for what products I made is reflected in my PPF.

The first PPF is linear and does not reflect how things actually played out. I had a choice from my scrap leather to make about 2 Wallets or 5 small keychains (This is an arbitrary assumption of what I could make, I am not too experienced or efficient yet). The issue here is the leather I had must be cut from the center of the leather sheet. Much of the scraps came in odd shapes that had to be shaven off in order to work with clean squares. Another important factor is the idea that if I wanted to make something nice, I had to pick the best spots of my leather to utilize. Something that had less marks, wrinkles or fraying edges. Thus the second PPF much more reflects this struggle. As I make one wallet the possibility to make more keychains diminishes. Because leather was my biggest scarcity issue I won’t make a PPF reflecting all my resources. If I chose to make a business out of this skill realistically on a large scale I would need to consider other factors such as tools wearing out (possibly ruining pieces of nice leather) or even oils/ paints staining leather incorrectly or even simply running out of supplies either thread, glue etc. The leather work I was doing really didn’t require all the tools I had which made me lucky in the sense that the value is preserved but on the other hand I was not operating for profit. Especially because I was not necessarily selling anything.

If I wanted to analyze my interest in Leather work as a firm. I came up with a rough idea of what my business could look like as a cost curve. As shown and as stated before I am making no profit. This means no matter what I do, whether I make the most beautiful bag in existence I will always be losing money. I have a fixed cost because I need resources. I may not own a factory or even the top of the line tools, but at the bare minimum I need blades, thread, and needles. However my fixed cost as much as I would like will never go to zero. This is because the way I view how I pay off the fixed cost is with practice. Everytime I complete a project, or learn it's costing me resources, durability on tools etc. However I because I am learning, and becoming more efficient in how I work the costs does go down in the long run in that regard. However I will still owe the monetary value thus it can never go or reach to zero. My AVC and my MC continue to grow especially because I don’t make any money. So If I were to evaluate my business I would say that I am operating at an economic loss hands down. But as everything does there are hidden costs. Following suit in this endeavor taught me valuable skills such as patience and budgeting. I also learned new sewing techniques and applied concepts from my classes into my work. The experience I gained from working with my hands on a project is more valuable than the money I put into this hobby. In terms of my social cost I would say I am making profit, especially because what I make is tangible and I can share it with my family. The fact that I am also using scraps instead of purchasing large commercial quantities of leather lets me be more resourceful and less wasteful than some other leather workers. I learned a lot in relation to sustainability and working with what I have rather than getting the top of the line tools.

Jonathan Ornelas

ID# 5562068

Ornelaj4

Econ 23 @7

0 notes

Text

Econ Live Presentation on Opportunity Costs

Rasek Chowdhury (20164904)

0 notes

Text

In my small home town, I knit custom blankets. My customers can choose the size of the blanket and the color of the yarn. In this scenario, we'll talk about my most popular option: a simple throw-sized blanket.

A simple throw-sized blanket takes 5 spools of yarn to make. Each spool of yarn costs $9.09. The cost of the yarn all together is $45.45. Knitting the blanket requires no more materials since I already have the tools to knit blankets.

So, the minimum cost that I could charge a client for a blanket of this size is $45.45. This would be considered market equilibrium price in a perfectly competitive market.

However, because I am the only knitter in my town with the time and patience to make blankets, I am a monopolist. I am the only supplier of custom-knit blankets in my small town. Because of this, I can raise the price of my blankets to make up for the time and energy I spend making their blankets.

Knitting a single blanket takes me 3-4 weeks. I spend ~150 hours during that time to just make one blanket.

The price I settled on for my blankets is $150 each (for this size). So we can calculate how much money I make by subtracting the cost of the blanket from the cost of the yarn:

$150.00 - $45.45 = $79.55 in revenue

This would mean that the hourly pay that I give myself is equal to my revenue divided by the time I take to make a blanket:

$79.55 / 150 hours = $0.5303/hour

Although this pay rate seems like such a small amount, I see it as worth it because it keeps my blankets within an affordable price range and I love knitting.

Watching others receive one of my blankets as a gift always makes the time I spend worth it.

Name: Richard R. Robles III

ID#: 94588215

1 note

·

View note