Don't wanna be here? Send us removal request.

Text

Can You Transfer Money Between Two Different Bank's UPI App

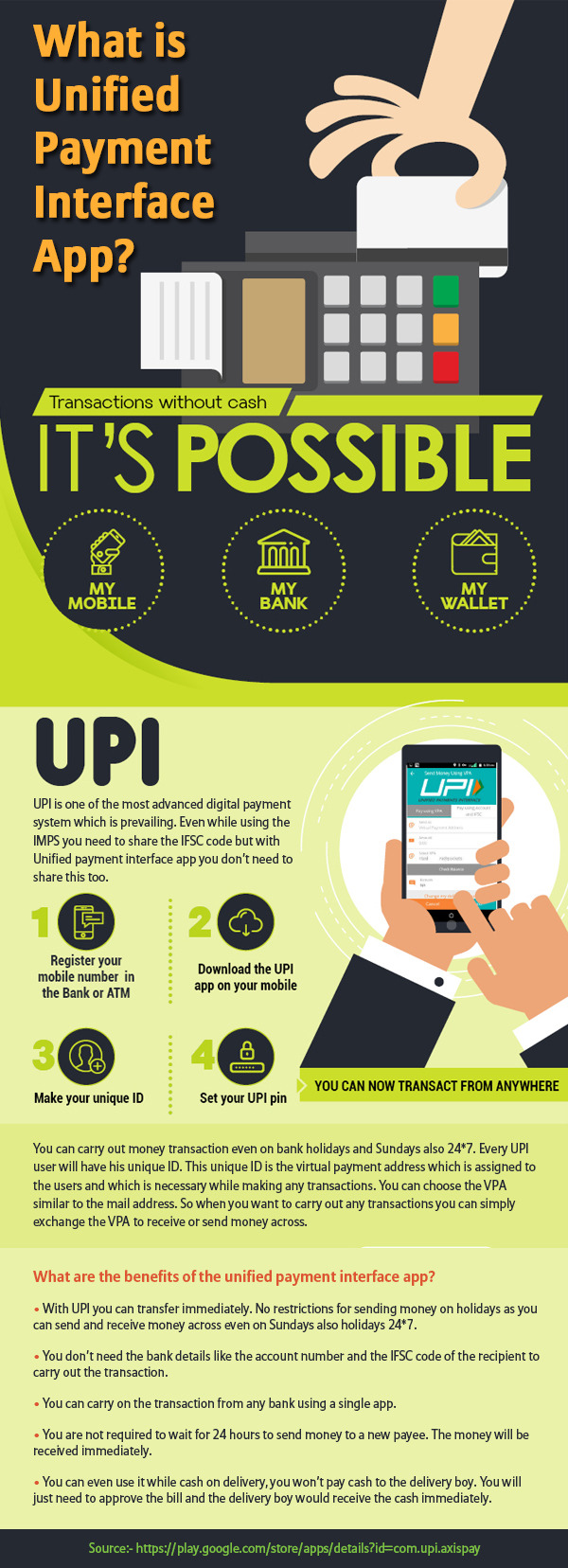

India Wallets and Online purchase interface is now gradually changing into UPI ( Unified payment Interface). In UPI App you only need to register once using your android,iphone or windows phone with mobile number registered at the bank. When you register your account you will get a unique address for the payment, like 9xxxxxxxxx@upi . @upi will change according to the UPI app you are using. With these unique address when you are transferring money to another account you only have to enter the other persons VPA(Virtual payment Address).

So there are a lots of UPI apps are available in Android and apple store to download for free. All banks created UPI apps for their customers. But they are not limited to only their bank account holders. That is even you are using UPI app of Axis bank you can link any other bank account to that App.

So The Next Question is whether you can transfer/pay money from UPI app of one bank to another banks Unified Payment Interface App Free? Yes

For example you installed UPI app developed by Yes bank (Phonepe) and your friend installed UPI app from Indian Government (BHIM). You want to transfer money from your account to your friends account through UPI. To transfer money to your friends account you only need your friends unique VPA. In this case the VPA will be mobile_number@upi . If you registered your UPI app recently it will give an error message that the VPA is not valid. It will take some time to update your VPA in the system.

Benefits of UPI

��No waiting for OTP (OTP is replaced with MPIN)

Don't want to remember your card details

Instant payment

Instant Refund

No need of Bank account number and IFSC code, the beneficiary mobile number or the VPA is enough for the transfer.

Source: http://bit.ly/2q9raa8

0 notes

Text

7 Ways UPI will change payments in India

Unified Payment Interface is set of services launched by NPCI (National Payments Corporation of India) which allows payments with aliases which does not need bank accounts and is interoperable across banks, this means you can simply turn your bank account into a wallet with simple authentication. Below is the basic architecture of UPI, you can see a detailed design document here.

7 Ways it will impact Payment business in India

1. Smartphone becomes Smart Banks

There are about 150 million active smartphones in Indian Market today. This number is projected to go to 500 million in next few years. Smartphone has already revolutionized how we communicate today.

UPI is designed to leverage smartphone revolution and bring about a payments revolution on top. Unified Payment Interface – UPI is designed as a mobile-first, bank interoperable platform which can utilize your virtual addresses email or phone number as a hook for payment requests.

This reduces costs and let you seamlessly move money through simplified authentication. Sending money can be as simple as sending a WhatsApp message – can you imagine ?

2. Simplify payments

Payments in their current form are cumbersome. You need lot of details like account number, bank details and then multilevel authentication to make the payment. This is going to fundamentally change with UPI which uses your phone number as an authentication so that you can just add potential payees and do single click payments.

3. Reduce costs of transactions

UPI will reduce cost of payments by reducing the cost of acquisition and infrastructure. You do not need to issue costly cards to get people on the grid. Simple mobile and OTM authentications will move money, hence reducing costs. This will have an impact on business models for PGWs and their margins and business will be under stress.

4. Wallets will be challenged

Last few years have seen mushrooming of Wallets in Indian market. While we regularly hear about likes of Paytm, Mobikwik or Oxigen, but there are 20+ wallets which are active in the Indian market and there are many other players who have a wallet license.

Some of the key value propositions wallets offer include:

Limited liability in wallets, i.e. storing some funds without exposing any card or other details in wallets

Ease of doing payments

Moving cash to digital currency

Unified Payment Interface – UPI is going to replicate ease of doing business for all players who work on their services. Also, you can do transactions up to 1 lacs instantaneously. For prepaid wallets this amount is currently Rs 10,000. So if you are a wallet and not building new differentiators for your customers, you will face real challenges. Wallets need to become smarter and they can probably leverage UPI in multiple ways.

5. Reduce Cash transactions

The Reserve bank of India (RBI) in its Payment System Vision Document (2012-2015) had mentioned the use of UPI for achieving its goal of a lower cash-intensive society and financial inclusion using technology.

UPI is a big step in achieving these visions, making online payments super easy and cheap will enable multiple service and ecosystems which will ultimately move us towards cashless payments.

As Wechat Red envelope case study has shown in China, cash transactions can move to digital currency overnight with right consumer experience.

6. Mushroom new services on top to enable various use cases like Recurring payment

Some of the best benefits of Unified Payment Interface – UPI are not yet visible. Simple payment use cases like recurring payments have not taken off in India because of lack of underlying infrastructure, cumbersome authentication with credit cards and ECS being really painful. UPI will enable some of these services and which in turn can enable multiple subscription-based services and business models.

7. Enabling efficient last mile payments

Last mile payments has been a tough nut to crack in India, GOI has been looking for cost effective models to push last mile payments for benefits like subsidies as well as get every citizen connected into the banking system. UPI in conjunction with authentications service like Aadhar can turbo charge this and will enable financial inclusion for millions of Indians.

Source: http://bit.ly/2nNekgy

0 notes

Text

Unified Payment Interface (UPI) Made Simple

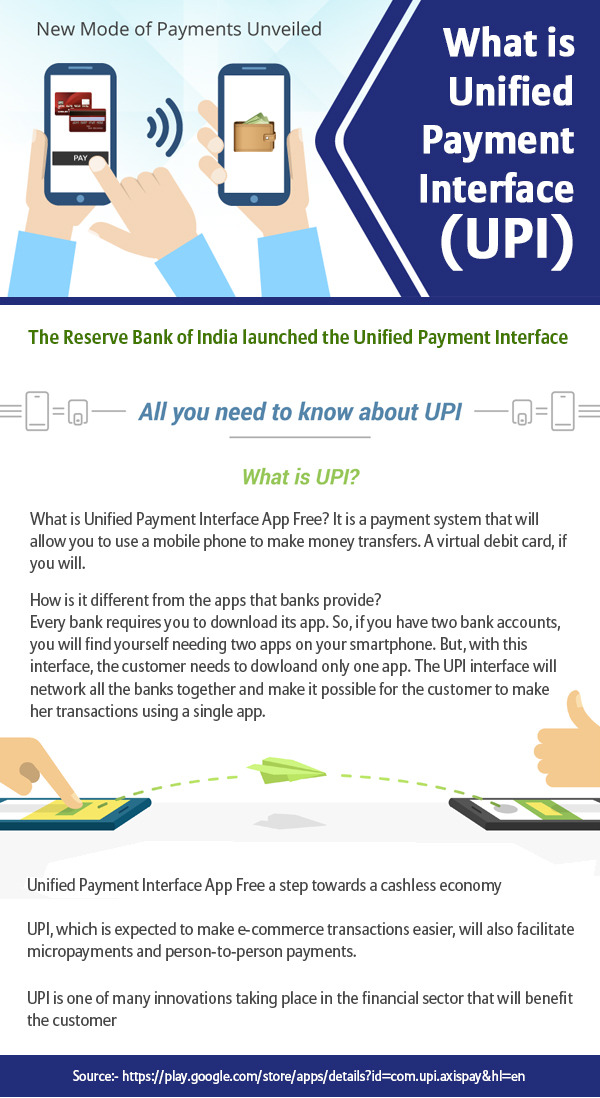

Unified Payment Interface (UPI) is a newly introduced platform to transfer money between any two bank accounts in India, by avoiding the existing complexities.

UPI is an indigenous payment system which works with the help of a smartphone.

But how is UPI different from netbanking (NEFT/RTGS/IMPS)?

UPI is standardized across banks, which means you can initiate a bank account transfer from anywhere with a few clicks. This means that UPI will help you to pay directly from your bank account to different merchants without the hassle of typing your netbanking password, credit card details or IFSC code.

Apart from cards, netbanking and wallets, your can now pay through UPI too.

Unified Payment Interface (UPI) allows to pay someone as well as ‘collect’ cash from someone.

Why UPI?

Even after introducing net-banking in India, the number of cash transaction happening in India is very high (almost 95% of all transactions).

UPI is part of RBI’s efforts towards ‘Less Cash’ India.

UPI was developed by National Payment Corporation of India (NPCI) under the guidelines of RBI. UPI is based on the Immediate Payment Service (IMPS) platform.

6 Steps to start using Unified Payment Interface

UPI is now publicly available. Check if your bank has released an updated mobile app with UPI support already.

Download the UPI app of your bank from Google Play Store/Apple Apps Store and install it in your phone.

Set app login.

Create a Virtual Payment Address (VPA). Eg: Roychoudary@icici

Add your bank account.

Set MPIN.

Start transacting using UPI.

Also read: Non-Performing Assets (NPA): How serious is India's bad loan problem?

What is MPIN?

An MPIN is given to a banking customer once they register for Mobile Banking support. Chances are you have one already, but have never used it.

How exactly does one make a payment transaction?

For example, consider that you are trying to book tickets online for a film via your mobile.

When you click buy, the mobile website/ mobile app you used will trigger the UPI payment link. Now, you are taken to the pay screen of the UPI app. Here, the transaction information is verified and a click followed by entry of a secure PIN completes the purchase.

How safe is UPI?

It is safe as the customers only share a virtual address and provide no other sensitive information. The ‘virtual payment address’ is alias to your bank account.

The virtual payment addresses doesn’t allow your security to be compromised when a certain merchant’s account is hacked, because their database will have only a list of virtual addresses. The payment addresses are denoted by ‘account@payment_service_provider’.

It offers better security than other payment methods where details like credit card numbers are send. While using UPI, all these details are hidden as only a Virtual Payment Address (VPA) is used.

What kind transactions can be performed via Unified Payment Interface?

Merchant payments, remittances, bill payments among others.

Is there any limit regarding the amount that can be transferred in a single transaction?

The per transaction limit is Rs.1 lakh.

UPI Payment Service Providers: Banks vs Wallets

Currently, UPI has permitted only banks to be registered as Payment Service Providers (which means they can run bank accounts). But this scope can get wider and perhaps even include wallets later.

Also read: Anti-Microbial Resistance (AMR) and the Red Line Campaign

Significance of Unified Payment Interface

Facilitate Person to Business (P2B) transactions via collect payment option. This would boost business and Indian Economy overall.

UPI will bring down cash circulated in the economy (currently cash in circulation is 12% of GDP).

UPI will bring down annual cost of currency transactions (currently around Rs. 20000 crore)

Ok; so far good. Any negatives?

Refunds are currently not part of UPI and the authority for all arbitration lies with NPCI.

The introduction of UPI is most likely to badly affect the Wallet Companies.

The per transaction limit of Rs.1 lakh may not go well with all customers/business.

Source: http://bit.ly/2oXLRXV

0 notes

Text

Demonetisation Wallet Companies Are Expanding, but Where Is UPI

In August, the rollout of the Unified Payments Interface, UPI, started with 21 banks across India. The UPI is a payment system that allows you to quickly and easily transfer money from a linked bank account - and although all the different banks are releasing their own UPI apps, the beauty of the system, which is powered by the National Payments Corporation of India, NPCI, is that these are all interoperable. This means that you could connect your Axis Bank account and your Yes Bank account to your ICICI Pockets app, or whichever app you're using. For e-commerce too, this is beneficial as you don't need to link your platform to dozens of different banks - just connect to the UPI and you can allow money transfers from all the connected banks.

The way UPI works is a lot like using a mobile wallet - you create a virtual identity (which could be something like yourname@icici) using one of the many UPI apps, and link it to a working bank account. Most banks have also enabled UPI functionality in their apps, so you could use the app you normally operate your account from and create a UPI id there. When you need to pay someone, just open the app, choose send money, and type in their virtual identity, and then the amount.

The UPI allows you to pay to a virtual identity, to an account number, or to pay via a QR code; you can also choose to collect funds on your virtual identity, where you can send a payment request to someone using only their virtual identity - the money is only transferred once the person paying accepts the request; this method could be used online as well.

(Also see: What is UPI - the Apps, Charges, and Everything Else You Should Know)

Since the UPI allows you to transfer money instantly from bank account to bank account, it is the digital equivalent of paying cash. The money isn't going to a wallet, from where you have to transfer it to your bank - it's going directly into your account; you don't have to keep topping up the wallet to spend your money, and you don't have to worry about whether the vendor prefers Paytm, FreeCharge, or MobiKwik; each wallet is its own walled garden right now, and funds in each sits separate from the others. With UPI, the money is in your bank, and that means you can write a cheque, withdraw the cash at an ATM, or spend it using your debit card.

So why are we stuck standing in lines waiting for cash from ATMs that are closed more often than not, and queuing up in front of banks that don't have enough cash for everybody? As long as you have a bank account, shouldn't the UPI be a simple solution to the problems being wrought by demonetisation?

We're seeing a surge in signups for wallets - but the government's own solution, the UPI, is something that most people we've spoken to in recent times have not even been aware of. Why is this?

For one thing, it's still very new - the mobile wallets have been around for years now. They're still growing slowly, but that's on the back of huge valuations, and large scale advertising campaigns. The day after Prime Minister Narendra Modi announced the demonetisation of the Rs. 500 and Rs. 1000 notes, the papers had 10 full page ads - including several before the first page of news - for the different mobile wallet companies. On the other hand, when was the last time you've seen an ad promoting the UPI?

The UPI rollout started only in the end of August, and as recently as October, we were hearing about companies running "alpha" tests to see how to implement the UPI. Given a few more months, it's possible that the infrastructure could have been in place to actually benefit from demonetisation, but the government's sudden move means that its own tools weren't ready, leaving the field clear for wallets to further steal a march.

The other problem of course is that the UPI is being led by the banks right now - for wallets, this is the only business they are in, but the banks have to grow in a dozen different directions. For them the UPI is just one part of the picture; as more and more third-parties enter the fray, including the wallet companies no doubt, we can expect the UPI to be used in a wider manner, and become actually useful. For now, it's simply a more convenient NEFT.

Flipkart is one of the companies that is investing in the Unified payment interface - it's PhonePe wallet has garnered a lot of praise for how easy it is to set up and use. But you can't pay using the UPI on Flipkart. If one of the biggest e-commerce companies in India were to fully embrace the UPI, it would go a long way in actually helping the adoption of this system.

There are simply not many systems in place to use UPI for payments, and at the same time, it suffers from some of the same restrictions that exist for wallets. To use the Unified Payment Interface, you still need a smartphone with the app installed, an Internet connection, and you have to create a virtual ID. It's a significant barrier for many.

In recent times, we know of someone who has switched to UPI to pay rent, as it's easier to manage than bank transfers. We have come across a doctor's office that accepts payments via UPI. You just enter their virtual ID and transfer the Rs. 300; the confirmation happens in real-time. But this is few and far between. Using the UPI is easy and painless; doesn't create any additional complications as the money is safely in the banks; and it's fully interoperable no matter which UPI app you use, unlike wallets where both parties need to be in the same ecosystem.

The UPI still has the potential to help ease the transition to digital money, and offers many benefits. What's needed now is for the banks to start working together, and for the government to lend a hand, in encouraging the adoption of this system, and in helping spread education about it, as a viable alternative to cash.

Source: http://bit.ly/2oGhKUY

0 notes

Text

India has Just Applied For A Patent for Its Unified Payments Interface (UPI) System Technology

The National Patents Corporation of India (NPCI) has filed a patent application form for its Unified Payments Interface (UPI) system that was launched earlier this year in April and went live in the county last month i.e. August, 2016. Ever since going live, the technology has gained immense popularity among masses.

Unified Payments Interface offers bank customers a seamless payments mechanism to send and receive money via their smartphones, that too in real time. One of the factors that has helped UPI become famous among the masses in absolutely no time is the extraordinary simplicity that it offers to its end-users. All a person requires to make a transfer of funds is a connected smartphone and an identifier such as an email address of the account of the person to whom the money has to be transferred.

In order to make it easier for the Indian banks to offer UPI applications for smartphones, a special effort has been made to build UPI on the extremely secure and robust Immediate Payment Service network. Currently, 21 banks are live on UPI and their apps can be easily downloaded from Google Play Store.

NPCI, which is a RBI backed entity, was able to develop and make the back end payments settlements technology a reality with strong support from banks in India.

Unified Payment Interface is being considered as a major step taken by the Indian banking sector to make Indians more accepting of digital payments and make small value transactions between individuals and for merchants much easier than before.

According to NPCI’s chief operating officer Dilip Asbe, the corporation has already taken the first step for filing of a patent in India, and now all they have to do is wait and see if such a platform is the first of its kind all around the globe. According to him, it is a long drawn process and would take sometime. He also explained that one of the major reasons behind filing the patent is, that the NPCI wanted to ensure that no one is able to replicate its wonder product.

Apparently, the NPCI is also mulling about filling patents abroad as well. If this does happen, then this would be the second Indian homegrown technology platform that would export to other parts of the world after Aadhaar.

Source: http://bit.ly/2oLOtJ3

0 notes

Photo

Unified Payment Interface App Free

0 notes

Text

What is UPI App – Unified Payment Interface of India Meaning

What is UPI App check out the complete details about the Unified Payment Interface supported applications & UPI payment system; it will make all your online payments very easy.

What is UPI App – Unified Payment Interface of India

Let’s talk about the new payment system in India which is known as Unified Payment Interface also called as UPI Payment System. It is a payment platform for various mobile applications, and this system has made online payment very easy. We let you all know all details in this article about its use, benefits, payment charges, how to connect with bank etc. This is the latest method for digital payments and even government is supporting it for online payments. Read this full article to know an importance of Unified Payment Interface of India.

Unified Payment Interface UPI Benefits

Ex-governor of Reserve Bank of India Raghuram Rajan has said that launching of UPI is a revolutionary measure for digital payments and it will make online payments as easy as sending an SMS.

Payments through Unified Payment Interface can be done in a fraction of seconds and people can use it 24*7 and 365 days a year. Holidays, working hours, bank strikes etc. won’t affect this system.

Sending money will not require bank account number and IFSC code of the recipient, it just required registered mobile number or virtual payment address.

With a single UPI app, people can use their multiple bank accounts that mean you do not have to download various applications for all bank accounts.

Through this, you can send money to anyone immediately, in other payment systems people have to wait for 24 hours to pay a new person.

People can also pay bills and get money from other people when they approve it.

By this system, if you have ordered something on a cash on delivery option, that time you just have to confirm the bill and delivery boy will get confirmation, no need to pay cash.

How to get UPI supported apps?

UPI is a payment getaway for mobile applications; a person will require a smartphone and internet facility on their phone to use any application for digital payments.

Currently, UPI supported apps are launch only for android users; soon they will announce it for OS and Windows based phones.

People can download any UPI application from Google play store of your phone after that register your mobile number and bank account number.

Most of the banks have their own payment applications and after UPI was launched, banks have added UPI features in their existing application.

People who have downloaded any payment app offered by a bank can just update that app to use UPI features.

There are many applications available on a play store, but recommend everyone to download which is very efficient and convenient to you.

Which UPI App should you download?

There are various UPI supported applications available on an app store, but people have to choose wisely which app they should download.

If you are using app provided by your bank then just updates that app to use UPI features, no need to download or try other applications.

If you are downloading for the first time, then we recommend people to download an app of their bank, mean in which you have an account.

Recently Government of India has launched a UPI app called BHIM (Bharat Interface for Money), people can download that as it is a government owned app so it is very safe and secure to use for online payments.

These days government of India has launched few schemes like Lucky Grahak Yojna and DigiDhan Vyapar Yojna to promote cashless transactions in the country. Every day government is announcing Result of Lucky Grahak Yojana for special cash benefits to them, these schemes is launched to encourage people to pay through credit or debit cards or online payment mode, to make country cashless as this is very beneficial for the development of a country.

How to Connect UPI app to Bank Accounts?

By any UPI app, people can send money with just a click a button, but you cannot use this app as a wallet.

You have to feed bank account number in this app and follow some simple step to register your bank account.

This application has made all your bank payments very easy, you can send money to anyone with a fraction of seconds.

People can also connect more than one bank accounts in a single UPI app and you can transact from all bank accounts.

Process to Send Money through UPI App

First of all, open a UPI payment system app on your mobile then feed passcode.

After feeding a password application will open and then after you can do all your transaction.

After that click on send money, after that choose a bank account from which you want to send.

Now select a recipient with virtual payment address or bank account number or mobile number.

if receipant is not in your list than you can add it.

Now enter the amount you want to send and after that, you have to enter Mpin.

After doing this, an amount will be immediately credited to recipient’s bank account.

Security of payment through UPI

Unified Payment Interface is much secure payment getaway for mobile banking and internet banking while transferring funds through UPI app, to open an app people have to feed passcode and at the end of transferring of fund people will require MPin. By this two steps authentication payment is much secured compared to other payment modes.

If we compare charges on other online payment options, transfer charges on UPI is very less, you will cost around 50paisa per transaction if you transfer funds through any UPI supported applications. If we look at charges on other payment modes, NEFT will cost you around RS. 2.5 And IMPS fund transfer will cost you around RS. 5.

Virtual Payment Address (VPA)

To transfer funds through UPI supported applications it does not require recipient bank account number or other bank details just with the help of Virtual Payment Address you can transfer fund in a fraction of a second. While you register your bank account number on UPI app you will be asked to create VPA, after creating it you can use this app to send and receive money.

VPA is very easy to remember it just like email address, you can also add recipients virtual payment address in UPI app, so next time you just have to select receiver’s VPA to send him or her fund. When you want to receive money from any person then just give them your VPA so that they can send you money instantly.

Why Unified Payment Interface is better than IMPS?

Just like UPI, IMPS also transfer funds 24*7 and 365 days a year, but there are more other benefits of UPI compare to IMPS method

To transfer funds through IMPS, you will require bank details of a receiver while on UPI it is not necessary.

It is compulsory to feed bank account number and IFSC code of recipient to transfer funds through IMPS, while it does not require on UPI.

By the UPI app, you can transfer funds with just one click and it would reflect immediately on your bank statement, this is the main benefit of this app, after using it you will also say this method is much better and faster than compared to other methods.

We have explained almost everything about What is UPI App, if still, anyone wants to ask us any questions relating to its use, download etc. please write us in a comment box provided below, we will reply back as early as possible with a suitable answer. We are here to help each and every person to use UPI payment system and encourage people to get used to this method and make your banking work easier and also support our PM’s cashless India dream.

Source: http://ow.ly/tCPo30asStC

0 notes

Photo

Unified Payment Interface App Free

0 notes

Text

Unified Payments Interface goes live with 21 banks

National Payments Corporation of India (NPCI), the umbrella organisation for all retail payments system in India on Thursday said that the Unified Payments Interface (UPI) was live for customers of 21 banks.

UPI is a payments solution that empowers a recipient to initiate the payment request from a smartphone. It facilitates virtual payment address as a payment identifier for sending and collecting money and works on single-click two-factor authentication. It also provides an option for scheduling push and pull transactions for various purposes such as sharing bills among peers.

Built on top of the IMPS (Immediate Payment Service platform), UPI needs to have the beneficiary’s UPI ID - a virtual identity like an email address. This could be your name, or your phone number, so for example, if your phone number is 1234567890, then your virtual address could be 1234567890@sbi (if your bank is SBI) or 1234567890@icici (if you’re an ICICI bank customer), and so on.

One can use the UPI app instead of paying cash on delivery on receipt of product from online shopping websites and can pay for miscellaneous expenses like paying utility bills, over-the -counter payments, barcode (scan and pay) based payments, donations, school fees and other such unique and innovative use cases.

Outgoing Reserve Bank of India governor Raghuram Rajan had announced the pilot of UPI on April 11, 2016. UPI was run for the last few months as a pilot with employee-customers. The purpose of the pilot run “was to ensure that technical glitches, if any, are fixed and the product gives a smooth experience for immediate pay and collect with Virtual Payment Address (VPA).”

“This is a success of enormous significance. Real-time sending and receiving money through a mobile application at such a scale on interoperable basis had not been attempted anywhere else in the world. Now the Unified Payment Interface App Free App will be made available on Google Play Store by banks,” AP Hota, MD and CEO of NPCI, said.

The relevant details of the service would be available on the website of 21 banks.

After assessing the success of pilot run, RBI had accorded their final approval for public launch of the product. NPCI had decided that only the banks with 1,000 pilot customers, 5,000 transactions and success rate of around 80% would be permitted to go live.

Some of the banks that are going live with Unified Payment Interface App Free are - Andhra Bank, Axis Bank, Bank of Maharashtra, Bhartiya Mahila Bank, Canara Bank, Oriental Bank of Commerce, Union Bank of India and Vijaya Bank, Karnataka Bank, UCO Bank, Union Bank of India, United Bank of India, Punjab National Bank, South Indian Bank, Vijaya Bank and YES Bank among others.

Analysts have also appreciated the launch of the new payments interface. “UPI is an unique world-class platform aimed at removing friction faced by customers during merchant payments through set up of an interoperable platform and an important step in India’s journey of reducing cash and improving inclusion,” Vivek Belgavi, leader at the FinTech divison of PwC India, said.

Source: http://ow.ly/QSsw30aaZKq

0 notes

Text

Unified Payment Interface – A Much-needed Change

Cash crunch has left people with no such alternate in hand. It has by-and-large affected the people who completely used to rely on the currency notes. But this is a nice initiative on the road to digitization. ’Go Cashless’ is the mantra of the age and this is step one towards the new-age revolution.

Unified Payment Interface- hereon referred to as UPI- is a new cashless payment method introduced by NPCI (National Payment Corporation of India). The aim behind the introduction of UPI is to enable real time money exchange.

Once you’ve created a unique identifier- Virtual Private Address (VPA) – the UPI permits you to send, receive, or directly pay from your bank account. The pre-requisite for the same is: download UPI app from any bank you have your account in and sign-up with the registered mobile number.

The good thing with UPI is that it comes decked with double security measures where the M-pin acts as the second factor of security. At the time of UPI creation, all you need to do is set a 4/6 digit long M-pin by authenticating with your debit card details. If you ever forget the M-pin details, all you need to do is simply re-set it by authenticating the debit card details in the respective app.

If you are on a merchant website and wish to pay via Unified Payment Interface, all you need to do is enter the UPI on the check-out page and proceed to pay. Within a couple seconds, you will receive a payment request on UPI app. Select transaction and enter the M-pin.

You could even send funds using Unified Payment Interface. For this, select the account you wish to send money from, enter the said amount as well as the VPA of the receiver. Click on Send, and the task is done. To receive funds, perform the above-mentioned activity and click on Receive. The good thing is that there are no charges levied for transactions done using UPI. The current per-transaction cap is INR 100,000. This may change from time to time and is subject to the UPI guidelines.

Since VPA is linked to your registered mobile number, you will receive all the notifications on the given number. If you ever miss the SMS notification, go to your UPI app, check for ‘Pending UPI Transactions’, and approve/ reject the transaction request from there.

Source: http://ow.ly/yNds309ZQDk

0 notes

Photo

Unified Payment Interface App Free

0 notes

Text

Road to cashless society Here’s how Unified Payment Interface works

RBI Governor Raghuram Rajan along with National Payments Corporation of India (NPCI) adviser Nandan Nilekani launched the Unified Payment Interface (UPI) with the objective of proactively encouraging electronic payment systems for ushering in a cashless society in India. The interface aims to provide a safe, efficient, accessible, inclusive, interoperable and authorised payment and settlement system for the country.

Here is a quick guide on one of the landmark changes to take place in the financial sector.

What is the United Payment Interface (UPI)?

As the name suggests, UPI is an application level interface that aims to bring under its umbrella the multiple payment service providers presently operating in the country by adding a layer of interoperability within such platforms. It will enable anyone with a bank account to complete a transfer or make a payment without having to share bank account or credit/debit card details. It also incorporates additional functionality of authenticating such transactions with known identifiers like Aadhaar number.

This interface is vendor agnostic, so banks, e-commerce portals or any other platform involved in monetary transactions will need to include this interface within their payment applications instead of the end users having to use multiple applications.

Why do we need a platform like this?

The record of cashless transactions in our country is very dismal. At present it stands at 6 transactions/person/year which is partly due to the fact that out of the 10 million plus retailers in India, hardly 1.1 million have card payment acceptance infrastructure. The RBI has been vocal about ushering in more cashless transactions and one of the ways to do so is to tap into the expanding smart phone ecosystem that is slated to reach close to 500 million users in next five years.

The long-term goal is to use the UPI as a means to financial inclusion by encouraging transactions among the newly added accounts under the Jan Dhan Yojana (PMJDY) and direct benefit transfer programs.

How much of a part does Aadhaar play in the UPI?

The Aadhaar system that has close to 80 crore enrolments and is now legally accepted as a form of identity for Indian residents is the backbone for authentication and authorisation in the UPI. Aadhaar authentication is the process wherein Aadhaar number, along with other attributes, including biometrics, will be submitted by the interface to the UIDAI system for verification. There is also a provision for financial institutions to integrate their Aadhaar based KYC into their applications that use UPI.

The most notable feature however is the Aadhaar Enabled Payment System (AEPS) that enables banks to route the financial transactions through a switching and clearing agency allowing citizens to authenticate and subsequently operate their respective Aadhaar enabled accounts as well as perform basic financial transactions. So essentially, Aadhaar-enabled payments architecture is an overlay on the existing payment architecture of UPI, with the task of user verification handed over to the Aadhaar repository with UIDAI.

How will transactions done under Unified Payment Interface work?

The interface will sit on top of existing payment system by integrating into their code. The National Payment Corporation of India (NPCI) will maintain a database of customer’s Aadhaar number, Mobile number and Bank accounts. This central repository (Central Mapper) will be used to route payment instructions based on Aadhaar number or mobile number.

Read | Safer, better, faster payments from National Payment Corp

The Aadhaar Payments Bridge System (APBS) will use the NPCI Central Mapper as a part of National Automated Clearing House (NACH) to enable government departments to electronically transfer subsidies and direct benefit transfers to individuals mapped to their Aadhaar number. Similarly, Central Mapper will allow anyone to send/receive money from a mobile number without knowing the destination account details. This is achieved by mapping mobile number to one or more accounts.

What are the main benefits of Unified Payment Interface?

For the end users the most important feature of UPI is the ability to make payments by providing a virtual ID without having to provide account details or credentials to 3rd party applications or websites. It would also provide the ability to pre-authorise multiple recurring payments similar to ECS (bill payments, fees, subscriptions, etc.) with a one-time secure authentication and rule based access. Payments would be more secure with the introduction of single click two-factor authentication by using a personal phone without the need of new devices or hardware tokens. Lastly, as more and more payment service providers integrate this interface in their applications it will led to a fully interoperable system across all PSPs.

What does this mean for e-wallets and bank specific mobile applications?

While the UPI platform appears to target the transactional space presently occupied by e-wallets, the fact that UPI is vendor agnostic, would allow e-wallets to integrate UPI in their application and ease the process of loading money in the applications. Interoperability among the applications bought about by integrating UPI will indirectly led to more user friendly features getting added to e-wallets in the long run. As for bank specific applications, they should look to integrate UPI at the earliest as these will be the first applications to enable end users to avail of the benefits of UPI. Some banks like Yes Bank have already integrated UPI in their application, and early movers will definitely have an advantage.

One aspect that has not been clearly defined in UPI is that of grievance redressal. It is expected that once the technical integrations begin, a very clear path of addressing end user issues is charted out. The ownership of transaction failure on a platform that is masking identity of the parties engages in the transaction needs to be defined on the onset. This will augment end user trust in the platform which will in turn lead to widening of the user base.

Indian banking sector should look at the UPI as the disruptive innovation that will take its service delivery to the next level while enabling financial inclusion in a single stroke and push for adopting this technology with a sense of urgency.

The author is a policy analyst in the information security and data privacy domain. Views express here are personal.

Source: http://bit.ly/2m2ubHn

0 notes

Photo

Unified Payment Interface App Free

0 notes