Don't wanna be here? Send us removal request.

Text

Solving the Housing Crisis in Africa

Ameet Dhillon

Marketing and Business Development Executive

The continent of Africa has about 1.3 billion people today and many demographers believe it will nearly double to 2.5 billion by 2050. Africa also has the youngest average population with a median age in 2012 of 19.7--the worldwide median age was 30.4. This unparalleled level of growth, coupled with youth, presents many problems such as housing: The African Development Bank estimates there is a deficit of 50.5 million housing units in Sub-Saharan Africa. Every government in Africa recognizes residential housing as a key problem, yet it is hardly being addressed. The problem seems almost intractable, particularly in the so-called “social housing” segment which is often defined as a residence that costs less than $25,000 USD. So what is the problem and is there any way to solve it?

Let’s briefly discuss the various issues that are compounding the housing crisis and then we will get to an innovative approach to solve, or at least lessen this problem. The issues with housing in Africa are numerous, but there are at least four main problems that must be overcome. The first is inconsistent or poor-quality construction due to a lack of international-class training for construction trades such as concrete mixing, roof installation, and final finish. The second is limited economies of scale because house construction is often project managed by the owner or his/her representative. As a result, cost overruns are common, and construction can take years to complete. The third is a lack of trust in real estate developers which is often what leads to the aforementioned second problem. Finally, the fourth and perhaps the biggest problem is financing. Without some sort of reasonable financing, a housing industry simply cannot exist. Imagine for a moment trying to buy your current residence in the US, Europe or indeed anywhere in the world by paying cash at the time of purchase. Would you be able to buy your house under those circumstances? For most people, the answer is no, yet that is the environment that the majority of African homebuyers face today.

These problems seem almost insurmountable; how do we even begin to address them? Rather than walk the reader through some theoretical exercise on what could be done, I will describe what two innovative companies (full disclosure: I am Managing Director of one of them) are successfully doing right now to prove these problems can be overcome. I don’t claim these companies have fully solved the problem, but they have laid out a clear blueprint in parts of West Africa that anyone else is free to emulate anywhere on the continent. In fact, the principals of both companies are willing to share their formula for success with anyone; just for the asking; no strings attached. Email [email protected] to begin a discussion.

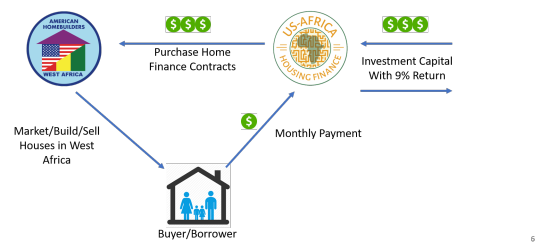

American Homebuilders of West Africa (AHWA) and US-Africa Housing Finance (USAHF) are both US-registered LLCs that symbiotically work together to build, sell and finance houses in West Africa. The following diagram illustrates the relationship between the two companies.

AHWA markets, builds, and sells houses in West Africa and USAHF provides the financing by purchasing loans originated by AHWA. Private investors provide the capital to USAHF (earning an annual 9%, us-dollar return over the last three years) which begins the virtuous cycle that propels this relationship forward.

One thing you will notice is the total lack of government help or any kind of philanthropy in this model to date. Both businesses are for-profit (and currently profitable) and have thus far relied 100% on private capital raised in the United States. Having said that, there is an appropriate place for governments, foundations or other quasi-government institutions to get involved to provide much needed catalytic capital to move the respective businesses forward more quickly and efficiently. Since the business model for both companies has been proven; now is the time for large institutions to step up and provide support.

So how did these companies overcome the four problems laid out earlier where others have failed? The first problem of poor construction quality is not conceptually hard to solve given that construction techniques are well understood in the US, Europe, and other developed markets. However, to do it in an environment that is used to accepting poor quality as a "fact of life" requires investing in the local team's development and a great deal of diligence and desire to produce a quality product. Fortunately, the co-founders of AHWA all have that desire and thus construct houses that anyone can be proud to live in. Part of this diligence can be traced back to their experience as peace corps volunteers in Cote d’Ivoire in the 1990s. As an example of their dedication, one of the co-founders of AHWA, Jonathan Halloran, personally trained the local African team in how to build a safer ladder (see photo below), use power tools effectively and organize a logistics depot.

Jonathan's theory is you teach one group how to do it in an international-class way and they will eagerly pass on that knowledge to anyone who will listen. Fortunately, most Africans are eager to listen and learn as they genuinely want to see their country and indeed their continent progress.

The second problem--limited economies of scale--, and the third--lack of trust in developers--go hand in hand. If there is trust in housing developers, then there is no need for individuals to build their own house and suffer the associated pain and heartache. Ask any member of the African diaspora and they will relate either a personal story or one of some close friends or relatives that involves getting “scammed” while trying to build a house back in Africa. AHWA has gotten over the trust problem the old-fashioned way: They provide a quality product to their customers and “word of mouth” over time has done the rest. AHWA is now a trusted brand in Guinea, West Africa and beginning to develop in neighboring countries such as Sierra Leone, Cote d’Ivoire and Senegal with many more to come.

The final problem is financing and this is perhaps the most vexing of all. Providing a home loan to a borrower is more complicated than it might seem at first glance. There is the obvious issue of raising the capital to fund the loans (this itself is hard enough when the target market is Africa), but perhaps more difficult is the underwriting process. The lender cannot just provide a loan to anyone; the borrower must be properly vetted via some systematic and repeatable process. This requires getting to know a prospective borrower and assessing the associated risk. To ease this daunting task, initially, USAHF only plans to offer loans to the African diaspora living in OECD countries such as the US, France, Canada, UK, etc. In addition, a 30% down payment is required along with customary verification of income, debt and the like.

One unique aspect of the joint AHWA/USAHF underwriting model is that they allow borrowers to pay monthly into what is effectively an "escrow account" for up to 24 months in order to reach the 30% down payment level. This is not only helpful for the borrower but also provides invaluable data and confidence about the borrower’s ability to pay. If someone has the financial discipline to make a monthly payment for a year or more without even having a house, the likelihood of them defaulting once they actually have the house is very low. In other words, they are an excellent credit risk.

The final piece of the financing puzzle is a well-developed process to handle the inevitable loan default. No matter how good an underwriting process you have, some number of defaults are expected. In fact, many bankers will tell you that if you don’t have any defaults that means you are too strict in your underwriting and should loosen the requirements. Both AHWA and USAHF have an agreed process in place for default and have successfully navigated the process multiple times with minimal impact on either business as well as the borrower. Because of the high demand for AHWA houses, resale has been relatively smooth and as expected prices are rising and this insulates the defaulting borrower from large losses.

In conclusion, both AHWA and USAHF believe they have a profitable, sustainable and replicable model that over time can solve the housing crisis in Africa. However, governments, DFIs, foundations and other similar types of institutions will need to step up and provide catalytic capital to make this promise a reality. To learn more please click on this presentation or email [email protected] or check out the website at www.usafricahf.com.

Disclaimer: This article is for information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any such offer is made only pursuant to a private placement memorandum.

1 note

·

View note