Don't wanna be here? Send us removal request.

Text

Itr

A person must submit an Income Tax Return (ITR) form to the Indian Income Tax Department. It includes details on the individual's earnings and the yearly taxes owed. People are entitled to file an income tax return if their taxable income exceeds the maximum amount exempt from taxation. For the fiscal year 2019–20, the basic exemption threshold is Rs 3 lakh for senior persons (aged 60 to 80), Rs 5 lakh for super senior citizens (aged 80 or more), and Rs 2.5 lakh for everyone else.

0 notes

Text

Llp Annual Compliance

A limited liability company is a distinct legal entity. to maintain active status and prevent default status. A regular filing with MCA is required to be taken care by all Limited Liability partnerships. llp Annual Compliance for any LLP is obligatory and unavoidable.

0 notes

Text

Restitution of Conjugal Rights

Restitution of conjugal rights is a weapon that a deserting spouse may employ against the other party. The guilty spouse may be required by court order to cohabitate with the resentful spouse. It is a procedure in religious courts as well as a procedure in court for divorce and marriage issues. It is one of the marital acts that the Christian courts had jurisdiction over in the past.

0 notes

Text

Gift Deed Registration

Gift Deed Registration is done as per the provisions provided under section 17 of the Registration Act, 1908. After registration, only the recipient can apply for transmutation or further transfer of property. The property being gifted needs to be valued by the approved valuation expert

0 notes

Text

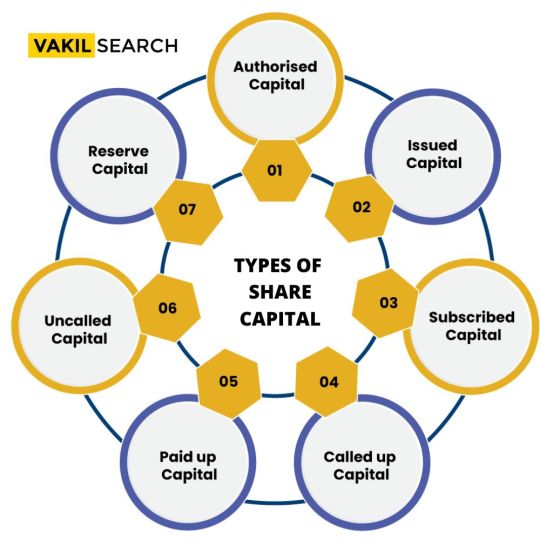

Share Capital Types

The amount of money that a company's shareholders have contributed to the enterprise through the purchase of common and/or preference shares is referred to as "share capital." Equity share capital and preference share capital are the two types of share capital.

0 notes

Text

US Taxation System

The US Taxation System has a progressive tax system that is based on the fundamental idea of "Earn High Pay High," according to which higher income earners are required to pay higher taxes with the intention that those with lower incomes be subjected to paying less tax than those with higher incomes. 21-Nov-2021

0 notes

Text

Financial Due Diligence

An investigation into a company's finances is known as financial due diligence. To verify the applicability and accuracy of these trends, a thorough investigation of a company's past and projected trends is required.

1 note

·

View note