Don't wanna be here? Send us removal request.

Text

Will the Patent Surge in Blockchain and AI Redefine Global Payments?

The intersection of blockchain technology and artificial intelligence (AI) holds promise for improving the digital payments sector. By offering decentralized, transparent, and secure ledger systems, these innovations could redefine how financial transactions are conducted. While blockchain and AI have yet to displace traditional payment models entirely, their growing influence on the industry suggests an impending transformation — especially in areas such as fraud reduction, security enhancement, and operational efficiency.

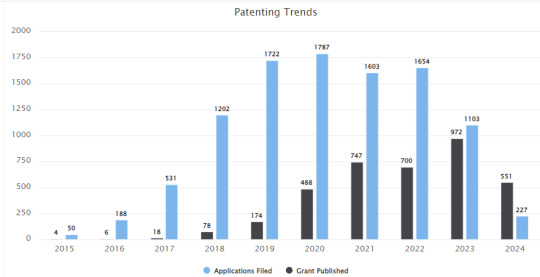

Over the past decade, we've witnessed a significant uptick in patent filings from global payment giants, signaling growing investment in these disruptive technologies. Despite the slow pace of adoption, the sheer volume of innovation—more than 14,000 patents in blockchain and AI for digital payment solutions—shows the potential for change. In 2022 alone, 700 patents were granted, and an additional 1,600 were filed, showcasing the increasing interest in harnessing these technologies for the future of payments.

Cross-Border Payments and the Future

Amid global shifts toward de-globalization, cross-border transactions are projected to grow by 5% annually through 2027. This surge is driven by unbanked populations gaining access to financial tools and companies needing to send payments across new trade routes due to disrupted supply chains. Blockchain and AI innovations are well-positioned to capitalize on this opportunity, offering solutions that streamline cross-border payments through real-time transaction capabilities.

Blockchain-based systems, for instance, have introduced real-time cross-border payments, eliminating the need for costly intermediaries. This approach enables direct, instantaneous transactions, reducing both time and cost—offering significant advantages over traditional systems, which often suffer from delays and high fees. Companies holding blockchain and AI patents are poised to capitalize on these efficiencies, potentially setting new standards for the industry.

The Surge in Payment-Related Patents

The patent landscape reflects the growing focus on blockchain and AI in payment applications. Among the 14,000+ patents filed in the last decade, many focus on payment protocols and transaction authorization, with over 4,000 patents dedicated to these areas alone. These innovations aim to improve the security, efficiency, and reliability of digital payments, particularly as digital transactions continue to rise. Verification mechanisms for payer and payee credentials are also a hotbed for innovation, with around 2,500 patents covering secure authentication technologies.

Blockchain and AI, when combined, offer transformative possibilities for the digital payment landscape. The convergence of these technologies offers several benefits, such as data security, decentralized decision-making, and scalability. AI can optimize blockchain’s transaction verification processes and predict market trends, enhancing both the speed and accuracy of financial transactions.

One of the key areas where this synergy excels is fraud prevention. Integration of AI-driven predictive analytics into blockchain systems, companies can identify potential fraud before it occurs, creating a more secure payment environment.

Obstacles to Adoption

Despite the rapid pace of innovation, blockchain and AI technologies have yet to make a significant impact in the traditional payments market. Payment giants like Visa and Mastercard still dominate due to their established infrastructure and consumer trust. Several factors contribute to the slow adoption of blockchain-based systems, including regulatory hurdles, scalability concerns, and consumer reluctance.

Regulatory complexity remains one of the largest barriers, as blockchain faces different and often conflicting regulations across countries, slowing global scalability. Moreover, while blockchain is secure and transparent, it struggles to handle the large transaction volumes required for global payment systems, resulting in slower transaction speeds during peak times.

Consumer and business hesitancy also play a role in delaying widespread adoption. Despite blockchain’s advantages, many users are hesitant to move away from trusted payment methods in favor of unfamiliar technologies. Until these trust issues are resolved and the technology matures, traditional payment systems will continue to dominate the landscape.

Looking Forward

Despite these challenges, the strategic interest in blockchain and AI by traditional payment companies suggests a potential tipping point. Both Visa and Mastercard have already begun incorporating blockchain into their offerings, with Mastercard holding at least 89 blockchain patents. This forward-looking strategy positions them to meet current market demands while preparing for a future where blockchain and AI could become mainstream.

The ongoing investment in patents around these technologies—particularly in areas that focus on innovative payment models — places companies in an advantageous position for the next gen digital payment innovation. As regulatory environments adapt and technological hurdles are overcome, those holding these patents could set the industry standard for blockchain and AI-driven payments.

If you are interested in evaluating high growth AI and blockchain patents with applications in payment solutions, contact Intellectual Frontiers to buy patents online or for inquiries.

0 notes

Text

0 notes

Text

From Concept to Market: How to 'Buy a Patent' and Accelerate Growth in Healthcare Technology

In the last decade, the healthcare industry has seen an unprecedented surge in patent filings, with a nearly 30% increase in medical device patents alone between 2010 and 2020. This rise is not just a reflection of technological advancements but a strategic maneuver by companies aiming to secure a foothold in an increasingly competitive and innovation-driven market. The analysis of over 14,023 firms[1] has shown that: (a) owners have acquired patents across borders, and (b) acquired patents (granted between 2013 and 2017) are cited by later patents (2018–2022).

The journey to acquiring a patent begins with identifying valuable IP that aligns with your business objectives. In healthcare, this means looking for patents that cover technologies or processes that can enhance your current offerings or open up new market opportunities for eventually improving patient care. The first step is to conduct a thorough analysis of the patent landscape within your industry. This involves examining existing patents, identifying gaps or “whitespace” areas where new patents could be highly valuable, and understanding the competitive landscape.

A critical aspect of this process is to assess the commercial viability of the patents you are considering. Not all patents hold the same value; some may cover groundbreaking technologies, while others may be less impactful. It’s essential to evaluate how a particular patent could integrate into your existing portfolio and contribute to your business goals and improve innovation performance of the acquiring firms[2]. This might involve analyzing the patent’s scope, the strength of its claims, and its potential to withstand legal challenges.

The Acquisition Process

This can be complex, involving negotiations with the patent holder, due diligence, and legal considerations. The first point of contact is typically the patent holder, which could be an individual inventor, a university, or another company. In some cases, patents are available for purchase through brokers or patent marketplaces where you can buy a patent for sale, which can facilitate the negotiation process.

During negotiations, it’s important to clearly understand the terms of the patent purchase. This includes the scope of the rights being transferred, the duration of those rights, and any restrictions or obligations that come with the patent. You’ll also need to consider the financial aspects, such as the purchase price, ongoing royalties, and any other costs associated with maintaining the patent.

Due diligence is a critical phase of the acquisition process. Before finalizing any purchase, you must ensure that the patent is valid, enforceable, and free of any legal encumbrances. This involves reviewing the patent’s prosecution history, checking for any existing disputes or litigation, and confirming that all necessary maintenance fees have been paid. Working with experienced IP attorneys and patent analysts is crucial during this stage to mitigate risks and ensure a smooth transaction.

Integrating the Patent into Your Business Strategy

Acquiring a patent is only the beginning. To truly accelerate growth, you must effectively integrate the patent into your overall business strategy. This involves leveraging the patent to improve your product offerings, enter new markets, or create new revenue streams.

A sophisticated strategy involves leveraging the patent to not merely develop derivative products, but to strategically position your IP within a broader innovation ecosystem. For instance, if the patent encapsulates a novel medical device, the focus should not only be on direct product development but on creating a framework for modular innovation, where the core technology is incrementally refined through subsequent patent filings. This enables a layered approach to IP protection, making it more difficult for competitors to manage around your patent portfolio.

Additionally, rather than enhancing an existing product in isolation, consider how the patent can be integrated into a platform-based approach, enabling cross-functional applications across different product lines. This approach not only enhances the value proposition of your current offerings but also establishes a robust IP moat that can deter potential infringers and attract strategic partnerships. The goal is to use the patent as a keystone in a broader strategic architecture that drives market leadership, rather than a simple tool for product enhancement.

Another strategy is to use the patent as a defensive tool to protect your market position. In the healthcare industry, where patent infringement can be a significant threat, owning a strong patent can deter competitors and prevent them from encroaching on your market share. This can be particularly valuable in highly competitive sectors, such as pharmaceuticals or medical devices, where patents are often the primary means of protecting innovation.

In some cases, you may choose to monetize the patent through licensing or selling it to another company. Licensing can generate additional revenue while allowing you to maintain control over the patent. Selling the patent outright could provide a significant financial return, especially if the patent is highly sought after in the market.

Tips for Effective Patent Acquisition

Maximizing the strategic value of patent acquisition requires more than a checklist approach; it demands a nuanced understanding of how IP assets align with broader business imperatives and sector-specific challenges. The real art lies in identifying patents that not only complement your existing portfolio but also serve as catalysts for market disruption or defense against emerging threats. A patent’s value is not static; it evolves with technological advancements, market shifts, and regulatory changes, making the timing of acquisition as critical as the IP itself.

When acquiring patents, it’s essential to move beyond surface-level alignment with business objectives and instead explore how the acquired IP can reshape your strategic direction. For example, consider how the patent could enable you to pivot into adjacent markets or create synergies with emerging technologies, such as AI-driven diagnostics or personalized medicine in the healthcare sector. The goal is to not merely integrate the patent into existing operations but to leverage it as a strategic asset that propels your company into new, high-growth areas.

Moreover, the acquisition process should involve a deep dive into the patent’s litigation history, competitive landscape, file wrapper analysis, and potential for future enforcement. A patent’s worth is as much about its defensibility and potential for licensing revenue as it is about its technological merits. Sophisticated patent buyers often employ advanced analytics to assess the strength of a patent’s claims, its citation network, and its position within the broader patent ecosystem. This level of analysis can uncover hidden opportunities for patent thickets or identify vulnerabilities that could undermine the patent’s long-term value.

Figueroa and Serrano[3] find that small firms are more engaged in patent licensing than larger ones. Small firms sell and disproportionately acquire more patents than large firms, especially those originally registered to other small firms. The employment of patent citation as a potential proxy of patent transaction is notable, in an extension of the usage of patent citation as the proxy of patent value. Patents with high citation count (received) have a higher chance of being sold to large firms. This provides an interesting insight into considerations larger firms should make while targeting companies for patent acquisition as well as triaging patents for evaluation from a bigger list. Companies and marketplaces like Intellectual Frontiers, which aggregate and analyze patents from smaller companies for listing and sale, provide an excellent starting point for assessing potential opportunities. You can explore their extensive collection of patents for sale to discover the right investment for your business.

Post-acquisition, the integration of a patent into your business strategy should be less about fitting it into predefined categories — such as product enhancement or market expansion — and more about rethinking your innovation model. Patents can serve as the foundation for entirely new business models, particularly in sectors like healthcare, where the convergence of technology and regulation opens up novel pathways for growth. Consider how the acquired IP can be leveraged to create new alliances, influence industry standards, or even reshape the regulatory landscape in your favor.

In healthcare industry, the ability to strategically acquire and deploy patents can differentiate market leaders from followers. However, this requires a shift from viewing patents as mere protective tools to seeing them as dynamic assets that drive competitive advantage. The patents you acquire today should not only safeguard your innovations but also act as the bedrock of your future strategic moves, enabling you to outmaneuver competitors and capitalize on emerging trends.

Bibliography

1. Giglio, Vocaturo, and Palmieri, "Patent Acquisitions in the Healthcare Industry: An Analysis of Learning Mechanisms," NCBI, February 24, 2023

2. Ahuja, Katila, "Technological acquisitions and the innovation performance of acquiring firms: a longitudinal study," Wiley, January 29, 2001

3. Figueroa, Serrano, "Patent Trading Flows of Small and Large Firms," National Bureau of Economic Research, April 2013

0 notes

Text

The Strategic Advantage of Acquiring Blockchain Patents

As the blockchain industry continues to mature and expand, the value of intellectual property within this space is becoming increasingly apparent. Investing in blockchain patents presents a unique opportunity for forward-thinking businesses and investors. This article explores why acquiring patents in the blockchain domain could be a strategic move and how you can capitalize on these opportunities.

The Rising Value of Blockchain Patents

Blockchain technology has moved beyond its initial applications in cryptocurrencies to become an important opportunity in various sectors, including finance, supply chain management, and healthcare. As the technology evolves, so does the portfolio of patents related to blockchain innovations. These patents cover a range of applications, from consensus algorithms to smart contract systems, representing significant intellectual assets.

Investing in a patent on blockchain can provide a competitive edge by securing exclusive rights to innovative technologies and methodologies. As blockchain technology continues to gain traction, the value of these patents is likely to appreciate, offering substantial returns on investment.

For companies looking to innovate or expand their technological capabilities, owning blockchain patents can be a strategic advantage. Patents not only provide protection for new technologies but also enhance a company's market position by establishing technological leadership.

There are various avenues to buy patents, including direct negotiations with patent holders or leveraging platforms that facilitate transactions such as Intellectual Frontiers. Buying patents online has become increasingly accessible, allowing businesses to explore a global market for blockchain and other intellectual property. This approach can streamline the acquisition process and open doors to a broader range of opportunities.

Risk Mitigation Through Patent Acquisition

Patent litigation and intellectual property disputes are becoming more common. Acquiring blockchain patents can serve as a defensive measure, safeguarding your business from potential legal conflicts and ensuring you have the rights to critical technologies.

By securing relevant patents, companies can protect their innovations and reduce the risk of infringement claims. This proactive strategy is essential for maintaining a competitive edge and avoiding costly legal battles.

Leveraging Patents for Strategic Partnerships

Blockchain patents can also be a valuable asset in forging strategic partnerships. Companies holding key patents can leverage their intellectual property to negotiate licensing agreements, joint ventures, or other collaborative opportunities that drive growth and innovation.

Engaging in licensing agreements or joint ventures with other technology providers can expand your market reach and enhance your product offerings. By utilizing your patents as negotiation tools, you can create mutually beneficial relationships that propel your business forward.

Exploring Investment Opportunities

For investors, blockchain patents offer a compelling investment opportunity. Investing in patents provides access to innovative technologies and potential revenue streams through licensing and royalties. Additionally, the growing importance of blockchain technology ensures that these patents are likely to appreciate in value over time.

To make informed investment decisions, consider partnering with patent brokers or consulting firms specializing in blockchain technology. They can provide valuable insights into the market value and potential returns of specific patents.

As blockchain technology continues to shape the future, the opportunities for investing in blockchain patents will likely grow. These opportunities will enhance your technological portfolio and position yourself at the forefront of this transformative industry.

0 notes

Text

When Will 14k+ Blockchain and AI Innovations Overthrow Traditional Payment Systems?

Blockchain technology and artificial intelligence (AI) have the potential to improve the digital payments industry by introducing decentralized and transparent ledger systems. While these technologies have not yet replaced traditional centralized systems, they have begun to influence the industry and could significantly improve security and reduce fraud risks. Over the past decade, there has been a significant surge in patenting activity by leading global payment companies, despite the slow adoption of blockchain and AI in traditional payment systems.

These patents have played a critical role in protecting proprietary blockchain protocols and payment applications, driving investment and innovation. More than 14,000 patents have been published on AI and blockchain for digital payment applications in the past decade. In 2022 alone, 700 patents were granted, with over 1,600 more filed, indicating a growing interest in these technologies.

The world may be entering towards de-globalization, but cross-border payments are rising, with international transfers expected to grow by 5% annually until 2027[2]. This growth is driven by previously unbanked populations gaining access to modern financial tools and the need for organizations to send payments to new countries due to disrupted trade corridors and fragmented supply chains. New technologies are helping seize that opportunity, whether it’s the latest generation of real-time payment rails or blockchain and AI.

The development of blockchain-based payment systems has facilitated real-time cross-border transactions, offering new models for payments and financial transactions that companies are exploring. Traditional payments are often slow and costly due to multiple intermediaries. Blockchain technology, however, enables direct and instantaneous transfers between parties, lowering transaction costs and time. Companies holding such patents for digital payments can gain competitive advantages and set industry standards through use of these advanced technologies in cross-border and instant transactions.

As evident from the 14000+ patents from across the world over the last one decade, the most significant area of patent activity focuses on payment protocols and their specific details, such as authorizing payments or confirming the validity of transactions with use of blockchain and AI integration. With around 4,000 patents in this category alone, there is intense innovation aimed at enhancing the security, efficiency, and reliability of digital payment processes. As digital transactions become more prevalent, the need for robust and secure payment protocols drives substantial research and patenting efforts in this area. Closely following is the authorization mechanism within payment protocols, including the verification of payer or payee credentials. This technology category has close to 2,500 patents, highlighting the importance of secure authentication mechanisms in digital transactions.

The Synergy of Blockchain and AI

The convergence of blockchain and AI presents many opportunities[5] for the digital payments industry, as reflected in the cross-pollinated patenting activity by top companies aiming to secure a whitespace for future demands. The key benefits are data security and privacy, data encryption, data sharing, decentralized intelligent systems, efficiency, automated decision systems, collective decision making, scalability, system security, transparency, sustainability, device cooperation, and mining hardware design. AI can enhance blockchain’s capabilities by optimizing transaction verification processes and predicting market trends. This fusion leverages the strengths of both AI and blockchain to mitigate various security risks, including fraud, data breaches, and identity theft, thereby improving trust and confidence in financial transactions[1]. System security concerns on the security and privacy of online transactions can be solved with the emergence of blockchain technology development[3]. Patents have played a crucial role in this synergistic relationship by innovating and protecting novel methods and systems arising from the integration of these technologies. Patented AI algorithms that streamline blockchain consensus mechanisms improve the efficiency and scalability of blockchain networks. Blockchain patent incorporating AI for predictive analytics provide valuable insights for payment processing and fraud detection.

The Reality Check: Challenges and Limitations

Despite the significant innovations and number of patents on blockchain and AI for digital payment applications, these technologies have not yet made a significant impact on the traditional payments market. Traditional payment giants like VISA and MasterCard continue to dominate the landscape through their traditional payment approaches and technologies. Several critical factors contribute to this scenario. Regulatory hurdles present a major challenge, as blockchain payments face complex and often conflicting regulatory environments across different jurisdictions, impeding widespread adoption and scalability.

Scalability issues also remain a significant barrier. Blockchain networks, while secure and transparent, often struggle to handle the high transaction volumes required for global payment systems efficiently. This can lead to slower transaction speeds and higher costs during peak times, making blockchain less competitive compared to the established infrastructure of traditional payment systems. Furthermore, the technology's nascent state means that many proposed solutions are still in developmental or pilot stages, lacking the robustness and reliability required for mainstream use. Each country is different and has its own interests, which makes it challenging to realize the blockchain-enabled cross-border real-time technology adoption fully[2].

Market adoption is a crucial factor. There is a substantial gap in both consumer and business acceptance of blockchain-based payments[4]. Many users are hesitant to switch from trusted, well-known payment methods to newer, less understood technologies. This lack of understanding and trust in blockchain and AI-driven payment solutions slows their integration into everyday financial transactions. Until these issues are addressed and the technologies mature, the dominance of traditional payment systems like VISA and MasterCard is likely to continue.

However, even with the current limitations, the interest of traditional payment systems in blockchain technology and AI suggests a potential shift and a long-term strategy. Both Visa and Mastercard have recently embraced blockchain technology, implementing it into several products and services. Mastercard, for instance, has at least 89 blockchain patents and continues investing in patents. This strategic foresight allows these companies to develop and refine solutions that meet existing market needs and anticipate future demands, providing a substantial competitive advantage.

Investing in blockchain and AI innovations and acquisition of patents, particularly around technologies that define alternative payment models and have the potential to revolutionize the way payment transactions are conducted now, positions companies to lead the charge in overcoming current barriers. As regulatory frameworks evolve and technological advancements address current limitations, businesses holding these patents will be at the forefront of the next wave of digital payment innovation. This strategic foresight allows companies to develop solutions that not only meet existing market needs but also anticipate future demands, providing a substantial competitive advantage and tap the technology whitespaces when the situation is more favourable for wide adoption of blockchain and AI-based disruptions in payment transactions.

1. Olubusola Odeyemi et al., "Integrating AI With Blockchain For Enhanced Financial Services Security," ResearchGate, March 2024

2. "The Race to Rewire Cross-Border Payments," JPMorgan Chase & Co, August 2023

3. Ahmed G. Gad et al., "Emerging Trends in Blockchain Technology and Applications: A Review and Outlook," ScienceDirect, October 2022

4. Saleem Malik et al., "Adoption of Blockchain Technology: Exploring the Factors," Wiley Online Library, August 20, 2022

5. Dhanasak Bhumichai et al., "The Convergence of Artificial Intelligence and Blockchain: The State of Play and the Road Ahead," MDPI journals, May 9, 2024

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes