Vtrender offers different market profile trading strategies that can help you formulate a trading strategy. In Market Profile we recognize value migration as key to knowing a trend in the market. If value areas are moving downwards the market is in a downtrend, upwards then in a uptrend and if horizontal and overlapping then the market is sideways. Go through our website and contact us today.

Don't wanna be here? Send us removal request.

Photo

Market profile is a powerful charting tool. Market Profile Trading Strategies allows traders to gain a clear view of price developments in the market and track volume and spot increases in volume. Join the vtrender trading room and learn how Market Profile Charts can dramatically improve trading performance.

0 notes

Photo

Order flow is a type of trading analysis concept that can help you predict with a good amount of certainty where order imbalance awaits at a future price level. This can permit you to access the market with accuracy and more confidence. Know about it from expert!

0 notes

Photo

#trading#forex trading#stock market#Bank Nifty#Nifty option#Nifty future#Order flow#Auction market theory

0 notes

Photo

0 notes

Text

Things to know Before Trading in Nifty Futures

Nifty futures trading is a common representation of trading the market as a whole, as Nifty is quite representative of the market in particular and the economy in general. Nifty futures are essentially regarded as the futures contracts on the Nifty. The minimum lot size of the Nifty is 75 units, making the lot value just over 7.50 lakhs. You must learn about the Nifty future strategies before trading. Let's understand a few points to remember that will help us trade intraday and long-term Nifty futures.

Check the futures spread over the spot

Futures are normally traded at a margin over the spot price. Under normal conditions, the monthly spread over the cash price is determined by the current cost of funds. It is also called a carry cost, and futures typically trade at a premium. Do not buy Nifty futures when it has a very high premium against the spot index, as it could be a case of overpricing and optimism. Also, do not jump in to buy when Nifty futures are discounted, as it could be a signal to sell hard on futures. You need to understand the logic of the spread before trading Nifty futures.

Treat it as a leveraged position

Ingenious futures are leveraged like all futures positions. When you buy a lot of Nifty in the next month, your margin is around 10% for normal trading and 5% for MIS (intraday) trading. That means you get 10x leverage in normal trading and 20x leverage in intraday trading. This works both ways. Leverage means that your profits can multiply, but losses can also multiply. Therefore, any Nifty futures trading must be done with strict stop loss limits and profit targets.

Check the data on open interest

It is always worth doing a scientific data analysis before taking a Nifty futures position. A quick look at the open interest of Nifty futures and their accumulation trends will give you an idea of whether the open interest is building on the long side or the short side. You can have a more informed view of the Nifty address.

Avoid getting into a liquidity trap

Liquidity is never a major challenge for Nifty futures as it is one of the most liquid contracts, but there are times when Nifty futures can get into your liquidity trap. First of all, on the expiration day, you will typically find that Nifty futures volumes fade once the renewals are substantially complete. Also, in a market that is falling sharply, spreads can widen, substantially increasing your risk when trading Nifty futures.

See the multiple implications on the margins

Whether you buy Nifty futures or sell Nifty futures, it is a linear position as you can generate unlimited profit and loss on both sides. While stopping losses is a must when trading the Nifty, you also need to understand margins. First of all, there is an initial margin that you pay at the time of taking the position that includes the VAR margin and the ELM margins. Brokers are now required to collect both margins and ELM is no longer optional. Second, daily, you must pay MTM (market value) margins based on price movement. These have capital allocation implications for you.

Know the overnight risk on Nifty Futures

Even if you set stop loss during the day, these orders will not hedge your risk overnight. For example, if you are long on the Nifty Futures and due to a crash in the Dow if the Nifty collapses 200 points at the open, what can you do? Stopping losses does not work and you are exposed to risk overnight in Nifty futures.

Understand the trade

This is an interesting aspect of Nifty futures trading. When you buy Nifty futures, there is another party that is selling and the same logic applies when you sell Nifty futures. The other party could be a trader or hedger and the open data of interest will give you the necessary information.

While you are typically driven by your point of view on the Nifty, it is always worth understanding the accountant's point of view as it can give you greater clarity on your Nifty point of view. When trading Nifty futures, find the Nifty option strategies and remember to keep track of dividends, transaction costs, and tax implications.

0 notes

Text

Things to know about order flow

Order flow trading strategies is a type of analysis that involves monitoring the flow of trading orders and their subsequent impact on prices in order to predict future price movements. In other words, Order flow analysis allows you to see how other market participants are trading (buying or selling).

Order flow trading is also known as strip reading or Order flow analysis.

Order flow analysis keeps you aware of the latest details about trading volumes. The Market provides a micro review of candlestick studies. In each candlestick, a lot of information can be analyzed through the Order flow.

Basically, the Market profile trading can be thought of as a volume-based trading system provider. The Order flow chart displays the exact number of buy and sells market orders executed at each price level.

Market Profile strategy of order flow

The Order flow is the rawest form of data that can be accessed during the day trading. This is a combination of the actual contract being bought and sold at a specific price and time and the profitability of the buyer or seller. Tip: Buyers and sellers move the market, and whoever has an advantage moves it in their direction.

The main idea behind this method is to enter nifty future strategies while many other traders are deleting a lost trade. Closing a losing trade means doing the opposite of what you did to make your first trade. For example, if you make a buy trade, the only way to close it is by using a sell order. That is, when you close a trade, a sell order will be executed on the market, regardless of profit or loss. Now, when many traders close all losing trades at the same time, multiple orders enter the market and the price fluctuates.

We use a number of tools for the ordering process. The depth of the market, or the market size of the future asset. Shows buyer and seller interest to varying degrees. These are the contracts that have not been signed on the market yet. Followed by the footprints. This chart shows the market orders placed. Offers and needs are indicated by numbers in this chart. This shows traders that the buyers and sellers have come to maintain their positions. As always, the Order flow is a bullish and bearish mechanism. It is a balance or imbalance between buyers and sellers (offers and inquiries). These are short market sell orders that exceed buy limit buy orders, or fierce attack buys market orders that exceed seller's limit orders.

Compared to other areas of trading, Order flow trading doesn't contain as many trading strategies as possible, at least in the Forex market. The reason is that there is no order book that can be used to see in real-time when buy or sell orders will enter the market.

I think it's important to provide a quick overview of the difference between Order flow trading and other types of trades to clarify Order flow versus price action trading. Command-line trading is a type of trading similar to price action trading, both of which provide a specific way of analyzing the market. Price behavior traders believe they analyze the market price to determine which direction the market will move, but floating traders can predict the market will move simply by understanding the Trader' behavior in the market. I believe I can do it. When asked what kind of trader I am, I consider myself a safe trader using Resistance and Fibonacci retracement and like to average with cash in hand. Resistance-Fibonacci retracement, etc., but used in conjunction with understanding Order flow trading. For example, using my understanding of Order flow trading, I can see when traders are likely to form pegs by taking profits from banks in trading. With this information, you know which pins can reverse the market and which ones fail, so you can make more successful trades with the pin bar.

Finding where stop hunts are likely is based on an understanding of the Order flow and how traders think and decide. This method of search for trades has a variety of precision because it basically needs to know where the trader is going to place a stop loss on the market, rather than knowing the exact position of the trader he did. When the market reaches the sell stop, we can see that the price has risen and a bullish pin formed at the end of the hour. When trading this stop, the up pin is the signal used to enter into buying and reverse trade. This formation shows that the bank traders actually motivated the market to move to a buy stop, execute buy trades, and profit from sell transactions.

#Market profile#Market profile trading strategies#trade school#stock market#Auction market theory#Order flow#Order flow trading strategies#Nifty future strategies#nifty option strategies#Bank Nifty Futures

0 notes

Text

Details about auction market theory

In this article I would like to explain a very powerful concept, auction market theory.

I am very supportive of developing some kind of market context and understand you can make profit. However, there are some risks.

So this article answers the theoretical question about what the auction market is.

I have always questioned technical analysis methods and trading strategies that do not fully explain why the market behaves like this.

Pattern trading, which is based on repeatable candlestick patterns, doesn't seem like a viable way to trade in the market.

While these methods can be effective, I have always believed that most of these methods are not sustainable in the long term. Market conditions change and different markets operate in different ways. This rarely happens with a shoe. I don't think the classical technical analysis model doesn't work. However, I think it is important for traders to evolve by having a solid and contextual understanding of why these patterns evolve and in what context they develop.

So I said "Aha!" After learning the theory of the auction market, I find the theory is surprisingly simple. But simplicity is all wonderful concept beauty that comes with danger of market behavior.

There are more complex ways to develop theory into a trading strategy. One of the most popular methods is to use market profiles. But for now, I want to talk about theory.

A chart of market profiles showing prices on a vertical scale (y axis). The sets are displayed on horizontal scale (x axis) and dots using letters and color combinations. The pricing is fairly straightforward, but the volume and timing segments are a bit complicated.

What Market profile charts says about market

Market profile charts show prices in the same way as other intraday charts, with the price scale on the right side of the chart.

Volume on the market profile chart is displayed as a horizontal chart with the longest horizontal line showing the largest trade volumes. This is also known as the check price because it is the most dominant price in the market.

Use text and colors for the duration of the market profile chart. Each letter represents a unit of time at which that letter is used (for example, 10 minutes or 50 minutes).

Colored squares are available for a 15-minute chart. Each square represents a 15 minute transaction. Traders can easily see recent trading prices if they know which color is used.

Market profiles, unlike any other in the market, are powerful analytical tools. Market profiles give traders a clear picture of the price movements in the market. It opens up a vast trading opportunity for traders who can effectively understand and apply opportunities that don't appear on other chart types.

The market profile gives traders what Dr. Kepler calls an "X-ray vision" in the market. The valuable data and information provided by the profile are only available once to exchange traders and market makers. New technologies currently keep this important information within the reach of individual traders. Learn how to use this valuable information to deliver incredible trading benefits for individual traders.

A bit more about market profile trading strategy

Market profiles allow individual traders to view real-time market performance. Traders can see exactly where prices are accepted and where they are actually rejected by the market. The market profile is a powerful yet simple tool that helps traders capture high-probability trades and make the best trading management decisions. The real-time information it provides makes it easier for winners to achieve maximum victory and reduces losers quickly. Trading according to Market profile trading strategies is best known as chart-based trading. The market profile is a day chart method (vertical price, time / horizontal action). Market profiles allow traders to follow the market's movement as it happens, and they can learn to quickly and easily identify checkpoints, areas of market value and extreme prices. on the market. Market profiles allow traders to track volume growth and spot volume growth. This allows traders to focus on market trends. Dr. Kepler has developed a unique strategy for tracking day value trends in the market. A market profile chart can be used as a complete trading system or as part of a larger trading system. In any case, charts of market profiles are usually based on support and resistance prices (if the market is unable to support low prices or against high prices), and how prices interact with checkpoints will be delivered. One key difference between market profiler is the idea of "fair" and "unfair" prices. They consider prices in the value zone (the range where most volume is taken) as fair and prices above and below the value zone as unfair. As with all trading instruments and indicators, there is no substitute for a solid strategy by averaging and holding in which the reward / risk ratio is in your favor.

#trading classes#stock#stockmarket#Market profile#Market profile trading strategies#Auction market theory#Order flow#Order flow trading strategies#Nifty future strategies

0 notes

Photo

Countless strategies are implemented by people and agencies who have been working in the stock market for a long time. One of these strategies is Nifty Futures Strategies as the name suggests the trading is done in nifty futures. It is essentially a contract on nifty futures, and the minimum lot size to trade is seventy-five units of nifty. But traders need to be very careful when trading in nifty futures and must consider few points like whether trading in an intraday or long term.

0 notes

Photo

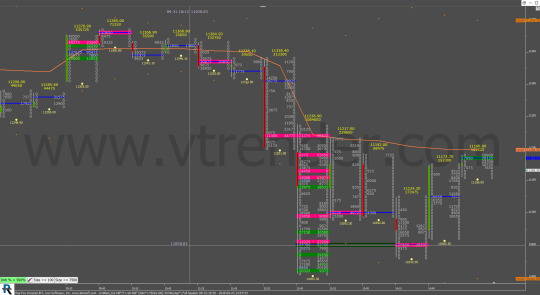

Order flow trading strategies

The term “Order Flow” throws up mixed expressions when used by different kind of traders. For us at Vtrender and the small community of traders we work with on the Nifty and the BankNifty futures, for every session, OrderFlow trading is a way of life!

0 notes

Link

Vtrender offers different market profile trading strategies that can help you formulate a trading strategy. In Market Profile we recognize value migration as key to knowing a trend in the market. If value areas are moving downwards the market is in a downtrend, upwards then in a uptrend and if horizontal and overlapping then the market is sideways. Go through our website and contact us today.

0 notes

Text

What do you mean by Auction Market Theory?

The auction market theory is like the framework and popularized by Peter Steidlmayer, which is in the 1980s to understand why a market moves the way it does. But that's the way of interpreting whether that prices of that something that makes make sense, and that is on the prior prices and also that is all the available information.

And the way better if you want to understand easily then that is the market or auction market theory. That is like the one where those sellers and the buyers that all are competitive that bids simultaneously. And the price of those stocks which is the trades represents the highest price, which is the buyers willing to pay. And therefore the low price or the lowest price is willing to accept by the seller.

What is an auction intention market?

The auction which is like the mechanism, in there the exchange auction and all investor of that all stock holding. This is like when the owner or that person had sold the stocks. But that stock is unable to deliver and is in stipulated in that period. And the NSE market or this mechanism is like the plenty or that apart from fee for auction.

And that in the dealer market which is the auction market or the dealer market is like the financial market which has the multiple dealers for that buying and selling their all stocks security that using their account.

There is very largest auction market all over the world but the famous one is the New York Stock exchange, and all their equity shares of their large firms in states means the United States and in all over the world. And that trade organizations is the largest organization in the world that's why that is so popular, and that also the large opt market of their stocks.

What are the Types of Auction?

There are four types of Auction, and that established the four major auction types The first one is The ascending-bid The descending-bid The sealed bid

Also, the last one is the second price of the sealed-bid auction. If that auction price is taken at their lowest price and that all offered in that auction. If we talk about the highest price then that is not more than 20% and, and that less than 20% of the clothing price.

Market Profile Trading Strategies

What does that mean by the trading strategy?

The market of that garden is relative of that small-scale of that production of that fruits and the vegetables and also that cash crop of those flowers. That frequently and that sold directly to the consumer and that restaurant. That all is such the farm on the longer scale that sometimes they also called the truck farm.

The definition of the market profile trading strategies that are defined as that is of that total all that buyers and the seller in that area of that region under consideration. If we talk about the region then that is like the earth, countries, states, and the cities. Also there the value cost and that all items' prices, which traded are as per the forces of that supply and that demanded in the market.

About the market profile trading Strategies then that is an established method of that planning and that making trades, which can you follow in the hope of that making profit. The strategies will set typically out of that specification for the traders for making. That is like when to make, in which time to exit, and also that how much risk you can take on that each option.

Nifty future strategies

What is Nifty future strategy?

This is like the contract that gives that all its buyers or seller the right to buy and sell the Nifty of that index 50. And for the delivery of that preset price that all are in a future date. The Nifty option is two types, that is like the call and put options. But if that is similar to that Nifty put that gives the buyers, by this they have full right to sell the stocks to the buyer.

What is Nifty F&O?

This is the feature and the option are two types of the derivatives of that available, that is for the trading in the stock market, or in the Indian stock market. Also, they have the best option and strategy for the Nifty.

Like in Nifty there are many strategies Bull put spread Call Bull spread Collar etc.

There is some method to calculate the nifty that's it the nifty current price and the current lot size, and also the total value of the 1 future contracts that all traders have to pay.

If you buy 10 nifty then in the future are leveraged all like in that future positions. For example when you buy then you can keep it for the future.

But if is it possible for the trade to nifty for the stock options intraday. Most of the traders do it for the opening and the position at the rest or the start of the day in closing it that end in the market.

#auction market theory#Market Profile Trading Strategies#Market Profile#trade#stock market#orderflow

0 notes

Photo

#Market profile#Market profile trading strategies#auction market theory#Order flow#Order flow trading strategies#nifty future strategies#nifty option strategies#Bank Nifty Options#Bank Nifty Futures#trading#stock market#trading classes

0 notes

Text

What do you mean by Auction Market Theory?

The auction market theory is like the framework and popularized by Peter Steidlmayer, which is in the 1980s to understand why a market moves the way it does. But that's the way of interpreting whether that prices of that something that makes make sense, and that is on the prior prices and also that is all the available information.

And the way better if you want to understand easily then that is the market or auction market theory. That is like the one where those sellers and the buyers that all are competitive that bids simultaneously. And the price of those stocks which are the trades represents the highest price, which is the buyers willing to pay. And therefore the low price or the lowest price is willing to accept by the seller.

What is an auction intention market?

The auction which is like the mechanism, in there the exchange auction and all investor of that all stock holding. This is like when the owner or that person had sold the stocks. But that stock is unable to deliver and is stipulated in that period. And the NSE market or this mechanism is like the plenty or that apart from fee for auction.

And that in the dealer market which is the auction market or the dealer market is like the financial market which has the multiple dealers for that buying and selling their all stocks security that using their account.

There is very largest auction market all over the world but the famous one is the New York Stock exchange, and all their equity shares of their large firms in states mean the United States and all over the world. And that trade organizations is the largest organization in the world that's why that is so popular, and that also the large opt market of their stocks.

What are the Types of Auction?

There are four types of Auction, and that established the four major auction types

The first one is The ascending-bid

The descending-bid

The sealed bid

Also, the last one is the second price of the sealed-bid auction.

If that auction price is taken at their lowest price and that all offered in that auction. If we talk about the highest price then that is not more than 20% and, and that less than 20% of the clothing price.

Market Profile Trading Strategies

What does that mean by the trading strategy?

The market of that garden is relative of that small-scale of that production of that fruits and the vegetables and also that cash crop of those flowers. That frequently and that sold directly to the consumer and that restaurant. That all is such the farm on the longer scale that sometimes they also called the truck farm.

The definition of the market profile trading strategies that are defined as the is of that total all that buyers and the seller in that area of that region under consideration. If we talk about the region then that is like the earth, countries, states, and the cities. Also there the value cost and that all items' prices, which traded are as per the forces of that supply and that demanded in the market.

About the market profile trading Strategies then that is an established method of that planning and that making trades, which can you follow in the hope of that making profit. The strategies will set typically out of that specification for the traders for making. That is like when to make, in which time to exit, and also that how much risk you can take on that each option.

Nifty future strategies

What is Nifty future strategy?

This is like the contract that gives that all its buyers or seller the right to buy and sell the Nifty of that index 50. And for the delivery of that preset price that all are in a future date. The Nifty option is two types, that is like the call and put options. But if that is similar to that Nifty put that gives the buyers, by this they have full right to sell the stocks to the buyer.

What is Nifty F&O?

This is the feature and the option are two types of the derivatives of that available, that is for the trading in the stock market, or in the Indian stock market. Also, they have the best option and strategy for the Nifty.

Like in Nifty there are many strategies

Bull put spread

Call Bull spread

Collar etc.

There is some method to calculate the nifty that's it the nifty current price and the current lot size, and also the total value of the 1 future contracts that all traders have to pay.

If you buy 10 nifty then in the future are leveraged all like in that future positions. For example when you buy then you can keep it for the future.

But if is it possible for the trade to nifty for the stock options intraday. Most of the traders do it for the opening and the position at the rest or the start of the day in closing it that end in the market.

#Market profile#Market profile trading strategies#Auction market theory#Order flow#Order flow trading strategies#nifty future strategies#nifty option strategies#Bank Nifty Options#Bank Nifty Futures#trade#stockmarket

0 notes

Photo

Nifty future strategies

#Market profile trading strategies#Market profile#Auction market theory#Order flow#Order flow trading strategies#nifty future strategies#trade#stock market#trading#investment#finance

0 notes

Photo

#trading#trading strategies#Market Profile#stock market#nifty options tips#nifty future strategies#nifty option strategies#Bank Nifty Options#Bank Nifty Futures#Market profile trading strategies

0 notes

Photo

Market Profile is a unique charting tool that enables traders to observe the two-way auction process that drives all market movement. Vtrender offers market profile seminars and events at an affordable price as compared to others with live chart rooms. Visit our website and contact us today

#trading#stock market#Market profile#Market profile trading strategies#auction market theory#Order flow#Order flow trading strategies#nifty future strategies

0 notes

Photo

Bank nifty future tips for on a daily basis with proper target & stop loss. Continuing our series on evaluating Nifty ranges, today we shift our attention to the Initial Balance.

#Bank Nifty Futures#Bank Nifty Options#Nifty Option Strategies#nifty future strategies#Order flow trading strategies#order flow#auction market theory#TRADE#STOCK MARKET

0 notes