The team of Financial Literacy Ambassadors at West Chester University have created a blog to talk about all things college related. Here on campus, our Financial Literacy Ambassadors go around and help students understand what financial literacy is. Financial literacy is understanding and applying different types of financial situations to every day life.

Don't wanna be here? Send us removal request.

Photo

If you really care about something, you will make sure it’s part of your budget. Check the 15% rule to find out how to do that.

10 notes

·

View notes

Photo

I kinda love making infographics…

Nice step by step method of keeping your maintenance loan under control and making the most of it!

8 notes

·

View notes

Text

4 Extremely Basic Steps for Students to Start Investing

Investing advice is confusing.

It’s not very practical and it can be very vague. And too many times it ends up with you researching everything you just read.

The thing is, it’s not easy as a student to see what a portfolio should look like. Not many people share what exactly they’re investing in (FoxyMonkey has a great post on his own portfolio). It’s true; every person invests differently and it all depends on your risk appetite and what you’re interested in investing in.

So here I’m going to take you through the individual steps to start investing as a student, and will encourage you to do research and shop around, as with all investing posts. However, we’ll also be following the steps of Katie, a normal (but still cool) student who wants to get started in the investing world.

(Remember that I am not a financial advisor and cannot be held accountable for any investments decisions) (Neither can Katie)

Vamos!

1. Make a plan

The number one reason people don’t start investing: ‘I don’t have money!’. Wrong! You do have money (yes, even students!). What you need is a plan.

Start by following the 15% rule: allocating 15% of your income to yourself (here’s a guide to get started). From that 15%, figure out how much you want to use for investing. This really depends on your priorities and where you want to put your money first.

You’ll be putting this money into index funds. Index funds are basically a basket of funds which track the market, and will have the same return as the market every year. This will be done through a Stocks and Shares ISA that gives you an allowance of £20,000 every year completely tax free. That means you won’t have to pay tax when you declare your investments.

As you put in some money every month, the amount will accumulate every time forming a nice nest egg. You can then use this little egg as an emergency fund, for a big expense or simply to save for the future – the decision is all yours. And if you suddenly you decide you need the money right now, you just sell your assets and the cash is there in 3-5 days. So chill.

Of course, remember that the market fluctuates over time you could lose money as well as gain some. However, in the long run, you’ll be gaining.

Our friend Katie is very excited to start investing. She earns £500 a month. 15% of 500 is £75. She decides she’s willing to put £50 every month into an index fund to start building her emergency fund. Now she has a plan.

2. Sign up to a platform

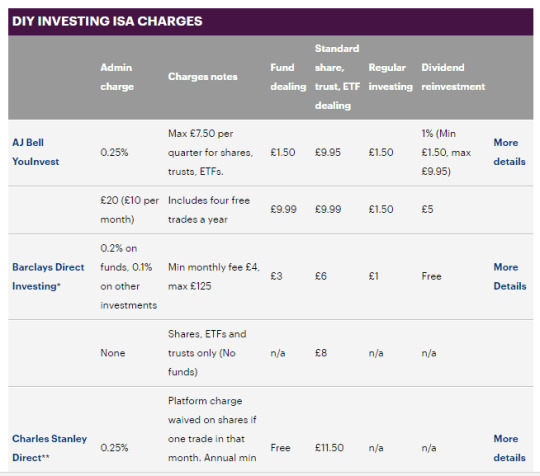

You’ve got your money, now you choose which platform to put it in. How to choose? Look for the one with the cheapest costs and which appeals the best to you. Here’s a list:

Image from This is Money

This is the part that frustrates me. No one wants to recommend a specific investment platform, so they just say do your own research. Personally, I use Vanguard for index investing. Which one should you use?

I recommend picking 3 from the list and signing up to them (the lower the costs, the better). No money, just signing up. Try them out and see which one you like the best: easy to understand platform, good customer service and a good choice of index funds – those are things you’re looking for. Vanguard is popular because of the extremely low costs, but maybe you prefer something else because it’s easier to understand.

Only you can say, which is why it’s good to try out several platforms. I also recommend going on Reddit threads and seeing how other people invest and what they recommend, you can really learn a lot.

Katie tries out a few. She visits their websites and even signs up to a few demo platforms (another good way to test a platform). Eventually she goes with Vanguard (what a coincidence). She signs up: sends them a photo of her passport and proof of address. Once she’s in, she opens up an ISA (the steps are detailed on the platform) and adds £50 – the first month. This means she has £50 in cash in the platform. She hasn’t invested any of it yet.

3. Invest

Once you’ve signed up to the platform of your choice, it’s time to choose what to invest in. Yes, we said index funds, but there are different types of index funds which track different markets. You could track the FTSE 100, Emerging markets, Global index funds and others such as small cap index funds(small companies). Check the info on each fund: it tells you their past performance, what fees they charge and how risky they are.

What I recommend: something global. You don’t want to invest only in one area, since it’s more likely to fluctuate (especially Britain with Brexit and all). Pick a few of the global ones and read through the info pdfs of each one. It will tell you the level of risk, the fees and what exactly it invests in. Pick 5 and try to narrow it down to 1 or 2. That’s where you’ll be putting your money!

Katie looks around Vanguard and decides she wants to go global (we have a clever one!). Vanguard offers Global index funds (called LifeStrategy 100% Equity) at 0.22% cost and with a risk of 5/7. She invests her £50 into the index fund. Yay! She then sets up a direct debit so that every month £50 go into Vanguard global index funds.

4. Practice

It’s exciting to see your money grow every month. You can now sit back and relax, your money is working for you as it earns interest and accumulates over time

But it’s good to keep practicing and keep being interested. You are now an investor: look at what’s going on in the news, check out how other people invest and where else you could do with your money. But of course, only if you want to. What’s great about passive investing is that it’s exactly that: passive. The fact that you’re investing in the first place already a huge step.

After a few months of investing and seeing her nest egg grow, Katie decides she wants to take the next step and really learn more about investing. She signs up to The Economist (which is £12 for the first 12 issues btw!) to keep up to date with the world, she checks out how other people invest on Reddit forums and she looks around for other ways to make her money work for her: maybe a side-hustle, a different index fund, etc. She’s pretty excited; she knows that as long as she keeps her 15% rule going, her nest egg will grow and so will her knowledge.

It’s not easy to get started with investing when it looks scary and risky, but once you understand what the steps are and how simple it can be, you realise how important it is to start investing now. Be like Katie: take the first step. Start researching, looking around and asking on forums. The amount of knowledge out there is astounding, you just need a little push to find it.

Have investing doubts? What’s holding you back? Lemme know below!

35 notes

·

View notes

Text

5 important tips you need to be credit savvy!

Tip 1: Set-up an Emergency Fund

An emergency fund is the key to making sure you won’t have to run up debt on a credit card or other source of credit when an unexpected cost pops up.

Taking a certain percentage of your paycheck and putting it into a savings account automatically will help build your emergency fund and later, a long-term savings fund.

Tip 2: Make a spending list:

Make a list of bills and priorities in order of importance.

Ask yourself essential questions:

What are the key categories that you want to be spending money on and what are you willing to trade in order to maintain those?

Is this a luxury or necessity ?

Tip 3: Focus on your Priorities FIRST

When you get your check or direct deposit, make sure you pay your essential bills such as rent or mortgage and utilities, then take out what seems like a necessary amount of cash for each budget item, starting with your highest priorities.

For more variable and flexible costs such as groceries, figure out how much you actually need to spend by carrying a notebook or take a tracking sheet with you to record purchases. That way you don't need to rely on your credit card for a major grocery purchase.

Tip 4: Use Extra Money to Pay off Debts.

This is mostly pertaining to people who have loans . One method is to begin paying down the smallest debts first. Doing so can boost your credit and free up more money in your budget to attack the next smallest debt, and so on.

Tip 5: Check your credit consistently

Checking your credit score is absolutely free! Never pass up a freebie, especially when it can affects your financial health and well-being. Your credit report plays an important part in your credit transactions and many other financial relationships. You should check your credit report just like you do your bank statements and credit card bills. Keeping track of spending and putting aside savings are all essential to being financially successful. Also social security numbers that don’t belong to you, or accounts that aren’t yours, you could possibly be a fraud victim. Be consistent to make sure your credit is safe and sound.

0 notes

Text

Budgeting with Food

As a college student, you're probably not working as much as you want to due to having a full course of classes, homework, and life. It can be difficult budgeting especially when you don’t have support from others as well. But we are to help! Regardless of whether you receive aid or not, learning how to budget especially when it comes to food is very important. Once you develop this skill, you will be able to save money much easier with a refrigerator filled with all your favorite foods.

Step 1: Create a Grocery Budget Sheet.

A grocery budget is a budget you plan when you go out shopping for food except it only requires necessities and produce that you really need for a healthy lifestyle. This budget plan should be based off of your monthly income also including any rent, utilities, and miscellaneous things you purchase throughout the month. Your budget sheet does not need to be as complex as the example above. It can be very simple and straight to the point. The purpose is to make sure you're aware of how much each item cost and what your actually purchasing.

DATE: ITEMS PURCHASED: PRICE:

06/12 (1) 2% Milk $2.09

06/12 (2) Whole grain cereal $2.10 each

06/12 (2) lb of fresh corn $0.97 per pound

06/12 (2) Frozen veggies $2.99 each

06/12 (3 )lbs of Chicken Breast 1.50 per pound

And so on…

____________________________________________________________

Budget: $60 What you actually spend: $55

By practicing this budget plan, you will be able to stay within your budget and become more aware and accustom to prices in the grocery store. While planning this grocery list, you should also be taking certain things into consideration such as…

-How often will you be eating out? Ex: Three Times a month? Once a week?

-How often will you go grocery shopping? Ex: Every two weeks? Once a month?

These particular questions will influence how much you spend or how often you purchase groceries from the market.

Step 2: The difference between needs & wants?

-Name your priorities such as the necessities you need for your well being in order obtain a well balanced diet

-Name your wants such as treats, sweets and snacks.

In order to have a successful grocery trip, you should be able to differentiate between the two. Sweets and treats should not be the main things your focusing on when grocery shopping, in fact it should be the last on your list of items to purchase because you absolutely DO NOT NEED to purchase them.

Tip: Create a Meal Planner to have alongside your Grocery Budget

By creating a meal planner, you can keep track of the items you want to purchase and maintain your consistency. For example, If chicken is an essential aspect to your diet then you should be mindful of how much chicken you use because you probably purchase that item the most.

The eatwell plate is a helpful resource to refer to because it shows what a balanced meal looks like.

Step 3: Compare different grocery stores around your area

Depending on whether you have a car or not, you should always explore your horizons! Some grocery stores tend to me a little more expensive than others. To prepare yourself for this, you should compare prices with other grocery stores. A great resource tool is : www.MyGroceryDeals.com

This website allows you to compare and contrast items from local markets around your way! Obviously, you do not have to go to each market that sells the item at a cheap price, but it allows you to have a better understanding of what’s out there.

Step 4: Look into Couponing

We are pretty sure that you’ve heard about the show “Extreme Couponing” which plays on TLC. Do we expect you to become an extreme couponer? Of course not.

Do we expect you to consider couponing ? Um yeah, duh.

Couponing is a helpful tool that allows you to save money so why not utilize it? A Lot of convenience stores sell newspapers which contain a lot of coupons for local stores. Here are some tips on how you should utilize them:

-Coupons have expiration dates and must be used before they expire. They also have other restrictions that need to be followed: size, quantity, brand, make, etc.

-Read each coupon carefully. This includes the small print.

-You can print off coupons online. Most all coupons can be printed 2 times per computer.

-Coupons come in the mail and newspapers. The main mailer is an insert called Red Plum. In some areas Red Plum also comes in the Sunday papers.

-If you can, buy items in bulk that have a coupon and that are also on sale.

0 notes

Text

A Guide To Buying College Textbooks:

The school year has finally started ,and we are pretty sure that your stressing out about the cost of textbooks. Don’t Panic! #WCUFINLIT is here to offer you tips to help you with this journey on purchasing affordable textbooks that fit your budget.

Tip # 1: As soon as you receive your Syllabus and review it, make sure you ask your professor essential questions that could possibly make your search a little bit easier.

Here are a few examples:

Does this book have different copies or versions ?

Does this hard copy have a paperback version (paperbacks tend to be much cheaper)?

Can I purchase another edition and still obtain the same information that’s needed for the course?

Tip # 2: Based on the information you received from your professor, visit your local campus library and check to see if this book is available in your school’s online library system.

Ask a Librarian to help you check to see if the book is offered at other nearby schools. If it is available, then ask them to check if the textbook is able to be sent out to another location for a period of time.

Tip #3: Check out various sites to rent or buy college textbooks cheaply.

Here’s a list of some popular sites:

Chegg.com

Valorebooks.com

Amazon.com

BookRenter.com

Textbooks.com

Bookbyte.com

A Lot of these websites offer two to seven day shipping for reasonable prices. Some websites offer free shipping when you spend over a certain amount.

Tip #4: Make friends within your major! A Lot of people on campus sell their textbooks after they complete a course. Don’t hesitate to ask around and look up pages on social media sites for people advertising their textbooks.

Tip #5: Don't settle for the book store! A Lot of students will settle for the bookstore because it’s close and convenient, but in reality it's actually inconvenient because a lot of the books are overpriced. Make sure you utilize your resources before settling for the book store.

Good Luck & Have a productive semester,

Your friends from #WCUFINLIT ♥

0 notes

Photo

a. Follow these steps to accept your financial aid:

i. Go to www.wcupa.edu

ii. Log into your myWCU account with your username and password

iii. In the middle section under “Financial Aid Alerts” click on “View Awards” in a blue underlined font.

iv. Select 2019 Aid Year

v. If you received grants they were automatically selected for you. You can either accept the full amount, decline, or adjust how much you want to take out in loans under the “Accepted” column. Remember to press “Submit” after you selected the appropriate amount of aid. #FAQfriday

0 notes

Photo

a. Follow these steps to accept your financial aid: i. Go to www.wcupa.edu ii. Log into your myWCU account with your username and password iii. In the middle section under “Financial Aid Alerts” click on “View Awards” in a blue underlined font. iv. Select 2019 Aid Year v. If you received grants they were automatically selected for you. You can either accept the full amount, decline, or adjust how much you want to take out in loans under the “Accepted” column. Remember to press “Submit” after you selected the appropriate amount of aid.

0 notes

Photo

a. In the case that your parents are not approved for a Parent PLUS Loan, you have three different options. 1. You can select the option that allows you to apply again with an endorser. 2. You can select the option that accepts the denied status and we can offer a $4,000 or $5000 (based on grade level) Unsubsidized loan for the 2018-2019 academic year. 3. Do not move forward with the process and either apply for a private loan or utilize the payment plan offered through the Bursar’s office.

0 notes

Photo

If you have already applied for summer financial aid using our online 2018 Summer Federal Direct Loan Request Application or through an outside institution, please log onto your myWCU account to check if your account is activated. If not please call the Bursar’s office at 610-436-2552 to activate your account. If you already have done so and your aid has still not disbursed, please email one of our specialists for assistance. [email protected]

0 notes

Text

Yes, You Can Go to University for Free

You’ve decided you want your higher education to be completely free – no student loans, no accommodation cost.

Whether that’s a wise or not, it’s up to you. But yes, you can go to university for free. Two things you’ll need: a lot of hustle (researching and applying) and flexibility (free education means you might miss out on something else).

Here are some tools and programs you can use to lower those big costs:

Grants

Grants are basically a sum of money the government gives you to help you out with university. Notice the give: you’re not expected to return it, unlike student loans. If you qualify for these grants and supplement it with something else, they can help you get to college for free. Pretty sweet.

You get different types of grants:

Maintenance grant

For living costs. You can get up to £3,475 if your household income is £19,203 or less. If it’s more than that, you may be eligible for a partial grant, depending on your income. These may not always be easy to get, but they’re worth a try.

Special support grant

This grant is to help with additional costs such as books, equipment and travel expenses. You could get up to £3,475 depending on your household income, but you also need to be eligible: be a single parent, have a certain disability, come from abroad, etc. You can’t get both the maintenance and special support grant, but you could try for one of them if you believe you’re eligible.

Travel grant

This one’s pretty cool. It’s basically a grant the government gives you to travel abroad, whether it’s on an Erasmus or to do with your university. The amount you’ll get also depends on your household income and some other factors. Here’s how much you can get (it’s a little confusing IMO):

There are a few other grants such as the Disabled Student’s Allowance and Dependents’ and Childcare Grants. As you can see you need to be in pretty specific situations to qualify, so grants are not the answer for everyone. But still worth a mention and a try.

For more info on grants and how to apply visit Gov.uk

Bursaries and scholarships

Bursaries and scholarships are pretty similar to grants except they offer larger amounts of money and aren’t always from the government. Although they may sound like the easy path to free education, they can be quite a hassle. The hardest part: research. There’s tons of bursaries and scholarships out there but you really have to find the right ones and apply as soon as possible. This includes asking your university, asking other students what they’ve done and spending a lot of time on our lil’ friend Google.

You also need specific criteria to pass: your household income, gender, nationality, grades, talents, etc.

The research isn’t easy because there’s not a huge directory with all the scholarships and bursaries available – you gotta do the work. Here are two of the largest directories I found to help you get started:

The Scholarship Hub

Scholarships for international students

List on TopUniversities

NHS

The beloved NHS! If you’re studying anything health related (dentistry, medicine), the NHS might come and help you out with the costs. The thing is, this one’s pretty complicated. You get different amounts depending on where you live, your household income and what you’ll be studying exactly. It varies so much that it’s kinda hard to be specific here, but here are some extra resources to find out more:

England, Scotland, Wales, Ireland

The great thing is that this can then help you do practices and internships with the NHS, which will then lead on to a job, a better opportunity, etc. All I’m saying is it could be worth a try…

Armed Forces

Not for everyone but could be a good option. No matter which degree you’re thinking of pursuing, you could get the Armed Forces to help you out with your education so you can then move on to working in the army. There’s a pretty large range of different bursaries available for army students depending on what subject you want to study.

In some places not only do you get a bursary but you also earn a little income of about £2,000 a year. You get different bursaries depending on what you qualify for: if you have amazing grades and potential to become an officer, you could be getting a total of £24,000!

There’s a ton of different options: training to become an Army medical profession, joining the Royal Navy or the Royal Air Force. I’m telling you, you’d be surprised by the amount of options out there – do a bit of research and planning and the free education will come rolling.

Find out more about your options and check out the guide to getting into the Armed Forces:

Sponsorships

Sponsorships are basically schemes where a company pays for your education in partly or in full. You could already be working for the company, going to work for them in the future or not working for them at all. There’s tons of different sponsorships available for different degrees and different cases. An example is Google: offering sponsorship to female students studying Computer Science and who demonstrate strong leadership skills.

You have a few odd ones here and there: sponsorships for vegetarians, for Welsh speakers only and even for golfers! Think you don’t have any skills? Look around… maybe some company has thought of you and has a pretty sweet deal you could take advantage of.

The Scholarship Hub has a section on finding sponsorships, or ‘company scholarships’ as they call them.

Apprenticeships

These are pure gold. And they’re becoming more and more popular nowadays as people realise getting a degree doesn’t always mean getting a job.

With an apprenticeship the company basically trains you for the job and combines it with some classroom style education. Then, the training is over and if you’ve done well – bam, a job.

You can also get a degree apprenticeship: basically the company sponsors you to go to university so you can then go work for them once you graduate. Not only do you get a degree for free but you are guaranteed a job once you graduate. Pretty sweet.

This page on Gov.uk has tons of resources on finding apprenticeships for your particular degree/field.

Crowdfunding

This plan may be a little on edge but could work if done well. It basically consists of asking strangers to donate to you to pay for your education. You go on a site like Crowdfunder, Hubbubor GoFundMe and ask for money to support your studies. You write a good essay on what you’re going to do with the money, what you’re going to study and why (something that stands out is better).

Here’s Brian who wants to go to Oxford to study a Masters in Development Studies. His motive? Research on LGBT communities in areas like China and South Africa. He also goes on to explain his achievements, where he’s from and even his sexual orientation (bisexual). He’s raised £18,117 so far. Congrats to Brian!

Crowdfunding is something that takes a lot of time and effort – you really need to convince people to give their money to you. They need to believe in you and trust that you will use the money well. But again, worth a try – and would look great on a CV if successful.

Go abroad

If you’re non-Scot, you won’t get free education offered next door in Scotland (and yes, we’re all sniggering over here). However, there are still some countries which offer a free education: Germany, France, Norway, Sweden and Denmark. Why not learn another language? Study something a little different? Get to know an interesting culture? Many degrees are done in English and offer a great range of opportunities for foreigners. Why not make an adventure out of your education?

This is also great for your CV: studying abroad shows an employer that you are flexible, adaptable and you look for opportunities. Great way to stand out from other candidates and gain a different and more interesting set of skills.

I did this for China: one trimester studying Chinese overseas wasn’t too expensive and I made amazing money as an English tutor – effectively making my education free.

It’s a little trickier to apply and organise – no European version of UCAS. You’ll have to go to our trusted friend Google and search for something along the lines of ‘apply for German/French/Norwegian university’ and see where it gets you from there. Some additional resources to check out are The Complete University Guide, list of countries and Top Universities

As I said before, if you want free/very cheap education, you’ll need some hustle. You can combine some of the options above and try to find what suits you best. Do your research, ask your university, do some networking. Keep going until you find something that works for you, and if you can’t find anything: do a gap year. Much better to go into university one year later doing something you want than going with everyone else and wasting your time (I say from experience).

Read more like this over at Financially Mint

9 notes

·

View notes

Text

What To Do At The End Of The Student Loan Grace Period

With November quickly approaching, many student loan borrowers are suddenly realizing that their grace periods are about to end. Soon, they’ll have to start making payments on the student loans that they took out over the last few years.

This article provides insights on how borrowers can take control of their student loans before payments even come due.

243 notes

·

View notes

Text

Credit cards

Credit cards can be your best friend or it could be your worst enemy, depending on how you use it. Credit cards can be used to build your credit score and also can be used to help you manage your budget. On the negative side credit cards carry the highest rates on debt, meaning that if your miss a payment it could spiral into a bigger problem. To help you with understanding credit cards, and how to manage them here are some tips:

1. If you are not sure what credit cards you qualify for and are likely to get, use the Creditkarma app and it will utilize your credit score to help you find the right card for you

2. Only purchase things on your credit card that you can afford normally and are already in your budget

3. Always make your payment either on time or early, you don’t have to wait until the end of the period to pay you can make a payment as soon as the expense shows up on your card.

4. Always try to keep your balance at $0, you can do this by paying on time or paying as much as you can to make sure it is not too much of a burden

0 notes

Text

Credit and Financial Independence

One of the most challenging parts of college is having to become financially independent. Besides having a steady income, building credit is an absolute must. Having a good credit score can help with applying for mortgages, auto loans, and can even affect your job outlook.

Here are 3 ways to start building credit:

1. Apply for a credit card

Opening a credit card is the easiest way to quickly build credit. Since most of us do not have much income, the limit on these cards will be low. By just making small purchases and paying them off right away, your credit score will improve drastically.

2. Pay your bills on time

If you are late on your rent, electricity, or phone bill that will negatively affect your credit score. Making sure you pay your bills on time is a simple way to build credit and learn how to manage your money.

3. Start to pay back your student loans

Most of us don’t want to think about having to pay back our student loans, but small payments of just 5-10 dollars a month can help you build credit.

0 notes

Text

Ten Ways To Pay For College Right Now

Sometimes, the hardest part is simply knowing where to begin. Here are some tips:

1) Fill out the Free Application for Federal Student Aid (FAFSA) form, even if you don’t think you’ll qualify.

2) Apply for national grants. Options include Pell Grants, Academic Competitiveness Grants and National SMART Grants.

3) Apply for local scholarships. Civic organizations and religious institutions often have meaningful amounts of aid to dole out.

4) Getting into more than one school translates to a higher likelihood of receiving a big financial aid package.

5) Bargain! Even schools that only provide need-based aid sometimes come up with drastically different offers.

6) AmeriCorps, Peace Corp, National Health Services Corps and ROTC programs offer college money in exchange for a service commitment.

7) Look abroad. At Scotland’s St. Andrews, U.S. students pay only $21,650.

8) Stay home. Starting out at a low-cost community college and transferring to a four-year college for the final two years will wipe away a hefty chunk of room and board costs, as well as some tuition.

9) The American Opportunity Tax Credit and the Lifetime Learning Credit are two excellent options.

10) Don’t forget to consult your local expert – guidance counselors are often aware of options you may not have considered; best of all, their help is free.

Read more.

1K notes

·

View notes

Text

how to save and make money as a student

making money

tutoring! one of the easiest to make good money in limited time! you don’t have to make home calls if you sign up to an online tutoring agency and tutor over skype

sell your old clothes. to friends/classmates or online (eBay or depop are my favourite platforms)

sell your old notes. this is easily done online and a good way to make a little extra cash

sell your skills. sites like etsy and redbubble are good places to make money off your creative talents

saving money

save £1378 in a year with my free printable

make coffee and tea at home. those daily £3 coffees add up quickly

take your own mug to coffee shops. if you can’t resist the temptation of a coffee shop coffee take your own mug. pret a manger gives you a 50p discount if you bring your own mug and caffe nero gives you double stamps

don’t carry money with you all the time. this will just make you tempted to spend

never buy another bottle of water. carry a reusable bottle with you, bottled water is very very overpriced considering most cafes will refill your bottle for free

don’t use apple pay. if you always have access to money you’ll be much more tempted to go into that shop and buy the top you passed in the window

food prep! carry snacks and a packed lunch with you to avoid pricey snack bars and ready meals. this is also an easy way to be healthier

home cook. this is always cheaper than eating out and 99% of the time cheaper than pot noodles/ramen. home cooking is even more affordable if you do it in bulk or with friends

borrow and download free ebooks and audiobooks as much as possible

make good use of the library. instead of buying books borrow them for free, a library membership is often free if you belong to a university/college but a membership is still often cheaper than buying lots of books if you’re a big reader

bring reusable bags to avoid paying for plastic bags and be kinder to the environment.

go paperless. avoid printing costs and look after the environment

cut your own hair. going to the hairdressers is expensive and can be saved as a treat but if you just need to trim your split ends there’s no reason why you shouldn’t do it yourself or get a friend to help you

pre drink! if you are going out then drink alcohol at home it’s much cheaper than buying it in pubs or bars

other

use cash. it’s much easier to avoid spending money and stick to your budget when you can see exactly how much you have

keep track of your saving and spending. i love the ‘pocket expense’ app. this will also show you what things you are overspending on

collect coupons and loyalty cards. points make prizes!

create a culture of clothes borrowing among your friends. instead of always buying new things for events

8K notes

·

View notes

Text

Ultimate List of Student Discounts

Hey lovelies, I’ve been getting some asks about student discounts. Here’s a list I made! Follow me for more.

Adobe: CreativeCloud, featuring PhotoShop) available for $19.99

AllState: Up to 25% off insurance with good grades until age 26

Amazon: Free two-day shipping and discounted Prime membership

AMC: Lowered prices on Thursdays

Amtrak: 15% off fare purchases

Ann Taylor: 20% off in-store purchases

Ann Taylor LOFT: 15% off online and in-store purchases

Apple: 8% off online and in-store purchases

Banana Republic: 15% off regular-priced in-store purchases

Ben Franklin Crafts: 10% off purchases

Burger King: 10% off purchases

Charlotte Russe: 10% off full-priced purchases

Chick-fil-A: Free drink

Chipotle: Free drink

Club Monaco: 20% off full/sale items in-store and online

Dairy Queen: 10% off purchases

Dell: Save up to 30% on select items

FedEx Office: 30% off documents and 20% off shipping services

Geico: 15% off for full-time students with at least a B average

J. Crew: 15% off in-store purchases

Jiffy Lube: $10 or 10% off purchases

JoAnn’s: 10% discount on all purchases and two monthly coupons

Juicy Couture: 15% off purchases

Kate Spade: 15% off purchases

Kroger: 5% off purchases

Hancock Fabrics: 10% off purchases

The Limited: 15% off in-store purchases

Logitech: 30% off purchases

Madewell: 15% off purchases

Norton: Up to 50% off protection software

NY Times: 50% off print and electronic subscriptions

Pizza Hut:10% off purchases

Qdoba: $5 burrito meals

Ralph Lauren Rugby: 15% off online or in-store purchases

Regal: Discounted tickets on Mondays

State Farm: 25% off insurance with good grades until age 25

Subway: 10% off purchases

Taco Cabana: 20% off purchases

T-Mobile: 10% off through StudentRate, waived activation fees

TopShop: 10% off online and in-store purchases

TOMS: Free shipping with online purchases

Waffle House: 10% off purchases

321 notes

·

View notes