Don't wanna be here? Send us removal request.

Text

https://docs.google.com/presentation/d/15baAMNC7RO0e-E8j5mp30Ry4UqOgQ9h4C4Ful5_fAmo/edit#slide=id.g2c3af6c9995_0_584

Tran Nguyen

Student ID: 82976101

Discussion: Wed 4:00 - 4:50 pm

Econ20A

0 notes

Text

Economic Tides

In Shanghai’s embrace, I start to dream. Of distant lands and a quick wind.But as I gaze at the sky, so wide,I’m trapped by the money tide.

The flights to LA, the hip hop ground. Yet prices soar, debates inflate.I loathe the cost, the barrier high,A vaulted sky, freedom’s sigh.

Monopolies hold the strings so tight. Controlling flights into the night. My heart sinks with each search, each find. A market’s grip, cold and unkind.

To Irvine’s peace, I wish to roam. To feel the warmth of a second home.But barriers rise, unseen, untold.

I curse the rules that charge these wings. The unseen hand, the price it brings. For home calls me, across the sea. But economics keep the key.

The dance of supply, demand’s cruel game. Leaves me as pawn, in a flight of shame. Elastic dreams, stretched too thin,Against the cost, no way be found.

From Shanghai’s heart to Irvine’s grace,I search for paths, a hidden trace.May the tides of economy, shift and sway,And lead me home, to what I miss.

(I wrote a poem to express my anger towards monopolies on international flights and a short video of what my trip to home looks like.)

Zijie Zhang

0 notes

Text

Economic Tides

In Shanghai’s embrace, I start to dream. Of distant lands and a quick wind.But as I gaze at the sky, so wide,I’m trapped by the money tide.

The flights to LA, the hip hop ground. Yet prices soar, debates inflate.I loathe the cost, the barrier high,A vaulted sky, freedom’s sigh.

Monopolies hold the strings so tight. Controlling flights into the night. My heart sinks with each search, each find. A market’s grip, cold and unkind.

To Irvine’s peace, I wish to roam. To feel the warmth of a second home.But barriers rise, unseen, untold.

I curse the rules that charge these wings. The unseen hand, the price it brings. For home calls me, across the sea. But economics keep the key.

The dance of supply, demand’s cruel game. Leaves me as pawn, in a flight of shame. Elastic dreams, stretched too thin,Against the cost, no way be found.

From Shanghai’s heart to Irvine’s grace,I search for paths, a hidden trace.May the tides of economy, shift and sway,And lead me home, to what I miss.

Zijie Zhang

0 notes

Text

Anannya Bhuskat - 79131414

Santiago Baltazar - 32163004

0 notes

Text

Ebooks and Monopolistic Competition

Reed Sinclair

69446220

During the COVID pandemic while everyone was stuck inside, I discovered that I could borrow ebooks from my library and read them on my phone. I experimented with a couple of different apps before I eventually landed on the app Libby, which is primarily used by libraries that lend digital copies of books. These ebook apps or websites are examples of monopolistic competition, which is a market in which many competitive firms produce similar products that are all slightly different from each other. I only tried two apps, but there are many other apps made for reading ebooks that all offer slightly different experiences or purposes. For example, Amazon’s Kindle and eBooks.com both provide the service of buying a book online. The experience between these two services differ in the format they provide the books in and the catalog of books they offer. In contrast, Libby also provides the service of ebooks but instead of specializing in selling ebooks to readers, it sells to libraries which then provide the ebooks for free.

During the pandemic, demand for ebooks increased drastically as people could not go to libraries in person. This large increase in demand shifted the market equilibrium out to the right which caused ebook suppliers, such as Overdrive, to look for more ways to sell ebooks. This led to Overdrive making more deals with libraries and having libraries buy more licenses of ebooks that transformed Overdrive into a firm primarily marketed towards libraries, and increasing its supply of ebook licenses.

On the short-run monopolistic equilibrium graph, the marginal revenue line shifts to the right as ebook firms sell more licenses and ebooks to libraries and readers respectively and demand increases. This leads to an increase of profits for the firm and incentivizes the firm to keep selling ebooks in order to keep raising profits.

Source:

Gross, Daniel A. “The Surprisingly Big Business of Library E-books”, The New Yorker, https://www.newyorker.com/news/annals-of-communications/an-app-called-libby-and-the-surprisingly-big-business-of-library-e-books.

0 notes

Text

The Economics of Food Delivery Apps During the Pandemic

In today’s pandemic-altered world, the way we access goods and services has changed dramatically. The interplay between supply and demand is an economic concept that gets a lot of attention, especially in the food delivery industry. Join me as I explore how the economy has impacted my experience with food delivery apps during these challenging times.

As I settle into my home, craving a delicious meal but hesitant to go out, I open my favorite food delivery app and turn to my phone. I immediately saw many dining options ranging from local to international cuisine. Such a wide selection reflects the restaurant’s service philosophy as it strives to meet the demand for convenient and safe dining options during the pandemic. However, as I browsed the menu, I noticed something strange - some once affordable dishes had higher price tags. This phenomenon can be attributed to the principle of demand, as consumers' increased reliance on food delivery services during the pandemic has led to a surge in demand for these convenience products. In response, restaurants may adjust their prices to take advantage of this increased demand, resulting in higher prices for consumers like me.

Additionally, as I considered the decision to place an order, the concept of resilience became apparent. While some items may cost more than they once did, I find myself willing to pay a premium for the convenience and security that food delivery provides during these uncertain times. This inelastic demand allows restaurants and delivery platforms to maintain higher prices without a significant drop in consumer demand, illustrating the economic concept of elasticity at work. My experience with a food delivery app is a concrete example of how economic principles have impacted our daily lives during the pandemic. From the dynamics of supply and demand to the concept of elasticity, economics plays a vital role in understanding the behavior of consumers, businesses and markets in these challenging times.

Jia Guo 27765166

0 notes

Text

Fluctuation of the Supply and Demand of Dating Apps

As our generation has gone increasingly digital due to the development of technology and with COVID pushing an online agenda for several aspects of life, such as work and school, it is no surprise that people have resorted to finding love online as well. When these apps were first launched, people held skepticism about the reliability of finding their future partners through a screen. However, there were still users who wanted to give this novel app a try, which depicts the original graph below.

However, COVID was the main push for more consumers to give dating apps a try. As it became more difficult for in person events and even face to face conversations, people began pushing their skepticism regarding dating apps to the side and became more open to the idea of finding love without needing physical presence. Hence, the graph below is what the status quo looks like.

Because of the sudden boom in demand, more and more dating apps were created in hopes of earning a share of the pot. In the past, Tinder was the main app that people went to for online dating, however now, Hinge and Bumble are taking away Hinge's monopolistic power and increasing the supply of dating apps to choose from. Though the pool of people may not change, as someone who is on Tinder is just as likely to be on Hinge, users have different options for platforms. Thus, the graph below is what the current stage of dating apps is:

There is also an indirect effect that could just be correlation and not causation for this phenomenon, however there has been an increase in divorces in recent years. I suspect that this could be an indirect result of relationships starting online and then developing to marriage without adequate physical time spent with each other. Living habits, work habits, work ethics, etc. are all characteristics that are unable to be observed behind a screen, which are is a recipe for failure.

I decided to do this project regarding the increase in popularity regarding dating apps mainly because I’ve observed the increased use of them in people surrounding me and although I personally would not indulge in it, it was always an interesting concept that it was possible to find love without any physical interaction.

By: Katie Wang

Student ID- 73023348

0 notes

Text

Chipotle's Price Hikes

Rachel Kim

ID: 79571828

As a first-year student living on campus without a personal vehicle, there aren’t many dining options outside of campus for me and my roommates to go to whenever we feel like treating ourselves, or when we simply don’t like the Brandywine menu at times. During such days, the University Town Center serves as our only convenient option as it remains the only area where students can go without having to walk too much or take modes of public transportation.

My roommates and I personally spend most of our money at Chipotle, as we typically go around 3 times per week, sometimes even more. However, it is no secret that Chipotle’s prices have been increasing at least twice a year for the past 2-3 years, and 2024 will not be an exception to these price hikes; due to negative externalities, such as rising minimum wages, inflation, and increasing marginal benefits from consumption (the increasing maximum amount consumers are willing to pay for burritos, bowls, etc.), it is expected–especially taking price histories into account–that Chipotle’s prices will remain on the rise.

Equilibrium Shift (2021)

During 2021, the year of the COVID-19 pandemic, various adjustments had to be made for restaurants and small food businesses to stay running and thriving in the market. Some adjustments included the creation of their loyalty program, delivery promotions, and Chipotlanes (Nation’s Restaurant News). These special additions led to growing production costs, along with a rise in overall employee wages. Due to such changes, Chipotle’s prices experienced their first notable jump in June 2021 as their menu observed an approximated 4% increase nationwide (USA Today).

As shown in the graph above, overall prices increased as the supply curve decreased, due to the nationwide quarantine and newly formed health regulations/adjustments for COVID-19, while the demand curve increased, as consumers began placing mobile orders and engaging with Chipotle’s promotions and loyalty program. The shift in the supply curve was also greater than that of the demand curve as the issue of obtaining the intermediate goods to bring their menu to life was much larger than consumers’ demands for Chipotle.

Production Cost Curves (2022)

During 2022, particularly during the first quarter, Chipotle experienced another 4% price hike as the company began noticing an increase in marginal benefits for consumption. In other words, consumers were now willing to pay $1+ for menu items for the same quantity. This was also the year when the nationwide quarantine came to an end. However, prices did not go back to pre-pandemic levels as a 41% inflation rate skyrocketed the prices for tortillas, dairy (7% ↑), beef (16% ↑), and avocados (Business Insider).

As shown in the graph above, the marginal cost (MC), average total cost (ATC), and average variable cost (AVC) curves would all increase due to the increases in variable costs. As variable costs increase, so does the total cost (TC = fixed + variable costs). This means the change in total costs (∆TC) would also experience an increase as both the ATC and MC would shift upward and rightward respectively (**ATC(q) = TC(q)/q & MC(q) = ∆TC(q)/q). AVC would also increase with the variable costs and shift upward as AVC(q) = VC(q)/q.

Chipotle's 2nd-quarter results (2023)

On June 30, 2023, Chipotle announced their second quarter results (shown above) in comparison with 2022 as they have reported an overall revenue increase of 13.6% to a combined total of $2.5 billion (numbers in the image above count by 1000s, hence the displayed value being set as $2,514,801, rather than $2,514,801,000). Digital sales have also continued rising as Chipotle reported that they made up 38% of the food and beverage revenue, whist in-restaurant sales increased 15.8%, even with the constant price hikes (Chipotle).

Due to these results, it is evident that another price hike will take place during 2024, as Jack Hartung, Chipotle's chief financial and administrative officer, revealed that due to new wage laws, the company plans on boosting wages to $20/hr starting from April. In order to price-match this wage growth, another significant price increase is bound to take place (Business Insider). In other words, my roommates and I might need to limit our Chipotle trips and explore other options close to the campus.

Works Cited

Dean, Grace. “Chipotle Says California Customers Will Soon Be Paying More for Their Burritos.” Business Insider, https://www.businessinsider.com/chipotle-confirms-california-price-increases-offsets-new-fast-food-wages-2024-2

“Chipotle Menu Prices Are Going up Again, Marking the 4th Increase in 2 Years.” USA TODAY, https://www.usatoday.com/story/money/food/2023/10/12/chipotle-raises-menu-prices-fourth-time-two-years/71153636007/

CHIPOTLE ANNOUNCES SECOND QUARTER 2023 RESULTS - Jul 26, 2023. https://www.chipotle.com/whats-new, https://ir.chipotle.com/2023-07-26-CHIPOTLE-ANNOUNCES-SECOND-QUARTER-2023-RESULTS

“Chipotle Mexican Grill Outlines Key Tactical Wins during COVID-19 Crisis.” Nation’s Restaurant News, 18 Sept. 2020, https://www.nrn.com/fast-casual/chipotle-mexican-grill-outlines-key-tactical-wins-during-covid-19-crisis

Meisenzahl, Mary. “Chipotle Keeps Raising Prices. Customers Don’t Seem to Care.” Business Insider, https://www.businessinsider.com/chipotle-increasing-prices-customers-dont-mind-2022-4

0 notes

Text

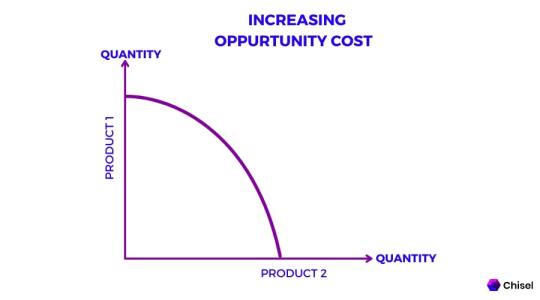

Opportunity Cost During Covid-19

In March of 2020 was when the pandemic had started to really take a toll in Southern California. In my sophomore year of high school, my school suddenly called for a “two-week break”, so the whole school had to adjust to online learning in just a few days. For the rest of the 2020 school year and into the 2021 school year, a lot of my friends were sad about having to do classes on Zoom without being able to see their friends in person, I personally loved doing class in bed a minute after waking up. A lot of the times, turning on our cameras and verbally participating was not required.

The reason why I bring this up about Covid is the idea of opportunity cost. In my junior year of high school was when I took AP English Language and Composition (AP Lang.) and AP US History (APUSH) and 4 other non-AP courses. The question I asked myself every morning was whether I wanted to wake up and actually pay attention to the teacher or if I wanted to log into Zoom and then just sleep through all of class. The opportunity cost of actually paying attention to the teacher was more time to sleep and then not doing so well on the AP tests, and the opportunity cost of sleeping through my classes was actually understanding the lessons and acing the AP tests. This was not the only question I asked every day. Every day, I also decided whether or not I wanted to do my homework or watch Youtube at night, whether I wanted to sleep early or stay up watching Korean drama, or whether I wanted to actually do the homework myself or look for answers online/getting answers from my friends.

Sadly, I chose to do a majority of my classes in bed and not pay attention to what the teacher was saying, leading to my not-so-high AP scores.

All to say, opportunity costs does not apply to student life during the Covid pandemic, but I still make choices and weigh the different opportunity costs in my every day life.

Source: Chisel Labs

Name: Janice Ji

ID: 15806404

0 notes

Text

What's the trade-offs and opportunity cost of Taylor Swift concert tickets?

As young as I can remember I loved Taylor Swift and her hit songs “You belong with me”, “We are never getting back together”, and so many more bop songs. All throughout my elementary, middle, and high school years, Taylor Swift consistently became my number one artist I listened to every year.

But one day in my freshman year at UCI, I was scrolling through TikTok and someone was announcing the fact that Taylor Swift was going to go on tour. The tour was called “The Eras Tour”, Taylor later would be touring over 150 shows across the country.

I did my due diligence and signed up for presale access while also encouraging my friends and family to also do so. At the end, I was the only one able to get presale access.

In the fall of 2022 I was able to secure 6 Taylor Swift tickets for the summer of 2023.

But here came the dilemma that I faced where I had to use the economic concept of opportunity cost to determine if this idea would be better for me in the long run.

The idea was to sell all 6 tickets which would be sufficient to pay my next year’s school tuition but the trade off would be not getting the opportunity to be 19 years old listening to my greatest idol. I was faced with this dilemma for the next 6 months.

Ultimately I chose to sell the tickets to support my education instead of going to a Taylor Swift concert and being in debt. But the opportunity cost was a hard decision because it’s something I’ve always dreamt of and this opportunity would fulfill a check on my bucket list.

Although decisions had to be made, I am still very hopeful that an opportunity like this will come by one day.

To analyze the reason the tickets were able to sell for far more than what I purchased it for was due to the market and scarcity. Through previous economic classes, I understood the concepts of supply and demand of goods. Therefore, there was far more demand for Taylor Swift tickets than the number of supplies that could be sold which created scarcity. Understanding the kind of market structure(monopolistic competition), it allowed me to price at a higher number than other concert tickets because of the demand.

I described this scenario as a monopolistic competition because there are many sellers of the tickets but also many buyers interested, but sellers have more power in controlling the market price. All transactions were also done through a secondary market which would be the resale market, prices are determined by supply and demand.

To conclude, the resale of Taylor Swift tickets was best described as a monopolistic competition with characteristics of limited supply, high demand, trade-offs, and secondary markets. And the dilemma I faced while using my understanding of opportunity cost and trade-offs, really fueled my decision for the better.

Below is a graph that displays the shift in demand that has caused an increase in price. When the demand increased, the market price also increased due to the sellers being able to price at a higher cost.

Name:Vivian Ma

Student ID:90747668

0 notes

Text

Apple's Monopolistic Power

I am a victim to consumerism. More specifically, to Apple’s overpriced ecosystem of products. Throughout the years, I have been a loyal Apple customer and most of my technological products bear the Apple logo. Recently over the summer, while preparing for college, I was looking to buy items such as a laptop and headphones. When looking into good headphones to buy, I was heavily debating between buying the Airpods Max, Beats by Dre, or Sony WH-1000XM4’s. Even though the Airpods Max were higher in price, yet similar in quality compared to the other headphones, I settled on the Airpods Max, mainly due to their name brand, preference to Apple products, and convenience.

A large number of consumers in America have a similar preference towards Apple products, resulting in a high demand for their products. This is mainly due to Apple’s recognizable name brand and their convenience in terms of their apple ecosystem, allowing all their products to be easily accessible between each other. Since the demand is much higher, people are willing to pay much more for their products.

Apple can be defined as an oligopoly, which is defined as a market structure with a small number of firms producing identical products. In terms of headphones, these other firms can be represented by Beats by Dre and Sony. These firms are all trying to replicate a monopoly market, where their quantity is equal to a monopolistic quantity. This results in Apple setting their prices at a monopolistic quantity, which is below competitive market quantity, making their prices even higher and the quantity sold lower. I experienced this when trying to buy my Airpod Maxes, as I was trying to find them in stores rather than purchasing them online. They were all sold out in Costco and BestBuy, which I had credit for, and I could only obtain them through the Apple Store. This can all be seen through the graph below.

Apple continues to be a successful oligopoly as they operate similarly to a monopoly, with the ability to set such high prices for their products to make a large profit, rather than charging at the equilibrium market price to allow for more to be sold. This can be seen with their most recent product, the Apple Vision Pro. Apple can be seen more as a monopolistic competitor in terms of the Apple Vision Pro as there aren’t many competitors in the market for VR devices at the same level of Apple Vision Pro. Its most direct competitor would be the Meta Quest 3, but the price difference between the two is staggering, with the Apple Vision Pro set at $3,500 and the Meta Quest 3 set at $500. The product itself has become a trend, which can be seen on social media such as TikTok, which results in an even higher demand for the new product. Even though its price point is way overpriced, especially compared to the Meta Quest 3 which is similar in quality, Apple’s ability to create such high demand lets them set their price points at these high values at a monopolistic quantity. Apple has maintained its status as one of the most successful companies because of their ability to market their products so well and create such a large preference towards their products, creating high demand and high price values.

Alexander Nguyen - 47888696

0 notes

Text

https://ucirvine-my.sharepoint.com/:p:/g/personal/shayespl_ad_uci_edu/EQCiGm_qnZtAn269YkgZAckBLfkp4UZcH2RZ-NE7lHXwEg?e=zuclc2

Sasha Hayes-Pleasant 48035037

0 notes

Text

Presentation by Jessie Lin (77996581) and Sophia Poa (24241553), hope you like Petr

0 notes

Text

Econ Live: KPop Concert Ticketing

Logan Chow #50062508 Derrick Tran #74225506

0 notes