Text

Revolutionizing Financial Services: A Look into London's Leading Fintech Solution and Mobile App Development Company for White Label E-Wallets

In recent years, the financial technology (fintech) industry has undergone a massive transformation. From digital banking to mobile payments, fintech has disrupted the traditional financial sector in numerous ways. One of the most significant changes is the emergence of white label e-wallets, which are electronic payment systems that enable users to make transactions from their mobile devices.

If you're looking for a fintech solution company in London that specializes in developing financial mobile apps, you're in luck. The UK is home to some of the best fintech companies in the world, and many of them offer white label e-wallet solutions.

A financial mobile apps development company in UK can help you create a customized e-wallet solution for your business. This solution will enable your customers to make transactions quickly and securely, without the need for physical cash or credit cards. With a white label e-wallet, you can also offer your customers added features such as loyalty programs and discounts.

One of the benefits of using a white label e-wallet is that it can be fully customized to meet your specific business needs. You can choose the design, functionality, and features that best suit your brand and your customers. This can help you differentiate your business from competitors and provide a seamless customer experience.

In addition, a white label e-wallet solution can help you reduce costs and increase revenue. By offering a digital payment system, you can save on the costs associated with handling physical cash and processing credit card payments. You can also generate additional revenue by charging fees for certain services, such as instant transfers or currency conversions.

Overall, a white label e-wallet can be a valuable addition to any business looking to improve its payment options and customer experience. Whether you're a small startup or a large enterprise, partnering with a fintech solution company in London can help you create a customized e-wallet solution that meets your unique needs. So why not explore this option and see how it can benefit your business?

0 notes

Text

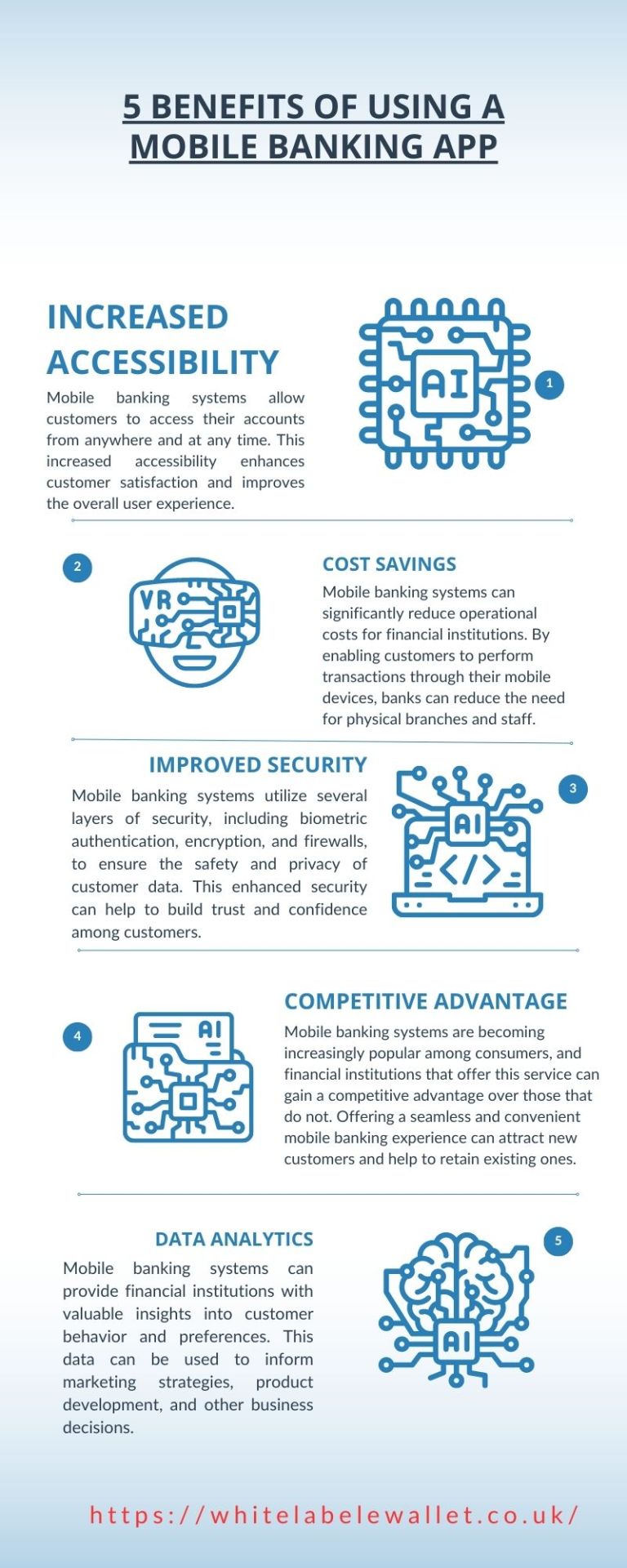

5 benefits of using a mobile banking app

Best Online Mobile Banking Software Development Company in UK, London (United Kingdom). Top Virtual Digital Banking System Software Solution at affordable price

Increased Accessibility: Mobile banking systems allow customers to access their accounts from anywhere and at any time. This increased accessibility enhances customer satisfaction and improves the overall user experience.

Cost Savings: Mobile banking systems can significantly reduce operational costs for financial institutions. By enabling customers to perform transactions through their mobile devices, banks can reduce the need for physical branches and staff.

Improved Security: Mobile banking systems utilize several layers of security, including biometric authentication, encryption, and firewalls, to ensure the safety and privacy of customer data. This enhanced security can help to build trust and confidence among customers.

Competitive Advantage: Mobile banking systems are becoming increasingly popular among consumers, and financial institutions that offer this service can gain a competitive advantage over those that do not. Offering a seamless and convenient mobile banking experience can attract new customers and help to retain existing ones.

Data Analytics: Mobile banking systems can provide financial institutions with valuable insights into customer behavior and preferences. This data can be used to inform marketing strategies, product development, and other business decisions.

0 notes

Text

Top Prepaid Card Provider Company in the UK

If you're looking for a reliable Prepaid Card Provider Company in UK, look no further than WhitelabelleWallet. Our prepaid card solutions are ideal for businesses of all sizes who want to offer their customers a secure and convenient way to make payments.

As a leading provider of prepaid card solutions, we offer a wide range of features that can be customised to suit the needs of your business. Our cards can be used anywhere in the world where Mastercard or Visa is accepted, making them a great option for international transactions.

One of the key benefits of our prepaid cards is the ability to control and monitor spending. As a business owner, you can set limits on how much can be spent on the card, as well as where it can be used. This gives you peace of mind that your employees or customers are using the card responsibly.

Our prepaid cards also come with a range of security features, including chip and pin technology, fraud monitoring, and 3D secure authentication. This ensures that your transactions are safe and secure, and that you can quickly detect any fraudulent activity.

At Whitelabelled Wallet, we also offer a range of value-added services, such as mobile banking, real-time notifications, and cardholder support. This helps to create a seamless and convenient experience for your customers, and helps to build loyalty and trust.

With our flexible pricing plans and customisable features, our Prepaid Card Solution Provider Company in UK are the perfect choice for businesses who want to offer a reliable and convenient payment option for their customers. Contact us today to learn more about how we can help you grow your business with our prepaid card solutions.

offering businesses a customizable and convenient solution for their payment needs

Customization: WhiteLabelEwallet understands that different businesses have different needs when it comes to payment solutions. That's why they offer a fully customizable prepaid card solution that can be tailored to meet the unique requirements of each business. Businesses can choose from a range of features and services that best suit their needs, including transaction limits, spending restrictions, and real-time notifications.

Convenience: With the rise of e-commerce and online shopping, consumers are demanding convenient and secure payment solutions. WhiteLabelEwallet's prepaid cards offer just that. Customers can easily make purchases online or in-store with their prepaid cards, without having to worry about carrying cash or remembering PINs. Additionally, businesses can offer their customers the ability to top-up their prepaid cards online, making it a hassle-free payment option.

Security: WhiteLabelEwallet takes security seriously. Their prepaid cards are equipped with chip and pin technology, fraud monitoring, and 3D secure authentication, ensuring that all transactions are safe and secure. In addition, businesses have access to real-time transaction monitoring, which allows them to quickly detect any fraudulent activity and take action.

Cost-effectiveness: Traditional payment solutions can be costly, with high transaction fees and monthly charges. WhiteLabelEwallet's prepaid card solution is an affordable alternative, with flexible pricing plans and no hidden fees. This allows businesses to save money on payment processing and offer their customers a cost-effective payment solution.

Support: WhiteLabelEwallet provides businesses with dedicated support, helping them to set up and manage their prepaid card program. Businesses have access to a range of support services, including cardholder support, technical support, and marketing support.

#Prepaid Card Solution Provider Company in UK#Prepaid Card Solution Provider Company in London#Prepaid Card Provider Company in UK#Prepaid Card Provider Company in London#Prepaid Card Solution Company in UK#Prepaid Card Solution Company in London

0 notes

Text

Online Banking System Software–Some Best Features to Look For

Digital inventions have converted colorful diligence in the history. One similar assiduity that passed a huge metamorphosis is the banking sector. To meet the changing demands of the guests, banks had to acclimatize to metamorphoses fleetly. The banking sector made it a precedence to give client-first digital service and it paved the way for digital core banking enterprise. If you're planning to up your game moment with the stylish digital software system it's time for you to borrow one with the stylish features.

Then are 4 features that you must look for in a banking services system.

A Online Banking System Software Company in UK will offer a myriad of features and operations. This list is to help you pick out the stylish grounded on its features

Advanced security integration

The banking result should allow advanced security integration. As banking conditioning tend to come more and more online, plutocrat mismanagement and fraudulent deals are largely likely to do at any time. One of the crucial features that you must concentrate on in a core banking system is high- precedence safety features across all verticals of the banking sector. Options like binary authentication processes and digital identity operation make sure tight security is on spot from both the bank and client sides. The banking software should misbehave with the rearmost banking rules and regulations of RBI, NPCI, UIDAI, and IDRBT and support banking at different situations.

Digital operation of cash

Day- to- day conditioning similar as deposits, recessions, and transfers can be reused digitally without any in- person contact. This makes the regular homemade conditioning largely safe and effective. As banking conditioning tend to come more and more online, plutocrat mismanagement and fraudulent deals are commodity that may do sometimes. With nonstop upgradation of the tackle, the software should extend its support for changes in the future.

client onboarding

In the traditional banking system, onboarding is one of the largely complicated tasks considering the factors similar as compliance with regulations, making utmost of the gift etc. with the videotape – KYC & Centralized KYC operation, you can make client onboarding less clumsy and flawless. The software helps in easy verification of the guests right from the processing of operations. The client onboarding features helps you escape the hassle of endless paperwork and verifications . The entire process of taking a new client becomes possible with only a many clicks.

Other features

The Online Banking System must also support other processes conducted throughout the day.

Loan operation

Client relationship operation (CRM)

Integration with new fiscal products

Record conservation

Stylish safety practices like firewall and DCDR against common software attacks.

These modules make the diurnal banking operations much more effective. It also helps the bank boost client engagement and generates better profit. This is because client engagement and excellent banking experience are the two most important pillars that make any banking experience outstanding.

Nethermost line

The online banking sector is about to transfigure the world of banking. Maximum proficiency and outstanding effectiveness are what banks desire and to attain that, hire the stylish online banking software provider who offer an intertwined result to every problem.

#Online Banking System Software Company in UK#Mobile Banking System Software Company in UK#White Label Payment Gateway Solution Company in London#Fintech Solution Provider Company in UK

0 notes

Text

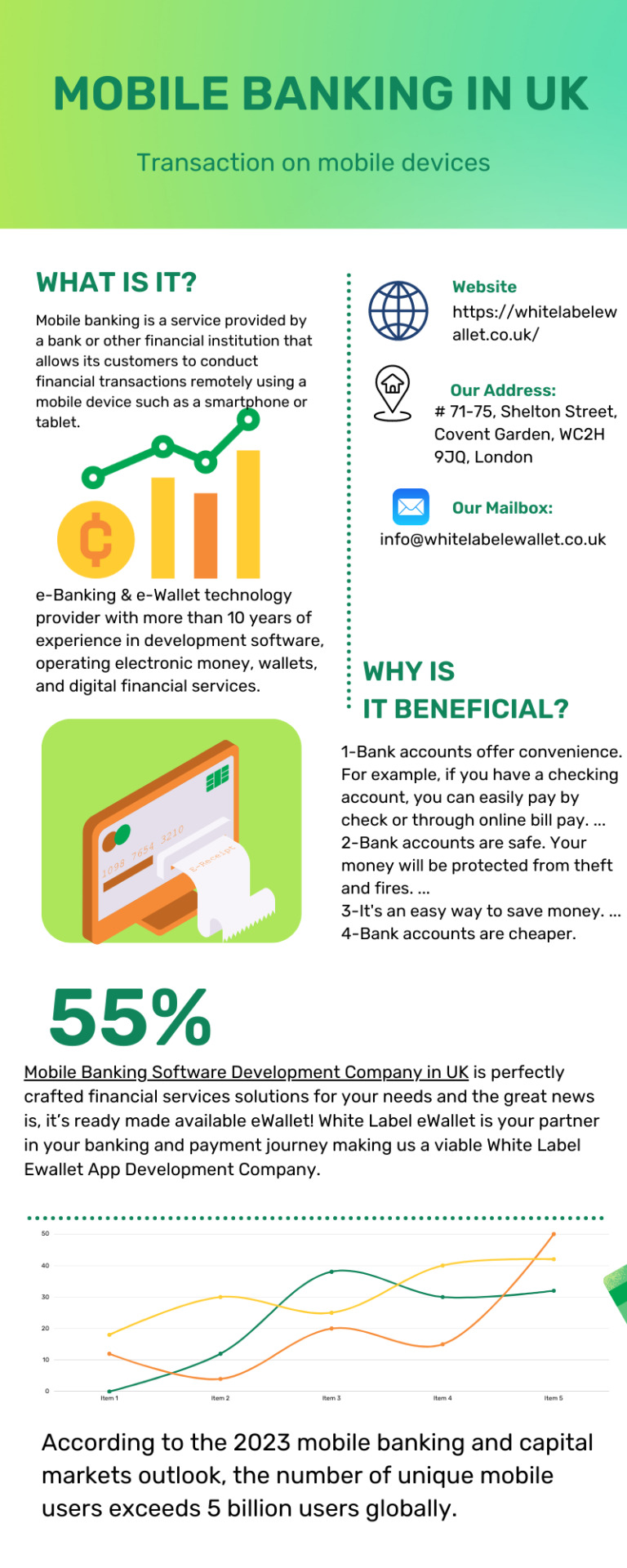

Mobile Banking Software Development Company in UK

Best Online Mobile Banking Software Development Company in UK, London (United Kingdom). Top Virtual Digital Banking System Software Solution at affordable price.

#Ewallet Payment System Solution in London#Ewallet App Development Company#ewallet app development company in uk#ewallet software development company#white label ewallet app development company#ewallet app development company#white label ewallet app development company in uk

0 notes

Text

Ewallet Payment System Solution in London

Best ewallet payment system development company in UK, London (United Kingdom). Wallet solution and services provider for digital and mobile online payments

#Ewallet Payment System Solution in London#Ewallet App Development Company in UK#White Label Ewallet App Development Company#Ewallet Software Development Company

0 notes

Text

#Ewallet App Development Company#Ewallet App Development Company in UK#White Label Ewallet App Development Company#White Label Ewallet App Development Company in UK#Ewallet Software Development Company

0 notes

Text

#White Label Ewallet App Development Company#Ewallet App Development Company#Ewallet App Development Company in UK#Ewallet Software Development Company

0 notes

Text

0 notes