We specialise in FREE forex trading education. Our forex trading courses will take you from beginner to advanced using proven forex trading strategies.

Don't wanna be here? Send us removal request.

Text

Master in forex trading - 15 minutes a day

Course Prerequisite

Forex Demo Broker Account (See below if you do not already have one) Passport or Identity Document and Proof of address not older than 90 days (You will need these documents for verification purposes) Your full attention Practice, practice practice!!! Forex Broker Demo Account In order to be able to practice the exercises in this course, you will need to open a demo account. A demo account is a practice account where you are able to trade live using fake money and not your own money. Once you are comfortable with a demo account, you can then deposit real money and apply what you learned while using a demo account. Here are the steps to follow when opening a demo account: Click on this link: Recommended broker. For the United States learners, follow this guide: Recommended US broker For the rest, let us continue. Click on the “Open Account” button at the top of the screen.

Fill in your details First name(s) – As per your Identity document Last Name – As per your Identity Document Country of residence – Should be chosen automatically if you are not using any proxy or VPN Mobile phone – Enter the correct number as this will be verified E-mail - Enter the correct e-mail address as this will also be verified Password – Choose a strong password with Letters, Numbers and Symbols (This will be your broker password on ForexTime.com) Click on “Send Pin” – A PIN will be sent to your cellphone and E-mail address. You may use any of the two PINs for verification. Enter the pin, accept the marketing consent and then click on “Register Now”. On the next page, enter all the necessary details to the best of your ability, Accept the agreements and click “Submit”

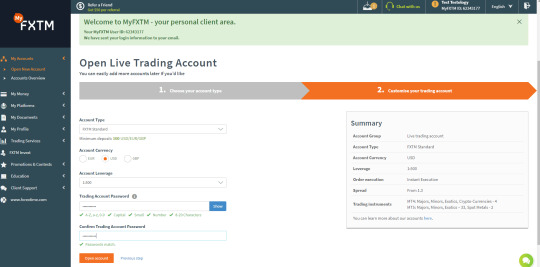

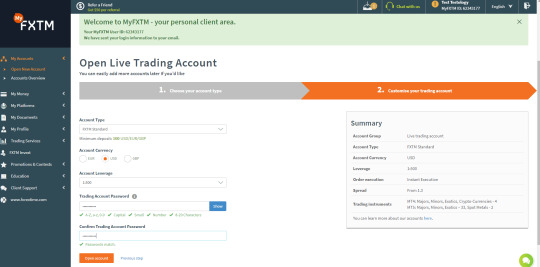

On the next page, select as follows: Account type – FXTM Standard Account currency – Any that you prefer Account leverage – 1:2000 Trading Account Password – Enter a strong password twice (This is different from your ForexTime portal login account that you set earlier. It will be your password to your MetaTrader account, more on this later) Click “Open Account” Next: Click on “Download platform”

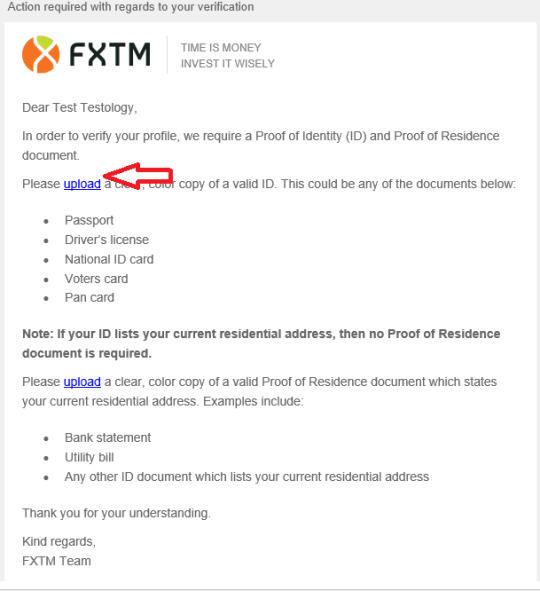

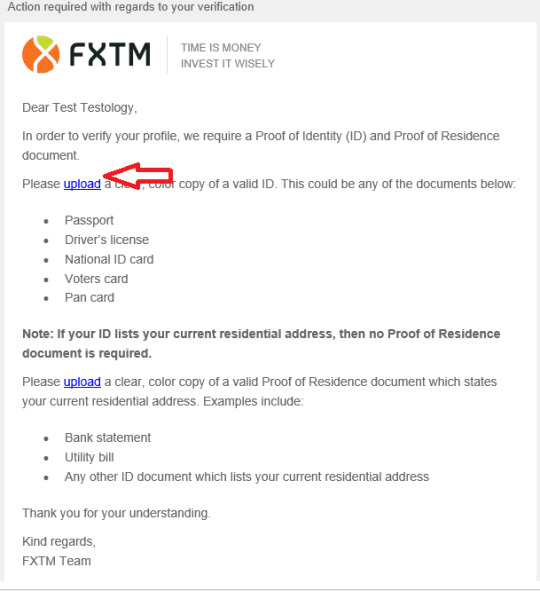

Select the “Metatrader 4 Trading Terminal for PC” or “Metatrader 4 Trading Terminal for MAC” depending on your Operating system. Download and install the application. Go to your Desktop, you will see a ForexTime (FXTM) MT4 icon (Windows). Double click the icon and login. To find your login details, go to the e-mail that says “Congratulations! Your new trading account is now open”. Metatrader login (at the bottom of the e-mail) and use the Trading Account Password that you entered above. Should you need to install one for your phone, hover your mouse over the QR code, scan the QR code with your phone to download the platform. Go to your e-mail account that you used for registration. Open the e-mail that says “action required with regard to your verification” – see below! Click “upload”

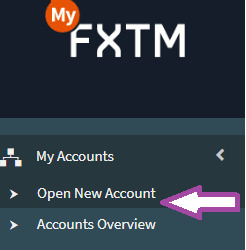

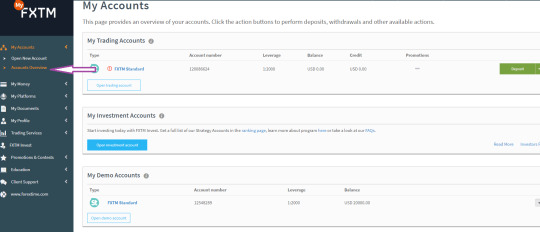

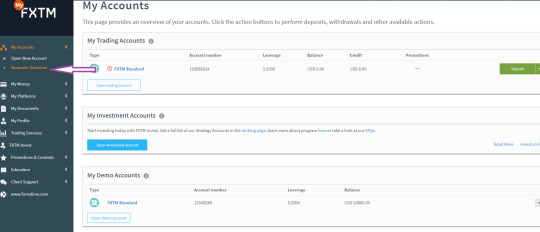

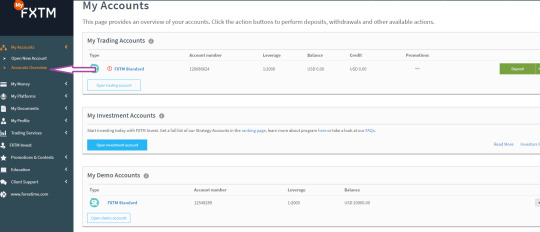

Upload your Identity document as per the e-mail and your proof of address. Open a Demo account Click on “My Accounts” on the left-hand side, then select “Open New Account”

Select Demo Account. Account type – FXTM Standard Choose currency Account Leverage 1:2000 Complete the passwords fields Initial balance – any amount, I suggest 20000 USD Click “Open Account”

Your Metatrader Login details will be displayed Download the Platform just as you did above and login using the details given. You are now ready to continue with the course content.

Introduction

Do you want to trade forex for a living just like I do? If your answer is yes, then this proven and actionable, profitable, forex trading strategy can lead to consistency and confidence. Follow this course and you will become a master in forex trading. With confidence and consistency, your trading can be a lot more profitable because you will trade less and focus on money management. The best part is that you need only 15 minutes a day to go through the currency pairs that move in this Foreign exchange market. You will avoid the mistakes that many beginning and frustrated traders make. I made these mistakes and learned from them to become the profitable trader that I am today. How will this help you? Well, if I knew then what I know now, I would have reached my goal of profitability faster and would have avoided all the trading stress that I experienced. Losing a lot of money is not fun. With this course, you have the opportunity to avoid trading stress, reach your goal of profitability faster and you will not lose a lot of money. You will keep your losses small and maximize your profits. You will trade without the fear of loss. This strategy is proven and will work for those who are patient to wait for the setups and the triggers. You will have an average of two trades a currency pair. The value you will gain from this course will definitely change the way you look at the forex market and you will know that while it is not easy, it can be made simple.

And those who keep it simple will become self-empowered, confident and consistently profitable forex traders. Are you ready to become a self-empowered, confident and profitable forex trader? If yes, then let’s get started. Tip: Profitable traders find one or two strategies that work for them and they repeat it over and over again. In the trading world, repetition is a good thing. This is one of those strategies you can put in your toolbox as a trader and just repeat over and over again. There is no guesswork in this forex trading strategy. If you follow the simple trading rules for setup, entry, and exit. The only thing I ask of you is that you should be patient and wait for the setup and the trigger. Sometimes you will have to wait for days before a setup. If you can do this, you will enjoy the fruits of patience as a trader. For long term profitability, you don’t have to trade every day. The platform that I use is MetaTrader4 (MT4) and you will need MT4 too. The indicators used in this trading strategy are common on all MT4 platforms. Many good brokers offer this platform and all the necessary indicators. Use the MT4 platform that you downloaded above as a demo. Warren Buffet, a master in forex trading, follows the strict rules of his investing strategy. My hope is that you will follow these simple rules to the tee and make it happen for you and your family. You need just 15 minutes a day to go through the currency pairs that make the most money. There are 100+ currency pairs, 7 are the most profitable, but you can add three more to make it 10. *USDCAD*USDJPY*EURUSD*GBPUSD*AUDUSD*EURJPY*GBPJPY If you would like to use a simple, low-risk, strategy of making consistent profits, then keep reading.

Chapter 1

The money When I started trading, I made a lot of money and I lost it all. It was very frustrating, but I never lost my vision of becoming a successful trader. A false sense of confidence let me believe that I could do it without following my restrictive rules. For a while, I made lots of money doing so, however, you guess it right, I lost it all in just a few trades. You see, the market will do what the market wants to do. After a few years, I quickly realized that sticking to the rules is the way that successful traders make it happen. So I stopped and really started testing this plan and this strategy. I tried different plans before, but this one stood out for me. When I stopped focusing on the money and instead focused on the trading process, things changed dramatically. Then I transitioned from a lower time frame to daily and weekly, things improved exponentially. I got my trading capital ($25,000) by winning a competition (FXCM King of the Micro). It was a micro account competition. So the lot sizes were small. I decided to include the results of this competition so you can see that trading small lot sizes in the long term can build up a substantial account. This strategy won the competition, taking a $540 account to $6000+ in a month. See published results here. This result is to impress upon you that the journey you are embarking on is a worthwhile trip and to let you know that there is money to be made starting a forex trading business. Can you do it? Well, I do not know you. However, I know you are teachable and I will walk you through, step by step, to show you how to succeed. I can show you how to succeed, but you will be the one responsible for your success. Agreed? Alright, let’s continue. You have to see yourself succeeding before you even get started. If you can guarantee to follow the system as explained, I can guarantee you will begin to experience success. Keep practicing and practicing and practicing. The execution of this strategy should be flawless. If you can flawlessly execute this strategy every single time, you will see a huge improvement in your trading results. If you are a new trader, you will experience success faster than most traders. The secret t becoming a master in forex trading is to practice, practice, practice......... Focus on the process of trading, and the money will follow. Ignore the trading process and the money will quickly exit your trading account to the account of those who follow their trading process. Can Money Be Made In The Forex Market? *George Soros made €1,000,000,000 (1billion Euros) in 1 day *Larry Williams turned €10,000 into €1,100,000 in 1 year *Alex Gerchik, Day trader hasn’t had a losing year since 1999 *Ed Seykota started with €5,000 and made €14,000,000 in 13 years *My results in a month from €540 to €6000. You have seen the results from all masters in forex trading. And the rest, as they say, is history. What will your history be? Will you be our next success story or will you just read through this, throw it away and then head off to the next Holy Grail? There is no holy grail, but I promise you, if you can work through this and implement the simple trading rules, you will become a confident, self-empowered and successful forex trader. Trading is hard and difficult because no one can predict the direction of the markets you can only focus on your trading plan. You have to be aware of this truth before embarking on your trading journey. Therefore, I encourage you to believe in yourself and give yourself a chance to learn the right way. We are going on this journey together. If you are a beginner, you will be starting right. If you an intermediate trader frustrated with your results, your trading can be a lot profitable than what it is now. This trading approach will enable you to grow your account exponentially from year to year, enrich your life from the profits generated, providing you with more free time and you can trade stress-free and grow your trading business. This style of trading requires patience. Patience is the key to execute your trading plan flawlessly. And successful traders are traders who have a plan and execute that plan flawlessly. How will you make money as a master in forex trading? From statistics of this trading methodology, just from one currency pair-GBPUSD, for a year we generated an average of 20 trades and made 3680 Pips from the trades. Trading a standard lot size, that is $36,800/year, a mini lot size will be $3680 and a micro lot size will yield $368, from one currency pair. This is on average. Pip value in dollar differs slightly per currency pair. But don’t worry about it. Just use the average of a pip being $1 for the mini lot, 10 cents for micro-lot and $10 for standard lot size. Now that you know there is money in the trading business, let me explain the mistakes that most traders make and how to avoid them. These mistakes are made by traders repeatedly. I made them over and over again. However, I learned from my mistakes when I started evaluating my losing trades. Remember losing is counted as a cost in our trading industry. If you count the losses as cost, it is easier to emotionally detach from losses. Let me address some of the struggles and mistakes that traders make and how you can avoid them from now onward.

Chapter 2

Trading Mistakes I did a survey of traders from across the globe and this is the results that came in.

From these statistics, you can see that the top problems are taking profits too early, over trading, changing strategy too often and allowing losses to run. I made these mistakes and learned from them. This trading strategy is designed to solve these mistakes and struggles. As you pursue this strategy, I want you to keep these mistakes on site. Print these statistics and display them where you can see them while trading. Make a decision not to repeat these mistakes. The only way to avoid these mistakes is to follow your trading plan, the entry setup, trade management process, and the exit setup. How to overcome these mistakes Taking profits too early The remedy for taking profits too early is to stick to the exit rules of this trading strategy. If you don’t get an exit signal, just allow the trade to play out. The exit plan includes initial stop loss, profit target and how to get out if the trade did not reach the profit target and turned in the opposite direction. You will see this in the exit rules under the Proven Forex trading money-making strategy. Changing trading strategy too often Trade this strategy for at least twelve months and you will overcome the problem of changing trading strategy too often. Most successful traders find one or two strategies that work and they repeat it over again and again. It is a decision. Don’t worry about the drawdown periods. Just focus on executing this strategy. Forget the forums, unsubscribes from newsletters and stop watching more youtube videos on new strategies. You can watch on matters like psychology, but again the psychology is within you. If you keep a cool head and focus on this strategy, you will soon discover for yourself that it works. Overtrading In this trading strategy, you only check your charts once a day. It takes about 15 minutes a day to look for setups, triggers and manage your trade. You will not be sitting in front of your computer following every move in the market. You will avoid over trading following this trading strategy. I over traded when I was trading of shorter time frames like 4 minutes and 1 minute. Now I am laser-focused and only trade when there are setup and a trigger. Allowing losses to run With this trading strategy, your initial stop loss takes care of the losses. You will not lose more than your 2% maximum risk per trade. Your edge is placing 20 trades following the strategy as outlined. If you can do so, and never move your stop loss, but follow the plan, then you will not allow losses to run. Profitable traders have learned this lesson. There is no way you can allow the losses to run if you follow this trading strategy and execute it flawlessly. That is your edge. Not following my trading plan You need to develop the self-discipline to follow your trading plan. Do not compromise the answers to the questions regarding the setup and the trigger. It is a decision and your intention should be to follow the plan. Be intentional with your trading. Decide that you are going to stick to the rules and visualize yourself sticking to your rules every day before your trading hour. My time is 23:00 pm every day. So I take some time about 22:00 visualizing how I am going to stick to my rules by focusing on answering the questions. Any discrepancy in the answers, I ignore the trade. Nobody, no system can remedy this mistake, only you. Ask yourself this question every time you want to go away from your plan. “Is this part of my plan?” If the answer is no, then don’t do it. Remember to treat this as a business. Focusing on too many currency pairs You should be looking at seven currency pairs with this strategy. You can look at 10 within 15 minutes because it is long term, you do not really have a problem of trading many pairs. It’s OK, however, if you are trading of the lower time frame, like 5 minutes, then you will be very confused even to monitor 4 currency pairs. I know a very successful forex trader who trades only the GBPUSD. He does not trade anything else. He is laser-focused on this pair and does well. You can also decide on limiting your trade to just one currency pair and become an expert in that pair. This problem arises when you are trading shorter terms. When I trade short term I only focus on one or two currency pairs. It is also a decision that I made. Therefore make a decision to stick with the daily time frame to overcome this problem. Listening to the opinions of others When you start trading and you focus on your plan, there will be no need to listen to the opinion of others. You will be deliberate with every trading business decision that you make. I overcame this problem, by unsubscribing from newsletters that I no longer needed, stopped going to forums and stopped listening to the talking heads on Bloomberg or CNBC. If you can focus on the trading plan, there will be no need to check with other people. The reason you check with other people is to give you a sense of confidence, you only need to focus on your trading plan. If you don’t have one, it is easy to tune in to listen to others. But this strategy has a clear plan of action for you. Just trade the plan. Chasing trades Chasing trades is also very common with day traders. The only way to continue struggling with chasing trades is to ignore your trading plan. If you stick to the trading plan of this strategy, you will never find yourself chasing trades. Trading becomes fun, because you know if you miss a trade, there will always be another trade. You chase trades when you sit in front of your computer all day and follow all the normal ups and downs move in the market. No need for this, if you trade just 15 minutes a day. The bottom line is this when you are using a proven trading strategy like PFTMMS, you will avoid almost all the mistakes and struggles that traders face. Stick to the rules and implement the strategy flawlessly for at least 12 months. Most of these mistakes are made because traders trade on a short term basis. If you are a beginner in forex trading, then trading off the daily charts just 15 minutes a day will help you overcome emotional trading and put you in the path of profitability. You will avoid the adrenaline rush that forces traders to make these mistakes, watching the charts all day long. If you hear that 90% of traders lose money in the markets, these mistakes are the reasons why. So you are already ahead of most traders and knowing this information and how to remedy the mistakes. So let’s get started with the trading business.

Chapter 3

Your Trading Business “A failure to plan is a plan to fail” - That is the mantra of a master in forex trading. Trading is a business and you must treat it as such from the very beginning. It will serve you well. Have you ever seen anyone with a successful business without a clear plan to reach their business goal? Many traders start out on the wrong path by treating trading as a hobby or just gambling, and playing around, wishing something happens. Do not make this rookie mistake on the road to becoming a master in forex trading. Trading is a business and if you treat it as a business, then following your plan will make sense to you. But if you treat it as a casino, then you will not follow the simple plan laid down on this course. The trading business has real running costs and requires a business plan and business structure to be able to accomplish the business goals. Revenue In A Forex Trading Business Profit from trading will only happen if your revenue is more than your costs. That is how business works. Our winners yield profits and our losses yield costs. As you start thinking in these terms, you will not attach your emotions to your losses, but you will treat your losses as business costs. Profitable businesses minimize costs and maximize profits. This knowledge alone will allow you to follow your trading plan and structure every time you approach trading without the fear of loss. If you allow your losses to be more than your revenue, you will go out of business. In trading, like in any other business, keeping the costs low is your goal. Experienced and profitable traders keep their losses small and allow their profits to run. You have to become a master of small losses. Profitable traders manage their losses and only focus on the trading process because they understand their system and are not afraid of losses anymore. Losses Will Teach You A lot About Your Business As a trader, your losses, as mentioned earlier, are the most costs you will incur in your business. The best thing is that you can effectively manage the losses. Losing is not fun and you will find it very unpleasant, however, this course is designed to help you cut the losses short and let the profits run. Reporting losses is not always easy for any business. While it is not pleasant to lose money, in the forex trading business, successful traders have learned to evaluate their losses, to gain great insights into their trading. You should do the same too. You will learn more from the losses than from the winning trades. I read this Oliver Valez quotes some time ago and have never forgotten it: “Our wins, although enjoyable, teach us nothing. It is our losses that lead the way to trading mastery.” Do you know why? Well, it is because your losses will tell you if you are sticking to your rules or not. You can make your losses work for you, by evaluating every loss. You will learn a lot about your business by doing this exercise either every time you experience a loss. Here is how you do it. When you experience a loss, evaluate the trading process, before you place the next trade. The reason why the trade fails will tell you a lot. Here are the two main reasons why a trade will fail You followed the rules to the tee, however, the market does its own thing and fail to go in your direction You completely fail to follow the rules in the trading strategy This evaluation must be done every time you lose a trade. If you followed the rules and the market does its own thing and fail to go in your direction, though you lost the trade, you indeed won the trade. You can keep your head up high, give a tick on your book and get back in the market and place your next trade. On the other hand, if your loss was based on point number two, meaning you failed to follow the rules then you may be in big trouble. Go back to chapter two and read how to overcome the struggle of “not following your trading plan” Follow the recommendation from chapter 2 and make a commitment to learn from your mistake and make a decision never to make that mistake again. Remember the quote by Oliver Valez, “Our wins, although enjoyable, teach us nothing. It is our losses that lead the way to trading mastery.” Don’t beat yourself up for making this mistake. I used to beat myself up for stupid mistakes that lead to losses but did not worry about it when it generated profits. But this was very wrong because it gave me a false sense of confidence. If you win a trade without following the rules, you may be domed in the long run if you continue ignoring your trading rules. Don’t do it, just commit to not making the mistake again. Strong self-confidence to execute your trade flawlessly is the key to trading success. Besides your losing trades, there is spread from your broker. Every trade you take costs you something small. The more you trade, the more costs you will incur. Your broker wants you to trade more, but they will not force you to trade more. Some brokers have commissions as well. Include all these to forecast your revenue in your trading business accounting. You will see that an average of 20 trades per currency pair a year will give you 140 trades a year from 7 currency pairs. However, if you analyze my results above, you will see that I took 167 trades for a month. So, day traders incur more costs than swing traders who trade from a daily chart at the end of the day. Swing trading will keep your spread and commission costs low. As an entrepreneur, you want to minimize costs and maximize profit. This course is designed to help you keep the costs low and maximize revenue from your trading activities. That is how a master in forex trading would do it! Trading Environment or Home Office It is very satisfying to trade in a clean environment. Some traders enjoy trading from multiple screens and some trade using a single computer or laptop. I do trade from a single screen. That is the only cost you really need in setting up your trading environment. Keep your trading office clean and clear. You can work on your laptop, but I still own a desktop computer. I find it more comfortable than a laptop. Choose whatever you prefer. Just be comfortable when you trade. Trading Plan of a master in forex trading Have you ever met a successful entrepreneur without a clear business plan? No, you will not meet any. Trading is also the same and you will never meet a successful trader without a trading plan. So if you are going to succeed, here is a simple plan you can adopt for yourself. Set goals for your trading business. Your goals must be specific, measurable, attainable, realistic and timely. For example, 200 pips a month on one currency pair is a good target. This is a target that is attainable. What you should do next is create a trading plan if you don’t have one yet. A simple, yet concise, a trading plan is necessary for running a successful trading business. Work on your trading plan by adopting the example below. What should you include in your trading plan? This is a trading plan example for you to adopt

Set Your Trading Goal

Use SMART goal tool to guide your trading goal setting. Remember, high performance in any field is accomplished by people who set clear goals. SMART is an acronym that stands for: Specific - Your goal must be specific. For example, instead of stating, I want to make more money from my trade, which is very vague, you can state, I want to make 4000 PIPS a Year. Measurable – New traders make this mistake all the time, they want to make a lot of money in the market. But you cannot measure a lot of money or a fortune. Your goal must be measurable. If your goal is measurable, then you will know when you’ve reached it and be able to monitor your goal to know when you are close to reaching it. Achievable – Your goal must be achievable. Let it be within your reach based on your skills and abilities. Let’s say your goal is 20 PIPs a day. You have a higher probability of reaching this goal than making say a million dollars in your first year. Realistic – Is your goal feasible? It should be challenging but within your capabilities. There are many traders who make millions of dollars a year. However, this will not be a realistic goal for a new player in this market. So set a goal that is realistic. Yes, like 400 PIPS a month. Timely – Time is an important factor. You see realistically, you can say 400PIPS a month. Now you are giving your goal a time period within which to reach it. Without a time limit, you may not achieve your goal. So let’s focus on the goal of 400 PIPS a month as we continue with this specific, measurable, achievable, realistic and timely goal. The goal of my trading account is to make 400 Pips a month and to maintain it. I will not withdraw any money until I make 4000 PIPS. (This is a simple goal) and that is what I want you to do. Keep it simple.

Market – What will you be trading?

I will be trading the spot forex market. AUD/USD,EUR/USD,EUR/JPY,GBP/USD,GBPJPY,USD/CAD and USD/JPY. These are the most traded pairs. Limiting to a few pairs will keep me focused. I will trade only at the New York Close (09:00 pm GMT which is 23:00 Central European Time). I will hold my position until there is an exit signal, which could be my stop loss, my target, or the appearance of an opposite signal. Business Work Week I work Monday to Friday and take all the time off during the day and check my charts at New York Close. Trading Style/Time frame I will be swing trading and focus on trading two charts: the daily chart and the weekly chart. I use the weekly chart to see the bigger picture and the daily chart to identify entry levels for my positions. Analysis At the close of the New York session each day, I will take a look at the economic calendar of the forex market for the day ahead at dailyfx.com. I will pay particular attention to fundamental data that could affect the trades that are open and currency pairs with potential trading opportunities. I will check the OsMA, 8-day WMA, 10-day WMA and Fractal indicators on my chart. These four parts of the trading plan are detailed in the trading strategy as will be explained in Chapter 6. Your plan should include the specific chart setup, the general trading rules, the specific entry rules, and the specific trade and money management rules. As you work on your business trading plan, ponder on questions like: What rate of return do I want per year? Do I want to trade long term or short term? Can I handle the intellectual and psychological demands for this profession? Do I want to trade for a living or just make some money on the side? Which full-time trader can I emulate and why? Do I really need a mentor in this trading business? Most successful traders have figure out the answers to all these questions, they are very relaxed and their plan is their business. Following the plan is their job. To become a successful trader, you need to complete your plan and develop the self-discipline to follow it. That is all there is to successful trading. As you trade every day, write down your thoughts and keep a journal. Keep a Trading Journal Keeping a trading journal is an important part of your trading business. Journaling your trades will help you develop good habits. Help you spot mistakes, and help you improve upon and repeat the behavior that leads to profitable trades and avoid behavior that leads to losses. Remember the Oliver Valez quote you read earlier: “Our wins, although enjoyable, teach us nothing. It is our losses that lead the way to trading mastery.” The only way you can look back and analyze your losses is by keeping a journal. This trading strategy makes it easy to keep a journal because you have very few trades and the trades last a few days. What should you include in your trade journal? You should include completed trades from entry to exit, stating the reasons for entry and the reasons for exit. Again, this will reveal important information regarding your trading business. It will show you if you are conducting your business with diligence. This is the difference between winning traders and losing traders. Which one would you like to become? Let’s look at the timing of your trades.

Chapter 4

Market Timing (End of day) Analyzing my results, you will notice that I traded a shorter time frame. However, I will be the first to admit that market timing in a shorter time frame is a skill that most experienced traders have learned over time. It is a very difficult skill and it messed up my trading results when I got started. Therefore, if you are still a struggling trader or a beginner, this strategy should be executed in a daily time frame. Working in a longer time frame like daily allows you to trade without all the noise that is generated in a shorter time frame. So to become a successful trader, I highly recommend you trade this strategy on a daily chart. I do trade on a daily basis from the 30-minute chart. However, the bulk of my income comes from trading the daily charts which is the strategy in this course. With this strategy, you can allow your money to work for you, while you do the things that you love. This is how the wealthy make money, without trading hours for dollars. You are well off to becoming a master in forex trading. When you trade from a shorter time frame, like five minutes, you are still exchanging time for money, but that may be the structure that suits you if you have the time. On the other hand, when you trade in the daily or weekly time frame, then you can allow your money to work for you while you go about your life and pursue other interests. You will avoid stress, overtrading, emotional trading and all the common mistakes that most beginning and frustrated traders make. You need just 15 minutes a day to look through the charts of all seven currency pairs. You start looking at the charts 15 minutes before the close of the day and you will be able to pinpoint the charts of interest at the close of the day.

You will look at your charts just once a day, at 23:00 Central European Time which is 17:00 Eastern Standard Time. You can convert this time to your time zone to trade this strategy. Look at a broker whose new day candle begins at 17:00 Eastern Standard Time. For European, African and Asian traders, you can open an account with this broker. Forex trading can be simple, but too many times we complicate it. Don’t be a victim of this complication. Watch your chart once a day, if you find a setup based on the trading rules then you enter the trade. If there is no setup, walk away and wait till the next day. So, trading this strategy will keep your trading simple, timing will be effective, emotions will be in check and you can focus on executing, trade management, making PIPs and keeping PIPS. If you don’t want to learn the strategy yourself and just want someone else to send you the signals between 23:00 and 00:00 CET, then visit here and subscribe, otherwise continue with your education.

Chapter 5

Charting Tools Charts tell us what we need to know. Charts do not lie. The chartings tools that are used in this system will help us get in and out of our trades. All of our entry and exit points are based on technical analyses. There is no speculation on your part on what to do. The rules are clear, there is either a setup, a trigger or there is none. You will enter the trade only if a combination of factors line up in your favor. Markets move when there is an imbalance between sellers and buyers. The combination of indicators and the price action helps us to pinpoint imbalance. For example, if the price has been going up, meaning there are more buyers than sellers, we will be looking for a scenario where sellers begin to return to the market. As traders, our job is to find the right time when an imbalance is happening and a change in power between the sellers and the buyers have occurred and momentum is building. The indicator combination and price action will lead to precision, giving us the edge that we need to succeed. Candles at the end of the day show the visual representation of what happens during the day. If price closed above the open, then the bulls (buyers) are in control for that day. The blue candles are bullish.

On the other hand, if the price closed below the opening price, it indicates that the bears (sellers) dominated the day. The white candles are bearish days.

Your job as a trader is to find the dominant group at the right time and trade with that group. I use the MT4 trading platform and it has many in-built indicators including the three that are used in this strategy. There is no perfect indicator however we have discovered that the combination of these three indicators works best for this trading strategy. Together with price action, they will keep you out of ranging markets and let you get in when a trend is developing. The Linear Weighted Moving Average, Bill Williams’s Fractal and the OsMA are the three indicators that we use in this system. Let’s begin by selecting the Linear Weighted Moving Average

Charting tool Linear Weighted Moving Average (LWMA) Moving Averages (MA) are mathematical items that add up prices during a selected time period and average them out. This eliminates the noise that occurs as the candles print. And we can see the overall direction of the markets from the moving average slope. There are different moving averages - simple, exponential and weighted. You can use any, but I prefer you to use weight for this system. Let’s add the Linear Weighted Moving Average to a chart. Follow this on your own MT4 platform. 10 LWMA apply to open and a shift of 1 See the chart after adding this indicator from your MT4 platform

Linear Weighted Average 8 applied to Close. See the chart after adding the second moving average also linear weighted. This time it is applied to close and no shift.

Those are two moving averages used in this very reliable trading strategy for consistent profit. Charting tool Bill Williams’s Fractal. There is a down fractal and an up fractal. We use the fractal in our system as points of stop loss. Candlestick combinations for the emergence of Williams’ fractals: *up fractal: set of 5 (at least) consecutive candles, where the average has the highest max; *down fractal: set of 5 (at least) consecutive candles, the average of which has the lowest min. See the chart as we add the fractal

Charting tool OsMA The OsMA which is Oscillator-Moving Average is a technical indicator that we use to pinpoint trend reversals and momentum. Other traders may use it to signal overbought or oversold, conditions in the markets. We have developed our own effective use of OsMA which is different from what the masses use. When the OsMA indicator - histogram is positive, we look to buy if the trade setup occurs. If the OsMA indicator-histogram is negative, we look to see if the trade setup occurs. See the indicator on the chart.

Our chart is complete. It is pretty simple. We have two moving averages. Linear Weighted Moving Average 8 applied to close, the moving average Linear Weighted Moving Average 10 applied to open and shift 1, the fractal and the OsMA. Remember with this strategy you need just 15 minutes a day, you can and will catch large market moves by entering the markets with precision, just when a trend is about to begin. Let’s get started with a detail explanation of the Proven Forex Trading Money Making Strategy (PFTMMS). Are you excited? After explaining the system, we will go through the daily charts of GBPUSD for two years to reveal setups based on the system, so you can follow on your historical charts too. This backtesting together is very important. You will see what is possible by sticking to the rules of this trading system.

Chapter 6

Proven Forex Trading Money Making Strategy (PFTMMS) A complete trading strategy is made up of the Entry Strategy, Trade Management Strategy/Money Management, and the Exit Strategy. We are going, to begin with, a step-by-step technique for trade entry. The most important step of any trade is the entry. If you get the entry right, your trade is 80% done. The remaining 20% consists of trade management and the trade exit. Let’s get into the entry rules. These rules are important because they determine your success as a trader if you follow them. Every single trade you place exposes your hard-earned cash to losses. What does that mean to you as a trader? It means you are in the driver’s seat and have to watch your capital like a hawk. Our approach is systematic and streamlined and control is completely in your hands. Be sure to trade wisely, invest your money in the right way to minimize risk and maximize profits. Every entry will include an entry price, an initial stop loss, and a profit target. The entry will either be a Buy or a Sell. Let’s delve into the important step of entering the trades in forex using a technique that has served me very well as a forex trader. A Step-by-Step Guide to Entering Trades Like the Master Trader All entry should be done at the open of a new daily candle at 23:00 CET which is 17:00 EST. You can flip through all the seven charts within 15 minutes. At 23:00 CET switch your machine on and start looking at your charts. You will either be closing open trades, managing open trades or placing new trades. Entry Rules to Buy At the end of the day at 23:00 CET and a new candle opens, answer the following questions. If you answer yes to all the questions, then you can enter the trade. *Is the low of the candle above the 10 Weighted Moving Average? *Is 8 Weighted Moving Average above the 10 Weighted Moving Average? *Is the OsMA positive? If the answers to all three questions are yes, then you have a setup candle to buy, but not the trigger to enter the trade. *Is the close of the setup candle equal to or less than 60 PIPS from the 8WMA? If the answer is yes, then the setup candle also qualifies as a trigger. You can enter your trade. If the close of the setup candle is further than 60 PIPS from the moving average, then place a pending buy order of 60 PIPS from the 8 WMA. Where do you place your initial stop loss? (Low of last down fractal) When you enter your trade, place the initial stop loss at the low of the last fractal. And place your target at 1.5 times the initial stop loss. (This is one way to exit the trade, see details on the exit strategy) Manage your open trades accordingly and shut down your computer and walk away till the next day at 23:00 CET. Let’s look at a chart example, so you can understand the rules. It takes a minute or two to see this on a chart. That’s why you can flip through 7 to 10 charts within 15 minutes. BUY Entry Chart Example.

You can see how clear this example is. Check the rules against this trade. At point A, the low is above the 10 WMA check, the 8 WMA is above the 10WMA check and OsMA is positive. There was no trade from the beginning of the month of April 2015. Setup occurred at point A, after 12 days of trading without setup on this pair. The setup candle did not qualify per our trading rules for entry. So we placed a pending buy order at 1.4860 and this was triggered 3 days after the setup candle. At point D, 6 days later, the profit target was triggered. This is the simplest form of trading. From setup to profit target was 9 days. You waited patiently and you got rewarded with a hefty profit of 444 pips. Can you repeat this over and over again? I am sure you can. I trust that you will follow these simple rules and make it work for you. What do you do every day at 23:00 pm after placing your trade, you simply check for new setups and manage your open positions if you have trades open. When price moves half of your initial stop loss in your favor, move your initial stop loss to breakeven. That is all the work you have to do when you place your trade. Entry Rules to Sell At the end of the trading day at 23:00, answer the following questions. If you answer yes, to all the questions, then place your sell trade. *Is the high of the candle below the 10-LWMA? *Is 8 WMA below the 10-LWMA? *Is the OsMA negative? Is the answers to all three questions yes then you have a setup candle to sell, but not the trigger to enter the trade. *Is the close of the setup candle equals or less than 60 PIPS from the 8-LWMA? If the answer is yes, then the setup candle also qualifies as a trigger. You can enter the trade. If the close of the setup candle is further than 60 PIPS from the moving average, then place a pending sell order 60 PIPS from the 8 WMA. If any of the answers are are no, then you skip and go to the next currency pair. SELL Entry Chart Example:

At point A, the high of the candle is below 10 WMA, 8WMA is below 10WMA, and the OsMA is negative, therefore there is a setup to go short. However, we have to check if the setup qualifies as a trigger. And yes, it does qualify as a trigger because the close of the setup candle is less than 60 PIPS from the 8 WMA. A sell trade is entered at market price and as you can see from the chart. Within 3 days, the target was triggered and you get rewarded with 294 PIPS. There is your holy grail of trading, a profitable yet simple way to enter the forex market like the Master Trader. Be patient and your waiting will pay off. A Step-by-Step Guide to Manage Trades Like the Master Trader We have already learned that losses are part of the trading business. We treat the losses in trading as business costs. Since costs are a permanent part of running a business, and successful businesses manage to minimize costs and maximize profits, your job as a trader is to manage the losses and keep them small, so that you can maximize your profits. One of the struggles of losing traders from our survey earlier is allowing the losses to run while cutting the profits short. On the other hand, successful traders cut their losses short and allow their profits to run. This is where trade management comes into play. How do you manage trades such that the losses are cut short and the profits run? Let’s look at the initial stop-loss that we placed in our last trade example. Initial Stop Loss The initial stop loss will guarantee that you never take an unexpected loss. That means, whenever you place a trade, your initial stop loss does determine how much you invest in the trade. In the proven forex trading money-making strategy, the initial stop loss is placed above the high of the last up fractal before the setup candle in a sell setup as seen in the chart point B. This gives you an assurance that if this trade fails as some will then you know precisely how much you stand to lose. This is acceptable as the costs for your business.

The initial stop loss is in this sell trade example is 196 PIPS from the entry and this gives the trade enough room to run while keeping the initial stop loss at a minimum. Keep your eye on the chart, at the close of day 2, the trade had moved about 126 pips. In managing this trade, the initial stop loss is moved to lock in 5 PIPs in profit. So whatever happens from this point, this trade will still end up a winner. If the trade moves a full 196 PIPS in your favor, move the stop loss to lock in half of that move which in this case would be 98 PIPS. This will enable you to trail the move until price triggers the profit target or price pulls back and hit the stop loss. This is the way to let the profit run, while cutting the losses short. In this example, the target was triggered within three days. In a buy setup, the initial stop loss is placed on the last down fractal before the setup candle for a buy setup. Examine the chart and you will see that the initial stop loss was placed at point C.

This buy trade also closed in a healthy profit. Placing your stop loss this way gives the trade enough room to play out and in this case, it did as expected. So initial stop loss is like an insurance policy for your trading business. Use the initial stop loss to protect your capital. Now we are going to look at moving your initial stop loss to breakeven and finally, we will look at trailing stop losses after reaching breakeven level. You need to learn this methods in order to become a master in forex trading. Getting to breakeven How soon should you move your initial stop loss to breakeven? You move your stop loss as soon as it is safe to do so and you are going to move it in one move. In the sell example chart, on day 2, the initial stop loss was moved to 5 PIPS below breakeven. This gives the trade room to play out while protecting profits. What do you do from breakeven? Let’s take a look at trailing stops. Trailing stop losses after reaching the breakeven You place the profit target at 1.5 times the risk. For example, the buy trade example had about 296 PIPs in stop losses. So the target was 296 + 148 giving you a total of 444 pips, the buy trade example we examined earlier. Let’s look at it again.

Within 7 days the profit target was triggered. So how do you trail your stop from the breakeven? If your trade moves full 296 PIPs from your entry, move the stop loss to half of the move to lock in 148 PIPs. This will enable you to trail the move until the profit target is triggered or price pulls back and hit your stop loss. This is the way to let your profit run while cutting the losses short. In this example, the stop loss moved one more time from the breakeven point to lock in 165 pips on day 5 of the trade and the profit target was triggered on day 7. See the chart. Trade management is about managing your stops to get out of losses fast. Immediately the market gives you an opportunity to move that stop loss to break even or lock-in 5 pips, do not hesitate. Now let’s consider the exit strategy. A Step-by-Step Guide to Exit Trades Like the Master Trader Profitable traders are master traders, because they’ve mastered the skills of entering the market at the right time, the art of managing the trades and they’ve mastered the art of exiting the trades with maximum profits or small losses. After this lesson, my hope is that you too will be able to exit your trades like the Master Trader with maximum profits or very small losses. Let’s now see how to properly exit trades so as to maximize the profits the market offers. The example we used already from the sell trade of 3rd March 2015 is a good example to illustrate the exit strategies. The rules of the exit strategy are very important because it leads to capturing the big moves in the market. Exiting Rule Knowing what to do at every stage of the trading process will enable you to act with confidence. If you know what to do at the end of each day at 23:00 pm CET, you will start acting with confidence and you will start trusting your trading system. The exit rules are as follows: The three ways to exit a trade First, if the price moves in the opposite direction than what you expect and hit your stop loss. That is OK. You’re out. Evaluate your trading process. If everything went according to the rules, then you succeeded though it is a lost trade. Your goal is to enter and exit a trade based on your rules. So a loss is not always a loss. If you followed your rules, this loss is actually a win. Secondly, if the price moves in the right direction and hit your profit target then great. This is what you will experience most of the time with this strategy. Within a few days, your trade will hit your profit targets. Let’s look at the sell example again.

I like this scenario a lot. This is the reward you will get if you are sincerely willing to get it done, by sticking with the rules no matter what. The third scenario will occur when a signal in the opposite direction is generated while the trade had not reached the target or has not hit the stop loss. In this case, you exit the trade and wait for a trigger to open a trade in the opposite direction. This will happen, but not very often. If you stick to these rules, you will cut your losses short and let your profit run. In this case, the profit target was hit within three days of entry. We will definitely come across the other scenarios when we look at the two years walkthrough of the GBPUSD currency pair. Now that you have all the rules of entry, trade management, and exit, let’s begin the walkthrough. Pay attention to the trade setups, and follow them on your own daily chart. Remember: practice like a master in forex trading! Before we go into the two years of backtesting the GBPUSD, let me share two things which are very important for your success. First, you have to believe in yourself and promise yourself to follow the trading rules as stated. This will require a lot of practice on your part. When you follow the trading process, you will soon become confident that it works, even if you lose some trades. We are going to talk about Risk Management and Self-Discipline

Chapter 7

Risk Management and Self-Discipline Risk management is one of the skills you will have to develop quickly as a trader if you want to become a successful forex trader. Do it from your first trade. Add this to your trading plan. I have kept is simple here so that you understand how to calculate it for every trade. Never risk more than 2% of your equity on any one trade and the maximum open positions total risks should be 6% or less. So if you have 2% on any one trade, then you can only have 3 trades maximum. However, if you have your risk at 1%, then you can have 6 trades maximum open. You can trade micro-lots, mini lots or standard lot sizes in forex. This will have drastic consequences for your trade. To keep it simple, when you trade 1 micro lot, a pip is about 10 cents and 1 mini lot a pip is $1 and for standard lot size, a pip is $10. You will calculate your lot size based on the stop. For example, if you trade 5 mini lots, then 1 pip will be $5. If you trade 5 micro lots, then 1 pip will be 50 cents. If you trade 5 standard lots, then a pip will be $50. So it is very important you trade with the proper lot size. Let’s say for the sell example we saw on the chart. The entry was at 1.5355 and initial stop loss at 1.5555 and target at 1.5055. If you have an account size (equity) of $10,000, 1% of $10,000 is $100. So your risk on any open trade should be $100 or less. For a 100 PIP SL, here is how you will calculate your lot size For a stop loss of 200 PIPS, you will be trading 5 micro-lots. This will give me 50 cents per PIP and 50 cents times 200 is $100. However, since the trade closed at a profit of 300 pips, you made 300 X 50 cents, so you made $150 in profit. The trading size is a very important factor in risk management When you trade large lots of sizes, it could potentially increase your profits however, you run the risk of losing big when it goes against you. You can use this position size calculator here. You should bookmark the position size calculator page because you will need it every time you have to place a trade. Follow this simple trading risk management calculation and you will survive another day to trade. With a 1% risk on any giving trade and a maximum of 6% open trade that means you can only have 6 positions open at a time. If you want to spread the risk and open more trades, then bring down your risk to 1% on any giving trade. This will give you the opportunity to open more positions without increasing your risks. Self-Discipline The Merriam-Webster dictionary defines discipline as “control gained by enforcing obedience or order.” Discipline can be enforced by authority however success in any area of life is possible for those who possess the trait of self-discipline. Trading is no different. Every successful trader possesses the trait of self-discipline. In more than 10 years of trading, I discovered that self-discipline is gained by simply following my trading rules. If you would do the same, you will become a self-empowered, confident and successful forex trader.

Chapter 8

Back Testing the Proven Forex Trading Money Making Strategy on GBPUSD We are going to look at several illustrations from the charts beginning from January 2015 until December 2016. Open up your MT4 platform, so you can follow along. See the labels on the chart. Follow these trades. Can you come up with the reason why the trades fit the rules? I have marked the entry and exits, with PIPS gain and pips lost in all the trades. You can use the rules to determine why those were entries and exits. This is GBPUSD for 2015 and 2016. I will explain the first chart, and you will explain the remaining charts. Get a book and work through the charts with me. Copy the rules or print them out, so as we work through the charts, you will look at the rules and see the setups. If you do this exercise, you will begin to picture these trades going forward as you improve your analysis. As you follow these trades, keep an eye on the candles at the beginning of a new month. Do you see how many signals occur at the beginning of the month? About mid-month, you can see some pullbacks and later continuation. So note tall these observations. Make this one of your standard strategies even if you are someone who likes more action and thinks your style is day trading. The long term trades will enable you to catch the big moves in the market and our goal here is to help you become a successful forex trader. Chart number 1 January to March 2015

The first setup was triggered during the last week of December. You will hear traders say it is not good to trade during the holiday period. It is true however, this strategy is great and does not care about the noise that day traders experience. When there is a setup, take the trade, you never know which trade is going to give you that huge profit. Trade number 1 opened in the last week of 2014, closed on the third day of trade in 2015 for a good profit of 330 PIPS. Fifteen days went by without a signal. This is the beauty of this strategy. Don’t worry until you have a good setup. See the second trade came around 15 trading days after the first trade with a profit of 255 pips and the trade lasted 14 days, without all the trading stress that most traders experience. See trade number 3, a sell was a fast trade. Within 4 days and closed at 300 PIPS. As you can see you had just 3 trades on one currency pair in 3 months giving the trader a total of 885 PIPs from 1 currency pair. Remember, you have 7 or more currency pairs to trade. Let’s look at the second chart. Your job is to figure out why the trades were taken. I have some labels on the charts. I will just give you a summary of each. The more charts you look at following the trade setups, the more you will begin to see as they unfold at the close of the day. Chart number 2 April to September, 2015

This chart is from April to September of 2015. There were a total of 8 trades, 7 winning trades and 1 losing trade for a total PIP gain of 1547 PIPS. Now after 9 months of trade, you have 11 trades and a total of 2432 PIPs. Awesome! You keep your expenses low because you enter high probability trades. Chart number 3 September to December 2015

The third chart showed four profitable trades and two losing trades. The total PIP gained for these trades totaled 757. So for the year 2015, the total PIP gained totaled 3189 PIPS. This is just 1 currency pair. So imagine right now what this means for your trading business. What if you had an average of 2000 PIPS per currency pair? It will total 14,000 PIPS. If you trade a standard lot per trade this is $140,000. This is something you can do in a year with trading the Proven Forex Trading Money Making Strategy. Let’s look at more charts. Chart number 4 January to June 2016

Take every trading and analyze it against the trading rules. This chart is from January to June of 2016. There were seven trades in total. In this case, they were all winning trades. The first trade occurred on the first trading day of 2016. The seven trades yielded 1800 PIPs. Let’s look at the last half of 2016. Chart number 5 July to December 2016

The last six months of 2016 gave us 8 trades in total. All trades were positive. The total PIP gained 345 +150+5 +330+345+315+200+250. This totaled 1940 PIPS. Alright, you have seen what is possible. The total PIP gained in 2016 trading only GBPUSD is 3740. You will achieve this kind of result when you continue to improve on yourself. Personal development in trading is very important. Using visualization techniques to see yourself as successful will enable you to stay strong and keep going when you experience drawdown in your account. Profitable traders still make mistakes however they’ve learned to relax when trading. They will plan every trade focusing on executing their plan flawlessly. As I became a professional forex trader, I realized that my growth actually mimics my personal growth. I am becoming a high performer in other areas of my life. I believe this is due to the routines that I started following when I made the decision that I love trading and I would love to pursue it as a career. So we will look at Personal Development to conclude this book and in it I will share with you my daily routine, in the hopes that you can read through and come up with your own daily routine, to help you become a better trader.

CHAPTER 9

Personal Development High-performance traders follow a daily routine for personal development. Personal development is in my best interest and I hope you realize that it is in your own best interest too. Following a daily routine for your personal development will definitely affect your trading performance. Trading will bring out the best and the worst of your emotions. When you are mentally prepared for all eventualities, trading will become easier. I believe personal development played a big part in my trading success. I live an intentional life. Everything I do is intentional. I use my imagination every day. Using your imagination How you see yourself in your mind’s eyes matters a great deal. As you begin this journey as a forex trader, begin by using your mind. See yourself as a successful trader. It is an exercise that most people are not willing to invest in. But if you do, you will definitely become one of the 10% who pulls money out of the market. If it was easy, many people will be doing it. Do not focus on your past failures, because this will only continue to affect your future success. All successful people and traders for that matter, see themselves in their mind as successful before it ever manifested itself in the physical. So you have to vividly imagine yourself as a successful trader. So picture yourself making 400 PIPS a month, remember our SMART goals? That is your job now. See yourself hitting the goal of 400 PIPS a month over and over again. How does it feel? Trading success all depends on you and the truth is you have to power to make it happen for you and your family. My Visualization technique as part of my daily routine How do I imagine myself as successful every day? Well, I learned this technique a few years ago and it has worked and has helped me become a better and more profitable trader. It is part of my trading routine now. I hope you will make it part of your trading routine. Here is what I do 30 minutes before my trading I lie down on a couch, very comfortably. I make sure there is no distraction and then I begin to visualize my trades and I see myself in the theater of my mind buying and selling at the best setups. Lie on a couch 30 minutes before you ever trade. Visualize your trades, and see yourself in your mind’s eyes buying and selling at the best setups. It feels like it is real, that is the point. My mind cannot determine when I am just imagining or when it is actually happening for real. You can begin imagining at this point the goal of 400 PIPs a month. See yourself placing trades when the setups are good. See yourself coming back the next day at 23:00 CET and the trade has moved in your favor. See yourself closing the trade at a huge profit. When I do this, a smile usually breaks on my face. It is an awesome feeling. Now I know why it works. Everything we see on this earth began with a thought in someone’s mind. So, therefore, we can create things with our imagination and God will bring them to reality. Be sure to pay close attention to the details of your trades in your mind’s eyes. Relax and let there be no distraction. This process lasts at least 30 minutes.

Work on your vision My success vision board is designed to reflect what I want to become as a person. I believe that trading is just a vehicle to reach my goals and accomplish my vision. If I become a better trader, I will execute my trading rules flawlessly. So work on your vision and as you do ask yourself these questions: what kind of trader do you want to become, what kind of person do you want to become? As you ponder on these questions, you will begin to see ideas for your vision. Trading will bring out the best and the worst of you and the market will do what it wants to do. Therefore, your mental preparedness is very important to execute your rules flawlessly. So start working on your Vision. Start my day with a quiet time I start my day by thanking God Almighty for life and asking for grace for an abundant life. I want rivers of living waters to flow from me each day. I will mention the things, persons and places I am grateful for. I spend some time in meditation and ask for grace for an abundant life. (Jesus said, I have come to give life and to give life abundantly.) With an abundance mindset, I am ready for my day. Work out and Nutrition I drink a glass of water with some lemon on an empty stomach every morning. There are many benefits, however, I really like the fact that it reduces stress levels and improves moods while boosting energy levels at the same time. Choose your workout routine and stick with it. Be consistent. This will make you physically strong. I just work out in my living room or go out for an early morning walk. We have to make healthy daily choices, to stay on top of our game.

CHAPTER 10

The Close My purpose is to change people’s lives. Commit to stop playing small and go big in your imagination. Your imagination can lead you to become one of the best traders in the world today. Armed with a proven forex trading money-making strategy (PFTMMS), you can use your imagination to take this strategy to whichever level you want. You may just be starting, but at least you are starting right. Commit to the flawless execution of this strategy and use your imagination at least 30 minutes a day. Conclusion You have seen how consistent the PFTMMS can be. It will help you to trade effectively and you can easily become a consistent trader by flawlessly executing the rules and trading only at the end of the day from 23:00 pm CET or 17:00 EST. The Proven Forex Trading Money Making Strategy (PFTMMS) will work for those who develop the self-discipline to implement the trade following its simple rules. To be a master in forex trading, follow our instructions and you will reach your goals. Good Luck!

Are you ready to trade on a real account?

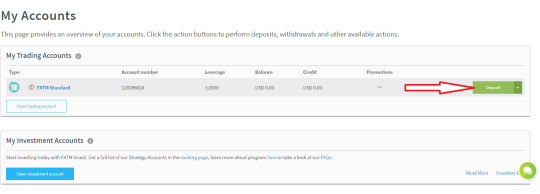

Go to forextime.com and login into your account. Click “My Accounts” and then “Accounts overview”

Under My Demo Accounts, click on the down arrow and select “Delete Account”. We would like to delete the Demo account so that we do not confuse it with our real accounts.

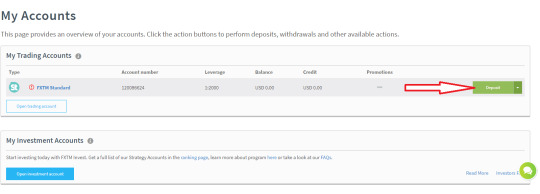

Under My Trading Accounts, click on the Deposit button (Minimum 100 USD).

Choose your deposit method and follow the instructions. Remember to deposit using your Credit card or Debit card (e.g. A cheque/current account) select the Credit/Debit Cards option depending on whether your card is VISA or Mastercard. Once the money deposited reflects on your account, you may trade real money the same way you have been trading with a demo account. Other courses offered by XYZ Pocket: Video courses Written courses Video Courses Link Ultimate Forex Trading Training Videos - Level 1 https://videos.xyzpocket.com/ Best forex trading videos - Level 2 Advanced https://videos.xyzpocket.com/best-forex-trading-videos-level-2-advanced/ Complete Forex Trading - how to do Forex trading https://videos.xyzpocket.com/complete-forex-trading-how-to-do-forex-trading-1/ Easy Forex Trading for Beginners https://videos.xyzpocket.com/easy-forex-trading-for-beginners-1/ Forex courses online – Trading Forex indices https://videos.xyzpocket.com/forex-courses-online-trading-forex-indices-2020/ Learn Fundamental Analysis - Best Forex Training Online https://videos.xyzpocket.com/learn-fundamental-analysis-best-forex-training-online-2020/ Winning Forex trading learning with Live Trading Examples https://videos.xyzpocket.com/winning-forex-trading-learning-with-live-trading-examples-2020/ Written Courses Link 50 Pips A Day https://www.xyzpocket.com/forex-trading-training-50-pips-a-day/ Forex Academy - The Ultimate Price Action https://www.xyzpocket.com/forex-academy-the-ultimate-price-action-2020/ Forex Masters Course 2020 - Follow Price Action Trends https://www.xyzpocket.com/forex-masters-course-2020-follow-price-action/ Forex Trading School - Best Day Trading Forex https://www.xyzpocket.com/forex-trading-school-best-day-trading-forex-2020/ Free Forex Training - The Ultimate Basics https://www.xyzpocket.com/free-forex-training-the-ultimate-basics-2020/ Master in forex trading - 15 minutes a day https://www.xyzpocket.com/master-in-forex-trading-15-minutes-a-day/ Read the full article

0 notes

Text

Free Forex Training - The Ultimate Basics 2020

Course Prerequisite

Forex Demo Broker Account (See below if you do not already have one) Passport or Identity Document and Proof of address not older than 90 days (You will need these documents for verification purposes) Your full attention Practice, practice practice!!! Forex Broker Demo Account In order to be able to practice the exercises in this course, you will need to open a demo account. A demo account is a practice account where you are able to trade live using fake money and not your own money. Once you are comfortable with a demo account, you can then deposit real money and apply what you learned while using a demo account. Here are the steps to follow when opening a demo account: Click on this link (Non-US learners): Recommended broker. For the United States learners, follow this guide: Recommended US broker For the rest, let us continue. Click on the “Open Account” button at the top of the screen.

Fill in your details First name(s) – As per your Identity document Last Name – As per your Identity Document Country of residence – Should be chosen automatically if you are not using any proxy or VPN Mobile phone – Enter the correct number as this will be verified E-mail - Enter the correct e-mail address as this will also be verified Password – Choose a strong password with Letters, Numbers and Symbols (This will be your broker password on ForexTime.com) Click on “Send Pin” – A PIN will be sent to your cellphone and E-mail address. You may use any of the two PINs for verification. Enter the pin, accept the marketing consent and then click on “Register Now”. On the next page, enter all the necessary details to the best of your ability, Accept the agreements and click “Submit”

On the next page, select as follows: Account type – FXTM Standard Account currency – Any that you prefer Account leverage – 1:2000 Trading Account Password – Enter a strong password twice (This is different from your ForexTime portal login account that you set earlier. It will be your password to your MetaTrader account, more on this later) Click “Open Account” Next: Click on “Download platform”

Select the “Metatrader 4 Trading Terminal for PC” or “Metatrader 4 Trading Terminal for MAC” depending on your Operating system. Download and install the application. Go to your Desktop, you will see a ForexTime (FXTM) MT4 icon (Windows). Double click the icon and login. To find your login details, go to the e-mail that says “Congratulations! Your new trading account is now open”. Metatrader login (at the bottom of the e-mail) and use the Trading Account Password that you entered above. Should you need to install one for your phone, hover your mouse over the QR code, scan the QR code with your phone to download the platform. Go to your e-mail account that you used for registration. Open the e-mail that says “action required with regard to your verification” – see below! Click “upload”

Upload your Identity document as per the e-mail and your proof of address. Open a Demo account Click on “My Accounts” on the left-hand side, then select “Open New Account”

Select Demo Account. Account type – FXTM Standard Choose currency Account Leverage 1:2000 Complete the passwords fields Initial balance – any amount, I suggest 20000 USD Click “Open Account”

Your Metatrader Login details will be displayed Download the Platform just as you did above and login using the details given. You are now ready to continue with the course content.

Chapter 1

Welcome to the World of Forex Trading with Free Forex training So you have heard about Forex Trading and you are now curious to check it out, but really don't know where to start. We offer free forex training that is comprehensive and complete. Well, you have come to the right place, as this book will take you through the basics, explain Forex in a plain and simple manner and give you enough information to get started sooner rather than later, in the exciting world of Forex Trading. What is Forex? Forex is the common term used to describe Foreign Exchange. It is also called currency trading, or just FX trading, and every now and then you may see it referred to as Spot FX.