Don't wanna be here? Send us removal request.

Text

How FX CFD can make a difference to your portfolio

In financial derivatives trading, a contract for difference (CFD) does not involve owning any physical goods or securities. Instead, traders agree to exchange the difference between the open and closing trade prices upon settlement. These prices depend largely on specific factors like supply and demand. Trading FX, which involves pure currency trading, is also affected by supply and demand, as well as fundamental factors like geopolitical events.

Other than FX currency pairs, there are several underlying assets you can trade a CFD on, each with its own market characteristics. Some asset classes include commodities, stocks and indices. Once you know the principles of CFD trading, they can be applied to different markets.

Why trade FX CFD instead of FX

Currency pairs include the currencies that are part of the FX market, such as EUR/USD, EUR/GBP and USD/JPY. More exotic currencies can involve high volatility and fluctuating prices, offering attractive opportunities for CFD traders.

Due to high liquidity created by supply and demand, with many different currency pairs to trade on, FX is one of the most widely traded financial markets and there are several ways to access the markets. But with the rise of market volatility and online trading, gone are the days where traders call their remisier to place trades.

Traders can seek opportunities with leveraged products like CFDs. Similar to FX, FX CFD can be conveniently traded online and have a pricing mechanism where they are both charged on the spread. Unlike non-leverage FX products, an advantage of trading FX CFD is that you can trade on margin, meaning you only need to place a fraction of the transaction value upfront. However, with leverage products, you can magnify your returns and losses if the markets go against you. Another advantage is that you can short or long the market based on your speculation on the direction of a currency pair, earning returns based on the movement of the underlying asset and your position. This can be particularly attractive for traders, given recent market volatility.

“Surrounding the US election in particular had been strong expectations for a pick-up in volatility,” commented Jingyi Pan, Senior Market Strategist at IG. “This can be seen via the VIX futures curve where heightened volatility is expected into the year-end from October. Uncertainty here could induce further volatilities that may ripple across asset classes.”

FX CFD can also aid traders by hedging their current portfolio, so if you believe that the price of a FX pair will drop, you can offset potential losses by going short with a FX CFD. In addition, FX markets are open 24/5 and are highly liquid, allowing traders to conduct rapid transactions according to market movements. They are also convenient to execute and can be traded for $0 commission.

Risks and the importance of risk management

Because there is ample room for both reward and risk, it’s important to have a sound risk management strategy in place. That means understanding your own risk tolerance and deciding ahead of time how much you are willing to lose and what your profit target is over a specific time frame.

“As the good old saying from Benjamin Franklin goes, ‘If you fail to plan, you are planning to fail,’” explained Pan. “Having a trade plan including objectives, time horizon and risk management will all be essential to weather an increasingly uncertain market.”

Risk management tools are often integrated into the best trading platforms. One of these is IG, an industry leader with over 45 years of experience in the trading space, which is licensed to conduct investment and digital asset businesses by the Bermuda Monetary Authority. IG’s risk management tools can help clients mitigate losses during major market volatility.

IG also offers a range of cutting-edge charting tools, like ProRealTime and MetaTrader4, which can help you plan your trades better, including entering, placing your stop-loss and taking profit orders. Another feature like IG’s trade analytics tool can also help traders take stock of trading performance, review your past trades and identify trading mistakes so you can avoid them for your future trades by helping to track trading and analyse data. To get started with your trading journey, it is important to read up with IG Academy, including a wide array of educational courses and webinars to help you dive into the market.

To help hone your trading skills and give yourself more practice before trading the real markets, you can start with a demo trading account that lets you practise with $20,000 in virtual credits. Visit IG to find out more.

Disclaimer: This article was written in partnership with IG. All views expressed in the article are the independent opinion of Yahoo and do not in any way reflect the views, opinions or endorsements of Bermuda under No. 54814. (“IG”).

IG provides an execution-only service. The information in this article is for informational and educational purposes only and does not constitute (and should not be construed as containing) any form of financial or investment advice or an investment recommendation, or an offer of or solicitation to invest or transact in any financial instrument. Nor does the information take into account the investment objective, financial situation or particular need of any person. Where in doubt, you should seek advice from an independent financial adviser regarding the suitability of your investment, under a separate arrangement, as you deem fit.

No responsibility is accepted by IG for any loss or damage arising in any way (including due to negligence) from anyone acting or refraining from acting as a result of the information. All forms of investment carry risks. Trading in leveraged products such as CFDs carry risks and may not be suitable for everyone. Losses can exceed deposits.

2 notes

·

View notes

Text

Going long and short in a volatile market

The foreign exchange market saw record-high volatility in 2019 as geopolitical tensions led to fears of a global recession. When the global pandemic hit in 2020, market action continued to be guided by geopolitical tensions, such as the US-China trade war and unrest in the Middle East. Amid such a backdrop, traders can find opportunities by going long or short on the FX markets.

Riding the volatility

“Evidently along each of these lines had been signs of evasion to safety, including the pick-up of haven assets such as gold and also the likes of JPY and CHF,” commented Jingyi Pan, Senior Market Strategist at IG. “These are expected to remain the type of behaviour we continue to see in markets with or without the COVID-19 pandemic overshadowing at the moment.” Foreign policy will remain a key topic, reflecting the market and people’s concerns about how geopolitics may be shaped and its profound impact.

Nevertheless, in 2020, many traders were interested in participating in market volatility. “SGX noted more CDP account openings generally, with investors also keen to take advantage of the market mispricing to gain entry,” continued Pan. Volatile markets mean that the prices can change quickly and significantly. Because of the rapid price changes, this opens up opportunities to generate larger profits in shorter amounts of time. Many traders are drawn to volatility because it creates profitable trading opportunities as currency pairs that are trending may see an increase in the rate of their trend. Traders also like to book the profits automatically using technical analysis to eliminate emotions.

Making the most of opportunities

In contract for differences (CFDs), traders agree to exchange the difference between the opening and closing trade prices upon settlement, without owning the underlying asset. Compared to other trading products, trading FX CFDs can be an alternative way that allows traders to find opportunities on markets because FX markets are open 24/5 and are highly liquid, allowing transactions to occur rapidly. FX CFDs also allow traders to access forex pairs with a leverage—that is, you can post just a fraction of the transaction value—and for $0 commission1. It is also important to note that with leverage, your profit can be magnified and so will your losses, if the markets go against you. With FX CFD, traders can go long or short—that is, buy or sell—when the currency appreciates or depreciates. This creates potential to profit on the changing price no matter which way the prices move.

To further enhance your trades, use of personal trading tools can help traders to better analyse the market and set parameters for selecting trades. Some features like IG’s trade analytics tool can also help traders take stock of trading performance, review your past trades and identify trading mistakes so you can avoid them for your future trades by helping to track trading and analyse data.

That is why CFD trading platforms like IG are becoming increasingly popular. A trusted partner for Singapore traders for 15 years now, IG is a leader in the FX space, and is regulated by the Monetary Authority of Singapore. IG also offers risk management tools that are essential when it comes to mitigating losses during market volatility. For traders who are interested in kickstarting your CFD FX trading journey, IG is offering a limited-time promotion for new account holders.

In celebration of IG’s 15 years in Singapore, new account holders can earn S$288, plus 1.5x more KrisFlyer miles when they trade with IG from now until 31 December2. To find out more and take advantage of market volatility, go to IG.com/sg/SG15 now.

Discover more of IG’s award-winning trading app.

1 Other charges may apply. 2 Full terms and conditions apply. For full disclaimers, risk fact sheet and risk disclosures, visit https://www.ig.com/sg/SG15.

Disclaimer: This article was written in partnership with IG, the world’s No. 1 CFD provider (by revenue excluding FX, published half yearly financial statements, June 2020).

All views expressed in the article are the independent opinion of Yahoo and do not in any way reflect the views, opinions or endorsements of IG Asia Pte Ltd (Co. Reg. No. 20051002K) (“IG”).

IG provides an execution-only service. The information in this article is for informational and educational purposes only and does not constitute (and should not be construed as containing) any form of financial or investment advice or an investment recommendation, or an offer of or solicitation to invest or transact in any financial instrument. Nor does the information take into account the investment objective, financial situation or particular need of any person. Where in doubt, you should seek advice from an independent financial adviser regarding the suitability of your investment, under a separate arrangement, as you deem fit.

No responsibility is accepted by IG for any loss or damage arising in any way (including due to negligence) from anyone acting or refraining from acting as a result of the information. All forms of investment carry risks. Trading in leveraged products such as CFDs carry risks and may not be suitable for everyone. Losses can exceed deposits.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

1 note

·

View note

Text

A Guide To Self-Care During A Pandemic

Please be aware that all forms of investments carry risks, including the risk of losing all of the invested amount. Such activities may not be suitable for everyone. We encourage our investors to invest carefully. All information provided in this article is on an "as is" basis, and is purely for information purposes. It is not intended for trading purposes or financial advice. Neither we nor any of our partners is liable for any informational errors, incompleteness, delays or for any actions taken in reliance on information contained in this article.

0 notes

Text

The biggest sale to hit 2020: Laptop deals at over $1508 off?!

We are in the third quarter of 2020 and if we have learnt anything this year, it is that the pandemic has forced us to rely heavier on technology. From working remotely to keeping in touch with our loved ones, having a portable personal device such as a laptop is more crucial than ever to navigate modern life.

But getting a new laptop or device doesn’t have to burn a hole in your pocket. Luckily for us, the annual 9.9 sale is almost here and we have it on good authority that it’s going to be the biggest sale of the year, especially for electronics.

To facilitate all that you need to go digital, we are highlighting three reasonably-priced laptops and some pretty sweet deals from Lenovo, with over $1508 off, and then some. Whether you’re getting a laptop for yourself or equipping your employees with tools for better productivity, don’t miss these deals!

X1 Extreme Gen 2 (save up to 39% + up to extra 12% off for LenovoPro Members)

Lenovo is known for being some of the best corporate stock laptops around, but the Lenovo Extreme Gen 2 is another level up. Solidly built with a 15-inch screen, it boasts the option of a 4K OLED touchscreen display with a carbon-fiber weave top cover. The general performance and stats of the laptop are sufficient for more than just everyday tasks, and it has one of the best keyboards on a laptop.

ThinkPad E14 (up to 29% off + up to extra 12% off for LenovoPro Members)

For something smaller and even more portable, Lenovo’s ThinkPad E14 is a lightweight 14-inch entry level laptop that can be upgraded to the latest 10th Gen Intel Core i7 processor, allowing you to run a tight ship at work while being highly portable. It also boasts of great audio with Skype-certified mics and Harman speakers. No more, “Hello can you hear me?” while on important concalls!

Legion (up to 15% + up to extra 12% off for LenovoPro Members)

There’s something for gamers too. The Legion series has got gaming laptops for every budget and type of gamers. Looking to run ram-intensive games such as Batman: Arkham Knight? The 16 GB memory of Legion 7i will more than do the trick. Want something friendlier on the pockets? The Legion 5i (15 inch) series still contain top line 10th Gen Intel®Core™ processors and great graphics at the price point. Have we mentioned that there’s further discounts going on too?

Get FREE 2 business delivery deals through this 9.9 Super Sale period. Check out these fast delivery deal here.

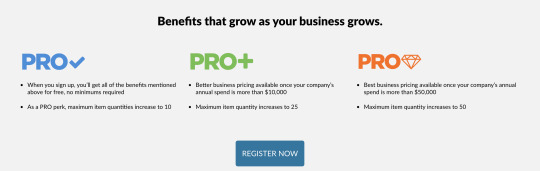

Want extra exclusive perks? Check out LenovoPro!

The best perks of LenovoPro is the additional discounts you will get on the personal device on top of the existing discounts. But not just that, Lenovo has tailored some work from home solutions to ensure that your business can operate efficiently during this difficult period, with two pre-approved “SMEs Go Digital Programme” solutions available for grant application of up to 80% subsidy. To top the cherry on top of the cake, laptop purchase through LenovoPro gets you and your staff free e-training programmes.

That’s not all, exclusive to Yahoo mailers, Sign up for LenovoPro using your valid Yahoo Mail address to enjoy 20% OFF on selected laptop models and stand a chance to win Lenovo’s Power Bank (worth $49) for FREE. Learn more here.

What are you still waiting for?

This content was produced in partnership with Lenovo.

0 notes

Text

The holy grail of gaming laptops: What's it like to be top of the range

For some, high-performing gaming laptops are like side dishes. Nice to have, but not entirely necessary if you have a perfectly functioning desktop at home. But, as the value of personal devices with both high-end performance and mobility goes up, easily portable laptops that can run the entire gamut of ram-heavy games and more, are now being sought after by discerning gamers.

What do top-of-the-range gaming laptops have to offer? Let's take a look at some key things to look out for, from display to CPU.

Display

Most laptop screens use liquid crystal display (LCD), but high-end laptops are now boasting 4K OLED displays, a feature that some phones and smart televisions are already enjoying. 4K OLED displays feature faster response timing, reduced power consumption and incredible image quality. Now apply that to some of the most beautiful games such as The Witcher 3: Wild Hunt, and think of what a visual treat it'll be!

Graphics Card

Graphic cards help render graphics, and the speed of which it can do so determines whether images look buttery smooth or choppy for the eyes. The best graphic card money can buy right now for laptops is the RTX 2080 Super Max-Q, which can handle reasonably high to demanding graphic settings, providing you with the best 4K gaming performance on-the-go.

System Memory

Random access memory (RAM) is one of the main components that makes a laptop powerful. High amount of RAM allows more programs to be run concurrently without affecting performance. For example, browsing the web may need around 2 GB of RAM, but running a ram-intensive game may require around 8 GB or more. You should see 16 GB of RAM on a high-end gaming laptop to allow you to run most games smoothly, and then some.

Central Processing Unit (CPU)

The CPU controls how fast your computer runs and performs its tasks. The more cores a laptop processor has, the quicker it can process tasks, and the more tasks it can handle at any given time. For high-end laptop models, we're looking at a minimum of six to eight cores for best performance.

Hard Drive

A hard drive is a memory storage. Today's high-performance laptop computers have a solid-state drive (SSD) that can hold up to two terabytes worth of storage space. Unlike hard drives, data is instantly accessible on the memory chips, transferring and retrieving data way faster in comparison.

Portability

While theoretically portable, gaming laptops used to weigh in like a couple of bricks just a few years ago. Now, even with all the improved performance and top-notch hardware, a high-performance laptop can weigh as little as 3 kg or even less.

Now that we know what to look out for, let's take a look at some gaming laptops from Razer that check off the above list.

Razer Blade 17 Pro

Built for extreme performance, the Razer Blade 17 Pro is packed with an 8-core 10th Gen Intel Core i7 processor and 16 GB of DDR4 memory. With three tiers to choose from, the Razer Blade 17 Pro at its best offers up a 1 TB SSD as well as the best graphic card and display (RTX 2080 Super Max-Q and 4K OLED respectively) a laptop can get in the market. This powerhouse doesn't just look good on the inside. All that power is contained within a robust aluminum-magnesium unibody chassis, lending strength and good looks to the package. Games aside, the powerful specs also allows the laptop to double up as workstation for professional use easily. Prices start from $3,959.

Razer Blade Stealth 15 Base /Advanced Model

The new Razer Blade 15 is a compact laptop that strikes the perfect balance between power and portability. Equipped with 10th Gen Intel Core i7 processors, faster dual-channel memory, and an arsenal of graphic options spanning from the GeForce GTX 1660 Ti up to GeForce RTX 2080 Super, you get to customise exactly how powerful you want the laptop to be. Options are available in both Base and Advanced Models, whether you lean towards everyday functions or an esports grade machine.

Razer Blade Stealth 13

The Razer Blade Stealth 13 is the most portable of the lot, weighing at less than 1.5 kg, armed with hardware that's perfect for gaming and productivity. The smallest guy in the series features the world's fastest 13.3" 120 Hz Full HD display for buttery smooth visuals or a 4K resolution touch display, depending on your needs. Utilising the 10th gen Intel® Core™ i7 processor at 25 W and the GeForce® GTX 1650 Ti, this mean machine packs a punch, allowing one to rip through games and content creation tasks easily.

All the laptops in the above-mentioned range feature a unibody frame fortified using precision CNC, where high-grade aluminium and the stealth black colour is anodised at a sub-molecular level for maximum durability. With no bloatware in the system and a clean-cut design, you're getting a premium machine that is capable of gaming and working anywhere you go.

For more information, check out the Razer Official Store on Lazada or Shopee to get your very own machine now.

This content was produced in partnership with Razer.

0 notes

Text

Protect your wealth by protecting your health

We might know someone—a mum, sister, grandma or an aunt – who has faced a critical illness like cancer. And it can be difficult to watch. Though many recover their health, the same cannot be said for their finances. A critical illness like breast cancer, which strikes 1 in 11 women in Singapore1, costs an average of S$8,000 to S$17,000 per month to treat2 – and treatment can take years.

Risks faced by modern women

The reality is that health and wealth go hand in hand, like how treatment prices soar as medical technology advances. If a health crisis catches you off guard, it could wipe out your savings, putting your loved ones under emotional and financial strain.

If you lose significant income because you need time off work to recover, the setback could be even longer term. Mortgage payments could be interrupted. Your children’s education fees could be diverted to medical treatment. It could threaten their future.

The risk increases during times of economic uncertainty. If interest rates are stagnant or falling, your cash might not grow outside of an interest-bearing or investment-tracking product. Add positive inflation into the mix, and your spending power will go down.

Based on research carried out by the Life Insurance Association Singapore, many face a significant CI protection gap of S$256,000. While the average CI cover is S$60,000, the reality is that people will need protection of at least S$316,000 to meet their needs3. Moreover, the older and more financially stable we get, the more expensive CI cover becomes. The smart move would be to take decisive action before a health crisis strikes.

Time to take back control

But that does not mean you should rush into investments. During an unstable market, you could be putting your savings at risk. What you need is a stable way to grow your money, while protecting your savings against critical illness.

The answer is adequate medical and critical illness protection. With life expectancy rising, Singaporeans are facing greater odds of becoming critically ill. This makes insurance protection an essential element of the savvy woman’s financial portfolio.

Another way to make your money work harder is to choose a good savings account that offers better rewards the more you save. This is often easier said than done as it involves a mindset shift – from one that is focused on the monetary rewards in the form of interest earned on your savings, to one where you look beyond to other benefits, such as critical illness coverage.

The upside of this is your savings account still earns interest, and is not locked up in long-term investments. If an emergency happens, you will still have cash to spare without interrupting your investments. On top of that, you also have critical illness coverage.

Best of both worlds

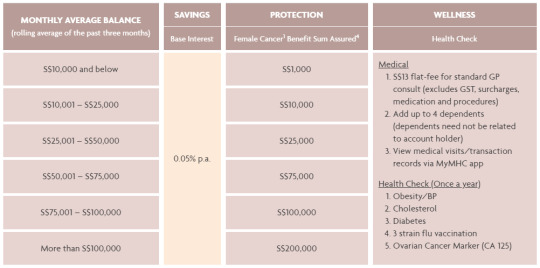

Enter the new UOB Lady’s Savings Account. This smart savings account makes your money work for you while providing up to S$200,000 female cancer coverage. This can substantially offset the average cost of treating critical illnesses. You will be covered for six types of female cancer, including breast, uterine and ovarian cancers, which are among the ten most common in Singapore4. All for absolutely zero premium payment on your side.

With the UOB Lady’s Savings Account, female cancer coverage is free and guaranteed# to eligible account holders as long as you maintain their Monthly Average Balance (MAB). Here’s an overview of the UOB Lady’s Savings Account and how you can get protected up to S$200,000.

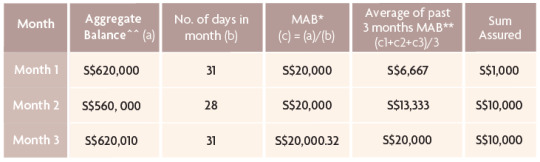

The female cancer benefit is based on the rolling average of the account holder’s MAB over the previous three months. See the illustration table below.

^^ Aggregate balance is the summation of all the daily day-end balances * Rounded down to 2 decimal places ** Rounded to nearest digit, without decimal

Enjoy complimentary yearly health checks for obesity/blood pressure, cholesterol, diabetes and ovarian cancer marker (CA 125), as well as a 3-strain flu vaccination. All this, along with S$13 flat-fee standard GP consultations (excluding GST, surcharges, medication and procedures) at any of the 500 clinics under MHC Asia Group island-wide, for you and up to 4 dependents. Most important of all, you will be looking out for your family by saving smarter and getting critical illness protection. After all, your safety net is their security too.

Sign up for a new UOB Lady’s Savings Account online via uob.com.sg/ladysaccount02, or the UOB Mighty app and get up to S$80 cash credit. Plus, deposit a minimum of S$10,000 into your new account to enjoy up to 10X additional UNI$ on either Fashion or Family category spend on your UOB Lady’s Card. Full terms and conditions apply.

# Subject to the exclusions and provisions contained in UOB Lady’s Savings Account Group Cancer Plan and UOB Lady’s Savings Account Terms and Conditions.

1 https://www.singaporecancersociety.org.sg/learn-about-cancer/types-of-cancer/breast-cancer.html 2 https://thecareissue.jaga-me.com/the-true-cost-of-breast-cancer-in-singapore/ 3 https://www.lia.org.sg/media/1332/protection-gap-study-report-2017.pdf 4 https://www.singaporecancersociety.org.sg/learn-about-cancer/cancer-basics/common-types-of-cancer-in-singapore.html

This content was produced in partnership with UOB.

0 notes

Text

How to defend against critical illness and the potential impact on your family

Ladies, we all have a lot going on. Whether it’s our careers, our family or our financial goals, there are too many responsibilities we are holding on to. And for most of us, family often rank right up there on our priority list.

But to take care of your family properly, you need to make sure you look after yourself first. That way, you can be better prepared if the unexpected happens. There are many ways you can care for yourself whether through exercise, a better diet, getting your finances in order or regular medical check-ups.

Coping with critical illnesses

All women face the risk of developing a critical illness at some point in their lives. Over the past 40 years, breast cancer occurrences in women has more than doubled in Singapore – from 25 to 65 in every 100,000 women. While it’s not the most common cancer among women, it is the biggest killer1. What’s more, between 2010 and 2015, incidents of female-related cancer rose by 17%, even though certain types, like breast2 or colorectal3 cancers, are potentially preventable by opting to live healthier lifestyles. For example, going running two nights a week will give your heart a healthy workout and help you maintain a healthy weight. Consider changing your diet so you aren’t consuming as much red meat, sugar or fried foods, and ramp up your intake of fresh vegetables.

We all need to be aware that critical illnesses – especially ovarian, cervical and breast cancers – could affect us at some point in our lives. Other conditions we need to think about include heart disease and strokes, which are among the biggest causes of death in Singapore4. This means more women than ever before may be less able to take care of their families as they fight critical illnesses. Not only do these conditions place substantial emotional strain on our loved ones upon diagnosis, the cost of treatment and recovery can be astronomical. Cancer treatment can last for several years, and this can put a huge financial strain on families by depleting savings or even getting them into debt if they don’t have sufficient critical illness coverage or savings.

Protection and prevention

Developing the right mindset around critical illnesses is a good place to start. Plan for the possibility that you might one day become unwell and with this mental shift, make adjustments to cope with the potential fallout. Take small, manageable steps first, such as adopting healthy lifestyle practices while looking into your insurance coverage. This will help you identify whether you need to recalibrate your plans to fit your needs.

Regular medical check-ups are important when it comes to cancer detection. Early detection and diagnosis more often than not means you get the best chance at successful treatment. This can have a very tangible impact on your quality of life and enable you to continue to care for those you love. How to cope with the cost

Treatment for critical illnesses can be prohibitively expensive. Apart from saving for rainy days, what if your savings can help you bear some of the cost for critical illness treatment? We recommend checking out the UOB Lady’s Savings Account, a savings account that provides female cancer coverage as you save. Not only will you have a savings account that makes your money work harder by giving you interest on your savings, but also coverage for six types of female cancer, including breast, uterine and ovarian cancers, which are among the ten most common in Singapore5. Saving on the UOB Lady’s Savings Account can give you up to $200,000 coverage, substantially defraying the average cost of treating cancer, which can cost between $8,000 and $17,000 per month6. The best part? The UOB Lady’s Savings Account female cancer coverage is guaranteed# with no medical underwriting to eligible account holders as long as they maintain their Monthly Average Balance (MAB). You don’t even need to pay any premiums to enjoy this female cancer coverage, in fact, you just need to save more.

Here’s how it works:

Not only that, the account also gives complimentary yearly health checks for obesity/blood pressure, cholesterol, diabetes and ovarian cancer marker (CA 125), as well as a 3 strain flu vaccination. In addition, you and up to four dependents will also get to enjoy $13 flat-fee standard GP consultation (excluding GST, surcharges, medication and procedures) at any of the 500 clinics under MHC Asia Group islandwide.

Isn’t it wonderful to know that you can kill not just one, not two but three birds with one stone? Save money, get female cancer coverage and most importantly, do the right thing for your family by putting yourself first.

Sign up online anytime, anywhere via uob.com.sg/ladysaccount01, or the UOB Mighty app and receive four medical consultations (worth $52) at any of the 500 clinics under MHC Asia Group. Full terms and conditions apply.

yahoo

1 https://www.straitstimes.com/singapore/health/breast-prostate-cancers-rising-sharply-in-spore

2 https://www.myheart.org.sg/my-heart/heart-statistics/singapore-statistics/

3 https://www.healthhub.sg/live-healthy/2056/9-Must-Know-Facts-About-Colorectal-Cancer

4 https://www.myheart.org.sg/my-heart/heart-statistics/singapore-statistics

5 https://www.singaporecancersociety.org.sg/learn-about-cancer/cancer-basics/common-types-of-cancer-in-singapore.html

6 https://blog.seedly.sg/true-cost-cancer-treatment-singapore

# Subject to the exclusions and provisions contained in UOB Lady’s Savings Account Group Cancer Plan and UOB Lady’s Savings Account terms and conditions.

This content was produced in partnership with UOB.

0 notes

Text

What’s the best gaming mouse for your grip style, and games that you’d own at

This content was produced in partnership with Razer.

0 notes

Text

Achoo! Is the fear of contracting COVID-19 getting to you?

Allergies, cold, or COVID-19? Some of the symptoms overlap, so here’s a guide to help you differentiate the symptoms.

Symptoms like coughs, sneezes and sore throats used to be a nuisance, but rarely something to worry about. Not anymore! In COVID-19 times, every sniffle is a cause for caution.

While there are some common factors between conditions like COVID-19, colds, flu and allergies, there are also some distinctions. Use the Symptoms Comparison Table below as a guide.

If you suffer from allergies, make sure you have a good supply of antihistamines such as Clarityn at home. They come in tiny tablets that you can easily take.

Antihistamines block the effect of histamine, the chemical that causes an allergic response, reducing symptoms such as sneezing, a runny nose and itchy skin. Some people are wary of antihistamines because of the drowsy effect. If you, like most, are working from home and need to stay awake, look for an ingredient called loratadine (the antihistamine in Clarityn). It can alleviate allergy symptoms without making you feel sleepy, and you need just one small tablet for 24 hours of relief.

Clarityn is available at Shopee, Lazada and other online retailers. Buy online if you can – that way, you can fight the sniffles, and still #stayhomeforsingapore.

* Information is still evolving.

** Allergies, cold and influenza/flu can all trigger asthma, which can lead to shortness of breath.

COVID-19 is the only virus of the four associated with shortness of breath on its own.

The content on this page is for informational purposes only and is not a substitute for medical advice, diagnosis or treatment. You should always seek advice from a qualified healthcare provider on queries regarding a medical condition. Any action taken by you in reliance on or in connection with this content is solely at your own risk.

This content was produced in partnership with Clarityn.

2 notes

·

View notes

Text

Test - Fireplace

Would you like to buy these products?

0 notes

Text

New Gold Coast experiences you absolutely must try

Most people visit Gold Coast for the sun, sand and sea. What else does the coastal city of Queensland have to offer besides pristine beaches that stretch for miles, especially when you want to take the kids along and add variety to the itinerary? Well, you’d be surprised.

Discover a whole new side to this seaside paradise as we uncover everything from buzzing new attractions, hip hangouts and outdoor adventures you won’t want to miss.

Reconnect with nature at the Sanctuary by Sirromet

Queensland’s first vineyard glamping accommodation offers the perfect getaway experience for families, couples or anyone looking to escape the stresses of everyday life.

Reconnect with nature at this tranquil bushland stay on the grounds of Sirromet Winery. You can look forward to a fabulous stay at their safari-style tents and luxury pavilions, overlooking the stunning views of Moreton Bay. Guests will be fully-immersed in the comfort and beauty of nature, and you could teach your child a few new things about nature without compromising on comfort!

Chow down on authentic eats at Miami Marketta

Miami Marketta is Gold Coast’s hidden haven for all things gastronomic. Tucked away amidst a strip of graffiti-filled warehouses in a suburban industrial estate, the market acts as a mecca for street food and live music. Whether you’re out with your family or having a drink with your pals, the awesome vibes and friendly atmosphere is unlike any you’d find in Gold Coast.

Expose your child to the arts at this kid-friendly establishment while families eat, drink and jive to the creative mix of musical gigs, slam poetry performances and art exhibitions.

Don’t be surprised to see kids of all ages dancing at the front of the stage during live performance set on the weekends!

Mom and dads on the other hand can bond over the wide selection of local and international eats from 25 different food vendors – all in one incredible space.

https://www.miamimarketta.com/

Immerse yourself in retail bliss at Pacific Fair

Which travel itinerary would be complete without adding a shopping destination to the list? Treat yourself and the kids to a little retail therapy at the new and improved Pacific Fair Shopping Centre, which, after extensive redevelopment that completed in 2016 has since reopened with over 400 stores, each offering an expansive line-up of iconic global brands and local retailers by leading Australian designers.

Aside from fashion, the mall also offers visitors the very best in casual and upmarket dining, with more than 20 restaurants and cafés to choose from, as well as a first-class Visitor’s Lounge with luggage storage lockers, complimentary WIFI and even shower facilities for shoppers to utilise.

https://www.pacificfair.com.au/

Booze it with a view at Nineteen at The Star

Positioned 19 floors above the coastal city of Gold Coast, the opulent new dining space takes patrons on an entirely new dining experience atop the decadent rooftop bar and restaurant.

The sky-high venue takes luxury to a whole new level, with a menu of world-class dishes like the slow-cooked rock lobster bolognese and grilled Patagonian tooth fish with caramelised miso, as well as an assortment of fresh Pacific oysters and Imperial Oscietra caviar for discerning guests to feast on.

Compliment your meal with a glass of wine, expertly paired by the restaurant’s talented sommeliers, or unwind at the uber-chic lounge bar as you indulge in a cocktail under the stars.

https://www.star.com.au/goldcoast/eat-and-drink/restaurants/nineteen-at-the-star

Hold on tight onboard the new Hypercoaster at Movie World

Dubbed the tallest, longest, fastest (and undoubtedly scariest) rollercoaster in the southern hemisphere, the DC Rivals HyperCoaster at Warner Bros. Movie World is a game-changer for Australian theme parks, reaching speeds of up to 115km/h and looping through elaborate twists and turns down a 1.4km track that’s set to excite any youngster (and terrify any parent!).

Unlike other roller coasters, the HyperCoaster will also be the first to include a non-inverted loop, giving riders the opportunity to ride the whole thing backwards, without knowing when the next drop will be! Yikes!

https://www.hypercoaster.com.au/

Fly non-stop to Gold Coast

Don’t miss these hip-swinging events and seafront celebrations! Fly non-stop from Singapore to Gold Coast 5 times weekly at $149 from basic FLY fare and $389 for ScootBiz. Promotional fares from now till 17 Jun 2018. Click HERE to book your tickets now! Terms and conditions apply.

0 notes

Text

5 things you probably never knew existed in Gold Coast… until now!

Turns out there’s more to an Australian getaway than expansive beaches and sandy surf spots. Whether you’re there with friends or family, Gold Coast is never short on activities to keep you and your crew entertained.

We reveal some of the latest and best of what this iconic holiday destination has to offer that you probably never knew about!

A party every weekend at NightQuarter

A post shared by NightQuarter (@nightquarter) on Mar 18, 2018 at 1:00am PDT

NightQuarter is Gold Coast’s newest food carnival that’s home to over 60 different food vendors and exotic micro-restaurants, each serving up a collection of specialty dishes, mix-and-match eats, and drool-worthy desserts from all over the world.

What you didn’t know…

A post shared by NightQuarter (@nightquarter) on Mar 22, 2018 at 3:00pm PDT

Good food aside, the fascinating ‘shipping container city’ hosts a party every weekend. This is where local artists and touring musicians take centre stage at the NightQuarter’s outdoor event space, The Paddock, for a night of music and dance.

Beer lovers and barbecue fans get the chance to indulge in a full range of wood-fired barbecues, boutique brews and interstate beers at The Backyard Bar and Barbecue, the perfect place to relax and knock back a cold one.

http://nightquarter.com.au/

A whirlwind ride on the HyperCoaster

A post shared by Warner Bros. Movie World (@movieworldaus) on Apr 1, 2018 at 12:00am PDT

“Don’t look down!” would be appropriate advice for anyone about to embark on this beast of a machine. Warner Bros Movie World‘s new DC Rivals HyperCoaster is “the longest, tallest and fastest rollercoaster in the Southern Hemisphere”.

At 61.6 metres high, the DC-inspired HyperCoaster sends riders hurtling through 1.4 km of twists and loops at 115km/h speeds that includes a menacing 89 degree drop into the lair of the Joker – Batman’s most iconic supervillain. It’s sure to thrill parents and children alike!

What you didn’t know…

A post shared by Warner Bros. Movie World (@movieworldaus) on Mar 4, 2018 at 11:00pm PST

This thing even rides backwards. #omgyes or #awwhellno? We’ll let you decide.

https://www.hypercoaster.com.au/

Take to new heights at SkyPoint Observation Deck

A post shared by SkyPoint (@skypoint_au) on May 26, 2018 at 1:00am PDT

How high you ask? 230 metres above sea level to be exact. That’s how high you’ll be taken to when visiting the SkyPoint Observation Deck, located on the 77th floor of the Q1 tower.

Renowned for being the tallest residential building in the world, SkyPoint offers stunning views and mouth-watering fares where you and your children can indulge in both food and scenery at the city’s highest dining destination, SkyPoint bistro + bar.

What you didn’t know…

A post shared by SkyPoint (@skypoint_au) on Mar 29, 2018 at 1:00am PDT

Those with children aged 12 and above can embark on the exhilarating SkyPoint Climb (Australia’s highest external building climb), which rises a further 40 metres from the building’s peak for unparalleled 360° views of the beachside city and beyond.

https://www.skypoint.com.au/

Feel right at home at the Worendo Cottages

There’s no place like home at the Worendo Cottages as you take part in an invigorating farm stay experience set in the peaceful Lost World Valley, overlooking the stunning mountains of Lamington National Park.

The family-owned business includes cottages for both couples and families alike and offers unique outdoor activities like feeding farm animals, roasting marshmallows by the fire, winery tours, exploring the legendary views of the Widgee Valley or channelling your inner chef at the Wild Lime Cooking School.

What you didn’t know…

Perhaps the best part about the Worendo Cottages is that it’s conveniently located just 90 minutes away from Brisbane and the Gold Coast, ideal for mixing a coastal blue holiday with a dose of countryside green!

Eat, drink and interact at The Collective

A post shared by The Collective Palm Beach (@thecollectivepalmbeach) on Apr 24, 2018 at 12:29am PDT

Gold Coast’s latest dining sensation, The Collective, features five individually owned restaurants, one bar, and a rooftop bar and dining experience that includes spectacular ocean views.

Originally the old Palm Beach post office, the venue has transformed into a vibrant foodie playground, sitting over 300 people in an open outdoor setting with live musical acts, a relaxing dining area and communal tables where hungry patrons can congregate.

What you didn’t know…

A post shared by The Collective Palm Beach (@thecollectivepalmbeach) on Nov 20, 2017 at 6:09pm PST

Fussy eaters need not worry. The menu here is sure to please even the fussiest of children and foodies, offering everything from Mexican tacos to oriental stir-fry, Italian pizzas to Japanese-inspired dishes. There’s also a specialty food menu for vegetarians, vegans and those with gluten-free diets.

http://www.thecollectivepalmbeach.com.au/

What are you waiting for?!

There’s more to see and discover than you think! Experience the best of Queensland with 5 times weekly non-stop flights from Singapore to Gold Coast at affordable prices thanks to Scoot.

Use promo code ‘ILOVEGC’ to get 20% off your flight. Book by 24 June 2018 and travel by 15 November 2018. Terms and conditions apply. Click HERE to book now!

0 notes

Text

Stories from modern towkays: Financing SMEs

“If you think doing business is just waltzing into the restaurant [to make easy money], you’re wrong.”

Take it from Selva Gunapathy, owner of Royal Prata & Curries Corner, a popular prata joint along Killiney Road.

An entrepreneur with over eight years of experience running his own businesses, Selva considers manpower management his biggest hurdle.

“Sometimes they don't come. Sometimes they don’t want to work weekends, which is when the business is at its best. They come in with a long list of what they want, and when they’re hired, go on MC (medical leave).” Selva said.

To circumvent the issue of manpower, Selva proposed two solutions.

“We shortlist the hardworking ones, increasing their salary in order to retain them and reward them for overtime work.”

Another solution is to automate restaurant services.

“Customers can order their food using a self-service system. The requests will go straight to the kitchen to be prepared and that’ll cut down a lot of manpower in terms of floor staff.”

These solutions not only reduced the issue of manpower shortage but allowed Selva to refocus his energy in developing other areas within the business - including being a GrabFood merchant partner. Yet, these changes resulted in high overhead costs, and were part of the reason why he decided to take up a business loan from GrabFinance.

“It’s good when [people] can see how our business is doing on the Grab merchant app. That’s very helpful [where Grab] creates an ecosystem where they know what business owners need, whether it’s increased financial input or visibility for the brand.” He added.

There are around 220,000 Small Medium Enterprises (SMEs) in Singapore since the last government census in April 2019. Financial movements from SMEs make up a significant part of Singapore’s GDP, but these enterprises are much more susceptible to liquidation and closure.

For Shilpa, owner of Shivshil Cuisine Private Limited, having started Siam Sensation which primarily serves authentic Thai cuisine, closure almost became a reality.

“After the successful first outlet, I started a second, and subsequently a third. But last year, we encountered cash flow issues,” Shilpa shared.

Source: Siamsensation.com

“As a GrabFood partner, I was already using Grab merchant app to ease the payment process. My husband saw that GrabFinance is financing loans, and encouraged me to try to get our cash flow in check.”

Over the past five years, and with her expanding business, Shilpa turned to GrabFinance, which provided her with the cash-flow stability that she needed to get through this rocky period.

“Especially for SMEs like us, GrabFinance business loans are efficient and fast ways to help businesses when we need a quick cash flow fix.”

Whether you’re looking to increase your working capital, manage daily operating costs, purchase inventory or meet other short-term business needs, GrabFinance business loans can provide the cash flow solutions your business needs. Find out more here.

This content was produced in partnership with GrabFinance.

All information provided "as is” for informational purposes only, not intended for trading purposes or advice. Neither Yahoo! nor any of independent providers is liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. By accessing the Yahoo! site, you agree not to redistribute the information found therein.

0 notes

Text

Show her that you know her: speak from your heart this Valentine’s Day

Love comes in many forms. Whether it’s romantic attachment, a cherished friendship, or self-love, Valentine’s Day celebrates love in all shapes and sizes. It’s also the one day in the year where we get to openly express our love and appreciation to the people who bring us so much joy. Build a deeper connection with the people who matter with Pandora. Its latest collection is all about appreciating genuine love expressed from the heart.

The One and Only

She’s the one you think of when you wake up, and before you close your eyes at night. Show her that you know her with the perfect gift to symbolise your relationship. A small and simple gesture like the Love Coupon Dangle Charm is a cute idea that will undoubtedly bring a smile to her face. Leave it on her wrist, and she'll never run out of coupons for a hug or kiss on your next date!

Sometimes, love makes us do crazy things in the most unexpected ways. Express your deep love for her with the Pave Key and Padlock charm, a simple reminder that only she can hold the key to your heart. Just don’t forget to seal the night with a kiss that will quickly become an everlasting memory.

Galentine’s Day

Romance aside, girlfriends certainly deserve to be honoured on this particular date too. Remember those sleepovers, girls-only trips, and that time your bestie stepped in at the exact moment to save the day? Galentine’s Day gives you the chance to celebrate friendships and show how much you appreciate your squad. After all, It's not easy to find someone whom you can laugh and cry with, and just be yourself.

Seal this incredible friendship bond with the Theo Bear charm – a cute, cuddly bear that symbolises loyalty and love, because you know that you wouldn’t be who you are today without great friends like her.

To Me, Love, Me

You’ve put so much effort into making the people around you happy. It is time to pamper yourself and indulge in some self-love. Whether it’s cosying up with a book in hand, going for a spa, or attending a yoga class, treat yourself the way only you know best.

Most importantly, enjoy the day guilt-free, because at the heart of a healthy body is a happy soul. As a cherry on top of the cake, gift yourself the Clear Heart Solitaire ring, which will be a lovely pick-me-up on cloudier days and a reminder that you're always beautiful, inside out.

A Bracelet of Everlasting Love

If you are looking for something that’s one of a kind, check out the Pandora Moments Pave Heart Clasp Snake Chain Slider bracelet. It is an everlasting gift that will be a favourite for years to come. Hand-finished in sterling silver and set with 174 perfectly cut clear cubic zirconia that covers both the heart and tips of the chain, this unique piece is a subtle reminder of how much you appreciate her.

Simple yet elegant, the bracelet is a timeless piece that will accentuate any outfit. It echoes the sparkle of chandeliers at night and amplifies the rays of sunshine in the morning.

With so many new designs to choose from this Valentine's Day, you'll be sure to find something that will speak to her in your unique way. It’s easy to pick up a box of chocolates, but show her that you know her with a well thought out gift, and make this the most memorable Valentine’s Day for her. Visit Pandora to see the designs yourself and fall in love all over again.

This content was produced in partnership with Pandora.

0 notes

Text

Get the most from your 5D Melbourne to Adelaide road trip with this handy guide

A driving holiday is arguably the best way to experience Australia – but planning one from scratch can be daunting. That’s why we’ve put together this handy guide for a road trip between Melbourne and Adelaide. Follow the itinerary to spend five or more days exploring two of Australia’s greatest cities – and everything in between.

Day 1: Melbourne (~150km, ~2h) > Lorne (~47km, ~1h) > Apollo Bay (~87km, ~1h20mins) > Twelve Apostles (~250km, ~3h) > Mount Gambier

Upon your arrival via Scoot at night, take a good rest and collect your rental car in Melbourne the next morning or, pick up your car directly at Melbourne Airport if you are taking Scoot’s morning flight.

Head along the scenic Great Ocean Road towards the Twelve Apostles – an iconic attraction. The distinctive limestone pillars towering 45 metres above the sea are a sight to behold. Be sure to stop along the way at Lorne and Apollo Bay lookout points for the stunning views.

After a long day of driving, end your day at Mount Gambier.

Stay: Look forward to a relaxing night at the luxurious The Barn. Or, if you want accommodations with a twist, spend the night in a former prison – The Old Mount Gambier Gaol.

Day 2: Mount Gambier (~4km, ~8mins) > Umpherston Sinkhole (~98km, ~1h) > Naracoorte Caves National Park (~30km, ~18mins) > Coonawarra

Today’s drive will cover under 150km, allowing plenty of time to marvel at these locations.

Start the day early: head towards Blue Lake and take a walk along the 3.6km circumference of the crater lake in Mount Gambier. The water turns turquoise in November, and reverts to a deeper blue in February when summer ends.

A short drive from the lake will take you to Umpherston Sinkhole, a gorgeous sunken garden that was once a limestone cave.

And don’t forget to check out the Naracoorte Caves National Park, South Australia’s only World Heritage Site, which is just an hour’s drive away. Apart from discovering caves full of ancient wonders, you can also spend your time hiking (and taking photos) at the park.

Stay: Experience Bellwether’s Glamping, situated in a winery, or at Coonawarra Bubble Tents, where clear plastic "bubbles” ensure panoramic views of the stars at night.

Day 3: Coonawarra (~305km, ~3h15mins) > Monarto (~83km, ~1h) > Victor Harbor

The day starts with a three-hour drive to Monarto Safari Park, the largest open range zoo in the world outside of Africa, where you can enjoy the Lions 360 Experience. This involves walking down a tunnel into an enclosure that gives you a 360-degree view of one of Australia’s largest lion prides. The park is also home to chimpanzees, cheetahs, meerkats, giraffes and more.

Next, take an hour’s drive to Victor Harbor, a popular seaside town. Take the iconic horse-drawn tram ride over the Granite Causeway to Granite Island. And if you want to check out the penguins there, be sure to book a night walking tour with Oceanic Victor. It also operates Aquarium Swim tour that offers you the opportunity to swim with the Southern Bluefin Tuna.

Stay: Spend the night at the quaint Beach Huts Middleton (a must for your Instagram feed) or, if you’re travelling with the family, stay at one of the cosy apartments or houses owned by Victor Lifestyle Properties.

Day 4: Victor Harbor (~50km, ~40mins) > McLaren Vale (~46km, ~40mins) > Hahndorf (~33km, ~40mins) > Glenelg (~10km, ~20mins) > Adelaide

Kickstart the day at the award-winning geometric design of d’Arenberg Cube, a multi-functional building in McLaren Vale. You can also opt for a fine-dining experience against the backdrop of the rolling hills of Willunga, but be sure to book in advance. Contemporary art displays and tactile experiences await at the Alternate Realities Museum and The Blending Bench.

Then it’s time to shop! Check out the main street of Hahndorf, Australia’s oldest German settlement. It’s full of galleries and stores where you can buy jewellery and homeware – Bamfurlong Fine Crafts is a favourite for Australian-made ceramics. For lunch, tuck in to Bavarian cuisine, a specialty at the Hahndorf Inn.

If you visit between late November and April, go strawberry picking at Beerenberg Farm. The farm shop is also open all year round and is a great place to sample and purchase locally-made condiments, jams and sauces.

Continue your drive to Glenelg for one of the best sunsets in South Australia, before heading to Adelaide for the night.

Stay: For a unique accommodation experience, opt for the Fire Station Inn, Adelaide’s first fire station, converted into a boutique spa hotel.

Day 5: Adelaide > Melbourne

For those who love road trips, we recommend driving back to Melbourne and exploring other parts of South Australia that you have yet to cover.

Alternatively, you could either catch a domestic flight back to Melbourne or fly from Adelaide back to Singapore (via Scoot’s partner airline, Virgin Australia).

You may also consider extending your stay in South Australia with a 3D2N visit to Kangaroo Island. Known as the zoo without fences, it includes the Hanson Bay Wildlife Sanctuary, Remarkable Rocks, Admirals Arch and Stokes Bay. At Kangaroo Island Outdoor Action, you can also enjoy sandboarding, quad biking and kayaking.

Between 27 November and 10 December, book your all-in one-way fare to Melbourne via Scoot from only S$180 per person. Plus, get S$50* off your rental car when you book your flight with Scoot.

This content was produced in partnership with Scoot and South Australian Tourism Commission.

0 notes

Text

Overcome the pains of entrepreneurship

You have seized the opportunity of a lifetime, turning your business idea into reality.

It has been a learning journey, with many ups and downs. From pitching your business idea to inventory management to handling tough customers, you faced one challenge after another, and overcame them.

If you are ready to take your business to the next level, here are some valuable learning points from entrepreneurs and SMEs:

Ace your customer service

Make building a loyal customer base a top priority in your business.

Foster long-term relationships — loyal customers are worth 10 times the value of their first product, so help them fulfil their needs. Train your staff to always add value and go the extra mile for all your customers. It will reap handsome rewards further down the road. Inculcate a collective commitment to exemplary service, and provide them with customer management skills in tandem with product knowledge training. Empower your staff to make decisions, such as offering a discount to customers when necessary.

When it comes to improving your business, your customer is the best teacher. Ask them for feedback — good and bad. Negative feedback provides entrepreneurs and businesses with the opportunity to find out what customers look for, and are willing to pay for.

Once the feedback has been implemented, be sure to follow up with the customer. Let him know that you have listened and as a result, added the new, suggested feature, or eliminated an old one.

Platform perfect

Your choice of e-commerce software can impact the stability of your business.

From Shopify to Magento to BigCommerce, entrepreneurs and SMEs are spoilt for choice when it comes to putting their business online.

Assess your shortlisted platform’s viability by buying a similar product or trying out a similar service on it.

The best way to determine if a platform works is by using it — if you are not convinced, it will be hard to convince your customers.

As most e-commerce operators offer various fee tiers, be clear about what your business needs. Buffer for growth by choosing an easily scalable platform that fits your business model.

Navigate the regulatory landscape

As you take your business to the next level, be mindful of the regulatory landscape that may impact your investment and expansion plans.

For example, you have a top-selling sauce in your café based on a family recipe, and you hope to manufacture and bottle it to target a larger audience.

To do so, you will need to navigate a different set of regulations pertinent to that plan.

Producing it yourself may require various food licences from the Singapore Food Agency, higher staff costs and related labour regulations. You will also need to decipher the nuances of food labels and expiry dates.

On the other hand, using a central kitchen or partnering a sauce making company with additional capacity may help to reduce the regulatory headaches. The only challenge left might be for you to figure out how to keep your sauce recipe a secret, and manage issues such as quality control.

Balancing the scales

Whichever it is – an F&B business, design firm, pet accessories or fashion business you own – you will need cash to run your business efficiently. For a complete picture of your cash flow, work out your profit as well as other factors including operational, investment and financing costs.

To build up your financial reserves, create and manage a detailed budget for all business expenses. Stay on top of your business’s total income and expenditures, including fixed, variable and additional costs. Scrutinise your cash flow results regularly, and review your expenses to see where you can save.

Greenlight your business future

yahoo

Being an entrepreneur also means being able to seize opportunities when they arise.

Utilising digital tools and upgrading one’s business strategy, just as chef Shakila Sham did, can help you realise your business’ growth potential.

Ms Sham, founder of local restaurant Eatz19, highlighted that there was a need to digitise operations by partnering with delivery platform Grabfood due to lesser walk-in customers. She further invested in social marketing efforts via Facebook and Instagram and as a result now enjoys greater online customer engagement and improvement in sales.

Local streetwear label Flesh Imp has also successfully increased its business footprint after it sought funding from GrabFinance, which provides flexible, short-term financing options. According to Mr Nicholas Cho, managing director of Flesh Imp, “Grab has this process where things are streamlined and funds are disbursed fast, which is great for businesses.”

The company received an order for $1.2 million worth of sales but with the loan in place, they were able to fulfil orders on time. More than that, this new cash flow meant that Mr Cho and fellow managing director Mr Vincent Quek was able to seize the opportunity to expand their business into China.

For SMEs like Eatz19 and Flesh Imp, digitising operations and fulfilling large orders do require an eye for timely investment. Traditional bank loans may be less than ideal when it comes to such opportunities. SMEs can simply apply online and access a GrabFinance funding. Interest rates can be as low as 0.7 per cent per month, and security deposits are not required.

Visit GrabFinance to find out more.

This content was produced in partnership with GrabFinance.

All information provided "as is” for informational purposes only, not intended for trading purposes or advice. Neither Yahoo! nor any of independent providers is liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. By accessing the Yahoo! site, you agree not to redistribute the information found therein.

0 notes

Text

Navy. Your way of life. What’s the connection?

This content was produced in partnership with The Republic of Singapore Navy.

0 notes