Vivek Singh is a seasoned real estate expert with 22+ years of experience in investment, residential, and commercial properties.

Don't wanna be here? Send us removal request.

Link

0 notes

Link

#bitcoin#bitcointoday#breakingnews#cnbc#crypto#cryptonews#cryptonewstoday#cryptotoday#fed#FSIexplained#homebuyingtipsIndia#housingmarket#interestrates#leaseholdvsfreehold#news#propertyfinancingIndia#realestate#realestateeducation#realestateIndia2025#realestatemarket#realestatemarketanalysis#recession#reporate#RERAguide#stockmarket

0 notes

Link

#casarthakahuja#consultant#finance#PropertyLawLandOwnershipIndiaIndianSupremeCourtRulingPropertyRegistrationvsOwnershipRealEstateRightsLiabilityinPropertyTransactionsLegalAd#RealEstate#shorts#youtubeshorts

0 notes

Link

#commercialrealestateinvesting#compoundinterest#daveramsey#equitygrowth#financialindependence#financialliteracy#FSIexplained#fsiinsights#housingmarket#howtomakemoney#investing#leaseholdvsfreehold#oldcommercials#passiveincome#propertyinvestmenttips#realestate#realestateagent#realestateeducation#realestateinvesting#realestatemarket#realestatemarketanalysis#reraexplained#RERAguide#stephenduncombe

0 notes

Link

#2025predictions#budgetmoneydebtcash#creditcard#daveramsey#dividendinvesting#financialfreedom#housingmarket#howtoinvestinstocks#indexfunds#investmentcomparison#investmentstrategies#mutualfunds#mymutualfundsportfoliogiving80%return#passiveincome#portfoliodiversification#propertyinvestment#propertymarket#realestate#retirement#stockmarket#stocks#thedaveramseyshow#wealth#wealthbuilding#wealthmanagement

0 notes

Text

Property Registration : Can you Register a Property Without Seller?

Property Registration

Definition of Property Registration after Purchase under RERA

Property registration is a crucial step in the real estate transaction process. It involves the legal transfer of ownership from the seller to the buyer. In India, the Real Estate (Regulation and Development) Act, 2016 (RERA) has been enacted to regulate the real estate sector and protect the interests of homebuyers. Under RERA, property registration after purchase refers to the process of registering the property in the buyer's name with the appropriate government authority. This registration provides legal recognition to the buyer as the new owner of the property.

Role of Power of Attorney (PoA) in Property Registration after Purchase

Power of Attorney (PoA) is a legal document that grants a person the authority to act on behalf of another person in specific matters. In the context of property registration, a PoA can be used to facilitate the registration process even without the physical presence of the seller. With a valid PoA, the buyer can appoint a trusted representative, often referred to as an attorney, to complete the property registration process on their behalf. The attorney will have the authority to sign documents, pay fees, and complete other necessary formalities related to registration. It is important to note that the PoA must be executed and registered as per the applicable laws and regulations. The buyer should consult with a legal professional to ensure that the PoA is valid and legally enforceable.

Is it Possible to do Property Registration Without the Seller?

The answer to this question depends on the specific circumstances and the laws of the jurisdiction where the property is located. In some cases, it may be possible to register a property without the physical presence of the seller. However, it is important to understand that property registration is a legal process, and compliance with the relevant laws and regulations is essential. The buyer must follow the prescribed procedures and fulfill all necessary requirements to ensure a valid and legally recognized registration. If the seller is unable or unwilling to be physically present for registration, alternative methods such as the use of a PoA or online registration facilities may be explored. These methods can help facilitate the registration process and ensure that the buyer's rights are protected. It is advisable for the buyer to consult with a legal professional to understand the specific requirements and options available in their jurisdiction.

Frequently Asked Questions

Can you sell the property without the original sale deed? No, the original sale deed is a crucial document that establishes the legal ownership of the property. It is required for the transfer of ownership from the seller to the buyer. Without the original sale deed, it would be difficult to sell the property or register it in the buyer's name. Is the seller required to be personally present at the time of registration in Maharashtra? In Maharashtra, the seller is generally required to be personally present at the time of property registration. However, as mentioned earlier, alternative methods such as the use of a PoA may be considered to facilitate the registration process without the physical presence of the seller. What happens if the property is not registered? If a property is not registered, it may lead to various legal and practical implications. The buyer may not have legal ownership rights over the property, which can create disputes and complications in the future. Additionally, the property may not be eligible for certain benefits and protections under the law. It is strongly recommended to complete the registration process to ensure a valid and legally recognized ownership. Property Registration is a significant step in the real estate transaction process. Understanding the options available and complying with the applicable laws and regulations is essential for a smooth and legally recognized registration. Consulting with a legal professional can provide the necessary guidance and support to navigate through the complexities of property registration. https://www.youtube.com/watch?v=Wdh08U-MvQc Read the full article

0 notes

Text

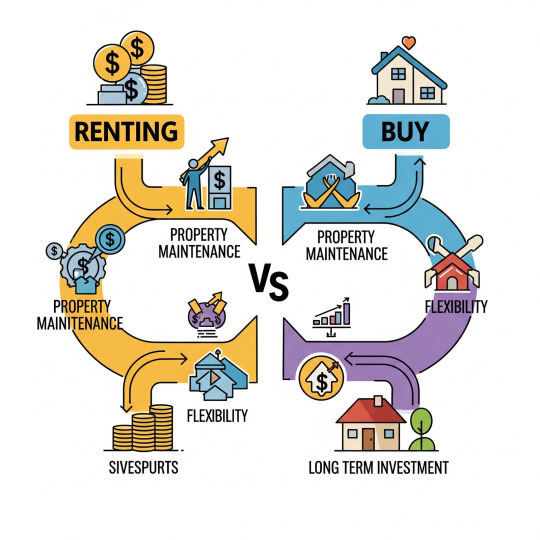

Rent vs Buy: The 4-2-0 Rule Explained!

Understanding the Rent vs Buy : 4-2-0 Rule The Rent vs Buy 4-2-0 rule is a straightforward framework designed to assist individuals in making informed decisions concerning housing, specifically when weighing the options to rent or buy a home. This rule serves as a guiding principle that simplifies the complexities of housing affodability, financial stability, and long-term investment potential. Each number in the framework presents a specific guideline that potential homeowners or renters can consider when evaluating their unique situations. The first component, "4," signifies that individuals should ideally aim for their housing expenses to be no more than 30% of their gross monthly income. This 30% threshold, when translated into practical terms, allows individuals to allocate their finances more effectively, ensuring that they maintain a balanced budget while covering all necessary living expenses. By adhering to this 4 guideline, individuals can determine their affordability limit, making it easier to choose between renting or buying based on their financial capacity. Lastly, the "0" in the Rent vs Buy 4-2-0 rule highlights the necessity of having zero debt at the time of making a housing decision. This does not suggest that one should never have debt but rather that aspiring renters or buyers should strive for a clean slate in their financial history. Doing so positions them favorably when pursuing loans or rental agreements, as lenders typically favor individuals with minimal existing financial obligations. Overall, the Rent vs Buy 4-2-0 rule serves as a practical tool that can effectively guide individuals through their rent versus buy dilemma. Rent vs Buy : Assessing Your Financial Situation Before making the pivotal decision to rent or buy a home, it is essential to thoroughly assess your financial situation. This evaluation helps in understanding your overall financial health, which plays a critical role in determining your capability to rent or buy a property. Key financial metrics such as income, savings, credit score, and debt-to-income ratio should be scrutinized. Your income is a primary factor in this assessment. A stable and sufficient income allows you to cover monthly housing payments, whether renting or owning. When examining your income, consider not only your salary but also other income sources such as bonuses or investments that can contribute to your housing budget. Savings also play a significant role in your financial assessment. Having a cash reserve can help mitigate unforeseen expenses related to a home. For prospective buyers, an adequate amount set aside for a down payment is crucial. As a general guideline, it is advisable to save at least 20% of the home price, particularly when considering the advantages of avoiding private mortgage insurance. Your credit score is another essential component. A higher credit score typically results in better mortgage rates and rental agreements. Aim to maintain a score above 700, as it demonstrates financial responsibility. If your credit score is lower, take time to improve it by paying bills on time and reducing existing debt. Lastly, assess your debt-to-income ratio, which evaluates the percentage of your income that goes toward debt payments. A lower ratio suggests better financial health and indicates that you may be more capable of affording housing expenses. Aim for a debt-to-income ratio of 36% or lower. Incorporating these factors into your financial assessment can provide clarity as you navigate the rent vs. buy decision guided by the Rent vs Buy 4-2-0 rule. Evaluating the Housing Market The decision to rent or buy a home is significantly influenced by the prevailing conditions of the housing market. Understanding these market dynamics is essential for anyone contemplating a major investment in real estate. Key factors such as home prices, rental rates, and economic forecasts directly impact the affordability and viability of either option. The Rent vs Buy 4-2-0 rule serves as a practical guideline to navigate these choices, highlighting the importance of timing and research. Currently, many regions experience fluctuating home prices, influenced by various factors such as interest rates, demand, and local market conditions. For instance, a decline in interest rates can stimulate home-buying activity, leading to increased demand and subsequently higher prices. Conversely, in markets where home prices are on the rise, renting may provide a more financially prudent option until the market stabilizes. Therefore, it is crucial to monitor these trends closely when evaluating whether to rent or buy. Rental rates also play a pivotal role in this decision-making process. In some areas, rising rental costs might suggest that purchasing a home could result in long-term savings, especially if prices are expected to continue increasing. Yet, renters should also consider the amenities and flexibility that renting provides, which may outweigh financial concerns in specific situations. Homebuyers need to assess the total cost of ownership, including maintenance, property taxes, and insurance, which can impact overall affordability. Finally, conducting thorough research on local market conditions and economic indicators is essential for making informed housing decisions. Utilizing tools such as housing market reports, neighborhood analyses, and financial calculators can empower potential renters and buyers to make strategic choices that align with the current environment. By carefully evaluating these factors within the context of the Rent vs Buy 4-2-0 rule, individuals can navigate the housing market more effectively and determine the best path for their unique circumstances. Making the Right Choice for You When it comes to deciding whether to rent or buy a home, applying the insights from the Rent vs Buy 4-2-0 rule requires careful financial assessment and consideration of market conditions. This decision is inherently personal and is influenced by numerous factors beyond mere financial calculations. To begin with, lifestyle preferences play a crucial role. Individuals who prioritize flexibility and mobility may find renting more beneficial, as it allows for easier relocation in response to job opportunities or personal circumstances. Conversely, those looking for stability and a sense of permanence might lean towards purchasing a property. Job stability is another significant consideration. The real estate market and economic conditions fluctuate, directly impacting the feasibility of buying a home. If an individual is in a stable job with a predictable outlook, investing in property may be a sound decision. In contrast, those who expect job changes or transitions might prefer the flexibility that renting offers. Future plans also need to be assessed; for couples considering starting a family or single professionals contemplating long-term commitments, home ownership might align better with their aspirations. Personal values and priorities should not be overlooked. Some individuals prioritize financial investment and home equity, valuing the potential for appreciation in property worth. Others may value experiences over possessions, prioritizing travel or personal growth over the responsibilities of homeownership. This perspective can significantly sway the decision to rent or buy. By reflecting on these individual priorities and combining them with a thorough analysis of one's financial situation and market conditions, individuals can confidently make a housing choice that best aligns with their overall life goals and needs. Ultimately, understanding personal motivations will facilitate informed and sustainable decisions in the rental versus ownership debate. https://youtu.be/anZD3J3scXI?si=Y7hzwHqbeENWmqj- Read the full article

1 note

·

View note