#BFSI Security Market History

Explore tagged Tumblr posts

Text

Staffing Solutions Creating Opportunities for Fresh Graduates in Pune

Staffing has evolved into a powerful bridge between education and employment, especially in a competitive job market where fresh graduates often struggle to secure their first professional break. With industries growing fast and companies needing skilled candidates for diverse roles, the role of staffing firms has become vital. These firms are no longer just recruitment intermediaries-they are now career enablers that guide job seekers through the transition from academic life to professional success. Fresh graduates frequently lace experience in real-world business environments, and that is where staffing solutions step in. By aligning young talent with job-ready opportunities, staffing agencies help them gain their first industry exposure, build confidence, and develop essential skills. In cities like Pune, where the demand for entry-level talent continues to rise in IT, manufacturing, BFSI, and e-commerce sectors, staffing partners serve as crucial allies. They provide access to roles that might otherwise remain hidden or competitive through traditional recruitment channels. Staffing acts as a launchpad for young professionals seeking long-term career growth.

For fresh graduates entering the job market, Staffing Companies in Pune provide the first platform to step into professional world. These companies actively connect recent pass-outs with entry-level roles in industries such as software development, marketing, operations, and customer support. Pune, being an educational hub, witnesses a high influx of graduates every year from technical and non-technical fields. Without prior experience, many of these graduates face rejection in direct hiring processes. Staffing firms act as mediators, helping them gain access to companies that prefer ready-to-learn and energetic candidates. The firms evaluate candidates based on aptitude and potential rather than only past work history. They also assist in resume building and soft skills development. By offering placements in reputed organizations on a temporary or probationary basis, these companies give graduates the chance to gain work experience and prove their capabilities. This initial exposure sets the foundation for future roles and long-term employment success.

Staffing Agencies in Pune are playing a transformative role in building the careers of fresh graduates by offering structured placement opportunities tailored to various academic backgrounds. These agencies do more than just match resumes with job descriptions-they consult with clients to understand their talent needs and identify candidates who fit both skill and attitude expectations. With a large network of corporate clients, these agencies often get first-hand knowledge of opening not advertised on public job portals. They extend their services to engineering graduates, commerce students, and even liberal arts degree holders by finding suitable internships, training-based placements, or contract-to-hire roles. For graduates with limited industry exposure, the agencies provide orientation sessions to help them understand workplace culture and expectations. By facilitating placements in Pune’s thriving tech parks and manufacturing belts, they offer young job seekers a realistic view of their chosen industries. As a result, these agencies help freshers overcome the classic challenge of having a degree but no experience.

Fresh graduates often find their way into corporate corridors through Outsourced Staffing Services in Pune, which offer scalable employment opportunities for beginners. These services provide companies with entry-level talent on a third party payroll, reducing their hiring risk and enabling cost-effective onboarding. For graduates, this opens up doors to reputed organizations that would otherwise require prior experience. Outsourced roles in IT support, sales, HR operations, and finance back-end functions are common entry points. What makes this model valuable is the learning it offers on the job. Graduates get exposed to real tasks, business tools, and cross-functional collaboration under guidance. Since companies evaluate performance over a contractual period, high-performing candidates often receive direct absorption into the company’s core team. From the graduate’s perspective, outsourced staffing eliminates barriers that come with limited references, poor interview preparation, or inconsistent academic records. It allows them to demonstrate practical aptitude, learn professional etiquette, and become career-ready while earning and evolving in the workplace.

Flexi Staffing Solutions in Pune offer fresh graduates an excellent opportunity to explore diverse roles before deciding on a long-term career path. In today’s world, where industries demand multi-skilled professionals, flexibility in early-stage employment is essential. These solutions allow graduates to engage in short-term assignments across sectors like logistics, healthcare support, content management, and technical support. The benefits are dual: employers receive a dynamic and energetic workforce for fluctuating workloads, while graduates get to discover their professional interests without the pressure of long-term commitment. For instance, a commerce graduate might take up a three-month role in accounts support and realize a passion for financial planning. In another case, an IT graduate might understand project management better through short-term assignments than theory classes. Flexi roles help build confidence, develop networks, and polish communication skills. Through these opportunities, many freshers land full-time jobs based on their performance and attitude. This model also suits students awaiting results or planning to pursue further studies.

Across industries, Staffing Solutions in Pune are driving an inclusive employment model that favors skill, adaptability, and learning mindset over prior experience. This approach is especially impactful for fresh graduates who bring new perspectives and energy to the workplace. These solutions help employers reduce the burden of onboarding and training while offering graduates a structured entry into their chosen field. As part of these solutions, staffing firms often conduct orientation programs, mock interviews, and workplace ethics sessions, which prepare candidates holistically. The job roles offered span across core technical domains, business process services, and creative fields like digital marketing and content writing. Staffing partners maintain long-term relations with clients and continuously update graduates about newer opportunities. Over time, many graduates who enter companies through staffing end up securing promotions, salary hikes, or internal job transfers. These outcomes underline the value of staffing as not just a stop-gap, but a genuine starting point for long-term career journeys in Pune’s vibrant economy.

Seven Consultancy stands as a benchmark in the staffing and recruitment industry, offering end-to-end human resource solutions with a focus on both quality and efficiency. With over 15 years of experience and a wide-reaching presence across PAN India and globally, the consultancy has built a reputation for delivering reliable staffing services. Their ability to identify top talent with the right skills and attitude ensures clients achieve their organizational goals effectively. The consultancy’s strength lies not only in temporary and contractual staffing but also in offering complete HR management solutions that streamline recruitment and workforce operations. This efficiency leads to enhanced client satisfaction and productivity. Their dedicated team of professionals provides tailored advice and compliance support across multiple industries, ensuring all hiring standards are met seamlessly. Recognized among the Best Temporary Staffing Agencies in India, Seven Consultancy consistently exceeds client expectations through personalized attention, industry expertise, and an unwavering commitment to service excellence. Whether it is for short-term roles or long-term staffing needs, they offer the right talent pool across various domains, including skilled and unskilled labor. Clients can rely on their professionalism, responsiveness, and deep understanding of market demands, making it a trusted partner for all staffing requirements.

#staffingagency#temporarystaffingservices#contractstaffingcompaniesinmumbai#payrolloutsourcing#payrolloutsourcingcompaniesinindia#thirdpartypayroll#temporary staffing services

0 notes

Text

Reshaping Wealth Management with Generative AI Assistants

A New Era in Wealth Management

Wealth management firms are adopting generative AI services to enhance the way clients interact with financial advisors, platforms, and services. AI-powered chatbots and virtual advisors are no longer futuristic tools—they’re actively helping clients make smarter investment decisions, receive portfolio guidance, and access personalized financial advice around the clock.

With generative AI enhancing communication and automation, financial institutions can offer more consistent, scalable, and data-driven wealth management experiences while reducing operational overhead.

The Rise of AI-Powered Financial Advisors

The role of generative AI in financial advisory is growing rapidly. Intelligent virtual assistants are now capable of analyzing a client’s financial profile, goals, and risk appetite to provide tailored investment recommendations. These AI-driven advisors operate continuously, removing the limitations of traditional advisor schedules.

According to PwC’s 2024 Global FinTech Report, 61% of wealth management firms are either investing in or planning to implement generative AI-based solutions by 2026. The reasons are clear: AI improves operational efficiency, enhances decision-making accuracy, and deepens customer engagement.

By utilizing generative AI solutions for BFSI, firms are reimagining how financial guidance is delivered—merging data science with conversational UX to create seamless experiences.

Personalized Portfolio Management

Generative AI chatbots can process massive volumes of real-time market data, client history, and behavioral analytics to suggest dynamic portfolio adjustments. These intelligent assistants continuously monitor asset performance and notify users when action is required—such as rebalancing a portfolio, diversifying holdings, or responding to macroeconomic shifts.

Traditional advisors may take hours or days to compile reports and make recommendations. In contrast, AI assistants can provide insights in seconds, ensuring that wealth management is not only reactive but also proactively aligned with market conditions.

McKinsey’s latest research estimates that generative AI has the potential to deliver over $200 billion in value annually to the banking sector, with wealth management being one of the fastest-growing application areas.

Enhancing Client Service with 24/7 Assistance

Client expectations have evolved. Investors, especially digital-native ones, demand round-the-clock access to their portfolios, insights, and support. AI assistants provide 24/7 service, answering queries, explaining financial terms, and even handling routine transactions like fund transfers or balance checks.

These always-available tools drastically reduce the pressure on human advisors and improve client satisfaction. According to a 2023 Deloitte survey, wealth management firms using generative AI tools report a 35% increase in client engagement and a 25% drop in customer service costs.

Whether it’s a new investor asking for ETF suggestions or a high-net-worth client reviewing performance reports at midnight, AI assistants ensure prompt and accurate responses.

Building Trust with Transparent AI

Financial advice is deeply personal and highly regulated. While generative AI solutions provide enormous value, building user trust is critical. Transparent algorithms, explainable recommendations, and clear disclaimers are essential for ethical implementation.

To support this, many organizations offering generative AI solutions for BFSI are building hybrid models combining AI with human oversight. In these models, AI handles initial queries and analysis, while certified advisors provide validation and deeper consultation.

The use of secure and compliant data handling practices—aligned with regulations such as GDPR and FINRA—also ensures data integrity and client confidentiality.

The Future of Financial Advisory is Hybrid

Generative AI is not replacing human advisors—it is redefining their role. By taking over repetitive tasks and providing data-driven insights, AI allows advisors to focus on strategic planning, high-value consultations, and relationship building.

As generative AI continues to mature, we can expect even more sophisticated applications—from voice-enabled portfolio reviews to sentiment-based investment analysis.

Forward-thinking wealth management firms leveraging generative AI services are positioning themselves to better serve clients across demographics and market conditions, combining efficiency with a personalized touch.

0 notes

Text

Agentic AI: Revolutionizing Digital Transformation in Browser, Retail and BFSI

Introduction

Industries are being changed by digital transformation, and at the head of this revolution is agentic artificial intelligence. Agentic AI functions on its own, reasoning through challenging situations and adjusting to changing surroundings, in contrast to conventional artificial intelligence, which shines in specialized tasks. For industries including browser technology, retail and Banking, Financial Services and Insurance (BFSI), its capacity to decide, data learn and cooperate with people transform it is simply astonishing. This paper looks at how agentic AI is digital transformation in these sectors, therefore releasing fresh efficiencies and possibilities.

What is Agentic AI?

Intelligent systems acting independently to achieve goals leveraging advanced reasoning, contextual awareness and adaptability are called agentic AI. These systems allow proactive problem-solving and decision-making above and above rule-based automation. For instance, agentic AI can personalize shopping trips in retail, enhance user experiences in browsers or identify fraud in real-time in BFSI. Autonomy, scalability and capacity to fit with already existing digital infrastructures define its main advantages.

Core Capabilities of Agentic AI

Autonomous Decision-Making: Executes tasks without constant human input.

Contextual Adaptability: Adjusts to real-time data and changing conditions.

Seamless Integration: Enhances existing systems with minimal disruption.

Human-AI Collaboration: Augments human expertise with AI-driven insights.

Agentic AI in Browser Technology

The gateway to the digital world is browsers agentic AI is revolutionizing their operation to improve user experiences and streamline corporate processes.

Key Applications

Personalized User Experiences: Agentic AI uses browsing behavior to provide personalized content including modified search results or adaptive interfaces.

Intelligent Automation: AI agents handle form-filling, tab organizing or predictive caching—and thereby enhance speed and usability—intelligent automation.

Enhanced Security:Users are shielded from phishing or malware attacks by real-time threat detection and response.

Voice and Visual Interaction: AI-driven assistants allow direct in-browser natural language queries and image-based searches using voice and visual interaction.

Impact

By lowering user friction and allowing developers to build smooth, safe and customized digital experiences, Agentic AI enables browsers to be more intelligent and more intuitive. For example, xAI's Grok shows how artificial intelligence may improve immediate problem-solving in browser settings.

Agentic AI in Retail

The retail sector is undergoing a digital overhaul, with agentic AI driving hyper-personalization and operational excellence.

Key Applications

Personalized Customer Journeys: AI agents analyze purchase history, preferences, and browsing patterns to offer tailored product recommendations and promotions.

Inventory Optimization: Agentic AI predicts demand, streamlines supply chains, and reduces overstock or stockouts.

Customer Service Automation: AI-powered chatbots and virtual assistants handle inquiries, returns, and support 24/7, improving customer satisfaction.

Dynamic Pricing: Real-time market analysis enables adaptive pricing strategies to maximize revenue.

Impact

According to a 2024 Gartner report, 80% of retailers adopting AI-driven personalization see increased customer retention. Agentic AI empowers retailers to deliver seamless omnichannel experiences while optimizing costs and boosting loyalty.

Agentic AI in BFSI

The BFSI sector is leveraging agentic AI to enhance security, streamline operations, and improve customer trust in a highly regulated environment.

Key Applications

Fraud Detection and Prevention: AI agents watch transactions in real time, spotting irregularities and highly accurately flagging dubious conduct.

Automated Compliance: Agentic AI guarantees compliance with regulatory requirements by autonomously report generation and data analysis.

Personalized Financial Services:From robo-advisors to customized loan possibilities, artificial intelligence improves client experiences with data-driven insights.

Risk Management: AI models evaluate investment prospects, market trends and credit risks, therefore fostering proactive decision-making.

Impact

According to a Deloitte study from 2025, AI adoption in BFSI could raise risk detection and lower operational expenses by as much as 25%. Real-time vast data processing by Agentic AI guarantees quicker, more secure and customer-oriented services.

Challenges and Considerations

While agentic AI offers transformative potential, it comes with challenges:

Ethical Concerns: Bias in AI decision-making or data privacy issues must be addressed to maintain trust.

Integration Complexity: Legacy systems in retail and BFSI may require significant upgrades to support agentic AI.

Skill Gaps: Organizations need skilled professionals to deploy and manage these systems effectively.

To overcome these, businesses should prioritize ethical AI frameworks, invest in interoperable technologies, and upskill their workforce.

How Businesses Can Adopt Agentic AI

To harness agentic AI for digital transformation, organizations should:

Assess Needs: Identify high-impact areas like customer experience or operational efficiency.

Start Small: Pilot AI projects in specific use cases, such as chatbots or fraud detection.

Partner with Experts: Collaborate with firms like Agami Technologies to design and deploy tailored AI solutions.

Upskill Teams: Train employees to work alongside AI systems, focusing on both technical and ethical skills.

Monitor and Iterate: Continuously evaluate AI performance and refine strategies based on real-world outcomes.

The Future of Agentic AI

Agentic AI will affect browser technology, retail, and BFSI increasingly as it develops. Advanced natural language models and real-time analytics among other innovations will further improve automation and personalization. Early adopters of agentic artificial intelligence will have a competitive advantage and provide better experiences and business resilience.

Conclusion

Redefining how browsers, retail and BFSI work, Agentic AI is a catalyst for digital transformation. Embracing its features helps companies reveal fresh degrees of security, customization and efficiency. Whether you are a retailer trying to make customers happy, a BFSI company increasing trust or a technology vendor improving browser performance, agentic AI is your key to staying ahead in the digital age. Start looking into its possibilities right now to create a more linked tomorrow.

0 notes

Text

North America Employee Monitoring Solution Market Trends, Size, Segment and Growth by Forecast to 2030

The North American employee monitoring solution market is experiencing significant growth, projected to increase from US$ 150.13 million in 2018 to US$ 242.0 million by 2027, demonstrating a Compound Annual Growth Rate (CAGR) of 5.6% during this period.

Why Companies Use Employee Monitoring Solutions

Employee monitoring solutions are increasingly adopted by organizations as a surveillance tool to track various activities, including:

Email and phone activity

Browse history and overall internet usage

Time spent on social media

Remote device access

This monitoring helps companies detect early signs of potential insider threats and prevent data leaks. Industries handling sensitive data, such as BFSI (Banking, Financial Services, and Insurance), IT and telecom, and the Government sector, are particularly vulnerable to insider attacks. The financial services industry, followed by consumer, retail, wholesale, and power and utilities sectors, faces the highest exposure to cyber-breaches and insider misuse. 📚Download Full PDF Sample Copy of Market Report @ https://www.businessmarketinsights.com/sample/TIPRE00007114

Impact of Social Media on Employee Monitoring

While social media is vital for business communication and marketing, open access can pose risks to organizational productivity and data security. Employees might inadvertently share sensitive information, and these platforms can be exploited by hackers for phishing and other attacks. To mitigate these risks and optimize enterprise resource allocation, organizations are increasingly implementing employee monitoring solutions.

The United States: A Key Driver in the Market

The United States currently leads the North American employee monitoring solution market in terms of adoption. As a technologically advanced nation with a high rate of technology adoption across various sectors, the U.S. is home to diverse industries and is a global leader in high-technology innovation. The presence of numerous well-established market players across different industries further fuels the demand for employee monitoring solutions in the country.

North America Employee Monitoring Solution Strategic Insights

Strategic insights for the North America Employee Monitoring Solution provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

Market leaders and key company profiles Awareness Technologies Inc

Birch Grove Software, Inc.,

EfficientLab, LLC

Ekran Systems, Inc.

iMonitor Software

Netsoft Holdings, LLC

SentryPC

StaffCop

Teramind, Inc.

Veriato Regional Insights for the North America Employee Monitoring Solution Market

The geographic scope of the North America Employee Monitoring Solution market encompasses the distinct regions where businesses operate and compete. Understanding regional differences—such as varying consumer preferences, economic landscapes, and regulatory requirements—is essential for creating effective, localized strategies. For instance, demand may differ based on industry norms or state-level compliance mandates. By identifying underserved areas and adapting solutions to meet specific regional needs, companies can enhance market penetration. A well-defined regional focus supports more efficient resource allocation, tailored marketing efforts, and stronger competitive positioning, ultimately driving growth in targeted markets across North America.

Can you see this our reports Europe Sports Nutrition Market – https://postyourarticle.com/europe-sports-nutrition-market-trends-size-segment-and-growth-by-forecast-to-2030-4/

Europe Natural Food Colors Market – https://businessmarketinsightsnews.hashnode.dev/europe-natural-food-colors-market-trends-size-segment-and-growth-by-forecast-to-2030

North America Contract Research Organization (CRO) Market – https://npr.eurl.live/blog/north-america-contract-research-organization–cro–market-trends–size–segment-and-growth-by-forecast-to-2030 North America Contract Logistics Market – https://github.com/businessmarketinsights985/business-market-insights/issues/167 Europe Medical Cannabis Market – https://www.linkedin.com/feed/update/urn:li:activity:7333480434770644993?utm_source=share&utm_medium=member_desktop&rcm=ACoAAFnAfesBPBegb3I50Jdly9_3GfM-XJp-Z-4 About Us: Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Défense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications Author’s Bio Akshay Senior Market Research Expert at Business Market Insights

0 notes

Text

Gridlines: Powering Seamless Digital Verification for India’s BFSI Sector

India’s BFSI (Banking, Financial Services, and Insurance) landscape is undergoing a digital transformation at an unprecedented pace. With users expecting instant services and regulators demanding rigorous compliance, companies across the board — from neobanks and NBFCs to insurers and wealth platforms — face a critical challenge: how to deliver fast, secure onboarding and verification while minimizing risk.

This is where Gridlines steps in — a powerful digital verification API suite built for the BFSI industry. With 150+ plug-and-play APIs, Gridlines enables real-time identity verification, KYC/KYB checks, and contextual underwriting — helping businesses scale securely and efficiently.

Why Digital Verification Needs a Smarter Solution

Manual verification methods are not just time-consuming; they’re also prone to errors, drop-offs, and compliance issues. Traditional processes often involve document uploads, in-person visits, or fragmented data checks — all of which hamper the user experience.

Gridlines solves this by offering end-to-end digital verification tools that plug directly into existing onboarding flows. The result? Instant identity confirmation, better risk profiling, and a seamless user journey — all while meeting India’s evolving regulatory standards.

Core Use Cases: Gridlines in Action Across BFSI

1. Digital Onboarding: Seamless, Secure, and Swift

Challenge: Lengthy manual onboarding processes lead to high user abandonment rates. Solution: Gridlines digitizes every step with:

Aadhaar, PAN, Passport, and Voter ID verification

Face match and liveness detection

RBI-compliant Video KYC

Mobile-Aadhaar/PAN linking

Instant bank account verification

With these tools, companies reduce onboarding times from days to minutes — while staying compliant.

2. Lending: Contextual Underwriting for Salaried & Self-Employed

Challenge: Different borrower profiles demand unique risk assessment models. Solution: Gridlines provides segment-specific APIs:

For Salaried Applicants:

PAN-UAN linking

EPFO passbook and employment history

Video KYC

For Self-Employed Applicants:

PAN-GSTIN mapping

GST filing data

Bank statement analysis

This ensures credit decisions are based on reliable, real-time financial indicators.

3. Digital Banking: Compliance-First, User-Ready

Challenge: Banks must meet regulatory requirements without compromising UX. Solution: Gridlines ensures end-to-end compliance through:

Aadhaar, PAN, Passport verification

AML and sanctions screening

Face match and liveness detection

DIN/directorship verification

Secure Video KYC

This builds trust from day one while reducing fraud risks.

4. Insurance: Underwrite & Settle with Confidence

Challenge: Delays in identity/risk verification slow down policy issuance and claims. Solution: Gridlines accelerates the process with:

Identity and address verification

Bank account validation for claim payouts

Court and criminal records check

Income and employment verification

Insurers can now onboard customers faster and settle claims without friction.

5. WealthTech: Personalization with Verified Financial Data

Challenge: Creating personalized financial journeys often requires manual data entry. Solution: Gridlines helps WealthTech platforms access verified financial signals directly:

EPFO/UAN data for retirement planning

PAN-DIN mapping for investor profiling

Bank statement insights for investment suitability

This ensures accurate recommendations and a tailored user experience.

What Makes Gridlines the BFSI Sector’s Preferred API Suite?

With over 3,000+ financial institutions relying on Gridlines, here’s what sets it apart:

Fast API integration & SDKs: Easily embed verification flows into any digital journey.

Security you can trust: ISO 27001 and SOC 2 Type II certifications.

Real-time and bulk data processing: Built for high-scale BFSI environments.

Plug-and-play architecture: Reduce go-to-market time dramatically.

Startup-focused initiatives: Gridlines’ dedicated StartUp Program accelerates innovation for early-stage fintechs.

Final Word: Build Smarter, Verify Faster with Gridlines

Whether you're a lender looking to streamline underwriting, a neobank striving for smoother onboarding, or an insurer aiming to process claims faster — Gridlines provides the digital foundation you need to move fast without breaking compliance.

Its expansive API suite, robust security, and deep BFSI focus make Gridlines the verification partner of choice for future-ready financial institutions.

0 notes

Text

Employment Background Screening With Criminal Record

A poor personnel selection choice or an unchecked business alliance can damage more than business finances because it impairs organizational reputation. Your precise employee background screening process operates under strict confidentiality to maintain correct employee appointments throughout every business operation.

Get the Truth, Before It Costs You

Establishing a reputation requires a prolonged effort, while the loss of it can occur instantaneously. Through our criminal record check in India service, you obtain verified information about litigation history and potential legal warnings, as well as public record deviations, before these factors develop into liabilities. Your organization receives accurate, real-time information, surpassing basic screening methods for protection.

Verify Before You Trust, Every Time

Professional resumes hide information which may turn out to be an unexpected truth. Employment background screening services from us offer extensive education verification alongside past work validation and ID authentication, and references checks for safely hiring intelligent candidates.

Navigate Risk with Informed Precision

Organizations risk high expenses from blind spots in background intelligence when they invest in mergers or onboard critical vendors. The system of conducting comprehensive criminal record checks in India helps professionals uncover historical offenses and legal history, which enables them to make well-informed, appropriate action choices.

Secure Your Workplace with Smarter Hiring

Tens of thousands of enterprises, including companies from different stages of development, trust us to provide risk intelligence solutions. Our company positions itself as the employment background screening industry leader by transforming our service offerings to match your operational size and industry sector, as well as your specific risk factors, so you can maintain operational integrity and regulatory compliance in all your markets.

Every Sector. Every Profile. Every Threat.

The investigation services we provide span across Manufacturing, Aviation, BFSI, IT/ITeS, Logistics, Healthcare and Power, along with the Sports sectors and many more. Your decision-making foundation rests on facts through which we help you select both executive leaders and vital vendors at any scale.

From Gut Feelings to Verified Facts

Your business cannot rely solely on suspicions to remain protected, but it depends on factual evidence. Tracking down the truth becomes achievable by using our employee background screening in combination with forensic analysis and due diligence evaluations. Our organization ensures you stay ahead of risks that stem from internal fraud as well as external security challenges.

Your Corporate Shield Against Hidden Threats

Trust is earned—but verify anyway. Your hiring process, along with partnerships and investments, will not only appear favorable through the right investigative partner but they will become truly beneficial. Our specialists will create clarity from challenging situations while turning risks into advantageous opportunities.

#employment background screening#criminal record check in India#Background verification company in India#background check in India#employee background verification companies#background verification#employee background check#employment pre screening

1 note

·

View note

Text

Enhancing Customer Experience in BFSI with Generative AI

In the competitive world of Banking, Financial Services, and Insurance (BFSI), delivering an exceptional customer experience is crucial for retaining clients and attracting new ones. Generative AI in BFSI is playing a transformative role in revolutionizing how financial institutions interact with their customers, offering personalized, efficient, and seamless experiences. This blog explores the various ways Generative AI is enhancing customer experience in BFSI, the benefits it brings, and the strategies for effective implementation.

What is Generative AI in BFSI?

Generative AI refers to advanced artificial intelligence models capable of creating new content, data, or insights by learning from existing information. In the BFSI sector, Generative AI is harnessed to analyze customer data, predict behaviors, and generate personalized interactions, thereby elevating the overall customer experience.

Innovative Applications of Generative AI in Customer Experience

Generative AI offers a multitude of applications that enhance customer experience in BFSI:

1. Personalized Financial Advisory

Generative AI can analyze a customer’s financial history, spending patterns, and investment preferences to provide tailored financial advice. This personalization ensures that customers receive relevant recommendations that align with their financial goals.

Benefits:

Customized Solutions: Offer financial products and services that meet individual customer needs.

Proactive Engagement: Anticipate customer requirements and offer timely advice, fostering trust and loyalty.

Enhanced Decision-Making: Empower customers with data-driven insights to make informed financial decisions.

2. Intelligent Chatbots and Virtual Assistants

AI-powered chatbots and virtual assistants leverage Generative AI to handle customer queries, provide account information, and assist with transactions in real-time. These intelligent systems offer a seamless and efficient customer support experience.

Benefits:

24/7 Availability: Provide round-the-clock support, ensuring customers can access assistance anytime.

Instant Responses: Deliver quick and accurate answers to customer inquiries, reducing wait times.

Scalability: Handle multiple customer interactions simultaneously, improving service efficiency during peak times.

3. Automated Content Generation

Generative AI can create personalized content for marketing, onboarding, and customer education purposes. From generating tailored emails to crafting informative blog posts, AI ensures that content is relevant and engaging.

Benefits:

Consistency: Maintain a consistent brand voice and message across all communication channels.

Efficiency: Automate content creation, saving time and resources for marketing teams.

Engagement: Produce high-quality, personalized content that resonates with customers and drives engagement.

4. Fraud Prevention and Security Enhancements

Generative AI enhances security measures by analyzing transaction patterns and identifying anomalies that may indicate fraudulent activities. This proactive approach not only protects customers but also strengthens their trust in financial institutions.

Benefits:

Real-Time Detection: Identify and prevent fraudulent transactions as they occur, minimizing financial losses.

Adaptive Learning: Continuously learn from new data to stay ahead of evolving fraud tactics.

Enhanced Security: Provide robust security features that safeguard customer information and transactions.

Benefits of Generative AI in Enhancing Customer Experience

Implementing Generative AI in BFSI brings numerous benefits that significantly enhance the customer experience:

1. Personalization at Scale

Generative AI enables financial institutions to deliver personalized experiences to a large customer base. By analyzing vast amounts of data, AI can tailor interactions and offerings to individual preferences, fostering a more meaningful connection with customers.

2. Improved Efficiency and Responsiveness

AI-driven systems automate routine tasks and provide instant responses to customer queries. This improved efficiency ensures that customers receive timely and accurate assistance, enhancing their overall satisfaction.

3. Data-Driven Insights

Generative AI provides deep insights into customer behavior and preferences by analyzing complex data patterns. These insights help financial institutions understand their customers better and develop strategies that align with their needs and expectations.

4. Enhanced Trust and Loyalty

By delivering consistent, reliable, and personalized experiences, Generative AI helps build trust and loyalty among customers. A positive customer experience leads to higher retention rates and encourages customers to advocate for the brand.

Strategies for Effective Implementation of Generative AI in BFSI

To maximize the benefits of Generative AI in enhancing customer experience, BFSI institutions should adopt the following strategies:

1. Invest in Quality Data

The effectiveness of Generative AI depends on the quality of data it processes. Ensure that data is accurate, comprehensive, and up-to-date to enable AI models to generate meaningful insights and recommendations.

2. Integrate AI with Existing Systems

Seamlessly integrate Generative AI solutions with existing IT infrastructure to ensure smooth operations and data flow. This integration enhances the overall efficiency and effectiveness of AI-driven customer interactions.

3. Focus on User-Centric Design

Design AI-driven tools with the end-user in mind. Ensure that interfaces are intuitive, user-friendly, and aligned with customer expectations to provide a seamless experience.

4. Ensure Compliance and Security

Adhere to regulatory standards and implement robust security measures to protect customer data. Compliance with data protection laws and ethical AI practices is crucial for maintaining customer trust and avoiding legal repercussions.

5. Continuous Monitoring and Improvement

Regularly monitor the performance of Generative AI systems and gather feedback from customers to identify areas for improvement. Continuous refinement ensures that AI solutions remain effective and aligned with evolving customer needs.

Conclusion

Generative AI in BFSI is transforming the way financial institutions interact with their customers, offering personalized, efficient, and secure experiences. By leveraging Generative AI, BFSI organizations can enhance customer satisfaction, build trust, and drive long-term loyalty. As the technology continues to advance, its role in shaping the future of customer experience in BFSI will only become more significant, paving the way for innovative and customer-centric financial services.

0 notes

Text

Why VoIP Matters for the BFSI Sector: Enhancing Security and Client Engagement

Over the years, the Banking, Financial Services, and Insurance (BFSI) sector has undergone significant transformations, driven by technological advancements and shifting customer expectations. One such technology that has revolutionized the way BFSI organizations operate is Voice over Internet Protocol (VoIP). VoIP has become an indispensable tool for BFSI institutions, enabling them to enhance security, improve client engagement, and streamline their operations.

Security is a top priority for BFSI organizations, and VoIP technology has proven to be a game-changer in this regard. Traditional phone systems are vulnerable to hacking and eavesdropping, which can compromise sensitive customer data. VoIP, on the other hand, offers advanced security features such as encryption, secure authentication, and firewalls, ensuring that all voice communications are protected from unauthorized access. This enables BFSI institutions to safeguard their customers' confidential information and maintain trust.

Besides security, VoIP also enables BFSI organizations to improve client engagement and provide personalized services. With VoIP, financial institutions can integrate their communication systems with customer relationship management (CRM) software, allowing them to access customer data and history in real-time. This enables them to offer tailored solutions, resolve issues promptly, and enhance overall customer experience. Moreover, VoIP's video conferencing capabilities enable remote meetings and consultations, making it easier for customers to interact with financial advisors and experts.

Another significant advantage of VoIP for BFSI institutions is its ability to facilitate seamless communication and collaboration among employees. With VoIP, teams can communicate effectively, regardless of their location, using features such as video conferencing, instant messaging, and file sharing. This enhances productivity, reduces response times, and enables faster decision-making. Furthermore, VoIP's scalability and flexibility make it an ideal solution for BFSI organizations with multiple branches or remote workers.

In addition to these benefits, VoIP also offers cost savings and increased efficiency for BFSI institutions. By leveraging the internet to make voice calling, VoIP eliminates the need for traditional phone lines and reduces long-distance call charges. This results in significant cost savings, which can be invested in other areas of the business. Moreover, VoIP's automated features, such as auto-attendants and call routing, reduce the need for manual intervention, freeing up staff to focus on more critical tasks.

All things considered, VoIP technology has become an necessary component of the BFSI sector, offering a range of benefits that enhance security, client engagement, and operational efficiency. As the BFSI sector continues to evolve, it is likely that VoIP will play an increasingly important role in shaping the future of financial services. By adopting VoIP solutions, BFSI institutions can stay ahead of the curve, improve customer satisfaction, and maintain a competitive edge in the market.

0 notes

Text

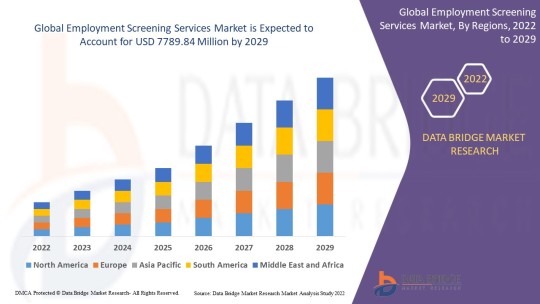

Employment Screening Services Market Size, Share, Trends, Global Demand, Growth and Opportunity Analysis

"Employment Screening Services Market Report has incorporated the analysis of different factors that augment the markets growth. It has various sections that provide the scope of different segments and applications that can potentially influence the market in the future. This market report is a thorough and professional report that focuses on primary and secondary drivers, market share, leading segments and geographical analysis. Painstakingly analysed market segmentation aspect provides a clear idea about the product consumption based on numerous factors ranging from type, application, deployment model, end user to geographical region.

Access Full 350 Pages PDF Report @

**Market Analysis of Employment Screening Services Market**

The global employment screening services market is expected to witness significant growth from 2021 to 2029, driven by the increasing demand for background verification services to ensure a safe and secure workplace environment. The market is segmented based on various factors that play a crucial role in shaping its dynamics during this period:

**On the basis of Service Type:** - Criminal Background Checks - Education & Employment Verification - Credit History Checks - Drug & Health Screening - Others

**On the basis of Application:** - Recruitment - Talent Management - Security & Compliance - Others

**On the basis of End-user:** - BFSI - IT & Telecom - Healthcare - Retail - Others

**Market Players in the Employment Screening Services Market:** - ADP, LLC - Experian Information Solutions, Inc. - First Advantage - HireRight, LLC - Paychex, Inc. - Sterling Infosystems Inc. - Infosys Limited - Capita plc - Triton - REED - DataFlow Group - GoodHire - Transparent Screenings - Verifile Limited

With the increasing emphasis on comprehensive employee background verification in organizations across various sectors, the market is witnessing a growing number of players offering specialized services to cater to the diverse needs of employers. Additionally, the rising concerns related to fraud, theft, and workplace safety further drive the demand for employment screening services globally. The integration of advanced technologies such as artificial intelligence and machine learning in screening processes is also expected to propel market growth during the forecast period. Overall, the employment screening services market is poised for substantial expansion, presenting lucrative opportunities for key market players to capitalize on the growing demand.

[Source: https://www.databridgemarketresearch.com/reports/global-employment-screening-services-market]The employment screening services market is experiencing a notable upsurge due to the escalating need for robust background verification procedures across diverse industries. The primary driver behind this surge is the imperative requirement for maintaining a safe and secure work environment by scrutinizing the criminal backgrounds, educational qualifications, employment history, credit records, and health statuses of potential employees. These meticulous screening processes are imperative for organizations to mitigate risks associated with fraudulent activities, theft, and non-compliance with regulatory standards. Moreover, the employment screening services market is witnessing a radical transformation due to the adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in the screening processes. These technological integrations offer enhanced accuracy, efficiency, and scalability, thereby driving market growth and optimization of screening procedures for organizations.

The market segmentation based on service type reflects a comprehensive framework for the varied screening services offered to organizations. Criminal background checks, education & employment verification, credit history checks, drug & health screenings, and other specialized services cater to the distinct needs of different industries and sectors. By offering a tailored suite of services, screening service providers can effectively address the specific requirements of their clients, ensuring thorough due diligence in the hiring process. This customization is particularly crucial in industries such as BFSI, IT & Telecom, healthcare, and retail where stringent regulatory requirements and security protocols necessitate stringent background verification procedures for personnel recruitment and management.

The application-based segmentation of the market delineates the diverse uses of employment screening services across recruitment, talent management, security & compliance, and other operational facets within organizations. The strategic integration of screening services in talent acquisition processes ensures the selection of qualified candidates with clean backgrounds, thereby reducing the risk of potential threats to the organization's reputation and operational integrity. Furthermore, the emphasis on security and compliance underscores the pivotal role of background verification in maintaining a transparent and ethical workplace culture, aligning with industry standards and best practices.

The competitive landscape of the employment screening services market is characterized by a mix of established players and emerging entrants**Global Employment Screening Services Market, By Services (Background Check, Verification, and Medical & Drug Testing), End-Use Industry (IT & Telecom, BFSI, Government Agencies, Travel & Hospitality, Manufacturing, Retail, Healthcare, and Others), and Organization Size (SMEs and Large Enterprise) – Industry Trends and Forecast to 2029**

The employment screening services market is witnessing a paradigm shift towards integrated and specialized services to meet the evolving demands of organizations across various industries. The market players are increasingly focusing on offering a diverse range of services such as background checks, verification services, and medical & drug testing to provide a holistic approach to employee screening. This trend is driven by the growing need for comprehensive background verification to ensure regulatory compliance, mitigate risks, and enhance workplace safety.

In terms of end-use industries, the employment screening services market caters to a wide range of sectors including IT & Telecom, BFSI, Government Agencies, Travel & Hospitality, Manufacturing, Retail, Healthcare, and others. Each industry has unique requirements and regulatory standards, necessitating customized screening solutions to address specific needs. For instance, the BFSI sector requires stringent background checks to maintain financial integrity, while healthcare organizations prioritize health screenings to ensure patient safety. The diverse end-use industries underscore the market's versatility and adaptability to meet sector-specific demands.

Moreover, the market segmentation based on organization size differentiates services targeting Small and Medium Enterprises (SMEs) from those tailored for Large Enterprises. SMEs often require cost-effective

Key Coverage in the Employment Screening Services Market Report:

Detailed analysis of Global Employment Screening Services Market by a thorough assessment of the technology, product type, application, and other key segments of the report

Qualitative and quantitative analysis of the market along with CAGR calculation for the forecast period

Investigative study of the market dynamics including drivers, opportunities, restraints, and limitations that can influence the market growth

Comprehensive analysis of the regions of the Employment Screening Services industry and their futuristic growth outlook

Competitive landscape benchmarking with key coverage of company profiles, product portfolio, and business expansion strategies

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global Employment Screening Services Market Landscape

Part 04: Global Employment Screening Services Market Sizing

Part 05: Global Employment Screening Services Market Segmentation by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Browse Trending Reports:

Fraxiparine Market Polycythemia Vera Treatment Market Pleurisy Market Low Calorie Food Market Yoga Apparel Market Folic Acid Market Chemicals Market Oyster Mushroom Market Intraoral Cameras Market Media Monitoring Tools Market Ayurvedic Personal Products Market Surgery Medical Bandage Market Non Starch Polysaccharides In Animal Feed Market Infused Dried Fruit Market More Electric Aircraft Market Flowers And Ornamental Plants Market Groove Pancreatitis Treatment Market Polyvinyl Alcohol Pva Market Tumor Tracking Systems Market Laminated Veneer Lumber Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

0 notes

Text

Version Control Systems Market 2024 | Growth, Report, Demand and Forecast Till 2032

IMARC Group's report titled "Version Control Systems Market Report by Type (Centralized Version Control Systems (CVCS), Distributed Version Control Systems (DVCS)), Deployment Type (On-premises, Cloud-based), Enterprise Size (Large Enterprises, Small and Medium Enterprises), End Use (BFSI, Education, Healthcare and Life Sciences, IT and Telecom, Retail and CPG, and Others), and Region 2024-2032", offers a comprehensive analysis of the industry, which comprises insights on the global version control systems market report. The global market size reached US$ 739.9 Million in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,525.4 Million by 2032, exhibiting a growth rate (CAGR) of 8.37% during 2024-2032.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/version-control-systems-market/requestsample

Factors Affecting the Growth of the Version Control Systems Industry:

Technological Advancements:

Modern version control system (VCS) solutions are equipped with features that enable developers to manage code more efficiently. This includes branching, merging, and conflict resolution tools that make collaboration smoother. In line with this, VCS incorporates continuous integration/continuous deployment (CI/CD) pipelines to enhance their utility. Furthermore, technological innovations benefit in providing real-time collaboration, enhanced visualization of code history, and improved user interfaces are outcomes. Additionally, advancements are making VCS more user-friendly, efficient, and adaptable to the ever-changing demands of modern software development.

Rising Remote Work Settings:

The escalating demand for VCS on account of the increasing remote work settings is contributing to the growth of the market. Apart from this, the rising need for seamless collaboration on software projects, as organizations are adapting to distributed work environments, is bolstering the market growth. Additionally, VCS systems enable geographically dispersed development teams to work together effectively by providing a centralized repository for code. VCS tools also facilitate version tracking, code sharing, and real-time updates, ensuring that team members can access and contribute to projects from anywhere in the world.

Increasing Focus on Open Source Solutions:

The rising focus on open source VCS due to their cost-effectiveness, flexibility, and robust feature sets is impelling the growth of the market. In addition, open-source solutions are accessible to enterprises of all sizes and cater to a wide range of development needs. Developers and organizations benefit from continuous improvements, bug fixes, and a wealth of documentation. This collaborative nature encourages innovation and ensures that open-source VCS tools remain competitive and up-to-date. Furthermore, open-source VCS solutions are platform-agnostic, allowing developers to work with different operating systems and development environments.

Leading Companies Operating in the Global Version Control Systems Industry:

Amazon.com Inc.

Atlassian Corporation Plc

GitHub Inc. (Microsoft Corporation)

International Business Machines Corporation

LogicalDOC

Luit Infotech

Micro Focus

Perforce Software Inc.

PTC Inc.

Unity Software Inc.

WANdisco plc.

Wildbit LLC

Version Control Systems Market Report Segmentation:

By Type:

Centralized Version Control Systems (CVCS)

Distributed Version Control Systems (DVCS)

Centralized version control systems (CVCS) represent the largest segment as they offer enhanced security and access control that is crucial for organizations with sensitive data.

By Deployment Type:

On-premises

Cloud-based

On-premises hold the biggest market share, which can be attributed to the rising focus on data security, control, and compliance.

By Enterprise Size:

Large Enterprises

Small and Medium Enterprises

Large enterprises account for the largest market share due to the growing need to manage complex codebases and ensure smooth collaboration.

By End Use:

BFSI

Education

Healthcare and Life Sciences

IT and Telecom

Retail and CPG

Others

IT and telecom exhibit a clear dominance in the market on account of the increasing complexity and scale of software projects.

Regional Insights:

North America: (United States, Canada)

Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America: (Brazil, Mexico, Others)

Middle East and Africa

North America enjoys the leading position in the version control systems market, which can be accredited to the rising adoption of advanced technologies, such as cloud computing, artificial intelligence (AI), and machine learning (ML).

Global Version Control Systems Market Trends:

The escalating demand for VCS due to the increasing number of data breaches is propelling the growth of the market. In addition, organizations are focusing on code security and compliance. VCS systems provide features like access control, authentication, and audit trails, which are crucial for maintaining the integrity and security of code repositories. The rising adoption of development and operations (DevOps) methodologies in software development is impelling the market growth. Furthermore, VCS tools allow teams to manage code changes efficiently, automate testing, and ensure seamless collaboration among development, testing, and operations teams.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the companys expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

0 notes

Text

Leveraging Big Data Analytics for Data-Driven Decision Making in BFSI

Leveraging Big Data Analytics for Data-Driven Decision Making in the Banking, Financial Services, and Insurance (BFSI) sector is crucial in today's data-driven world. Big Data Analytics can help BFSI organizations extract valuable insights, reduce risks, and enhance customer experiences. Here's how this can be achieved:

Fraud Detection and Prevention: Big Data Analytics can be used to detect and prevent fraudulent activities in real-time. By analyzing transaction data, customer behavior, and historical fraud patterns, anomalies can be identified quickly, minimizing financial losses.

Customer Segmentation: BFSI organizations can leverage big data to segment their customer base effectively. This enables them to tailor their products and services to different customer groups, improving customer satisfaction and increasing sales.

Credit Scoring and Risk Assessment: By analyzing a wide range of data sources, including transaction history, social media, and even non-traditional data like behavioral patterns, organizations can refine their credit scoring models and better assess the credit risk of customers.

Personalized Marketing: Big Data Analytics allows BFSI companies to offer highly personalized marketing campaigns. By analyzing customer data, organizations can target individuals with the right products and services at the right time, increasing conversion rates and revenue.

Operational Efficiency: Data analytics can be used to optimize internal operations and reduce costs. For instance, predictive maintenance can be implemented in the insurance sector to reduce the downtime of insured assets.

Regulatory Compliance: The BFSI sector is highly regulated. Big Data Analytics can help organizations ensure they are in compliance with various regulations by tracking and analyzing relevant data, including customer transactions and communication.

Customer Churn Prediction: By analyzing customer data and behavior, BFSI organizations can predict when a customer is likely to churn. This information can be used to implement retention strategies to reduce customer attrition.

Market and Competitive Analysis: BFSI companies can use big data to gain insights into market trends and understand their position relative to competitors. This information is invaluable for strategy development.

Claims Processing and Underwriting: Insurance companies can expedite the claims processing and underwriting processes by using big data analytics to assess claims and underwrite policies more accurately and quickly.

Cybersecurity: The BFSI sector is a prime target for cyberattacks. Big Data Analytics can help in identifying potential security threats, monitoring network traffic, and responding to breaches in real-time.

Investment and Portfolio Management: Asset management firms can use big data to analyze various market and economic indicators, helping in investment and portfolio management decisions.

To implement big data analytics effectively in the BFSI sector, organizations should consider the following:

Data Quality and Security: Ensure data is accurate, secure, and compliant with regulations such as GDPR and HIPAA.

Scalable Infrastructure: Invest in scalable IT infrastructure to handle the large volume of data generated in the BFSI sector.

Skilled Workforce: Employ data scientists and analysts with expertise in finance and data analytics.

Advanced Analytics Tools: Implement powerful analytics tools and machine learning algorithms to extract valuable insights from data.

Data Governance: Establish robust data governance practices to ensure data accuracy, integrity, and compliance.

Ethical Considerations: Be mindful of data privacy and ethical concerns, especially when dealing with customer data.

In conclusion, Big Data Analytics is a game-changer for the BFSI sector. Organizations that effectively leverage data-driven decision-making will gain a competitive edge, improve customer experiences, and optimize their operations.

B2b events and conferences

Business events in Bangalore

B2b events

Tech summit

Business events in India

corporate events in India

Business Events

HR World Summit

0 notes

Text

What are the uses of AI to stop and detect payment fraud?

Financial fraud detection has become an essential component of the BFSI market due to the exponential rise of digital banking and online transactions. Financial institutions may suffer large financial losses, legal repercussions, and reputational harm as a result of cybercrime operations such as account takeover (ATO), credit card scams, and identity fraud. Therefore, it has become a top issue for firms to identify instances of payment fraud and mitigate related losses.

Traditional fraud detection methods, which rely on rule-based systems, have some drawbacks and are ineffective at detecting sophisticated fraud threats. This is where machine learning-based financial fraud detection comes into play.

Businesses can detect and prevent fraud in real-time by using machine learning to uncover trends and anomalies that point to fraudulent behavior by using massive datasets and sophisticated algorithms. In the end, machine learning development services may assist companies in maintaining a secure environment for payments to safeguard their clients, income, and reputation.

What You Should Know About Machine Learning in Banking and Finance

Due to its ability to execute crucial tasks including transaction processing and calculation, risk assessment, and even behavior prediction, machine learning in finance is today regarded as one of the anchor points of several disciplines of finance and banking services.

Machine learning, a subset of data science, is also capable of learning from experience and improving without being explicitly programmed, which means that technology will continue to advance over time.

One of the most important components is identifying fraud activities, responding quickly to any questionable behavior, and gathering a wealth of insightful data for future fraud cases.

Here are some illustrations of how it functions:

Automates the services by learning from the payment information.

Detects fraud activities and reduces the dangers of payment system penetration. For instance, using machine learning to analyze unintentional false positives in fraud detection can help to avoid cost overruns.

Pay attention to the odd features of payments. For example, to confirm and finish the sale transaction, request double authentication.

How to detect fraud prevention using machine learning?

Machine learning is increasingly being used in fraud detection and prevention because of its capacity to assess vast amounts of data, spot patterns, and adapt to new information. Machine learning is frequently used in fraud prevention, for example:

Analyzing anomalies

In transactional data, machine-learning algorithms can spot odd patterns or departures from typical activity. The algorithms gain the ability to distinguish between valid transactions and highlight unusual activities that might be signs of fraud by "training" on historical data.

Assessing risk

Based on a variety of variables, including transaction amount, location, frequency, and previous behavior, machine-learning models can give risk scores to transactions or user accounts. Organizations can prioritize their efforts and concentrate on Data Science Services or accounts that demand additional examination by using risk ratings, which show the potential of fraud at various risk levels.

Examination of Credit Scoring

However, machine learning in finance is not just about looking up credit card transactions. Credit scoring automation can also tremendously benefit from it because it entails a thorough review of a variety of data, including a person's personal information, payment history, current income, and even the credit history of other financial institutions, before making a final judgment about each case.

By using numerous algorithms that are continually evolving to automate the process and improve the quality of the credit scoring process, machine learning may quickly and simply tackle this problem, resulting in significant investment savings and improved workflow for financial institutions.

Additionally, fraud detection through machine learning renders it extremely hard for con artists to rig the credit rating system in their favor.

Analyzing networks

To carry out their operations, dishonest actors frequently band together and create networks. By studying the links between items (such as people, accounts, or devices) and spotting odd connections or clusters, machine-learning techniques like graph analysis can assist in revealing these networks.

Analyzing text

In order to find trends or keywords that can point to fraud or scams, machine-learning algorithms can analyze unstructured text data from sources like emails, social media posts, and consumer reviews.

Verification of identity

Machine-learning algorithms can examine and validate information supplied by users, such as pictures of identification documents or facial recognition data, to confirm that a person is who they say they are and stop identity fraud.

Adaptive education

The capacity of machine learning to pick up on and adjust to new knowledge is one of its main advantages. Machine-learning models may be updated with fresh data when fraudsters alter their strategies, keeping them current and better able to recognize new fraud tendencies.

In order to improve detection efficiency, lower the possibility of false positives, and enhance overall security and customer satisfaction, businesses can use machine learning in fraud prevention.

Conclusion

As you can see, machine learning and financial fraud are currently almost inseparable. It has become the ideal technology for automated financial fraud detection through the use of numerous rules and artificial algorithms.

In contrast to the traditional system of analysis, which is mostly carried out by human decisions, it enables covering much more information and analyses massive data in shorter periods of time, saving the financial units a significant amount of expenditures, resources, and time. By analyzing diverse transactions and questionable financial behavior, fraud detection using machine learning enables the development of new rules and more complicated algorithms, hence reducing the likelihood of financial loss. Because of this, the financial industry has made the development of financial software a top priority.

#Artificial Intelligence Service Gurgaon#Data Science Service Gurgaon#Machine Learning Development Services in Gurgaon#Computer Vision Service Gurgaon#Voice Assistant Service Gurgaon

0 notes

Text

Leveraging Big Data Analytics for Data-Driven Decision-Making in BFSI

Leveraging Big Data Analytics for Data-Driven Decision-Making in the Banking, Financial Services, and Insurance (BFSI) sector is crucial in today's data-driven world. It enables organizations to extract valuable insights from the vast amount of data they generate and collect, leading to better decision-making, improved customer experiences, enhanced risk management, and increased operational efficiency. Here's a breakdown of how BFSI can benefit from big data analytics:

Customer Insights and Personalization:

Big data analytics allows BFSI companies to analyze customer data to gain deep insights into their behaviors, preferences, and needs.

This data can be used to personalize marketing efforts, recommend tailored financial products, and improve customer service.

Risk Management:

Big data analytics can help banks and insurance companies assess risk more accurately by analyzing historical data, market trends, and real-time information.

Predictive analytics can be used to identify potential fraudulent activities and mitigate risks in real-time.

Fraud Detection and Prevention:

BFSI companies can leverage big data analytics to detect unusual patterns and anomalies in transactions, which might indicate fraudulent activities.

Machine learning algorithms can help in identifying fraud in real-time, reducing financial losses.

Credit Scoring and Underwriting:

Big data analytics allows for a more holistic view of a customer's creditworthiness, incorporating non-traditional data sources like social media, online behavior, and transaction history.

This enables more accurate and dynamic credit scoring and underwriting processes.

Operational Efficiency:

Data analytics can optimize internal processes such as risk assessment, compliance, and back-office operations.

Automation and AI-driven analytics can reduce manual effort and minimize errors.

Market and Competitive Analysis:

BFSI companies can use big data analytics to monitor market trends, assess competitors' performance, and identify new market opportunities.

This helps in making informed strategic decisions.

Regulatory Compliance:

Compliance is a critical aspect of the BFSI sector. Big data analytics can help automate compliance checks and reporting.

It also assists in identifying potential compliance risks early on.

Customer Retention and Churn Prediction:

By analyzing customer data, companies can predict churn and take proactive measures to retain valuable customers.

This can involve offering customized incentives or addressing customer issues promptly.

Portfolio Management:

In the investment and asset management segment, big data analytics aids in portfolio optimization by analyzing market data, economic indicators, and asset performance.

It helps in making timely investment decisions.

Cybersecurity:

Big data analytics plays a vital role in identifying and mitigating cybersecurity threats by monitoring network traffic, identifying anomalies, and responding in real-time.

In conclusion, the BFSI sector stands to gain immensely from big data analytics. By harnessing the power of big data, organizations can make more informed decisions, improve customer experiences, enhance risk management, and streamline operations. However, it's essential to invest in the right technology, talent, and data governance to fully realize the benefits of big data analytics while also addressing privacy and security concerns.

B2b events and conferences

Business events in Bangalore

B2b events

Tech summit

Business events in India

corporate events in India

Business Events

0 notes

Photo

The BFSI sector is growing far beyond the traditional method and is improving the spectrum of services & customer experience. The growth in terrorism, physical, and cyber-attacks (2016 attack which led to compromise 3.2 million debit card holders in India), the incidence of ransomware attack intruding the systems in around 150 countries are some of the major reasons driving the change in the BFSI industry and necessitating the need for enhanced security measures. Also, the increased need for remote monitoring and banking solutions is further giving impetus to the growth of the market. The market has high opportunities in analytics, biometrics, and ethical hacking. Biometrics has largely been implemented in the industry, and its adoption is increasing at a fast pace owing to the extent of security and safety it leverages.

#BFSI Security Global Market#Global BFSI Security Market Insight#bfsi security market growth#BFSI Security Market Opportunities#BFSI Security Market Trends#BFSI Security Market Forecast#BFSI Security Market History#Global BFSI Cyber Security Market#BFSI Security Market Scenario

0 notes

Text

Cloud Database Security Industry Outlook to 2025 – IBM Corporation, FORTINET INC, MCAFEE LLC, GEMALTO NV, ORACLE

2018 Global Cloud Database SecurityIndustry Report – History, Present and Future

In the Global Cloud Database SecurityIndustry Market Analysis & Forecast 2018-2025, the revenue is valued at USD XX million in 2017 and is expected to reach USD XX million by the end of 2025, growing at a CAGR of XX% between 2018 and 2025. The production is estimated at XX million in 2017 and is forecasted to reach XX million by the end of 2025, growing at a CAGR of XX% between 2018 and 2025.

Request for Sample of Global Cloud Database SecurityMarket 2018 Research Report: https://www.researchreportsinc.com/sample-request?id=212406

Major Market Players

IBM Corporation

FORTINET INC

MCAFEE LLC

GEMALTO NV

ORACLE CORPORATION

IMPERVA INC

INTEL SECURITY GROUP

INFORMATICA LTD

ENTIT SOFTWARE LLC

AXIS TECHNOLOGY LLC

Ask for Customized Report: https://researchreportsinc.com/enquiry?id=212406

By Application:

§ Cloud Activity Monitoring

§ Access Management

§ User Authentication

By Type:

§ Public Cloud

§ Private Cloud

§ Hybrid Cloud

By Verticals:

§ Retail

§ BFSI

§ Transportation

§ Hospitality

§ Government