#CBOE Volatility Index

Explore tagged Tumblr posts

Text

Stock trading app eToro pops 29% in Nasdaq debut after pricing IPO above expected range

Shares of stock brokerage platform eToro popped in their Nasdaq debut on Wednesday after the company raised almost $310 million in its initial public offering. The stock opened at $69.69, or 34% above its IPO. Shares closed up nearly 29% at $67 a share, bringing its total market capitalization to more than $5.4 billion. The Israel-based company sold nearly six million shares at $52 each, above…

#Breaking News: Technology#Business#business news#CBOE Volatility Index#Donald J. Trump#Donald Trump#eToro Group Ltd#ipo#Robinhood Markets Inc#Technology

0 notes

Text

It may be a good time for investors to look at less risky ways to stay in the stock market

As President Trump’s “not going to bend at all” approach to tariffs raises recession risk and helped to send the market into a correction last week, investors may want to consider strategies that focus more on the downside — ways to stay invested but stay protected during major stock downswings. Alternative exchange-traded funds are an option, and they have been growing in popularity in recent…

#Breaking News: Markets#business news#CBOE Volatility Index#Exchange-traded funds#Goldman Sachs Group Inc#Goldman Sachs Nasdaq-100 Core Premium Income ETF#Goldman Sachs S&P 500 Core Premium Income ETF#Goldman Sachs U.S. Large Cap Buffer 3 ETF#Investment strategy#Investors#JPMorgan Chase & Co#JPMorgan Equity Premium Income ETF#Markets#Personal finance#Personal investing#Portfolio management#Retail Investors#S&P 500 Index#Stock markets

0 notes

Text

Market Sentiment Cautious as Political Uncertainty Affects Trends

Market Sentiment Remains Cautious Amid Political Uncertainty Risk-off sentiment continued to dominate market trends as the week commenced, with major indices in both Europe and the US experiencing a downturn. The pan-European Stoxx 600 index saw a decline of 0.3%, while the S&P 500 followed suit, dropping by 0.28%. Additionally, the CBOE Volatility Index (VIX), often referred to as the “fear…

#Bitcoin fluctuations#bond yields#CBOE Volatility Index#Election 2024#financial trends#gold prices#Kamala Harris#market sentiment#political uncertainty#Trump trade#US dollar

0 notes

Text

Understanding Stock Market Volatility: A Closer Look at the CBOE Volatility Index (VIX)

Written by Delvin The stock market is a dynamic environment, subject to periods of both stability and volatility. Investors and traders alike often monitor the ebb and flow of the market’s volatility, seeking to understand and anticipate its impact on their investments. Central to this quest is the CBOE Volatility Index (VIX), commonly known as the “fear gauge,” a measure of the market’s…

View On WordPress

#CBOE Volatility Index (VIX)#dailyprompt#Financial#knowledge#money#Money Fun Facts#Stock Market#Stock Market Volatility#Stocks

0 notes

Text

Bear Market Rally? Near-Term Bounce?

Uncertainty still hangs over the market, economy & global trade. But based upon the retreat in CBOE Volatility index (VIX) from around 60 back down to around 30, our waterfall decline research, and the Republican post-election year seasonal trend, the bottom could be in, at least in the short term.

S&P 500 Post-Election Year Seasonal patterns all show some degree and duration of strength from around now through sometime between early June to early August, before the next bout of seasonal weakness could arrive at the same time the 90-day tariff pause ends.

The market may be giving the Trump administration the benefit of the doubt on tariffs for now, but time is running out for them to start showing progress and announce new meaningful trade deals.

60 notes

·

View notes

Text

April 7, 2025

HEATHER COX RICHARDSON

APR 8

READ IN APP

Major indexes on the stock market began down more than 3% today when, as Allison Morrow of CNN reported, a rumor that Trump was considering delaying his tariffs by three months sent stocks surging upward by almost 8%. The rumor was unfounded—it appeared to begin from a small account on X—but it indicated how desperate traders are to see an end to President Donald J. Trump’s trade war.

As soon as the rumor was discredited, the market began to fall again, although Treasury Secretary Scott Bessent’s announcement that he is opening trade negotiations with Japan and looking forward to talks with other countries appeared to reassure some traders that Trump's tariffs will not last. The wild swings made the day one of the most volatile in stock market history. It ended with the Dow Jones Industrial Average down by 349 points and the S&P 500 and the Nasdaq Composite staying relatively flat. Futures for tomorrow are up slightly.

Foreign markets fared badly today, suggesting that the reality of Trump’s tariffs is beginning to sink in. Sam Goldfarb of the Wall Street Journal notes that Hong Kong’s Hang Seng took its biggest dive since the 1997 Asian financial crisis, losing 13%, and that other markets also fell today.

Goldfarb reports that in the U.S., traders are deeply worried about losses but also anxious about missing a rebound if the administration changes its policies. Hence the extreme volatility of the market. Generally, values over 30 are considered indicators of increased risk and uncertainty in the Chicago Board Options Exchange (CBOE) Volatility Index, the so-called fear gauge. Today, it spiked to 60.

Business leaders are speaking out publicly against Trump’s tariffs. Today, Ken Langone, the co-founder of Home Depot and a major Republican donor, told the Financial Times: “I don’t understand the goddamn formula.”

Senate Republicans are also starting to push back. Seven Republican senators have now signed onto a bill that would limit Trump’s ability to impose tariffs. The power to levy tariffs belongs to Congress, but Congress has permitted a president to adjust tariffs on an emergency basis. Trump declared an emergency, and it is on that ground that he has upended more than 90 years of global economic policy.

Trump has threatened to veto any such legislation, but he will not need to if Senate majority leader John Thune (R-SD) and House speaker Mike Johnson (R-LA) refuse to bring the measure to a vote. Jordain Carney and Meredith Lee Hill of Politico report that while Republicans express concern about the tariffs in private, leaders will stand with the president because they must have the votes of MAGA lawmakers to pass any of their legislative agenda through Congress, and to get that they will need Trump’s support. Others are worried about incurring Trump’s wrath and, with it, a primary challenger.

“People are skittish. They’re all worried about it,” Senator Rand Paul (R-KY) told Carney and Hill. “But they are putting on a stiff upper lip to act as though nothing is happening and hoping it goes away.”

But so far, it does not look as if it’s going to go away. Today the European Commission has announced 25% countertariffs in retaliation for Trump’s tariffs.

Trump’s response to the crisis has been to double down on his tariff plan. This morning he wrote on his social media network that he will impose additional 50% tariffs on China effective on Wednesday unless it drops the retaliatory tariffs it has placed on U.S. products. Rather than backing down, China said it would “fight to the end.”

Today, in a press conference convened in the Oval Office, Trump explained his thinking behind why he has begun a global tariff war. "You know, our country was the strongest, believe it or not, from 1870 to 1913. You know why? It was all tariff based. We had no income tax,” he said. “Then in 1913, some genius came up with the idea of let’s charge the people of our country, not foreign countries that are ripping off our country, and the country was never, relatively, was never that kind of wealth. We had so much wealth we didn’t know what to do with our money. We had meetings, we had committees, and these committees worked tirelessly to study one subject: we have so much money, what are going to do with it, who are we going to give it to? And I hope we’re going to be in that position again.”

Aside from this complete misreading of American history—Civil War income taxes lasted until 1875, for example, tariffs are paid by consumers, the Panics of 1873 and 1893 devastated the economy, few Americans at the time thought the Gilded Age was a golden age, and I have no clue what he’s referring to with the talk about committees—Trump’s larger motivation is clear: he wants to get rid of income taxes.

Congress passed the 1913 Revenue Act imposing income taxes to shift the cost of supporting the government from ordinary Americans, especially the women who by then made up a significant portion of household consumers, to men of wealth. Tariffs were regressive because they fell disproportionately on working-class Americans through their everyday purchases. Income taxes spread costs more evenly, according to a man’s ability to pay. The switch from tariffs to income taxes helped to break the power of the so-called robber barons, the powerful industrialists who controlled the U.S. economy and government in the late nineteenth century.

To get rid of income taxes, Trump and his Republicans have backed the decimation of the government services that support ordinary Americans.

Today, in the Oval Office press conference, Trump and Defense Secretary Pete Hegseth suggested where they intend to put government money, promising a defense budget of $1 trillion, a significant jump from the current $892 defense budget. “[W]e have to be strong because you’ve got a lot of bad forces out there now,” Trump said.

Allison McCann, Alexandra Berzon, and Hamed Aleaziz of the New York Times reported today that the administration also intends to spend as much as $45 billion over the next two years on new detention facilities for immigrants. In the last fiscal year, the total amount of federal money allocated to the Immigration and Customs Enforcement was about $3.4 billion. The new facilities will be in private hands and will operate with lower standards and less oversight than current detention facilities.

—

10 notes

·

View notes

Text

Bill Bramhall

* * * *

LETTERS FROM AN AMERICAN

April 7, 2025

Heather Cox Richardson

Apr 08, 2025

Major indexes on the stock market began down more than 3% today when, as Allison Morrow of CNN reported, a rumor that Trump was considering delaying his tariffs by three months sent stocks surging upward by almost 8%. The rumor was unfounded—it appeared to begin from a small account on X—but it indicated how desperate traders are to see an end to President Donald J. Trump’s trade war.

As soon as the rumor was discredited, the market began to fall again, although Treasury Secretary Scott Bessent’s announcement that he is opening trade negotiations with Japan and looking forward to talks with other countries appeared to reassure some traders that Trump's tariffs will not last. The wild swings made the day one of the most volatile in stock market history. It ended with the Dow Jones Industrial Average down by 349 points and the S&P 500 and the Nasdaq Composite staying relatively flat. Futures for tomorrow are up slightly.

Foreign markets fared badly today, suggesting that the reality of Trump’s tariffs is beginning to sink in. Sam Goldfarb of the Wall Street Journal notes that Hong Kong’s Hang Seng took its biggest dive since the 1997 Asian financial crisis, losing 13%, and that other markets also fell today.

Goldfarb reports that in the U.S., traders are deeply worried about losses but also anxious about missing a rebound if the administration changes its policies. Hence the extreme volatility of the market. Generally, values over 30 are considered indicators of increased risk and uncertainty in the Chicago Board Options Exchange (CBOE) Volatility Index, the so-called fear gauge. Today, it spiked to 60.

Business leaders are speaking out publicly against Trump’s tariffs. Today, Ken Langone, the co-founder of Home Depot and a major Republican donor, told the Financial Times: “I don’t understand the goddamn formula.”

Senate Republicans are also starting to push back. Seven Republican senators have now signed onto a bill that would limit Trump’s ability to impose tariffs. The power to levy tariffs belongs to Congress, but Congress has permitted a president to adjust tariffs on an emergency basis. Trump declared an emergency, and it is on that ground that he has upended more than 90 years of global economic policy.

Trump has threatened to veto any such legislation, but he will not need to if Senate majority leader John Thune (R-SD) and House speaker Mike Johnson (R-LA) refuse to bring the measure to a vote. Jordain Carney and Meredith Lee Hill of Politico report that while Republicans express concern about the tariffs in private, leaders will stand with the president because they must have the votes of MAGA lawmakers to pass any of their legislative agenda through Congress, and to get that they will need Trump’s support. Others are worried about incurring Trump’s wrath and, with it, a primary challenger.

“People are skittish. They’re all worried about it,” Senator Rand Paul (R-KY) told Carney and Hill. “But they are putting on a stiff upper lip to act as though nothing is happening and hoping it goes away.”

But so far, it does not look as if it’s going to go away. Today the European Commission has announced 25% countertariffs in retaliation for Trump’s tariffs.

Trump’s response to the crisis has been to double down on his tariff plan. This morning he wrote on his social media network that he will impose additional 50% tariffs on China effective on Wednesday unless it drops the retaliatory tariffs it has placed on U.S. products. Rather than backing down, China said it would “fight to the end.”

Today, in a press conference convened in the Oval Office, Trump explained his thinking behind why he has begun a global tariff war. "You know, our country was the strongest, believe it or not, from 1870 to 1913. You know why? It was all tariff based. We had no income tax,” he said. “Then in 1913, some genius came up with the idea of let’s charge the people of our country, not foreign countries that are ripping off our country, and the country was never, relatively, was never that kind of wealth. We had so much wealth we didn’t know what to do with our money. We had meetings, we had committees, and these committees worked tirelessly to study one subject: we have so much money, what are going to do with it, who are we going to give it to? And I hope we’re going to be in that position again.”

Aside from this complete misreading of American history—Civil War income taxes lasted until 1875, for example, tariffs are paid by consumers, the Panics of 1873 and 1893 devastated the economy, few Americans at the time thought the Gilded Age was a golden age, and I have no clue what he’s referring to with the talk about committees—Trump’s larger motivation is clear: he wants to get rid of income taxes.

Congress passed the 1913 Revenue Act imposing income taxes to shift the cost of supporting the government from ordinary Americans, especially the women who by then made up a significant portion of household consumers, to men of wealth. Tariffs were regressive because they fell disproportionately on working-class Americans through their everyday purchases. Income taxes spread costs more evenly, according to a man’s ability to pay. The switch from tariffs to income taxes helped to break the power of the so-called robber barons, the powerful industrialists who controlled the U.S. economy and government in the late nineteenth century.

To get rid of income taxes, Trump and his Republicans have backed the decimation of the government services that support ordinary Americans.

Today, in the Oval Office press conference, Trump and Defense Secretary Pete Hegseth suggested where they intend to put government money, promising a defense budget of $1 trillion, a significant jump from the current $892 defense budget. “[W]e have to be strong because you’ve got a lot of bad forces out there now,” Trump said.

Allison McCann, Alexandra Berzon, and Hamed Aleaziz of the New York Times reported today that the administration also intends to spend as much as $45 billion over the next two years on new detention facilities for immigrants. In the last fiscal year, the total amount of federal money allocated to the Immigration and Customs Enforcement was about $3.4 billion. The new facilities will be in private hands and will operate with lower standards and less oversight than current detention facilities.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Bill Bramhall#Letters From An American#Heather Cox Richardson#American History#Income Tax#Pete Hegseth#immigration#robber barons#Civil War#Mike Johnson#Stock Market

7 notes

·

View notes

Text

CNN 3/29/2025

BusinessInvesting• 5 min read

Dow closes more than 700 points lower and the S&P 500 is on track for its worst quarter since 2022

By John Towfighi, CNN

Updated: 4:04 PM EDT, Fri March 28, 2025

Source: CNN

US stocks tumbled Friday and a broad selloff gripped Wall Street as investors digested slightly stubborn inflation data and weakening consumer sentiment while wrestling with continued tariff anxiety.

The Dow tumbled and closed lower by 716 points, or 1.7%. The broader S&P 500 fell 1.97% and the Nasdaq Composite slid 2.7%. The slide on Friday put all three major indexes in the red for this week.

The S&P 500 is down more than 5% this year. The benchmark index is on track for its first losing quarter since September 2023 and its worst quarter since September 2022.

US stocks opened the day lower and began to slide as data from the Commerce Department showed inflation in February remained slightly sticky.

The Personal Consumption Expenditures index rose 2.5% year-over-year in February, unchanged from January and matching expectations. Yet the core PCE index, which strips out volatile categories like food and energy, ticked up to 2.8% year-over-year from 2.7% in January. That hotter-than-expected rise signals that inflation, while broadly cooling, remains above the Fed’s target of 2%.

Meanwhile, consumer sentiment tanked 12% this month, according to the University of Michigan’s latest survey released Friday.

The selloff gradually turned into a rout as investors dumped stocks in industries including technology, autos and airlines. Google (GOOG) slid 4.9%, Stellantis (STLA) slid 4% and Delta Air Lines (DAL) slid 5%.

Lululemon (LULU) stock tumbled 14% on Friday after the company flagged concerns about the outlook for consumer spending on a call with investors.

“We also believe the dynamic macro environment has contributed to a more cautious consumer,” said Calvin McDonald, chief executive at Lululemon.

The selloff in major names wasn’t the only concern for investors. CoreWeave (CRWV), an AI venture backed by chip giant Nvidia (NVDA), had a disappointing debut on the Nasdaq Friday, offering a bleak outlook for both the prospects of a continued AI boom and the market for initial public offerings.

CoreWeave had listed its IPO at $40, which was below its target range of $47 to $55, according to the Wall Street Journal. However, the stock began trading on Friday at $39, below that IPO price.

The poor debut is a sign of cooling enthusiasm for AI as investors continue to debate whether the money being poured into the industry is worth it. It also offers a meager outlook for IPOs this year as markets struggle to look past headwinds from tariffs.

Tariff anxiety continues to roil markets

President Donald Trump’s tariff proposals have also clouded investor sentiment and stoked uncertainty on Wall Street.

Investors continued to grapple with Trump’s announcement on Wednesday of 25% tariffs on all cars shipped into the US, set to go into effect April 3. Trump also announced tariffs on car parts like engines and transmissions, set to take effect “no later than May 3,” according to the proclamation he signed.

Investors sold off stocks amid renewed anxiety about the impact of auto tariffs on the economy. Tariffs are a tax on imported goods, and economists expect Trump’s sweeping tariff proposals will cause an increase in consumer prices and drag on economic growth.

“It’s natural for people to expect higher prices because we haven’t seen a trade war like this since McKinley,” Art Hogan, chief market strategist at B. Riley Wealth Management, told CNN’s Matt Egan.

The yield on the 10-year Treasury note fell to 4.26% as investors snapped up government bonds, highlighting a risk-averse sentiment amid tariff uncertainty.

Wall Street’s fear gauge, the Cboe Volatility Index, or VIX, surged 16%. CNN’s Fear and Greed Index ticked into “extreme fear” territory, highlighting renewed anxiety among investors.

The tariffs on autos are an escalation in a trade war with the US’ biggest trading partners, threatening to roil global markets and disrupt a deeply intertwined supply chain across North America.

“While the economy appears solid, business executives are adopting a cautious stance on new investments, largely due to the Trump administration’s aggressive and unpredictable tariff policy,” said Matt Stephani, president of Cavanal Hill Investment Management, in an email.

Trump’s decision to announce the tariffs on autos ahead of the April 2 deadline when reciprocal tariffs are set to be revealed — a date dubbed “Liberation Day” by the Trump administration — has caused unease in markets. The early announcement highlights Trump’s commitment to tariffs, testing some investors’ initial hope that they might only be a negotiating tactic.

“We think the proposed tariffs as announced would deliver a big hit to the auto industry, stoking higher costs, higher prices and a sharp decline in US sales,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, in a note Thursday.

“[The] question is what these very aggressive automotive tariffs signal for next week’s announcement on both reciprocal and ex-auto sector tariffs,” Marcelli added.

Wall Street’s outlook sours

Wall Street’s expectations for US stocks this year are being revised down amid continued announcements about tariffs.

Analysts at UBS on Friday trimmed their year-end target for the S&P 500 to 6,400 from 6,600.

Analysts at Barclays this week lowered their year-end target for the S&P 500 to 5,900 from 6,600. Goldman Sachs earlier this month lowered its year-end target to 6,200 from 6,500.

Ed Yardeni, president of investment advisory Yardeni Research, recently lowered his year-end target to 6,400 from 7,000.

Meanwhile, the most actively traded gold futures contract in New York on Friday surged above a record high $3,100. Gold is considered a safe haven amid economic turmoil and a hedge against potential inflation.

Goldman Sachs this week revised its year-end target for gold prices to $3,300, up from $3,100, underscoring how the yellow metal’s rise this year is expected to last amid economic and geopolitical uncertainty.

See Full Web Article

Go to the full CNN experience

© 2025 Cable News Network. A Warner Bros. Discovery Company. All Rights Reserved.

Terms of Use | Privacy Policy | Ad Choices | Do Not Sell or Share My Personal Information

4 notes

·

View notes

Text

5 Trade Ideas for Monday: AMD, CBOE, Capital One, Illumina and Microsoft

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Advanced Micro Devices, $AMD, comes into the week at resistance. It has a RSI in the bullish zone with the MACD crossing up and positive. Look for a push over resistance to participate…

Cboe Global, $CBOE, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…

Capital One Financial, $COF, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…

Illumina, $ILMN, comes into the week approaching resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…

Microsoft, $MSFT, comes into the week at short term resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into earnings season and the July options expiration week, saw equity markets exhibit continued strength holding at the highs.

Elsewhere, look for Gold to continue to consolidate in its uptrend while Crude Oil drifts up in consolidation. The US Dollar Index continues to drift higher in the short term move to the downside at more than 3 year lows while US Treasuries consolidate in their downtrend. The Shanghai Composite looks to continue the move higher in consolidation while Emerging Markets continue their break to the upside.

The Volatility Index looks to continue in the normal range making life easier for equity markets to the upside. The charts of the SPY and QQQ are showing strength on both timeframes as they continue to print new all-time highs. The IWM continues to lag the SPY and QQQ in recovery in price but is looking stronger as it moves higher as well. The classic “V” recovery continues to build in all 3 Index ETFs. Use this information as you prepare for the coming week and trad’em well.

4 notes

·

View notes

Text

Find out what is Volatility Index or VIX

Learn all about Volatility Index

What is VIX? The VIX, or Volatility Index, is a real-time market index that reflects the market’s expectations for volatility over the coming 30 days. The VIX is often referred to as the “fear gauge” or “fear index” because it tends to spike during periods of market uncertainty or stress. It was created by the Chicago Board Options Exchange (CBOE) and measures the implied volatility of S&P 500…

#capitalmarket#finance#financefordummies#financefornonfinancepeople#financialmarkets#Investment#learnaboutmarkets#marketterminology#stockmarket

2 notes

·

View notes

Text

Oil at $100 a barrel? U.S. role in Iran-Israel fight fuels market jitters

Oil prices jumped more than 7% on Friday, hitting their highest in months after Israel said it struck Iran, dramatically escalating tensions in the Middle East and raising worries about disrupted oil supplies. Eli Hartman | Reuters Oil markets are entering a new phase of uncertainty after the U.S. joined the war between Iran and Israel, with experts warning of triple-digit prices. Investors are…

#Breaking News: Politics#business news#CBOE Crude Oil Volatility Index#Commodity markets#energy#Foreign policy#Iran#Israel#Oil and Gas#Politics#United States

3 notes

·

View notes

Text

Taming Market Fear with VIX Options: Strategies for Professionals and Entrepreneurs

The VIX, often dubbed the “investor fear gauge,” 📉 is a zero to 100 metric that measures market volatility expectations. While it’s a go-to indicator for gauging panic or complacency, few know that the Cboe created derivatives to trade the index directly: VIX options. 😲 But how do these tools work—and more importantly, how can professionals and entrepreneurs use them to navigate unpredictable…

0 notes

Text

Israel-Iran Escalation Spikes Oil and Sparks Market Volatility-

Investors have turned sharply risk averse after a dramatic military clash between Israel and Iran, sending oil prices to fresh highs and rattling global markets. On June 13 Israel launched air strikes on Iran’s nuclear and missile facilities – killing several senior commanders and scientists – prompting Iran to retaliate with ballistic missiles into Israel. The flare up forced Israel to warn of a “prolonged” operation and cancel nuclear talks with Tehran Even Iran’s state media reported fires at oil and gas sites, while Israel warned civilian ships to avoid Yemen’s Hodeidah port after striking Houthi run docks there The prospect of a broader Middle East war has stoked acute investor fear.

1• Brent crude jumped 7.0% on June 13, settling at $74.23/bbl (up ~$4.87)reuters.com, after intraday spikes above $78 – its largest move since early 2022. WTI rose 7.6% to ~$72.98reuters.com. Both benchmarks are ~12% higher than a week earlier. 2• Stocks fell worldwide: on June 13 the Dow fell 1.8%, S&P 500 –1.1% and Nasdaq –1.3%reuters.com. Europe’s STOXX 600 slid ~0.9% to three week lows, and Asian shares in Tokyo, Seoul and Hong Kong were down ~1% eachreuters.com. By Sunday June 15 Gulf stock indexes plunged: Qatar’s fell 2.9%, Kuwait –4.3% and Saudi Arabia’s Tadawul index –1.6%reuters.comreuters.com. Israel’s TA 35 initially dipped nearly 2% but recovered to +0.5% on June 15reuters.com. 3• Bond yields were mixed: U.S. 10 year Treasury yields jumped to about 4.41% (+5.6 bps)reuters.com as inflationary pressures from oil rose, while safe havens in Europe pushed yields down (e.g. 10Y Bunds dipped). Israel’s government bonds rallied ~+0.4% (yields fell)reuters.com as officials promised to keep markets open. 4• Currencies & safe assets: The US dollar index rose ~+0.5%reuters.com as traders fled risk. The Swiss franc and Japanese yen initially strengthened (JPY briefly touched 144 per USD)reuters.com, while the euro weakened ($1.15)reuters.com. Gold jumped +1.4% to ~$3,431/ozreuters.com, near record highs, and even Bitcoin fell amid the sell off. These moves reflect a classic “risk off” rotation. One analyst called the current phase a “controlled confrontation” – markets are jittery but have not priced in a full war yetreuters.comreuters.com. The CBOE Volatility Index spiked to 20.82 on June 13, a three week peakreuters.com. U.S. futures and Asian markets will reopen after the weekend with all eyes on whether tensions ease or spread.

Oil Market Impact-

Crude has borne the brunt of geopolitical risk. Brent crude on Friday (June 13) surged from ~$69 to ~$78 intradayreuters.com, before settling at $74.23 – a 7.0% jumpreuters.com. WTI reached ~$77.62 intra day (a ~14% spike) and closed $72.98reuters.com. These are the largest one day percentage moves since early 2022reuters.com. By Monday, prices held near six month highs (front month Brent ~$74.17 on June 13)spglobal.com. Analysts note that actual output so far remains uninterrupted: Iran’s state oil company reported that refineries and storage were undamagedreuters.com, and Western officials say Iran still exports ~2 million bpd. OPEC’s spare capacity (Saudi/Russia, etc.) is roughly Iran’s outputreuters.com. But any wider war could quickly choke supplies. About 20 million barrels per day (nearly 20% of world oil) transit the Strait of Hormuzreuters.comaljazeera.com. “Saudi Arabia, Kuwait, Iraq and Iran are wholly locked into one tiny passage,” noted Rabobankreuters.com. Israel’s strikes on an Iranian offshore gas platform (in the shared South Pars field)reuters.com and Tehran’s threats to close Hormuz have “sent shockwaves” through marketsaljazeera.com. In response, policymakers are treading carefully. The IEA says it is “monitoring” developments and stands ready to release crude from its 1.2 billion-barrel emergency stockpile if neededspglobal.com. OPEC’s secretary-general Haitham al-Ghais urged calm, insisting there are “no developments in supply or market dynamics” that require new measuresspglobal.com. OPEC delegates note that, besides Iran, major producers (Saudi, UAE, Iraq) also ship via Hormuzspglobal.com, so full war would be a grave concern. Still, OPEC+ plans to boost output (adding ~2.2 mbd in July) are on trackspglobal.com, and one analyst reckons the cartel will stick to market share policies despite the crisisspglobal.com.

Global Equity Retreat and Safe Havens- The sudden risk shock knocked global equities off record highs. On Friday (June 13), major U.S. indexes fell: the Dow lost 1.8%, S&P 500 –1.1% and Nasdaq –1.3%reuters.com. European Stoxx 600 closed 0.9% lowerreuters.com, briefly hitting a three-week low, and MSCI Asia-Pacific slipped similarly. By Monday, U.S. futures and Asian bourses were poised for more weakness. Analysts attribute the broad sell off to “flight to safety” flows. Gold’s sharp rise to ~$3431/ozreuters.com and a rally in the U.S. dollarreuters.com signal that risk assets are under pressure. Volatility surveys confirm jitters: the VIX fear index jumped to 20.82 on June 13reuters.com. “Markets are struggling,” said one strategist, citing the inflationary oil shock (which should push bond yields higher) versus the safe haven bid (which drives yields lower)reuters.com. Indeed, U.S. 10-year yields briefly pulled back after the overnight shock, before trending up again. In Israel, markets are trying to stay open despite attacks. The Tel Aviv 35 Index erased early losses and closed up 0.5% on June 15reuters.com. Treasury prices rose (yields down ~0.4%)reuters.com and the shekel weakened from ~3.50 to 3.61 per USD by Fridayreuters.com. Finance Minister Smotrich hailed the “strong, stable, resilient” economyreuters.com, and the central bank stressed normal operations (banks and markets) would continuereuters.com. Nonetheless, forecasters warn that deeper conflict could eventually test even Israel’s robust finance.

Energy and Security Concerns-

Beyond financial markets, the standoff has raised energy-security fears. The most immediate worry is about oil chokepoints. If the Strait of Hormuz were disrupted, supply losses could be severe. One oil market strategist noted that any conflict “impacting output, shipping lanes like the Strait of Hormuz, or key infrastructure would directly affect global supply”spglobal.com. Al Jazeera reports that merchant shipping is still transiting Hormuz “on high alert,” and even talk of a closure has already pushed prices higheraljazeera.comaljazeera.com. A Houthi ultimatum also looms: Yemen’s Iran-aligned Houthis have begun targeting Israel (even claiming to fire missiles toward Tel Aviv)reuters.com and warned that Israel’s Haifa oil port could be hit next. Israel in turn struck the Red Sea port of Hodeidah on June 10, saying it was used by Houthis to funnel weaponsreuters.com. Such incidents threaten regional shipping in the Red Sea and Gulf of Aden – home to major oil and trade routes. Global shipping insurers have already raised premiums for Red Sea passages.

Policy Outlook and Investor Sentiment-

For now, central bankers appear reluctant to overreact to the shock. Experts point out that oil’s latest surge, while significant, may not derail monetary policy. “Long gone are the days when a central bank would hike rates because of a spike in oil prices,” said a Lombard Odier economist, noting that other producers (OPEC+ spare) can offset some Iranian cutsreuters.com. Still, officials will watch core inflation closely. The U.S. Federal Reserve meets on June 17–18 amid these tensions; Fed speakers may have to balance upside surprises from fuel costs against still weak growth signals. Government reactions have mostly aimed to contain panic. U.S. officials have urged calm, with President Trump (via social media) calling on Iran to negotiate rather than escalatereuters.com. Gulf Arab states (though sympathetic to Iran) held talks to defuse the crisis, and the U.S. Navy remains on alert to secure commerce. On markets, investors are in “wait-and-see” mode. One Washington CIO said the risk profile is “still too high” to jump back into stocksreuters.com. Indeed, funds have partially reversed recent bullish positions: commodity speculators piled into crude (raising net longs), but risk parities have reduced equity exposure. The bottom line: energy prices and risk sentiment are now hostage to the Iran-Israel skirmish. Markets will watch daily developments (rocket alerts, diplomatic moves, Houthi actions) for clues. If the confrontation remains limited, oil may retreat from its spikes; but any blow to Middle East output or chokepoints could send prices well above $80–$90/bbl. Until then, investors brace for volatility, with inflation expectations (driven by oil) and global growth outlook hanging in the balancespglobal.comreuters.com.

Sources: Reuters market reports and Middle East conflict updatesreuters.comreuters.comreuters.comspglobal.comreuters.com, Al Jazeeraaljazeera.com. All data as of mid-June 2025.

#IsraelIranConflict #MiddleEastTensions #Geopolitics2025 #GlobalConflict #WorldNews #BreakingNews #PoliticalAnalysis

0 notes

Text

Market Not Out of October Woods Yet

Aside from weakness earlier in the month, this October has been rather sanguine. S&P 500 and DJIA have recorded new all-time highs and extended a weekly advancing streak to six in a row. But throughout the month the CBOE VIX index has remained stubbornly elevated around 20 and the 10-year Treasury bond yield has risen back above 4.10% while gold is also trading at new all-time highs.

Although the market did close mixed today, DJIA, S&P 500, Russell 1000 and 2000 were down while NASDAQ recorded a modest advance, today’s trading seems like a reminder that it is still October, and more volatility is not out of the question. At least until after the dust has settled on the presidential election.

Looking at October’s Election Year seasonal patterns compared to 2024 above, this October’s mid-month strength stands out as being well above average while today’s weakness aligns with the beginning of a typical, seasonal pullback in the second half of the month. Market weakness could last through the rest of this month before bouncing back during the final week of October.

5 notes

·

View notes

Text

Criptomoedas avançam até 65% e o Bitcoin recupera US$ 107 mil após payroll — TradingView News

News https://portal.esgagenda.com/criptomoedas-avancam-ate-65-e-o-bitcoin-recupera-us-107-mil-apos-payroll-tradingview-news/

Criptomoedas avançam até 65% e o Bitcoin recupera US$ 107 mil após payroll — TradingView News

O mercado de criptomoedas se encontrava avançado a US$ 3,34 trilhões (+2%) na manhã desta segunda-feira (9). Ocasião em que o Bitcoin BTCUSD se encontrava precificado em US$ 107,3 mil (+2,1%) com dominância de mercado elevada a 63,9%, sentimento de neutralidade dos investidores (55%) e a maioria das altcoins em alta, de até 65%.

A recuperação do BTC se correlacionava, dentre outros, ao desempenho dos índices S&P 500 e Nasdaq, encerrados em respectivos 6.000,36 (+1,03%) e 19.529,95 pontos (+1,20%). Nesse caso, a pernada de alta sucedeu a divulgação otimista do payroll de maio.

De acordo com o relatório do Departamento do Trabalho referente a folhas de pagamento na agrícolas dos Estados Unidos, o país abriu 139 mil postos de trabalho em maio, acima das 130 vagas esperadas pelos analistas. Já os dados de abril, foram revisados para baixo, de 177 mil para 147 mil.

A desaceleração no mercado de trabalho, em tese, afasta o risco de inflação e pode favorecer mercados como o de criptomoedas em caso de corte na taxa de juros pelo Federal Reserve (Fed).

Nessa direção, o presidente dos Estados Unidos, Donald Trump, voltou a pressionar o presidente da autoridade monetária, Jerome Powell, pelo corte na taxa básica anual de juros. Em suas redes sociais, Trump mais uma vez alfinetou Powell ao chamar o Chair do Fed de “Too Late” (“Muito Tardio”) em cortar as taxas de juros.

Too Late no Fed é um desastre. Leia mais: (Trump pressiona Powell, do Fed, a reduzir ‘um ponto inteiro’ [de corte nos juros]”, disse.

Notícias Cripto: Valor Capital entra para a Linux Foundation, RedotPay integra a Circle, tokenização no Febraban Tech e outras novidades

Por outro lado, analistas projetam para setembro a retomada de cortes nas taxas de juros do Fed, porque os dados da semana passada projetaram crescimento nos salários e no número de vagas de emprego. O que pode levar o Fed a não ceder às pressões de Trump.

O Volatility Index (VIX), “índice do medo” calculado pela Bolsa de Valores de Chicago (CBOE) a partir do desempenho das empresas de capital aberto que compõem o S&P 500, encontrava-se recuado a 17,59 pontos (-4,8%). Já os fundos negociados em bolsa (ETFs) estadunidenses baseados em negociação à vista (spot) de Bitcoin reduziram o fluxo de saída ao recuarem em líquidos US$ 47,82 milhões, enquanto os ETFs de Ethereum (ETH) avançaram em líquidos US$ 25,22 milhões, segundo dados da plataforma SoSoValue.

Criptomoedas avançam 10,3% e máxima do Bitcoin golpeia ursos em US$ 1 bilhão em maio, aponta relatório

O índice altseason, que mede o nível de rotação de capital para os principais tokens em capitalização de mercado, estava avançado de 23 para 29 pontos em sinal de rotação de capital para as principais altcoins em capitalização de mercado. Nesse grupo de tokens, o DEXE derretia a US$ 8,97 (-15,7%), o TRX recuava a US$ 0,28 (-1,4%), o RAY era trocado por US$ 2,32 (+8,5%), o WIF atingia US$ 0,91 (+8,4%), o BONK representava US$ 0,000016 (+6,3%), o TAO valia US$ 397,76 (+6,2%), o VIRTUAL era trocado de mãos por US$ 1,86 (+5,3%) e o ENA representava US$ 0,32 (+4,9%).

Quanto às altas de dois dígitos percentuais, o KAIA chegava a US$ 0,12 (+14,7%), o SPX alcançava US$ 1,32 (+13,4%), o RVN era transacionado por US$ 0,017 (+12,7%), o TOSHI se equiparava a US$ 0,00056 (+11,8%), o UMA se nivelava por US$ 1,76 (+35,1%), o KTA estava estimado em US$ 1,61 (+16,3%), o PCI se convertia em US$ 0,10 (+59,5%), o VVV estava cotado a US$ 3,60 (+27,9%), o BORA estava quantificado em US$ 0,10 (+17,6%), o VICE se transformava em US$ 0,062 (+39,7%), o IXS era negociado por US$ 0,24 (+40,3%), o GFT respondia por US$ 0,021 (+18,9%), o AVA estava localizado em US$ 0,040 (+15,55) e o MIXIE era comprado por US$ 0,076 (+65%) com acumulado de 845% em sete dias.

Na semana anterior, as “memecoins de Elon Musk” derreteram após farpas com Trump, enquanto as liquidações beiravam US$ 1 bilhão com a pressão sobre o Bitcoin, conforme noticiou o Cointelegraph Brasil.

0 notes

Text

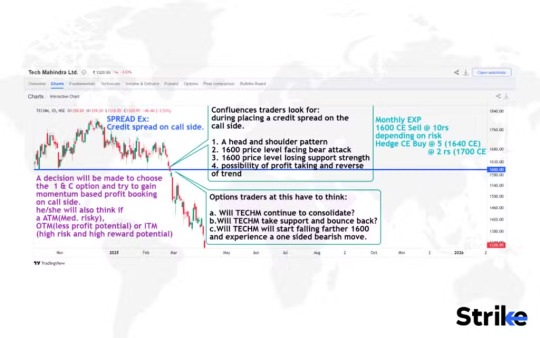

🧠 Complete Guide to Credit Spread: Smart Options Strategy for Profitable, Defined Risk Trading

The options market has exploded in popularity, especially with the rise of retail traders in India. Among dozens of complex strategies, the credit spread stands out as a smart, controlled-risk strategy for traders who want income with a hedge.

Whether you’re an experienced trader on NSE options, or just learning the ropes through tools like Strike Money, this guide walks you through everything—from how a credit spread works to real-world India-focused examples, payoff structures, and backtested results.

🤔 What is a Credit Spread in Options Trading?

A credit spread is a type of vertical options spread where you sell one option and buy another of the same expiry but different strike price. The result? You receive a net credit—hence the name.

⚡ Example: On Nifty 50, let’s say the index is at 22,500. You:

Sell a 22,400 PUT

Buy a 22,300 PUT

You receive a net premium of ₹45. This is your maximum potential profit, while your maximum loss is capped at ₹55 (difference in strikes – premium received). It's a defined risk strategy.

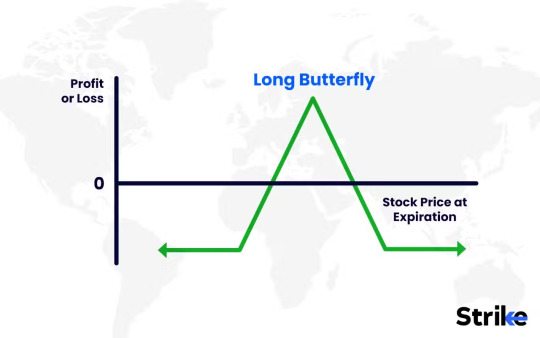

⚔️ Credit Spread vs Debit Spread – Know the Key Difference

While both use two options of the same type (calls or puts), the major difference lies in:

💵 Cash Flow: Credit spreads give you premium upfront, debit spreads cost you money.

📈 Probability of Profit: Credit spreads generally have a higher chance of profit but offer lower returns. Debit spreads need a stronger directional move to win.

📉 Risk Profile: Both are defined risk, but credit spreads are preferred by theta-positive traders who benefit from time decay.

Most Indian traders use credit spreads during range-bound or mildly trending markets, especially around weekly expiry on instruments like Bank Nifty and FINNIFTY.

🚀 Master the Two Types of Credit Spreads: Bull Put & Bear Call

🔼 Bull Put Spread – The Bullish Income Strategy

If you expect Nifty to stay above a support level, a bull put spread is ideal.

📍 Real Example: Suppose Nifty is at 22,500, and you believe it won't fall below 22,200. You:

Sell 22,300 PUT @ ₹60

Buy 22,200 PUT @ ₹20

👉 Net credit: ₹40 👉 Max loss: ₹60 👉 Breakeven: 22,260 👉 POP (Probability of Profit): 68% (based on Delta)

It’s a theta-positive, low-volatility strategy, best used when implied volatility (IV) is high and expected to fall.

🔽 Bear Call Spread – The Bearish Control Strategy

If you expect resistance to hold, use a bear call spread.

📍 Say Bank Nifty is at 48,000 and facing resistance at 48,500:

Sell 48,300 CALL @ ₹70

Buy 48,500 CALL @ ₹30

👉 Net credit: ₹40 👉 Max loss: ₹160 👉 Breakeven: 48,340 👉 Best in sideway markets post-earnings or RBI event

Strike Money’s IV charts and option chain overlays help identify the right strikes and IV levels.

📅 When Should You Deploy a Credit Spread?

Timing is everything.

⏰ Ideal time to enter a credit spread is:

7–10 days before expiry

IV Rank above 50

Delta of short leg around 20–30

Support or resistance confirmed by price action or indicators

India’s weekly options (especially on Nifty, Bank Nifty, and FinNifty) offer ideal setups with high liquidity and tight bid-ask spreads—both crucial for credit spread execution.

🛡️ Risk Management: Don’t Let Small Spreads Become Big Losses

Every trade has risk—but credit spreads offer you built-in insurance.

😨 Max loss happens only if the index breaches the long leg and expires beyond it.

🧠 Smart risk management tips:

Never hold till expiry if the trade is in danger

Use STOP LOSS on premium, e.g., exit if premium doubles

Roll the spread if direction changes

Use Strike Money alerts to get notified when your breakeven is approached

Many traders make the mistake of letting “high POP” fool them into complacency. But data from CBOE and Option Alpha shows that probability-based strategies still need active management.

🧮 How to Select the Right Strike Prices & Expirations

Your strike choice determines your success rate.

🎯 Ideal setup:

Short leg delta: 0.25–0.30

Spread width: 100–200 points (Nifty) or 200–300 (Bank Nifty)

DTE (Days to Expiration): 7–14 days for weekly spreads

Look for high open interest + volume

🔍 Use Strike Money’s Options Flow Scanner to find high-probability setups on stocks like Reliance, HDFC Bank, or ICICI Bank.

Data from OCC suggests that credit spreads with short legs in the 30-delta zone tend to deliver a 70–75% win rate, if risk is managed.

🧪 Are Credit Spreads Actually Profitable? Let’s Look at the Data

Let’s back it up with numbers.

According to a study by TastyTrade, credit spreads on the S&P 500 (similar in behavior to Nifty 50) with:

45 DTE

30 Delta short leg

1 SD width ...have delivered a 74% win rate over 10 years.

📈 On the Indian side, analysis of weekly Bank Nifty spreads from Jan–Apr 2024:

Strategy: Bull Put Spreads

Avg credit: ₹40

Win rate: 68%

Avg ROI: 9.3% per week

These strategies shine especially when combined with event-based setups like RBI policy, FED speech, or macro announcements.

🧰 Best Tools to Trade Credit Spreads in India

Your broker matters.

Most popular platforms:

Zerodha (low cost, but no execution spread orders)

Upstox

Fyers

Angel One

But what matters more is your analysis tool.

💻 Enter Strike Money—a growing charting and analysis platform tailored for Indian options traders:

Live Option Chain Analytics

IV Rank Tracker

Real-Time Breakout Alerts

Probability of Profit calculators

Multi-leg Strategy Builder

If you trade credit spreads without tracking volatility and real-time premiums, you're flying blind. Strike Money gives you the edge.

💥 Real-World Example: Credit Spread on Reliance Industries

Let’s say Reliance is trading at ₹2,900 and you anticipate range-bound behavior ahead of earnings.

You create a Bear Call Spread:

Sell ₹2,950 CALL @ ₹38

Buy ₹3,000 CALL @ ₹20

✅ Net credit: ₹18 ❌ Max loss: ₹32 🧮 ROI: 56.25% if Reliance stays below ₹2,950 at expiry

This setup would benefit from theta decay and falling IV post-earnings—a typical pattern observed in Indian stocks.

📢 FAQs About Credit Spreads in India

🧐 Is a credit spread bullish or bearish? Both. Use a bull put for bullish bias and bear call for bearish bias.

🧨 Can you lose more than you earn? Yes. Credit spreads have limited profit, but loss can be higher if poorly structured.

📈 Are credit spreads taxable? Yes, profits are considered business income under Indian tax laws, taxed as per slab.

🔍 Is it safer than a naked option? Absolutely. You always cap your risk with the long leg, avoiding margin calls.

📉 Is holding till expiry risky? Yes. Exercise risk, gamma spikes, and sudden IV changes can flip the trade. Exit when 70–80% profit is achieved.

🔚 Should You Trade Credit Spreads?

✅ If you:

Prefer defined risk

Thrive in range-bound markets

Want high probability setups

Use tools like Strike Money for smart entry and alerts

...then credit spreads are a solid strategy to add to your options playbook.

❗But remember: It's not “set and forget.” Monitor. Adjust. Respect the data.

🎯 Final Takeaway:

In the Indian options market, credit spreads provide a calculated way to generate consistent income while controlling risk. Backed by strong math, accessible instruments, and platforms like Strike Money, this strategy belongs in every serious trader’s arsenal.

💬 Ready to explore spreads? Use Strike Money’s multi-leg strategy builder today and start testing setups before going live.

0 notes