#CIFDAQ

Explore tagged Tumblr posts

Text

play time for cat Kedi İçin Oyun Zamanı🐈

dailymotion

#oil on canvas#cats of tumblr#cats#call of duty#warrior cats#cute cats#catholic#60s#across the spiderverse#animals#animation#anime and manga#arcane#art#architecture#23 nisan#deprem#kediler#kedi#kedicik#yavru kedi#crazy dance#going crazy#coffe#cifdaq#coffee#the coffin of andy and leyley#coffetime#good afternoooooon#good mood

50 notes

·

View notes

Text

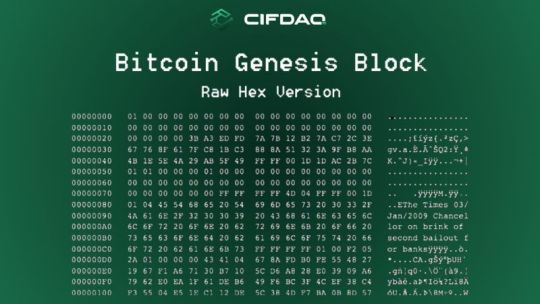

On January 3, 2009, a quiet yet revolutionary moment unfolded—the mining of the Bitcoin Genesis Block. This "primordial block" marked the birth of the Bitcoin blockchain, and with it, the dawn of decentralized finance. The first block, mined by the enigmatic Satoshi Nakamoto, carried a reward of 50 bitcoins. At today’s rates, that’s roughly $4.8 million. Yet, back then, it symbolized more than monetary value—it embodied a vision for a peer-to-peer electronic cash system, outlined in Nakamoto’s whitepaper. Sixteen years later, Bitcoin’s mining reward stands at 3.125 BTC per block, reduced by halving events occurring every four years. This deflationary model keeps Bitcoin scarce, bolstering its value over time. From its humble beginnings, Bitcoin has catalyzed the creation of over 2.4 million cryptocurrencies, pushing the total market cap to a jaw-dropping $3.4 trillion. Still, Bitcoin reigns supreme, commanding $1.91 trillion of that share. January 3 is more than a date; it’s a reminder that as Bitcoin continues its journey, it remains a symbol of innovation, resilience, and the power of decentralized ideas—a stark contrast to the centralized systems it aimed to disrupt, forever etched with the Genesis Block's message: “Chancellor on brink of second bailout for banks.” Himanshu Maradiya Sheetal Maradiya Rahul Maradiya Jay Hao Krunal Nilesh Sheth Anil Vasu Ankur Garg Muthuswamy Iyer Shipra Anand Mishra https://www.linkedin.com/posts/cifdaq_cifdaq-bitcoin-satoshinakamoto-activity-7280908184527982592-xUGW?utm_source=share&utm_medium=member_desktop

3 notes

·

View notes

Text

#desktop pc#mail4#aliexpress#affiliatemarketing#taylor swift#jvzoo#warriorplus#amazon#ai#gadget item#75k#cifdaq#20k#100 kudos#100k+ words#over 100k#100 kanojo#50k to 100k#50k#125k#usdc#ethereum#cryptotrading#cryptocurrency#bitcoin#cryptonews#sysblr#system things#system stuff#traumagenic system

6 notes

·

View notes

Text

Unveiling: The CIFDAQ Crypto Almanac 2024!

The ultimate guide to navigating the ever-evolving world of crypto! From Bitcoin’s rise as a strategic reserve to Ethereum’s breakthroughs in scalability and the tokenization of real-world assets — discover the trends, insights, and forecasts shaping the digital economy in 2024. Packed with expert analysis covering the entire ecosystem, this is your roadmap to unlocking opportunities in the blockchain revolution. Whether you're an investor, innovator, or enthusiast, this Almanac is your edge for the year ahead! Folks thesis, research reports and interviews, helped us immensely to build this report. We are tagging them as a token of thanks. James Butterfill Zach Pandl Matthew Hougan Dominic Weibel Mikko Ohtamaa Matthew Sigel, recovering CFA Lauren Goodwin, CFA and Donald Trump Jr. News Channels : CNBC Cointelegraph CoinGecko CoinMarketCap CryptoPanic Cryptopolitan Decrypt Block Mining, Inc. Projects mentioned in the report : Dogecoin DOGECOIN Shiba Inu Fetch.ai Render Mantle ZKsync Foundation ZKsync Central Bank Digital Currencies Companies Mentioned: Apple Microsoft Microsoft AI Amazon Netflix Google Meta

#Blochain#CIFDAQ#Web3#ETFs#Faang#AnnualReportCrypto#DePIN#DeSic#Trump#Layer1#Layer2#BlackRock#BankOfAmerica#Fidielity#HSBC#MasterCard#MorganStanely#Paypal#UBS#Visa#JPMorganChase#DeutscheBank#CitiBank#CitiBankReports

2 notes

·

View notes

Text

Unveiling: The CIFDAQ Crypto Almanac 2024! The ultimate guide to navigating the ever-evolving world of crypto! From Bitcoin’s rise as a strategic reserve to Ethereum’s breakthroughs in scalability and the tokenization of real-world assets — discover the trends, insights, and forecasts shaping the digital economy in 2024. Packed with expert analysis covering the entire ecosystem, this is your roadmap to unlocking opportunities in the blockchain revolution. Whether you're an investor, innovator, or enthusiast, this Almanac is your edge for the year ahead! Himanshu MaradiyaRahul MaradiyaJay HaoAnkur GargSheetal MaradiyaAnil VasuMuthuswamy IyerShipra Anand Mishra Folks thesis, research reports and interviews, helped us immensely to build this report. We are tagging them as a token of thanks. James Butterfill Zach Pandl Matthew HouganDominic WeibelMikko OhtamaaMatthew Sigel, recovering CFALauren Goodwin, CFA and Donald Trump Jr. News Channels : CNBCCointelegraphCoinGeckoCoinMarketCapCryptoPanicCryptopolitanDecryptBlock Mining, Inc. Projects mentioned in the report : DogecoinDOGECOINShiba InuFetch.aiRenderMantleZKsync FoundationZKsyncCentral Bank Digital Currencies Companies Mentioned: AppleMicrosoftMicrosoft AIAmazonNetflixGoogleMeta

#Blochain#CIFDAQ#Web3#ETFs#Faang#AnnualReportCrypto#DePIN#DeSic#Trump#Layer1#Layer2#BlackRock#BankOfAmerica#Fidielity#HSBC#MasterCard#MorganStanely#Paypal#UBS#Visa#JPMorganChase#DeutscheBank#CitiBank#CitiBankReports

3 notes

·

View notes

Text

Founder & Chairman, Himanshu Maradiya has been featured in 11-12-2024 print edition of The Hindu businessline, Print Edition, page 2, commenting on the recent Google Willow Chip. https://www.linkedin.com/posts/cifdaq_cifdaq-googlewillowchip-bitcoin-activity-7272503053969211392-fUSK/

2 notes

·

View notes

Text

Unveiling: The CIFDAQ Crypto Almanac 2024!

The ultimate guide to navigating the ever-evolving world of crypto! From Bitcoin’s rise as a strategic reserve to Ethereum’s breakthroughs in scalability and the tokenization of real-world assets — discover the trends, insights, and forecasts shaping the digital economy in 2024.

Packed with expert analysis covering the entire ecosystem, this is your roadmap to unlocking opportunities in the blockchain revolution. Whether you're an investor, innovator, or enthusiast, this Almanac is your edge for the year ahead!

Folks thesis, research reports and interviews, helped us immensely to build this report. We are tagging them as a token of thanks. James Butterfill Zach Pandl Matthew Hougan Dominic Weibel Mikko Ohtamaa Matthew Sigel, recovering CFA Lauren Goodwin, CFA and Donald Trump Jr. News Channels : CNBC Cointelegraph CoinGecko CoinMarketCap CryptoPanic Cryptopolitan Decrypt Block Mining, Inc. Projects mentioned in the report : Dogecoin DOGECOIN Shiba Inu Fetch.ai Render Mantle ZKsync Foundation ZKsync Central Bank Digital Currencies Companies Mentioned: Apple Microsoft Microsoft AI Amazon Netflix Google Meta

#Blochain#CIFDAQ#Web3#ETFs#Faang#AnnualReportCrypto#DePIN#DeSic#Trump#Layer1#Layer2#BlackRock#BankOfAmerica#Fidielity#HSBC#MasterCard#MorganStanely#Paypal#UBS#Visa#JPMorganChase#DeutscheBank#CitiBank#CitiBankReports

2 notes

·

View notes

Text

Türkiye vs Azerbaycan Boksörü🥊🥊🥊🎸📀♥️♥️😆

dailymotion

#booklr#books#bokeh#boks#60s#across the spiderverse#animals#animation#anime and manga#arcane#art#architecture#23 nisan#deprem#anneler günü#crazy dance#just dance#hugh dancy#dancers#dance#dandys world#dan and phil#crazy#going crazy#crazy girl#this is crazy#crafts#coffe#cifdaq#coffincest

43 notes

·

View notes

Text

Dogecoin (DOGE) Price Prediction 2024, 2025, 2026 And 2030

Dogecoin (DOGE) Price Prediction 2024, 2025, 2026 And 2030

Dogecoin is an open-source peer-to-peer virtual currency favored by Shiba Inus globally. At least in part, it was created as a lighthearted joke for crypto enthusiasts and took its name from a once-popular meme.

DOGE is a meme coin cryptocurrency that utilizes blockchain technology, a highly secure decentralized system of storing information as a public ledger that is maintained by nodes (a network of computers). According to CoinMarketCap, Dogecoin is now among the top seven cryptocurrencies by market capitalization.

Dogecoin and other meme coins have outperformed Bitcoin over the past weeks, driven by an altcoin rally amid reduced regulatory uncertainty following the counting of the U.S. presidential election and Donald Trump’s victory. DOGE nearly surged over 167% in the last month. According to market capitalization, Dogecoin moved from the 10th to the 7th cryptocurrency on the CoinMarketCap ranking. DOGE Historical Price As of Nov. 19, 2024, Doge is trading at $0.3825 with a market capitalization of $56.39 billion, up by 168.36% in the last month. DOGE Price Prediction 2024 The dog-themed meme coin has surged approximately 167% in the last month, mainly after Donald Trump’s election.

DOGE experienced a bullish trend in the last quarter of 2024; Dogecoin is likely to skyrocket with the current rally, which is known for igniting massive jumps in altcoins due to the U.S. presidential election 2024

According to Coinpedia, the meme coin could witness a boost from the broader market recovery fueled by a potential rate cut in September. Hence, by the end of 2024, DOGE will likely hit the $0.3751 mark, a 270% price hike from current prices.

According to CoinDCX, the DOGE price is expected to be heavily volatile in the last few weeks of the year, attracting massive liquidity onto the platform. Market sentiments may change significantly, with market participants optimistic about the next price action. By the end of the month, the price may trade approximately $0.31 to $0.33, setting up a path toward DOGE’s new ATH in 2025. DOGE Price Prediction 2025,2026..2030 Ryan Lee, chief analyst at Bitget Research, said that, according to historical records, DOGE rallied before Bitcoin prices moved towards its new ATH. Even more recently, Dogecoin outperformed Bitcoin after Donald Trump’s win and the influential backing of Elon Musk, a strong advocate for Dogecoin. This combination of political momentum and celebrity endorsement increases support for DOGE prices in the long run.

As we approach 2025, investor optimism is rising regarding Dogecoin’s growth potential due to its increasing acceptance worldwide and the anticipation of breaking the $1 mark. With its strong community backing, Dogecoin can go beyond its ATH of $0.7, but it will have to accumulate over a hundred billion dollars for that to happen.

According to Changelly, after analyzing Dogecoin prices in previous years, it is assumed that in 2025, the DOGE minimum price will be around $0.101, and the maximum may be around $0.173. On average, the trading price of DOGE might be $0.248 in 2025.

According to Changelly, based on cryptocurrency experts’ technical analysis of Dogecoin prices, 2026 DOGE is expected to be between $0.2777 and $0.3337. The average trading cost is expected to be $0.2856.

According to Binance, as of Nov. 19, 2024, the price prediction input for Dogecoin gathered from 269 users, the value of DOGE may increase by 5% and reach $ 0.489843 by 2030. According to the consensus rating, the current sentiment is that 128% of users are very bullish.

Anish Jain, founder of WadzChain, said that as Dogecoin continues to experience notable gains, even outperforming Bitcoin in specific metrics, it highlights the evolution of public sentiment and adoption trends within the cryptocurrency ecosystem. Dogecoin’s 2025 forecast reflects the meme currency’s resilience and the power of community-driven projects in shaping market movements.

However, as with all cryptocurrencies, significant volatility remains a consideration. A diversified approach—focusing on leading coins like Bitcoin and emergent tokens with solid community backing like Dogecoin—will help advance financial inclusion and digital asset awareness worldwide.

What is the Future of Dogecoin? Unlike most cryptocurrencies, Dogecoin’s supply is unlimited, as it mines blocks indefinitely. This unlimited inflation could dampen price appreciation over the long haul compared to coins with capped circulating supplies.

Dogecoin’s future depends on its potential utility. Meme popularity may only sustain DOGE for a while. However, progress in speed, lower transaction fees, and business collaboration could see it thrive as a mainstream digital currency. Its passionate and large community will likely keep evolving positively.

While long-term predictability is tough, Dogecoin shows signs of being more than a temporary phenomenon. Provided that upgrades and adoption progress address technical challenges, DOGE stands a reasonable chance of enduring as a cryptocurrency widely used with upside price potential in the coming years.

www.cifdaq.com

0 notes

Text

Insights from CIFDAQ COO Jay Hao: A Guide to Fund Raising for Web3 Startups

Insights from CIFDAQ COO Jay Hao: A Guide to Fund Raising for Web3 Startups

Web3 startups have raised over $5.4 billion in venture capital during the first three quarters of 2024. This figure reflects a significant investment trend, with $1.4 billion raised in the third quarter alone.

Investors are increasingly targeting emerging markets at the intersection of blockchain and artificial intelligence (AI), while projects focused on decentralized blockchain infrastructure have also recently drawn substantial capital flow.

However, despite these glowing statistics and trends, securing funds for Web3 startups is no straightforward feat. And as a Web3 journalist, I have witnessed the tension in the industry firsthand. Conversations with founders and investors have revealed a landscape marked by both potential and uncertainty.

There’s no doubt that startups are emerging with innovative concepts. But then they’re confronting an investment arena that demands more than just a compelling pitch—it requires strategic precision, robust fundamentals, and a clear, executable vision.

To help Web3 startups go about fundraising the right way, I spoke with Jay Hao, Co-Founder and Global Chief Operating Officer of CIFDAQ, and former CEO of OKX. In this exclusive interview, Hao shared practical tips on building a solid foundation, crafting a compelling narrative, and tokenomics. He also offered guidance on identifying investment needs, attracting the right investors, and negotiating deals.

Editorial Note: The article is derived directly from the exclusive interview with Jay Hao. While the original interview format has been transformed into a comprehensive narrative, every insight and quote remains authentic to Hao’s original responses.

Building a Strong Foundation Every great Web3 startup begins with a rock-solid foundation. According to Hao, building a solid foundation is more than a preliminary step—it’s a critical determinant of a startup’s potential success. Hao emphasizes that this foundation rests on three fundamental pillars: team, technology, and business model.

“A strong foundation for a Web3 startup hinges on assembling a visionary, skilled team, developing innovative and secure technology, and crafting a business model that leverages blockchain’s decentralization,” Hao explains.

This holistic approach goes beyond mere technical capabilities, focusing on scalability, real-world impact, and creating a unique value proposition that captivates both users and investors.

Additionally, central to a startup’s foundation is the ability to tell a compelling story. According to Hao, a powerful narrative combines the mission with an engaging story about how the project solves an urgent problem in an innovative way. And this approach is not merely about marketing—it reflects a profound understanding of the problem and presents a visionary solution capable of transforming existing paradigms.

When asked whether tokenomics is essential, Hao emphasized its importance in aligning the interests of all stakeholders. He explained that effective tokenomics goes beyond simply creating a cryptocurrency.

“It involves creating a model with fair token distribution, real utility such as governance, staking, or transactions within the platform, and mechanisms to balance supply and demand. This fosters trust among investors and the community while driving ecosystem adoption,” Hao adds.

The Right Funding Strategy Having established the foundational elements of a Web3 startup, the next challenge is securing the right capital from the right investors for the right reasons.

Now, the first question any startup must ask is whether funding is even necessary. And Hao offers a clear perspective on this:

“Investment is essential only if it addresses critical growth gaps like product development, scaling, or market entry. One should avoid the allure of fundraising for PR hype; instead, ensure funding directly accelerates achieving your startup’s long-term vision.”

This perspective demands a strategic, almost surgical approach to fundraising. Startups must move beyond the glamour of raising capital and focus on precise, milestone-driven funding that propels genuine growth. Meticulously forecasting costs, aligning funding with specific growth targets, and benchmarking valuations against market trends become paramount.

The quest for the right investor is equally nuanced. You shouldn’t raise from any investor, but find a partner who comprehends the unique challenges and potential of your Web3 venture.

“The right investor understands your vision, brings strategic value beyond funding, and aligns with your long-term goals. Whether it’s an angel for early validation or a VC for scaling, prioritizing those who can offer expertise, connections, and credibility boosts the success of a startup,” Hao emphasizes.

Adding another layer to the complexity are Key Opinion Leaders (KOLs), who are increasingly stepping into the investor role. While they can offer massive exposure and credibility, their involvement requires careful consideration. The equity they demand must be proportional to their tangible impact—measured not by social media followers, but by their ability to drive meaningful community growth and user adoption.

Closing the Right Deal Negotiating investment terms is another critical moment for Web3 startups. Founders must balance financial strategy with collaborative partnership, viewing investor discussions as opportunities to align mutual goals and create shared value.

Following are some of the key tactics that Hao emphasizes for getting the best deal:

Don’t limit yourself to one source of funding. Having a range of options gives you leverage in negotiations and avoids being cornered into unfavorable terms. Be upfront about your startup’s valuation and the reasoning behind it. A clear, well-supported explanation shows investors that you understand your worth and the market. Focus on terms that benefit both sides, such as vesting schedules, governance rights, and token lockups. These provisions help align the interests of the startup and investors over the long term. Always bring legal experts into the process to ensure that agreements are fair and enforceable, and protect your startup’s best interests. After the Funding Securing funding is not the finish line. The transition from fundraising to execution is where many Web3 startups falter. Successful teams understand that investor confidence is continuously earned, not just initially obtained.

This is where the roadmap developed during the fundraising process becomes a critical navigation tool, guiding the startup’s strategic decisions and demonstrating commitment to its original vision.

“Post-funding, the team must focus on disciplined execution, strategically hiring talent, and delivering on the promised milestones,” Hao advises.

This approach goes beyond mere financial management—it’s about building trust, maintaining transparency, and demonstrating the ability to transform potential into tangible results.

Here are the key strategies that Hao shares for fostering strong relationships with investors:

Keep investors in the loop with regular updates on progress, challenges, and new opportunities. This helps build trust and ensures everyone stays aligned with the vision. Involve investors in key decisions when appropriate. Their expertise can be invaluable, and giving them a stake in important choices strengthens their connection to the project. Encourage investors to get involved in the ecosystem, whether through roles like validators, token holders, or advisors. This deepens their engagement and makes them feel more invested in the startup’s success. “By sticking to the roadmap you’ve built, you naturally boost confidence among both the community and the team,” Hao continues.

Critical to this process is building a loyal community, tracking key performance indicators (KPIs), and maintaining organizational agility. Every funding dollar must be viewed as an investment in growth and innovation, requiring constant evaluation and strategic reallocation.

The Web3 landscape is unforgiving to startups that cannot translate capital into meaningful progress. Success demands more than a compelling pitch or an impressive funding round—it requires relentless execution, strategic talent acquisition, and an unwavering commitment to the original mission.

www.cifdaq.com

0 notes

Text

🚢 OpenSea is making waves again! 🌊

With the launch of OS2 and the upcoming $SEA token, OpenSea is setting the stage for a major comeback. 🔥

Himanshu Maradiya Sheetal Maradiya Rahul Maradiya Krunal Sheth Jay Hao Anil Vasu Ankur Garg Muthuswamy Iyer Shipra Anand Mishra

www.cifdaq.com

1 note

·

View note

Text

Shib , an Inu whale, accumulates over 397.8 SHIB in the face of market volatility

In this article: Shib a Inu (SHIB) remains in the spotlight despite the overall downward trend. Current data shows that a single wallet has accumulated over 397 billion SHIB tokens. Coinbase's hot wallet sees an inflow of 725.79 billion SHIB worth over $10 million. Despite fluctuating market conditions, a single wallet recently accumulated 397.845 billion SHIB tokens. The value of the wallet holdings is $5.21 million, demonstrating continued interest in Shib a Inu despite market uncertainties. On-chain records show that the wallet was experiencing a significant increase in SHIB tokens due to fluctuating prices . Despite this, the owner has continuously acquired SHIB tokens without making any transactions.

Whales increase their SHIB holdings despite losses The ups and downs in this wallet's earnings highlight the unpredictability of Shib a Inu. Initially, things remained relatively stable, with only minor shifts in cumulative gains and losses, until a dip on August 12 caused a decline, which was somewhat offset by a rebound the next day. On August 15 and 16, further fluctuations occurred, with the wallet experiencing further losses in value; however, these declines were not as severe as those on August 12.

Notably, Shib a-Inu whales and sharks have recently increased their holdings, accumulating 4.35 trillion SHIB between March and mid-May. On May 2, an anonymous wallet withdrew 1.75 trillion SHIB tokens from Robinhood, continuing its accumulation streak amid a price crash.

As of August 12, 1.36 million addresses held Shib a-Inu tokens, with the price at approximately $0.000014. Interest from small retail investors has increased significantly, with the number of addresses holding 0 to 1 million SHIB increasing by approximately 1.58% over the past month.

Recent on-chain data shows a sharp decline in the volume of large transactions, suggesting that whales, typically market movers, are withdrawing their SHIB. The seven-day high of 46 transactions on August 9 was surpassed by just 39 large transactions the day before.

Shib a Inu sees heavy bleeding and loses 18.75% in two weeks On August 1, 2024, the price of Shib a Inu was $0.000016, reflecting a correction phase under severe pressure. Buyers struggled to regain control, and SHIB failed to sustain its breakout rally. After starting the year below $0.000010, the price has fallen 18.75% over the past two weeks.

If the SHIB price rises above $0.00003682 and continues to do so, it could reach the target of $0.00006697 in 2024. However, if the price reverses, it could undoubtedly fall to $0.000010. Overall, the outlook for Shib a Inu is positive, although there is a risk of downside.

Himanshu Maradiya, founder and chairman of the CIFDAQ Blockchain Ecosystem, explained that predicting the future price of Shib a Inu (SHIB) is challenging due to its highly speculative nature and the volatility inherent in the cryptocurrency market.

www.cifdaq.com

0 notes