#SATOSHINAKAMOTO

Explore tagged Tumblr posts

Text

Bitcoin Revolution: As Revolutionary as the Gutenberg Press

Imagine living in 15th-century Europe. Knowledge was guarded jealously by elites, handwritten in rare manuscripts, locked away from ordinary people. Then came Johannes Gutenberg. His printing press shattered these barriers, spreading knowledge rapidly, forever altering society’s landscape. The revolution wasn’t just technological—it was societal, intellectual, and cultural. It empowered individuals, challenged the status quo, and ultimately reshaped civilization.

Today, we stand at a similar crossroads with Bitcoin.

Bitcoin is much more than digital money. It’s a powerful movement breaking down the centralized walls that have kept financial knowledge and control firmly in the hands of a privileged few. Just as the Gutenberg press democratized information, Bitcoin democratizes finance, giving anyone with internet access the power to reclaim financial sovereignty.

The parallel is striking: The printing press decentralized the flow of information; Bitcoin decentralizes financial power. Institutions initially resisted the printing press, fearing loss of control. Today, banks, financial institutions, and even governments express similar apprehensions about Bitcoin, resisting change and spreading fear, uncertainty, and doubt.

Yet, history repeats itself. Just as the printing press catalyzed the Renaissance, sparking revolutions in science, philosophy, and politics, Bitcoin carries the potential to ignite a modern renaissance. It challenges outdated economic systems, fosters transparency, and empowers individuals through financial literacy and autonomy.

But how can you, today, join this revolution practically?

Enter Dollar-Cost Averaging (DCA)—the simplest, most effective way to join this financial renaissance. DCA allows anyone to steadily invest a fixed amount into Bitcoin regularly, minimizing risks and reducing anxiety about Bitcoin's famous volatility. Think of it as building your financial literacy page by page, just as Europeans once gained knowledge book by book. Over time, small, consistent contributions grow into meaningful financial empowerment.

If you had invested just $10 weekly since 2017, today you'd have built an impressive financial foundation. No expertise required, no large initial capital necessary—only patience and consistency.

Like the spread of literacy through Gutenberg's press, the adoption and understanding of Bitcoin won't happen overnight. It’s gradual, incremental, yet unstoppable. Embrace this powerful shift. Choose a reputable platform, set your comfortable investment amount, automate your investments, and watch your own financial revolution unfold.

We are fortunate to witness history repeating itself, standing once again on the cusp of a revolutionary change. The printing press took power from the elites and put it into the hands of the people. Bitcoin is doing exactly that, but this time it’s your financial freedom at stake.

Don't just observe history—become part of it.

Tick Tock Next Block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#CryptoRevolution#FinancialFreedom#GutenbergPress#Decentralization#BitcoinEducation#SoundMoney#FutureOfFinance#BTC#MoneyRevolution#DigitalGold#BitcoinAdoption#TickTockNextBlock#BitcoinRenaissance#FinancialSovereignty#MoneyMatters#DCA#InvestWisely#SatoshiNakamoto#CryptoHistory#blockchain#digitalcurrency#financial experts#finance#financial education#globaleconomy#financial empowerment#unplugged financial#cryptocurrency

3 notes

·

View notes

Text

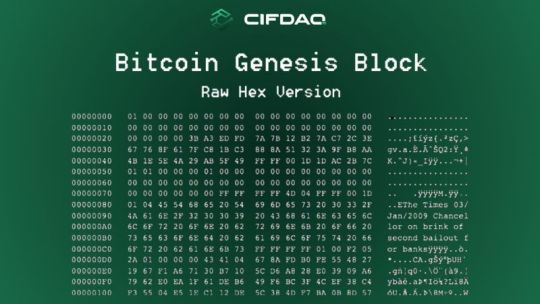

On January 3, 2009, a quiet yet revolutionary moment unfolded—the mining of the Bitcoin Genesis Block. This "primordial block" marked the birth of the Bitcoin blockchain, and with it, the dawn of decentralized finance. The first block, mined by the enigmatic Satoshi Nakamoto, carried a reward of 50 bitcoins. At today’s rates, that’s roughly $4.8 million. Yet, back then, it symbolized more than monetary value—it embodied a vision for a peer-to-peer electronic cash system, outlined in Nakamoto’s whitepaper. Sixteen years later, Bitcoin’s mining reward stands at 3.125 BTC per block, reduced by halving events occurring every four years. This deflationary model keeps Bitcoin scarce, bolstering its value over time. From its humble beginnings, Bitcoin has catalyzed the creation of over 2.4 million cryptocurrencies, pushing the total market cap to a jaw-dropping $3.4 trillion. Still, Bitcoin reigns supreme, commanding $1.91 trillion of that share. January 3 is more than a date; it’s a reminder that as Bitcoin continues its journey, it remains a symbol of innovation, resilience, and the power of decentralized ideas—a stark contrast to the centralized systems it aimed to disrupt, forever etched with the Genesis Block's message: “Chancellor on brink of second bailout for banks.” Himanshu Maradiya Sheetal Maradiya Rahul Maradiya Jay Hao Krunal Nilesh Sheth Anil Vasu Ankur Garg Muthuswamy Iyer Shipra Anand Mishra https://www.linkedin.com/posts/cifdaq_cifdaq-bitcoin-satoshinakamoto-activity-7280908184527982592-xUGW?utm_source=share&utm_medium=member_desktop

3 notes

·

View notes

Text

WEB 3 POINT NO HAPPENING (High Level Why)

World of Nerds, WinkleVi, & the Reality Challenged

By ScriptureKiddie

Disclaimer: If you offend easily (stop being a pu**y) TURN BACK

Do you ever wonder why you feel so disconnected and lonely while living in a world with eight billion plus “intelligent” beings? The fact that most humans buy into intellectual superiority over any other of God’s creations may succinctly recapitulate the sum of glaring historical failures in every facet of our existence on this planet. Humans decadently guzzle their homemade, flavorless Kool-Aid until they convince themselves it is top shelf quality hydration. If you are offended by that truth, then stop reading now because this pill is jagged as fuck.

The world is loud, unnecessarily busy, riddled with red tape, wrapped in policy, with a policy to that policy on top of its policy, smothered in misinterpretation of misrepresentation and outright lies. Any of the few who fluently speak and comprehend reality (truth) feel the disconnect, the rest revel in the bro-ness of connectivity. The geeks and weirdos behind the wondrous blockchain and the idiocy that has ensued take this shit to a whole other level of fuckery, though. This is not a history paper so I will not delve into the faceless moron who started all this stupidity (I wouldn’t want anyone to know how big a failure I was either with this garbage). Well intended or not, the proof is in the Fonzarelli of Ponzi schemes known as crypto and Web 3.0 that click baiters from all walks of the lower rung of media can’t help but splatter all over the land of fake believe.

Meet The Fockers

I will not go deep, because TLDR is a waste of (y)our more precious than thou time, but let’s have a high-level gander at the cast of characters. It is pretty telling that some of the biggest names in nerdom have been handed or are awaiting lengthy (you think your juice box got jacked in high school) prison sentences. Names that I do not care enough about to research for recognition because who really cares? While they focus on the art of steady and firm grips on soap bars, we will cover the ones who will most likely practice the butthole pucker at a later date.

Let’s begin with the oddball, malnourished, (I am on the spectrum, so I get to dismantle others on it) Russian sheet stain, the godfather of gouging, ahem, gas fees, Vitamin Butterfinger. The aforementioned, faceless, Satoshi (I am probably not Asian but want a name that makes me appear wiser in the ways of merging tech and finance) Shamalamadingdong, who was gone like a fart in the wind upon learning what scalability meant. The familiar faces from the boomer gen of geriatrics that refuse to retire, gam gam and gampy who publicly criticize technology while privately having their grandchildren lace em up with streams of income directly from such, leveraging assets acquired by not having to pay 15 dollars a grocery item. And last but not least, Gen(der) Z, the 9th place ribbon wielding, everyone a winner, 10 billion gender bending, soft and oft offended by: lifting fingers, shit that’s none ya business, work, and business in general, plus anything that begins with re and ends with sponsibility. Honorable mention goes to the WinkleVi brethren simply because it is almost as humorous as it is sad to watch these lovable losers scratch and claw for relevancy in a world that wants nothing to do with them. Just because Hollywood portrayed you as such, you aren’t Armie Hammer, Bruhs. Not even if there was a special ed version. Not even if there was a fire. (Random but necessary Step Brothers)

Harsh assessments, maybe, but do your homework on any of them and you will understand that equalizers exist in this world to remind the wicked of who they truly are. Though I am not proclaiming I was sent, I will absolutely be dealt with by The Creator for the judgment of others, I am necessary. My sins versus any other person, are equal in weight to God but since humans have a different measurement system, at least I am not stealing from people by way of lies and manipulation. The sheer volume of Russian players and investors should be all the warning needed to steer clear of this insanity. That Russian in the shadows of the underbelly sure looks like a square businessman to me said no one ever.

By ScriptureKiddie

The Labyrinth

Smoke and mirrors, a boomer simplicity passed on as genius to a generation of identifiers of magical meows, void of gold royalty, and entrepreneurial owners of nothing. A “decentralized” web of dubiety, dumb contracts, and tens of thousands of fly by night, backed by jack “currencies” that have zero value to anyone trading tangible items. The exception being drugs, which, hey, you had something. Untraceable currency, until it was traceable. Hence, fail, fail, fail, and N FAIL T. Since we are now obligated to not hurt the feelings of those who fail, you get a pink ribbon of FAIL. Oh, but you are all wealthy, self-made (that word alone will spark my next blog as I school you on why you own nothing, have no talent, nor control a thing aside from the grace given of Whom you probably deny), and probably even conned some real humans into giving you nice things based on the ledger of lies you call a “Blockchain” huh? See how bought in they are when your system implodes, and they come looking for real things to collect to cover the debt for your Maybach bro. The point is, no matter how much complexity you wrap bullshit in, it is still bullshit. Nothing more, nothing less. The value of which is equivalent to the depths of your morals and ethics.

Why It Isn’t Expanding

So, you have this exciting new galaxy of anonymity and opportunity. Fundamentally based on a “level” playing field free from the oppression of Illuminatic (I identify that as a word now before you open your mouth Sir Poops with Kitty Kitties) dark forces and oversight by the blind, yet you are not growing at a pace commensurate with the lies of allure you are pumping into the ether. You woke though bro, so how is it not knocking you upside your mis-shaped/guided noggin?? Perhaps you had a realistic shot if you hadn’t outsmarted your own stupidity by creating a matrix of protocols too intricate for you to even explain in layman’s about how to send your “currency” from one shady entity to the next. This custodial wallet does this and supports this network of noncustodial sham dams which can bridge to that flatulent DEX to the one you can’t use in America but is being heavily promoted to Americans, so yea we are working on that, but you need to call Biden. Advise the poster child of confusion to fix it so we can share digital nothingness across invisible international lines of ignorance? You have the face and brain capacity only a mother could love. I won’t even mention, except I will, that Vitamin McForehead’s gas fees more oft than not exceed the transactional value being placed. Brilliance on levels of epic never before seen in the history of mental you know the R word. *** So as not to be canceled by the generation that ignores the fact that God is THE ONLY ONE who can cancel anything ***

Allow me a moment to google how to speak in idiot so I can break it down for all the “illuminated” minds who will more than likely be stuck at the first analogy wrapped fuck you I have placed throughout this un and necessarily pointed reality check. Suzie homemaker and simplistic business Bob aren’t down with it bruh. The seniority of Millennials are getting older and beginning to realize the massive mistakes made coddling you into the problem you have become. They do not have 35 hours a day to learn how to buy the drugs needed to cope with you on the dark web with the latest meme scam coin. Drug dealers do and will continue to exist in the flesh. Younger Millennials still buying in will begin having children that require resources bought in places that do not support Shima Uba Fluffy tokens. Biden gets confused tying his shoe and the boomers ultimately will fade into the afterlife for which they have prepared by faith and works (or lack thereof) during their lives (Trump is stuck on 2nd grade arithmetic so I wouldn’t get my hopes up). Gen X would rather send you to oblivion by way of banishing you to a nature preserve and placing bets on how many days (hours) will pass before corpses start surfacing. Do I need to elaborate any further?

By ScriptureKiddie

Novel Idea with Shady Intentions

The idea behind blockchain technology is sufficiently relevant and necessary. The problem is, you aren’t operating any differently than the evil scum that you claim to be building impenetrable walls against. The transparency is of paramount importance, that of which is the only protocol decently in place. Anyone with basic reading and comprehension skills can ascertain that financial, corporate, and government entities are nothing more than transparently in bed swapping syphilis, gonorrhea, and herpes amongst one another. Inserting complexity into elementary processes in an effort to line beneficiary pockets has been employed by bureaucrats since humans magically morphed into intelligent beings from tsetse fly excrement 200 billion trillion fillion years ago per the rocks and shit. Right after the bang that came from absolutely nothing. You are doing the same thing.

The cryptocurrency infrastructure is no different and it is a system destined for inevitable failure as referenced by every other innovation bred by human greed. You aren’t going mainstream with the status quo. Granted there are ways to profit with Bitcoin (at this point you need some money to play with), the Ether business model is a not so cleverly concocted Ponzi scheme staying glued together by a generation of creatively challenged copy/paste bloggers and untalented bags of douche known as influencers. It is not set up for the average Joe to do anything other than dump real money in and “HODL”, stake (scam), and mint (scam) NFT’s so the whales can gobble up the proceeds.

I intentionally did not dive into Web 3.0 because every other point renders it useless as is constructed. A collection of Atari inspired landing pages offering more confusion into the madness will last as long as the blockchain it is built on. The concept has merit, but you mofo’s are way off right now. If you would just surrender your life to God, you wouldn’t have to trick people into thinking you are relevant and swindle them for money they actually earn, remove all value from it, then turn into a bag of magic beans. You have only managed to take something worthless and make it worth less. I will give you a first-place ribbon for that shit.v

3 notes

·

View notes

Text

Who Created Bitcoin? The Mystery of Satoshi Nakamoto

Who Created Bitcoin? The Mystery of Satoshi Nakamoto Bitcoin, the world’s first decentralized cryptocurrency, was introduced in 2008 through a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” The author, or authors, used the pseudonym Satoshi Nakamoto, but their true identity remains one of the biggest mysteries in the tech and financial world. The Origins of Bitcoin Satoshi…

View On WordPress

0 notes

Text

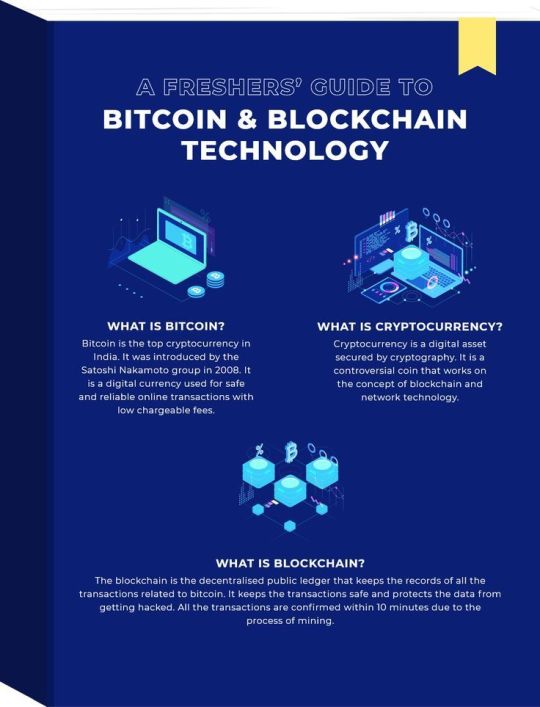

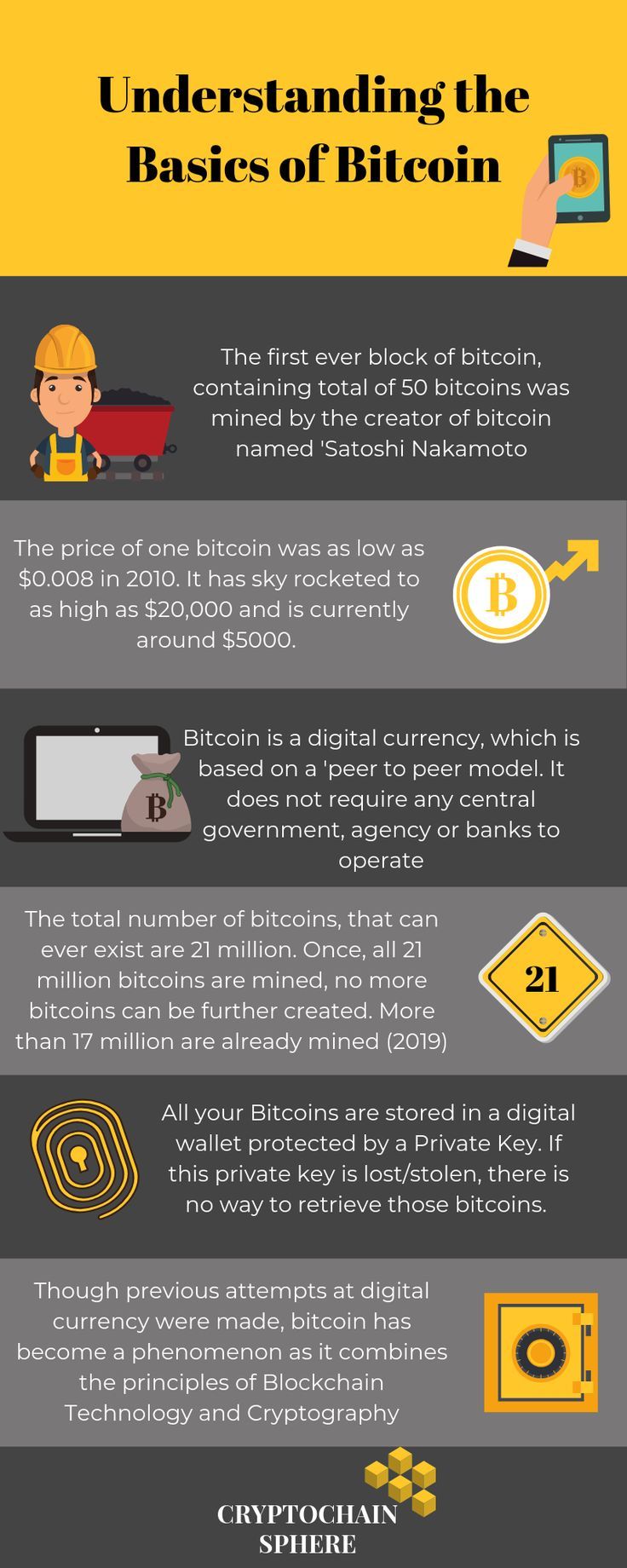

🧠💰 "BITCOIN: What They Didn't Teach You in School... 😳"

🚨 You’ve heard the word. Now understand it. Bitcoin isn’t just “internet money” – it’s a global rebellion against banks, borders, and broken systems 🌍💣

🔐 Created in 2008 by a mysterious figure named Satoshi Nakamoto, Bitcoin lets you send money with no banks, no borders, and no permission. 🧬 It's powered by blockchain & cryptography – and backed by pure math.

💼 Your Bitcoin wallet has 2 keys: one public, one super private (lose it = bye-bye forever 😬). 💸 Buy, send, store, and own your money like never before.

👀 The best part? All your transactions are etched into a public ledger forever – transparent & unchangeable.

🔗 Want to understand the real future of money?

👉 https://t.co/Ttddedmvoc

#WhatIsBitcoin#CryptoSimplified#BitcoinForBeginners#BlockchainEducation#DigitalCurrency101#SatoshiNakamoto#Web3Revolution#CryptoAwareness#BitcoinWallet#FinancialFreedom#InfographicVibes

0 notes

Text

🚀 Confused by Crypto? This Beginner's Guide Will Make You a Blockchain GENIUS! 🚀

Heard of Bitcoin but still scratching your head? 🤔 The world of cryptocurrency and blockchain can seem daunting, but it's the future of finance! 💰 This ultimate beginner's guide breaks down everything you need to know in simple, easy-to-understand terms. From what Bitcoin really is to how blockchain works its magic, you'll go from crypto-curious to confident in minutes! 🤯 Don't miss out on understanding the technology that's changing the world. Click here to unlock the secrets of digital currency and become crypto-savvy: 👉 https://t.co/Ttddedmvoc 👈 Your financial future starts now! ✨

#Bitcoin#Blockchain#Cryptocurrency#CryptoGuide#BeginnerFriendly#FreshersGuide#DigitalCurrency#FutureOfFinance#TechExplained#Web3#Decentralized#FinTech#LearnCrypto#Crypto101#SatoshiNakamoto#Mining#DigitalAsset#InvestmentTips#FinancialLiteracy#ViralContent#Clickbait#MustRead#BlockchainTechnology#CryptoBasics#UnderstandingCrypto#GetSmart#FinancialFreedom#Education#Innovation

1 note

·

View note

Text

Who is Satoshi Nakamoto | Founder of Bitcoin

0 notes

Text

#Bitcoin#Cryptocurrency#Blockchain#CryptoInvesting#DigitalCurrency#BitcoinInvestment#BitcoinMining#CryptoNews#BitcoinCommunity#Decentralization#Fintech#BitcoinTrading#Altcoins#CryptoMarket#BitcoinAdoption#SatoshiNakamoto#BitcoinWallet#InvestInBitcoin#BitcoinTechnology#CryptoTrends#BitcoinFuture#BitcoinEconomics#BitcoinRegulation#CryptoEducation#BitcoinAnalysis#BitcoinPrice#HODL#BitcoinWealth#CryptoAssets#BitcoinInnovation

0 notes

Text

The Dollar-Bitcoin Dance: Revisiting a Momentous Parity

In the annals of financial history, few stories are as captivating, as improbable, and as revolutionary as that of Bitcoin. From its enigmatic origins in the aftermath of the 2008 global financial crisis to its current status as a trillion-dollar asset class, Bitcoin’s journey has been nothing short of extraordinary. Yet, amidst its meteoric rises and dramatic corrections, one particular…

0 notes

Text

Criptovalute: tutto quello che c’è da sapere http://dlvr.it/TKwjgj

0 notes

Text

The Philosophy Behind Bitcoin

Introduction

In the world of finance, few innovations have sparked as much intrigue and debate as Bitcoin. But beyond its role as a digital currency, Bitcoin embodies a profound philosophy that challenges traditional financial systems and proposes a new paradigm for economic freedom. Understanding the philosophy behind Bitcoin is essential to grasp its potential impact on our world.

The Origins of Bitcoin

In 2008, amid the global financial crisis, a mysterious figure known as Satoshi Nakamoto published the Bitcoin whitepaper. This document outlined a revolutionary idea: a decentralized digital currency that operates without the need for a central authority. The financial turmoil of the time, characterized by bank failures and government bailouts, underscored the need for a system that could function independently of traditional financial institutions.

Core Philosophical Principles

Decentralization-Decentralization lies at the heart of Bitcoin’s philosophy. Unlike traditional financial systems that rely on centralized authorities such as banks and governments, Bitcoin operates on a decentralized network of computers (nodes). Each node maintains a copy of the blockchain, Bitcoin's public ledger, ensuring that no single entity has control over the entire network. This decentralization is crucial for maintaining the integrity and security of the system, as it prevents any one party from manipulating the currency or its underlying data.

Trustlessness-Bitcoin's trustless nature is another fundamental principle. In traditional financial systems, trust is placed in intermediaries like banks and payment processors to facilitate transactions. Bitcoin eliminates the need for these intermediaries by using blockchain technology, where transactions are verified by network nodes through cryptography. This system ensures that transactions are secure and reliable without requiring trust in any third party.

Transparency-The transparency of Bitcoin’s blockchain is a key philosophical aspect. Every transaction that has ever occurred on the Bitcoin network is recorded on the blockchain, which is publicly accessible. This transparency allows anyone to verify transactions and ensures accountability. However, while the ledger is public, the identities of the individuals involved in transactions remain pseudonymous, balancing transparency with privacy.

Immutability-Immutability is the concept that once a transaction is recorded on the blockchain, it cannot be altered or deleted. This is achieved through cryptographic hashing and the decentralized nature of the network. Immutability ensures the integrity of the blockchain, making it a reliable and tamper-proof record of transactions. This principle is crucial for maintaining trust in the system, as it prevents fraudulent activities and data corruption.

Financial Sovereignty-Bitcoin empowers individuals by giving them full control over their own money. In traditional financial systems, access to funds can be restricted by banks or governments. Bitcoin, however, allows users to hold and transfer funds without relying on any central authority. This financial sovereignty is particularly valuable in regions with unstable economies or oppressive governments, where individuals may face restrictions on their financial freedom.

The Ideological Spectrum

Bitcoin’s philosophy is deeply rooted in libertarian values, emphasizing personal freedom and minimal government intervention. It also draws inspiration from the cypherpunk movement, a group of activists advocating for privacy-enhancing technologies to promote social and political change. These ideological influences shape Bitcoin's emphasis on decentralization, privacy, and individual empowerment.

Real-World Applications and Challenges

Bitcoin's philosophy extends beyond theory into practical applications. It is used for various purposes, from everyday transactions to a store of value akin to digital gold. However, this revolutionary system also faces challenges. Regulatory issues, scalability concerns, and environmental impact are some of the hurdles that need addressing to realize Bitcoin’s full potential.

Conclusion

The philosophy behind Bitcoin is a radical departure from traditional financial systems. Its principles of decentralization, trustlessness, transparency, immutability, and financial sovereignty offer a new vision for economic freedom and integrity. As Bitcoin continues to evolve, its underlying philosophy will play a crucial role in shaping its future and potentially transforming the global financial landscape.

Call to Action

Explore more about Bitcoin and consider its implications for your own financial freedom. Engage with the community, stay informed, and think critically about the role Bitcoin can play in our economic future. Let’s continue the journey of understanding and embracing the Bitcoin revolution together.

#Bitcoin#Cryptocurrency#FinancialFreedom#Decentralization#Blockchain#DigitalCurrency#CryptoPhilosophy#SatoshiNakamoto#Cypherpunk#FinancialSovereignty#BitcoinRevolution#CryptoCommunity#DigitalEconomy#TechInnovation#FutureOfFinance#EconomicFreedom#CryptoEducation#BitcoinPhilosophy#BlockchainTechnology#financial education#financial empowerment#financial experts#finance#unplugged financial#globaleconomy

8 notes

·

View notes

Text

Mistério sobre identidade de Satoshi Nakamoto ganha novos rumos

A investigação sobre a identidade de Satoshi Nakamoto, o enigmático criador do bitcoin, voltou a ser um tema central de discussão, especialmente após o lançamento de obras que exploram a busca por essa figura icônica. O jornalista americano Benjamin Wallace, que passou os últimos 15 anos tentando desmascarar Nakamoto, lançou recentemente o livro "The Mysterious Mr. Nakamoto – a 15 Year Quest to Unmask the Secret Genius Behind Crypto". O interesse pelo assunto foi ainda mais intensificado por dois documentários, um pelo Channel 4 no Reino Unido, intitulado "Seeking Satoshi: The Mystery Bitcoin Creator", e outro programado para ser exibido pela HBO em 2024, chamado "Dinheiro Elétrico: o Mistério do bitcoin".(...)

Leia a noticia completa no link abaixo:

https://www.inspirednews.com.br/misterio-sobre-identidade-de-satoshi-nakamoto-ganha-novos-rumos

#satoshinakamoto#bitcoin#benjaminwallace#petertodd#criptomoedas#kanyewest#laszlohanyecz#jamesadonald#investigacao#channel4#hbo#culturadigital

0 notes

Text

Fine del sogno anarchico dei crypto asset

Semplice asset d’investimento? Oppure oro digitale? O, ancora, mezzo di pagamento che farà concorrenza alle monete statali? Le domande sul Bitcoin, a fronte delle mosse effettuate dal nuovo presidente USA Donald Trump, sono legittime. Riguardano la natura stessa della cryptocurrency su cui, da anni, si polemizza. Proprio rispetto al tema in discussione Adam Back, crittografo e già cypherpunk (il gruppo da cui il token trae le origini socio/politiche/economiche e tecnologiche), ha una posizione precisa: «Non credo - ha dichiarato di recente al Sole24Ore - che il Bitcoin, nel mondo industrializzato, assumerà la caratteristica di mezzo di pagamento». In questi mercati «le persone sono servite da un sistema bancario che già soddisfa le esigenze del retail. Inoltre i regolatori», come abbiamo visto, «sono contrari ad una simile ipotesi». È più probabile che «il bitcoin mantenga la valenza di riserva di valore. In altre parole: oro digitale». Paesi poco bancarizzati Diverso il discorso nei Paesi scarsamente bancarizzati. «Qui il token può essere sfruttato», ad esempio, nelle rimesse dei migranti. L’obiettivo? Disintermediare i sistemi di trasferimento del denaro che, non di rado, hanno elevate commissioni. Insomma: l’unico scienziato citato nel White paper di Satoshi Nakamoto non ipotizza per la criptocurrency un futuro da moneta concorrente a quella fiat. Bensì, per l’appunto, di asset che conserva valore nel tempo. Vero! C’è chi - sottolineandone, tra le altre cose, l’elevata volatilità e la mancanza di un sottostante reale - ne esclude anche questa caratteristica. E, tuttavia, i sostenitori del cripto asset ribattono che, dalle origini ad oggi, l’andamento sinuisoidale del bitcoin è inclinato positivamente. Vale a dire: tra alti e bassi è sempre salito. Il sogno anti sistema Già, salito! A ben vedere, ciò che invece pare sceso dal treno delle cripto è il sogno anti sistema. «Uno spettro si aggira per il mondo moderno, è lo spettro della cripto anarchia». Così Timoty C. May (tra i più noti cypherpunk), richiamandosi all’incipit del Manifesto del Partito Comunista di Karl Marx e Friedrich Engels, iniziava il suo “The Crypto Anarchist Manifest” scritto nel 1988 e diffuso nel 1994. Un chiaro inno - trasversale ad anarco capitalisti di destra e libertari con vocazione più solidarista - in favore della disintermediazione del sistema finanziario. Lo stesso Nakamoto riprende il concetto nel suo White paper. «Una versione puramente peer-to-peer di denaro elettronico (...) senza passare tramite un’istituzione finanziaria». Quindi: è la disintermediazione una delle caratteristiche del Bitcoin. Sennonché: al di là delle mosse (a fini politici) di Trump, la finanza tradizionale va “appropriandosi” del token. Il segno di come l’ideale anti-sistema sia sullo sfondo. Certo: la geniale struttura socio-tecnologica non è mutata e i bitcoiner restano “sovrani” di loro stessi. E, però, la massa retail “passa” per gli Etf emessi da classici istituti finanziari e quotati a Wall Street. L’utopia anarchica, alla fine, sparisce. Ma nel sistema capitalistico, si sa, l’utopia è destinata a lasciare il passo a profitto e speculazione. Read the full article

0 notes

Text

Craig Wright Hapis Cezası Aldı Bitcoin’in Mucidi Olduğunu İddia Eden Kişi, Mahkeme Kararına İtaatsizlikten Suçlu Bulundu Bitcoin’in mucidi olduğunu yanlış bir şekilde iddia eden bir bilgi...

1 note

·

View note

Text

Who Created Bitcoin? The Mystery of Satoshi Nakamoto

Who Really Created Bitcoin? The Unsolved Mystery of Satoshi Nakamoto “The most significant technological innovation since the internet itself.” – Marc Andreessen on Bitcoin In October 2008, an anonymous person (or group) using the name Satoshi Nakamoto published a whitepaper that would change finance forever. Titled “Bitcoin: A Peer-to-Peer Electronic Cash System”, this 9-page document…

View On WordPress

0 notes

Text

🔥 "Bitcoin Explained in 60 Seconds: What Schools Never Taught You 🧠💸"

📌 Think Bitcoin is just internet money? Think again. The truth behind how it started, how much it’s worth now, and why it's limited forever will BLOW your mind. 😱 No banks. No governments. Just pure math, code & power. ⚠️ If you lose your private key, you lose your fortune. Forever. You NEED to understand this before it's too late. 👇 Dive into the world-changing tech now:

👉 https://t.co/Ttddedmvoc

#BitcoinBasics#CryptoForBeginners#Blockchain101#BitcoinExplained#DigitalGold#CryptoEducation#CryptoRevolution#SatoshiNakamoto#FinancialFreedom#LearnCrypto#InfographicEducation#Web3

0 notes