#Computer or System on Module Market Research

Explore tagged Tumblr posts

Text

Computer or System on Module Market Size, Business Revenue Forecast, Leading Competitors And Growth Trends

Strategic Insights and Forecasts: Computer or System on Module Market Leaders

The Computer or System on Module Size report is anticipated to experience significant growth in the coming years. As the world continues to recover from the pandemic, the market is expected to expand. The Computer or System on Module research not only highlights current industry standards but also reveals the latest strategic trends and patterns among market players. This research serves as an essential business document, aiding global market buyers in planning their next steps regarding the market's future trajectory.

According to Straits Research, the global Computer or System on Module Market size was valued at USD 1.23 Billion in 2021. It is projected to reach from USD XX Billion in 2022 to USD 2.35 Billion by 2030, growing at a CAGR of 6% during the forecast period (2022–2030).

The Computer or System on Module Report is an essential resource for business strategists, offering insightful data and analysis. It includes an industry overview, growth analysis, and historical and projected figures for cost, revenue, supply, and demand (where applicable). Research analysts offer a thorough description of the value chain and distributor analysis. This report provides comprehensive information to deepen understanding, broaden the scope, and enhance the application of the findings.

Get Free Request Sample Report @ https://straitsresearch.com/report/computer-or-system-on-module-market/request-sample

Leading Computer or System on Module Market include: -

Digi International (the U.S.)

Advantech Co., Ltd. (Taiwan)

Aaeon (Taiwan)

Variscite (Israel)

Axiomtek Co., Ltd. (Taiwan)

MSC Technology (India)

Olimex (Bulgaria)

Kontron (Bulgaria)

PHYTEC Embedded Pvt. Ltd. (India)

Toradex (Switzerland)

Microchip Technology Inc. (the U.S.)

Congatec AG(Germany)

Eurotech, Inc. (Switzerland)

SECO s.r.l. (Italy)

The Computer or System on Module Market Report helps a wide range of businesses determine what their consumers truly want by doing extensive market research. When it comes to new products, every company owner wants to know how much demand there is, and this report is a great resource. Additional benefits include ensuring that the most recent market developments are covered. You may closely check key rivals and their company growth tactics by reading the Computer or System on Module market research. It also does an in-depth research for the years 2022-2030 in order to provide company owners with new business options.

This research also provides a dashboard view of prominent Organizations, highlighting their effective marketing tactics, market share and most recent advances in both historical and current settings.

Global Computer or System on Module Market: Segmentation

By Product Type

ARM (Advanced RISC Machines) Architecture

Power Architecture

x86 Architecture

By Standard

Qseven

Smart Mobile Architecture

Embedded Technology Extended

COM Express

By Industry Vertical

Transportation

Industrial Automation

Medical

Gaming

Communication

Entertainment

Test & Measures

The report forecasts revenue growth at all geographic levels and provides an in-depth analysis of the latest industry trends and development patterns from 2022 to 2030 in each of the segments and sub-segments. Some of the major geographies included in the market are given below:

The regions covered include:

North America (United States, Canada, Mexico)

Europe (United Kingdom, France, Germany, Russia)

Asia-Pacific (China, Japan, Australia, Indonesia)

Middle East and Africa (UAE, Iran, Syria, South Africa)

South America (Brazil, Peru, Chile, Colombia)

You can check In-depth Segmentation from here: https://straitsresearch.com/report/computer-or-system-on-module-market/segmentation

Reasons to Purchase This Report:

The Computer or System on Module Market report provides an analysis of the evolving competitive landscape.

The report offers valuable analytical insights and strategic planning tools to support informed business decisions.

Researchers highlight key market dynamics, including drivers, restraints, trends, developments, and opportunities.

The report includes regional market estimates and business profiles of various stakeholders.

It helps in understanding all significant market segments.

The report provides extensive data on trending factors that will impact market growth.

This Report is available for purchase on Buy Computer or System on Module Market Report

Research Methodology:

We employ a robust research methodology that includes data triangulation based on top-down and bottom-up approaches, along with validation of estimated market figures through primary research. The data used to estimate the Computer or System on Module market size and forecast across various segments at the global, regional, and country levels is sourced from the most reliable published materials and through interviews with relevant stakeholders.

About Us:

StraitsResearch.com is a leading research and intelligence organization, specializing in research, analytics, and advisory services along with providing business insights & research reports.

Contact Us: Email: [email protected] Address: 825 3rd Avenue, New York, NY, USA, 10022 Tel: +1 6464807505, +44 203 318 2846

#Computer or System on Module Market#Computer or System on Module Market Share#Computer or System on Module Market Size#Computer or System on Module Market Research#Computer or System on Module Industry

1 note

·

View note

Text

New SpaceTime out Friday

SpaceTime 20240913 Series 27 Episode 111

Evidence of Unexpected Population of Kuiper Belt Objects

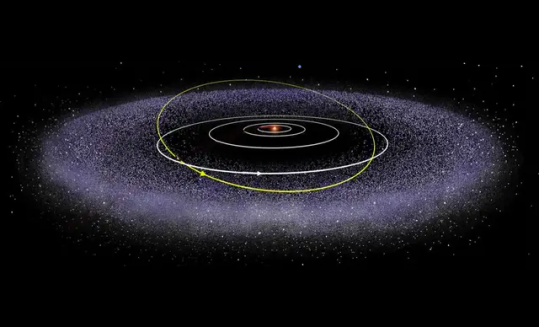

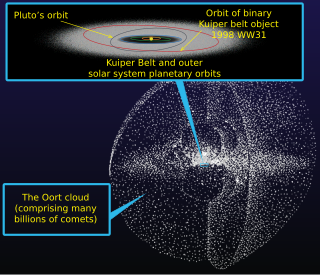

A new study has detected an unexpected population of very distant bodies in the Kuiper Belt, an outer region of the solar system populated by ancient remnants of planetary building blocks lying beyond the orbit of Neptune.

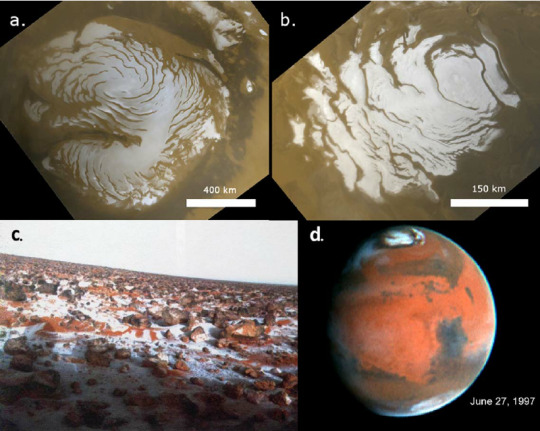

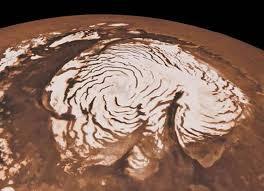

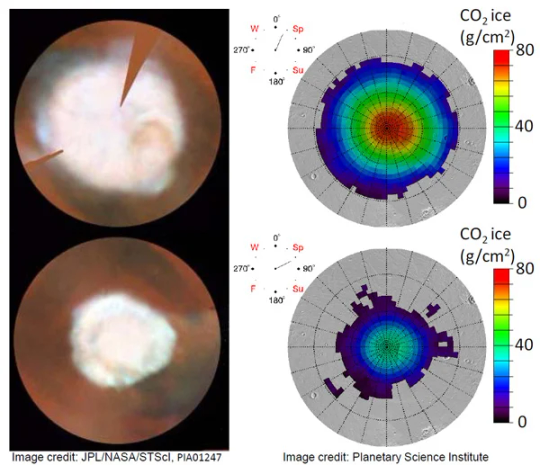

The Martian polar caps are not created equally

A new study has confirmed that the Martian polar ice caps are evolving very differently from each other.

Artemis III service module on its way to NASA

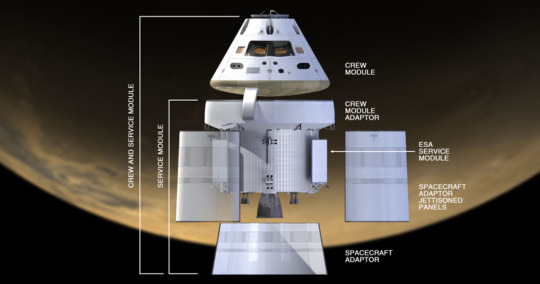

The European Space Agency’s Artemis III service module destined for use on the historic mission that will return humans to the lunar surface in 2026 is about to commence its journey to the Kennedy Space Center.

The Science Report

Bird flu now spreading on Antarctica’s South Georgia island and the Falkland Islands.

Finding New Zealand’s original native animals.

Australian HIV levels continue to drop.

SpaceTime covers the latest news in astronomy & space sciences.

The show is available every Monday, Wednesday and Friday through Apple Podcasts (itunes), Stitcher, Google Podcast, Pocketcasts, SoundCloud, Bitez.com, YouTube, your favourite podcast download provider, and from www.spacetimewithstuartgary.com

SpaceTime is also broadcast through the National Science Foundation on Science Zone Radio and on both i-heart Radio and Tune-In Radio.

SpaceTime daily news blog: http://spacetimewithstuartgary.tumblr.com/

SpaceTime facebook: www.facebook.com/spacetimewithstuartgary

SpaceTime Instagram @spacetimewithstuartgary

SpaceTime twitter feed @stuartgary

SpaceTime YouTube: @SpaceTimewithStuartGary

SpaceTime -- A brief history

SpaceTime is Australia’s most popular and respected astronomy and space science news program – averaging over two million downloads every year. We’re also number five in the United States. The show reports on the latest stories and discoveries making news in astronomy, space flight, and science. SpaceTime features weekly interviews with leading Australian scientists about their research. The show began life in 1995 as ‘StarStuff’ on the Australian Broadcasting Corporation’s (ABC) NewsRadio network. Award winning investigative reporter Stuart Gary created the program during more than fifteen years as NewsRadio’s evening anchor and Science Editor. Gary’s always loved science. He studied astronomy at university and was invited to undertake a PHD in astrophysics, but instead focused on his career in journalism and radio broadcasting. Gary’s radio career stretches back some 34 years including 26 at the ABC. He worked as an announcer and music DJ in commercial radio, before becoming a journalist and eventually joining ABC News and Current Affairs. He was part of the team that set up ABC NewsRadio and became one of its first on air presenters. When asked to put his science background to use, Gary developed StarStuff which he wrote, produced and hosted, consistently achieving 9 per cent of the national Australian radio audience based on the ABC’s Nielsen ratings survey figures for the five major Australian metro markets: Sydney, Melbourne, Brisbane, Adelaide, and Perth. The StarStuff podcast was published on line by ABC Science -- achieving over 1.3 million downloads annually. However, after some 20 years, the show finally wrapped up in December 2015 following ABC funding cuts, and a redirection of available finances to increase sports and horse racing coverage. Rather than continue with the ABC, Gary resigned so that he could keep the show going independently. StarStuff was rebranded as “SpaceTime”, with the first episode being broadcast in February 2016. Over the years, SpaceTime has grown, more than doubling its former ABC audience numbers and expanding to include new segments such as the Science Report -- which provides a wrap of general science news, weekly skeptical science features, special reports looking at the latest computer and technology news, and Skywatch – which provides a monthly guide to the night skies. The show is published three times weekly (every Monday, Wednesday and Friday) and available from the United States National Science Foundation on Science Zone Radio, and through both i-heart Radio and Tune-In Radio.

#science#space#astronomy#physics#news#nasa#astrophysics#esa#spacetimewithstuartgary#starstuff#spacetime#jwst#hubble space telescope

10 notes

·

View notes

Text

How to Choose the Best ERP for Engineering and Manufacturing Industry

In today’s fast-paced world, engineering and manufacturing companies face increasing pressure to deliver high-quality products while maintaining efficiency and cost-effectiveness. Implementing the right Enterprise Resource Planning (ERP) software can significantly enhance operations, streamline workflows, and boost productivity. However, with numerous options available, selecting the best ERP software for the engineering and manufacturing industry can be challenging. This guide will help you navigate this decision-making process and choose the most suitable solution for your business.

Why ERP is Crucial for Engineering and Manufacturing

ERP software integrates various business processes, including production, inventory management, supply chain, finance, and human resources. For engineering and manufacturing companies, ERP solutions are particularly vital because they:

Facilitate real-time data sharing across departments.

Enhance supply chain management.

Optimize production planning and scheduling.

Ensure compliance with industry standards.

Reduce operational costs.

Partnering with the right Engineering ERP software company ensures that your organization leverages these benefits to stay competitive in a dynamic market.

Steps to Choose the Best ERP for Engineering and Manufacturing

1. Understand Your Business Needs

Before exploring ERP solutions, evaluate your company’s specific requirements. Identify the pain points in your current processes and prioritize the features you need in an ERP system. Common features for engineering and manufacturing companies include:

Bill of Materials (BOM) management

Production planning and scheduling

Inventory control

Quality management

Financial reporting

Consulting with a reputed ERP software company can help you match your needs with the right features.

2. Look for Industry-Specific Solutions

Generic ERP software might not address the unique needs of the engineering and manufacturing sector. Opt for an ERP software in India that offers modules tailored to your industry. Such solutions are designed to handle specific challenges like multi-level BOM, project costing, and shop floor management.

3. Check Vendor Expertise

Choosing a reliable vendor is as important as selecting the software itself. Research ERP solution providers with a strong track record in serving engineering and manufacturing companies. Look for reviews, case studies, and client testimonials to gauge their expertise.

4. Evaluate Scalability and Flexibility

Your business will grow, and so will your operational requirements. Ensure that the ERP system you choose is scalable and flexible enough to accommodate future needs. The top 10 ERP software providers in India offer scalable solutions that can adapt to changing business demands.

5. Assess Integration Capabilities

An ERP system must integrate seamlessly with your existing tools, such as Computer-Aided Design (CAD) software, Customer Relationship Management (CRM) systems, and IoT devices. A well-integrated system reduces redundancies and enhances efficiency.

6. Prioritize User-Friendliness

A complex system with a steep learning curve can hinder adoption. Choose an ERP software with an intuitive interface and easy navigation. This ensures that your employees can use the system effectively without extensive training.

7. Consider Customization Options

No two businesses are alike. While standard ERP solutions offer core functionalities, some companies require customization to align with specific workflows. A trusted ERP software company in India can provide custom modules tailored to your unique needs.

8. Focus on Data Security

Engineering and manufacturing companies often deal with sensitive data. Ensure that the ERP solution complies with the latest security standards and offers robust data protection features.

9. Compare Pricing and ROI

While cost is an important factor, it should not be the sole criterion. Evaluate the long-term return on investment (ROI) offered by different ERP software. A slightly expensive but feature-rich solution from the best ERP software provider in India may deliver better value than a cheaper alternative with limited functionalities.

10. Test Before You Commit

Most ERP software companies offer free trials or demo versions. Use these opportunities to test the software in a real-world scenario. Gather feedback from your team and ensure the solution meets your expectations before finalizing your decision.

Benefits of Partnering with the Best ERP Software Providers in India

India is home to some of the leading ERP software providers in India, offering state-of-the-art solutions for the engineering and manufacturing sector. Partnering with a reputable provider ensures:

Access to advanced features tailored to your industry.

Reliable customer support.

Comprehensive training and implementation services.

Regular updates and enhancements to the software.

Companies like Shantitechnology (STERP) specialize in delivering cutting-edge ERP solutions that cater specifically to engineering and manufacturing businesses. With years of expertise, they rank among the top 10 ERP software providers in India, ensuring seamless integration and exceptional performance.

Conclusion

Selecting the right ERP software is a critical decision that can impact your company’s efficiency, productivity, and profitability. By understanding your requirements, researching vendors, and prioritizing features like scalability, integration, and security, you can find the perfect ERP solution for your engineering or manufacturing business.

If you are looking for a trusted ERP software company in India, consider partnering with a provider like STERP. As one of the best ERP software providers in India, STERP offers comprehensive solutions tailored to the unique needs of engineering and manufacturing companies. With their expertise, you can streamline your operations, improve decision-making, and stay ahead in a competitive market.

Get in touch with STERP – the leading Engineering ERP software company – to transform your business with a reliable and efficient ERP system. Take the first step toward a smarter, more connected future today!

#Manufacturing ERP software company#ERP solution provider#Engineering ERP software company#ERP software company#ERP software companies

6 notes

·

View notes

Text

Photonic Integrated Circuit Market 2033: Key Players, Segments, and Forecasts

Market Overview

The Global Photonic Integrated Circuit Market Size is Expected to Grow from USD 11.85 Billion in 2023 to USD 94.05 Billion by 2033, at a CAGR of 23.02% during the forecast period 2023-2033.

Photonic Integrated Circuit (PIC) Market is witnessing transformative momentum, fueled by the global push towards faster, energy-efficient, and miniaturized optical components. As data demands soar and photonics become essential in telecom, AI, quantum computing, and biosensing, PICs are emerging as the nerve center of next-generation optical solutions. These chips integrate multiple photonic functions into a single chip, drastically improving performance and cost-efficiency.

Market Growth and Key Drivers

The market is set to grow at an exceptional pace, driven by:

Data Center Expansion: Surging internet traffic and cloud services are fueling PIC-based optical transceivers.

5G & Beyond: Demand for faster, low-latency communication is driving adoption in telecom infrastructure.

Quantum & AI Computing: PICs are critical to the advancement of light-based quantum circuits and high-speed AI processors.

Medical Diagnostics: Miniaturized photonic sensors are revolutionizing biomedical imaging and lab-on-chip diagnostics.

Defense & Aerospace: PICs provide enhanced signal processing and secure communication capabilities.

Get More Information: Click Here

Market Challenges

Despite strong potential, the PIC market faces several hurdles:

Fabrication Complexity: Advanced PICs demand high-precision manufacturing and integration techniques.

Standardization Issues: Lack of global standards slows down mass deployment and interoperability.

High Initial Investment: R&D and setup costs can be prohibitive, especially for SMEs and startups.

Thermal Management: Maintaining performance while managing heat in densely packed circuits remains a challenge.

Market Segmentation

By Component: Lasers, Modulators, Detectors, Multiplexers/Demultiplexers, Others

By Integration Type: Monolithic Integration, Hybrid Integration

By Material: Indium Phosphide (InP), Silicon-on-Insulator (SOI), Others

By Application: Optical Communication, Sensing, Biomedical, Quantum Computing, RF Signal Processing

By End User: Telecom, Healthcare, Data Centers, Aerospace & Defense, Academia

Regional Analysis

North America: Leading in R&D, startups, and federal defense contracts.

Europe: Home to silicon photonics innovation and academic-industrial collaboration.

Asia-Pacific: Witnessing rapid adoption due to telecom expansion and smart manufacturing in China, South Korea, and Japan.

Middle East & Africa: Emerging opportunities in smart city and surveillance tech.

Latin America: Gradual growth driven by increasing telecom and IoT penetration.

Competitive Landscape

Key players shaping the market include:

Intel Corporation

Cisco Systems

Infinera Corporation

NeoPhotonics

IBM

II-VI Incorporated

Hewlett Packard Enterprise

Broadcom Inc.

GlobalFoundries

PhotonDelta (Europe-based accelerator)

Positioning and Strategies

Leading companies are focusing on:

Vertical Integration: Owning every stage from design to packaging for cost control and performance.

Strategic Partnerships: Collaborations with telecom operators, hyperscalers, and research institutes.

Application-Specific Customization: Tailoring PICs for specific end-user applications (e.g., medical devices or LiDAR systems).

Global Fab Alliances: Leveraging cross-continental manufacturing capabilities for scale and speed.

Buy This Report Now: Click Here

Recent Developments

Intel unveiled a next-gen 200G PIC-based optical transceiver targeting AI data centers.

Infinera's XR optics platform is redefining network scaling with dynamic bandwidth allocation.

European Photonics Alliance launched an initiative to accelerate PIC adoption in SMEs.

Startups like Ayar Labs and Lightmatter raised significant VC funding to develop photonics-based computing solutions.

Trends and Innovation

Co-Packaged Optics (CPO): Integrating optics with switching ASICs for power and latency optimization.

Silicon Photonics: Scalable, CMOS-compatible manufacturing opening the doors to mass production.

Quantum Photonic Chips: Rapid R&D in quantum-safe communications and computing.

Edge Photonics: Enabling localized, high-speed data processing for Industry 4.0 and IoT applications.

AI-Powered Design: ML models used for photonic circuit simulation and optimization.

Related URLS:

https://www.sphericalinsights.com/our-insights/antimicrobial-medical-textiles-market https://www.sphericalinsights.com/our-insights/self-contained-breathing-apparatus-market https://www.sphericalinsights.com/our-insights/ozone-generator-market-size https://www.sphericalinsights.com/our-insights/agro-textile-market

Opportunities

Telecom & Cloud Providers: Demand for next-gen, low-latency networks creates significant opportunities.

Healthcare Startups: PICs enable affordable, portable diagnostics, expanding precision medicine.

Defense & Security: High-performance signal processing and surveillance enhancements.

Automotive LiDAR: Integration of PICs into autonomous vehicle sensor suites.

Future Outlook

The Photonic Integrated Circuit Market is moving from research-focused innovation to mainstream commercial adoption. By 2030, PICs are expected to power a wide array of industries—fundamentally redefining computing, communication, and sensing systems. Standardization, improved design tools, and silicon photonics will be pivotal in unlocking scalable mass adoption.

Conclusion

As digital transformation becomes more photon-powered, Photonic Integrated Circuits stand at the frontier of high-speed, high-efficiency technology. For decision-makers, investors, startups, and policymakers, now is the moment to align strategies, fund innovation, and build the ecosystem that will define the photonic era.

About the Spherical Insights

Spherical Insights is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

Contact Us:

Company Name: Spherical Insights

Email: [email protected]

Phone: +1 303 800 4326 (US)

Follow Us: LinkedIn | Facebook | Twitter

1 note

·

View note

Text

The Evolution of Augmented Reality Design: From Concept to Creation

In recent years, the field of augmented reality (AR) has witnessed a remarkable evolution, transforming from a futuristic concept into a tangible and transformative technology that is shaping various industries. This shift has been greatly propelled by the innovative work of augmented reality design agencies, which have played a pivotal role in refining and actualizing AR experiences. Let's delve into the fascinating journey of AR design, exploring how it has evolved from concept to creation.

The Early Days: Conceptualizing AR

Augmented reality, as a concept, emerged with ambitious visions of overlaying digital information onto the real world through advanced technology. The earliest ideas stemmed from science fiction and speculative research, envisioning a future where digital elements seamlessly integrate with our physical environment. It was a concept that sparked the imagination of tech enthusiasts and designers alike.

Pioneering Technologies

The evolution of AR design was closely tied to the development of enabling technologies. Key milestones included the advent of smartphones with sophisticated sensors and processing power, which made AR accessible through mobile apps. Additionally, advancements in computer vision, 3D modeling, and spatial tracking systems laid the groundwork for more immersive and responsive AR experiences.

AR Design Agencies: Shaping the Landscape

As the potential of AR became apparent, specialized design agencies began to emerge, dedicated to pushing the boundaries of this technology. These agencies brought together multidisciplinary teams comprising UX/UI designers, 3D artists, software engineers, and AR specialists. Their mission: to bridge the gap between concept and reality, crafting compelling and functional AR solutions.

From Concept to Creation

The journey of an AR project typically begins with ideation and conceptualization. Design agencies collaborate closely with clients to understand objectives, target audience, and context. This phase involves sketching out user journeys, storyboarding interactions, and defining the visual style.

Next comes prototyping and iterative design. AR designers leverage tools like Unity, Unreal Engine, and specialized AR development kits to bring concepts to life in a virtual space. They refine interactions, test usability, and iterate based on feedback to ensure a seamless and engaging user experience.

Challenges and Innovations

AR design isn't without its challenges. Designers must contend with technical constraints, such as device compatibility and performance optimization, while maintaining a focus on user-centric design principles. However, these challenges fuel innovation, prompting agencies to explore novel solutions and experiment with emerging technologies like spatial computing and wearable AR devices.

The Impact on Industries

Today, AR design agencies are transforming industries across the board. From retail and marketing to healthcare and education, AR is revolutionizing how businesses engage with their customers and stakeholders. Immersive product experiences, virtual try-ons, interactive training modules—these are just a few examples of AR applications that are reshaping traditional practices.

Looking Ahead: The Future of AR Design

The evolution of augmented reality design is far from over. As technology continues to advance, we can expect even more sophisticated AR experiences that blur the lines between digital and physical realities. Design agencies will continue to lead this charge, harnessing creativity and innovation to unlock the full potential of AR across diverse sectors.

In conclusion, the evolution of augmented reality design—from its conceptual origins to its current state of innovation—demonstrates the transformative power of human imagination and technological progress. As we embrace this exciting era of AR, we can anticipate that design agencies will remain at the forefront, shaping the way we interact with and experience the world around us.

If you're considering embarking on an AR project or seeking to leverage AR for your business, partnering with a specialized augmented reality design agency can be the key to unlocking groundbreaking experiences that captivate and inspire. As we witness the evolution of AR design, one thing is certain: the future promises to be even more immersive and extraordinary than we can imagine.

2 notes

·

View notes

Text

DDR4 Register Clock Driver Market - Key Players, Size, Trends, Growth Opportunities, Analysis and Forecast

Global DDR4 Register Clock Driver Market Research Report 2025(Status and Outlook)

The global DDR4 Register Clock Driver Market size was valued at US$ 284.7 million in 2024 and is projected to reach US$ 196.3 million by 2032, at a CAGR of -4.6% during the forecast period 2025-2032.

DDR4 Register Clock Drivers (RCDs) are critical components in server-grade memory modules, specifically designed for Registered DIMM (RDIMM) and Load-Reduced DIMM (LRDIMM) configurations. These chips act as buffers between the memory controller and DRAM chips, enabling higher capacity memory subsystems while maintaining signal integrity in data center and enterprise applications. The technology is fully compliant with JEDEC DDR4 specifications.

The market growth is primarily driven by expanding cloud computing infrastructure and increasing server deployments worldwide. However, the transition to DDR5 technology in high-performance computing presents a long-term challenge. Key players like Renesas, Montage Technology, and Rambus continue to innovate in this space, with recent developments focusing on power efficiency improvements to meet evolving data center requirements. Asia-Pacific currently dominates consumption due to concentrated server manufacturing in China and Taiwan.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=95817

Segment Analysis:

By Type

RDIMM Segment Leads the Market Due to High Utilization in Enterprise Server Applications

The global DDR4 Register Clock Driver market is segmented based on type into:

RDIMM (Registered Dual In-Line Memory Module)

LRDIMM (Load-Reduced Dual In-Line Memory Module)

Other specialized variants

By Application

Server Applications Dominate Demand Owing to Cloud Computing and Data Center Expansion

The market is segmented based on application into:

Servers

Enterprise servers

Cloud computing servers

Workstations

Storage systems

Telecom systems

Other embedded applications

By End-User Industry

Data Centers Exhibit Strong Growth Potential Due to Increasing Cloud Adoption

The market is segmented based on end-user industry into:

Data centers

Telecommunications

Enterprise IT

High-performance computing

Other industrial applications

By Memory Capacity

High-density Modules Gain Traction for Memory-intensive Workloads

The market exhibits segmentation based on supported memory capacity:

Low-density modules (≤16GB)

Medium-density modules (16GB-64GB)

High-density modules (≥64GB)

Regional Analysis: Global DDR4 Register Clock Driver Market

North America The North American DDR4 Register Clock Driver market is driven by robust demand from enterprise server infrastructure and cloud service providers. The U.S. leads in adoption due to significant investments in data center modernization, with hyperscalers like AWS, Google, and Microsoft expanding their server fleets. The region benefits from strong R&D capabilities of key players like Intel and Rambus, who are pushing advancements in JEDEC-compliant memory solutions. However, the gradual shift toward DDR5 in high-performance computing applications is moderating growth prospects for DDR4 RCDs in premium segments. Canada and Mexico show steady but slower adoption due to smaller-scale data infrastructure.

Europe Europe’s market growth is fueled by strict data sovereignty regulations (GDPR) driving localized server deployments, particularly in Germany, France, and the UK. The region shows strong uptake of LRDIMM-based solutions for enterprise applications due to their higher capacity advantages. European manufacturers like STMicroelectronics are focusing on energy-efficient RCD designs to align with the EU’s sustainability directives. While Western Europe remains the dominant adopter, Eastern European countries are emerging as cost-effective server hosting locations, creating secondary demand. The market faces headwinds from economic uncertainties and inflation impacting enterprise IT budgets.

Asia-Pacific APAC dominates global DDR4 RCD consumption, accounting for over 40% of the market share. China’s massive server OEM ecosystem and hyperscale data center boom propel demand, while India shows the fastest growth rate due to digital transformation initiatives. Japan and South Korea host leading memory manufacturers who prioritize high-quality RCD components for export-oriented production. The region benefits from cost-competitive manufacturing of RDIMM modules, though price sensitivity sometimes compromises adoption of premium solutions. Southeast Asian nations are gaining importance as alternative production hubs amid global supply chain diversification efforts.

South America The South American market remains niche but shows gradual growth potential as Brazil and Argentina expand their data infrastructure. Limited local manufacturing capabilities result in heavy import dependence, making the region sensitive to currency fluctuations and trade policies. Enterprise server deployments in banking and telecom sectors drive most demand, though adoption of advanced LRDIMM solutions lags due to budget constraints. Government initiatives to develop local data centers are creating opportunities, but political and economic instability continues to deter larger investments in memory infrastructure.

Middle East & Africa MEA presents a mixed landscape, with the UAE and Saudi Arabia leading in data center investments through sovereign wealth fund initiatives like NEOM. South Africa serves as a regional hub for cloud service providers expanding into Africa. However, limited technical expertise and reliance on imported components constrain market growth. The region shows preference for cost-effective RDIMM solutions in most applications, with premium RCD adoption concentrated in oil & gas and financial sectors. While long-term potential exists with digital transformation programs, current market penetration remains low compared to global standards.

List of Key DDR4 Register Clock Driver Manufacturers

Renesas Electronics Corporation (Japan)

Rambus Inc. (U.S.)

Montage Technology (China)

STMicroelectronics (Switzerland)

ON Semiconductor (U.S.)

Intel Corporation (U.S.)

EDOM Technology (Taiwan)

Micron Technology (U.S.)

SK Hynix (South Korea)

The global DDR4 Register Clock Driver market is experiencing significant growth driven by the escalating demand for high-performance computing across various industries. With cloud computing workloads increasing by over 30% annually, data centers are rapidly adopting DDR4 RCD solutions to enhance memory performance and capacity. These components are critical for maintaining signal integrity in large memory arrays, enabling processing speeds up to 3200 Mbps. The server segment, which accounts for approximately 60% of total DDR4 RCD usage, continues to expand as enterprises migrate workloads to hybrid cloud environments.

Artificial intelligence applications are creating unprecedented demand for high-bandwidth memory solutions. DDR4 RCDs play a pivotal role in enabling the memory subsystem performance required for AI training workloads, which typically demand 2-5x more memory bandwidth than conventional applications. The machine learning accelerator market, projected to maintain a 25% CAGR through 2027, is driving innovations in registered DIMM designs that leverage advanced RCD solutions for improved timing accuracy and power efficiency.

While developed markets transition to DDR5, emerging economies continue to present strong demand for DDR4-based solutions due to cost sensitivity and existing infrastructure. Countries in Southeast Asia and Latin America are expected to maintain 15-18% year-over-year growth in DDR4 server deployments through 2025, creating opportunities for RCD suppliers to extend product lifecycles with cost-optimized variants.

The telecommunications sector also offers promising growth avenues as 5G network deployments accelerate globally. Edge computing nodes and baseband units increasingly incorporate registered memory configurations to handle growing data throughput requirements. This application segment could account for nearly 25% of total DDR4 RCD demand by 2026 as network operators continue their infrastructure modernization efforts.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95817

Key Questions Answered by the DDR4 Register Clock Driver Market Report:

What is the current market size of Global DDR4 Register Clock Driver Market?

Which key companies operate in Global Dissolvable Microneedle Patches Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

Dual in-line Memory Module (DIMM) Market: Revenue Trends and Pricing Analysis 20

Global Dual in-line Memory Module (DIMM) Market Research Report 2025(Status and Outlook)

Dual in-line Memory Module (DIMM) Market size was valued at US$ 16.84 billion in 2024 and is projected to reach US$ 32.47 billion by 2032, at a CAGR of 7.8% during the forecast period 2025-2032

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=95815

MARKET INSIGHTS

The global Dual in-line Memory Module (DIMM) Market size was valued at US$ 16.84 billion in 2024 and is projected to reach US$ 32.47 billion by 2032, at a CAGR of 7.8% during the forecast period 2025-2032.

DIMMs (dual in-line memory modules) are essential components for modern computing systems, providing high-speed data transfer capabilities through their 64-bit architecture. These modules contain multiple RAM chips mounted on a printed circuit board, connecting directly to computer motherboards via standardized pins. DIMMs are widely used across desktop PCs, servers, industrial systems, and high-performance computing applications due to their reliability and superior bandwidth compared to older SIMM (single in-line memory module) technology.

The market growth is driven by increasing demand for high-performance computing across data centers, AI applications, and 5G infrastructure. Furthermore, the rising adoption of DDR5 technology with higher bandwidth capacities (up to 6400 MT/s) is accelerating market expansion. Key industry players like Micron, Kingston, and SK Hynix are investing heavily in advanced manufacturing processes, with recent developments including 1α nm DRAM production nodes that offer 15% better power efficiency. However, cyclical memory pricing and geopolitical trade tensions present ongoing challenges for market stability.

List of Key DIMM Manufacturers Profiled

Kingston Technology Company (U.S.)

Micron Technology, Inc. (U.S.)

ADATA Technology Co., Ltd. (Taiwan)

Ramaxel Technology (Shenzhen) Limited (China)

Transcend Information, Inc. (Taiwan)

Tigo Corporation (China)

Apacer Technology Inc. (Taiwan)

Corsair Memory, Inc. (U.S.)

Team Group Inc. (Taiwan)

Kingmax Semiconductor Inc. (Taiwan)

Innodisk Corporation (Taiwan)

Segment Analysis:

By Type

UDIMM Segment Leads the Market Due to Wide Adoption in Consumer Electronics and Budget Systems

The market is segmented based on type into:

UDIMM (Unbuffered DIMM)

FB-DIMM (Fully Buffered DIMM)

RDIMM (Registered DIMM)

LR-DIMM (Load-Reduced DIMM)

Other specialized DIMM variants

By Application

Computers Segment Dominates Through Pervasive Use in Desktops and Laptops Globally

The market is segmented based on application into:

Computers (desktops & laptops)

Servers

Industrial applications

Aerospace and defense systems

Manufacturing equipment

By Memory Technology

DDR4 Maintains Strong Position While DDR5 Adoption Gains Momentum

The market is segmented based on memory technology into:

DDR3

DDR4

DDR5

Specialized memory variants

By Capacity

8GB-16GB Range Captures Significant Market Share Across Multiple Applications

The market is segmented based on capacity into:

Below 4GB

4GB-8GB

8GB-16GB

Above 16GB

Regional Analysis: Global Dual In-line Memory Module (DIMM) Market

North America North America remains a dominant region in the DIMM market due to its strong technological infrastructure and high adoption of advanced computing solutions. The U.S. leads the region with robust demand from data centers, enterprise IT infrastructure, and gaming markets. Companies like Micron (Crucial) and Corsair are key players driving innovation in high-performance memory solutions, particularly for servers and industrial applications. The growing cloud computing sector is a significant growth driver, with hyperscalers investing heavily in upgrading their data center architectures. Regulatory concerns about energy efficiency and supply chain resilience are influencing material sourcing and manufacturing strategies, pushing vendors toward sustainable production methods.

Europe Europe’s DIMM market is shaped by stringent data privacy regulations and high enterprise adoption of server-grade memory solutions. Countries like Germany, the UK, and France are frontrunners in data center expansions, fueling demand for RDIMM and LR-DIMM products. The automotive sector is also emerging as a key DIMM consumer due to advancements in autonomous driving and in-vehicle computing. However, the region faces challenges in semiconductor supply chain dependencies, prompting local governments to increase investments in domestic manufacturing capabilities under programs like the European Chips Act. This push for self-reliance is expected to amplify competition among global memory manufacturers.

Asia-Pacific The Asia-Pacific region is the fastest-growing DIMM market, accounting for over 40% of global consumption, led by China, Japan, and South Korea. Rapid digital transformation across industries and heavy investments in AI and cloud infrastructure are accelerating demand for high-capacity DIMM modules. China dominates in both production and consumption, with local players like Ramaxel and ADATA competing aggressively on price-performance metrics. Meanwhile, India is witnessing a surge in data center deployments, driving the adoption of enterprise-grade memory solutions. Price sensitivity remains a key factor in consumer-grade DIMM adoption, although the shift toward DDR5 technology is gradually reshaping mid-to-high-tier market segments.

South America South America represents a developing market with moderate but steady growth potential in DIMM adoption. Brazil and Argentina are seeing increased demand for consumer and industrial-grade memory modules, primarily due to gaming PC markets and localized manufacturing automation. Economic volatility and import dependency on foreign memory suppliers create pricing fluctuations, limiting widespread adoption of cutting-edge DIMM technologies. Government initiatives to bolster local tech manufacturing could unlock opportunities, though infrastructure constraints continue to slow large-scale enterprise adoption compared to other regions.

Middle East & Africa The Middle East & Africa region is experiencing nascent but promising growth, particularly in GCC countries and South Africa, where data center investments and smart city projects are expanding. High-performance computing applications in oil & gas analytics and financial services are driving specialized DIMM demand. However, the market remains constrained by limited local manufacturing and reliance on imports, leading to higher consumer pricing. Long-term opportunities are tied to digital infrastructure expansions, especially as 5G deployments and IoT adoption increase across the region.

MARKET DYNAMICS

As memory densities scale beyond 64GB per module, thermal management becomes a critical challenge. The industry’s shift to 1α nm DRAM processes increases power density, requiring sophisticated heat spreaders and airflow solutions. These thermal limitations directly impact real-world performance—some high-frequency DDR5 DIMMs throttle speeds by 15-20% under sustained loads. For data center operators, this translates into either performance compromises or increased cooling costs, creating difficult TCO calculations when specifying server configurations.

Compatibility Issues During Technology Transitions The heterogeneous nature of memory ecosystems creates validation challenges, particularly during DDR generational transitions. Cases of BIOS incompatibilities between certain DIMMs and platforms have been reported, requiring extensive qualification processes. These technical hurdles slow down adoption cycles and increase development costs for module manufacturers.

Counterfeit Components in Supply Chain The prevalence of counterfeit DRAM chips remains an industry challenge, with some estimates suggesting 8-12% of aftermarket modules contain substandard components. This not only jeopardizes system reliability but also erodes confidence in value-chain suppliers, particularly in price-sensitive market segments.

The advent of Compute Express Link (CXL) technology is enabling revolutionary memory expansion architectures. CXL-attached memory buffers allow for novel DIMM designs that break traditional capacity barriers, with prototypes demonstrating 4TB memory modules. Early deployments in AI training clusters show 30% performance improvements over conventional configurations. As the CXL 2.0/3.0 ecosystem matures, it will create opportunities for specialized DIMMs incorporating memory pooling and tiering capabilities—a potential $3 billion market by 2027.

The proliferation of edge computing in harsh environments is generating demand for industrial-grade DIMMs with extended temperature ranges (-40°C to 85°C) and vibration resistance. Applications in autonomous vehicles, oil/gas monitoring, and factory automation require memory modules that can withstand extreme conditions while maintaining data integrity. The market for such specialized DIMMs is forecast to grow at 28% CAGR, significantly outpacing the broader memory module sector.

With increasing concerns about memory-based attacks, hardware-level security features in DIMMs are becoming differentiation points. Technologies like memory encryption (Intel TME, AMD SME) and physical tamper detection are being integrated into premium modules. Government and financial sectors are early adopters of these solutions, with secure DIMM variants commanding 50-70% price premiums over standard modules—a high-margin opportunity for vendors with robust security architectures.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95815

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global DIMM Market?

Which key companies operate in Global DIMM Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Related Reports:

https://semiconductorblogs21.blogspot.com/2025/07/network-set-top-box-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/digital-set-top-box-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/5g-base-station-microwave-dielectric.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/automotive-magnetic-sensor-market-cost.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/holographic-diffraction-grating-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/electronic-grade-silicon-wafer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/silicon-epitaxial-wafer-market-value.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/annealed-silicon-wafer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/computer-power-supplies-market-revenue.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/power-supply-unit-psu-market-innovation.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/automotive-cockpit-domain-control-unit.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-vehicle-ecus-and-dcus-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-automotive-ecuelectronic-control.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-vehicle-electronic-control-units.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-automotive-ecus-and-dcus-market.html

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes

Text

Robotic Machine Sensor Market Growth Analysis, Market Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

According to new market research, the global robotic machine sensor market was valued at USD 867 million in 2024 and is projected to reach USD 1,344 million by 2032, growing at a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period (2025-2032). This growth is driven by rapid automation adoption across industries, advancements in Industry 4.0 technologies, and increasing demand for precision robotics.

Download FREE Sample Report: Robotic Machine Sensor Market - View Detailed Research Report

What Are Robotic Machine Sensors?

Robotic machine sensors are intelligent components that enable robots to perceive and interact with their environment. These sophisticated devices replicate human sensory capabilities, providing critical data on position, force, vision, touch, and other variables that robotic controllers use to execute precise movements and operations. The market encompasses specialized sensors including: movement sensors (accelerometers, gyroscopes), vision systems (2D/3D cameras), tactile sensors, proximity detectors, and voice recognition modules. Modern sensors increasingly incorporate AI and edge computing capabilities, transforming them from passive components into active decision-makers within automated systems.

Key Market Drivers

1. Industry 4.0 Revolution Fuels Sensor Demand

The transformation toward smart factories is accelerating sensor adoption, with modern automated production lines now incorporating 150-200 sensors per robotic cell compared to just 50-75 five years ago. Vision systems account for nearly 40% of this growth, as manufacturers implement real-time quality control across assembly lines. The automotive sector shows particularly strong adoption, where sensor-guided robotic welding now achieves placement accuracy within 0.1mm - crucial for electric vehicle battery assembly.

2. Human-Robot Collaboration Expands Applications

The rise of collaborative robots (cobots) has created new sensor requirements, particularly for force-torque detection and tactile feedback systems that ensure worker safety. Recent innovations include AI-powered skins that give robots a sense of touch across entire surfaces, enabling delicate operations in electronics manufacturing where human-like dexterity is essential. The global cobot market is projected to require over 8 million specialized sensors annually by 2026.

Market Challenges

Despite strong growth, several barriers persist. High implementation costs remain prohibitive for SMEs, with integrated robotic workcells often exceeding $250,000. Sensor reliability in extreme environments presents another hurdle - welding cells experience sensor failures every 600-800 hours due to arc glare and metal spatter. Additionally, cybersecurity risks in interconnected sensor networks have caused 35% of manufacturers to delay IIoT adoption until encryption standards improve.

Emerging Opportunities

The market presents significant growth potential in micro-manufacturing, where new nano-precision sensors enable robotic assembly of components smaller than human hair. The medical robotics sector alone will require 850,000 high-accuracy sensors by 2026. Another promising avenue is modular sensor platforms that reduce integration time from weeks to days - early adopters report 40% faster deployment and 30% lower engineering costs compared to traditional solutions.

Regional Market Insights

Asia-Pacific dominates with 45% market share, led by China's electronics manufacturing boom and Japan's leadership in precision robotics. The region grows at 8.9% CAGR, with sensor demand in South Korea's semiconductor sector increasing 22% annually.

North America maintains strong growth through aerospace and automotive investments, with U.S. facilities incorporating 50% more sensors per robot compared to conventional lines. Strict OSHA safety standards are accelerating tactile sensor adoption.

Europe shows steady expansion through Industry 4.0 initiatives, particularly in German automotive plants where vision system adoption has doubled since 2020. The EU's machine safety directives continue to drive innovation in collaborative robotics sensing.

Emerging markets demonstrate potential, with Brazil's automotive sector and the Middle East's logistics automation driving regional growth, though high technology costs remain a barrier to widespread adoption.

Competitive Landscape

Keyence and Cognex lead the vision sensor segment with 28% combined market share, recently introducing AI-enhanced pattern recognition systems that achieve 99.5% detection accuracy.

Baumer Group expanded its capabilities through strategic acquisitions, while Rockwell Automation partnered with NVIDIA to integrate advanced simulation and edge-based perception technologies.

Specialized manufacturers like ATI Industrial Automation continue innovating in force-torque sensing, recently launching a new series with 0.01N resolution for delicate assembly applications.

Market Segmentation

By Sensor Type:

Vision Systems (2D/3D cameras, LiDAR)

Force-Torque Sensors

Tactile and Proximity Sensors

Position and Motion Detectors

Environmental Sensors

Specialized Industrial Variants

By Application:

Industrial Automation

Collaborative Robotics

Autonomous Mobile Robots

Precision Manufacturing

By End-Use Industry:

Automotive and Transportation

Electronics and Semiconductors

Healthcare and Life Sciences

By Integration Level:

Standalone Sensors

Report Scope & Offerings

This comprehensive market analysis provides:

2025-2032 market size forecasts with COVID-19 impact analysis

Competitive intelligence on 12 major players (Keyence, Cognex, Baumer, Rockwell, etc.)

Technology trend analysis including AI integration, edge computing, and miniaturization

Strategic recommendations for suppliers and end-users

Download FREE Sample Report: Robotic Machine Sensor Market - View Detailed Research Report

Access Full Market Research: Complete Robotic Machine Sensor Market Analysis 2025-2032

Visit more reports :

https://www.tumblr.com/intelmarketresearch/787942687211929600/waterborne-curing-agents-market-growth-analysishttps://www.bundas24.com/blogs/52656/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://hallbook.com.br/blogs/630744/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://logcla.com/blogs/710480/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://controlc.com/a314248bhttps://justpaste.it/fyhckhttps://www.flexartsocial.com/blogs/11096/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://sidintelmarketresearch.blogspot.com/2025/07/waterborne-curing-agents-market-growth.htmlhttps://pastelink.net/gab25yi0https://penposh.com/blogs/448159/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://iamstreaming.org/siddheshkapshikar/blog/11027/waterborne-curing-agents-market-growth-analysis-market-dynamics-key-players-and-innovations-outlook-and-forecast-2025-2032https://intel24.hashnode.dev/waterborne-curing-agents-market-growth-analysis-market-dynamics-key-players-and-innovations-outlook-and-forecast-2025-2032-1https://manage.wix.com/dashboard/feeb7ef3-a212-4275-a860-fdd6d8a9ee22/blog/posts?status=%5B%7B%22id%22%3A%22PUBLISHED%22%2C%22name%22%3A%22Published%22%7D%5D&selectedColumns=col-thumbnail%2Ccol-post%2Ccol-published%2Ccol-views%2Ccol-comments%2Ccol-likes%2Ccol-categories%2Ccol-tags%2Ccol-spacerhttps://www.pearltrees.com/sid7011/item724195739https://sites.google.com/view/intel-market-research/home/waterborne-curing-agents-market-2025

About Intel Market Research

Intel Market Research delivers actionable insights in technology and infrastructure markets. Our data-driven analysis leverages:

Real-time infrastructure monitoring

Techno-economic feasibility studies

Competitive intelligence across 100+ countries Trusted by Fortune 500 firms, we empower strategic decisions with precision. International: +1(332) 2424 294 | Asia: +91 9169164321

Website: https://www.intelmarketresearch.com

Follow us on LinkedIn: https://www.linkedin.com/company/intel-market-research

0 notes

Text

Global Transceiver Chip Market Size, Share, Growth, Trends, Opportunities and Forecast to 2032

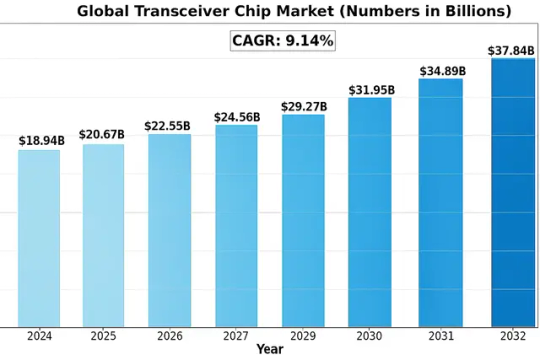

Global Transceiver Chip Market size was valued at US$ 18.94 billion in 2024 and is projected to reach US$ 37.84 billion by 2032, at a CAGR of 9.14% during the forecast period 2025-2032.

Transceiver chips are integrated circuits that enable bidirectional communication by combining both transmitter and receiver functions in a single device. These semiconductor components are fundamental to modern telecommunications, supporting data transmission across wired and wireless networks including 5G infrastructure, fiber-optic systems, and IoT devices. The technology has evolved significantly to support higher bandwidth requirements while minimizing power consumption and physical footprint.

The market growth is driven by increasing demand for high-speed data communication, expansion of 5G networks worldwide, and proliferation of cloud computing services. However, supply chain challenges and geopolitical factors affecting semiconductor availability present temporary constraints. Major players like Broadcom, Infineon Technologies, and Texas Instruments are investing heavily in R&D to develop next-generation chips with improved energy efficiency and data handling capabilities. The Asia-Pacific region currently dominates production and consumption due to concentrated electronics manufacturing hubs in China, South Korea, and Taiwan.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-transceiver-chip-market/

Segment Analysis:

By Type

Single-Chip Transceiver Segment Dominates Market Share Due to Compact Design and Energy Efficiency

The market is segmented based on type into:

Single-Chip Transceiver

Subtypes: Silicon photonics, InP-based, and GaAs-based

Standalone-Chip Transceiver

Subtypes: Co-optimized modules and discrete component assemblies

Mixed-Signal Transceiver Chips

Others

By Application

Mobile Devices Lead Application Segment with Rising 5G Adoption Worldwide

The market is segmented based on application into:

Mobile Devices

Routers

Add-On Cards

Embedded Modules

Others

By Data Rate

High-Speed Segment Growing Rapidly as Datacenters Upgrade Infrastructure

The market is segmented based on data rate into:

≤10 Gbps

10-25 Gbps

25-50 Gbps

50-100 Gbps

>100 Gbps

By Technology

Optical Fiber Technology Segment Leads Owing to Superior Performance Characteristics

The market is segmented based on technology into:

Optical Fiber

Cable

Wireless

Others

Regional Analysis: Global Transceiver Chip Market

North America The transceiver chip market in North America is driven by strong demand for high-speed data communication, particularly in the U.S. and Canada. The region’s leadership in 5G deployment and data center expansion creates significant opportunities for optical transceiver chips. Major telecom operators’ investments in fiber-optic networks—exceeding $35 billion annually—further stimulate growth. The presence of key players like Broadcom and Texas Instruments strengthens the supply chain. However, stringent export controls on semiconductor technologies and trade tensions with China present challenges for market expansion. The adoption of coherent optics in long-haul networks remains a key trend as bandwidth demands continue escalating with cloud computing and IoT applications.

Europe Europe’s transceiver chip market benefits from robust R&D initiatives and the EU’s focus on digital sovereignty. Countries like Germany and France are investing heavily in photonics research programs, with Horizon Europe allocating €700 million for optical communication technologies. The market shows strong preference for energy-efficient designs to meet sustainability targets, driving innovation in low-power transceiver solutions. While automotive applications present growth potential, particularly for LiDAR systems, the region faces stiff competition from Asian manufacturers in consumer electronics segments. Regulatory standards like RoHS and REACH continue shaping product development strategies across the value chain.

Asia-Pacific Dominating over 45% of global transceiver chip production, Asia-Pacific remains the powerhouse of market growth. China’s nationwide fiber-to-the-home deployment and India’s BharatNet project drive massive demand for optical components. Taiwan and South Korea lead in advanced packaging technologies for high-density transceivers used in AI servers. Despite trade restrictions affecting some Chinese firms like Huawei, domestic manufacturers have successfully developed competitive alternatives for 25G/50G chips. Japan maintains strength in optical materials and precision manufacturing, supplying critical components to global players. Price sensitivity remains a key market characteristic, prompting continuous cost reduction efforts throughout the supply chain.

South America The South American market shows moderate but steady growth, primarily fueled by Brazil’s expanding telecom infrastructure. Mobile operators are gradually upgrading to 4.5G networks, creating opportunities for RF transceiver chips. However, economic instability and currency fluctuations deter major investments in cutting-edge optical technologies. Most countries rely heavily on imports, with local assembly accounting for less than 15% of total consumption. Government initiatives to improve digital connectivity, such as Brasil Digital, aim to stimulate demand, but progress remains constrained by limited R&D capabilities and underdeveloped semiconductor ecosystems.

Middle East & Africa This emerging market demonstrates growing potential through infrastructure projects like Saudi Arabia’s Vision 2030 and UAE’s smart city initiatives. Gulf countries are actively deploying 5G networks, requiring advanced transceiver solutions for base stations. Sub-Saharan Africa shows increasing mobile broadband adoption, though mostly serviced by cost-effective 4G solutions. The lack of local manufacturing results in complete import dependence, creating supply chain vulnerabilities. South Africa serves as a regional hub for distribution, while North African countries are beginning to attract investment in telecom equipment production facilities, signaling long-term market development potential.

MARKET OPPORTUNITIES

Emerging Co-Packaged Optics Technology Opens New Frontiers

The development of co-packaged optics (CPO) represents a paradigm shift in data center interconnects, with potential to create a multibillion-dollar market segment. By integrating optical engines directly with switching ASICs, CPO solutions promise to overcome the bandwidth limitations of traditional pluggable transceivers. Early implementations demonstrate 50% power reduction compared to discrete components while enabling terabit-scale connectivity. The technology is particularly compelling for AI clusters and high-performance computing applications where bandwidth density and energy efficiency are paramount.

Additionally, the growing adoption of silicon photonics is enabling cost-effective production of integrated transceivers at scale. This technological convergence presents opportunities for semiconductor firms to develop innovative solutions that combine CMOS electronics with optical components on a single chip.

The enterprise sector also shows increasing demand for affordable optical solutions as 10G/25G connectivity becomes standard in office networks and campus environments. This diversification beyond hyperscale and telecom markets offers manufacturers new avenues for revenue growth.

GLOBAL TRANSCEIVER CHIP MARKET TRENDS

Data Center Expansion and 5G Deployment Driving Market Growth

The global transceiver chip market is experiencing accelerated growth due to rising demand for high-speed data transmission across telecommunications and data center infrastructure. With global internet traffic projected to exceed 4.8 zettabytes annually, hyperscale data centers are increasingly adopting optical transceivers to handle massive bandwidth requirements. Furthermore, the ongoing 5G network rollout across key markets is creating unprecedented demand for advanced transceiver chips capable of supporting millimeter wave frequencies and lower latency requirements. Manufacturers are responding with innovative solutions, including co-packaged optics that integrate transceivers directly with networking silicon to improve power efficiency by up to 30%.

Other Trends

Artificial Intelligence Integration

AI-powered optimization is emerging as a transformative trend in transceiver chip development. Machine learning algorithms are being deployed to enhance signal processing while reducing power consumption in next-generation chips. This technological integration is particularly crucial for edge computing applications where energy efficiency directly impacts operational costs. The automotive sector demonstrates this shift clearly, where advanced driver-assistance systems (ADAS) now incorporate AI-optimized transceivers for low-latency vehicle-to-everything (V2X) communication.

Silicon Photonics Revolutionizing Chip Design

Silicon photonics technology is reshaping the transceiver chip landscape by enabling higher integration densities and cost-effective mass production. This approach combines optical components with traditional silicon chips, allowing data transmission speeds exceeding 400Gbps in compact form factors. The technology is gaining significant traction in telecom applications, where it reduces power consumption by approximately 40% compared to conventional solutions. Recent developments include the emergence of coherent optics for long-haul transmission, with several industry leaders now offering solutions supporting 800Gbps and terabit-scale throughput.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Chip Manufacturers Compete for Market Share Through Innovation and Strategic Expansion

The global transceiver chip market features a highly competitive landscape, dominated by semiconductor giants with extensive R&D capabilities and global distribution networks. Broadcom Inc. emerged as the market leader in 2023, commanding approximately 22% of the market share due to its comprehensive portfolio of optical networking solutions and strategic acquisitions in the fiber optics space.

While Broadcom maintains dominance, Infineon Technologies AG and Texas Instruments Incorporated have significantly increased their market presence through focused investments in 5G and IoT applications. These companies collectively account for nearly 35% of the transceiver chip market, benefiting from the growing demand for high-speed data transmission in telecommunications infrastructure.

Meanwhile, Asian manufacturers like Fujitsu Limited and Murata Manufacturing are gaining traction through competitive pricing and localized production facilities. Their growth is particularly strong in emerging APAC markets where cost-sensitive deployments are common. However, these players face challenges matching the technological sophistication of Western competitors in high-performance applications.

The competitive intensity is further amplified by continuous product innovation cycles. Analog Devices Inc. recently launched its new low-power optical transceiver series, while NXP Semiconductors expanded its automotive-grade chip offerings – both moves designed to capture niche market segments with specialized requirements.

List of Key Transceiver Chip Manufacturers Profiled

Broadcom Inc. (U.S.)

Infineon Technologies AG (Germany)

Texas Instruments Incorporated (U.S.)

Analog Devices Inc. (U.S.)

STMicroelectronics N.V. (Switzerland)

Qorvo Inc. (U.S.)

Qualcomm Incorporated (U.S.)

Telefonaktiebolaget LM Ericsson (Sweden)

Skyworks Solutions (U.S.)

Samsung Electronics (South Korea)

ON Semiconductor Corporation (U.S.)

NXP Semiconductors N.V. (Netherlands)

Nokia Corporation (Finland)

Murata Manufacturing (Japan)

Huawei Technologies (China)

ZTE Corporation (China)

Fujitsu Limited (Japan)

Learn more about Competitive Analysis, and Global Forecast of Global Transceiver Chip Market : https://semiconductorinsight.com/download-sample-report/?product_id=95825

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Transceiver Chip Market?

-> The global Transceiver Chip Market size was valued at US$ 18.94 billion in 2024 and is projected to reach US$ 37.84 billion by 2032, at a CAGR of 9.14% during the forecast period 2025-2032.

Which key companies operate in Global Transceiver Chip Market?

-> Key players include Broadcom, Intel, Infineon, Texas Instruments, Huawei, Analog Devices, and STMicroelectronics, among others.

What are the key growth drivers?

-> Key growth drivers include 5G network deployment, hyperscale data center expansion, and increasing adoption of optical communication technologies.

Which region dominates the market?

-> Asia-Pacific dominates with 42% market share, driven by semiconductor manufacturing in China, Taiwan, and South Korea.

What are the emerging trends?

-> Emerging trends include co-packaged optics, silicon photonics integration, and development of 800G/1.6T transceivers for data centers.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

Best Degree College in Warangal for Modern Curriculum

Elevating India's Educational Standards

Introduction: Empowering India Through Next-Gen Education

In the rapidly evolving education landscape of India, Warangal emerges as a strategic hub for aspirants aiming for a blend of tradition and technology in academics. Whether you're a student, entrepreneur, developer, or a professional, choosing the right college is a game-changer. Among the rising academic stars, one institution is setting an unparalleled benchmark with its future-ready approach: Bharathi Degree College – the best degree college in Warangal for modern curriculum.

A college where innovation meets academic excellence, Bharathi Degree College has become the preferred choice for students across India who are looking for more than just a degree. Let us explore why it stands out and how it aligns perfectly with today’s industry expectations and educational aspirations.

India’s Shift Towards a Modern Curriculum: Why It Matters

Modern education in India is no longer confined to rote learning. The National Education Policy has encouraged institutions to move towards flexible, multidisciplinary, and skill-based learning. A modern curriculum means:

Real-world problem-solving exposure

Technology-integrated learning

Project-based assessments

Soft skills, communication, and leadership development

Internships and start-up incubator programs

"Today’s learners want a curriculum that mirrors the real world. That’s the only way to future-proof their careers." — Academic Director, Hyderabad Institute of Advanced Studies

India’s demographic dividend lies in its educated youth. Institutions like Bharathi Degree College are stepping up to ensure this workforce is ready for the future.

Bharathi Degree College: The Best Degree College in Warangal for Modern CurriculumInstitution Snapshot:

Location: Warangal, Telangana, India

Courses Offered: B.Sc. (Maths, Stats, CS), B.Com, BBA, BA

Accreditation: Affiliated with a recognized university

Infrastructure: Smart classrooms, advanced labs, digital libraries, startup incubator, WiFi campus

Faculty: A dynamic blend of academicians, researchers, and industry experts

Core Curriculum Features:

Analytics Modules

Industry-Linked Projects

Career Development Workshops

Coding Hackathons and Business Competitions

Digital Literacy Certifications

"Our mission is to turn degree students into digital-era professionals." — Principal, Bharathi Degree College

Top Courses That Define Bharathi’s Academic EdgeB.Sc. (Mathematics, Statistics, Computer Science)

Perfect for data analysts, AI engineers, and tech developers. The program is designed with:

Statistical software training

Programming and data tools

Cloud computing and database systems

BBA (Business Administration)

Equipping students with:

Marketing and brand management modules

Live industry projects

Entrepreneurial development workshops

B.Com (Commerce)

Focus on financial systems, taxation, and business law, featuring:

Compliance training

Financial analytics labs

Guest lectures from business leaders

Success Story: From Warangal to Startup Success

Meet a graduate in B.Sc. from Bharathi Degree College. This student now leads the analytics division at a leading tech startup.

“Bharathi didn’t just teach me subjects, it taught me how to learn, adapt, and lead in the real world.”

They credit the real-time projects and industry internship facilitated by the college as the turning point of their academic journey.

Placement & Industry Collaboration

Bharathi Degree College ensures strong placement preparation through:

Aptitude, soft skills and technical training

Tie-ups with companies across India

Alumni working in top firms

Modern Learner Support Services

Career Mentorship Programs

Digital Portfolio Creation for Students

Online Learning Access

On-campus Innovation & Entrepreneurship Cell

Language Labs for Communication Excellence

Trends in Indian Education

Modern curriculum colleges are gaining preference over traditional institutions. They focus on practical training, skill enhancement, and career readiness, making them a top choice among students and professionals alike.

FAQs

Q: Is Bharathi Degree College recognized? A: Yes, it is affiliated with a recognized university and approved by relevant education authorities.

Q: Are hostel facilities available? A: Yes. Safe, hygienic hostels for both boys and girls with campus security.

Q: Is placement support provided? A: Absolutely. Students are guided into internships and full-time roles.

Q: Is online learning supported? A: Yes. Hybrid and online platforms are integrated.

Final Word: Choose Excellence, Choose Bharathi

If you’re an aspiring student, entrepreneur, or professional looking to upskill in one of India’s growing academic cities, Bharathi Degree College is your gateway to success. With a modern curriculum aligned with current industry trends and strong academic mentorship, it truly is the best degree college in Warangal for the leaders of tomorrow.

Apply now, embrace a future of possibilities, and be part of India's educational transformation.

0 notes

Text

Smart Sensor Market Expands Rapidly in Asia-Pacific Due to Smart Infrastructure Development Investments

The global smart sensor market is witnessing significant growth driven by rapid advancements in technology, rising adoption of IoT (Internet of Things), and increasing demand for automation across various industries. Smart sensors, which are devices that collect data from the environment and process it for intelligent decision-making, play a vital role in modern applications including industrial automation, healthcare monitoring, smart homes, automotive systems, and consumer electronics.

Technological Advancements Driving Market Growth