#Computer or System on Module Market Share

Explore tagged Tumblr posts

Text

Computer or System on Module Market Size, Business Revenue Forecast, Leading Competitors And Growth Trends

Strategic Insights and Forecasts: Computer or System on Module Market Leaders

The Computer or System on Module Size report is anticipated to experience significant growth in the coming years. As the world continues to recover from the pandemic, the market is expected to expand. The Computer or System on Module research not only highlights current industry standards but also reveals the latest strategic trends and patterns among market players. This research serves as an essential business document, aiding global market buyers in planning their next steps regarding the market's future trajectory.

According to Straits Research, the global Computer or System on Module Market size was valued at USD 1.23 Billion in 2021. It is projected to reach from USD XX Billion in 2022 to USD 2.35 Billion by 2030, growing at a CAGR of 6% during the forecast period (2022–2030).

The Computer or System on Module Report is an essential resource for business strategists, offering insightful data and analysis. It includes an industry overview, growth analysis, and historical and projected figures for cost, revenue, supply, and demand (where applicable). Research analysts offer a thorough description of the value chain and distributor analysis. This report provides comprehensive information to deepen understanding, broaden the scope, and enhance the application of the findings.

Get Free Request Sample Report @ https://straitsresearch.com/report/computer-or-system-on-module-market/request-sample

Leading Computer or System on Module Market include: -

Digi International (the U.S.)

Advantech Co., Ltd. (Taiwan)

Aaeon (Taiwan)

Variscite (Israel)

Axiomtek Co., Ltd. (Taiwan)

MSC Technology (India)

Olimex (Bulgaria)

Kontron (Bulgaria)

PHYTEC Embedded Pvt. Ltd. (India)

Toradex (Switzerland)

Microchip Technology Inc. (the U.S.)

Congatec AG(Germany)

Eurotech, Inc. (Switzerland)

SECO s.r.l. (Italy)

The Computer or System on Module Market Report helps a wide range of businesses determine what their consumers truly want by doing extensive market research. When it comes to new products, every company owner wants to know how much demand there is, and this report is a great resource. Additional benefits include ensuring that the most recent market developments are covered. You may closely check key rivals and their company growth tactics by reading the Computer or System on Module market research. It also does an in-depth research for the years 2022-2030 in order to provide company owners with new business options.

This research also provides a dashboard view of prominent Organizations, highlighting their effective marketing tactics, market share and most recent advances in both historical and current settings.

Global Computer or System on Module Market: Segmentation

By Product Type

ARM (Advanced RISC Machines) Architecture

Power Architecture

x86 Architecture

By Standard

Qseven

Smart Mobile Architecture

Embedded Technology Extended

COM Express

By Industry Vertical

Transportation

Industrial Automation

Medical

Gaming

Communication

Entertainment

Test & Measures

The report forecasts revenue growth at all geographic levels and provides an in-depth analysis of the latest industry trends and development patterns from 2022 to 2030 in each of the segments and sub-segments. Some of the major geographies included in the market are given below:

The regions covered include:

North America (United States, Canada, Mexico)

Europe (United Kingdom, France, Germany, Russia)

Asia-Pacific (China, Japan, Australia, Indonesia)

Middle East and Africa (UAE, Iran, Syria, South Africa)

South America (Brazil, Peru, Chile, Colombia)

You can check In-depth Segmentation from here: https://straitsresearch.com/report/computer-or-system-on-module-market/segmentation

Reasons to Purchase This Report:

The Computer or System on Module Market report provides an analysis of the evolving competitive landscape.

The report offers valuable analytical insights and strategic planning tools to support informed business decisions.

Researchers highlight key market dynamics, including drivers, restraints, trends, developments, and opportunities.

The report includes regional market estimates and business profiles of various stakeholders.

It helps in understanding all significant market segments.

The report provides extensive data on trending factors that will impact market growth.

This Report is available for purchase on Buy Computer or System on Module Market Report

Research Methodology:

We employ a robust research methodology that includes data triangulation based on top-down and bottom-up approaches, along with validation of estimated market figures through primary research. The data used to estimate the Computer or System on Module market size and forecast across various segments at the global, regional, and country levels is sourced from the most reliable published materials and through interviews with relevant stakeholders.

About Us:

StraitsResearch.com is a leading research and intelligence organization, specializing in research, analytics, and advisory services along with providing business insights & research reports.

Contact Us: Email: [email protected] Address: 825 3rd Avenue, New York, NY, USA, 10022 Tel: +1 6464807505, +44 203 318 2846

#Computer or System on Module Market#Computer or System on Module Market Share#Computer or System on Module Market Size#Computer or System on Module Market Research#Computer or System on Module Industry

1 note

·

View note

Text

How to Choose the Best ERP for Engineering and Manufacturing Industry

In today’s fast-paced world, engineering and manufacturing companies face increasing pressure to deliver high-quality products while maintaining efficiency and cost-effectiveness. Implementing the right Enterprise Resource Planning (ERP) software can significantly enhance operations, streamline workflows, and boost productivity. However, with numerous options available, selecting the best ERP software for the engineering and manufacturing industry can be challenging. This guide will help you navigate this decision-making process and choose the most suitable solution for your business.

Why ERP is Crucial for Engineering and Manufacturing

ERP software integrates various business processes, including production, inventory management, supply chain, finance, and human resources. For engineering and manufacturing companies, ERP solutions are particularly vital because they:

Facilitate real-time data sharing across departments.

Enhance supply chain management.

Optimize production planning and scheduling.

Ensure compliance with industry standards.

Reduce operational costs.

Partnering with the right Engineering ERP software company ensures that your organization leverages these benefits to stay competitive in a dynamic market.

Steps to Choose the Best ERP for Engineering and Manufacturing

1. Understand Your Business Needs

Before exploring ERP solutions, evaluate your company’s specific requirements. Identify the pain points in your current processes and prioritize the features you need in an ERP system. Common features for engineering and manufacturing companies include:

Bill of Materials (BOM) management

Production planning and scheduling

Inventory control

Quality management

Financial reporting

Consulting with a reputed ERP software company can help you match your needs with the right features.

2. Look for Industry-Specific Solutions

Generic ERP software might not address the unique needs of the engineering and manufacturing sector. Opt for an ERP software in India that offers modules tailored to your industry. Such solutions are designed to handle specific challenges like multi-level BOM, project costing, and shop floor management.

3. Check Vendor Expertise

Choosing a reliable vendor is as important as selecting the software itself. Research ERP solution providers with a strong track record in serving engineering and manufacturing companies. Look for reviews, case studies, and client testimonials to gauge their expertise.

4. Evaluate Scalability and Flexibility

Your business will grow, and so will your operational requirements. Ensure that the ERP system you choose is scalable and flexible enough to accommodate future needs. The top 10 ERP software providers in India offer scalable solutions that can adapt to changing business demands.

5. Assess Integration Capabilities

An ERP system must integrate seamlessly with your existing tools, such as Computer-Aided Design (CAD) software, Customer Relationship Management (CRM) systems, and IoT devices. A well-integrated system reduces redundancies and enhances efficiency.

6. Prioritize User-Friendliness

A complex system with a steep learning curve can hinder adoption. Choose an ERP software with an intuitive interface and easy navigation. This ensures that your employees can use the system effectively without extensive training.

7. Consider Customization Options

No two businesses are alike. While standard ERP solutions offer core functionalities, some companies require customization to align with specific workflows. A trusted ERP software company in India can provide custom modules tailored to your unique needs.

8. Focus on Data Security

Engineering and manufacturing companies often deal with sensitive data. Ensure that the ERP solution complies with the latest security standards and offers robust data protection features.

9. Compare Pricing and ROI

While cost is an important factor, it should not be the sole criterion. Evaluate the long-term return on investment (ROI) offered by different ERP software. A slightly expensive but feature-rich solution from the best ERP software provider in India may deliver better value than a cheaper alternative with limited functionalities.

10. Test Before You Commit

Most ERP software companies offer free trials or demo versions. Use these opportunities to test the software in a real-world scenario. Gather feedback from your team and ensure the solution meets your expectations before finalizing your decision.

Benefits of Partnering with the Best ERP Software Providers in India

India is home to some of the leading ERP software providers in India, offering state-of-the-art solutions for the engineering and manufacturing sector. Partnering with a reputable provider ensures:

Access to advanced features tailored to your industry.

Reliable customer support.

Comprehensive training and implementation services.

Regular updates and enhancements to the software.

Companies like Shantitechnology (STERP) specialize in delivering cutting-edge ERP solutions that cater specifically to engineering and manufacturing businesses. With years of expertise, they rank among the top 10 ERP software providers in India, ensuring seamless integration and exceptional performance.

Conclusion

Selecting the right ERP software is a critical decision that can impact your company’s efficiency, productivity, and profitability. By understanding your requirements, researching vendors, and prioritizing features like scalability, integration, and security, you can find the perfect ERP solution for your engineering or manufacturing business.

If you are looking for a trusted ERP software company in India, consider partnering with a provider like STERP. As one of the best ERP software providers in India, STERP offers comprehensive solutions tailored to the unique needs of engineering and manufacturing companies. With their expertise, you can streamline your operations, improve decision-making, and stay ahead in a competitive market.

Get in touch with STERP – the leading Engineering ERP software company – to transform your business with a reliable and efficient ERP system. Take the first step toward a smarter, more connected future today!

#Manufacturing ERP software company#ERP solution provider#Engineering ERP software company#ERP software company#ERP software companies

6 notes

·

View notes

Text

Top BCA Programs in Warangal, India

Introduction: Why Warangal Is Emerging as a BCA Education Hub

Warangal, one of India’s fastest-growing educational and IT corridors, is steadily making its mark as a hotbed for technical education, particularly in the domain of computer applications. For ambitious students, entrepreneurs, developers, and even working professionals across India, the Bachelor of Computer Applications (BCA) program serves as a gateway into the digital economy. With the rapid evolution of the IT landscape, powered by advancements in artificial intelligence, data analytics, cloud computing, and software development, the demand for skilled professionals is at an all-time high.

This article explores the top BCA programs in Warangal, India, focusing specifically on the quality of education, real-world exposure, campus placements, and value-added features offered by premier degree colleges in Warangal. This guide is tailored for a diverse readership — from aspiring students and their families to business owners and developers looking to upskill in India’s growing digital-first economy.

Why Choose BCA in Warangal?

Warangal’s advantage lies in its fusion of traditional academic excellence with emerging digital opportunities. Located within Telangana — a state actively promoting digital infrastructure and startup ecosystems — Warangal houses institutions that emphasize innovation-led education, practical exposure, and professional readiness.

Key Highlights:

Academic-Industry Integration: Degree colleges in Warangal collaborate with industry leaders for curriculum updates, ensuring students are job-ready.

Affordability: Compared to metro cities, tuition and living expenses are more economical, without compromising educational quality.

Placement Records: Many colleges have tie-ups with IT companies and startups, ensuring solid placement pipelines for students.

Growing Tech Infrastructure: The Warangal IT Hub, inaugurated in partnership with Tech Mahindra, opens newer prospects for internships and employment.

How BCA Graduates from Warangal are Changing the Game in India’s Digital Economy

According to a 2024 report by NASSCOM, India will need over 15 lakh new software professionals by 2026. With Warangal becoming a feeder city for major IT hubs like Hyderabad and Bengaluru, students who graduate from local colleges find themselves at a distinct advantage.

Alumni Case Study:

Akhila Reddy, a 2022 BCA graduate from Bharathi Degree College, now works as a software developer at a tech startup in Hyderabad. Her final-year project — an AI-driven college management app — earned her an internship, followed by a full-time job offer.

“Bharathi gave me the platform to think beyond textbooks and work on real-world solutions. The mentorship and coding labs made all the difference,” she shares.

Curriculum Trends: What Makes Warangal's BCA Programs Unique?

Top degree colleges in Warangal are designing their BCA curriculum with foresight. Here's what modern BCA syllabi now include:

Core Programming Languages: C, Java, Python, Kotlin, Swift

Web & Mobile Application Development: HTML5, CSS3, React, Flutter

Database Management: MySQL, MongoDB, Oracle

Cloud Computing & DevOps: AWS, Git, Docker

AI & Machine Learning Basics

Cybersecurity Modules

Entrepreneurship and Project Management

Such inclusion of forward-looking subjects makes graduates job-ready and startup-capable from day one.

The Role of SEO and Digital Marketing in BCA Today

India's growing digital economy has seen a 32% rise in demand for SEO professionals and digital marketers in 2024 (source: TeamLease EdTech). As part of the BCA course structure, top Warangal colleges are embedding modules on:

Search Engine Optimization (SEO)

Social Media Algorithms

Content Management Systems like WordPress

Web Analytics

Paid Search Campaigns (Google Ads, Facebook Ads)

“Understanding SEO in Warangal or any city is no longer optional — it’s foundational,” remarks Smt. Kavitha Rao, visiting faculty and digital strategist.

Why Business Owners and Entrepreneurs Should Consider a BCA Degree or Collaboration

Today’s business ecosystem is data-driven. Business owners and entrepreneurs across India are increasingly exploring BCA degrees for themselves or encouraging collaboration with institutions like Bharathi Degree College.

Collaboration Benefits:

Internship Opportunities: Businesses can hire interns for real-time software and digital projects.

Research Projects: Collaborate with students on building MVPs for apps or websites.

Training Workshops: Get access to campus-led digital marketing and SEO workshops.

This synergy between education and entrepreneurship helps uplift local economies and digital infrastructure. FAQs: Top BCA Programs in Warangal, India

Q1: What are the eligibility criteria for BCA in Warangal? A: Candidates should have passed 10+2 with Mathematics or Computer Science as a subject.

Q2: Is coding experience necessary before joining a BCA program? A: No. However, basic familiarity with computers is helpful. Most colleges begin with foundational training.

Q3: What career paths can BCA graduates pursue? A: Software development, web and mobile application design, SEO specialist, IT analyst, and startup founder roles.

Q4: Are there internship opportunities for BCA students in Warangal? A: Yes, especially through colleges like Bharathi Degree College that have strong industry tie-ups.

Q5: What makes Warangal a good city for BCA education compared to metros? A: Lower cost of education, high-quality faculty, and growing IT support from the Telangana government.

Conclusion: The Smart Choice for Future-Ready Education

Choosing to pursue a BCA degree in Warangal is not just about earning a qualification — it's about joining a movement. As India accelerates toward digital transformation, the need for skilled tech professionals has never been greater. Institutions like Bharathi Degree College, known for delivering academically rigorous and professionally aligned BCA programs, are setting a high benchmark.

For students, entrepreneurs, and developers between 18 to 60 years of age — this is your chance to upskill, pivot, or lead. Choose a degree college in Warangal that not only educates but equips you with tools to thrive in tomorrow’s digital ecosystem.

To explore the BCA program at Bharathi Degree College, visit bharathieducationalsociety.com and become a part of Warangal’s rising tech narrative.

0 notes

Text

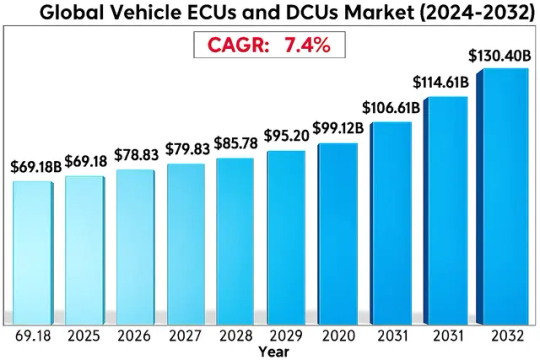

Global Vehicle Electronic Control Units (ECU) Market : Key Trends, Latest Technologies, and Forecast to 2032

Global Vehicle Electronic Control Units (ECU) Market size was valued at US$ 67.34 billion in 2024 and is projected to reach US$ 124.73 billion by 2032, at a CAGR of 7.3% during the forecast period 2025-2032.

Electronic Control Units (ECUs) are embedded systems that manage various electrical subsystems in vehicles, including engine control, transmission, braking, and infotainment systems. These units serve as the central nervous system of modern vehicles, processing sensor data and executing control algorithms to optimize performance, safety, and efficiency. The market encompasses various ECU types such as Engine Control Modules (ECM), Transmission Control Modules (TCM), Brake Control Modules (BCM), and Body Control Modules (BCM).

The market growth is primarily driven by increasing vehicle electrification, stringent emission regulations, and rising demand for advanced driver-assistance systems (ADAS). The automotive industry’s shift toward connected, autonomous, shared, and electric (CASE) vehicles is accelerating ECU adoption. While passenger vehicles dominate the market share, commercial vehicles are witnessing faster growth due to telematics mandates. Regional analysis shows Asia-Pacific leading the market, propelled by China’s automotive production boom and India’s growing vehicle parc. Key players like Bosch, Continental, and DENSO continue to innovate with domain controller architectures, consolidating multiple ECUs into high-performance computing units.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-vehicle-electronic-control-units-ecu-market/

Segment Analysis:

By Type

Passenger Vehicle Segment Dominates Due to Increasing Adoption of Advanced Driver Assistance Systems (ADAS)

The market is segmented based on type into:

Passenger Vehicle

Subtypes: Sedans, SUVs, Hatchbacks, and others

Commercial Vehicle

Electric Vehicles

Subtypes: Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and others

Off-Highway Vehicles

Subtypes: Agricultural Equipment, Construction Machinery, and others

Others

By Application

Powertrain Control ECUs Lead Market Share Due to Increasing Vehicle Electrification

The market is segmented based on application into:

Powertrain Control

Body Control

Chassis Control

Safety & Security Systems

Infotainment

By Vehicle System

Engine Management Systems Account for Significant Market Share

The market is segmented based on vehicle system into:

Engine Management System

Transmission System

Braking System

Steering System

Others

By ECU Capacity

32-Bit ECUs Hold Majority Share Due to Higher Processing Requirements

The market is segmented based on ECU capacity into:

16-Bit ECUs

32-Bit ECUs

64-Bit ECUs

Regional Analysis: Global Vehicle Electronic Control Units (ECU) Market

North America The North American ECU market is characterized by high technological adoption and stringent automotive safety regulations. The U.S. accounted for over 75% of the regional market share in 2023, driven by premium vehicle penetration and advanced driver-assistance systems (ADAS) mandates. Canada follows with steady growth in commercial vehicle ECU demand, particularly for fleet telematics. While Mexico serves as a manufacturing hub for cost-sensitive ECU production, trade agreements like USMCA continue to shape supply chain dynamics. A notable trend is the shift toward domain controller architectures as automakers like Tesla and Ford consolidate multiple ECUs into centralized computing modules.

Europe Europe’s ECU market is at the forefront of electrification and cybersecurity innovations, with Germany contributing approximately 30% of regional ECU demand. Stricter Euro 7 emissions standards and mandatory eCall emergency systems have accelerated ECU sophistication. The region also leads in AI-powered ECUs for predictive maintenance, with players like Bosch investing heavily in machine learning algorithms. However, the post-pandemic semiconductor shortage exposed vulnerabilities in just-in-time manufacturing models, prompting EU initiatives to boost local chip production. Eastern European nations are emerging as competitive ECU manufacturing bases, benefiting from lower labor costs while maintaining EU compliance standards.

Asia-Pacific As the largest and fastest-growing ECU market, Asia-Pacific is projected to maintain a 6.8% CAGR through 2028, fueled by China’s dominance in EV production and India’s expanding automotive sector. Japanese automakers prioritize reliability-focused ECU designs, while Korean manufacturers integrate advanced infotainment controls. Southeast Asia represents an untapped growth frontier, with Thailand and Indonesia attracting ECU investments due to favorable FDI policies. A dual-market dynamic exists: premium vehicles adopt next-gen ECUs with 5G connectivity, while entry-level models use cost-optimized solutions. The region also faces unique challenges like counterfeit ECU proliferation in secondary markets.

South America ECU adoption in South America trails other regions due to economic volatility and older vehicle fleets. Brazil dominates with 60% market share, where flex-fuel vehicle ECUs remain a specialization area. Argentina shows potential in agricultural vehicle ECUs, though currency fluctuations impact import-dependent component sourcing. The region benefits from proximity to North American supply chains but struggles with inconsistent regulatory frameworks across countries. Recent trade agreements with Chinese ECU suppliers are reducing historical dependence on European and American vendors, creating more competitive pricing in the aftermarket segment.

Middle East & Africa This emerging market shows divergent trends: Gulf Cooperation Council (GCC) countries demand luxury vehicle ECUs with climate-specific adaptations, while African nations prioritize ruggedized units for harsh operating conditions. The UAE leads in smart mobility ECU integration, supporting autonomous vehicle pilot programs. However, infrastructural limitations in Sub-Saharan Africa restrict advanced ECU adoption, with the market relying heavily on refurbished units. Long-term growth potential exists through Chinese investments in local automotive assembly plants, though political instability in some regions creates supply chain uncertainties.

MARKET OPPORTUNITIES

Emergence of Software-Defined Vehicles Creating New Revenue Streams

The shift toward software-defined vehicles presents transformative opportunities for ECU manufacturers. Rather than discrete hardware units, future architectures will emphasize centralized computing power with software applications running on virtualized ECUs. This transition enables over-the-air updates and new monetization models through feature-on-demand services. Leading automakers have already demonstrated that software-enabled features can generate 30-40% higher margins than traditional hardware options. Suppliers who successfully transition to this software-centric approach stand to gain substantial market share in the coming decade.

Expansion of Predictive Maintenance Solutions in Commercial Vehicles

The commercial vehicle sector represents a high-growth opportunity for advanced ECU applications, particularly in predictive maintenance systems. Fleet operators increasingly demand real-time monitoring solutions that can reduce unplanned downtime, with some systems demonstrating 25-30% improvement in maintenance efficiency. Specialized ECUs that integrate with telematics and AI-based analytics platforms are becoming essential components in modern trucks and construction equipment. Suppliers who develop ruggedized, high-reliability ECUs for harsh operating environments can capitalize on this underserved market segment.

Advancements in Edge Computing for Autonomous Systems

The evolution of autonomous vehicle technologies is driving innovation in edge computing capabilities within ECUs. Next-generation systems require substantial local processing power to minimize latency for safety-critical functions, with some autonomous driving ECUs now featuring over 50 TOPS (trillions of operations per second) of computing performance. This performance demand creates opportunities for suppliers specializing in high-performance computing architectures optimized for automotive applications. The integration of neural processing units directly into ECUs represents particularly promising territory for technological differentiation.

GLOBAL VEHICLE ELECTRONIC CONTROL UNITS (ECU) MARKET TRENDS

Increasing Vehicle Electrification to Dominate Market Growth

The global automotive industry is undergoing a paradigm shift toward electrification, with over 26 million electric vehicles projected to be sold annually by 2030. This transformation is significantly driving demand for advanced Electronic Control Units (ECUs) that manage powertrain systems, battery management, and energy efficiency in electric and hybrid vehicles. Modern ECUs now integrate AI-powered predictive maintenance capabilities, enabling real-time monitoring of vehicle subsystems. Furthermore, the development of domain controller architectures consolidates multiple ECUs into centralized units, reducing complexity while improving processing power—a critical requirement for autonomous driving functionalities.

Other Trends

Autonomous Driving Technology Integration

As autonomous vehicle development accelerates, the need for high-performance ECUs capable of processing massive sensor data has surged. ADAS (Advanced Driver Assistance Systems) alone requires up to 70 interconnected ECUs in modern vehicles, creating substantial market opportunities. Leading manufacturers are developing ECU solutions with neural network processors that can handle 100+ TOPS (Tera Operations Per Second) for Level 4 autonomous operations. This trend is coupled with growing investments in vehicle-to-everything (V2X) communication systems that demand specialized telematics control units.

Cybersecurity and Over-the-Air Updates

The automotive cybersecurity market is projected to grow at over 12% CAGR through 2028, directly impacting ECU development. Modern ECUs incorporate hardware security modules and cryptographic authentication to prevent ECU hacking, which has become critical as vehicles handle more sensitive data. Additionally, OEMs increasingly require ECU architectures supporting secure Over-the-Air (OTA) updates, allowing remote firmware updates without dealership visits. This capability reduces recall costs while enabling continuous feature enhancements throughout a vehicle’s lifecycle.

COMPETITIVE LANDSCAPE

Key Market Players

Automotive Giants and Suppliers Compete Through Technological Advancements

The global vehicle ECU market features a competitive hierarchy dominated by established automotive suppliers and electronics specialists. This landscape remains moderately consolidated, with the top five players collectively holding over 45% market share in 2024. Among these, BOSCH maintains its market leadership with a diversified ECU portfolio that spans engine control modules, transmission control units, and advanced driver assistance systems (ADAS) ECUs. The company’s technological edge in automotive semiconductors and its presence across all major vehicle segments contribute significantly to its dominant position.

Continental AG and DENSO Corporation follow closely, capitalizing on their vertically integrated supply chains and strong OEM partnerships. Continental’s strength lies in chassis and safety systems control units, while DENSO has made significant strides in powertrain ECUs for hybrid and electric vehicles. Both companies allocated approximately 7-9% of their annual revenues to R&D in recent years, focusing on next-generation ECUs with higher computing power and AI capabilities.

The market also features specialized players making strategic inroads. Delphi Technologies (now part of BorgWarner) commands notable market share in commercial vehicle ECUs, with its proprietary software algorithms offering enhanced fuel efficiency. Similarly, ZF TRW has expanded its footprint through acquisitions and now provides integrated safety ECU solutions for premium automakers.

Chinese manufacturers like UAES and Weifu Group represent the growing influence of regional players, particularly in cost-sensitive segments. These companies compete through localized production and government-supported technology transfer programs, capturing nearly 20% of the Asia-Pacific ECU market. Meanwhile, Japanese firms such as Hitachi Automotive and Mitsubishi Electric maintain technological leadership in microcontrollers and power management systems for ECUs.

List of Major Vehicle ECU Manufacturers Profiled

BOSCH (Germany)

Continental AG (Germany)

DENSO Corporation (Japan)

Delphi Technologies (U.K.)

ZF TRW (Germany)

Hyundai AUTRON (South Korea)

Marelli (Italy)

Mitsubishi Electric (Japan)

UAES (China)

Weifu Group (China)

LinControl (U.S.)

Hitachi Automotive (Japan)

Learn more about Competitive Analysis, and Forecast of Global Vehicle ECU Market : https://semiconductorinsight.com/download-sample-report/?product_id=95798

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Vehicle ECU Market?

-> The Global Vehicle Electronic Control Units (ECU) Market size was valued at US$ 67.34 billion in 2024 and is projected to reach US$ 124.73 billion by 2032, at a CAGR of 7.3%.

Which key companies operate in Global Vehicle ECU Market?

-> Key players include BOSCH, Continental, DENSO, Delphi, ZF TRW, Hyundai AUTRON, Marelli, Mitsubishi Electric, and Hitachi Automotive, among others.

What are the key growth drivers?

-> Key growth drivers include vehicle electrification, autonomous driving trends, increasing electronics content per vehicle, and stringent emission regulations.

Which region dominates the market?

-> Asia-Pacific dominates the market with 42.7% share, driven by automotive production in China, Japan, and South Korea.

What are the emerging trends?

-> Emerging trends include domain controller architectures, over-the-air updates, AI-powered ECUs, and cybersecurity solutions for connected vehicles.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

Dual in-line Memory Module (DIMM) Market: Revenue Trends and Pricing Analysis 20

Global Dual in-line Memory Module (DIMM) Market Research Report 2025(Status and Outlook)

Dual in-line Memory Module (DIMM) Market size was valued at US$ 16.84 billion in 2024 and is projected to reach US$ 32.47 billion by 2032, at a CAGR of 7.8% during the forecast period 2025-2032

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=95815

MARKET INSIGHTS

The global Dual in-line Memory Module (DIMM) Market size was valued at US$ 16.84 billion in 2024 and is projected to reach US$ 32.47 billion by 2032, at a CAGR of 7.8% during the forecast period 2025-2032.

DIMMs (dual in-line memory modules) are essential components for modern computing systems, providing high-speed data transfer capabilities through their 64-bit architecture. These modules contain multiple RAM chips mounted on a printed circuit board, connecting directly to computer motherboards via standardized pins. DIMMs are widely used across desktop PCs, servers, industrial systems, and high-performance computing applications due to their reliability and superior bandwidth compared to older SIMM (single in-line memory module) technology.

The market growth is driven by increasing demand for high-performance computing across data centers, AI applications, and 5G infrastructure. Furthermore, the rising adoption of DDR5 technology with higher bandwidth capacities (up to 6400 MT/s) is accelerating market expansion. Key industry players like Micron, Kingston, and SK Hynix are investing heavily in advanced manufacturing processes, with recent developments including 1α nm DRAM production nodes that offer 15% better power efficiency. However, cyclical memory pricing and geopolitical trade tensions present ongoing challenges for market stability.

List of Key DIMM Manufacturers Profiled

Kingston Technology Company (U.S.)

Micron Technology, Inc. (U.S.)

ADATA Technology Co., Ltd. (Taiwan)

Ramaxel Technology (Shenzhen) Limited (China)

Transcend Information, Inc. (Taiwan)

Tigo Corporation (China)

Apacer Technology Inc. (Taiwan)

Corsair Memory, Inc. (U.S.)

Team Group Inc. (Taiwan)

Kingmax Semiconductor Inc. (Taiwan)

Innodisk Corporation (Taiwan)

Segment Analysis:

By Type

UDIMM Segment Leads the Market Due to Wide Adoption in Consumer Electronics and Budget Systems

The market is segmented based on type into:

UDIMM (Unbuffered DIMM)

FB-DIMM (Fully Buffered DIMM)

RDIMM (Registered DIMM)

LR-DIMM (Load-Reduced DIMM)

Other specialized DIMM variants

By Application

Computers Segment Dominates Through Pervasive Use in Desktops and Laptops Globally

The market is segmented based on application into:

Computers (desktops & laptops)

Servers

Industrial applications

Aerospace and defense systems

Manufacturing equipment

By Memory Technology

DDR4 Maintains Strong Position While DDR5 Adoption Gains Momentum

The market is segmented based on memory technology into:

DDR3

DDR4

DDR5

Specialized memory variants

By Capacity

8GB-16GB Range Captures Significant Market Share Across Multiple Applications

The market is segmented based on capacity into:

Below 4GB

4GB-8GB

8GB-16GB

Above 16GB

Regional Analysis: Global Dual In-line Memory Module (DIMM) Market

North America North America remains a dominant region in the DIMM market due to its strong technological infrastructure and high adoption of advanced computing solutions. The U.S. leads the region with robust demand from data centers, enterprise IT infrastructure, and gaming markets. Companies like Micron (Crucial) and Corsair are key players driving innovation in high-performance memory solutions, particularly for servers and industrial applications. The growing cloud computing sector is a significant growth driver, with hyperscalers investing heavily in upgrading their data center architectures. Regulatory concerns about energy efficiency and supply chain resilience are influencing material sourcing and manufacturing strategies, pushing vendors toward sustainable production methods.

Europe Europe’s DIMM market is shaped by stringent data privacy regulations and high enterprise adoption of server-grade memory solutions. Countries like Germany, the UK, and France are frontrunners in data center expansions, fueling demand for RDIMM and LR-DIMM products. The automotive sector is also emerging as a key DIMM consumer due to advancements in autonomous driving and in-vehicle computing. However, the region faces challenges in semiconductor supply chain dependencies, prompting local governments to increase investments in domestic manufacturing capabilities under programs like the European Chips Act. This push for self-reliance is expected to amplify competition among global memory manufacturers.

Asia-Pacific The Asia-Pacific region is the fastest-growing DIMM market, accounting for over 40% of global consumption, led by China, Japan, and South Korea. Rapid digital transformation across industries and heavy investments in AI and cloud infrastructure are accelerating demand for high-capacity DIMM modules. China dominates in both production and consumption, with local players like Ramaxel and ADATA competing aggressively on price-performance metrics. Meanwhile, India is witnessing a surge in data center deployments, driving the adoption of enterprise-grade memory solutions. Price sensitivity remains a key factor in consumer-grade DIMM adoption, although the shift toward DDR5 technology is gradually reshaping mid-to-high-tier market segments.

South America South America represents a developing market with moderate but steady growth potential in DIMM adoption. Brazil and Argentina are seeing increased demand for consumer and industrial-grade memory modules, primarily due to gaming PC markets and localized manufacturing automation. Economic volatility and import dependency on foreign memory suppliers create pricing fluctuations, limiting widespread adoption of cutting-edge DIMM technologies. Government initiatives to bolster local tech manufacturing could unlock opportunities, though infrastructure constraints continue to slow large-scale enterprise adoption compared to other regions.

Middle East & Africa The Middle East & Africa region is experiencing nascent but promising growth, particularly in GCC countries and South Africa, where data center investments and smart city projects are expanding. High-performance computing applications in oil & gas analytics and financial services are driving specialized DIMM demand. However, the market remains constrained by limited local manufacturing and reliance on imports, leading to higher consumer pricing. Long-term opportunities are tied to digital infrastructure expansions, especially as 5G deployments and IoT adoption increase across the region.

MARKET DYNAMICS

As memory densities scale beyond 64GB per module, thermal management becomes a critical challenge. The industry’s shift to 1α nm DRAM processes increases power density, requiring sophisticated heat spreaders and airflow solutions. These thermal limitations directly impact real-world performance—some high-frequency DDR5 DIMMs throttle speeds by 15-20% under sustained loads. For data center operators, this translates into either performance compromises or increased cooling costs, creating difficult TCO calculations when specifying server configurations.

Compatibility Issues During Technology Transitions The heterogeneous nature of memory ecosystems creates validation challenges, particularly during DDR generational transitions. Cases of BIOS incompatibilities between certain DIMMs and platforms have been reported, requiring extensive qualification processes. These technical hurdles slow down adoption cycles and increase development costs for module manufacturers.

Counterfeit Components in Supply Chain The prevalence of counterfeit DRAM chips remains an industry challenge, with some estimates suggesting 8-12% of aftermarket modules contain substandard components. This not only jeopardizes system reliability but also erodes confidence in value-chain suppliers, particularly in price-sensitive market segments.

The advent of Compute Express Link (CXL) technology is enabling revolutionary memory expansion architectures. CXL-attached memory buffers allow for novel DIMM designs that break traditional capacity barriers, with prototypes demonstrating 4TB memory modules. Early deployments in AI training clusters show 30% performance improvements over conventional configurations. As the CXL 2.0/3.0 ecosystem matures, it will create opportunities for specialized DIMMs incorporating memory pooling and tiering capabilities—a potential $3 billion market by 2027.

The proliferation of edge computing in harsh environments is generating demand for industrial-grade DIMMs with extended temperature ranges (-40°C to 85°C) and vibration resistance. Applications in autonomous vehicles, oil/gas monitoring, and factory automation require memory modules that can withstand extreme conditions while maintaining data integrity. The market for such specialized DIMMs is forecast to grow at 28% CAGR, significantly outpacing the broader memory module sector.

With increasing concerns about memory-based attacks, hardware-level security features in DIMMs are becoming differentiation points. Technologies like memory encryption (Intel TME, AMD SME) and physical tamper detection are being integrated into premium modules. Government and financial sectors are early adopters of these solutions, with secure DIMM variants commanding 50-70% price premiums over standard modules—a high-margin opportunity for vendors with robust security architectures.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95815

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global DIMM Market?

Which key companies operate in Global DIMM Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Related Reports:

https://semiconductorblogs21.blogspot.com/2025/07/network-set-top-box-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/digital-set-top-box-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/5g-base-station-microwave-dielectric.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/automotive-magnetic-sensor-market-cost.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/holographic-diffraction-grating-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/electronic-grade-silicon-wafer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/silicon-epitaxial-wafer-market-value.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/annealed-silicon-wafer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/computer-power-supplies-market-revenue.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/power-supply-unit-psu-market-innovation.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/automotive-cockpit-domain-control-unit.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-vehicle-ecus-and-dcus-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-automotive-ecuelectronic-control.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-vehicle-electronic-control-units.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-automotive-ecus-and-dcus-market.html

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes

Text

Dual in-line Memory Module (DIMM) Market - Detailed Analysis Of Current Industry Demand with Forecasts Growth

Global Dual in-line Memory Module (DIMM) Market Research Report 2025(Status and Outlook)

The global Dual in-line Memory Module (DIMM) Market size was valued at US$ 16.84 billion in 2024 and is projected to reach US$ 32.47 billion by 2032, at a CAGR of 7.8% during the forecast period 2025-2032.

DIMMs (dual in-line memory modules) are essential components for modern computing systems, providing high-speed data transfer capabilities through their 64-bit architecture. These modules contain multiple RAM chips mounted on a printed circuit board, connecting directly to computer motherboards via standardized pins. DIMMs are widely used across desktop PCs, servers, industrial systems, and high-performance computing applications due to their reliability and superior bandwidth compared to older SIMM (single in-line memory module) technology.

The market growth is driven by increasing demand for high-performance computing across data centers, AI applications, and 5G infrastructure. Furthermore, the rising adoption of DDR5 technology with higher bandwidth capacities (up to 6400 MT/s) is accelerating market expansion. Key industry players like Micron, Kingston, and SK Hynix are investing heavily in advanced manufacturing processes, with recent developments including 1α nm DRAM production nodes that offer 15% better power efficiency. However, cyclical memory pricing and geopolitical trade tensions present ongoing challenges for market stability.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=95815

Segment Analysis:

By Type

UDIMM Segment Leads the Market Due to Wide Adoption in Consumer Electronics and Budget Systems

The market is segmented based on type into:

UDIMM (Unbuffered DIMM)

FB-DIMM (Fully Buffered DIMM)

RDIMM (Registered DIMM)

LR-DIMM (Load-Reduced DIMM)

Other specialized DIMM variants

By Application

Computers Segment Dominates Through Pervasive Use in Desktops and Laptops Globally

The market is segmented based on application into:

Computers (desktops & laptops)

Servers

Industrial applications

Aerospace and defense systems

Manufacturing equipment

By Memory Technology

DDR4 Maintains Strong Position While DDR5 Adoption Gains Momentum

The market is segmented based on memory technology into:

DDR3

DDR4

DDR5

Specialized memory variants

By Capacity

8GB-16GB Range Captures Significant Market Share Across Multiple Applications

The market is segmented based on capacity into:

Below 4GB

4GB-8GB

8GB-16GB

Above 16GB

Regional Analysis: Global Dual In-line Memory Module (DIMM) Market

North America North America remains a dominant region in the DIMM market due to its strong technological infrastructure and high adoption of advanced computing solutions. The U.S. leads the region with robust demand from data centers, enterprise IT infrastructure, and gaming markets. Companies like Micron (Crucial) and Corsair are key players driving innovation in high-performance memory solutions, particularly for servers and industrial applications. The growing cloud computing sector is a significant growth driver, with hyperscalers investing heavily in upgrading their data center architectures. Regulatory concerns about energy efficiency and supply chain resilience are influencing material sourcing and manufacturing strategies, pushing vendors toward sustainable production methods.

Europe Europe’s DIMM market is shaped by stringent data privacy regulations and high enterprise adoption of server-grade memory solutions. Countries like Germany, the UK, and France are frontrunners in data center expansions, fueling demand for RDIMM and LR-DIMM products. The automotive sector is also emerging as a key DIMM consumer due to advancements in autonomous driving and in-vehicle computing. However, the region faces challenges in semiconductor supply chain dependencies, prompting local governments to increase investments in domestic manufacturing capabilities under programs like the European Chips Act. This push for self-reliance is expected to amplify competition among global memory manufacturers.

Asia-Pacific The Asia-Pacific region is the fastest-growing DIMM market, accounting for over 40% of global consumption, led by China, Japan, and South Korea. Rapid digital transformation across industries and heavy investments in AI and cloud infrastructure are accelerating demand for high-capacity DIMM modules. China dominates in both production and consumption, with local players like Ramaxel and ADATA competing aggressively on price-performance metrics. Meanwhile, India is witnessing a surge in data center deployments, driving the adoption of enterprise-grade memory solutions. Price sensitivity remains a key factor in consumer-grade DIMM adoption, although the shift toward DDR5 technology is gradually reshaping mid-to-high-tier market segments.

South America South America represents a developing market with moderate but steady growth potential in DIMM adoption. Brazil and Argentina are seeing increased demand for consumer and industrial-grade memory modules, primarily due to gaming PC markets and localized manufacturing automation. Economic volatility and import dependency on foreign memory suppliers create pricing fluctuations, limiting widespread adoption of cutting-edge DIMM technologies. Government initiatives to bolster local tech manufacturing could unlock opportunities, though infrastructure constraints continue to slow large-scale enterprise adoption compared to other regions.

Middle East & Africa The Middle East & Africa region is experiencing nascent but promising growth, particularly in GCC countries and South Africa, where data center investments and smart city projects are expanding. High-performance computing applications in oil & gas analytics and financial services are driving specialized DIMM demand. However, the market remains constrained by limited local manufacturing and reliance on imports, leading to higher consumer pricing. Long-term opportunities are tied to digital infrastructure expansions, especially as 5G deployments and IoT adoption increase across the region.

List of Key DIMM Manufacturers Profiled

Kingston Technology Company (U.S.)

Micron Technology, Inc. (U.S.)

ADATA Technology Co., Ltd. (Taiwan)

Ramaxel Technology (Shenzhen) Limited (China)

Transcend Information, Inc. (Taiwan)

Tigo Corporation (China)

Apacer Technology Inc. (Taiwan)

Corsair Memory, Inc. (U.S.)

Team Group Inc. (Taiwan)

Kingmax Semiconductor Inc. (Taiwan)

Innodisk Corporation (Taiwan)

The exponential growth of data-driven applications in artificial intelligence, machine learning, and cloud computing is creating unprecedented demand for high-performance memory solutions. DIMM modules, particularly LR-DIMMs and RDIMMs, are becoming critical components as they enable larger memory capacities and faster data transfer rates. The AI hardware market, which heavily relies on efficient memory architectures, is projected to grow at 40% annually, directly fueling DIMM adoption. Furthermore, hyperscale data centers are increasingly deploying servers with 1TB+ memory configurations, requiring advanced DIMM technologies to maintain performance benchmarks.

The transition from DDR4 to DDR5 DIMMs represents a fundamental market driver, offering nearly double the bandwidth (4800-6400 MT/s vs DDR4’s 3200 MT/s) at 20% lower power consumption. As mainstream CPU platforms now natively support DDR5, OEMs are rapidly transitioning their product lines. Enterprise server upgrades are particularly significant, with major cloud providers planning complete infrastructure refreshes by 2025. This technological shift isn’t just about speed—the improved error correction and bank grouping architectures in DDR5 DIMMs make them essential for mission-critical applications in finance and healthcare sectors.

With global cloud service spending surpassing $500 billion annually, the server DIMM market is experiencing sustained growth. Hyperscalers now account for over 35% of all memory module purchases, with average server configurations containing 20-30% more DIMMs compared to pre-pandemic levels. The shift towards memory-intensive workloads like in-memory databases and real-time analytics requires high-density RDIMMS and LR-DIMMS. Major CSPs (Cloud Service Providers) have publicly disclosed plans to double their data center footprints within three years, ensuring long-term demand visibility for server-grade memory modules.

The advent of Compute Express Link (CXL) technology is enabling revolutionary memory expansion architectures. CXL-attached memory buffers allow for novel DIMM designs that break traditional capacity barriers, with prototypes demonstrating 4TB memory modules. Early deployments in AI training clusters show 30% performance improvements over conventional configurations. As the CXL 2.0/3.0 ecosystem matures, it will create opportunities for specialized DIMMs incorporating memory pooling and tiering capabilities—a potential $3 billion market by 2027.

The proliferation of edge computing in harsh environments is generating demand for industrial-grade DIMMs with extended temperature ranges (-40°C to 85°C) and vibration resistance. Applications in autonomous vehicles, oil/gas monitoring, and factory automation require memory modules that can withstand extreme conditions while maintaining data integrity. The market for such specialized DIMMs is forecast to grow at 28% CAGR, significantly outpacing the broader memory module sector.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95815

Key Questions Answered by the Dual in-line Memory Module (DIMM) Market Report:

What is the current market size of Global Dual in-line Memory Module (DIMM) Market?

Which key companies operate in Global Dual in-line Memory Module (DIMM) Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

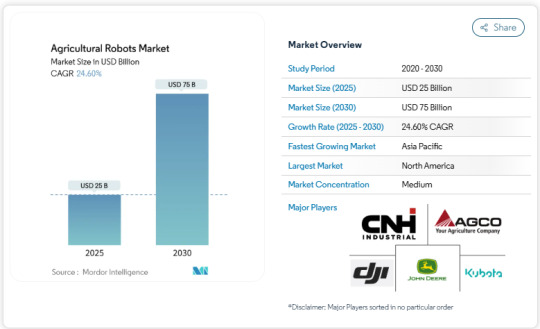

Agricultural Robots Market Set to Triple by 2030 Amid Labor Shortages and Tech Advancements

The global agricultural robots market size is experiencing rapid growth, with its value projected to rise from USD 25 billion in 2025 to USD 75 billion by 2030, reflecting a robust CAGR of 24.6%. This expansion is driven by the need to offset labor shortages, boost productivity, and manage input costs through advanced automation technologies.

Get More Insights: https://www.mordorintelligence.com/industry-reports/agricultural-robots-market

Why Farmers are Turning to Robots

Farm labor shortages have become a structural issue, particularly in North America and Europe, where an aging farmer population and shrinking rural workforce threaten production continuity. For instance, 60% of U.S. agribusinesses delayed projects in 2024 due to difficulties in securing seasonal labor. Autonomous robots offer a reliable solution, operating 24/7 without overtime and reducing wage-related pressures. Companies now focus on deploying user-friendly systems that integrate easily into existing farm operations, lowering adoption barriers for growers.

Strong Investment Backing Fuels Innovation

Investment trends continue to favor agricultural robotics, despite broader AgTech funding volatility. In 2024, capital directed to farm robotics rose 9%, highlighting investor confidence in scalable automation. Notable collaborations include New Holland’s partnership with Bluewhite to retrofit specialty tractors, a move expected to cut orchard and vineyard operating costs by up to 85%. Start-ups such as Verdant Robotics and Fieldwork Robotics have also secured significant funding to accelerate product development and global market entry.

Government Incentives Accelerate Adoption

Public initiatives tying sustainability goals to technology adoption are shaping the market. For example, the UK’s Improving Farm Productivity grant subsidizes autonomous systems, while Australia’s National Robotics Strategy targets AUD 600 billion (USD 420 billion) in economic gains through robotics, with agriculture as a priority sector. These incentives shorten payback periods for farmers and encourage investments in advanced automation.

Rapid Technological Advances

Technological progress in AI, computer vision, and LIDAR is enhancing agricultural robots’ capabilities. Companies like John Deere are integrating multi-camera systems and machine learning to achieve centimeter-level precision under challenging field conditions. Such advances enable robots to detect obstacles, classify plants, and adapt their operations in real time, supporting new use cases in greenhouse and broad-acre farming.

Market Segmentation Insights

By Technology: UAVs and drones held a 35% market share in 2024, with automated harvesting systems posting the fastest 26% CAGR. Drones remain essential for aerial imagery and spraying, while harvesting robots address labor shortages in fruit and vegetable production.

By Application: Broad-acre farming tasks, such as fertilizing and weeding, accounted for 24% of market revenue in 2024. Greenhouse automation is growing at a 24% CAGR, with robots performing tasks like spraying, pollination, and selective harvesting in controlled environments.

By Offering: Hardware dominated with 60% of revenue in 2024, driven by robust robotic chassis, arms, and navigation modules. However, software is expanding at a 21% CAGR, as farmers demand integrated platforms for fleet management, predictive maintenance, and prescription mapping.

Regional Analysis

North America leads the market share with a 37% revenue share, backed by large farm sizes, regulatory support, and strong venture capital flows. Companies like Carbon Robotics continue to attract major investments for chemical-free weeding solutions.

Asia-Pacific is the fastest-growing region at a 25.5% CAGR, driven by China’s funding of domestic robotics firms and Japan’s subsidies for orchard automation. Australia’s National Robotics Strategy further fuels regional growth, while India explores affordable weeding and spraying robots suited to smallholders.

Europe’s growth is supported by labor shortages, strict crop protection regulations, and sustainability goals. The EU’s updated Machinery Regulation provides clearer compliance pathways for autonomous machines, while countries like Germany and the UK pilot electric and multi-robot solutions in various crop sectors.

Challenges Facing the Market

Despite its growth, the agricultural robots market faces barriers, particularly in developing economies. High upfront costs and uncertain returns deter smallholders, while fragmented certification standards for autonomous machines increase compliance complexity for manufacturers. Gaps in rural connectivity also limit real-time control capabilities in parts of Africa and Asia.

Competitive Landscape

The market is moderately concentrated, with the top five companies commanding 56% of global revenue. Key players include:

Deere & Company: Leading innovations in battery-powered electric powertrains and autonomous navigation.

CNH Industrial N.V.: Partnering with start-ups to retrofit tractors with autonomy kits.

AGCO Corporation: Offering OutRun retrofit kits that enhance fuel efficiency and cross-fleet compatibility.

Kubota Corporation: Advancing specialized autonomous machinery for orchard and horticulture use.

SZ DJI Technology Co., Ltd.: Dominating UAV segments with robust drone solutions.

The competitive edge now hinges on AI model robustness, precision perception systems, and integrated software ecosystems. Companies that bundle hardware with subscription-based software and service packages are better positioned to capture long-term customer value, especially as hardware becomes increasingly commoditized.

Looking Ahead

As agricultural robots continue to prove their value in boosting productivity, reducing labor dependence, and supporting sustainable farming, their adoption is set to accelerate across regions and crop segments. Falling component prices, supportive policies, and rapid technological innovation suggest a market poised for robust expansion through the next decade.

0 notes

Text

IoT Communication Protocol Market Enabling Next-Gen Industrial IoT (IIoT) Innovations

TheIoT Communication Protocol Market Size was valued at USD 16.95 Billion in 2023 and is expected to reach USD 23.94 Billion by 2032 and grow at a CAGR of 4.2% over the forecast period 2024-2032.

IoT Communication Protocol Market is witnessing notable growth as the demand for seamless device connectivity accelerates across industries. With businesses increasingly adopting smart devices, machine-to-machine communication has become essential for data sharing, automation, and efficiency. Protocols such as MQTT, CoAP, and Zigbee are playing a vital role in enabling reliable, low-power, and scalable communication.

U.S. Leads in Advancing IoT Infrastructure Through Protocol Innovation

IoT Communication Protocol Market is evolving with the integration of edge computing, AI, and 5G, which are reshaping how devices interact in real time. As industries like healthcare, automotive, and manufacturing pivot to intelligent operations, the need for secure, flexible, and interoperable communication standards continues to rise.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6554

Market Keyplayers:

Huawei Technologies (OceanConnect IoT Platform, LiteOS)

Arm Holdings (Mbed OS, Cortex‑M33 Processor)

Texas Instruments (SimpleLink CC3220 Wi‑Fi MCU, SimpleLink CC2652 Multiprotocol Wireless MCU)

Intel (XMM 7115 NB‑IoT Modem, XMM 7315 LTE‑M/NB‑IoT Modem)

Cisco Systems (Catalyst IR1101 Rugged Router, IoT Control Center)

NXP Semiconductors (LPC55S6x Cortex‑M33 MCU, EdgeLock SE050 Secure Element)

STMicroelectronics (STM32WL5x LoRaWAN Wireless MCU, SPIRIT1 Sub‑GHz Transceiver)

Thales (Cinterion TX62 LTE‑M/NB‑IoT Module, Cinterion ENS22 NB‑IoT Module)

Zebra Technologies (Savanna IoT Platform, SmartLens for Retail Asset Visibility)

Wind River (Helix Virtualization Platform, Helix Device Cloud)

Ericsson (IoT Accelerator, Connected Vehicle Cloud)

Qualcomm (IoT Services Suite, AllJoyn Framework)

Samsung Electronics (ARTIK Secure IoT Modules, SmartThings Cloud)

IBM (Watson IoT Platform, Watson IoT Message Gateway)

Market Analysis

The IoT Communication Protocol Market is driven by the explosion of connected devices and the need for efficient, low-latency data transmission. Communication protocols serve as the foundation for interoperability among heterogeneous IoT devices, ensuring real-time synchronization and security. The U.S. is leading with early adoption and robust R&D, while Europe contributes significantly with regulatory support and smart city deployments.

Market Trends

Increasing adoption of LPWAN protocols like LoRaWAN and NB-IoT

Rise of MQTT and CoAP in industrial and home automation applications

Shift towards IPv6 for improved scalability and addressability

Integration of 5G enhancing speed and reliability in protocol performance

Growing emphasis on cybersecurity and encrypted data exchange

Development of hybrid protocols to support multi-layered IoT architectures

Market Scope

The market is expanding beyond traditional device communication and into intelligent ecosystems. Protocols are now expected to support not only connectivity but also data prioritization, edge computing compatibility, and energy efficiency.

Real-time communication for industrial automation

Protocols optimized for ultra-low power IoT devices

Interoperability across cloud, edge, and device layers

Smart city applications requiring scalable communication

Healthcare devices demanding secure and reliable data transfer

Automotive systems relying on low-latency connections

Forecast Outlook

The IoT Communication Protocol Market is set to grow at a rapid pace as device ecosystems multiply and application complexity deepens. Success will depend on protocol adaptability, security, and standardization efforts that support global deployment. With North America at the forefront and Europe driving policy-aligned innovation, the market is primed for a shift from fragmented systems to harmonized connectivity solutions.

Access Complete Report: https://www.snsinsider.com/reports/iot-communication-protocol-market-6554

Conclusion

As industries become increasingly connected, the IoT Communication Protocol Market plays a crucial role in shaping the future of smart operations. From San Francisco’s automated logistics to Berlin’s connected healthcare systems, the demand for agile, secure, and scalable communication protocols is setting new standards. Forward-thinking enterprises that prioritize protocol innovation will lead the charge in building resilient and intelligent digital ecosystems.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

U.S.A sees rising adoption of IoT middleware as industries push for smarter automation solutions

U.S.A. accelerates financial innovation through Robotic Process Automation in BFSI operations

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

#IoT Communication Protocol Market#IoT Communication Protocol Market Scope#IoT Communication Protocol Market Share#IoT Communication Protocol Market Growth

0 notes

Text

Robotic Machine Sensor Market Growth Analysis, Market Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

According to new market research, the global robotic machine sensor market was valued at USD 867 million in 2024 and is projected to reach USD 1,344 million by 2032, growing at a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period (2025-2032). This growth is driven by rapid automation adoption across industries, advancements in Industry 4.0 technologies, and increasing demand for precision robotics.

Download FREE Sample Report: Robotic Machine Sensor Market - View Detailed Research Report

What Are Robotic Machine Sensors?

Robotic machine sensors are intelligent components that enable robots to perceive and interact with their environment. These sophisticated devices replicate human sensory capabilities, providing critical data on position, force, vision, touch, and other variables that robotic controllers use to execute precise movements and operations. The market encompasses specialized sensors including: movement sensors (accelerometers, gyroscopes), vision systems (2D/3D cameras), tactile sensors, proximity detectors, and voice recognition modules. Modern sensors increasingly incorporate AI and edge computing capabilities, transforming them from passive components into active decision-makers within automated systems.

Key Market Drivers

1. Industry 4.0 Revolution Fuels Sensor Demand

The transformation toward smart factories is accelerating sensor adoption, with modern automated production lines now incorporating 150-200 sensors per robotic cell compared to just 50-75 five years ago. Vision systems account for nearly 40% of this growth, as manufacturers implement real-time quality control across assembly lines. The automotive sector shows particularly strong adoption, where sensor-guided robotic welding now achieves placement accuracy within 0.1mm - crucial for electric vehicle battery assembly.

2. Human-Robot Collaboration Expands Applications

The rise of collaborative robots (cobots) has created new sensor requirements, particularly for force-torque detection and tactile feedback systems that ensure worker safety. Recent innovations include AI-powered skins that give robots a sense of touch across entire surfaces, enabling delicate operations in electronics manufacturing where human-like dexterity is essential. The global cobot market is projected to require over 8 million specialized sensors annually by 2026.

Market Challenges

Despite strong growth, several barriers persist. High implementation costs remain prohibitive for SMEs, with integrated robotic workcells often exceeding $250,000. Sensor reliability in extreme environments presents another hurdle - welding cells experience sensor failures every 600-800 hours due to arc glare and metal spatter. Additionally, cybersecurity risks in interconnected sensor networks have caused 35% of manufacturers to delay IIoT adoption until encryption standards improve.

Emerging Opportunities

The market presents significant growth potential in micro-manufacturing, where new nano-precision sensors enable robotic assembly of components smaller than human hair. The medical robotics sector alone will require 850,000 high-accuracy sensors by 2026. Another promising avenue is modular sensor platforms that reduce integration time from weeks to days - early adopters report 40% faster deployment and 30% lower engineering costs compared to traditional solutions.

Regional Market Insights

Asia-Pacific dominates with 45% market share, led by China's electronics manufacturing boom and Japan's leadership in precision robotics. The region grows at 8.9% CAGR, with sensor demand in South Korea's semiconductor sector increasing 22% annually.

North America maintains strong growth through aerospace and automotive investments, with U.S. facilities incorporating 50% more sensors per robot compared to conventional lines. Strict OSHA safety standards are accelerating tactile sensor adoption.

Europe shows steady expansion through Industry 4.0 initiatives, particularly in German automotive plants where vision system adoption has doubled since 2020. The EU's machine safety directives continue to drive innovation in collaborative robotics sensing.

Emerging markets demonstrate potential, with Brazil's automotive sector and the Middle East's logistics automation driving regional growth, though high technology costs remain a barrier to widespread adoption.

Competitive Landscape

Keyence and Cognex lead the vision sensor segment with 28% combined market share, recently introducing AI-enhanced pattern recognition systems that achieve 99.5% detection accuracy.

Baumer Group expanded its capabilities through strategic acquisitions, while Rockwell Automation partnered with NVIDIA to integrate advanced simulation and edge-based perception technologies.

Specialized manufacturers like ATI Industrial Automation continue innovating in force-torque sensing, recently launching a new series with 0.01N resolution for delicate assembly applications.

Market Segmentation

By Sensor Type:

Vision Systems (2D/3D cameras, LiDAR)

Force-Torque Sensors

Tactile and Proximity Sensors

Position and Motion Detectors

Environmental Sensors

Specialized Industrial Variants

By Application:

Industrial Automation

Collaborative Robotics

Autonomous Mobile Robots

Precision Manufacturing

By End-Use Industry:

Automotive and Transportation

Electronics and Semiconductors

Healthcare and Life Sciences

By Integration Level:

Standalone Sensors

Report Scope & Offerings

This comprehensive market analysis provides:

2025-2032 market size forecasts with COVID-19 impact analysis

Competitive intelligence on 12 major players (Keyence, Cognex, Baumer, Rockwell, etc.)

Technology trend analysis including AI integration, edge computing, and miniaturization

Strategic recommendations for suppliers and end-users

Download FREE Sample Report: Robotic Machine Sensor Market - View Detailed Research Report

Access Full Market Research: Complete Robotic Machine Sensor Market Analysis 2025-2032

Visit more reports :

https://www.tumblr.com/intelmarketresearch/787942687211929600/waterborne-curing-agents-market-growth-analysishttps://www.bundas24.com/blogs/52656/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://hallbook.com.br/blogs/630744/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://logcla.com/blogs/710480/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://controlc.com/a314248bhttps://justpaste.it/fyhckhttps://www.flexartsocial.com/blogs/11096/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://sidintelmarketresearch.blogspot.com/2025/07/waterborne-curing-agents-market-growth.htmlhttps://pastelink.net/gab25yi0https://penposh.com/blogs/448159/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://iamstreaming.org/siddheshkapshikar/blog/11027/waterborne-curing-agents-market-growth-analysis-market-dynamics-key-players-and-innovations-outlook-and-forecast-2025-2032https://intel24.hashnode.dev/waterborne-curing-agents-market-growth-analysis-market-dynamics-key-players-and-innovations-outlook-and-forecast-2025-2032-1https://manage.wix.com/dashboard/feeb7ef3-a212-4275-a860-fdd6d8a9ee22/blog/posts?status=%5B%7B%22id%22%3A%22PUBLISHED%22%2C%22name%22%3A%22Published%22%7D%5D&selectedColumns=col-thumbnail%2Ccol-post%2Ccol-published%2Ccol-views%2Ccol-comments%2Ccol-likes%2Ccol-categories%2Ccol-tags%2Ccol-spacerhttps://www.pearltrees.com/sid7011/item724195739https://sites.google.com/view/intel-market-research/home/waterborne-curing-agents-market-2025

About Intel Market Research

Intel Market Research delivers actionable insights in technology and infrastructure markets. Our data-driven analysis leverages:

Real-time infrastructure monitoring

Techno-economic feasibility studies

Competitive intelligence across 100+ countries Trusted by Fortune 500 firms, we empower strategic decisions with precision. International: +1(332) 2424 294 | Asia: +91 9169164321

Website: https://www.intelmarketresearch.com

Follow us on LinkedIn: https://www.linkedin.com/company/intel-market-research

0 notes

Text

LED Display Manufacturer

The evolution of digital display technology has dramatically reshaped how information is shared in both public and private spaces. From outdoor billboards to indoor signage in shopping malls and stadiums, LED displays are at the core of modern visual communication. Behind these glowing panels are the companies that build them — the LED Display Manufacturer.

Understanding what it means to be an LED Display Manufacturer involves more than knowing how to assemble a screen. It’s about mastering complex technology, navigating competitive markets, and constantly innovating to meet ever-evolving customer demands.

What Is an LED Display Manufacturer?

An LED Display Manufacturer is a company that specializes in the design, development, and production of LED (Light Emitting Diode) display systems. These manufacturers produce screens that can range from small indoor panels to massive outdoor digital billboards.

The job of an LED Display Manufacturer includes several core responsibilities:

Designing circuit boards and pixel configurations.

Choosing and integrating diodes, drivers, and chips.

Engineering the screen housing and waterproofing.

Developing control systems and software.

Conducting quality testing for brightness, refresh rate, and reliability.