#Computer or System on Module Market Size

Explore tagged Tumblr posts

Text

Computer or System on Module Market Size, Business Revenue Forecast, Leading Competitors And Growth Trends

Strategic Insights and Forecasts: Computer or System on Module Market Leaders

The Computer or System on Module Size report is anticipated to experience significant growth in the coming years. As the world continues to recover from the pandemic, the market is expected to expand. The Computer or System on Module research not only highlights current industry standards but also reveals the latest strategic trends and patterns among market players. This research serves as an essential business document, aiding global market buyers in planning their next steps regarding the market's future trajectory.

According to Straits Research, the global Computer or System on Module Market size was valued at USD 1.23 Billion in 2021. It is projected to reach from USD XX Billion in 2022 to USD 2.35 Billion by 2030, growing at a CAGR of 6% during the forecast period (2022–2030).

The Computer or System on Module Report is an essential resource for business strategists, offering insightful data and analysis. It includes an industry overview, growth analysis, and historical and projected figures for cost, revenue, supply, and demand (where applicable). Research analysts offer a thorough description of the value chain and distributor analysis. This report provides comprehensive information to deepen understanding, broaden the scope, and enhance the application of the findings.

Get Free Request Sample Report @ https://straitsresearch.com/report/computer-or-system-on-module-market/request-sample

Leading Computer or System on Module Market include: -

Digi International (the U.S.)

Advantech Co., Ltd. (Taiwan)

Aaeon (Taiwan)

Variscite (Israel)

Axiomtek Co., Ltd. (Taiwan)

MSC Technology (India)

Olimex (Bulgaria)

Kontron (Bulgaria)

PHYTEC Embedded Pvt. Ltd. (India)

Toradex (Switzerland)

Microchip Technology Inc. (the U.S.)

Congatec AG(Germany)

Eurotech, Inc. (Switzerland)

SECO s.r.l. (Italy)

The Computer or System on Module Market Report helps a wide range of businesses determine what their consumers truly want by doing extensive market research. When it comes to new products, every company owner wants to know how much demand there is, and this report is a great resource. Additional benefits include ensuring that the most recent market developments are covered. You may closely check key rivals and their company growth tactics by reading the Computer or System on Module market research. It also does an in-depth research for the years 2022-2030 in order to provide company owners with new business options.

This research also provides a dashboard view of prominent Organizations, highlighting their effective marketing tactics, market share and most recent advances in both historical and current settings.

Global Computer or System on Module Market: Segmentation

By Product Type

ARM (Advanced RISC Machines) Architecture

Power Architecture

x86 Architecture

By Standard

Qseven

Smart Mobile Architecture

Embedded Technology Extended

COM Express

By Industry Vertical

Transportation

Industrial Automation

Medical

Gaming

Communication

Entertainment

Test & Measures

The report forecasts revenue growth at all geographic levels and provides an in-depth analysis of the latest industry trends and development patterns from 2022 to 2030 in each of the segments and sub-segments. Some of the major geographies included in the market are given below:

The regions covered include:

North America (United States, Canada, Mexico)

Europe (United Kingdom, France, Germany, Russia)

Asia-Pacific (China, Japan, Australia, Indonesia)

Middle East and Africa (UAE, Iran, Syria, South Africa)

South America (Brazil, Peru, Chile, Colombia)

You can check In-depth Segmentation from here: https://straitsresearch.com/report/computer-or-system-on-module-market/segmentation

Reasons to Purchase This Report:

The Computer or System on Module Market report provides an analysis of the evolving competitive landscape.

The report offers valuable analytical insights and strategic planning tools to support informed business decisions.

Researchers highlight key market dynamics, including drivers, restraints, trends, developments, and opportunities.

The report includes regional market estimates and business profiles of various stakeholders.

It helps in understanding all significant market segments.

The report provides extensive data on trending factors that will impact market growth.

This Report is available for purchase on Buy Computer or System on Module Market Report

Research Methodology:

We employ a robust research methodology that includes data triangulation based on top-down and bottom-up approaches, along with validation of estimated market figures through primary research. The data used to estimate the Computer or System on Module market size and forecast across various segments at the global, regional, and country levels is sourced from the most reliable published materials and through interviews with relevant stakeholders.

About Us:

StraitsResearch.com is a leading research and intelligence organization, specializing in research, analytics, and advisory services along with providing business insights & research reports.

Contact Us: Email: [email protected] Address: 825 3rd Avenue, New York, NY, USA, 10022 Tel: +1 6464807505, +44 203 318 2846

#Computer or System on Module Market#Computer or System on Module Market Share#Computer or System on Module Market Size#Computer or System on Module Market Research#Computer or System on Module Industry

1 note

·

View note

Text

Photonic Integrated Circuit Market 2033: Key Players, Segments, and Forecasts

Market Overview

The Global Photonic Integrated Circuit Market Size is Expected to Grow from USD 11.85 Billion in 2023 to USD 94.05 Billion by 2033, at a CAGR of 23.02% during the forecast period 2023-2033.

Photonic Integrated Circuit (PIC) Market is witnessing transformative momentum, fueled by the global push towards faster, energy-efficient, and miniaturized optical components. As data demands soar and photonics become essential in telecom, AI, quantum computing, and biosensing, PICs are emerging as the nerve center of next-generation optical solutions. These chips integrate multiple photonic functions into a single chip, drastically improving performance and cost-efficiency.

Market Growth and Key Drivers

The market is set to grow at an exceptional pace, driven by:

Data Center Expansion: Surging internet traffic and cloud services are fueling PIC-based optical transceivers.

5G & Beyond: Demand for faster, low-latency communication is driving adoption in telecom infrastructure.

Quantum & AI Computing: PICs are critical to the advancement of light-based quantum circuits and high-speed AI processors.

Medical Diagnostics: Miniaturized photonic sensors are revolutionizing biomedical imaging and lab-on-chip diagnostics.

Defense & Aerospace: PICs provide enhanced signal processing and secure communication capabilities.

Get More Information: Click Here

Market Challenges

Despite strong potential, the PIC market faces several hurdles:

Fabrication Complexity: Advanced PICs demand high-precision manufacturing and integration techniques.

Standardization Issues: Lack of global standards slows down mass deployment and interoperability.

High Initial Investment: R&D and setup costs can be prohibitive, especially for SMEs and startups.

Thermal Management: Maintaining performance while managing heat in densely packed circuits remains a challenge.

Market Segmentation

By Component: Lasers, Modulators, Detectors, Multiplexers/Demultiplexers, Others

By Integration Type: Monolithic Integration, Hybrid Integration

By Material: Indium Phosphide (InP), Silicon-on-Insulator (SOI), Others

By Application: Optical Communication, Sensing, Biomedical, Quantum Computing, RF Signal Processing

By End User: Telecom, Healthcare, Data Centers, Aerospace & Defense, Academia

Regional Analysis

North America: Leading in R&D, startups, and federal defense contracts.

Europe: Home to silicon photonics innovation and academic-industrial collaboration.

Asia-Pacific: Witnessing rapid adoption due to telecom expansion and smart manufacturing in China, South Korea, and Japan.

Middle East & Africa: Emerging opportunities in smart city and surveillance tech.

Latin America: Gradual growth driven by increasing telecom and IoT penetration.

Competitive Landscape

Key players shaping the market include:

Intel Corporation

Cisco Systems

Infinera Corporation

NeoPhotonics

IBM

II-VI Incorporated

Hewlett Packard Enterprise

Broadcom Inc.

GlobalFoundries

PhotonDelta (Europe-based accelerator)

Positioning and Strategies

Leading companies are focusing on:

Vertical Integration: Owning every stage from design to packaging for cost control and performance.

Strategic Partnerships: Collaborations with telecom operators, hyperscalers, and research institutes.

Application-Specific Customization: Tailoring PICs for specific end-user applications (e.g., medical devices or LiDAR systems).

Global Fab Alliances: Leveraging cross-continental manufacturing capabilities for scale and speed.

Buy This Report Now: Click Here

Recent Developments

Intel unveiled a next-gen 200G PIC-based optical transceiver targeting AI data centers.

Infinera's XR optics platform is redefining network scaling with dynamic bandwidth allocation.

European Photonics Alliance launched an initiative to accelerate PIC adoption in SMEs.

Startups like Ayar Labs and Lightmatter raised significant VC funding to develop photonics-based computing solutions.

Trends and Innovation

Co-Packaged Optics (CPO): Integrating optics with switching ASICs for power and latency optimization.

Silicon Photonics: Scalable, CMOS-compatible manufacturing opening the doors to mass production.

Quantum Photonic Chips: Rapid R&D in quantum-safe communications and computing.

Edge Photonics: Enabling localized, high-speed data processing for Industry 4.0 and IoT applications.

AI-Powered Design: ML models used for photonic circuit simulation and optimization.

Related URLS:

https://www.sphericalinsights.com/our-insights/antimicrobial-medical-textiles-market https://www.sphericalinsights.com/our-insights/self-contained-breathing-apparatus-market https://www.sphericalinsights.com/our-insights/ozone-generator-market-size https://www.sphericalinsights.com/our-insights/agro-textile-market

Opportunities

Telecom & Cloud Providers: Demand for next-gen, low-latency networks creates significant opportunities.

Healthcare Startups: PICs enable affordable, portable diagnostics, expanding precision medicine.

Defense & Security: High-performance signal processing and surveillance enhancements.

Automotive LiDAR: Integration of PICs into autonomous vehicle sensor suites.

Future Outlook

The Photonic Integrated Circuit Market is moving from research-focused innovation to mainstream commercial adoption. By 2030, PICs are expected to power a wide array of industries—fundamentally redefining computing, communication, and sensing systems. Standardization, improved design tools, and silicon photonics will be pivotal in unlocking scalable mass adoption.

Conclusion

As digital transformation becomes more photon-powered, Photonic Integrated Circuits stand at the frontier of high-speed, high-efficiency technology. For decision-makers, investors, startups, and policymakers, now is the moment to align strategies, fund innovation, and build the ecosystem that will define the photonic era.

About the Spherical Insights

Spherical Insights is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

Contact Us:

Company Name: Spherical Insights

Email: [email protected]

Phone: +1 303 800 4326 (US)

Follow Us: LinkedIn | Facebook | Twitter

1 note

·

View note

Text

Introducing Samsung 24GB GDDR7 DRAM For AI Computing

24GB GDDR7 DRAM

Future AI Computing: Samsung Launches 24GB GDDR7 DRAM. It sets the standard for graphics DRAM with its industry-leading capacity and performance of over 40Gbps.

First 24-gigabit (Gb) GDDR7 DRAM from memory pioneer Samsung was revealed today. Next-generation applications benefit from it’s speed and capacity. Data centers, AI workstations, graphics cards, gaming consoles, and autonomous driving will employ the 24Gb GDDR7 because to its high capacity and excellent performance.

“By introducing next-generation products that meet the expanding demands of the AI market, it will maintain to leadership position in the graphics DRAM market.” The 5th-generation 10-nanometer (nm)-class DRAM used in the 24Gb GDDR7 allows for a 50% increase in cell density while keeping the same package size as the previous model.

The industry-leading graphics DRAM performance of 40 gigabits per second (Gbps), a 25% increase over the previous iteration, is achieved in part by the advanced process node and three-level Pulse-Amplitude Modulation (PAM3) signaling. The performance of it may be further improved to 42.5 Gbps, contingent on the environment in which it is used.

Applying technology previously used in mobile devices to graphics DRAM for the first time also improves power efficiency. Power efficiency may be increased by more than 30% by reducing needless power use via the use of techniques like dual VDD design and clock control management.

The 24Gb GDDR7 uses power gating design approaches to reduce current leakage and increase operational stability during high-speed operations.

Major GPU customers will start validating the 24Gb GDDR7 in next-generation AI computing systems this year, with intentions to commercialize the technology early the next year.

GDDR6 vs GDDR7

Compared to the current 24Gbps GDDR6 DRAM, GDDR7 offers a 20% increase in power efficiency and a 1.4-fold increase in performance.

Today, Samsung Electronics, a global leader in cutting-edge semiconductor technology, said that it has finished creating the first Graphics Double Data Rate 7 (GDDR7) DRAM in the market. This year, it will be first placed in important clients’ next-generation systems for validation, propelling the graphics market’s future expansion and solidifying Samsung’s technical leadership in the industry.

Samsung’s 16-gigabit (Gb) GDDR7 DRAM will provide the fastest speed in the industry to date, after the introduction of the first 24Gbps GDDR6 DRAM in 2022. Despite high-speed operations, new developments in integrated circuit (IC) design and packaging provide more stability.

With a boosted speed per pin of up to 32Gbps, Samsung’s GDDR7 reaches a remarkable 1.5 terabytes per second (TBps), which is 1.4 times that of GDDR6’s 1.1 TBps. The improvements are made feasible by the new memory standard’s use of the Pulse Amplitude Modulation (PAM3) signaling technique rather than the Non Return to Zero (NRZ) from earlier generations. Compared to NRZ, PAM3 enables 50% greater data transmission in a single signaling cycle.

Notably, using power-saving design technologies tailored for high-speed operations, the most recent architecture is 20% more energy efficient than GDDR6. Samsung provides a low-operating voltage option for devices like laptops that are particularly concerned about power consumption.

In addition to optimizing the IC design, the packaging material uses an epoxy molding compound (EMC) with good thermal conductivity to reduce heat production. Compared to GDDR6, these enhancements significantly lower heat resistance by 70%, ensuring reliable product performance even under high-speed operating settings.

GDDR7 Release Date

According to Samsung, commercial manufacturing of their 24GB GDDR7 DRAM is scheduled to begin in early 2024. Although the precise public release date is yet unknown, this year’s certification process with major GPU manufacturers is already under way. With the availability of next-generation GPUs that will support the new memory standard, GDDR7 DRAM is now expected to be readily accessible in the market by 2024.

Read more on Govindhtech.com

#Samsung#Samsung24GBGDDR7#GDDR7DRAM#24GBGDDR7DRAM#DRAM#GDDR6DRAM#GPU#AI#News#Technews#Technology#Technologynews#Technologytrends#govindhtech

3 notes

·

View notes

Text

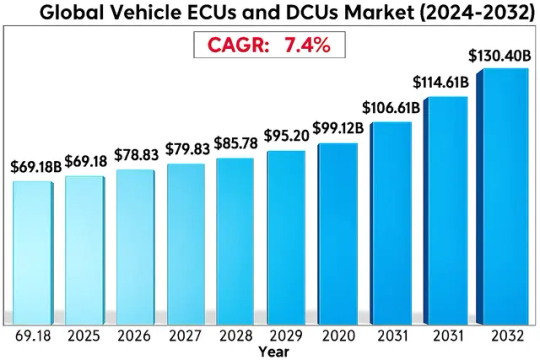

Global Vehicle Electronic Control Units (ECU) Market : Key Trends, Latest Technologies, and Forecast to 2032

Global Vehicle Electronic Control Units (ECU) Market size was valued at US$ 67.34 billion in 2024 and is projected to reach US$ 124.73 billion by 2032, at a CAGR of 7.3% during the forecast period 2025-2032.

Electronic Control Units (ECUs) are embedded systems that manage various electrical subsystems in vehicles, including engine control, transmission, braking, and infotainment systems. These units serve as the central nervous system of modern vehicles, processing sensor data and executing control algorithms to optimize performance, safety, and efficiency. The market encompasses various ECU types such as Engine Control Modules (ECM), Transmission Control Modules (TCM), Brake Control Modules (BCM), and Body Control Modules (BCM).

The market growth is primarily driven by increasing vehicle electrification, stringent emission regulations, and rising demand for advanced driver-assistance systems (ADAS). The automotive industry’s shift toward connected, autonomous, shared, and electric (CASE) vehicles is accelerating ECU adoption. While passenger vehicles dominate the market share, commercial vehicles are witnessing faster growth due to telematics mandates. Regional analysis shows Asia-Pacific leading the market, propelled by China’s automotive production boom and India’s growing vehicle parc. Key players like Bosch, Continental, and DENSO continue to innovate with domain controller architectures, consolidating multiple ECUs into high-performance computing units.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-vehicle-electronic-control-units-ecu-market/

Segment Analysis:

By Type

Passenger Vehicle Segment Dominates Due to Increasing Adoption of Advanced Driver Assistance Systems (ADAS)

The market is segmented based on type into:

Passenger Vehicle

Subtypes: Sedans, SUVs, Hatchbacks, and others

Commercial Vehicle

Electric Vehicles

Subtypes: Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and others

Off-Highway Vehicles

Subtypes: Agricultural Equipment, Construction Machinery, and others

Others

By Application

Powertrain Control ECUs Lead Market Share Due to Increasing Vehicle Electrification

The market is segmented based on application into:

Powertrain Control

Body Control

Chassis Control

Safety & Security Systems

Infotainment

By Vehicle System

Engine Management Systems Account for Significant Market Share

The market is segmented based on vehicle system into:

Engine Management System

Transmission System

Braking System

Steering System

Others

By ECU Capacity

32-Bit ECUs Hold Majority Share Due to Higher Processing Requirements

The market is segmented based on ECU capacity into:

16-Bit ECUs

32-Bit ECUs

64-Bit ECUs

Regional Analysis: Global Vehicle Electronic Control Units (ECU) Market

North America The North American ECU market is characterized by high technological adoption and stringent automotive safety regulations. The U.S. accounted for over 75% of the regional market share in 2023, driven by premium vehicle penetration and advanced driver-assistance systems (ADAS) mandates. Canada follows with steady growth in commercial vehicle ECU demand, particularly for fleet telematics. While Mexico serves as a manufacturing hub for cost-sensitive ECU production, trade agreements like USMCA continue to shape supply chain dynamics. A notable trend is the shift toward domain controller architectures as automakers like Tesla and Ford consolidate multiple ECUs into centralized computing modules.

Europe Europe’s ECU market is at the forefront of electrification and cybersecurity innovations, with Germany contributing approximately 30% of regional ECU demand. Stricter Euro 7 emissions standards and mandatory eCall emergency systems have accelerated ECU sophistication. The region also leads in AI-powered ECUs for predictive maintenance, with players like Bosch investing heavily in machine learning algorithms. However, the post-pandemic semiconductor shortage exposed vulnerabilities in just-in-time manufacturing models, prompting EU initiatives to boost local chip production. Eastern European nations are emerging as competitive ECU manufacturing bases, benefiting from lower labor costs while maintaining EU compliance standards.

Asia-Pacific As the largest and fastest-growing ECU market, Asia-Pacific is projected to maintain a 6.8% CAGR through 2028, fueled by China’s dominance in EV production and India’s expanding automotive sector. Japanese automakers prioritize reliability-focused ECU designs, while Korean manufacturers integrate advanced infotainment controls. Southeast Asia represents an untapped growth frontier, with Thailand and Indonesia attracting ECU investments due to favorable FDI policies. A dual-market dynamic exists: premium vehicles adopt next-gen ECUs with 5G connectivity, while entry-level models use cost-optimized solutions. The region also faces unique challenges like counterfeit ECU proliferation in secondary markets.

South America ECU adoption in South America trails other regions due to economic volatility and older vehicle fleets. Brazil dominates with 60% market share, where flex-fuel vehicle ECUs remain a specialization area. Argentina shows potential in agricultural vehicle ECUs, though currency fluctuations impact import-dependent component sourcing. The region benefits from proximity to North American supply chains but struggles with inconsistent regulatory frameworks across countries. Recent trade agreements with Chinese ECU suppliers are reducing historical dependence on European and American vendors, creating more competitive pricing in the aftermarket segment.

Middle East & Africa This emerging market shows divergent trends: Gulf Cooperation Council (GCC) countries demand luxury vehicle ECUs with climate-specific adaptations, while African nations prioritize ruggedized units for harsh operating conditions. The UAE leads in smart mobility ECU integration, supporting autonomous vehicle pilot programs. However, infrastructural limitations in Sub-Saharan Africa restrict advanced ECU adoption, with the market relying heavily on refurbished units. Long-term growth potential exists through Chinese investments in local automotive assembly plants, though political instability in some regions creates supply chain uncertainties.

MARKET OPPORTUNITIES

Emergence of Software-Defined Vehicles Creating New Revenue Streams

The shift toward software-defined vehicles presents transformative opportunities for ECU manufacturers. Rather than discrete hardware units, future architectures will emphasize centralized computing power with software applications running on virtualized ECUs. This transition enables over-the-air updates and new monetization models through feature-on-demand services. Leading automakers have already demonstrated that software-enabled features can generate 30-40% higher margins than traditional hardware options. Suppliers who successfully transition to this software-centric approach stand to gain substantial market share in the coming decade.

Expansion of Predictive Maintenance Solutions in Commercial Vehicles

The commercial vehicle sector represents a high-growth opportunity for advanced ECU applications, particularly in predictive maintenance systems. Fleet operators increasingly demand real-time monitoring solutions that can reduce unplanned downtime, with some systems demonstrating 25-30% improvement in maintenance efficiency. Specialized ECUs that integrate with telematics and AI-based analytics platforms are becoming essential components in modern trucks and construction equipment. Suppliers who develop ruggedized, high-reliability ECUs for harsh operating environments can capitalize on this underserved market segment.

Advancements in Edge Computing for Autonomous Systems

The evolution of autonomous vehicle technologies is driving innovation in edge computing capabilities within ECUs. Next-generation systems require substantial local processing power to minimize latency for safety-critical functions, with some autonomous driving ECUs now featuring over 50 TOPS (trillions of operations per second) of computing performance. This performance demand creates opportunities for suppliers specializing in high-performance computing architectures optimized for automotive applications. The integration of neural processing units directly into ECUs represents particularly promising territory for technological differentiation.

GLOBAL VEHICLE ELECTRONIC CONTROL UNITS (ECU) MARKET TRENDS

Increasing Vehicle Electrification to Dominate Market Growth

The global automotive industry is undergoing a paradigm shift toward electrification, with over 26 million electric vehicles projected to be sold annually by 2030. This transformation is significantly driving demand for advanced Electronic Control Units (ECUs) that manage powertrain systems, battery management, and energy efficiency in electric and hybrid vehicles. Modern ECUs now integrate AI-powered predictive maintenance capabilities, enabling real-time monitoring of vehicle subsystems. Furthermore, the development of domain controller architectures consolidates multiple ECUs into centralized units, reducing complexity while improving processing power—a critical requirement for autonomous driving functionalities.

Other Trends

Autonomous Driving Technology Integration

As autonomous vehicle development accelerates, the need for high-performance ECUs capable of processing massive sensor data has surged. ADAS (Advanced Driver Assistance Systems) alone requires up to 70 interconnected ECUs in modern vehicles, creating substantial market opportunities. Leading manufacturers are developing ECU solutions with neural network processors that can handle 100+ TOPS (Tera Operations Per Second) for Level 4 autonomous operations. This trend is coupled with growing investments in vehicle-to-everything (V2X) communication systems that demand specialized telematics control units.

Cybersecurity and Over-the-Air Updates

The automotive cybersecurity market is projected to grow at over 12% CAGR through 2028, directly impacting ECU development. Modern ECUs incorporate hardware security modules and cryptographic authentication to prevent ECU hacking, which has become critical as vehicles handle more sensitive data. Additionally, OEMs increasingly require ECU architectures supporting secure Over-the-Air (OTA) updates, allowing remote firmware updates without dealership visits. This capability reduces recall costs while enabling continuous feature enhancements throughout a vehicle’s lifecycle.

COMPETITIVE LANDSCAPE

Key Market Players

Automotive Giants and Suppliers Compete Through Technological Advancements

The global vehicle ECU market features a competitive hierarchy dominated by established automotive suppliers and electronics specialists. This landscape remains moderately consolidated, with the top five players collectively holding over 45% market share in 2024. Among these, BOSCH maintains its market leadership with a diversified ECU portfolio that spans engine control modules, transmission control units, and advanced driver assistance systems (ADAS) ECUs. The company’s technological edge in automotive semiconductors and its presence across all major vehicle segments contribute significantly to its dominant position.

Continental AG and DENSO Corporation follow closely, capitalizing on their vertically integrated supply chains and strong OEM partnerships. Continental’s strength lies in chassis and safety systems control units, while DENSO has made significant strides in powertrain ECUs for hybrid and electric vehicles. Both companies allocated approximately 7-9% of their annual revenues to R&D in recent years, focusing on next-generation ECUs with higher computing power and AI capabilities.

The market also features specialized players making strategic inroads. Delphi Technologies (now part of BorgWarner) commands notable market share in commercial vehicle ECUs, with its proprietary software algorithms offering enhanced fuel efficiency. Similarly, ZF TRW has expanded its footprint through acquisitions and now provides integrated safety ECU solutions for premium automakers.

Chinese manufacturers like UAES and Weifu Group represent the growing influence of regional players, particularly in cost-sensitive segments. These companies compete through localized production and government-supported technology transfer programs, capturing nearly 20% of the Asia-Pacific ECU market. Meanwhile, Japanese firms such as Hitachi Automotive and Mitsubishi Electric maintain technological leadership in microcontrollers and power management systems for ECUs.

List of Major Vehicle ECU Manufacturers Profiled

BOSCH (Germany)

Continental AG (Germany)

DENSO Corporation (Japan)

Delphi Technologies (U.K.)

ZF TRW (Germany)

Hyundai AUTRON (South Korea)

Marelli (Italy)

Mitsubishi Electric (Japan)

UAES (China)

Weifu Group (China)

LinControl (U.S.)

Hitachi Automotive (Japan)

Learn more about Competitive Analysis, and Forecast of Global Vehicle ECU Market : https://semiconductorinsight.com/download-sample-report/?product_id=95798

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Vehicle ECU Market?

-> The Global Vehicle Electronic Control Units (ECU) Market size was valued at US$ 67.34 billion in 2024 and is projected to reach US$ 124.73 billion by 2032, at a CAGR of 7.3%.

Which key companies operate in Global Vehicle ECU Market?

-> Key players include BOSCH, Continental, DENSO, Delphi, ZF TRW, Hyundai AUTRON, Marelli, Mitsubishi Electric, and Hitachi Automotive, among others.

What are the key growth drivers?

-> Key growth drivers include vehicle electrification, autonomous driving trends, increasing electronics content per vehicle, and stringent emission regulations.

Which region dominates the market?

-> Asia-Pacific dominates the market with 42.7% share, driven by automotive production in China, Japan, and South Korea.

What are the emerging trends?

-> Emerging trends include domain controller architectures, over-the-air updates, AI-powered ECUs, and cybersecurity solutions for connected vehicles.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

DDR4 Register Clock Driver Market - Key Players, Size, Trends, Growth Opportunities, Analysis and Forecast

Global DDR4 Register Clock Driver Market Research Report 2025(Status and Outlook)

The global DDR4 Register Clock Driver Market size was valued at US$ 284.7 million in 2024 and is projected to reach US$ 196.3 million by 2032, at a CAGR of -4.6% during the forecast period 2025-2032.

DDR4 Register Clock Drivers (RCDs) are critical components in server-grade memory modules, specifically designed for Registered DIMM (RDIMM) and Load-Reduced DIMM (LRDIMM) configurations. These chips act as buffers between the memory controller and DRAM chips, enabling higher capacity memory subsystems while maintaining signal integrity in data center and enterprise applications. The technology is fully compliant with JEDEC DDR4 specifications.

The market growth is primarily driven by expanding cloud computing infrastructure and increasing server deployments worldwide. However, the transition to DDR5 technology in high-performance computing presents a long-term challenge. Key players like Renesas, Montage Technology, and Rambus continue to innovate in this space, with recent developments focusing on power efficiency improvements to meet evolving data center requirements. Asia-Pacific currently dominates consumption due to concentrated server manufacturing in China and Taiwan.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=95817

Segment Analysis:

By Type

RDIMM Segment Leads the Market Due to High Utilization in Enterprise Server Applications

The global DDR4 Register Clock Driver market is segmented based on type into:

RDIMM (Registered Dual In-Line Memory Module)

LRDIMM (Load-Reduced Dual In-Line Memory Module)

Other specialized variants

By Application

Server Applications Dominate Demand Owing to Cloud Computing and Data Center Expansion

The market is segmented based on application into:

Servers

Enterprise servers

Cloud computing servers

Workstations

Storage systems

Telecom systems

Other embedded applications

By End-User Industry

Data Centers Exhibit Strong Growth Potential Due to Increasing Cloud Adoption

The market is segmented based on end-user industry into:

Data centers

Telecommunications

Enterprise IT

High-performance computing

Other industrial applications

By Memory Capacity

High-density Modules Gain Traction for Memory-intensive Workloads

The market exhibits segmentation based on supported memory capacity:

Low-density modules (���16GB)

Medium-density modules (16GB-64GB)

High-density modules (≥64GB)

Regional Analysis: Global DDR4 Register Clock Driver Market

North America The North American DDR4 Register Clock Driver market is driven by robust demand from enterprise server infrastructure and cloud service providers. The U.S. leads in adoption due to significant investments in data center modernization, with hyperscalers like AWS, Google, and Microsoft expanding their server fleets. The region benefits from strong R&D capabilities of key players like Intel and Rambus, who are pushing advancements in JEDEC-compliant memory solutions. However, the gradual shift toward DDR5 in high-performance computing applications is moderating growth prospects for DDR4 RCDs in premium segments. Canada and Mexico show steady but slower adoption due to smaller-scale data infrastructure.

Europe Europe’s market growth is fueled by strict data sovereignty regulations (GDPR) driving localized server deployments, particularly in Germany, France, and the UK. The region shows strong uptake of LRDIMM-based solutions for enterprise applications due to their higher capacity advantages. European manufacturers like STMicroelectronics are focusing on energy-efficient RCD designs to align with the EU’s sustainability directives. While Western Europe remains the dominant adopter, Eastern European countries are emerging as cost-effective server hosting locations, creating secondary demand. The market faces headwinds from economic uncertainties and inflation impacting enterprise IT budgets.

Asia-Pacific APAC dominates global DDR4 RCD consumption, accounting for over 40% of the market share. China’s massive server OEM ecosystem and hyperscale data center boom propel demand, while India shows the fastest growth rate due to digital transformation initiatives. Japan and South Korea host leading memory manufacturers who prioritize high-quality RCD components for export-oriented production. The region benefits from cost-competitive manufacturing of RDIMM modules, though price sensitivity sometimes compromises adoption of premium solutions. Southeast Asian nations are gaining importance as alternative production hubs amid global supply chain diversification efforts.

South America The South American market remains niche but shows gradual growth potential as Brazil and Argentina expand their data infrastructure. Limited local manufacturing capabilities result in heavy import dependence, making the region sensitive to currency fluctuations and trade policies. Enterprise server deployments in banking and telecom sectors drive most demand, though adoption of advanced LRDIMM solutions lags due to budget constraints. Government initiatives to develop local data centers are creating opportunities, but political and economic instability continues to deter larger investments in memory infrastructure.

Middle East & Africa MEA presents a mixed landscape, with the UAE and Saudi Arabia leading in data center investments through sovereign wealth fund initiatives like NEOM. South Africa serves as a regional hub for cloud service providers expanding into Africa. However, limited technical expertise and reliance on imported components constrain market growth. The region shows preference for cost-effective RDIMM solutions in most applications, with premium RCD adoption concentrated in oil & gas and financial sectors. While long-term potential exists with digital transformation programs, current market penetration remains low compared to global standards.

List of Key DDR4 Register Clock Driver Manufacturers

Renesas Electronics Corporation (Japan)

Rambus Inc. (U.S.)

Montage Technology (China)

STMicroelectronics (Switzerland)

ON Semiconductor (U.S.)

Intel Corporation (U.S.)

EDOM Technology (Taiwan)

Micron Technology (U.S.)

SK Hynix (South Korea)

The global DDR4 Register Clock Driver market is experiencing significant growth driven by the escalating demand for high-performance computing across various industries. With cloud computing workloads increasing by over 30% annually, data centers are rapidly adopting DDR4 RCD solutions to enhance memory performance and capacity. These components are critical for maintaining signal integrity in large memory arrays, enabling processing speeds up to 3200 Mbps. The server segment, which accounts for approximately 60% of total DDR4 RCD usage, continues to expand as enterprises migrate workloads to hybrid cloud environments.

Artificial intelligence applications are creating unprecedented demand for high-bandwidth memory solutions. DDR4 RCDs play a pivotal role in enabling the memory subsystem performance required for AI training workloads, which typically demand 2-5x more memory bandwidth than conventional applications. The machine learning accelerator market, projected to maintain a 25% CAGR through 2027, is driving innovations in registered DIMM designs that leverage advanced RCD solutions for improved timing accuracy and power efficiency.

While developed markets transition to DDR5, emerging economies continue to present strong demand for DDR4-based solutions due to cost sensitivity and existing infrastructure. Countries in Southeast Asia and Latin America are expected to maintain 15-18% year-over-year growth in DDR4 server deployments through 2025, creating opportunities for RCD suppliers to extend product lifecycles with cost-optimized variants.

The telecommunications sector also offers promising growth avenues as 5G network deployments accelerate globally. Edge computing nodes and baseband units increasingly incorporate registered memory configurations to handle growing data throughput requirements. This application segment could account for nearly 25% of total DDR4 RCD demand by 2026 as network operators continue their infrastructure modernization efforts.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95817

Key Questions Answered by the DDR4 Register Clock Driver Market Report:

What is the current market size of Global DDR4 Register Clock Driver Market?

Which key companies operate in Global Dissolvable Microneedle Patches Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

Dual in-line Memory Module (DIMM) Market: Revenue Trends and Pricing Analysis 20

Global Dual in-line Memory Module (DIMM) Market Research Report 2025(Status and Outlook)

Dual in-line Memory Module (DIMM) Market size was valued at US$ 16.84 billion in 2024 and is projected to reach US$ 32.47 billion by 2032, at a CAGR of 7.8% during the forecast period 2025-2032

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=95815

MARKET INSIGHTS

The global Dual in-line Memory Module (DIMM) Market size was valued at US$ 16.84 billion in 2024 and is projected to reach US$ 32.47 billion by 2032, at a CAGR of 7.8% during the forecast period 2025-2032.

DIMMs (dual in-line memory modules) are essential components for modern computing systems, providing high-speed data transfer capabilities through their 64-bit architecture. These modules contain multiple RAM chips mounted on a printed circuit board, connecting directly to computer motherboards via standardized pins. DIMMs are widely used across desktop PCs, servers, industrial systems, and high-performance computing applications due to their reliability and superior bandwidth compared to older SIMM (single in-line memory module) technology.

The market growth is driven by increasing demand for high-performance computing across data centers, AI applications, and 5G infrastructure. Furthermore, the rising adoption of DDR5 technology with higher bandwidth capacities (up to 6400 MT/s) is accelerating market expansion. Key industry players like Micron, Kingston, and SK Hynix are investing heavily in advanced manufacturing processes, with recent developments including 1α nm DRAM production nodes that offer 15% better power efficiency. However, cyclical memory pricing and geopolitical trade tensions present ongoing challenges for market stability.

List of Key DIMM Manufacturers Profiled

Kingston Technology Company (U.S.)

Micron Technology, Inc. (U.S.)

ADATA Technology Co., Ltd. (Taiwan)

Ramaxel Technology (Shenzhen) Limited (China)

Transcend Information, Inc. (Taiwan)

Tigo Corporation (China)

Apacer Technology Inc. (Taiwan)

Corsair Memory, Inc. (U.S.)

Team Group Inc. (Taiwan)

Kingmax Semiconductor Inc. (Taiwan)

Innodisk Corporation (Taiwan)

Segment Analysis:

By Type

UDIMM Segment Leads the Market Due to Wide Adoption in Consumer Electronics and Budget Systems

The market is segmented based on type into:

UDIMM (Unbuffered DIMM)

FB-DIMM (Fully Buffered DIMM)

RDIMM (Registered DIMM)

LR-DIMM (Load-Reduced DIMM)

Other specialized DIMM variants

By Application

Computers Segment Dominates Through Pervasive Use in Desktops and Laptops Globally

The market is segmented based on application into:

Computers (desktops & laptops)

Servers

Industrial applications

Aerospace and defense systems

Manufacturing equipment

By Memory Technology

DDR4 Maintains Strong Position While DDR5 Adoption Gains Momentum

The market is segmented based on memory technology into:

DDR3

DDR4

DDR5

Specialized memory variants

By Capacity

8GB-16GB Range Captures Significant Market Share Across Multiple Applications

The market is segmented based on capacity into:

Below 4GB

4GB-8GB

8GB-16GB

Above 16GB

Regional Analysis: Global Dual In-line Memory Module (DIMM) Market

North America North America remains a dominant region in the DIMM market due to its strong technological infrastructure and high adoption of advanced computing solutions. The U.S. leads the region with robust demand from data centers, enterprise IT infrastructure, and gaming markets. Companies like Micron (Crucial) and Corsair are key players driving innovation in high-performance memory solutions, particularly for servers and industrial applications. The growing cloud computing sector is a significant growth driver, with hyperscalers investing heavily in upgrading their data center architectures. Regulatory concerns about energy efficiency and supply chain resilience are influencing material sourcing and manufacturing strategies, pushing vendors toward sustainable production methods.

Europe Europe’s DIMM market is shaped by stringent data privacy regulations and high enterprise adoption of server-grade memory solutions. Countries like Germany, the UK, and France are frontrunners in data center expansions, fueling demand for RDIMM and LR-DIMM products. The automotive sector is also emerging as a key DIMM consumer due to advancements in autonomous driving and in-vehicle computing. However, the region faces challenges in semiconductor supply chain dependencies, prompting local governments to increase investments in domestic manufacturing capabilities under programs like the European Chips Act. This push for self-reliance is expected to amplify competition among global memory manufacturers.

Asia-Pacific The Asia-Pacific region is the fastest-growing DIMM market, accounting for over 40% of global consumption, led by China, Japan, and South Korea. Rapid digital transformation across industries and heavy investments in AI and cloud infrastructure are accelerating demand for high-capacity DIMM modules. China dominates in both production and consumption, with local players like Ramaxel and ADATA competing aggressively on price-performance metrics. Meanwhile, India is witnessing a surge in data center deployments, driving the adoption of enterprise-grade memory solutions. Price sensitivity remains a key factor in consumer-grade DIMM adoption, although the shift toward DDR5 technology is gradually reshaping mid-to-high-tier market segments.

South America South America represents a developing market with moderate but steady growth potential in DIMM adoption. Brazil and Argentina are seeing increased demand for consumer and industrial-grade memory modules, primarily due to gaming PC markets and localized manufacturing automation. Economic volatility and import dependency on foreign memory suppliers create pricing fluctuations, limiting widespread adoption of cutting-edge DIMM technologies. Government initiatives to bolster local tech manufacturing could unlock opportunities, though infrastructure constraints continue to slow large-scale enterprise adoption compared to other regions.

Middle East & Africa The Middle East & Africa region is experiencing nascent but promising growth, particularly in GCC countries and South Africa, where data center investments and smart city projects are expanding. High-performance computing applications in oil & gas analytics and financial services are driving specialized DIMM demand. However, the market remains constrained by limited local manufacturing and reliance on imports, leading to higher consumer pricing. Long-term opportunities are tied to digital infrastructure expansions, especially as 5G deployments and IoT adoption increase across the region.

MARKET DYNAMICS

As memory densities scale beyond 64GB per module, thermal management becomes a critical challenge. The industry’s shift to 1α nm DRAM processes increases power density, requiring sophisticated heat spreaders and airflow solutions. These thermal limitations directly impact real-world performance—some high-frequency DDR5 DIMMs throttle speeds by 15-20% under sustained loads. For data center operators, this translates into either performance compromises or increased cooling costs, creating difficult TCO calculations when specifying server configurations.

Compatibility Issues During Technology Transitions The heterogeneous nature of memory ecosystems creates validation challenges, particularly during DDR generational transitions. Cases of BIOS incompatibilities between certain DIMMs and platforms have been reported, requiring extensive qualification processes. These technical hurdles slow down adoption cycles and increase development costs for module manufacturers.

Counterfeit Components in Supply Chain The prevalence of counterfeit DRAM chips remains an industry challenge, with some estimates suggesting 8-12% of aftermarket modules contain substandard components. This not only jeopardizes system reliability but also erodes confidence in value-chain suppliers, particularly in price-sensitive market segments.

The advent of Compute Express Link (CXL) technology is enabling revolutionary memory expansion architectures. CXL-attached memory buffers allow for novel DIMM designs that break traditional capacity barriers, with prototypes demonstrating 4TB memory modules. Early deployments in AI training clusters show 30% performance improvements over conventional configurations. As the CXL 2.0/3.0 ecosystem matures, it will create opportunities for specialized DIMMs incorporating memory pooling and tiering capabilities—a potential $3 billion market by 2027.

The proliferation of edge computing in harsh environments is generating demand for industrial-grade DIMMs with extended temperature ranges (-40°C to 85°C) and vibration resistance. Applications in autonomous vehicles, oil/gas monitoring, and factory automation require memory modules that can withstand extreme conditions while maintaining data integrity. The market for such specialized DIMMs is forecast to grow at 28% CAGR, significantly outpacing the broader memory module sector.

With increasing concerns about memory-based attacks, hardware-level security features in DIMMs are becoming differentiation points. Technologies like memory encryption (Intel TME, AMD SME) and physical tamper detection are being integrated into premium modules. Government and financial sectors are early adopters of these solutions, with secure DIMM variants commanding 50-70% price premiums over standard modules—a high-margin opportunity for vendors with robust security architectures.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95815

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global DIMM Market?

Which key companies operate in Global DIMM Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Related Reports:

https://semiconductorblogs21.blogspot.com/2025/07/network-set-top-box-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/digital-set-top-box-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/5g-base-station-microwave-dielectric.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/automotive-magnetic-sensor-market-cost.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/holographic-diffraction-grating-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/electronic-grade-silicon-wafer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/silicon-epitaxial-wafer-market-value.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/annealed-silicon-wafer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/computer-power-supplies-market-revenue.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/power-supply-unit-psu-market-innovation.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/automotive-cockpit-domain-control-unit.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-vehicle-ecus-and-dcus-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-automotive-ecuelectronic-control.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-vehicle-electronic-control-units.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-automotive-ecus-and-dcus-market.html

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes

Text

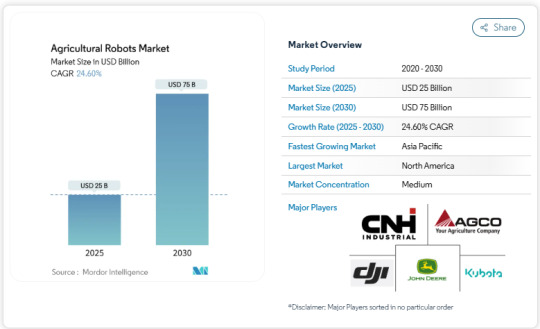

Agricultural Robots Market Set to Triple by 2030 Amid Labor Shortages and Tech Advancements

The global agricultural robots market size is experiencing rapid growth, with its value projected to rise from USD 25 billion in 2025 to USD 75 billion by 2030, reflecting a robust CAGR of 24.6%. This expansion is driven by the need to offset labor shortages, boost productivity, and manage input costs through advanced automation technologies.

Get More Insights: https://www.mordorintelligence.com/industry-reports/agricultural-robots-market

Why Farmers are Turning to Robots

Farm labor shortages have become a structural issue, particularly in North America and Europe, where an aging farmer population and shrinking rural workforce threaten production continuity. For instance, 60% of U.S. agribusinesses delayed projects in 2024 due to difficulties in securing seasonal labor. Autonomous robots offer a reliable solution, operating 24/7 without overtime and reducing wage-related pressures. Companies now focus on deploying user-friendly systems that integrate easily into existing farm operations, lowering adoption barriers for growers.

Strong Investment Backing Fuels Innovation

Investment trends continue to favor agricultural robotics, despite broader AgTech funding volatility. In 2024, capital directed to farm robotics rose 9%, highlighting investor confidence in scalable automation. Notable collaborations include New Holland’s partnership with Bluewhite to retrofit specialty tractors, a move expected to cut orchard and vineyard operating costs by up to 85%. Start-ups such as Verdant Robotics and Fieldwork Robotics have also secured significant funding to accelerate product development and global market entry.

Government Incentives Accelerate Adoption

Public initiatives tying sustainability goals to technology adoption are shaping the market. For example, the UK’s Improving Farm Productivity grant subsidizes autonomous systems, while Australia’s National Robotics Strategy targets AUD 600 billion (USD 420 billion) in economic gains through robotics, with agriculture as a priority sector. These incentives shorten payback periods for farmers and encourage investments in advanced automation.

Rapid Technological Advances

Technological progress in AI, computer vision, and LIDAR is enhancing agricultural robots’ capabilities. Companies like John Deere are integrating multi-camera systems and machine learning to achieve centimeter-level precision under challenging field conditions. Such advances enable robots to detect obstacles, classify plants, and adapt their operations in real time, supporting new use cases in greenhouse and broad-acre farming.

Market Segmentation Insights

By Technology: UAVs and drones held a 35% market share in 2024, with automated harvesting systems posting the fastest 26% CAGR. Drones remain essential for aerial imagery and spraying, while harvesting robots address labor shortages in fruit and vegetable production.

By Application: Broad-acre farming tasks, such as fertilizing and weeding, accounted for 24% of market revenue in 2024. Greenhouse automation is growing at a 24% CAGR, with robots performing tasks like spraying, pollination, and selective harvesting in controlled environments.

By Offering: Hardware dominated with 60% of revenue in 2024, driven by robust robotic chassis, arms, and navigation modules. However, software is expanding at a 21% CAGR, as farmers demand integrated platforms for fleet management, predictive maintenance, and prescription mapping.

Regional Analysis

North America leads the market share with a 37% revenue share, backed by large farm sizes, regulatory support, and strong venture capital flows. Companies like Carbon Robotics continue to attract major investments for chemical-free weeding solutions.

Asia-Pacific is the fastest-growing region at a 25.5% CAGR, driven by China’s funding of domestic robotics firms and Japan’s subsidies for orchard automation. Australia’s National Robotics Strategy further fuels regional growth, while India explores affordable weeding and spraying robots suited to smallholders.

Europe’s growth is supported by labor shortages, strict crop protection regulations, and sustainability goals. The EU’s updated Machinery Regulation provides clearer compliance pathways for autonomous machines, while countries like Germany and the UK pilot electric and multi-robot solutions in various crop sectors.

Challenges Facing the Market

Despite its growth, the agricultural robots market faces barriers, particularly in developing economies. High upfront costs and uncertain returns deter smallholders, while fragmented certification standards for autonomous machines increase compliance complexity for manufacturers. Gaps in rural connectivity also limit real-time control capabilities in parts of Africa and Asia.

Competitive Landscape

The market is moderately concentrated, with the top five companies commanding 56% of global revenue. Key players include:

Deere & Company: Leading innovations in battery-powered electric powertrains and autonomous navigation.

CNH Industrial N.V.: Partnering with start-ups to retrofit tractors with autonomy kits.

AGCO Corporation: Offering OutRun retrofit kits that enhance fuel efficiency and cross-fleet compatibility.

Kubota Corporation: Advancing specialized autonomous machinery for orchard and horticulture use.

SZ DJI Technology Co., Ltd.: Dominating UAV segments with robust drone solutions.

The competitive edge now hinges on AI model robustness, precision perception systems, and integrated software ecosystems. Companies that bundle hardware with subscription-based software and service packages are better positioned to capture long-term customer value, especially as hardware becomes increasingly commoditized.

Looking Ahead

As agricultural robots continue to prove their value in boosting productivity, reducing labor dependence, and supporting sustainable farming, their adoption is set to accelerate across regions and crop segments. Falling component prices, supportive policies, and rapid technological innovation suggest a market poised for robust expansion through the next decade.

0 notes

Text

IoT Communication Protocol Market Enabling Next-Gen Industrial IoT (IIoT) Innovations

TheIoT Communication Protocol Market Size was valued at USD 16.95 Billion in 2023 and is expected to reach USD 23.94 Billion by 2032 and grow at a CAGR of 4.2% over the forecast period 2024-2032.

IoT Communication Protocol Market is witnessing notable growth as the demand for seamless device connectivity accelerates across industries. With businesses increasingly adopting smart devices, machine-to-machine communication has become essential for data sharing, automation, and efficiency. Protocols such as MQTT, CoAP, and Zigbee are playing a vital role in enabling reliable, low-power, and scalable communication.

U.S. Leads in Advancing IoT Infrastructure Through Protocol Innovation

IoT Communication Protocol Market is evolving with the integration of edge computing, AI, and 5G, which are reshaping how devices interact in real time. As industries like healthcare, automotive, and manufacturing pivot to intelligent operations, the need for secure, flexible, and interoperable communication standards continues to rise.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6554

Market Keyplayers:

Huawei Technologies (OceanConnect IoT Platform, LiteOS)

Arm Holdings (Mbed OS, Cortex‑M33 Processor)

Texas Instruments (SimpleLink CC3220 Wi‑Fi MCU, SimpleLink CC2652 Multiprotocol Wireless MCU)

Intel (XMM 7115 NB‑IoT Modem, XMM 7315 LTE‑M/NB‑IoT Modem)

Cisco Systems (Catalyst IR1101 Rugged Router, IoT Control Center)

NXP Semiconductors (LPC55S6x Cortex‑M33 MCU, EdgeLock SE050 Secure Element)

STMicroelectronics (STM32WL5x LoRaWAN Wireless MCU, SPIRIT1 Sub‑GHz Transceiver)

Thales (Cinterion TX62 LTE‑M/NB‑IoT Module, Cinterion ENS22 NB‑IoT Module)

Zebra Technologies (Savanna IoT Platform, SmartLens for Retail Asset Visibility)

Wind River (Helix Virtualization Platform, Helix Device Cloud)

Ericsson (IoT Accelerator, Connected Vehicle Cloud)

Qualcomm (IoT Services Suite, AllJoyn Framework)

Samsung Electronics (ARTIK Secure IoT Modules, SmartThings Cloud)

IBM (Watson IoT Platform, Watson IoT Message Gateway)

Market Analysis

The IoT Communication Protocol Market is driven by the explosion of connected devices and the need for efficient, low-latency data transmission. Communication protocols serve as the foundation for interoperability among heterogeneous IoT devices, ensuring real-time synchronization and security. The U.S. is leading with early adoption and robust R&D, while Europe contributes significantly with regulatory support and smart city deployments.

Market Trends

Increasing adoption of LPWAN protocols like LoRaWAN and NB-IoT

Rise of MQTT and CoAP in industrial and home automation applications

Shift towards IPv6 for improved scalability and addressability

Integration of 5G enhancing speed and reliability in protocol performance

Growing emphasis on cybersecurity and encrypted data exchange

Development of hybrid protocols to support multi-layered IoT architectures

Market Scope

The market is expanding beyond traditional device communication and into intelligent ecosystems. Protocols are now expected to support not only connectivity but also data prioritization, edge computing compatibility, and energy efficiency.

Real-time communication for industrial automation

Protocols optimized for ultra-low power IoT devices

Interoperability across cloud, edge, and device layers

Smart city applications requiring scalable communication

Healthcare devices demanding secure and reliable data transfer

Automotive systems relying on low-latency connections

Forecast Outlook

The IoT Communication Protocol Market is set to grow at a rapid pace as device ecosystems multiply and application complexity deepens. Success will depend on protocol adaptability, security, and standardization efforts that support global deployment. With North America at the forefront and Europe driving policy-aligned innovation, the market is primed for a shift from fragmented systems to harmonized connectivity solutions.

Access Complete Report: https://www.snsinsider.com/reports/iot-communication-protocol-market-6554

Conclusion

As industries become increasingly connected, the IoT Communication Protocol Market plays a crucial role in shaping the future of smart operations. From San Francisco’s automated logistics to Berlin’s connected healthcare systems, the demand for agile, secure, and scalable communication protocols is setting new standards. Forward-thinking enterprises that prioritize protocol innovation will lead the charge in building resilient and intelligent digital ecosystems.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

U.S.A sees rising adoption of IoT middleware as industries push for smarter automation solutions

U.S.A. accelerates financial innovation through Robotic Process Automation in BFSI operations

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

#IoT Communication Protocol Market#IoT Communication Protocol Market Scope#IoT Communication Protocol Market Share#IoT Communication Protocol Market Growth

0 notes

Text

Military Wearables Market Report: Unlocking Growth Potential and Addressing Challenges

United States of America – Date – 30/06/2025 - The Insight Partners is proud to announce its newest market report, "Military Wearables Market: An In-depth Analysis of the Military Wearables Market". The report provides a holistic view of the Military Wearables market and describes the current scenario as well as growth estimates for Military Wearables during the forecast period.

Overview of Military Wearables Market

There has been some development in the Military Wearables market, such as growth and decline, shifting dynamics, etc. This report provides insight into the driving forces behind this change: technological advancements, regulatory changes, and changes in consumer preference.

Key findings and insights

Market Size and Growth

Historical Data: The Military Wearables market is estimated to reach US$ 3,325.67 million in 2024 and is expected to reach US$ 4,261.44 million by 2031; it is estimated to record a CAGR of 3.9% from 2025 to 2031.These estimates provide valuable insights into the market's dynamics and can inform future projections.

Key Factors Affecting the Military Wearables Market:

Increasing Defense Budgets and Soldier Modernization Programs: Governments worldwide are investing heavily in modernizing their armed forces, focusing on equipping soldiers with advanced technology to improve their combat effectiveness, safety, and efficiency. This directly fuels the demand for military wearables.

Growing Emphasis on Soldier Safety and Health Monitoring: The well-being of military personnel is a top priority. Wearables that monitor vital signs, detect fatigue, track location, and provide real-time health data are becoming essential for proactive health management, injury prevention, and rapid medical intervention.

Demand for Enhanced Situational Awareness and Real-time Data: In modern warfare, timely and accurate information is critical for decision-making. Military wearables provide soldiers with real-time access to battlefield intelligence, navigation data, and target identification, significantly improving situational awareness and operational efficiency.

Advancements in Connectivity and Communication Technologies: The need for secure, reliable, and high-speed communication in harsh environments is paramount. Integration of advanced communication modules, 5G technology, enhanced encryption, and satellite communication into wearables ensures uninterrupted connectivity.

Proliferation of Asymmetric Warfare and Geopolitical Tensions: The rise of irregular warfare, terrorism, and cross-border disputes necessitates agile and well-equipped forces. Wearables provide a tactical advantage by enhancing coordination, communication, and overall combat effectiveness.

Spotting Emerging Trends:

Technological Advancements:

Artificial Intelligence (AI) and Machine Learning (ML): Increasingly integrated for predictive health monitoring, real-time data analysis, intelligent decision support, autonomous network routing, and enhanced target recognition in AR systems.

Augmented Reality (AR) and Virtual Reality (VR): Revolutionizing soldier training and situational awareness. AR headsets provide real-time tactical overlays, navigation, and target identification, while VR offers immersive training simulations.

Smart Textiles and Advanced Materials: Development of combat uniforms and gear with embedded sensors, conductive fibers, and microelectronics for physiological monitoring, environmental sensing, adaptive camouflage, and enhanced ballistic protection.

Miniaturization and Energy Harvesting: Continuous focus on reducing the size and weight of wearable devices while extending battery life through more efficient components, flexible batteries, wireless charging, and kinetic/solar energy harvesting.

Edge Computing: Processing data closer to the source (on the wearable device) to reduce latency, enable real-time analysis, and enhance decision-making in communication-denied environments.

Changing Consumer Preferences and Demand:

Integrated Systems over Standalone Devices: Demand for comprehensive, interconnected wearable systems that seamlessly integrate multiple functionalities (communication, navigation, health, situational awareness) rather than disparate devices.

Lightweight, Durable, and Comfortable Designs: Soldiers prefer wearables that are less cumbersome, highly durable, and comfortable for prolonged use in extreme conditions, without hindering mobility.

User-Friendly Interfaces and Intuitive Operation: Simplified controls and intuitive displays are increasingly sought after to minimize training requirements and reduce cognitive load during high-stress operations.

Modularity and Customization: Preference for modular designs that allow for easy upgrades, repairs, and customization to specific mission requirements or individual soldier needs.

Regulatory Changes:

Standardization Initiatives: Organizations like NATO and various national defense bodies are continuously developing and updating standards for military wearables concerning interoperability, data formats, communication protocols, and safety. Compliance with these standards is crucial for market access and integration.

Export Control Regulations: Strict regulations on the export of military-grade technology, including advanced wearables, can impact global market reach and require careful navigation for manufacturers.

Spectrum Allocation Policies: Government agencies regulate the use of radio frequency spectrum. Changes in spectrum availability or licensing for military applications can influence the design and capabilities of wireless communication components in wearables.

Growth Opportunities of the Military Wearables Market:

Soldier Modernization Programs: Ongoing and future soldier modernization programs globally present a continuous demand for advanced, integrated wearable systems to enhance combat effectiveness and survivability.

Integration with Future Soldier Systems: Significant opportunities exist in developing wearables that seamlessly integrate with emerging future soldier concepts, including networked soldier systems, intelligent uniforms, and robotic combat teams.

Conclusion

The Military Wearables Market: Global Industry Trends, Share, Size, Growth, Opportunity, and Forecast Military Wearables 2023-2031 report provides much-needed insight for a company willing to set up its operations in the Military Wearables market. Since an in-depth analysis of competitive dynamics, the environment, and probable growth path are given in the report, a stakeholder can move ahead with fact-based decision-making in favor of market achievements and enhancement of business opportunities.

About The Insight Partners

The Insight Partners is among the leading market research and consulting firms in the world. We take pride in delivering exclusive reports along with sophisticated strategic and tactical insights into the industry. Reports are generated through a combination of primary and secondary research, solely aimed at giving our clientele a knowledge-based insight into the market and domain. This is done to assist clients in making wiser business decisions. A holistic perspective in every study undertaken forms an integral part of our research methodology and makes the report unique and reliable.

0 notes

Text

Mixed Signal System-on-Chip (MxSoC) Market : Size, Trends, and Growth Analysis 2032

In today’s increasingly connected and data-driven world, the ability to integrate both analog and digital functionalities into a single microchip is essential. Mixed Signal System-on-Chip (MxSoC) technology is revolutionizing this space by combining analog components—such as sensors, RF interfaces, and power management units—with high-performance digital processing capabilities. These chips serve as compact, energy-efficient, and cost-effective solutions for devices that require real-time interfacing between the physical and digital worlds.

The Mixed Signal System-on-Chip (MxSoC) Market has become critical across a range of industries, including automotive, telecommunications, consumer electronics, industrial automation, and healthcare. From smartphones and wearable devices to electric vehicles (EVs) and industrial IoT sensors, the growing reliance on integrated electronics is fueling the rapid expansion of this market.

Market Overview

The Mixed Signal System-on-Chip (MxSoC) Market was valued at USD 712,345 million in 2024, and it is projected to grow at a CAGR of 12.2% from 2025 to 2032. This robust growth is being driven by the need for reduced system complexity, lower power consumption, miniaturization of devices, and the integration of multifunctional capabilities into a single chip.

MxSoCs simplify product design by minimizing the number of components on a printed circuit board, reducing manufacturing costs and increasing performance. This makes them ideal for high-volume, cost-sensitive applications where space, power, and speed are all crucial.

Market Drivers

1. Booming Demand in IoT and Wearables

The rapid proliferation of Internet of Things (IoT) devices and smart wearables has created massive demand for compact and power-efficient chips capable of interfacing with analog signals like temperature, pressure, motion, or biometric data. MxSoCs are particularly well-suited to this application because they integrate both the signal acquisition (analog) and data processing/communication (digital) blocks into one unit.

From fitness trackers and medical wearables to smart home automation systems, manufacturers are increasingly adopting mixed-signal SoCs to streamline device design and improve battery efficiency.

2. Telecom and 5G Infrastructure Expansion

As global 5G deployment accelerates, telecom equipment requires highly integrated chips capable of processing both high-frequency analog signals and massive digital data streams in real-time. MxSoCs serve as the backbone of modern base stations, signal modulators, and mobile handsets that rely on advanced RF front-ends and digital baseband processing.

These chips enable seamless transitions between analog signal reception and digital signal computation—an essential function in any 5G or RF communication device.

3. Electrification and Automation in Automotive Industry

Modern vehicles are becoming increasingly electronic, with advanced driver-assistance systems (ADAS), electric drivetrains, infotainment systems, and in-vehicle connectivity all relying on embedded processing. MxSoCs support these systems by interfacing with analog sensors (such as LiDAR, radar, or tire pressure monitors) while executing complex digital algorithms.

In EVs and hybrids, they also manage power control units, battery monitoring, and vehicle-to-everything (V2X) communication—areas where performance, size, and efficiency are non-negotiable.

4. Healthcare and Biomedical Device Innovation

Portable diagnostic tools, implantable devices, and patient monitoring systems require low-power chips capable of interpreting biological signals (ECG, EEG, oxygen saturation, etc.) and converting them into digital data for analysis or transmission. MxSoCs have become instrumental in building compact, connected, and efficient medical electronics that maintain accuracy while reducing size and power consumption.

With increasing demand for remote patient monitoring and personalized healthcare, MxSoC adoption in biomedical applications is poised to rise steadily.

Application Segmentation

Consumer Electronics: Smartphones, tablets, smartwatches, and other portable devices rely heavily on mixed-signal SoCs for multimedia processing, sensor integration, and wireless communication.

Automotive: Used in electronic control units (ECUs), safety systems, EV battery management, and vehicle infotainment modules.

Telecommunications: Supports signal processing and transmission in mobile networks, base stations, modems, and satellite communication equipment.

Industrial Automation: Used in robotics, motion control, machine vision, and factory sensors for real-time control and data analytics.

Healthcare Devices: Powers wearable and implantable devices for diagnostics and continuous health monitoring.

Aerospace & Defense: Provides radar signal processing, avionics, navigation systems, and secure communication functionalities.

Regional Insights

North America dominates the MxSoC market due to strong investments in semiconductor R&D, a robust tech ecosystem, and early adoption of 5G, autonomous vehicles, and AI-based consumer electronics. The U.S. remains a key innovation hub.

Asia-Pacific is the fastest-growing region, driven by high-volume electronics manufacturing in China, South Korea, Taiwan, and Japan. The region’s massive smartphone production, automotive electronics boom, and smart city projects are all fueling demand.