#CoreBanking

Explore tagged Tumblr posts

Text

Accelerate FinTech Innovation with Expert IT Talent & Agile Teams

Accelerate your FinTech innovation by leveraging i-Verve's expert IT talent and agile teams. We provide pre-vetted, domain-trained professionals—including specialized developers, business analysts, and QA experts—with deep experience across Core Banking, Payments, Lending, WealthTech, and InsurTech. Our agile-certified talent is adept at ensuring compliance (ISO 20022, PCI-DSS, SOC 2, KYC/AML) and quickly integrates into your workflow. From Core Banking Devs to AI/ML Specialists, benefit from quick onboarding and flexible engagement models (Staff Augmentation, Dedicated Teams, BOT) for compliance-ready, U.S.-aligned global delivery. Partner with us to transform your digital payments, lending, and core modernization initiatives with scalable, expert-driven FinTech staffing solutions.

#FinTechInnovation#ITStaffing#AgileTeams#FinTechTalent#DigitalTransformation#CoreBanking#PaymentsModernization

0 notes

Text

#CoreBanking#RetailBanking#BankTech#DigitalBanking#BankingSoftware#FintechSolutions#CoreBankingSystems#BankTransformation#FinancialTechnology#BankingInnovation#CloudBanking#BankingAutomation#FintechMarket

0 notes

Text

Core Banking Software’s Role in Modern Digital Banking Trends

Discover how Core Banking Software drives digital transformation in the banking industry. Learn how CBS enhances customer experience, improves operational efficiency, ensures security, and integrates emerging technologies like AI and blockchain. Explore the future of banking with advanced core banking solutions that enable seamless digital services, real-time data processing, and personalized banking experiences. Stay competitive by embracing the role of core banking software in the evolving digital landscape.

0 notes

Text

How Banking Management System Software Works

Banking Management System Software (BMSS) serves as the backbone of financial institutions, integrating various modules and functionalities to streamline operations, enhance customer service, and ensure regulatory compliance. This blog explores in-depth how BMSS operates, its core components, security measures, compliance frameworks, and practical applications within the banking industry.

Cloud vs. On-Premise Banking Management System Software

Cloud-Based Solutions

Cloud-based BMSS offers flexibility, scalability, and accessibility over the internet. It leverages cloud infrastructure for data storage, processing, and application deployment, allowing real-time updates, seamless integration with third-party services, and enhanced disaster recovery capabilities. Cloud solutions reduce upfront costs, improve resource allocation, and support remote access, making them ideal for modern banking environments.

On-Premise Solutions

On-premise BMSS operates within an institution's local infrastructure, providing full control over data security and customization. It requires significant initial investment in hardware, software, and maintenance but offers greater control over data governance and compliance. On-premise solutions are preferred by institutions with specific security requirements or regulatory constraints that mandate local data storage.

Components and Functionality of Banking Management System Software

Real-time Updates

BMSS facilitates real-time updates across banking operations, ensuring timely transaction processing, account updates, and regulatory compliance. Real-time data synchronization between backend systems and user interfaces enables seamless customer interactions and operational efficiency.

User-friendly Interface

An intuitive user interface (UI) is essential for BMSS adoption and usability. It provides easy navigation, personalized dashboards, and role-based access to functionalities such as account management, payment processing, and financial planning tools. A user-friendly UI enhances employee productivity, customer service, and overall user satisfaction.

Data Encryption

Data encryption is critical in BMSS to protect sensitive customer information, transactional data, and financial records from unauthorized access and cyber threats. Advanced encryption algorithms ensure data integrity and confidentiality, complying with regulatory standards like GDPR, PCI-DSS, and local data protection laws.

Workflow Automation

Workflow automation streamlines routine tasks and processes within BMSS, reducing manual errors, improving operational efficiency, and accelerating service delivery. Automated workflows manage loan approvals, account openings, compliance checks, and transaction reconciliations, enhancing productivity and resource optimization.

Asset Liability Management (ALM)

ALM modules in BMSS monitor and manage the balance between assets and liabilities to optimize liquidity, profitability, and risk exposure. ALM functionalities include interest rate risk management, liquidity forecasting, stress testing, and scenario analysis to support strategic decision-making and regulatory compliance.

Investment Portfolio Management

BMSS includes investment portfolio management tools to oversee and optimize investment strategies, asset allocations, and performance tracking. It provides real-time portfolio analytics, risk assessments, and client reporting to financial advisors and investment managers, enhancing investment decision-making and client satisfaction.

Loan Management System

Loan management systems within BMSS automate the lifecycle of loans, from application processing and credit scoring to disbursement, servicing, and collections. It supports various loan products, borrower profiles, and regulatory requirements, ensuring efficient loan origination and management processes.

Credit Scoring

Credit scoring modules assess the creditworthiness of applicants based on financial data, credit history, and risk factors. BMSS utilizes predictive analytics and scoring models to evaluate loan applications, determine interest rates, and mitigate credit risks, supporting sound lending decisions and portfolio management.

Best Practices in Implementing Banking Management System Software

Compliance Monitoring

BMSS monitors regulatory frameworks, compliance requirements, and internal policies to ensure adherence and mitigate compliance risks. Automated compliance monitoring tools generate reports, conduct audits, and manage regulatory changes, fostering regulatory transparency and accountability.

Selection Criteria for Banking Management System Software

Vendor Evaluation

Choosing the right BMSS vendor involves evaluating factors such as industry experience, technology expertise, scalability, customer support, and pricing models. Vendor partnerships should align with institutional goals, regulatory compliance, and long-term strategic objectives to ensure successful implementation and ROI.

Core Components of Banking Management System Software

Data Management

BMSS centralizes and manages vast amounts of financial data, including customer information, transaction records, account balances, and regulatory reports. It ensures data integrity, accessibility, and security through robust data management protocols and encryption standards.

Transaction Processing

Transaction processing modules within BMSS facilitate seamless execution of financial transactions, including deposits, withdrawals, fund transfers, and payments. Real-time transaction monitoring and processing ensure prompt service delivery and transaction accuracy while adhering to regulatory guidelines.

Customer Relationship Management (CRM)

CRM functionalities enable personalized customer interactions, complaint resolution, and relationship management. BMSS tracks customer preferences, transaction histories, and communication channels to enhance customer satisfaction and loyalty through tailored services and proactive engagement.

Risk Management

BMSS incorporates risk management tools to identify, assess, and mitigate financial risks such as credit risk, market risk, and operational risk. It uses predictive analytics, stress testing, and scenario analysis to optimize risk exposure and safeguard financial stability.

Compliance and Regulatory Reporting

Compliance modules in BMSS automate regulatory reporting, ensuring adherence to industry standards, legal requirements, and internal policies. It generates audit trails, monitors compliance metrics, and facilitates regulatory submissions to regulatory bodies like central banks and financial authorities.

Security Aspects of Banking Management System Software

Data Encryption and Privacy

BMSS employs advanced encryption algorithms to protect sensitive data, including customer information, transaction details, and financial records. It ensures data privacy, confidentiality, and integrity across all communication channels and storage systems to mitigate cybersecurity threats.

Access Control and Authentication

Access control mechanisms restrict system access based on user roles, permissions, and authentication factors. BMSS implements multi-factor authentication, biometric verification, and role-based access controls to prevent unauthorized access and data breaches.

Intrusion Detection and Prevention

Intrusion detection systems (IDS) and intrusion prevention systems (IPS) monitor network traffic and system activities for suspicious behavior and potential security breaches. BMSS uses real-time monitoring and automated alerts to respond promptly to security incidents and mitigate risks.

Continuity and Disaster Recovery

BMSS includes contingency planning and disaster recovery measures to ensure business continuity in the event of system failures, natural disasters, or cyber attacks. It implements data backup protocols, redundant systems, and recovery procedures to minimize downtime and preserve operational continuity.

Compliance Requirements for Banking Management System Software

Regulatory Frameworks

BMSS adheres to regulatory frameworks such as GDPR, KYC (Know Your Customer), AML (Anti-Money Laundering), PCI-DSS (Payment Card Industry Data Security Standard), and local financial regulations. It incorporates compliance monitoring tools, conducts regular audits, and maintains documentation to demonstrate regulatory compliance.

Real-World Applications and Use Cases

Retail Banking

In retail banking, BMSS supports everyday banking operations such as account management, loan processing, payment services, and customer service. It enhances operational efficiency, accelerates service delivery, and improves customer satisfaction through personalized banking experiences.

Corporate Banking

Corporate banking utilizes BMSS for cash management, treasury services, corporate lending, trade finance, and risk management. It provides corporate clients with tailored financial solutions, real-time reporting, and liquidity management capabilities to optimize financial operations and support business growth.

Investment Management

BMSS aids investment managers in portfolio management, asset allocation, performance analysis, and client reporting. It integrates investment analytics, risk assessment tools, and compliance monitoring to maximize investment returns, mitigate risks, and meet regulatory obligations.

Wealth Management

Wealth management platforms leverage BMSS for client relationship management, financial planning, estate planning, and wealth preservation strategies. It offers wealth advisors comprehensive insights, personalized advice, and investment solutions to manage affluent clients' financial goals effectively.

Conclusion

Banking Management System Software (BMSS) plays a pivotal role in modernizing financial institutions, ensuring operational efficiency, enhancing security, and enabling compliance with regulatory requirements. By integrating advanced functionalities, robust security measures, and comprehensive compliance frameworks, BMSS empowers banks to deliver superior financial services, mitigate risks, and achieve sustainable growth in a competitive market environment.

0 notes

Text

Unleashing the Power of Analytics in Banking

Sutra Management is excited to announce our participation in the Middle East Banking AI & Analytics Summit event. Come and meet our team to learn more about our analytics-driven offerings in risk management, compliance, credit decisioning, and beyond.

#finance#banking#middleeast#analytics#Digital#FSI#BFSI#uae#AI#FinTech#Payments#RetailBanking#Innovation#CoreBanking#Banking#Financial#Insurance#Microfinance

0 notes

Text

#corebanking#banking#bankingsoftware#fintech#nbfcconsultant#nidhi#nbfcsoftware#nbfccompanies#finance#nbfc#ckyfc#nbfcbankingsoftware#corebankingsoftware#bestcorebankingsoftare#nidhisoftware#ckycsoftware#ckycsoftwarefornbfc#ckycsoftwareandnbfcsoftware#jobinbank#corporatejob#dreams#teller#achievement#udaipur#saynotounemployment#backoffice#iim#bankingsolutions#bank#official

0 notes

Text

Boost Efficiency with Intellect's Core Banking Solutions

Intellect Design Arena Ltd, a leading financial technology company, provides core banking solutions that help banks and financial institutions to streamline their operations, enhance efficiency, and improve customer experience. The company's core banking platform is designed to support a wide range of banking products and services, including retail banking, corporate banking, treasury management, and wealth management. It offers advanced features such as real-time processing, multi-channel delivery, and omnichannel customer engagement. The platform is built on a modern, scalable architecture that supports open banking and APIs, enabling institutions to integrate third-party services and offer a wider range of products and services to their customers.

#CoreBanking#CoreBankingSystems#CoreBankingSoftware#CoreBankingService#BankingSolutions#BankingSoftware#BankingPlatforms#DigitalTransformation

0 notes

Text

Finacle Core Banking Solution is a comprehensive platform designed to revolutionize banking operations. It empowers financial institutions with an integrated and scalable system, ensuring seamless customer experiences. With Finacle Core Banking Solution, banks can streamline processes, manage customer data efficiently, and enhance overall productivity.

The system offers real-time insights, simplifying decision-making and enabling banks to adapt to changing market dynamics swiftly. What sets Finacle apart is its focus on security and compliance, ensuring that sensitive financial data remains protected. This innovative solution is the cornerstone of modern banking, facilitating growth and innovation for financial institutions worldwide.

#infosysfinacle#corebanking#finaclecorebankingsolution#globalretailcorebanking#retailcorebanking#digitalbanking#corebankingsystem

0 notes

Text

What a Moment at #RedHatSummit 2025!

The energy. The innovation. The conversations that matter.

Team Prodevans lit up the Partner Zone Booth with powerful insights on how AI, Automation, and Real-Time Decisions are transforming Field & Core Banking forever.

Big thanks to our visionary speakers — Deepak Mishra, Vijay Agarwal, and Sharath Hosagrahar — for steering the future of finance, one innovation at a time.

Swipe through the action-packed highlights and relive the moments that made it unforgettable.

The future of digital banking isn’t coming — it’s already here, and we’re proud to be leading the charge.

Learn more: prodevans.com

#RedHatSummit#Prodevans#FinTechRevolution#CoreBanking#AIinBanking#BankingInnovation#Automation#DigitalBanking#TechTrailblazers#BostonSummit#FutureOfFinance#PostEventMagic

0 notes

Text

Build Agile FinTech & HealthTech IT Teams with i-Verve Expert Staffing & Talent Solutions.

i-Verve Inc specializes in building high-performing, agile IT teams for the complex FinTech and HealthTech sectors. We understand the unique challenges of these regulated industries and provide expert staffing and talent solutions tailored to your needs. Gain immediate access to our meticulously pre-vetted IT professionals who possess deep domain knowledge in areas like core banking, digital lending, payments, healthcare IT, EHR/FHIR, and crucial compliance frameworks such as HIPAA, SOC 2, PCI-DSS, and ISO 20022. Whether you need flexible Staff Augmentation, dedicated project teams, or a strategic Build-Operate-Transfer model, i-Verve seamlessly integrates U.S.-time zone aligned global talent

#iVerve#FinTech#HealthTech#AgileTeams#ITStaffing#TalentSolutions#CoreBanking#DigitalLending#Payments#HealthcareIT#EHR#FHIR#Compliance#HIPAA#SOC2#PCIDSS#ISO20022#StaffAugmentation#DedicatedTeams#BOTModel#GlobalTalent#TechRecruitment#ITProfessionals#DigitalTransformation#Innovation

0 notes

Text

"Navigating the Third-Party Banking Software Landscape: Market Trends for 2024-2033"

In the age of digital transformation, third-party banking software is reshaping the financial services landscape by providing innovative, flexible, and efficient solutions. These platforms offer a wide array of functionalities, from core banking operations to customer relationship management, payment processing, and compliance management. By leveraging third-party solutions, banks can accelerate their digital initiatives, enhance customer experiences, and stay competitive in a rapidly evolving market. With seamless integration capabilities, robust security features, and the ability to scale effortlessly, third-party banking software empowers financial institutions to streamline operations, reduce costs, and focus on strategic growth. Embrace the future of banking by harnessing the power of cutting-edge third-party software to drive efficiency, innovation, and customer satisfaction.

#BankingSoftware #FinTech #DigitalBanking #FinancialInnovation #BankingSolutions #ThirdPartySoftware #CoreBanking #CustomerExperience #PaymentProcessing #ComplianceManagement #DigitalTransformation #BankingTech #FinancialServices #SeamlessIntegration #BankingSecurity #ScalableSolutions #CostEfficiency #OperationalExcellence #StrategicGrowth #TechInBanking #BankingTrends #FutureOfBanking #FinancialTechnology #BankingEfficiency #CustomerSatisfaction #InnovationInBanking

0 notes

Text

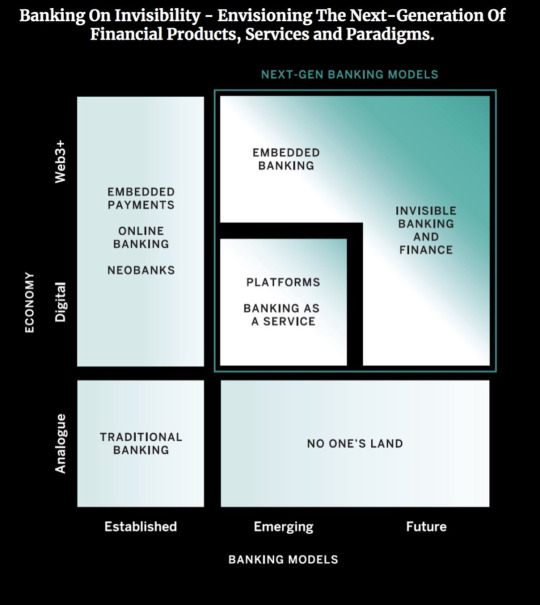

"Unlocking the Invisible: Pioneering the Future of Banking and FinTech"

Banking On Invisibility - Envisioning The Next-Generation Of Financial Products, Services and Paradigms

In the not-so-distant past, banks adorned prime locations along bustling streets. Today, their prominence is wavering, and a future looms where they might vanish even from our phone screens. Financial services are seamlessly intertwining with technology and various industries, almost fading into invisibility.

While the demise of traditional banking has been a recurring topic among pundits, the ascent of digital finance has unquestionably chipped away at the once-familiar brick-and-mortar bank. Yet, could digital finance merely serve as a transient bridge to a truly revolutionary era?

Open Banking has empowered diverse brands to embody financial institutions, seamlessly integrating loans, payments, payroll, and more into their existing offerings. The ongoing surge of consumer tech innovation merges the physical and digital realms in our daily lives, enabling us to transact effortlessly without fixating on the financial dimension. Departing a store, our purchases are automatically tallied and deducted; our smart devices autonomously place orders and process payments. Our bank accounts evolve into intelligent, automated allies, optimizing our savings journey.

Financial services, a traditionally conservative industry, are subject to rigorous regulation. While change may be gradual, its impact ripples across sectors, given money's fundamental role. This metamorphosis heralds fresh revenue avenues beyond finance's confines, catalyzing transformative repercussions.

Alternative operational models and revenue streams are sprouting across the financial landscape. Next-gen banking paradigms foretell an array of innovative products and services tailored for a world where industry boundaries blur or fade away.

The automotive industry's evolution from "car" to "mobility" exemplifies this shift, extending value chains beyond physical products and fostering broader interpretation. As financial and non-financial sectors intermingle, banking gains the ability to subtly infiltrate the subconscious, steering evolving customer expectations and novel competitive dynamics.

To thrive in this invisible landscape, banks must fathom customer needs, habits, and aspirations. Financial professionals must conjure the dual magic of becoming both unseen and all-seeing. An entirely novel form of finance beckons on the horizon—one abstract, seamless, and intrinsically interconnected.

#InvisibleFinance #FutureBanking #TechInnovation #FinancialEvolution #CustomerCentric #SeamlessTransactions #InnovationFrontiers #Innovation #Fintech #Banking #OpenBanking #OpenFinance #EmbeddedFinance #OpenAPIs #BaaS #BaaP #FinancialServices #CoreBanking #Payments #SaaS

1 note

·

View note

Text

RiskPro understands and provides the services of the Concurrent Audit of the Data Centre. For more details, please visit our website.

#-#InternalAudit#riskmanagement#riskassessment#riskproservices#cybersecurity#dataprivacy#DataCentre#TAT#ITManagement#CoreBanking#ConcurrentAuditEmpanelment#ConcurrentauditICAI#concurrentauditofbanks#risk assessment#incidentmanagement#internal audit#internalaudit#riskadvisory#gapassessment

0 notes

Text

Empowering Global Financial Institutions with Cutting-Edge Core Banking Solutions

Intellect Design Arena Ltd. provides an extensive range of advanced core banking solutions, tailored to empower financial institutions globally. Our state-of-the-art core banking software offers robust features for overseeing diverse banking products and services, encompassing trade finance, digital lending, and cash management. Our sophisticated core banking system enables banks to optimize liquidity management, streamline transaction banking processes, and offer a frictionless digital banking experience to their customers.

https://dglonet.com/intellectdesign

0 notes

Photo

AI chatbots in banking and financial services

The use of advanced AI chatbots is based on 2 things

1. Analysis of the kind of problems that may arise from the customers

2. The kind of functionalities the banks and financial institutions would want to offer

Depending on this, banks and financial institutions can decide on the chatbot best suited for them, which would help them extend and improve the customer support system.

Informational Chatbot: This kind of chatbot is best suited to handle routine queries from customers. The source for the interaction is based on the wealth of information publicly available on the internet. These are generally related to routine and repetitive tasks. These chatbots can be customized based on requirements and are rule-based.

Transactional Chatbot: These chatbots are best suited to help in self-service transactions, securely and efficiently. It helps customers to make payments, transfer money, pay bills and a lot more.

For more information, click here: Finacle Digital Banking Solution Suite

0 notes