#CreditNotes

Explore tagged Tumblr posts

Text

Debit and credit notes are essential accounting tools used to adjust or correct invoices. A Debit Note is issued by a buyer to increase the amount owed to a seller, often due to returned goods or billing errors. It reflects a reduction in the seller’s revenue. On the other hand, a Credit Note is issued by a seller to decrease the amount due from the buyer, often as a result of overcharging, returned goods, or discounts. Both notes help maintain accurate financial records, ensure correct invoicing, and facilitate smooth transaction adjustments in business operations.

#DebitNotes#CreditNotes#AccountingBasics#FinancialAdjustments#InvoiceCorrections#BusinessAccounting#AccountingTips#AccountingSoftware#TaxAndAccounting#InvoiceManagement#BusinessFinance#DebitVsCredit#AccountingTerms#TransactionManagement

0 notes

Text

Understanding Credit Notes and Reversals

What is a Credit Note?

A credit note is a document issued by a seller to a buyer when there is a need to reverse or adjust an invoice. It serves as a formal acknowledgment of the seller's intent to credit the buyer's account with a specific amount. Credit notes can be issued for various reasons, including errors in the original invoice, product returns, discounts, or adjustments for damaged or defective goods.

Conditions for Issuing a Credit Note:

Incorrect Invoice:

If an invoice contains errors such as overcharging, undercharging, incorrect quantities, or wrong product descriptions, a credit note can be issued to rectify the mistake.

To continue reading click here.

For more detailed information, visit Swipe Blogs.

0 notes

Text

How to Handle Credit Notes and Debit Notes in GSTR-1

📢 Credit Notes, Debit Notes & GSTR-1 – Let’s simplify this GST puzzle!

When should you issue a credit note vs a debit note? Or how to report them correctly in your GSTR-1? 🤔📄 One wrong move, and your books or your client’s, could end up with mismatched data and compliance headaches.

Here’s the quick inside👇

🔁 Credit Note – Issued when there’s an excess invoice, return of goods, or discount.

➕ Debit Note – Issued when undercharging or raising extra invoice value.

✅ Must be reported in Table 9B of GSTR-1

📆 Ensure correct month of reporting to avoid ITC mismatches

📌 Link them to the original invoice—precision matters!

If you’re still manually entering this info or second-guessing GST rules each time, stop.

With tools like Suvit, you can automate GST data entry, match notes with invoices, and file with confidence. 🧠⚙️

🔍 Whether you’re a CA, tax consultant, or business owner, understanding these notes is crucial to keep GST clean and compliant.

👉 Dive into the full blog to get clarity (and peace of mind):

🔗 https://www.suvit.io/post/handling-credit-debit-notes-in-gstr1

0 notes

Text

჻ϟ჻

#჻ϟ჻ under the cape#(( im sooo peeved#still have some work to finish up#its 7:38 pm#whyyyy >:C#no drafting for now#just downing monsters and processing creditnotes for a bit#and sending LUV to the peeps ))#- grumbles in corporate -

2 notes

·

View notes

Text

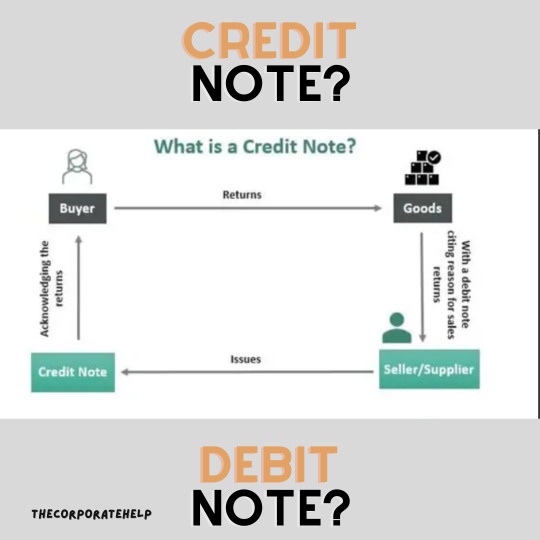

What is a Credit note?

When the goods are returned by the buyer, either the buyer can raise a debit note or the vendor can raise a credit note.

The credit note reduces the vendor's receivables from the customers for the goods returned or excess payments/overcharges against any invoice (credit entry in the account books of the vendor).

Debit/Credit notes are also used to adjust the revenue recognized by the vendor against the selling transaction.

What is a Debit Note?

When a buyer returns some goods to its suppliers, it prepares a debit note and sends it along with the goods returned to the supplier.

Debit note results in a debit entry against the seller's account, in the books of the buyer.

#Debitnote #creditnote #p2p #corporatehelp #thecorporatehelp #procuretopay

0 notes

Text

What is credit note and debit note? What are the differences between them? Both are important documentary evidence that supports the purchase and sales. This is generated by accounting software and ERP. Let us find out the detailed information here.

#debitnote#creditnote#debitnoteandcreditnote#debitnotevscreditnote#differencebetweencreditnoteanddebitnote#creditnoteformat#debitnoteformat

0 notes

Photo

For those customers that have asked if their credit voucher/credit note is ATOL protected.... this is the best way to explain 👇 ➡️[email protected] ⬅️ ➡️Lauradaykin.inteletravel.uk⬅️ 07414566036 📞 #creditnote #creditvoucher #refunds #cashrefunds #covid19 #coronavirus #pandemic #companies #holidays #travelagent #travelagency #travelindustry #abta #atolprotected #atolprotection (at Doncaster Town) https://www.instagram.com/p/CANDMaZJt8j/?igshid=1utq7vx0vyj4y

#creditnote#creditvoucher#refunds#cashrefunds#covid19#coronavirus#pandemic#companies#holidays#travelagent#travelagency#travelindustry#abta#atolprotected#atolprotection

0 notes

Video

youtube

Check out this video how to set up credit notes report with Moon Invoice app. In case of any query, feel free to ask our experts for instant resolution at [email protected]

0 notes

Photo

[Fiskalizimi] Njoftim për implementimin me sukses të faturës korrigjuese https://zcu.io/M5YO Drejtoria e Përgjithshme e Tatimeve, në vijim të komunikimit të datës 11.03.2021 për implementimet dhe zhvillimet e reja, lidhur me disa përmirësime si dhe zgjidhjen e problematikave, të konstatuara në lidhje me faturën elektronike E-invoice, bën me dije se zhvillimi ishte i suksesshëm. Të gjithë tatimpaguesit, persona fizik të cilët nuk janë të regjistruar me përgjegjësinë Tatimore me TVSH dhe nuk mundin të lëshonin fature elektronike nga platforma Self-Care dhe tatimpaguesit e tjerë që ishin hasur më parë me problematikën e korrigjimit të një fature, mund të vijojnë më tej me këtë proces. Administrata Tatimore ju inkurajon të kryeni të gjitha veprimet dhe konfirmon edhe një herë mbështetjen dhe bashkëpunimin në këtë proces të rëndësishëm si për tatimpaguesit ashtu edhe për DPT. #eInvoice #eFatura #Fiskalizimi #CreditNote #FaturëKorigjuese — view on Instagram https://ift.tt/3cPSKlN

0 notes

Text

Do you want to know how to calculate interest in tally ?

Watch our latest video on YouTube

https://youtu.be/aoMKhEFnaXg

Do give your takeways in comment section if you liked the video

Don't forget to follow us on Facebook , instagram

Instagram:https://www.instagram.com/bpaeducator/

Facebook:https://www.facebook.com/bpaeducator

#bpa #bpaeducators #learnwithbpa #bpamastery #bpaindelhi #bpainbihar #tally #learntally #interest #compundinterest #simpleinterest #debitnote #creditnote

0 notes

Text

All You Need To Know About Debit and Credit Note under GST

Credit note and debit notes are key concepts under the new GST Law, and are central to the processing of GST invoices. Read on to know more about them:

What is credit note and debit note?

Debit note and credit notes are documents issued by the receiver/supplier of goods and services in case of some errors in the already issued invoices.

A debit note is issued by the buyer to the seller to inform them that a debit has been made in the seller’s account. Usually, when the goods are to be returned or found not up to the expectations, buyers can still issue a debit note. It can be raised under 2 circumstances:

· When the amount of taxable value of goods needs to be amended after an invoice has been issued;

· When there is a change in the tax after an invoice has been issued.

On the other hand, credit note under GST is issued by the seller to the buyer when a credit has been made in the buyer’s account. Credit note is essentially a document noting the issuer owes money to someone. It can be raised under 3 circumstances:

· When the recipient returns the goods;

· When the goods are of inferior quality, and therefore returned back to the supplier;

· When there is excess tax being charged by the supplier than the actual.

What is the format of debit notes and credit notes?

The debit and credit note in GST needs to have the following requirements:

ü Name, address, and GSTIN of the supplier;

ü Nature of the document;

ü A consecutive serial number that contains only alphabets and/or numerals, unique for a financial year;

ü Date the document was issued;

ü Name, address and GSTIN/ Unique ID Number, if registered, of the recipient,

ü Delivery address, along with State and pin code, if such recipient is unregistered,

ü serial number and date of the corresponding tax invoice or bill of supply,

ü the taxable value of goods or services, rate of tax, and the amount of the tax credited/debited to the recipient,

ü Signature or digital signature of the supplier or an authorized representative.

0 notes

Text

Store Credit: Everything You Need to Know

Is offering a store credit really good? This is one of a few questions retailers always have in mind. While cash is considered to be the king in business, it is not always possible to make all sales on a cash basis. Since all businesses have to beat the competition, giving customers credit terms can be a great option. However, from the name itself, it can be risky. You are giving out products or services without any immediate pay. It is greatly important to weigh things up before deciding to offer such an uncertain thing so your business won’t be compromised. In this post, we will help you do that!

Pros and Cons of Offering Store Credit

The Good Side

Store credit can be used to: Reward customers Offer compensation Encourage sales Improve customer retention Customers with retail store credit account can earn rewards. They may also receive coupons and invitations when there are special events in the store. This can also be an easy way for them to track their spending at a particular store they are registered at. If you want to improve customer retention, offering store credit can also be a big help.

The Bad Side

Creating store credit accounts is popular in retail marketing but it is not good for everyone. Unlike credit cards issued by the bank, one who created a store credit account is not allowed or is limited to purchase in the markets outside of the store. Store credit is not a part of the major payment network that they can’t easily shop around elsewhere.

Things to Remember

Store credit can create a big impact on the cash on hand and in-stock products of the company. Before offering things like this, make sure you can take hold of the financing options. Evaluate how credit can help your business in the first place. Let your customers know exactly about the payment terms, the due date, the fees, and the interests. One other thing you need to consider is how to track your customers. Most retailers draw on WooCommerce POS to ease the pain but you can also use other software relevant to the kind of industry you are currently in. Using such kind of tools can also help you to stay on top of your customer’s needs and monitor their queries even those who owe you money. This means there is no more extra expenses to be paid while there is only less effort exerted. What if your customer needs to return an item in your store? Of course, it can affect your current cash but there is one thing you can issue to make sure your cash on hand remains intact – credit note.

Issuing Credit Note

Issuing credits is one of the most complex scenarios you can experience in the world of business. A credit note or credit memo is not actually a refund. It is used to document the changes happen on the items already paid. Instead of giving cash for the defected products they are returning in, you can issue a credit note instead which can be applied to future purchases. WooPOS is able to produce a credit note which your customer can use in your store any time. Store credit is daunting and WooPOS would like to take the load off your shoulder by issuing a credit note in just a single tap on the screen. Do you have any other way to improve customer retention? We’d like to hear your thoughts below. Read the full article

0 notes

Photo

Boosted up the speed for API calling for import/export operations. Import (Xero to Odoo) Currencies - Taxes - ChartofAccounts - ManualJournals - BankAccounts - ContactGroups - Contacts - Products (Tracked / Untracked) - Invoices / Bills - CreditNotes - Invoice / BillPayments - Credit Notes Payments / Allocation Export (Odoo to Xero) Taxes - Chart of Accounts - Bank Accounts - Contact Groups - Contacts - Products - Invoices/ Bills - Credit Notes - Invoices/ Bills - Invoice / Bill Payments - Credit Notes Payments / Allocation - Inventory Adjustments - Invoice Attachments - Credit Notes Attachments - Contact Attachments Buy now from synconicsappstore : https://bit.ly/3yQlWU5

0 notes

Text

🚀 SMRT Software Update 🚀

Hello and Happy July to our wonderful community of SMRT Users!

We’ve just released a software update that’s chock full of new features, helpful fixes, and back-end system enhancements. The highlights are below, and, as always, your feedback is not only welcome — it’s encouraged. :)

We sincerely appreciate your diligent issue reporting, insightful feature suggestions and thoughtful questions. Thank you, and keep 'em coming!

Warm regards,

Your SMRT Software Development and Support Teams

SOFTWARE UPDATE - HIGHLIGHTS

DELIVERY

Upgraded delivery manifest: Now, in addition to the traditional stop list with customer names, addresses and notes, users will have the option to enable a separate, detailed report for any customer on the manifest, showing all bags and items that are being delivered — with the further option to show prices on those items — and the ability to filter the report to show only those bags that have been racked to the delivery vehicle. And YES, this document is PRINTABLE!

Users will experience speedier loading of the delivery app and delivery module.

Sub delivery accounts can now have pickups “scheduled,” indicating there's a bag to pickup at the building.

If you’re a frequent visitor to the Delivery page and Route Manager, you’ve likely already noticed that GoogleMaps has been replaced with Mapbox. System speed improvement was the driving factor behind the switch; however, other Mapbox features we love:

You can now see live traffic status

Hovering/mousing over the stop number on the delivery roster will light up that stop location on the map

Completed (and Missed) stops remain on the active map with grayed-out stop numbers

Greater User Interface and design control enables us to customize the map to better suit the system and the route manager’s purposes (for example, we’ve removed the unnecessary street sign clutter)

STATEMENTS & RECEIPTS

Automatic emailing of Statements: If the “Email automatically” flag is checked in a customer’s statement settings, the monthly statement will now email automatically, even if the customer’s message settings have “Send Emails?” set to No. (Previously, automatic emailing of statements required the customer to have the “Send Emails?” option set to Yes, in addition to checking the “Email automatically” box in the statement settings. No more!!)

Improved receipt styling so that any SMRT receipt (Order, Claim, Payment, CreditNote) fits in a letter-sized envelope.

CUSTOMER SIGN-UP

Ability to pre-fill promotion code field on sign-up page using pc URL option. Useful if you want to embed a promotion in a marketing email, asking for customers to sign up.

Ability to pre-fill address info by specifying URL options: address [street_address], street_address2, city_address, state_address, zip_address. Useful if you want to send out a sign up link to customers in a building so they don't have to fill in the address when registering.

SEARCH

Improved search for orders: Searching on an Order number will now highlight the searched order in yellow, and put that order at the top of ClothesTracker for current and historical orders.

Bug fix: We experienced a regression where the universal search bar wasn't focusing after load. This has been resolved.

WINDOWS-SPECIFIC UPDATES

Fixed issues with shutting down the SMRT Windows app — now shows an "Are you sure you want to quit?" popup to prevent accidental closing of the app.

MetalProgetti support has been added to Windows devices.

Windows users can now print Claim receipts.

MISCELLANEOUS

We’ve added a "To Deposit" line for the Z-report.

Ensure Production-level employees cannot inadvertently click the <customer name> in Pressing and other production modules (previously generated a confusing “access denied” error).

What used to say “Missing Card” at the top of customer’s account page, now says “No Card on File.”

Bug fix: The date and issue filters available under the Problems/Notes tab (in the Customer Module) are working again.

0 notes