#DDR4 memory server

Explore tagged Tumblr posts

Text

High-Density Server for HPC & Edge – HexaData HD‑H242‑Z10

The HexaData HD‑H242‑Z10 Ver Gen001 is a 2U high-density server with 4 independent single-socket nodes powered by AMD EPYC™ 7003 CPUs. It offers up to 32 DDR4 DIMMs, NVMe storage, PCIe Gen4 support, and redundant 1200W PSUs. Designed for HPC, data analytics, 5G, and edge deployments, it delivers performance and efficiency in a compact footprint. For more details Visit: Hexadata HD-H242-Z10 Ver: Gen001 | High Density Server Page

#high density server#AMD EPYC server#2U server#data center hardware#edge computing server#5G infrastructure#HPC server#NVMe server#enterprise server#multi-node server#server with redundant PSU#DDR4 memory server#PCIe Gen4 server#rackmount server#remote management server

0 notes

Text

DDR5 Chip Market 2025-2032

MARKET INSIGHTS

The global DDR5 Chip Market size was valued at US$ 12,400 million in 2024 and is projected to reach US$ 34,700 million by 2032, at a CAGR of 15.81% during the forecast period 2025-2032. This growth aligns with the broader semiconductor market expansion, which was estimated at USD 579 billion in 2022 and is expected to reach USD 790 billion by 2029.

DDR5 chips represent the fifth generation of double data rate synchronous dynamic random-access memory (SDRAM), offering significant improvements over DDR4 technology. These chips feature higher bandwidth (up to 6.4 Gbps per pin), improved power efficiency (operating at 1.1V), and doubled bank groups compared to previous generations. The technology enables capacities ranging from 8GB to 128GB per module, with mainstream applications currently focused on 16GB and 32GB configurations.

The market growth is driven by multiple factors including the increasing demand for high-performance computing in data centers, gaming PCs, and AI applications. While the server segment currently dominates DDR5 adoption, the PC market is expected to accelerate its transition from DDR4. Major manufacturers like Samsung, SK Hynix, and Micron have been ramping up production, with Micron reporting a 50% increase in DDR5 bit output quarter-over-quarter in Q1 2024. However, pricing premiums and compatibility requirements with new motherboard chipsets remain adoption challenges in the consumer segment.

Get Your Free Sample Report Today-https://semiconductorinsight.com/download-sample-report/?product_id=97587

Key Industry Players

Semiconductor Giants Accelerate DDR5 Adoption Through Innovation and Strategic Partnerships

The global DDR5 memory chip market demonstrates a highly concentrated competitive landscape, dominated by a handful of major semiconductor manufacturers with significant technological and production capabilities. Samsung Electronics leads the market with approximately 42% revenue share in 2024, owing to its early mover advantage in DDR5 production and vertically integrated supply chain. The company’s recent $17 billion investment in new memory production facilities positions it strongly for continued market leadership.

SK Hynix and Micron Technology follow closely, collectively accounting for nearly 45% of global DDR5 shipments. These companies have differentiated themselves through advanced manufacturing processes – SK Hynix’s 1α nm DDR5 modules and Micron’s 16Gb monolithic DDR5 dies demonstrate the fierce innovation race in this sector. While DDR4 still dominates the broader memory market, DDR5 adoption is accelerating dramatically in high-performance computing segments.

Several second-tier players are making strategic moves to capture niche opportunities. Kingston Technology has strengthened its position through partnerships with motherboard manufacturers, while ADATA focuses on cost-optimized solutions for the burgeoning mid-range PC upgrade market. The emergence of specialized brands like TEAMGROUP and AORUS illustrates how product segmentation is evolving to address diverse customer needs.

Looking ahead, the competitive dynamics will be shaped by two key trends: the transition to higher density modules (32GB+ becoming mainstream) and increasing server segment penetration. With cloud providers rapidly adopting DDR5 for next-generation data centers, companies with strong server-oriented product lines and validation capabilities stand to gain disproportionate market share.

List of Key DDR5 Chip Manufacturers

Samsung Electronics (South Korea)

SK Hynix (South Korea)

Micron Technology (U.S.)

Crucial (U.S.)

ADATA Technology (Taiwan)

AORUS (Taiwan)

TEAMGROUP (Taiwan)

Kingston Technology (U.S.)

Segment Analysis:

By Type

16 GB DDR5 Segment Leads Due to Optimal Balance of Performance and Cost-Efficiency

The market is segmented based on type into:

8 GB

16 GB

32 GB

Other capacities

By Application

Server Segment Dominates Demand Owing to Data Center Expansion Worldwide

The market is segmented based on application into:

Server

PC

Consumer Electronics

Others

By Speed Tier

4800-5600 MT/s Range Captures Major Share for Mainstream Computing Needs

The market is segmented based on speed into:

Below 4800 MT/s

4800-5600 MT/s

Above 5600 MT/s

By End-User Industry

Cloud Computing Providers Drive Adoption Through Hyperscale Data Center Investments

The market is segmented based on end-user industry into:

Cloud Service Providers

Enterprise IT

Gaming

Industrial

Others

Get Your Free Sample Report Today-https://semiconductorinsight.com/download-sample-report/?product_id=97587

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global DDR5 Chip Market?

-> DDR5 Chip Market size was valued at US$ 12,400 million in 2024 and is projected to reach US$ 34,700 million by 2032, at a CAGR of 15.81% during the forecast period 2025-2032.

Which key companies operate in Global DDR5 Chip Market?

-> Key players include Samsung (28% share), SK Hynix (25%), Micron (22%), Kingston, and ADATA, dominating 80% of the market.

What are the key growth drivers?

-> Growth is driven by data center expansion (25% server demand CAGR), AI adoption, and next-gen Intel/AMD platforms requiring DDR5.

Which region dominates the market?

-> Asia-Pacific leads with 42% share, while North America shows fastest growth at 18% CAGR through 2032.

What are the emerging trends?

-> Emerging trends include DDR5-6400 adoption, power efficiency improvements (1.1V operation), and increasing 32GB module penetration.

About Semiconductor Insight:

Established in 2016, Semiconductor Insight specializes in providing comprehensive semiconductor industry research and analysis to support businesses in making well-informed decisions within this dynamic and fast-paced sector. From the beginning, we have been committed to delivering in-depth semiconductor market research, identifying key trends, opportunities, and challenges shaping the global semiconductor industry.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

Global DDR5 Chip Market Emerging Trends, and Forecast to 2032

Global DDR5 Chip Market size was valued at US$ 12,400 million in 2024 and is projected to reach US$ 34,700 million by 2032, at a CAGR of 15.81% during the forecast period 2025-2032. This growth aligns with the broader semiconductor market expansion, which was estimated at USD 579 billion in 2022 and is expected to reach USD 790 billion by 2029.

DDR5 chips represent the fifth generation of double data rate synchronous dynamic random-access memory (SDRAM), offering significant improvements over DDR4 technology. These chips feature higher bandwidth (up to 6.4 Gbps per pin), improved power efficiency (operating at 1.1V), and doubled bank groups compared to previous generations. The technology enables capacities ranging from 8GB to 128GB per module, with mainstream applications currently focused on 16GB and 32GB configurations.

The market growth is driven by multiple factors including the increasing demand for high-performance computing in data centers, gaming PCs, and AI applications. While the server segment currently dominates DDR5 adoption, the PC market is expected to accelerate its transition from DDR4. Major manufacturers like Samsung, SK Hynix, and Micron have been ramping up production, with Micron reporting a 50% increase in DDR5 bit output quarter-over-quarter in Q1 2024. However, pricing premiums and compatibility requirements with new motherboard chipsets remain adoption challenges in the consumer segment.

Get Full Report : https://semiconductorinsight.com/report/ddr5-chip-market/

MARKET DYNAMICS

MARKET DRIVERS

Expansion of High-performance Computing and AI Infrastructure Fuels DDR5 Adoption

The global surge in artificial intelligence and high-performance computing applications is creating unprecedented demand for DDR5 memory solutions. Data centers handling AI workloads require memory bandwidth exceeding 400 GB/s, which DDR4 architecture cannot reliably deliver. DDR5 chips provide a 50-60% performance improvement over DDR4 through increased channel efficiency and higher base speeds starting at 4800 MT/s. Major cloud service providers have begun large-scale deployment of DDR5-enabled servers, with enterprise adoption projected to grow at 68% CAGR through 2027. This transition is accelerated by the need for real-time processing of massive datasets in machine learning applications.

Next-generation Gaming Consoles and PCs Drive Consumer Demand

Consumer electronics manufacturers are rapidly transitioning to DDR5 as the new standard for premium computing devices. The gaming hardware market, valued at over $33 billion globally, shows particular enthusiasm for DDR5’s capabilities. Compared to DDR4, DDR5 reduces latency by 30-40% while doubling memory density, enabling smoother 8K gaming and advanced ray tracing effects. Leading GPU manufacturers now optimize their architectures for DDR5 compatibility, with adoption in high-end PCs expected to reach 75% market penetration by 2026. This shift coincides with the release of new processor generations from major chipset designers that exclusively support DDR5 memory configurations.

5G Network Expansion Creates Infrastructure Demand

Global 5G network deployment is driving significant investment in edge computing infrastructure that requires DDR5’s high-bandwidth capabilities. Each 5G base station processes 10-100x more data than 4G equipment, necessitating memory solutions that handle massive parallel data streams. Telecom operators are prioritizing DDR5 adoption in network equipment to support emerging technologies like network slicing and ultra-low latency applications. The telecommunications sector is projected to account for 25% of industrial DDR5 demand by 2025, with particularly strong growth in Asia-Pacific markets leading 5G implementations.

MARKET RESTRAINTS

High Production Costs Delay Mass Market Adoption

While DDR5 offers significant performance benefits, its premium pricing remains a barrier for widespread adoption. Current DDR5 modules carry a 60-80% price premium over equivalent DDR4 products due to complex manufacturing processes and lower production yields. The advanced power management integrated circuits (PMICs) required for DDR5 operation add approximately $15-20 per module in additional costs. This pricing disparity has slowed adoption in price-sensitive segments, particularly in emerging markets where cost optimization remains a priority. Industry analysts estimate DDR5 won’t achieve price parity with DDR4 until at least 2026.

Component Shortages and Supply Chain Constraints

The DDR5 market faces persistent supply challenges stemming from the semiconductor industry’s ongoing capacity constraints. Production of DDR5 chips requires specialized 10-14nm process nodes that remain in high demand across multiple semiconductor categories. Memory manufacturers report lead times exceeding 30 weeks for certain DDR5 components, particularly power management ICs and register clock drivers. These bottlenecks have forced many system integrators to maintain dual DDR4/DDR5 production lines, increasing operational complexity. While new fabrication facilities are coming online, they may not reach full production capacity until late 2025.

Compatibility Issues with Legacy Systems

The transition to DDR5 introduces technical hurdles for system integrators and end-users. Unlike previous DDR generation transitions, DDR5 requires complete platform redesigns due to fundamental architectural changes in memory channels and power delivery. Many enterprises face significant upgrade costs as DDR5 is incompatible with existing DDR4 motherboards and chipsets. This incompatibility has created a transitional market period where manufacturers must support both standards, slowing the depreciation cycle for DDR4 infrastructure. Industry surveys indicate 45% of IT managers are delaying DDR5 adoption until their next full hardware refresh cycle.

MARKET OPPORTUNITIES

Emerging Data-intensive Applications Create New Use Cases

The proliferation of immersive technologies and advanced analytics is opening new markets for DDR5 adoption. Virtual reality systems require memory bandwidth exceeding 100GB/s to support high-resolution stereo displays, positioning DDR5 as the only viable solution. Similarly, autonomous vehicle developers are specifying DDR5 for in-vehicle AI systems that must process sensor data with latency under 10 milliseconds. These emerging applications represent a $8-10 billion addressable market for DDR5 by 2028, particularly in sectors requiring real-time data processing at scale.

Advanced Packaging Technologies Enable Performance Breakthroughs

Memory manufacturers are developing innovative 3D stacking techniques that overcome DDR5’s density limitations. Through-silicon via (TSV) technology allows vertical integration of multiple DDR5 dies, potentially tripling module capacities while reducing power consumption by 30-40%. These advancements enable server configurations with 2TB+ memory capacities using standard form factors, addressing the needs of in-memory database applications. Leading foundries have committed over $20 billion to advanced packaging R&D through 2026, with DDR5 positioned as a key beneficiary of these investments.

Government Investments in Domestic Semiconductor Production

National semiconductor self-sufficiency initiatives worldwide are accelerating DDR5 manufacturing capabilities. The CHIPS Act in the United States has allocated $52 billion to bolster domestic memory production, including dedicated funding for next-generation DRAM technologies. Similar programs in Europe and Asia are fostering regional DDR5 supply chains, reducing geopolitical risks in the memory market. These investments are expected to shorten product development cycles and improve yield rates, making DDR5 more accessible to mid-tier equipment manufacturers by 2025.

MARKET CHALLENGES

Thermal Management Complexities in High-density Configurations

DDR5 modules operating at speeds above 6400 MT/s generate significant thermal loads that challenge conventional cooling solutions. Each DIMM can dissipate 10-15 watts under full load, creating thermal throttling issues in dense server deployments. Memory manufacturers report that every 10°C temperature increase reduces DDR5 reliability by 15-20%, necessitating expensive active cooling systems. These thermal constraints limit DDR5’s deployment in space-constrained edge computing environments where airflow is restricted, potentially slowing adoption in 5G infrastructure applications.

Standardization Gaps Create Interoperability Risks

Unlike previous DDR transitions, DDR5 introduces multiple implementation variations that complicate system design. The JEDEC standard allows for 11 different speed grades and multiple voltage regulation schemes, creating compatibility challenges between vendors. Industry testing reveals 35% of DDR5 modules show performance variations when used with non-validated motherboards. This fragmentation forces OEMs to perform extensive qualification testing, adding 3-6 months to product development cycles. The lack of unified validation standards may delay mainstream adoption until 2025 when more mature ecosystems emerge.

Cybersecurity Vulnerabilities in Advanced Memory Architectures

DDR5’s sophisticated power management features introduce new attack surfaces for memory-based exploits. Researchers have demonstrated Rowhammer attacks against early DDR5 implementations that circumvent existing mitigation techniques. Each DDR5 module contains 50+ firmware-controlled parameters that could potentially be manipulated by sophisticated threat actors. These security concerns have prompted some government agencies to delay DDR5 certification for sensitive systems until 2024, creating a temporary barrier for adoption in defense and financial sectors that account for 18% of enterprise memory demand.

DDR5 CHIP MARKET TRENDS

Increasing Demand for High-Performance Computing Drives DDR5 Adoption

The transition to DDR5 memory is accelerating due to growing computational requirements across data centers, AI applications, and gaming platforms. With data transfer speeds reaching 6400 MT/s—nearly double DDR4’s capabilities—DDR5 reduces latency while improving energy efficiency through 1.1V operating voltage. Server deployments account for over 60% of early adopters, as cloud providers prioritize infrastructure upgrades. Meanwhile, PC OEMs are gradually integrating DDR5, with premium laptops and desktops leading the shift. While pricing remains a barrier for mainstream consumers, analysts project cost parity with DDR4 by late 2025 as production scales.

Other Trends

AI and Cloud Infrastructure Expansion

The exponential growth of AI workloads and hyperscale data centers is fueling DDR5 demand. Modern AI training models require bandwidths exceeding 400 GB/s per GPU, which DDR5’s multi-channel architecture enables. Major cloud service providers have begun phased DDR5 rollouts, with server DRAM configurations now reaching 1TB per module. This aligns with forecasts suggesting 40% of all data center memory will transition to DDR5 by 2027, supported by Intel’s Sapphire Rapids and AMD’s Genoa platforms.

Manufacturing Challenges and Supply Chain Dynamics

Despite strong demand, the DDR5 market faces yield challenges at advanced nodes below 10nm. Samsung, SK Hynix, and Micron currently control 98% of production capacity, creating supply constraints. The 16Gb DDR5 die shortage in 2024 temporarily slowed adoption, though new fabrication plants coming online in 2025 should alleviate bottlenecks. Packaging innovations like 3D-stacked memory and hybrid bonding techniques are emerging to boost densities beyond 32Gb per chip. Geopolitical factors also influence the landscape—export controls on EUV machinery have prompted Chinese manufacturers to accelerate domestic DDR5 development.

COMPETITIVE LANDSCAPE

Key Industry Players

Semiconductor Giants Accelerate DDR5 Adoption Through Innovation and Strategic Partnerships

The global DDR5 memory chip market demonstrates a highly concentrated competitive landscape, dominated by a handful of major semiconductor manufacturers with significant technological and production capabilities. Samsung Electronics leads the market with approximately 42% revenue share in 2024, owing to its early mover advantage in DDR5 production and vertically integrated supply chain. The company’s recent $17 billion investment in new memory production facilities positions it strongly for continued market leadership.

SK Hynix and Micron Technology follow closely, collectively accounting for nearly 45% of global DDR5 shipments. These companies have differentiated themselves through advanced manufacturing processes – SK Hynix’s 1α nm DDR5 modules and Micron’s 16Gb monolithic DDR5 dies demonstrate the fierce innovation race in this sector. While DDR4 still dominates the broader memory market, DDR5 adoption is accelerating dramatically in high-performance computing segments.

Several second-tier players are making strategic moves to capture niche opportunities. Kingston Technology has strengthened its position through partnerships with motherboard manufacturers, while ADATA focuses on cost-optimized solutions for the burgeoning mid-range PC upgrade market. The emergence of specialized brands like TEAMGROUP and AORUS illustrates how product segmentation is evolving to address diverse customer needs.

Looking ahead, the competitive dynamics will be shaped by two key trends: the transition to higher density modules (32GB+ becoming mainstream) and increasing server segment penetration. With cloud providers rapidly adopting DDR5 for next-generation data centers, companies with strong server-oriented product lines and validation capabilities stand to gain disproportionate market share.

List of Key DDR5 Chip Manufacturers

Samsung Electronics (South Korea)

SK Hynix (South Korea)

Micron Technology (U.S.)

Crucial (U.S.)

ADATA Technology (Taiwan)

AORUS (Taiwan)

TEAMGROUP (Taiwan)

Kingston Technology (U.S.)

Segment Analysis:

By Type

16 GB DDR5 Segment Leads Due to Optimal Balance of Performance and Cost-Efficiency

The market is segmented based on type into:

8 GB

16 GB

32 GB

Other capacities

By Application

Server Segment Dominates Demand Owing to Data Center Expansion Worldwide

The market is segmented based on application into:

Server

PC

Consumer Electronics

Others

By Speed Tier

4800-5600 MT/s Range Captures Major Share for Mainstream Computing Needs

The market is segmented based on speed into:

Below 4800 MT/s

4800-5600 MT/s

Above 5600 MT/s

By End-User Industry

Cloud Computing Providers Drive Adoption Through Hyperscale Data Center Investments

The market is segmented based on end-user industry into:

Cloud Service Providers

Enterprise IT

Gaming

Industrial

Others

Regional Analysis: DDR5 Chip Market

North America The North American DDR5 market is currently the most advanced, driven by major technology firms and hyperscale data centers upgrading their infrastructure to support AI, cloud computing, and high-performance computing (HPC) applications. The U.S. holds over 60% of the regional market share, owing to rapid adoption in server and enterprise segments. Companies like Intel and AMD have been aggressively promoting DDR5-compatible platforms, accelerating the transition from DDR4. However, premium pricing remains a barrier for broader consumer adoption, particularly in the PC segment. Government initiatives to bolster domestic semiconductor manufacturing, including the CHIPS Act, could further stimulate supply chain resilience and local production capabilities in the long term.

Europe Europe’s DDR5 adoption is growing steadily, albeit at a slower pace than North America, with Germany, France, and the U.K. leading demand. The enterprise and automotive sectors are key drivers, as DDR5’s energy efficiency aligns with the region’s stringent sustainability regulations. However, economic uncertainty has delayed upgrades in some industries, particularly small and medium-sized businesses. On the bright side, innovation hubs in the Nordic countries and Benelux are spearheading edge computing and IoT applications that benefit from DDR5’s performance advantages. Unlike North America, Europe remains highly dependent on imports from Asian manufacturers, which could impact supply stability in the near future.

Asia-Pacific As the manufacturing hub for memory chips, the Asia-Pacific region dominates DDR5 production, with South Korea (Samsung, SK Hynix) and Taiwan (Micron partners) accounting for over 70% of global output. China is rapidly expanding its domestic DDR5 capabilities to reduce reliance on foreign suppliers, supported by government subsidies. Despite slower consumer adoption due to cost sensitivity, demand from data centers, AI startups, and 5G infrastructure projects is surging. India is emerging as a high-growth market, particularly for server deployments in IT and banking sectors. Japan remains a niche player, focusing on specialized industrial and automotive applications that require reliability over raw speed.

South America South America’s DDR5 market is still nascent, with Brazil and Argentina representing the majority of demand. Limited IT budgets and economic instability have slowed server upgrades, though cloud service providers are gradually investing in newer infrastructure. Consumer adoption is minimal due to high import costs and low availability of compatible hardware. The region faces supply chain bottlenecks, as most DDR5 chips are routed through distributors serving North America first. However, increasing digitization in sectors like finance and telecommunications could drive modest growth, provided geopolitical and currency risks stabilize.

Middle East & Africa The Middle East is witnessing pockets of growth, particularly in the UAE and Saudi Arabia, where smart city initiatives and sovereign wealth fund-backed tech investments are fueling data center expansions. DDR5 adoption remains limited to high-end enterprise applications, however, due to cost constraints. Africa’s market is largely untapped, though South Africa and Kenya show potential as regional hubs for data infrastructure. Overall, the region’s reliance on external suppliers and underdeveloped semiconductor ecosystem means progress will be gradual, with demand concentrated in the oil & gas, finance, and government sectors.

Get A Sample Report : https://semiconductorinsight.com/download-sample-report/?product_id=97587

Report Scope

This market research report provides a comprehensive analysis of the global and regional DDR5 Chip market, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. Global DDR5 Chip market was valued at USD 1.2 billion in 2024 and is projected to reach USD 3.8 billion by 2032, growing at a CAGR of 15.7%.

Segmentation Analysis: Detailed breakdown by capacity (8GB, 16GB, 32GB, Others) and application (Server, PC, Consumer Electronics) to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with Asia-Pacific accounting for 42% market share in 2024.

Competitive Landscape: Profiles of leading participants including Samsung (28% market share), SK Hynix (25%), Micron (22%), and their product strategies.

Technology Trends: Assessment of DDR5-6400 adoption, power efficiency improvements (1.1V operation), and on-die ECC implementation.

Market Drivers: Evaluation of factors including data center expansion (projected 25% CAGR in server demand), AI workloads, and next-gen CPU adoption.

Stakeholder Analysis: Strategic insights for memory manufacturers, OEMs, cloud service providers, and investors.

The research methodology combines primary interviews with industry leaders and analysis of shipment data from memory manufacturers, ensuring data accuracy and reliability.

Customisation of the Report In case of any queries or customisation requirements, please connect with our sales team, who will ensure that your requirements are met.

Related Reports :

Contact us:

+91 8087992013

0 notes

Text

DRAM Market Size Empowering Data Centric Innovation Across Industries

The DRAM Market Size is undergoing a transformative phase as the demand for high-speed memory solutions accelerates across consumer electronics, data centers, automotive systems, and industrial computing. As data consumption soars and real-time processing becomes essential, DRAM (Dynamic Random-Access Memory) plays a critical role in enabling fast, scalable, and responsive computing environments. According to Market Size Research Future, the global DRAM Market Size is expected to reach a value of USD 191.1 billion by 2030, growing at a CAGR of 10.40% from 2022 to 2030.

Market Size Overview

DRAM is a type of volatile memory that stores data temporarily and enables quick read/write operations. Its architecture makes it a vital component for multitasking and high-speed data processing in devices ranging from smartphones and laptops to servers and autonomous vehicles.

The explosive growth of AI, cloud computing, and 5G infrastructure is reshaping the Market Size landscape, increasing demand for next-generation DRAM technologies such as DDR5, LPDDR5, and HBM (High Bandwidth Memory). Additionally, the semiconductor industry's rapid expansion—fueled by digitization trends and emerging economies—is further propelling DRAM adoption worldwide.

Key Market Size Drivers

1. Proliferation of Consumer Electronics

Smartphones, tablets, gaming consoles, and smart TVs are key drivers of DRAM demand. As these devices integrate more advanced features—such as AI-powered cameras and 4K/8K resolution—they require greater memory bandwidth and faster response times.

2. Data Center Expansion

Hyperscale cloud providers and enterprises are significantly investing in server farms to support big data, AI, and machine learning workloads. These workloads require high-capacity DRAM modules for real-time data analysis and smooth multi-user operation.

3. Adoption in Automotive Systems

Modern vehicles, especially electric and autonomous models, require DRAM for ADAS (Advanced Driver Assistance Systems), infotainment, and connectivity features. The automotive sector is fast becoming a high-growth vertical in the DRAM Market Size.

4. Transition to DDR5 and HBM

The rollout of DDR5 memory—with higher data transfer rates and improved power efficiency—is driving replacement cycles in computing devices. Meanwhile, HBM is becoming essential for graphics cards, AI accelerators, and scientific computing systems.

Market Size Segmentation

By Type:

DDR3

DDR4

DDR5

LPDDR4/5

HBM (High Bandwidth Memory)

By Application:

Consumer Electronics

Computing Devices

Servers and Data Centers

Automotive Electronics

Industrial and Embedded Systems

By End-User:

Individual Consumers

Enterprises

Government and Defense

Automotive OEMs

Telecommunication Providers

Regional Insights

North America

North America commands a substantial Market Size share, led by advanced data center infrastructure, strong semiconductor R&D, and robust demand from the tech and defense sectors. The U.S. is home to major chip designers and cloud service providers.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing DRAM Market Size, with countries like South Korea, China, Taiwan, and Japan dominating production and consumption. South Korean giants like Samsung and SK Hynix are global leaders in DRAM manufacturing.

Europe

The European Market Size is witnessing steady demand from the automotive sector, with German and Nordic countries spearheading innovation in autonomous driving and EV systems that rely on embedded DRAM solutions.

Competitive Landscape

The global DRAM Market Size is highly consolidated, with a few key players dominating global supply. These companies are focused on capacity expansion, R&D in next-gen memory technologies, and strategic alliances to meet surging demand. Major players include:

Samsung Electronics Co., Ltd.

SK Hynix Inc.

Micron Technology Inc.

Nanya Technology Corporation

Winbond Electronics Corporation

Intel Corporation

ADATA Technology Co., Ltd.

These companies continue to innovate across DRAM form factors, manufacturing nodes, and energy-efficient architectures to maintain competitive advantage.

Challenges and Opportunities

Challenges:

Price Volatility: The DRAM Market Size is cyclical and highly sensitive to supply-demand dynamics, which often causes price fluctuations.

Geopolitical Tensions: Trade restrictions and export controls between key nations can disrupt DRAM supply chains.

Manufacturing Complexity: As memory density increases, maintaining high yield and low defect rates becomes more challenging.

Opportunities:

Edge Computing and AI: Growth in AIoT and edge AI devices creates new demand for compact, low-power DRAM.

5G-Enabled Devices: Smartphones and base stations with 5G capabilities require enhanced DRAM performance.

Green Computing: Eco-efficient memory modules are gaining traction as sustainability becomes a priority for OEMs and data centers.

Conclusion

The DRAM Market Size is poised for sustained expansion in the decade ahead, powered by data-driven innovations, AI acceleration, and smart infrastructure. As demand continues to diversify—from mobile and gaming to enterprise and automotive—manufacturers must balance scale, speed, and technological advancement.

With next-generation technologies like DDR5 and HBM on the rise, the industry is on the cusp of a new era where memory performance will be as critical as processing power. Stakeholders that invest in agile R&D, scalable production, and strategic global partnerships will lead in shaping the future of dynamic memory.

Trending Report Highlights

Explore additional high-growth and emerging technology Market Sizes:

Touch Display for Household Appliances Market Size

US Wafer Level Packaging Market Size

Solid State LiDAR Market Size

China E Paper Display Market Size

India E Paper Display Market Size

Germany Facial Recognition Market Size

UK IGBT Market Size

Italy Hardware Security Modules Market Size

Homologation Market Size

Canada Fiber Optic Sensor Market Size

0 notes

Text

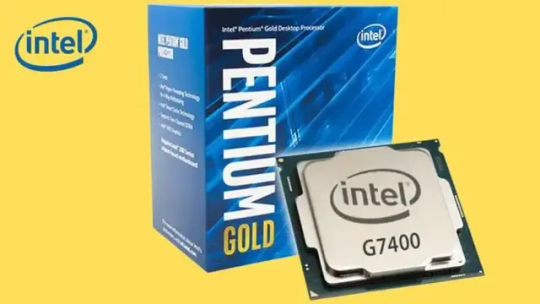

Intel Pentium Gold G7400 Benchmark, Specs and Price

Alder Lake-based Intel Pentium Gold G7400 is a cheap desktop processor. It performs well for entry-level users, small business PCs, and modest multimedia or gaming configurations despite its inexpensive price. This document details the G7400's specs, benchmarks, comparisons, and best practices.

Intel UHD 710

A major upgrade from Pentium-class integrated graphics is the UHD 710 iGPU. Although less powerful than an AMD Radeon Vega iGPU or Iris Xe, it can:

Play 720p or 1080p videos easily.

Simple browser or indie game management.

Drive up to 4K at 60Hz for media.

Customers who don't play many games or undertake GPU-intensive jobs will find the UHD 710 reliable and power-efficient.

Budget DDR5 Memory Compatibility

One of its best features is that the Intel Pentium Gold G7400 can support DDR5 memory, one of the cheapest CPUs that can. Despite DDR5's increased cost, the chip is compatible with DDR4-3200 kits. Budget builders can maximise memory options with this flexibility.

Ideal Intel Pentium Gold G7400 Use Cases

G7400 is suited for some user groups that need reliable performance without going over budget:

Students: Great for online courses, research, and remote learning.

Office PCs: Manage email, Word, Excel, and Zoom easily.

HTPCs play 4K videos smoothly and efficiently.

Budget Gaming Builds: GTX 1650 and RX 6400 graphics cards enable casual gaming.

Entry-Level Linux Servers: The Intel Pentium Gold G7400 is efficient enough for home labs and lightweight servers.

Motherboard compatibility, platform longevity

Because of its LGA 1700 socket, the G7400 supports many Intel 600 and 700 series motherboards, including:

H610 (best for cheap building)

B660 improves memory and connection overclocking

Z690 (possible but excessive)

LGA 1700 is advanced with PCIe 5.0 and faster NVMe SSDs. Even with the G7400, upgrading to a Core i5 or i7 is simple.

Thermal Efficiency, Cooling

Intel Pentium Gold G7400 runs quietly and coolly at 46W TDP. Even Intel's factory cooling maintains optimal temperatures under load. This is ideal for fanless or low-noise PCs.

The G7400 outperforms AMD's Athlon products in practically every category, including architecture, memory support, PCIe lanes, and multimedia iGPU.

Future-proofing and upgrading

In spite of being an entry-level CPU, the Intel Pentium Gold G7400 is worth it. Since it uses LGA 1700:

Upgrade without replacing the motherboard to Intel Core i3-12100, i5-12400, or i7-12700.

Platform life is extended via Resizable BAR, PCIe Gen 4/5, and DDR5.

Without a complete system redesign, builders can start small and grow.

Price of Intel Pentium Gold G7400

The Intel Pentium Gold G7400 costs $65–$80 USD, depending on location and availability. Large online retailers including Amazon, Newegg, and Micro Centre stock it.

A desktop PC with the G7400, a H610 motherboard, and 8GB of DDR4 RAM can cost about $250 for many workloads.

In conclusion

The powerful dual-core Intel Pentium Gold G7400 defies low-end CPU clichés. Performance, platform support, and upgradeability make this CPU ideal for students, budget gamers, and home cinema system builders.

DDR5, PCIe 4.0/5.0, UHD 710 Graphics, and excellent single-core performance distinguish it in the entry-level market. You should start with the G7400 if you want a CPU that delivers more than it costs.

#IntelPentiumGoldG7400#IntelPentiumGold#PentiumGoldG7400Benchmark#IntelPentium#IntelUHDGraphics710#GoldG7400#technology#technews#technologynews#news#govindhetch

0 notes

Text

Price: [price_with_discount] (as of [price_update_date] - Details) [ad_1] From the manufacturer Centralized backup solution for your digital devices Synology's comprehensive multi-version backup solutions protect your digital assets on computers (Windows/Mac) and mobile phones (Android/iOS) against malicious attacks, including the rising threat from encryption-based ransomware. Stream content to your TV Turn your Synology NAS into a home media hub and stream your digital content to your favorite electronic devices, including computers, mobile devices, Samsung TV, Apple TV, Google Chromecast, and DLNA devices. Seamless integration with your mobile devices Synology mobile applications are designed to give you quick and secure access to your data wherever you are. File Server/Management Powerful built-in file management and sharing services. Multimedia Complete multimedia solution for management, streaming, and playback. Hyper Backup Store multiple backup versions with block-level incremental data backup and cross-version deduplication. Security Comprehensive built-in security tools are constantly updated to protect your devices against evolving threats. Hardware Spec CPU Realtek RTD1296 (64-bit, 4-core 1.4 GHz) Memory 512 MB DDR4 non-ECC Drive Bays 2 Compatible Drive Type 3.5" SATA HDD/2.5" SATA HDD/2.5" SATA SSD Maximum Internal Raw Capacity 32 TB (16 TB drive x 2) RJ-45 1GbE LAN Port 1 USB 3.0 Port 2 File System (Internal Drives) EXT4 File System (External Drives) EXT4/EXT3/FAT/NTFS/HFS+/exFAT*

A Simple-to-Use Private Cloud for Everyone Award-winning DiskStation Manager (DSM) brings intuitive operation flow and reduces learning curve Access and share data with any Windows, macOS, and Linux computers or mobile devices Integrated media server to support multimedia content streaming [ad_2]

0 notes

Text

A-Tech 128GB Kit (2x64GB) DDR4 2933MHz PC4-23400 ECC RDIMM 2Rx4 Dual Rank 1.2V ECC Registered DIMM 288-Pin Server & Workstation RAM Memory Upgrade Modules (A-Tech Enterprise Series)

See on Amazon A-Tech 128GB Kit (2x64GB) If you’re in the market for a high-performance RAM upgrade for your server or workstation, look no further than the A-Tech 128GB Kit. This kit consists of two 64GB modules that work together to deliver speeds up to 2933MHz, making it an ideal choice for demanding applications and workloads. One of the standout features of this kit is its use of ECC…

0 notes

Text

Hexadata HD-H261-H61 Gen001 – 2U High-Density Server for Optimal Performance

The Hexadata HD-H261-H61 Ver: Gen001 is a 2U high-density server engineered to support a wide range of CPU SKUs, delivering enhanced performance with higher CPU frequencies and improved turbo profiles. It accommodates up to 2933MHz DDR4 memory, ensuring rapid data processing and increased capacity. Designed with advanced thermal solutions, this server efficiently supports CPUs with up to 165W TDP, making it ideal for demanding enterprise applications.

Key Features:

Support for a broad range of Intel® Xeon® Scalable processors

Up to 2933MHz DDR4 memory speed and increased capacity

Advanced thermal design for CPUs up to 165W TDP

High-density fan configurations for efficient cooling

Optimized for enterprise-level performance and reliability

for more detail, visit: Hexadata HD-H261-H61 Ver: Gen001 | 2U High Density Server

#2u high-density server#Hexadata HD-H261-H61#Intel Xeon Scalable#DDR4 memory#enterprise server solutions#high-performance computing#Hexadata

0 notes

Text

Why Major Mix Brand Pulled RAM is a Budget-Friendly Upgrade for Your PC

If your computer is slowing down or struggling with multitasking, upgrading your RAM is one of the easiest and most cost-effective ways to breathe new life into your system. But what if you’re on a tight budget? That’s where Major Mix Brand Pulled RAM comes in—a smart, wallet-friendly alternative to brand-new memory modules.

What is Pulled RAM?

Pulled RAM refers to memory modules that have been carefully removed from working systems (often from enterprise environments, data centers, or upgraded PCs) and rigorously tested for reliability. Unlike generic "used" RAM, Major Mix Pulled RAM undergoes strict quality checks to ensure it performs like new—just without the premium price tag.

Why Choose Pulled RAM Over New?

1. Significant Cost Savings

New DDR4 RAM can cost anywhere from 30to30to100+ per stick, depending on capacity and speed. In contrast, pulled RAM from reputable sellers often sells for 50-70% less, making it ideal for budget-conscious builders, students, or small businesses.

2. Fully Tested & Reliable

Reputable vendors test pulled RAM using industry-standard diagnostics (like MemTest86 or manufacturer tools) to verify stability. Many even offer warranties, so you’re not taking a blind risk.

3. Perfect for Older Systems

If you’re upgrading an older PC or laptop that still uses DDR3 or slower DDR4, buying new RAM may be overkill. Pulled RAM offers a practical way to extend your machine’s lifespan without overspending.

4. Eco-Friendly Choice

Electronics waste is a growing problem. By choosing pulled RAM, you’re giving functional hardware a second life—reducing e-waste and supporting sustainable tech practices.

Who Should Consider Pulled RAM?

Gamers on a Budget: A 16GB DDR4 kit can boost performance in games like Fortnite or Valorant without breaking the bank.

Small Businesses: Bulk deals (e.g., 10x 16GB sticks for under $200) are great for office workstations.

DIY PC Builders: Ideal for budget builds, home servers, or testing rigs.

Final Thoughts

If you need a fast, reliable, and affordable RAM upgrade, Major Mix Brand Pulled RAM is a fantastic option. Just be sure to buy from trusted sellers (check reviews and return policies) and verify compatibility with your motherboard.

Want to Buy Pulled RAM in Bulk at Affordable Prices from VSTL?

If you're looking to buy pulled RAM in bulk at affordable prices, a leading global supplier offers high-quality, fully tested modules from top brands like Samsung, Kingston, and Crucial. Their inventory includes DDR3, DDR4, and DDR5 RAM in various capacities (8GB, 16GB, etc.), catering to both laptops and desktops. Each module undergoes rigorous testing for compatibility and performance, ensuring reliability. Bulk buyers benefit from competitive wholesale pricing, customization options, and global shipping, making it a cost-effective solution for businesses, resellers, or DIY builders.

0 notes

Text

PowerEdge R660:Your Strong Engine for Digital Transformation

In today's world where the digital wave is sweeping across the globe, data has become the most valuable asset for enterprises. How to efficiently process, analyze, and utilize data has become the key to winning the future. The Dell PowerEdge R660 server, a 2U dual-socket rack server designed for modern workloads, stands out as a powerful engine for enterprise digital transformation with its exceptional performance, flexible scalability, and reliable security.

Exceptional Performance to Meet Future Challenges

Powered by the 3rd Gen Intel® Xeon® Scalable processors, the PowerEdge R660 delivers robust computing performance, easily handling demanding workloads such as virtualization, databases, and artificial intelligence. Supporting up to 4TB of DDR4 memory, it ensures rapid processing of even the most complex datasets, meeting the ever-growing data processing needs of enterprises.

Flexible Scalability to Adapt to Business Growth

The PowerEdge R660 offers flexible storage and I/O options, supporting up to 10 x 2.5-inch or 4 x 3.5-inch drives, and can be configured with various RAID levels to meet the storage requirements of different application scenarios. Its abundant PCIe slots and network interfaces provide ample room for future business expansion.

Secure and Reliable, Ensuring Data Peace of Mind

The PowerEdge R660 features a multi-layered security design, safeguarding data from hardware, firmware, to software. It supports silicon-rooted trust, secure boot, and system lockdown, effectively defending against various security threats and ensuring enterprise data security.

Intelligent Management, Simplifying Operations

Equipped with iDRAC9 with Lifecycle Controller, the PowerEdge R660 enables automated server deployment, monitoring, and management, simplifying IT operations and reducing management costs. Integrated with OpenManage Enterprise, it provides a centralized server management platform, helping enterprises achieve comprehensive control over their IT infrastructure.

Empowering the Future, Achieving Infinite Possibilities

The PowerEdge R660 server, with its exceptional performance, flexible scalability, reliable security, and intelligent management features, provides strong momentum for enterprise digital transformation. Whether building a private cloud, deploying AI applications, or conducting big data analytics, the PowerEdge R660 can meet your needs, helping enterprises unleash the power of data and empower future innovation.

Choose PowerEdge R660, Choose Infinite Possibilities for the Future!

0 notes

Text

DDR4 RAM Market to reach US$ 18,600 million by 2032, at a CAGR of -3.24%

Global DDR4 RAM Market size was valued at US$ 23,800 million in 2024 and is projected to reach US$ 18,600 million by 2032, at a CAGR of -3.24% during the forecast period 2025-2032.

DDR4 RAM (Double Data Rate 4 Synchronous Dynamic Random-Access Memory) represents the fourth generation of DDR memory technology. These high-speed memory modules deliver improved performance, lower power consumption (1.2V operating voltage), and higher data transfer rates (up to 3200 MT/s) compared to previous DDR3 standards. Key variants include 4GB, 8GB, 16GB and 32GB modules catering to different computing requirements.

While enterprise server upgrades continue driving bulk demand, the consumer segment shows strong growth due to gaming PCs and high-performance workstations. The 32GB module segment is projected to grow at 8.2% CAGR through 2032 as applications demand higher memory capacities. However, supply chain constraints and the gradual transition to DDR5 present challenges. Major manufacturers like Samsung (holding 42% market share) and SK Hynix are investing in production capacity expansions to meet growing demand across data center and automotive applications.

Get Full Report : https://semiconductorinsight.com/report/ddr4-ram-market/

MARKET DYNAMICS

MARKET DRIVERS

Proliferation of High-Performance Computing to Fuel DDR4 Demand

The global DDR4 RAM market is experiencing robust growth, driven by accelerating adoption across data centers, cloud computing, and enterprise applications. Modern workloads in artificial intelligence, machine learning, and big data analytics demand faster memory bandwidth and lower power consumption – capabilities where DDR4 excels over previous generations. The technology’s 50% higher bandwidth efficiency and 20% lower operating voltage compared to DDR3 make it indispensable for performance-intensive scenarios. Enterprise server deployments continue to favor DDR4 modules, with average per-server memory capacity growing 15-20% annually to handle virtualization and containerization requirements.

5G Infrastructure Rollout Accelerating Memory Requirements

Telecommunications infrastructure upgrades represent another significant growth vector. As 5G networks achieve broader deployment globally, base stations and edge computing nodes require high-density DDR4 solutions to manage increased data throughput. Network function virtualization (NFV) implementations particularly benefit from DDR4’s 3200 Mbps transfer rates when processing real-time analytics. The technology’s superior signal integrity also makes it ideal for the low-latency requirements of next-generation networks. Memory manufacturers report that 5G-related orders now account for over 30% of industrial DDR4 shipments, a figure projected to increase as standalone 5G cores become standard.

➤ Major hyperscale data centers are now standardizing on 64GB DDR4 RDIMMs as baseline memory configuration, driving double-digit year-over-year growth in enterprise segment.

Consumer electronics remain a vital market driver, with gaming PCs and workstations adopting higher-capacity DDR4 configurations. The shift toward hybrid work models has sustained demand for performance-optimized systems, where DDR4’s balance of speed and efficiency delivers tangible user benefits. This segment demonstrates particular elasticity, with premium configurations frequently outperforming market forecasts.

MARKET RESTRAINTS

DDR5 Transition Creating Market Uncertainty

While DDR4 maintains strong market positioning, the accelerating adoption of DDR5 technology introduces competitive pressures. Next-generation platforms from major CPU vendors now natively support DDR5, offering 50% greater bandwidth and improved power efficiency. This transition has created bifurcation in procurement strategies, particularly in the enterprise segment where long-term infrastructure planning must balance current DDR4 availability against future DDR5 roadmaps. Industry analysis suggests that while DDR4 will remain relevant through 2026, its share of new system deployments could decrease by 15-20% annually as DDR5 achieves price parity.

Other Restraints

Geopolitical Factors Affecting Supply Chains Trade restrictions and semiconductor export controls continue disrupting memory supply chains. Certain regional markets face 8-12 week lead times for specialty DDR4 products, forcing OEMs to maintain elevated inventory levels. These constraints particularly impact industrial and medical applications where component qualification processes limit supplier flexibility.

Pricing Volatility in Commodity Segments Standard DDR4 modules experience price sensitivity in consumer channels, with 10-15% quarterly fluctuations based on wafer allocation decisions. This volatility complicates inventory management for system integrators and distributors operating with narrow margins.

MARKET CHALLENGES

Thermal and Power Constraints in High-Density Configurations

As DDR4 implementations push density boundaries with 32GB and 64GB modules, thermal management becomes increasingly complex. Server deployments utilizing eight or more DIMMs per CPU socket must carefully balance performance targets with power budgets. Signal integrity challenges escalate at higher frequencies, requiring sophisticated PCB designs and voltage regulation modules that add 10-15% to bill of materials costs. These engineering constraints limit adoption in price-sensitive edge computing applications where simpler DDR3 solutions often remain technically adequate.

Manufacturers face additional validation challenges when supporting legacy platforms. With DDR4 specifications spanning multiple JEDEC standards and vendor-specific implementations, ensuring compatibility across generations of host controllers demands extensive qualification testing. This complexity particularly affects industrial applications requiring decade-long component availability guarantees.

MARKET OPPORTUNITIES

Emerging Applications in Automotive and IoT Ecosystems

Automotive computing architectures present significant untapped potential for DDR4 adoption. Advanced driver assistance systems (ADAS) and in-vehicle infotainment platforms increasingly require the reliability and bandwidth that DDR4 provides. With automotive memory markets projected to grow at 12% CAGR, suppliers are developing ruggedized modules meeting AEC-Q100 qualification standards. These solutions address the harsh operating environments of electric and autonomous vehicles while providing the deterministic latency required for safety-critical systems.

The proliferation of industrial IoT gateways creates adjacent opportunities. Smart manufacturing implementations utilize DDR4 in edge computing nodes that aggregate sensor data and run predictive analytics. Unlike consumer applications, these deployments prioritize longevity and stability over peak performance – characteristics aligning well with DDR4’s mature ecosystem. Suppliers now offer extended lifecycle versions with 7-10 year availability guarantees to meet industrial procurement requirements.

Memory technology transitions always create nuanced market dynamics. While DDR5 represents the future, DDR4’s cost-performance balance and extensive qualification base ensure its relevance across multiple industries for years to come. Strategic focus on high-value applications rather than broad commoditization will define supplier success during this transitional period.

DDR4 RAM MARKET TRENDS

Growing Demand for High-performance Computing Drives DDR4 Adoption

The global DDR4 RAM market continues to experience robust growth, driven by increasing demand for high-performance computing across multiple industries. DDR4 technology, offering superior bandwidth (up to 3200 Mbps) and lower power consumption (1.2V compared to DDR3’s 1.5V), has become the standard for modern computing systems. Recent market analyses indicate that the 32GB module segment shows the fastest growth, projected to expand at a compound annual growth rate exceeding 15% through 2032. This trend aligns with the requirements of data-intensive applications in AI, machine learning, and cloud computing sectors.

Other Trends

Consumer Electronics Miniaturization

The ongoing miniaturization of consumer electronics coupled with performance demands is reshaping DDR4 implementation strategies. Manufacturers are developing low-profile DDR4 modules with capacities reaching 16GB in single-die packages for ultra-thin laptops and IoT devices. The consumer electronics segment accounted for approximately 42% of total DDR4 shipments last year as premium smartphones increasingly incorporate LPDDR4X variants. This specialization enables 30% power reduction while maintaining performance benchmarks critical for battery-powered devices.

Automotive Sector Emerges as Strategic Growth Area

Automotive applications present a significant growth opportunity as vehicle architectures evolve toward connected and autonomous platforms. The automotive DDR4 market is projected to triple by 2028 as advanced driver assistance systems (ADAS) and in-vehicle infotainment require reliable, high-bandwidth memory solutions. These specialized automotive-grade modules feature extended temperature ranges (-40°C to 105°C) and enhanced error correction capabilities. Leading manufacturers have formed partnerships with Tier 1 automotive suppliers to develop customized solutions meeting stringent AEC-Q100 qualification standards.

Supply Chain Diversification

Recent geopolitical tensions have accelerated supply chain restructuring in the memory sector. While Samsung and SK Hynix maintain approximately 68% combined market share, regional players like China’s CXMT and Taiwan’s Nanya Technology are expanding production capacities. Industry reports indicate over $25 billion in new fabrication investments announced across Asia through 2026, targeting both mainstream DDR4 and next-generation technologies. This geographic diversification aims to mitigate risks while meeting growing demand, particularly in emerging markets where local sourcing requirements are becoming more prevalent.

COMPETITIVE LANDSCAPE

Key Industry Players

Memory Giants Compete Through Innovation and Strategic Capacity Expansions

The global DDR4 RAM market is dominated by a handful of memory semiconductor heavyweights, creating an oligopolistic competitive environment. As of 2024, the top five manufacturers collectively held approximately 78% of global revenue share, with Samsung Electronics maintaining its pole position through technological leadership in high-density modules and superior manufacturing yields. The South Korean giant’s market dominance stems from its vertical integration capabilities and continuous R&D investments exceeding $15 billion annually in semiconductor development.

SK Hynix and Micron Technology follow closely, leveraging their advanced fabrication facilities and patented memory architectures. These players are aggressively transitioning production to more advanced nodes (1α nm and below) to improve power efficiency and density – critical factors driving adoption in data center and mobile applications. Both companies recently announced billion-dollar expansions of their DRAM fab capacities in response to growing cloud infrastructure demand.

Meanwhile, emerging Chinese players like CXMT (ChangXin Memory Technologies) are disrupting the market through aggressive pricing and government-backed capacity expansions. While currently holding single-digit market share, these domestic champions are rapidly closing the technology gap through licensing agreements and reverse engineering.

List of Key DDR4 RAM Manufacturers

Samsung Electronics (South Korea)

SK Hynix (South Korea)

Micron Technology (U.S.)

Nanya Technology (Taiwan)

Winbond Electronics (Taiwan)

Powerchip Semiconductor Manufacturing Corp. (Taiwan)

ChangXin Memory Technologies (China)

Shenzhen Longsys Electronics (China)

Segment Analysis:

By Type

32G Segment Leads Growth Due to High-Performance Computing Demands

The market is segmented based on type into:

32G

16G

8G

4G

By Application

Consumer Electronics Dominates Market Share Owing to Proliferation of Smart Devices

The market is segmented based on application into:

Industrial Computers

Medical

Automotive

Consumer Electronics

Regional Analysis: DDR4 RAM Market

North America The North American DDR4 RAM market is characterized by strong demand from enterprise data centers, gaming industries, and high-performance computing applications. The U.S. dominates regional consumption, driven by technological advancements and significant investments in IT infrastructure. However, the gradual transition to DDR5 in premium segments is creating pricing pressures on DDR4 products. Major manufacturers like Micron Technology and Intel continue to innovate with higher-density modules (32G/16G) to meet data center needs. While commercial adoption remains steady, consumer demand is slowing due to market saturation and longer upgrade cycles.

Europe Europe’s DDR4 RAM market relies heavily on automotive electronics and industrial computing applications, where reliability and mid-range performance are prioritized. Germany and France lead in automotive semiconductor consumption, with DDR4 being integral to advanced driver-assistance systems (ADAS). However, strict EU regulations on energy efficiency and e-waste recycling are pushing manufacturers toward eco-design principles. The competitive landscape features strong local procurement policies, with companies like SK Hynix expanding production facilities in Eastern Europe. The region also sees steady demand from medical imaging systems, which require stable, high-bandwidth memory solutions.

Asia-Pacific As the largest regional market, Asia-Pacific benefits from massive electronics manufacturing hubs in China, South Korea, and Taiwan. Samsung and SK Hynix control significant market shares, benefiting from vertical integration with local OEMs. China’s push for semiconductor self-sufficiency has led to increased DDR4 production by domestic players like CXMT, though quality gaps remain compared to global leaders. The 16G segment dominates due to balanced cost-performance ratios favored by smartphone and PC manufacturers. Despite growing DDR5 adoption in flagship devices, DDR4 maintains strong demand across mid-tier consumer electronics and IoT devices.

South America The South American DDR4 RAM market faces constraints from currency volatility and reliance on imports, with Brazil being the primary consumption center. Local assembly of computers and servers creates consistent demand, but infrastructure limitations hinder large-scale data center growth. Price sensitivity leads to higher sales of 4G-8G modules for entry-level devices. Political instability in key markets occasionally disrupts supply chains, forcing distributors to maintain higher inventory buffers. Nonetheless, increasing digitization in banking and public sectors offers stable opportunities for industrial-grade memory solutions.

Middle East & Africa This emerging market shows fragmented growth patterns, with UAE and Saudi Arabia driving demand through smart city initiatives and data center construction. The lack of local semiconductor manufacturing results in complete dependence on imports, primarily from Asian suppliers. Government IT modernization projects sustain steady demand for server-grade DDR4, while consumer markets lag due to low disposable incomes. The region also serves as a secondary market for refurbished DDR4 modules from Europe and North America, creating price competition for new products. Long-term growth potential exists in 5G infrastructure deployments, which will require compatible memory solutions.

Download a Sample Report : https://semiconductorinsight.com/download-sample-report/?product_id=97961

Report Scope

This market research report provides a comprehensive analysis of the global and regional DDR4 RAM markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global DDR4 RAM market was valued at USD million in 2024 and is projected to reach USD million by 2032.

Segmentation Analysis: Detailed breakdown by product type (32G, 16G, 8G, 4G), technology, application (Industrial Computer, Medical, Automotive, Consumer Electronics), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant. The U.S. market size is estimated at USD million in 2024, while China is expected to reach USD million.

Competitive Landscape: Profiles of leading market participants including Samsung, SK Hynix, Intel, Micron Technology, and Nanya Technology, covering their product offerings, R&D focus, manufacturing capacity, pricing strategies, and recent developments.

Technology Trends & Innovation: Assessment of emerging memory technologies, integration with next-gen computing platforms, semiconductor design trends, and evolving industry standards.

Market Drivers & Restraints: Evaluation of factors driving market growth along with challenges, supply chain constraints, regulatory issues, and market-entry barriers.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

Customisation of the Report In case of any queries or customisation requirements, please connect with our sales team, who will ensure that your requirements are met.

Contact us:

+91 8087992013

0 notes

Text

High-Performance SSD & RAM Storage Solutions | Lampo Computers Pvt Ltd

In today’s fast-paced digital world, businesses and individuals require reliable, high-speed storage solutions to enhance system performance, improve efficiency, and reduce latency. At Lampo Computers Pvt Ltd, we provide cutting-edge SSD (Solid State Drive) and RAM (Random Access Memory) solutions that cater to diverse computing needs, from personal workstations to enterprise-grade servers.

Why Choose Our SSD Solutions?

Blazing-Fast Speeds – Experience ultra-fast boot times, seamless multitasking, and reduced application loading times.

Enhanced Durability – Unlike traditional HDDs, SSDs have no moving parts, making them more resistant to shocks and vibrations.

Power Efficiency – Our SSDs consume less power, improving battery life for laptops and reducing energy costs for enterprises.

Advanced NVMe & SATA Options – Whether you need lightning-fast NVMe PCIe SSDs or reliable SATA SSDs, we offer a variety of options tailored to your needs.

High-Performance RAM Upgrades

Boost System Speed – Our DDR4 and DDR5 RAM modules ensure smooth performance, minimizing lag during high-intensity tasks.

Optimized for Multitasking – Handle complex workloads, gaming, and professional applications effortlessly.

High-Capacity Modules – From 8GB to 128GB, we provide RAM solutions for desktops, laptops, and servers.

Reliable and Compatible – Our RAM modules undergo rigorous testing for compatibility with major motherboard brands.

Industries We Serve

Gaming & Content Creation – High-speed memory solutions for professional gaming rigs and video editing workstations.

Enterprise & Data Centers – Scalable storage solutions for businesses needing reliability and performance.

AI & Machine Learning – Advanced SSDs and RAM for high-performance computing and deep learning applications.

At Lampo Computers Pvt Ltd, we ensure you get the best SSD and RAM storage solutions tailored to your requirements. Contact us today to upgrade your system for unmatched speed, performance, and efficiency!

0 notes

Text

Intel Xeon Platinum 8480+: Modern Workload Scalability

Introduction

Sapphire Rapids and Xeon Platinum 8480+ were released by Intel. This generation prioritises memory bandwidth, I/O extension, AI acceleration, and compute density. It used Intel 7 (10nm Enhanced SuperFin) fabrication.

The 8480+, a flagship model in this generation, has 56 cores and 112 threads, a significant boost over prior Xeon variants.

Architectural Innovation

MCM Multichip Module

The Xeon Platinum 8480+ has four processing tiles coupled by an Intel EMIB in an MCM design. This architecture balances performance and manufacturing efficiency to improve yields and thermal characteristics.

Memory bandwidth and DDR5

The Xeon Platinum 8480+ supports DDR5-4800, which boosts bandwidth over DDR4. It supports large-scale simulations, AI inference, and in-memory databases with 8 memory channels.

Supports PCIe 5.0

This processor's 80 PCIe Gen 5.0 lanes can swiftly link GPUs, FPGAs, SSDs, and networking devices. This benefits accelerator card-based AI systems and hybrid cloud infrastructure.

Built-In Accelerators

The high-core Intel Xeon Platinum 8480+ contains hardware accelerators to relieve CPU cores of certain tasks.

Amx from Intel

AMX increases AI and deep learning performance by enabling matrix multiplication. It enhances inference tasks like image recognition and NLP.

Intel AVX512

Scientific computing, cryptography, and large-scale simulations use the AVX-512. It speeds up vector operations, which are crucial to HPC workloads.

Intel QuickAssist Technology

QAT increases security by outsourcing cryptography and compression and reducing CPU demand. Important for data centres that handle massive compression workloads or encrypted communications.

In-Memory Analytics Accelerator

IAA accelerates database workloads and data analytics by scanning, filtering, and transforming data in memory.

Applications in Real Life

The Xeon Platinum 8480+ is designed for industry-specific deployments and raw computation.

The Cloud and Virtualisation

The 8480+'s 56 cores and support for Intel VT-x, VT-d, and EPT boost hyperconverged infrastructure (HCI) and multi-tenant cloud systems. Consolidating workloads reduces overhead.

High-performance computing

Vector-heavy calculations in genomics, seismic studies, and aeronautical simulations benefit from the processor's AVX-512 and AMX.

Machine Learning, AI

This CPU can handle deep learning inference workloads without GPUs with built-in AI accelerators, saving money and energy.

Data Analysis

With its massive L3 cache and IAA, it can process large datasets directly in memory, speeding up ETL and OLAP.

Edge and network computing

DLB and Intel QAT give the Xeon Platinum 8480+ low-latency processing for 5G and telecom operators, making it ideal for high-throughput packets.

Security Upgrades

Modern infrastructure prioritises security, therefore Intel has multiple defences:

The Intel SGX software guard extensions for safe havens

Intel TME encrypts all memory.

Intel Boot Guard and PFR

Crypto Acceleration & Key Locker for fast, secure cryptography

Pricing, availability

The Xeon Platinum 8480+ MSRP is $10,710 USD, although vendor and volume buy agreements affect pricing. Dell, HPE, Lenovo, and Supermicro sell pre-configured and customised server platforms.

In conclusion

A strong server CPU for prospective data-driven activities is the Intel Xeon Platinum 8480+. DDR5 compatibility, PCIe 5.0, 56 cores, and integrated accelerators give it power and intelligent computing for AI, data analytics, and cloud infrastructure. Intel's ecosystem and customised accelerators make the 8480+ appealing to many organisations despite AMD EPYC series competition.

#XeonPlatinum8480#IntelXeonPlatinum#XeonPlatinum#Platinum8480#Intel8480#IntelXeon8480#technology#technews#technologynews#news#govindhtech

0 notes

Text

Price: [price_with_discount] (as of [price_update_date] - Details) [ad_1] From the manufacturer Compact and high performance NAS solution Synology DS220+ is a compact network-attached storage solution designed to streamline your data and multimedia management. It features smooth data sharing, video streaming, and photo indexing, as well as well-rounded data protection and recovery options. Accelerate demanding applications A more powerful CPU speeds up computing-intensive applications. Easily categorize your photo memories, smoothly manage files across computers and mobile devices, and enjoy blazing fast web applications. 2-core 2.0 GHz, burst up to 2.9 GHz 2 GB DDR4 memory (expandable up to 6GB) Two USB 3.0 ports Provides over 225 MB/s sequential read and 192 MB/s sequential write throughput* *Performance figures may vary depending on the environment, usage, and configuration File sharing and syncing With comprehensive support for network file sharing protocols — like CIFS, AFP, NFS, FTP and more — DiskStation allows the entire office to centralize files and collaborate on projects. Or synchronize files across multiple devices or even across several locations so remote teams can work together. Your own personal multimedia server DiskStation allows you to transcode H.265/H.264 4K videos to 1080p and stream them to high-definition TVs, digital media players, mobile handsets, and computers in the required format, making it easy to watch your entire multimedia library without having to install a 3rd party player. Bulletproof backup Maintain control of your data and ensure your files are safe with Synology. We provide secure, reliable, and affordable solutions that make it easy to backup files for all your devices and protect yourself from accidental data loss. 24/7 smart security solution Surveillance Station delivers intelligent monitoring and video management tools such as managing multiple IP cameras with live streaming, integration of I/O modules and more to help safeguard all the important places in your life. Easy file access with QuickConnect Access your files anywhere, any time, over the Internet without the hassle of setting up port forwarding rules, DDNS, or other complicated network settings.

QuickConnect allows you to connect via a simple customizable address so that you can instantly access media and work files on any Windows/Mac/Linux computer, laptop, or mobile device without additional charge. More Than Just Storage DS220+ is more than just storage, featuring a suite of add-on applications via Synology Package Center. With 90+ apps to choose from, you can transform your Synology NAS into an all-in-one server, cloud syncing host, multimedia hub, and much more. Rest assured your data remains safe and secure DiskStation offers an arsenal of security enhancements and tools to safeguard your data from malicious or snooping parties. You can block threats with the firewall, auto-blocking, and more. Audit configurations, detect weak passwords, and ensure the system remains free of vulnerabilities with the built-in Security Advisor. Lock down data storage and network communication with sophisticated AES encryption and SSL certification/Let’s Encrypt tools. Integrate into your business environment With the support of Windows AD, LDAP, and Domain Trust, DS220+ enables seamless account integration. Windows ACL support allows admins to fine-tune access controls and set up privileges to files and folders. For larger deployments, the Central Management System (CMS) application delivers a single-pane-of-glass admin console, where you can batch manage multiple Synology products by automating tasks and setting up policies.

Add to Cart Customer Reviews 4.7 out of 5 stars 2,427 4.7 out of 5 stars 409 4.8 out of 5 stars 914 4.8 out of 5 stars 1,721 Price ₹33,895.00₹33,895.00 — no data — no data — no data Drive Bays 2 4 2 4 Maximum Drive Bays with Expansion Unit 2 4 7 9 CPU 2-core 2.0 (base) / 2.9 (burst) GHz 2-core 2.0 (base) / 2.9 (burst) GHz 4-core 2.0 (base) / 2.7 (burst) GHz 4-core 2.0 (base) / 2.7 (burst) GHz Memory 2 GB DDR4 (Expandable up to 6GB) 2 GB DDR4 (Expandable up to 6GB) 2 GB DDR4 (Expandable up to 6GB) 4 GB DDR4 (Expandable up to 8GB) Compatible Drive Type 3.5" SATA HDD, 2.5" SATA HDD, 2.5" SATA SSD 3.5" SATA HDD, 2.5" SATA HDD, 2.5" SATA SSD, M.2 2280 NVMe SSD 3.5" SATA HDD, 2.5" SATA HDD, 2.5" SATA SSD, M.2 2280 NVMe SSD 3.5" SATA HDD, 2.5" SATA HDD, 2.5" SATA SSD, M.2 2280 NVMe SSD Maximum Internal Raw Capacity 32 TB (16 TB drive x 2) (Capacity may vary by RAID types) 64 TB (16 TB drive x 4) (Capacity may vary by RAID types) 32 TB (16 TB drive x 2) (Capacity may vary by RAID types) 64 TB (16 TB drive x 4) (Capacity may vary by RAID types) RJ-45 1GbE LAN Port 2 (with Link Aggregation / Failover support) 2 (with Link Aggregation / Failover support)

2 (with Link Aggregation / Failover support) 2 (with Link Aggregation / Failover support) USB 3.0 2 2 2 2 Effortless Data Sharing & Synchronization Entertaining Multimedia Hub Accelerated Application Performance Protect and Restore Data in a Snap Hardware Platform: Diskstation Manager(Dsm); Hardware Interface: Usb3.0; Hard Disk Description: Disk-Less [ad_2]

0 notes

Text

A-Tech 64GB Kit (2x32GB) DDR4 2400MHz PC4-19200 ECC RDIMM 2Rx4 Dual Rank 1.2V ECC Registered DIMM 288-Pin Server & Workstation RAM Memory Upgrade Modules (A-Tech Enterprise Series)

See on Amazon A-Tech Enterprise Series I’m impressed with the A-Tech 64GB RAM kit, specifically designed for select DDR4 servers and workstations. The kit consists of two 32GB modules, each running at 2400MHz speed. As a serious upgrade for high-performance systems, this memory is ECC Registered RDIMM, which ensures reliability and accuracy in data processing. With its dual rank design, the…

0 notes

Text

Exploring the MOREFINE Ryzen 9 8945HS AMD Mini PC: Power Meets Portability

MOREFINE Rzyen 9 8945HS AMD Mini PC R7 8845HS 2xDDR5 2xPCIe4.0 2x2.5G LAN Windows11 MINI PC Desktop Computer Gaming PC WiFi6

👉👉Buy now: https://youtu.be/dYanCvcqtGQ

🔥🔥 DISCOUNT: 68% 🔥🔥

In today’s digital landscape, the demand for compact yet powerful computing solutions has never been greater. The MOREFINE Ryzen 9 8945HS AMD Mini PC is a shining example of this trend, combining high performance with portability to meet the needs of gamers, professionals, and tech enthusiasts alike. With features such as dual DDR5 RAM slots, PCIe 4.0 support, dual 2.5G LAN ports, and WiFi 6 capabilities, this mini PC is redefining what a small form factor computer can achieve.

Performance at the Core