#DigitalPublicInfrastructure

Explore tagged Tumblr posts

Text

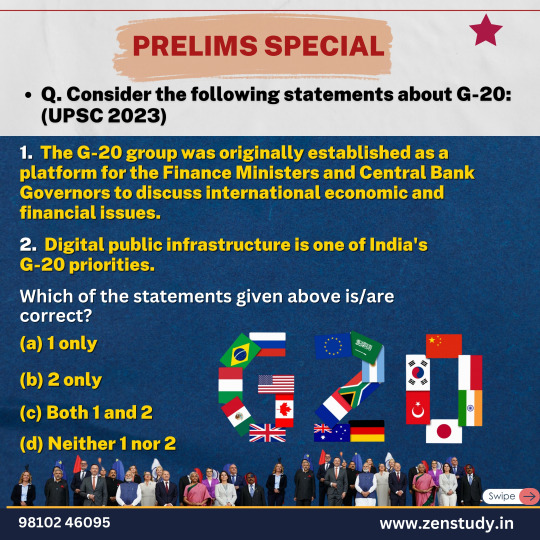

G-20 in UPSC 2023 – Know What Was Asked!

G-20 has become a key topic in UPSC prelims and mains alike! In UPSC 2023, candidates were tested on their knowledge of G-20’s origin and India’s leadership role. The group was initially created to bring together Finance Ministers and Central Bank Governors for discussions on global economic stability. Under India’s presidency, Digital Public Infrastructure became a top agenda, showcasing India's tech leadership. If you’re aiming for UPSC, stay updated on international groupings and India’s evolving role. Follow ZenStudy for daily UPSC content, mock tests, and explainer posts that simplify complex topics. Prep smart, prep current!

🌐 Website: https://zenstudy.in/ 📲 Telegram: https://t.me/Zenstudyltd 📘 Facebook: https://www.facebook.com/profile.php?id=61555473406607 📸 Instagram: https://www.instagram.com/zenstudyz/ ▶️ YouTube: https://www.youtube.com/@Zenstudyz

#G20#UPSC2023#UPSCPrelims#IndiaG20#DigitalPublicInfrastructure#UPSCPreparation#UPSCQuestion#UPSCPolity#G20Summit#GlobalGovernance#IASAspirant#UPSCIndia#UPSCFacts#CurrentAffairs2025#G20India#InternationalRelationsUPSC#UPSCMotivation#G20Explained#UPSCMockTest#UPSCNotes#UPSCUpdates#UPSCWithZenStudy#UPSCExamReady#G20History#EconomicIssues#IndianDiplomacy

0 notes

Text

#Protean eGov Technologies#GoogleCloud#DigitalPublicInfrastructure#deployment#GenerativeAI#sectors#electronicsnews#technologynews

0 notes

Text

How RWA Tokens are Leading DeFi?

As per SkyQuest, the market size of Decentralized Finance (DeFi) was $22 billion in 2022, which increased to $23.99 billion in 2023. The market is projected to reach $48.25 billion at a CAGR of 9.06% by 2031. What is the reason for this exponential growth? There are two main reasons: First, it excludes third-party involvement, and second, it is cost-effective.

Based on smart contracts and peer-to-peer networks, DeFi is a revolutionary idea that has completely changed the financial ecosystem. The rising popularity of Real-World Assets (RWA), Decentralized Exchange (DEX), the insurance and gaming industry, and Esports surged the market of DeFi. The key components like ease of use, accessibility, and transparency are the key driver for its exponential growth.

Also, there is a growing trend among developers to use Decentralized Finance tokens for in-app purchases. For example, Uniswap, a P2P system that allows the users to bet on variety of things like token trading, swapping digital assets on decentralized exchanges and many more. Blockchain based technology provides prediction solutions for various industries including networking systems, trading platforms, esports, and supply chain management enable you to explore new opportunities in tech-based world order.

How RWA Stabilizing DeFi?

Market analysts are propounding to integrate Real World Assets (RWAs) into the DeFi system. Real World Assets (RWA) are digital tokens that contain the value of real-world assets and are established as financial assets, unlike cryptocurrencies. The main drawback of cryptocurrencies is their unpredictable market value due to constant fluctuation in their price therefore, RWA tokens come in handy as their physical value gives a level of security and predictability to the investors.

Many companies are developing a DeFi system for RWA tokens. For instance, KALP, a Digital Public Infrastructure (DPI) offers a platform that allows asset holders to efficiently tokenize their real-world assets. It provides a platform to the growing network of financial institutions and investors by leveraging standard security measures to protect the assets.

Today, the market cap of Real-World Assets is $6.28 billion, which reflects a daily change of +0.09%. According to Standard Charter, this market will grow to become $30 trillion by 2034. Stakeholders are predicting the next three years as a critical junction for real world assets tokens. This is why industries are collaborating with a wide-range of stakeholders from financial institutions, government, investors, and other regulators to unlock the potential of trillion-dollar tech-industry.

How are RWAs Used in DeFi?

There are many viable uses of RWA as tokens in new tech-based global financial market. Here are some of the examples how RWAs are used in Decentralized Finance:

Tokenization

Creating digital tokens of Real-World Assets like real estate, invoices, commodities, and artworks is one of the use cases of RWAs in DeFi. This process includes creating a single or more than one digital token providing the ownership in an underlying asset. It opens new areas of investment involving many stakeholders. Investors can easily buy their stakes in RWA.

Secure Loans

Unlike cryptocurrency-based loans, digital tokens provide more tangible security to the stakeholders. These tokens are more stable and allow lenders to increase borrowing limits and fixed interest rates as there will be tangible collateral securities at their disposal.

Yield Farming Benefits

RWAs benefits are not limited to organizations. Token stakeholders can also benefit by earning interest on transactions. For instance, if you contribute to the liquidity pool of real estate tokens as a stakeholder, you can earn yield through every transaction interest. It is a win-win situation for both owners and investors.

Global Market Access

DeFi eliminates geographical investment limitations and provides the best platform that caters to the investment needs of global audience. In layman term, an investor sitting in India can easily invest in real estate of Dubai through RWA. Thereby, an investor can diversify its portfolio while maintaining the fluidity of the market.

Conclusion

From global banks like JP Morgan to investors and creators, everyone is betting on this new blockchain-based technology. DeFi technology is rapidly emerging as a transformative force in finance that offers new solutions to age-old problems. Whereas RWA tokens are unlocking the new area of decentralized lending. It has the potential to develop a secure, transparent, and inclusive financial system for all.

For businesses that are looking for opportunities to offer RWA to their customers, KALP is your go-to platform. It provides the infrastructure for tokenizing, trading, and managing your RWAs. It bridges the gap between the asset owner and investors creating liquidity, diversity, and accessibility to the global financial market

0 notes

Text

Digital Foundation of Viksit Bharat: Leveraging DPI & Bridging the Divide @neosciencehub #ViksitBharat #DigitalPublicInfrastructure #BharatNet #neosciencehub

#Digital Public Infrastructure (DPI)#featured#sciencenews#the Open Network for Digital Commerce (ONDC)#Viksit Bharat

0 notes

Text

The Amrit Kal: Unveiling India's Economy Growth Post 2014 As the general elections for 2024 are nearing, it is very important for citizens of India to understand the importance of voting the right regime for economic prosperity of a given country. Catch the full story here: https://goo.su/48tCE By Samrat Pradhan, Managing Editor, #FinanceOutlookIndia #Indianeconomy #GeneralElections2024 #IndianVisionfor2047 #DigitalPublicInfrastructure #GST #MSMEs #growingeconomy #DigitalPublicInfrastructure

1 note

·

View note

Text

Why Biometrics is Inevitably Probabilistic ?

Dr Debesh Choudhury — Nice to have another informative newsletter. https://www.linkedin.com/pulse/probabilistic-nature-biometrics-recognition-makes-choudhury-phd

I would like to add that biometrics is not probabilistic because of the high signal-noise ratio of the electric circuits for scanning. Biometrics is probabilistic in nature because it measures the unpredictably variable body features of living animals in ever changing environment.

Ref: “What these 2 graphs tell us about biometrics” https://www.linkedin.com/pulse/what-2-graphs-tell-us-biometrics-hitoshi-kokumai

Passwords and physical tokens are deterministic because judging ‘Yes’ or ‘No’ on whether or not the presented passwords and physical tokens are correct/authentic are deterministic by nature.

Ref: “What We Know for Certain about Authentication Factors” https://www.linkedin.com/pulse/what-we-know-certain-authentication-factors-hitoshi-kokumai/

By the way, it is not possible to decide that deterministic passwords are more secure than probabilistic biometrics. — Comparison between deterministic passwords and probabilistic biometrics would get us nowhere, say, it is an attempt to compare what cannot be compared by nature. It might be likened to attempting to compare the weight of my head and the warmth of your heart.

That the biometrics used with a default/fallback password in a two-entrance/in-parallel formation would provide the level of security lower than a password-only authentication, is an inevitable scientific conclusion.

Well, you might also be interested in this happy-go-lucky biometrics discussion, which Dr Choudhury and I jumped into — https://www.linkedin.com/posts/sandeepalur_digiyatra-digitalpublicgoods-digitalpublicinfrastructure-activity-7076957506379415552-m2Ol

0 notes