#Doig & Swift

Explore tagged Tumblr posts

Text

#rottmnt#rise of the teenage mutant ninja turtles#animatic#video#the movie#Old Swifty#Michael Doig#Doig & Swift#mad dogs#donnie#leo#mikey#raph#kraang

2K notes

·

View notes

Text

Doig and swift fan art!

#doig and swift#art#fan art#fanart#bird#bear#furry#game design#gamedev#indiegamedev#cartoon#illuistration#illustrator#artist#digital art#drawing#my art#artists on tumblr

18 notes

·

View notes

Note

Hey Evay! Have you ever watched Brooklyn Nine-Nine? The main character Jake Peralta gives me SUCH Sonic vibes 🤣

His playful crush on Amy (happy coincidence her name is also Amy in the show lol) is also so on brand too I feel - the constant teasing without him really realizing he’s into her lmao it’s so good

I love Brooklyn Nine-Nine! And yes, I completely agree with the parallels between Jake & Sonic and Amy & Amy haha. Speaking of, have you seen the Sonic/B99 animatic by Doig & Swift? I've shared it on this blog before but I'll always reshare it because it's perfect. AND it's got Sonic as Jake and Amy as Amy 😘

#ask me#evayQA#brooklyn 99#b99#jake peralta#amy santiago#sonic the hedgehog#amy rose#sonamy#sonic trash

60 notes

·

View notes

Text

youtube

Just kinda causally dying over this amazing amv by Doig & Swift over on YouTube nbd 😍

#seriously its so fucking good#rottmnt#rottmnt donnie#rottmnt leo#rottmnt raph#rottmnt mikey#rottmnt splinter#rottmnt april#rottmnt shredder#video edit#amv#whats up danger#rise of the teenage mutant ninja turtles#Youtube

22 notes

·

View notes

Text

Links to all the storyboards so far!

Posted by @/eatherstar, @/jjconway, @/Doig and Swift (YouTube) and others.

Season 1, Episode 6 (Traditions) - Alex talks to Robby and Bee

youtube

Season 1, Episode 10 (Age of Evolution) - "Careful, Little Bird" / Battle against Mandroid

youtube

Season 1, Episode 13 (Missed Connection) - Nightshade's invention malfunctions in the Dugout

youtube

Season 1, Episode 16 (Warzone) - Megatron explains the story of the Allspark, flashback scene to Shockwave and Megatron's fight

youtube

Season 1, Episode 16 (Warzone) - Deleted Scene: Prison Blues

youtube

Season 1, Episode 26 (Last Hope) - Finale, Parts 1, 2, and 3

This will be updated with more storyboards when I find them! I know a few are missing from this list already.

#>> mod: firefly#{ important }#earthspark#transformers earthspark#tf earthspark#earthspark spoilers#tfe#transformers#maccadam#tfes#Youtube

342 notes

·

View notes

Photo

This week, Dior announced it would part ways with men’s artistic director Kim Jones.A masterful tailor and deft curator of men’s style, Jones reconnected Dior Homme with the brand’s founding codes — creating a regal fantasy filled with draped jackets, floral motifs and pearl embellishments — as well as a proposing utilitarian everyday luxuries like combat boots and bomber jackets. The brand cultivated a younger, more global audience by collaborating with brands like Nike, Birkenstock and Stone Island as well as animating its collections by teaming up with contemporary artists such as Peter Doig, Hylton Nel, Kaws and more.Jones was prolific, creating two men’s shows in Paris each year, traveling shows for pre-fall, and countless commercial capsules. And his vision helped fuel rapid growth: Dior’s sales of men’s products grew by around five-fold, topping 1.2 billion by 2021 according to market sources (owner LVMH does not break out sales for individual brands). It’s hard to imagine, then, why Dior would let Jones go. (The English designer’s next moves are not known). But a broader shakeup is in the works at Dior, where sources say LVMH is preparing to transfer Jonathan Anderson, the star designer of its breakout Loewe unit, to a top creative role.In addition to Jones’ exit, industry sources say womenswear artistic director Maria Grazia Chiuri is also on the way out. A pre-fall show in Kyoto in April and a cruise show in Rome, her hometown, in May are expected to be her last outings for the brand. Chiuri, too, has transformed Dior with a collaborative, globally-minded and commercially potent vision. Her storytelling has elevated women artists, photographers, filmmakers and craftspeople, while a keen eye for product design helped the brand create a broader menu of commercial hits across categories, which powered rapid growth and reduced the brand’s dependence on its flagship Lady Dior range.According to HSBC estimates, Dior’s overall sales almost quadrupled from €2.7 billion in 2018 to more than €9 billion in 2023. But the brand started to slip in 2024. While LVMH has only signalled that Dior’s growth is “slightly below average,” analysts say sales may have declined by a double-digit percentage in recent months. At a press conference Tuesday, LVMH chairman Bernard Arnault emphasised that Dior continues to outperform other French couture houses in a rocky market. But his company is known for taking swift action at the first sign of softness at its fashion brands, often preferring to open a new cycle of growth than defend an old one.The reasons Dior is ready for a creative shakeup go beyond commercial softness. At the brand’s haute couture show Monday, a key ingredient was missing amid the crowd crush of celebrity ambassadors and camera crews: genuine anticipation for the clothes. New silhouettes and masterful craft techniques proposed by Chiuri faded into the backdrop — literally in this case, as the collection was shown once more against a monumental tapestry in a black box behind the Musée Rodin. After more than 8 years of Chiuri staging 6 collections per year across ready-to-wear and couture, the necessary tension between a fashion brand and its audience — where anticipation builds before each new collection — has eroded, giving way to an ethos of push, push, push. Dior risks falling into a similar trap as Alessandro Michele’s Gucci, whose boom was driven by brushing off critique and staying true to its designer’s vision. But that support became counterproductive, and it found itself stuck in an aesthetic that felt increasingly time-stamped. Similarly, Dior stood by Maria Grazia Chiuri’s vision for a more casual, joyful and easy-to-wear couture house, giving the designer time to reinforce her vision with layers of research and craft that eventually won over many early critics. The problem, then, becomes realising when the detractors are right. In recent seasons, the brand has continued to put its full marketing muscle behind its womenswear image, rolling it out across categories (including, for the first time, cosmetics and perfume), perhaps without paying enough attention to signs it was losing appeal.The picture isn’t terribly different for Dior men’s, whose thundering string soundtracks and streetwear-inflected collaborations increasingly felt like business as usual.As Dior struggles to respond to a softer luxury market with ultra-consistent creativity, CEO Delphine Arnault has brought in additional management support: including a new managing director hired from Miu Miu, Benedetta Petruzzo, and a new chief commercial officer, Nicolas Baretzski, as well as elevating longtime communications boss Olivier Bialobos to the role of deputy CEO. But in the absence of new stories to tell, teams are left to iterate faster and louder.“Consistency, having collections that build on each other — that’s a good thing in fashion, but it can only take you so far. There’s the risk that the market will eventually lose interest,” said Alice Bouleau, partner at executive search firm Sterling International. While details of the transition remain unconfirmed, sources say Anderson is gunning for sweeping authority across men’s and women’s — which would see the lines unified under a single designer for the first time since the creation of Dior Homme under Hedi Slimane in 2001.Anderson understands that the context in which fashion collections are shown can be as important as their content. While Dior’s sprawling machine helped power years of recent expansion, an exacting, directional designer with a broad creative mandate may now be needed to update some of the more cheesy elements of the brand’s template.Following up either Jones’ or Chiuri’s era-defining, best-selling visions is sure to be a Herculean task — to do both at once may be near impossible. But it just might work.THE NEWS IN BRIEFFASHION, BUSINESS AND THE ECONOMYLVMH growth boosts luxury outlook. The sector bellwether beat expectations with a 1 percent rise in fourth-quarter sales. The growth outpaced an expected 1.6 percent decline, according to a consensus forecast cited by Morgan Stanley.LVMH and Stella McCartney brand part ways. The designer is buying back LVMH’s minority stake in her namesake label but will continue to advise the group on sustainability issues as a Global Ambassador on Sustainability.Burberry soars after US demand pickup. Retail sales fell 4 percent on a comparable basis, Burberry said in a statement Friday, better than the drop of almost 13 percent forecast by analysts. Sales in the Americas unexpectedly climbed, while China fell less than estimates.Zegna Group returns to growth in the fourth quarter. The group’s fourth-quarter revenue reached €589 million ($619 million), up 3 percent year-on-year. The return to growth in the fourth quarter is driven by the strength of the Zegna brand, where revenue rose 8 percent.Ferragamo’s sales were down 4 percent in the fourth quarter. Sales in the North American region, which accounted for 29 percent of total revenue, were up 6.3 percent in the quarter. Overall preliminary revenues reached 1.03 billion euros ($1.07 billion) in 2024, in line with analysts' estimates.Mytheresa to rename parent company after YNAP acquisition. Mytheresa is planning to rename its parent company, MYT Netherlands Parent B.V., to LuxExperience once its deal to acquire its luxury e-commerce rival Yoox-Net-a-Porter closes in the first half of the year. The company’s flagship site, Mytheresa, will keep its name.Alessandro Michele staged his couture debut for Valentino. The star designer opted for a multimedia performance over a traditional couture defilé. The garments were more convincing as costumes than clothes, reports Angelo Flaccavento.Black-owned brands urge US consumers not to boycott Target over end of diversity efforts. The companies and entrepreneurs urged against a boycott, saying they would lose revenue and consumer exposure, which would harm the brands more than the retailer. Some backers of a Target boycott call for buying directly from Black-owned brands' websites instead. Levi’s full-year guidance disappoints analysts. The San Francisco-based retailer is expecting revenue to fall 1 percent to 2 percent in fiscal 2025. The company cited the weakness of foreign currencies, one fewer week in the fiscal year, an exit from the footwear business and the discontinuation of its Denizen brand as reasons for a possible drop. VF Corp beats quarterly estimates as turnaround plan pays off. For the quarter ended Dec. 28, the company’s revenue rose 2 percent to $2.83 billion from a year ago, beating analysts' estimates of $2.75 billion. VF Corp has now beaten revenue and profit estimates for three successive quarters. H&M shares tumble as sales growth continues to disappoint. Sales, which edged up 3 percent for the fourth quarter, rose by less than analysts had projected during the crucial Christmas trading period. The sales weakness came even as the company posted operating profit for the three months ended November of 4.6 billion Swedish kronor ($420 million).Milan court to try influencer Chiara Ferragni for fraud over charity claims. Ferragni was fined almost €1.1 million ($1.14 million) in 2023 by Italy’s competition authority AGCM over sales of Ferragni-branded Pandoro Christmas cakes with packaging mentioning a children’s hospital. The trial was scheduled to begin on Sept. 23 at a court in Milan.Trump to hold off on 25 percent Colombia tariffs. His administration abruptly pulled the threat after reaching a deal on the return of deported migrants, a move that rattled global markets. Trump’s action upended decades of warm relations between the US and Colombia. Jewellery-shipper Ferrari group kicks off Amsterdam IPO plans. The controlling Deiana family will sell a 25 percent stake in the IPO, according to a statement. A valuation of more than $1 billion may be sought, Bloomberg reported. THE BUSINESS OF BEAUTYEstée Lauder reviews brands amid management change. The company is working with Evercore Inc. on the review, which could lead to the sale of some brands, according to people familiar with the matter. Shares in Estée Lauder rose as much as 4.7 percent in New York trading on Monday.Silas Capital invests in J-beauty brand Damdam. Damdam has raised $3 million in a seed funding round led by private equity and venture capital firm Silas Capital. The firm is responsible for the successful exit of Ilia Beauty. Nykaa expects strong growth as shoppers keep spending on luxury beauty. The company has seen annual revenues jump nearly fourfold to 64 billion rupees ($739 million) post-pandemic. Nykaa said it expects net revenues from the beauty business to grow “higher than mid-twenties.”PEOPLEKim Jones was awarded Chevalier de la Légion d’Honneur. The award was presented to him by Anna Wintour. Jones became a knight in the process. Before the ceremony, he described it as a “life milestone,” though he said notoriety was not his endgame.Glenn Martens named creative director of Maison Margiela. The Belgian designer, known for his work at Y/Project and Diesel, succeeds John Galliano as creative director of the French luxury house. Galliano announced his exit from Margiela in December after a successful ten-year run at the maison.Compiled by Yola Mzizi. Source link

0 notes

Photo

This week, Dior announced it would part ways with men’s artistic director Kim Jones.A masterful tailor and deft curator of men’s style, Jones reconnected Dior Homme with the brand’s founding codes — creating a regal fantasy filled with draped jackets, floral motifs and pearl embellishments — as well as a proposing utilitarian everyday luxuries like combat boots and bomber jackets. The brand cultivated a younger, more global audience by collaborating with brands like Nike, Birkenstock and Stone Island as well as animating its collections by teaming up with contemporary artists such as Peter Doig, Hylton Nel, Kaws and more.Jones was prolific, creating two men’s shows in Paris each year, traveling shows for pre-fall, and countless commercial capsules. And his vision helped fuel rapid growth: Dior’s sales of men’s products grew by around five-fold, topping 1.2 billion by 2021 according to market sources (owner LVMH does not break out sales for individual brands). It’s hard to imagine, then, why Dior would let Jones go. (The English designer’s next moves are not known). But a broader shakeup is in the works at Dior, where sources say LVMH is preparing to transfer Jonathan Anderson, the star designer of its breakout Loewe unit, to a top creative role.In addition to Jones’ exit, industry sources say womenswear artistic director Maria Grazia Chiuri is also on the way out. A pre-fall show in Kyoto in April and a cruise show in Rome, her hometown, in May are expected to be her last outings for the brand. Chiuri, too, has transformed Dior with a collaborative, globally-minded and commercially potent vision. Her storytelling has elevated women artists, photographers, filmmakers and craftspeople, while a keen eye for product design helped the brand create a broader menu of commercial hits across categories, which powered rapid growth and reduced the brand’s dependence on its flagship Lady Dior range.According to HSBC estimates, Dior’s overall sales almost quadrupled from €2.7 billion in 2018 to more than €9 billion in 2023. But the brand started to slip in 2024. While LVMH has only signalled that Dior’s growth is “slightly below average,” analysts say sales may have declined by a double-digit percentage in recent months. At a press conference Tuesday, LVMH chairman Bernard Arnault emphasised that Dior continues to outperform other French couture houses in a rocky market. But his company is known for taking swift action at the first sign of softness at its fashion brands, often preferring to open a new cycle of growth than defend an old one.The reasons Dior is ready for a creative shakeup go beyond commercial softness. At the brand’s haute couture show Monday, a key ingredient was missing amid the crowd crush of celebrity ambassadors and camera crews: genuine anticipation for the clothes. New silhouettes and masterful craft techniques proposed by Chiuri faded into the backdrop — literally in this case, as the collection was shown once more against a monumental tapestry in a black box behind the Musée Rodin. After more than 8 years of Chiuri staging 6 collections per year across ready-to-wear and couture, the necessary tension between a fashion brand and its audience — where anticipation builds before each new collection — has eroded, giving way to an ethos of push, push, push. Dior risks falling into a similar trap as Alessandro Michele’s Gucci, whose boom was driven by brushing off critique and staying true to its designer’s vision. But that support became counterproductive, and it found itself stuck in an aesthetic that felt increasingly time-stamped. Similarly, Dior stood by Maria Grazia Chiuri’s vision for a more casual, joyful and easy-to-wear couture house, giving the designer time to reinforce her vision with layers of research and craft that eventually won over many early critics. The problem, then, becomes realising when the detractors are right. In recent seasons, the brand has continued to put its full marketing muscle behind its womenswear image, rolling it out across categories (including, for the first time, cosmetics and perfume), perhaps without paying enough attention to signs it was losing appeal.The picture isn’t terribly different for Dior men’s, whose thundering string soundtracks and streetwear-inflected collaborations increasingly felt like business as usual.As Dior struggles to respond to a softer luxury market with ultra-consistent creativity, CEO Delphine Arnault has brought in additional management support: including a new managing director hired from Miu Miu, Benedetta Petruzzo, and a new chief commercial officer, Nicolas Baretzski, as well as elevating longtime communications boss Olivier Bialobos to the role of deputy CEO. But in the absence of new stories to tell, teams are left to iterate faster and louder.“Consistency, having collections that build on each other — that’s a good thing in fashion, but it can only take you so far. There’s the risk that the market will eventually lose interest,” said Alice Bouleau, partner at executive search firm Sterling International. While details of the transition remain unconfirmed, sources say Anderson is gunning for sweeping authority across men’s and women’s — which would see the lines unified under a single designer for the first time since the creation of Dior Homme under Hedi Slimane in 2001.Anderson understands that the context in which fashion collections are shown can be as important as their content. While Dior’s sprawling machine helped power years of recent expansion, an exacting, directional designer with a broad creative mandate may now be needed to update some of the more cheesy elements of the brand’s template.Following up either Jones’ or Chiuri’s era-defining, best-selling visions is sure to be a Herculean task — to do both at once may be near impossible. But it just might work.THE NEWS IN BRIEFFASHION, BUSINESS AND THE ECONOMYLVMH growth boosts luxury outlook. The sector bellwether beat expectations with a 1 percent rise in fourth-quarter sales. The growth outpaced an expected 1.6 percent decline, according to a consensus forecast cited by Morgan Stanley.LVMH and Stella McCartney brand part ways. The designer is buying back LVMH’s minority stake in her namesake label but will continue to advise the group on sustainability issues as a Global Ambassador on Sustainability.Burberry soars after US demand pickup. Retail sales fell 4 percent on a comparable basis, Burberry said in a statement Friday, better than the drop of almost 13 percent forecast by analysts. Sales in the Americas unexpectedly climbed, while China fell less than estimates.Zegna Group returns to growth in the fourth quarter. The group’s fourth-quarter revenue reached €589 million ($619 million), up 3 percent year-on-year. The return to growth in the fourth quarter is driven by the strength of the Zegna brand, where revenue rose 8 percent.Ferragamo’s sales were down 4 percent in the fourth quarter. Sales in the North American region, which accounted for 29 percent of total revenue, were up 6.3 percent in the quarter. Overall preliminary revenues reached 1.03 billion euros ($1.07 billion) in 2024, in line with analysts' estimates.Mytheresa to rename parent company after YNAP acquisition. Mytheresa is planning to rename its parent company, MYT Netherlands Parent B.V., to LuxExperience once its deal to acquire its luxury e-commerce rival Yoox-Net-a-Porter closes in the first half of the year. The company’s flagship site, Mytheresa, will keep its name.Alessandro Michele staged his couture debut for Valentino. The star designer opted for a multimedia performance over a traditional couture defilé. The garments were more convincing as costumes than clothes, reports Angelo Flaccavento.Black-owned brands urge US consumers not to boycott Target over end of diversity efforts. The companies and entrepreneurs urged against a boycott, saying they would lose revenue and consumer exposure, which would harm the brands more than the retailer. Some backers of a Target boycott call for buying directly from Black-owned brands' websites instead. Levi’s full-year guidance disappoints analysts. The San Francisco-based retailer is expecting revenue to fall 1 percent to 2 percent in fiscal 2025. The company cited the weakness of foreign currencies, one fewer week in the fiscal year, an exit from the footwear business and the discontinuation of its Denizen brand as reasons for a possible drop. VF Corp beats quarterly estimates as turnaround plan pays off. For the quarter ended Dec. 28, the company’s revenue rose 2 percent to $2.83 billion from a year ago, beating analysts' estimates of $2.75 billion. VF Corp has now beaten revenue and profit estimates for three successive quarters. H&M shares tumble as sales growth continues to disappoint. Sales, which edged up 3 percent for the fourth quarter, rose by less than analysts had projected during the crucial Christmas trading period. The sales weakness came even as the company posted operating profit for the three months ended November of 4.6 billion Swedish kronor ($420 million).Milan court to try influencer Chiara Ferragni for fraud over charity claims. Ferragni was fined almost €1.1 million ($1.14 million) in 2023 by Italy’s competition authority AGCM over sales of Ferragni-branded Pandoro Christmas cakes with packaging mentioning a children’s hospital. The trial was scheduled to begin on Sept. 23 at a court in Milan.Trump to hold off on 25 percent Colombia tariffs. His administration abruptly pulled the threat after reaching a deal on the return of deported migrants, a move that rattled global markets. Trump’s action upended decades of warm relations between the US and Colombia. Jewellery-shipper Ferrari group kicks off Amsterdam IPO plans. The controlling Deiana family will sell a 25 percent stake in the IPO, according to a statement. A valuation of more than $1 billion may be sought, Bloomberg reported. THE BUSINESS OF BEAUTYEstée Lauder reviews brands amid management change. The company is working with Evercore Inc. on the review, which could lead to the sale of some brands, according to people familiar with the matter. Shares in Estée Lauder rose as much as 4.7 percent in New York trading on Monday.Silas Capital invests in J-beauty brand Damdam. Damdam has raised $3 million in a seed funding round led by private equity and venture capital firm Silas Capital. The firm is responsible for the successful exit of Ilia Beauty. Nykaa expects strong growth as shoppers keep spending on luxury beauty. The company has seen annual revenues jump nearly fourfold to 64 billion rupees ($739 million) post-pandemic. Nykaa said it expects net revenues from the beauty business to grow “higher than mid-twenties.”PEOPLEKim Jones was awarded Chevalier de la Légion d’Honneur. The award was presented to him by Anna Wintour. Jones became a knight in the process. Before the ceremony, he described it as a “life milestone,” though he said notoriety was not his endgame.Glenn Martens named creative director of Maison Margiela. The Belgian designer, known for his work at Y/Project and Diesel, succeeds John Galliano as creative director of the French luxury house. Galliano announced his exit from Margiela in December after a successful ten-year run at the maison.Compiled by Yola Mzizi. Source link

0 notes

Photo

This week, Dior announced it would part ways with men’s artistic director Kim Jones.A masterful tailor and deft curator of men’s style, Jones reconnected Dior Homme with the brand’s founding codes — creating a regal fantasy filled with draped jackets, floral motifs and pearl embellishments — as well as a proposing utilitarian everyday luxuries like combat boots and bomber jackets. The brand cultivated a younger, more global audience by collaborating with brands like Nike, Birkenstock and Stone Island as well as animating its collections by teaming up with contemporary artists such as Peter Doig, Hylton Nel, Kaws and more.Jones was prolific, creating two men’s shows in Paris each year, traveling shows for pre-fall, and countless commercial capsules. And his vision helped fuel rapid growth: Dior’s sales of men’s products grew by around five-fold, topping 1.2 billion by 2021 according to market sources (owner LVMH does not break out sales for individual brands). It’s hard to imagine, then, why Dior would let Jones go. (The English designer’s next moves are not known). But a broader shakeup is in the works at Dior, where sources say LVMH is preparing to transfer Jonathan Anderson, the star designer of its breakout Loewe unit, to a top creative role.In addition to Jones’ exit, industry sources say womenswear artistic director Maria Grazia Chiuri is also on the way out. A pre-fall show in Kyoto in April and a cruise show in Rome, her hometown, in May are expected to be her last outings for the brand. Chiuri, too, has transformed Dior with a collaborative, globally-minded and commercially potent vision. Her storytelling has elevated women artists, photographers, filmmakers and craftspeople, while a keen eye for product design helped the brand create a broader menu of commercial hits across categories, which powered rapid growth and reduced the brand’s dependence on its flagship Lady Dior range.According to HSBC estimates, Dior’s overall sales almost quadrupled from €2.7 billion in 2018 to more than €9 billion in 2023. But the brand started to slip in 2024. While LVMH has only signalled that Dior’s growth is “slightly below average,” analysts say sales may have declined by a double-digit percentage in recent months. At a press conference Tuesday, LVMH chairman Bernard Arnault emphasised that Dior continues to outperform other French couture houses in a rocky market. But his company is known for taking swift action at the first sign of softness at its fashion brands, often preferring to open a new cycle of growth than defend an old one.The reasons Dior is ready for a creative shakeup go beyond commercial softness. At the brand’s haute couture show Monday, a key ingredient was missing amid the crowd crush of celebrity ambassadors and camera crews: genuine anticipation for the clothes. New silhouettes and masterful craft techniques proposed by Chiuri faded into the backdrop — literally in this case, as the collection was shown once more against a monumental tapestry in a black box behind the Musée Rodin. After more than 8 years of Chiuri staging 6 collections per year across ready-to-wear and couture, the necessary tension between a fashion brand and its audience — where anticipation builds before each new collection — has eroded, giving way to an ethos of push, push, push. Dior risks falling into a similar trap as Alessandro Michele’s Gucci, whose boom was driven by brushing off critique and staying true to its designer’s vision. But that support became counterproductive, and it found itself stuck in an aesthetic that felt increasingly time-stamped. Similarly, Dior stood by Maria Grazia Chiuri’s vision for a more casual, joyful and easy-to-wear couture house, giving the designer time to reinforce her vision with layers of research and craft that eventually won over many early critics. The problem, then, becomes realising when the detractors are right. In recent seasons, the brand has continued to put its full marketing muscle behind its womenswear image, rolling it out across categories (including, for the first time, cosmetics and perfume), perhaps without paying enough attention to signs it was losing appeal.The picture isn’t terribly different for Dior men’s, whose thundering string soundtracks and streetwear-inflected collaborations increasingly felt like business as usual.As Dior struggles to respond to a softer luxury market with ultra-consistent creativity, CEO Delphine Arnault has brought in additional management support: including a new managing director hired from Miu Miu, Benedetta Petruzzo, and a new chief commercial officer, Nicolas Baretzski, as well as elevating longtime communications boss Olivier Bialobos to the role of deputy CEO. But in the absence of new stories to tell, teams are left to iterate faster and louder.“Consistency, having collections that build on each other — that’s a good thing in fashion, but it can only take you so far. There’s the risk that the market will eventually lose interest,” said Alice Bouleau, partner at executive search firm Sterling International. While details of the transition remain unconfirmed, sources say Anderson is gunning for sweeping authority across men’s and women’s — which would see the lines unified under a single designer for the first time since the creation of Dior Homme under Hedi Slimane in 2001.Anderson understands that the context in which fashion collections are shown can be as important as their content. While Dior’s sprawling machine helped power years of recent expansion, an exacting, directional designer with a broad creative mandate may now be needed to update some of the more cheesy elements of the brand’s template.Following up either Jones’ or Chiuri’s era-defining, best-selling visions is sure to be a Herculean task — to do both at once may be near impossible. But it just might work.THE NEWS IN BRIEFFASHION, BUSINESS AND THE ECONOMYLVMH growth boosts luxury outlook. The sector bellwether beat expectations with a 1 percent rise in fourth-quarter sales. The growth outpaced an expected 1.6 percent decline, according to a consensus forecast cited by Morgan Stanley.LVMH and Stella McCartney brand part ways. The designer is buying back LVMH’s minority stake in her namesake label but will continue to advise the group on sustainability issues as a Global Ambassador on Sustainability.Burberry soars after US demand pickup. Retail sales fell 4 percent on a comparable basis, Burberry said in a statement Friday, better than the drop of almost 13 percent forecast by analysts. Sales in the Americas unexpectedly climbed, while China fell less than estimates.Zegna Group returns to growth in the fourth quarter. The group’s fourth-quarter revenue reached €589 million ($619 million), up 3 percent year-on-year. The return to growth in the fourth quarter is driven by the strength of the Zegna brand, where revenue rose 8 percent.Ferragamo’s sales were down 4 percent in the fourth quarter. Sales in the North American region, which accounted for 29 percent of total revenue, were up 6.3 percent in the quarter. Overall preliminary revenues reached 1.03 billion euros ($1.07 billion) in 2024, in line with analysts' estimates.Mytheresa to rename parent company after YNAP acquisition. Mytheresa is planning to rename its parent company, MYT Netherlands Parent B.V., to LuxExperience once its deal to acquire its luxury e-commerce rival Yoox-Net-a-Porter closes in the first half of the year. The company’s flagship site, Mytheresa, will keep its name.Alessandro Michele staged his couture debut for Valentino. The star designer opted for a multimedia performance over a traditional couture defilé. The garments were more convincing as costumes than clothes, reports Angelo Flaccavento.Black-owned brands urge US consumers not to boycott Target over end of diversity efforts. The companies and entrepreneurs urged against a boycott, saying they would lose revenue and consumer exposure, which would harm the brands more than the retailer. Some backers of a Target boycott call for buying directly from Black-owned brands' websites instead. Levi’s full-year guidance disappoints analysts. The San Francisco-based retailer is expecting revenue to fall 1 percent to 2 percent in fiscal 2025. The company cited the weakness of foreign currencies, one fewer week in the fiscal year, an exit from the footwear business and the discontinuation of its Denizen brand as reasons for a possible drop. VF Corp beats quarterly estimates as turnaround plan pays off. For the quarter ended Dec. 28, the company’s revenue rose 2 percent to $2.83 billion from a year ago, beating analysts' estimates of $2.75 billion. VF Corp has now beaten revenue and profit estimates for three successive quarters. H&M shares tumble as sales growth continues to disappoint. Sales, which edged up 3 percent for the fourth quarter, rose by less than analysts had projected during the crucial Christmas trading period. The sales weakness came even as the company posted operating profit for the three months ended November of 4.6 billion Swedish kronor ($420 million).Milan court to try influencer Chiara Ferragni for fraud over charity claims. Ferragni was fined almost €1.1 million ($1.14 million) in 2023 by Italy’s competition authority AGCM over sales of Ferragni-branded Pandoro Christmas cakes with packaging mentioning a children’s hospital. The trial was scheduled to begin on Sept. 23 at a court in Milan.Trump to hold off on 25 percent Colombia tariffs. His administration abruptly pulled the threat after reaching a deal on the return of deported migrants, a move that rattled global markets. Trump’s action upended decades of warm relations between the US and Colombia. Jewellery-shipper Ferrari group kicks off Amsterdam IPO plans. The controlling Deiana family will sell a 25 percent stake in the IPO, according to a statement. A valuation of more than $1 billion may be sought, Bloomberg reported. THE BUSINESS OF BEAUTYEstée Lauder reviews brands amid management change. The company is working with Evercore Inc. on the review, which could lead to the sale of some brands, according to people familiar with the matter. Shares in Estée Lauder rose as much as 4.7 percent in New York trading on Monday.Silas Capital invests in J-beauty brand Damdam. Damdam has raised $3 million in a seed funding round led by private equity and venture capital firm Silas Capital. The firm is responsible for the successful exit of Ilia Beauty. Nykaa expects strong growth as shoppers keep spending on luxury beauty. The company has seen annual revenues jump nearly fourfold to 64 billion rupees ($739 million) post-pandemic. Nykaa said it expects net revenues from the beauty business to grow “higher than mid-twenties.”PEOPLEKim Jones was awarded Chevalier de la Légion d’Honneur. The award was presented to him by Anna Wintour. Jones became a knight in the process. Before the ceremony, he described it as a “life milestone,” though he said notoriety was not his endgame.Glenn Martens named creative director of Maison Margiela. The Belgian designer, known for his work at Y/Project and Diesel, succeeds John Galliano as creative director of the French luxury house. Galliano announced his exit from Margiela in December after a successful ten-year run at the maison.Compiled by Yola Mzizi. Source link

0 notes

Text

#rottmnt#rise of the teenage mutant ninja turtles#Old Swifty#Michael Doig#Doig & Swift#the movie#animatic#leo#mikey#casey jr.#video

533 notes

·

View notes

Text

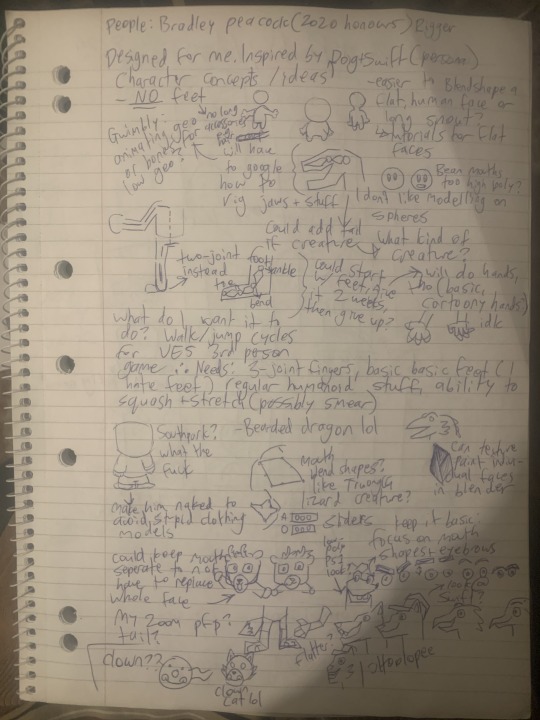

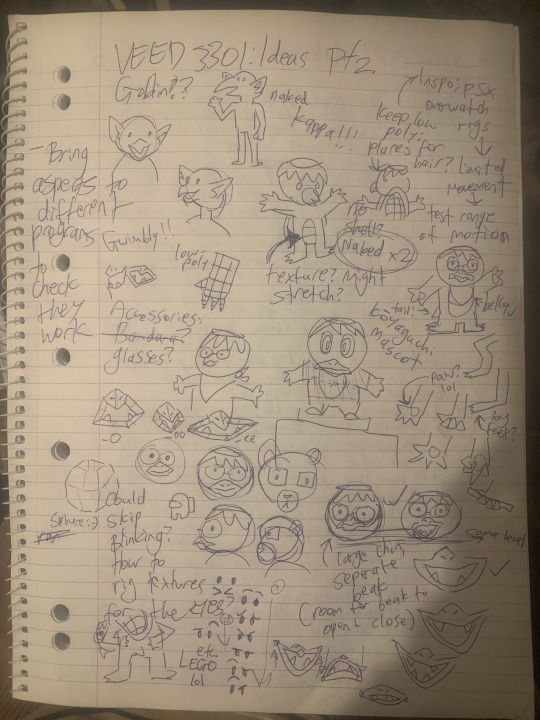

Week 3 - Planning

I wanted to use Wordspace for this, but I couldn't figure it out lol.

The goal of my project is to model and texture a model in Blender that I can bring into Maya to rig so I can bring it into Unreal Engine 5 to make a controllable character with fitting animations.

I was inspired to do this by visual artists Doig and Swift, as they have created little controllable characters for Unity, and I wish to do something similar for UE5. I was also inspired by Louie Zong's designs for Casper and Nova from the show Fiona and Cake, as well as the low-poly style of Gwimbly from Smiling Friends, designed by Hoolopee. Like these designs, I want the simple, flat textures with bright colours, as well as cartoonish proportions.

Before actually brainstorming designs, I decided to test-model some mouth shapes in Blender with a low-poly style that I wanted. At this point, I was thinking of modelling a creature with some kind of snout.

The actual design I settled on was a kappa, a yokai of a turtle-like creature that hangs out near rivers and kidnaps children and really likes cucumbers. These are some pages from my brainstorming.

These are two photos I took of kappa statues that also partially inspired the design. They are from near where my grandparents live in Kouyaguchi, so we walk past them a lot when visiting. I think it's a simple but cute design, which should be easy enough to model. I think I could make some interesting mouth shapes with the beak, even if it will be low -poly. I like the proportions of this statue as well, with the little arms and legs and big head, which I also liked about the aforementioned designs, and which I wish to include in my design.

I have decided to finalise the design to a little kappa with round glasses so I can get stuck into modelling. I still have to draw T-pose images of the design to model off of, but I currently have a clear image of what that will look like in my head. I am glad I managed to decide what I wanted the creature I am modelling to be so soon, as I thought I was going to be very indecisive about it or run out of time to come up with an idea I was actually satisfied with.

For future reference, I have found this website with information about edge loops and polygon density for rigging, this website for information about polygons near the shoulder, and this website about rigging low-poly models.

Edit: My rough timeline for this project

1 note

·

View note

Text

The Artforum booth at the 2023 Armory Show at Javits Center on Sept. 7, 2023, in New York City. Photo: Sean Zanni/Patrick McMullan via Getty Images

AFTER THOUSANDS OF high-profile artists and curators signed an open letter expressing solidarity with Palestinians and supporting a ceasefire in Gaza, published in the magazine Artforum on October 19, the public pushback was swift. The following day, the magazine posted a public response signed by prominent gallerists denouncing the original letter as “one-sided.”

Behind the scenes, however, powerful art dealers and gallerists who control the cultural and monetary tides of the art world began a private campaign to force some of the biggest names on the letter to retract their support, according to a half dozen sources, including letter signatories as well as others informed about the influence campaign.

Soon after the letter was posted, Martin Eisenberg, a high-profile collector and inheritor of the now-bankrupt Bed Bath & Beyond fortune, began contacting famous art world figures on the list whose work he had championed to express his objections to the letter.

Eisenberg, who owns millions of dollars’ worth of work by Artforum letter signatories, contacted at least four artists whose work he owns to convey his displeasure at seeing their names on the letter. (Eisenberg did not respond to The Intercept’s request for comment.)

On Thursday, a week after the letter was posted, Artforum editor-in-chief David Velasco was summoned to a meeting with Jay Penske, the CEO of Artforum’s parent company, according to three sources. The son of billionaire Roger Penske, Jay oversees the conglomerate Penske Media Corporation. (Penske Media did not respond to a request for comment.) Before the day was out, Velasco was fired after six years at the helm of the magazine.

“This magazine has been my life for 18 years and I’ve given everything to it,” Velasco, who rose from being an editorial assistant to the coveted editor-in-chief job, told The Intercept. “I have done nothing but exceptional work at the magazine for 18 years and this is a sad day. It breaks my heart.”

In a statement to the New York Times, Velasco said, “I’m disappointed that a magazine that has always stood for freedom of speech and the voices of artists has bent to outside pressure.”

The pressure campaign against the letter echoes a wave of repercussions faced by writers, activists, and students who have spoken out for Palestinians. Right-wing groups lobbying for Israel, as well as donors to prominent institutions and various other wealthy interests, are condemning open letters and using the lists of signatories as blacklists across cultural, professional, and academic spheres.

“Anecdotally, I know that a majority of people in the art world are devastated by the genocide in Gaza but many are scared to speak out or even join the call for a ceasefire,” said Hannah Black, an artist and writer who signed the Artforum letter but was not pressured to remove her signature. “It is absolutely McCarthyite and many of the dogmatic anti-Palestinians within the art world have, as Joseph Welch said of McCarthy, ‘no sense of decency.’ They are willing to destroy careers, destroy the value of artworks, to maintain their unofficial ban on free speech about Palestine.”

In a testament to the efficacy of the campaign against the Artforum letter, artists Peter Doig, Joan Jonas, Katharina Grosse, and Tomás Saraceno all withdrew their support. According to an Intercept analysis, the three artists were among 36 names removed from the online version of the letter between October 20 and October 26. (An additional 32 names were added during that period.)

Artforum, a premier international art publication, published the October 19 open letter calling for humanitarian aid to Gaza, accountability for war crimes, and an end to violence against civilians. The letter — which was not commissioned or drafted by Artforum, but published on the magazine’s website as well as in other publications like e-flux — went on to condemn the occupation of the Palestinian territories and reiterate its demands with a call for peace.

“We believe that the arts organizations and institutions whose mission it is to protect freedom of expression, to foster education, community, and creativity, also stand for freedom of life and the basic right of existence,” the signatories concluded. “We call on you to refuse inhumanity, which has no place in life or art, and make a public demand from our governments to call for a ceasefire.”

In a post on the Artforum website before news broke of Velasco’s firing, the publishers Danielle McConnell and Kate Koza wrote that the publication of the letter was “not consistent with Artforum’s editorial process.”

“The open letter was widely misinterpreted as a statement from the magazine about highly sensitive and complex geopolitical circumstances,” the publishers wrote. “That the letter was misinterpreted as being reflective of the magazine’s position understandably led to significant dismay among our readers and community, which we deeply regret.”

Marty Eisenberg and Warren Eisenberg at the 2010 Annual Gala of The Studio Museum Harlem at Museum of American Finance on October 25, 2010 in New York City. Photo: Ryan McCune/Patrick McMullan via Getty Images

Backlash

Critics of the letter said its failure to mention the surprise attack by Hamas on October 7 — in which some 1,400 Israelis, mostly civilians, were killed — was offensive and, according to some, antisemitic. Four days after the letter was published, Artforum posted an update reiterating the letter organizers’ condemnation of the loss of all civilian life, adding that they “share revulsion at the horrific massacres” of October 7.

The response published in Artforum the day after the original letter came out was signed by three influential gallery owners: Dominique Lévy, Brett Gorvy, and Amalia Dayan. In their critique, the gallerists wrote:

We are distressed by the open letter recently posted on Artforum, which does not acknowledge the ongoing mass hostage emergency, the historical context, and the atrocities committed in Israel on October 7, 2023—the bloodiest day in Jewish history since the Holocaust.

We denounce all forms of violence in Israel and Gaza and we are deeply concerned over the humanitarian crisis. We—Dominique Lévy, Brett Gorvy, Amalia Dayan—condemn the open letter for its one-sided view. We hope to foster discourse that can lead to a better understanding of the complexities involved. May we witness peace soon.

The authors of the response letter — the joint directors of Lévy Gorvy Dayan, which has gallery spaces and offices in New York, London, Paris, and Hong Kong — curate shows with some of the most prolific and highest grossing artists in the world, both living and dead. Their website lists Jean-Michel Basquiat, Gerhard Richter, Andy Warhol, Cy Twombly, Joel Mesler, and Adrian Piper as representative artists and collaborators. Dayan is the granddaughter of Moshe Dayan, the Israeli politician and military commander who is alleged to have ordered the country’s military to attack the American naval ship the USS Liberty during the Six-Day War of 1967.

Lévy Gorvy Dayan is more than a series of galleries; the venture is a powerful consortium, described by the New York Times as a “one-stop shop for artists and collectors,” representing artists, organizing exhibitions and auction sales, and advising collectors. In 2021, Lévy told the Financial Times, “I grew up feeling that art was freedom and fresh air.” She said she did not believe in gallerists and representatives “controlling them” — the artists — “completely.”

According to two artists who appeared as signatories on the first Artforum post, the Lévy Gorvy Dayan letter was a shot across the bow by powerful art dealers and influencers, warning others to stay in line. One artist who spoke to The Intercept said a collector offended by the Artforum letter returned a work by the artist to a dealer. The collector did not contact the artist prior to returning the work, according to the artist, who asked for anonymity to protect their livelihood.

Another open letter posted under the title “A United Call from the Art World: Advocating for Humanity” called the original Artforum letter “uninformed.” It offered no criticism of Israel’s onslaught on Gaza, which has killed an estimated 7,000 people in the last 19 days. This letter, issued under the banner of “peace, understanding, and human dignity” garnered over 4,000 signatures. Among them was that of Warren Kanders, who resigned from the Whitney Museum of American Art board following protests over the fact that his companies sell chemical weapons. (The Intercept reported last year that, despite claims of divestment, Kanders remains in the tear gas business.)

Penske Media Corporation, Artforum’s parent company, drew criticism in 2018 selling a $200 million stake to Saudi Arabia’s public investment fund. That same year, Washington Post journalist Jamal Khashoggi was brutally murdered and dismembered under orders from Saudi’s de facto ruler, Crown Prince Mohammed bin Salman.

Another artist, who spoke on the condition of anonymity to protect their livelihood, said the affair with the Artforum letter showed that many of the gallerists and collectors whose money makes the art world turn did not understand artists’ subject matter.

“It really shows that they never cared about the art,” the artist said. “My art, like a lot of the people facing this, has always been political, about oppression and dispossession.”

1 note

·

View note

Text

The Girl and The Glim

Writer/Pencils/Inks: India Swift

Colors: Michael Doig

Letters: Hassan Otsmane-Elhaou

#IDW#IDW Publishing#The Girl and The Glim#India Swift#Michael Doig#Hassan Otsmane-Elhaou#Hassan OE#2022#IDW Sonic Contributors

7 notes

·

View notes

Photo

Out this week: The Girl and the Glim (IDW, $12.99):

India Swift and Michael Doig tell the story of Bridgette, a girl having a hard time fitting in in hew new town, and the supernatural presence that takes notice. You can learn more about it at its dedicated website.

See what else is arriving in comic shops this week.

#the girl and the glim#graphic novels#idw#idw publishing#ncbd#new comics#can't wait for comics#india swift#michael doig#new comics day#new comic book day

7 notes

·

View notes

Text

More people should be watching doigswift

4 notes

·

View notes