#Exchange Rate

Explore tagged Tumblr posts

Text

Anyone else notice the random price differences between UK Pounds Sterling and American Dollars in sponsorships? They are completely arbitrary and not based on any actual monetary values. If you pay American dollars, you get screwed on the low and high tiers because it's not premised on the actual exchange rate! Using today's rate, £50k is $66.5k not $70k and £200k is $225k American not $260k. The middle tier actually saves you $3k as it's under the current exchange rate at $130k instead of $133k. It also looks sooooo tacky to show figures for the different currencies. It should just have one figure regardless of the currency...🙄

#Arbitrary pricing#I'm surprised they didn't offer surge pricing figuring a lot of people wanted to sponsor#royalty is not celebrity#merch your royalty#just call me harry#traitor prince#i stand with dr sophie#baka abuse#usaid fraud#irs audit#using your office for personal gain#can't buy credibility#lies and the lying liars who tell them#unsussexful#grifters gonna grift#surrogacy isn't a crime but lying is#the only people dining off stories of your dead mum are you and your wife#Diana would be mortified#bitter ginger princeling#Thank God for birth order and William.#pound Sterling#American dollar#exchange rate#Just when I think they couldn't get any tackier

3 notes

·

View notes

Text

Kiddushin 12a

#daf yomi#talmud#kiddushin#judaism#jumblr#harry potter#hagrid#gringotts#exchange rate#the wizarding world has no monetary policy

3 notes

·

View notes

Text

1 note

·

View note

Text

0 notes

Text

How to Know the Current Rate of Dollar to Naira Anytime you Want In Nigeria

Do you want to known how to easily check the current rate of dollar to naira in Nigeria? Worry no more! This article is created to help you quickly find out the latest current exchange rates for dollar to naira anytime you need to change your funds. Whether you are a business owner importing goods, a student planning to pay school fee abroad, or just someone looking to manage personal finances,…

0 notes

Text

Exchange Rate Update: USD Stable, Euro and Pound Sterling Rise

Nepal Rastra Bank (NRB) has announced the foreign exchange rates for today, showing stability in the value of the US Dollar while other currencies, including the Euro and Pound Sterling, have seen increases.

Kathmandu, December 31: Nepal Rastra Bank (NRB) has announced the foreign exchange rates for today, showing stability in the value of the US Dollar while other currencies, including the Euro and Pound Sterling, have seen increases. As per NRB, the buying rate for 1 USD is set at NPR 136.56, while the selling rate is NPR 137.16. The Euro’s buying rate stands at NPR 142.67, with a selling rate of…

0 notes

Text

A foreign exchange (FX) market is an over-the-counter (OTC) global market that determines the exchange rate for currencies worldwide. The market is the largest financial market in the world and comprises a global network of financial centres that operate 24 hours a day. These markets allow participants to buy, sell, exchange, and speculate on the relative exchange rates of different currency pairs. To gain a deeper understanding of the FX market, read this article.

0 notes

Text

The Institute of International Bankers in New York, of which Tony Walton was vice-chairman, had addressed the problem in an April 1991 paper submitted to the US Treasury and the Internal Revenue Service, and continued to raise the issue in meetings with Treasury and IRS staff. The institute noted:

The key issue affecting the international banks arises in the context of cross-border interbranch transactions. For example, a US branch of an international bank that has entered into an interest rate or currency swap with a customer will often enter into a cross-border interbranch swap, the terms of which mirror the terms of the swap with the customer. The US branch's counterparty in such a 'mirror' interbranch swap will often be the bank's head office or another branch responsible for managing worldwide swap risk. The result is that the US branch has hedged its position economically through the mirror interbranch swap, and the bank's head office will be in a position to hedge the bank's overall position.

However, the IRS position is that US tax law does not recognise interbranch swaps or other interbranch transactions (although many countries treat branches of American banks as separate entities). Accordingly, a US branch of an international bank that hedges its swap transactions in this way will be treated by the IRS as if it held an unhedged position for federal tax purposes, even though the US branch is fully hedged economically. As a result, the back can have US taxable income far in excess of the bank's hedged economic income depending on the movements of interest or currency exchange rates. Likewise, depending on these market factors, a bank can generate a substantial tax loss in the United States, even though the bank has economic income on its hedged transaction.

The IRS has attempted to address the cross-border interbranch transactions arising from global trading operations by offering to enter into so-called 'advance pricing agreements' . . . between the affected taxpayer, the IRS and the home country tax authority of the taxpayer.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quotes#westpac#edna carew#nonfiction#institute of international bankers#new york#tony walton#vice chairman#problem#april#90s#1990s#20th century#us treasury#irs#internal revenue service#meetings#banking#finance#taxes#united states#hedging#exchange rate

0 notes

Text

Wong said in a statement that her aim in risk-management was to try to unwind a hedge in whole or in part from time to time to take advantage of movements in exchange rates.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#agnes wong#risk management#exchange rate#forex market#banking#finance#lending#loans

0 notes

Text

何が起こっているのか理解不可

20240805

0 notes

Text

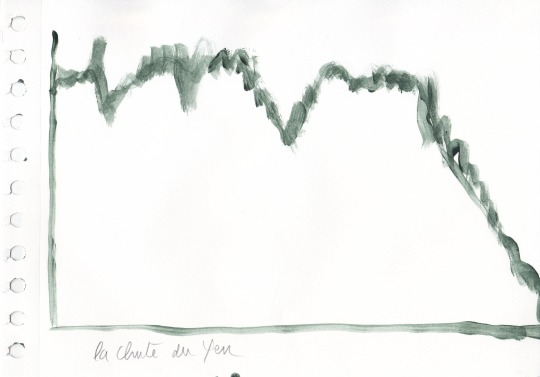

Yen tumbles past 158 against dollar on stubborn U.S. inflation

From food to travel, it’s hard to find an aspect of life in Japan that hasn’t been affected by its sinking currency. The yen has been on the skids for years and hit its weakest level since 1990 against the US dollar earlier this week, pressured by expectations of that the US Federal Reserve will have to keep interest rates higher for longer to tame American inflation. For Hiroko Ishikawa, a…

View On WordPress

0 notes

Text

Black Market Dollar (USD) To Naira (NGN) Exchange Rate Today 9th April 2024

What is the Dollar to Naira Exchange rate at the black market also known as the parallel market (Aboki fx)? See the black market Dollar to Naira exchange rate for 8th April, below. You can swap your dollar for Naira at these rates. How much is a dollar to naira today in the black market? Dollar to naira exchange rate today black market (Aboki dollar rate): The exchange rate for a dollar to naira…

View On WordPress

#Black Market#Black Market Dollar (USD) To Naira (NGN) Exchange Rate Today 9th April 2024#Dollar (USD)#Exchange Rate#Naira (NGN)

0 notes

Text

WHAT IS FUEL SUBSIDY

A fuel subsidy is a financial assistance provided by a government to reduce the cost of energy products, particularly fuels such as gasoline, diesel, or natural gas. The subsidy aims to make these essential energy sources more affordable for consumers by lowering their market prices. Governments may implement fuel subsidies for various reasons, including social welfare, economic stability, or…

View On WordPress

#bank#brics#climate-change#dollars#economics#economy#ecowas#energy#exchange rate#export#free trade#government#imf#import#news#opec#policy#subsidies#subsidy removal

0 notes

Text

Arbitrage is a trading strategy that converts inefficiencies in the market into profitable opportunities. Traders employ several arbitrage techniques. These include triangular arbitrage, peer-to-peer (P2P) arbitrage, cross-border and arbitrage. All these strategies aim to capitalise on price discrepancies across numerous marketplaces.

0 notes

Text

The report noted that, given the volatile exchange rate environment, further substantial devaluations in the $A could not be ruled out. It went on:

A major cause of concern is the lack of complete product knowledge by most people handling OCLs (this extends to administrative areas). Account managers appear uncertain as to the appropriate steps to take as losses caused by the $A depreciation is a relatively new situation, over which they have no power to manage or control (unlike an overdraft facility where cheques can be returned, and position crystallised). Most OCL borrowers are considered good customers of the bank – there appears to exist a high level of optimism by both customers and managers in that a solid $A appreciation is only a matter of time. Borrowers (and many managers) are of the view that if a loan is on a bullet repayment basis [payment on maturity] the only forex rate that matters is the one prevailing at the time of the maturity of the facility.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quotes#westpac#edna carew#nonfiction#report#volatile#exchange rate#devaluation#ocl#loans#lending#banking#finance#forex market

1 note

·

View note

Text

Management of the foreign-currency borrowers fell between two stools, in what lawyer Paddy Jones, a partner of Allen Allen & Hemsley, later described as a 'period of non-management'.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#management#banking#finance#exchange rate#foreign currency#lawyer#paddy jones#allen allen & hemsley

0 notes