#Food Processing Automation

Explore tagged Tumblr posts

Text

Food processing automation improves hygiene, speed, and consistency. From slicing to packaging, automation ensures product integrity at every step. Discover how modern tech meets strict industry regulations.

0 notes

Text

🛠️ X-Ray Inspection Machines for Food Industry Market to Reach $1.77 Billion by 2035 Driven by Safety and Technological Innovations

The X-Ray Inspection Machines for the Food Industry market is set to grow from $823.7 million in 2024 to $1,769.7 million by 2035, marking a CAGR of 7.2% over the forecast period.

Detailed Analysis - https://datastringconsulting.com/industry-analysis/x-ray-inspection-machines-for-food-industry-market-research-report

These machines are integral in ensuring foreign object detection, quality assurance, product integrity, and bone & hard material detection in food products. This report highlights key opportunities for growth in product types, technological advancements, and detection capabilities, along with future revenue projections.

🔍 Industry Leadership & Competitive Landscape

The X-Ray Inspection Machines for Food Industry market is characterized by intense competition, with leading players implementing advanced technologies and automation solutions. Prominent companies in the market include:

Mettler-Toledo International Inc.

Thermo Fisher Scientific Inc.

Anritsu Corporation

Ishida Co. Ltd.

Loma Systems

Eagle Product Inspection

Sesotec GmbH

Mekitec Ltd.

WIPOTEC-OCS GmbH

JBT Corporation

Minebea Intec

Multivac Group

These companies are driving the market’s growth by focusing on safety regulations compliance, enhanced detection technologies, and efficiency improvements in food processing.

🚀 Key Growth Drivers & Opportunities

Several factors are fueling the growth of the X-ray inspection machine market for the food industry, including:

Compliance with stringent food safety regulations across various regions

Technological advancements in X-ray inspection technologies for more efficient and accurate detection

Increased demand for process optimization in food production to reduce waste and increase operational efficiency

Rising automation in food processing plants to enhance product consistency and reduce human error

Key opportunities include tapping into emerging markets in developing countries, along with continued innovation in automation and inspection technologies.

🌍 Regional Trends & Evolving Ecosystems

While North America and Europe lead the market, emerging regions such as Brazil, India, and South Africa present significant growth opportunities. Market players are expanding their presence in these regions to address growing food safety needs and the adoption of advanced inspection equipment.

The market faces challenges such as:

High costs of implementation for advanced machinery

Dependency on skilled labor for machine operation and maintenance

Supply chain complexities in raw materials and distribution channels

As a result, the market ecosystem—from raw material suppliers and equipment manufacturers to distributors and end users—is evolving rapidly to accommodate the growing demand.

🧠 About DataString Consulting

DataString Consulting is a global market research and business intelligence firm that provides bespoke market research, strategic consulting, and insight-driven solutions for both B2B and B2C industries. With more than 30 years of experience, we offer expertise in identifying high-growth opportunities and delivering tailored solutions to meet the strategic needs of businesses.

Our services include:

In-depth market research reports

Comprehensive opportunity assessments

Strategy consulting for market penetration and expansion

Industry trend analysis and forecasting

#X-Ray Inspection for Food Industry#Food Safety Technology#Food Processing Automation#Food Quality Assurance Solutions#Foreign Object Detection Systems#X-Ray Detection Equipment Market#Food Industry Inspection Machines#Technological Advancements in Food Safety#Global X-Ray Inspection Market Growth#Food Industry Regulatory Compliance#Inspection Equipment Market in Food Processing#Emerging Markets for Food Inspection Technology

0 notes

Text

Streamline Restaurant Orders with AI Assistants

How AI Virtual Assistants Make Restaurant Order Processing Effortless Hey friends, I’m Iryna Tymchenko, and I want to share my excitement about something that’s quietly reshaping how restaurants handle orders—smart virtual assistants. If you’ve ever worked in food service during a lunch or dinner rush, you know that the chaos of ringing phones and non-stop live chats can test anyone’s patience.…

#ai#AI customer service#artificial-intelligence#business#Customer service with AI#Digital transformation for restaurant business#Food orders online with AI#marketing#Restaurant AI order processing#Restaurant automation#Restaurant business automation#technology

0 notes

Text

⚡ The One-Step Magic Trick Molding + labeling in 1 automated dance:

30% faster than traditional methods

Zero misalignment meltdowns

Production zen for cookie factories 🍃 Real talk: Efficiency shouldn’t sacrifice beauty.

#manufacturing#automation#factory life#packaging engineering#process optimization#China manufacturing#IML#food tech

0 notes

Text

In the ever-evolving landscape of regulatory compliance, Intelligent Process Automation (IPA) is revolutionizing how organizations in the Food and Drug Administration (FDA) sector streamline workflows, reduce manual errors, and enhance operational efficiency.

#Intelligent Process Automation#Automation#Drug Administration#Food Administration#streamline workflows

0 notes

Text

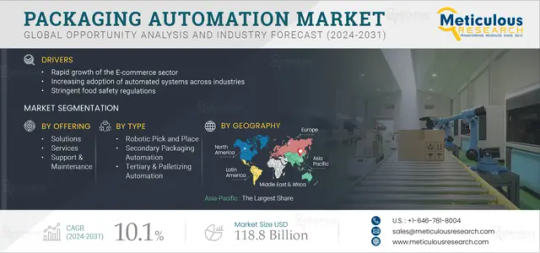

Packaging Automation Market Size, Share, Forecast, & Trends Analysis

Meticulous Research®—a leading global market research company, published a research report titled, ‘Packaging Automation Market by Offering (Solution, Services), Type, End-use Industry (Healthcare & Pharmaceuticals, E-commerce & Logistics, Food & Beverage, Chemical & Refinery, Aerospace & Defense), and Geography - Global Forecast to 2031.’

According to this latest publication from Meticulous Research®, the global packaging automation market is projected to reach $118.8 billion by 2031, at a CAGR of 10.1% during the forecast period. The growth of the packaging automation market is mainly attributed to the rapid growth of the E-commerce sector, the increasing adoption of automated systems across industries, and stringent food safety regulations. However, the high initial costs of installing automated systems restrain the market’s growth.

The high demand for packaging automation in the logistics industry and the increasing demand for sustainable and eco-friendly packaging are expected to create market growth opportunities. However, the shortage of skilled operators is a major challenge for the players in this market. Integration of advanced technologies and smart packaging are major trends in the packaging automation market.

The global packaging automation market is segmented by offering (solutions [case sealers & erectors, sleevers & cartoners, palletizers & depalletizers, strappers, markers & labelers, automated mailer systems, case packers, and other solutions], services [consulting, installation & training, and support & maintenance]), type (robotic pick & place, secondary packaging, and tertiary & palletizing), end-use industry (healthcare & pharmaceuticals [healthcare & pharmaceuticals manufacturing companies and contract manufacturing organizations], e-commerce & logistics [E-commerce, contract packaging, and logistics companies], food & beverage, automotive, chemical & refineries, aerospace & defense, and other end-use industries), and geography (Asia-Pacific, Europe, North America, Latin America, and the Middle East & Africa). The study also evaluates industry competitors and analyses the market at the country and regional levels.

Based on offering, the packaging automation market is segmented into solutions and services. Furthermore, the solutions segment is subsegmented into case sealers & erectors, sleevers & cartoners, palletizers & depalletizers, strappers, markers & labelers, automated mailer systems, case packers, and other solutions. The services segment is subsegmented into consulting, installation & training, and support & maintenance. In 2024, the solutions segment is expected to account for the larger share of the global packaging automation market. The segment’s large market share is mainly attributed to the need for increased manufacturing speed and ensuring products and workers’ safety. However, the services segment is projected to record the highest CAGR during the forecast period. The segment’s growth is driven by the increasing deployment of automation in various industries such as e-commerce, healthcare & pharmaceuticals, food & beverage, automotive, and chemical & refineries and the growing demand for packaging automation to speed up production, optimize warehouse space, and reduce reliance on labor to provide more value-added services to their customers.

Based on type, the packaging automation market is segmented into robotic pick & place, secondary packaging, and tertiary & palletizing. In 2024, the robotic pick & place segment is expected to account for the largest share of the global packaging automation market. The segment’s large market share is mainly attributed to rising demand for pick and place robots in various industries such as manufacturing, food & beverage, automotive, chemical & refineries, aerospace & defense, e-commerce & logistics, healthcare & pharmaceuticals, and the growing demand for automation from manufacturing companies to increase production rates. However, the secondary packaging segment is projected to record the highest CAGR during the forecast period. The segment’s growth is driven by the rising need to safely transport products during shipment and the growing demand for supplementary protection in the e-commerce and pharmaceutical sectors.

Based on end-use industry, the packaging automation market is segmented into healthcare & pharmaceuticals, E-commerce & logistics, food & beverage, automotive, chemical & refineries, aerospace & defense, and other end-use industries. Furthermore, the healthcare & pharmaceuticals segment is subsegmented into healthcare & pharmaceuticals manufacturing companies and contract manufacturing organizations. The E-commerce & logistics segment is subsegmented into E-commerce, contract packaging, and logistics companies. In 2024, the food & beverage segment is expected to account for the largest share of the global packaging automation market. The segment’s large market share is mainly attributed to shifting consumer tastes, high competition in the packaged food market, and a surge in demand for packaged food. However, the e-commerce & logistics segment is projected to record the highest CAGR during the forecast period. The segment’s growth is attributed to various factors, including the rise in online sales channels, the increase in online shopping among customers, the increasing adoption of automation in e-commerce & logistics to ensure timely delivery, and the rising consumer demand for convenience shopping.

Based on geography, the global packaging automation market is segmented into North America, Europe, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of the packaging automation market, followed by Europe, North America, Latin America, and the Middle East & Africa. Asia-Pacific’s significant market share is attributed to the increasing utilization of sustainable packaging in the food & beverage sector, supportive government initiatives aimed at promoting the adoption of automation and Industry 4.0 technologies to enhance manufacturing capabilities, the growing demand for eco-friendly packaging solutions, and the rapid expansion of the E-commerce sector in countries like China and India. Moreover, Asia-Pacific is also projected to register the highest CAGR over the forecast period.

Key Players

The key players operating in the global packaging automation market are ABB, Ltd. (Switzerland), Robert Bosch GmbH (Germany), Siemens AG (Germany), Fanuc Corporation(Japan), and Mitsubishi Electric Corporation (Japan), Swisslog Holding AG (Switzerland), Rockwell Automation, Inc. (U.S.), Schneider Electric SE (France), WestRock Company (U.S.), SATO Holdings Corporation (Japan), Krones AG (Germany), Automated Packaging Systems, Inc. (U.S.), Emerson Electric Co. (U.S.), Crawford Packaging (Canada), Fuji Machinery (Japan), Brenton LLC (U.S.), BEUMER Group GmbH & Co. KG(Germany), Barry-Wehmiller Group, Inc. (U.S.), KHS GmbH (Italy), MULTIVAC Sepp Haggenmüller SE & Co. KG (Germany), Omori Machinery Co., Ltd. (Japan), and Syntegon Technology GmbH (Germany).

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5324

Key Questions Answered in the Report:

Which are the high-growth market segments in terms of offering, type, and end-use industry?

What is the historical market for packaging automation across the globe?

What are the market forecasts and estimates for the period of 2024–2031?

What are the major drivers, restraints, opportunities, challenges, and trends in the global packaging automation market?

Who are the major players in the global packaging automation market, and what are their market shares?

What is the competitive landscape like?

What are the recent developments in the global packaging automation market?

What are the different strategies adopted by the major players in the market?

What are the geographic trends and high-growth countries?

Who are the emerging players in the global packaging automation market, and how do they compete with the other players?

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#Packaging Automation Market#Packaging Automation#Smart Packaging#Automated Packaging Systems#Packaging & Processing Solutions#Portioning#Labeling#Marking#Inspection#Handling#Packaging Machines#Robotic Pick & Place#Secondary Packaging#Tertiary & Palletizing#Automation Solutions#Automated Equipment#Automated Bagging Systems#Transit Packaging#Food Packaging Equipment

0 notes

Text

How AI is Revolutionizing the Food Industry with Automation?

AI is revolutionizing the food industry with automation by streamlining operations, improving food quality, and enhancing customer experiences. From predictive analytics for inventory management to AI-powered cooking and delivery systems, automation is driving efficiency. With AI, food companies can better forecast demand, personalize services, and optimize supply chains. USM Business Systems specializes in AI-driven solutions that help businesses in the food sector stay ahead in this rapidly evolving market.

#AI in food industry#Food automation technology#AI-driven food solutions#Automation in food apps#Artificial intelligence food#AI for food production#Food industry automation#AI food delivery solutions#AI in food processing#Smart food industry AI#Automation in restaurants#AI in food supply chain#Food industry efficiency#AI-powered food services#AI-driven restaurant tech

1 note

·

View note

Text

Food Robotics Market is expected to reach a value of USD 6.9 Billion in 2033 at a CAGR of 9.9%.

The Global Food Robotics Market: Trends, Analysis, and Future Outlook

Market Overview

The Global Food Robotics Market is witnessing a robust expansion, fueled by advances in automation technology and evolving industry dynamics. With an anticipated market value of USD 3.0 billion in 2024, it is projected to reach USD 6.9 billion by 2033, reflecting a compound annual growth rate (CAGR) of 9.9%. This growth is driven by the increasing need for operational efficiencies, consistency in product quality, and rising demand for high-volume production with minimal human intervention.

The Food Robotics Market integrates advanced robotics technology into the food industry, automating processes such as food preparation, processing, packaging, and quality control. Robotics in this sector not only increases operational efficiencies but also addresses challenges related to labor shortages, cost reduction, and the quest for greater precision and safety in food handling. Advances in artificial intelligence (AI) and machine learning (ML) further enhance the capabilities of food robotics, offering transformative potential for streamlining operations, improving hygiene standards, and creating competitive advantages in an increasingly demanding food sector.

Get a Free PDF Sample Copy of this Report@ https://dimensionmarketresearch.com/report/food-robotics-market/request-sample

Key Drivers of Market Growth

Several factors are driving the growth of the Global Food Robotics Market:

Market Segmentation

By Type

Articulated Robots

In 2023, articulated robots dominated the Global Food Robotics Market, holding a 42% market share. Their versatility and ability to perform complex tasks make them ideal for various food processing and packaging applications. These robots can handle intricate movements and are used in tasks such as sorting, packaging, and palletizing, where precision and flexibility are crucial.

Cartesian Robots

Cartesian robots, with a market share of approximately 25%, are favored for their cost-effectiveness, especially in applications involving repetitive linear movements. They excel in sorting and packaging tasks where high repeatability is essential, making them a popular choice for cost-conscious enterprises.

SCARA Robots

SCARA (Selective Compliance Assembly Robot Arm) robots represent about 15% of the market. Their speed and accuracy in pick-and-place operations make them suitable for high-throughput environments requiring rapid and precise movements.

Parallel Robots

Comprising roughly 8% of the market, parallel robots are known for their high speed and dexterity, making them suitable for handling delicate objects. Their applications include tasks that demand simultaneous speed and precision.

Cylindrical Robots

Cylindrical robots account for approximately 5% of the market. They are used in tasks that involve rotational movements, such as filling and dispensing, due to their ability to operate within cylindrical workspaces.

Collaborative Robots (Cobots)

Collaborative robots, or cobots, have gained popularity for their ability to work alongside human operators, enhancing flexibility and safety. Their increasing adoption in food manufacturing environments reflects their role in improving operational efficiency and safety.

Buy This Exclusive Report Here@ https://dimensionmarketresearch.com/checkout/food-robotics-market/

By Payload

Low-Cost Robots

Low-cost robots led the market in 2023, holding approximately 50% of the market share. Their affordability and accessibility make them particularly appealing to smaller enterprises seeking to automate operations without significant upfront investment. These robots are commonly used for tasks like packaging and material handling.

Medium-Cost Robots

Medium-cost robots represented about 35% of the market share. They offer a balance between performance and cost, making them suitable for applications requiring advanced functionalities such as precision food processing or moderate-speed packaging.

High-Cost Robots

High-cost robots, accounting for approximately 15% of the market, feature advanced technology and superior performance. They are utilized for complex tasks like advanced quality control or high-speed sorting, where investment in technology leads to significant operational improvements and efficiency gains.

By Application

Palletizing

Palletizing robots held the largest market share in 2023, approximately 40%. Their role in improving supply chain efficiency by handling high volumes of goods and streamlining stacking and arranging processes is crucial in ensuring that products reach their destinations safely and efficiently.

Packaging

Packaging robots accounted for around 30% of the market. These robots perform essential tasks such as filling, sealing, and labeling with high speed and accuracy. Their adaptability to various packaging formats and product types makes them indispensable in modern food manufacturing.

Repackaging

Repackaging robots held approximately 15% of the market share. They specialize in adjusting packaging to meet diverse consumer demands and retail specifications, which is increasingly important for businesses aiming to offer tailored packaging solutions and respond to shifting market needs.

Pick & Place

Pick & Place robots represent about 10% of the market. They excel in high-speed product sorting and handling tasks, performing operations requiring precision and rapid movement, such as sorting items on production lines or placing products into containers.

Processing

Processing robots account for roughly 3% of the market. They automate food preparation tasks like cutting, mixing, and cooking, contributing significantly to the efficiency and consistency of food processing operations.

Regional Analysis

Asia-Pacific

Asia-Pacific dominated the Global Food Robotics Market in 2023, holding an approximate 45% market share. This region's rapid industrialization, significant investments in automation systems, and growing demand for efficient food processing and packaging solutions in countries like China, Japan, and India drive its leading position. The region's robust manufacturing base and focus on improving food safety and production efficiency further support its market dominance.

Europe

Europe captured around 30% of the market share. The region benefits from strong regulatory frameworks that prioritize food safety and quality, along with advanced technological infrastructure. Countries like Germany, France, and the United Kingdom are pioneers in adopting sophisticated robotic solutions due to stringent food regulations and a drive towards increased automation.

North America

North America represented approximately 20% of the market. The region's well-established food industry and rapid technological innovation contribute to its significance. The United States and Canada are leading adopters of robotics in food manufacturing, focusing on improving operational efficiencies, addressing labor shortages, and maintaining high food safety standards.

Latin America

Latin America, though smaller in market share compared to other regions, is experiencing growth due to increasing investments in automation and modernization of food processing facilities. Countries like Brazil and Mexico are making strides in adopting robotics to enhance production efficiency.

Middle East & Africa

The Middle East & Africa region is also witnessing growth, driven by increasing investments in food manufacturing technologies and infrastructure development. Countries in this region are gradually adopting robotics to improve food processing and packaging efficiency.

Competitive Landscape

The Global Food Robotics Market is characterized by the presence of several key players who are driving innovation through technological advancements and robust product offerings.

ABB Group

ABB Group is a prominent player in the food robotics sector, offering a comprehensive suite of robotic solutions tailored for complex production environments. The company's focus on automation and smart manufacturing systems enhances efficiency and flexibility, meeting the growing demand for sophisticated food processing solutions.

KUKA AG

KUKA AG excels in providing flexible automation solutions for various food industry applications, including packaging and processing. The company's versatile robotic systems are designed to meet the needs of modern food manufacturing environments.

Fanuc Corporation

Fanuc Corporation is known for its durable and high-performance robots that excel in speed and reliability. The company's robotic systems are widely used in food manufacturing environments, contributing to the industry's advancement through innovative technology.

Kawasaki Heavy Industries Ltd.

Kawasaki Heavy Industries Ltd. offers high-speed and precision robots that support complex food handling tasks. The company's robots are designed to enhance operational efficiency and accuracy in food processing and packaging.

Rockwell Automation Inc.

Rockwell Automation Inc. integrates robotics with advanced control systems to increase operational intelligence. The company's solutions aim to streamline food manufacturing processes and improve overall efficiency.

Mitsubishi Electric Corporation

Mitsubishi Electric Corporation is known for its energy-efficient high-performance robots. The company's recent introduction of a teaching-less robot system for food-processing factories demonstrates its commitment to innovation and efficiency.

Yaskawa Electric Corporation

Yaskawa Electric Corporation delivers versatile robotic solutions that maximize operational efficiency. The company's robots are designed to meet the diverse needs of food manufacturing environments.

Recent Developments

Several recent developments highlight the continuous evolution and innovation within the Global Food Robotics Market:

FAQs

What is the current size of the Global Food Robotics Market?

As of 2024, the Global Food Robotics Market is projected to hold a market value of USD 3.0 billion and is expected to reach USD 6.9 billion by 2033.

What are the main drivers of growth in the Food Robotics Market?

Key drivers include advancements in automation technology

, rising food safety regulations, labor shortages, cost reduction, and increasing consumer demand for high-quality, personalized food products.

Which segment holds the largest market share in Food Robotics?

In 2023, articulated robots held the largest market share, approximately 42%, due to their versatility and ability to perform complex tasks in various food processing and packaging applications.

What regions are leading in the Food Robotics Market?

Asia-Pacific leads the market with approximately 45% share, followed by Europe at 30%, and North America at 20%. The region's rapid industrialization and investment in automation systems are key factors driving growth.

How does robotics improve food safety and efficiency?

Robotics enhances food safety by reducing human contact, which minimizes contamination risks. Additionally, automated systems improve efficiency by performing repetitive tasks with high precision and consistency, leading to better operational performance.

Conclusion

The Global Food Robotics Market is poised for substantial growth, driven by technological advancements and increasing demand for automation in the food industry. With a projected market value of USD 6.9 billion by 2033 and a robust CAGR of 9.9%, the sector is set to revolutionize food processing, packaging, and handling. The integration of robotics into food manufacturing offers significant benefits, including cost reduction, enhanced precision, improved safety, and the ability to meet evolving consumer demands.

As the market continues to expand, key players such as ABB Group, KUKA AG, and Fanuc Corporation are leading the way with innovative solutions that address the industry's needs. The ongoing developments and advancements in robotics technology are expected to further drive growth and transform the food sector, making it more efficient, safe, and responsive to market changes.

#Food Robotics#Market Growth#Automation#Food Industry#Tech Innovation#Robotics#Food Processing#Packaging Solutions#AI#Machine Learning#Food Safety#Operational Efficiency

0 notes

Text

Top Benefits of Investing in High-Quality Supermarket and Kitchen Equipment | Global Automation Ltd

Discover the advantages of investing in premium supermarket and kitchen equipment from Global Automation Ltd. Enhance operational efficiency, ensure durability, and improve customer satisfaction with our top-tier products designed for long-term success in the food industry.

#Global Automation Ltd#Premium Kitchen Equipment#Supermarket Equipment Supplier#Commercial Kitchen Appliances#Warehouse Storage Solutions#Durable Food Industry Equipment#Supermarket Equipment in Bangladesh#Retail Store Equipment#Supermarket Shelving and Racks#Commercial Refrigeration Units#Supermarket Checkout Counters#Cold Storage Solutions#Industrial Refrigeration#Cold Storage Bangladesh#Temperature Control Systems#Cold Chain Logistics#Industrial Storage Systems#Warehouse Automation#Storage Racks Bangladesh#Warehouse Management#Food Processing Equipment#Industrial Food Machinery#Food Processing Solutions#Food Production Equipment#Processing Machinery Bangladesh#Meat Processing Equipment#Industrial Meat Machinery#Meat Processing Solutions#Meat Production Equipment#Slaughterhouse Solutions

0 notes

Text

Batch Fluid Bed Dryers Market Set to Hit $1,593.7 Million by 2035

The global Batch Fluid Bed Dryers market is projected to experience significant growth, rising from $697.6 million in 2024 to $1,593.7 million by 2035. The market is expected to grow at an average annual rate of 10.3% from 2024 to 2035, driven by strong demand across pharmaceutical manufacturing, food processing, chemical processing, and plastics manufacturing industries.

Access detailed report insights here - https://datastringconsulting.com/industry-analysis/batch-fluid-bed-dryers-market-research-report

Key Applications Driving Market Growth

Batch Fluid Bed Dryers play a critical role in several industries due to their ability to provide consistent, efficient, and rapid drying. In the pharmaceutical industry, these dryers are essential for preserving the integrity of sensitive ingredients during the drying process, ensuring higher quality end products. Leading pharmaceutical companies such as Novartis and Pfizer rely on these dryers for their accuracy and reliability, securing a competitive edge in the market.

In the food processing sector, Batch Fluid Bed Dryers are used for their uniform drying capabilities. These dryers help preserve the nutritional value and extend the shelf life of food products. Companies like Nestlé and Kraft Heinz utilize these systems for drying fruits, vegetables, herbs, spices, and coffee beans, benefiting from superior heat transfer and moisture removal.

Technological Advancements and Market Innovation

Technological advancements have significantly impacted the Batch Fluid Bed Dryers market, particularly in pharmaceutical and food processing sectors. Modern fluid bed dryers now offer enhanced efficiency, reduced energy consumption, and improved output quality. These innovations enable superior drying uniformity, moisture removal, and particle size reduction, making them ideal for drying powders and granules.

The integration of automation into these systems has optimized the drying process, ensuring consistent quality output while reducing human error. As a result, the Batch Fluid Bed Dryers market has seen substantial growth, driving productivity improvements, reducing resource wastage, and lowering production costs, which in turn boosts profitability and sustainability.

Industry Leadership and Competitive Landscape

The Batch Fluid Bed Dryers market is highly competitive, with key players such as GEA Group AG, Andritz AG, Bühler Holding AG, Glatt GmbH, FLSmidth & Co. A/S, ThyssenKrupp AG, and SPX Flow Technology Danmark A/S leading the market. These companies are driving innovation by focusing on developing advanced solutions for fluid bed drying technology, customizable dryers, energy-efficient designs, and automation to improve performance and reduce operational costs.

The market’s growth is supported by shifting trends in pharmaceutical manufacturing, the expansion of chemical industries, and continuous technological advancements in fluid bed drying systems. As demand for efficient and precise drying solutions continues to rise, industry players are positioned to capitalize on significant growth opportunities.

Regional Analysis and Market Dynamics

North America remains a dominant player in the Batch Fluid Bed Dryers market, driven by robust industrial growth and technological advancements in drying systems. The pharmaceutical and food processing sectors, in particular, offer substantial opportunities due to their ongoing demand for high-efficiency drying solutions.

Key drivers in the region include stringent regulatory standards focused on quality and safety in production, along with a growing preference for sustainable and energy-efficient equipment. Europe and China are also strong contributors to market growth, with significant demand from local industries and manufacturers focusing on improving productivity and sustainability.

As these regions continue to expand, emerging markets in India, Brazil, and South Africa are expected to become increasingly important, offering new revenue opportunities for manufacturers seeking to diversify their portfolios and expand their total addressable market (TAM).

About DataString Consulting

DataString Consulting offers a comprehensive suite of market research and business intelligence solutions for both B2C and B2B markets. Specializing in bespoke research projects, the firm helps businesses achieve their strategic objectives, whether it’s expanding into new markets, increasing revenue, or addressing industry challenges.

With over 30 years of combined experience, DataString’s leadership team is well-versed in market & business research and strategy advisory across diverse sectors globally. Their expert consultants track high-growth segments within more than 15 industries and 60 sub-industries, providing actionable insights and data-driven strategies to help businesses thrive in competitive markets.

#Batch Fluid Bed Dryers#Market Growth#Pharmaceutical Manufacturing#Food Processing#Chemical Processing#Energy-efficient Drying Systems#Technological Advancements#Automation in Drying#Global Market Analysis#Industry Leadership#Competitive Landscape#Regional Market Dynamics#Sustainable Equipment#DataString Consulting

0 notes

Text

Coca-Cola Singapore Enhances Operations with XSQUARE's Autonomous Forklifts

Coca-Cola has introduced five autonomous forklifts (AGVs) at its regional beverage concentrate plant in Singapore through a partnership with XSQUARE Technologies. This move is part of Coca-Cola's digital transformation strategy, integrating Industrial 4.0 capabilities... READ MORE

0 notes

Text

Useful Tips for Becoming a Successful Agriculture Investor

Agriculture investment refers to the allocation of financial resources, capital, or assets into various aspects of the agricultural sector with the expectation of generating a return on investment (ROI). This could mean investing monies in agriculture land for sale such as coconut land for sale in Sri Lanka, or other types of investments. It involves deploying funds in activities and projects related to agriculture for the purpose of profit, income generation, or long-term wealth creation. Agriculture investment can take many forms, including:

Farmland Acquisition: Purchasing agricultural land for the cultivation of crops or the raising of livestock. This can involve both large-scale and small-scale farming operations.

Infrastructure Development: Investing in the construction and improvement of infrastructure such as irrigation systems, roads, storage facilities, and processing plants to enhance agricultural productivity and efficiency.

Technological Advancements: Funding the development and adoption of agricultural technologies, such as precision agriculture, automation, and biotechnology, to improve crop yields and reduce operational costs.

Agribusiness Ventures: Investing in agribusinesses, such as food processing, distribution, and marketing, that are part of the agricultural value chain.

Research and Development: Supporting research initiatives related to agriculture to develop new crop varieties, pest-resistant strains, and sustainable farming practices.

Input Supply: Investing in the production and distribution of agricultural inputs like seeds, fertilisers, pesticides, and machinery.

Commodity Trading: Speculating on the future prices of agricultural commodities, such as grains, oilseeds, and livestock, through commodity markets or futures contracts.

Sustainable Agriculture: Funding practices and projects aimed at sustainable and environmentally responsible farming methods, which can include organic farming, agroforestry, and conservation efforts.

Rural Development: Supporting initiatives that improve the overall economic and social well-being of rural communities, often through investments in education, healthcare, and infrastructure.

Venture Capital and Start-ups: Investing in start-ups and companies focused on innovations in agriculture, such as vertical farming, aquaculture, or agricultural technology (AgTech).

Agriculture investment is important for food security, economic development, and job creation in many regions. However, it also comes with risks related to weather conditions, commodity price fluctuations, and market dynamics. Investors often conduct thorough research and risk assessments before committing their resources to agricultural ventures. Additionally, they may need to consider factors like government policies, environmental regulations, and social impacts on their investment decisions in the agricultural sector.

How to become a successful agriculture investor

Becoming a successful agriculture investor requires a combination of financial acumen, agricultural knowledge, and a strategic approach to investment. Here are some steps to help you become a successful agriculture investor:

Educate Yourself: Gain a strong understanding of the agricultural sector, including the different sub-sectors (crops, livestock, agribusiness, etc.). Stay updated on industry trends, market conditions, and emerging technologies.

Set Clear Investment Goals: Define your investment objectives, whether it is long-term wealth creation, income generation, or diversification of your investment portfolio.

Risk Assessment: Understand and assess the risks associated with agriculture investments, such as weather-related risks, market volatility, and regulatory changes, whether you are looking at land for sale or any other type of investment.

Develop a Diversified Portfolio: Diversify your investments across different agricultural sectors and geographic regions to spread risk.

Market Research: Conduct thorough market research to identify promising investment opportunities and potential demand for agricultural products.

Build a Network: Establish connections with farmers, agricultural experts, government agencies, and industry stakeholders who can provide insights and opportunities.

Financial Planning: Create a budget and financial plan that outlines your investment capital, expected returns, and cash flow requirements.

Select the Right Investment Type: Choose the type of agriculture investment that aligns with your goals, whether it is farmland, agribusiness ventures, or agricultural technology.

Due Diligence: Conduct comprehensive due diligence on potential investments, including assessing the quality of farmland, the financial health of agribusinesses, and the technology's potential for scalability and profitability.

Sustainable Practices: Consider investments in sustainable and environmentally responsible agriculture practices, as they are gaining importance in the industry.

Risk Management: Implement risk management strategies, such as insurance, to protect your investments from unforeseen events like natural disasters or crop failures.

Continuous Learning: Stay informed about changes in the agricultural industry and adapt your investment strategy accordingly.

Legal and Regulatory Compliance: Understand and comply with local, national, and international regulations and tax laws that may impact your agriculture investments.

Monitor and Adjust: Regularly review the performance of your investments and be prepared to make adjustments or exit underperforming ones.

Long-Term Perspective: Agriculture investments often require a long-term perspective, so be patient and avoid making impulsive decisions based on short-term market fluctuations.

Seek Professional Advice: Consult with financial advisors, agricultural experts, and legal professionals to ensure that your investments are structured and managed effectively.

Successful agriculture investment often involves a mix of financial expertise, industry knowledge, and a willingness to adapt to changing conditions. It is important to approach agriculture investment with a well-thought-out strategy, and to be prepared for both opportunities and challenges in this sector.

#Agriculture investment refers to the allocation of financial resources#capital#or assets into various aspects of the agricultural sector with the expectation of generating a return on investment (ROI). This could mean#or other types of investments. It involves deploying funds in activities and projects related to agriculture for the purpose of profit#income generation#or long-term wealth creation. Agriculture investment can take many forms#including:#●#Farmland Acquisition: Purchasing agricultural land for the cultivation of crops or the raising of livestock. This can involve both large-sc#Infrastructure Development: Investing in the construction and improvement of infrastructure such as irrigation systems#roads#storage facilities#and processing plants to enhance agricultural productivity and efficiency.#Technological Advancements: Funding the development and adoption of agricultural technologies#such as precision agriculture#automation#and biotechnology#to improve crop yields and reduce operational costs.#Agribusiness Ventures: Investing in agribusinesses#such as food processing#distribution#and marketing#that are part of the agricultural value chain.#Research and Development: Supporting research initiatives related to agriculture to develop new crop varieties#pest-resistant strains#and sustainable farming practices.#Input Supply: Investing in the production and distribution of agricultural inputs like seeds#fertilisers#pesticides#and machinery.

1 note

·

View note

Text

AI can’t do your job

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in SAN DIEGO at MYSTERIOUS GALAXY on Mar 24, and in CHICAGO with PETER SAGAL on Apr 2. More tour dates here.

AI can't do your job, but an AI salesman (Elon Musk) can convince your boss (the USA) to fire you and replace you (a federal worker) with a chatbot that can't do your job:

https://www.pcmag.com/news/amid-job-cuts-doge-accelerates-rollout-of-ai-tool-to-automate-government

If you pay attention to the hype, you'd think that all the action on "AI" (an incoherent grab-bag of only marginally related technologies) was in generating text and images. Man, is that ever wrong. The AI hype machine could put every commercial illustrator alive on the breadline and the savings wouldn't pay the kombucha budget for the million-dollar-a-year techies who oversaw Dall-E's training run. The commercial market for automated email summaries is likewise infinitesimal.

The fact that CEOs overestimate the size of this market is easy to understand, since "CEO" is the most laptop job of all laptop jobs. Having a chatbot summarize the boss's email is the 2025 equivalent of the 2000s gag about the boss whose secretary printed out the boss's email and put it in his in-tray so he could go over it with a red pen and then dictate his reply.

The smart AI money is long on "decision support," whereby a statistical inference engine suggests to a human being what decision they should make. There's bots that are supposed to diagnose tumors, bots that are supposed to make neutral bail and parole decisions, bots that are supposed to evaluate student essays, resumes and loan applications.

The narrative around these bots is that they are there to help humans. In this story, the hospital buys a radiology bot that offers a second opinion to the human radiologist. If they disagree, the human radiologist takes another look. In this tale, AI is a way for hospitals to make fewer mistakes by spending more money. An AI assisted radiologist is less productive (because they re-run some x-rays to resolve disagreements with the bot) but more accurate.

In automation theory jargon, this radiologist is a "centaur" – a human head grafted onto the tireless, ever-vigilant body of a robot

Of course, no one who invests in an AI company expects this to happen. Instead, they want reverse-centaurs: a human who acts as an assistant to a robot. The real pitch to hospital is, "Fire all but one of your radiologists and then put that poor bastard to work reviewing the judgments our robot makes at machine scale."

No one seriously thinks that the reverse-centaur radiologist will be able to maintain perfect vigilance over long shifts of supervising automated process that rarely go wrong, but when they do, the error must be caught:

https://pluralistic.net/2024/04/01/human-in-the-loop/#monkey-in-the-middle

The role of this "human in the loop" isn't to prevent errors. That human's is there to be blamed for errors:

https://pluralistic.net/2024/10/30/a-neck-in-a-noose/#is-also-a-human-in-the-loop

The human is there to be a "moral crumple zone":

https://estsjournal.org/index.php/ests/article/view/260

The human is there to be an "accountability sink":

https://profilebooks.com/work/the-unaccountability-machine/

But they're not there to be radiologists.

This is bad enough when we're talking about radiology, but it's even worse in government contexts, where the bots are deciding who gets Medicare, who gets food stamps, who gets VA benefits, who gets a visa, who gets indicted, who gets bail, and who gets parole.

That's because statistical inference is intrinsically conservative: an AI predicts the future by looking at its data about the past, and when that prediction is also an automated decision, fed to a Chaplinesque reverse-centaur trying to keep pace with a torrent of machine judgments, the prediction becomes a directive, and thus a self-fulfilling prophecy:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

AIs want the future to be like the past, and AIs make the future like the past. If the training data is full of human bias, then the predictions will also be full of human bias, and then the outcomes will be full of human bias, and when those outcomes are copraphagically fed back into the training data, you get new, highly concentrated human/machine bias:

https://pluralistic.net/2024/03/14/inhuman-centipede/#enshittibottification

By firing skilled human workers and replacing them with spicy autocomplete, Musk is assuming his final form as both the kind of boss who can be conned into replacing you with a defective chatbot and as the fast-talking sales rep who cons your boss. Musk is transforming key government functions into high-speed error-generating machines whose human minders are only the payroll to take the fall for the coming tsunami of robot fuckups.

This is the equivalent to filling the American government's walls with asbestos, turning agencies into hazmat zones that we can't touch without causing thousands to sicken and die:

https://pluralistic.net/2021/08/19/failure-cascades/#dirty-data

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/03/18/asbestos-in-the-walls/#government-by-spicy-autocomplete

Image: Krd (modified) https://commons.wikimedia.org/wiki/File:DASA_01.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

--

Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#reverse centaurs#automation#decision support systems#automation blindness#humans in the loop#doge#ai#elon musk#asbestos in the walls#gsai#moral crumple zones#accountability sinks

277 notes

·

View notes

Text

Packaging Automation Market to be Worth $118.8 Billion by 2031

Meticulous Research®—a leading global market research company, published a research report titled, ‘Packaging Automation Market by Offering (Solution, Services), Type, End-use Industry (Healthcare & Pharmaceuticals, E-commerce & Logistics, Food & Beverage, Chemical & Refinery, Aerospace & Defense), and Geography - Global Forecast to 2031.’

According to this latest publication from Meticulous Research®, the global packaging automation market is projected to reach $118.8 billion by 2031, at a CAGR of 10.1% during the forecast period. The growth of the packaging automation market is mainly attributed to the rapid growth of the E-commerce sector, the increasing adoption of automated systems across industries, and stringent food safety regulations. However, the high initial costs of installing automated systems restrain the market’s growth.

The high demand for packaging automation in the logistics industry and the increasing demand for sustainable and eco-friendly packaging are expected to create market growth opportunities. However, the shortage of skilled operators is a major challenge for the players in this market. Integration of advanced technologies and smart packaging are major trends in the packaging automation market.

The global packaging automation market is segmented by offering (solutions [case sealers & erectors, sleevers & cartoners, palletizers & depalletizers, strappers, markers & labelers, automated mailer systems, case packers, and other solutions], services [consulting, installation & training, and support & maintenance]), type (robotic pick & place, secondary packaging, and tertiary & palletizing), end-use industry (healthcare & pharmaceuticals [healthcare & pharmaceuticals manufacturing companies and contract manufacturing organizations], e-commerce & logistics [E-commerce, contract packaging, and logistics companies], food & beverage, automotive, chemical & refineries, aerospace & defense, and other end-use industries), and geography (Asia-Pacific, Europe, North America, Latin America, and the Middle East & Africa). The study also evaluates industry competitors and analyses the market at the country and regional levels.

Based on offering, the packaging automation market is segmented into solutions and services. Furthermore, the solutions segment is subsegmented into case sealers & erectors, sleevers & cartoners, palletizers & depalletizers, strappers, markers & labelers, automated mailer systems, case packers, and other solutions. The services segment is subsegmented into consulting, installation & training, and support & maintenance. In 2024, the solutions segment is expected to account for the larger share of the global packaging automation market. The segment’s large market share is mainly attributed to the need for increased manufacturing speed and ensuring products and workers’ safety. However, the services segment is projected to record the highest CAGR during the forecast period. The segment’s growth is driven by the increasing deployment of automation in various industries such as e-commerce, healthcare & pharmaceuticals, food & beverage, automotive, and chemical & refineries and the growing demand for packaging automation to speed up production, optimize warehouse space, and reduce reliance on labor to provide more value-added services to their customers.

Based on type, the packaging automation market is segmented into robotic pick & place, secondary packaging, and tertiary & palletizing. In 2024, the robotic pick & place segment is expected to account for the largest share of the global packaging automation market. The segment’s large market share is mainly attributed to rising demand for pick and place robots in various industries such as manufacturing, food & beverage, automotive, chemical & refineries, aerospace & defense, e-commerce & logistics, healthcare & pharmaceuticals, and the growing demand for automation from manufacturing companies to increase production rates. However, the secondary packaging segment is projected to record the highest CAGR during the forecast period. The segment’s growth is driven by the rising need to safely transport products during shipment and the growing demand for supplementary protection in the e-commerce and pharmaceutical sectors.

Based on end-use industry, the packaging automation market is segmented into healthcare & pharmaceuticals, E-commerce & logistics, food & beverage, automotive, chemical & refineries, aerospace & defense, and other end-use industries. Furthermore, the healthcare & pharmaceuticals segment is subsegmented into healthcare & pharmaceuticals manufacturing companies and contract manufacturing organizations. The E-commerce & logistics segment is subsegmented into E-commerce, contract packaging, and logistics companies. In 2024, the food & beverage segment is expected to account for the largest share of the global packaging automation market. The segment’s large market share is mainly attributed to shifting consumer tastes, high competition in the packaged food market, and a surge in demand for packaged food. However, the e-commerce & logistics segment is projected to record the highest CAGR during the forecast period. The segment’s growth is attributed to various factors, including the rise in online sales channels, the increase in online shopping among customers, the increasing adoption of automation in e-commerce & logistics to ensure timely delivery, and the rising consumer demand for convenience shopping.

Based on geography, the global packaging automation market is segmented into North America, Europe, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of the packaging automation market, followed by Europe, North America, Latin America, and the Middle East & Africa. Asia-Pacific’s significant market share is attributed to the increasing utilization of sustainable packaging in the food & beverage sector, supportive government initiatives aimed at promoting the adoption of automation and Industry 4.0 technologies to enhance manufacturing capabilities, the growing demand for eco-friendly packaging solutions, and the rapid expansion of the E-commerce sector in countries like China and India. Moreover, Asia-Pacific is also projected to register the highest CAGR over the forecast period.

Key Players

The key players operating in the global packaging automation market are ABB, Ltd. (Switzerland), Robert Bosch GmbH (Germany), Siemens AG (Germany), Fanuc Corporation(Japan), and Mitsubishi Electric Corporation (Japan), Swisslog Holding AG (Switzerland), Rockwell Automation, Inc. (U.S.), Schneider Electric SE (France), WestRock Company (U.S.), SATO Holdings Corporation (Japan), Krones AG (Germany), Automated Packaging Systems, Inc. (U.S.), Emerson Electric Co. (U.S.), Crawford Packaging (Canada), Fuji Machinery (Japan), Brenton LLC (U.S.), BEUMER Group GmbH & Co. KG(Germany), Barry-Wehmiller Group, Inc. (U.S.), KHS GmbH (Italy), MULTIVAC Sepp Haggenmüller SE & Co. KG (Germany), Omori Machinery Co., Ltd. (Japan), and Syntegon Technology GmbH (Germany).

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5324

Key Questions Answered in the Report:

Which are the high-growth market segments in terms of offering, type, and end-use industry?

What is the historical market for packaging automation across the globe?

What are the market forecasts and estimates for the period of 2024–2031?

What are the major drivers, restraints, opportunities, challenges, and trends in the global packaging automation market?

Who are the major players in the global packaging automation market, and what are their market shares?

What is the competitive landscape like?

What are the recent developments in the global packaging automation market?

What are the different strategies adopted by the major players in the market?

What are the geographic trends and high-growth countries?

Who are the emerging players in the global packaging automation market, and how do they compete with the other players?

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#Packaging Automation Market#Packaging Automation#Smart Packaging#Automated Packaging Systems#Packaging & Processing Solutions#Portioning#Labeling#Marking#Inspection#Handling#Packaging Machines#Robotic Pick & Place#Secondary Packaging#Tertiary & Palletizing#Automation Solutions#Automated Equipment#Automated Bagging Systems#Transit Packaging#Food Packaging Equipment

0 notes