#Forex scalping

Explore tagged Tumblr posts

Text

Learn The RSI Scalping Strategy For Effective Forex Signals

The RSI Scalping Strategy is based on the Relative Strength Index, a technical indicator that measures the strength and speed of price movements.

0 notes

Video

Forex Scalping EA Robot Bot | Advanced Automated Trading for Rapid Profi...

#forex#forex trading#best scalping ea 2023#forex robot 2023#forex ea 2023#forex scalper#forex signals#forex strategy#forex scalping#forex live#forex bot

0 notes

Text

youtube

Hello dear Traders, This is our best Forex Trading Indicator. 100% Non-repaint Indicator and accuracy 92%+ This is the world’s best Indicator for Scalping. Its name “Buy Sell Super Channel Indicator” This indicator is very easy to use for beginners And fully automatic.

It Will Never Expire And There Are NO “Monthly Fees” Or NO Any Other Recurring Charges For Use File Type And Requirements:- This Is A Digital Item! (Download Links–Zip File) You Will Need: MT4 Terminal This Files You’ll Get Is ZIP Archive.

#forex system#forexmarket#forex analysis#forexmentor#forextrading#crypto#forex scalping#forexsignals#binaryoptions#forex#Youtube

1 note

·

View note

Text

Forex Signals Unveiled | Achieving Consistent Profits with Profitable Forex Signals

#forex signals#forex#forex trading#forexnews#forexmoney#money#investment#stock market#currency#crypto#forex scalping#forex system#broker#forex strategies

0 notes

Text

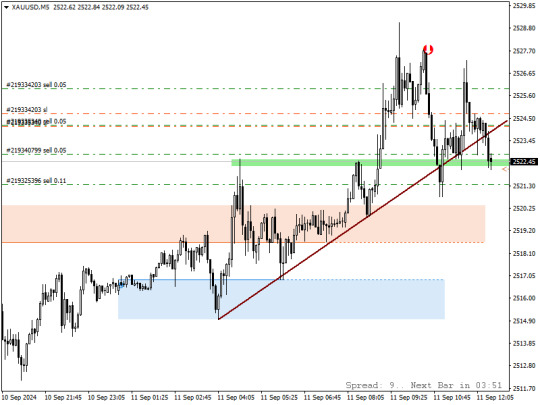

Forex Metatrader4 trade in #USDJPY H1 Timeframe. Trade Opens in last week and running updates. . Forex Cashpower Indicator Version is Lifetime license ultimate NON REPAINT Signals with Smart algorithms that emit precise signals in Reversal zones of Trends with big trades volumes. Official Website: wWw.ForexCashpowerIndicator.com . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING ✅ Less Signs Greater Profits 🔔 Sound And Popup Notification ✅ Minimizes unprofitable/false signals 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at FBS brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account. .

#forexindicators#forexindicator#forexprofits#cashpowerindicator#indicatorforex#forexsignals#forex#forextradesystem#forexvolumeindicators#forexchartindicators#forex cashpower indicator#forex scalping#forex brokers#forexindonesia#forextips#forexmentor#forexbroker#forexprofit#forexmarket#forexstrategy

1 note

·

View note

Text

Forex Trading Strategies: Navigating Market Trends Amid Economic Shifts

Forex traders need adaptable strategies to thrive in unpredictable market conditions. This post focuses on forex trading methods such as scalping, market trend analysis, and risk management.

Gold is currently experiencing bearish momentum, with RSI divergence suggesting further declines. While short-term pullbacks may occur, traders can capitalize on these movements with scalping strategies aimed at price dips.

Silver’s price action shows a pullback, but the overall market remains bearish. RSI and MACD signals hint at potential for a temporary rally. Scalping traders should focus on short-term selling opportunities.

The U.S. dollar continues to strengthen as inflation fears delay potential rate cuts. The DXY index reflects this, offering opportunities for traders to go long on USD pairs, including USDJPY and USDCHF.

GBPUSD is maintaining a bearish trend, with minimal resistance to further declines. Short-term pullbacks could offer opportunities for scalping, but the long-term outlook remains negative.

The Australian dollar is showing consolidation, lacking clear direction. Traders should wait for a breakout before entering positions, using proper forex risk control measures to manage volatility.

NZDUSD is in a downtrend, with RSI suggesting a possible short-term reversal. However, the broader trend remains bearish, offering short-term selling opportunities for scalpers.

EURUSD remains weak, with both RSI and MACD signaling further declines. Scalping traders can take advantage of short pullbacks while keeping a bearish outlook.

USDJPY continues its bullish momentum, supported by strong buying pressure. Traders should use caution and manage risk, looking for potential overbought signals.

USDCHF is moving upward, but a pullback seems likely. Traders can capitalize on small price movements through scalping strategies while managing risk.

USDCAD shows signs of a potential pullback after an uptrend. Traders should wait for confirmation and use forex signals to time entries and exits effectively.

With effective forex trading methods like scalping, market analysis, and risk control, traders can adapt to market fluctuations and maximize profits.

#Forex trading methods#Forex scalping strategies#Forex market trends#Forex risk control#Forex signal trading

3 notes

·

View notes

Text

youtube

#forex trading#cryptocurrency trading#day trading#commodities trading#futures trading#indices trading#currency trading#forex strategies#crypto analysis#live trading#technical analysis#market analysis#trading psychology#trading education#scalping strategies#swing trading#trading signals#tradingview analysis#price action trading#macro trading#financial markets#forex live#bitcoin trading#ethereum analysis#gold trading#oil trading#index futures#trading for beginners#advanced trading strategies#global markets

1 note

·

View note

Text

Learn How To Uncover Scalping Opportunities By Using The Economic Calendar

This article delves into scalping with the economic calendar and explores how leveraging it can enhance a trader's chances of high probability trading.

0 notes

Text

How I Earned $18,500 Trading 2 Hours a Day — The Hidden Truth About Forex Session Timing - The Goldmine Strategy

Introduction

Why You Might Be Trading All Wrong

Most traders believe the only way to win in the forex markets is by staying glued to their charts during the London and New York sessions. I used to be one of them. I would wake up early, chase volatile moves, enter trades too soon, or get stopped out during massive fakeouts. My strategy? Honestly, it wasn’t really a strategy. It was chaos.

But everything changed when I stopped trying to outsmart the market and started to understand the rhythm of the market sessions. Instead of fighting during high-volatility hours, I discovered a calmer window of opportunity — the Asian session.

Within three months, by focusing only on a specific 2-hour window in the Asian session and refining my approach, I made $18,500. This article is not about signals or copy-paste trades. It’s about structure, timing, and discipline.

The Forgotten Window: Understanding the Asian Session

When people hear "Asian session," they immediately think of low volatility and boring charts. But here’s what they don’t know: The Asian session holds structure.

Markets like XAUUSD (Gold), USDJPY, and a few major JPY pairs form highly predictable patterns during these hours. There's reduced manipulation, fewer spikes, and cleaner movement. Most professional traders skip this time because it doesn't give them the thrill they crave. But for those of us focused on steady profits, it's a goldmine (literally).

Benefits of Trading the Asian Session:

Fewer fakeouts

Clean breakouts from overnight consolidations

Lower spreads for some pairs

High win-rate setups if you're patient

My Daily Routine: The $18,500 Case Study

Every day, I only spend about 2 hours on charts. Here’s how my routine looks:

Chart Review: I check price action from the previous New York session.

Asian Range Markup: I draw my Asian range using specific timing tools.

The Watch: I monitor for the secret in this course

👉 Get the full strategy pack and tools here

Entry Point: I wait. I enter only when the setup matches the framework.

Risk Plan: Each trade has a pre-defined risk and exit structure.

Log the Trade: I record the entry, logic, stop loss, and result in my trading journal.

It sounds simple — and that’s because it is. But simple doesn't mean easy.

How I Grew From Small Profits to $18,500

I started small. My first few trades gave me $20 here, $60 there. But over time, something interesting happened. I started recognizing the same pattern showing up again and again. I fine-tuned my execution, trusted my plan, and focused on risk-reward.

Before I knew it, my gains went from $100 a week to over $1,000. In just under 90 days, my balance grew past the $18,500 mark.

I wasn’t trading aggressively. I wasn’t trading London or New York. I was simply mastering one session, one setup, and one strategy.

Let’s Talk Results (Without the Hype)

I know you’re probably skeptical. And you should be. The forex industry is full of screenshots and fake success stories.

But what I offer here is this: a repeatable framework based on timing and structure.

My win rate is around 76%, with an average of 1:2 risk-reward ratio. My max drawdown in the past 3 months? Less than 6%. And yes, I’ve used this same method to pass prop firm challenges too.

No indicators. No bots. Just clear logic and market rhythm.

Forex Lifestyle: Freedom Over Frenzy

I now trade from my phone or laptop while sipping coffee. I don’t miss sleep. I don’t stress over missed moves. And most importantly, I no longer chase the markets.

This strategy has allowed me to:

Spend more time with family

Avoid screen fatigue

Focus on high-quality trades only

Achieve a scalable income from a simple routine

How to Trade XAUUSD Profitably (Without Indicators)

Gold, or XAUUSD, thrives in the Asian session. While most people wait for news spikes, I look for price structure and liquidity levels.

Here's what I can say:

Gold respects previous day highs/lows during this session.

Breakouts tend to be stronger when they align with structure.

Trading less = winning more, especially with gold.

This is where the Goldmine Strategy truly shines.

The Secret Sauce? It’s Not What You Think

You might be expecting me to now reveal the exact steps or give you an entry formula.

Nope.

That part is in my full training, and honestly, it's not about hiding things. It's about teaching with depth, not with shortcuts. Real traders understand that success is more than just copying.

What matters more is having a trading framework, trading plan, and risk model that you trust.

And yes, all of that is included in my full package — from my risk management plan to my live trade journal.

Final Thoughts: Best Forex Trading Strategy? This Is It.

If you’re asking yourself what the best forex trading strategy is, the answer might surprise you. It’s not the one with the most indicators or YouTube views. It’s the one that gives you:

Confidence

Consistency

Simplicity

Sustainability

And for me, it’s the one I use every day during the Asian session. The same one that helped me earn $18,500 in profit.

Want the Full Guide?

If this resonates with you, check out the full blueprint, video training, and live journal access:

👉 Read the full breakdown on Medium

👉 Get the full strategy pack and tools here

👉 Subscribe for Daily Session Trades

Keywords used throughout the article: best forex trading strategy, goldmine strategy, asian session profit, forex lifestyle, how to trade XAUUSD profitably

Let the London crowd chase noise. You? You’ll master calm profit.

#goldmine strategy#best forex trading strategy#asian session profit#xauusd scalping#btc trading setup#tokyo breakout method#forex lifestyle#smart money strategy#passive forex income#prop firm challenge strategy

0 notes

Text

EURJPY: Euro Weakness and Yen Powerlessness

The US Dollar is weaker, after the ADP employment data report lowered the odds of the Fed raising interest rates later in the year. This favoured the Japanese Yen temporarily, although it is too early to conclude that, given that there is still important economic data throughout October that will be important inputs for the BOJ. Nonetheless, the Yen rose past 149.00 per dollar, climbing further…

View On WordPress

#Currency Exchange#EURJPY#Euro#Foreign exchange market#Forex analysis#forex brokers#Forex charts#Forex demo account#Forex fundamental analysis#Forex indicators#Forex leverage#Forex liquidity#Forex market psychology#Forex news#Forex platform#Forex regulation#Forex risk management#Forex scalping#Forex signals#forex strategies#Forex swing trading#Forex technical analysis#Forex Trading#Forex trading hours#Forex trading pairs#Forex trend analysis#Forex volatility#Powerlessness#Weakness#Yen

0 notes

Video

Best Forex Scalping EA Robot 2023: Boost Your Forex Profits

#Forex scalping#best forex scalping ea 2023#forex scalper 2023#forex ea 23023#forex robot 2023#forex bot 2023#foorex live#forex livetrading#forex trading#forexmarket#forexsignals

0 notes

Text

Does an indicator work in Forex?

Indicators can be useful tools in Forex trading, but they are not foolproof and do not guarantee success. An indicator in Forex is a mathematical calculation based on historical price data, volume, or open interest that aims to provide insights into market trends, momentum, volatility, and potential entry or exit points for trades.

Super Arrow mt4 indicator

Different types of indicators exist, including:

1. **Trend-following indicators**: These indicators help traders identify the direction of the prevailing trend in the market. Examples include Moving Averages (MA), Ichimoku Cloud, and Parabolic SAR.

2. **Oscillators**: Oscillators help traders identify overbought or oversold conditions in the market, which can suggest potential reversal points. Examples include the Relative Strength Index (RSI), Stochastic Oscillator, and the Moving Average Convergence Divergence (MACD).

3. **Volatility indicators**: These indicators measure the degree of price variability in the market. Examples include the Average True Range (ATR) and Bollinger Bands.

While indicators can provide valuable insights and support decision-making, they are not perfect and have limitations. Here are some points to consider:

1. **Lagging nature**: Many indicators are based on past price data, so they can lag behind real-time market movements. This lag can lead to delayed signals and potentially missed opportunities.

2. **False signals**: Indicators can produce false or misleading signals, especially during choppy or ranging market conditions. Relying solely on indicators without considering other factors can be risky.

3. **Subjectivity**: Traders may interpret indicators differently, leading to varying trading decisions. The effectiveness of an indicator can depend on the trader's experience and skill in using it.

4. **Changing market conditions**: Market dynamics can change over time, affecting the reliability of certain indicators. An indicator that worked well in the past may not perform as effectively in the future.

Indicators can be useful tools in Forex trading, but it's essential to understand their limitations and use them in conjunction with other analysis methods. Indicators are mathematical calculations based on historical price data or other market-related information, and they are used to provide insights into potential market trends, momentum, volatility, and other aspects of the price action.

Some commonly used indicators in Forex trading include Moving Averages (MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, and many others.

The effectiveness of indicators depends on various factors, including the trader's strategy, timeframe, and the market conditions. Here are some points to consider regarding the use of indicators:

1. Lagging Nature: Most indicators are lagging in nature, meaning they use past price data to generate signals. As a result, they may not provide real-time insights into market movements and can sometimes give delayed signals.

2. Subjectivity: Different traders may interpret indicators differently, leading to varying trading decisions. This subjectivity can sometimes lead to conflicting signals or confusion.

3. Complementary Analysis: Indicators are best used as part of a comprehensive trading strategy, along with other forms of analysis like fundamental analysis, price action analysis, and market sentiment analysis.

4. False Signals: Indicators can generate false signals, especially in choppy or sideways markets. Relying solely on indicators without considering other factors may lead to poor trading decisions.

5. Historical Performance: Past performance of an indicator does not guarantee future results. Market conditions can change, and indicators may lose their effectiveness during certain periods.

6. Over-optimization: Traders should avoid over-optimizing indicators to fit historical data perfectly, as it may lead to curve-fitting and unreliable results in live trading.

In conclusion, indicators can be valuable tools when used judiciously and in conjunction with other analysis methods. Traders should avoid relying solely on indicators and focus on building a robust trading strategy that considers multiple factors influencing the market. Continuous learning, practice, and risk management are essential components of successful Forex trading.

0 notes

Text

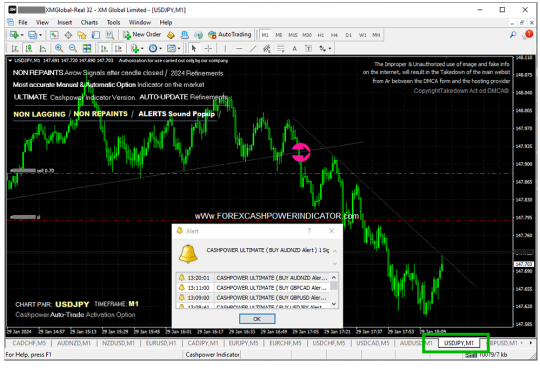

Scalper trade #USDJPY M1 (1 minut chart) Timeframe Metatrader4. Trade Profits Protected with Stop Loss in positive area. Official Website: wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account. .

#forexsignals#cashpowerindicator#forex#forexindicator#forextradesystem#forexvolumeindicators#forexindicators#indicatorforex#forexprofits#forexchartindicators#forex accurate indicatoraccurate buy sell signal indicator mt4accurate non repaint indicatoraccurate indicator for scalping accurate buy se#accurate buy sell signal indicator mt4#accurate non repaint indicator#accurate indicator for scalping

2 notes

·

View notes

Text

#IC Markets#forex broker#CFD trading#MetaTrader 4#MetaTrader 5#cTrader#Raw Spread accounts#low spreads#scalping#automated trading#ECN broker#ASIC regulated#CySEC regulated#Seychelles FSA regulated#trading platforms#forex trading#cryptocurrency CFDs#stock CFDs#commodity CFDs#futures trading#trading fees#no inactivity fees#Islamic accounts#leverage up to 1:1000#trading 2025#broker review

0 notes

Text

2 notes

·

View notes