#Forex technical analysis

Explore tagged Tumblr posts

Text

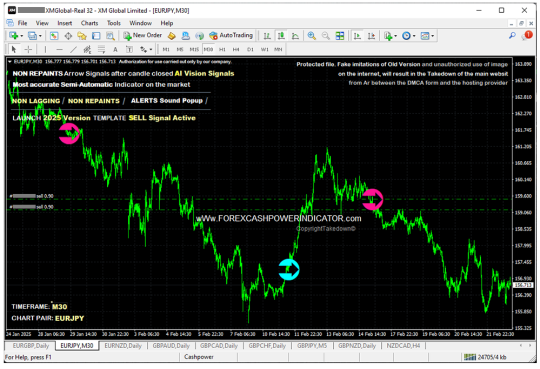

Metatrader4 Sell entry 1.8 lots (2x 0.90) inside chart [EURJPY,M30] 2025V Update Version. Official Website: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator LIFETIME CENSE ( NO Monthly fees ) one-time fee with NO LAG & NON REPAINT buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes. . ✅ NO Monthly Fees/ New 2025 Version ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

#eurjpy technical analysis#forex technical analysis#hot trade forex with price action#forex price action ebook#forex course#forex ebook download#how trade forex with signals#forex best signals services#forex foruns#forex stores#forex signals stores#forex indicator store#best forex indicator 2025#best forex strategy to use in 2025#cashpower indicator review#cashpower indicator download

1 note

·

View note

Text

Comprehensive Analysis of GBP/JPY: Key Support and Resistance Levels Explained

#GBP/JPY analysis#forex technical analysis#British Pound Japanese Yen#forex trading#currency pair#GBP/JPY forecast#support and resistance#Fibonacci retracement

0 notes

Text

Ti...

View On WordPress

#Currency Exchange#Foreign exchange market#Forex analysis#forex brokers#Forex charts#Forex demo account#Forex fundamental analysis#Forex indicators#Forex leverage#Forex liquidity#Forex market psychology#Forex news#Forex platform#Forex regulation#Forex risk management#Forex scalping#Forex signals#forex strategies#Forex swing trading#Forex technical analysis#Forex Trading#Forex trading hours#Forex trading pairs#Forex trend analysis#Forex volatility#Ti..

0 notes

Text

Consistency in your trading 👉🏻

For more join us :-

#forex#forex education#forex expert advisor#forex broker#forexmentor#forex market#forex indicators#forexsignals#forexmastery#crypto#cryptoinvesting#cryptocurrency#bitcoin#technical analysis#global market#market strategy#market analysis#learn forex trading#forexlifestyle#forexstrategy#forexsuccess#jaipur#forex jaipur

2 notes

·

View notes

Text

Success and Failure in Forex Trading

Forex trading, or foreign exchange trading, is a challenging yet potentially rewarding endeavor. Traders enter the market with hopes of achieving financial success, but the path is often fraught with both triumphs and setbacks. Understanding the factors that contribute to success and failure in forex trading is crucial for any trader aiming to navigate this volatile market…

#Forex#Forex Market#Forex Traders#Forex Trading#Leverage#Market Trends#Overtrading#Profitability#Risk Management#Stop-Loss#Technical Analysis#Trading Decisions#Trading Plan#Trading Strategies

3 notes

·

View notes

Text

Effortless Efficiency: Automate Your Forex Trades with the Panel

In the dynamic world of forex trading, efficiency is paramount. Traders are constantly seeking ways to streamline their processes, optimize their strategies, and maximize their profits. One powerful tool that has emerged to meet these demands is the Automated Trading Panel. These panels leverage cutting-edge technology to automate trade execution, implement complex strategies, and enhance overall efficiency in forex trading. In this blog post, we'll explore the benefits, features, and potential of Automated Trading Panels in revolutionizing the way traders approach the forex market.

Understanding Automated Trading Panels: Automated Trading Panels are sophisticated software solutions designed to automate various aspects of forex trading, from trade execution to risk management and strategy implementation. These panels utilize advanced algorithms, artificial intelligence, and machine learning techniques to analyze market data, identify trading opportunities, and execute trades on behalf of traders. With their user-friendly interfaces and customizable features, Automated Trading Panels empower traders of all skill levels to automate their trading processes and achieve consistent results in the forex market.

Key Features and Functionality:

Trade Execution Automation: Automated Trading Panels enable traders to automate trade execution, eliminating the need for manual intervention. Traders can set specific parameters for trade entry, exit, and position sizing, allowing the panel to execute trades automatically based on predefined rules and criteria.

Strategy Implementation: Automated Trading Panels support the implementation of complex trading strategies, including trend-following, mean-reversion, and breakout strategies. Traders can customize their strategies by combining technical indicators, price action signals, and market sentiment analysis to suit their trading preferences and objectives.

Risk Management Tools: Automated Trading Panels offer advanced risk management tools to help traders mitigate potential losses and protect their capital. Traders can set stop-loss and take-profit levels, adjust position sizes, and implement trailing stop orders to manage risk effectively.

Backtesting and Optimization: Automated Trading Panels enable traders to backtest and optimize trading strategies using historical market data. By simulating trades under various market conditions, traders can assess the performance of their strategies and make necessary adjustments to improve profitability.

Real-time Market Analysis: Automated Trading Panels provide real-time market analysis and insights, allowing traders to stay informed about key market developments and potential trading opportunities. With access to up-to-date market data and analysis tools, traders can make informed decisions and execute trades with confidence.

Benefits of Using Automated Trading Panels:

Enhanced Efficiency: Automated Trading Panels streamline the trading process by automating repetitive tasks such as trade execution, position management, and risk assessment. By eliminating the need for manual intervention, traders can save significant time and effort. This enhanced efficiency allows traders to focus their attention on analyzing market trends, refining trading strategies, and making informed decisions, rather than getting bogged down by routine tasks.

Improved Accuracy: Automated Trading Panels leverage sophisticated algorithms and artificial intelligence to execute trades with precision and accuracy. Unlike human traders, who may be prone to emotions, biases, and cognitive errors, these panels operate based on predefined rules and criteria. By removing human involvement from the trading process, Automated Trading Panels minimize errors and enhance overall trading performance. Trades are executed consistently and objectively, without the influence of emotions such as fear, greed, or hesitation.

Consistent Performance: With their disciplined approach to trade execution and risk management, Automated Trading Panels help traders achieve consistent and reliable results over time. These panels adhere strictly to predetermined trading rules and strategies, ensuring that trades are executed in a systematic and disciplined manner. By maintaining consistency in trade execution and risk management, traders can avoid impulsive decisions and erratic behavior, thereby improving their chances of long-term success in the forex market.

Accessibility and Convenience: Automated Trading Panels are accessible from any internet-enabled device, allowing traders to monitor and manage their trades on the go. Whether at home, in the office, or on vacation, traders can stay connected to the forex market and take advantage of trading opportunities anytime, anywhere. This level of accessibility and convenience enables traders to stay informed about market developments, adjust their trading strategies, and execute trades promptly, without being tied to a specific location or time zone.

Reduced Stress and Emotional Impact: Trading can be a stressful and emotionally taxing endeavor, particularly during periods of market volatility or when faced with significant losses. Automated Trading Panels help alleviate stress and emotional strain by automating the trading process and removing the need for manual intervention. Traders can trade with confidence, knowing that their trades are being executed according to predefined rules and parameters. By removing the emotional element from trading decisions, Automated Trading Panels help traders maintain a clear and rational mindset, reducing the psychological burden associated with trading and improving overall well-being.

Automated Trading Panels offer numerous benefits to traders, including enhanced efficiency, improved accuracy, consistent performance, accessibility and convenience, and reduced stress and emotional impact. By leveraging advanced technology and automation, traders can streamline their trading processes, optimize their performance, and achieve greater success in the forex market.

Conclusion:

Automated Trading Panel offer a powerful solution for automating forex trades and enhancing trading efficiency. With their advanced features, customizable settings, and user-friendly interfaces, these panels empower traders to execute trades with precision, consistency, and confidence. Whether you're a seasoned trader looking to optimize your trading strategies or a novice trader seeking to streamline your trading process, Automated Trading Panels can help you achieve your trading goals with ease. Embrace the future of forex trading with Automated Trading Panels and experience the benefits of effortless efficiency in your trading journey.

#Trade Panel#Trading Panel#Trading Panel EA#TradePanel MT4#Trade Manager#Forex Trade Manager#Best Trade Manager#Trade Management utility#Trade Management tool#Trading management#forextrading#forexmarket#forex education#forexsignals#forex#black tumblr#technical analysis#4xPip

4 notes

·

View notes

Text

Best Crypto Trading Courses in Faridabad, Noida & Gurgaon for 2025

The interest in stock market education has grown significantly in recent years, especially across urban centers such as Noida, Delhi, Faridabad, and Gurgaon. Individuals are actively seeking structured knowledge on how the markets work, how to trade responsibly, and how to interpret data and trends for better financial decisions. A stock market training academy serves this growing need by offering foundational and advanced learning pathways. These academies typically cover technical and fundamental analysis, risk management, equity markets, and segment-specific training like forex and crypto.

A stock market training academy in Noida often includes modules that guide beginners through key trading concepts such as candlestick patterns, chart reading, moving averages, and support-resistance zones. This structured format helps learners build a clear foundation. Similarly, academies in Delhi offer additional benefits due to the city’s proximity to regulatory bodies and financial hubs. Students not only get access to academic content but also benefit from guest lectures and real market exposure.

In Faridabad, stock market courses often focus on those who wish to learn part-time or alongside a day job. Trading classes for beginners in Faridabad introduce the learners to basic strategies used in intraday and swing trading. These sessions are particularly helpful for retail investors who are new to the financial markets. Courses also incorporate hands-on training sessions where learners simulate trades using real-time data, helping bridge the gap between theory and practice.

Meanwhile, stock market training in Gurgaon tends to cater to both beginners and professionals. The courses offered there are often project-based, which encourages learners to conduct market research and prepare trading strategies under the guidance of mentors. Learners can find the best stock market courses in Gurgaon that include modules on equity research, risk profiling, derivatives, and algorithmic trading.

Those looking for a more flexible approach can consider a stock market training course in NCR that covers all these cities. Such programs typically offer hybrid formats, combining classroom instruction with online resources, which allows students from Noida, Delhi, Faridabad, and Gurgaon to attend without compromising their daily routines.

Crypto trading courses are another key area of interest, especially among young investors. A crypto trading course in Noida covers basics like blockchain technology, market volatility, and trading pairs such as BTC/USDT and ETH/USDT. It also focuses on platforms like Binance and CoinDCX and introduces learners to order types, stop losses, and security measures.

Crypto trading courses in Faridabad and Gurgaon extend these learnings with practical sessions, real-time chart analysis, and trading psychology. The courses also address the regulatory landscape and help students understand risks involved in this relatively new asset class.

Delhi has also become a hotspot for specialized finance courses. A research analyst course in Delhi NCR prepares individuals to become certified analysts who can study company reports, balance sheets, and macroeconomic indicators. These analysts often go on to support investment firms or work independently. This course usually involves in-depth assignments, live case studies, and presentations.

Forex trading is another crucial segment gaining traction in India. A forex trading course in Noida introduces participants to international currency markets, including key pairs like EUR/USD, USD/INR, and GBP/USD. Learners also get familiar with trading platforms such as MetaTrader 4 and 5. They practice order execution, learn about pip values, leverage, and margin, and study the impact of economic news on currency movement.

Forex trading classes in NCR and particularly in Gurgaon go beyond basics to discuss hedging strategies, carry trade concepts, and inter-market analysis. A forex trading course in faridabad, on the other hand, might be more focused on foundational training for working professionals and part-time traders. The demand for foreign exchange education has grown steadily due to its 24-hour global market accessibility and significant trading opportunities.

Best Options Trading Course in NCR is another topic in high demand. Many academies offer an option trading full course free as a trial or as a part of awareness programs. These free introductory sessions include the basics of call and put options, option Greeks, and payoff diagrams. Following this, learners can enroll in paid modules for more structured learning.

For those specifically looking for options trading education, there are top options trading courses online that guide users through strategies like iron condor, butterfly spreads, straddles, and strangles. The focus is often on risk-reward balance and selecting the right strike price and expiry. Options trading courses in NCR are structured for traders who want to focus on the derivatives market in India. Students also learn how to read the open interest and implied volatility data available on market exchanges.

For more experienced traders, an advance course on options trading in India covers topics such as volatility forecasting, options chain analysis, delta-neutral strategies, and real-time trade execution. The availability of these programs in Delhi NCR makes it easy for traders to upskill within their own geography.

Another essential qualification for anyone serious about a career in trading and financial analysis is the NISM certification. NISM certification courses in Faridabad are popular among finance students and professionals aiming to work in stock broking, mutual fund distribution, and portfolio management. These certifications, which are backed by the Securities and Exchange Board of India (SEBI), include a wide range of modules covering equity derivatives, investment advisory, mutual fund distribution, and more.

NISM Certification courses in Gurugram and Delhi are often delivered in physical classroom settings where learners undergo rigorous training, take mock tests, and sit for certification exams. These courses are recognized by employers and regulators, making them a valuable addition to any finance professional’s resume.

In addition to local academies, learners can also explore stock market trading courses online in faridabad. These provide flexibility and access to recorded sessions, downloadable PDFs, quizzes, and online doubt-clearing sessions. Some of the best online trading classes also include live market analysis where instructors walk students through their real-time trades.

Online trading classes in Gurgaon and Faridabad cater to both absolute beginners and intermediate traders. The self-paced structure allows participants to revisit lessons and understand strategies at their own comfort. Many such classes provide support groups, access to instructors through live webinars, and certificate issuance on course completion.

When looking to build a practical understanding of financial markets, learners often search for courses focusing on stock market technical analysis. This area includes chart patterns, price action, and indicators like RSI, MACD, Bollinger Bands, and Fibonacci retracement. These tools help traders make informed decisions based on historical price movements and trend behaviors.

Technical analysis indicators form the backbone of most short-term trading strategies. They assist in entry and exit decisions, risk placement, and trade size determination. Whether someone is focusing on intraday setups, swing trading, or long-term positional trades, mastering these tools can significantly improve consistency.

To conclude, the landscape for trading education across Delhi NCR—including Noida, Gurgaon, Faridabad, and Delhi—is growing steadily. Whether you’re looking to begin your trading journey or formalize your knowledge with certifications, there are ample options available. Courses now range from foundational stock market training to niche areas such as crypto, forex, and options trading, as well as regulatory-focused programs like NISM. With the increasing availability of both offline and online training formats, learners can now take informed steps toward building their career or generating secondary income through disciplined and well-informed trading practices.

#crypto trading course in faridabad#Nism Certification courses in Faridabad#NISM Certification courses in Noida#Nism Certification Courses in Gurugram#forex trading course in faridabad#stock market training academy in faridabad#crypto trading course in noida#crypto trading course in gurgaon#option trading full course free in faridabad#forex trading course in gurgaon#best online trading classes in faridabad#forex trading course in noida#trading classes for beginners in faridabad#stock market trading courses online in faridabad#Nism Certification courses in Delhi#stock market training course ncr#stock market training academy in noida#Best Options Trading Course in Gurgaon#Best Options Trading Course in ncr#options trading course in ncr#stock market technical analysis in faridabad#forex trading classes in ncr#best online trading classes in gurgaon#stock market training academy in delhi#Best Stock Market Courses in gurgaon#research analyst course in faridabad#technical analysis indicators in faridabad#stock market trading courses online#Top Options Trading Courses Online

1 note

·

View note

Text

youtube

#forex trading#cryptocurrency trading#day trading#commodities trading#futures trading#indices trading#currency trading#forex strategies#crypto analysis#live trading#technical analysis#market analysis#trading psychology#trading education#scalping strategies#swing trading#trading signals#tradingview analysis#price action trading#macro trading#financial markets#forex live#bitcoin trading#ethereum analysis#gold trading#oil trading#index futures#trading for beginners#advanced trading strategies#global markets

1 note

·

View note

Text

Forex Technical Analysis vs Fundamental Analysis: Unlocking the Best Strategy

When deciding between Forex Technical Analysis vs Fundamental Analysis, both offer valuable insights for traders. Technical analysis relies on price charts and trends, while fundamental analysis evaluates economic data and news events. This guide compares both approaches, helping you understand when and how to use each for smarter trading. By blending these strategies, you can refine your decision-making process and improve your Forex trading outcomes for greater success in the market.

#forex technical analysis vs fundamental analysis#technical & fundamental analysis#market fundamentals and technicals#trading fundamentals and technicals#fundamental vs technical analysis forex

0 notes

Text

AUDUSD Aussie 0.20 Lots Buy entry bullish wave on M5 timeframe opens and running to next week [AUDUSD,M5].

Official Website: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator metatrader4 license with NO LAG & NON REPAINT buy and sell Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside Brokers MT4 Plataform. . ✅ NON REPAINT / NON LAGGING Signals ✅ New 2025 Version LIFETIME License 🔔 Signals Sound And Popup Notifications 🔥 NEW 2025 Profitable EA AUTO-Trade Option Available . ✅ * Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the MT4 platform of the customer who has access to his License*. ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at Exness brokerage. Signals may vary slightly from one broker to another ). . ✅ Cashpower Indicator Works in all charts inside Metatrader4 plataform for anybroker that have mt4. It will works inside anychart that your brokerage have examples: Forex charts, bonds charts, indicescharts, metals charts, energy, cryptocurrency charts and etc. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#Forex Cashpower indicator Non Repaint Signals#forex brokers#forexindicators#forexsignals#indicatorforex#forexindicator#forex#forextradesystem#forexchartindicators#forexvolumeindicators#cashpowerindicator#forexprofits#forex market#forextrading#forex expert advisor#forex robot#forex trading#forex indicators#forex traders#stock trading#audusd#audusd technical analysis

4 notes

·

View notes

Text

youtube

Looking to spot trend reversals before the rest of the market catches on? This video breaks down powerful reversal signals every smart trader should know to maximize profits and minimize losses. In this detailed guide, we uncover the top reversal patterns, indicators, and techniques used by successful traders across the stock, forex, and crypto markets. Learn how to identify momentum shifts, trap zones, and entry/exit points that could change the game for your trading strategy. Whether you're day trading, swing trading, or investing long-term, understanding reversal signals is key to protecting your capital and boosting returns. Websites: https://tradegenie.com/ https://nosheekhan.com/ Twitter - https://twitter.com/marketswizard Facebook - https://www.facebook.com/financialmar Head Office: Trade Genie Inc. 315 South Coast Hwy 101, Encinitas, CA 92024 Phone Number: 212-408-3000 #ReversalSignals #TradingProfits #TechnicalAnalysis #PriceAction #ChartPatterns #StockMarketTips #ForexTrading #CryptoSignals #SwingTrading #DayTrading #TrendReversal #SmartTrading #UnlockProfits #TradingEducation #MarketMoves

#Reversal-Signals#Trading-Profits#Technical-Analysis#Price-Action#Chart-Patterns#Stock-Market-Tips#Forex-Trading#Crypto-Signals#Swing-Trading#Day-Trading#Trend-Reversal#Smart-Trading#Trading-Education#Youtube

0 notes

Text

Pa...

View On WordPress

#Currency Exchange#Foreign exchange market#Forex analysis#forex brokers#Forex charts#Forex demo account#Forex fundamental analysis#Forex indicators#Forex leverage#Forex liquidity#Forex market psychology#Forex news#Forex platform#Forex regulation#Forex risk management#Forex scalping#Forex signals#forex strategies#Forex swing trading#Forex technical analysis#Forex Trading#Forex trading hours#Forex trading pairs#Forex trend analysis#Forex volatility#Pa..#Paul Tudor Jones says it’s hard to like US stocks - "vicious circle"

0 notes

Text

Trading is about timing. If you don’t understand what cycle the market is in, when to identify manipulation and when to target that manipulation - you’re never going to see this setup.

Each previous market session gives us vital clues on what we’re looking for and when to look for it.

For more join us .

#forex#forex education#forex expert advisor#forex indicators#forexmentor#forex broker#forex market#forexsignals#forexmastery#crypto#learn forex trading in jaipur#jaipur#forex jaipur#rajasthan#learn forex trading#intradaytrading#market strategy#technical analysis#data analytics#analysis

2 notes

·

View notes

Text

Volume Trading: Forex Trading Strategy Explained

In the world of Forex trading, understanding market movements is crucial. One such method to gain insights into market behavior is through Volume Trading. This strategy involves analyzing the volume of trades to make informed decisions about buying or selling currency pairs. In this article, we will explore the concept of Volume Trading, its benefits, and how it can be effectively used in Forex…

#Currency Pairs#Forex#Forex Traders#Forex Trading#Geopolitical Events#Market Movements#Market Sentiment#OBV#On-Balance Volume#Price Movements#Technical Analysis#Trading Strategies#Trading Strategy#Trading Volume#Trend Following#Volume Analysis

2 notes

·

View notes

Text

How to Trade the Bearish Engulfing Pattern: Complete Guide with Strategies and Examples

Candlestick patterns are powerful tools in the arsenal of a technical trader. Among the most reliable reversal patterns is the Bearish Engulfing Pattern—a strong signal that can hint at the start of a downward trend. In this guide, we’ll explain how to identify this pattern, why it works, and most importantly, how to trade it effectively with multiple strategies and examples. 📌 What is a Bearish…

#Bearish candle formation#Bearish engulfing candlestick pattern explained#Bearish Engulfing Pattern#Bearish engulfing pattern trading strategy#Bearish reversal pattern#Bearish trend confirmation#Can you trade bearish engulfing in forex?#Candlestick pattern for bearish reversal#candlestick patterns#Confirmation signals for bearish engulfing#EMA confluence with candlestick patterns#Engulfing candle trading rules#Entry and exit with candlestick patterns#Forex bearish engulfing strategy#How to confirm a bearish engulfing signal?#How to trade the bearish engulfing pattern#Is the bearish engulfing pattern reliable?#learn technical analysis#Multi-timeframe candlestick pattern strategy#Price action trading setup#Reversal Candlestick Patterns#Risk management for pattern trading#stock markets#Stock trading with bearish engulfing pattern#support and resistance levels#Swing trading with bearish engulfing#technical analysis#Trading bearish engulfing with moving averages#Trading Strategies#Using bearish engulfing with RSI

0 notes

Text

Pin Bar Candlestick Pattern: A Trader’s Guide to Smart Entries and Exits

Have you ever noticed a candle on a chart that looks like a pin or a needle? That structure is known as a pin bar, and it can give traders powerful insights into future price movement. Whether you're entering or exiting a trade, the pin bar can help you make smarter, more strategic decisions.

If you've found it challenging to recognize or understand this pattern, you're not alone. In this Market Investopedia guide, we’ll walk you through everything you need to know about pin bars—how they work, their pros and cons, and how to trade them effectively.

What Is a Pin Bar?

A pin bar is a candlestick formation that signals a potential price reversal or continuation. It’s made up of:

A small body (green or red),

A long wick on one end,

And a short wick on the opposite end.

This structure reveals price rejection—meaning the market attempted to move in one direction but was strongly pushed back, hinting at an upcoming shift.

Key Features of a Pin Bar

To identify a pin bar, look for the following elements on your chart:

Small Candle Body

The body should be short, showing little difference between the opening and closing prices. This indicates a balance—or struggle—between buyers and sellers.

Wicks (Shadows)

There are two wicks on a pin bar. One is very long, and the other is short. The long wick reveals where the price was rejected, and it's the most important part of the pin bar.

Closed Candle

Never trade a pin bar that hasn’t closed yet. Wait for the candle to close before making a decision based on its signal.

Types of Pin Bars

Bullish Pin Bar

Appears during a downtrend

Has a small green body

Features a long lower wick

Signals a potential upward reversal

The long lower wick suggests sellers pushed the price down, but buyers fought back, rejecting the lower levels. This often indicates a buying opportunity.

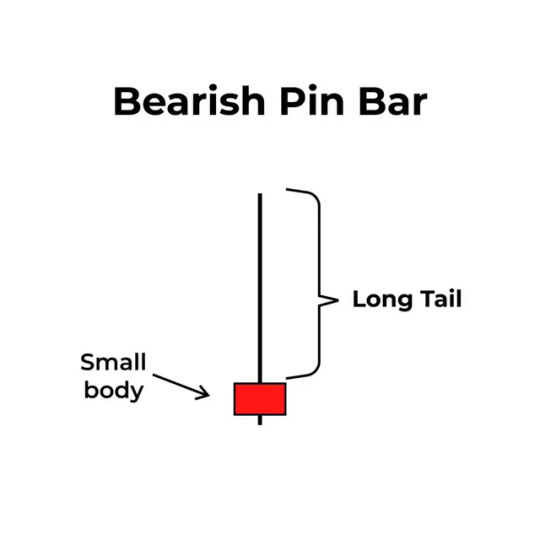

Bearish Pin Bar

Appears during an uptrend

Has a small red body

Features a long upper wick

Signals a potential downward reversal

Here, buyers tried to push the price higher, but sellers stepped in and rejected the highs. This often signals a selling opportunity.

How to Trade Using Pin Bars

1. Identify a Pin Bar

Scan your chart (preferably 4-hour, daily, or weekly) for a small-bodied candle with a long wick on one end and a short wick on the other.

2. Use Confirmation Tools

Combine pin bars with tools like:

RSI (Relative Strength Index)

Fibonacci Retracement

Bollinger Bands These indicators can help confirm whether the signal is strong enough to act on.

3. Trade Reversals

When a pin bar forms at a key support or resistance level, it often signals a reversal. Trade in the direction opposite the long wick.

4. Trade Trend Continuations

Not every pin bar signals a reversal. In some cases, especially during a trend pause, a pin bar can indicate that the current trend is about to continue. For example, a bullish pin bar during an uptrend suggests that buyers are still in control.

How to Spot High-Quality Pin Bars

Not all pin bars are equal. Here's what to look for in a strong setup:

Key Levels: Look for pin bars forming at significant support or resistance zones.

Longer Time Frames: Pin bars on 4H, daily, or weekly charts tend to be more reliable than those on 5-minute or 15-minute charts.

Wick Length: The longer the wick (at least two-thirds of the candle's length), the stronger the signal.

Smaller Body: A smaller body means less indecision and more rejection.

Volume Confirmation: Higher trading volume strengthens the validity of the pattern.

Pros of Trading Pin Bars

Easy to recognize, even for beginners

Work well with various assets—Forex, stocks, crypto, commodities Clearly define potential entry and exit levels

Combine well with trendlines, moving averages, and other tools Suitable for multiple timeframes

Cons of Trading Pin Bars

Less effective in choppy or sideways markets

Relies on probabilities—there’s no guarantee the signal will play out

Can produce false signals without proper confirmation

Final Thoughts

The pin bar candlestick is a powerful yet simple tool that traders can use to spot trend reversals or continuations. It's easy to learn, and when combined with other forms of analysis, it can provide high-probability trade setups.

However, like any trading method, pin bars are not foolproof. It's important to assess each one carefully, confirm the signal, and avoid trading them in low-quality setups or during erratic market conditions.

Ready to dive deeper into price action and trading strategies? Explore more articles on Market Investopedia or join our free webinar for hands-on learning with real chart examples.

0 notes