#ForexTradingStrategy

Explore tagged Tumblr posts

Text

Forex Tools Checkers - MONEY MAKER TURBO MT4 FX EA Download Now...

#FX自動売買・EA#forexrobot#tradingforex#forexsignals#forexsuccess#forexinvesting#forextradingstrategy#automatedtrading#howtotradeforexforbeginners#metatrader#forexprofit#tradingbot#FOREX#tradingsoftware#forextrading#howtotradeforex#forexstrategy#forextradingforbeginners#forextrader#howtostartforex#forexforbeginners#forextradingsystem#forextips#algorithmictrading#forexmarket#forextradingstrategies#forexea

0 notes

Text

Trading Forex in a Downward Market: A Guide to Short Selling

Many forex traders focus on rising currency pairs, as opening BUY positions feels more straightforward and often yields good returns. However, choosing to hit that SELL button can also be a strategic move in certain conditions. Understanding short selling in the forex market can help you capitalize on various market trends. Here’s what you need to know about short selling forex assets to make the most out of any market condition.

Learn more on: https://www.investchannels.com/trading-forex-in-a-downward-market-a-guide-to-short-selling/

What is a Short Position in Forex?

Taking a “short” or SELL position in forex trading involves speculating that the asset’s price will decrease. Success depends on the asset moving down, turning a profit on the downward trend. These positions are also called “bearish,” and traders who take them are known as “bears.”

Just like long (BUY) positions, short positions are flexible in quantity—you can open as many as your account balance supports.

When Should You Short Sell in Forex?

The choice to BUY or SELL should depend on asset performance and your trading strategy. Generally, short positions are opened when an asset is predicted to drop soon. The key lies in choosing the best entry and exit points to optimize returns.

Traders may rely on technical or fundamental analysis, or a combination of both, to decide. When short selling, it’s wise to apply risk management tools, such as setting a stop-loss level, to counter potential market volatility.

How to Short Sell Forex on IQ Option

To start short selling on the IQ Option platform, follow these steps:

1. Choose a currency pair expected to fall in price.

2. Select the investment amount for the trade.

3. Enter the trade at the current price.

4. If the price moves down as predicted, close the trade to secure your profit.

Tips for Successful Short Selling in Forex

Short selling offers a way to profit when the market trends down, though it may take time to master. Here are four tips to improve your short-selling results.

1. Conduct Market Analysis

Performing comprehensive technical and fundamental analysis is crucial before short selling forex. Identify downtrends, resistance levels, and bearish signals on price charts. Indicators like the STARC Bands, Relative Vigor Index (RVI), or Psychological Line can provide insight.

For instance, when the RVI crosses below the zero line, it often signals a bearish trend. You may also want to monitor economic and geopolitical news, as events can influence currency pairs’ performance. The IQ Option platform’s ‘Market Analysis’ section is a good place to track such news without leaving the traderoom.

2. Set Realistic Profit Goals

Greed can lead traders to keep short positions open too long, risking profits. Instead, have a profit target in mind and stick to it. However, if unexpected market changes occur, be flexible—sometimes an early exit can safeguard your gains.

3. Use Risk Management Tools

Define your risk tolerance and apply a stop-loss to limit potential losses. A well-placed stop-loss can prevent surprises and secure capital in the event of sudden market shifts.

4. Keep Practicing

Short selling forex, like any trading technique, demands practice and patience. Start small, then gradually increase position sizes as you gain confidence. Maintain a trading journal to record deals, analyze outcomes, and learn from any mistakes.

Ready to try short selling? Visit IQ Option to start exploring the forex market’s full potential, regardless of direction.

#ForexTrading#ShortSelling#ForexStrategy#ForexTips#ForexMarket#ForexAnalysis#TechnicalAnalysis#ForexEducation#BearMarket#RiskManagement#ForexTradingStrategy#ForexForBeginners#HowToTradeForex#ForexIndicators#TradingPsychology

0 notes

Text

💹📚 Unlock the Secrets of Forex Trading Strategy: Your Path to Financial Success! 🚀💰

Hey Tumblr fam, Hope you had a great weekend!

This is what I have prepared for you last weekend! Are you ready to embark on a thrilling journey into the world of forex trading? 🌐💹 Whether you're a seasoned trader or a complete beginner, understanding the art of forex trading strategy is essential for unlocking the door to financial success! 💼📈

🌟 Deciphering Price Patterns: In the fast-paced world of forex, price patterns hold the key to profitable trades! 🗝️💹 By learning to read and interpret candlestick charts, you can spot trend reversals and potential entry and exit points for your trades. From head and shoulders to double tops and triangles, these patterns provide valuable insights into market dynamics. 📊📈

📈 Embrace Technical Indicators: Technical indicators are the trader's best friend! 🕵️📉 From Moving Averages to Relative Strength Index (RSI) and MACD (Moving Average Convergence Divergence), these tools help you gauge market momentum and identify overbought or oversold conditions. 📈💪 By mastering these indicators, you can fine-tune your trading strategies and gain a competitive edge in the forex market. 💼🚀

🔄 The Power of Trends: In forex trading strategy, "the trend is your friend"! 🔄📈 Identifying and following market trends is a fundamental principle for successful trading. By understanding trend lines and support/resistance levels on charts, you can make informed trading decisions and ride the wave of profitability! 🌊📈

💡 Logic vs. Emotion: Forex trading is as much about psychology as it is about strategy. 🧠📊 Emotions like fear and greed can cloud your judgment and lead to impulsive decisions. However, by relying on logic and sound analysis, you can navigate the forex market with confidence and discipline. 💼📉

🗝️ The Three Steps to Success: Step 1️⃣: Open a Currency Trading Account Select a reliable forex trading broker and open a currency trading account. Most brokers offer a two-in-one account, providing both trading and a Demat account.

Step 2️⃣: Submit KYC Documents Complete the KYC process by submitting the necessary documents, including proof of identity, address, income, and bank account details.

Step 3️⃣: Choose a Currency Pair Pick a currency pair to trade. While beginners often start with major currency pairs, experienced traders can explore a wide range of options.

🌐💼 Are you ready to take charge of your financial future? Don't miss the opportunity to master the art of forex trading strategy! 🚀📊 Learn the ropes, harness the power of technical analysis, and make informed trading decisions. With dedication, knowledge, and practice, you can chart a course towards financial success! 📈💰

Learn here: Top 10 Must-Know Currency Trading Strategies!

#currencytradinganalysis#currencytradingfundamentalanalysis#onlinecurrencytrading#currencytradingstrategies#onlineforextrading#forextradingstrategy#forexmarketanalysis#forexchartsanalysis#forexwhatisit#forextradinganalysis

0 notes

Text

Ready to elevate your forex trading game? 📈 In this video, we dive deep into mastering moving averages and using trend lines for trading to identify trends, perfect your entries, and boost your profits. Discover how to combine these essential tools to create a winning strategy that works for any market. Don’t miss out—watch now and learn how to trade like a pro! 🚀

https://www.duramarkets.com

#duramarkets#trending#movingaverage#forextradingstrategies#forex#currencytrading#learnforex#money#profit

0 notes

Text

AI in Forex Trading: Top Benefits for Traders!

Artificial intelligence (AI) is making big waves in Forex trading. It’s making trading faster, more accurate, and a lot easier to handle. This blog will break down the main perks of using AI in Forex trading and show why it’s becoming a must-have in the trading world.

Quick and Smart Decisions AI systems can analyze huge amounts of data in a blink. They spot patterns and trends that humans might miss. This means traders can make quick, informed decisions without spending hours on research.

Less Risk, More Reward AI helps manage risk by predicting possible changes in the market. This helps traders avoid big losses and find the best times to enter or exit a trade.

Trading Non-Stop Forex markets are open 24/7, and AI systems can work all day and night. This lets traders take advantage of opportunities even when they’re asleep.

Personalized Trading Strategies AI can learn from your past trades and preferences to suggest customized trading strategies. This tailored approach can often lead to better results.

Fewer Errors Humans can make mistakes, especially when tired or stressed. AI doesn’t have these issues, so it tends to be more reliable and consistent.

Conclusion AI in Forex trading isn’t just a fancy tool; it’s becoming essential for traders who want to stay ahead in the fast-paced trading environment. By using AI, traders can enjoy faster decision-making, reduced risks, and personalized strategies that could lead to higher profits.

Ready to give AI Forex trading a try and see how it can change your trading game?

#AIForexTrading#forex analysis#forextrading#forex market#ai forex#forexstrategy#ForexTradingStrategies#InvestmentTechnology#ArtificialIntelligence#trending#trendingnow#viralshorts#viral trends#viral video#viral

0 notes

Text

Mastering Forex Chart Patterns: 4 Keys to Identifying Reversal and Continuation Signals

Forex trading involves analyzing various indicators to predict market movements and make informed trading decisions. One of the most powerful tools in a trader's arsenal is the study of Forex chart patterns. These patterns offer valuable insights into potential price movements, helping traders spot both trend reversals and continuation signals. In this article, we'll explore ten key Forex chart patterns, providing clear explanations and real-life examples to make understanding these patterns easier for traders of all levels.

Reversal Chart Patterns

Which Forex broker is reliable for Forex trading and has less spread and instant withdrawal? Head and Shoulders: The head and shoulders pattern is a reliable trend reversal indicator. It consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). The pattern signals a potential shift from an uptrend to a downtrend or vice versa. Let's take a look at a real-life example:

In this example, the head and shoulders pattern formed after a prolonged uptrend. Once the price broke below the neckline (the line connecting the two shoulders), it confirmed the trend reversal, leading to a bearish move. Double Tops and Double Bottoms: Double tops and double bottoms are reversal patterns that form after an uptrend or downtrend, respectively. A double top consists of two peaks at roughly the same price level, while a double bottom comprises two troughs at approximately the same level. These patterns suggest a potential reversal in the current trend. Here's a practical illustration:

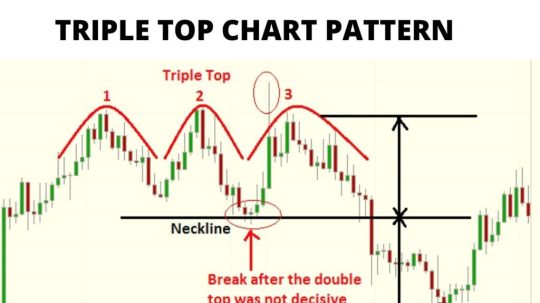

In this example, we can observe both a double top and a double bottom pattern. The double top signals a shift from an uptrend to a downtrend, while the double bottom indicates a shift from a downtrend to an uptrend. Triple Tops and Triple Bottoms: Triple tops and triple bottoms are similar to double tops and double bottoms but involve three peaks or troughs. They indicate even stronger potential reversals in the current trend. Here's an example:

In this case, we see a triple top formation, which preceded a significant downtrend as the price broke below the support level.

Continuation Chart Patterns

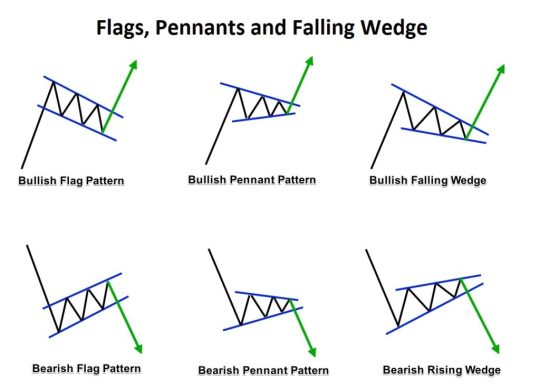

CL2. What is the Forex market and how does it's work? Flags and Pennants: Flags and pennants are continuation patterns that occur after strong price moves. A flag resembles a small rectangle, while a pennant looks like a small symmetrical triangle. These patterns suggest that the market is taking a breather before resuming the previous trend. Let's see a real-life example:

In this example, we can observe both a flag and a pennant pattern. After a sharp upward move, the price consolidated within the flag and pennant formations before continuing its uptrend. Symmetrical Triangles: Symmetrical triangles are continuation patterns that show a period of consolidation before a potential trend continuation. These triangles have converging trendlines and imply an imminent breakout. Let's examine an illustration:

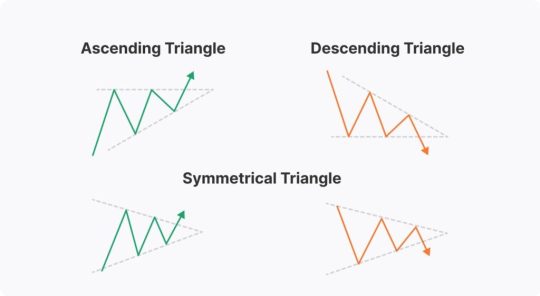

In this example, the symmetrical triangle formed during a downtrend. Once the price broke above the upper trendline, it confirmed the continuation of the upward movement. Ascending and Descending Triangles: Ascending triangles and descending triangles are also continuation patterns. An ascending triangle features a horizontal resistance line and an upward-sloping support line, while a descending triangle has a horizontal support line and a downward-sloping resistance line. Let's explore an example:

In this instance, both ascending and descending triangles are present. The ascending triangle preceded an upward breakout, while the descending triangle led to a downward breakout.

Combining Chart Patterns with Other Technical Indicators

CL4. What are Support Resistance and Chart types in Forex trading? Successful Forex trading often involves combining chart patterns with other technical indicators for better confirmation and accuracy. Here are some popular indicators to consider: - Moving Averages: Moving averages help smooth out price fluctuations and identify trends. Combining moving averages with chart patterns can provide additional confirmation of potential trend reversals or continuations. - RSI (Relative Strength Index): The RSI measures the strength of price movements and can signal overbought or oversold conditions. When RSI aligns with a chart pattern's signals, it strengthens the overall trading strategy. - MACD (Moving Average Convergence Divergence): The MACD is a trend-following indicator that highlights the relationship between two moving averages. When used with chart patterns, it can offer insights into trend direction and momentum.

Tips for Chart Pattern Trading

How to Use Forex Custom Indicators, Templates, and Profiles in MT4? - Risk Management: Set appropriate stop-loss levels to protect your capital in case the market moves against your trade. - Setting Proper Stop-Loss and Take-Profit Levels: Determine your risk-reward ratio and identify suitable points to exit trades both in profit and loss scenarios. - Practicing Patience and Discipline: Be patient and wait for strong chart pattern confirmations before entering a trade. Stick to your trading plan and avoid emotional decisions.

Frequently Asked Questions

Q: What are the most common Forex chart patterns? - A: The most common Forex chart patterns include head and shoulders, double tops, double bottoms, ascending triangles, and flags. These patterns provide valuable insights into potential price movements and can be used to identify both trend reversals and continuation signals. Q: How can I trade Forex chart patterns effectively? - A: To trade Forex chart patterns effectively, start by identifying the pattern and wait for a clear breakout confirmation. Use additional technical indicators like moving averages and RSI to strengthen your analysis. Set proper stop-loss and take-profit levels, practice patience, and stick to your trading plan. Q: What is the difference between a continuation pattern and a reversal pattern? - A: A continuation pattern indicates a temporary pause in the current trend before it continues in the same direction. Examples include flags and pennants. On the other hand, a reversal pattern signals a potential change in the current trend. Examples include head and shoulders and double tops/bottoms. Q: Can I rely solely on chart patterns for Forex trading? - A: While chart patterns are powerful tools, relying solely on them for Forex trading is not recommended. It's essential to consider other factors like fundamental analysis, market sentiment, and economic indicators to make well-informed trading decisions. Q: How do I avoid false signals in Forex chart patterns? - A: To avoid false signals, look for patterns that are well-defined and have strong breakout confirmations. Consider using multiple time frames for analysis to increase accuracy. Combining chart patterns with other technical indicators can also help filter out false signals and improve your trading success.

Conclusion

Forex chart patterns provide valuable insights into market behavior, offering traders the opportunity to identify trend reversals and continuations. By understanding these patterns and combining them with other technical indicators, traders can enhance their trading strategies and make more informed decisions. Remember, practice and discipline are key to mastering chart pattern trading, so keep honing your skills and stay dedicated to becoming a successful Forex trader. Do you need a Deep Road Map for Forex learning? Structural Forex Trading Learning Road Map We hope you found our article on "Mastering Forex Chart Patterns: Identifying Reversal and Continuation Signals" insightful and informative. We believe that your thoughts, experiences, and questions are invaluable to the trading community. We invite you to share your feedback, ideas, and any additional chart patterns you've come across in the Forex market. Your comments will not only enrich our content but also foster a collaborative learning environment for all traders. So, don't hesitate to join the discussion, and let's grow together as knowledgeable and successful Forex traders. We look forward to hearing from you! Read the full article

#ForexChartPatterns#ForexContinuationSignals#ForexReversalSignals#ForexTradingCourseforBeginners#ForexTradingforBeginners#ForexTradingStrategies

0 notes

Text

#1 Forex Psychology for Scalping With Small Forex Accounts | Solo E TV Trading

Unlock the secrets of Forex Psychology for scalping with small Forex accounts in this exclusive Solo E TV Trading episode. Dive deep into the mindset and strategies that can help you conquer the challenges of trading with a small account while aiming for substantial gains. Gain insights into risk management, discipline, and the psychological aspects that separate successful scalpers from the rest. Don't miss this essential guide to harnessing the power of your mind in Forex trading! 🧠📈💹

#ForexPsychology#Scalping#SmallForexAccounts#TradingMindset#RiskManagement#ForexTradingStrategies#SoloETV#TradingTips#FinancialMarkets#ForexEducation

0 notes

Text

Making 40% Per Month with Forex Robot | King Forex EA Review

#FX自動売買・EA#forexrobotsthatreallywork#forextradinglive#forexrobot#forexea#forexexpertadvisor#wakawakaea#forextradingstrategies#kingforexea#kingeareview#kingforexreview#kingforexeareview#kingforexrobot#kingforexroboteareview#tradingrobot#forextradingbot#wakawakaeareview#forextrading#forexearobot

0 notes

Text

A Session Is Just Adding 20% To My Trade

#forextrading #tradingtips #learntrading #tradingbeginner #tradingtip #tradinglessons #fyp #forextradingforbeginners #forextradingtips #forextradingstrategy #tradingstrategy #tradingstrategyforbeginners #tradingstructure

24 notes

·

View notes

Text

Unlock the secrets of successful trading with Cyclopes! https://forexroboteasy.com/trading-robot/cyclopes/ #ForexTradingStrategies

0 notes

Text

Up to 10% on the first deposit in cryptocurrency

Up to 10% on the first deposit in cryptocurrency Replenish your account with any type of cryptocurrency and receive additional funds on your balance

https://www.fxnewsnow.com/news/details/up-to-10-on-the-first-deposit-in-cryptocurrency

#ForexBonuses, #CryptoDepositBonus, #ForexTrading, #CryptocurrencyBonus, #ForexBrokerPromotion, #CryptoForex, #ForexBonus2024, #FirstDepositBonus, #ForexTradingTips, #CryptoForexTrading, #ForexBrokerDeals, #CryptoInForex, #ForexTraders, #DepositBonusForex, #ForexTradingStrategy, #dubai

0 notes

Text

Forex trading strategies

Discover effective Forex trading strategies with Axe Trader to boost your success in the currency markets. Learn how to trade using proven methods like scalping, day trading, swing trading, and more at: https://www.axetrader.com/forex-trading-strategies

#forextradingstrategies #bestpropfirms #smartproptrader #forex #fundednext #forextrading #trading #riskmanagement #proptrading #propfirm #usa #unitedstates #axetrader

#Forex trading strategies#prop firms#funded trading accounts#cheapest prop firms#trading risk management#instant funding prop firm#the talented trader#proprietary trading firm#prop firm trading#prop firm challenge#prop firms instant funding#martingale strategy#scalping trading strategy#Axe Trader

0 notes

Text

Some common reasons why 90% of traders fail #motivation #trading

Some common reasons why 90% of traders fail #motivation #trading https://ift.tt/Ahtfa2L Some common reasons why 90% of traders fail #motivation #trading https://ift.tt/Cf4abX3 Some common reasons why 90% of traders fail #motivation #tradingstrategy #motivation #bankniftyintradaytradingstrategy #currencytrading #automobile #forextradingstrategies day trading,how to day trade,day trading crypto,rsi 80-20 trading strategy,type of trading,trading with rsi,forex trading course,profitable trading strategy,rsi 10 strategy,adx trading strategy,forex trading system,day trading strategy,trading strategy pdf,best trading strategy,forex trading analysis,stock trading strategy,rsi currency strength meter,exit strategy forex trading,most popular trading strategy,best forex strategy,rsi weekly,rsi setting from Solo E TV https://www.youtube.com/watch?v=k4p6TyShT0k via Solo E TV Trading https://ift.tt/0wISxmW August 04, 2024 at 06:00AM via Solo E TV Trading https://ift.tt/Fm4Eqdx August 04, 2024 at 12:39AM

0 notes

Text

Some common reasons why 90% of traders fail #motivation #trading

Some common reasons why 90% of traders fail #motivation #trading https://ift.tt/Cf4abX3 Some common reasons why 90% of traders fail #motivation #tradingstrategy #motivation #bankniftyintradaytradingstrategy #currencytrading #automobile #forextradingstrategies day trading,how to day trade,day trading crypto,rsi 80-20 trading strategy,type of trading,trading with rsi,forex trading course,profitable trading strategy,rsi 10 strategy,adx trading strategy,forex trading system,day trading strategy,trading strategy pdf,best trading strategy,forex trading analysis,stock trading strategy,rsi currency strength meter,exit strategy forex trading,most popular trading strategy,best forex strategy,rsi weekly,rsi setting from Solo E TV https://www.youtube.com/watch?v=k4p6TyShT0k via Solo E TV Trading https://ift.tt/0wISxmW August 04, 2024 at 06:00AM

#solosforexstrategy#highwinrate#forexscalping#supplyanddemand#forextrading#forexmastery#solonetwork#soloe#soloetv#forexmistakes#forexsuccess

0 notes

Video

youtube

Mastering Volume in Forex Trading #trading #forextradingstrategies#ytshorts

0 notes

Text

Currency Trading Analysis for Beginners in India

Hey there, fellow traders! 🌟 Are you new to the exciting world of currency trading and looking to unlock the secrets of successful trading in the Indian market? You've come to the right place! 🇮🇳💹

Currency Trading Analysis

Currency trading, also known as forex trading, offers immense potential for financial growth and independence. But, let's admit it, diving into the forex market without a solid understanding can be overwhelming. That's why we're here to share some essential insights on currency trading analysis for beginners in India! 💡

1️⃣ What is Currency Trading Analysis?

Currency trading analysis is the process of evaluating various factors that influence currency pairs' price movements. It helps traders make informed decisions, predict market trends, and execute profitable trades. From understanding technical indicators to keeping an eye on global economic events, analysis is the key to navigating the forex market like a pro! 📈💹

2️⃣ Currency Trading Fundamental Analysis

Fundamental analysis focuses on assessing economic, social, and political factors that influence currency values. As a beginner, keeping track of key indicators, interest rates, and government policies can help you understand a currency's intrinsic value and potential future direction. Knowledge is power, my friends! 📚🔍

3️⃣ Technical Analysis:

Your Trading Superpower! 💪 Technical analysis involves studying historical price charts and patterns to predict future market movements. By learning to read candlestick charts, identify support and resistance levels, and utilize various indicators like Moving Averages and RSI, you'll gain valuable insights to make smart trading decisions. 📊📉

4️⃣ Risk Management:

Protecting Your Capital 💼 A crucial aspect of currency trading analysis is managing risks. As a beginner, it's essential to set stop-loss and take-profit levels, adhere to a trading plan, and avoid over-leveraging. Remember, preserving your capital is just as important as making profits! 🛡️💰

Ready to dive in and explore the exciting world of currency trading analysis? Check out our in-depth blog for Beginners in India, where we've compiled expert tips, real-life examples, and practical strategies to help you kickstart your forex journey! 🌐📚 Here: Currency Trading Analysis for Beginners in India

Happy trading, and may the pips be ever in your favor!

#currencytradinganalysis#currencytradingfundamentalanalysis#onlinecurrencytrading#currencytradingstrategies#onlineforextrading#forextradingstrategy#forexmarketanalysis#forexchartsanalysis#forexwhatisit#forextradinganalysis

0 notes