#Free Fraud Prevention APIs

Explore tagged Tumblr posts

Text

Who Are Online Casino Software Providers

Online casino software providers in 2025 have evolved into full-service technology partners that support every layer of digital gambling operations. They no longer offer just games — they design, maintain, and optimize the platforms that power casinos around the world. These providers deliver the architecture behind user accounts, real-time gameplay, analytics, financial processing, and regulatory compliance — forming the backbone of the iGaming industry.

Services Offered by Online Casino Providers

Aggregation and Modular Content Delivery

Instead of developing every game from scratch, providers integrate titles from hundreds of studios into a single hub. Modular content delivery lets operators choose what features to enable — jackpots, bonus rounds, multiplayer, and more — with full control over user experience.

Scalable Infrastructure and Omni-Channel Integration

The ability to scale is essential in 2025. Providers offer robust cloud-based infrastructures that allow seamless access across mobile, desktop, and even physical gaming terminals — ensuring consistent performance across devices and geographies.

Security Protocols and Fraud Prevention

Top-tier platforms deploy advanced fraud detection, biometric login, and end-to-end encryption to protect sensitive user data and financial transactions. These systems also feature AI-based behavior monitoring to prevent suspicious activities.

Analytical Tools and Business Intelligence

Modern platforms deliver actionable data — from heatmaps and user funnels to session duration and conversion rates. Casino operators use this to shape marketing strategies and increase player retention.

Player Engagement and Retention Features

Providers now integrate loyalty engines, free spin triggers, real-time rewards, progress bars, and other gamified experiences to enhance engagement and reduce churn.

Regulatory Compliance and Multi-Jurisdictional Licensing

Meeting the legal requirements of different regions is no small feat. Software providers offer automated KYC, multi-license support, age verification tools, and jurisdiction-specific features to help operators stay compliant effortlessly.

Other Considerations When Picking The Best Casino Software Provider

Marketing Tools

Integration Capabilities

Open APIs allow casinos to seamlessly connect with CRMs, analytics tools, payment gateways, and third-party extensions, creating a flexible digital ecosystem.

SEO & Content Marketing Integration

Modern casino platforms feature built-in tools for blog publishing, SEO optimization, and meta management — crucial for organic visibility and search performance.

Campaign Automation & Multi-Channel Marketing

The best providers support personalized marketing across SMS, push notifications, email, and in-app popups — all automated through a central control panel.

Affiliate Management Systems

Operators gain access to performance dashboards, fraud detection tools, commission models, and real-time tracking to run scalable and profitable affiliate programs.

Payment Processing

Reliable payment integration means supporting fast deposits, real-time withdrawals, and multiple currencies — including crypto — with fraud protection and audit trails.

Speed

Modern casino users expect ultra-fast load times, seamless transitions, and real-time gaming without lag. Providers must deliver exceptional system speed and uptime.

Metrics

To make smart decisions, casinos need real-time performance metrics: churn rate, player value, LTV, traffic sources, and ROI — all visualized in customizable dashboards.

The Bottom Line

In 2025, choosing an online casino software provider means choosing the foundation of your entire operation. It’s not just about flashy games — it’s about long-term scalability, trust, data, and compliance. For those seeking a reliable, high-performance iGaming solution, https://internetcafesoft.com delivers the tools and expertise to build and grow a competitive online casino business.

0 notes

Text

Why API Integration Is Essential for Seamless Payment Processing

Discover how PayAgency’s API-first approach empowers high-risk merchants with faster approvals, fewer errors, and scalable global solutions.

Introduction

For high-risk merchants, seamless payment processing isn’t optional—it’s critical. From real-time approvals to intelligent routing, API integration transforms how businesses handle transactions. PayAgency’s API solutions are designed to deliver speed, flexibility, and security while minimizing failures and maximizing success.

1. Real-Time Transactions, Zero Delays

With API integration, transactions are processed instantly. As soon as a customer initiates payment, the API talks directly to the processor, ensuring immediate authorization and confirmation—no human intervention, no wait times.

This is essential for time-sensitive industries like gaming, crypto, and betting, where users expect rapid responses and smooth experiences. PayAgency’s real-time API guarantees fast, accurate processing with high availability across platforms.

2. Higher Approval Rates with Smart Routing

In high-risk sectors, payment approval rates make all the difference. Traditional gateways often reject valid transactions based on industry, location, or banking rules.

PayAgency’s intelligent API routes payments dynamically. If one route fails, the transaction is instantly redirected to another MID or PSP. Our cascading logic minimizes declines and maximizes approvals—ideal for sensitive verticals.

3. Flexible and Scalable Infrastructure

Every business has unique payment needs. Whether you're handling large forex trades or frequent micro-deposits, API integration allows complete customization of your payment system, including:

Multi-currency support

Dynamic routing

Regional payment method preferences

Tailored reporting and reconciliation

With PayAgency’s modular API architecture, businesses scale effortlessly with market demands, customer needs, and compliance updates.

4. Robust Security and Compliance

Security is at the core of any payment solution. PayAgency’s API adheres to global compliance standards such as PCI DSS, using advanced encryption, tokenization, and fraud prevention protocols.

Our API-driven fraud tools help protect your business from chargebacks, unauthorized activity, and regulatory breaches—keeping your payments secure and your reputation intact.

5. Automated Workflows = Fewer Errors

Manual processes slow down operations and open the door to mistakes. APIs automate critical workflows like:

Billing

Refunds

Retry logic

Settlement and reconciliation

With automation, your operations run smoother, error-free, and more efficiently—letting your team focus on strategy, not spreadsheets.

How PayAgency Powers API-Based Payment Solutions

As a global aggregator, PayAgency gives high-risk merchants a reliable and flexible payment infrastructure. Our API-first model puts control in your hands and scales as your business grows.

Key Features of PayAgency’s API Suite:

Real-time server-to-server API integration

Full support for cards, APMs, and crypto

Smart cascading routing to improve approval rates

API-integrated fraud protection

24/7 technical support

Integrations with PRAXIS, BridgerPay, PaynetEasy, and more

White-label PSP solutions for branded payment systems

Who Benefits from API-Driven Payments?

🎮 Gaming & Casino Platforms

Real-time deposits and withdrawals enhance user experience and retention.

🔄 Forex & Crypto Exchanges

High-volume, multi-currency environments need reliable, scalable APIs.

🛒 E-Commerce & Digital Products

Offer smooth checkouts, fast refunds, and ERP integration.

🔞 Adult & Dating Services

Smart routing and alt payment support reduce declines in high-risk industries.

🔁 Subscription Businesses

Manage recurring billing, upgrades, and cancellations with automated API flows.

Why Choose PayAgency for API Integration?

Speed to Market: Quick onboarding with clear API documentation

Customization: Build flows tailored to your platform

Reliability: Industry-best uptime with 24/7 monitoring

Security: PCI-DSS certified infrastructure

Scalability: Handle thousands of transactions per minute

Transparency: Access real-time reporting and reconciliation

Getting Started with PayAgency API

Apply for a Merchant Account Share your business profile—no setup fee required.

Get API Credentials Receive secure keys, documentation, and sandbox access.

Customize Integration Build your payment flow with full flexibility.

Go Live Process real transactions and monitor performance in real-time.

What’s Next for API-Based Payment Processing?

PayAgency is leading the charge with innovations like:

Open Banking APIs for instant bank transfers

Machine learning-powered smart routing

Embedded Finance capabilities

Unified APIs for cards, APMs, and crypto

Cross-border compliance integrations for KYC, AML, and local regulations

Final Thoughts

API integration isn’t just about technology—it’s about competitive advantage. For high-risk merchants, the ability to process payments seamlessly and intelligently is the key to growth and sustainability.

With PayAgency’s API-driven platform, you gain more than just a processor. You gain a partner committed to your success—offering the flexibility, control, and innovation you need to thrive in any market.

FAQs

1. What is API integration in payment processing? It enables your system to connect directly with a payment provider to perform real-time, automated transactions.

2. Why is it important for high-risk merchants? It improves approval rates, supports alternative payments, and reduces manual errors—critical for high-risk sectors.

3. Does it improve transaction success rates? Yes. Intelligent routing and fallback systems increase the likelihood of successful transactions.

4. Is API integration secure? Absolutely. APIs are secured with PCI-DSS standards, encryption, and tokenization.

5. How can I integrate PayAgency’s API? Apply for an account, get your API keys, build and test your integration, then go live with full support.

0 notes

Text

Transform Your Business with Future-Ready iGaming Solutions

The online gaming industry is more competitive than ever. To stand out, operators need more than a basic platform—they need advanced, scalable, and user-focused iGaming solutions. At Microbit Media, we deliver exactly that.

We specialize in helping you launch and grow high-performance iGaming platforms that engage users, boost retention, and maximize revenue. Whether you're starting from scratch or upgrading your current operation, our technology and expertise ensure you're always one step ahead.

What Sets Our iGaming Solutions Apart

1. Full-Service Technology Platform Our powerful backend system supports sports betting, casino, live games, and more. Built on a secure, scalable infrastructure, our iGaming solutions allow you to operate smoothly under any load—whether you're managing 100 or 100,000 players.

With modular architecture and customizable interfaces, we adapt the platform to fit your branding, business model, and geographic needs.

2. Quick Deployment, Full Control Time is money in the gaming industry. Our team helps you go live quickly with a turnkey solution—complete with licensing, payment integration, content, and user management tools. Once live, you stay in full control through an easy-to-use dashboard, allowing you to track data, manage users, and optimize performance in real-time.

Mobile-First Experience for Global Reach

More than 70% of online gaming happens on mobile devices. That’s why our iGaming solutions are designed mobile-first, ensuring fast, responsive gameplay on any device.

From the betting interface to secure wallet features, every component is optimized for smartphones and tablets—giving your players a seamless, on-the-go experience.

Integrated Payment & Security Systems

Our platform supports a wide range of global payment options including credit cards, e-wallets, bank transfers, and cryptocurrencies. Transactions are protected with industry-leading security protocols, ensuring both compliance and customer confidence.

We also handle all essential regulatory components—including KYC (Know Your Customer), AML (Anti-Money Laundering), and real-time fraud prevention—so your business stays secure and legally compliant at all times.

Player Engagement That Delivers Results

Our iGaming solutions are not just about performance—they’re built for retention and revenue growth. We provide:

Personalized user journeys

Smart segmentation and targeting

Loyalty programs and bonuses

Automated marketing workflows

Real-time analytics and A/B testing

These tools help you increase player lifetime value, reduce churn, and build long-term loyalty.

Ready-Made Casino & Sportsbook Content

Microbit Media partners with top-tier game providers to bring you a wide variety of games—from slots and table games to live dealer and sports betting. Our content library is constantly updated to keep players engaged and returning for more.

Our API-based integration allows you to add or switch content providers with ease, giving you total flexibility over your game offerings.

Global Reach, Local Expertise

Whether you’re targeting Europe, Asia, LATAM, or beyond, our iGaming solutions are built to support multi-language, multi-currency, and localized UI/UX. We understand the challenges of entering new markets—and we equip you with the tools to meet them.

Let’s Build Your iGaming Brand—Together

With Microbit Media, you don’t just get a platform—you gain a dedicated partner. From launch to growth, we’re here to provide support, strategy, and scalable tech. Our team of iGaming professionals is available 24/7 to guide your journey, troubleshoot issues, and ensure you’re always ahead of the curve.

Whether you're building a niche betting site or a global gaming platform, our customizable iGaming solutions help you get there faster—and smarter.

Ready to Launch? Start with a Free Demo.

Take the first step toward growing your iGaming business. Contact us today for a free consultation and discover how our complete iGaming solutions can power your success in the fast-moving world of online gaming.

0 notes

Text

How Payment Orchestration Improves Payment Reconciliation Efficiency

Enter the game-changer: payment orchestration.

In this blog, we’ll explore how a robust Payment Orchestration Platform like Payomatix enhances Payment Reconciliation Efficiency through integrated payment systems, real-time insights, automation, and improved financial control.

What Is a Payment Orchestration Platform?

A Payment Orchestration Platform (POP) is a centralized layer that connects various payment gateways, methods, fraud prevention tools, and back-end financial systems. It manages the entire transaction flow—routing, processing, settlement, and reporting—while abstracting the technical complexity from the merchant.

Key Features:

Multi-gateway routing

Centralized transaction reporting

API-driven integrations

Fraud prevention and compliance management

By integrating all systems into a single orchestration layer, businesses gain end-to-end control over payments.

Understanding Payment Reconciliation Challenges

Payment reconciliation is the process of matching financial transactions recorded in internal systems with those reported by banks or payment processors. For growing businesses using multiple payment methods, this can get complicated fast.

Common challenges include:

Mismatched data across providers

Delayed settlement reports

Manual data entry errors

Inconsistent reporting formats

Lack of real-time visibility

These issues delay month-end closings, impact cash flow, and reduce financial accuracy.

How Payment Orchestration Improves Reconciliation

Here’s how a payment orchestration platform revolutionizes the reconciliation process:

Unified Transaction Reporting

With Payomatix’s orchestration layer, businesses can consolidate transaction data from all gateways into a centralized dashboard. This unified view simplifies the reconciliation process by eliminating fragmented reporting.

Real-Time Data Sync

Payment orchestration platforms offer real-time sync between payment processors and internal financial systems. This ensures that finance teams always work with the most current data.

Automated Matching & Flagging

Advanced orchestration platforms use automation and AI to match payments with invoices, flag discrepancies, and generate alerts for unresolved items. This significantly reduces manual effort.

Seamless Integration with ERP & Accounting Tools

Payomatix integrates effortlessly with ERP systems and accounting software like QuickBooks, Zoho, or SAP, ensuring that payment data flows directly into your books without human error.

Enhanced Security & Compliance

Integrated fraud detection and PCI-compliant workflows ensure that your reconciliation process is secure and adheres to global payment standards.

Section 4: Technical & Operational Efficiency with Payomatix

Payomatix goes beyond orchestration. Our platform delivers technical and operational efficiency across your entire payment infrastructure.

Our payment reconciliation services are part of our broader ecosystem of integrated payment systems. With Payomatix, you can:

Access real-time transaction reports

Reduce reconciliation time by up to 60%

Minimize chargebacks and fraud risk

Eliminate redundant integrations and data silos

Looking to streamline your finance operations?

Explore Payomatix’s Technical & Operational Efficiency services for Payment Gateway Integration and Reconciliation Solutions.

[Contact our team today for a free consultation.]

Benefits of Using Payment Orchestration for Reconciliation

Here are the major advantages businesses can unlock:

Faster Month-End Closures

Improved Cash Flow Management

Higher Accuracy in Financial Reporting

Reduced Operational Costs

Better Customer Experience (fewer billing errors)

In high-volume industries like e-commerce, fintech, SaaS, and marketplaces, these benefits have a direct impact on profitability.

Real-World Use Case

Imagine an online marketplace processing payments via Stripe, Razorpay, and PayPal. Without orchestration, reconciliation is chaotic, time-consuming, and error-prone.

With Payomatix:

All transactions from multiple gateways are unified

Refunds and chargebacks are auto-mapped

Reports are exported to the ERP in seconds

Fraud risks are flagged in real-time

The result? A smoother financial workflow and greater confidence in financial reporting.

Getting Started with Payomatix

Integrating Payomatix’s payment orchestration platform is simple and scalable.

Steps:

Book a demo with our solutions team

Share your current payment architecture

Receive a customized orchestration & reconciliation plan

Integrate via our easy-to-use APIs

Go live with full support from our onboarding specialists

Conclusion: Orchestrate Smarter, Reconcile Faster

In 2025, businesses cannot afford payment inefficiencies. With the right payment orchestration platform, reconciliation can move from being a bottleneck to a business advantage.

At Payomatix, we help businesses take control of their financial operations with cutting-edge orchestration and reconciliation tools.

Start your journey toward frictionless finance today.

Book your free consultation to explore Payomatix’s Payment Reconciliation Services.

FAQs

What is a payment orchestration platform? Answer: A payment orchestration platform is a central system that connects and manages multiple payment gateways, methods, and tools to streamline transactions and reporting.

How does payment orchestration help with reconciliation? Answer: It unifies transaction data from all providers, automates matching, flags discrepancies, and syncs with accounting tools—making reconciliation faster and more accurate.

Why do startups and businesses need payment reconciliation services? Answer: Payment reconciliation services reduce manual work, prevent errors, improve financial accuracy, and speed up month-end closings—critical for cash flow and reporting.

Can Payomatix integrate with accounting software? Answer: Yes, Payomatix integrates seamlessly with ERP and accounting systems like QuickBooks, Zoho, and SAP to automate payment data entry and reporting.

How do I get started with Payomatix’s reconciliation platform? Answer: You can start by booking a demo, sharing your current payment setup, and integrating Payomatix through easy-to-use APIs with full onboarding support.

0 notes

Text

Top Benefits of Using a Cheque API for Businesses and Financial Institutions

In an era dominated by digital transactions and automation, the need for efficient, secure, and scalable payment solutions has never been more critical. While electronic fund transfers and real-time payments are becoming increasingly popular, cheques still play a vital role in business and financial transactions—especially for high-value payments, vendor settlements, and B2B operations. A Cheque API offers a modern solution to automate and streamline cheque issuance, processing, and management for businesses and financial institutions.

In this comprehensive guide, we’ll explore the top benefits of using Cheque APIs, how it enhances operational efficiency, reduces costs, improves compliance, and integrates with modern financial systems. Whether you're a small business owner, fintech startup, or enterprise-level financial institution, this article will help you understand how Cheque APIs can future-proof your payment workflows.

What is a Cheque API?

A Cheque API (Application Programming Interface) is a software interface that allows businesses to automate the process of creating, printing, mailing, tracking, and managing cheques through a secure and programmable platform. It integrates with accounting software, enterprise resource planning (ERP) systems, or custom applications to offer seamless cheque-related functions.

Instead of manually writing cheques or relying on traditional banking channels, a Cheque API enables you to send payments with a few lines of code—reducing human errors, speeding up payment cycles, and ensuring full traceability.

1. Automation of Cheque Printing and Mailing

✅ Why it Matters:

Manual cheque writing and mailing can be time-consuming, error-prone, and resource-heavy. By using a Cheque API, businesses can automate this entire process—from payment approval to cheque dispatch.

💡 Benefit:

Reduces manual workload: No need for printing, signing, or envelope stuffing.

Improves accuracy: Eliminates data entry errors.

Enhances scalability: Process thousands of cheques with minimal overhead.

🧠 Example Use Case:

A payroll department can integrate a Cheque API to automatically send out physical paychecks to remote employees or contractors who prefer non-digital payments.

2. Improved Security and Fraud Prevention

✅ Why it Matters:

Cheque fraud is still a significant concern, especially in sectors like real estate, finance, and healthcare. A Cheque API offers advanced security measures such as encryption, digital signatures, audit trails, and secure printing practices.

💡 Benefit:

Encrypted data transmission ensures sensitive information is secure.

Secure check stock and MICR printing reduce the risk of forgery.

Tamper-evident envelopes and tracking enhance trust.

🧠 Example Use Case:

Financial institutions can use a Cheque API with built-in fraud detection tools to screen unusual payment patterns and prevent unauthorized disbursements.

3. Cost Reduction and Operational Efficiency

✅ Why it Matters:

Manual cheque issuance involves multiple steps—paper, ink, envelopes, postage, and labor. These costs add up quickly, especially for companies processing large volumes.

💡 Benefit:

Eliminates hardware needs: No printers, ink, or paper inventory required.

Saves on mailing and postage: Outsourced mailing via API providers can be cheaper.

Reduces administrative workload: Free up staff to focus on strategic tasks.

🧠 Example Use Case:

A medium-sized law firm can save thousands annually by automating settlement cheque distribution using a Cheque API service.

4. Real-Time Tracking and Reconciliation

✅ Why it Matters:

Traditional cheque systems often lack transparency. Tracking a payment involves calling banks, emailing support, or manually checking account statements.

💡 Benefit:

End-to-end cheque tracking from dispatch to delivery.

Automated reconciliation with financial software.

Digital audit trails for every payment.

🧠 Example Use Case:

An accounting team can reconcile issued cheques with invoices in real-time using API-generated status updates and webhook notifications.

5. Integration with Accounting and ERP Systems

✅ Why it Matters:

Modern finance teams rely on tools like QuickBooks, Xero, Netsuite, and SAP. Manual cheque issuance disrupts workflow continuity.

💡 Benefit:

Seamless integration with platforms like QuickBooks, FreshBooks, and Zoho.

Triggers and webhooks automate actions like status updates and reporting.

Custom API endpoints for different departments and use cases.

🧠 Example Use Case:

An e-commerce business can integrate their ERP system with a Cheque API to issue vendor payments automatically after fulfillment or invoice approval.

6. Enhanced Compliance and Record-Keeping

✅ Why it Matters:

Regulatory bodies like FINTRAC, SOX, and PCI-DSS require transparent and auditable payment records. Manual cheque systems lack this granularity.

💡 Benefit:

Timestamped records for each transaction.

Digital backups of issued cheques.

Easier audits and regulatory compliance with financial laws.

🧠 Example Use Case:

A healthcare organization ensures HIPAA-compliant financial documentation by using a Cheque API with encrypted storage and secure audit logs.

7. Faster Payment Turnaround Time

✅ Why it Matters:

Delayed payments can strain vendor relationships, lead to penalties, or disrupt service continuity.

💡 Benefit:

Same-day cheque processing and dispatch.

APIs trigger payment workflows instantly.

Reduces cheque issuance time from days to minutes.

🧠 Example Use Case:

A construction company can instantly issue urgent payments to subcontractors through an API-based cheque dispatch after milestone approval.

8. Customization and White-Labeling

✅ Why it Matters:

Maintaining brand identity in all customer and vendor communications is essential for trust and professionalism.

💡 Benefit:

Custom-branded cheque templates with logos and brand colors.

White-labeled envelopes for uniform correspondence.

Personalized messaging for recipients (e.g., payment notes).

🧠 Example Use Case:

A fintech startup uses a white-labeled Cheque API to build trust with customers by sending branded refund cheques.

9. Remote Access and Cloud-Based Control

✅ Why it Matters:

With hybrid work models and distributed teams, cloud-based cheque issuance is more critical than ever.

💡 Benefit:

Issue cheques from anywhere, anytime.

Role-based access control for teams.

Admin dashboards for real-time visibility and management.

🧠 Example Use Case:

A nonprofit can issue grant cheques remotely to global recipients without relying on in-office staff.

10. Scalability for Growing Businesses

✅ Why it Matters:

As businesses grow, cheque volume may increase exponentially. Manual systems can’t keep up.

💡 Benefit:

Elastic infrastructure to support 10 to 10,000 cheques per day.

API rate limits and batching options for high-volume sending.

Support for recurring payments, bulk uploads, and templates.

🧠 Example Use Case:

A franchise business uses a Cheque API to handle royalty payments to 200+ locations every month automatically.

11. Global Cheque Delivery and Cross-Border Capabilities

✅ Why it Matters:

International vendors or clients may require physical cheques due to local banking practices or legal requirements.

💡 Benefit:

Supports multi-currency cheques.

Global printing and mailing via local facilities.

Compliance with international postal and cheque standards.

🧠 Example Use Case:

An educational publisher sends royalty cheques to authors in different countries using a global cheque API provider.

12. Business Continuity and Disaster Recovery

✅ Why it Matters:

In the event of office closures, natural disasters, or pandemics, having off-site cheque management is critical.

💡 Benefit:

Redundant infrastructure ensures cheque issuance continues uninterrupted.

Cloud backups protect data and transaction records.

Business continuity planning becomes seamless.

🧠 Example Use Case:

A university finance department continues to issue scholarship cheques during lockdowns through cloud-integrated cheque APIs.

13. Eco-Friendly and Paper Reduction Options

✅ Why it Matters:

Many businesses are focused on sustainability. Cheque APIs can offer hybrid solutions to reduce waste.

💡 Benefit:

Eco-certified printing options.

Digital delivery tracking minimizes duplicate printing.

Option to transition to e-cheques or EFT gradually.

🧠 Example Use Case:

A government agency reduces environmental impact by using APIs to issue only essential physical cheques, while others are handled digitally.

Choosing the Right Cheque API Provider

When selecting a Cheque API solution for your business or institution, consider these key factors:

Security compliance (PCI-DSS, SOC 2, HIPAA if applicable)

Ease of integration with your current systems

API documentation and developer support

Customization and branding options

Global coverage and multi-currency support

Delivery time and tracking capabilities

Pricing and scalability

Some popular Cheque API providers in 2025 include:

Lob.com

Checkflo

PostGrid

Print & Mail APIs by Click2Mail

Online Check Writer

Final Thoughts

A Cheque API transforms traditional cheque processing into a modern, efficient, and secure operation. For businesses and financial institutions, it enables streamlined payments, minimizes errors, reduces operational costs, and ensures compliance—all while maintaining the flexibility of cheque-based transactions.

Whether you’re managing payroll, vendor payments, customer refunds, or disbursements, automating the cheque issuance process through an API is a strategic move that drives digital transformation while respecting legacy systems.

Start by exploring providers that match your industry needs, test API integrations with your software stack, and scale your cheque operations with confidence in 2025 and beyond.

youtube

SITES WE SUPPORT

Mail & Print Letters – Wix

0 notes

Text

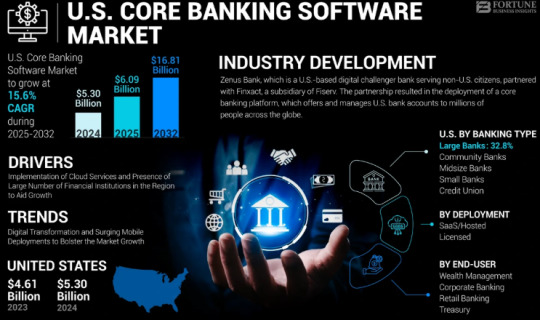

The U.S. Core Banking Software Market Size, Share | CAGR 15.6% during 2024-2030

The U.S. core banking software market Size was valued at USD 5.30 billion in 2024 and is projected to grow from USD 6.09 billion in 2025 to USD 16.81 billion by 2032, exhibiting a CAGR of 15.6% during the forecast period. Driven by the modernization of legacy banking systems, increasing customer demand for digital-first banking experiences, and adoption of cloud-native platforms, the U.S. banking industry is rapidly shifting toward agile, API-driven core banking systems.

Key Market Highlights:

2024 U.S. Market Size: USD 5.30 billion

2025 U.S. Market Size: USD 6.09 billion

2032 U.S. Market Size: USD 16.81 billion

CAGR (2025–2032): 15.6%

Market Outlook: Cloud-first transformation of retail and commercial banking infrastructure

Leading Players in the U.S. Market:

FIS (Fidelity National Information Services)

Finastra

Temenos USA

Oracle Financial Services Software

Jack Henry & Associates

SAP America

nCino

Infosys (EdgeVerve)

Thought Machine

Backbase

Mambu

Q2 Holdings

TCS BaNCS (U.S. operations)

Request Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/u-s-core-banking-software-market-107481

Market dynamics:

Growth Drivers:

Legacy System Modernization: Traditional banks are replacing decades-old core systems to enable agility, scalability, and faster innovation.

Rise of Digital-Only Banks & Neobanks: Challenger banks are opting for coreless and cloud-native platforms to deliver real-time banking experiences.

Regulatory Mandates: U.S. regulations increasingly demand transparency, real-time compliance, and modular tech stacks.

Omnichannel and Mobile Banking Boom: Surge in mobile-first customers is accelerating demand for flexible and API-driven core systems.

Adoption of BaaS & Embedded Finance: Banks are embedding financial services into non-banking platforms, requiring agile backend core systems.

Key Opportunities:

AI-Powered Core Modernization: Integration of AI for risk scoring, predictive analytics, and process automation

Cloud Migration Projects: Large-scale re-platforming from on-premise to cloud-native or hybrid models

Banking-as-a-Service (BaaS): U.S. institutions offering core services to fintechs and enterprises

Open Banking APIs: Ecosystem expansion through developer-friendly, regulatory-compliant APIs

Personalized Customer Experience Engines: Data-driven personalization built directly into core systems

Technology & Application Scope:

Deployment Models:

Cloud-native

On-premises

Hybrid (transitional)

Core Features:

Customer and account management

Payments and transaction processing

Lending and credit modules

Risk and compliance automation

Real-time reporting and dashboards

Target Users:

Retail banks

Credit unions

Community banks

Commercial and corporate banks

Neobanks and fintechs

Speak to Analysts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/u-s-core-banking-software-market-107481

Recent Developments:

January 2024 – A top-10 U.S. bank announced a $700M multiyear plan to migrate its entire core system to a cloud-native microservices architecture with Temenos and AWS.

October 2023 – Jack Henry & Associates launched a new AI-powered fraud prevention module integrated into its core platform, reducing false positives by 45%.

July 2023 – A mid-sized credit union in the Midwest completed a legacy core banking system overhaul, leading to a 22% increase in customer satisfaction due to improved digital banking capabilities.

Trends Shaping the U.S. Core Banking Market:

Composable Banking Architecture: Shift toward modular, plug-and-play architecture

AI & Machine Learning in Core: Real-time fraud detection, dynamic credit risk models, and intelligent automation

Blockchain Integration: Experiments in real-time settlement, decentralized identity, and smart contracts

Low-Code/No-Code Customization: Democratization of development within banking teams

Cybersecurity Embedded in Core: Zero-trust frameworks and secure-by-design approaches

Conclusion:

The U.S. core banking software market is undergoing a significant transformation, driven by rising customer expectations, digital competition, and the imperative to stay compliant and resilient. The future belongs to banks that embrace modular, cloud-native, and API-driven core platforms—designed to scale, personalize, and evolve. As the market accelerates toward modernization, technology vendors and banks alike are finding immense value in flexible ecosystems, open banking capabilities, and real-time innovation.

Frequently Asked Questions: 1. What is the projected value of the global market by 2032?

2. What was the total market value in 2024?

3. What is the expected compound annual growth rate (CAGR) for the market during the forecast period of 2025 to 2032?

4. Which industry segment dominated market in 2023?

5. Who are the major companies?

6. Which region held the largest market share in 2023?

#U.S. Core Banking Software Market Share#U.S. Core Banking Software Market Size#U.S. Core Banking Software Market Industry#U.S. Core Banking Software Market Driver#U.S. Core Banking Software Market Growth#U.S. Core Banking Software Market Analysis#U.S. Core Banking Software Market Trends

0 notes

Text

Streamline Onboarding with Business Verification API by NifiPayments

In today’s fast-paced digital ecosystem, businesses are under constant pressure to verify entities quickly, accurately, and in compliance with regulations. Manual verification processes are time-consuming, error-prone, and often lead to onboarding delays or security risks.

To tackle this, NifiPayments offers a powerful solution — the Business Verification API, designed to simplify and automate the process of verifying business identities in real-time.

🔍 What is the Business Verification API?

The Business Verification API by NifiPayments enables businesses, fintech platforms, lending companies, and marketplaces to instantly validate the authenticity of business entities. This includes confirming business registration details, legal status, GST information, and more — directly from authoritative data sources.

✅ Key Features

Real-Time Business Lookup Access up-to-date business data in seconds using just a PAN, GSTIN, or registration number.

Compliance-Ready Ensure that your onboarding process adheres to KYC, AML, and RBI regulatory guidelines.

Seamless API Integration Plug-and-play API that can be easily integrated into your onboarding workflows or existing systems.

Bulk Verification Support Need to verify hundreds or thousands of businesses? No problem — our API supports bulk processing for scale.

Fraud Prevention Detect and block fraudulent or shell companies before they enter your ecosystem.

🚀 Benefits for Your Business

Faster Onboarding: Reduce manual checks and approve legitimate businesses instantly.

Better Risk Management: Access verified data from trusted sources to reduce financial and compliance risks.

Operational Efficiency: Free up internal teams from repetitive verification tasks.

Improved User Experience: Deliver a smoother onboarding process that builds trust from the first interaction.

Scalability: Whether you’re a startup or enterprise, the API grows with your needs.

💼 Who Can Use It?

Fintech companies

Payment gateways

NBFCs & banks

Marketplaces & aggregators

SaaS platforms

Insurance & lending firms

🔗 Why Choose NifiPayments?

At NifiPayments, we combine cutting-edge technology with regulatory compliance to empower digital businesses. Our Business Verification API is not only fast and secure but also tailored to meet the evolving demands of modern finance and commerce.

📝 Final Thoughts

In a world where speed, accuracy, and security define success, the Business Verification API by NifiPayments is your ally in building a trusted, compliant, and scalable business ecosystem. Make smarter decisions with verified data — instantly.

📞 Ready to automate your business verification process? Connect with NifiPayments today and get started!

0 notes

Text

1 Transfer That Can Pierce Your LLC Shield (Banking Compliance PSA)

You formed an LLC to protect your assets, right? Yeah, it’s tricky. But here’s the kicker: 62% of IRS audits targeting small businesses start with banking errors not tax filings. One client mixed personal groceries with business software purchases (oops!), triggering a $10k penalty and piercing their liability shield. Poof! Your protection disappears faster than free office snacks.

Let’s unpack why your business bank account for LLC isn’t just a formality it’s your legal moat.

The 3-Second Mistake That Pierces Your Liability Shield

Picture this: You pay your kid’s tuition from your LLC account. Seems harmless? Big mistake. Courts call this “commingling” mixing personal and business funds and it’s the #1 reason judges ignore LLC protections. Suddenly, your house, car, and savings are lawsuit targets.

Fix it now (literally 10 minutes):

1. Open a dedicated business account (not your personal checking with a new label). 2. Document every transfer as “owner’s draw” or “expense reimbursement.” 3. Cancel LLC debit cards used for personal errands yesterday.

| Pro Tip: Use apps like Relay (free ACH/wires) to auto-categorize transfers. No more “oops” moments .

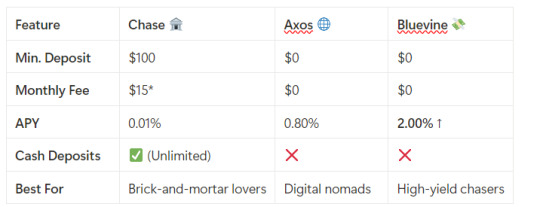

Chase vs. Axos vs. Bluevine: The LLC Banking Thunderdome

-Chase fees waived with $2k min balance. Bluevine’s 2% APY covers balances up to $250k free money, folks .

-Why it matters: Axos refunds all ATM fees globally crucial if you travel. But Bluevine wins for growth-stage LLCs hoarding cash. Chase? Only if you’re depositing cash weekly.

The EIN Trap: When Your SSN Isn’t Enough

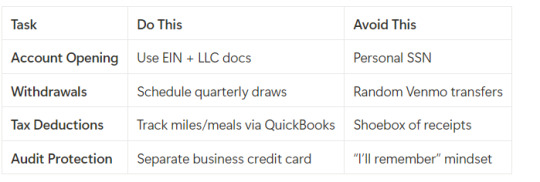

Single-member LLCs think: “I’ll just use my Social Security Number for banking.” Stop! Banks like Mercury freeze accounts without an EIN (Employer Identification Number). Why? Fraud prevention.

Worse: If your LLC has foreign owners (e.g., a Chinese investor with 25%+ stake), you must file Form 5472 or face $25k+ fines. Yeah, the IRS doesn’t play .

Action plan:

-Get an EIN online (http://irs.gov/), 4-minute process). - Update EVERY account banking, payroll, utilities. - Foreign members? Hire a CPA who knows international KYC.

Tax Savings: How to Withdraw Cash Like a Mob Boss (Legally!)

Withdrawing LLC profits isn’t a free-for-all. Do it wrong, and you’ll pay 15.3% self-employment tax plus income tax. Ouch.

Smart moves:

- Owner’s Draw (Single-Member LLC): Take cash anytime. But: Set aside 30% for taxes (use Form 1040-ES quarterly) . - Guaranteed Payments (Multi-Member LLC): Pay yourself a “salary” pre-profit split. Deducts from company income. - S Corp Election: Slash self-employment tax by paying yourself a “reasonable salary” (e.g., $80k) and taking excess as distributions.

| Example: $200k profit? Save $12,000+ by electing S corp status.

Deduct EVERYTHING:

-Home office? Deduct 30% of rent. - Business meals? 50% off (keep receipts!). - Car use? Track miles 2025 rate: 67¢/mile.

The Compliance Bomb Hiding in Your Statements

Think “low fees” are the holy grail? Wait till you miss these landmines:

-BOI Report (2025): New law! LLCs must file Beneficial Ownership Info with FinCEN. Penalty: $500/day . - $10k+ Deposits: Banks file CTRs (Currency Transaction Reports). If your coffee shop deposits $9,999 weekly? Structured a federal crime. - PayPal/Stripe Freezes: Platforms hate “disregarded entities” (single-member LLCs). Solution: Incorporate as C-Corp if scaling globally .

Contrarian Take: Ditch Your LLC (Sometimes)

Here’s the twist: LLCs aren’t magic. For SaaS founders eyeing VC funding? Incorporate as a C-Corp. Delaware C-Corps avoid the 5472 foreign-owner trap and attract investors. E-commerce sellers? Stick with LLCs pass-through taxes keep it simple.

| Real talk: I’ve seen LLC owners lose $37k in tax savings by ignoring entity structure. Don’t be them.

Your 10-Minute Audit Fix:

1. Open Bluevine/Axos for high-yield, no-fee business banking. 2. Get an EIN. 3. Move all business transactions to this account. 4. Elect S corp status if earning >$80k profit (ask your CPA). 5. File that damn BOI report!

| CONTACT ME FOR MORE INFORMATION

| Mail: [email protected]

0 notes

Text

IP to City Lookup: Why It Matters for Business

IP to city lookup is a powerful tool that enables businesses to identify the precise location of their website visitors, down to the city level. This geographic insight is crucial for personalizing content, targeting regional marketing campaigns, and improving user experience. By integrating an advanced IP address location Api, companies can access real-time, accurate data that drives smarter decisions. Understanding user location through IP-to-City lookup optimizes ad delivery and helps prevent fraud, giving your business a competitive edge in today’s digital landscape.

Read More:- https://archieheaton.com/ip-to-city-lookup-why-it-matters-for-business/

0 notes

Text

Simplified High Risk Payment Processing for Growing Businesses

Operating in a high-risk industry can make payment processing feel like a constant struggle. At CreditCardPayment.us, we believe that every high risk merchant deserves access to seamless, secure, and scalable payment solutions—no matter the industry.

Whether you’re in adult content, CBD, forex, online gaming, or nutraceuticals, our tailored high risk payment services are built to support your growth. Say goodbye to declined applications, frozen funds, or complicated onboarding processes.

We offer a robust high risk payment gateway that provides:

⚡ Fast and hassle-free approvals

🌎 Global processing capabilities with multi-currency support

🔐 Fraud prevention and chargeback reduction tools

🔌 Smooth API integration with your existing systems

Unlike mainstream providers, we specialize in supporting merchants with unique business models and higher chargeback risks. We don’t just offer a payment solution—we become your partner in success.

Our high risk payment gateway is designed for reliability, ensuring your customers can pay easily while you stay compliant and operational around the clock.

Thousands of high risk merchants trust us to handle their transactions with professionalism, speed, and transparency. From subscription-based billing to large one-time purchases, we provide flexible solutions that adapt to your needs.

Let your business thrive without limits.

📞 Have questions or ready to start processing today? 🌐 Visit our website: https://creditcardpayment.us/

0 notes

Text

Tips for Breaking into the AI Cloud Industry

Think of a single AI system that processes over 160 billion transactions annually, identifying fraudulent activities within milliseconds. This is not a futuristic concept but a current reality at Mastercard, where AI-driven solutions have significantly enhanced fraud detection capabilities. Their flagship system, Decision Intelligence, assigns risk scores to transactions in real time, effectively safeguarding consumers from unauthorized activities.

In the healthcare sector, organizations like Humana have leveraged AI to detect and prevent fraudulent claims. By analyzing thousands of claims daily, their AI-powered fraud detection system has eliminated potential fraudulent actions worth over $10 million in its first year. (ClarionTech)

These examples underscore the transformative impact of AI cloud systems across various industries. As businesses continue to adopt these technologies, the demand for professionals skilled in both AI and cloud computing is surging. To meet this demand, individuals are turning to specialized certifications.

Because of this, certifications such as the AWS AI Certification, Azure AI Certification, and Google Cloud AI Certification are becoming essential credentials for those looking to excel in this field. These programs provide comprehensive training in deploying and managing AI solutions on respective cloud platforms. Thus equipping professionals with the necessary skills to navigate the evolving technological landscape.

For those aspiring to enter this dynamic industry, it’s crucial to learn AI cloud systems and enroll in AI cloud training programs that offer practical, hands-on experience. By doing so, professionals can position themselves at the forefront of innovation, ready to tackle challenges and drive progress in the AI cloud domain.

If you’re looking to break into the AI cloud industry, you’re on the right track. This guide shares real-world tips to help you land your dream role, with insights on what to learn, which AI cloud certifications to pursue, and how to stand out in a rapidly evolving tech space.

1. Understand the AI Cloud Ecosystem

Before diving in, it’s critical to understand what the AI cloud ecosystem looks like.

At its core, the industry is powered by major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). These platforms offer the infrastructure, tools, and APIs needed to train, deploy, and manage AI models at scale.

Companies are increasingly looking for professionals who can learn AI cloud systems and use them to deliver results. It could be for deploying a machine learning model to recognize medical images or training a large language model for customer support automation.

2. Build a Strong Foundation in AI and Cloud

You don’t need a Ph.D. to get started, but you do need foundational knowledge. Here’s what you should focus on:

Programming Languages: Python is essential for AI, while JavaScript, Java, and Go are common in cloud environments.

Mathematics & Algorithms: A solid grasp of linear algebra, statistics, and calculus helps you understand how AI models work.

Cloud Fundamentals: Learn how storage, compute, containers (like Kubernetes), and serverless functions work in cloud ecosystems.

Free resources like IBM SkillsBuild and Coursera offer solid entry-level courses. But if you’re serious about leveling up, it’s time to enroll in AI cloud training that’s tailored to real-world applications.

3. Get Hands-On with Projects

Theory alone won’t get you hired—practical experience is the key. Build personal projects that show your ability to apply AI to solve real-world problems.

For example:

Use Google Cloud AI to deploy a sentiment analysis tool.

Train an image recognition model using AWS SageMaker.

Build a chatbot with Azure’s Cognitive Services.

Share your work on GitHub and LinkedIn. Recruiters love candidates who not only understand the tools but can demonstrate how they have used them.

4. Earn an AI Cloud Certification That Counts

One of the most impactful things you can do for your career is to earn a recognized AI cloud certification. These credentials show employers that you have the technical skills to hit the ground running.

Here are three standout certifications to consider:

AWS AI Certification – Ideal if you’re working with services like SageMaker, Rekognition, or Lex. It’s great for machine learning engineers and data scientists.

Azure AI Certification – This credential is best if you’re deploying AI through Microsoft tools, such as Azure Machine Learning, Bot Services, or Form Recognizer.

Google Cloud AI Certification – This one validates your ability to design and build ML models using Vertex AI and TensorFlow on GCP.

These certifications not only sharpen your skills but also significantly boost your resume. Many employers now prefer or even require an AI cloud certification for roles in AI engineering and data science.

5. Stay Current with Industry Trends

The AI cloud field changes quickly. New tools, platforms, and best practices emerge almost monthly. Stay informed by:

Following blogs by AWS, Google Cloud, and Microsoft

Joining LinkedIn groups and Reddit communities focused on AI and cloud

Attending free webinars and local meetups

For example, Nvidia recently introduced DGX Cloud Lepton—a new service aimed at making high-powered GPUs more accessible for developers via the cloud. Understanding innovations like this keeps you ahead of the curve.

6. Network Like Your Career Depends on It (Because It Does)

Many people underestimate the power of networking in the tech industry. Join forums, attend AI meetups, and don’t be afraid to slide into a LinkedIn DM to ask someone about their job in the AI cloud space.

Even better, start building your brand by sharing what you’re learning. Write LinkedIn posts, Medium articles, or even record YouTube tutorials. This not only reinforces your knowledge but also makes you more visible to potential employers and collaborators.

7. Ace the Interview Process

You’ve done the training, the certs, and built a few cool projects—now it’s time to land the job.

AI cloud interviews usually include:

Technical assessments (coding, cloud architecture, model evaluation)

Case studies (e.g., “How would you build a recommendation engine on GCP?”)

Behavioral interviews to assess team fit and communication skills

Prepare by practicing problems on HackerRank or LeetCode, and be ready to talk about your projects and certifications in depth. Showing off your Google Cloud AI certification, for instance, is impressive, but tying it back to a project where you built and deployed a real-world application? That’s what seals the deal.

Start Small, Think Big

Breaking into the AI cloud industry might feel intimidating, but remember: everyone starts somewhere. The important thing is to start.

Learn AI cloud systems by taking free courses.

Enroll in AI cloud training that offers hands-on labs and practical projects.

Earn an AI cloud certification—whether it’s AWS AI Certification, Azure AI Certification, or Google Cloud AI Certification.

And most importantly, stay curious, stay consistent, and keep building.

There’s never been a better time to start your journey. Begin with AI CERTs! Consider checking the AI+ Cloud Certification, if you’re serious about building a future-proof career at the intersection of artificial intelligence and cloud computing. This certification is designed for professionals who want to master real-world AI applications on platforms like AWS, Azure, and Google Cloud.

Enroll today!

0 notes

Text

Why E-commerce Businesses Need an Address Verification API in 2025

In the ever-evolving world of e-commerce, precision and speed are key to ensuring customer satisfaction and operational efficiency. As we step into 2025, the stakes are higher than ever. With growing consumer expectations, intensified competition, and increased instances of fraud, e-commerce businesses must equip themselves with advanced tools to stay ahead. One such essential tool is the Address Verification API.

The Critical Role of Address Verification in E-commerce

Address verification is the process of validating the accuracy and deliverability of a customer's shipping address. For e-commerce companies, this step is not just administrative—it’s mission-critical. An incorrect address can result in failed deliveries, increased shipping costs, frustrated customers, and a tarnished brand reputation.

What is an Address Verification API?

An Address Verification API (Application Programming Interface) integrates with an e-commerce platform to automatically check and standardize address data during checkout or in the backend. These APIs use real-time data from postal services and geolocation tools to ensure the address exists and is correctly formatted for delivery.

Why It Matters More in 2025

1. Increased Consumer Expectations

Customers now expect fast, error-free deliveries. A single mistake in address entry can lead to significant delays, which in turn can damage customer trust.

2. Growth of Cross-border E-commerce

International shipping introduces complexity due to varying address formats and languages. Address Verification APIs help standardize global addresses to ensure successful deliveries.

3. Rising Costs of Failed Deliveries

According to industry reports, the cost of failed deliveries exceeds $5 billion annually. In 2025, reducing these unnecessary expenses is crucial to maintain profitability.

4. Fraud Prevention

Address verification APIs can detect fraudulent entries by cross-referencing addresses with official postal databases, reducing chargebacks and fake orders.

Benefits of Address Verification API for E-commerce

1. Enhanced Customer Experience

By catching errors at the point of entry, these APIs eliminate the frustration of missed or delayed deliveries.

2. Operational Efficiency

Accurate addresses reduce the burden on customer service teams and cut down on reshipping and return processing.

3. Cost Savings

Avoiding failed deliveries, reshipments, and customer complaints leads to significant savings over time.

4. Better Analytics and Insights

Clean, verified address data improves customer segmentation and targeting for marketing campaigns.

5. Scalability

As your business grows, a robust API ensures that increasing order volumes don’t translate to increasing delivery errors.

SEO-Optimized Features

Address Validation API for Shopify

WooCommerce Address Autocomplete API

Magento Address Validation Tool

Real-Time USPS Address Verification

Global Address Verification for International E-commerce

How to Implement an Address Verification API

Choose the Right Provider: Evaluate based on coverage, response time, integration ease, and support.

Integrate with Your Platform: Use plugins or custom code for seamless integration.

Test Thoroughly: Validate on different devices and address formats.

Monitor & Optimize: Track delivery success rates and optimize rules based on analytics.

Conclusion

In 2025, an Address Verification API is no longer optional for e-commerce success—it’s essential. From preventing fraud and reducing costs to enhancing customer satisfaction, this API offers measurable benefits. Businesses that prioritize clean, accurate data will stand out in the crowded online marketplace.

youtube

SITES WE SUPPORT

Address Mailing APIs – Wix

0 notes

Text

The Future is Now: Why Cryptocurrency Payments are a Game-Changer for High-Risk Merchants

Faster settlements, reduced fees, and global accessibility—crypto payments are transforming the high-risk payment landscape. Discover how PayAgency leads the way.

PayAgency Team | July 01, 2025 | 10 min read

#Cryptocurrency #HighRiskMerchants #CryptoPayments #Blockchain #FintechSolutions

The Financial Revolution for High-Risk Merchants

In today's fast-evolving digital economy, financial inclusion is no longer optional—it’s a necessity. Yet many high-risk businesses face constant rejection from traditional banks. From online gaming and forex to adult content and CBD products, these sectors often struggle with account freezes, declined transactions, and sky-high fees.

Cryptocurrency is emerging as a powerful alternative—giving high-risk merchants freedom from outdated systems, along with access to secure, scalable, and cost-effective payment infrastructure.

If you're looking to future-proof your business, PayAgency provides a complete crypto payment solution tailored for high-risk industries.

Why High-Risk Merchants Are Embracing Crypto

1. Escape from Traditional Banking Barriers Gaming, forex, adult, and nutraceutical businesses are routinely flagged by banks. Crypto payments allow merchants to bypass these limitations and operate freely across global markets.

2. No Chargebacks, No Hassle Crypto transactions are irreversible—eliminating chargeback fraud and giving merchants more confidence in every transaction.

3. Faster Settlements, Lower Fees With no intermediaries, crypto transactions offer near-instant settlements and significantly lower processing costs.

4. Enhanced Privacy Industries like adult services value discretion. Crypto enables private, anonymous payments, protecting both merchants and users.

5. Global Reach Cryptocurrency unlocks access to underserved markets where banking systems are slow or inaccessible, enabling borderless growth.

Why Choose PayAgency for Crypto Payments?

PayAgency, part of Xorapay Limited (licensed in Canada & the EU), is a global leader in high-risk payment solutions. We help merchants across industries like gaming, adult, crypto, forex, and e-commerce accept crypto payments with ease and compliance.

Key Features:

Multi-Currency Support: Accept BTC, ETH, USDT, XRP, and more.

Crypto-Banking Integration: Compatible with crypto-friendly financial institutions.

AI-Powered Risk Control: Real-time fraud monitoring and chargeback prevention.

White-Label Gateways: Launch your own branded crypto PSP.

24/7 Onboarding & Support: Full tech guidance and dedicated merchant success team.

Real-World Use Cases

Forex Platforms: Enable fast, global trader deposits and withdrawals.

Online Gaming & Casinos: Secure, anonymous payments and same-day settlements.

Adult Subscriptions: Private payment channels increase client trust and retention.

E-commerce (CBD, Supplements, Digital Goods): Higher approval rates and fewer disputes.

What Sets PayAgency Apart?

USDT-Based Settlements: Minimize volatility with a USD-pegged stablecoin.

Server-to-Server API: Flexible, scalable integrations for any platform.

Global APM Coverage: Combine crypto with local options like Pix (Brazil), Interac (Canada), and PayID (Australia).

Regulatory Compliance: Fully licensed under Canada’s MSB and Poland’s SPI frameworks.

Start Accepting Crypto with PayAgency

Getting started is easy:

Complete KYC/KYB verification

Choose your integration method (API or plug-ins)

Go live and start accepting payments worldwide

Ready to scale your business securely? Schedule a free consultation and see how crypto can transform your high-risk operation.

The Road Ahead: Crypto Is Here to Stay

Global crypto adoption is accelerating—especially in emerging markets. According to Chainalysis, usage has surged over 800%, signaling a permanent shift toward decentralized finance.

Early adopters gain speed, customer trust, and a global edge—those who wait may fall behind.

At PayAgency, we’re committed to building inclusive, compliant tools that empower high-risk merchants to thrive in the future of payments.

About PayAgency

PayAgency, a division of Xorapay Limited, delivers advanced payment infrastructure for high-risk verticals—gaming, adult content, forex, e-commerce, and crypto. Licensed in the EU and Canada, we connect businesses with 200+ PSPs, smart routing systems, and secure crypto payment gateways.

FAQs

1. What is a cryptocurrency payment? A digital payment using blockchain-based currencies like Bitcoin or Ethereum—fast, secure, and borderless.

2. Why is crypto ideal for high-risk merchants? It reduces chargebacks, lowers fees, and enables faster, unrestricted transactions.

3. How fast are crypto payments? Most transactions settle within seconds to minutes—far quicker than banks.

4. Does crypto help prevent fraud? Yes. Blockchain transparency and finality make crypto far less prone to fraud or disputes.

5. How do I accept crypto with PayAgency? Just sign up at PayAgency.io, complete KYC, and integrate the gateway. You're ready to go live.

0 notes

Text

TheSMSPoint: Best OTP SMS Service Provider in India

In today’s fast-paced digital world, secure and instant communication is crucial for businesses to build trust and enhance user experience. One of the most effective ways to ensure security is through OTP (One-Time Password) SMS services, which add an extra layer of protection during user authentication. When it comes to reliable, fast, and cost-effective OTP SMS services in India, TheSMSPoint stands out as the best provider.

Why OTP SMS is Essential for Your Business?

OTP SMS is widely used for user verification, transaction confirmation, password resets, and secure login processes. It helps businesses:

Prevent fraud: By verifying the user’s identity during critical transactions.

Increase user trust: Secure communication fosters confidence among users.

Ensure compliance: Many regulatory frameworks require two-factor authentication (2FA).

However, to truly benefit from OTP SMS, businesses need a service provider who guarantees timely delivery, scalability, and affordability. This is where TheSMSPoint shines.

Why Choose TheSMSPoint for OTP SMS Services?

1. Reliable and Fast Delivery

TheSMSPoint ensures that OTP messages are delivered instantly and reliably across all major telecom networks in India. Speed is crucial for OTP messages because delays can cause user frustration and drop-offs. TheSMSPoint’s robust infrastructure guarantees lightning-fast delivery, making sure your users get their OTPs without any delay.

2. Extensive Network Coverage

Whether your customers are in metro cities or remote areas, TheSMSPoint’s extensive network coverage ensures seamless OTP delivery across India. This wide reach enables businesses to connect with their users anytime, anywhere.

3. High Security Standards

TheSMSPoint understands the sensitivity of OTP messages and employs stringent security protocols to protect your data and ensure message integrity. Their platform supports encrypted SMS services, reducing the risk of interception or misuse.

4. User-Friendly Dashboard and API Integration

TheSMSPoint offers an intuitive dashboard and powerful API that allows easy integration of OTP SMS services into your existing systems, be it websites, mobile apps, or CRM platforms. Their comprehensive documentation and developer support make setup hassle-free.

5. Cost-Effective Pricing

Budget matters for businesses of all sizes. TheSMSPoint offers competitive pricing with flexible plans, ensuring you get the best value without compromising on quality. Their pay-as-you-go and bulk SMS plans suit startups to large enterprises alike.

6. Excellent Customer Support

Customer satisfaction is a priority at TheSMSPoint. Their dedicated support team is available 24/7 to assist with any technical or operational issues, ensuring smooth and uninterrupted service.

Use Cases of TheSMSPoint OTP SMS Service

Banking & Finance: Secure transactions and login authentications.

E-commerce: Confirming orders and account verification.

Healthcare: Patient login and appointment confirmations.

Education: Student verification and exam access.

Telecom: SIM verification and recharge confirmations.

How to Get Started with TheSMSPoint?

Getting started is simple:

Sign up on TheSMSPoint website.

Choose your OTP SMS plan based on your business needs.

Integrate the API into your platform with developer support.

Start sending secure OTP messages instantly.

Conclusion

For businesses seeking a trustworthy, fast, and affordable OTP SMS service provider in India, TheSMSPoint is the ultimate choice. With its reliable delivery, extensive network coverage, strong security, and excellent customer support, TheSMSPoint empowers businesses to enhance user authentication and build trust with their customers.

Start securing your digital transactions today with TheSMSPoint — where reliability meets affordability!

0 notes

Text

KYC API provider in India

✅ Ekychub – India’s Trusted KYC API Provider for Seamless Digital Verification

In an age where digital onboarding and instant customer verification are the norm, businesses need a secure and scalable solution to manage KYC (Know Your Customer) processes. From fintech startups to large enterprises, verifying customer identity quickly and accurately has become essential — not just for compliance, but for trust and fraud prevention.

Ekychub is a leading KYC API provider in India, offering real-time, secure, and paperless identity verification APIs tailored to businesses of all sizes.

🔍 Why KYC Matters More Than Ever

KYC is not just a compliance requirement — it’s a frontline defense against fraud, identity theft, and money laundering. Whether you're onboarding new users, merchants, agents, or employees, verifying who they are is critical.

Manual KYC processes are slow, expensive, and prone to errors. Ekychub solves this by providing automated, digital KYC APIs that verify documents and identities in seconds.

⚙️ Ekychub’s KYC API Services

Ekychub provides a suite of verification APIs, including:

🔹 PAN Card Verification API

Instantly verify PAN numbers and match the holder’s name for financial onboarding.

🔹 Aadhaar KYC API

Verify Aadhaar via OTP-based eKYC, XML, or QR code — UIDAI-compliant and secure.

🔹 GSTIN Verification API

Validate GST numbers and fetch business details for vendor and partner verification.

🔹 UPI Verification API

Verify UPI IDs and account holder names in real-time to prevent fraud.

🔹 Bank Account Verification API

Confirm bank account ownership by matching account number with account holder name.

⚡ Key Features of Ekychub KYC APIs

✅ Real-Time Identity Checks

🔐 Secure & Encrypted Data Handling

🔄 Bulk Verification Support

💼 Business-Grade Uptime & Scalability

📘 Developer-Friendly API Docs

🆓 Free Trial Available

💡 Who Should Use Ekychub KYC APIs?

Ekychub’s KYC APIs are designed for:

Fintech platforms & neobanks

Payment gateways & wallets

Lending & insurance apps

eCommerce & marketplaces

Logistics, gaming & workforce apps

If your business deals with users, customers, vendors, or partners — KYC verification is critical.

🚀 Why Choose Ekychub?

🇮🇳 100% India-compliant verification solutions

🧠 Easy API integration with quick onboarding

🕒 Reduce verification time from days to seconds

🛡️ Prevent fraud & stay audit-ready

💰 Affordable plans for startups & enterprises

🔗 Start Verifying Instantly

With Ekychub, KYC is no longer a bottleneck — it’s a competitive advantage. Streamline onboarding, reduce fraud, and stay compliant with our powerful KYC APIs.

#technews#tech#techinnovation#aadhaarintegration#identityvalidation#kycverificationapi#fintech#ekychub#technology#aadhaarverificationapi#✅ Ekychub – India’s Trusted KYC API Provider for Seamless Digital Verification#In an age where digital onboarding and instant customer verification are the norm#businesses need a secure and scalable solution to manage KYC (Know Your Customer) processes. From fintech startups to large enterprises#verifying customer identity quickly and accurately has become essential — not just for compliance#but for trust and fraud prevention.#Ekychub is a leading KYC API provider in India#offering real-time#secure#and paperless identity verification APIs tailored to businesses of all sizes.

1 note

·

View note

Text

How Online RC Verification APIs Are Transforming Vehicle Ownership Checks

In today’s fast-paced digital landscape, verifying vehicle ownership has become essential for businesses operating in sectors like fintech, insurance, logistics, car rentals, and vehicle financing. Traditional RC (Registration Certificate) verification processes are slow, manual, and often prone to errors or fraud. This is where Online RC Verification APIs step in as game changers.

Let’s explore how an RC Verification API like the one offered by Gridlines is simplifying workflows, ensuring regulatory compliance, and improving customer experience across industries.

What is RC Verification?

RC (Registration Certificate) is an official document issued by the RTO (Regional Transport Office) that certifies the ownership of a motor vehicle. Verifying this document is critical in scenarios like:

Vehicle loan disbursals

Car/bike rental sign-ups

Logistics fleet onboarding

Motor insurance issuance

Second-hand vehicle marketplaces

Manual verification of RC details can take hours or days. This delay not only impacts business efficiency but also increases the risk of onboarding fraudulent vehicles.

The Rise of Online RC Verification APIs

An Online RC Verification API allows businesses to verify vehicle registration details instantly using the vehicle registration number. With seamless integration into mobile apps or platforms, it fetches real-time data directly from government-authorized sources like Vahan.

Key details typically verified via the API include:

Owner’s name

Vehicle class and fuel type

Registration date

Engine and chassis number (partially masked)

RC status (active/scrapped/expired)

Key Benefits of RC Verification APIs

Instant Results: No more waiting for manual checks. Get verified RC data within seconds.

Compliance Made Easy: Stay aligned with KYC/AML regulations and onboarding protocols.

Reduced Fraud Risk: Ensure vehicle authenticity and detect tampering or forged documents.

Seamless Digital Journeys: Integrate into your existing app, platform, or CRM with minimal code.

Scalable for All Sizes: Whether you’re a startup or enterprise, APIs scale with your needs.

Industries Benefiting from RC Verification APIs

Fintech & NBFCs: Speed up vehicle loan approvals by verifying ownership in real-time.

Insurance Providers: Quickly validate vehicle details before policy issuance.

Car Rental & Leasing: Ensure accurate owner data to prevent misuse or theft.

Logistics & Fleet Management: Onboard new vehicles into your fleet efficiently.

Why Gridlines RC Verification API?

Gridlines offers a robust, secure, and developer-friendly RC Verification API. It provides high uptime, lightning-fast responses, and access to reliable data from official sources. With clear documentation and dedicated support, Gridlines ensures a hassle-free integration experience.

Whether you're a fintech app aiming to reduce turnaround times or an auto marketplace that needs to verify listings, Gridlines’ RC Verification API empowers your platform with the tools you need to build trust and scale faster.

Final Thoughts

In an era where speed, accuracy, and compliance are paramount, Online RC Verification APIs are indispensable tools. By automating and securing the vehicle verification process, businesses can deliver faster services, build credibility, and reduce risk.

#RCVerificationAPI#VehicleVerification#DigitalOnboarding#GridlinesAPI#FleetManagement#APIIntegration#VehicleData#FintechSolutions#OnlineKYC#RegTech

0 notes