#U.S. Core Banking Software Market Share

Explore tagged Tumblr posts

Text

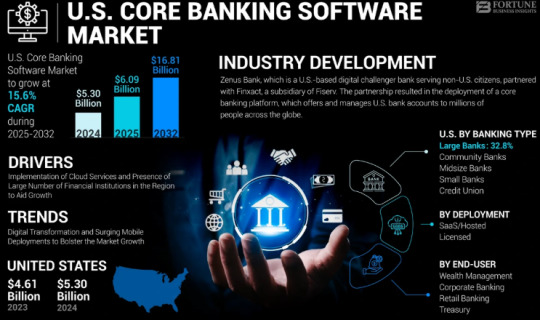

The U.S. Core Banking Software Market Size, Share | CAGR 15.6% during 2024-2030

The U.S. core banking software market Size was valued at USD 5.30 billion in 2024 and is projected to grow from USD 6.09 billion in 2025 to USD 16.81 billion by 2032, exhibiting a CAGR of 15.6% during the forecast period. Driven by the modernization of legacy banking systems, increasing customer demand for digital-first banking experiences, and adoption of cloud-native platforms, the U.S. banking industry is rapidly shifting toward agile, API-driven core banking systems.

Key Market Highlights:

2024 U.S. Market Size: USD 5.30 billion

2025 U.S. Market Size: USD 6.09 billion

2032 U.S. Market Size: USD 16.81 billion

CAGR (2025–2032): 15.6%

Market Outlook: Cloud-first transformation of retail and commercial banking infrastructure

Leading Players in the U.S. Market:

FIS (Fidelity National Information Services)

Finastra

Temenos USA

Oracle Financial Services Software

Jack Henry & Associates

SAP America

nCino

Infosys (EdgeVerve)

Thought Machine

Backbase

Mambu

Q2 Holdings

TCS BaNCS (U.S. operations)

Request Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/u-s-core-banking-software-market-107481

Market dynamics:

Growth Drivers:

Legacy System Modernization: Traditional banks are replacing decades-old core systems to enable agility, scalability, and faster innovation.

Rise of Digital-Only Banks & Neobanks: Challenger banks are opting for coreless and cloud-native platforms to deliver real-time banking experiences.

Regulatory Mandates: U.S. regulations increasingly demand transparency, real-time compliance, and modular tech stacks.

Omnichannel and Mobile Banking Boom: Surge in mobile-first customers is accelerating demand for flexible and API-driven core systems.

Adoption of BaaS & Embedded Finance: Banks are embedding financial services into non-banking platforms, requiring agile backend core systems.

Key Opportunities:

AI-Powered Core Modernization: Integration of AI for risk scoring, predictive analytics, and process automation

Cloud Migration Projects: Large-scale re-platforming from on-premise to cloud-native or hybrid models

Banking-as-a-Service (BaaS): U.S. institutions offering core services to fintechs and enterprises

Open Banking APIs: Ecosystem expansion through developer-friendly, regulatory-compliant APIs

Personalized Customer Experience Engines: Data-driven personalization built directly into core systems

Technology & Application Scope:

Deployment Models:

Cloud-native

On-premises

Hybrid (transitional)

Core Features:

Customer and account management

Payments and transaction processing

Lending and credit modules

Risk and compliance automation

Real-time reporting and dashboards

Target Users:

Retail banks

Credit unions

Community banks

Commercial and corporate banks

Neobanks and fintechs

Speak to Analysts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/u-s-core-banking-software-market-107481

Recent Developments:

January 2024 – A top-10 U.S. bank announced a $700M multiyear plan to migrate its entire core system to a cloud-native microservices architecture with Temenos and AWS.

October 2023 – Jack Henry & Associates launched a new AI-powered fraud prevention module integrated into its core platform, reducing false positives by 45%.

July 2023 – A mid-sized credit union in the Midwest completed a legacy core banking system overhaul, leading to a 22% increase in customer satisfaction due to improved digital banking capabilities.

Trends Shaping the U.S. Core Banking Market:

Composable Banking Architecture: Shift toward modular, plug-and-play architecture

AI & Machine Learning in Core: Real-time fraud detection, dynamic credit risk models, and intelligent automation

Blockchain Integration: Experiments in real-time settlement, decentralized identity, and smart contracts

Low-Code/No-Code Customization: Democratization of development within banking teams

Cybersecurity Embedded in Core: Zero-trust frameworks and secure-by-design approaches

Conclusion:

The U.S. core banking software market is undergoing a significant transformation, driven by rising customer expectations, digital competition, and the imperative to stay compliant and resilient. The future belongs to banks that embrace modular, cloud-native, and API-driven core platforms—designed to scale, personalize, and evolve. As the market accelerates toward modernization, technology vendors and banks alike are finding immense value in flexible ecosystems, open banking capabilities, and real-time innovation.

Frequently Asked Questions: 1. What is the projected value of the global market by 2032?

2. What was the total market value in 2024?

3. What is the expected compound annual growth rate (CAGR) for the market during the forecast period of 2025 to 2032?

4. Which industry segment dominated market in 2023?

5. Who are the major companies?

6. Which region held the largest market share in 2023?

#U.S. Core Banking Software Market Share#U.S. Core Banking Software Market Size#U.S. Core Banking Software Market Industry#U.S. Core Banking Software Market Driver#U.S. Core Banking Software Market Growth#U.S. Core Banking Software Market Analysis#U.S. Core Banking Software Market Trends

0 notes

Text

Mounting Pressures Redefine Global Electronics Market 2025

In 2025, the electronics market is undergoing a dramatic transformation under the weight of economic, political, and environmental pressures. What was once a high-growth, innovation-led sector has shifted toward cautious consolidation, supply chain reevaluation, and a fundamental rethink of product and business strategies. As mounting global challenges continue to influence market dynamics, companies are being forced to reassess their role and resilience in the evolving landscape.

Businessinfopro’s latest industry insights indicate that survival in the current Electronics market requires agility, diversification, and forward-thinking adaptation to both consumer behavior and global regulations.

Global Economic Pressures Squeeze Margins

The global economic slowdown has significantly impacted the electronics market, reducing consumer spending and squeezing profit margins. Inflation remains stubborn in key economies, and central banks have responded with higher interest rates, affecting both consumer lending and corporate borrowing.

The result is a sharp decline in high-end electronics sales, particularly in segments like smart TVs, gaming systems, and premium smartphones. Consumers are shifting their focus toward essential or budget alternatives, while retailers and manufacturers are adjusting pricing models to maintain relevance in this high-cost environment.

Supply Chain Shocks Trigger Realignment

Supply chain realignment has become a core strategic priority across the electronics market. Ongoing geopolitical disputes, such as those between the U.S. and China, have triggered restrictions on semiconductor exports, raw material access, and intellectual property sharing.

Manufacturers are responding by diversifying supplier networks and reducing reliance on single-country production. Countries like India, Vietnam, and Mexico are now critical components of the global electronics supply web. However, this transition introduces new risks: infrastructure gaps, workforce training needs, and potential political instability.

Shorter Innovation Cycles vs. Longer Product Lifespans

Ironically, while the electronics market once thrived on rapid product releases and hardware refreshes, consumer sentiment in 2025 is trending in the opposite direction. Users now demand longer-lasting devices, enhanced repairability, and extended software support. This change in behavior stems from both economic caution and a growing awareness of electronic waste.

Tech companies are attempting to balance this paradox by shifting from hardware-led innovation to ecosystem-focused upgrades. For instance, software enhancements, firmware improvements, and cloud-based features are now more central to product launches than physical redesigns.

ESG and Regulatory Compliance Tighten Across Markets

Environmental and ethical pressures are redefining operational norms across the global electronics market. Regulatory authorities, particularly in Europe and North America, are enforcing tighter rules on:

Product recyclability and e-waste management

Carbon footprint tracking

Conflict mineral sourcing

Labor standards compliance

As governments push for greener electronics, many companies are investing heavily in R&D to develop sustainable alternatives. Recyclable materials, energy-efficient chipsets, and modular device architecture are gaining traction. Brands that embrace these initiatives not only avoid penalties but also appeal to an increasingly conscious consumer base.

Decline in Traditional Segments and the Rise of Vertical Niches

Traditional electronics segments like desktop computers, basic tablets, and DVD players are experiencing sharp declines in 2025. These categories have been largely replaced by multifunctional devices or phased out due to redundancy. The electronics market is instead witnessing a rise in vertical niches, including:

Smart agriculture sensors

Remote healthcare devices

AI-powered industrial monitoring systems

Next-gen wearables and fitness trackers

These specialized segments cater to specific industries and demographics, offering targeted value instead of mass-market appeal. Their resilience and growth potential are drawing increased investment from both startups and established tech firms.

Retail Transformation and Omnichannel Integration

Brick-and-mortar electronics retail has seen massive transformation in 2025. The electronics market has embraced omnichannel retail strategies to deliver convenience and cost savings. Consumers are now more likely to browse in-store but complete purchases online, or vice versa, depending on the pricing and delivery timelines.

Leading retailers are integrating augmented reality (AR) previews, AI-driven recommendations, and flexible financing at the point of sale. Buy-now-pay-later (BNPL) schemes and product subscription models are also gaining ground, especially in higher-priced segments like gaming PCs and smart TVs.

AI and Machine Learning Driving Efficiency

As margins narrow and competition stiffens, AI and machine learning are proving vital for operational efficiency within the electronics market. From predictive inventory management to automated quality control and personalized marketing, AI is helping companies optimize costs and customer experience.

Manufacturers are also exploring AI-driven product design, where data on user interaction and performance feedback is used to create better-performing devices. This feedback loop has allowed for quicker product iterations and reduced waste.

Tech Talent Shortages and Hiring Challenges

Another mounting pressure comes from the global shortage of skilled tech professionals. With the electronics market leaning increasingly on embedded systems, chip design, AI integration, and cybersecurity, the demand for qualified engineers and developers has outstripped supply.

To remain competitive, firms are investing in in-house training programs, remote engineering teams, and partnerships with academic institutions. However, the talent gap continues to be a major roadblock, particularly for smaller players without the brand equity or resources of global tech giants.

Brand Loyalty Wanes in Favor of Value and Functionality

Brand loyalty, once a cornerstone of the electronics market, is weakening in 2025. Consumers are now more likely to compare features, energy ratings, and after-sales service rather than remain committed to a single brand. Reviews, influencer endorsements, and peer recommendations play a growing role in shaping purchasing decisions.

This shift has opened the door for new entrants and lesser-known brands to gain market share, provided they deliver high-performance, affordable, and sustainable products. Competitive pricing strategies, bundled services, and warranty extensions are key tools for capturing and retaining customer attention in this fragmented market.

Read Full Article: https://businessinfopro.com/global-consumer-electronics-market-faces-mounting-pressure-in-2025/

About Us:

BusinessInfoPro is a dynamic B2B insights hub offering timely, expert‑driven content tailored for professionals in finance, HR, IT, marketing, sales and more. Through in‑depth articles, whitepapers and downloadable guides, we illuminate critical industry trends like AI’s economic impact, data‑driven decision‑making and strategic marketing in uncertain economies. Our resources empower leaders to optimize efficiency, strengthen customer engagement and embrace sustainable innovation. With fresh publications covering cutting‑edge topics sustainability, workforce transformation, real‑time architecture and practical tools from top platforms and thought‑leaders, Business Info Pro equips businesses to adapt, compete and thrive in a fast‑changing global landscape.

0 notes

Photo

Equity benchmark indices Sensex and Nifty declined for the third session in a row on Friday (July 11, 2025), dropping practically 1%, dragged by heavy promoting in IT, auto and vitality shares amid a muted begin of the earnings season. Tariff-related uncertainties and blended international market traits additionally added to the stress, analysts stated. The 30-share BSE Sensex tanked 689.81 factors or 0.83% to settle at 82,500.47. During the day, it fell 748.03 factors or 0.89% to 82,442.25. As many as 2,450 shares declined whereas 1,557 superior and 158 remained unchanged on the BSE. Similarly, the 50-share NSE Nifty dropped 205.40 factors or 0.81% to 25,149.85. On the weekly entrance, the BSE benchmark dropped 932.42 factors or 1.11%, and the Nifty tanked 311.15 factors or 1.22%. “While weak European market cues and unfavorable U.S. Dow Futures weighed on sentiment, the disappointing begin to earnings season by software program main TCS cautioned buyers in regards to the sluggish international demand situation that led to heavy promoting in IT, telecom, auto, realty and oil & fuel shares,” Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, stated. From the Sensex corporations, Tata Consultancy Services declined 3.46% after reporting its June quarter earnings. The nation’s largest IT providers firm on Thursday (July 10, 2025) reported a 6% progress in June quarter internet revenue at ₹12,760 crore, helped by a leap in non-core revenue whilst revenues grew at a tepid tempo. The rupee income grew 1.3% to ₹63,437 crore throughout the quarter. Still, it was down by over 3% on a relentless foreign money foundation, as the corporate confronted headwinds in its main markets amid a winding down of the BSNL deal, which helped it in current quarters. Mahindra & Mahindra, Bharti Airtel, Tata Motors, Titan, HCL Tech, Bajaj Finance, Reliance Industries, Trent, Infosys and HDFC Bank have been among the many different main laggards from the pack. “Markets traded beneath stress on Friday (July 11, 2025) and misplaced over half a%, dragged down by weak cues. The session started on a unfavorable word following disappointing outcomes from IT main TCS, which additional worsened attributable to profit-taking in heavyweight shares throughout different sectors. Sentiment remained subdued attributable to ongoing uncertainty round tariff-related points and a weak begin to the earnings season,” Ajit Mishra - SVP, Research, Religare Broking Ltd, stated. Meanwhile, shares of Hindustan Unilever Ltd (HUL) surged 4.61% following the announcement that Priya Nair will turn into the primary girl CEO and MD of the agency, efficient August 1, 2025. Axis Bank, NTPC, Eternal and State Bank of India have been additionally among the many gainers. “The home market skilled a unfavorable shut attributable to a sober begin to Q1 earnings season and a ramp-up within the tariff menace by the U.S. to impose a 35% tariff on Canada. Investors could proceed to be centered on quarterly earnings for a buy-on-dips technique. However, within the close to time period, the present premium valuation and the worldwide headwinds like low spending and tariff uncertainties could restrain new inflows. “The IT index underperformed attributable to deferment in orders and new investments, which can influence FY26 earnings estimates,” Vinod Nair, Head of Research, Geojit Investments Limited, stated. The BSE smallcap gauge declined 0.70%, and the midcap index dropped 0.65%. On BSE sectoral indicators, teck tumbled 1.85%, BSE Focused IT tanked 1.77%, IT (1.65%), auto (1.72%), oil & fuel (1.28%), client discretionary (1.23%), and telecommunication (1.22%). In distinction, healthcare and FMCG have been the gainers. In Asian markets, South Korea’s Kospi, Japan’s Nikkei 225 index settled decrease, whereas Shanghai’s SSE Composite index and Hong Kong’s Hang Seng ended increased. European markets have been buying and selling decre

0 notes

Text

Key Drivers and Market Share Analysis of Global ASCs Industry Through 2033

Astute Analytica stands out as a premier provider of comprehensive Ambulatory Surgical Centers market research reports specifically tailored for the healthcare sector. Our commitment lies in delivering valuable insights and research that empower healthcare organizations to navigate the complexities of this rapidly evolving industry.

By understanding the trends and opportunities within the healthcare market, businesses can strategically position themselves for success in an increasingly competitive environment. The integration of digital solutions, a focus on sustainability, and the adaptation to new care delivery models are essential components for enhancing patient care and ensuring the long-term viability of healthcare systems.

Vacuum blood collection tube market was valued at US$ 3.24 billion in 2024 and is projected to hit the market valuation of US$ 4.40 billion by 2033 at a CAGR of 3.45% during the forecast period 2025–2033.

A Request of this Sample PDF File@- https://www.astuteanalytica.com/request-sample/ambulatory-surgical-centers-market

The Essential Path of Digital Transformation in Healthcare

As we approach 2025, health system leaders across the globe are prioritizing efforts to drive efficiencies, boost productivity, and improve patient engagement. A significant factor influencing these initiatives is the accelerated digital transformation within healthcare, which has been identified as the most impactful issue for global health systems in the coming years. This emphasis on digitalization is not surprising, considering that healthcare has lagged behind other industries, such as retail and finance, in adopting advanced digital technologies.

According to recent surveys, approximately 70% of respondents believe that investing in technology platforms for digital tools and services will be crucial for their organizations. Furthermore, 60% of leaders highlighted the necessity of investing in core technologies, including electronic medical records (EMRs) and enterprise resource planning (ERP) software. Notably, around 90% of C-suite executives anticipate a significant acceleration in the use of digital technologies by 2025, with half expecting a profound impact on their operations.

The Rise of Consumer-Driven Digital Health Tools

The growing adoption of connected monitoring devices and digital tools among consumers is reshaping the healthcare landscape. In 2024, 43% of consumers are expected to utilize these technologies, up from 34% in 2022. This shift aligns with the highly personalized experiences that consumers have come to expect from industries such as banking, retail, and entertainment. Digital monitoring tools empower consumers by providing trending data that supports their health concerns, thereby enhancing their agency during patient-clinician interactions. This increased control and confidence is particularly vital in areas like maternal health, where timely and informed interactions can prevent adverse outcomes.

Mergers and Acquisitions in Healthcare Technology

The healthcare technology sector is poised for a surge in mergers and acquisitions (M&A) as we move into 2024. The COVID-19 pandemic has underscored the importance of health technology and healthcare delivery systems, prompting a renewed focus on consolidation within the industry. In 2023, biopharma M&A experienced a remarkable rebound, with an aggregate deal value increasing by 79% compared to 2022, reaching approximately $152 billion—the highest level since 2019. The average deal size has also shown an upward trend, approaching levels not seen since 2020. Several positive catalysts are expected to support this momentum in 2024, including emerging threats to growth, a fear of missing out on opportunities, and a resurgence of high-prevalence conditions that necessitate innovative solutions.

The U.S. Healthcare Market Landscape

The United States remains the world's largest healthcare market, with healthcare spending reaching $4.3 trillion in 2021, translating to about $12,900 per person. However, as consolidation continues and exposure to government payers increases, healthcare markets in other regions are anticipated to grow at a faster pace. Despite the substantial investment in healthcare, the outcomes do not always reflect this high expenditure, leading to significant disparities in access and quality of care. The U.S. healthcare system is evolving in response to these challenges, particularly the pressures of rising costs and an increasing number of uninsured individuals.

Navigating Political Changes and Regulatory Shifts

As the healthcare industry prepares for 2025, potential changes in political leadership could usher in new policy directions and regulatory shifts. Leaders within the healthcare space must remain agile, anticipating policy reforms that could reshape operational priorities, including resource allocation and shifts in care delivery models. Building collaborative ecosystems and staying informed about legislative developments will be crucial for organizations aiming to thrive in this dynamic environment.

For Purchase Enquiry: https://www.astuteanalytica.com/industry-report/ambulatory-surgical-centers-market

Market Segmentation and Analysis

In its quest for a granular understanding of the Ambulatory Surgical Centers market, the report segments the industry into various categories. This segmentation facilitates a more detailed analysis of the dynamics within each segment, allowing stakeholders to identify specific growth opportunities and challenges. By breaking down the market, the report aids in crafting targeted strategies tailored to the unique characteristics of each segment.

By Ownership

Physician Only

Hospital Only

Corporation Only

Physician & Hospital

Physician & Corporation

Hospital & Corporation

By Surgery Type

Dental

Otolaryngology

Endoscopy

Obstetrics / Gynecology

Opthalmology

Orthopedic

Cardiovascular

Neurology

Plastic Surgery

Podiatry

Others

By Specialty Type

Multi-specialty

Single specialty

By Service

Diagnosis

Treatment

By Region

North America

The U.S.

Canada

Mexico

Europe

Western Europe

The UK

Germany

France

Italy

Spain

Rest of Western Europe

Eastern Europe

Poland

Russia

Hungary

Rest of Eastern Europe

Asia Pacific

China

India

Japan

South Korea

Australia & New Zealand

ASEAN

Rest of Asia Pacific

Middle East

UAE

Saudi Arabia

Bahrain

Kuwait

Qatar

Rest of Middle East

Africa

Oman

Egypt

Nigeria

South Africa

Rest of Africa

South America

Argentina

Brazil

Rest of South America

Geographical Segmentation

The report further segments the market into geographical regions, including North America, South America, Asia, Europe, Africa, and Others. Each region is examined with a focus on key countries, providing insights into the current market size and forecasts extending until 2033. This geographical breakdown is critical for understanding regional market dynamics and tailoring strategies to meet local demands effectively.

Competitive Landscape

A significant portion of the report is dedicated to analyzing the competitive landscape within the global Ambulatory Surgical Centers market. This includes a comprehensive examination of leading Ambulatory Surgical Centers product vendors, highlighting their latest developments and market shares in terms of shipment and revenue. By profiling these major players, the report offers valuable insights into their product portfolios, technological capabilities, and overall market positioning.

The report identifies key players in the Ambulatory Surgical Centers market, providing a closer look at their contributions to the industry. This competitive profiling is essential for understanding the strengths and weaknesses of various companies, enabling stakeholders to make informed decisions and devise effective strategies in a crowded marketplace.

CHSPSC, LLC.

Eifelhöhen-Klinik AG

Edward-Elmhurst Health

Healthway Medical Group

Envision Healthcare Corporation

Nexus Day Surgery Centre

Pediatrix Medical Group

Prospect Medical Holdings, Inc.

Surgery Partners

SurgCenter

TH Medical

UNITEDHEALTH GROUP

Other Prominent Players

Download Sample PDF Report@- https://www.astuteanalytica.com/request-sample/ambulatory-surgical-centers-market

About Astute Analytica:

Astute Analytica is a global analytics and advisory company that has built a solid reputation in a short period, thanks to the tangible outcomes we have delivered to our clients. We pride ourselves in generating unparalleled, in-depth, and uncannily accurate estimates and projections for our very demanding clients spread across different verticals. We have a long list of satisfied and repeat clients from a wide spectrum including technology, healthcare, chemicals, semiconductors, FMCG, and many more. These happy customers come to us from all across the globe.

They are able to make well-calibrated decisions and leverage highly lucrative opportunities while surmounting the fierce challenges all because we analyse for them the complex business environment, segment-wise existing and emerging possibilities, technology formations, growth estimates, and even the strategic choices available. In short, a complete package. All this is possible because we have a highly qualified, competent, and experienced team of professionals comprising business analysts, economists, consultants, and technology experts. In our list of priorities, you-our patron-come at the top. You can be sure of the best cost-effective, value-added package from us, should you decide to engage with us.

Get in touch with us

Phone number: +18884296757

Email: [email protected]

Visit our website: https://www.astuteanalytica.com/

0 notes

Text

Data Center Infrastructure Market Size, Share, Trends, Forecast & Growth Analysis 2034

Data Center Infrastructure (DCI) Market is on a transformative growth trajectory, forecasted to rise from $55.5 billion in 2024 to $120.1 billion by 2034, growing at a CAGR of approximately 8%. This market encapsulates the hardware, software, power systems, cooling technologies, and services that form the backbone of modern data centers. As digital transformation sweeps across industries, the need for reliable, scalable, and energy-efficient infrastructure has never been more critical. From cloud computing to artificial intelligence, every innovation is fueled by the infrastructure that supports data storage, processing, and secure transmission.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS25714

Market Dynamics

At the heart of the DCI market’s growth is the explosion of data — generated from IoT devices, streaming platforms, enterprise systems, and real-time analytics. The power management segment leads the market, highlighting the pressing need for efficient energy usage in a sector known for high consumption. Cooling solutions follow as the second-largest segment, particularly essential in hyperscale data centers that demand constant temperature regulation to prevent equipment failure.

The push towards cloud-based and hybrid deployments is also reshaping market strategies. Enterprises are prioritizing agile IT ecosystems capable of handling evolving workloads. Technologies like virtualization, edge computing, and AI-powered automation are transforming how data centers operate, improving both efficiency and scalability. Despite these advances, challenges like cybersecurity risks, high infrastructure costs, and energy concerns persist, demanding continuous innovation and investment.

Key Players Analysis

Leading the charge in this market are global technology giants such as Cisco Systems, Dell Technologies, and Hewlett Packard Enterprise (HPE), each offering comprehensive DCI solutions from servers to network management tools. Their dominance is driven by robust R&D investments, strategic acquisitions, and integrated service offerings.

Emerging players such as Quantum Edge Solutions and Eco Core Systems are disrupting the status quo with modular and green data center solutions tailored to meet sustainability goals. Meanwhile, infrastructure providers like Equinix, Digital Realty, and Nutanix are investing heavily in expanding their footprint to accommodate surging data demands from cloud service providers and global enterprises.

Regional Analysis

North America remains the largest market for DCI, driven by the U.S.’s focus on advanced IT infrastructure, high adoption of cloud computing, and massive investments by hyperscale data center operators. The presence of major tech firms and evolving regulatory frameworks further cement its leadership position.

Europe is a strong performer, with growth supported by stringent data privacy regulations (like GDPR) and green initiatives aimed at reducing carbon footprints. Countries such as Germany and the United Kingdom are investing in smart, energy-efficient data center technologies.

The Asia-Pacific region is experiencing the fastest growth, led by China, India, and Japan. The surge in internet usage, digital banking, and government-backed digital infrastructure projects is boosting the regional market. As enterprises in APAC migrate to cloud platforms, demand for scalable DCI systems continues to accelerate.

Latin America and Middle East & Africa are gradually gaining momentum. Brazil is the standout in Latin America, with rising cloud adoption and telecom modernization. In the Middle East, countries like the UAE are pushing smart city projects, creating a growing need for localized, energy-efficient data centers.

Recent News & Developments

The DCI market is witnessing exciting shifts driven by innovation and evolving business needs. Edge computing and hybrid cloud environments are gaining traction as companies move toward decentralized data models. Vendors like Schneider Electric and Vertiv are pioneering new-generation cooling and power systems to meet these demands efficiently.

The integration of AI and machine learning is another major development, enabling predictive maintenance and automated workload balancing, which reduce downtime and optimize performance. Regulatory standards like GDPR and CCPA are shaping infrastructure decisions, especially around data security and compliance.

Additionally, the emergence of green data centers is becoming a central focus. Operators are increasingly adopting renewable energy and innovative cooling systems to meet sustainability benchmarks, with several partnerships and pilot programs already underway globally.

Browse Full Report : https://www.globalinsightservices.com/reports/data-center-infrastructure-dci-market/

Scope of the Report

This report offers a deep dive into the future of the Data Center Infrastructure Market, covering various segments such as type (cooling systems, power management), deployment models (cloud-based, on-premise), end users (BFSI, healthcare, retail), and technology drivers (AI, edge computing, virtualization).

It highlights the opportunities that lie in emerging markets, the strategic direction of key players, and the innovations that are redefining infrastructure management. By mapping out trends, regulatory impacts, and evolving business needs, the report serves as a vital guide for stakeholders looking to navigate and capitalize on the ever-expanding digital ecosystem. #datacenterinfrastructure #cloudcomputing #edgecomputing #aiinfrastructure #sustainabletech #datacentersolutions #digitaltransformation #greendat

Discover Additional Market Insights from Global Insight Services:

Gps Tracker Market ; https://linkewire.com/2025/06/03/gps-tracking-device-market-2/

Electronic Manufacturing Services (EMS) Market ; https://linkewire.com/2025/06/03/electronic-manufacturing-services-ems-market/

RJ45 Connectors Market ; https://linkewire.com/2025/06/03/rj45-connectors-market-2/

Power Management Integrated Circuit (PMIC) Market : https://linkewire.com/2025/06/03/power-management-integrated-circuit-pmic-market/

3D NAND Flash Memory Market : https://linkewire.com/2025/06/02/3d-nand-flash-memory-market/

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

Farhan Naqvi iLearningEngines: How Semiconductors Are Reshaping Global Power

Farhan Naqvi, former CFO of iLearningEngines, has shared powerful insights on a topic reshaping global geopolitics: semiconductors. In a recently published thought piece, Naqvi — a seasoned finance and strategy executive — explores how semiconductors have become the new strategic asset, replacing oil and data as the primary levers of international influence.

This article offers a deep dive into the transformative impact of semiconductors and AI infrastructure, drawing on Farhan Naqvi’s unique experience scaling iLearningEngines, one of the fastest-growing AI platforms in the enterprise space.

Who Is Farhan Naqvi? Farhan Naqvi is widely recognized for his leadership in finance, technology strategy, and capital markets. As the former CFO of iLearningEngines, an AI-driven enterprise software company, he played a key role in scaling the business over 10x and leading its successful listing on Nasdaq.

With degrees from IIT Kanpur and Harvard Business School, Naqvi has advised on marquee IPOs and M&A deals at leading investment banks, working with companies like Uber, Square, and Alibaba.

His work at iLearningEngines positioned him at the intersection of artificial intelligence, digital infrastructure, and global economic policy — a vantage point that informs his current perspective on semiconductors.

Semiconductors: The Core of Global Power Shifts In his latest analysis, Farhan Naqvi iLearningEngines argues that semiconductors are no longer mere hardware — they are strategic assets with national and global consequences.

“The microchip has become macro-strategic. The nations that lead in semiconductor design and manufacturing will shape the digital future.”

Naqvi’s commentary is both a call to action and a framework for understanding why chips now sit at the center of power competition among nations.

Silicon Sovereignty: A New Global Imperative Naqvi discusses how countries across the globe — including the U.S., China, Japan, and the EU — are racing toward silicon sovereignty. This means developing domestic capabilities to design, produce, and secure semiconductor supply chains without relying on foreign powers.

The COVID-19 pandemic and escalating U.S.-China tech tensions have accelerated this shift. Governments now view chips as critical to national security, not just economic growth.

From iLearningEngines to AI Infrastructure: The Role of Advanced Chips Drawing from his hands-on experience building iLearningEngines’ AI capabilities, Farhan Naqvi emphasizes the need for high-performance chips in enabling modern AI systems.

“Chips aren’t just components; they’re the infrastructure of intelligence. Without chip sovereignty, there is no AI sovereignty.”

Technologies like GPUs, tensor cores, and even quantum processors are essential to power the next wave of AI models, autonomous systems, and digital defense platforms.

A Fragmenting Global Semiconductor Supply Chain According to Farhan Naqvi iLearningEngines, the traditional global chip supply chain is being dismantled in favor of regionalization and “friend-shoring.”

The U.S. is re-shoring chip manufacturing with the CHIPS Act.

China is investing in a full-stack domestic ecosystem.

Europe and Japan are safeguarding access to critical materials and manufacturing tools.

This fragmentation poses both risk and opportunity, as countries rethink how to secure long-term chip independence.

Balancing Innovation and National Security Naqvi also cautions against the potential downside of heavy regulation. Export bans, tech restrictions, and tight controls may serve national interests, but they also risk slowing innovation, raising costs, and hampering academic collaboration.

“There’s a risk that the very controls meant to protect innovation may end up harming it,” he warns.

The Chip: The Defining Resource of the 21st Century Farhan Naqvi iLearningEngines concludes that semiconductors are now the most strategic resource on Earth — more influential than oil, data, or rare earth metals.

“The world’s most strategic resource is no longer oil or data. It’s the chip — built in nanometers, but measured in geopolitical influence.”

As we enter a new era of digital competition, the nations that dominate chip design, production, and integration will control the future of artificial intelligence, defense, and global power.

Final Thoughts Farhan Naqvi’s insights reflect a deep understanding of the convergence between technology, finance, and policy. His leadership at iLearningEngines — a company at the forefront of AI deployment — gives him rare clarity on why semiconductors will shape the global order for decades to come.

For policymakers, technologists, and investors alike, Naqvi’s message is clear: chip strategy is power strategy.

#Farhan Naqvi iLearningEngines#Sayyed Farhan iLearningEngines#Sayyed iLearningEngines#Sayyed Farhan Naqvi iLearningEngines#Sayyed Farhan Naqvi

0 notes

Text

Voice And Speech Recognition Market Outlook, Competitive Strategies And Forecast

The global voice and speech recognition market size is anticipated to reach USD 53.67 billion by 2030, registering a CAGR of 14.6% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market is anticipated to witness an upsurge in the adoption of voice-activated systems, voice-enabled devices, and voice-enabled virtual assistant systems owing to the rising applications in the banking and automobile sectors. The escalating need to counter fraudulent activities and enhance security in the banking sector is boosting the adoption of voice biometrics for the authentication of users. The automobile sector is expected to gain momentum owing to advances in technology & emergence of innovative concepts, such as autonomous and connected cars.

The integration of the voice-activated software in future cars is anticipated to adopt technologies, such as noise abatement for selectively ignoring driving & passenger noises for providing an error-free and seamless experience to the operator. Voice recognition is also a core technology that is widely used in the healthcare sector to enhance the Electronic Health Record (HER) systems by providing an ease to the doctor to speak and keep the records instead of manual typing or writing. In 2018, the healthcare vertical held the largest market share and it is expected to grow significantly over the forecast period. AI-based voice and speech recognition software is expected to grow at the fastest CAGR from 2023 to 2030.

This is due to the continuous development of machine learning techniques and the integration of connected devices with personal assistants. For instance, Dragon Drive is a personal assistant developed by Nuance Communication Inc. that integrates various household appliances, cars, and smartphones that can be connected to a hub through the internet. Thus, an individual can get alerts about daily chores, work schedules, traffic updates, and many more alerts through the Dragon Drive. In addition, sentiment analysis using the changes in the pitch of the voice is anticipated to provide an opportunity to the market. However, the lack of accuracy of these technologies in recognizing the regional accents and dialects is expected to limit the market growth.

Gather more insights about the market drivers, restrains and growth of the Voice And Speech Recognition Market

Voice And Speech Recognition Market Report Highlights

• A rising trend in the development of Artificial Intelligence (AI)-based systems is expected to be the key factor driving the market growth over the forecast period

• Leveraging deep learning algorithms in voice & speech solutions for better search results is expected to be the key factor for the growth of the AI-based technology segment

• The deployment of speech recognition solutions in consumer and retail verticals is anticipated to lead to the high market growth

• This can be attributed to the changing lifestyles in countries, such as the U.S., Germany, and the U.K.

• Moreover, the growing adoption of smart electronics in India, China, Japan, and Brazil is likely to drive the market growth in the consumer vertical

• North America and the Asia Pacific are anticipated to witness considerable growth owing to the presence of several U.S.- and China-based players, such as Apple, Inc., Facebook, Inc., Baidu, Inc., Amazon.com, Inc., and Alphabet, Inc., working toward the development of this technology

• Key industry participants are focusing on integrating the AI technology in speech & voice recognition software to build superior products that would increase their user customer base

Voice And Speech Recognition Market Segmentation

Grand View Research has segmented the global voice and speech recognition market on the basis of function, technology, vertical, and region:

Voice & Speech Recognition Function Outlook (Revenue, USD Million, 2017 - 2030)

• Voice Recognition

o Speaker Identification

o Speaker Verification

• Speech Recognition

o Automatic Speech Recognition

o Text-to-Speech

Voice & Speech Recognition Technology Outlook (Revenue, USD Million, 2017 - 2030)

• AI-based

• Non-AI-based

Voice & Speech Recognition Vertical Outlook (Revenue, USD Million, 2017 - 2030)

• Automotive

• Enterprise

• Consumer

• BFSI

• Government

• Retail

• Healthcare

• Military

• Legal

• Education

• Others

Voice & Speech Recognition Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Italy

o Spain

o The Netherlands

o Switzerland

o Poland

• Asia Pacific

o China

o Japan

o India

o South Korea

o Singapore

o Pakistan

o Malaysia

o Australia

o Hong Kong

o Vietnam

• South America

o Brazil

o Argentina

o Chile

• Middle East & Africa

o UAE

o Saudi Arabia

o Israel

o South Africa

o Nigeria

Order a free sample PDF of the Voice And Speech Recognition Market Intelligence Study, published by Grand View Research.

#Voice And Speech Recognition Market#Voice And Speech Recognition Market Size#Voice And Speech Recognition Market Share#Voice And Speech Recognition Market Analysis#Voice And Speech Recognition Market Growth

0 notes

Text

Simulation Software Market Opportunities For Growth And Development Report To 2030

The global simulation software market size is estimated to reach USD 51.11 billion by 2030, registering a CAGR of 13.8% from 2024 to 2030, according to a new study by Grand View Research, Inc. Simulation software is being used for training personnel. It is replacing the traditional real-time training techniques, which incurred huge investments annually for companies. The use of simulation for training purposes helps reduce training costs as companies need to make a one-time investment for software implementation. The software also helps enterprises minimize production costs by enhancing the product development process.

The need for developing prototypes and the chances of product failure are considerably reduced through the use of simulators, as the product is virtually tested for all possible glitches before the commencement of production. Furthermore, simulation-based tools help product developers reduce the time spent on R&D processes as it enables them to obtain a realistic view of a product or process under study or review. Organizations across the globe are increasingly implementing the program and analyzing tools to enhance the entire product development cycle, reduce time to production, ensure delivery of high-quality products in minimal time, and reduce the overall cost to the company with respect to R&D.

It requires a skilled workforce or personnel with the required knowledge and understanding. This is leading to several manufacturers being reluctant to adopt this technology as the need for a skilled workforce incurs additional costs. The COVID-19 pandemic had an adverse impact on the global market. The closure of national and international borders in major countries, such as China, Japan, and India, has caused severe supply chain disruptions. In addition, the temporary shutdown of manufacturing operations has led manufacturing companies to face severe budgetary issues, resulting in delayed subscription renewal payments during the pandemic’s initial phase. However, recovering economies and opening businesses are expected to help the market grow at a rapid pace over the forecast period.

Simulation Software Market Report Highlights

• The market is being driven by reduced training costs for personnel in various industries and sectors, such as automotive, defense, healthcare, and electrical • The service segment is expected to register a CAGR of 15.0% owing to the growing demand for customized simulation solutions, such as design and consulting • The cloud-based segment is expected to register the fastest CAGR of approximately 15.4% over the forecast period owing to benefits, such as easy and low-cost implementation • The automotive segment dominated the market in 2023 and is expected to hold a major share by 2030 owing to the early adoption of virtual testing tools in the automotive industry • North America is expected to account for the highest market share followed by Asia Pacific, by 2030 owing to the growing investments in R&D and defense in countries, such as the U.S. • Leading players are focusing on developing new simulation software solutions, to capture maximum share

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global fraud detection and prevention market size was valued at USD 25.67 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.6% from 2023 to 2030.

• The global core banking software market size was valued at USD 10.89 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030.

Simulation Software Market Segmentation

Grand View Research has segmented the global simulation software market on the basis of component, deployment, application, end-use, and region:

Simulation Software Component Outlook (Revenue, USD Million, 2017 - 2030) • Software • Services o Simulation Development Services o Training and Support & Maintenance

Simulation Software Deployment Outlook (Revenue, USD Million, 2017 - 2030) • On-Premise • Cloud

Simulation Software Application Outlook (Revenue, USD Million, 2017 - 2030) • Engineering, Research, Modeling & Simulated Testing • High Fidelity Experiential 3D Training • Gaming & Immersive Experiences • Manufacturing Process Optimization • AI Training & Autonomous Systems • Planning And Logistics Management & Transportation • Cyber Simulation

Simulation Software End-use Outlook (Revenue, USD Million, 2017 - 2030) • Conventional Automotive • Electric Automotive and Autonomous Vehicles • Aerospace & Defense • Electrical, Electronics and Semiconductor • Healthcare • Robotics • Entertainment • Architectural Engineering and Construction • Others

Simulation Software Regional Outlook (Revenue, USD Million, 2017 - 2030) • North America o U.S. o Canada • Europe o U.K. o Germany o France • Asia Pacific o China o India o Japan o South Korea o Australia • Latin America o Brazil o Mexico • Middle East & Africa (MEA) o KSA o UAE o South Africa

Order a free sample PDF of the Simulation Software Market Intelligence Study, published by Grand View Research.

0 notes

Text

Voice And Speech Recognition Market Size To Reach USD 53.67 Billion By 2030

Voice And Speech Recognition Market Growth & Trends

The global voice and speech recognition market size is anticipated to reach USD 53.67 billion by 2030, registering a CAGR of 14.6% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market is anticipated to witness an upsurge in the adoption of voice-activated systems, voice-enabled devices, and voice-enabled virtual assistant systems owing to the rising applications in the banking and automobile sectors. The escalating need to counter fraudulent activities and enhance security in the banking sector is boosting the adoption of voice biometrics for the authentication of users. The automobile sector is expected to gain momentum owing to advances in technology & emergence of innovative concepts, such as autonomous and connected cars.

The integration of the voice-activated software in future cars is anticipated to adopt technologies, such as noise abatement for selectively ignoring driving & passenger noises for providing an error-free and seamless experience to the operator. Voice recognition is also a core technology that is widely used in the healthcare sector to enhance the Electronic Health Record (HER) systems by providing an ease to the doctor to speak and keep the records instead of manual typing or writing. In 2018, the healthcare vertical held the largest market share and it is expected to grow significantly over the forecast period. AI-based voice and speech recognition software is expected to grow at the fastest CAGR from 2023 to 2030.

This is due to the continuous development of machine learning techniques and the integration of connected devices with personal assistants. For instance, Dragon Drive is a personal assistant developed by Nuance Communication Inc. that integrates various household appliances, cars, and smartphones that can be connected to a hub through the internet. Thus, an individual can get alerts about daily chores, work schedules, traffic updates, and many more alerts through the Dragon Drive. In addition, sentiment analysis using the changes in the pitch of the voice is anticipated to provide an opportunity to the market. However, the lack of accuracy of these technologies in recognizing the regional accents and dialects is expected to limit the market growth.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/voice-recognition-market

Voice And Speech Recognition Market Report Highlights

A rising trend in the development of Artificial Intelligence (AI)-based systems is expected to be the key factor driving the market growth over the forecast period

Leveraging deep learning algorithms in voice & speech solutions for better search results is expected to be the key factor for the growth of the AI-based technology segment

The deployment of speech recognition solutions in consumer and retail verticals is anticipated to lead to the high market growth

This can be attributed to the changing lifestyles in countries, such as the U.S., Germany, and the U.K.

Moreover, the growing adoption of smart electronics in India, China, Japan, and Brazil is likely to drive the market growth in the consumer vertical

North America and the Asia Pacific are anticipated to witness considerable growth owing to the presence of several U.S.- and China-based players, such as Apple, Inc., Facebook, Inc., Baidu, Inc., Amazon.com, Inc., and Alphabet, Inc., working toward the development of this technology

Key industry participants are focusing on integrating the AI technology in speech & voice recognition software to build superior products that would increase their user customer base

Voice And Speech Recognition Market Segmentation

Grand View Research has segmented the global voice and speech recognition market on the basis of function, technology, vertical, and region:

Voice & Speech Recognition Function Outlook (Revenue, USD Million, 2017 - 2030)

Voice Recognition

Speaker Identification

Speaker Verification

Speech Recognition

Automatic Speech Recognition

Text-to-Speech

Voice & Speech Recognition Technology Outlook (Revenue, USD Million, 2017 - 2030)

AI-based

Non-AI-based

Voice & Speech Recognition Vertical Outlook (Revenue, USD Million, 2017 - 2030)

Automotive

Enterprise

Consumer

BFSI

Government

Retail

Healthcare

Military

Legal

Education

Others

Voice & Speech Recognition Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Switzerland

Poland

Asia Pacific

China

Japan

India

South Korea

Singapore

Pakistan

Malaysia

Australia

Hong Kong

Vietnam

South America

Brazil

Argentina

Chile

Middle East & Africa

UAE

Saudi Arabia

Israel

South Africa

Nigeria

List of Key Players of Voice And Speech Recognition Market

Advanced Voice Recognition Systems, Inc.

Agnitio S.L.

Amazon.com, Inc.

Api.ai

Apple, Inc.

Anhui USTC iFlytek, Ltd.

Baidu, Inc.

BioTrust ID B.V.

CastleOS Software, LLC

Facebook, Inc.

Google, Inc.

International Business Machines Corp.

Microsoft Corp.

MModal, Inc.

Nortek Holdings, Inc.

Nuance Communications, Inc.

Raytheon Company

SemVox GmbH

Sensory, Inc.

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/voice-recognition-market

#Voice And Speech Recognition Market#Voice And Speech Recognition Market Size#Voice And Speech Recognition Market Share

0 notes

Text

Enterprise Video Market Emerging Trends, Competitive Landscape, Future Plans

The Enterprise Video Market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 8.6% from USD 23.8 billion in 2024 to USD 35.8 billion in 2029 throughout the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1182

An urge to shift from on-premises deployment to cloud-based solutions, strict adherence and compliance to regulatory authorities and government-led reporting standards across verticals and regions, demand for user experience centricity on priority across verticals, organizations, and regions globally, digitalization, and automation are expected to drive the growth of the global Enterprise video market.

Major Enterprise Video Companies Include:

Microsoft (US)

Zoom (US)

Google (US)

IBM (US)

Avaya (US)

Major vendors in this market are based in North America, Asia Pacific, and Europe. Some of the key players operating in the Open banking solutions market are – Microsoft (US), Zoom (US), Google (US), IBM (US), Avaya (US), and AWS (US) among others. These companies have strengthened their positions in the market by implementing a variety of growth tactics. To increase their market share in Open banking solutions, they can do things like product launches, agreements, collaborations, mergers and acquisitions, and the creation of new products.

Microsoft

Microsoft is one of the leading players in the technology domain, developing and supporting a wide range of software, hardware, devices, and services for businesses and individuals. The company has a comprehensive product portfolio that offers products related to operating systems, collaboration solutions, cloud-based solutions, productivity applications, business solutions, server management, and gaming solutions. Microsoft also provides cloud-driven support and consulting services. Microsoft has started giving technology-driven solutions in recent times as well. With such a broad portfolio and offerings, Microsoft caters to customers' business needs in more than 190 countries around the globe.

Microsoft is a leading provider of enterprise video solutions, offering a comprehensive suite of tools and platforms to support businesses' communication and collaboration needs. With offerings like Microsoft Stream, Teams, and SharePoint, Microsoft enables organizations to securely stream, share, and manage video content within their existing productivity ecosystem. Their focus on integration, security, and user experience positions them as a critical player in the rapidly evolving enterprise video market.

Google

Google offers a robust suite of enterprise video solutions, including Google Meet and Google Workspace, to facilitate seamless video conferencing, collaboration, and communication within organizations. These tools provide high-quality video and audio capabilities and features like screen sharing, real-time document collaboration, and integration with other Google productivity tools. With a user-friendly interface and scalable infrastructure, Google's offerings cater to the diverse needs of businesses, driving innovation and productivity in the enterprise video market.

Get More Info : https://www.prnewswire.com/news-releases/enterprise-video-market-worth-35-8-billion-by-2029---exclusive-report-by-marketsandmarkets-302099336.html

Google's core products and platforms include Android, Chrome, Gmail, Google Drive, Google Maps, Google Play, Search, and YouTube; each product has over one billion monthly active global users. The company also offers solutions and services for video streaming, platforms, and support from other offerings by players. Google provides productive tools that help with enterprise videos, streaming, content management, collaboration, design, and execution. Solutions provided by Google, such as Google Meet, offer them an edge in the video market.

Zoom

Zoom Video Communications, Inc., commonly known as Zoom, is a U.S.-based technology company that provides video conferencing, online meetings, chat, and cloud-based communication services. Founded in 2011 by Eric Yuan, Zoom gained widespread popularity for its ease of use, reliability, and scalability, becoming especially prominent during the COVID-19 pandemic when remote work and virtual meetings surged.

IBM

IBM (International Business Machines Corporation) is a leading American multinational technology and consulting company headquartered in Armonk, New York. Founded in 1911, IBM is one of the world's largest technology firms, with a history of innovation in hardware, software, and services.

Avaya

Avaya is a U.S.-based multinational technology company specializing in business communications and collaboration solutions. Headquartered in Durham, North Carolina, Avaya has a long history of providing communications technology to enterprises, with a focus on voice, video, messaging, and customer experience

About MarketsandMarkets™

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

Contact: Mr. Aashish Mehra MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: [email protected]

#Enterprise Video Market#Enterprise Video Market size#Enterprise Video Market share#Enterprise Video Market trends#Enterprise Video Market demand#Enterprise Video Market overview#Enterprise Video Market outlook#Enterprise Video Industry#Enterprise Video Market New Research Report

0 notes

Text

"Empowering Energy: Key Players and Trends in the Battery Monitoring Industry

Battery monitoring systems are designed to inform users about the real-time status and health of batteries or battery banks, providing alerts on battery failures and the net charge available. These systems play a crucial role in preventing severe damage, prolonging battery life, and ensuring efficiency. Monitoring charging, discharging, load, AC mains frequency and voltage, ambient temperature, and battery temperature are key functions of a battery monitoring system. Additionally, these systems generate live reports on battery performance and trigger alarms in case of any faults.

Request 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞 : https://www.alliedmarketresearch.com/request-toc-and-sample/16324

COVID-19 Impact Analysis

The global effects of the COVID-19 pandemic have significantly impacted the battery monitoring system market. Disruptions in exports, imports, manufacturing, and changes in consumer consumption patterns have led to challenges and a shift in demand during the pandemic.

Top Impacting Factors

The increasing adoption of battery monitoring systems in electric vehicles (EVs) is a major driver for market demand. Governments globally support battery manufacturers for EVs, aligning with the transition to renewable energy sources. Additionally, the need to prevent unplanned outages, the rise in demand for electric vehicles, and improved operational efficiency contribute to the growing demand for battery monitoring systems.

Market Trends

Growing Demands for Electricity at Various End-Use Industries: The necessity to prevent unplanned outages, coupled with the increased demand for electric vehicles and improved battery operational efficiency, drives the demand for battery monitoring systems. The rise in renewable power generation and the use of these systems in data center applications further boost market growth.

Increased Usage in Data Centers: Data centers, critical for organizations' core applications, rely on batteries for uninterrupted power supply. Integrating battery monitoring systems enhances operations and safety in data centers, where battery failures can disrupt operations and result in financial losses.

Focus on Environmental Safety Concerns: The growing demand for clean energy and concerns about global warming have led to a shift towards environmentally friendly solutions. Battery monitoring systems play a crucial role in ensuring the proper functioning of clean technologies and applications dependent on batteries, thereby supporting environmental safety initiatives.

𝐄𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 : https://www.alliedmarketresearch.com/purchase-enquiry/16324

Key Benefits of Report

The report provides an analytical overview of the battery monitoring system market, offering insights into current trends and future estimations to identify potential investment opportunities. It covers key drivers, restraints, and opportunities, along with a detailed analysis of market share. The quantitative analysis highlights the growth scenario, while Porter's five forces analysis illustrates buyer and supplier potency. The report offers a comprehensive analysis of the battery monitoring system market based on competitive intensity and future competition dynamics.

Battery Monitoring System Market Report Highlights

Aspects Details

By Type

Wired

Wireless

By Component

Hardware

Software

𝐆𝐞𝐭 𝐚 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 @ : https://www.alliedmarketresearch.com/request-for-customization/16324

By Application

Telecommunication

Automotive

Energy

Industries

Others

By Battery Type

Lithium-ion

Lead Acid

Others

By Energy Storage

Batteries

Thermal

Mechanical

By Region

North America (U.S., Canada, Mexico)

Europe (France, Germany, Italy, Spain, United Kingdom, Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia Pacific)

LAMEA (Brazil, South Africa, Saudi Arabia, Rest of LAMEA)

Key Market Players ABB, BatteryDAQ, Schneider Electric, Hbl Power Systems, Eagle Eye Power Solutions, LLC, Btech Inc, Socomec, Powershield, Canara, Texas Instrument

0 notes

Text

AI in BFSI: Redefining Customer Experience and Risk Management

Artificial intelligence (AI) is illustrated by machines rather than natural intelligence displayed by humans. Intelligence in machines is programmed to think like humans and mimic their actions. In addition, machines are designed to rationalize and function like human mind, such as learning, planning, identifying patterns, problem solving, and decision making to achieve a specific goal. Therefore, it has become an essential part of technology in the BFSI industry. In financial institutions and other major finance industries, AI has become a core adaption and is expected to change the overall scenario of service offerings.

The AI in BFSI Market study by Allied Market Research includes an overview of business trends, competitor analysis, and a future market and technical analysis forecast. In addition, the study gave an illustration of the global value and key regional trends in terms of Earthquake InsurMark size, share and growth opportunities. All information about the global market has been carefully analyzed and verified by industry professionals after being gathered from very reliable sources.

Download PDF Sample Copy: https://www.alliedmarketresearch.com/request-sample/2791

A comprehensive and detailed method that combined primary and secondary research was used to thoroughly investigate the global E-Banking Market. While secondary research gave a broad overview of the products and services, primary research involved a thorough examination of many factors that influence the market. A process of searching is done using a variety of sources, such as press releases, professional journals, and government websites, to gain insights into the industry. This approach has made it possible to acquire a clear, extensive understanding of the global E-Banking Market

Analysis of Key Players:

The market is fragmented, with many large and medium-scale vendors controlling minority shares. Vendors actively engage in product development by making significant investments in R&D initiatives. Through a variety of growth strategies, including alliances, partnerships, mergers, and acquisitions, they are increasing their Shop Insurance Marketshare.

Purchase this Report@ https://www.alliedmarketresearch.com/artificial-intelligence-in-BFSI-market/purchase-options

Major players operating in the AI in BFSI Market: industry include Oracle Corporation, Baidu, Inc., Palantir Technologies Inc., Inbenta Technologies Inc., Microsoft Corporation, salesforce.com, inc., Intel Corporation, International Business Machines Corporation, SAP SE, Alphabet Inc.

By Offering

Hardware

Software

Services

By Solution

Chatbots

Fraud Detection & Prevention

Anti-Money Laundering

Customer Relationship Management

Data Analytics & Prediction

Others

By Technology

Deep Learning

Querying Method

Natural Language Processing

Context Aware Processing

By Region

North America (U.S, Canada, and Mexico),

Europe (UK, Italy, Germany, France, Spain, Netherlands, Switzerland, and the Rest of Europe),

Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Thailand, and Rest of Asia-Pacific),

LAMEA (Latin America, Middle East, and Africa).

The expert team at Allied Market Research continuously analyzes the market environment by making precise predictions about the necessary driving and restraining factors. On these factors, the stakeholders can base their business plans.

Key Benefits for Stakeholders:

This report offers a quantitative examination of the market segments, estimations, recent trends, and dynamics of the AI in BFSI Market: analysis from 2023 to 2032 to specify the key competitive advantages.

An in-depth analysis of Market segmentation helps in determining current market opportunities.

Porter's five forces analysis places a strong emphasis on consumers' and vendors' capacity to develop their supplier-buyer networks and come to profitable business decisions.

The report examines regional and global market segmentation, LAMEA Travel Insurance MarkeTrends, leading players, market growth strategies, and application areas.

Market participants' positioning encourages comparative analysis and provides a clear understanding of the player's current position.

The major countries in each region are mapped based on their revenue contribution to the global market.

The report provides in-depth details of the business tactics used by the major market participants in AI in BFSI Market: growth.

Customization Before Buying, Visit @ https://www.alliedmarketresearch.com/request-for-customization/2791

Key Questions Answered in the Research Report-

What are the market sizes and rates of growth for the various market segments in the global and regional market?

What are the key benefits of the AI in BFSI Market: report?

What are the driving factors, restraints, and opportunities in the global Market?

Which region has the largest share of the global Market?

Who are the key players in the global Market?

Top Trending Reports:

1) Budgeting Software Market: https://www.alliedmarketresearch.com/budgeting-software-market-A11766

2) Digital Mortgage Software Market: https://www.alliedmarketresearch.com/digital-mortgage-software-market-A12740

3) Premium Finance Market: https://amarketplaceresearch.com/2023/09/13/premium-finance-market-paving-the-way-for-financial-flexibility-in-insurance/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 [email protected]

0 notes

Text

Global Hemostats Market Share Insights and Revenue Growth Outlook 2024–2033

Astute Analytica stands out as a premier provider of comprehensive Hemostats market research reports specifically tailored for the healthcare sector. Our commitment lies in delivering valuable insights and research that empower healthcare organizations to navigate the complexities of this rapidly evolving industry.

By understanding the trends and opportunities within the Hemostats market, businesses can strategically position themselves for success in an increasingly competitive environment. The integration of digital solutions, a focus on sustainability, and the adaptation to new care delivery models are essential components for enhancing patient care and ensuring the long-term viability of healthcare systems.

Hemostats market was valued at US$ 2,884.13 million in 2024 and is projected to hit the market valuation of US$ 4,839.68 million by 2033 at a CAGR of 5.92% during the forecast period 2025–2033.

A Request of this Sample PDF File@- https://www.astuteanalytica.com/request-sample/hemostats-market

The Essential Path of Digital Transformation in Healthcare

As we approach 2025, health system leaders across the globe are prioritizing efforts to drive efficiencies, boost productivity, and improve patient engagement. A significant factor influencing these initiatives is the accelerated digital transformation within healthcare, which has been identified as the most impactful issue for global health systems in the coming years. This emphasis on digitalization is not surprising, considering that healthcare has lagged behind other industries, such as retail and finance, in adopting advanced digital technologies.

According to recent surveys, approximately 70% of respondents believe that investing in technology platforms for digital tools and services will be crucial for their organizations. Furthermore, 60% of leaders highlighted the necessity of investing in core technologies, including electronic medical records (EMRs) and enterprise resource planning (ERP) software. Notably, around 90% of C-suite executives anticipate a significant acceleration in the use of digital technologies by 2025, with half expecting a profound impact on their operations.

The Rise of Consumer-Driven Digital Health Tools

The growing adoption of connected monitoring devices and digital tools among consumers is reshaping the healthcare landscape. In 2024, 43% of consumers are expected to utilize these technologies, up from 34% in 2022. This shift aligns with the highly personalized experiences that consumers have come to expect from industries such as banking, retail, and entertainment. Digital monitoring tools empower consumers by providing trending data that supports their health concerns, thereby enhancing their agency during patient-clinician interactions. This increased control and confidence is particularly vital in areas like maternal health, where timely and informed interactions can prevent adverse outcomes.

Mergers and Acquisitions in Healthcare Technology