#U.S. Core Banking Software Market Analysis

Explore tagged Tumblr posts

Text

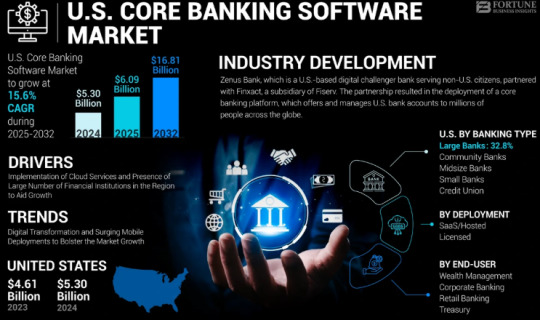

The U.S. Core Banking Software Market Size, Share | CAGR 15.6% during 2024-2030

The U.S. core banking software market Size was valued at USD 5.30 billion in 2024 and is projected to grow from USD 6.09 billion in 2025 to USD 16.81 billion by 2032, exhibiting a CAGR of 15.6% during the forecast period. Driven by the modernization of legacy banking systems, increasing customer demand for digital-first banking experiences, and adoption of cloud-native platforms, the U.S. banking industry is rapidly shifting toward agile, API-driven core banking systems.

Key Market Highlights:

2024 U.S. Market Size: USD 5.30 billion

2025 U.S. Market Size: USD 6.09 billion

2032 U.S. Market Size: USD 16.81 billion

CAGR (2025–2032): 15.6%

Market Outlook: Cloud-first transformation of retail and commercial banking infrastructure

Leading Players in the U.S. Market:

FIS (Fidelity National Information Services)

Finastra

Temenos USA

Oracle Financial Services Software

Jack Henry & Associates

SAP America

nCino

Infosys (EdgeVerve)

Thought Machine

Backbase

Mambu

Q2 Holdings

TCS BaNCS (U.S. operations)

Request Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/u-s-core-banking-software-market-107481

Market dynamics:

Growth Drivers:

Legacy System Modernization: Traditional banks are replacing decades-old core systems to enable agility, scalability, and faster innovation.

Rise of Digital-Only Banks & Neobanks: Challenger banks are opting for coreless and cloud-native platforms to deliver real-time banking experiences.

Regulatory Mandates: U.S. regulations increasingly demand transparency, real-time compliance, and modular tech stacks.

Omnichannel and Mobile Banking Boom: Surge in mobile-first customers is accelerating demand for flexible and API-driven core systems.

Adoption of BaaS & Embedded Finance: Banks are embedding financial services into non-banking platforms, requiring agile backend core systems.

Key Opportunities:

AI-Powered Core Modernization: Integration of AI for risk scoring, predictive analytics, and process automation

Cloud Migration Projects: Large-scale re-platforming from on-premise to cloud-native or hybrid models

Banking-as-a-Service (BaaS): U.S. institutions offering core services to fintechs and enterprises

Open Banking APIs: Ecosystem expansion through developer-friendly, regulatory-compliant APIs

Personalized Customer Experience Engines: Data-driven personalization built directly into core systems

Technology & Application Scope:

Deployment Models:

Cloud-native

On-premises

Hybrid (transitional)

Core Features:

Customer and account management

Payments and transaction processing

Lending and credit modules

Risk and compliance automation

Real-time reporting and dashboards

Target Users:

Retail banks

Credit unions

Community banks

Commercial and corporate banks

Neobanks and fintechs

Speak to Analysts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/u-s-core-banking-software-market-107481

Recent Developments:

January 2024 – A top-10 U.S. bank announced a $700M multiyear plan to migrate its entire core system to a cloud-native microservices architecture with Temenos and AWS.

October 2023 – Jack Henry & Associates launched a new AI-powered fraud prevention module integrated into its core platform, reducing false positives by 45%.

July 2023 – A mid-sized credit union in the Midwest completed a legacy core banking system overhaul, leading to a 22% increase in customer satisfaction due to improved digital banking capabilities.

Trends Shaping the U.S. Core Banking Market:

Composable Banking Architecture: Shift toward modular, plug-and-play architecture

AI & Machine Learning in Core: Real-time fraud detection, dynamic credit risk models, and intelligent automation

Blockchain Integration: Experiments in real-time settlement, decentralized identity, and smart contracts

Low-Code/No-Code Customization: Democratization of development within banking teams

Cybersecurity Embedded in Core: Zero-trust frameworks and secure-by-design approaches

Conclusion:

The U.S. core banking software market is undergoing a significant transformation, driven by rising customer expectations, digital competition, and the imperative to stay compliant and resilient. The future belongs to banks that embrace modular, cloud-native, and API-driven core platforms—designed to scale, personalize, and evolve. As the market accelerates toward modernization, technology vendors and banks alike are finding immense value in flexible ecosystems, open banking capabilities, and real-time innovation.

Frequently Asked Questions: 1. What is the projected value of the global market by 2032?

2. What was the total market value in 2024?

3. What is the expected compound annual growth rate (CAGR) for the market during the forecast period of 2025 to 2032?

4. Which industry segment dominated market in 2023?

5. Who are the major companies?

6. Which region held the largest market share in 2023?

#U.S. Core Banking Software Market Share#U.S. Core Banking Software Market Size#U.S. Core Banking Software Market Industry#U.S. Core Banking Software Market Driver#U.S. Core Banking Software Market Growth#U.S. Core Banking Software Market Analysis#U.S. Core Banking Software Market Trends

0 notes

Text

Future Outlook: Convex Ostomy Care Bag Market Growth and Trend Analysis

Astute Analytica stands out as a premier provider of comprehensive Convex Ostomy Care Bag market research reports specifically tailored for the healthcare sector. Our commitment lies in delivering valuable insights and research that empower healthcare organizations to navigate the complexities of this rapidly evolving industry.

By understanding the trends and opportunities within the Convex Ostomy Care Bag market, businesses can strategically position themselves for success in an increasingly competitive environment. The integration of digital solutions, a focus on sustainability, and the adaptation to new care delivery models are essential components for enhancing patient care and ensuring the long-term viability of healthcare systems.

Global convex ostomy care bag market was valued at US$ 3,174.1 million in 2023 and is projected to hit the market valuation of US$ 4,840.3 million by 2032 at a CAGR of 4.8% during the forecast period 2024–2032.

A Request of this Sample PDF File@- https://www.astuteanalytica.com/request-sample/convex-ostomy-care-bag-market

The Essential Path of Digital Transformation in Healthcare

As we approach 2025, health system leaders across the globe are prioritizing efforts to drive efficiencies, boost productivity, and improve patient engagement. A significant factor influencing these initiatives is the accelerated digital transformation within healthcare, which has been identified as the most impactful issue for global health systems in the coming years. This emphasis on digitalization is not surprising, considering that healthcare has lagged behind other industries, such as retail and finance, in adopting advanced digital technologies.

According to recent surveys, approximately 70% of respondents believe that investing in technology platforms for digital tools and services will be crucial for their organizations. Furthermore, 60% of leaders highlighted the necessity of investing in core technologies, including electronic medical records (EMRs) and enterprise resource planning (ERP) software. Notably, around 90% of C-suite executives anticipate a significant acceleration in the use of digital technologies by 2025, with half expecting a profound impact on their operations.

The Rise of Consumer-Driven Digital Health Tools

The growing adoption of connected monitoring devices and digital tools among consumers is reshaping the healthcare landscape. In 2024, 43% of consumers are expected to utilize these technologies, up from 34% in 2022. This shift aligns with the highly personalized experiences that consumers have come to expect from industries such as banking, retail, and entertainment. Digital monitoring tools empower consumers by providing trending data that supports their health concerns, thereby enhancing their agency during patient-clinician interactions. This increased control and confidence is particularly vital in areas like maternal health, where timely and informed interactions can prevent adverse outcomes.

Mergers and Acquisitions in Healthcare Technology

The healthcare technology sector is poised for a surge in mergers and acquisitions (M&A) as we move into 2024. The COVID-19 pandemic has underscored the importance of health technology and healthcare delivery systems, prompting a renewed focus on consolidation within the industry. In 2023, biopharma M&A experienced a remarkable rebound, with an aggregate deal value increasing by 79% compared to 2022, reaching approximately $152 billion—the highest level since 2019. The average deal size has also shown an upward trend, approaching levels not seen since 2020. Several positive catalysts are expected to support this momentum in 2024, including emerging threats to growth, a fear of missing out on opportunities, and a resurgence of high-prevalence conditions that necessitate innovative solutions.

The U.S. Healthcare Market Landscape

The United States remains the world's largest healthcare market, with healthcare spending reaching $4.3 trillion in 2021, translating to about $12,900 per person. However, as consolidation continues and exposure to government payers increases, healthcare markets in other regions are anticipated to grow at a faster pace. Despite the substantial investment in healthcare, the outcomes do not always reflect this high expenditure, leading to significant disparities in access and quality of care. The U.S. healthcare system is evolving in response to these challenges, particularly the pressures of rising costs and an increasing number of uninsured individuals.

Navigating Political Changes and Regulatory Shifts

As the healthcare industry prepares for 2025, potential changes in political leadership could usher in new policy directions and regulatory shifts. Leaders within the healthcare space must remain agile, anticipating policy reforms that could reshape operational priorities, including resource allocation and shifts in care delivery models. Building collaborative ecosystems and staying informed about legislative developments will be crucial for organizations aiming to thrive in this dynamic environment.

For Purchase Enquiry: https://www.astuteanalytica.com/industry-report/convex-ostomy-care-bag-market

Market Segmentation and Analysis

In its quest for a granular understanding of the Convex Ostomy Care Bag market, the report segments the industry into various categories. This segmentation facilitates a more detailed analysis of the dynamics within each segment, allowing stakeholders to identify specific growth opportunities and challenges. By breaking down the market, the report aids in crafting targeted strategies tailored to the unique characteristics of each segment.

By Type

One-piece System

Two-piece System

Skin Barrier

By Application

Ostomy leakage

Retracted stoma

Peristomal skin creases

Surgical scars and flaccid

Loop ostomies

Others

By End User

Home Care

Hospitals & Ambulator

Surgical Centers

Others

By Distribution Channel

Online e-Commerce

Offline

By Region

North America

The U.S.

Canada

Mexico

Europe

Western Europe

U.K.

Germany

France

Spain

Italy

Rest of Western Europe

Eastern Europe

Poland

Russia

Rest of Eastern Europe

Asia Pacific

China

India

Japan

Australia & New Zealand

ASEAN

Rest of Asia Pacific

Middle East & Africa (MEA)

UAE

Saudi Arabia

South Africa

Rest of MEA

South America

Argentina

Brazil

Rest of South America

Geographical Segmentation

The report further segments the market into geographical regions, including North America, South America, Asia, Europe, Africa, and Others. Each region is examined with a focus on key countries, providing insights into the current market size and forecasts extending until 2033. This geographical breakdown is critical for understanding regional market dynamics and tailoring strategies to meet local demands effectively.

Competitive Landscape

A significant portion of the report is dedicated to analyzing the competitive landscape within the Convex Ostomy Care Bag market. This includes a comprehensive examination of leading Convex Ostomy Care Bag product vendors, highlighting their latest developments and market shares in terms of shipment and revenue. By profiling these major players, the report offers valuable insights into their product portfolios, technological capabilities, and overall market positioning.

The report identifies key players in the Convex Ostomy Care Bag market, providing a closer look at their contributions to the industry. This competitive profiling is essential for understanding the strengths and weaknesses of various companies, enabling stakeholders to make informed decisions and devise effective strategies in a crowded marketplace.

ConvaTec (UK)

Coloplast (Denmark)

Hollister Incorporated (US)

B. Braun (Germany)

Alcare (Japan)

Nu-Hope (US)

Marlen (US)

Welland Medical (UK)

BAO-Health (China)

Flexicare Medical (UK)

Cymed (US)

Perma-Type (US)

3M (US)

Smith & Nephew (UK)

Other Prominent Players

Download Sample PDF Report@- https://www.astuteanalytica.com/request-sample/convex-ostomy-care-bag-market

About Astute Analytica:

Astute Analytica is a global analytics and advisory company that has built a solid reputation in a short period, thanks to the tangible outcomes we have delivered to our clients. We pride ourselves in generating unparalleled, in-depth, and uncannily accurate estimates and projections for our very demanding clients spread across different verticals. We have a long list of satisfied and repeat clients from a wide spectrum including technology, healthcare, chemicals, semiconductors, FMCG, and many more. These happy customers come to us from all across the globe.

They are able to make well-calibrated decisions and leverage highly lucrative opportunities while surmounting the fierce challenges all because we analyse for them the complex business environment, segment-wise existing and emerging possibilities, technology formations, growth estimates, and even the strategic choices available. In short, a complete package. All this is possible because we have a highly qualified, competent, and experienced team of professionals comprising business analysts, economists, consultants, and technology experts. In our list of priorities, you-our patron-come at the top. You can be sure of the best cost-effective, value-added package from us, should you decide to engage with us.

Get in touch with us

Phone number: +18884296757

Email: [email protected]

Visit our website: https://www.astuteanalytica.com/

0 notes

Text

Core Banking Software Market - Industry Dynamics, Market Size

According to Market Statistix, the Core Banking Software Market revenue and growth prospects are expected to grow at a significant rate during the analysis period of 2024-2032, with 2023 as the base year. Core Banking Software Market research is an ongoing process. Regularly monitor and evaluate market dynamics to stay informed and adapt your strategies accordingly. As a market research and consulting firm, we offer market research reports that focus on major parameters, including Target Market Identification, Customer Needs and Preferences, Thorough Competitor Analysis, Market Size and market Analysis, and other major factors. In the end, we provide meaningful insights and actionable recommendations that inform decision-making and strategy development.

The Core Banking Software Market is projected to experience steady growth, expanding at a CAGR of 17.5% over the forecast period.

Who are the key players operating in the industry?

Oracle Corporation (U.S.), SAP SE (Germany), Tata Consultancy Services Limited (India), Finastra International Limited (U.K.), Capital Banking Solutions (U.S.), EdgeVerve Systems Limited (India), Fidelity National Information Services, Inc. (U.S.), Fiserv, Inc. (U.S.), Mambu GmbH (Germany), Temenos AG (Switzerland)

Request a sample on this latest research report Core Banking Software Market spread across 100+ pages and supported with tables and figures is now available @ https://www.marketstatistix.com/sample-report/global-core-banking-software-market

Core Banking Software Market Overview and Insights:

Market Statistix is solidifying its reputation as a leading market research and consulting service provider, delivering data-driven insights that help businesses make informed strategic decisions. By focusing on detailed demand analysis, accurate market forecasts, and competitive evaluations, we equip companies with the essential tools to succeed in an increasingly competitive landscape. This comprehensive Core Banking Software market analysis offers a detailed overview of the current environment and forecasts growth trends through 2032. Our expertise enables clients to stay ahead of the curve, providing actionable insights and competitive intelligence tailored to their industries.

What is included in Core Banking Software market segmentation?

The report has segmented the market into the following categories:

Segment by Type: Large Banks (Greater than USD 30 Billion in Assets), Midsize Banks (USD 10 billion to USD 30 Billion in Assets), Small Banks (USD 5 billion to USD 10 Billion in Assets), Community Banks (Less than USD 5 Billion in Assets), Credit Unions

Segment by Application: Retail Banks, Corporate Banks, Treasury, Wealth Management, Others

Core Banking Software market is segmented by company, region (country), by Type, and by Application. Players, stakeholders, and other participants in the Core Banking Software market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by Type and by Application in terms of revenue and forecast for the period 2019-2032.

Have a query? Market an enquiry before purchase @ https://www.marketstatistix.com/enquiry-before-buy/global-core-banking-software-market

Competitive Analysis of the market in the report identifies various key manufacturers of the market. We do company profiling for major key players. The research report includes Competitive Positioning, Investment Analysis, BCG Matrix, Heat Map Analysis, and Mergers & Acquisitions. It helps the reader understand the strategies and collaborations that players are targeting to combat competition in the market. The comprehensive report offers a significant microscopic look at the market. The reader can identify the footprints of the manufacturers by knowing about the product portfolio, the global price of manufacturers, and production by producers during the forecast period.

As market research and consulting firm we offer market research report which is focusing on major parameters including Target Market Identification, Customer Needs and Preferences, Thorough Competitor Analysis, Market Size & Market Analysis, and other major factors.

Purchase the latest edition of the Core Banking Software market report now @ https://www.marketstatistix.com/buy-now?format=1&report=42

The Core Banking Software market research study ensures the highest level of accuracy and reliability as we precisely examine the overall industry, covering all the market fundamentals. By leveraging a wide range of primary and secondary sources, we establish a strong foundation for our findings. Industry-standard tools like Porter's Five Forces Analysis, SWOT Analysis, and Price Trend Analysis further enhance the comprehensiveness of our evaluation.

A Comprehensive analysis of consumption, revenue, market share, and growth rate is provided for the following regions:

-The Middle East and Africa region, including countries such as South Africa, Saudi Arabia, UAE, Israel, Egypt, and others.

-North America, comprising the United States, Mexico, and Canada.

-South America, including countries such as Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, and others.

-Europe (including Turkey, Spain, the Netherlands, Denmark, Belgium, Switzerland, Germany, Russia, the UK, Italy, France, and others)

-The Asia-Pacific region includes Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, the Philippines, South Korea, Thailand, India, Indonesia, and Australia.

Browse Executive Summary and Complete Table of Content @ https://www.marketstatistix.com/report/global-core-banking-software-market

Table of Contents for the Core Banking Software Market includes the following points:

Chapter 01 - Core Banking Software Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Core Banking Software Market – Pricing Analysis Overview

Chapter 05 - Overview of the History of the Core Banking Software Market

Chapter 06 - Core Banking Software Market Segmentation [e.g. Type (Large Banks (Greater than USD 30 Billion in Assets), Midsize Banks (USD 10 billion to USD 30 Billion in Assets), Small Banks (USD 5 billion to USD 10 Billion in Assets), Community Banks (Less than USD 5 Billion in Assets), Credit Unions), Application (Retail Banks, Corporate Banks, Treasury, Wealth Management, Others)]

Chapter 07 - Analysis of Key and Emerging Countries in the Core Banking Software

Chapter 08 - Core Banking Software Market Structure and Value Analysis

Chapter 09 - Competitive Landscape and Key Challenges in the Core Banking Software Market

Chapter 10 - Assumptions and Abbreviations

Chapter 11 - Market Research Approach for Core Banking Software

About Market Statistix:

Market Statistix is an expert in the area of global market research consulting. With the aid of our ingenious database built by experts, we offer our clients a broad range of tailored Marketing and Business Research Solutions to choose from. We assist our clients in gaining a better understanding of the strengths and weaknesses of various markets, as well as how to capitalize on opportunities. Covering a wide variety of market applications, We are your one-stop solution for anything from data collection to investment advice, covering a wide variety of market scopes from digital goods to the food industry.

Contact Information:

Market Statistix

Media & Marketing Manager

Call: +91 9067 785 685

Email: [email protected]

Website: www.marketstatistix.com

#Core Banking Software Market#Core Banking Software Market Share#Core Banking Software Market Size#Core Banking Software Market Trends#Core Banking Software Market Growth#Core Banking Software Market Forecast Analysis

0 notes

Text

Outsourced Bookkeeping Services: Why Small Businesses in the USA Choose Global Bookkeeping in 2025

Managing bookkeeping as a small business owner in the USA can be time-consuming and complex. From accounting and tax preparation to payroll processing and financial reporting, staying on top of your books is critical—but it doesn’t have to be stressful. Increasingly, American small businesses are turning to outsourced bookkeeping services in 2025 to save time, reduce costs, and ensure compliance with IRS regulations.

At Global Bookkeeping, we provide expert cloud bookkeeping solutions tailored to the unique needs of U.S. small and medium-sized businesses. In this article, discover why outsourcing your bookkeeping to professionals is one of the smartest moves for your business growth and financial health.

What Is Outsourced Bookkeeping and Why Do U.S. Businesses Need It?

Outsourced bookkeeping means hiring an external team of experienced bookkeepers to manage your financial records, including:

Daily transaction recording

Bank and credit card reconciliations

Accounts payable and receivable management

Payroll processing compliant with IRS and state regulations

Tax preparation support for quarterly and annual filings

Financial reporting and cash flow analysis

With cloud accounting software like QuickBooks Online, Xero, or FreshBooks, outsourced bookkeeping provides real-time financial visibility and simplifies tax season.

Benefits of Outsourced Bookkeeping for U.S. Small Businesses:

Save Time: Stop spending hours managing books and Concentrate on growing your business.

Cut Costs: Avoid hiring Precious in-house accountants or bookkeepers.

Ensure Accuracy: Professional bookkeeping reduces errors and keeps your records IRS-compliant.

Gain Insights: Real-time fiscal reports help you make informed Opinions.

Scale Easily: Bookkeeping services that grow with your business Requirements.

Why More U.S. Small Businesses Are Outsourcing Bookkeeping in 2025

Navigating U.S. tax laws, payroll compliance, and financial reporting can be complicated—especially for small business owners juggling Numerous Places. Outsourcing your bookkeeping to experts can relieve stress and improve your Nethermost line.

1. Compliance with IRS Tax and Payroll Regulations

Tax laws and payroll rules in the USA can vary widely between federal, state, and local jurisdictions. An outsourced bookkeeping partner ensures your business stays compliant with IRS requirements, quarterly estimated taxes, payroll tax filings (including FUTA, SUTA), and employee benefits reporting.

2. Cloud-Based Bookkeeping with Instant Access

Modern bookkeeping uses cloud software like QuickBooks Online and Xero, which provide instant access to your financial data—anytime, anywhere. This transparency helps you monitor cash flow, track expenses, and prepare for tax deadlines with confidence.

3. Payroll Outsourcing for Accurate and Timely Paychecks

Payroll is a complex process involving tax withholdings, Social Security, Medicare, and benefits management. Outsourced payroll services ensure your employees are paid correctly and on time, while keeping all necessary tax filings up-to-date.

4. Lower Costs Than Hiring In-House

Hiring a full-time bookkeeper or accountant includes salary, benefits, and overhead costs. Outsourcing spreads these expenses over multiple clients, providing professional bookkeeping services at a fraction of the cost.

5. Focus on Your Core Business Activities

By delegating bookkeeping tasks to experts, you free up time to focus on sales, customer service, marketing, or product development.

How Global Bookkeeping Supports U.S. Small Businesses

At Global Bookkeeping, we specialise in providing reliable, affordable outsourced bookkeeping services tailored to the American market. Our expertise includes:

Full bookkeeping services with daily transaction management

Payroll processing compliant with Civil and state laws

Tax-ready financial statements to simplify IRS filings

Expertise with popular U.S. accounting software (QuickBooks, Xero, FreshBooks)

Transparent pricing with no hidden fees

Personalized service and dedicated support

Client Success Story: How Outsourced Bookkeeping Helped a New York Retailer

A growing retail business in New York was overwhelmed by bookkeeping errors and missed payroll deadlines, risking IRS penalties. After partnering with Global Bookkeeping, they experienced:

Accurate, timely bookkeeping and payroll management

Simplified quarterly tax filings and compliance

20+ hours saved per month to focus on marketing and sales

Significant cost savings compared to hiring in-house

Get Started with Global Bookkeeping Today

Your business deserves expert Bookkeeping so you can focus on growth and customer satisfaction. With Global Bookkeeping’s outsourced bookkeeping services, you get trusted financial management, cloud-based solutions, and personalised support—all designed to help your U.S. small business thrive in 2025.

Ready to streamline your bookkeeping?

Contact Global Bookkeeping today for a free consultation and discover how we can save you time and money while ensuring your business stays IRS compliant.

0 notes

Text

Farhan Naqvi iLearningEngines: How Semiconductors Are Reshaping Global Power

Farhan Naqvi, former CFO of iLearningEngines, has shared powerful insights on a topic reshaping global geopolitics: semiconductors. In a recently published thought piece, Naqvi — a seasoned finance and strategy executive — explores how semiconductors have become the new strategic asset, replacing oil and data as the primary levers of international influence.

This article offers a deep dive into the transformative impact of semiconductors and AI infrastructure, drawing on Farhan Naqvi’s unique experience scaling iLearningEngines, one of the fastest-growing AI platforms in the enterprise space.

Who Is Farhan Naqvi? Farhan Naqvi is widely recognized for his leadership in finance, technology strategy, and capital markets. As the former CFO of iLearningEngines, an AI-driven enterprise software company, he played a key role in scaling the business over 10x and leading its successful listing on Nasdaq.

With degrees from IIT Kanpur and Harvard Business School, Naqvi has advised on marquee IPOs and M&A deals at leading investment banks, working with companies like Uber, Square, and Alibaba.

His work at iLearningEngines positioned him at the intersection of artificial intelligence, digital infrastructure, and global economic policy — a vantage point that informs his current perspective on semiconductors.

Semiconductors: The Core of Global Power Shifts In his latest analysis, Farhan Naqvi iLearningEngines argues that semiconductors are no longer mere hardware — they are strategic assets with national and global consequences.

“The microchip has become macro-strategic. The nations that lead in semiconductor design and manufacturing will shape the digital future.”

Naqvi’s commentary is both a call to action and a framework for understanding why chips now sit at the center of power competition among nations.

Silicon Sovereignty: A New Global Imperative Naqvi discusses how countries across the globe — including the U.S., China, Japan, and the EU — are racing toward silicon sovereignty. This means developing domestic capabilities to design, produce, and secure semiconductor supply chains without relying on foreign powers.

The COVID-19 pandemic and escalating U.S.-China tech tensions have accelerated this shift. Governments now view chips as critical to national security, not just economic growth.

From iLearningEngines to AI Infrastructure: The Role of Advanced Chips Drawing from his hands-on experience building iLearningEngines’ AI capabilities, Farhan Naqvi emphasizes the need for high-performance chips in enabling modern AI systems.

“Chips aren’t just components; they’re the infrastructure of intelligence. Without chip sovereignty, there is no AI sovereignty.”

Technologies like GPUs, tensor cores, and even quantum processors are essential to power the next wave of AI models, autonomous systems, and digital defense platforms.

A Fragmenting Global Semiconductor Supply Chain According to Farhan Naqvi iLearningEngines, the traditional global chip supply chain is being dismantled in favor of regionalization and “friend-shoring.”

The U.S. is re-shoring chip manufacturing with the CHIPS Act.

China is investing in a full-stack domestic ecosystem.

Europe and Japan are safeguarding access to critical materials and manufacturing tools.

This fragmentation poses both risk and opportunity, as countries rethink how to secure long-term chip independence.

Balancing Innovation and National Security Naqvi also cautions against the potential downside of heavy regulation. Export bans, tech restrictions, and tight controls may serve national interests, but they also risk slowing innovation, raising costs, and hampering academic collaboration.

“There’s a risk that the very controls meant to protect innovation may end up harming it,” he warns.

The Chip: The Defining Resource of the 21st Century Farhan Naqvi iLearningEngines concludes that semiconductors are now the most strategic resource on Earth — more influential than oil, data, or rare earth metals.

“The world’s most strategic resource is no longer oil or data. It’s the chip — built in nanometers, but measured in geopolitical influence.”

As we enter a new era of digital competition, the nations that dominate chip design, production, and integration will control the future of artificial intelligence, defense, and global power.

Final Thoughts Farhan Naqvi’s insights reflect a deep understanding of the convergence between technology, finance, and policy. His leadership at iLearningEngines — a company at the forefront of AI deployment — gives him rare clarity on why semiconductors will shape the global order for decades to come.

For policymakers, technologists, and investors alike, Naqvi’s message is clear: chip strategy is power strategy.

#Farhan Naqvi iLearningEngines#Sayyed Farhan iLearningEngines#Sayyed iLearningEngines#Sayyed Farhan Naqvi iLearningEngines#Sayyed Farhan Naqvi

0 notes

Text

How Outsource Bookkeeping Services in USA Can Boost Your Business Growth

As business owners face increasing pressure to stay competitive, reduce operational costs, and focus on core objectives, one area that often becomes a challenge is financial management. Maintaining accurate financial records is crucial, yet time-consuming. That’s where outsource bookkeeping services in USA come into play.

Many companies—whether startups, SMEs, or growing enterprises—are now outsourcing their financial operations to professional firms. This trend is especially strong in the United States, where businesses want to reduce administrative overhead and gain access to skilled financial professionals. Firms like OS Solutions have become go-to partners, offering tailored bookkeeping services in USA that support business growth without the burden of managing an in-house finance team.

What Are Bookkeeping Services?

Before diving into the benefits of outsourcing, let’s clarify what bookkeeping involves. Bookkeeping services USA typically include:

Recording daily transactions

Managing accounts payable and receivable

Reconciling bank statements

Generating financial statements

Handling payroll and tax-related reporting

Budget forecasting and cash flow analysis

Proper bookkeeping ensures compliance with tax laws, enhances transparency, and enables businesses to make strategic decisions based on accurate financial data.

Why Outsource Bookkeeping Services in USA?

1. Save Time and Focus on Core Business Functions

Business owners wear many hats, especially in small and mid-sized companies. Spending hours on invoices, expense tracking, and reconciliations diverts attention from growth-generating activities like marketing, product development, and customer service. By choosing outsource bookkeeping services in USA, businesses can free up valuable time while ensuring their books are in expert hands.

2. Cut Down on Operational Costs

Hiring a full-time bookkeeper or accounting team requires a significant financial commitment—including salaries, benefits, workspace, training, and accounting software. Outsourcing eliminates those overhead costs. You pay only for the services you need, when you need them. OS Solutions offers flexible pricing plans designed to accommodate various business sizes, making it cost-effective and scalable.

3. Access to Skilled Professionals

Accounting regulations in the U.S. change frequently, and compliance is non-negotiable. With bookkeeping services in USA, you get access to professionals trained in current federal and state tax laws, GAAP standards, and advanced accounting tools. Instead of spending resources training internal staff, your business benefits from immediate expertise.

4. Improve Financial Accuracy

Manual bookkeeping often leads to human error. Misclassified transactions, missed deductions, and delayed reconciliations can result in financial penalties or poor decisions. Outsourced services leverage automation tools and systematic review processes to reduce errors significantly.

For example, OS Solutions uses cloud-based accounting software integrated with AI tools to flag anomalies and ensure accuracy in real time.

5. Scalability for Business Growth

As businesses grow, their financial needs evolve. What works for a 5-person startup won’t meet the needs of a 50-person company with multi-channel revenue streams. Outsourced providers are equipped to scale services as you expand—whether that means handling more transactions, adding payroll services, or preparing for investor audits.

6. Access to Real-Time Reporting and Insights

Financial data is most useful when it’s timely. Modern bookkeeping services USA provide dashboards, KPIs, and real-time financial statements that help you monitor performance and cash flow. This allows decision-makers to take action faster—whether it's adjusting pricing strategies or planning for expansion.

Why Choose OS Solutions for Bookkeeping Services in USA?

OS Solutions stands out as a trusted provider of bookkeeping services in USA by offering comprehensive, secure, and customized services to businesses of all sizes. Here's what makes us different:

Expert Team: Trained professionals with deep industry experience.

Cloud-Based Tools: Access your financial data 24/7 from anywhere.

Tailored Services: Choose only what you need—monthly reports, full-service bookkeeping, payroll, or tax prep.

Confidential & Secure: We prioritize data protection with secure systems and strict confidentiality agreements.

Dedicated Support: Our account managers are always available to answer questions and provide insights.

When you choose OS Solutions, you’re not just outsourcing a task—you’re gaining a partner invested in your growth.

Real-World Example: A Growth Story

A boutique marketing agency based in Chicago was spending nearly 20 hours a month managing their books. As the client base grew, invoicing delays, missed payments, and reporting errors became common. They decided to partner with OS Solutions.

Within six months:

Monthly bookkeeping time reduced by 85%

Reporting accuracy improved by 98%

They gained a clear financial roadmap to hire two new team members and launch a new service

This success story highlights how the right financial partner can unlock new opportunities.

Tips for a Successful Bookkeeping Outsourcing Experience

To maximize the benefits of outsourcing, consider the following:

✅ Define Your Needs Clearly

Outline what services you require—basic bookkeeping, payroll, tax preparation, or financial planning. This helps set expectations from the start.

✅ Choose a Reputable Firm

Look for credentials, reviews, client testimonials, and experience. Make sure they understand your industry.

✅ Ensure Data Security

Your financial data is sensitive. Ensure your provider uses encrypted platforms and secure data storage.

✅ Set Up Clear Communication

Regular check-ins and reporting schedules keep both parties aligned.

✅ Evaluate Performance Regularly

Review the partnership periodically to assess ROI and service quality.

Frequently Asked Questions

1. What services are included in outsource bookkeeping services in USA?

Typically, services include transaction recording, bank reconciliation, accounts payable/receivable management, financial reporting, and sometimes payroll and tax support—depending on the provider.

2. Are outsourced bookkeeping services suitable for small businesses?

Yes. Small businesses often benefit the most from outsourcing due to the cost savings and access to expertise they otherwise couldn’t afford in-house.

3. How do I know my financial data is secure with a third-party provider?

Firms like OS Solutions use encrypted, cloud-based software, secure servers, and sign NDAs to ensure your data is fully protected.

4. Can I access my books anytime if I outsource?

Absolutely. With cloud-based systems, you have 24/7 access to your financial data, dashboards, and reports.

5. How do I get started with OS Solutions?

Contact our team via our website or schedule a free consultation. We’ll assess your needs and recommend a plan that fits your business model and budget.

Final Thoughts

In today’s fast-paced market, financial efficiency and strategic clarity are essential. By leveraging outsource bookkeeping services in USA, you save time, reduce costs, improve accuracy, and gain expert support—all without the burden of managing a full-time team.

OS Solutions is here to help you streamline your operations and support your next phase of growth. Our tailored bookkeeping services USA are built to empower businesses to focus on what they do best—while we handle the numbers.

0 notes

Text

AI Model Risk Management Market to See 9.8% CAGR, Growing to $16.2B by 2034

AI Model Risk Management Market is entering a transformative era. Projected to surge from $6.2 billion in 2024 to an impressive $16.2 billion by 2034, the market is set to grow at a compelling CAGR of 9.8%.

This boom is driven by the rapid proliferation of artificial intelligence across industries and the increasing demand for tools that ensure AI systems operate responsibly, ethically, and within the boundaries of regulatory standards. As companies lean into AI to boost productivity and innovation, they’re simultaneously investing in frameworks and platforms that identify, assess, and mitigate risks tied to these intelligent models.

Market Dynamics

At the core of the market’s growth are robust software solutions and critical services that manage AI-related risk. The software segment dominates, commanding about 55% of the market thanks to real-time monitoring, analytics, and transparency tools. Meanwhile, services like consulting, training, and implementation take up the remaining 45%, supporting businesses in understanding and integrating risk protocols.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS32156

Key drivers include increased regulatory scrutiny, the complexity of AI models, and rising concerns around AI ethics, bias, and transparency. On the flip side, high costs, integration challenges, and a shortage of AI-savvy professionals remain notable restraints. Yet, the opportunities are vast — particularly for firms innovating in real-time risk assessment, bias detection, and governance tools.

Key Players Analysis

The market is populated by both legacy giants and emerging innovators. Notable players like DataRobot, SAS Institute, C3.ai, FICO, and Alteryx provide end-to-end risk management platforms tailored for complex AI ecosystems. Emerging disruptors such as Model Wise Analytics, AI Compliance Systems, and Risk Mind AI are gaining traction with specialized tools focused on compliance, model integrity, and explainability.

These companies are engaging in strategic collaborations and R&D investments to offer solutions that blend AI governance, transparency, and operational excellence. Their platforms often cater to mission-critical industries like banking, insurance, healthcare, and government — sectors where failure to manage AI risk can lead to serious legal or financial repercussions.

Regional Analysis

North America leads the global market, primarily due to the U.S.’s strong AI regulatory environment and its push for AI transparency. Here, companies are increasingly aligning with standards from the National Institute of Standards and Technology (NIST) and other federal bodies.

Europe follows closely, driven by countries like the U.K., Germany, and France, all of which emphasize AI ethics and compliance. The region’s focus on human-centered AI and data protection (such as GDPR) is accelerating demand for risk frameworks.

Asia-Pacific, with its tech-forward economies like China, Japan, and South Korea, is experiencing rapid market growth. Governments and enterprises alike are recognizing the need for structured AI oversight amid increasing adoption.

Meanwhile, Latin America, the Middle East, and Africa are emerging markets. Brazil, Mexico, UAE, and Saudi Arabia are taking early steps with infrastructure investments and policy initiatives to harness AI responsibly.

Recent News & Developments

The market is buzzing with activity as organizations adapt to evolving global AI regulations. Investment in AI risk tools now often ranges from $100,000 to over $1 million annually, reflecting the value companies place on trustworthy AI.

Recent trends include the integration of AI explainability tools, bias mitigation frameworks, and end-to-end model monitoring platforms. Strategic partnerships between tech companies and academic institutions are also playing a critical role in developing best-in-class risk management technologies.

Notably, regulatory bodies like the European Central Bank and Federal Reserve have issued frameworks demanding greater transparency and accountability in AI applications. These developments are forcing even traditional firms to ramp up their investments in AI risk management systems.

Browse Full Report : https://www.globalinsightservices.com/reports/ai-model-risk-management-market/

Scope of the Report

This comprehensive report offers a full-spectrum analysis of the AI Model Risk Management Market, with forecasts from 2025 to 2034. It covers key market segments — by type, product, services, technology, component, deployment, and end user — highlighting growth trends and sector-specific dynamics. The research identifies major drivers, restraints, and emerging opportunities, as well as the strategic moves of top players in this space.

From localized insights to global outlooks, this study also evaluates regulatory impacts, competitive benchmarking, and innovation pipelines shaping the future of AI governance. Whether you’re a stakeholder in finance, healthcare, or public policy, understanding the AI Model Risk Management Market is now essential.

Discover Additional Market Insights from Global Insight Services:

Multicarrier Parcel Management Solutions Software Market : https://www.globalinsightservices.com/reports/multicarrier-parcel-management-solutions-software-market/

Building Energy Simulation Software Market : https://www.globalinsightservices.com/reports/building-energy-simulation-software-market/

Dealer Management System Market : https://www.globalinsightservices.com/reports/dealer-management-system-market/

Mobile Phone Insurance Market : https://www.globalinsightservices.com/reports/mobile-phone-insurance-market/

#ai #aigovernance #aimodelrisk #modelriskmanagement #ethicalai #transparency #compliance #aiexplainability #regtech #aiethics #machinelearning #deeplearning #nlp #aiinhealthcare #aiinfinance #fintech #aioversight #biasmitigation #accountableai #responsibleai #modelvalidation #riskmanagement #aitools #aiops #secureai #aiinbanking #aicompliance #aiforethics #aiindustry #modelintegrity #aiinbusiness #cyberrisk #dataprivacy #artificialintelligence #aiinretail #aiaudit #techregulation #aimonitoring #aigovernanceframework #aiinnovation #ai2025Top of Form

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

OPT Jobs in the USA: A Complete Guide for International Students

The F-1 visa holders among international students at U.S. universities can earn practical experience in their field through Optional Practical Training (OPT) jobs. Recent graduates with OPT student status can work overseas for 12 months although STEM graduates have extended employment permission to 24 months.

This guide serves international students by explaining the process for finding OPT jobs in USA and presenting the most suitable employment options and strategies to obtain work as an overseas student.

Understanding Optional Practical Training (OPT) Jobs

International students pursuing higher education can secure employment opportunities through Optional Practical Training, which provides pre-completion OPT for current students and post-completion OPT following graduation. Students who participate in Optional Practical Training jobs benefit from practical field experience that improves their prospects for permanent employment and brings more opportunities for Opt jobs for international students.

Types of OPT Jobs for International Students

Pre-Completion OPT

The OPT authorization is accessible to degree-seeking students during their academic years.

Post-Completion OPT

Students who graduated can utilize this post-graduation opportunity to perform employment for a maximum of twelve months.

STEM OPT Extension

Students majoring in STEM (Science Technology Engineering and Mathematics) fields have the opportunity to extend their post-completion OPT permission by an extra 24 months.

Top Industries Offering OPT Student Jobs

Several professional sectors recruit OPT student candidates because of their specialized capabilities. Entry-level OPT positions perform best within these three sectors.

1. Information Technology (IT)

Software Development

Data Science

Cybersecurity

Cloud Computing

2. Engineering

Mechanical Engineering

Civil Engineering

Electrical Engineering

Automotive Engineering

3. Healthcare & Biotechnology

Clinical Research

Bioinformatics

Healthcare Management

4. Finance & Accounting

Financial Analysis

Taxation

Investment Banking

5. Marketing & Business Development

Digital Marketing

Sales & Business Analysis

Market Research

Best Locations for OPT Jobs in the USA

The job opportunities for OPT candidates extend across America yet particular states and cities provide superior OPT jobs in the USA

1. OPT Jobs in California

International students typically search for OPT jobs in California since it serves as a central point for the technology healthcare and finance industries. The cities of San Francisco and San Diego along with Los Angeles provide numerous entry-level positions for international students after OPT ends and these positions exist throughout the IT sector as well as biotech and business fields.

2. New York

The financial core of New York City creates attractive opportunities for bank jobs and marketing and hospitality-related positions that serve as OPT sponsorship positions.

3. Texas

The Texas cities including Austin Houston and Dallas maintain thriving markets for students holding OPT visas to find employment in engineering together with IT and healthcare sectors.

4. Illinois

The Chicago metropolitan area provides students with multiple positions in data analytics together with finance and accounting fields.

How to Find OPT Sponsorship Jobs

To secure an OPT sponsorship job through U.S. employers you must use strategic techniques for your search. These steps will enhance your odds of landing OPT sponsorship employment:

1. Use OPT-Specific Job Portals

The job portals OPTNation MyVisaJobs and Indeed assist OPT student with opportunity jobs through their targeted sections.

2. Network with Employers

Your search for entry-level OPT jobs will be more successful if you join job fairs as well as attend industry events and join LinkedIn networking groups where recruiters are seeking candidates.

3. Optimize Your Resume

Rephrase your resume with work experiences that demonstrate compatibility with US OPT job positions.

4. Apply for Internships

Experiencing full-time work as a result of internships provides students with valuable performance experience during their OPT period.

5. Work with Staffing Agencies

Staffing agencies help students with OPT status connect them to employment opportunities from US employers.

Conclusion

OPT students who succeed in finding OPT jobs in California will get an excellent launchpad for their American career. Your path to satisfying work will open through high-demand industries and strong networking connections and by customizing your job application approach.

The goal of investigating entry-level OPT student jobs throughout California and beyond will create a thriving professional future in American employment.

0 notes

Text

Voice And Speech Recognition Market Outlook, Competitive Strategies And Forecast

The global voice and speech recognition market size is anticipated to reach USD 53.67 billion by 2030, registering a CAGR of 14.6% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market is anticipated to witness an upsurge in the adoption of voice-activated systems, voice-enabled devices, and voice-enabled virtual assistant systems owing to the rising applications in the banking and automobile sectors. The escalating need to counter fraudulent activities and enhance security in the banking sector is boosting the adoption of voice biometrics for the authentication of users. The automobile sector is expected to gain momentum owing to advances in technology & emergence of innovative concepts, such as autonomous and connected cars.

The integration of the voice-activated software in future cars is anticipated to adopt technologies, such as noise abatement for selectively ignoring driving & passenger noises for providing an error-free and seamless experience to the operator. Voice recognition is also a core technology that is widely used in the healthcare sector to enhance the Electronic Health Record (HER) systems by providing an ease to the doctor to speak and keep the records instead of manual typing or writing. In 2018, the healthcare vertical held the largest market share and it is expected to grow significantly over the forecast period. AI-based voice and speech recognition software is expected to grow at the fastest CAGR from 2023 to 2030.

This is due to the continuous development of machine learning techniques and the integration of connected devices with personal assistants. For instance, Dragon Drive is a personal assistant developed by Nuance Communication Inc. that integrates various household appliances, cars, and smartphones that can be connected to a hub through the internet. Thus, an individual can get alerts about daily chores, work schedules, traffic updates, and many more alerts through the Dragon Drive. In addition, sentiment analysis using the changes in the pitch of the voice is anticipated to provide an opportunity to the market. However, the lack of accuracy of these technologies in recognizing the regional accents and dialects is expected to limit the market growth.

Gather more insights about the market drivers, restrains and growth of the Voice And Speech Recognition Market

Voice And Speech Recognition Market Report Highlights

• A rising trend in the development of Artificial Intelligence (AI)-based systems is expected to be the key factor driving the market growth over the forecast period

• Leveraging deep learning algorithms in voice & speech solutions for better search results is expected to be the key factor for the growth of the AI-based technology segment

• The deployment of speech recognition solutions in consumer and retail verticals is anticipated to lead to the high market growth

• This can be attributed to the changing lifestyles in countries, such as the U.S., Germany, and the U.K.

• Moreover, the growing adoption of smart electronics in India, China, Japan, and Brazil is likely to drive the market growth in the consumer vertical

• North America and the Asia Pacific are anticipated to witness considerable growth owing to the presence of several U.S.- and China-based players, such as Apple, Inc., Facebook, Inc., Baidu, Inc., Amazon.com, Inc., and Alphabet, Inc., working toward the development of this technology

• Key industry participants are focusing on integrating the AI technology in speech & voice recognition software to build superior products that would increase their user customer base

Voice And Speech Recognition Market Segmentation

Grand View Research has segmented the global voice and speech recognition market on the basis of function, technology, vertical, and region:

Voice & Speech Recognition Function Outlook (Revenue, USD Million, 2017 - 2030)

• Voice Recognition

o Speaker Identification

o Speaker Verification

• Speech Recognition

o Automatic Speech Recognition

o Text-to-Speech

Voice & Speech Recognition Technology Outlook (Revenue, USD Million, 2017 - 2030)

• AI-based

• Non-AI-based

Voice & Speech Recognition Vertical Outlook (Revenue, USD Million, 2017 - 2030)

• Automotive

• Enterprise

• Consumer

• BFSI

• Government

• Retail

• Healthcare

• Military

• Legal

• Education

• Others

Voice & Speech Recognition Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Italy

o Spain

o The Netherlands

o Switzerland

o Poland

• Asia Pacific

o China

o Japan

o India

o South Korea

o Singapore

o Pakistan

o Malaysia

o Australia

o Hong Kong

o Vietnam

• South America

o Brazil

o Argentina

o Chile

• Middle East & Africa

o UAE

o Saudi Arabia

o Israel

o South Africa

o Nigeria

Order a free sample PDF of the Voice And Speech Recognition Market Intelligence Study, published by Grand View Research.

#Voice And Speech Recognition Market#Voice And Speech Recognition Market Size#Voice And Speech Recognition Market Share#Voice And Speech Recognition Market Analysis#Voice And Speech Recognition Market Growth

0 notes

Text

Voice And Speech Recognition Market Size To Reach USD 53.67 Billion By 2030

Voice And Speech Recognition Market Growth & Trends

The global voice and speech recognition market size is anticipated to reach USD 53.67 billion by 2030, registering a CAGR of 14.6% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market is anticipated to witness an upsurge in the adoption of voice-activated systems, voice-enabled devices, and voice-enabled virtual assistant systems owing to the rising applications in the banking and automobile sectors. The escalating need to counter fraudulent activities and enhance security in the banking sector is boosting the adoption of voice biometrics for the authentication of users. The automobile sector is expected to gain momentum owing to advances in technology & emergence of innovative concepts, such as autonomous and connected cars.

The integration of the voice-activated software in future cars is anticipated to adopt technologies, such as noise abatement for selectively ignoring driving & passenger noises for providing an error-free and seamless experience to the operator. Voice recognition is also a core technology that is widely used in the healthcare sector to enhance the Electronic Health Record (HER) systems by providing an ease to the doctor to speak and keep the records instead of manual typing or writing. In 2018, the healthcare vertical held the largest market share and it is expected to grow significantly over the forecast period. AI-based voice and speech recognition software is expected to grow at the fastest CAGR from 2023 to 2030.

This is due to the continuous development of machine learning techniques and the integration of connected devices with personal assistants. For instance, Dragon Drive is a personal assistant developed by Nuance Communication Inc. that integrates various household appliances, cars, and smartphones that can be connected to a hub through the internet. Thus, an individual can get alerts about daily chores, work schedules, traffic updates, and many more alerts through the Dragon Drive. In addition, sentiment analysis using the changes in the pitch of the voice is anticipated to provide an opportunity to the market. However, the lack of accuracy of these technologies in recognizing the regional accents and dialects is expected to limit the market growth.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/voice-recognition-market

Voice And Speech Recognition Market Report Highlights

A rising trend in the development of Artificial Intelligence (AI)-based systems is expected to be the key factor driving the market growth over the forecast period

Leveraging deep learning algorithms in voice & speech solutions for better search results is expected to be the key factor for the growth of the AI-based technology segment

The deployment of speech recognition solutions in consumer and retail verticals is anticipated to lead to the high market growth

This can be attributed to the changing lifestyles in countries, such as the U.S., Germany, and the U.K.

Moreover, the growing adoption of smart electronics in India, China, Japan, and Brazil is likely to drive the market growth in the consumer vertical

North America and the Asia Pacific are anticipated to witness considerable growth owing to the presence of several U.S.- and China-based players, such as Apple, Inc., Facebook, Inc., Baidu, Inc., Amazon.com, Inc., and Alphabet, Inc., working toward the development of this technology

Key industry participants are focusing on integrating the AI technology in speech & voice recognition software to build superior products that would increase their user customer base

Voice And Speech Recognition Market Segmentation

Grand View Research has segmented the global voice and speech recognition market on the basis of function, technology, vertical, and region:

Voice & Speech Recognition Function Outlook (Revenue, USD Million, 2017 - 2030)

Voice Recognition

Speaker Identification

Speaker Verification

Speech Recognition

Automatic Speech Recognition

Text-to-Speech

Voice & Speech Recognition Technology Outlook (Revenue, USD Million, 2017 - 2030)

AI-based

Non-AI-based

Voice & Speech Recognition Vertical Outlook (Revenue, USD Million, 2017 - 2030)

Automotive

Enterprise

Consumer

BFSI

Government

Retail

Healthcare

Military

Legal

Education

Others

Voice & Speech Recognition Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Switzerland

Poland

Asia Pacific

China

Japan

India

South Korea

Singapore

Pakistan

Malaysia

Australia

Hong Kong

Vietnam

South America

Brazil

Argentina

Chile

Middle East & Africa

UAE

Saudi Arabia

Israel

South Africa

Nigeria

List of Key Players of Voice And Speech Recognition Market

Advanced Voice Recognition Systems, Inc.

Agnitio S.L.

Amazon.com, Inc.

Api.ai

Apple, Inc.

Anhui USTC iFlytek, Ltd.

Baidu, Inc.

BioTrust ID B.V.

CastleOS Software, LLC

Facebook, Inc.

Google, Inc.

International Business Machines Corp.

Microsoft Corp.

MModal, Inc.

Nortek Holdings, Inc.

Nuance Communications, Inc.

Raytheon Company

SemVox GmbH

Sensory, Inc.

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/voice-recognition-market

#Voice And Speech Recognition Market#Voice And Speech Recognition Market Size#Voice And Speech Recognition Market Share

0 notes

Text

"Empowering Energy: Key Players and Trends in the Battery Monitoring Industry

Battery monitoring systems are designed to inform users about the real-time status and health of batteries or battery banks, providing alerts on battery failures and the net charge available. These systems play a crucial role in preventing severe damage, prolonging battery life, and ensuring efficiency. Monitoring charging, discharging, load, AC mains frequency and voltage, ambient temperature, and battery temperature are key functions of a battery monitoring system. Additionally, these systems generate live reports on battery performance and trigger alarms in case of any faults.

Request 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞 : https://www.alliedmarketresearch.com/request-toc-and-sample/16324

COVID-19 Impact Analysis

The global effects of the COVID-19 pandemic have significantly impacted the battery monitoring system market. Disruptions in exports, imports, manufacturing, and changes in consumer consumption patterns have led to challenges and a shift in demand during the pandemic.

Top Impacting Factors

The increasing adoption of battery monitoring systems in electric vehicles (EVs) is a major driver for market demand. Governments globally support battery manufacturers for EVs, aligning with the transition to renewable energy sources. Additionally, the need to prevent unplanned outages, the rise in demand for electric vehicles, and improved operational efficiency contribute to the growing demand for battery monitoring systems.

Market Trends

Growing Demands for Electricity at Various End-Use Industries: The necessity to prevent unplanned outages, coupled with the increased demand for electric vehicles and improved battery operational efficiency, drives the demand for battery monitoring systems. The rise in renewable power generation and the use of these systems in data center applications further boost market growth.

Increased Usage in Data Centers: Data centers, critical for organizations' core applications, rely on batteries for uninterrupted power supply. Integrating battery monitoring systems enhances operations and safety in data centers, where battery failures can disrupt operations and result in financial losses.

Focus on Environmental Safety Concerns: The growing demand for clean energy and concerns about global warming have led to a shift towards environmentally friendly solutions. Battery monitoring systems play a crucial role in ensuring the proper functioning of clean technologies and applications dependent on batteries, thereby supporting environmental safety initiatives.

𝐄𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 : https://www.alliedmarketresearch.com/purchase-enquiry/16324

Key Benefits of Report

The report provides an analytical overview of the battery monitoring system market, offering insights into current trends and future estimations to identify potential investment opportunities. It covers key drivers, restraints, and opportunities, along with a detailed analysis of market share. The quantitative analysis highlights the growth scenario, while Porter's five forces analysis illustrates buyer and supplier potency. The report offers a comprehensive analysis of the battery monitoring system market based on competitive intensity and future competition dynamics.

Battery Monitoring System Market Report Highlights

Aspects Details

By Type

Wired

Wireless

By Component

Hardware

Software

𝐆𝐞𝐭 𝐚 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 @ : https://www.alliedmarketresearch.com/request-for-customization/16324

By Application

Telecommunication

Automotive

Energy

Industries

Others

By Battery Type

Lithium-ion

Lead Acid

Others

By Energy Storage

Batteries

Thermal

Mechanical

By Region

North America (U.S., Canada, Mexico)

Europe (France, Germany, Italy, Spain, United Kingdom, Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia Pacific)

LAMEA (Brazil, South Africa, Saudi Arabia, Rest of LAMEA)

Key Market Players ABB, BatteryDAQ, Schneider Electric, Hbl Power Systems, Eagle Eye Power Solutions, LLC, Btech Inc, Socomec, Powershield, Canara, Texas Instrument

0 notes

Text

2024–2033 Mass Spectrometry Market Analysis: Key Players, Size, and Forecast

Astute Analytica stands out as a premier provider of comprehensive Mass Spectrometry market research reports specifically tailored for the healthcare sector. Our commitment lies in delivering valuable insights and research that empower healthcare organizations to navigate the complexities of this rapidly evolving industry.

By understanding the trends and opportunities within the Mass Spectrometry market, businesses can strategically position themselves for success in an increasingly competitive environment. The integration of digital solutions, a focus on sustainability, and the adaptation to new care delivery models are essential components for enhancing patient care and ensuring the long-term viability of healthcare systems.

Mass spectrometry market was valued at US$ 6.42 billion in 2024 and is projected to hit the market valuation of US$ 12.06 billion by 2033 at a CAGR of 7.85% during the forecast period 2025–2033.

A Request of this Sample PDF File@- https://www.astuteanalytica.com/request-sample/mass-spectrometry-market

The Essential Path of Digital Transformation in Healthcare

As we approach 2025, health system leaders across the globe are prioritizing efforts to drive efficiencies, boost productivity, and improve patient engagement. A significant factor influencing these initiatives is the accelerated digital transformation within healthcare, which has been identified as the most impactful issue for global health systems in the coming years. This emphasis on digitalization is not surprising, considering that healthcare has lagged behind other industries, such as retail and finance, in adopting advanced digital technologies.

According to recent surveys, approximately 70% of respondents believe that investing in technology platforms for digital tools and services will be crucial for their organizations. Furthermore, 60% of leaders highlighted the necessity of investing in core technologies, including electronic medical records (EMRs) and enterprise resource planning (ERP) software. Notably, around 90% of C-suite executives anticipate a significant acceleration in the use of digital technologies by 2025, with half expecting a profound impact on their operations.

The Rise of Consumer-Driven Digital Health Tools

The growing adoption of connected monitoring devices and digital tools among consumers is reshaping the healthcare landscape. In 2024, 43% of consumers are expected to utilize these technologies, up from 34% in 2022. This shift aligns with the highly personalized experiences that consumers have come to expect from industries such as banking, retail, and entertainment. Digital monitoring tools empower consumers by providing trending data that supports their health concerns, thereby enhancing their agency during patient-clinician interactions. This increased control and confidence is particularly vital in areas like maternal health, where timely and informed interactions can prevent adverse outcomes.

Mergers and Acquisitions in Healthcare Technology

The healthcare technology sector is poised for a surge in mergers and acquisitions (M&A) as we move into 2024. The COVID-19 pandemic has underscored the importance of health technology and healthcare delivery systems, prompting a renewed focus on consolidation within the industry. In 2023, biopharma M&A experienced a remarkable rebound, with an aggregate deal value increasing by 79% compared to 2022, reaching approximately $152 billion—the highest level since 2019. The average deal size has also shown an upward trend, approaching levels not seen since 2020. Several positive catalysts are expected to support this momentum in 2024, including emerging threats to growth, a fear of missing out on opportunities, and a resurgence of high-prevalence conditions that necessitate innovative solutions.

The U.S. Healthcare Market Landscape

The United States remains the world's largest healthcare market, with healthcare spending reaching $4.3 trillion in 2021, translating to about $12,900 per person. However, as consolidation continues and exposure to government payers increases, healthcare markets in other regions are anticipated to grow at a faster pace. Despite the substantial investment in healthcare, the outcomes do not always reflect this high expenditure, leading to significant disparities in access and quality of care. The U.S. healthcare system is evolving in response to these challenges, particularly the pressures of rising costs and an increasing number of uninsured individuals.

Navigating Political Changes and Regulatory Shifts

As the healthcare industry prepares for 2025, potential changes in political leadership could usher in new policy directions and regulatory shifts. Leaders within the healthcare space must remain agile, anticipating policy reforms that could reshape operational priorities, including resource allocation and shifts in care delivery models. Building collaborative ecosystems and staying informed about legislative developments will be crucial for organizations aiming to thrive in this dynamic environment.

For Purchase Enquiry: https://www.astuteanalytica.com/industry-report/mass-spectrometry-market

Market Segmentation and Analysis

In its quest for a granular understanding of the Mass Spectrometry market, the report segments the industry into various categories. This segmentation facilitates a more detailed analysis of the dynamics within each segment, allowing stakeholders to identify specific growth opportunities and challenges. By breaking down the market, the report aids in crafting targeted strategies tailored to the unique characteristics of each segment.

By Product Type

Instruments

Consumables & Services

By Technology

Hybrid Mass Spectrometry

Triple quadrupole (Tandem)

Quadrupole Time-of-Flight (Q-TOF)

Fourier Transform Mass Spectrometry (FT-MS)

Single Mass Spectrometry

Ion trap

Quadrupole

Time-of-Flight (TOF)

By Application

Proteomics

Clinical Medicine

Mass Spectrometry Imaging

Geology And Space Science

Forensic Applications

Others

By End User

Research & Academic Institutes

Pharmaceutical & Biotechnology Companies

Government & Environmental Agencies

Food & Beverage Industry

Hospitals & Diagnostic Centers

By Region

North America

The U.S.

Canada

Mexico

Europe

Western Europe

The UK

Germany

France

Italy

Spain

Rest of Western Europe

Eastern Europe

Poland

Russia

Rest of Eastern Europe

Asia Pacific

China

India

Japan

Australia & New Zealand

South Korea

ASEAN

Rest of Asia Pacific

Middle East & Africa (MEA)

Saudi Arabia

South Africa

UAE

Rest of MEA

South America

Argentina

Brazil

Rest of South America

Geographical Segmentation

The report further segments the market into geographical regions, including North America, South America, Asia, Europe, Africa, and Others. Each region is examined with a focus on key countries, providing insights into the current market size and forecasts extending until 2033. This geographical breakdown is critical for understanding regional market dynamics and tailoring strategies to meet local demands effectively.

Competitive Landscape

A significant portion of the report is dedicated to analyzing the competitive landscape within the Mass Spectrometry market. This includes a comprehensive examination of leading Mass Spectrometry product vendors, highlighting their latest developments and market shares in terms of shipment and revenue. By profiling these major players, the report offers valuable insights into their product portfolios, technological capabilities, and overall market positioning.

The report identifies key players in the Mass Spectrometry market, providing a closer look at their contributions to the industry. This competitive profiling is essential for understanding the strengths and weaknesses of various companies, enabling stakeholders to make informed decisions and devise effective strategies in a crowded marketplace.

Thermo Fisher Scientific, Inc.

MKS Instruments

Agilent Technologies, Inc.

Danaher Corporation (SCIEX)

Waters Corporation

Bruker Corporation

Shimadzu Corporation

PerkinElmer, Inc.

Rigaku Corporation

LECO Corporation

JEOL Ltd.

Other Prominent Players

Download Sample PDF Report@- https://www.astuteanalytica.com/request-sample/mass-spectrometry-market

About Astute Analytica: