#GST billing procedure

Explore tagged Tumblr posts

Text

Simplify Your GST Billing Process with Our Invoice Temple - Online Bill Format

GST Billing

The Goods and Services Tax (GST) is an indirect tax imposed on the supply of goods and services in India. It has replaced several indirect taxes previously charged by the state and federal governments.

The GST is a complex tax scheme, and businesses might find it hard to comply with the numerous laws and regulations. Billing is one of the most difficult issues that businesses confront.

Businesses can, however, use our Invoice Temple — online bill format to ease their GST invoicing process and comply with GST rules and regulations.

In India, the GST (Goods and Services Tax) is an indirect tax levied on the sale of goods and services. It is a comprehensive tax system that has replaced many indirect taxes that were previously levied by the state and central governments. The GST has been introduced with the aim of simplifying the tax structure, reducing the tax burden on businesses, and boosting economic growth.

The GST bill works in the following way in India:

GST Registration: The initial step in the GST billing procedure is to register for GST. GST registration is required if the average annual turnover of the company exceeds Rs. 20 lakh (Rs. 10 lakh for rural and northeastern enterprises). Businesses receive a GSTIN (Goods and Services Tax Identification Number) after they register.

GST Invoicing: Once registered, businesses are required to issue GST-compliant invoices for all goods and services supplied. The GST invoice should include the supplier’s and recipient’s names and addresses, their GSTINs, the date of supply, the description of the goods or services supplied, the HSN code (Harmonized System of Nomenclature) or SAC code (Services Accounting Code), the quantity of goods or services supplied, the taxable value, and the GST rate and amount.

GST Calculation: The GST amount is calculated based on the GST rate applicable to the goods or services supplied. The GST rate varies depending on the nature of the goods or services supplied. There are four different tax rates under the GST regime — 5%, 12%, 18%, and 28%.

GST Payment: Once the GST invoice is issued, the supplier is required to collect the GST amount from the recipient and pay it to the government. GST payments can be made online through the GST portal or through authorized banks.

GST Returns: Businesses are required to file GST returns on a monthly or quarterly basis, depending on their turnover. The GST returns should include details such as the total sales, purchases, and GST paid and collected during the period. The GST returns can be filed online through the GST portal.

GST Billing Process with Invoice Temple:

We, Invoice Temple — online bill format is designed to make it easy for businesses to create GST-compliant invoices. It is a user-friendly platform that can be accessed from anywhere and at any time. With our online bill format, businesses can create invoices quickly and efficiently, and ensure that they are GST-compliant.

Our effective online billing software format is customizable, which means that businesses can add their company logo, address, and other details to the invoice. This helps to make the invoice look professional and adds a personal touch to it.

Our online bill format also makes it easy to add the details of the goods and services that have been supplied. The GST rules require businesses to provide specific information on their invoices, such as the HSN or SAC codes, the quantity of the goods or services, and the value of the goods or services. Our online bill format has pre-defined fields for all these details, making it easy for businesses to add them to the invoice.

In addition to this, Our Invoice Temple — online bill format also calculates the GST automatically. This means that businesses do not need to calculate the GST manually, which can be time-consuming and prone to errors. The online bill format automatically calculates the GST based on the HSN or SAC codes and the value of the goods or services supplied.

Our online bill format also generates reports that can be used for GST compliance. Businesses can generate reports for sales, purchases, and other transactions, which can be used to file GST returns. The reports are generated in a standardized format that is compliant with the GST rules and regulations.

Invoice Temple online bill format is also secure and reliable. It is hosted on secure servers that are protected by firewalls and other security measures. This ensures that the data is safe and secure and cannot be accessed by unauthorized persons.

Another benefit of our online bill format is that it is cost-effective. Businesses do not need to invest in expensive software or hardware to use the online bill format. They can simply access it through a web browser and start using it immediately.

Finally, the online bill format is scalable. It is suitable for companies of all sizes, from small start-ups to major businesses. As the business grows, the online bill format can be adjusted and scaled to match the demands of the company.

Final Thoughts

In conclusion, our online bill format is an essential tool for businesses that need to comply with the GST rules and regulations. It simplifies the GST billing process and makes it easy for businesses to create GST-compliant invoices. With its customizable fields, automatic GST calculation, and reporting features, the online bill format saves time and effort for businesses. It is also secure, reliable, cost-effective, and scalable, making it an ideal solution for businesses of all sizes.

0 notes

Text

The House of Commons has passed legislation that will remove the federal sale tax for two months from a range of items, including childrens' toys, books, restaurant meals and takeout, as well as beer and wine. As expected, the NDP helped the minority Liberals push the exemption through Thursday night. The Conservatives voted against the bill, calling the measure a "temporary two-month tax trick," as did the Bloc Québécois. The bill, which the Liberals and NDP agreed to fast-track through the usual procedural steps, now goes to the Senate. Once passed, the legislation will provide a GST rebate beginning Dec. 14. The tax vacation will remain in effect until Feb.15, 2025.

Continue Reading

Tagging: @newsfromstolenland

#taxes#holidays#liberal party of canada#ndp#tax breaks#cdnpoli#canadian politics#canadian news#canada

49 notes

·

View notes

Text

How to Register a Private Limited Company in India: A Step-by-Step Guide

Starting a business in India? One of the most reliable and sought-after business structures is a private limited company. With the increasing number of startups and entrepreneurs, private limited company registration in India has become a preferred choice because of the benefits like limited liability, separate legal identity, and ease of funding.

In this article, we’ll cover the key advantages and the registration process of a private limited company in India.

Why Opt for a Private Limited Company?

Choosing a private limited company offers multiple benefits:

Limited Liability Protection: Owners’ personal assets are protected from company liabilities.

Separate Legal Entity: The company can own assets, incur debts, and sue or be sued.

Credibility and Investor Confidence: Investors and banks are more willing to engage with registered companies.

Perpetual Succession: The company continues irrespective of changes in shareholders or directors.

Attractive for Funding: Easier to raise capital via equity or venture capital.

Stepwise Process for Private Limited Company Registration in India

The Ministry of Corporate Affairs (MCA) has simplified the incorporation procedure. Below are the main steps to complete your private limited company registration in India:

Digital Signature Certificate (DSC) Obtain DSCs for all directors for secure online filings.

Director Identification Number (DIN) Apply for DIN for all proposed directors using the MCA portal.

Name Approval Submit the desired company name(s) through the RUN service to ensure availability.

Filing SPICe+ Form This all-in-one form covers company incorporation, DIN allotment, PAN and TAN application, and optionally GST registration.

Prepare MOA and AOA These documents define your company’s objectives and governance.

Incorporation Certificate Issuance After verification, the Registrar of Companies (ROC) issues the certificate confirming your company’s registration.

Documents Needed for Registration

To successfully complete the process, prepare these essential documents:

Identity proof (PAN card, Aadhar card) of directors

Address proof (bank statement, electricity bill)

Passport-size photographs of directors

Registered office proof (rent agreement, NOC)

Passport copy for foreign nationals (if any)

Post-Incorporation Requirements

After registration, your company must comply with these legal requirements:

Open a dedicated bank account in the company’s name

Appoint statutory auditors

File commencement of business declaration (Form INC-20A)

Maintain all necessary statutory records and books

File annual returns and financial statements with ROC

Final Thoughts

Choosing private limited company registration in India provides a robust foundation for your business, offering flexibility, legal protection, and growth opportunities. With streamlined government processes, it’s easier than ever to register and start operations confidently.

#registration in India#charted accountant#private limited company registration in India#company registration in india

2 notes

·

View notes

Text

Company Registration in India by Mercurius & Associates LLP

Starting a business in India requires a proper legal structure, and registering a company is the first crucial step. Mercurius & Associates LLP offers seamless company registration services to help entrepreneurs establish their business with ease. Whether you are a startup or an established entity, understanding the company registration process is essential to ensure legal compliance and business growth.

Why Register a Company in India?

Registering a company in India provides several benefits, such as:

Legal Recognition – A registered company enjoys legal status and credibility.

Limited Liability Protection – Shareholders' liability is limited to their shares.

Easy Fundraising – Registered entities can raise funds from banks and investors.

Perpetual Succession – The company continues to exist even if ownership changes.

Tax Benefits – Companies can avail of various tax incentives and exemptions.

Types of Companies You Can Register

Mercurius & Associates LLP provides assistance in registering different types of companies based on business needs:

Private Limited Company (PLC) – Ideal for startups and small businesses seeking investment.

Public Limited Company – Suitable for large-scale businesses planning to raise capital from the public.

Limited Liability Partnership (LLP) – A mix of partnership and corporate structure with limited liability.

One Person Company (OPC) – Best for solo entrepreneurs wanting limited liability.

Sole Proprietorship & Partnership Firm – Suitable for small businesses with fewer compliance requirements.

Step-by-Step Process of Company Registration

Mercurius & Associates LLP ensures a hassle-free company registration process, which includes:

Step 1: Choosing the Right Business Structure

Select the company type that aligns with your business goals and legal requirements.

Step 2: Obtaining Digital Signature Certificate (DSC)

DSC is required for digitally signing incorporation documents.

Step 3: Applying for Director Identification Number (DIN)

Every director must have a unique DIN issued by the Ministry of Corporate Affairs (MCA).

Step 4: Name Approval

Propose and reserve a unique company name through the MCA’s RUN (Reserve Unique Name) service.

Step 5: Drafting & Filing Incorporation Documents

Submit essential documents, including the Memorandum of Association (MoA) and Articles of Association (AoA).

Step 6: Company Incorporation Certificate

Once approved by the MCA, you will receive a Certificate of Incorporation (COI) along with a Corporate Identity Number (CIN).

Step 7: PAN, TAN & Bank Account Setup

Post-registration, apply for PAN (Permanent Account Number) and TAN (Tax Deduction & Collection Account Number), and open a business bank account.

Documents Required for Company Registration

To register your company, you need the following documents:

PAN Card and Aadhaar Card of directors

Address proof (Utility bills, Bank statements)

Registered office address proof (Rental agreement, Electricity bill)

MoA & AoA

Passport-size photographs of directors

Why Choose Mercurius & Associates LLP?

With years of expertise, Mercurius & Associates LLP provides end-to-end assistance in company registration. Here’s why you should choose us:

Expert Guidance – Our professionals simplify legal procedures.

Quick & Hassle-Free Process – Ensuring smooth registration with minimal paperwork.

Affordable Pricing – Transparent and cost-effective solutions.

Post-Incorporation Support – Assistance with GST registration, tax filing, and compliance.

Conclusion

Registering a company in India is an essential step towards building a legally recognized business. Mercurius & Associates LLP offers expert guidance to ensure a seamless company registration process. Whether you need help with legal formalities, documentation, or compliance, our team is here to assist you at every step.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

3 notes

·

View notes

Text

A Complete Guide to Customs Clearance in Shipping in India

Introduction

Customs clearance is an essential part of international shipping, ensuring goods comply with all legal and regulatory requirements before they are allowed to enter or leave a country. In India, the customs process can be intricate, involving several regulations, duties, and documentation. Failure to follow proper customs procedures can lead to delays, fines, and additional costs for businesses.

Whether you’re an importer or exporter, understanding the customs clearance process can help avoid unnecessary complications and streamline your shipping operations. In this guide, we’ll walk you through the entire customs clearance process in India, from the steps involved to the required documents, duties and taxes, and tips to ensure smooth clearance.

What is Customs Clearance?

Customs clearance is the official procedure that permits goods to enter or leave a country after verifying compliance with trade regulations. The process involves:

Documentation Verification: Ensuring all required documents are in place.

Duty & Tax Assessment: Calculating and paying applicable customs duties.

Physical Inspection: Checking goods to ensure they comply with regulations.

Approval & Release: Granting permission for goods to proceed to their final destination.

Why is Customs Clearance Important?

Customs clearance is critical for several reasons:

Legal Compliance: Ensures that shipments adhere to Indian trade laws.

Avoids Delays & Penalties: Proper documentation helps avoid shipment hold-ups.

Ensures Tax & Duty Collection: Ensures the government collects the necessary revenue from imports and exports.

Prevents Smuggling & Illegal Trade: Customs checks prevent prohibited goods from entering or leaving the country.

Key Authorities Involved in Customs Clearance in India

The following government agencies oversee the customs clearance process in India:

Central Board of Indirect Taxes and Customs (CBIC): Regulates customs policies and tariffs.

Directorate General of Foreign Trade (DGFT): Issues export/import licenses.

Food Safety and Standards Authority of India (FSSAI): Regulates food imports.

Plant Quarantine & Animal Quarantine Departments: Control agricultural and livestock imports.

Drug Controller General of India (DCGI): Approves pharmaceutical imports.

Step-by-Step Process of Customs Clearance in India

Step 1: Importer/Exporter Registration

Before engaging in international trade, businesses must complete the following registrations:

Obtain an Import Export Code (IEC) from the DGFT.

Register with the GST (Goods & Services Tax) system.

Get a Customs Broker License if necessary.

Step 2: Filing Shipping Bill (Export) or Bill of Entry (Import)

For Exports: File a Shipping Bill with Indian Customs.

For Imports: File a Bill of Entry to declare imported goods. Both documents are processed through the Indian Customs Electronic Gateway (ICEGATE).

Step 3: Customs Duty Assessment

Indian Customs calculates applicable duties and taxes based on:

Type of Goods: Based on HS Code classification.

Declared Value: The invoice value converted to INR.

Tariff Rates: According to India’s customs policies.

Step 4: Payment of Customs Duties & Taxes

Importers must pay the required customs duties, Integrated GST (IGST), and other charges before their goods can be cleared.

Types of Customs Duties in India:

Basic Customs Duty (BCD): Standard import tax on goods.

Integrated GST (IGST): Applicable on imports under GST law.

Social Welfare Surcharge: Additional tax imposed on imported goods.

Anti-Dumping Duty: Levied on goods priced below market value to protect local industries.

Safeguard Duty: Imposed to protect domestic industries from a surge in imports.

Step 5: Customs Inspection & Verification

Goods may undergo physical inspection for regulatory compliance. The clearance channels are:

Green Channel: No inspection for trusted importers/exporters.

Yellow Channel: Requires documentary check.

Red Channel: Requires physical examination of goods.

Certain products like pharmaceuticals, electronics, and food items may need special approvals from regulatory bodies.

Step 6: Customs Clearance & Release of Goods

After customs duties are paid and goods pass inspection, the Customs authorities issue a clearance certificate. The shipment is then:

Released for domestic delivery (Imports).

Allowed to depart for export (Exports).

Common Challenges in Customs Clearance & How to Overcome Them

Incorrect Documentation: Always double-check paperwork before submission.

High Customs Duties: Check for exemptions under Free Trade Agreements (FTAs).

Customs Delays: Work with an experienced customs broker to prevent delays.

Restricted & Prohibited Goods: Ensure compliance with Indian trade policies.

How to Ensure Smooth Customs Clearance?

To ensure a seamless customs clearance process:

Work with a Licensed Customs Broker: Brokers handle documentation and ensure compliance.

Classify Goods Correctly: Use the accurate HS Code to avoid misclassification.

Ensure Proper Valuation: Declare the correct invoice value to avoid penalties.

Use ICEGATE for Faster Processing: Digitally file documents for quicker clearance.

Stay Updated on Customs Regulations: Customs policies can change, so stay informed with CBIC updates.

Top Customs Clearance Service Providers in India

Everfast Freight Pvt. Ltd.

Specialization: Customs Brokerage & Freight Forwarding

Expertise in Customs Clearance for Imports & Exports

Documentation Handling & Compliance Management

Freight Forwarding & Supply Chain Solutions

Verfast Freight Forwarders Pvt. Ltd.

Specialization: Global Shipping & Logistics

Seamless Customs Documentation Processing

Duty Optimization & Trade Compliance

Multimodal Transport & Warehousing

DHL Global Forwarding

Specialization: International Logistics

Fast-Track Customs Clearance

Integrated Freight Solutions

Trade Compliance & Consultancy

FedEx Express

Specialization: Express Shipping

Customs Brokerage for Time-Sensitive Shipments

Digital Clearance Documentation

Global Trade Consulting

Future of Customs Clearance in India

Digitization & AI-Based Customs Clearance: Faster processing with automation.

Blockchain Technology in Trade Compliance: Enhancing transparency and security in the customs process.

Green Customs Initiatives: Promoting sustainability in cargo handling.

Integration with GST & E-Invoicing: Simplifying tax and duty calculations.

Conclusion

Customs clearance is a vital part of international shipping, ensuring goods comply with all regulations before entering or leaving India. Understanding the customs clearance process, required documents, duties, and compliance measures will help businesses avoid delays, penalties, and extra costs.

Partnering with a reliable freight forwarder like Everfast Freight Pvt. Ltd. or Verfast Freight Forwarders Pvt. Ltd. ensures efficient and hassle-free customs clearance for smooth international trade operations.

🚀 Need a reliable logistics partner? Contact: Everfast Freight Pvt. Ltd. today!

#air cargo#cargo shipping#freightforwarding#cargo services#shipping#transportation#sea freight#logistics

2 notes

·

View notes

Text

A Successful Inventory and Billing Solution for Businesses in Saudi Arabia

One's inventory and bills can be the lifeline in a fast-paced, modern business environment within Saudi Arabia (KSA). Be it small or big enterprises, an efficient inventory and billing solution leads the way for the difference in the end. From tracking levels of stock towards generating perfect, accurate invoices, these tools enable your business to run seamlessly. Business houses in KSA prefer Tally Solutions as one of the top ones to gain complete solutions related to managing the inventory and requirements for billing.

Why inventory software is important to Saudi Arabian businesses:

Inventory software is something that cannot be avoided today as it really helps the business manage stock and optimize operations. Here are a few reasons why it becomes necessary for the businesses in Saudi Arabia:

It is real-time monitoring of the stock; thus, no overstocking and stockouts are encountered.

Improvement in the accuracy; here human errors can be completely removed, thus avoiding any kind of mismanagement of the inventory as well as missed orders.

Excess stocks are reduced so that holding costs are also low.

There is assurance the product will get delivered on the scheduled date with adequate inventory availability for customer fulfilment.

Tally Solutions is one of the leading companies, providing stockroom software across the globe including KSA.

Key Features:

Inventory Monitoring: Maintains records of various warehouses, such that stock of various items and places can easily be viewable at any time.

Barcoding and Scanning: This allows easy identification of products with barcode scanning for faster data entry.

Procurement and Sales Management: It reduces the procurement and sales process. Paperwork is eliminated, thus increasing efficiency.

Stock Valuation: It provides multiple methods of inventory valuation, including FIFO, LIFO, and Weighted Average.

Integration Capabilities: It successfully integrates with every other business application like accounting smoothly without any kinds of hurdles flowing data.

Benefits of billing software for businesses in Saudi Arabia:

Efficient Management of Invoices: The whole procedure of raising and managing the invoices is automatic for saving time and avoiding any errors.

GST Compliance: All the invoices will be as per the Saudi tax rules, and all compliance concerning VAT and other financial compliances will be taken care of.

Customization: It would allow businesses the potential to personalize their invoices in accordance with the brand identification of the businesses.

Real-time Reporting: It would give real-time financial reporting, thus reducing the complexity and increasing the productivity of tracing payments and handling accounts.

1 note

·

View note

Text

gst accounting software in kollam

In today's rapidly developing business environment, it is not only necessary to comply with GST regulations and at the same time to efficiently master your finances. For Kollam companies, Xoerp offers a powerful and user-friendly solution tailored to the unique accounting needs of local companies. Whether you're a small shopkeeper, growing dealer, or a medium-sized company, Kollam's GST accounting software is designed to make your financial company seamless and stress-free.

Why Kollam companies need GST accounting software. As GST conformance becomes more and more strict, manual accounting procedures cannot be maintained. Switching to Xeroerps GST-Buchtungs software is returned directly via the software to generate Smart Move:

automated GST invoices and registration

GST compliant invoices, and manual activity times are saved.

Errors - Free Calculation

Reports No errors found Avoid penalties and fines with accurate tax calculations and verification measures.

Real-time Reports

Accept the company's financial overview, including sales, purchases, profit and loss, and GST liabilities.

Custom Reports for Local Needs

Xeroerp understands Kollam's local business environment. Our software supports the Malayalam language, regional tax structure and bank integration that are common in Kerala.

Key characteristics of Xoerp-GST Bookkeeping Software

✅ GST Compliant Billing

Create control invoices, credit stoves and purchase calculations using integrated GST rules.

✅ Inventory and Inventory Management

Automatic renewal quantity with stock levels, sales and resistance notifications.

✅ Sync different

accounts with local banks to automate transaction tracking.

✅Multi-user access

Only allow accountants, employees and business partners to do what they need.

✅ Cloud Access

manage your entire company anywhere with cloud-based backup and encryption.

Kollam

Customer Support

Enjoy quick and personalized support from team-based teams who understand the context of your business.

Who can benefit from it?

XEROERP's KOLLAM GST Accounting Software is available for

Retail and Supermarkets

Whosale Traders & Distributors

Startups & Small Business

Manufacturing Units Units

Freelancers

For tax registration, Xeroerp simplifies everything.

Why choose Xoerp with Kollam?

is made for Indian companies

Our software is basically built with GST, TDS and Indian compliance.

collam Local presence

based on Collam offers personal training, rapid support and direct interaction.

🔹Affordable Plans

acquire powerful features against some of the costs of other companies software.

joins the growth list of satisfied customers across Kerala, relying on Xoerp every day, with hundreds of local businesses trusted

.

Final Thoughts

If you're looking for reliable, efficient and affordable GST bookkeeping software in Kollam, you're just right as Xoerp. We combine technology with local expertise to provide solutions that are truly useful to your company. Say goodbye to accounting headaches, hello, hello to achieve smooth and intelligent financial management.

still visit https://xeroerp.com and book a free demo to experience the difference!

0 notes

Text

What is an Importer of Record? Roles, Obligations, And Prison Necessities Defined

In the international of global change, the time period Importer of record (IOR) plays a critical position in ensuring clean and legal motion of products across borders. If you're coping with international shipping or logistics, expertise what an Importer of Record is and why it matters is essential. On this guide, we’ll explore the definition, responsibilities, and prison obligations of an IOR and how professional services like One Union solutions can simplify this complicated manner.

What Does “Importer of Record” Imply?

The Importer of Record (IOR) is the entity or individual chargeable for ensuring that imported goods observe local legal guidelines and regulations. This includes proper Recordation, fee of obligations and taxes, and ensuring customs clearance. The IOR is legally accountable for the shipment from the moment it enters a rustic.

In easy terms, the Importer of Record is the felony owner or exact celebration who takes responsibility for the importation procedure.

Key Responsibilities of An Importer of Record

Appearing as an Importer of Record comes with huge duties. Here are the number one duties:

1. Customs Compliance

The IOR have to make sure that each one goods meet the import policies of the destination u . S . A .. This includes correct category of goods, valuation, and starting place assertion.

2. Recordation Control

The IOR is accountable for supplying and keeping all vital office work, inclusive of:

Business invoices

Packing lists

Import licenses

Certificate of beginning

Bills of lading

Those Records ought to be accurate, entire, and compliant with the customs authorities.

3. Payment Of Responsibilities and Taxes

An Importer of Record is chargeable for paying all required customs responsibilities, VAT/GST, and any other relevant prices. Failure to do so can bring about delays, fines, or seizure of goods.

4. Record-keeping

Customs authorities require importers to hold specific information of all shipments for a certain length—frequently among five to 7 years. The IOR should make sure comfy and prepared garage of those statistics.

5. Product Compliance

The goods being imported have to follow nearby standards and policies (e.G., safety certifications, labelling necessities, and environmental requirements). The IOR ensures this compliance.

Who Can Act as an Importer of Record?

The Importer of Record can be:

The actual patron or consignee of the products

A freight forwarder or logistics provider

A 3rd party IOR carrier provider like One Union solutions

In many instances, particularly with foreign agencies uploading into international locations like the America, United Kingdom, or India, groups hire IOR provider companies to behave on their behalf. That is regularly vital when the foreign entity doesn’t have a felony presence in the destination country.

Criminal Requirements for An Importer of Record

Being an IOR entails prison responsibilities under customs law. Those consist of:

Registering with customs authorities (such as obtaining an importer range or EORI)

Understanding and complying with nearby trade legal guidelines

Submitting accurate import declarations

Responding to audits or customs inspections

Failure to conform can result in hefty consequences, revocation of import rights, and harm to business organisation recognition.

Benefits of Hiring a professional IOR provider

Given the complexity, many businesses outsource this characteristic to specialists. Here’s how a enterprise like One Union solutions facilitates:

Quit-to-end compliance control

Actual-time updates and Record monitoring

Customs filing and tax payment assistance

Skilled support for navigating import challenges

The usage of a reliable Importer of Record service eliminates the danger of non-compliance and guarantees that items reach their destination legally and on time.

Why One Union Solutions?

One Union solutions specialize in international IOR services throughout a couple of international locations. We cope with:

Complicated import rules

Recordation and submitting

Fee of obligations and taxes

Compliance across industries (IT hardware, clinical devices, telecom, and extra)

With One Union solutions, agencies can awareness on increase while we manipulate the returned-cease import technique seamlessly.

Final Mind

The Importer of Record performs a pivotal position in ensuring that global shipments are legally compliant and effectively managed. Whether or not you are a small agency increasing globally or a multinational getting into new markets, expertise the obligations and requirements of an IOR is essential.

By means of partnering with experienced professionals like One Union Solutions, businesses can simplify the method and keep away from steeply-priced delays, penalties, and compliance problems.

#importer of record#foreign importer of record#importer on record usa#importer of record meaning#ior meaning#what is an importer of record

0 notes

Text

LawProGuru – Your Complete Partner for Company Registration and Business Compliance in Hyderabad

Starting and managing a business in India requires navigating through a web of legal, financial, and regulatory compliances. From selecting the right business structure to filing regular tax returns and securing licenses, entrepreneurs often find themselves overwhelmed. That’s where LawProGuru comes in—a professional consultancy firm based in Hyderabad that simplifies business registration and compliance through expert-driven and affordable services.

If you're searching for Company Registration in Hyderabad, LLP registration in Hyderabad, Private Limited Company Registration in Hyderabad, or GST return filing, LawProGuru offers a one-stop solution with transparency, speed, and reliability.

About LawProGuru

LawProGuru is an online consultancy and business services platform that specializes in company formation, legal documentation, tax filings, trademark services, and compliance management. The platform supports entrepreneurs, small businesses, startups, and MSMEs across India, with a strong presence in Hyderabad.

Whether you are launching a startup in Hyderabad or looking to register a new branch office, LawProGuru handles end-to-end procedures—from documentation to government approvals—making your journey seamless and stress-free.

Core Services Offered by LawProGuru

1. Company Registration Services in Hyderabad

Choosing the right legal structure is the foundation of a successful business. LawProGuru offers complete assistance in:

Private Limited Company Registration in Hyderabad Ideal for startups and businesses aiming for funding and scalability.

LLP Registration in Hyderabad A flexible structure with limited liability and operational simplicity.

One Person Company (OPC) Registration in Hyderabad Best suited for solo entrepreneurs looking for a corporate identity.

Section 8 Company Registration in Hyderabad For NGOs, non-profits, and charitable organizations.

Partnership Firm Registration Consultants in Hyderabad Fast and cost-effective solutions for family-run or small-scale businesses.

From name reservation to incorporation certificates and PAN/TAN registration, LawProGuru handles it all with expert precision.

2. GST Registration and Return Filing Services

Goods and Services Tax (GST) is a mandatory indirect tax in India. LawProGuru offers:

GST Registration in Hyderabad

Monthly and Quarterly GST Return Filing

E-Way Bill Generation

GST Amendments and LUT Filing

Advisory on GST compliance and notices

If you're a business owner dealing with product or service transactions, regular and accurate GST filings are crucial to avoid penalties. LawProGuru ensures timely filings and complete guidance.

3. Trademark Registration and Brand Protection

Building a brand requires protecting its identity. LawProGuru provides:

Trademark Search & Application

Trademark Consultants in Hyderabad

Objection and Opposition Handling

Trademark Renewal Services

With expert advice and prompt follow-ups, LawProGuru helps you safeguard your brand across India with valid and recognized trademarks under the Trade Marks Act, 1999.

4. Income Tax Return Filing and Tax Compliance

Stay on top of your tax obligations with our comprehensive IT services:

Income Tax Return (ITR) Filing for Individuals, Freelancers, Salaried Professionals, and Companies

Advance Tax Planning

TDS Returns

Audit Reports and Form 26AS Reconciliation

Filing accurate income tax returns on time is critical for both legal compliance and financial planning. LawProGuru makes it easy and paperless.

5. MSME/Udyam Registration

Small and Medium Enterprises are the backbone of India's economy. LawProGuru assists in MSME/Udyam Registration so you can benefit from:

Government subsidies

Loan interest concessions

Preference in tenders

Easier license and approval procedures

Registration is online and takes just a few hours with LawProGuru’s expert support.

6. FSSAI, Import Export Code (IEC), and Other Business Licenses

LawProGuru also helps with acquiring important business certifications and licenses, including:

FSSAI License Registration (for food businesses)

Import Export Code (IEC) for importers/exporters

Digital Signature Certificate (DSC)

Professional Tax, Shops & Establishment License

These legal licenses build trust with customers and vendors while ensuring compliance with government authorities.

7. Legal Drafting and Documentation

A single legal error can lead to massive losses. LawProGuru offers professional legal drafting for:

MOA & AOA

Shareholder Agreements

Partnership Deeds

Founders' Agreements

Employment Contracts

NDA and Vendor Agreements

Legal documentation is handled by experienced professionals to avoid loopholes and litigation risks.

Why LawProGuru?

Choosing LawProGuru means choosing a trusted partner who understands Indian legal frameworks and business goals. Here’s why thousands of clients trust us:

Affordable Pricing Plans

Expert Legal & Financial Professionals

100% Online and Paperless Process

Fast Turnaround Times

PAN-India Reach

Dedicated Client Support

Conclusion

In the fast-paced world of startups and entrepreneurship, staying legally compliant and operationally sound is not optional—it’s essential. Whether you're a new founder or a seasoned business owner, LawProGuru provides all the tools you need to succeed, from company registration to tax filing and beyond.

LawProGuru is more than just a compliance partner—it’s your legal backbone for business growth in Hyderabad and across India.

0 notes

Text

2025 Step‑by‑Step LLP Registration in India: The Ultimate Beginner’s Guide

Embarking on a new business journey? Understanding the LLP registration process India is essential for aspiring partners and entrepreneurs. In this guide, we unpack every stage—from digital signatures to statutory filings—so you can set up your Limited Liability Partnership with confidence and compliance.

What Is an LLP?

A Limited Liability Partnership (LLP) combines the operational flexibility of a traditional partnership with the limited liability protection of a company. In an LLP, each partner’s personal assets are generally protected from business debts, making it an attractive structure for small and medium‑sized enterprises, professional services, and startups alike.

Who Can Register an LLP?

Before diving into the formalities, make sure you meet these criteria:

Minimum Partners: At least two individuals or entities.

Designated Partner: One partner must be an Indian resident.

Digital Signature Certificate (DSC): Every partner needs a DSC to sign forms electronically.

Gathering Your Documents and Estimating Costs

To streamline the LLP registration cost and documents India, prepare the following in advance:

Identity Proof of Partners: Copies of PAN cards and Aadhaar cards.

Address Proof of Partners: Recent utility bills, passport, or voter ID.

Registered Office Proof: Latest electricity or telephone bill (not older than two months).

No‑Objection Certificate: From the property owner if you’re renting your office.

Subscription Agreement: A signed statement by partners committing to the LLP.

Government fees and professional charges typically range between ₹4,000 and ₹8,000, depending on your state of registration and the capital you declare. Planning this budget upfront avoids surprises later in the process.

Step‑by‑Step Registration Process

Wondering how to register an LLP online India? Follow these steps precisely:

Obtain Digital Signature Certificates (DSC): Visit a licensed Certifying Authority, submit identity and address proofs, and receive Class 2 or Class 3 DSCs. The DSC enables secure e‑filing on the MCA portal.

Apply for Designated Partner Identification Number (DPIN/DIN): Through the SPICe+ Part A form on the MCA website, furnish partner details along with your DSC. Upon approval, you receive unique DPINs for each designated partner.

Reserve Your LLP Name: Use the RUN‑LLP form to propose two distinct names, following the MCA naming guidelines. Approval typically takes 1–2 working days.

Incorporate Your LLP (SPICe+ Part B): Complete the SPICe+ Part B by entering details such as partner contributions, business activities, and registered office address. Upload the subscription agreement and NOC, then submit.

Payment of Government Fees: Pay the requisite government charges online. This fee varies by state and the amount of capital you declare.

Certificate of Incorporation: Once processed, the MCA issues an Incorporation Certificate containing your unique LLPIN (LLP Identification Number).

File the LLP Agreement (Form 3): Within 30 days of incorporation, you must upload and register the LLP agreement, which governs profit‑sharing, roles, and operational procedures.

Timeline and Key Deadlines

DSC & DPIN: 1–2 days

Name Reservation: 1–2 days

Incorporation Certificate: 2–4 days after application

LLP Agreement Filing: Within 30 days of incorporation

Sticking to these timelines helps you avoid penalties and maintain regulatory goodwill.

Post‑Registration Compliance

After incorporation, ongoing compliance keeps your LLP in good standing:

Annual Return (Form 11): File within 60 days of the financial year‑end.

Statement of Accounts & Solvency (Form 8): Submit within 30 days following financial year‑end.

Maintain Statutory Registers: Keep records of capital contributions, partner changes, and minutes of meetings.

Other Registrations: Obtain GST registration, Professional Tax, or Shops & Establishment licenses as applicable.

Adhering to these requirements prevents fines and builds investor confidence.

Why 2025 Is the Right Time to Register

With the MCA enhancing its online infrastructure, 2025 brings smoother digital filings, faster name approvals, and integrated compliance dashboards. By following this step-by-step LLP registration 2025 guide, you leverage the latest government updates and tools, ensuring a seamless incorporation experience.

Conclusion

Getting your LLP off the ground doesn’t have to be daunting. From securing DSCs to filing annual returns, each stage plays a crucial role in your business’s legal health. Armed with this comprehensive roadmap, you’re ready to launch and grow with peace of mind.

Ready to take the next step? Explore our detailed resources on LLP registration cost and documents India at Compliance Sarathi or book a free consultation—let’s make your LLP dream a reality!

Original Source: https://bit.ly/4lNYe2t

#LLP registration process India#how to register an LLP online India#step-by-step LLP registration#LLP registration cost and documents India

0 notes

Text

Hospital Management System Software Improves Billing

Billing is one of the most critical yet complex processes in hospital administration. Manual errors, duplicate entries, unclear service charges, and delayed insurance claims not only affect hospital revenue but also frustrate patients. This is where a hospital management system software becomes a powerful solution.

MediBest, a trusted hospital software company, provides the best hospital management software designed to optimize the billing process. With automation, accuracy, and real-time data, hospitals can now enhance patient satisfaction while improving financial control.

The Challenges in Traditional Hospital Billing Systems

Before digitization, hospital billing involved stacks of paper, manual data entry, and time-consuming reconciliation processes. Common issues included:

Missed charges for tests, consultations, or procedures

Human errors in data entry

Lack of synchronization between departments

Unclear breakdown of billing for patients

Delayed insurance and reimbursement claims

Difficulty in tracking pending payments or overcharges

These inefficiencies can lead to revenue leakage, patient dissatisfaction, and regulatory non-compliance.

How Hospital Management System Software Improves Billing

A hospital management system software simplifies and streamlines every aspect of hospital billing. By connecting all departments to a central system, it ensures accurate and timely invoicing, minimizing errors and delays.

Key Benefits of Automated Billing with HMS:

Accurate Charge Capture Every service, from consultations to surgeries, is logged and billed automatically.

Integrated Departmental Billing Lab, pharmacy, and radiology charges are captured directly into the patient’s final bill.

Real-Time Billing Updates As services are rendered, the system updates the billing module instantly.

Insurance Claim Management Automates pre-authorization, policy validation, and claim submission.

Customizable Billing Formats Supports different payment modes, discounts, tax structures, and packages.

Reduces Billing Errors Checks for duplicate entries, coding mistakes, and misapplied discounts.

Modules of Hospital Management Software That Enhance Billing

1. Patient Registration & Records

Right from the first patient interaction, HMS begins data capture. Demographic details, insurance policy, and billing category are stored, enabling personalized billing.

2. Outpatient & Inpatient Billing (OPD/IPD)

Charges are calculated based on treatment types, duration, consultation fees, and medication. Integration ensures all departments contribute their charges in real time.

3. Pharmacy & Diagnostic Integration

Pharmacy sales, lab reports, imaging, and other consumables are automatically pushed to the billing dashboard, avoiding manual entries.

4. Cashless & Insurance Processing

For insured patients, HMS assists with:

Policy validation

TPA linking

Cashless approval tracking

Automated claim submission

Reimbursement tracking

5. Billing Reports & Audit Trails

MediBest’s HMS provides detailed billing summaries, outstanding payment reports, and audit logs to enhance financial oversight.

Advantages of Using the Best Hospital Management Software

MediBest, as a top hospital software company, offers more than just automation. Our software is built for accuracy, transparency, and speed, resulting in:

📌 Faster Discharge Process With centralized data and automated billing, patients don’t have to wait for hours.

📌 Better Transparency Clear breakdown of charges improves patient trust.

📌 Improved Financial Control Real-time dashboards show revenue flow, pending dues, and departmental profitability.

📌 Minimized Revenue Leakage Accurate charge capture eliminates unbilled services.

📌 Compliance Ready GST-compliant billing, audit trails, and secure data backups help meet legal requirements.

Frequently Asked Questions (FAQs)

1. How does hospital management system software help in billing?

Hospital management system software automates billing by capturing charges directly from different departments like pharmacy, diagnostics, and nursing. It reduces human error, ensures real-time updates, and simplifies insurance processing, resulting in accurate and timely patient billing.

2. What are the common billing errors in hospitals?

Common issues include duplicate entries, missed services, wrong tariff codes, and unclaimed insurance. These errors can lead to revenue leakage and patient dissatisfaction. An HMS eliminates these by integrating billing with every service rendered.

3. Is HMS suitable for small and medium-sized hospitals?

Yes. Modern HMS platforms like MediBest are modular and scalable. They cater to hospitals of all sizes, from small nursing homes to multi-specialty hospitals, offering customized billing solutions and compliance features.

Final Thoughts

Hospitals must treat billing not just as a back-office function but as a patient experience and revenue driver. Delays, errors, and confusion can tarnish the reputation of even the most reputed medical institutions.

MediBest’s hospital management system software brings billing into the 21st century with automation, accuracy, and transparency. By integrating departments, automating workflows, and supporting insurance processes, it improves both operational efficiency and patient trust.

Contact Details 📍 Address:Corporate Office 303, IT Park Center, IT Park Sinhasa Indore, Madhya Pradesh, 452013

📞 Phone: ++91 79098 11515 +91 97139 01529 +91 91713 41515

📧 Email: [email protected] [email protected] [email protected] 🌐 Website: https://medibest.in/contact-us/

0 notes

Text

Top Regulatory Requirements New Businesses Cannot Ignore

A new business is an adventure that is very thrilling, yet it is accompanied by numerous legal and regulatory compliance requirements that should be fulfilled to allow successful operations without encountering hefty penalties.

Are you looking for the best Legal Compliance for a New Business? If yes, look no further than Corporate Clairvoyants is your one-stop shop when it comes to helping startups understand the messy world of compliance. The following is an exhaustive list of the best regulatory requirements every business startup ought to consider-

1. Business Registration and Licensing

Make sure your business is duly registered and that you possess all licenses before starting your business.

Company Registration- Use the Ministry of Corporate Affairs (MCA) to determine the proper company registration (e.g., Private Limited Company, Limited Liability Partnership (LLP), etc.).

GST Registration- This is an obligatory requirement in case your turnover sum is 20 lakh (in the case of special category states, it is 10 lakh) annually, following the Goods and Services Tax Act, 2017. This is a registration that enables you to charge tax to clients and be able to receive tax credit on the tax paid on business purchases.

Trade License- It is required to obtain a trade license offered by local municipalities to conduct legal activity in their region.

Industry-Specific License- There may be further licenses that will be needed since most businesses have specific licenses needed, such as FSSAI in the case of food businesses and a Drug License in the case of pharmaceuticals.

2. Intellectual Property Defense

Protect your innovations and brand-

Trademark Registration: This protects against abuse of your brand name, logo, and slogans.

Patent Filing: Grants rights to your inventions or distinct procedures.

Copyrights: It defends things that are original, such as software, designs, and marketing material.

The Design Registration: Protects the special visual appearance of your goods.

3. Compliance with Employment and Labor Laws: Employment and labor law compliance

Just and right treatment of your employees-

Employment Contracts- Employment, job roles, and duties should be clearly defined in terms of employment.

Minimum Wages Act- Comply with the stipulated minimum wage standards.

Provident Fund (PF) and Employees State Insurance (ESI)- Get registered and contribute accordingly by the existing thresholds.

Shops and Establishments Act: Adhere to the work, rest, and overtime guidelines.

Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013: Where 10 or more employees are working, form an Internal Complaints Committee (ICC) that can deal with cases of harassment at the workplace.

4. Tax Compliance

Keep current with the tax liability-

Income Tax, 1961- Annual returns must be filed, and Tax Deducted at Source (TDS), wherever necessary, will be deducted.

GST Compliance- Maintain the required records and file GST regularly (GSTR-1, GSTR-3B, and GSTR-9).

Advance Tax Payments- You can pay taxes beforehand in case your tax burden is higher than 10000 rupees in the financial year.

Tax Audits- File any tax audit in case your turnover exceeds the stipulated limits.

5. Data Security and Protection

As everything becomes more digitalized, the need to provide customer data security is the priority-

Data Privacy Laws- Adhere to the Information Technology Act,2000, and the prospective Personal Data Protection Bill.

Privacy Policy- A well-written policy should explain the method of collection, storage, and usage of customer data.

Cybersecurity- Take measures such as ensuring a strong security protocol is applied to data to prevent its abuse.

6. Environmental and Regulatory Compliance

Depending on your industry and business, you may also need to consider-

Environmental Clearances- For any business that may harm the environment, including a manufacturing unit.

Industry-Specific Regulations- Businesses need to remain aware of industry regulations (e.g., healthcare, finance, food preparation).

7. Regular Compliance Audits

It is important to conduct regular reviews and updates of your compliance status-

Internal Audits- Conduct an internal audit periodically to confirm compliance with all the regulatory requirements.

Record Keeping- Have clear financial records, contracts, employee records, and compliance records on file.

Legal Counsel- Seek legal advice to support compliance with complicated regulatory issues and limit the exposure to risks.

Conclusion

Starting any business is tough, and figuring out the regulatory environment can be tough. And that's exactly what Corporate Clairvoyants will help you with when it comes to the business side of things. Aside from helping new businesses get started, we offer enough corporate services that make compliance safe and easy, so you can focus your attention on being exponential. If you are searching forward to a Corporate Lawyer, we are here to assist you.

If you'd like to get in touch with any one of the Corporate Clairvoyants team members or just to learn more about us, visit Corporate Clairvoyants Corporate Services.

0 notes

Text

Company Registration in India from USA: A Complete Guide for NRIs and Foreign Nationals

Expanding your business to India can be a great opportunity, especially with its fast-growing economy and large consumer base. If you're based in the USA and planning to register a company in India, this guide will walk you through everything you need to know—from legal requirements to step-by-step procedures.

Why Register a Company in India from the USA?

India offers several advantages for foreign investors, including:

A large and diverse market

Cost-effective operations

Government initiatives promoting foreign investment (like Make in India and Startup India)

Access to skilled labor By registering a company in India, US-based entrepreneurs can tap into these opportunities and build a strong business presence in South Asia.

Types of Business Entities You Can Register in India

As a US resident or company, you can register different types of entities in India:

Private Limited Company (most popular)

Limited Liability Partnership (LLP)

Branch Office or Liaison Office

Wholly Owned Subsidiary (WOS) Among these, a Private Limited Company is the most common and preferred structure due to limited liability, ease of operations, and investment readiness.

Steps to Register a Company in India from the USA

1. Obtain a Digital Signature Certificate (DSC)

All directors need a DSC to sign documents electronically. This can be obtained through authorized Indian certifying agencies.

2. Get a Director Identification Number (DIN)

DIN is mandatory for all directors. It can be applied through the SPICe+ form during registration.

3. Choose a Company Name

Reserve your company name through the RUN (Reserve Unique Name) service on the Ministry of Corporate Affairs (MCA) portal.

4. File the Incorporation Documents (SPICe+ Form)

You’ll need to submit:

Memorandum of Association (MoA)

Articles of Association (AoA)

Proof of registered office

Identity & address proof of directors/shareholders

5. Get PAN & TAN

Your company will automatically be issued a Permanent Account Number (PAN) and Tax Deduction Account Number (TAN) as part of the SPICe+ form.

6. Open a Bank Account

Open an Indian bank account in the company’s name to handle all financial transactions and capital investment.

Key Documents Required

Passport and ID proof of foreign directors/shareholders

Address proof (utility bill or bank statement)

Photograph of each director

No Objection Certificate (NOC) from the property owner (for the registered office)

Board resolution (if applicable)

Can an NRI or Foreign National Be a Director or Shareholder?

Yes. As per Indian company law:

At least one director must be an Indian resident.

Foreign nationals and NRIs can be shareholders and directors, but at least one Indian director is mandatory.

Cost and Timeframe

Cost: ₹15,000 – ₹30,000+ (varies depending on services and type of company)

Timeframe: 10 to 20 working days (assuming all documents are in order)

Tax and Compliance After Registration

Once your company is registered, you'll need to follow ongoing compliance, including:

Filing of annual returns

Income tax filings

Maintaining statutory registers

GST registration (if applicable)

ROC filings

Professional Help for US Entrepreneurs

Navigating Indian legal and procedural requirements from the USA can be complex. It’s advisable to work with a professional firm like CompaniesNext, which specializes in helping NRIs and foreign nationals register and manage businesses in India seamlessly.

Conclusion

Registering a company in India from the USA is a straightforward process if you follow the correct legal steps and have the right guidance. With the right structure and strategy, you can tap into India's vast market potential and build a strong cross-border business.

Need Help Registering a Company in India? Contact CompaniesNext for expert support with end-to-end company registration services tailored for US-based founders and NRIs.

0 notes

Text

How to Avoid GST Registration Rejection When Using Virtual Office Addresses?

Today In India's business scenario, startups, freelancers, and small businesses prefer virtual office addresses for their ability, flexibility and ability to establish presence in many states. These addresses are particularly helpful for obtaining GST registration to rent a physical office location. However, many GST apps face rejection due to incomplete documents, address mismatched or non-non-approval when using virtual offices.

To ensure a smooth registration process, it is important to understand the GST guidelines and follow appropriate procedures when using virtual addresses. This blog highlights major tips and best practices to help avoid general mistakes and ensures successful GST registration when using a virtual office setup.

Understanding the Basics: GST and Virtual Offices

GST, or Goods and Services Tax, is an integrated indirect tax that applies to the sale of goods and services across India. Registration for GST will have to be done by attaching to business or inter -state trade over the prescribed turnover limit. Registration provides a GSTIN, allowing legal tax collection and input tax credit claims.

A virtual office refers to a commercial address introduced by a service provider, allowing operations without the need of the physical work. It is ideal for startups, freelancers and businesses that expand in states. Provide mail handling, call support and legal documentation for virtual office registration. When used for GST, accurate paperwork like rental agreements, NOCs and utility bills is important to ensure that the application is accepted without an issue.

Why Do Businesses Use Virtual Offices for GST Registration?

In today's rapidly developed commercial scenario, many companies are adopting virtual offices for GST (Goods and Services Tax) registration. This modern solution is particularly popular among the expansion of businesses looking to customize startups, freelancers and costs and operations.

1. Cost-effect Setup:- Virtual offices eliminate the requirement of the physical office space, significantly reduce the expenses of rent, utility and maintenance. This allows small and medium enterprises to maintain a professional appearance without high overhead costs.

2. Replacement Business Address:- A virtual office provides a reputed business address in major commercial areas, increasing the reliability of your business. This address can be used for GST registration, branding and communication purposes.

3. GST compliance in states:- Businesses working in many states require separate GST registration. Virtual offices help meet this legal requirement without installing material branches, making multi-state compliance easier and more inexpensive.

4. Office services access:- Most providers offer services such as mail reception, call answering and meeting room use. These features support business operations while maintaining a flexible, distance work model.

5. Quick and Trouble Free Setup:- Virtual offices can be rapidly installed with minimal documentation, especially for new entrepreneurs to ensure rapid GST registration and commercial initiation.

Finally, virtual offices provide an efficient, obedient and cost -effective solution for GST registration, making them a smart option for modern businesses.

Common Reasons for GST Registration Rejection with Virtual Offices

Many applications are rejected due to specific, avoidable issues. Here are the five major reasons for refusing GST registration while using the virtual office:

1. Inadequate proof of address:- GST officers require valid and detailed documentation, which proves that the virtual office is a valid business place. It is not enough to submit just a fare agreement - you have to provide supporting documents such as NOC and recent utility bills to establish authenticity.

2. Mismatch or incompatible information:- Any difference on the addresses mentioned in your GST application and your assistant documents (PAN, base, utility bill) can create doubt. Small discrepancies in formatting, spelling, or pin code can also cause rejection.

3. Physical verification failure:- Tax officials can visit the virtual office address listed to confirm the presence of your business. If the office provider does not display your business name or cannot verify your connection to the premises, the application can be rejected due to lack of evidence.

4. Non-transport of virtual office provider:- If the provider is not recognized or has poor compliance records, your application can be viewed adversely. Officers are cautious of the address used repeatedly by many businesses without proper hard work.

5. Errors in application or business code:- The selection of wrong HSN/SAC code for incorrectly filled GST REG-01 form or business activities can trigger questions. Incomplete or incorrect form is a common cause of automatic rejection.

When using the virtual office address, avoiding GST registration rejection, expansion for compliance norms and strict adherence requires careful attention.

Step-by-Step Guide to Avoid GST Rejection with Virtual Office Address

Using a virtual office address for GST registration can be a smart step, but it is important to follow the right stages to avoid rejection by GST authorities. It is a step-by-step guide to ensure that your registration is successful and obedient.

1. Choose a reliable virtual office provider:- Start by selecting a reliable virtual office service provider with a proven track record and a legitimate commercial address. Ensure that they are required for GST-Complin Documentation such as rental agreements, NOC (no objection certificate), and utility bill-all successful registration.

2. Verify the document well:- Check that all documents have been properly signed, dated and aligned with GST requirements. Incomplete or mismatched documents are one of the top causes of GST app rejects. Ensure the address on all documents that match the one to be used on your GST application.

3. Register under correct state jurisdiction:- Make sure that the virtual office you are finding out is in the right position where you want to register your GST. GST is state-specific, so the address should be under the jurisdiction of the appropriate GST office.

4. Use professional signage (if necessary):- Some courts require businesses to display their company's nameparen at the virtual office place. Local GST officers coordinate with your provider to follow the inspections, if necessary, to ensure this.

5. Be prepared for verification:- GST officers can physically verify the location. Coordinate with your virtual office provider so that one is available for assistance during verification and ensure that all documents are accessible.

By carefully following these stages, you can significantly reduce the possibility of GST registration rejection when using the virtual office.

Best Practices for a Smooth GST Registration with a Virtual Office

Using a virtual office for GST registration can be a convenient and cost -effective solution, but success only depends more than submitting documents. Following the best practices can greatly improve your chances of approval and ensure long -term compliance. Here are five necessary stages to direct their process:

1. Choose a reliable and experienced provider:- Select a virtual office provider with a solid reputation and proven experience that is handling GST-related services. Ask if they offer GST-Compliant documentation (rent agreement, NOC, utility bill) and whether they assist during physical verification by tax authorities.

2. Make sure the address is a commercial zone:- The GST departments usually reject applications related to residential addresses. Confirm that your virtual office address is located in a commercial zone area. This can prevent major issues during small check verification.

3. Prepare for physical verification:- Coordinate with the provider to support the physical site's visit. Arrange for temporary signage, someone officer, and to obtain a specified desk or scope. It displays authenticity and improves approval opportunities.

4. Maintain continuity in documents:- Ensure that your business name, address and other major details are the same in all documents - such as GST form, PAN card, Aadhaar card, bank statement and rent contract. Even small inequalities can reject your application.

5. Keep records and answer immediately:- Collect all applications-related documents safely. If the GST officer sends a question or notice, respond quickly and professionally with full support evidence, such as your website, business card, or marketing materials characterized by virtual office address.

By following these best practices, businesses can avoid unnecessary obstacles and also secure GST registration smoothly when using the virtual office setup.

Real-Life Scenarios Where Rejection Was Avoided

Many businesses have successfully used the virtual office address for GST registration by following appropriate procedures.

1. Startup expansion in states:- A Mumbai -based tech startup wanted to expand operations in Bangalore without opening a physical office. He opted for a virtual office in a major Bangalore place. The provider offered a GST-non-approval fare agreement, NOC and utility bills. With complete and correct formatted documents, their GST registration was approved without issues, helping them to save them at the setup cost.

2. Freelancer is registering as the only owner:- A freelance graphic designer from Delhi needed a GST number to work with corporate customers. Using a virtual office in a commercial field, he presented all the necessary documents, including his PAN, base, and professional evidence. His GST application was verified and approved smoothly due to alignment and assistance from the virtual office team.

3. E -commerce vendor in Tier -2 city:- An online seller from Jaipur wanted to register in Maharashtra to store goods in a Mumbai godown. Instead of renting the office instead of the office, he used a virtual office address and ensured that the professional was displayed at the signage location. The GST officer verified the address and approved the application immediately.

These examples highlight how GST registration can be ensured without delay or rejection by using a virtual office with proper documentation and plan.

FAQs

1. Is a fare agreement sufficient for GST registration with a virtual office?

No, you also require a recent utility bill from the office provider for no object certificate (NOC) and full address proof.

2. Can I use a virtual office in another state for GST registration?

Yes, as long as you have a legitimate commercial reason for proper documentation and operation in that state.

3. What if the tax officer physically confirms the address?

Ensure that the provider displays your business name and supports verification to avoid rejection.

4. Do virtual office providers need to be in line with GST?

Yes, non-compliance or blacklisted providers can negatively affect your application.

5. Can the wrong HSN/SAC code cause rejection?

Absolutely. Using incorrect code for your business activities can cause rejection or delay.

Conclusion

To avoid GST registration rejection when using a virtual office address, businesses must focus on accuracy, stability and compliance. Always choose a prestigious provider who provides GST-ComplianT documentation and is located in a commercial zone area. This is important to maintain stability in all documents - such as PAN, Aadhaar, bank statement and rental agreements - to match the details in your GST application. When using the virtual office space, make sure that preparations are made for physical verification including a specified point of signage and contact. By following the best practices and being active, businesses can ensure a smooth gst registration process and avoid expensive delays or rejects.

0 notes

Text

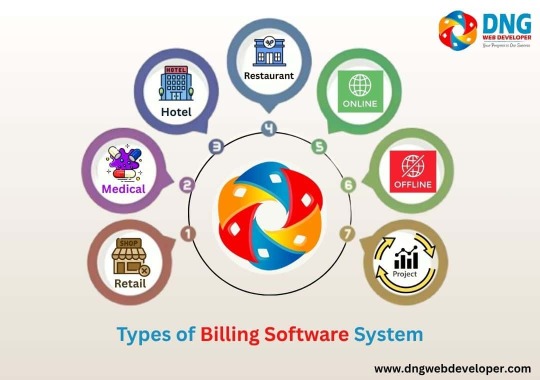

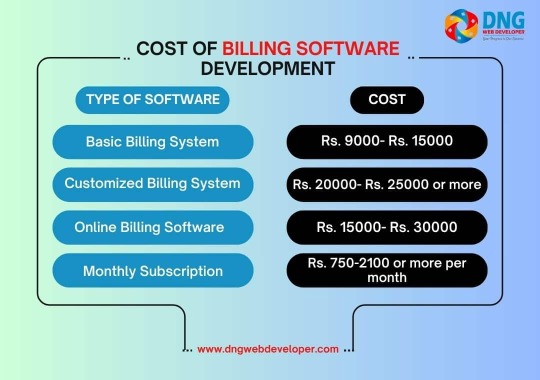

What Is Billing Software? Things You Need to Know

No more time-consuming and errorful manual billing in businesses! The invention of billing software has transformed manual billing into easy and automated billing. A billing software system is now an integral part of every business. But what exactly does this software does? Why this is a game-changing software and a must-have element for every business? What features can you get with this software? You will find all the answers in this blog. Let us tell you everything about a billing software.

Definition of Billing System Software

A billing software is a digital tool that can create error-free and professional bills and invoices, and handles the entire transaction procedure in an enterprise. Using a billing system can simplify the hectic billing procedure and make it faster and automated, ensuring billing efficiency.

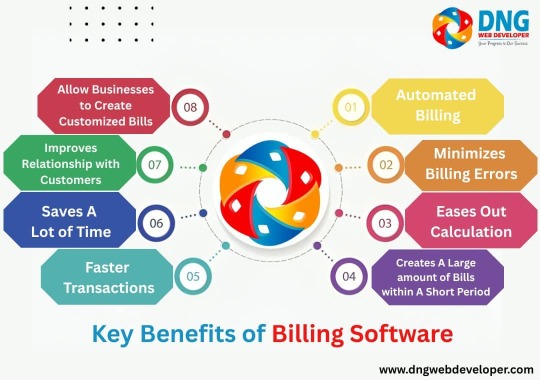

Key Benefits of Billing Software Which Make It An Essential for Businesses

A billing system plays very important roles in any business. Because of the too many benefits it offers to every business, almost every company has started using this tool for invoicing. Here are the major advantages of billing software that every business can enjoy-

1. Automated Billing

Calculations and creating bills, sending digital invoices and tracking each payment, a billing software makes every process related to billing automated, faster and efficient. You don’t need to hire a large billing team to handle billing related tasks as this software can do everything in a smarter way than human beings.

2. Minimizes Billing Errors

In manual human-made billing, there is always risks of errors. But whenever you generate bills using a billing system, it will generate 100 accurate bills, reducing the mistakes in billing.

3. Eases Out Calculation

Some billing calculation, especially the tax and GST calculation are extremely complex and take a lot of time and sharp mind as well. But a billing software can reduce the complexity and makes the calculation easiest for anyone.

4. Creates A Large amount of Bills within A Short Period

You just need a few minutes to generate the largest number of bills using a billing system software which will reduce the long queue in the billing counters in shopping malls, medical stores and more places.

5. Faster Transactions

As you can provide invoices within a few minutes to your customers using this software, the transaction process will also become faster.

6. Saves A Lot of Time

By generating bills within a few second and making the transactions faster, a billing system reduce a huge amount of time for every businesses. The time which will be saved because of the software, employers can use those extra times to do other business operations and also get relief from time-taking billing procedure.

7. Improves Relationship with Customers

When customers will get full professional, error-free bills without any long wait, automatically they will be impressed with your service and a good bond will create between you and your customers.

8. Allow Businesses to Create Customized Bills

This system helps enterprises make the bills customized as per the products and total items of the customers.

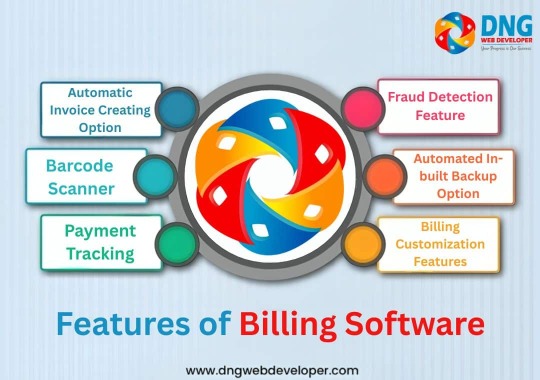

What Features You Can Find in A Billing Software?

A billing system handles several billing tasks with the help of its multiple features. Check out what common features you can find in every billing software-

1. Automatic Invoice Creating Option

Each billing software comes with automated invoice generation options which helps in creating bills in as many quantity as you want. This makes the entire billing simplified and faster, reducing manual labour.

2. Barcode Scanner

Since people are more into digital payments these days than offline transactions, the latest billing software comes with a barcode scanner for digital transactions. Customers can scan the barcodes and experience secure and faster transactions.

3. Payment Tracking

Businesses can track the daily, monthly and yearly payments they receive from their customers, check if there is any due payment and so on using the payment tracking option.

4. Fraud Detection Feature

The fraud detection feature of billing software helps businesses to detect any fraud transaction, ensuring security in each transaction. When you learn about any fraud payment you can easily take necessary actions before it’s too late.

5. Automated In-built Backup Option

Now you can get access to your lost transaction record or a very old record as well in the billing software as its automated backup option saves every data related to everyday transactions of your enterprise.

6. Billing Customization Features

With the help of customized invoice feature of a billing software, you can generate customized design, logo, product names, color of the bills and more.

How to Create Bills Using A Billing System?

Calculating totals and generating bills is now one of the easiest tasks among all other business operations. Just follow the right ways and you can create professional bills with just a few clicks without any error or hassle. Here is the step by step process to use a billing software system to generate billings-

1. Create An Account First

To use the billing system, first you need to create a user account.

2. Add the Price of Items

Then you need to add the number of the items or services and the price of all the items or services that your customers are buying from you.

3. Apply Tax and Discounts

After you get the total price of the added items, apply tax and discounts if applicable on the prices of each product. Then press the enter button or any other option available on your device and the software will provide you with the final calculation.

4. Add Customer Details

Don’t forget to add the customer details in the software as it will help you to keep the record every customer whom you served. So, add customers’ name, phone number etc and mention the products or service you provided them in the software.

5. Generate Bills

The final step is generating bills. Click on the ‘’generate bill’’ or ‘’ print bill’’ option and a paper bill will come out from your machine. In case you are serving customers remotely, instead of generating bills, send the invoice to their phones or laptops.