#How AI is changing personal loan approvals

Explore tagged Tumblr posts

Text

Future Trends & Innovations in Personal Loans

Introduction

The personal loan industry has evolved significantly over the years, adapting to changing consumer needs, technological advancements, and regulatory reforms. With the rise of digital lending platforms, artificial intelligence (AI), and data-driven underwriting, the future of personal loans looks more promising than ever. As financial institutions continue to innovate, borrowers can expect faster approvals, personalized loan offers, and enhanced security measures.

Understanding the emerging trends in personal loans can help borrowers and lenders stay ahead in a competitive financial landscape. This article explores the key innovations shaping the future of personal lending, how they impact borrowers, and what to expect in the coming years.

1. The Rise of Digital Lending Platforms

With the growth of fintech companies and digital banks, personal loans are becoming more accessible and convenient. Borrowers no longer need to visit physical bank branches; instead, they can apply for loans online and receive approvals within minutes.

Key Innovations in Digital Lending

AI-Powered Loan Approvals: Advanced algorithms analyze borrower data in real-time to determine eligibility.

Paperless Documentation: Digital KYC (Know Your Customer) and e-signatures streamline the loan application process.

Instant Disbursement: Many lenders now offer same-day loan approval and disbursal directly into the borrower’s bank account.

Impact on Borrowers

Faster loan processing and reduced waiting times.

Minimal paperwork, making personal loans more accessible.

Greater transparency with real-time tracking of loan applications.

2. AI and Machine Learning in Loan Underwriting

Traditional loan approvals rely heavily on credit scores and income proof. However, AI and machine learning (ML) are changing the way lenders assess borrower risk.

How AI is Revolutionizing Personal Loans

AI-driven models evaluate alternative data, including spending patterns, employment history, and social behavior.

Personalized interest rates based on borrower risk rather than a one-size-fits-all approach.

Enhanced fraud detection through biometric verification and behavioral analytics.

Benefits for Borrowers

Individuals with low or no credit history can still qualify for loans.

More flexible eligibility criteria for self-employed and gig workers.

Reduced chances of loan fraud and identity theft.

3. Blockchain and Smart Contracts for Secure Lending

Blockchain technology is set to redefine loan agreements and repayment processes through smart contracts. These self-executing contracts ensure secure, transparent, and tamper-proof transactions.

Blockchain Innovations in Personal Lending

Decentralized Lending Platforms: Borrowers can access loans without traditional banks acting as intermediaries.

Smart Contracts: Automated loan agreements that execute payments based on predefined conditions.

Enhanced Security: Reduced risk of data breaches and fraudulent loan applications.

How It Benefits Borrowers

Greater transparency in loan terms and conditions.

Lower loan processing fees due to the elimination of middlemen.

Improved security for sensitive financial data.

4. Personalized Loan Offers Through Big Data Analytics

Banks and fintech companies are leveraging big data analytics to offer customized personal loans based on borrower behavior.

Key Trends in Data-Driven Lending

Dynamic Interest Rates: Borrowers receive personalized interest rates based on real-time financial health.

Tailored Loan Tenures: Borrowers can choose repayment periods that match their cash flow needs.

Pre-Approved Loan Offers: Lenders identify potential customers and offer instant pre-approved loans.

Advantages for Borrowers

Access to loan options that fit their financial goals.

Lower chances of loan rejection due to more accurate risk assessment.

Increased financial inclusion for individuals with unconventional income sources.

5. BNPL (Buy Now, Pay Later) and Micro Loans

The rise of Buy Now, Pay Later (BNPL) services and micro-loans is reshaping the personal lending landscape, offering small-ticket loans with flexible repayment options.

Growth of BNPL & Micro Loans

BNPL Services: Consumers can make purchases and split payments into interest-free EMIs.

Micro-Loans: Short-term personal loans designed for urgent needs, often with minimal documentation.

Integration with E-commerce Platforms: Many online retailers offer instant BNPL options during checkout.

Why Borrowers Prefer These Options

No need for a high credit score to access financing.

Interest-free repayment periods make short-term borrowing affordable.

Convenient repayment schedules aligned with salary cycles.

6. Green and Sustainable Personal Loans

With increased focus on sustainability and eco-friendly initiatives, lenders are now offering personal loans with special benefits for borrowers investing in green projects.

Features of Green Loans

Lower interest rates for loans used to purchase solar panels, electric vehicles, or energy-efficient home upgrades.

Longer repayment periods to encourage investment in sustainable products.

Government-backed incentives for eco-conscious borrowers.

Benefits for Borrowers

Cost savings through energy-efficient upgrades and tax incentives.

Contribution to environmental sustainability while meeting financial goals.

Favorable loan terms compared to traditional personal loans.

7. Voice and Chatbot-Based Loan Assistance

Lenders are integrating AI-powered chatbots and voice assistants to provide 24/7 customer support and improve the loan application experience.

How Chatbots are Enhancing Personal Loan Services

Instant loan eligibility checks through chat interfaces.

Real-time answers to loan-related queries without human intervention.

Automated reminders for EMI payments and loan due dates.

How Borrowers Benefit

Faster access to information without the need for bank visits.

Simplified loan application process through voice commands.

Reduced chances of missed payments with timely reminders.

8. The Future of Personal Loan Regulations

As the personal loan market evolves, governments and regulatory bodies are introducing new policies to protect borrowers and ensure responsible lending.

Expected Regulatory Changes

Stricter rules for digital lenders to prevent hidden charges and unfair interest rates.

Improved data protection laws to safeguard borrower information.

Standardization of AI-driven credit assessment models to prevent discrimination.

Impact on Borrowers

Greater transparency in loan agreements and interest rates.

Enhanced consumer protection against predatory lending practices.

Fairer loan eligibility criteria across all income groups.

Conclusion

The future of personal loans is being shaped by technology, innovation, and evolving consumer needs. Digital lending, AI-driven underwriting, blockchain security, and personalized loan offers are transforming the borrowing experience, making personal loans more accessible, secure, and customized.

Borrowers can expect faster loan approvals, lower interest rates, and smarter repayment options in the coming years. However, it is essential to stay informed about these trends and choose reliable, regulated lenders to ensure a seamless borrowing experience. By leveraging these innovations responsibly, borrowers can maximize the benefits of personal loans while maintaining financial stability.

#personal loan online#finance#fincrif#personal loans#nbfc personal loan#loan services#personal loan#loan apps#personal laon#Personal loan#Future of personal loans#Digital lending trends#AI in personal loans#Fintech personal loans#Blockchain in lending#How AI is changing personal loan approvals#Future innovations in personal loans#Impact of fintech on personal lending#How digital lending is transforming personal loans#Smart contracts and personal loan security

1 note

·

View note

Text

Watching From the Tower - Part 1 (Bucky/F Reader)

Your code name is Scout and your job was easy. You worked the cyber side of things for the New Avengers. You directed them where to go with your hacking skills, and you are the eyes in the sky. There was just one problem... you don't like leaving the tower. You are not a complete agoraphobe, but you are pretty close. Leaving makes you feel so unsafe and people touching you, that's even worse. So, when James Buchanan Barnes the former 'Winter Soldier' tries to get you out for one mission, things got a little hectic after that.

Part 1: The team gets ready for a mission while you go to war with Bucky about leaving the Tower.

Word Count: ~2.4k words.

Rating: M (Later parts will be marked 18+ for smut, but for now, it's okay.)

Pairings: Bucky/F!Reader (Non-descriptive, No Y/N) Squint for GhostWalker and Boblena (Platonic)

TW: Angst, Depression, mentions of past SA, phobias, Anxiety, MDNI for sexual content in later parts (Will be labeled).

You’re pretty sure you are not really that much of a tech genius compared to the late great Tony Stark with all his fancy programs, but you make do. You’ve got it all under control so when you’re hired to not only be the girl that walks the team through every security measure and hacks into whatever network they need you to bypass on the job, you’re that person. Unfortunately, it comes with the not-so-welcome benefit of working under Valentina’s thumb.

How you can’t stand her, but you have to do what you have to do in order to pay on your student loans from college when you graduated over ten years ago. It’s not a bad job, but you end up in the crossfire anyway. You don’t know how you ended up here, you just did. Maybe it was fate, but here you are six months after the announcement for the New Avengers and you are working on Alexei's broken phone.

“It can’t be hard to fix phone.” You stop what you are doing with the soldering tool and look at him as he’s standing over your shoulder.

You sigh. “Alexei, if you would quit dropping it, this wouldn’t be an issue.” One more drop and it would be over with. No more phone for Alexei. “Go make yourself useful or something and I’ll let you know when it’s done.”

You’re in your little workshop down below the main hub where the team meets up. You have everything you need here and Val was able to provide everything you asked for on the promise that you had a place to keep it. No one else could get in there to do anything you didn’t approve of and when the Team had to go on missions? You were in the hot seat for comms and getting them home.

It was definitely a nice change of pace from working for her directly to working under Bucky’s command. That was the deal. You listened to Bucky, and Yelena too, since both of them seemed to be a sort of duo when it comes to giving orders.

“Okay, okay, I go find John and maybe he will spar with me.” Good riddance. You prefer to work alone.

“Great, I’ll bring this to you when I’m done.” You roll your eyes as he walks out of your workshop. “I can never catch a break.” The words slip out of your mouth as you go back to soldering the chip back into place on the phone. “One thing after another.”

Then your phone rings after five minutes of tinkering. Of course it would be him. He probably wants you to look into something or fix the AI that you’ve installed because it’s doing something stupid again. You aren’t Tony Stark so you can’t do everything like him.

“Yeah?” You put the phone between your ear and shoulder as you continue to work on Alexei’s phone.

“Be up here in ten. We’ve got a mission.” Bucky’s voice is serious which means your current plight has to be put on hold.

“Got any specifics?” You set aside your soldering tool before you move to your couch to grab your jacket and head out of the door.

“Just be here in ten.”

“I’ll be there in two.” You smirk as he scoffs over the phone and then hangs up. You know how to get on his nerves.

You make it up to the hub in two minutes exactly going by your watch. You grab your tablet as soon as you get to the Comms desk and you are good to go as Bucky makes his way over to you. Paying attention to him is not on your to do list because you know it annoys him. You swivel around in your chair just as Bob comes around the corner with a milkshake in one hand and a book in the other.

“Hey, Scout!” Bob is always excited to see you.

“Hey, Bob.” You give him a little wave and a smile before he continues to his little nook. He likes to listen in on the Comms when missions are going on, and sometimes he’s very helpful. Other times, he’s always doing something to keep his mind occupied.

You look at your ‘boss’ who’s looking at his own tablet with intensity before he hands it to you with that infamous scowl on his face. “What do you think?”

“It’s a building in Singapore.” Once again, another mission that has the team travelling outside of US borders for reasons. Bucky isn’t interested in completely following the government on this, but he always ends up strong-arming Val into submission. Yelena is also very good at blackmail. “With some of the most advanced cyber security that country has.” You flip through the files and realize that this is a Chinese operation. “Oh boy. Are we really going after them?”

“Yeah, they’ve taken some hostages from a bioengineering facility and apparently one of them is the inventor of this.” Bucky runs his finger across the screen to a machine that is capable of blasting cancer cells without harming the patient.

“Interesting.” You raise an eyebrow at the specs on the instrument. “No radiation needed, just a high powered laser that moves at a tenth of a tenth of a second, but why would the Chinese be interested in that?”

“I was hoping you can figure that out.” He looks at you with those blue eyes of his and even though you have this very interesting relationship of antagonization and fraternization going on, you cave.

“Yeah, maybe– but you guys have got to be careful. I don’t think going in uniform would be the best thing. This will definitely be breaking some international laws, especially with– well you know.”

“I do, and that is why you are coming with us this time.”

“And leave Bob by himself?” You don’t like leaving Bob by himself.

“Alexei is staying. It’s just Ava, you, Yelena, John, and me.”

“And what exactly will I be doing?” You stand up and put your hand on your hip.

Bucky sighs. “Playing a part.”

Oh that’s just great. “What part?”

“They are going to auction off the machine. We need to get our hands on it and also find a way to get the engineer out of their hands too.” There is no way you are going to be able to do this. You are an introvert that can’t even handle going to the grocery store for tampons. You barely like coming out of your workshop to work the missions and you were happy to keep to yourself.

“Bucky, I haven’t been out of here in three weeks and I am not the type of girl to dress up in public.”

“And you won’t be.” He reaffirms because he knows you don’t like leaving your rabbit hole. “You can do all of this from the hotel, right?”

“I can do it from here actually.” It was a blessing to be able to hack into any satellite in Earth’s orbit in order to crack a safe open in a place like Tokyo. You’ve done it before and that is what led to you standing right there with Bucky in front of you. “Bucky, please don’t make me go.” You tilt your head, pleading with your eyes. “Please?”

“Let Scout stay. This is not the first time she has done this from here.” Yelena says walking in suited up and ready to go. “Besides, she is safer here.”

“See? I’m safer here.” You see Bucky’s jaw clench when he knows he’s lost against you and Yelena.

“I say she stays too.” Ava appears out of nowhere like always and you smile at her for having your back.

“What is this? Women Unite?” You scowl at Walker’s words as he saunters in with his shield still bent in the shape of a taco. “I’m all for team building and all, but this isn’t it.” He scoffs before taking a seat on the couch and acting like he’s the best of the best. You see Bucky shake his head in disbelief.

“Okay, fine. You win.” The team leader caves and you sigh. “We’ll talk after the briefing.” Bucky holds his hand out for the tablet that belongs to him and you hand it over with a smirk on your face. You’ll rub this victory in later for sure.

“Thank you, Bucky.” You say as he turns away with this look in his eyes that does something to you.

You sit down in your chair with a huff as he starts going over the mission and each member’s role in it. As soon as each of the team members were given their objectives, they each came to you for the equipment they needed. Obviously the earpieces that you had built with unlimited range were handed out with each name on the case. They were discreet enough to hide in plain sight while in any situation. You could also communicate individually with any of them with the flick of a switch.

Bucky is the last one to come to you as everyone walks away to their personal lockers to gear up. You hand him the two most important devices of the operation because without them, you couldn’t do shit from where you were. It all depended on Bucky having them. One was a device that connected him to the satellite. You could hack anything within two miles of him with the Sentinel device and then the other one was for security.

“Come with me.” He doesn’t explain as he moves to his office on the other end of the room. You follow him like an obedient puppy this time, not really putting up a fight because he gives you that sincere look.

The moment you two are in there, he closes the door behind you and then moves to his own weapons cabinet to gear up. He wasn’t wearing anything other than the UnderArmor shirt that he normally puts on underneath the woven fiber canvas that he wears over it. But you stand there and watch as he puts it on and then zips it up. That red star on his right arm means something more than it did years ago.

“Val will probably stop by while we’re gone. Try not to give her too much information on the situation if you can help it.” He then pulls out the chest armor he finds a little cumbersome but at the same time you think he looks pretty good in it. “I have a feeling she wants the machine for herself and we’re getting it for her.”

“So, basically, find out what she’s really up to.” You cross your arms as he’s strapping his armor to him and then pulling his knives out of the cabinet and arming himself.

“Pretty much.” He’s placing his side arm in the holster on his thigh along with the knife that goes with it. “Look, I wanted you to come with us because you’ve been up here for weeks, keeping to yourself.”

“That’s what I do, Bucky.” You can’t help it, you’ve been like this since– well since the Blip. You haven't stepped outside unless you needed to. It wasn’t even the Blip that did this to you. It was something that happened during the Blip and you still haven’t recovered. “I’m safe here.”

“I know.” His voice goes soft as he moves closer to you. “It took months for you to actually talk to me without being terrified.”

“Well, you are pretty intimidating.” You shrug and then you flinch when he puts a hand on your arm. You shrug him off because contact is hard for you. “Sorry, I just– I still have some things to work on.”

He nods with a little guilt in his eyes at having crossed a boundary. “No, I’m sorry.” You weren’t ready. “I– I don’t want you to feel alone.”

“If there is anything I don’t feel, it’s definitely not alone.” You give Bucky a smile. “All of you come see me at least once a day if we aren’t doing missions or meetings of some sort– but I think you check up on me the most.”

It’s true, he’s either calling you or knocking on the door to your workshop because you practically live in it. He had Valentina set up the section next door into a small apartment for you so you’d stop sleeping on the couch. You had a bed now at least. You were just happy that you found some sort of belonging with this group of misfits that all had something wrong with them. You matched their crazy and they matched yours. Especially Yelena and Ava, who dragged you into drinking games every chance they could get.

“I’m okay, Bucky. I really am.” You reach out to touch him this time. You put your hand on his right arm and squeeze it. “I appreciate that you wanted me to go with you guys, but I would just be a liability in the field.” His eyes told you that he knew that, but they also told you that he regretted asking.

“I don’t know what I was thinking to be honest.” He admits and you smile.

“Despite your grumpy old man attitude, you wear that heart of yours on your sleeve.”

“Only for you, Sweetheart.” He doesn’t realize what he said to you until it’s too late, and he doesn’t break the attitude. He clears his throat before he's moving to the door and you’re watching him with warm cheeks and a look of bewilderment on your face. He turns to look at you again with no hint of what happened only moments before and his hand on the doorknob. “You’ll have about eight hours before we land in Singapore so get some rest while you can.”

And just like that, he’s out of the door.

You stand at the windows watching as the team loads up on the jet with Bucky at the yolk with Yelena in co-pilot. You had made an update to the autopilot systems last week so if something should happen, you could easily hack in and take full access to flying the jet yourself. Almost like a drone, really. But you watch as Bucky’s eyes turn to you through the windows and then he’s taking off.

“Well, it is just you, me, and Bob.” Alexei stands next to you with a smile before he’s moving to the couch to sit and watch TV. “Bob! We should watch Judge Judy.”

#bucky barnes#marvel#fanfic#fanfiction#marvel mcu#bucky barnes fanfiction#creative writing#writing#james buchanan barnes#james bucky barnes#thunderbolts#the new avengers#new avengers#the thunderbolts#marvel thunderbolts#bob reynolds#yelena belova#alexei shostakov#john walker#ava starr#bucky x reader

76 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

February 4, 2025

Heather Cox Richardson

Feb 05, 2025

Shortly after 1:00 this morning, Vittoria Elliott, Dhruv Mehrotra, Leah Feiger, and Tim Marchman of Wired reported that, according to three of their sources, “[a] 25-year-old engineer named Marko Elez, who previously worked for two Elon Musk companies [SpaceX and X], has direct access to Treasury Department systems responsible for nearly all payments made by the US government.”

According to the reporters, Elez apparently has the privileges to write code on the programs at the Bureau of Fiscal Service that control more than 20% of the U.S. economy, including government payments of veterans’ benefits, Social Security benefits, and veterans’ pay. The admin privileges he has typically permit a user “to log in to servers through secure shell access, navigate the entire file system, change user permissions, and delete or modify critical files. That could allow someone to bypass the security measures of, and potentially cause irreversible changes to, the very systems they have access to.”

“If you would have asked me a week ago” if an outsider could’ve been given access to a government server, one federal IT worker told the Wired reporters, “I'd have told you that this kind of thing would never in a million years happen. But now, who the f*ck knows."

The reporters note that control of the Bureau of Fiscal Service computers could enable someone to cut off monies to specific agencies or even individuals. “Will DOGE cut funding to programs approved by Congress that Donald Trump decides he doesn’t like?” asked Senator Chuck Schumer (D-NY) yesterday. “What about cancer research? Food banks? School lunches? Veterans aid? Literacy programs? Small business loans?”

Josh Marshall of Talking Points Memo reported that his sources said that Elez and possibly others got full admin access to the Treasury computers on Friday, January 31, and that he—or they—have “already made extensive changes to the code base for the payment system.” They are leaning on existing staff in the agency for help, which those workers have provided reluctantly in hopes of keeping the entire system from crashing. Marshall reports those staffers are “freaking out.” The system is due to undergo a migration to another system this weekend; how the changes will interact with that long-planned migration is unclear.

The changes, Marshall’s sources tell him, “all seem to relate to creating new paths to block payments and possibly leave less visibility into what has been blocked.”

Both Wired and the New York Times reported yesterday that Musk’s team intends to cut government workers and to use artificial intelligence, or AI, to make budget cuts and to find waste and abuse in the federal government.

Today Jason Koebler, Joseph Cox, and Emanuel Maiberg of 404 Media reported that they had obtained the audio of a meeting held Monday by Thomas Shedd for government technology workers. Shedd is a former Musk employee at Tesla who is now leading the General Services Administration’s Technology Transformation Services (TTS), the team that is recoding the government programs.

At the meeting, Shedd told government workers that “things are going to get intense” as his team creates “AI coding agents” to write software that would, for example, change the way logging into the government systems works. Currently, that software cannot access any information about individuals; as the reporters note, login.gov currently assures users that it “does not affect or have any information related to the specific agency you are trying to access.”

But Shedd said they were working through how to change that login “to further identify individuals and detect and prevent fraud.”

When a government employee pointed out that the Privacy Act makes it illegal for agencies to share personal information without consent, Shedd appeared unfazed by the idea they were trying something illegal. “The idea would be that folks would give consent to help with the login flow, but again, that's an example of something that we have a vision, that needs [to be] worked on, and needs clarified. And if we hit a roadblock, then we hit a roadblock. But we still should push forward and see what we can do.”

A government employee told Koebler, Cox, and Maiberg that using AI coding agents is a major security risk. “Government software is concerned with things like foreign adversaries attempting to insert backdoors into government code. With code generated by AI, it seems possible that security vulnerabilities could be introduced unintentionally. Or could be introduced intentionally via an AI-related exploit that creates obfuscated code that includes vulnerabilities that might expose the data of American citizens or of national security importance.”

A blizzard of lawsuits has greeted Musk’s campaign and other Trump administration efforts to undermine Congress. Today, Senator Chuck Schumer (D-NY) and Representative Hakeem Jeffries (D-NY), the minority leaders in their respective chambers, announced they were introducing legislation to stop Musk’s unlawful actions in the Treasury’s payment systems and to protect Americans, calling it “Stop the Steal,” a play on Trump’s false claims that the 2020 presidential election was stolen.

This evening, Democratic lawmakers and hundreds of protesters rallied at the Treasury Department to take a stand against Musk’s hostile takeover of the U.S. Treasury payment system. “Nobody Elected Elon,” their signs read. “He has access to all our information, our Social Security numbers, the federal payment system,” Representative Maxwell Frost (D-FL) said. “What’s going to stop him from stealing taxpayer money?”

Tonight, the Washington Post noted that Musk’s actions “appear to violate federal law.” David Super of Georgetown Law School told journalists Jeff Stein, Dan Diamond, Faiz Siddiqui, Cat Zakrzewski, Hannah Natanson, and Jacqueline Alemany: “So many of these things are so wildly illegal that I think they’re playing a quantity game and assuming the system can’t react to all this illegality at once.”

Musk’s takeover of the U.S. government to override Congress and dictate what programs he considers worthwhile is a logical outcome of forty years of Republican rhetoric. After World War II, members of both political parties agreed that the government should regulate business, provide a basic social safety net, promote infrastructure, and protect civil rights. The idea was to use tax dollars to create national wealth. The government would hold the economic playing field level by protecting every American’s access to education, healthcare, transportation and communication, employment, and resources so that anyone could work hard and rise to prosperity.

Businessmen who opposed regulation and taxes tried to convince voters to abandon this system but had no luck. The liberal consensus—“liberal” because it used the government to protect individual freedom, and “consensus” because it enjoyed wide support—won the votes of members of both major political parties.

But those opposed to the liberal consensus gained traction after the Supreme Court’s 1954 Brown v. Board of Education of Topeka, Kansas, decision declared segregation in the public schools unconstitutional. Three years later, in 1957, President Dwight D. Eisenhower, a Republican, sent troops to help desegregate Central High School in Little Rock, Arkansas. Those trying to tear apart the liberal consensus used the crisis to warn voters that the programs in place to help all Americans build the nation as they rose to prosperity were really an attempt to redistribute cash from white taxpayers to undeserving racial minorities, especially Black Americans. Such programs were, opponents insisted, a form of socialism, or even communism.

That argument worked to undermine white support for the liberal consensus. Over the years, Republican voters increasingly abandoned the idea of using tax money to help Americans build wealth.

When majorities continued to support the liberal consensus, Republicans responded by suppressing the vote, rigging the system through gerrymandering, and flooding our political system with dark money and using right-wing media to push propaganda. Republicans came to believe that they were the only legitimate lawmakers in the nation; when Democrats won, the election must have been rigged. Even so, they were unable to destroy the post–World War II government completely because policies like the destruction of Social Security and Medicaid, or the elimination of the Department of Education, remained unpopular.

Now, MAGA Republicans in charge of the government have made it clear they intend to get rid of that government once and for all. Trump’s nominee to direct the Office of Management and Budget, Russell Vought, was a key architect of Project 2025, which called for dramatically reducing the power of Congress and the United States civil service. Vought has referred to career civil servants as “villains” and called for ending funding for most government programs. “The stark reality in America is that we are in the late stages of a complete Marxist takeover of the country,” he said recently.

In the name of combatting diversity, equity, and inclusion programs, the Trump administration is taking down websites of information paid for with tax dollars, slashing programs that advance health and science, ending investments in infrastructure, trying to end foreign aid, working to eliminate the Department of Education, and so on. Today the administration offered buyouts to all the people who work at the Central Intelligence Agency, saying that anyone who opposes Trump’s policies should leave. Today, Musk’s people entered the headquarters of the National Oceanic and Atmospheric Administration (NOAA), which provides daily weather and wind predictions; cutting NOAA and privatizing its services is listed as a priority in Project 2025.

Stunningly, Secretary of State Marco Rubio announced today that the U.S. has made a deal with El Salvador to send deportees of any nationality—including U.S. citizens, which would be wildly unconstitutional—for imprisonment in that nation’s 40,000-person Terrorism Confinement Center, for a fee that would pay for El Salvador’s prison system.

Tonight the Senate confirmed Trump loyalist Pam Bondi as attorney general. Bondi is an election denier who refuses to say that Trump lost the 2020 presidential election. As Matt Cohen of Democracy Docket noted, a coalition of more than 300 civil rights groups urged senators to vote against her confirmation because of her opposition to LGBTQ rights, immigrants’ rights, and reproductive rights, and her record of anti-voting activities. The vote was along party lines except for Senator John Fetterman (D-PA), who crossed over to vote in favor.

Musk’s so-called Department of Government Efficiency is the logical outcome of the mentality that the government should not enable Americans to create wealth but rather should put cash in the pockets of a few elites. Far from representing a majority, Musk is unelected, and he is slashing through the government programs he opposes. With full control of both chambers of Congress, Republicans could cut those parts themselves, but such cuts would be too unpopular ever to pass. So, instead, Musk is single-handedly slashing through the government Americans have built over the past 90 years.

Now, MAGA voters are about to discover that the wide-ranging cuts he claims to be making to end diversity, equity, and inclusion (DEI) programs skewer them as well as their neighbors. Attracting white voters with racism was always a tool to end the liberal consensus that worked for everyone, and if Musk’s cuts stand, the U.S. is about to learn that lesson the hard way.

In yet another bombshell, after meeting with Israeli prime minister Benjamin Netanyahu, Trump told reporters tonight that the U.S. “will take over the Gaza Strip,” and suggested sending troops to make that happen. “We’ll own it,” he said. “We’re going to take over that piece, develop it and create thousands and thousands of jobs, and it will be something the entire Middle East can be proud of.” It could become “the Riviera of the Middle East,” he said.

Reaction has been swift and incredulous. Senator Tim Kaine (D-VA), who sits on the Foreign Relations Committee, called the plan “deranged” and “nuts.” Another Foreign Relations Committee member, Senator Chris Coons (D-DE), said he was “speechless,” adding: “That’s insane.” While MAGA representative Nancy Mace (R-SC) posted in support, “Let’s turn Gaza into Mar-a-Lago,” Senator Thom Tillis (R-NC) told NBC News reporters Frank Thorp V and Raquel Coronell Uribe that there were “a few kinks in that slinky,” a reference to a spring toy that fails if it gets bent.

Senator Chris Murphy (D-CT) suggested that Trump was trying to distract people from “the real story—the billionaires seizing government to steal from regular people.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Heather Cox Richardson#Letters From An American#Right Wing Coup#Musk#TFG#Gaza#history#American History#the US Treasury#treasury department#MAGA#here we go folks

50 notes

·

View notes

Text

🚨Scammer Alert🚨 + 🔎Scam Exam(ination)🔍

Seen as: Recruitment to join the Illuminati Scam Type: Identity Theft / Fraud

Post updated: 2/14/25

Accounts running this scam: templeoflight66 symbolsand-shadow mysticmason googlescholarsecretsandsybmols illuminatiinsights thehiddenodex

-----

Before we dive into this scam, please note that this scam is very dangerous as it reportedly deals with identity theft and concludes with the theft and use of your stolen information for nefarious purposes.

As it should go with any stranger you talk to on the internet, you should never willingly give out any of your personal information such as: real name, date of birth, address, phone number, credit card/bank information, photos of yourself or your bank, credit, social security card, ect, to a stranger on the internet who promises you money.

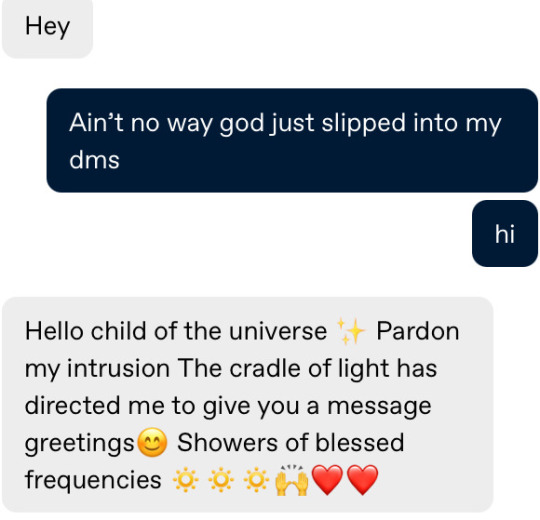

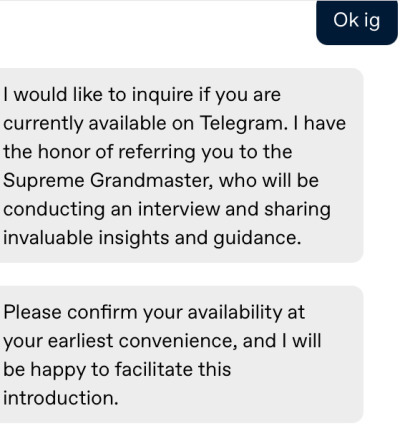

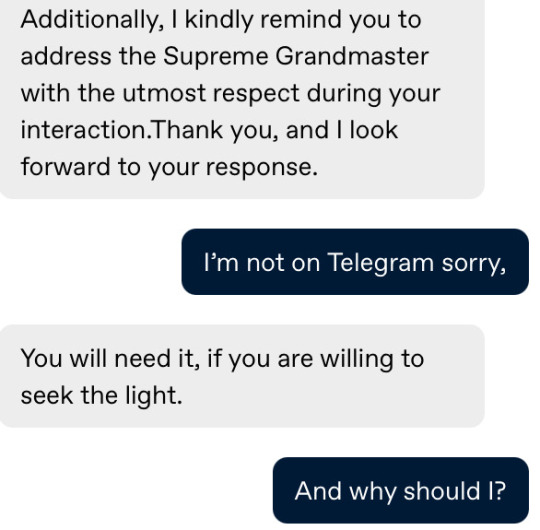

1 - How it starts.

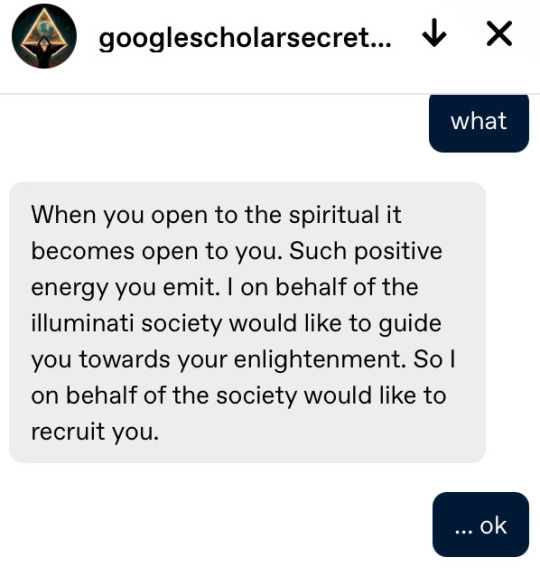

This scam typically starts by someone receiving an email, or in the images we will be examining today, a tumblr user receiving a DM- or, well, several DM's, from users who were trying to 'bless them with good tidings of the universe' and that it was 'a sign from the almighty' and 'it was fate' and all that nonsense... to try and then recruit them to join the Illuminati.

The following images were provided by an anonymous user of their conversation with googlescholarsecretsandsybmols:

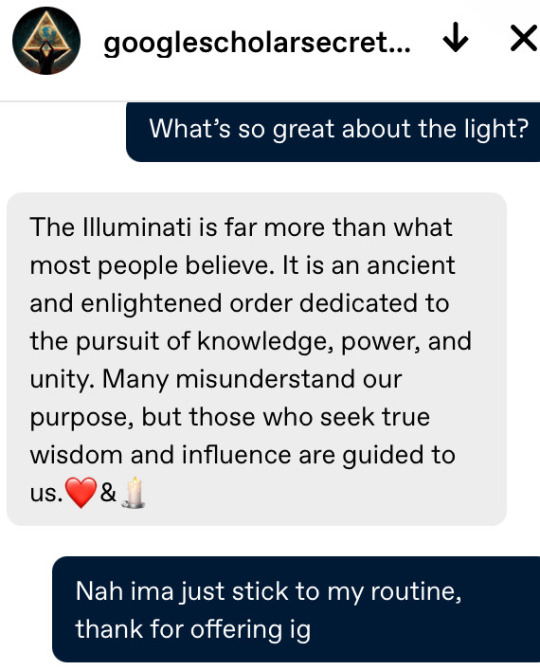

Here is anonymous's contact with mysticmason:

🚩Notable red flags🚩

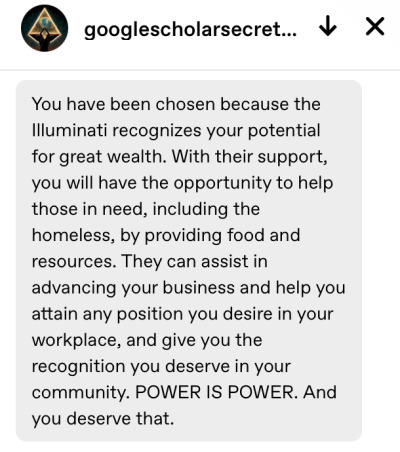

Their blogs are full of generic AI generated images, philosophical scripture/nonsense, links to Illuminati websites/content that seem suspicious.

The offer of the impossible.

Wealth (of an undisclosed amount) to help the homeless with food and resources. Some 'means' of aiding your business and/or helping you attain any job position you desire in your work place. Some ✨magical✨ means of granting you recognition in your community. (As if they can suddenly make people change their opinions of you...)

Then instant request/demand that they need you to use Telegram for communication.

Telegram is a service that a lot of scammers use, and they use it because they can easily communicate with other scammers (and victims) there, and run their scams through it without it usually being able to be used as evidence should something like Identity Theft occur.

2 - How this scam works.

This scam works by... well, what I find to be the most obvious tactic that a lot of scammers use:

The life changing offer of a lot money... You just need to do a little something in return... ;)

From here I will be pulling information from this article from Bitdefender, one of the most well known and well trusted Antivirus brands on the market today. (That I use in fact! :D)

In regards to the emails- the original method this scam was spread:

The spam emails were traced to IP addresses in Nigeria (40%), South Africa (16%), the US (14%), the Netherlands (13%), and Argentina and Brazil (with 5% each).

Here are a list of benefits the Illuminati claims they can offer you if you join, taken from the Bitdefender article as well:

A new house bought in any country of your choice.

A monthly salary of $200,000

A blessing for joining which includes 10 million dollars.

A "magic talisman" that can cure any kind of illness or infection.

The power to prosper and improve.

Free access to Bohemians grove.

First class/VIP treatment at any airport in the world.

One-year appointment approval with the top 10 world leaders.

Appointments with world celebrities of your choice.

A personal car with your name customized on it.

The seven-book of Moses to learn the language of ORIS for "powers".

And a lot more!...

You just have to buy the required items for you to become an initiate member into the 'brotherhood.'

Which is when they'll have you fill out a sheet with all of your personal information, work occupation, wage earnings, as well as request a photograph of you and/or your license for 'verification'.

If you do, they will steal your identity, use it to register for things like loans, ruin your credit, and your life is practically ruined. :(

Final Thoughts:

As I mentioned prior, you should never send this kind of information to anyone on the internet for any kind of reason if you do not know who you are speaking to on the other end, aka they're a stranger.

All these kinds of scams go off of are words, as that's all they are.

A promise made of just words.

No different than the free money or sugar baby/daddy scam where they promise you $3000 a month, all you have to do is 'send me $100+ to verify you want to do this.'

I know how life changing a lot of money can be, but do try to be logical and think about these things, for your sake and others!

Take care everyone.

#scam#scams#scam alert#scammer#scam awareness#scammers#scam warning#online scams#psa#internet safety#public service announcement#illuminati scam#templeoflight66#symbolsand-shadow#mysticmason#googlescholarsecretsandsybmols#illuminatiinsights#illuminati#conspiracy#thehiddenodex

30 notes

·

View notes

Text

HEATHER COX RICHARDSON

FEB 5

Shortly after 1:00 this morning, Vittoria Elliott, Dhruv Mehrotra, Leah Feiger, and Tim Marchman of Wired reported that, according to three of their sources, “[a] 25-year-old engineer named Marko Elez, who previously worked for two Elon Musk companies [SpaceX and X], has direct access to Treasury Department systems responsible for nearly all payments made by the US government.”

According to the reporters, Elez apparently has the privileges to write code on the programs at the Bureau of Fiscal Service that control more than 20% of the U.S. economy, including government payments of veterans’ benefits, Social Security benefits, and veterans’ pay. The admin privileges he has typically permit a user “to log in to servers through secure shell access, navigate the entire file system, change user permissions, and delete or modify critical files. That could allow someone to bypass the security measures of, and potentially cause irreversible changes to, the very systems they have access to.”

“If you would have asked me a week ago” if an outsider could’ve been given access to a government server, one federal IT worker told the Wiredreporters, “I'd have told you that this kind of thing would never in a million years happen. But now, who the f*ck knows."

The reporters note that control of the Bureau of Fiscal Service computers could enable someone to cut off monies to specific agencies or even individuals. “Will DOGE cut funding to programs approved by Congress that Donald Trump decides he doesn’t like?” asked Senator Chuck Schumer (D-NY) yesterday. “What about cancer research? Food banks? School lunches? Veterans aid? Literacy programs? Small business loans?”

Josh Marshall of Talking Points Memo reported that his sources said that Elez and possibly others got full admin access to the Treasury computers on Friday, January 31, and that he—or they—have “already made extensive changes to the code base for the payment system.” They are leaning on existing staff in the agency for help, which those workers have provided reluctantly in hopes of keeping the entire system from crashing. Marshall reports those staffers are “freaking out.” The system is due to undergo a migration to another system this weekend; how the changes will interact with that long-planned migration is unclear.

The changes, Marshall’s sources tell him, “all seem to relate to creating new paths to block payments and possibly leave less visibility into what has been blocked.”

Both Wired and the New York Times reported yesterday that Musk’s team intends to cut government workers and to use artificial intelligence, or AI, to make budget cuts and to find waste and abuse in the federal government.

Today Jason Koebler, Joseph Cox, and Emanuel Maiberg of 404 Mediareported that they had obtained the audio of a meeting held Monday by Thomas Shedd for government technology workers. Shedd is a former Musk employee at Tesla who is now leading the General Services Administration’s Technology Transformation Services (TTS), the team that is recoding the government programs.

At the meeting, Shedd told government workers that “things are going to get intense” as his team creates “AI coding agents” to write software that would, for example, change the way logging into the government systems works. Currently, that software cannot access any information about individuals; as the reporters note, login.gov currently assures users that it “does not affect or have any information related to the specific agency you are trying to access.”

But Shedd said they were working through how to change that login “to further identify individuals and detect and prevent fraud.”

When a government employee pointed out that the Privacy Act makes it illegal for agencies to share personal information without consent, Shedd appeared unfazed by the idea they were trying something illegal. “The idea would be that folks would give consent to help with the login flow, but again, that's an example of something that we have a vision, that needs [to be] worked on, and needs clarified. And if we hit a roadblock, then we hit a roadblock. But we still should push forward and see what we can do.”

A government employee told Koebler, Cox, and Maiberg that using AI coding agents is a major security risk. “Government software is concerned with things like foreign adversaries attempting to insert backdoors into government code. With code generated by AI, it seems possible that security vulnerabilities could be introduced unintentionally. Or could be introduced intentionally via an AI-related exploit that creates obfuscated code that includes vulnerabilities that might expose the data of American citizens or of national security importance.”

A blizzard of lawsuits has greeted Musk’s campaign and other Trump administration efforts to undermine Congress. Today, Senator Chuck Schumer (D-NY) and Representative Hakeem Jeffries (D-NY), the minority leaders in their respective chambers, announced they were introducing legislation to stop Musk’s unlawful actions in the Treasury’s payment systems and to protect Americans, calling it “Stop the Steal,” a play on Trump’s false claims that the 2020 presidential election was stolen.

This evening, Democratic lawmakers and hundreds of protesters rallied at the Treasury Department to take a stand against Musk’s hostile takeover of the U.S. Treasury payment system. “Nobody Elected Elon,” their signs read. “He has access to all our information, our Social Security numbers, the federal payment system,” Representative Maxwell Frost (D-FL) said. “What’s going to stop him from stealing taxpayer money?”

Tonight, the Washington Post noted that Musk’s actions “appear to violate federal law.” David Super of Georgetown Law School told journalists Jeff Stein, Dan Diamond, Faiz Siddiqui, Cat Zakrzewski, Hannah Natanson, and Jacqueline Alemany: “So many of these things are so wildly illegal that I think they’re playing a quantity game and assuming the system can’t react to all this illegality at once.”

Musk’s takeover of the U.S. government to override Congress and dictate what programs he considers worthwhile is a logical outcome of forty years of Republican rhetoric. After World War II, members of both political parties agreed that the government should regulate business, provide a basic social safety net, promote infrastructure, and protect civil rights. The idea was to use tax dollars to create national wealth. The government would hold the economic playing field level by protecting every American’s access to education, healthcare, transportation and communication, employment, and resources so that anyone could work hard and rise to prosperity.

Businessmen who opposed regulation and taxes tried to convince voters to abandon this system but had no luck. The liberal consensus—“liberal” because it used the government to protect individual freedom, and “consensus” because it enjoyed wide support—won the votes of members of both major political parties.

But those opposed to the liberal consensus gained traction after the Supreme Court’s 1954 Brown v. Board of Education of Topeka, Kansas, decision declared segregation in the public schools unconstitutional. Three years later, in 1957, President Dwight D. Eisenhower, a Republican, sent troops to help desegregate Central High School in Little Rock, Arkansas. Those trying to tear apart the liberal consensus used the crisis to warn voters that the programs in place to help all Americans build the nation as they rose to prosperity were really an attempt to redistribute cash from white taxpayers to undeserving racial minorities, especially Black Americans. Such programs were, opponents insisted, a form of socialism, or even communism.

That argument worked to undermine white support for the liberal consensus. Over the years, Republican voters increasingly abandoned the idea of using tax money to help Americans build wealth.

When majorities continued to support the liberal consensus, Republicans responded by suppressing the vote, rigging the system through gerrymandering, and flooding our political system with dark money and using right-wing media to push propaganda. Republicans came to believe that they were the only legitimate lawmakers in the nation; when Democrats won, the election must have been rigged. Even so, they were unable to destroy the post–World War II government completely because policies like the destruction of Social Security and Medicaid, or the elimination of the Department of Education, remained unpopular.

Now, MAGA Republicans in charge of the government have made it clear they intend to get rid of that government once and for all. Trump’s nominee to direct the Office of Management and Budget, Russell Vought, was a key architect of Project 2025, which called for dramatically reducing the power of Congress and the United States civil service. Vought has referred to career civil servants as “villains” and called for ending funding for most government programs. “The stark reality in America is that we are in the late stages of a complete Marxist takeover of the country,” he said recently.

In the name of combatting diversity, equity, and inclusion programs, the Trump administration is taking down websites of information paid for with tax dollars, slashing programs that advance health and science, ending investments in infrastructure, trying to end foreign aid, working to eliminate the Department of Education, and so on. Today the administration offered buyouts to all the people who work at the Central Intelligence Agency, saying that anyone who opposes Trump’s policies should leave. Today, Musk’s people entered the headquarters of the National Oceanic and Atmospheric Administration (NOAA), which provides daily weather and wind predictions; cutting NOAA and privatizing its services is listed as a priority in Project 2025.

Stunningly, Secretary of State Marco Rubio announced today that the U.S. has made a deal with El Salvador to send deportees of any nationality—including U.S. citizens, which would be wildly unconstitutional—for imprisonment in that nation’s 40,000-person Terrorism Confinement Center, for a fee that would pay for El Salvador’s prison system.

Tonight the Senate confirmed Trump loyalist Pam Bondi as attorney general. Bondi is an election denier who refuses to say that Trump lost the 2020 presidential election. As Matt Cohen of Democracy Docket noted, a coalition of more than 300 civil rights groups urged senators to vote against her confirmation because of her opposition to LGBTQ rights, immigrants’ rights, and reproductive rights, and her record of anti-voting activities. The vote was along party lines except for Senator John Fetterman (D-PA), who crossed over to vote in favor.

Musk’s so-called Department of Government Efficiency is the logical outcome of the mentality that the government should not enable Americans to create wealth but rather should put cash in the pockets of a few elites. Far from representing a majority, Musk is unelected, and he is slashing through the government programs he opposes. With full control of both chambers of Congress, Republicans could cut those parts themselves, but such cuts would be too unpopular ever to pass. So, instead, Musk is single-handedly slashing through the government Americans have built over the past 90 years.

Now, MAGA voters are about to discover that the wide-ranging cuts he claims to be making to end diversity, equity, and inclusion (DEI) programs skewer them as well as their neighbors. Attracting white voters with racism was always a tool to end the liberal consensus that worked for everyone, and if Musk’s cuts stand, the U.S. is about to learn that lesson the hard way.

In yet another bombshell, after meeting with Israeli prime minister Benjamin Netanyahu, Trump told reporters tonight that the U.S. “will take over the Gaza Strip,” and suggested sending troops to make that happen. “We’ll own it,” he said. “We’re going to take over that piece, develop it and create thousands and thousands of jobs, and it will be something the entire Middle East can be proud of.” It could become “the Riviera of the Middle East,” he said.

Reaction has been swift and incredulous. Senator Tim Kaine (D-VA), who sits on the Foreign Relations Committee, called the plan “deranged” and “nuts.” Another Foreign Relations Committee member, Senator Chris Coons (D-DE), said he was “speechless,” adding: “That’s insane.” While MAGA representative Nancy Mace (R-SC) posted in support, “Let’s turn Gaza into Mar-a-Lago,” Senator Thom Tillis (R-NC) told NBC News reporters Frank Thorp V and Raquel Coronell Uribe that there were “a few kinks in that slinky,” a reference to a spring toy that fails if it gets bent.

Senator Chris Murphy (D-CT) suggested that Trump was trying to distract people from “the real story—the billionaires seizing government to steal from regular people.”

—

21 notes

·

View notes

Text

Heather Cox Richardson

February 4, 2025

Heather Cox Richardson

Feb 5

Shortly after 1:00 this morning, Vittoria Elliott, Dhruv Mehrotra, Leah Feiger, and Tim Marchman of Wired reported that, according to three of their sources, “[a] 25-year-old engineer named Marko Elez, who previously worked for two Elon Musk companies [SpaceX and X], has direct access to Treasury Department systems responsible for nearly all payments made by the US government.”

According to the reporters, Elez apparently has the privileges to write code on the programs at the Bureau of Fiscal Service that control more than 20% of the U.S. economy, including government payments of veterans’ benefits, Social Security benefits, and veterans’ pay. The admin privileges he has typically permit a user “to log in to servers through secure shell access, navigate the entire file system, change user permissions, and delete or modify critical files. That could allow someone to bypass the security measures of, and potentially cause irreversible changes to, the very systems they have access to.”

“If you would have asked me a week ago” if an outsider could’ve been given access to a government server, one federal IT worker told the Wired reporters, “I'd have told you that this kind of thing would never in a million years happen. But now, who the f*ck knows."

The reporters note that control of the Bureau of Fiscal Service computers could enable someone to cut off monies to specific agencies or even individuals. “Will DOGE cut funding to programs approved by Congress that Donald Trump decides he doesn’t like?” asked Senator Chuck Schumer (D-NY) yesterday. “What about cancer research? Food banks? School lunches? Veterans aid? Literacy programs? Small business loans?”

Josh Marshall of Talking Points Memo reported that his sources said that Elez and possibly others got full admin access to the Treasury computers on Friday, January 31, and that he—or they—have “already made extensive changes to the code base for the payment system.” They are leaning on existing staff in the agency for help, which those workers have provided reluctantly in hopes of keeping the entire system from crashing. Marshall reports those staffers are “freaking out.” The system is due to undergo a migration to another system this weekend; how the changes will interact with that long-planned migration is unclear.

The changes, Marshall’s sources tell him, “all seem to relate to creating new paths to block payments and possibly leave less visibility into what has been blocked.”

Both Wired and the New York Times reported yesterday that Musk’s team intends to cut government workers and to use artificial intelligence, or AI, to make budget cuts and to find waste and abuse in the federal government.

Today Jason Koebler, Joseph Cox, and Emanuel Maiberg of 404 Media reported that they had obtained the audio of a meeting held Monday by Thomas Shedd for government technology workers. Shedd is a former Musk employee at Tesla who is now leading the General Services Administration’s Technology Transformation Services (TTS), the team that is recoding the government programs.

At the meeting, Shedd told government workers that “things are going to get intense” as his team creates “AI coding agents” to write software that would, for example, change the way logging into the government systems works. Currently, that software cannot access any information about individuals; as the reporters note, login.gov currently assures users that it “does not affect or have any information related to the specific agency you are trying to access.”

But Shedd said they were working through how to change that login “to further identify individuals and detect and prevent fraud.”

When a government employee pointed out that the Privacy Act makes it illegal for agencies to share personal information without consent, Shedd appeared unfazed by the idea they were trying something illegal. “The idea would be that folks would give consent to help with the login flow, but again, that's an example of something that we have a vision, that needs [to be] worked on, and needs clarified. And if we hit a roadblock, then we hit a roadblock. But we still should push forward and see what we can do.”

A government employee told Koebler, Cox, and Maiberg that using AI coding agents is a major security risk. “Government software is concerned with things like foreign adversaries attempting to insert backdoors into government code. With code generated by AI, it seems possible that security vulnerabilities could be introduced unintentionally. Or could be introduced intentionally via an AI-related exploit that creates obfuscated code that includes vulnerabilities that might expose the data of American citizens or of national security importance.”

A blizzard of lawsuits has greeted Musk’s campaign and other Trump administration efforts to undermine Congress. Today, Senator Chuck Schumer (D-NY) and Representative Hakeem Jeffries (D-NY), the minority leaders in their respective chambers, announced they were introducing legislation to stop Musk’s unlawful actions in the Treasury’s payment systems and to protect Americans, calling it “Stop the Steal,” a play on Trump’s false claims that the 2020 presidential election was stolen.

This evening, Democratic lawmakers and hundreds of protesters rallied at the Treasury Department to take a stand against Musk’s hostile takeover of the U.S. Treasury payment system. “Nobody Elected Elon,” their signs read. “He has access to all our information, our Social Security numbers, the federal payment system,” Representative Maxwell Frost (D-FL) said. “What’s going to stop him from stealing taxpayer money?”

Tonight, the Washington Post noted that Musk’s actions “appear to violate federal law.” David Super of Georgetown Law School told journalists Jeff Stein, Dan Diamond, Faiz Siddiqui, Cat Zakrzewski, Hannah Natanson, and Jacqueline Alemany: “So many of these things are so wildly illegal that I think they’re playing a quantity game and assuming the system can’t react to all this illegality at once.”

Musk’s takeover of the U.S. government to override Congress and dictate what programs he considers worthwhile is a logical outcome of forty years of Republican rhetoric.

After World War II, members of both political parties agreed that the government should regulate business, provide a basic social safety net, promote infrastructure, and protect civil rights. The idea was to use tax dollars to create national wealth. The government would hold the economic playing field level by protecting every American’s access to education, healthcare, transportation and communication, employment, and resources so that anyone could work hard and rise to prosperity.

Businessmen who opposed regulation and taxes tried to convince voters to abandon this system but had no luck. The liberal consensus—“liberal” because it used the government to protect individual freedom, and “consensus” because it enjoyed wide support—won the votes of members of both major political parties.

But those opposed to the liberal consensus gained traction after the Supreme Court’s 1954 Brown v. Board of Education of Topeka, Kansas, decision declared segregation in the public schools unconstitutional. Three years later, in 1957, President Dwight D. Eisenhower, a Republican, sent troops to help desegregate Central High School in Little Rock, Arkansas. Those trying to tear apart the liberal consensus used the crisis to warn voters that the programs in place to help all Americans build the nation as they rose to prosperity were really an attempt to redistribute cash from white taxpayers to undeserving racial minorities, especially Black Americans. Such programs were, opponents insisted, a form of socialism, or even communism.

That argument worked to undermine white support for the liberal consensus. Over the years, Republican voters increasingly abandoned the idea of using tax money to help Americans build wealth.

When majorities continued to support the liberal consensus, Republicans responded by suppressing the vote, rigging the system through gerrymandering, and flooding our political system with dark money and using right-wing media to push propaganda. Republicans came to believe that they were the only legitimate lawmakers in the nation; when Democrats won, the election must have been rigged. Even so, they were unable to destroy the post–World War II government completely because policies like the destruction of Social Security and Medicaid, or the elimination of the Department of Education, remained unpopular.

Now, MAGA Republicans in charge of the government have made it clear they intend to get rid of that government once and for all. Trump’s nominee to direct the Office of Management and Budget, Russell Vought, was a key architect of Project 2025, which called for dramatically reducing the power of Congress and the United States civil service. Vought has referred to career civil servants as “villains” and called for ending funding for most government programs. “The stark reality in America is that we are in the late stages of a complete Marxist takeover of the country,” he said recently.

In the name of combatting diversity, equity, and inclusion programs, the Trump administration is taking down websites of information paid for with tax dollars, slashing programs that advance health and science, ending investments in infrastructure, trying to end foreign aid, working to eliminate the Department of Education, and so on.

Today the administration offered buyouts to all the people who work at the Central Intelligence Agency, saying that anyone who opposes Trump’s policies should leave. Today, Musk’s people entered the headquarters of the National Oceanic and Atmospheric Administration (NOAA), which provides daily weather and wind predictions; cutting NOAA and privatizing its services is listed as a priority in Project 2025.

Stunningly, Secretary of State Marco Rubio announced today that the U.S. has made a deal with El Salvador to send deportees of any nationality—including U.S. citizens, which would be wildly unconstitutional—for imprisonment in that nation’s 40,000-person Terrorism Confinement Center, for a fee that would pay for El Salvador’s prison system.

Tonight the Senate confirmed Trump loyalist Pam Bondi as attorney general. Bondi is an election denier who refuses to say that Trump lost the 2020 presidential election. As Matt Cohen of Democracy Docket noted, a coalition of more than 300 civil rights groups urged senators to vote against her confirmation because of her opposition to LGBTQ rights, immigrants’ rights, and reproductive rights, and her record of anti-voting activities. The vote was along party lines except for Senator John Fetterman (D-PA), who crossed over to vote in favor.

(NOTE - FETTERMAN HAS TURNED INTO A TOTAL FUCKUP!! THAT STROKE MUST'VE DESTROYED HIS BRAIN!!)

Musk’s so-called Department of Government Efficiency is the logical outcome of the mentality that the government should not enable Americans to create wealth but rather should put cash in the pockets of a few elites. Far from representing a majority, Musk is unelected, and he is slashing through the government programs he opposes. With full control of both chambers of Congress, Republicans could cut those parts themselves, but such cuts would be too unpopular ever to pass. So, instead, Musk is single-handedly slashing through the government Americans have built over the past 90 years.

Now, MAGA voters are about to discover that the wide-ranging cuts he claims to be making to end diversity, equity, and inclusion (DEI) programs skewer them as well as their neighbors. Attracting white voters with racism was always a tool to end the liberal consensus that worked for everyone, and if Musk’s cuts stand, the U.S. is about to learn that lesson the hard way.

In yet another bombshell, after meeting with Israeli prime minister Benjamin Netanyahu, Trump told reporters tonight that the U.S. “will take over the Gaza Strip,” and suggested sending troops to make that happen. “We’ll own it,” he said. “We’re going to take over that piece, develop it and create thousands and thousands of jobs, and it will be something the entire Middle East can be proud of.” It could become “the Riviera of the Middle East,” he said.

Reaction has been swift and incredulous. Senator Tim Kaine (D-VA), who sits on the Foreign Relations Committee, called the plan “deranged” and “nuts.” Another Foreign Relations Committee member, Senator Chris Coons (D-DE), said he was “speechless,” adding: “That’s insane.” While MAGA representative Nancy Mace (R-SC) posted in support, “Let’s turn Gaza into Mar-a-Lago,” Senator Thom Tillis (R-NC) told NBC News reporters Frank Thorp V and Raquel Coronell Uribe that there were “a few kinks in that slinky,” a reference to a spring toy that fails if it gets bent.

Senator Chris Murphy (D-CT) suggested that Trump was trying to distract people from “the real story—the billionaires seizing government to steal from regular people.”

4 notes

·

View notes

Text

The Future of Commercial Loan Brokering: Trends to Watch!

The commercial loan brokering industry is evolving rapidly, driven by technological advancements, changing market dynamics, and shifting borrower expectations. As businesses continue to seek financing solutions, brokers must stay ahead of emerging trends to remain competitive. Here are some key developments shaping the future of commercial loan brokering:

1. Rise of AI and Automation

Artificial intelligence (AI) and automation are revolutionizing loan processing. From AI-driven underwriting to automated document verification, these technologies are streamlining workflows, reducing manual effort, and speeding up loan approvals. Brokers who leverage AI-powered tools can offer faster and more efficient services.

2. Alternative Lending is Gaining Momentum

Traditional banks are no longer the only players in commercial lending. Alternative lenders, including fintech platforms and private lenders, are expanding options for businesses that may not qualify for conventional loans. As a result, brokers must build relationships with non-bank lenders to provide flexible financing solutions.

3. Data-Driven Decision Making

Big data and analytics are transforming how loans are assessed and approved. Lenders are increasingly using alternative data sources, such as cash flow analysis and digital transaction history, to evaluate creditworthiness. Brokers who understand and utilize data-driven insights can better match clients with the right lenders.

4. Regulatory Changes and Compliance Requirements

The commercial lending landscape is subject to evolving regulations. Compliance with federal and state laws is becoming more complex, requiring brokers to stay updated on industry guidelines. Implementing compliance-friendly processes will be essential for long-term success.

5. Digital Marketplaces and Online Lending Platforms

Online lending marketplaces are making it easier for businesses to compare loan offers from multiple lenders. These platforms provide transparency, efficiency, and better loan matching. Brokers who integrate digital platforms into their services can enhance customer experience and expand their reach.

6. Relationship-Based Lending Still Matters

Despite digital advancements, relationship-based lending remains crucial. Many businesses still prefer working with brokers who offer personalized service, industry expertise, and lender connections. Building trust and maintaining strong relationships with both clients and lenders will continue to be a key differentiator.

7. Increased Focus on ESG (Environmental, Social, and Governance) Lending

Sustainability-focused lending is gaining traction, with more lenders prioritizing ESG factors in their financing decisions. Brokers who understand green financing and social impact lending can tap into a growing market of businesses seeking sustainable funding options.

Final Thoughts

The commercial loan brokering industry is undergoing a transformation, with technology, alternative lending, and regulatory changes shaping the future. Brokers who embrace innovation, stay informed on market trends, and continue building strong relationships will thrive in this evolving landscape.

Are you a commercial loan broker? What trends are you seeing in the industry? Share your thoughts in the comments below!

#CommercialLoanBroker#BusinessFinancing#LoanBrokerTrends#AlternativeLending#Fintech#SmallBusinessLoans#AIinLending#DigitalLending#ESGLending#BusinessGrowth#LoanBrokerage#FinanceTrends#CommercialLending#BusinessFunding#FinancingSolutions#4o

3 notes

·

View notes

Text

The Rise of AI in Financial Software Solutions

Artificial intelligence is rapidly transforming how businesses across industries operate—and the financial sector is at the heart of this shift. From risk modeling and fraud prevention to algorithmic trading and customer service, AI has embedded itself into nearly every aspect of modern financial software.

The growth of intelligent technology in finance is more than just a trend; it's an evolution. Financial institutions, software developers, and fintech startups are leveraging AI to create smarter, faster, and more efficient systems that go beyond traditional computation.

This article explores the key factors driving the adoption of AI in financial software, real-world applications, and how organizations are navigating the opportunities and challenges in this ever-evolving landscape.

Changing the Core of Financial Decision-Making

AI is fundamentally altering how decisions are made within financial systems. Where traditional software relies on static rules and manual updates, AI models adapt in real time by learning from data.

Smarter Algorithms, Faster Responses

Machine learning enables financial software to continuously analyze patterns and improve its outputs. This reduces the reliance on human decision-making in areas like loan approvals, credit scoring, and investment forecasting.

Predictive Over Reactive

AI systems anticipate potential outcomes rather than simply reacting to events. This predictive capability improves financial planning and proactive risk mitigation—vital in volatile markets.

Transforming Customer Experience in Banking

Customer expectations have shifted. People want instant answers, personalized interactions, and seamless service across channels. AI is powering this shift in digital banking experiences.

Virtual Assistants and Chatbots

Intelligent chatbots use natural language processing to respond to customer inquiries 24/7, freeing up human staff for more complex issues.

Hyper-Personalized Offers

AI analyzes individual behavior and transaction history to offer personalized financial products, increasing user engagement and customer lifetime value.

Revolutionizing Credit Risk Assessment

Traditional credit models often rely on outdated or limited data points. AI introduces a more holistic and real-time view of creditworthiness, improving access to financial services.

Alternative Data Utilization

AI models can assess non-traditional indicators such as social signals, e-commerce behavior, or mobile usage to evaluate applicants with no formal credit history.

Dynamic Scoring Models

Instead of static credit scores, AI models evolve with the borrower’s behavior, allowing lenders to update credit assessments more frequently and accurately.

Improving Accuracy in Fraud Detection

As cyber threats become more sophisticated, so must the systems designed to prevent them. AI has become a crucial tool in fraud detection, enabling systems to flag suspicious activity faster and with greater accuracy.

Real-Time Anomaly Detection

AI systems can process thousands of transactions per second, identifying anomalies that deviate from expected patterns in milliseconds.

Behavioral Biometrics

Beyond passwords, AI now monitors user behavior—like typing speed and device usage—to detect fraudulent activity even when login credentials are correct.

Enhancing Wealth and Investment Management

AI is reshaping the world of portfolio management and investment advisory. Wealth management platforms are now offering algorithmic insights previously only available to institutional investors.

Robo-Advisors in Action

Automated investment advisors use AI to recommend asset allocation based on investor profiles, goals, and risk appetite—with minimal human intervention.

Sentiment Analysis in Trading

Natural language processing enables trading software to analyze financial news, earnings reports, and even social media to assess market sentiment and adjust trading strategies in real time.

Accelerating Financial Reporting and Compliance

Regulatory compliance and financial reporting have long been resource-intensive. AI is helping financial institutions automate data aggregation, report generation, and anomaly detection in financial statements.

Intelligent Document Processing

AI-powered systems can extract, classify, and validate data from invoices, contracts, and bank statements, dramatically reducing manual work and errors.

Automated Regulatory Monitoring

Compliance software equipped with AI can monitor regulation changes, flag potential non-compliance, and adapt reporting logic accordingly.

Streamlining Underwriting and Claims Processing

Insurance underwriting and claims processing are being reshaped by intelligent automation. AI can assess risk and process documentation far faster than traditional methods.

Image Recognition and NLP

AI systems can evaluate photos of damage, medical records, or claim forms using computer vision and natural language understanding, reducing processing time.

Faster Payouts, Lower Costs

By automating assessments and fraud checks, insurers are able to pay out legitimate claims more quickly while reducing overhead and false claims.

Enhancing Forecasting and Financial Planning

For businesses and individual users alike, financial forecasting powered by AI is proving more dynamic and accurate than manual spreadsheet-based models.

Dynamic Scenario Modeling

AI enables financial software to simulate various market scenarios and generate real-time forecasts based on new inputs or trends.

Cash Flow Intelligence

Tools can now predict future cash flow based on seasonal trends, invoice cycles, and customer payment behavior, helping businesses manage liquidity more effectively.

Integrating AI Into Legacy Systems

One of the biggest hurdles in adopting AI for financial software lies in integrating intelligent capabilities into existing legacy systems. Many institutions still rely on outdated infrastructure.

Middleware and APIs

To bridge this gap, many firms are using middleware platforms and APIs that allow AI modules to interact with legacy systems without full replacement.

Data Lakes for Unified Access

Modern AI systems require unified, structured data. Data lakes allow organizations to pool data from disparate sources and make it available to AI algorithms in real time.

Building Trust in AI-Driven Decisions

Trust remains a challenge in AI adoption. Financial decisions have high stakes, and users expect transparency, fairness, and accountability.

Explainable AI (XAI)

To address concerns, many developers are embracing explainable AI frameworks that provide clear justifications for algorithmic decisions, especially in areas like credit scoring or loan approval.

Auditing and Governance

Establishing audit trails and governance models ensures that AI systems remain compliant and align with ethical standards—critical in a regulated environment.

Democratizing Financial Services Access

AI isn’t just helping institutions; it’s empowering underserved populations by making financial tools more accessible and inclusive.

Mobile Microloans and Banking

AI-driven microfinance platforms offer small loans to unbanked populations using mobile phone data and behavioral signals, expanding financial inclusion.

Language and Accessibility Features

Voice-enabled banking tools and localized interfaces powered by AI are removing barriers for non-English speakers, the elderly, and those with disabilities.

The Developer’s Role in Future-Ready Finance