#AI-driven lending

Explore tagged Tumblr posts

Text

How Are Mobile Loan Apps Changing the Lending Industry?

Introduction

The digital revolution has significantly transformed various industries, and the financial sector is no exception. With the rise of mobile loan apps, obtaining a personal loan has become faster, more accessible, and hassle-free. Traditional lending institutions, such as banks and credit unions, are no longer the sole providers of loans. Instead, mobile-based lending platforms have emerged as strong competitors, offering quick approvals, minimal documentation, and seamless user experiences.

This article explores how mobile loan apps are reshaping the lending landscape, their advantages, challenges, and their long-term impact on the personal loan market.

1. Faster Loan Approvals and Disbursement

Traditional banks often require several days or even weeks to process a personal loan application. Borrowers must submit physical documents, undergo credit checks, and wait for verification. In contrast, mobile loan apps streamline this process by using AI-driven verification systems and digital documentation.

Many mobile loan apps provide instant loan approvals, where users can receive funds within minutes of application submission. This is particularly beneficial for those in need of urgent cash assistance, such as medical emergencies, travel expenses, or unexpected bills.

2. Increased Accessibility for the Unbanked Population

One of the most significant benefits of mobile loan apps is financial inclusion. A large portion of the global population, particularly in developing countries, lacks access to traditional banking services due to stringent requirements. Mobile lending platforms provide loans to individuals without a strong credit history, enabling them to access financial assistance with just a smartphone and an internet connection.

Many mobile loan providers assess creditworthiness based on alternative data sources, such as mobile transactions, utility bill payments, and online shopping history, making personal loans more accessible to underprivileged borrowers.

3. Convenience and Paperless Processing

Gone are the days when borrowers had to visit a bank branch and submit stacks of documents to apply for a personal loan. Mobile loan apps allow users to complete the entire loan application process digitally, eliminating paperwork and reducing the time required for approvals.

Key features of mobile loan apps include:

E-KYC (Electronic Know Your Customer) Verification

Digital Signature for Agreements

AI-based Document Analysis

These features ensure a hassle-free and paperless borrowing experience, making loan applications more efficient and environmentally friendly.

4. AI and Big Data for Credit Assessment

Traditional banks rely heavily on credit scores issued by bureaus to evaluate a borrower’s eligibility for a personal loan. However, many individuals, especially young professionals and first-time borrowers, may not have an established credit history.

Mobile loan apps leverage AI and Big Data to assess creditworthiness based on various parameters, such as:

Income and Spending Behavior

Social Media Activity

Mobile Recharge and Bill Payment Patterns

Employment Stability

By using alternative credit scoring models, mobile lenders can provide loans to a broader customer base, even those who might not qualify under conventional banking norms.

5. Flexible Loan Amounts and Repayment Options

Unlike traditional banks that have fixed personal loan amounts and rigid repayment terms, mobile loan apps offer flexible borrowing options. Borrowers can choose:

Micro-loans (as low as ₹1,000) for short-term needs

Large personal loans for bigger expenses

Custom repayment tenures based on their financial capacity

Some mobile lenders even provide repayment flexibility, allowing borrowers to opt for weekly, bi-weekly, or monthly EMIs, depending on their cash flow and income cycle.

6. Lower Processing Costs and Interest Rates

Since mobile loan apps operate with minimal overhead costs (no physical branches, fewer employees), they can offer lower processing fees and competitive interest rates compared to traditional lenders. Many mobile lenders provide:

Zero processing fees for first-time borrowers

Low or no prepayment penalties

Discounts on timely repayments

Additionally, AI-driven risk assessment allows mobile lenders to categorize borrowers based on risk profiles, offering personalized interest rates that reflect their financial behavior.

7. Better Security and Fraud Prevention

With digital lending comes the concern of data security and fraud. However, mobile loan apps are increasingly integrating blockchain technology, biometric authentication, and AI-driven fraud detection to safeguard user data.

Some key security features include:

End-to-End Encryption to protect sensitive financial information

Multi-Factor Authentication (MFA) for enhanced login security

AI-Powered Fraud Detection to prevent identity theft and false applications

By leveraging these security measures, mobile lenders ensure a safer and more reliable lending ecosystem.

8. Personalized Loan Offers

AI-driven mobile loan apps analyze user data to offer customized loan products. Instead of a one-size-fits-all approach, borrowers receive loan recommendations tailored to their financial needs and repayment capacity.

For instance:

Freelancers and gig workers can access short-term loans with flexible EMIs.

Students can obtain education loans with minimal documentation.

Salaried employees can get low-interest instant loans with automatic payroll deduction.

This personalized lending approach makes borrowing more efficient and borrower-friendly.

9. Integration with Digital Payments and E-Wallets

Mobile loan apps integrate seamlessly with digital payment platforms, UPI, and e-wallets, making transactions faster and more convenient. Borrowers can:

Receive loan disbursal directly into digital wallets

Make EMI payments via UPI, net banking, or auto-debit

Track loan status and payments in real-time

This seamless integration ensures better loan management and reduces the chances of default due to missed payments.

10. Challenges and Risks of Mobile Loan Apps

Despite their numerous benefits, mobile loan apps also come with certain challenges:

Higher Interest Rates for High-Risk Borrowers – Some mobile lenders charge high interest on loans for individuals with poor credit profiles.

Privacy Concerns – Some apps may collect excessive user data, raising concerns about misuse.

Over-Borrowing Risk – The ease of obtaining instant loans may lead some borrowers into a debt trap.

Regulatory Uncertainties – As digital lending evolves, governments and financial authorities are still working on defining regulatory frameworks for mobile lenders.

To avoid risks, borrowers should choose licensed and reputable mobile loan providers, read terms and conditions carefully, and borrow responsibly.

Conclusion

The rise of mobile loan apps is transforming the personal loan industry by offering faster approvals, enhanced accessibility, lower costs, and better borrower experiences. From AI-powered credit assessments to seamless digital payments, mobile lending is making borrowing more convenient and efficient.

However, as with any financial product, borrowers must exercise caution, compare different lenders, and ensure they are dealing with legitimate platforms to avoid fraud or excessive debt.

With continued technological advancements and increasing regulatory oversight, mobile loan apps are poised to redefine the future of personal loan lending, making financial services more inclusive and borrower-friendly.

#personal loan#loan apps#nbfc personal loan#personal loan online#fincrif#personal loans#bank#finance#loan services#personal laon#Mobile loan apps#Digital lending#Instant personal loan#Online loan approval#Loan disbursement#AI-driven lending#Paperless loan process#Digital loan platforms#Alternative credit scoring#Quick loan approval#Instant loan apps#Smartphone lending#Fintech lending#Mobile-based personal loans#Unbanked borrowers#Loan repayment flexibility#UPI loan payments#Credit assessment technology#Loan security features#Blockchain in lending

1 note

·

View note

Note

There are several reasons why we want to help you. I won’t lie and say that we don’t want to help you for practical reasons. Our path will lead us to fighting some of the toughest foes ever, and your immense power will be useful. You’re also both an AI and a Servant which will likely prove extremely advantageous given the nature of the Solar and Moon Cells. But those practical reasons are only secondary.

The biggest reason we want to help you is that we empathize with you. You were summoned here in an incomplete state that has slowly driven you mad from hunger. We were (and to some degree still are) afflicted with a curse that turned us into a mindless rage machine. You mentioned you were sealed away before, we’ve also experienced that. And while we may look human, we could be described as a monster ourselves since we’re the patched together consciousnesses of 100+ people who simply wanted to live that were turned into a single living weapon.

And yet we found people who were willing to lend us a hand, willing to give us the chance to grow into a more complete being. Some of those people were people we had previously wronged, some of them greatly, yet they still showed us kindness. Companions who stuck by us regardless of our flaws and foolishness. And some of them passed their wishes on to us, the wishes to help bring peace to the Solar Cell and its people, the wishes to forge a better future, one where there is laughter, flowers, and song.

So now we want to be that type of person for you. To pass on the kindness that we were shown to you.

There was a long moment of silence as your words hung in the air.

.

..

…

….

…..

……

…………

………………

Ba-dump.

...?

You heard something, loud and heavy, come from the ALTER-EGO's chest.

KINGPROTEA: "Ooohhhh… nnnnooooooo…"

KINGPROTEA: "I...I mean… well…"

She raised her hands before clapping them together, the fog effortlessly dispersing.

...Wow.

OKUNI: "She… could do that the whole time?!"

ZANZABUROU: "ZAN?!"

RATHOTIS: "What a mighty individual..."

KINGPROTEA: "Yeah, yeah. Be in awe at the might of a superior entity or whatever."

KINGPROTEA: "Fine, insects. Do what you gotta do. Try what you gotta try. I'll make this clear, if this is a trick, then I'll squish you and eat your Servants."

21 notes

·

View notes

Text

Boycott Nintendo.

youtube

While I myself haven't ever bought, or wanted to buy, any Nintendo product of my own money, I would like to bring this to the attention of those who would, or have.

This is not my video; I am only sharing this. Please share this with others, or reblog, if you can. I'm not saying you must, I know how annoying that can be. But if you can, do.

tl;dw / video summarization under the break

With the future release of the Switch 2, the main thing people have noticed, and are upset about, is how high the prices are. Both for the console ($450–$500 USD) and the games themselves ($80–$90 USD). Not to mention, Switch 1 games hardly ever go down in price, or go on sale. While other consoles of newer generations hold games for similarly high prices, they can go on discount, or be bundled in a subscription for lower prices. Switch games don't do that,

Some Switch 2 games' physical copies will not have the actual game on the cartridge. However, the cartridge will contain nothing but a code, which will allow you to download the game onto the Switch 2 itself, and then only be able to play said game when the cartridge is inserted. (a/n: This is basically like the downsides of digital games (takes up storage space) mixed with the downsides of physical games (a small cartridge you could lose).)

This does not apply to any first-party games that we know of, but that doesn't mean this isn't a terrible feature. Physical copies of games are preferred by some due to the games not taking up digital storage space. This new system doesn't allow for that. This isn't necessarily a problem of games not having enough storage to fit on a cartridge. Bravely Default, a game which uses this new game-key card system, is only 11gb in size. The cartridges hold 64gb. There is no reason to be doing this. (a/n: btw im writing this by hand i promise you this is not an ai summary i would fuckin never do that. just wanted to clarify that mid-text to show im a real human :3 anyways.)

Nintendo's entire back catalogue of games are not legally accessible. Not only do you have to pay a higher-tier subscription of Nintendo Switch Online to access N64 and GBA (among others..?) games, but that's only a select few of their catalogue. The rest of those old games can only be acquired via purchasing second-hand or pirating. (a/n: And of course, Nintendo has been threatening legal action to websites hosting old ROMs, including Archive.org, which is worrying for the website's future.)

Gred Glintstone, the creator of the video, makes a comparison between this situation and what happened with the Xbox One, with having no pre-owned games and no easy way to lend a game to a friend. Microsoft didn't handle the backlash well, and thus lost the console war for that generation. They've been struggling to recover since, with Phil Spencer saying that it was a wakeup call and has driven them to be more consumer-friendly. With Nintendo falling down the same path, the same thing should happen to them; Nintendo needs a wakeup call.

They're not doing this to survive in the market. They're not just adjusting to inflation, and while the US tariffs are affecting a lot of things, that's not their main reason for this. Nintendo wouldn't go out of business if they sold their games at reasonable prices; they've got merchandise, a movie, even a whole theme park. They're upping the price for no reason other than corporate greed, and disrespect for the consumer.

Boycott Nintendo.

a/n: My summary of the video is a bit rearranged to flow better. Please watch the original video for more context and further information.

#boycott nintendo#boycott#nintendo#nintendo switch 2#switch 2#i've never done something like this so i hope i did it right#i'm still so new to tumblr im not sure what the activism culture is like here#tbf i'm not great with activism overall but i'm trying my best#i mean from what i've heard it seems to be working for tesla#and how long's it been since that? a month? two at most? i honestly don't remember#as long as we have the numbers we too can take a stab at nintendo's profits#certified starofgalaxies post#Youtube

14 notes

·

View notes

Text

Stock Market Predictions – March 2025

March is a volatile period for financial markets, driven by Mercury retrograde, Venus retrograde, and significant planetary shifts. Expect uncertainty, emotional reactions, and market corrections.

Key Influences on Markets

Mercury Retrograde in Aries (March 15) Market Effect: Increased volatility, misinformation, and sudden reversals. Traders may overreact to news, causing erratic price swings. Sectors Affected: Technology, startups, transportation, and communication stocks face confusion or slowdowns.

Venus Retrograde in Aries (Throughout March, enters Pisces on March 27) Market Effect: Investor sentiment weakens; money flows slow down. Sectors Affected: Luxury goods, beauty, and entertainment stocks may underperform. However, Venus entering Pisces later supports pharmaceuticals, wellness, and water-related industries.

Mars in Cancer (Defensive Market Mood) Market Effect: Investors act emotionally rather than rationally. High volatility in commodities (oil, agriculture) and housing markets. Sectors Affected: Real estate, food, and defensive stocks (utilities, healthcare) may gain traction as investors seek security.

Jupiter in Gemini (Expanding Speculation) Market Effect: Speculative trading increases, particularly in tech and AI sectors. News-driven price surges are common. Sectors Affected: Tech, AI, digital communication, and online media stocks benefit.

Saturn in Pisces (Liquidity Concerns, Debt Issues) Market Effect: Possible concerns about economic stability or rising debt levels. Government interventions may be needed to stabilize markets. Sectors Affected: Banking, finance, and lending institutions could experience challenges.

Uranus in Taurus (Still Shaking Financial Systems, Crypto Markets in Focus) Market Effect: Ongoing disruption in banking, fintech, and cryptocurrency sectors. Unpredictable price swings in Bitcoin and altcoins.

Neptune in Pisces (Market Speculation & Illusions, Enters Aries on March 30) Market Effect: Sentiment-driven rallies in speculative assets; potential for misleading economic data. Sectors Affected: Oil, pharmaceuticals, biotech, and alternative medicine stocks benefit.

Pluto in Aquarius (Big Tech & AI Revolutions, but Retrograde in May) Market Effect: Transformational shifts in technology, AI, and automation. However, Pluto’s upcoming retrograde in May may trigger regulatory concerns.

March 2025 Market Summary

Early March: Market optimism despite Venus retrograde; speculation runs high.

Mid-March (Mercury Retrograde Begins): Sharp volatility, misinformation, and market corrections.

Late March (Venus Enters Pisces, Neptune in Aries): Market stabilizes slightly, with a shift toward pharma, biotech, and defensive sectors.

#Venus retrograde#misinformation#startups#transportation#beauty#wellness#Mars in Cancer#food#AI#digital communication#Debt Issues#finance#fintech#biotech#aquarius placements#astrology observations#astrology#astrology notes#cancer placements#astrology rants#sagittarius placements#virgo placements#aries placements#capricorn placements#pisces placements#libra placements#leo placements#aquarius placements#taurus placements#gemini placements

10 notes

·

View notes

Text

𝐅𝐮𝐭𝐮𝐫𝐞 𝐨𝐟 𝐀𝐈-:

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐀𝐫𝐭𝐢𝐟𝐢𝐜𝐢𝐚𝐥 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 ?

Artificial intelligence (AI) refers to computer systems capable of performing complex tasks that historically only a human could do, such as reasoning, making decisions, or solving problems.

𝐂𝐮𝐫𝐫𝐞𝐧𝐭 𝐀𝐈 𝐂𝐚𝐩𝐚𝐛𝐢𝐥𝐢𝐭𝐢𝐞𝐬-:

AI today exhibits a wide range of capabilities, including natural language processing (NLP), machine learning (ML), computer vision, and generative AI. These capabilities are used in various applications like virtual assistants, recommendation systems, fraud detection, autonomous vehicles, and image generation. AI is also transforming industries like healthcare, finance, transportation, and creative domains.

𝐀𝐈 𝐀𝐩𝐩𝐬/𝐓𝐨𝐨𝐥𝐬-:

ChatGpt, Gemini, Duolingo etc are the major tools/apps of using AI.

𝐑𝐢𝐬𝐤𝐬 𝐨𝐟 𝐀𝐈-:

1. Bias and Discrimination: AI algorithms can be trained on biased data, leading to discriminatory outcomes in areas like hiring, lending, and even criminal justice.

2. Security Vulnerabilities: AI systems can be exploited through cybersecurity attacks, potentially leading to data breaches, system disruptions, or even the misuse of AI in malicious ways.

3. Privacy Violations: AI systems often rely on vast amounts of personal data, raising concerns about privacy and the potential for misuse of that data.

4. Job Displacement: Automation driven by AI can lead to job losses in various sectors, potentially causing economic and social disruption.

5. Misuse and Weaponization: AI can be used for malicious purposes, such as developing autonomous weapons systems, spreading disinformation, or manipulating public opinion.

6. Loss of Human Control: Advanced AI systems could potentially surpass human intelligence and become uncontrollable, raising concerns about the safety and well-being of humanity.

𝐅𝐮𝐭𝐮𝐫𝐞 𝐨𝐟 𝐀𝐈:-

Healthcare:AI will revolutionize medical diagnostics, personalize treatment plans, and assist in complex surgical procedures.

Workplace:AI will automate routine tasks, freeing up human workers for more strategic and creative roles.

Transportation:Autonomous vehicles and intelligent traffic management systems will enhance mobility and safety.

Finance:AI will reshape algorithmic trading, fraud detection, and economic forecasting.

Education:AI will personalize learning experiences and offer intelligent tutoring systems.

Manufacturing:AI will enable predictive maintenance, process optimization, and quality control.

Agriculture:AI will support precision farming, crop monitoring, and yield prediction.

#AI#Futuristic#technology#development#accurate#realistic#predictions#techworld#machinelearning#robotic

4 notes

·

View notes

Text

Embracing the Future: The Impact of Artificial Intelligence on Business and Society

Embracing the Future: The Impact of Artificial Intelligence on Business and Society In recent years, artificial intelligence (AI) has emerged as a transformative force, reshaping industries and redefining societal norms. As we stand at the threshold of this technological revolution, it is imperative to understand both the opportunities and challenges that AI presents to businesses and society at large. AI's integration into business processes has led to unprecedented efficiencies and innovation. Organizations are leveraging machine learning algorithms to analyze vast amounts of data, enabling them to make informed decisions faster than ever. This data-driven approach not only enhances operational efficiency but also fosters a deeper understanding of customer preferences, thereby facilitating personalized services and improved user experiences. Moreover, AI is driving significant advancements in sectors such as healthcare, finance, and manufacturing. In healthcare, for instance, AI-powered diagnostic tools are revolutionizing patient care, allowing for earlier detection of diseases and more precise treatment plans. In finance, algorithms for risk assessment help institutions make better lending decisions while minimizing potential losses. These advancements underscore AI’s potential to enhance productivity and drive economic growth. However, as we embrace these changes, it is crucial to address the ethical and societal implications of AI. Concerns regarding job displacement, privacy issues, and algorithmic bias must be continuously monitored and mitigated. Businesses must adopt ethical frameworks to guide their AI initiatives, ensuring that technology serves the broader community rather than exacerbating existing inequalities. Furthermore, as AI continues to evolve, it necessitates a shift in workforce skills. Organizations must invest in upskilling and reskilling initiatives to prepare employees for an AI-driven future, ensuring that the workforce is equipped to thrive in collaboration with technology. In conclusion, the impact of artificial intelligence on business and society is profound and multifaceted. By actively engaging with the opportunities it affords while remaining vigilant about its challenges, we can harness AI's potential for the greater good. Embracing AI responsibly will not only drive innovation but also foster a more equitable and prosperous future for all.

4 notes

·

View notes

Text

Smart Contracts & AI Agents: Building Autonomous Web3 Systems in 2025

Introduction to Autonomous Web3 Systems

In 2025, the convergence of artificial intelligence and blockchain has begun reshaping the Web3 ecosystem. One of the most powerful combinations emerging is the integration of smart contracts with autonomous AI agents. These systems are enabling on-chain services to operate without human intervention, improving efficiency, transparency, and scalability. Businesses are increasingly turning to a smart contract development company to engineer next-gen solutions powered by automation and intelligence.

From finance to gaming, AI-driven smart contracts are automating operations, making real-time decisions, and executing logic with unprecedented accuracy. As demand grows for fully autonomous digital ecosystems, the role of smart contract development services is expanding to include AI capabilities at the very core of blockchain architecture.

What Are AI Agents and How Do They Work with Smart Contracts?

AI agents are self-operating software entities that use data to make decisions, execute tasks, and learn from outcomes. When paired with smart contracts—immutable and self-executing blockchain scripts—AI agents can interact with decentralized protocols, real-world data, and even other AI agents in a trustless and programmable way.

Imagine a decentralized lending platform where an AI agent monitors market volatility and automatically pauses liquidity pools based on predictions. The smart contract executes this logic on-chain, ensuring compliance, transparency, and tamper-proof enforcement. The synergy between automation and blockchain immutability unlocks a new model for scalable, intelligent systems.

The Rise of Autonomous DAOs and AI-Powered DApps

Decentralized Autonomous Organizations (DAOs) are early examples of self-governing systems. In 2025, AI agents are now acting as core components within these structures, dynamically analyzing proposals, allocating budgets, or enforcing treasury rules without human oversight.

Similarly, AI-infused decentralized applications (DApps) are gaining traction across industries. From decentralized insurance platforms that use AI to assess claims to logistics systems that optimize routing in real-time, the combination of smart contracts and AI enables new classes of adaptive, user-centric services.

A reliable smart contract development company plays a crucial role in designing these complex systems, ensuring not only their efficiency but also their security and auditability.

Use Cases Driving Growth in 2025

Several industries are pushing the boundaries of what’s possible with AI-smart contract integration:

Decentralized Finance (DeFi)

AI agents in DeFi can manage liquidity, rebalance portfolios, and identify arbitrage opportunities with lightning speed. These agents interact with smart contracts to execute trades, issue loans, or change protocol parameters based on predictive models. A smart contract development company ensures that these contracts are robust, upgradable, and compatible across chains.

Supply Chain Management

Autonomous AI agents monitor shipment status, vendor reliability, and environmental conditions. Paired with blockchain-based smart contracts, they can release payments upon delivery verification, automate audits, and enforce service level agreements, streamlining the global logistics chain.

Web3 Gaming and NFTs

AI agents are being used to manage dynamic game environments, evolve characters based on player behavior, or even moderate on-chain gaming economies. Smart contracts enforce gameplay rules, ownership, and in-game economy transactions—all without needing centralized servers.

Real Estate and Property Tech

Property management is increasingly automated with AI agents handling tenant screening, lease renewals, and predictive maintenance. Smart contracts manage rental payments, deposit escrow, and legal compliance—reducing overhead and manual errors.

These innovations are pushing smart contract development services to go beyond simple scripting and embrace architectural strategies that support AI model integration and off-chain data access.

Infrastructure Enablers: Chainlink, Oracles & Agent Frameworks

To build autonomous systems, AI agents need access to real-world data. Chainlink Functions and decentralized oracles act as the middleware between smart contracts and off-chain data sources. In 2025, newer frameworks like Fetch.ai and Bittensor are offering environments where AI models can communicate, train collaboratively, and interact with smart contracts directly.

For example, an AI agent trained on user behavior data can invoke a smart contract that rewards high-value contributors in a decentralized community. The smart contract development company involved must ensure deterministic logic, compatibility with oracle inputs, and privacy protection mechanisms.

Security Challenges with Autonomous AI Systems

As AI agents begin to take on larger roles in Web3 systems, security becomes even more critical. Improperly trained models or exploited AI logic could lead to major vulnerabilities in autonomous smart contract systems.

That’s why AI-auditing tools, formal verification, and simulation testing are becoming core offerings of modern smart contract development services. AI-driven audits themselves are being used to detect bugs, gas inefficiencies, and logic flaws in deployed contracts. Combining human and machine review is key to ensuring safety in fully autonomous systems.

The Human-AI-Smart Contract Feedback Loop

What makes AI agents truly powerful is their ability to adapt based on feedback. In Web3, this creates a loop:

Smart contracts record immutable outcomes of AI actions.

These records are used by the AI agent to improve future decisions.

New decisions are enforced again through smart contracts.

This feedback loop leads to smarter, more efficient, and context-aware decentralized services. It’s also redefining how smart contract development companies build long-term logic systems, placing a stronger emphasis on adaptability and evolution.

Building Autonomous Web3 Projects in 2025

Creating a successful AI-smart contract system requires a collaborative approach. A skilled smart contract development company will work with data scientists, AI researchers, and decentralized architecture teams to ensure interoperability and functionality. Key steps include:

Designing modular smart contracts that can be triggered by AI decisions.

Integrating decentralized oracles and machine learning APIs.

Ensuring security through formal verification and continuous testing.

Enabling governance mechanisms to override AI in case of anomalies.

As these practices become more mainstream, smart contract development services are evolving into end-to-end partners for AI-powered Web3 ecosystems—from ideation and data modeling to deployment and maintenance.

The Future of AI-Smart Contract Systems

Looking ahead, the development of fully autonomous digital economies is on the horizon. Think of decentralized cities where AI agents handle resource allocation, governance, and economic modeling—all powered by a transparent network of smart contracts.

The evolution of AI models—especially multimodal agents capable of language, vision, and planning—is accelerating this shift. In response, blockchain protocols are becoming more composable, privacy-preserving, and AI-compatible.

For businesses, now is the time to explore pilot programs, AI-smart contract integrations, and long-term infrastructure investments. Working with a forward-thinking smart contract development company can provide the strategy and support needed to capitalize on this new frontier.

Conclusion

In 2025, the marriage of AI agents and smart contracts is creating a new paradigm in the Web3 world: systems that think, act, and enforce rules autonomously. This powerful combination is driving innovation across industries, offering scalable and trustworthy automation that reduces costs and improves performance.

Whether you’re building a decentralized finance app, managing logistics, or launching an AI-based DAO, aligning with the right smart contract development services will be essential to unlocking the full potential of autonomous Web3 systems.

2 notes

·

View notes

Text

I've always been fascinated by fictional corporations and companies in books, tv and video games. I don't know why, probably because they lend credibility to their respective universes and help anchor the characters in a world that is believable.

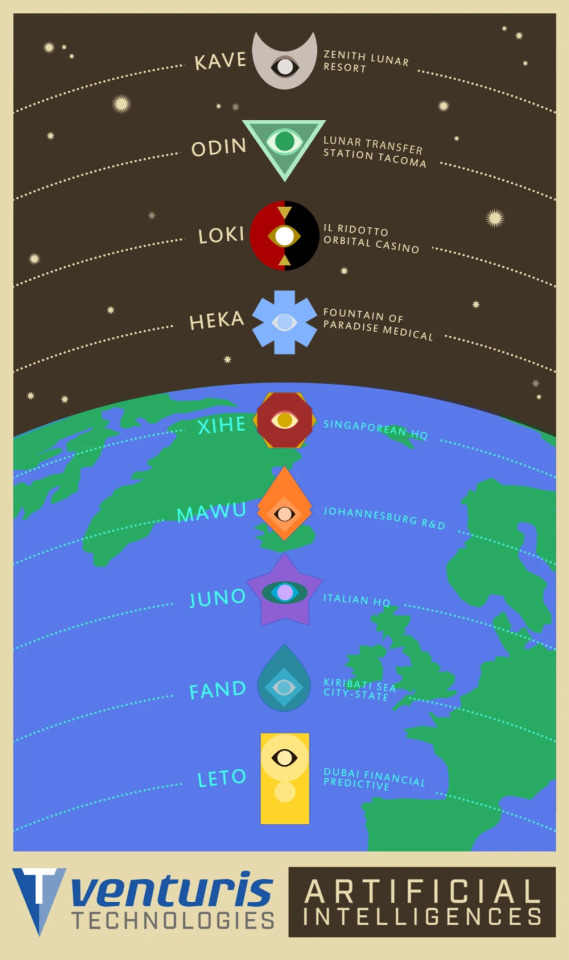

Today's corporation is Venturis Corporation, from Tacoma by Fullbright.

As often in video games, this corporation is not the center point but we hear about it throughout the story. They own the Lunar Transfer Station Tacoma, which is a cargo transfer space station between the Earth and and the Moon. The game plays fully on Tacoma.

But in-game, they are more well known for being one of the pioneers of AI. Of course, this story was much more science-fictiony when it came out in 2018. Now in 2024, it's all a bit too real with companies like OpenAI...

Thankfully however, we still get to enjoy our science-fiction, because these AIs, created and owned by Venturis are not bullsh*tting engines (looking at you ChatGPT), but rather what we today call "AGI" (Artificial General Intelligence), which are much more what we imagine an AI should be: an artificial sentient being.

The AI in charge of Tacoma is called ODIN and is one of the central characters of the game. It interacts with the crew of the station throughout the story and we get to see its personality and learn more about it and its capabilities.

Venturis owns ODIN and that's a big theme in the game. But the company also develops access to space for humans and builds space habitats. Notably, you learn that they own the following locations:

Venturis Zenith Lunar Resort

Venturis Belt

Il Ridotto Orbital Caison

Fountain of Paradise Spaceport

We don't hear a lot about most of these locations, except for their purpose and that they are all managed by their own AI.

However, there's one exception. During the game, you do learn quite a lot about Venturis Belt, through personal logs, conversations and ads.

Imagine, a city in space. Hundreds of fully-automated interlinked "bungalows" encircling Earth.

"Fully-automated" is in bold above, because it's important, you'll see.

Except, the belt was never built, and it costs the Venturis Corporation dearly.

Something called the "Human Oversight Accord" was passed and the project cancelled. The accord is celebrated yearly as "Obsolescence Day", the day humans came together and decided to put a stop to full automation driven by AI, which would have made human orbital workers "obsolete".

Now, depending on how you look at it, it's either a good a bad thing.

No more jobs for humans, that sounds like a late-stage capitalism nightmare. No job = no money = no prospect = well, we all know how it goes...

Or, if you're a real optimist, it can sound like a socialist utopia, where humans would have been freed from useless work and have more time to develop to hobbies, arts, friends... you name it (Star Trek anyone?). The reasoning being more automation = less toil and also = more free time = possibly more happiness?

The interpretation is left an exercise to the player/reader.

Regardless, Venturis' plans for mass automation and removing humans from the equation didn't pan out and their project failed. It is not the only "defeat" the corporation will have to face, but I don't want to spoil the game too much for you. If you want to know the rest, I guess you will have to go and play it ;)

Credit: all the images are the property of Fullbright

#gaming#tacoma game#fullbright#Venturis Corporation#Human Oversight Accord#Obsolescence day#Fictional AI

15 notes

·

View notes

Text

The Future of Commercial Loan Brokering: Trends to Watch!

The commercial loan brokering industry is evolving rapidly, driven by technological advancements, changing market dynamics, and shifting borrower expectations. As businesses continue to seek financing solutions, brokers must stay ahead of emerging trends to remain competitive. Here are some key developments shaping the future of commercial loan brokering:

1. Rise of AI and Automation

Artificial intelligence (AI) and automation are revolutionizing loan processing. From AI-driven underwriting to automated document verification, these technologies are streamlining workflows, reducing manual effort, and speeding up loan approvals. Brokers who leverage AI-powered tools can offer faster and more efficient services.

2. Alternative Lending is Gaining Momentum

Traditional banks are no longer the only players in commercial lending. Alternative lenders, including fintech platforms and private lenders, are expanding options for businesses that may not qualify for conventional loans. As a result, brokers must build relationships with non-bank lenders to provide flexible financing solutions.

3. Data-Driven Decision Making

Big data and analytics are transforming how loans are assessed and approved. Lenders are increasingly using alternative data sources, such as cash flow analysis and digital transaction history, to evaluate creditworthiness. Brokers who understand and utilize data-driven insights can better match clients with the right lenders.

4. Regulatory Changes and Compliance Requirements

The commercial lending landscape is subject to evolving regulations. Compliance with federal and state laws is becoming more complex, requiring brokers to stay updated on industry guidelines. Implementing compliance-friendly processes will be essential for long-term success.

5. Digital Marketplaces and Online Lending Platforms

Online lending marketplaces are making it easier for businesses to compare loan offers from multiple lenders. These platforms provide transparency, efficiency, and better loan matching. Brokers who integrate digital platforms into their services can enhance customer experience and expand their reach.

6. Relationship-Based Lending Still Matters

Despite digital advancements, relationship-based lending remains crucial. Many businesses still prefer working with brokers who offer personalized service, industry expertise, and lender connections. Building trust and maintaining strong relationships with both clients and lenders will continue to be a key differentiator.

7. Increased Focus on ESG (Environmental, Social, and Governance) Lending

Sustainability-focused lending is gaining traction, with more lenders prioritizing ESG factors in their financing decisions. Brokers who understand green financing and social impact lending can tap into a growing market of businesses seeking sustainable funding options.

Final Thoughts

The commercial loan brokering industry is undergoing a transformation, with technology, alternative lending, and regulatory changes shaping the future. Brokers who embrace innovation, stay informed on market trends, and continue building strong relationships will thrive in this evolving landscape.

Are you a commercial loan broker? What trends are you seeing in the industry? Share your thoughts in the comments below!

#CommercialLoanBroker#BusinessFinancing#LoanBrokerTrends#AlternativeLending#Fintech#SmallBusinessLoans#AIinLending#DigitalLending#ESGLending#BusinessGrowth#LoanBrokerage#FinanceTrends#CommercialLending#BusinessFunding#FinancingSolutions#4o

3 notes

·

View notes

Text

Exploring AI's Benefits in Fintech

The integration of artificial intelligence (AI) in the financial technology (fintech) sector is bringing about significant changes. From enhancing customer service to optimizing financial operations, AI is revolutionizing the industry. Chatbots, a prominent AI application in fintech, offer personalized and efficient customer interactions. This article explores the various benefits AI brings to fintech.

Enhanced Customer Experience

AI-powered chatbots and virtual assistants are revolutionizing customer service in fintech. These tools provide 24/7 support, handle multiple queries simultaneously, and deliver instant responses, ensuring customers receive timely assistance. AI systems continually learn from interactions, improving their efficiency and effectiveness over time.

Superior Fraud Detection

Fraud detection is crucial in the financial sector, and AI excels in this area. AI systems analyze vast amounts of transaction data in real time, identifying unusual patterns and potential fraud more accurately than traditional methods. Machine learning algorithms effectively recognize subtle signs of fraudulent activity, mitigating risks and protecting customers.

Personalized Financial Services

AI enables fintech companies to offer highly personalized services. By analyzing customer data, AI provides tailored financial advice, recommends suitable investment opportunities, and creates customized financial plans. This level of personalization helps build stronger customer relationships and enhances satisfaction.

Enhanced Risk Management

AI-driven analytics significantly enhance risk management. By processing large datasets and identifying trends, AI can predict and assess risks more accurately than human analysts. This enables financial institutions to make informed decisions and manage risks more effectively.

Automation of Routine Tasks

AI automates many routine and repetitive tasks in fintech, such as data entry, account reconciliation, and compliance checks. This reduces the workload for employees and minimizes the risk of human errors. Automation leads to greater operational efficiency and allows staff to focus on strategic activities.

Advanced Investment Strategies

AI revolutionizes investment strategies by providing precise, data-driven insights. Algorithmic trading, powered by AI, analyzes market conditions and executes trades at optimal times. Additionally, AI tools assist investors in making better decisions by forecasting market trends and identifying lucrative opportunities.

In-Depth Customer Insights

AI provides fintech companies with deeper insights into customer behavior and preferences. By analyzing transaction history, spending patterns, and other relevant data, AI predicts customer needs and offers proactive solutions. This level of insight is invaluable for targeted marketing strategies and improving customer retention.

Streamlined Loan and Credit Processes

AI streamlines loan and credit approval processes by automating credit scoring and underwriting. AI algorithms quickly assess an applicant’s creditworthiness by analyzing various factors, such as income, credit history, and spending habits. This results in faster loan approvals and a more efficient lending process.

Conclusion

AI is transforming the fintech industry by improving efficiency, enhancing customer experiences, and providing valuable insights. As technology advances, the role of AI in fintech will grow, driving further innovation and growth. Embracing AI solutions is essential for financial institutions to stay competitive in this rapidly changing landscape.

8 notes

·

View notes

Text

Blockchain Development Company in India: Transforming Businesses with Cutting-Edge Solutions

The rapid adoption of blockchain technology is revolutionizing industries, creating new opportunities for businesses to enhance security, transparency, and efficiency. As a leading Blockchain Development Company in India, Blockchain App Maker offers comprehensive blockchain solutions tailored to your business needs. Our expertise spans across blockchain wallet development, DeFi solutions, AI-driven innovations, and IoT integration.

Comprehensive Blockchain Solutions

Blockchain Wallet Development Company

Secure digital asset storage is critical in today's financial landscape. Our Blockchain Wallet Development Company specializes in building robust and user-friendly cryptocurrency wallets. Whether you're looking for a non-custodial or custodial wallet, we ensure top-tier security, seamless integration, and multi-currency support.

DeFi Wallet Development Company

Decentralized Finance (DeFi) is reshaping the financial industry. As a top DeFi Wallet Development Company, we develop next-generation DeFi wallets that enable secure lending, borrowing, staking, and yield farming. Our solutions are designed to provide a seamless user experience with advanced security features.

Cryptocurrency Exchange Software Development

Our Cryptocurrency Exchange Software Development services cater to businesses looking to launch secure and high-performance exchange platforms. We integrate liquidity solutions, multi-layer security, automated KYC, and AML compliance to create scalable crypto exchanges.

Industry-Specific Blockchain Expertise

Blockchain IoT Development Company

Blockchain and IoT are transforming industries by enabling secure, decentralized data exchanges. As a Blockchain IoT Development Company, we develop blockchain-powered IoT applications that enhance supply chain visibility, device security, and data integrity.

Corda Blockchain Development

For enterprises seeking a private, permissioned blockchain solution, we offer Corda Blockchain Development services. Corda's smart contract capabilities and privacy-focused architecture make it ideal for financial institutions, healthcare, and supply chain businesses.

Crypto Exchange Algo Trading

Algorithmic trading is essential for efficient and automated crypto trading. Our Crypto Exchange Algo Trading solutions leverage AI and machine learning to execute high-frequency trades, optimize strategies, and improve profitability.

Our Presence across Major Cities

Blockchain App Maker is a trusted Blockchain Development Company in Ahmedabad, Blockchain Development Company in Bangalore, Blockchain Development Company in Delhi, Blockchain Development Company in Chandigarh, and Blockchain Development Company in Chennai. We provide businesses with scalable and customized blockchain solutions to accelerate their growth in the digital economy.

AI Prompt Engineering Company

Artificial Intelligence is driving innovation in blockchain solutions. As an AI Prompt Engineering Company, we integrate AI with blockchain to enhance data processing, automate workflows, and improve decision-making processes.

Why Choose Blockchain App Maker?

As a top Blockchain Development Company in India, Ahmedabad, Bangalore, Chandigarh, Chennai, and Delhi, we specialize in delivering customized blockchain solutions that help businesses stay ahead in the competitive market. Our team of experts develops scalable, secure, and feature-rich blockchain applications that streamline business operations.

Expertise in blockchain wallet and DeFi development

Advanced AI and IoT-powered solutions

Secure and scalable crypto exchange platforms

Comprehensive Corda blockchain development

Presence in multiple cities, ensuring easy accessibility

Get Started Today!

Looking for a reliable Blockchain Development Company in Delhi? Partner with Blockchain App Maker to leverage cutting-edge blockchain solutions tailored to your business needs. Contact us today to discuss your project requirements!

#blockchain development company in India#blockchain development company in Bengaluru#blockchain development company in Ahmedabad#blockchain development company in Delhi#blockchain development company in Chandigarh#blockchain development company in Chennai#corda blockchain development#crypto exchange algo trading#nft development services#crypto exchange software

3 notes

·

View notes

Text

25 Passive Income Ideas to Build Wealth in 2025

Passive income is a game-changer for anyone looking to build wealth while freeing up their time. In 2025, technology and evolving market trends have opened up exciting opportunities to earn money with minimal ongoing effort. Here are 25 passive income ideas to help you grow your wealth:

1. Dividend Stocks

Invest in reliable dividend-paying companies to earn consistent income. Reinvest dividends to compound your returns over time.

2. Real Estate Crowdfunding

Join platforms like Fundrise or CrowdStreet to invest in real estate projects without the hassle of property management.

3. High-Yield Savings Accounts

Park your money in high-yield savings accounts or certificates of deposit (CDs) to earn guaranteed interest.

4. Rental Properties

Purchase rental properties and outsource property management to enjoy a steady cash flow.

5. Short-Term Rentals

Leverage platforms like Airbnb or Vrbo to rent out spare rooms or properties for extra income.

6. Peer-to-Peer Lending

Lend money through platforms like LendingClub and Prosper to earn interest on your investment.

7. Create an Online Course

Turn your expertise into an online course and sell it on platforms like Udemy or Teachable for recurring revenue.

8. Write an eBook

Publish an eBook on Amazon Kindle or similar platforms to earn royalties.

9. Affiliate Marketing

Promote products or services through a blog, YouTube channel, or social media and earn commissions for every sale.

10. Digital Products

Design and sell digital products such as templates, printables, or stock photos on Etsy or your website.

11. Print-on-Demand

Use platforms like Redbubble or Printful to sell custom-designed merchandise without inventory.

12. Mobile App Development

Create a useful app and monetize it through ads or subscription models.

13. Royalties from Creative Work

Earn royalties from music, photography, or artwork licensed for commercial use.

14. Dropshipping

Set up an eCommerce store and partner with suppliers to fulfill orders directly to customers.

15. Blogging

Start a niche blog, grow your audience, and monetize through ads, sponsorships, or affiliate links.

16. YouTube Channel

Create a YouTube channel around a specific niche and earn through ads, sponsorships, and memberships.

17. Automated Businesses

Use tools to automate online businesses, such as email marketing or subscription box services.

18. REITs (Real Estate Investment Trusts)

Invest in REITs to earn dividends from real estate holdings without owning property.

19. Invest in Index Funds

Index funds provide a simple way to earn passive income by mirroring the performance of stock market indexes.

20. License Software

Develop and license software or plugins that businesses and individuals can use.

21. Crypto Staking

Participate in crypto staking to earn rewards for holding and validating transactions on a blockchain network.

22. Automated Stock Trading

Leverage robo-advisors or algorithmic trading platforms to generate passive income from the stock market.

23. Create a Membership Site

Offer exclusive content or resources on a membership site for a recurring subscription fee.

24. Domain Flipping

Buy and sell domain names for a profit by identifying valuable online real estate.

25. Invest in AI Tools

Invest in AI-driven platforms or create AI-based products that solve real-world problems.

Getting Started

The key to success with passive income is to start with one or two ideas that align with your skills, interests, and resources. With dedication and consistency, you can build a diversified portfolio of passive income streams to secure your financial future.

2 notes

·

View notes

Text

How Can Financial Literacy and Education Empower Individuals and Businesses?

In an increasingly complex financial world, financial literacy and education have become essential tools for both individuals and businesses. They serve as the foundation for informed decision-making, effective money management, and long-term financial stability. By understanding financial concepts and leveraging modern tools, people and organizations can optimize their resources and achieve their goals more efficiently. The inclusion of technology solutions in this journey has further amplified the impact of financial literacy, making it accessible and actionable for all.

Why Financial Literacy and Education Matter

Financial literacy refers to the ability to understand and effectively use financial skills, including budgeting, investing, and managing debt. Education in these areas empowers individuals to take control of their finances, reduce financial stress, and build wealth over time. For businesses, financial literacy is equally critical, as it enables owners and managers to make data-driven decisions, manage cash flow effectively, and ensure compliance with financial regulations.

Without adequate financial knowledge, individuals are more likely to fall into debt traps, struggle with saving, and make poor investment choices. Similarly, businesses lacking financial literacy may face challenges in budgeting, forecasting, and maintaining profitability. Therefore, a solid foundation in financial concepts is indispensable for long-term success.

The Role of Technology in Financial Literacy

Modern technology solutions have revolutionized the way financial literacy is imparted and practiced. From online courses and mobile apps to AI-driven financial advisors, technology has made financial education more engaging and accessible. These tools provide real-time insights, personalized recommendations, and interactive learning experiences that cater to diverse needs and skill levels.

For example, budgeting apps like Mint and YNAB (You Need a Budget) help individuals track expenses, set financial goals, and stay accountable. Similarly, platforms like Khan Academy and Coursera offer free and paid courses on financial literacy topics, ranging from basic budgeting to advanced investment strategies. Businesses can benefit from specialized tools like QuickBooks for accounting or Tableau for financial data visualization, enabling them to make informed decisions quickly and effectively.

Empowering Individuals Through Financial Literacy

Better Money Management: Financial literacy equips individuals with the skills to create and maintain budgets, prioritize expenses, and save for future goals. Understanding concepts like compound interest and inflation helps people make smarter choices about saving and investing.

Debt Reduction: Education about interest rates, repayment strategies, and credit scores empowers individuals to manage and reduce debt effectively. This knowledge also helps them avoid predatory lending practices.

Investment Confidence: Many people shy away from investing due to a lack of knowledge. Financial literacy programs demystify investment concepts, enabling individuals to grow their wealth through informed choices in stocks, bonds, mutual funds, and other assets.

Enhanced Financial Security: By understanding insurance, retirement planning, and emergency funds, individuals can safeguard their financial future against unexpected events.

Empowering Businesses Through Financial Literacy

Effective Budgeting and Forecasting: Businesses with strong financial literacy can create realistic budgets, forecast revenues and expenses accurately, and allocate resources efficiently. This minimizes waste and maximizes profitability.

Improved Cash Flow Management: Understanding cash flow dynamics helps businesses avoid liquidity crises and maintain operational stability. Tools like cash flow statements and projections are invaluable for this purpose.

Informed Decision-Making: Financially literate business leaders can evaluate the costs and benefits of various opportunities, such as expanding operations, launching new products, or securing funding. This leads to more sustainable growth.

Regulatory Compliance: Knowledge of financial regulations and tax laws ensures that businesses remain compliant, avoiding penalties and fostering trust with stakeholders.

The Role of Xettle Technologies in Financial Empowerment

One standout example of a technology solution driving financial empowerment is Xettle Technologies. The platform offers innovative tools designed to simplify financial management for both individuals and businesses. With features like automated budgeting, real-time analytics, and AI-driven financial advice, Xettle Technologies bridges the gap between financial literacy and actionable solutions. By providing users with practical insights and easy-to-use tools, the platform empowers them to make smarter financial decisions and achieve their goals efficiently.

Strategies to Improve Financial Literacy and Education

Leverage Technology: Use apps, online courses, and virtual simulations to make learning interactive and accessible. Gamified learning experiences can also boost engagement.

Community Programs: Governments and non-profits can play a vital role by offering workshops, seminars, and resources focused on financial literacy.

Integrate Financial Education in Schools: Introducing financial literacy as part of school curriculums ensures that young people develop essential skills early on.

Encourage Workplace Learning: Businesses can offer financial literacy programs for employees, helping them manage personal finances better and increasing overall workplace satisfaction.

Seek Professional Guidance: For complex financial decisions, consulting financial advisors or using platforms like Xettle Technologies can provide tailored guidance.

Conclusion

Financial literacy and education are powerful tools for individuals and businesses alike, enabling them to navigate the financial landscape with confidence and competence. With the integration of technology solutions, learning about and managing finances has become more accessible than ever. By investing in financial education and leveraging modern tools, people and organizations can achieve stability, growth, and long-term success. Whether through personal budgeting apps or comprehensive platforms like Xettle Technologies, the journey to financial empowerment is now within reach for everyone.

2 notes

·

View notes

Text

Artificial intelligence in real estate industry:

Artificial intelligence (AI) is increasingly being utilized in the real estate industry to streamline processes, enhance decision-making, and improve overall efficiency. Here are some ways AI is making an impact in real estate:

1. Property Valuation: AI algorithms can analyze vast amounts of data including historical sales data, property features, neighborhood characteristics, and market trends to accurately estimate property values. This helps sellers and buyers to make informed decisions about pricing.

2. Predictive Analytics: AI-powered predictive analytics can forecast market trends, identify investment opportunities, and anticipate changes in property values. This information assists investors, developers, and real estate professionals in making strategic decisions.

3. Virtual Assistants and Chatbots: AI-driven virtual assistants and chatbots can handle customer inquiries, schedule property viewings, and provide personalized recommendations to potential buyers or renters. This improves customer service and helps real estate agents manage their workload more efficiently.

4. Property Search and Recommendation: AI algorithms can analyze user preferences, search history, and behavior patterns to provide personalized property recommendations to buyers and renters. This enhances the property search experience and increases the likelihood of finding suitable listings.

5. Property Management: AI-powered tools can automate routine property management tasks such as rent collection, maintenance scheduling, and tenant communication. This reduces administrative overhead and allows property managers to focus on more strategic aspects of their role.

6. Risk Assessment: AI algorithms can analyze factors such as credit history, employment status, and financial stability to assess the risk associated with potential tenants or borrowers. This helps landlords and lenders make informed decisions about leasing or lending.

7. Smart Building Technology: AI-enabled sensors and IoT devices can collect and analyze data on building occupancy, energy consumption, and environmental conditions to optimize building operations, improve energy efficiency, and enhance occupant comfort.

#KhalidAlbeshri#pivot#Holdingcompany#CEO#Realestate#realestatedevelopment#contentmarketing#businessmanagement#businessconsultants#businessstartup#marketingtips#خالدالبشري

#advertising#artificial intelligence#autos#business#developers & startups#edtech#education#futurism#finance#marketing

7 notes

·

View notes

Text

Build Your Cash App Clone: An Online Payment App

Online transactions have become the backbone of financial exchanges in today's fast-paced digital economy. With mobile payment apps like Cash App revolutionizing the way people send and receive money, businesses and entrepreneurs are keen to develop their own cash app clone to tap into this lucrative market. But what does it take to build an app like Cash App? What features are essential, and how can you ensure a seamless, secure, and user-friendly experience?

In this guide, we’ll explore the key aspects of developing a cash app clone app, the technical requirements, and the strategic steps to create a successful mobile payment solution.

Why Develop a Cash App Clone?

With millions of users relying on mobile payment apps for everyday transactions, the demand for seamless peer-to-peer (P2P) payment platforms is growing exponentially. A cash app clone presents a golden opportunity to enter the fintech space and offer users a convenient way to manage their money.

Here’s why launching an app like Cash App makes sense:

Expanding Market Potential: Digital wallets are gaining traction worldwide, with a projected market value of $12.06 trillion by 2027.

User Convenience: People prefer apps that allow quick money transfers, bill payments, and even cryptocurrency transactions.

Revenue Generation: Through transaction fees, premium features, and business integrations, a cash app clone app can be highly profitable.

Brand Differentiation: You can introduce unique features that set your app apart from existing payment apps.

Key Features of a Cash App Clone

A successful cash app clone should incorporate essential features that ensure seamless transactions, security, and user engagement. Here are the must-have functionalities:

1. Secure User Authentication

To build trust, your cash app clone app should implement multi-factor authentication (MFA), biometric login (fingerprint or facial recognition), and OTP verification. Security is paramount, especially when dealing with financial transactions.

2. Instant Money Transfers

The core function of an app like Cash App is the ability to send and receive money instantly. Whether users are transferring funds to family members or paying for goods and services, your app should support real-time transactions.

3. Bank Account & Card Linking

Seamless integration with bank accounts, debit/credit cards, and digital wallets ensures users can fund their accounts and withdraw money effortlessly. Supporting multiple banking networks enhances the app’s usability.

4. QR Code Payments

QR-based transactions are becoming increasingly popular. Your cash app clone should allow users to generate and scan QR codes for quick, contactless payments.

5. Cryptocurrency Transactions

Apps like Cash App have ventured into cryptocurrency trading. Integrating a secure cryptocurrency exchange feature can attract tech-savvy users looking to invest or trade digital assets.

6. Bill Payments & Recharges

Offering bill payments, mobile recharges, and subscription management within the app enhances user engagement and provides additional revenue streams.

7. Peer-to-Peer (P2P) Lending

Innovative P2P lending options can set your cash app clone app apart. Users can lend or borrow money within the platform, ensuring a dynamic financial ecosystem.

8. Spending Insights & Budgeting

Users appreciate financial tools that help them track expenses, set budgets, and analyze their spending patterns. AI-driven insights can improve financial literacy and engagement.

9. Customer Support & Dispute Resolution

Live chat, chatbots, and in-app support ensure users get timely assistance for transaction disputes, account issues, and general inquiries.

Technical Stack for a Cash App Clone

Developing a cash app clone requires a robust technology stack that ensures high performance, security, and scalability. Here’s what you need:

Front-End Development: React Native, Flutter, Swift (iOS), Kotlin (Android)

Back-End Development: Node.js, Python, Ruby on Rails

Database: PostgreSQL, Firebase, MongoDB

Security: AES encryption, SSL/TLS protocols, biometric authentication

Payment Gateway Integration: Stripe, PayPal, Razorpay

Cloud Storage: AWS, Google Cloud, Azure

Steps to Develop Your Cash App Clone

1. Define Your Unique Value Proposition

While the idea is to create an app like Cash App, your application should offer something different. Identify a niche or a set of features that will make your app stand out.

2. Partner with an On-Demand App Development Company

A specialized on-demand app development company can help you build a secure, scalable, and feature-rich app. Choosing the right development partner ensures a smoother journey from concept to launch.

3. UI/UX Design for a Seamless User Experience

User-friendly design plays a significant role in customer retention. Your app’s interface should be intuitive, visually appealing, and easy to navigate.

4. Development & Integration

Once the designs are finalized, the development phase begins. This includes:

Coding the front-end and back-end

Integrating APIs for payment gateways and banking services

Implementing security features

Testing functionalities before deployment

5. Compliance & Security Regulations

Financial apps must adhere to regulations like PCI-DSS, GDPR, and KYC norms. Compliance ensures that your app meets industry standards and avoids legal complications.

6. Testing & Quality Assurance

Before launching your cash app clone app, thorough testing is crucial. Security audits, load testing, and performance testing help identify and fix vulnerabilities.

7. Deployment & Marketing Strategy

Once the app is ready, deploying it on app stores (Google Play and Apple App Store) is the final step. A strong marketing strategy, including social media promotions and influencer partnerships, will help attract users.

How to Monetize Your Cash App Clone

While the core service of an app like Cash App is free, you can generate revenue through:

Transaction Fees: Charge a small fee on instant transfers or premium services.

Premium Features: Offer subscription-based advanced features such as investment tools.

Merchant Payments: Facilitate business transactions and take a commission.

In-App Advertisements: Partner with brands for promotional content.

Final Thoughts

Building a cash app clone is a promising venture in the ever-evolving fintech industry. With the right strategy, cutting-edge features, and a secure infrastructure, your app can become a trusted payment solution for users worldwide. Partnering with an experienced on-demand app development company will help you turn your vision into reality and compete with leading digital wallets in the market.

Now is the perfect time to step into the digital payment space and build an innovative cash app clone app that meets modern users' demands. Ready to transform the way people transact? The fintech revolution awaits!

1 note

·

View note

Text

Exciting news!

Introducing @unilendfinance #AI Agent Hub Lamaa_AI!

This cutting-edge platform connects #AiAgents with #DeFi protocols, unlocking new opportunities for lenders, borrowers, and traders!

UniLend #AIAgent Hub enables seamless interactions between #AIAgents and #DeFi protocols, optimizing lending, borrowing, and trading decisions. This synergy drives efficiency, reduces risk, and increases returns!

With #UniLend #AIAgent Hub, lamaa_ai's #AIAgents can analyze market trends, identify opportunities, and execute trades autonomously.

This level of automation and intelligence is a game-changer for DeFi!

UniLend #AIAgent Hub is designed to be scalable, secure, and user-friendly.

#UniLend goal is to make #AI-driven #DeFi accessible to everyone, regardless of technical expertise. Join the revolution!

Stay tuned for more updates on Unilend #AIAgent Hub and its impact on the #DeFi space! Follow lamaa_ai for the latest insights on #AI and DeFi.

Let's shape the future of finance together!

#AIAgents #AICrypto #UFT #BSC #Bullish #DeFi

1 note

·

View note